Document

false--01-31FY20182018-01-3110-K000008216635796857YesLarge Accelerated Filer1231707927RAVEN INDUSTRIES INCNoYes000.04212333110.100.200.100.200.102933000002014-05-012012-01-0657140000.520.520.521110000000010000000067060000671240000.100.10000072000114970008700003154000250001180006200055400038260002590000227800000001250000001250000004331620000129000440000P7YP3YP39YP15YP5YP5YP12YP3YP3YP5Y6610000P4Y3098400031332000

0000082166

2017-02-01

2018-01-31

0000082166

2017-07-31

0000082166

2018-03-16

0000082166

2018-01-31

0000082166

2017-01-31

0000082166

2016-02-01

2017-01-31

0000082166

2015-02-01

2016-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2015-02-01

2016-01-31

0000082166

us-gaap:ParentMember

2015-02-01

2016-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2016-02-01

2017-01-31

0000082166

us-gaap:TreasuryStockMember

2015-02-01

2016-01-31

0000082166

2015-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-01-31

0000082166

us-gaap:ParentMember

2017-02-01

2018-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-02-01

2017-01-31

0000082166

us-gaap:CommonStockMember

2017-02-01

2018-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2016-02-01

2017-01-31

0000082166

us-gaap:TreasuryStockMember

2016-01-31

0000082166

us-gaap:ParentMember

2016-02-01

2017-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2015-02-01

2016-01-31

0000082166

us-gaap:TreasuryStockMember

2015-01-31

0000082166

us-gaap:ParentMember

2017-01-31

0000082166

us-gaap:TreasuryStockMember

2017-02-01

2018-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2017-02-01

2018-01-31

0000082166

us-gaap:TreasuryStockMember

2018-01-31

0000082166

us-gaap:RetainedEarningsMember

2016-02-01

2017-01-31

0000082166

us-gaap:CommonStockMember

2015-02-01

2016-01-31

0000082166

us-gaap:RetainedEarningsMember

2018-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-02-01

2016-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2017-02-01

2018-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-02-01

2018-01-31

0000082166

us-gaap:TreasuryStockMember

2016-02-01

2017-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2018-01-31

0000082166

us-gaap:TreasuryStockMember

2017-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-01-31

0000082166

us-gaap:CommonStockMember

2018-01-31

0000082166

us-gaap:ParentMember

2016-01-31

0000082166

us-gaap:CommonStockMember

2016-02-01

2017-01-31

0000082166

us-gaap:RetainedEarningsMember

2015-02-01

2016-01-31

0000082166

us-gaap:CommonStockMember

2017-01-31

0000082166

us-gaap:ParentMember

2015-01-31

0000082166

us-gaap:CommonStockMember

2016-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2017-01-31

0000082166

us-gaap:ParentMember

2018-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-31

0000082166

us-gaap:CommonStockMember

2015-01-31

0000082166

us-gaap:RetainedEarningsMember

2017-02-01

2018-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2015-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2015-01-31

0000082166

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-31

0000082166

2016-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2018-01-31

0000082166

us-gaap:NoncontrollingInterestMember

2016-01-31

0000082166

us-gaap:RetainedEarningsMember

2016-01-31

0000082166

us-gaap:RetainedEarningsMember

2015-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2016-01-31

0000082166

us-gaap:RetainedEarningsMember

2017-01-31

0000082166

us-gaap:AdditionalPaidInCapitalMember

2017-01-31

0000082166

ravn:AgEagleAerialSystemsMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

ravn:AgEagleAerialSystemsMember

ravn:AppliedTechnologyMember

2018-01-31

0000082166

ravn:SstMember

ravn:AppliedTechnologyMember

2018-01-31

0000082166

us-gaap:MaximumMember

2017-02-01

2018-01-31

0000082166

ravn:AerostarIntegratedSystemsMember

2018-01-31

0000082166

us-gaap:MinimumMember

2017-02-01

2018-01-31

0000082166

ravn:SstMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

us-gaap:MinimumMember

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

us-gaap:MinimumMember

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

us-gaap:BuildingAndBuildingImprovementsMember

us-gaap:MaximumMember

2017-02-01

2018-01-31

0000082166

ravn:FurnitureFixturesOfficeEquipmentAndOtherMember

us-gaap:MinimumMember

2017-02-01

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

us-gaap:MaximumMember

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

ravn:FurnitureFixturesOfficeEquipmentAndOtherMember

us-gaap:MaximumMember

2017-02-01

2018-01-31

0000082166

us-gaap:BuildingAndBuildingImprovementsMember

us-gaap:MinimumMember

2017-02-01

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

us-gaap:MinimumMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

us-gaap:MaximumMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

us-gaap:MaximumMember

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

ravn:PropertyplantandequipmentOwnedMember

2018-01-31

0000082166

us-gaap:AssetsHeldUnderCapitalLeasesMember

2018-01-31

0000082166

us-gaap:AssetsHeldUnderCapitalLeasesMember

2017-01-31

0000082166

us-gaap:BuildingAndBuildingImprovementsMember

2018-01-31

0000082166

ravn:AssetsownedorheldundercapitalleaseMember

2017-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

2017-01-31

0000082166

ravn:PropertyplantandequipmentOwnedMember

2017-01-31

0000082166

us-gaap:LandMember

2018-01-31

0000082166

us-gaap:MachineryAndEquipmentMember

2018-01-31

0000082166

us-gaap:LandMember

2017-01-31

0000082166

us-gaap:BuildingAndBuildingImprovementsMember

2017-01-31

0000082166

ravn:AssetsownedorheldundercapitalleaseMember

2018-01-31

0000082166

ravn:ClientprivateproductassetsMember

ravn:AerostarMember

2018-01-31

0000082166

ravn:AllSegmentsMember

2017-01-31

0000082166

us-gaap:OperatingIncomeLossMember

ravn:ClientprivateproductassetsMember

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

us-gaap:AccumulatedTranslationAdjustmentMember

2017-02-01

2018-01-31

0000082166

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-02-01

2017-01-31

0000082166

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2017-02-01

2018-01-31

0000082166

us-gaap:AccumulatedTranslationAdjustmentMember

2016-02-01

2017-01-31

0000082166

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-31

0000082166

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2017-01-31

0000082166

us-gaap:AccumulatedTranslationAdjustmentMember

2016-01-31

0000082166

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-01-31

0000082166

us-gaap:AccumulatedTranslationAdjustmentMember

2017-01-31

0000082166

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-01-31

0000082166

ravn:AllEquityMethodInvestmentsMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

ravn:AllEquityMethodInvestmentsMember

ravn:AppliedTechnologyMember

2016-01-31

0000082166

ravn:AllEquityMethodInvestmentsMember

ravn:AppliedTechnologyMember

2016-02-01

2017-01-31

0000082166

ravn:AllEquityMethodInvestmentsMember

ravn:AppliedTechnologyMember

2018-01-31

0000082166

ravn:AllEquityMethodInvestmentsMember

ravn:AppliedTechnologyMember

2017-01-31

0000082166

ravn:VistaResearchMember

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

ravn:CLIMember

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

ravn:SBGInnovatiieandaffiliateMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

