Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

Commission file number 000-20557

THE ANDERSONS, INC.

(Exact name of the registrant as specified in its charter)

|

| | |

OHIO | | 34-1562374 |

(State of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

1947 Briarfield Boulevard, Maumee, Ohio | | 43537 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (419) 893-5050

Securities registered pursuant to Section 12(b) of the Act: Common Shares

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ý | Accelerated Filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the registrant's voting stock which may be voted by persons other than affiliates of the registrant was $944.2 million as of June 30, 2016, computed by reference to the last sales price for such stock on that date as reported on the Nasdaq Global Select Market.

The registrant had approximately 28.2 million common shares outstanding, no par value, at February 24, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on May 12, 2017, are incorporated by reference into Part III (Items 10, 11, 12, 13 and 14) of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Commission on or about March 15, 2017.

THE ANDERSONS, INC.

Table of Contents

|

| |

| Page No. |

PART I. | |

Item 1. Business | |

Item 1A. Risk Factors | |

Item 1B. Unresolved Staff Comments | |

Item 2. Properties | |

Item 3. Legal Proceedings | |

Item 4. Mine Safety | |

PART II. | |

Item 5. Market for the Registrant's Common Equity and Related Stockholder Matters | |

Item 6. Selected Financial Data | |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. Quantitative and Qualitative Disclosures about Market Risk | |

Item 8. Financial Statements and Supplementary Data | |

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | |

Item 9A. Controls and Procedures | |

PART III. | |

Item 10. Directors and Executive Officers of the Registrant | |

Item 11. Executive Compensation | |

Item 12. Security Ownership of Certain Beneficial Owners and Management | |

Item 13. Certain Relationships and Related Transactions | |

Item 14. Principal Accountant Fees and Services | |

PART IV. | |

Item 15. Exhibits, Financial Statement Schedules, and Reports on Form 8-K | |

Item 16. Form 10-K Summary | |

Signatures | |

Exhibits | |

Part I.

Item 1. Business

Company Overview

The Andersons, Inc. (the "Company") is a diversified company rooted in agriculture. Founded in Maumee, Ohio in 1947, the Company conducts business across North America in the grain, ethanol, plant nutrient and rail sectors. The Company also produces turf and cob products and has a consumer retailing presence.

Segment Descriptions

The Company's operations are classified into five reportable business segments: Grain, Ethanol, Rail, Plant Nutrient, and Retail. Each of these segments is organized based upon the nature of products and services offered. See Note 13 to the Consolidated Financial Statements in Item 8 for information regarding business segments.

Grain Group

The Grain business primarily operates grain elevators in various states in the U.S. Corn Belt. Income is earned on grain bought and sold or “put thru” the elevator, grain that is purchased and conditioned for resale, and space income. Space income consists of appreciation or depreciation in the basis value of grain held and represents the difference between the cash price of a commodity in one of the Company's facilities and an exchange traded futures price (“basis”); appreciation or depreciation between the future exchange contract months (“spread”); and grain stored for others upon which storage fees are earned. The Grain business also offers a number of unique grain marketing, risk management and corn origination services to its customers and affiliated ethanol facilities for which it collects fees.

The Company has a lease and marketing agreement with Cargill, Incorporated (“Cargill”) for Cargill's Maumee and Toledo, Ohio grain handling and storage facilities. As part of the agreement, Cargill is given the marketing rights to grain in the Cargill-owned facilities as well as the adjacent Company-owned facilities in Maumee and Toledo. The lease of the Cargill-owned facilities covers approximately 6%, or 8.7 million bushels, of the Company's total storage space.

Grain prices are not predetermined, so sales are negotiated by the Company's merchandising staff. The principal grains sold by the Company are corn, soybeans and wheat. Approximately 97% of grain sales by the Company in 2016 were purchased by U.S. grain processors and feeders, and approximately 3% were exported. Most of the Company's exported grain sales are done through intermediaries while some grain is shipped directly to foreign countries, mainly Canada. Grain shipments from our facilities are by rail, truck, or boat. Rail shipments are made primarily to grain processors and feeders with some rail shipments made to exporters on the Gulf of Mexico or east coast. Boat shipments are from the Port of Toledo. In addition, grain is transported via truck for direct ship transactions where producers sell grain to the Company but have it delivered directly to the end user.

The Company's grain operations rely principally on forward purchase contracts with producers, dealers and commercial elevators to ensure an adequate supply of grain to the Company's facilities throughout the year. The Company makes grain purchases at prices referenced to the Chicago Mercantile Exchange (“the CME”).

The Company competes in the sale of grain with other public and private grain brokers, elevator operators and farmer owned cooperative elevators. Some of the Company's competitors are also its customers. Competition is based primarily on price, service and reliability. Because the Company generally buys in smaller lots, its competition for the purchase of grain is generally local or regional in scope, although there are some large national and international companies that maintain regional grain purchase and storage facilities. Significant portions of grain bushels purchased and sold are done so using forward contracts.

The grain handling business is seasonal in nature in that the largest portion of the principal grains are harvested and delivered from the farm and commercial elevators in July, October and November although a significant portion of the principal grains are bought, sold and handled throughout the year.

Fixed price purchase and sale commitments as well as grain held in inventory expose the Company to risks related to adverse changes in market prices. Grain prices are typically comprised of two components, futures prices on the CME and local basis adjustments. The Company manages the futures price risk by entering into exchange-traded futures and option contracts with

the CME. The contracts are economic hedges of price risk, but are not designated or accounted for as hedging instruments. The CME is a regulated commodity futures exchange that maintains futures markets for the grains merchandised by the Company. Futures prices are determined by worldwide supply and demand.

