|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES |

|||||||||||||||||

|

SECURITIES AND EXCHANGE COMMISSION |

|||||||||||||||||

|

Washington, D.C. 20549 |

|||||||||||||||||

|

FORM 10-Q |

|||||||||||||||||

|

(Mark One) |

|||||||||||||||||

|

[x] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||||||||||||||

|

For the quarterly period ended September 30, 2017 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||||||||||||||

|

For the transition period from to |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission file number 001-09712 |

|||||||||||||||||

|

|

|

(Exact name of Registrant as specified in its charter) |

|||||||||||||||||

|

Delaware |

|

|

62-1147325 |

||||||||||||||

|

(State or other jurisdiction of incorporation or organization) |

|

|

(IRS Employer Identification No.) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8410 West Bryn Mawr, Chicago, Illinois 60631 |

|||||||||||||||||

|

(Address of principal executive offices) (Zip code) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (773) 399-8900 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

[x] |

[ ] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

[x] |

[ ] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

|||||||||||||||||

|

Large accelerated filer |

[ ] |

|

|

|

|

|

|

|

Accelerated filer |

[x] |

|||||||

|

Non-accelerated filer |

[ ] |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

[ ] |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

[ ] |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

[ ] |

||||||||||||||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

[ ] |

[x] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class |

|

|

Outstanding at September 30, 2017 |

||||||||||||||

|

Common Shares, $1 par value |

|

|

52,117,967 Shares |

||||||||||||||

|

Series A Common Shares, $1 par value |

|

|

33,005,877 Shares |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

United States Cellular Corporation |

||

|

|

|

|

|

Quarterly Report on Form 10-Q |

||

|

For the Period Ended September 30, 2017 |

||

|

|

|

|

|

Index |

Page No. |

|

|

|

|

|

|

|

Management Discussion and Analysis of Financial Condition and Results of Operations |

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

Supplemental Information Relating to Non-GAAP Financial Measures |

|

|

|

||

|

|

||

|

|

||

|

|

Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

United States Cellular Corporation Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The following discussion and analysis compares United States Cellular Corporation’s (U.S. Cellular) financial results for the three and nine months ended September 30, 2017, to the three and nine months ended September 30, 2016. It should be read in conjunction with U.S. Cellular’s interim consolidated financial statements and notes included herein, and with the description of U.S. Cellular’s business, its audited consolidated financial statements and Management's Discussion and Analysis (MD&A) of Financial Condition and Results of Operations included in U.S. Cellular’s Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2016. Certain numbers included herein are rounded to millions for ease of presentation; however, calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, including the words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement for additional information.

U.S. Cellular uses certain “non-GAAP financial measures” and each such measure is identified in the MD&A. A discussion of the reason U.S. Cellular determines these metrics to be useful and a reconciliation of these measures to their most directly comparable measures determined in accordance with accounting principles generally accepted in the United States of America (GAAP) are included in the Supplemental Information Relating to Non-GAAP Financial Measures section within the MD&A of this Form 10-Q Report.

|

|

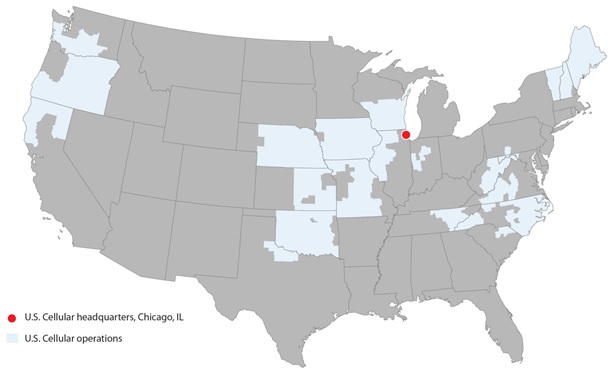

U.S. Cellular owns, operates, and invests in wireless markets throughout the United States. U.S. Cellular is an 83%-owned subsidiary of Telephone and Data Systems, Inc. (TDS). U.S. Cellular’s strategy is to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans, and pricing, all provided with a local focus.

|

OPERATIONS |

|

|

|

|

|

U.S. Cellular Mission and Strategy

U.S. Cellular’s mission is to provide exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the mid-sized and rural markets served.

In 2017, U.S. Cellular continues to execute on its strategies to protect its current customer base, grow revenues by attracting new customers through economical offerings and identifying new revenue opportunities, and drive improvements in its overall cost structure. Strategic efforts include:

- U.S. Cellular continues to devote efforts to enhance its network capabilities. During the first half of 2017, U.S. Cellular commercially deployed VoLTE technology for the first time in one key market and will continue to build out VoLTE services over the next few years. The next commercial launch is expected to occur in several additional operating markets in early 2018. VoLTE technology allows customers to utilize a 4G LTE network for both voice and data services, and offers enhanced services such as high definition voice, video calling and simultaneous voice and data sessions. In addition, the deployment of VoLTE technology expands U.S. Cellular’s ability to offer roaming services to other carriers.

- U.S. Cellular continues to enhance its spectrum position and monetize non-strategic assets by participating in auctions and entering into agreements with third parties. During the nine months ended September 30, 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an aggregate purchase price of $329 million. In addition, U.S. Cellular closed on certain license exchange agreements and received $15 million of cash and recognized gains of $19 million. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to certain of these transactions.

- U.S. Cellular is focused on expanding its solutions available to business and government customers, including a growing suite of connected machine-to-machine solutions and software applications across various categories. U.S. Cellular will continue to enhance its advanced wireless services and connected solutions for consumer, business and government customers.

Net loss attributable to U.S. Cellular shareholders was $299 million and $261 million for the three and nine months ended September 30, 2017, respectively. Such net losses include a non-cash charge related to goodwill impairment of $370 million ($309 million, net of tax), which was recorded for the three months ended September 30, 2017. See Note 6 — Intangible Assets for a detailed discussion regarding the goodwill impairment. Refer to Supplemental Information to Non-GAAP Financial Measures within this MD&A for a reconciliation of the goodwill impairment, net of tax.

|

|

The following is a list of definitions of certain industry terms that are used throughout this document:

- 4G LTE – fourth generation Long-Term Evolution which is a wireless broadband technology.

- Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

- Auctions 1000, 1001, and 1002 – Auction 1000 is an FCC auction of 600 MHz spectrum licenses that started in 2016 and continued into 2017 involving: (1) a “reverse auction” in which broadcast television licensees submit bids to voluntarily relinquish spectrum usage rights in exchange for payments (referred to as Auction 1001); (2) a “repacking” of the broadcast television bands in order to free up certain broadcast spectrum for other uses; and (3) a “forward auction” of licenses for spectrum cleared through this process to be used for wireless communications (referred to as Auction 1002).

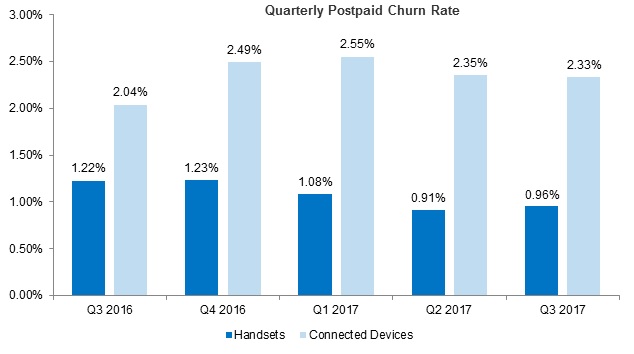

- Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

- Connections – individual lines of service associated with each device activated by a customer. This includes smartphones, feature phones, tablets, modems, hotspots, and machine-to-machine devices.

- Connected Devices – non-handset devices that connect directly to the U.S. Cellular network. Connected devices include products such as tablets, modems, and hotspots.

- EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document.

- FCC – Federal Communications Commission.

- Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

- Machine-to-Machine or M2M – technology that involves the transmission of data between networked devices, as well as the performance of actions by devices without human intervention. U.S. Cellular sells and supports M2M solutions to customers, provides connectivity for M2M solutions via the U.S. Cellular network, and has agreements with device manufacturers and software developers which offer M2M solutions.

- Net Additions – represents the total number of new connections added during the period, net of connections that were terminated during that period.

- OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document.

- Postpaid Average Billings per Account (Postpaid ABPA) – non-GAAP metric is calculated by dividing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid accounts and by the number of months in the period.

- Postpaid Average Billings per User (Postpaid ABPU) – non-GAAP metric is calculated by dividing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid connections and by the number of months in the period.

- Postpaid Average Revenue per Account (Postpaid ARPA) – metric is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

- Postpaid Average Revenue per User (Postpaid ARPU) – metric is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

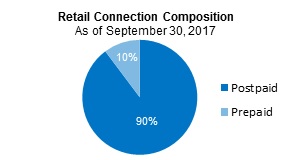

- Retail Connections – the sum of postpaid connections and prepaid connections.

- Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

- VoLTE – Voice over Long-Term Evolution is a technology specification that defines the standards and procedures for delivering voice communications and related services over 4G LTE networks.

|

|

|

|

|

|

|

|

Q3 |

Q3 |

YTD |

YTD |

|||||

|

|

|

|

|

|

2017 |

2016 |

2017 |

2016 |

|||||

|

|

Postpaid Activity and Churn |

|

|

|

|

||||||||

|

|

|

Gross Additions: |

|||||||||||

|

|

|

||||||||||||

|

|

|

|

|

Handsets |

|||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

Connected Devices |

|||||||||

|

|

|

|

|

||||||||||

|

As of September 30, |

|

|

Net Additions (Losses): |

||||||||||

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

Handsets |

||||||

|

|

|

|

|

|

|

|

|||||||

|

Retail Connections – End of Period |

|

|

|

|

Connected Devices |

||||||||

|

|

|

|

|

||||||||||

|

|

Postpaid |

|

|

|

Churn: |

1.16% |

1.34% |

1.19% |

1.27% |

||||

|

|

|

|

|

||||||||||

|

|

Prepaid |

|

|

|

|

|

Handsets |

0.96% |

1.22% |

0.98% |

1.17% |

||

|

|

|

|

|

|

|

||||||||

|

|

Total |

|

|

|

|

|

Connected Devices |

2.33% |

2.04% |

2.41% |

1.97% |

||

|

|

|

|

|

|

|

||||||||

The increase in postpaid net additions for the three months ended September 30, 2017, when compared to the same period last year, was driven mainly by higher handsets gross additions as well as lower handsets churn. These impacts were slightly offset by a decline in tablet gross additions and higher tablet churn which are included in the connected devices line above.

The decrease in postpaid net additions for the nine months ended September 30, 2017, when compared to the same period last year, was driven mainly by lower tablet gross additions and an increase in tablet churn, partially offset by an improvement in handsets net additions largely reflecting a decline in handsets churn.

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

||||||||

|

|

|

September 30, |

|

|

September 30, |

|||||||

|

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||

|

Average Revenue Per User (ARPU) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average Billings Per User (ABPU)1 |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

Average Revenue Per Account (ARPA) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average Billings Per Account (ABPA)1 |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Postpaid ABPU and Postpaid ABPA are non-GAAP financial measures. Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of these measures. |

|||||||||||

Postpaid ARPU and Postpaid ARPA decreased for the three and nine months ended September 30, 2017, due primarily to industry-wide price competition resulting in overall price reductions on plan offerings.

Equipment installment plans increase equipment sales revenue as customers pay for their wireless devices in installments at a total device price that is generally higher than the device price offered to customers in conjunction with alternative plans that are subject to a service contract. Equipment installment plans also have the impact of reducing service revenues as certain equipment installment plans provide for reduced monthly service charges. In order to show the trends in total service and equipment revenues received, U.S. Cellular has presented Postpaid ABPU and Postpaid ABPA, which are calculated as Postpaid ARPU and Postpaid ARPA plus average monthly equipment installment plan billings per connection and account, respectively.