ravn:CLIMember

ravn:EngineeredFilmsMember

2017-09-01

2017-09-01

0000082166

ravn:SBGInnovatiieandaffiliateMember

ravn:AppliedTechnologyMember

2018-01-31

0000082166

ravn:AppliedTechnologyMember

2018-01-31

0000082166

ravn:CLIMember

ravn:EngineeredFilmsMember

2017-09-01

0000082166

ravn:CLIMember

ravn:CustomerRelationshipsandCustomerContractsMember

ravn:EngineeredFilmsMember

2017-09-01

0000082166

ravn:CLIMember

ravn:EngineeredFilmsMember

2018-01-31

0000082166

ravn:VistaResearchMember

ravn:AerostarMember

2018-01-31

0000082166

ravn:AppliedTechnologyMember

2017-01-31

0000082166

us-gaap:CustomerRelationshipsMember

2017-01-31

0000082166

us-gaap:CustomerRelationshipsMember

2018-01-31

0000082166

us-gaap:PatentedTechnologyMember

2017-01-31

0000082166

us-gaap:PatentedTechnologyMember

2018-01-31

0000082166

ravn:ExistingTechnologyMember

2017-01-31

0000082166

ravn:ExistingTechnologyMember

2018-01-31

0000082166

us-gaap:OperatingIncomeLossMember

2016-02-01

2017-01-31

0000082166

us-gaap:CostOfSalesMember

2017-02-01

2018-01-31

0000082166

ravn:VistaReportingUnitMember

2015-10-31

0000082166

ravn:AerostarMember

2016-10-31

0000082166

us-gaap:OperatingIncomeLossMember

ravn:VistaReportingUnitMember

2015-08-01

2015-10-31

0000082166

us-gaap:PropertyPlantAndEquipmentMember

ravn:VistaReportingUnitMember

2015-08-01

2015-10-31

0000082166

us-gaap:CostOfSalesMember

ravn:RadarInventoryMember

ravn:AerostarMember

2016-08-01

2016-10-31

0000082166

ravn:RadarTechnologyandRadarCustomersMember

ravn:AerostarMember

2016-10-31

0000082166

2016-02-01

2016-04-30

0000082166

us-gaap:CustomerRelatedIntangibleAssetsMember

us-gaap:OperatingIncomeLossMember

ravn:AgEagleAerialSystemsMember

ravn:AppliedTechnologyMember

2017-02-01

2017-04-30

0000082166

us-gaap:PatentedTechnologyMember

ravn:AerostarMember

2016-08-01

2016-10-31

0000082166

us-gaap:OperatingIncomeLossMember

2017-02-01

2018-01-31

0000082166

us-gaap:CostOfSalesMember

ravn:VistaResearchMember

2015-08-01

2015-10-31

0000082166

ravn:LighterthanAirassetgroupMember

ravn:AerostarMember

2016-10-31

0000082166

us-gaap:OtherNonoperatingIncomeExpenseMember

ravn:AgEagleAerialSystemsMember

ravn:AppliedTechnologyMember

2017-02-01

2017-04-30

0000082166

ravn:RadarTechnologyandRadarCustomersMember

us-gaap:OperatingIncomeLossMember

ravn:AerostarMember

2016-08-01

2016-10-31

0000082166

ravn:VistaReportingUnitMember

2015-08-01

2015-10-31

0000082166

us-gaap:CostOfSalesMember

ravn:VistaResearchMember

2015-05-01

2015-07-31

0000082166

us-gaap:PatentedTechnologyMember

ravn:VistaReportingUnitMember

2015-11-01

2016-01-31

0000082166

ravn:AerostarMember

2018-01-31

0000082166

us-gaap:PatentedTechnologyMember

ravn:VistaReportingUnitMember

2015-08-01

2015-10-31

0000082166

us-gaap:PropertyPlantAndEquipmentMember

ravn:AerostarMember

2016-08-01

2016-10-31

0000082166

ravn:RadarTechnologyandRadarCustomersMember

ravn:VistaReportingUnitMember

2015-08-01

2015-10-31

0000082166

ravn:EngineeredFilmsMember

2017-01-31

0000082166

ravn:AerostarMember

2017-01-31

0000082166

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

ravn:EngineeredFilmsMember

2018-01-31

0000082166

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

ravn:EngineeredFilmsMember

2016-02-01

2017-01-31

0000082166

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

ravn:AppliedTechnologyMember

2016-02-01

2017-01-31

0000082166

ravn:EngineeredFilmsMember

2016-01-31

0000082166

ravn:AppliedTechnologyMember

2016-01-31

0000082166

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

ravn:AerostarMember

2016-01-31

0000082166

us-gaap:PatentedTechnologyMember

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

us-gaap:CostOfSalesMember

2015-02-01

2016-01-31

0000082166

ravn:VistaReportingUnitMember

2016-02-01

2017-01-31

0000082166

us-gaap:PropertyPlantAndEquipmentMember

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

ravn:RadarTechnologyandRadarCustomersMember

us-gaap:OperatingIncomeLossMember

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

us-gaap:PatentedTechnologyMember

ravn:VistaReportingUnitMember

2016-02-01

2017-01-31

0000082166

ravn:RadarTechnologyandRadarCustomersMember

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

us-gaap:CustomerRelatedIntangibleAssetsMember

us-gaap:OperatingIncomeLossMember

ravn:AgEagleAerialSystemsMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

us-gaap:CostOfSalesMember

2016-02-01

2017-01-31

0000082166

us-gaap:OtherNonoperatingIncomeExpenseMember

ravn:AgEagleAerialSystemsMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

ravn:RadarTechnologyandRadarCustomersMember

ravn:VistaReportingUnitMember

2016-02-01

2017-01-31

0000082166

us-gaap:PropertyPlantAndEquipmentMember

ravn:VistaReportingUnitMember

2016-02-01

2017-01-31

0000082166

us-gaap:OperatingIncomeLossMember

2015-02-01

2016-01-31

0000082166

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2018-01-31

0000082166

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2017-02-01

2018-01-31

0000082166

us-gaap:MaximumMember

2018-01-31

0000082166

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2016-02-01

2017-01-31

0000082166

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2017-01-31

0000082166

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2016-01-31

0000082166

us-gaap:MaximumMember

2017-01-31

0000082166

us-gaap:MaximumMember

2016-01-31

0000082166

country:CA

2017-02-01

2018-01-31

0000082166

country:US

2017-02-01

2018-01-31

0000082166

country:CA

2018-01-31

0000082166

ravn:JPMorganChaseandWellsFargoMember

2018-01-31

0000082166

ravn:JPMorganChaseandWellsFargoMember

2017-01-31

0000082166

ravn:JPMorganChaseBankMember

2017-01-31

0000082166

ravn:JPMorganChaseBankMember

2018-01-31

0000082166

ravn:JPMorganChaseBankMember

2017-02-01

2018-01-31

0000082166

ravn:JPMorganChaseBankMember

2016-02-01

2017-01-31

0000082166

ravn:JPMorganChaseBankMember

2015-02-01

2016-01-31

0000082166

ravn:JPMorganChaseBankMember

2016-01-31

0000082166

ravn:VistaResearchMember

2015-02-01

2016-01-31

0000082166

us-gaap:ResearchAndDevelopmentExpenseMember

ravn:VistaResearchMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AppliedTechnologyMember

2015-02-01

2016-01-31

0000082166

us-gaap:CostOfSalesMember

ravn:AppliedTechnologyMember

2015-02-01

2016-01-31

0000082166

us-gaap:SellingGeneralAndAdministrativeExpensesMember

ravn:AppliedTechnologyMember

2015-02-01

2016-01-31

0000082166

ravn:AppliedTechnologyMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AppliedTechnologyMember

