Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on October 21, 2009

Registration No. 333-161548

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PLAINSCAPITAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Texas | 6022 | 75-2182440 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2323 Victory Avenue, Suite 1400

Dallas, Texas 75219

(214) 252-4100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

PlainsCapital Corporation

Attention: Alan B. White, Chief Executive Officer

2323 Victory Avenue, Suite 1400

Dallas, Texas 75219

(214) 252-4100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Greg R. Samuel, Esq. Haynes and Boone, LLP |

Richard D. Truesdell, Jr., Esq. Davis Polk & Wardwell LLP | |

| 2323 Victory Avenue, Suite 700 Dallas, TX 75219 (214) 651-5000 Fax: (214) 200-0577 |

450 Lexington Avenue New York, New York 10017 (212) 450-4000 Fax: (212) 450-3800 |

Approximate date of proposed sale to public: As soon as practicable on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated October 21, 2009

Preliminary Prospectus

15,000,000 shares

Common stock

This is an initial public offering of Common Stock by PlainsCapital Corporation. PlainsCapital Corporation is selling 10,257,200 shares of our Common Stock and the selling shareholders, including certain members of our senior management, are selling 4,742,800 shares of our Common Stock. The estimated initial public offering price is between $14.00 and $16.00 per share.

Our Common Stock has been authorized for listing on the New York Stock Exchange under the symbol “PCB,” subject to official notice of issuance.

| Per share | Total | |||||

| Initial public offering price |

$ | $ | ||||

| Underwriting discounts and commissions |

$ | $ | ||||

| Proceeds to PlainsCapital Corporation, before expenses |

$ | $ | ||||

| Proceeds to selling shareholders, before expenses |

$ | $ | ||||

We have granted the underwriters an option for a period of 30 days to purchase from us up to additional shares of Common Stock. We will not receive any proceeds from the sale of shares by the selling shareholders.

Following this offering, we will have two outstanding classes of common stock, Common Stock and Original Common Stock. The rights of the holders of the shares of Common Stock and Original Common Stock are identical, except with respect to conversion. Each share of Original Common Stock is convertible at any time at our election into one share of Common Stock. The Original Common Stock also will automatically convert into shares of Common Stock in certain circumstances. See “Description of capital stock” beginning on page 155.

Investing in our Common Stock involves a high degree of risk. See “Risk factors” beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Common Stock is not a deposit or savings account. The Common Stock is not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality.

J.P. Morgan

Sole book-running manager

| Fox-Pitt Kelton Cochran Caronia Waller | ||||

| Keefe, Bruyette & Woods | ||||

| Stephens Inc. | ||||

, 2009

Table of Contents

Index to Financial Statements

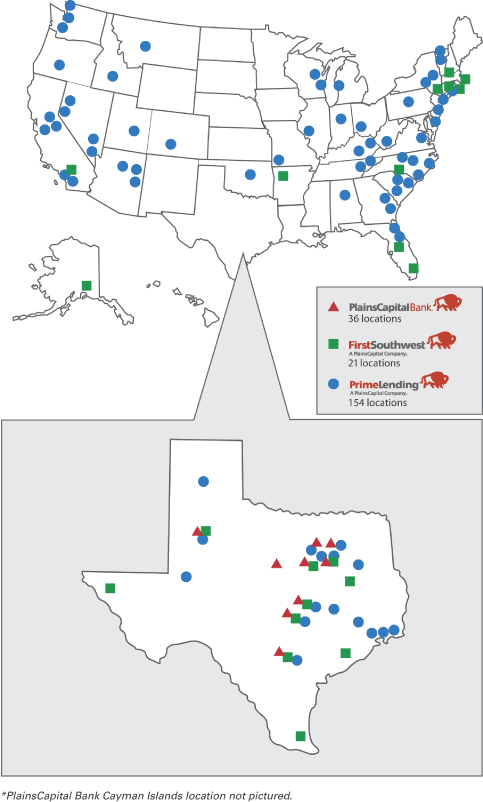

Markets of Principal Subsidiaries

Table of Contents

Index to Financial Statements

| 1 | ||

| 10 | ||

| 27 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| 33 | ||

| Management’s discussion and analysis of financial condition and results of operations |

36 | |

| 86 | ||

| 112 | ||

| 119 | ||

| 141 | ||

| 143 | ||

| 155 | ||

| 160 | ||

| Certain material U.S. federal income and estate tax considerations for non-U.S. shareholders |

162 | |

| 164 | ||

| 170 | ||

| 170 | ||

| 170 | ||

| 170 | ||

| F-1 | ||

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. If you receive any information not authorized by us, then you should not rely on it.

We are offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the Common Stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

i

Table of Contents

Index to Financial Statements

This summary highlights certain information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our Common Stock. You should read this entire prospectus carefully, including the risks discussed under “Risk factors” and the financial statements and notes thereto included elsewhere in this prospectus. Some of the statements in this summary constitute forward-looking statements. See “Forward-looking statements”.

As used in this prospectus, unless the context otherwise indicates, the references to “we,” “us,” “our,” “our company,” or “PlainsCapital” refer to PlainsCapital Corporation, a Texas corporation, and its consolidated subsidiaries as a whole, references to the “Bank” refer to PlainsCapital Bank (a wholly-owned subsidiary of PlainsCapital Corporation), references to “First Southwest” refer to First Southwest Holdings, LLC (a wholly-owned subsidiary of the Bank) and its subsidiaries as a whole, and references to “PrimeLending” refer to PrimeLending, a PlainsCapital Company (a wholly-owned subsidiary of the Bank) and its subsidiaries as a whole. Statistical information concerning metropolitan markets are calculated based upon the applicable Metropolitan Statistical Area.

During the third quarter of 2009, we changed our segment reporting. We describe this change in Note 18 to our consolidated interim financial statements for the three and nine months ended September 30, 2009. We did not restate our annual financial information for the periods ended December 31, 2008, 2007 and 2006 because the information for these periods is presented on the basis that management used to manage our business during these periods.

Overview

We are a Texas corporation and a financial holding company registered under the Bank Holding Company Act of 1956 (as amended, the “Bank Holding Company Act”), as amended by the Gramm-Leach-Bliley Act of 1999 (the “Gramm-Leach-Bliley Act”). Five members of our senior executive team have worked together for the last 21 years. We have paid constant or increased dividends to our shareholders for each of the past 20 years and have been profitable for each of those years. For the years 1990 though 2008, our consolidated assets increased from $346.0 million to $4.0 billion and our consolidated net income increased from $2.0 million to $24.1 million, representing a compounded annual growth rate of 14% and 15%, respectively. As of September 30, 2009, we employed approximately 2,600 people in 211 locations in 36 states across our three business segments.

We provide the personalized client service and responsiveness most often associated with smaller financial institutions while offering the sophisticated products and services frequently associated with larger financial institutions. In addition to traditional banking services, we also provide wealth and investment management, treasury management, capital equipment leasing, residential mortgage lending, investment banking, public finance advisory services, fixed income sales and trading, asset management and correspondent clearing.

As of September 30, 2009, on a consolidated basis, we had total assets of approximately $4.7 billion, total deposits of approximately $3.2 billion, total loans, including loans held for sale, of approximately $3.5 billion and shareholders’ equity of approximately $431.1 million. We have

1

Table of Contents

Index to Financial Statements

experienced significant growth since our inception. Over the five-year period ending December 31, 2008, our net revenues, which we define as the sum of net interest income and noninterest income, increased 30.3% from $189.1 million to $246.4 million.