Equipment installment plan billings increased for the three and nine months ended September 30, 2017, when compared to the same periods last year, mainly due to increased penetration of equipment installment plans. Postpaid ABPU and ABPA decreased for the three and nine months ended September 30, 2017, when compared to the same periods last year, as the increase in equipment installment plan billings was more than offset by the decline in Postpaid ARPU and ARPA discussed above. U.S. Cellular expects the penetration of equipment installment plans to continue to increase over time due to the fact that, effective in September 2016, all equipment sales to retail customers are made under installment plans.

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|||||||||||||

|

|

|

|

|

|

September 30, |

|

September 30, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

2017 vs. |

|||||

|

|

|

|

|

|

2017 |

|

2016 |

|

2016 |

|

2017 |

|

2016 |

|

2016 |

||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Retail service |

|

$ |

|

$ |

|

(7)% |

|

$ |

|

$ |

|

(5)% |

|||||||

|

Inbound roaming |

|

|

|

|

|

(17)% |

|

|

|

|

|

(20)% |

|||||||

|

Other1 |

|

|

|

|

|

12% |

|

|

|

|

|

13% |

|||||||

|

|

Service revenues1 |

|

|

|

|

|

(6)% |

|

|

|

|

|

(5)% |

||||||

|

Equipment sales |

|

|

|

|

|

(5)% |

|

|

|

|

|

(3)% |

|||||||

|

|

Total operating revenues1 |

|

|

|

|

|

(6)% |

|

|

|

|

|

(4)% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

System operations (excluding Depreciation, amortization and accretion reported below) |

|

|

|

|

|

(6)% |

|

|

|

|

|

(4)% |

|||||||

|

Cost of equipment sold |

|

|

|

|

|

(7)% |

|

|

|

|

|

(6)% |

|||||||

|

Selling, general and administrative |

|

|

|

|

|

(5)% |

|

|

|

|

|

(4)% |

|||||||

|

Depreciation, amortization and accretion |

|

|

|

|

|

(2)% |

|

|

|

|

|

– |

|||||||

|

Loss on impairment of goodwill |

|

|

|

|

|

N/M |

|

|

|

|

|

N/M |

|||||||

|

(Gain) loss on asset disposals, net |

|

|

|

|

|

(26)% |

|

|

|

|

|

(17)% |

|||||||

|

(Gain) loss on sale of business and other exit costs, net |

|

|

|

|

|

N/M |

|

|

|

|

|

>(100)% |

|||||||

|

(Gain) loss on license sales and exchanges, net |

|

|

|

|

|

100% |

|

|

|

|

|

(16)% |

|||||||

|

|

Total operating expenses |

|

|

|

|

|

32% |

|

|

|

|

|

8% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Operating income (loss)¹ |

|

$ |

|

$ |

|

>(100)% |

|

$ |

|

$ |

|

>(100)% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Net income (loss) |

|

$ |

|

$ |

|

>(100)% |

|

$ |

|

$ |

|

>(100)% |

|||||||

|

Adjusted OIBDA (Non-GAAP)1,2 |

|

$ |

|

$ |

|

(6)% |

|

$ |

|

$ |

|

– |

|||||||

|

Adjusted EBITDA (Non-GAAP)2 |

|

$ |

|

$ |

|

(6)% |

|

$ |

|

$ |

|

(1)% |

|||||||

|

Capital expenditures |

|

$ |

|

$ |

|

8% |

|

$ |

|

$ |

|

(7)% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/M - Percentage change not meaningful |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with an accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

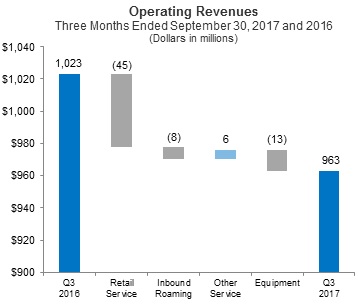

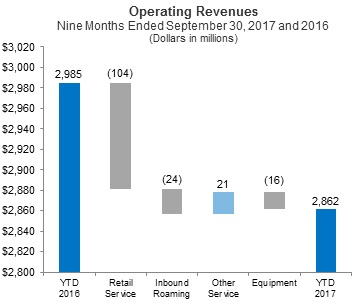

Service revenues consist of:

Equipment revenues consist of:

|

|

Key components of changes in the statement of operations line items were as follows:

Total operating revenues

On January 1, 2017, U.S. Cellular elected to change the classification of interest income on equipment installment plan contracts from Interest and dividend income to Service revenues in the Consolidated Statement of Operations. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details.

Service revenues decreased for the three and nine months ended September 30, 2017, as a result of (i) a decrease in retail service revenues primarily driven by industry-wide price competition resulting in overall price reductions on plan offerings; and (ii) a decrease in inbound roaming revenues primarily driven by lower roaming rates. Such reductions were partially offset by an increase in imputed interest income due to an increase in the total number of active equipment installment plans.

Federal USF revenue remained flat at $23 million and $69 million for the three and nine months ended September 30, 2017, respectively, when compared to the same periods last year. See the Regulatory Matters section in this MD&A for a description of the FCC Mobility Fund II Order (MF2 Order) and its expected impacts on U.S. Cellular’s current Federal USF support.

Equipment sales revenues decreased for the three months ended September 30, 2017, when compared to the same period last year, due a reduction in guarantee liability amortization for equipment installment contracts as a result of changes in plan offerings and an overall reduction in the number of devices sold. See Note 3 – Equipment Installment Plans in the Notes to Consolidated Financial Statements for additional details regarding the amortization of the guarantee liability. These impacts were partially offset by a mix shift to higher end smartphone devices as well as an increase in accessories revenues.

Equipment sales revenues decreased for the nine months ended September 30, 2017, when compared to the same period last year, as a result of an overall reduction in the number of devices sold and, as a result of changes in plan offerings, a decrease in guarantee liability amortization for equipment installment contracts and lower device activation fees. These impacts were partially offset by an increase in the proportion of new device sales made under equipment installment plans, a mix shift from feature phones and connected devices to smartphones and, to a lesser extent, an increase in accessories revenues.

|

|

System operations expenses

System operations expenses decreased for the three and nine months ended September 30, 2017, when compared to the same periods last year, as a result of (i) a decrease in roaming expenses driven primarily by lower roaming rates, partially offset by increased data roaming usage; and (ii) a decrease in customer usage expenses primarily driven by decreased circuit costs.