2016-02-01

2017-01-31

0000082166

us-gaap:CostOfSalesMember

ravn:VistaResearchMember

2015-02-01

2016-01-31

0000082166

ravn:TimeVestedUnitsMember

ravn:A2010StockIncentivePlanMember

2018-01-31

0000082166

ravn:TimeVestedUnitsMember

ravn:A2010StockIncentivePlanMember

2017-02-01

2018-01-31

0000082166

ravn:TimeVestedUnitsMember

ravn:A2010StockIncentivePlanMember

2017-01-31

0000082166

us-gaap:DirectorMember

2017-02-01

2018-01-31

0000082166

us-gaap:DirectorMember

2017-01-31

0000082166

us-gaap:DirectorMember

2018-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

2017-02-01

2018-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

2017-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

2018-01-31

0000082166

ravn:TimeVestedUnitsMember

ravn:A2010StockIncentivePlanMember

2015-02-01

2016-01-31

0000082166

ravn:TimeVestedUnitsMember

ravn:A2010StockIncentivePlanMember

2016-02-01

2017-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

2016-02-01

2017-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

2015-02-01

2016-01-31

0000082166

us-gaap:RestrictedStockUnitsRSUMember

2015-02-01

2016-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

us-gaap:MaximumMember

2017-02-01

2018-01-31

0000082166

us-gaap:RestrictedStockUnitsRSUMember

2018-01-31

0000082166

us-gaap:RestrictedStockUnitsRSUMember

2017-02-01

2018-01-31

0000082166

us-gaap:RestrictedStockUnitsRSUMember

2016-02-01

2017-01-31

0000082166

ravn:A2010StockIncentivePlanMember

2012-05-22

0000082166

ravn:A2010StockIncentivePlanMember

2017-02-01

2018-01-31

0000082166

ravn:PerformanceBasedRestrictedStockUnitsMember

ravn:A2010StockIncentivePlanMember

us-gaap:MinimumMember

2017-02-01

2018-01-31

0000082166

ravn:A2010StockIncentivePlanMember

2018-01-31

0000082166

ravn:CorporateOtherMember

2017-02-01

2018-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

ravn:CorporateOtherMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AerostarMember

2017-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

us-gaap:OperatingSegmentsMember

2017-02-01

2018-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

2016-02-01

2017-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AerostarMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AerostarMember

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:EngineeredFilmsMember

2016-02-01

2017-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:AerostarMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AppliedTechnologyMember

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:AppliedTechnologyMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AerostarMember

2018-01-31

0000082166

ravn:CorporateOtherMember

2016-02-01

2017-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:EngineeredFilmsMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

2016-02-01

2017-01-31

0000082166

us-gaap:IntersegmentEliminationMember

2017-02-01

2018-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:EngineeredFilmsMember

2016-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:AerostarMember

2017-02-01

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

2017-01-31

0000082166

us-gaap:OperatingSegmentsMember

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:EngineeredFilmsMember

2016-02-01

2017-01-31

0000082166

ravn:CorporateOtherMember

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

ravn:CorporateOtherMember

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AppliedTechnologyMember

2016-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:EngineeredFilmsMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:AppliedTechnologyMember

2017-01-31

0000082166

ravn:CorporateOtherMember

2017-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:AerostarMember

2016-02-01

2017-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:AppliedTechnologyMember

2016-02-01

2017-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:EngineeredFilmsMember

2017-01-31

0000082166

us-gaap:IntersegmentEliminationMember

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

2017-01-31

0000082166

us-gaap:IntersegmentEliminationMember

ravn:AppliedTechnologyMember

2017-02-01

2018-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:EngineeredFilmsMember

2018-01-31

0000082166

us-gaap:IntersegmentEliminationMember

2016-01-31

0000082166

us-gaap:OperatingSegmentsMember

ravn:VistaReportingUnitMember

2015-02-01

2016-01-31

0000082166

us-gaap:CostOfSalesMember

ravn:RadarInventoryMember

ravn:VistaResearchMember

2016-02-01

2017-01-31

0000082166

ravn:HurricaneRecoveryFilmMember

ravn:EngineeredFilmsMember

2017-02-01

2018-01-31

0000082166

ravn:VistaReportingUnitMember

2015-02-01

2016-01-31

0000082166

ravn:OneCustomerMember

2017-02-01

2018-01-31

0000082166

ravn:VistaResearchMember

us-gaap:CostOfSalesMember

2015-02-01

2016-01-31

0000082166

us-gaap:OperatingIncomeLossMember

ravn:VistaReportingUnitMember

2015-02-01

2016-01-31

0000082166

country:US

2016-02-01

2017-01-31

0000082166

us-gaap:LatinAmericaMember

2016-02-01

2017-01-31

0000082166

country:CA

2015-02-01

2016-01-31

0000082166

ravn:OtherforeignsalesMember

2016-02-01

2017-01-31

0000082166

us-gaap:LatinAmericaMember

2017-02-01

2018-01-31

0000082166

us-gaap:LatinAmericaMember

2015-02-01

2016-01-31

0000082166

ravn:OtherforeignsalesMember

2017-02-01

2018-01-31

0000082166

country:US

2015-02-01

2016-01-31

0000082166

us-gaap:AsiaMember

2016-02-01

2017-01-31

0000082166

ravn:OtherforeignsalesMember

2015-02-01

2016-01-31

0000082166

ravn:AllforeignMember

2015-02-01

2016-01-31

0000082166

ravn:AllforeignMember

2017-02-01

2018-01-31

0000082166

us-gaap:AsiaMember

2017-02-01

2018-01-31

0000082166

us-gaap:EuropeMember

2015-02-01

2016-01-31

0000082166

ravn:AllforeignMember

2016-02-01

2017-01-31

0000082166

us-gaap:EuropeMember

2017-02-01

2018-01-31

0000082166

country:CA

2016-02-01

2017-01-31

0000082166

us-gaap:AsiaMember

2015-02-01

2016-01-31

0000082166

us-gaap:EuropeMember

2016-02-01

2017-01-31

0000082166

ravn:OneCustomerMember

2016-02-01

2017-01-31

0000082166

ravn:OneCustomerMember

2015-02-01

2016-01-31

0000082166

us-gaap:SubsequentEventMember

2018-02-05

2018-02-05

0000082166

ravn:SstMember

ravn:AppliedTechnologyMember

us-gaap:SubsequentEventMember

2018-02-05

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2016-02-01

2017-01-31

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2017-02-01

2018-01-31

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2017-01-31

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2015-01-31

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2016-01-31

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2015-02-01

2016-01-31

0000082166

us-gaap:AllowanceForDoubtfulAccountsMember

2018-01-31

ravn:Divisions

xbrli:shares

iso4217:USD

ravn:ReportingUnits

ravn:contribution_plan

iso4217:USD

xbrli:shares

xbrli:pure

ravn:investments

ravn:customer

ravn:Plans

ravn:Director

ravn:percentagepoints

ravn:Award

|

| | |

| | |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM 10-K |

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2018 |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission File Number: 001-07982 |