Business segments

We operate through three complementary business segments: banking, mortgage origination and financial advisory. We believe the diversification of income sources from each of our business segments mitigates business risk and provides opportunities for growth in varied economic conditions. During 2008 and the first nine months of 2009, approximately 59.9% and 35.0%, respectively, of our net revenue was derived from our banking segment. The operations of our mortgage origination segment have historically represented our second largest source of annual revenue, but have represented our largest net revenue segment in the first nine months of 2009, primarily as a result of a favorable interest rate environment for mortgage refinancing in the first half of 2009, as well as an increase in the volume of mortgage originations for home purchases that began in the third quarter of 2009. During 2008 and the first nine months of 2009, the mortgage origination segment generated approximately 37.7% and 44.3%, respectively, of our net revenue. The operations of First Southwest were acquired on December 31, 2008 and have been included in our financial advisory segment beginning as of January 1, 2009. The financial advisory segment contributed 20.7% to total net revenue for the first nine months of 2009.

Banking. The Bank was the ninth largest bank headquartered in Texas based upon deposits as of June 30, 2009 with 35 locations in the Austin, Dallas/Fort Worth, Lubbock and San Antonio markets. The Bank seeks to differentiate itself from its competitors by offering highly personalized service and tailoring its operating strategy to different markets. The Lubbock market serves as a strong source of core deposits for the Bank. In other markets, we operate a model focusing on middle-market companies and high net worth individuals. With $4.4 billion in assets as of September 30, 2009, and capital ratios that significantly exceed regulatory guidelines for “well capitalized” banks, we believe the Bank is well positioned for continued growth.

Mortgage origination. Our mortgage origination segment is operated through the Bank’s wholly-owned subsidiary, PrimeLending, and offers a variety of residential mortgage loan products from offices in 32 states. We sell substantially all mortgage loans we originate in the secondary market and do not service these loans. Last year we originated more than $2.3 billion in mortgage loans, and, in the first nine months of 2009, set a new company record for the highest aggregate dollar amount of loans originated in the first nine months of a year. By dollar volume, approximately half of our loans originated during the first nine months of 2009 were collateralized by residential real estate located in Texas. In 2008, according to Computer Business Methods, Inc., as a result of our substantial PrimeLending operations in Texas, we ranked sixth in Texas for total dollar amount of Texas mortgage loan originations and first in Texas for Federal Housing Administration (“FHA”) mortgage loan originations in Texas.

Financial advisory. Through our wholly-owned subsidiary, First Southwest, we offer public finance, advisory and related services, which, for the nine months ended September 30, 2009, represented a majority of the net revenues of First Southwest. Additionally, First Southwest offers corporate finance, investment banking, fixed income sales and trading services, asset management and correspondent clearing. Our financial advisory segment includes 23 offices nationwide, 13 of which are in Texas. We believe that the public finance industry is well

2

Table of Contents

Index to Financial Statements

positioned to capitalize on the federal government’s infrastructure stimulus legislation. Our public finance advisory business ranked first nationally, based upon number of issuances, and third nationally, based upon par volume of issuances, for the five-year period ending on September 30, 2009, according to information derived from MuniAnalytics. First Southwest currently has a financial advisory relationship with more than 1,300 public sector clients.

History and expansion

We were founded in Lubbock, Texas, in 1987 by current Chairman and Chief Executive Officer Alan B. White, other members of senior management and a group of investors. At the time we acquired the Bank in 1988, it had approximately $198.8 million in assets and was the fifth largest bank in the Lubbock market by deposits. Over the next 20 years, our market share and service offering grew, highlighted by the following events:

| • | In 1998, we expanded our product offerings beyond traditional banking services by entering the mortgage origination segment through the acquisition of a Lubbock-based mortgage company. |

| • | In 1999, we entered a new geographic market by expanding our mortgage origination operations through the acquisition of PrimeLending, a Dallas-based mortgage company with five locations in the Dallas-Fort Worth metroplex. The Bank also opened its first banking location outside of the West Texas region in the Turtle Creek neighborhood of Dallas. |

| • | In 2000, we moved our corporate headquarters to Dallas and opened our first banking location in Austin. |

| • | In 2004, the Bank entered the Fort Worth and San Antonio markets. |

| • | In 2008, we acquired First Southwest, a diversified private investment banking firm, in order to expand our financial advisory segment. |

Markets

We are based in Texas, a state with a population expected to grow 9.3% over the next five years compared to expected growth of 4.6% for the United States. If Texas were its own country, it would have the 11th largest economy in the world according to the Texas Comptroller of Public Accounts. Texas hosts the headquarters of more Fortune 500 companies than any other state according to the July 9, 2009 edition of The Economist and as of August 2009 had an unemployment rate that was 1.7 percentage points below the national average according to the U.S. Bureau of Labor Statistics.

We have an expanding footprint in the “Texaplex,” the geographic region encompassing Dallas-Fort Worth, Houston, San Antonio and Austin. Of the 24 million Texas residents, four out of five live inside this region according to GMAC Real Estate. The Texaplex is projected to grow by 14 million people by the year 2030 according to GMAC Real Estate and represents the primary focus of our geographic growth efforts.

We also benefit from having our headquarters and a strong presence in Dallas. The Dallas-Fort Worth region ranks second for revenue generated from Fortune 500 companies according to the

3

Table of Contents

Index to Financial Statements

April 2008 issue of Fortune, and Dallas-Fort Worth ranks fourth nationally in the number of corporate headquarters according to the North Texas Commission. To capture opportunities in this region, the Bank has 13 branches in the Dallas-Fort Worth market with $1,131 million in deposits as of September 30, 2009.

In addition, we are a leader in the Lubbock market, with approximately $1.0 billion in deposits and a 19.2% deposit market share as of June 30, 2009. In the Lubbock market, we employ a traditional community bank marketing strategy. Our Lubbock deposit base has provided dependable funding for our historical growth.

Although each of our segments generated most of its revenue from within Texas during 2008, our mortgage origination and financial advisory segments also operate in markets outside of Texas. We intend to expand our existing footprint into other markets.

Business and growth strategies

We intend to grow by employing the following business strategies:

Focus on medium-sized businesses owned and operated by high net worth individuals. Unlike many of our competitors, the Bank has, with the exception of the Lubbock market, foregone a branch intensive, mass marketing retail strategy. Rather, we have focused, and we will continue to focus, the Bank’s growth efforts on privately held businesses with $5 million—$250 million in annual revenue. Often through a banking relationship with these types of businesses, we also develop business relationships with associated high net worth individuals and affluent households.

Emphasize customer responsiveness and personalized service. We provide clients with prompt, local decision-making concerning their borrowing and other financial needs. We entrust our experienced leadership teams with the authority and flexibility to enable us to implement and maintain the most effective solutions personalized for our customers. As a result, we intend to continue to capitalize on attracting new customers from our competitors who have not adequately met the dynamic and fast-paced financial needs of entrepreneurs and middle market businesses. As an example of our personalized services, our staff of couriers bring branch banking services to our business customers and other select high net worth customers.

Cross-sell products and realize operational synergies among our three businesses. We intend to continue to identify products and services to cross-sell to customers among our business segments. In addition, we expect to increase revenues by continuing to realize synergies among our three business segments. For example, the Bank provides our mortgage origination segment with a consistent source of funding, and First Southwest’s correspondent clearing business represents a dependable and significant source of deposits for the Bank.