Cost of equipment sold

The decrease in Cost of equipment sold for the three and nine months ended September 30, 2017, when compared to the same periods last year, was mainly due to a reduction in the number of devices sold as well as a decrease in the average cost of smartphones, partially offset by a mix shift from feature phones and connected devices to higher cost smartphones. Loss on equipment, defined as Equipment sales revenues less Cost of equipment sold, was $35 million and $41 million for the three months ended September 30, 2017 and 2016, respectively, and $110 million and $144 million for the nine months ended September 30, 2017 and 2016, respectively.

Selling, general and administrative expenses

Selling expenses for the three and nine months ended September 30, 2017, decreased by $8 million and $24 million, respectively, mainly due to lower advertising expenses, including a decrease in sponsorship expenses related to the termination of a naming rights agreement during the third quarter of 2016; increases in commissions expenses were partially offsetting. General and administrative expenses for the three and nine months ended September 30, 2017, decreased $11 million and $25 million, respectively, mainly due to lower bad debts and phone program expenses together with reductions in numerous other general and administrative categories.

Loss on impairment of goodwill

During the third quarter of 2017, U.S. Cellular recorded a $370 million loss on impairment related to goodwill. See Note 6 — Intangible Assets in the Notes to Consolidated Financial Statements for additional information.

(Gain) loss on license sales and exchanges, net

Net gains in 2017 and 2016 were due to gains recognized on license exchange transactions with third parties. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information.

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

|||||||||||||

|

|

|

|

|

|

September 30, |

|

September 30, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

|

|

2017 |

|

2016 |

|

2016 |

|

2017 |

|

2016 |

|

2016 |

||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Operating income (loss)¹ |

|

$ |

|

$ |

|

>(100)% |

$ |

|

$ |

|

>(100)% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Equity in earnings of unconsolidated entities |

|

|

|

|

|

(7)% |

|

|

|

|

(8)% |

||||||||

|

Interest and dividend income1 |

|

|

|

|

|

68% |

|

|

|

|

45% |

||||||||

|

Interest expense |

|

|

|

|

|

(2)% |

|

|

|

|

(1)% |

||||||||

|

Other, net |

|

|

|

|

|

29% |

|

|

|

|

(9)% |

||||||||

|

Total investment and other income1 |

|

|

|

|

|

(21)% |

|

|

|

|

(25)% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Income (loss) before income taxes |

|

|

|

|

|

>(100)% |

|

|

|

|

>(100)% |

||||||||

|

Income tax expense (benefit) |

|

|

|

|

|

>(100)% |

|

|

|

|

>(100)% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Net income (loss) |

|

|

|

|

|

>(100)% |

|

|

|

|

>(100)% |

||||||||

|

Less: Net income (loss) attributable to noncontrolling interests, net of tax |

|

|

|

|

|

(9)% |

|

|

|

|

>100% |

||||||||

|

Net income (loss) attributable to U.S. Cellular shareholders |

|

$ |

|

$ |

|

>(100)% |

$ |

|

$ |

|

>(100)% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with an accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details. |

||||||||||||||||||

|

|

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents U.S. Cellular’s share of net income from entities in which it has a noncontrolling interest and that are accounted for by the equity method. U.S. Cellular’s investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed $17 million to Equity in earnings of unconsolidated entities for both the three months ended September 30, 2017 and 2016, and $50 million and $57 million for the nine months ended September 30, 2017 and 2016, respectively. See Note 7 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Income tax expense

U.S. Cellular’s effective tax rate on Income (loss) before income taxes for the three and nine months ended September 30, 2017, was not meaningful due primarily to the recognition of a loss on impairment of goodwill and for the three and nine months ended September 30, 2016, was 46.0% and 41.4%, respectively. Due to difficulty in reliably projecting an annual tax rate, U.S. Cellular calculated income taxes for the nine months ended September 30, 2017, based on an estimated year-to-date tax rate.

A reconciliation of U.S. Cellular’s income tax expense (benefit) computed at the statutory rate to the reported income tax expense (benefit) and effective tax rate is as follows:

|

|

|

Nine Months Ended |

||||||

|

|

|

|

September 30, |

|||||

|

|

|

|

2017 |

|

|

2016 |

||

|

|

|

|

Amount |

Rate |

|

|

Amount |

Rate |

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

Pretax income (loss) |

$ |

N/A |

|

$ |

N/A |

|||

|

|

|

|

|

|

|

|||

|

Statutory federal income tax expense (benefit) and rate |

|

35.0 % |

|

|

35.0% |

|||

|

Goodwill impairment1 |

|

(27.3)% |

|

|

0.0% |

|||

|

Other differences, net |

|

(0.7)% |

|

|

6.4% |

|||

|

Total tax expense (benefit) and rate |

$ |

7.0 % |

|

$ |

41.4% |

|||

|

|

|

|

|

|

|

|

|

|

|

1 |

Goodwill impairment reflects an adjustment to increase federal and state income tax expense by $76 million related to a portion of the goodwill impairment U.S. Cellular recorded which is nondeductible for tax purposes. See Note 6 - Intangible Assets for a detailed discussion regarding the goodwill impairment. |

|||||||

|

|

Liquidity and Capital Resources

Sources of Liquidity

U.S. Cellular operates a capital-intensive business. Historically, U.S. Cellular has used internally-generated funds and also has obtained substantial funds from external sources for general corporate purposes. In the past, U.S. Cellular’s existing cash and investment balances, funds available under its revolving credit facility, funds from other financing sources, including a term loan and other long-term debt, and cash flows from operating, certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for U.S. Cellular to meet its normal day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund acquisitions, primarily of spectrum licenses. There is no assurance that this will be the case in the future. See Market Risk for additional information regarding maturities of long-term debt.