RAVEN INDUSTRIES, INC. |

(Exact name of registrant as specified in its charter) |

|

| | | | |

| South Dakota | | 46-0246171 | |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) | |

| 205 E. 6th Street, P.O. Box 5107, Sioux Falls, SD | | 57117- 5107 | |

| (Address of principal executive offices) | | (Zip Code) | |

| Registrant's telephone number including area code (605) 336-2750 | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class: | | Name of each exchange on which registered | |

| Common Stock, $1 par value | | The NASDAQ Stock Market | |

Securities registered pursuant to Section 12(g) of the Act: None |

| | | | |

|

| | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | þ | Yes | o | No |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | o | Yes | þ | No |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ | Yes | o | No |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | þ | Yes | o | No |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | þ | | | |

|

| | | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer | þ | | | Accelerated filer | o |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o |

| | Emerging growth company | o |

|

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | o | Yes | þ | No |

|

| | | | |

The aggregate market value of the registrant's common stock held by non-affiliates at July 31, 2017 was approximately $1,231,707,927. The aggregate market value was computed by reference to the closing price as reported on the NASDAQ Global Select Market, $34.40, on July 31, 2017, which was as of the last business day of the registrant's most recently completed second fiscal quarter. The number of shares outstanding on March 16, 2018 was 35,796,857. |

DOCUMENTS INCORPORATED BY REFERENCE |

The definitive proxy statement relating to the registrant's Annual Meeting of Shareholders, to be held May 22, 2018, is incorporated by reference into Part III to the extent described therein. |

| | | | |

|

| | | |

PART I | | |

Item 1. | BUSINESS | | |

Item 1A. | RISK FACTORS | | |

Item 1B. | UNRESOLVED STAFF COMMENTS | | |

Item 2. | PROPERTIES | | |

Item 3. | LEGAL PROCEEDINGS | | |

Item 4. | MINE SAFETY DISCLOSURES | | |

| | | |

PART II | | |

Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES | | |

| Quarterly Information | | |

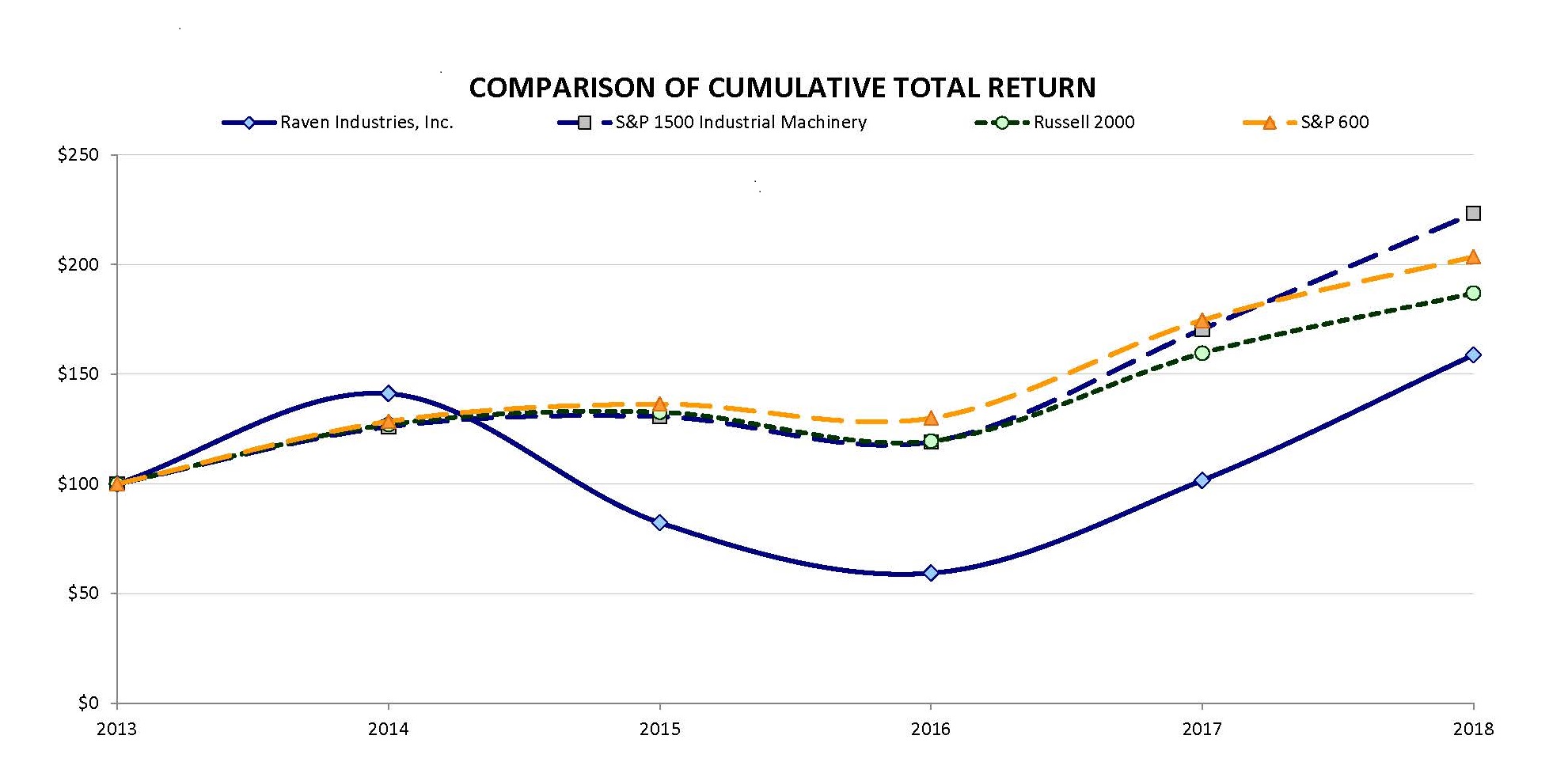

| Stock Performance | | |

Item 6. | SELECTED FINANCIAL DATA | | |

| Five-year Financial Summary | | |

Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| Executive Summary | | |

| Results of Operations - Segment Analysis | | |

| Liquidity and Capital Resources | | |

| Off-Balance Sheet Arrangements and Contractual Obligations | | |

| Critical Accounting Policies and Estimates | | |

| Accounting Pronouncements | | |

| Forward-Looking Statements | | |

Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | |

Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | |

| Management's Report on Internal Control Over Financial Reporting | | |

| Report of Independent Registered Public Accounting Firm - Deloitte & Touche LLP | | |

| Report of Independent Registered Public Accounting Firm - PricewaterhouseCoopers LLP | | |

| Consolidated Balance Sheets | | |

| Consolidated Statements of Income and Comprehensive Income | | |

| Consolidated Statements of Shareholders' Equity | | |

| Consolidated Statements of Cash Flows | | |

| Notes to Consolidated Financial Statements | | |

Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | | |

Item 9A. | CONTROLS AND PROCEDURES | | |

Item 9B. | OTHER INFORMATION | | |

| | | |

PART III | | |

Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | | |

Item 11. | EXECUTIVE COMPENSATION | | |

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS | | |

Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | | |

Item 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | | |

| | | |

PART IV | | |

Item 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULE | | |

Item 16. | 10-K SUMMARY | | |

INDEX TO EXHIBITS | | |

SIGNATURES | | |

SCHEDULE II | | |

Raven Industries, Inc. (the Company or Raven) was incorporated in February 1956 under the laws of the State of South Dakota and began operations later that same year. The Company is a diversified technology company providing a variety of products to customers within the industrial, agricultural, geomembrane, construction, and aerospace/defense markets. The Company markets its products around the world and has its principal operations in the United States of America. Raven began operations as a manufacturer of high-altitude research balloons before diversifying into product lines that extended from technologies and production methods of this original balloon business. The Company employs 1,157 people and is headquartered at 205 E. 6th Street, Sioux Falls, SD 57104 - telephone (605) 336-2750. The Company's Internet address is http://www.ravenind.com and its common stock trades on the NASDAQ Global Select Market under the ticker symbol RAVN. The Company has adopted a Code of Conduct applicable to all officers, directors and employees, which is available on its website. Information on the Company's website is not part of this filing.