Target hiring of experienced professionals that fit with our culture. We intend to continue to hire and retain highly experienced and qualified banking and financial professionals with successful track records and, for account managers, established relationships within our target customer population. Our historical growth has primarily been the result of hiring experienced bankers rather than acquiring banks. Our success has resulted from our knowledge of, and relationships with, our clients that our bankers have developed over time. We believe this knowledge and these relationships have enabled us to mitigate many of the credit difficulties that our competitors have experienced.

4

Table of Contents

Index to Financial Statements

Acquire companies, branches and offices that fit with our unique culture and philosophy. Consistent with our strategy of hiring experienced bankers and financial professionals, we intend to pursue strategic acquisitions where we obtain a leadership team and

structure with significant banking or financial services experience in a market area that will smoothly integrate into and complement our present operational culture and/or supplement our geographic footprint. In light of recent unprecedented market conditions, we may also pursue other distressed sale opportunities to acquire assets that complement our existing operations on a cost-effective basis.

Corporate information

Our principal executive office is located at 2323 Victory Avenue, Suite 1400, Dallas, TX 75219. Our telephone number is (214) 252-4100 and our corporate website address is www.plainscapital.com. Information contained on our website is not incorporated by reference into this prospectus and you should not consider information contained on, or accessible through, our website as part of this prospectus.

5

Table of Contents

Index to Financial Statements

The offering

The following summary of the offering contains basic information about the offering and the Common Stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the Common Stock, please refer to the section of this prospectus entitled “Description of capital stock”.

Common Stock offered:

| By PlainsCapital Corporation |

10,257,200 shares. |

12,507,200 shares if the underwriters exercise their over-allotment option in full.

| By the selling shareholders |

4,742,800 shares. |

| Total Common Stock offered |

15,000,000 shares. |

Common Stock to be outstanding immediately after this offering:

| Common Stock |

15,000,000 shares. |

17,250,000 shares if the underwriters exercise their over-allotment option in full.

| Original Common Stock |

29,071,013 shares.1 |

| Total shares |

44,071,013 shares. |

| Use of proceeds |

We estimate that our net proceeds from this offering, after deducting underwriting discounts, commissions and offering expenses, will be approximately $141.5 million, or approximately $172.9 million if the underwriters exercise their over-allotment option in full, based on an assumed initial offering price of $15.00 per share (the midpoint of the estimated public offering price set forth on the cover page of this prospectus). We intend to use the net proceeds: |

| • |

first, to redeem for approximately $92 million our Fixed Rate Cumulative Perpetual Preferred Stock, Series A and Fixed Rate Cumulative Perpetual Preferred Stock, Series B (the “Series A and Series B Preferred Stock”) that we issued to the U.S. Treasury pursuant to the U.S. Treasury’s Capital Purchase Program; |

| • |

second, to repay approximately $20 million of our existing debt under a revolving line of credit owed to an affiliate of J.P. Morgan Securities Inc.; and |

| • |

third, the remainder to support and enhance our operations. |

| 1 | No later than June 30, 2011, each share of Original Common Stock will convert into one share of Common Stock. See “Description of capital stock”. |

6

Table of Contents

Index to Financial Statements

The approval of the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) is required for the repurchase of these Series A and Series B Preferred Stock. We do not know when, or if, we will receive such approval. If we do not receive the necessary regulatory approval to repurchase the Series A and Series B Preferred Stock, or our board of directors subsequently determines not to repurchase the Series A and Series B Preferred Stock, then we intend to use approximately $20 million of the net proceeds of the offering to repay existing debt owed to an affiliate of J.P. Morgan Securities Inc. and to use the remaining net proceeds to support and enhance operations. We will not receive any proceeds from the sales of our Common Stock by the Selling Shareholders.

| Risk factors |

You should carefully read and consider the information set forth under “Risk factors,” together with all of the other information set forth in this prospectus, before deciding to invest in shares of our Common Stock. |

| Proposed New York Stock Exchange listing |

Our Common Stock has been authorized for listing on the New York Stock Exchange (the “NYSE”) under the symbol “PCB,” subject to official notice of issuance. Our Original Common Stock will not be listed. |

The number of shares of our Common Stock and Original Common Stock to be outstanding after this offering based on 33,813,813 shares of our Original Common Stock outstanding as of September 30, 2009 will be 44,071,013 including 1,697,430 shares of Original Common Stock escrowed pursuant to the earnout provisions of the Merger Agreement (defined herein) but excluding 969,552 shares of common stock reserved for issuance upon the exercise of outstanding options at a weighted average exercise price of $8.43 per share.

Except as otherwise indicated, all information contained in this prospectus assumes:

| • | an initial offering price of $15.00 per share (which is the midpoint of the range on the cover page of this prospectus); and |

| • | the underwriters’ option to purchase up to 2,250,000 additional shares of Common Stock is not exercised. |

All share and per share information referenced through this prospectus has been retroactively adjusted to reflect the following actions effected on August 28, 2009:

| • | a redesignation of our then-outstanding shares of common stock as “Original Common Stock” (except for our audited consolidated financial statements for the years ended December 31, 2008, 2007 and 2006 and the notes thereto) and |

| • | a three-for-one stock split of our Original Common Stock and a change in the par value of our Original Common Stock from $10.00 per share to $0.001 per share. |

7

Table of Contents

Index to Financial Statements

Summary historical consolidated financial information

The following tables set forth our summary historical consolidated financial information for each of the periods indicated. The historical information as of and for the years ended December 31, 2004 through 2008 has been derived from our audited consolidated financial statements for the years ended December 31, 2004 through 2008, and our historical information for the nine months ended September 30, 2009 and 2008 has been derived from our unaudited financial statements for the nine months ended September 30, 2009 and 2008. The historical results set forth below and elsewhere in this prospectus are not necessarily indicative of our future performance.

The following selected historical financial information is only a summary and should be read in conjunction with “Use of proceeds,” “Capitalization,” “Management’s discussion and analysis of financial condition and results of operations,” “Certain relationships and related party transactions” and our audited and unaudited financial statements and related notes included elsewhere in this prospectus. The operating results and financial condition of First Southwest are included in the tables below as of January 1, 2009 and December 31, 2008, respectively.