Although U.S. Cellular currently has a significant cash balance, in certain recent periods, U.S. Cellular has incurred negative free cash flow (non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment) and this will continue in the future if operating results do not improve or capital expenditures are not reduced. U.S. Cellular currently expects to have negative free cash flow in 2017. However, U.S. Cellular believes that existing cash and investment balances, funds available under its revolving credit facility, and expected cash flows from operating and investing activities provide liquidity for U.S. Cellular to meet its normal day-to-day operating needs and debt service requirements for the coming year.

U.S. Cellular may require substantial additional capital for, among other uses, funding day-to-day operating needs including working capital, acquisitions of providers of wireless telecommunications services, spectrum license or system acquisitions, system development and network capacity expansion, debt service requirements, the repurchase of shares, the payment of dividends, or making additional investments. It may be necessary from time to time to increase the size of the existing revolving credit facility, to put in place a new credit facility, or to obtain other forms of financing in order to fund potential expenditures. U.S. Cellular is exploring a potential securitized borrowing using its equipment installment plan receivables, which may occur in 2018. U.S. Cellular’s liquidity would be adversely affected if, among other things, U.S. Cellular is unable to obtain short or long-term financing on acceptable terms, U.S. Cellular makes significant spectrum license purchases, the LA Partnership discontinues or reduces distributions compared to historical levels, or Federal USF and/or other regulatory support payments decline. In addition, although sales of assets or businesses by U.S. Cellular have been an important source of liquidity in prior periods, U.S. Cellular does not expect a similar level of such sales in the future.

U.S. Cellular’s credit rating has been sub-investment grade since 2014. There can be no assurance that sufficient funds will continue to be available to U.S. Cellular or its subsidiaries on terms or at prices acceptable to U.S. Cellular. Insufficient cash flows from operating activities, changes in its credit ratings, defaults of the terms of debt or credit agreements, uncertainty of access to capital, deterioration in the capital markets, reduced regulatory capital at banks which in turn limits their ability to borrow and lend, other changes in the performance of U.S. Cellular or in market conditions or other factors could limit or restrict the availability of financing on terms and prices acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its acquisition, capital expenditure and business development programs, reduce the acquisition of spectrum licenses, and/or reduce or cease share repurchases and/or the payment of dividends. U.S. Cellular cannot provide assurance that circumstances that could have a material adverse effect on its liquidity or capital resources will not occur. Any of the foregoing would have an adverse impact on U.S. Cellular’s businesses, financial condition or results of operations.

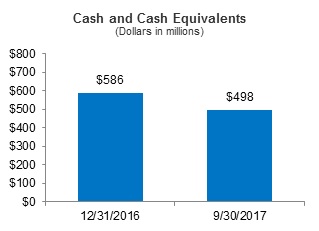

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments. The primary objective of U.S. Cellular’s Cash and cash equivalents is for use in its operations and acquisition, capital expenditure and business development programs.

|

|

At December 31, 2016, U.S. Cellular’s cash and cash equivalents totaled $586 million compared to $498 million at September 30, 2017.

The majority of U.S. Cellular’s Cash and cash equivalents was held in bank deposit accounts and in money market funds that purchase only debt issued by the U.S. Treasury or U.S. government agencies across a range of eligible money market investments that may include, but are not limited to, government agency repurchase agreements, government agency debt, U.S. Treasury repurchase agreements, U.S. Treasury debt, and other securities collateralized by U.S. government obligations. U.S. Cellular monitors the financial viability of the money market funds and direct investments in which it invests and believes that the credit risk associated with these investments is low. |

|

|

At September 30, 2017, U.S. Cellular held $50 million of Short-term investments which consisted of U.S. Treasury Bills with original maturities of six months. For these investments, U.S. Cellular’s objective is to earn a higher rate of return on funds that are not anticipated to be required to meet liquidity needs in the immediate future while maintaining low investment risk. See Note 2 – Fair Value Measurements in the Notes to Consolidated Financial Statements for additional details on short-term investments.

Financing

U.S. Cellular has a revolving credit facility available for general corporate purposes, including spectrum purchases and capital expenditures. This credit facility matures in June 2021.

U.S. Cellular’s unused capacity under its revolving credit facility was $298 million as of September 30, 2017. U.S. Cellular believes it was in compliance with all of the financial covenants and requirements set forth in its revolving credit facility as of that date.

U.S. Cellular has in place an effective shelf registration statement on Form S-3 to issue senior or subordinated debt securities.

Long-term debt payments due for the remainder of 2017 and the next four years represent less than 4% of U.S. Cellular’s total long-term debt obligation as of September 30, 2017.

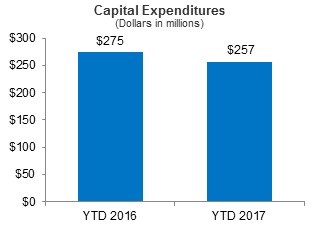

Capital Expenditures

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures), which include the effects of accruals and capitalized interest, in 2017 and 2016 were as follows:

|

|

Capital expenditures for the nine months ended September 30, 2016 and 2017 were $275 million and $257 million, respectively. Capital expenditures for the full year 2017 are expected to be approximately $500 million. These expenditures are expected to be for the following general purposes:

|

U.S. Cellular plans to finance its capital expenditures program for 2017 using primarily Cash flows from operating activities and existing cash balances.

Acquisitions, Divestitures and Exchanges

U.S. Cellular may be engaged from time to time in negotiations (subject to all applicable regulations) relating to the acquisition, divestiture or exchange of companies, properties or wireless spectrum. In general, U.S. Cellular may not disclose such transactions until there is a definitive agreement. U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy, U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets and wireless spectrum, including pursuant to FCC auctions. U.S. Cellular also may seek to divest outright or include in exchanges for other wireless interests those interests that are not strategic to its long-term success.

In July 2016, the FCC announced U.S. Cellular as a qualified bidder in the FCC’s forward auction of 600 MHz spectrum licenses, referred to as Auction 1002. In April 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an aggregate purchase price of $329 million. Prior to commencement of the forward auction, U.S. Cellular made an upfront payment to the FCC of $143 million in June 2016. U.S. Cellular paid the remaining $186 million to the FCC and was granted the licenses during the second quarter of 2017.