We make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports available, free of charge, in the “Investor Relations” section of our Internet website as soon as reasonably practicable after we electronically file these materials with, or furnish these materials to, the Securities and Exchange Commission (SEC). Information on or connected to our website is neither part of, nor incorporated by reference into, this Form 10-K or any other report filed with or furnished to the SEC.

You may also read or copy any materials that we file with the SEC at its Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You may obtain additional information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, you will find these materials on the SEC Internet site at www.sec.gov. This site contains reports, proxy statements and other information regarding issuers that file electronically with the SEC.

This Annual Report on Form 10-K (Form 10-K) contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Form 10-K are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations and other important information about forward-looking statements are disclosed under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations, Forward-Looking Statements” in this Form 10-K.

BUSINESS SEGMENTS

The Company has three unique operating units, or divisions, that are also its reportable segments: Applied Technology Division (Applied Technology), Engineered Films Division (Engineered Films), and Aerostar Division (Aerostar). Product lines have been generally grouped in these segments based on technology, manufacturing processes, and end-use application; however, a business segment may serve more than one of the product markets identified above. The Company measures the profitability performance of its segments primarily based on their operating income excluding general and administrative expenses. Other expense and income taxes are not allocated to individual operating segments, and assets not identifiable to an individual segment are included as corporate assets. Segment information is reported consistent with the Company's management reporting structure.

|

| |

Business segment financial information is found on the following pages of this Form 10-K: |

| Results of Operations – Segment Analysis |

| Note 16 Business Segments and Major Customer Information |

Applied Technology

Applied Technology designs, manufactures, sells, and services innovative precision agriculture products and information management tools that help growers reduce costs, more precisely control inputs, and improve farm yields. The Applied Technology product families include field computers, application controls, GPS-guidance steering systems, automatic boom controls, injection systems, and planter and seeder controls. Applied Technology's services include high-speed in-field Internet connectivity and cloud-based data management. The Company's investment in the continued build-out of the Slingshot™ platform has also

positioned Applied Technology as an information platform that improves decision-making and achieves business efficiencies for its agriculture retail partners.

Applied Technology sells its precision agriculture control products to both original equipment manufacturers (OEMs) and through aftermarket distribution partners in the United States and in most major agricultural areas around the world. The Company's competitive advantage in this segment is designing and selling easy to use, reliable, and innovative value-added products that are supported by an industry-leading service and support team.

Engineered Films

Engineered Films produces high-performance plastic films and sheeting for geomembrane, agricultural, construction, and industrial applications. Engineered Films acquired the assets of Colorado Lining International, Inc. (CLI) in September 2017. This acquisition enhanced the division's geomembrane market position through extended service and product offerings with the addition of new design-build and installation service components. The acquisition of CLI advanced Engineered Films’ business model into a vertically-integrated, full-service solutions provider for the geomembrane market.

Engineered Films sells both direct to end-customers and through independent third-party distributors. The majority of product sold into the construction and agriculture markets is through distributors, while sales into the geomembrane and industrial markets are more direct in nature. The Company extrudes a significant portion of the film converted for its commercial products and believes it is one of the largest sheeting converters in the United States in the markets it serves. Engineered Films' ability to extrude and convert films, along with offering installation services for its geomembrane products, allows it to provide a more customized solution to customers. A number of film manufacturers compete with the Company on both price and product availability. Engineered Films is the Company's most capital-intensive business segment, and historically has made sizable investments in new extrusion capacity and conversion equipment. This segment's capital expenditures were $8.1 million in fiscal 2018, $2.8 million in fiscal 2017, and $10.8 million in fiscal 2016.

Aerostar

Aerostar serves the aerospace/defense, radar and lighter-than-air markets. Aerostar's primary products include high-altitude (stratospheric or lighter-than-air) balloons, tethered aerostats, and radar systems. These products can be integrated with additional third-party sensors to provide research, communications, and situational awareness capabilities to governmental and commercial customers. Aerostar’s growth strategy emphasizes the design and manufacture of proprietary products in these markets. Aerostar also pursues product and support services contracts with agencies and instrumentalities of the U.S. government as well as sales of advanced radar systems and aerostats in international markets. In previous years, Aerostar also provided contract manufacturing services. The Company largely exited this business and the planned reduction of contract manufacturing activities was completed in fiscal 2016.

Aerostar sells to government agencies as both a prime contractor and subcontractor, and to commercial users primarily as a sub-contractor. Further, sales to government agencies often involve large contracts subject to frequent delays because of budget uncertainties, and protracted negotiation processes. The timing and size of contract wins can create volatility in Aerostar’s results.

OUTLOOK

The Company is very pleased with the performance achieved by all three operating divisions throughout fiscal 2018. All three divisions achieved double-digit sales growth and the Company believes it is well positioned for the year ahead.

In fiscal 2018 Applied Technology achieved strong results in the face of challenging agricultural market conditions. The Company expects to continue to drive growth and will continue to strategically fund several long-term investments. Subsequent to the end of the fourth quarter, the division launched a strategic initiative to grow its local presence in Brazil and drive organic growth in Latin America, in order to better capitalize on one of the largest agricultural markets in the world.

Engineered Films demonstrated impressive operational discipline and sustained high plant utilization throughout fiscal 2018. The division grew sales by approximately $75 million year-over-year, and prior investments in acquisitions and manufacturing capacity drove strong growth in every market served. The division continues to see opportunities for growth and is investing in additional capacity in fiscal 2019. As for hurricane recovery efforts, the delivery of hurricane recovery film will result in sales of approximately $9 million in the first quarter and then return to significantly reduced levels consistent with prior years.

During the year, Aerostar improved its financial performance and achieved more consistency and stability in its results. The division continues to sharpen its focus on the stratospheric balloon platform, and has divested of a few non-strategic portions of its business during and subsequent to the end of fiscal 2018. Strong performance on existing programs is driving confidence for continued growth with Aerostar’s stratospheric balloon platform.

Overall, the Company is well positioned as it enters fiscal 2019 because of the actions taken and investments made to preserve and strengthen our core business. Furthermore, the Company is evaluating strategic acquisitions and will continue to invest in additional manufacturing capacity and technology development to enhance its core product lines. The Company's goal remains to generate 10 percent annualized earnings growth over the long-term, excluding unusual and generally non-recurring items.

MAJOR CUSTOMER INFORMATION

No customers accounted for 10% or more of consolidated sales in fiscal years 2018, 2017, or 2016.

SEASONAL WORKING CAPITAL REQUIREMENTS

Some seasonal demand exists in both the Applied Technology and Engineered Films divisions, primarily due to their respective exposure to the agricultural market. However, given the overall diversification of the Company, the seasonal fluctuations in net working capital (accounts receivable, net plus inventories less accounts payable) are not usually significant.

FINANCIAL INSTRUMENTS

The principal financial instruments that the Company maintains are cash, cash equivalents, short-term investments, accounts receivable, accounts payable, accrued liabilities, and acquisition-related contingent payments. The Company manages the interest rate, credit, and market risks associated with these accounts through periodic reviews of the carrying value of assets and liabilities and establishment of appropriate allowances in accordance with Company policies. The Company does not use off-balance sheet financing, except to enter into operating leases.