| As of and for the Nine Months Ended September 30, |

As of and for the Years Ended December 31, | |||||||||||||

| 2009 | 2008 | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||

| Income Statement Data: |

||||||||||||||

| Total interest income |

$149,946 | $146,923 | $193,392 | $220,895 | $192,812 | $148,636 | $108,373 | |||||||

| Total interest expense |

31,992 | 52,167 | 66,069 | 104,805 | 86,973 | 58,307 | 27,513 | |||||||

| Net interest income |

117,954 | 94,756 | 127,323 | 116,090 | 105,839 | 90,329 | 80,860 | |||||||

| Provision for loan losses |

39,073 | 7,818 | 22,818 | 5,517 | 5,049 | 5,516 | 2,604 | |||||||

| Net interest income after provision for loan losses |

78,881 | 86,938 | 104,505 | 110,573 | 100,790 | 84,813 | 78,256 | |||||||

| Total noninterest income |

248,420 | 86,709 | 119,066 | 84,281 | 101,776 | 110,027 | 109,882 | |||||||

| Total noninterest expense |

271,435 | 135,702 | 186,722 | 151,358 | 163,203 | 163,708 | 157,161 | |||||||

| Income from continuing operations before income taxes |

55,866 | 37,945 | 36,849 | 43,496 | 39,363 | 31,132 | 30,977 | |||||||

| Federal income tax provision |

19,991 | 13,448 | 12,725 | 14,904 | 13,624 | 12,612 | 11,043 | |||||||

| Income from continuing operations |

35,875 | 24,497 | 24,124 | 28,592 | 25,739 | 18,520 | 19,934 | |||||||

| Income from discontinued Amarillo operations (net-of-tax) |

— | — | — | — | — | 11,536 | 1,161 | |||||||

| Net income |

35,875 | 24,497 | 24,124 | 28,592 | 25,739 | 30,056 | 21,095 | |||||||

| Less: Net income attributable to noncontrolling interest |

126 | 234 | — | — | — | — | — | |||||||

| Net income attributable to PlainsCapital Corporation |

35,749 | 24,263 | 24,124 | 28,592 | 25,739 | 30,056 | 21,095 | |||||||

| Dividends on preferred stock and other |

4,319 | — | — | — | — | — | — | |||||||

| Income applicable to PlainsCapital Corporation common shareholders |

$31,430 | $24,263 | $24,124 | $28,592 | $25,739 | $30,056 | $21,095 | |||||||

| Per Share Data: |

||||||||||||||

| Income from continuing operations—basic |

$1.01 | $0.93 | $0.92 | $1.10 | $1.00 | $0.73 | $0.94 | |||||||

| Discontinued operations—basic |

— | — | — | — | — | $0.45 | $0.06 | |||||||

| Net income—basic |

$1.01 | $0.93 | $0.92 | $1.10 | $1.00 | $1.18 | $1.00 | |||||||

| Weighted average shares outstanding—basic |

31,255,362 | 26,101,797 | 26,117,934 | 26,012,250 | 25,785,612 | 25,552,734 | 21,185,286 | |||||||

| Income from continuing operations—diluted |

$0.95 | $0.92 | $0.92 | $1.09 | $0.99 | $0.71 | $0.93 | |||||||

| Discontinued operations—diluted |

— | — | — | — | — | $0.45 | $0.05 | |||||||

| Net income—diluted |

$0.95 | $0.92 | $0.92 | $1.09 | $0.99 | $1.16 | $0.98 | |||||||

| Weighted average shares outstanding—diluted |

33,141,824 | 26,245,619 | 26,256,165 | 26,195,211 | 26,030,505 | 25,874,433 | 21,463,983 | |||||||

| Book value per common share |

$10.97 | $9.71 | $9.99 | $8.97 | $8.06 | $7.26 | $7.52 | |||||||

| Tangible book value per common share |

$9.30 | $8.31 | $8.82 | $7.54 | $6.63 | $5.81 | $5.68 | |||||||

8

Table of Contents

Index to Financial Statements

| As of and for the Nine Months Ended September 30, |

As of and for the Years Ended December 31, |

||||||||||||||||||||

| 2009 | 2008 | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

| Balance Sheet Data(1): |

|||||||||||||||||||||

| Total assets |

$4,676,303 | $3,367,099 | $3,951,996 | $3,182,863 | $2,880,697 | $2,690,305 | $2,426,040 | ||||||||||||||

| Loans held for sale |

428,341 | 145,681 | 198,866 | 100,015 | 126,839 | 194,712 | 181,134 | ||||||||||||||

| Investment securities |

479,615 | 208,859 | 385,327 | 191,175 | 187,225 | 177,379 | 196,617 | ||||||||||||||

| Loans, net of unearned income |

3,052,348 | 2,696,345 | 2,965,619 | 2,597,362 | 2,203,019 | 1,956,066 | 1,648,243 | ||||||||||||||

| Allowance for loan losses |

(39,799 | ) | (26,404 | ) | (40,672 | ) | (26,517 | ) | (24,722 | ) | (22,666 | ) | (22,086 | ) | |||||||

| Goodwill and intangible assets, net |

52,101 | 36,586 | 36,568 | 37,307 | 37,136 | 37,362 | 38,977 | ||||||||||||||

| Total deposits |

3,249,772 | 2,328,789 | 2,926,099 | 2,393,354 | 2,496,050 | 2,321,109 | 1,929,898 | ||||||||||||||

| Capital lease obligations |

8,441 | 8,719 | 8,651 | 3,994 | 4,148 | 72 | 143 | ||||||||||||||

| Notes payable |

70,691 | 52,425 | 151,014 | 40,256 | 35,860 | 46,460 | 55,500 | ||||||||||||||

| Junior subordinated debentures |

67,012 | 67,012 | 67,012 | 51,548 | 51,548 | 51,548 | 50,000 | ||||||||||||||

| PlainsCapital Corporation shareholders’ equity |

431,068 | 253,407 | 399,815 | 233,890 | 209,332 | 186,431 | 159,178 | ||||||||||||||

| Performance Ratios*: |

|||||||||||||||||||||

| Return on average equity |

11.56% | 13.31% | 7.61% | 12.98% | 13.20% | 17.42% | 14.13% | ||||||||||||||

| Return on average assets |

1.11% | 0.99% | 0.68% | 0.95% | 0.95% | 1.19% | 0.95% | ||||||||||||||

| Net interest margin (taxable equivalent)(2) |

4.02% | 4.20% | 4.17% | 4.27% | 4.36% | 3.96% | 4.22% | ||||||||||||||

| Efficiency ratio(3) |

74.09% | 74.78% | 75.93% | 75.40% | 78.20% | 81.19% | 81.64% | ||||||||||||||

| Asset Quality Ratios: |

|||||||||||||||||||||

| Total nonperforming assets to total loans and other real estate |

2.49% | 2.32% | 2.03% | 0.96% | 0.75% | 1.09% | 0.80% | ||||||||||||||

| Allowance for loan losses to nonperforming loans |

63.63% | 60.21% | 86.87% | 153.81% | 226.79% | 119.43% | 636.67% | ||||||||||||||

| Allowance for loan losses to total loans |

1.30% | 0.98% | 1.37% | 1.02% | 1.12% | 1.16% | 1.34% | ||||||||||||||

| Net charge-offs to average loans* |

1.19% | 0.28% | 0.37% | 0.15% | 0.14% | 0.24% | 0.12% | ||||||||||||||

| Capital Ratios: |

|||||||||||||||||||||

| Leverage ratio |

9.98% | 8.81% | 12.70% | 8.06% | 8.22% | 7.92% | 7.12% | ||||||||||||||

| Tier 1 risk-based capital ratio |

11.95% | 9.73% | 12.83% | 8.99% | 9.27% | 9.24% | 8.22% | ||||||||||||||

| Total risk-based capital ratio |

13.57% | 11.32% | 14.53% | 10.67% | 10.91% | 10.97% | 10.01% | ||||||||||||||

| Equity to assets ratio |

9.22% | 7.53% | 10.12% | 7.35% | 7.27% | 6.93% | 6.56% | ||||||||||||||

| Dividend payout ratio(4) |

14.19% | 16.37% | 22.02% | 17.26% | 19.06% | 15.33% | 16.82% | ||||||||||||||

| Tangible common equity to tangible assets(5) |

6.29% | 6.51% | 7.04% | 6.25% | 6.06% | 5.62% | 5.04% | ||||||||||||||

| * | Annualized for interim periods. |

| (1) | Balance sheet includes First Southwest as of December 31, 2008. |

| (2) | Net interest income (taxable equivalent) divided by average interest-earning assets. |

| (3) | Noninterest expense divided by the sum of total noninterest income and net interest income for the period. |

| (4) | Total dividends paid divided by net income attributable to PlainsCapital Corporation for the period. |

| (5) | See “Selected historical financial Information—GAAP reconciliation and management explanation of non-GAAP financial measure.” |

We adopted SFAS 160, Noncontrolling Interest in Consolidated Financial Statements, an Amendment of ARB Statement No. 5, on January 1, 2009. Noncontrolling interests reported in the table above for periods prior to the adoption of SFAS 160 have not been retrospectively adjusted to conform to the provisions of SFAS 160 due to the immateriality of those adjustments.