In February 2016, U.S. Cellular entered into an agreement with a third party to exchange certain 700 MHz licenses for certain AWS and PCS licenses and $28 million of cash. This license exchange was accomplished in two closings. The first closing occurred in the second quarter of 2016, at which time U.S. Cellular received $13 million of cash and recorded a gain of $9 million. The second closing occurred in the first quarter of 2017, at which time U.S. Cellular received $15 million of cash and recorded a gain of $17 million.

|

|

U.S. Cellular consolidates certain “variable interest entities” as defined under GAAP. See Note 8 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. U.S. Cellular may elect to make additional capital contributions and/or advances to these variable interest entities in future periods in order to fund their operations.

During the first quarter of 2017, U.S. Cellular formed USCC EIP LLC, a special purpose entity (SPE), to facilitate a potential securitized borrowing using its equipment installment plan receivables in the future. During the nine months ended September 30, 2017, net equipment installment plan receivables totaling $1,093 million were transferred to the newly formed SPE from affiliated entities. On a consolidated basis, the transfer of receivables into this SPE did not have a material impact to the financial condition of U.S. Cellular.

Common Share Repurchase Program

U.S. Cellular has repurchased and expects to continue to repurchase its Common Shares, subject to its repurchase program. Share repurchases made under this program in 2017 and 2016 were as follows:

|

|

Nine Months Ended |

|||||

|

|

|

September 30, |

||||

|

|

|

2017 |

|

2016 |

||

|

Number of shares |

|

|

||||

|

Average cost per share |

$ |

|

$ |

|||

|

Dollar amount (in millions) |

$ |

|

$ |

|||

For additional information related to the current repurchase authorization, see Unregistered Sales of Equity Securities and Use of Proceeds.

Contractual and Other Obligations

There were no material changes outside the ordinary course of business between December 31, 2016 and September 30, 2017, to the Contractual and Other Obligations disclosed in Management’s Discussion and Analysis of Financial Condition and Results of Operations included in U.S. Cellular’s Form 10-K for the year ended December 31, 2016.

Off-Balance Sheet Arrangements

U.S. Cellular had no transactions, agreements or other contractual arrangements with unconsolidated entities involving “off-balance sheet arrangements,” as defined by SEC rules, that had or are reasonably likely to have a material current or future effect on its financial condition, results of operations, liquidity, capital expenditures or capital resources.

|

|

Consolidated Cash Flow Analysis

U.S. Cellular operates a capital- and marketing-intensive business. U.S. Cellular makes substantial investments to acquire wireless licenses and properties and to construct and upgrade wireless telecommunications networks and facilities as a basis for creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities have required substantial investments in potentially revenue‑enhancing and cost-reducing upgrades to U.S. Cellular’s networks. U.S. Cellular utilizes cash on hand, cash from operating activities, cash proceeds from divestitures and dispositions of investments, short-term credit facilities and long-term debt financing to fund its acquisitions (including spectrum licenses), construction costs, operating expenses and share repurchases. Cash flows may fluctuate from quarter to quarter and year to year due to seasonality, the timing of acquisitions and divestitures, capital expenditures and other factors. The following discussion summarizes U.S. Cellular's cash flow activities for the nine months ended September 30, 2017 and 2016.

2017 Commentary

U.S. Cellular’s Cash and cash equivalents decreased $88 million in 2017. Net cash provided by operating activities was $394 million and was offset by Cash flows used for investing activities of $472 million and Cash flows used for financing activities of $10 million.

Net cash provided by operating activities consisted of net income adjusted for non-cash items of $477 million, distributions received from unconsolidated entities of $85 million, including $30 million in distributions from the LA Partnership, and changes in working capital items which decreased net cash by $168 million. The non-cash items included a $370 million loss on impairment of goodwill. The decrease resulting from changes in working capital items was due in part to a $164 million increase in equipment installment plan receivables, which are expected to continue to increase and further require the use of working capital in the near term.

Cash flows used for investing activities were $472 million. Cash paid in 2017 for additions to property, plant and equipment totaled $252 million. Cash paid for acquisitions and licenses was $189 million which included the remaining $186 million due to the FCC for licenses U.S. Cellular won in Auction 1002. Cash paid for investments was $50 million which included the purchase of short-term Treasury bills. This was partially offset by Cash received from divestitures and exchanges of $19 million. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to these transactions.

Cash flows used for financing activities were $10 million, primarily for scheduled repayments of debt.

2016 Commentary

U.S. Cellular’s Cash and cash equivalents decreased $41 million in 2016. Net cash provided by operating activities was $415 million in 2016 due to net income of $54 million plus non-cash items of $450 million and distributions received from unconsolidated entities of $55 million including a $10 million distribution from the LA Partnership. This was partially offset by changes in working capital items which decreased cash by $144 million. The decrease in working capital items was due primarily to a $160 million increase in equipment installment plan receivables. This was partially offset by a federal tax refund of $28 million related to an overpayment of the 2015 tax liability, which resulted from the enactment of federal bonus depreciation in December 2015.

The net cash provided by operating activities was offset by Cash flows used for investing activities of $449 million. Cash paid in 2016 for additions to property, plant and equipment totaled $280 million. In June 2016, U.S. Cellular made a deposit of $143 million to the FCC for its participation in Auction 1002. Cash paid for acquisitions and licenses in 2016 was $46 million partially offset by Cash received from divestitures and exchanges of $20 million.

Cash flows used for financing activities were $7 million, reflecting ordinary activity such as scheduled repayments of debt.

|

|

Consolidated Balance Sheet Analysis

The following discussion addresses certain captions in the consolidated balance sheet and changes therein. This discussion is intended to highlight the significant changes and is not intended to fully reconcile the changes. Changes in financial condition during 2017 are as follows:

Cash and cash equivalents

Cash and cash equivalents decreased $88 million due primarily to the purchase of $50 million in short-term investments. See the Consolidated Cash Flow analysis above for a discussion of cash and cash equivalents.