The Company does not enter into derivatives or other financial instruments for trading or speculative purposes. The Company uses derivative financial instruments to manage foreign currency balance sheet risk. The use of these financial instruments has had no material effect on consolidated results of operations, financial condition, or cash flows.

RAW MATERIALS

The Company obtains a wide variety of materials from numerous vendors. Principal materials include electronic components for Applied Technology and Aerostar, various polymeric resins for Engineered Films, and fabrics and film for Aerostar. Engineered Films has experienced volatile resin prices over the past three years. Price increases could not always be passed on to customers due to weak demand and/or a competitive pricing environment. Predicting future material volatility and the related potential impact on the Company is not easily estimated and the Company is unable to do so to the degree required to build reliance on such forecasts.

PATENTS

The Company owns a number of patents. The Company does not believe that its business, as a whole, is materially dependent on any one patent or related group of patents. The Company focuses significant research and development effort to develop technology-based offerings. As such, the protection of the Company’s intellectual property is an important strategic objective. Along with an aggressive posture toward patenting new technology and protecting trade secrets, the Company has restrictions on the disclosure of our technology to industry and business partners to ensure that our intellectual property is maintained and protected.

RESEARCH AND DEVELOPMENT

The three business segments conduct ongoing research and development (R&D) efforts to improve their product offerings and develop new products. Most of the Company's R&D expenditures are directed toward new product development. R&D investment is particularly strong within the Applied Technology Division. Development of new technology and product enhancements within Applied Technology is a competitive differentiator and central to its long-term strategy. Engineered Films also utilizes R&D spending to develop new products and to value engineer and reformulate its products. These R&D investments deliver high-value film solutions to the markets it serves and also result in lower raw material costs and improved quality for existing product lines. Aerostar's investment in the development of new technology has a particular emphasis on its core stratospheric balloon platform. The Company's total R&D costs are presented in the Consolidated Statements of Income and Comprehensive Income.

ENVIRONMENTAL MATTERS

The Company believes that, in all material respects, it is in compliance with applicable federal, state and local environmental laws and regulations. Expenditures incurred in the past relating to compliance for operating facilities have not significantly affected the Company's capital expenditures, earnings, or competitive position. The Company is unaware of any potential liabilities as of January 31, 2018 for any environmental matters that would have a material effect on the Company's results of operations, financial position, or cash flows.

BACKLOG

As of February 1, 2018, the Company's order backlog totaled approximately $40.3 million. Backlog amounts as of February 1, 2017 and 2016 were $25.7 million and $18.6 million, respectively. Because the length of time between order and shipment varies considerably by business segment and customers can change delivery schedules or potentially cancel orders, the Company does not believe that backlog, as of any particular date, is necessarily indicative of actual net sales for any future period.

EMPLOYEES

As of January 31, 2018, the Company had 1,157 employees (including temporary workers). Following is a summary of active employees by segment: Applied Technology - 394; Engineered Films - 471; Aerostar - 195; and Corporate Services - 97. Management believes its relationship with its employees is good.

|

| | |

EXECUTIVE OFFICERS | | |

| | |

Name, Age, and Position | | Biographical Data |

Daniel A. Rykhus, 53 | | Mr. Rykhus became the Company's President and Chief Executive Officer in 2010. He joined the Company in 1990 as Director of World Class Manufacturing, was General Manager of the Applied Technology Division from1998 through 2009, and served as Executive Vice President from 2004 through 2010. |

President and Chief Executive Officer | |

| |

| | |

Steven E. Brazones, 44 | | Mr. Brazones joined the Company in December 2014 as its Vice President, Chief Financial Officer, and Treasurer. From 2002 to 2014, Mr. Brazones held a variety of positions with H.B. Fuller Company. Most recently, he served as H.B. Fuller's Americas Region Finance Director. Previously, he served as the Assistant Treasurer and the Director of Investor Relations. Prior to his tenure with H.B. Fuller, Mr. Brazones held various roles at Northwestern Growth. |

Vice President and Chief Financial Officer | |

| |

| |

| | |

Lee A. Magnuson, 62 | | Mr. Magnuson joined the Company in June 2017, as Vice President and General Counsel and also became the Company's Secretary in August 2017. Prior to joining the Company, Mr. Magnuson was managing partner of Lindquist and Vennum Law Firm's Sioux Falls, SD office for 5 years, practicing in the areas of commercial transactions, mergers and acquisitions, corporate matters, real estate and regulatory matters. |

General Counsel and Vice President | |

| |

| | |

Janet L. Matthiesen, 60 | | Ms. Matthiesen joined the Company in 2010 as Director of Administration and has been the Company's Vice President of Human Resources since 2012. Prior to joining Raven, Ms. Matthiesen was a Human Resource Manager at Science Applications International Corporation from 2002 to 2010.

|

Vice President of Human Resources | |

| |

| | |

Brian E. Meyer, 55 | | Mr. Meyer was named Division Vice President and General Manager of the Applied Technology Division in May 2015. He joined the Company in 2010 as Chief Information Officer. Prior to joining the Company, Mr. Meyer was an information and technology executive in the health insurance industry and vice president of systems development in the property and casualty insurance industry.

|

Division Vice President and General Manager - Applied Technology Division | |

| |

| | |

Anthony D. Schmidt, 46 | | Mr. Schmidt was named Division Vice President and General Manager of the Engineered Films Division in 2012. He joined the Company in 1995 in the Applied Technology Division performing various leadership roles within manufacturing and engineering. He transitioned to Engineered Films Division in 2011 as Manufacturing Manager. |

Division Vice President and General Manager - Engineered Films Division | |

| |

| | |

Scott W. Wickersham, 44 | | Mr. Wickersham was named Division Vice President and General Manager of the Aerostar Division in January 2018. He joined the Company in 2010 as the Director of Product Development and Engineering Manager and has been the General Manager for the Aerostar Division since November 2015. Prior to joining the Company, Mr. Wickersham held a range of engineering and operational roles with various technology companies. |

Division Vice President and General Manager - Aerostar Division | |

| |

RISKS RELATING TO THE COMPANY

The Company's business is subject to many risks, which by their nature are unpredictable or unquantifiable and may be unknown. In an attempt to provide you with information on potential risks the Company may encounter, we have provided below, what we believe are the most significant risks the Company could potentially face, based on our knowledge, experience, information and assumptions. The risks provided below should be assessed contemporaneously with other information contained in this Form 10-K, including Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the risks and uncertainties addressed under "Forward-Looking Statements" on page 35, the Notes to the Consolidated Financial Statements on page 45, and other information presented in or incorporated by reference into this Annual Report on Form 10-K. The risks contained herein, as well as other statements in this 10-K are forward-looking statements and, as such, are uncertain. Such statements are

not guarantees of future performance and undue reliance should not be placed on them. The indeterminate nature of risk factors makes them subject to change, and certain risks and uncertainties could potentially cause material changes to actual results. Some of these risks may affect the entire Company, where others may only affect particular segments of our business, or may have no material affect at all.

The Company, except as required by law, disclaims any obligation to update or revise the risk factors contained herein, regardless of changes, whether as a result of new information, developments or otherwise. The risks provided in this form 10-K and in other documents filed with the SEC are not exclusive in nature and, as such, there are other potential risks and uncertainties that the Company is not aware of, or does not presently consider material in nature that could feasibly cause actual results to vary materially from expectations.

Weather conditions or natural disasters could affect certain of the Company's markets, such as agriculture and construction, or the Company's primary manufacturing facilities.