9

Table of Contents

Index to Financial Statements

Investing in our Common Stock involves a high degree of risk. You should consider carefully the following risk factors and the other information in this prospectus (including our consolidated financial statements and related notes appearing at the end of this prospectus) before you decide to purchase our Common Stock. The risks described below are those that we believe are the material risks we face currently, but are not the only risks facing us and our business prospects. If any of the events contemplated by the following discussion should occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our Common Stock could decline and you could lose part or all of your investment.

Risks related to our business

Recent negative developments in the financial industry and the domestic and international credit markets may adversely affect our operations and results.

The U.S. and global economies have suffered a dramatic downturn during the past few years, which has negatively impacted many industries, including the financial industry. As a result, commercial as well as consumer loan portfolio performances have deteriorated at many financial institutions, and the competition for deposits and quality loans has increased significantly. In addition, the values of real estate collateral supporting many commercial loans and home mortgages have declined and may continue to decline, which has contributed to a greater degree of loan defaults. Financial institutions have also been particularly impacted by the lack of liquidity and loss of confidence in the financial sector. These factors collectively have negatively impacted our business, financial condition and results of operations, including decreased net income due to increased provisions for loan losses, and there is no guarantee when market conditions will improve.

In response to some of these concerns, the federal government has adopted significant new laws and regulations relating to financial institutions, including, without limitation, the Emergency Economic Stabilization Act of 2008 (the “EESA”) and the American Recovery and Reinvestment Act of 2009 (the “ARRA”). Numerous other actions have been taken by the Federal Reserve Board, the U.S. Congress, the U.S. Treasury, the Federal Deposit Insurance Corporation (the “FDIC”), the Securities and Exchange Commission (the “SEC”) and others to address the current liquidity and credit crisis, and we cannot predict the full effect of these actions or any future regulatory reforms. Negative developments in the financial industry and the domestic and international credit markets, and the impact of new or future legislation in response to those developments, may negatively impact our operations by restricting our business operations, including our ability to originate or sell loans and attract and retain experienced personnel, and adversely impact our financial performance.

A further adverse change in real estate market values may result in losses and otherwise adversely affect our profitability.

As of September 30, 2009, approximately 51% of our loan portfolio was comprised of loans with real estate as a primary or secondary component of collateral. The real estate collateral in each case provides an alternate source of repayment in the event of default by the borrower and may deteriorate in value during the time the credit is extended. The recent negative developments in the financial industry and economy as a whole have adversely affected real estate market values generally and in our market areas in Texas specifically and may continue to decline. A further

10

Table of Contents

Index to Financial Statements

decline in real estate values could further impair the value of our collateral and our ability to sell the collateral upon any foreclosure. In the event of a default with respect to any of these loans, the amounts we receive upon sale of the collateral may be insufficient to recover the outstanding principal and interest on the loan. As a result, our profitability and financial condition may be adversely affected by a further decrease in real estate market values.

If our allowance for loan losses is insufficient to cover actual loan losses, our earnings will be adversely affected.

As a lender, we are exposed to the risk that our loan customers may not repay their loans according to the terms of these loans and the collateral securing the payment of these loans may be insufficient to fully compensate us for the outstanding balance of the loan plus the costs to dispose of the collateral. We may experience significant loan losses that may have a material adverse effect on our operating results and financial condition.

We maintain an allowance for loan losses intended to cover loan losses inherent in our loan portfolio. In determining the size of the allowance, we rely on an analysis of our loan portfolio, our experience and our evaluation of general economic conditions. We also make various assumptions and judgments about the collectibility of our loan portfolio, including the diversification by industry of our commercial loan portfolio, the effect of changes in the economy on real estate and other collateral values, the results of recent regulatory examinations, the effects on the loan portfolio of current economic indicators and their probable impact on borrowers, the amount of charge-offs for the period and the amount of non-performing loans and related collateral security. If our assumptions prove to be incorrect, our current allowance may not be sufficient and adjustments may be necessary to allow for different economic conditions or adverse developments in our loan portfolio. Material additions to the allowance for loan losses would materially decrease our net income and adversely affect our financial condition generally.

In addition, federal and state regulators periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan charge-offs, based on judgments different than our own. Any increase in our allowance for loan losses or loan charge-offs required by these regulatory agencies could have a material adverse effect on our operating results and financial condition.

Our geographic concentration may magnify the adverse effects and consequences of any regional or local economic downturn.

We conduct our operations primarily in Texas. Substantially all of the real estate loans in our loan portfolio are secured by properties located in Texas, with more than 70% secured by properties located in the Dallas/Fort Worth and Austin/San Antonio markets. Likewise, substantially all of the real estate loans in our loan portfolio are made to borrowers who live and conduct business in Texas. In addition, mortgage origination fee income is heavily dependent on economic conditions in Texas. During the first nine months of 2009, approximately half by dollar volume of our mortgage loans originated were collateralized by properties located in Texas. Our businesses are affected by general economic conditions such as inflation, recession, unemployment and many other factors beyond our control. Adverse economic conditions in Texas may result in a reduction in the value of the collateral securing our loans. Any regional or local economic downturn that affects Texas or existing or prospective property or borrowers in Texas may affect us and our profitability more significantly and more adversely than our competitors that are less geographically concentrated.

11

Table of Contents

Index to Financial Statements

Our business is subject to interest rate risk and fluctuations in interest rates may adversely affect our earnings and capital levels and overall results.

The majority of our assets are monetary in nature and, as a result, we are subject to significant risk from changes in interest rates. Changes in interest rates may impact our net interest income as well as the valuation of our assets and liabilities. Our earnings are significantly dependent on our net interest income, which is the difference between interest income on interest-earning assets, such as loans and securities, and interest expense on interest-bearing liabilities, such as deposits and borrowings. We expect to periodically experience “gaps” in the interest rate sensitivities of our assets and liabilities, meaning that either our interest-bearing liabilities will be more sensitive to changes in market interest rates than our interest-earning assets, or vice versa. In either event, if market interest rates should move contrary to our position, this “gap” may work against us, and our earnings may be adversely affected.

An increase in the general level of interest rates may also, among other things, adversely affect the demand for loans and our ability to originate loans. In particular, if mortgage interest rates increase, the demand for residential mortgage loans and the refinancing of residential mortgage loans will likely decrease, which will have an adverse effect on our income generated from mortgage origination activities. Conversely, a decrease in the general level of interest rates, among other things, may lead to prepayments on our loan and mortgage-backed securities portfolios and increased competition for deposits. Accordingly, changes in the general level of market interest rates may adversely affect our net yield on interest-earning assets, loan origination volume and our overall results.