Short-term investments

Short-term investments increased $50 million due to the purchase of short-term investments, which consisted of U.S. Treasury Bills with original maturities of six months. See Note 2 – Fair Value Measurements in the Notes to Consolidated Financial Statements for additional details on short-term investments.

Inventory, net

Inventory, net decreased $36 million due primarily to overall improvements in inventory planning and procurement practices.

Licenses

Licenses increased $339 million due primarily to an aggregate winning bid of $329 million in FCC Auction 1002. These licenses were granted by the FCC in the second quarter of 2017. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for more information about this transaction.

Goodwill

Goodwill decreased $370 million due to the impairment loss recorded in the third quarter of 2017. See Note 6 — Intangible Assets in the Notes to Consolidated Financial Statements for additional information.

Accounts payable — Trade

Accounts payable — Trade decreased $50 million due primarily to reduction of expenses in 2017 as well as payment timing differences.

Accrued taxes

Accrued taxes increased $26 million due primarily to the excess of current income tax expense over federal estimated payments made during the nine months ended September 30, 2017.

|

|

Supplemental Information Relating to Non-GAAP Financial Measures

U.S. Cellular sometimes uses information derived from consolidated financial information but not presented in its financial statements prepared in accordance with U.S. GAAP to evaluate the performance of its business. Certain of these measures are considered “non-GAAP financial measures” under U.S. Securities and Exchange Commission Rules. Specifically, U.S. Cellular has referred to the following measures in this Form 10-Q Report:

- EBITDA

- Adjusted EBITDA

- Adjusted OIBDA

- Free cash flow

- Postpaid ABPU

- Postpaid ABPA

- Goodwill impairment, net of tax

Following are explanations of each of these measures.

Adjusted EBITDA and Adjusted OIBDA

Adjusted EBITDA is defined as net income (loss) adjusted for the items set forth in the reconciliation below. Adjusted OIBDA is defined as net income (loss) adjusted for the items set forth in the reconciliation below. Adjusted EBITDA and Adjusted OIBDA are not measures of financial performance under GAAP and should not be considered as alternatives to Net income (loss) or Cash flows from operating activities, as indicators of cash flows or as measures of liquidity. U.S. Cellular does not intend to imply that any such items set forth in the reconciliation below are non-recurring, infrequent or unusual; such items may occur in the future.

Management uses Adjusted EBITDA and Adjusted OIBDA as measurements of profitability and, therefore, reconciliations to Net income (loss) are deemed appropriate. Management believes Adjusted EBITDA and Adjusted OIBDA are useful measures of U.S. Cellular’s operating results before significant recurring non-cash charges, gains and losses, and other items as presented below as they provide additional relevant and useful information to investors and other users of U.S. Cellular’s financial data in evaluating the effectiveness of its operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. Adjusted EBITDA shows adjusted earnings before interest, taxes, depreciation, amortization and accretion, and gains and losses, while Adjusted OIBDA reduces this measure further to exclude Equity in earnings of unconsolidated entities and Interest and dividend income in order to more effectively show the performance of operating activities excluding investment activities. The following table reconciles Adjusted EBITDA and Adjusted OIBDA to the corresponding GAAP measure, Net income (loss).

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|||||||||

|

|

|

|

September 30, |

|

September 30, |

||||||||

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

||

|

Net income (loss) (GAAP) |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Add back: |

|

|

|

|

|

|

|

||||||

|

|

Income tax expense (benefit) |

|

|

|

|

|

|

|

|||||

|

|

Interest expense |

|

|

|

|

|

|

|

|||||

|

|

Depreciation, amortization and accretion |

|

|

|

|

|

|

|

|||||

|

EBITDA (Non-GAAP) |

|

|

|

|

|

|

|

||||||

|

Add back or deduct: |

|

|

|

|

|

|

|

||||||

|

|

Loss on impairment of goodwill |

|

|

|

|

|

|

|

|||||

|

|

(Gain) loss on sale of business and other exit costs, net |

|

|

|

|

|

|

|

|||||

|

|

(Gain) loss on license sales and exchanges, net |

|

|

|

|

|

|

|

|||||

|

|

(Gain) loss on asset disposals, net |

|

|

|

|

|

|

|

|||||

|

Adjusted EBITDA (Non-GAAP) |

|

|

|

|

|

|

|

||||||

|

Deduct: |

|

|

|

|

|

|

|

||||||

|

|

Equity in earnings of unconsolidated entities |

|

|

|

|

|

|

|

|||||

|

|

Interest and dividend income1 |

|

|

|

|

|

|

|

|||||

|

|

Other, net |

|

|

|

|

|

|

|

|||||

|

Adjusted OIBDA (Non-GAAP)1 |

|

|

|

|

|

|

|

||||||

|

Deduct: |

|

|

|

|

|

|

|

||||||

|

|

Depreciation, amortization and accretion |

|

|

|

|

|

|

|

|||||

|

|

Loss on impairment of goodwill |

|

|

|

|

|

|

|

|||||

|

|

(Gain) loss on sale of business and other exit costs, net |

|

|

|

|

|

|

|

|||||

|

|

(Gain) loss on license sales and exchanges, net |

|

|

|

|

|

|

|

|||||

|

|

(Gain) loss on asset disposals, net |

|

|

|

|

|

|

|

|||||

|

Operating income (loss) (GAAP)¹ |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with the accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details. |

||||||||||||

|

|

The following table presents Free cash flow. Management uses Free cash flow as a liquidity measure and it is defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment. Free cash flow is a non-GAAP financial measure which U.S. Cellular believes may be useful to investors and other users of its financial information in evaluating liquidity, specifically, the amount of net cash generated by business operations after deducting Cash paid for additions to property, plant and equipment.

|

|

Nine Months Ended September 30, |

|||||

|

|

|

2017 |

|

2016 |

||

|

(Dollars in millions) |

|

|

|

|

|

|

|

Cash flows from operating activities (GAAP) |

$ |

|

$ |

|||

|

Less: Cash paid for additions to property, plant and equipment |

|

|

|

|||

|

|

Free cash flow (Non-GAAP) |

$ |

|

$ |

||

Postpaid ABPU and Postpaid ABPA

U.S. Cellular presents Postpaid ABPU and Postpaid ABPA to reflect the revenue shift from Service revenues to Equipment sales resulting from the increased adoption of equipment installment plans. Postpaid ABPU and Postpaid ABPA, as previously defined herein, are non-GAAP financial measures which U.S. Cellular believes are useful to investors and other users of its financial information in showing trends in both service and equipment sales revenues received from customers.