The Company's Applied Technology Division is largely dependent on the ability of farmers, agricultural service providers, and custom applicators to purchase agricultural equipment, including its products. If such farmers, agricultural service providers, or custom applicators experience weather conditions or natural disasters resulting in unfavorable crop prices or farm incomes, sales in the Applied Technology Division may be adversely affected.

Weather conditions and natural disasters can also adversely affect sales in the Company's Engineered Films Division. To the extent weather conditions or natural disasters curtail construction or agricultural activity, sales of the division's plastic sheeting would likely decrease.

Seasonal and weather-related variation could also affect quarterly results. If expected sales are deferred in a fiscal quarter while inventory has been built and operating expenses incurred, financial results could be negatively impacted.

The Company’s primary manufacturing facilities for each of its operating divisions are located on contiguous properties in Sioux Falls, South Dakota. If weather-related natural disasters such as tornadoes or flooding were to occur in the area, such conditions could impede the manufacturing and shipping of products and potentially adversely affect the Company’s sales, transactions processing, and financial reporting. The Company has disaster recovery plans in place to manage the Company’s risks to these vulnerabilities but these measures may not be adequate, implemented properly, or executed timely to ensure that the Company’s operations are not disrupted. Such consequences could adversely affect our results of operations, financial condition, liquidity, and cash flows.

The loss, disruption, or material change in our business relationship with single source suppliers for particular materials, components or services, could cause a disruption in supply, or substantial increase in cost of any such products or services, and therefore could result in harm to our sales, profitability, cash flows and financial condition.

The Company obtains certain materials, components, or services from suppliers that serve as the only source of supply, or that supply the majority of the Company’s requirements of the particular material, component, or service. While these materials, components, services, or suitable replacements, could potentially be sourced from other suppliers, in the event of a disruption or loss of supply of relevant materials, components, or services for any reason, the Company may not be able to immediately find alternative sources of supply, or if found, may not be found on similar terms. If the Company’s relationship with any of these single source suppliers became challenged, or is terminated, we could have difficulty replacing these sources without causing disruption to the business.

Price fluctuations in, and shortages of, raw materials could have a significant impact on the Company's ability to sustain and grow earnings.

The Company's Engineered Films Division utilizes significant amounts of polymeric resin, the cost of which depends upon market prices for natural gas and oil and other market forces. These prices are subject to worldwide supply and demand as well as other factors beyond our control. Although the Engineered Films Division is sometimes able to pass on price increases to its customers, significant variations in the cost of polymeric resins can affect the Company's operating results from period to period. Success in offsetting higher raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the market served. Unusual supply disruptions, such as one caused by a natural disaster, could cause suppliers to invoke "force majeure" clauses in their supply agreements, causing shortages in supply of material. If the Company is not able to fully offset the effects of adverse materials availability or higher costs, financial results could be adversely affected, which in turn could adversely affect our results of operations, financial condition, liquidity, and cash flows.

Electronic components used by both the Applied Technology Division and Aerostar Division are sometimes in short supply, which may impact our ability to meet customer demand. If a supplier of raw materials or electronic components were unable to deliver due to shortage or financial difficulty, any of the Company's segments could be adversely affected.

Fluctuations in commodity prices can increase our costs and decrease our sales.

Agricultural income levels are affected by agricultural commodity prices and input costs. As a result, changes in commodity prices or input costs that reduce agricultural income levels could have a negative effect on the ability of growers and their service providers to purchase the Company's precision agriculture products manufactured by its Applied Technology Division.

Exploration for oil and natural gas fluctuates with their price and energy market conditions are subject to volatility. Certain plastic sheeting manufactured and sold by our Engineered Films Division is sold as pit and pond liners to contain water used in the drilling processes for these energy commodities. Lower prices for oil and natural gas could reduce exploration activities and demand for our products.

Film manufacturing uses polymeric resins, which can be subject to changes in price as the cost of oil or natural gas changes. Accordingly, volatility in oil and natural gas prices may negatively affect our raw material costs and cost of goods sold and potentially cause us to increase prices, which could adversely affect our sales and/or profitability.

Failure to develop and market new technologies and products could impact the Company's competitive position and have an adverse effect on the Company's financial results.

The Company's operating results in Applied Technology, Engineered Films, and Aerostar depend upon the ability to renew the pipeline of new technologies and products and to bring these to market. This ability could be adversely affected by difficulties or delays in product development, such as the inability to identify viable new products, successfully complete research and development projects, obtain relevant regulatory approvals, obtain intellectual property protection, or gain market acceptance of new products and services. Because of the lengthy development process, technological challenges, and competition, there can be no assurance that any of the products the Company is currently developing, or could begin to develop in the future, will achieve commercial success. Technical advancements in products may also increase the risk of product failure, increasing product returns or warranty claims and settlements. In addition, sales of the Company's new products could replace sales of some of its current products, offsetting the benefit of a successful new product introduction.

Failure to develop and maintain partnerships, alliances, and other distribution or supplier relationships could adversely impact the Company's financial results.

In certain areas of the Company’s business, continued success depends on developing and maintaining relationships with other industry participants, such as original equipment manufacturers, dealers and distributors. If the Company fails to develop and maintain such relationships, or if there is disruption of current business relationships, due to actions of the Company, its partners or competitors, our ability to effectively market and sell certain products could be harmed. The Company’s relationships with other industry participants are complex and multifaceted, and evolve over time. Often, these relationships contribute to substantial ongoing business and operations in particular markets; therefore, changes in these relationships could have an adverse impact on our sales and revenue.

Additionally, the Company uses dealer/distributor networks, some of which are affiliated with strategic and industry partners. Enlisting and retaining qualified dealers and distributors and training them in the use and selling of product offerings necessitates substantial time and resources. If we were to lose a significant dealer or distributor relationship, and were forced to identify new channels, the time and expense of training new dealers or distributors may make new-product introduction difficult and also may hinder end-user sales and adoption, which could result in decreased revenues. Additionally, the interruption of dealer coverage within specific regions or markets could cause difficulties in marketing, selling or servicing our products and could harm the Company’s business, operating results or financial condition.

The Company's sales of products that are specialized and highly technical in nature are subject to uncertainties, start-up costs and inefficiencies, as well as market, competitive, and compliance risks.

The Company’s growth strategy relies on the design and manufacture of proprietary products. Highly technical, specialized product inventories may be more susceptible to fluctuations in market demand. If demand is unexpectedly low, write-downs or impairments of such inventory may become necessary. Either of these outcomes could adversely affect our results of operations. Start-up costs and inefficiencies can adversely affect operating results and such costs may not be recoverable in a proprietary product environment because the Company may not receive reimbursement from its customers for such costs.

Competition in agriculture markets could come from our current customers if original equipment manufacturers develop and integrate precision agriculture technology products themselves rather than purchasing from third parties, thereby reducing demand for Applied Technology’s products.

Regulatory restrictions could be placed on hydraulic fracturing activities because of environmental and health concerns, reducing demand for Engineered Film’s products. For Engineered Films, the development of alternative technologies, such as closed loop drilling processes that reduce the need for pit liners in energy exploration, could also reduce demand for the Company’s products.