Although our asset-liability management strategy is designed to control and mitigate exposure to the risks related to changes in the general level of market interest rates, market interest rates are affected by many factors outside of our control, including inflation, recession, unemployment, money supply, and international disorder and instability in domestic and foreign financial markets. We may not be able to accurately predict the likelihood, nature and magnitude of such changes or how and to what extent such changes may affect our business. We also may not be able to adequately prepare for or compensate for the consequences of such changes. Any failure to predict and prepare for changes in interest rates or adjust for the consequences of these changes may adversely affect our earnings and capital levels and overall results.

We are heavily dependent on dividends from our subsidiaries.

We are a bank holding company and a financial holding company engaged in the business of managing, controlling and operating our subsidiaries, including the Bank and the Bank’s subsidiaries, PrimeLending and First Southwest. We conduct no material business or other activity other than activities incidental to holding stock in the Bank. As a result, we rely substantially on the profitability of the Bank and dividends from the Bank to pay our operating expenses, to satisfy our obligations and the expenses and obligations of all of our subsidiaries and to pay dividends on our common stock and preferred stock. As with most financial institutions, the profitability of the Bank is subject to the fluctuating cost and availability of money, changes in interest rates and in economic conditions in general. The Bank has several subsidiaries, including PrimeLending and First Southwest, that may also contribute to its profitability and ability to pay dividends to us. However, if the Bank is unable to make cash distributions to us, then we may also be unable to obtain funds from PrimeLending and First Southwest, and we may be unable to satisfy our obligations or make distributions on our common stock and preferred stock.

12

Table of Contents

Index to Financial Statements

Our banking segment is subject to funding risks associated with its high deposit concentration and reliance on brokered deposits.

At September 30, 2009, our fifteen largest depositors, excluding First Southwest, our indirect wholly-owned subsidiary, accounted for approximately 27% of our total deposits, and our five largest depositors, excluding First Southwest, accounted for approximately 15% of our total deposits. Brokered deposits at September 30, 2009 accounted for 5.6% of our total deposits. Loss of one or more of our largest Bank customers, a significant decline in our deposit balances due to ordinary course fluctuations related to these customers’ businesses, or a loss of a significant amount of our brokered deposits could adversely affect our liquidity. Additionally, such circumstances could require us to raise deposit rates in an attempt to attract new deposits, or purchase federal funds or borrow funds on a short-term basis at higher rates, which would adversely affect our results of operations. Under applicable regulations, if the Bank were no longer “well-capitalized,” the Bank would not be able to accept broker deposits without the approval of the FDIC. See “Business—Government supervision and regulation—PlainsCapital Corporation”.

We are subject to losses due to fraudulent and negligent acts.

Our business is subject to potential losses resulting from fraudulent activities. Our banking segment is subject to the risk that our customers may engage in fraudulent activities, including fraudulent access to legitimate customer accounts or the use of a false identity to open an account, or the use of forged or counterfeit checks for payment. The banking segment is subject to the risk of higher than expected charge offs for loans it holds to maturity on its balance sheet if its borrowers supply fraudulent information. Such types of fraud may be difficult to prevent or detect, and we may not be able to recover the losses caused by such activities. Any such losses could have a material adverse effect on our business, financial condition and operating results.

In our mortgage origination segment, we rely heavily upon information supplied by third parties including the information contained in the loan application, property appraisal, title information and employment and income documentation. If any of this information is intentionally or negligently misrepresented and such misrepresentation is not detected prior to loan funding, the investment value of the loan may be significantly lower than expected. Whether a misrepresentation is made by the loan applicant, another third party or one of our own employees, we generally bear the risk of loss associated with the misrepresentation. A mortgage loan subject to a material misrepresentation is typically unsaleable to investors in the secondary market. If we have already sold the loan when the material misrepresentation is discovered, then the loan is subject to repurchase, but we will often instead agree to indemnify the purchaser for any losses arising from such loan because in the general course of business we do not seek to hold mortgage loans we originate for investment. Even though we may have rights against persons and entities who made or knew about the misrepresentation, such persons and entities are often difficult to locate, and it is often difficult to collect any monetary losses that we have suffered from them. We cannot assure you that we have detected or will detect all misrepresented information in our loan originations. If we experience a significant number of such fraudulent or negligent acts, our business, financial condition, liquidity and results of operations could be significantly harmed.

On August 14, 2009, one of our employees was indicted, along with eleven other individuals and three business entities, in Cuyahoga County, Ohio. The indictment alleges that our employee was part of a loan application fraud scheme, and specifically identifies loans on three properties in the aggregate amount of approximately $3.3 million that we originated and sold to investors. If

13

Table of Contents

Index to Financial Statements

those loans were in fact obtained through fraud, we could be forced to repurchase such loans at the purchase price, or would be required to indemnify such investors for any losses they suffer from such loans pursuant to our agreements with such investors. We cannot assure you that we have detected or will detect all misrepresented information in our loan originations, including with respect to such employee.

First Southwest engages in the underwriting of municipal and other tax-exempt debt securities. As an underwriter, First Southwest may be liable jointly and severally under federal, state and foreign securities laws for false and misleading statements concerning the securities, or the issuer of the securities, that it underwrites. In addition, First Southwest may act as a fiduciary in other capacities. Liability under such laws or under common law fiduciary principles could have a material adverse effect on our business, financial condition, liquidity, and results of operations.

Our mortgage origination segment is subject to investment risk on loans that it originates.

We intend to sell, and not hold for investment, all residential mortgage loans that we originate through PrimeLending. At times, however, we may originate a loan or execute an interest rate lock commitment (“IRLC”) with a customer pursuant to which we agree to originate a mortgage loan on a future date at an agreed-upon interest rate without having identified a purchaser for such loan or the loan underlying such IRLC. An identified purchaser may also decline to purchase a loan for a variety of reasons. In these instances, we will bear interest rate risk on an IRLC until, and unless, we are able to find a buyer for the loan underlying such IRLC and the risk of investment on a loan until, and unless, we are able to find a buyer for such loan. In addition, if a customer defaults on a mortgage payment shortly after the loan is originated, the purchaser of the loan may have a put right, whereby they can require us to repurchase the loan at the full amount paid by the purchaser. During periods of market downturn, we have at times chosen to hold mortgage loans when the identified purchasers have declined to purchase such loans because we could not obtain an acceptable substitute bid price for such loan. The failure of mortgage loans that we hold on our books to perform adequately will have a material adverse effect our financial condition, liquidity and results of operations.

First Southwest is subject to various risks associated with the securities industry, particular those impacting the public finance industry.

Our financial advisory business, conducted primarily through First Southwest, is subject to uncertainties that are common in the securities industry. These uncertainties include:

| • | intense competition in the public finance and other sectors of the securities industry; |

| • | the volatility of domestic and international financial, bond and stock markets; |

| • | extensive governmental regulation; |

| • | litigation; and |

| • | substantial fluctuations in the volume and price level of securities. |

As a result, the revenues and earnings of our financial advisory segment may vary significantly from quarter to quarter and from year to year. In periods of low transaction volume such as in the current economic downturn, profitability is impaired because certain expenses remain relatively fixed. First Southwest is much smaller and has much less capital than many competitors in the securities industry. During the current market downturn, First Southwest’s business has been, and could continue to be, adversely affected in many ways. In addition, First Southwest is an operating subsidiary of the Bank, which means that its activities are limited to those that are permissible for the Bank.