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|||||||||

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||||

|

(Dollars and connection counts in millions) |

|

|

|

|

|

|

|

|

|

|

|

||

|

Calculation of Postpaid ARPU |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Average number of postpaid connections |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ARPU (GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Postpaid ABPU |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Equipment installment plan billings |

|

|

|

|

|

|

|

||||||

|

|

Total billings to postpaid connections |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average number of postpaid connections |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ABPU (Non-GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Postpaid ARPA |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Average number of postpaid accounts |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ARPA (GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Postpaid ABPA |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Equipment installment plan billings |

|

|

|

|

|

|

|

||||||

|

|

Total billings to postpaid accounts |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average number of postpaid accounts |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ABPA (Non-GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

Goodwill impairment, net of tax

The following non-GAAP financial measure isolates the total effect on net income of the current period loss on impairment of goodwill including tax impacts. U.S. Cellular believes this measure may be useful to investors and other users of its financial information to assist in comparing the current period financial results with periods that were not impacted by such a charge.

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

|

|

|

|

2017 |

|

2016 |

2017 |

|

2016 |

||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill impairment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on impairment of goodwill |

$ |

|

$ |

|

$ |

|

$ |

||||

|

|

Tax benefit on impairment of goodwill1 |

|

|

|

|

|

|

|

||||

|

|

Goodwill impairment, net of tax (Non-GAAP) |

$ |

|

$ |

|

$ |

|

$ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Tax benefit represents the amount associated with the tax-deductible portion of the loss on goodwill impairment. |

|||||||||||

|

|

Application of Critical Accounting Policies and Estimates

U.S. Cellular prepares its consolidated financial statements in accordance with GAAP. U.S. Cellular’s significant accounting policies are discussed in detail in Note 1 — Summary of Significant Accounting Policies and Recent Accounting Pronouncements in the Notes to Consolidated Financial Statements and U.S. Cellular’s Application of Critical Accounting Policies and Estimates is discussed in detail in Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are included in U.S. Cellular’s Form 10-K for the year ended December 31, 2016.

Effective January 1, 2017, U.S. Cellular elected to change the classification of interest income on equipment installment plan contracts from Interest and dividend income to Service revenues in the Consolidated Statement of Operations. All prior period numbers have been recast to conform to the current year presentation. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional information regarding this accounting change. There were no other material changes to U.S. Cellular’s application of critical accounting policies and estimates during the nine months ended September 30, 2017.

Goodwill Interim Impairment Assessment

U.S. Cellular adopted ASU 2017-04, Intangibles – Goodwill and Other: Simplifying the Test for Goodwill Impairment, in the third quarter of 2017 and applied the guidance to interim goodwill impairment tests. During the third quarter of 2017, U.S. Cellular recorded a loss on impairment of goodwill of $370 million. Further, U.S. Cellular’s asset group was assessed for recoverability, which resulted in no impairment. See Note 6 — Intangible Assets in the Notes to Consolidated Financial Statements for additional details.

Management continues to monitor industry conditions and other economic factors such as the success of new and existing products and services, competition, and/or operational difficulties for negative trends. Such trends if identified, could adversely influence future forecasted cash flows, market prices on key assets such as spectrum licenses or recoverability of long-lived assets, which could result in possible impairments of such assets in future periods.

Recent Accounting Pronouncements

See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for information on recent accounting pronouncements.

FCC Auction 1002

U.S. Cellular was a bidder in the FCC’s forward auction of 600 MHz spectrum licenses, referred to as Auction 1002, which concluded in March 2017. In April 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an aggregate purchase price of $329 million. Prior to commencement of the forward auction, U.S. Cellular made an upfront payment to the FCC of $143 million in June 2016. U.S. Cellular paid the remaining $186 million to the FCC and was granted the licenses during the second quarter of 2017.

FCC Mobility Fund Phase II Order

In October 2011, the FCC adopted its USF/Intercarrier Compensation Transformation Order (USF Order). Pursuant to this order, U.S. Cellular’s then current Federal USF support was to be phased down at the rate of 20% per year beginning July 1, 2012. The USF Order contemplated the establishment of a new mobile USF program and provided for a pause in the phase down if that program was not timely implemented by July 2014. The Phase II Connect America Mobility Fund (MF2) was not operational as of July 2014 and, therefore, as provided by the USF Order, the phase down was suspended at 60% of the baseline amount until such time as the FCC had taken steps to establish the MF2. In February 2017, the FCC adopted the MF2 Order addressing the framework for MF2 and the resumption of the phase down. The MF2 Order establishes a support fund of $453 million annually for ten years to be distributed through a market-based, multi-round reverse auction. The MF2 Order further states that the phase down of legacy support for areas that do not receive support under MF2 will commence on the first day of the month following the completion of the auction and will conclude two years later.

In August 2017, the FCC adopted the MF2 Challenge Process Order, which laid out procedures for establishing areas that would be eligible for support under the MF2 program. This will include a collection process to be followed by a challenge window, a challenge response window, and finally adjudication of any coverage disputes. In September 2017, the FCC issued a public notice initiating the collection of 4G LTE coverage data. Responses submitting the collected data are due on January 4, 2018.

In October 2017, the FCC issued a public notice proposing and seeking comment on detailed challenge procedures and a schedule for the challenge process. Under this proposal, the challenge window would begin no earlier than four weeks after the January 4 collection date and would last 150 days. No earlier than five business days after the close of the challenge window, the FCC would open a thirty-day challenge response window. Following the challenge response window, the FCC would adjudicate any disputes. This entire process must be completed before an auction can be commenced.

|

|