Aerostar’s future growth relies on sales of high-altitude balloons, as well as advanced radar systems and aerostats to international markets. In limited cases, such sales may be direct commercial sales to foreign governments rather than foreign military sales through the U.S. government. Direct commercial sales to foreign governments often involve large contracts subject to frequent delays because of budget uncertainties, regional military conflicts, political instability, and protracted negotiation processes. Such delays could adversely affect our results of operations. The nature of these markets for certain of Aerostar's advanced radar systems and aerostats makes these products particularly susceptible to fluctuations in market demand. Demand fluctuations and the likelihood of delays in sales involving large contracts for such products also increase the risk of these products becoming obsolete, increasing the risk associated with expected sales of such products. The value of certain advanced radar systems and aerostat inventory at January 31, 2018 was $1.6 million and $3.4 million, respectively. This valuation is based on an estimate that the market demand for these products will be sufficient in future periods such that these inventories will be sold at a price greater than carrying value and related selling costs. Write-downs or impairment of the value of such products carried in inventory could adversely affect our results of operations. To the extent products become obsolete or anticipated sales are not realized, our expected future cash flows could be adversely impacted. This could also lead to an impairment, which could adversely impact the Company's results of operations and financial condition.

Sales of certain of Aerostar’s products into international markets increase the compliance risk associated with regulations such as International Traffic in Arms Regulations and Foreign Corrupt Practices Act, as well as others, exposing the Company to fines and its employees to fines, imprisonment, or civil penalties. Potential consequences of a material violation of such regulations include damage to our reputation, litigation, and increased costs.

The Company's Aerostar segment depends on the U.S. government for a significant portion of its sales, creating uncertainty in the timing of and funding for projected contracts.

A significant portion of Aerostar's sales are to the U.S. government or U.S. government agencies as a prime or sub-contractor. Government spending has historically been cyclical. A decrease in U.S. government defense or near-space research spending or changes in spending allocations could result in one or more of the Company's programs being reduced, delayed, or terminated. Reductions in the Company's existing programs, unless offset by other programs and opportunities, could adversely affect its ability to sustain and grow its future sales and earnings. The Company's U.S. government sales are funded by the federal budget, which operates on an October-to-September fiscal year. Changes in congressional schedules, negotiations for program funding levels, reduced program funding due to U.S government debt limitations, automatic budget cuts ("sequestration"), or unforeseen world events can interrupt the funding for a program or contract. Funds for multi-year contracts can be changed in subsequent years in the appropriations process.

In addition, many U.S. government contracts are subject to a competitive bidding and funding process even after the award of the basic contract, adding an additional element of uncertainty to future funding levels. Delays in the funding process or changes in funding are common and can impact the timing of available funds or can lead to changes in program content or termination at the government's convenience. The loss of anticipated funding or the termination of multiple or large programs could have an adverse effect on the Company's future sales and earnings.

The Company derives a portion of its revenues from foreign markets, which subjects the Company to business risks, including risk of changes in government policies and laws or changes in worldwide economic conditions.

The Company's consolidated net sales to locations outside of the U.S. were $41.6 million in fiscal 2018, representing approximately 11% of consolidated net sales. The Company's financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations, along with changes in worldwide economic conditions. These conditions include, but are not limited to, changes in a country's or region's economic or political condition; trade regulations affecting production, pricing, and marketing of products; local labor conditions and regulations; reduced protection of intellectual property rights in some countries; changes in the regulatory or legal environment; restrictions on currency exchange activities; the impact of fluctuations in foreign currency exchange rates, which may affect product demand and may adversely affect the profitability of our products in U.S. dollars in foreign markets where payments are made in the local currency; burdensome taxes and tariffs; and other trade barriers. International risks and uncertainties also include changing social and economic conditions, terrorism, political hostilities and war, difficulty in enforcing agreements or collecting receivables, and increased transportation or other shipping costs. Any of these such risks could lead to reduced sales and reduced profitability associated with such sales.

Adverse economic conditions in the major industries the Company serves may materially affect segment performance and consolidated results of operations.

The Company's results of operations are impacted by the market fundamentals of the primary industries served. Significant declines of economic activity in the agricultural, oil and gas exploration, construction, industrial, aerospace/defense, and other major markets served may adversely affect segment performance and consolidated results of operations.

The Company may pursue or complete acquisitions which represent additional risk and could impact future financial results.

The Company's business strategy includes pursuing future acquisitions. Acquisitions involve a number of risks, including integration of the acquired company with the Company's operations and unanticipated liabilities or contingencies related to the acquired company. Further, business strategies supported by the acquisition may be in perceived, or actual, opposition to strategies of certain of our customers and our business could be materially adversely affected if those relationships are terminated and the expected strategic benefits are delayed or are not achieved. The Company cannot ensure that the expected benefits of any acquisition will be realized. Costs could be incurred on pursuits or proposed acquisitions that have not yet or may not close, which could significantly impact the operating results, financial condition, or cash flows. Additionally, after the acquisition, unforeseen issues could arise, which adversely affect the anticipated returns or which are otherwise not recoverable as an adjustment to the purchase price. Other acquisition risks include delays in realizing benefits from the acquired companies or products; difficulties due to lack of or limited prior experience in any new product or geographic markets we enter; unforeseen adjustments, charges or write-offs; unforeseen losses of customers of, or suppliers to, acquired businesses; difficulties in retaining key employees of the acquired businesses; or challenges arising from increased geographic diversity and complexity of our operations and our information technology systems.

Total goodwill and intangible assets accounted for $57.3 million, or approximately 18%, of the Company's total assets as of January 31, 2018. The Company evaluates goodwill and intangible assets for impairment annually, or when evidence of potential impairment exists. The annual impairment test is based on several factors requiring judgment. Principally, a significant decrease in expected cash flows or changes in market conditions may indicate potential impairment of recorded goodwill or intangible assets. Our expected future cash flows are dependent on several factors, including revenue growth in certain of our product lines. Our expected future cash flows could be adversely impacted if our anticipated revenue growth is not realized or if pricing in commodities markets does not recover in future periods. Reductions in cash flows could result in an impairment of goodwill and/or intangible assets, which could adversely impact the Company's results of operations and financial condition.

The Company may fail to continue to attract, develop, and retain key management and other key employees, which could negatively impact our operating results.

We depend on the performance of our board of directors, senior management team and other key employees, including experienced and skilled technical personnel. The loss of certain members of our board of directors, senior management, including our Chief Executive Officer, or other key employees, could negatively impact our operating results and ability to execute our business strategy. Our future success will also depend, in part, upon our ability to attract, train, motivate, and retain qualified board members, senior management and other key personnel.

The Company may fail to protect its intellectual property effectively, or may infringe upon the intellectual property of others.

The Company has developed significant proprietary technology and other rights that are used in its businesses. The Company relies on trade secret, copyright, trademark, and patent laws and contractual provisions to protect the Company's intellectual property. While the Company takes enforcement of these rights seriously, other companies, such as competitors or persons in related markets, may attempt to copy or use the Company's intellectual property for their own benefit.

In addition, intellectual property of others has an impact on the Company's ability to offer some of its products and services for specific uses or at competitive prices. Competitors' patents or other intellectual property may limit the Company's ability to offer products and services to its customers. Any infringement or claimed infringement by the Company on the intellectual property rights of others could result in litigation and adversely affect the Company's ability to continue to provide, or could increase the cost of providing, products and services and negatively impact sales and profitability. Any infringement by the Company could also result in judgments against the Company, which could adversely affect our results of operations, financial condition, liquidity, and cash flows.

The Company could be impacted by unfavorable results or material settlement of legal proceedings.

The Company is sometimes a party to various legal proceedings and claims that arise in the ordinary course of business.