14

Table of Contents

Index to Financial Statements

We are dependent on our management team, and the loss of our senior executive officers or other key employees could impair our relationship with customers and adversely affect our business and financial results.

Our success is dependent, to a large degree, upon the continued service and skills of our existing management team, including Messrs. Alan White, Allen Custard, Jerry Schaffner, Hill Feinberg and Ms. Roseanna McGill and other key employees with long-term customer relationships. Our business and growth strategies are built primarily upon our ability to retain employees with experience and business relationships within their respective segments. The loss of one or more of these key personnel could have an adverse impact on our business because of their skills, knowledge of the market, years of industry experience and the difficulty of finding qualified replacement personnel. In addition, we currently do not have non-competition agreements with certain members of management and other key employees. If any of these personnel were to leave and compete with us, our business, financial condition, results of operations and growth could suffer.

If we are not able to manage our growth effectively, our results of operations may be adversely affected.

Although our historical performance may not be indicative of our future performance, during the last five years, we have experienced significant and rapid growth and may continue to grow. Companies like us that experience rapid growth face various risks and difficulties, including:

| • | opening new branch offices of the Bank, First Southwest or PrimeLending or acquiring existing branches of other financial institutions; |

| • | attracting clients, borrowers and depositors to those locations; |

| • | attracting and retaining qualified management, bankers and other personnel to each of our three primary businesses; |

| • | maintaining adequate information and reporting systems within our organization; |

| • | maintaining asset quality and credit risk controls; |

| • | maintaining our cost controls; |

| • | maintaining adequate regulatory capital and obtaining regulatory approvals necessary for entry into new markets or establishing new branches, applications for which have recently been subject to increased regulatory scrutiny; |

| • | finding suitable acquisition candidates; and |

| • | identifying suitable geographic markets for expansion outside the Texaplex. |

As we continue to open new branches and offices or if management determines to acquire branches, offices or other banks, we expect to incur increased personnel, occupancy and other operating expenses. In the case of new Bank branches, we must absorb those higher expenses while we begin to generate new deposits and then redeploy those new deposits into attractively priced loans and other interest-earning assets. Based on our experience, it generally takes at least a year for new branches to achieve operational profitability, if ever. Similarly, in the case of new offices for PrimeLending or First Southwest, we may face periods of losses before these offices achieve operational profitability, if ever. Thus, our plans to establish additional branches and

15

Table of Contents

Index to Financial Statements

offices could depress our earnings in the short run, even if we efficiently execute our expansion strategy. Further, if we are not able to manage our growth effectively, our business, financial condition, results of operations and future prospects could be adversely affected and we may not be able to continue to implement our business strategy and successfully conduct our operations.

We only recently became a public reporting company, and the obligations associated with being a public reporting company will require significant resources and management attention, which may divert from our business operations.

We have only recently become a public reporting company, and the expenses of being a public reporting company, including compliance with periodic disclosure requirements and the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), are not reflected in our audited financial statements, and are not fully reflected in our unaudited interim financial statements. The Sarbanes-Oxley Act requires, among other things, our management to assess annually the effectiveness of our internal control over financial reporting and our independent registered public accounting firm to issue a report on our internal control over financial reporting beginning with our Annual Report on Form 10-K for the year ending December 31, 2010. As a result, we will incur significant legal, accounting and other expenses that we did not previously incur.

Furthermore, the need to establish and maintain the corporate infrastructure demanded of a public company may divert management’s attention from implementing our business and growth strategies, which could prevent us from improving our business, results of operations and financial condition. We have made, and will continue to make, changes to our internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations as a public company. However, the measures we take may not be sufficient to satisfy our obligations as a public company. In addition, we cannot predict or estimate the amount of additional costs that we may incur in order to comply with these requirements. We anticipate that these costs will materially increase our noninterest expenses.

We may not be able to remediate any future deficiencies in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, failure to achieve and maintain an effective internal control environment could have a material adverse effect on our business and stock price.

We may decide to make future acquisitions, which could dilute current shareholders’ ownership and expose us to additional risks.

We periodically evaluate opportunities to acquire financial services businesses, including other banks and/or branch or office locations. As a result, we may engage in negotiations or discussions that, if they were to result in a transaction, could have a material effect on our operating results and financial condition, including short and long-term liquidity. For example, we could issue additional shares of common stock in a purchase transaction, which could dilute current shareholders’ ownership interests. Acquisition activities could require us to use a substantial amount of cash, other liquid assets, and/or incur debt. In addition, if goodwill recorded in connection with our prior or potential future acquisitions were determined to be impaired, then we would be required to recognize a charge against our earnings, which could materially and adversely affect our results of operations during the period in which the impairment was recognized.

16

Table of Contents

Index to Financial Statements

These acquisition activities could involve a number of additional risks, including the risks of: (i) incurring time and expense associated with identifying and evaluating potential acquisitions and merger partners and negotiating potential transactions, resulting in management’s attention being diverted from the operation of our existing business; (ii) using inaccurate estimates and judgments to evaluate credit, operations, management and market risks with respect to the target institution or assets; (iii) failing to discover material factors when examining a potential acquisition during the due diligence period; (iv) incurring time and expense required to integrate the operations and personnel of the combined businesses, creating an adverse short-term effect on results of operations; and (v) losing key employees and customers as a result of an acquisition that is poorly received.

Financial markets are susceptible to disruptive events that may lead to little or no liquidity for auction rate bonds.

As of December 31, 2008, we held approximately $168.4 million face value of auction rate bonds backed by pools of student loans under the Federal Family Education Loan Program. These auction rate bonds were acquired in conjunction with our acquisition of First Southwest. Since December 31, 2008 and in conjunction with a settlement with the Financial Industry Regulatory Authority (“FINRA”) pursuant to a Letter of Acceptance, Waiver and Consent accepted on December 16, 2008 by FINRA (the “FINRA Settlement”), as of September 30, 2009, we had repurchased approximately $41.6 million in face value of certain auction rate bonds from current and former clients. The auction rate bonds are currently held in the Bank’s securities portfolio. In late 2007, the market for auction rate securities began experiencing disruptions through the failure of auctions for auction rate securities issued by leveraged closed-end funds, municipal governments, state instrumentalities and student loan companies backed by pools of student loans guaranteed by the U.S. Department of Education. Certain clients of First Southwest were adversely affected by the failures in this market, which resulted in limited options to liquidate holdings in these positions or to post these securities as collateral for loans. These conditions will likely continue until either these securities are restructured or refunded or a liquid secondary market re-emerges for these securities. The estimated fair value of our auction rate bonds as of September 30, 2009 was $174.0 million. To address a change in an interpretation of the regulatory requirements regarding the maximum allowed level of investments in certain securities, in June 2009 the Bank transferred auction rate bonds with a net carrying amount of $22.6 million from held to maturity to available for sale. The net carrying amount of the transferred securities included an unrealized loss of $0.2 million. If the Bank were forced to sell these securities, our results of operations could be adversely affected. The estimated fair value of these auction rate bonds may further decline and require write-downs and losses as additional market information is obtained or in the event the current market conditions continue or worsen, in which case, our results of operations would be adversely affected.

The accuracy of our financial statements and related disclosures could be affected if we are exposed to actual conditions different from the judgments, assumptions or estimates used in our critical accounting policies.

The preparation of financial statements and related disclosure in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires us to make judgments, assumptions and estimates that affect the amounts reported in our consolidated financial statements and accompanying notes. Our critical accounting policies, which are included in this prospectus, describe those significant accounting policies and methods used in the

17

Table of Contents

Index to Financial Statements

preparation of our consolidated financial statements that are considered “critical” by us because they require judgments, assumptions and estimates that materially impact our consolidated financial statements and related disclosures. As a result, if future events differ significantly from the judgments, assumptions and estimates in our critical accounting policies, such events or assumptions could have a material impact on our audited consolidated financial statements and related disclosures.

The FDIC and SIPC deposit insurance assessments that we are required to pay have recently increased and may materially increase in the future, which would have an adverse effect on our earnings.

As a member institution of the FDIC, we are required to pay semi-annual deposit insurance premium assessments to the FDIC. During the year ended December 31, 2008, we paid approximately $1.6 million in deposit insurance assessments. On September 29, 2009, the Board of Directors of the FDIC adopted a Notice of Proposed Rulemaking that would require FDIC-insured institutions, such as the Bank, to prepay on December 30, 2009 their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. In addition, the FDIC voted to adopt a uniform three-basis point increase in assessment rates effective on January 1, 2011, which increase would be reflected in our prepaid assessments. We expect that we may be required to prepay an estimated $14 million on December 30, 2009 for our fourth quarter of 2009 and all of 2010, 2011 and 2012 FDIC assessments. Our prepaid assessments would be subject to adjustment based upon our assessment base during the prepaid period.

In addition, First Southwest is a registered broker-dealer and a member of the Securities Investor Protection Corporation (“SIPC”) and is required to pay assessments. On March 2, 2009, the SIPC informed its members of an increase in assessments. The increase became effective on April 1, 2009. As a result of the increase, First Southwest expects to pay approximately $200,000 in SIPC assessments annually. The deposit insurance premium assessment and the SIPC assessment rates applicable to us will adversely impact our future earnings.

Economic stimulus legislation imposes certain executive compensation and corporate governance requirements that may adversely affect us and our business, including our ability to recruit and retain qualified employees, and by requiring reimbursement of disapproved executive compensation.

The EESA, as amended by the ARRA, includes extensive restrictions on our ability to pay retention awards, bonuses and other incentive compensation during the period in which we have any outstanding obligation arising under the Troubled Asset Relief Program (“TARP”) Capital Purchase Program. Many of the restrictions are not limited to our senior executives and cover other employees whose contributions to revenue and performance can be significant.

In addition, on June 15, 2009, the U.S. Treasury adopted and made effective an interim final rule (the “Interim Rule”), which implemented and further expanded the limitations and restrictions imposed on executive compensation and corporate governance by the TARP Capital Purchase Program and the EESA, as amended by the ARRA. Pursuant to the Interim Rule, the U.S. Treasury established the Office of the Special Master for TARP Executive Compensation (the “Special Master”). The Interim Rule authorizes the Special Master to review the compensation structures and payments of, and to independently issue advisory opinions to, those financial institutions that have participated in the TARP Capital Purchase Program with respect to compensation

18

Table of Contents

Index to Financial Statements

structures and payments made by those financial institutions during the period that the financial institution received financial assistance under TARP. If the Special Master finds that a TARP recipient’s compensation structure or the payments that it has made to its employees are inconsistent with the purposes of the EESA or TARP, or otherwise contrary to the public interest, the Special Master may negotiate with the TARP recipient and the subject employee for appropriate reimbursements to the TARP recipient or the federal government. Because we are participating in the TARP Capital Purchase Program, the Special Master may review our compensation structure and payments that we have made to our employees.

These provisions and any future rules issued by the U.S. Treasury could adversely affect our ability to attract and retain management capable and motivated sufficiently to manage and operate our business through difficult economic and market conditions, especially if we are competing for management talent against institutions that are not subject to the same restrictions. If we are unable to attract and retain qualified employees to manage and operate our business, we may not be able to successfully execute our business and growth strategies. These provisions could also adversely affect our business by requiring us or our employees to reimburse the federal government for any executive compensation that the Special Master finds inconsistent with the purposes of EESA or TARP, or otherwise contrary to the public interest. For more information, see the section entitled “Executive compensation—Compensation discussion and analysis—TARP Capital Purchase Program”.

A decline in the market for advisory services could adversely affect our business and results of operations.

First Southwest has historically earned a significant portion of its revenues from advisory fees paid to it by its clients, in large part upon the successful completion of the client’s transaction. Financial advisory revenues represented a majority of First Southwest’s net revenues for the nine months ended September 30, 2009. Unlike other investment banks, First Southwest earns most of its revenues from its advisory fees and, to a lesser extent, from other business activities such as underwriting. We expect that First Southwest’s reliance on advisory fees will continue for the foreseeable future, and a decline in advisory engagements or the market for advisory services generally would have an adverse effect on our business and results of operations.

An interruption in, or breach in security of, our information systems may result in a loss of customer business.

We rely heavily on communications and information systems to conduct our business. Any failure or interruption or breach in security of these systems could result in failures or disruptions in our customer relationship management, securities trading, general ledger, deposits, servicing or loan origination systems. If such failures or interruptions occur, we may not be able to adequately address them at all or in a timely fashion. The occurrence of any failures or interruptions could result in a loss of customer business, expose us to civil litigation and possible financial liability and could have a material adverse effect on our public relations, reputation, results of operations and financial condition.

We are subject to extensive regulation that could restrict our activities and impose financial requirements or limitations on the conduct of our business and limit our ability to receive dividends from our bank subsidiary.

We are subject to extensive federal and state regulation and supervision, including that of the Federal Reserve Board, the Texas Department of Banking, the FDIC, the SEC and FINRA. Banking

19

Table of Contents

Index to Financial Statements

regulations are primarily intended to protect depositors’ funds, federal deposit insurance funds and the banking system as a whole, not security holders. Likewise, regulations promulgated by FINRA are primarily intended to protect customers of broker-dealer businesses rather than security holders. These regulations affect our lending practices, capital structure, investment practices, dividend policy and growth, among other things. The U.S. Congress and federal regulatory agencies continually review banking and securities laws, regulations and policies for possible changes. It is likely that there will be significant changes to the banking and financial institutions regulatory regimes in the near future in light of the recent performance of, and government intervention in, the financial services sector. Changes to statutes, regulations or regulatory policies, including changes in interpretation or implementation of statutes, regulations or policies, could affect us in substantial and unpredictable ways. For instance, on June 17, 2009, President Barack Obama laid out a comprehensive regulatory reform plan aiming to modernize and protect the integrity of the U.S. financial system. Among other things, President Obama’s plan contemplates increased supervision and higher capital requirements for financial institutions. We cannot predict whether or in what form any proposed regulation or statute will be adopted or the extent to which our business may be affected by any new regulation or statute. Such changes could subject our business to additional costs, limit the types of financial services and products we may offer and increase the ability of non-banks to offer competing financial services and products, among other things. Failure to comply with laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties or reputational damage, which could have a material adverse effect on our business, financial condition and results of operations. While we have policies and procedures designed to prevent any such violations, there can be no assurance that such violations will not occur. See the section entitled “Government supervision and regulation”.