The Company's grain risk management practices are designed to reduce the risk of changing commodity prices. In that regard, such practices also limit potential gains from further changes in market prices. The Company has policies that provide key controls over its risk management practices. These policies include a description of the objectives of the programs and review of position limits by key management outside of the trading function on a daily basis along with other internal controls. The Company monitors current market conditions and may expand or reduce the purchasing program in response to changes in those conditions. In addition, the Company monitors its counterparties on a regular basis for credit worthiness, defaults and non-delivery.

Purchases of grain can be made the day the grain is delivered to a terminal or via a forward contract made prior to actual delivery. Sales of grain generally are made by contract for delivery in a future period. When the Company purchases grain at a fixed price or at a price where a component of the purchase price is fixed via reference to a futures price on the CME, it also enters into an offsetting sale of a futures contract on the CME. Similarly, when the Company sells grain at a fixed price, the sale is offset with the purchase of a futures contract on the CME. At the close of business each day, inventory and open purchase and sale contracts as well as open futures and option positions are marked-to-market. Gains and losses in the value of the Company's ownership positions due to changing market prices are netted with, and generally offset in the statement of operations by, losses and gains in the value of the Company's futures positions.

When a futures contract is entered into, an initial margin deposit must be sent to the CME. The amount of the margin deposit is set by the CME and varies by commodity. If the market price of a futures contract moves in a direction that is adverse to the Company's position, an additional margin deposit, called a maintenance margin, is required by the CME. Subsequent price changes could require additional maintenance margin deposits or result in the return of maintenance margin deposits by the CME. Significant increases in market prices, such as those that occur when grain supplies are affected by unfavorable weather conditions and/or when increases in demand occur, can have an effect on the Company's liquidity and, as a result, require it to maintain appropriate short-term lines of credit. The Company may utilize CME option contracts to limit its exposure to potential required margin deposits in the event of a rapidly rising market.

The Company owns 33% of the equity in Lansing Trade Group LLC (“LTG”). LTG is largely focused on the movement of physical commodities, including grain and ethanol and is exposed to some of the same risks as the Company's grain and ethanol businesses. LTG also trades in commodities that the Company's grain and ethanol businesses do not trade in, some of which are not exchange traded. This investment provides the Company with further opportunity to diversify and complement its income through activity outside of its traditional product and geographic regions. This investment is accounted for under the equity method. The Company, along with LTG, also established joint ventures and purchased a grain and food-bean handler and agronomy input provider with 12 locations across Ontario, Canada and Minnesota. These investments are accounted for under the equity method. The Company periodically enters into transactions with these joint ventures as disclosed in Note 12 to the Consolidated Financial Statements in Item 8.

Ethanol Group

The Ethanol Group has ownership interests in four Limited Liability Companies (“the ethanol LLCs” or “LLCs”). Each of the LLCs owns an ethanol plant that is operated by the Company's Ethanol Group. The plants are located in Iowa, Indiana, Michigan, and Ohio and have combined nameplate capacity of 330 million gallons of ethanol. The Group purchases and sells ethanol, offers facility operations, risk management, and ethanol and corn oil marketing services to the ethanol plants it invests in and operates.

The Company holds an 85% interest in The Andersons Denison Ethanol LLC ("TADE"), which is a consolidated entity that was acquired on May 1, 2012. The Company holds a 55% interest in The Andersons Albion Ethanol LLC (“TAAE”) and a 39% interest in The Andersons Clymers Ethanol LLC (“TACE”). The Company holds a 50% interest in The Andersons Marathon Ethanol LLC (“TAME”) through its majority owned subsidiary The Andersons Ethanol Investment LLC (“TAEI”). A third party owns 34% of TAEI. All operating ethanol LLC investments, except TADE, are accounted for using the equity method of accounting.

The Company has a management agreement with each of the LLCs. As part of these agreements, the Ethanol Group runs the day-to-day operations of the plants and provides all administrative functions. The Company is compensated for these services based on a fixed cost plus an indexed annual increase determined by a consumer price index. Additionally, the Company has entered into agreements with each of the unconsolidated LLCs under which it has the exclusive right to act as supplier for

100% of the corn used by the LLCs in the production of ethanol. For this service, the Company receives a fee for each bushel of corn sold. The Company has entered into marketing agreements with each of the ethanol LLCs. Under the ethanol marketing agreements, the Company purchases 100% of the ethanol produced by TAAE, TACE and TADE and 50% of the ethanol produced by TAME at the same price it will resell the ethanol to external customers. The Ethanol Group receives a fee for each gallon of ethanol sold to external customers sourced from these LLCs. Under the distillers dried grains ("DDG") and corn oil marketing agreements, the Company markets the DDG and corn oil and receives a fee on units sold.

Plant Nutrient Group

The Plant Nutrient Group is a leading manufacturer, distributor and retailer of agricultural and related plant nutrients, corncob-based products, and pelleted lime and gypsum products in the U.S. Corn Belt, Florida and Puerto Rico. The Group provides warehousing, packaging and manufacturing services to basic nutrient producers and other distributors. The Group also manufactures and distributes a variety of industrial products throughout the U.S. and Puerto Rico including nitrogen reagents for air pollution control systems used in coal-fired power plants, and water treatment and dust abatement products.

In its plant nutrient businesses, the Company competes with regional and local cooperatives, wholesalers and retailers, predominantly publicly owned manufacturers and privately owned retailers, wholesalers and importers. Some of these competitors are also suppliers and have considerably larger resources than the Company. Competition in the nutrient business is based largely on depth of product offering, price, location and service. Sales and warehouse shipments of agricultural nutrients are heaviest in the spring and fall.

Wholesale Nutrients - The Wholesale Nutrients business manufactures, stores, and distributes dry and liquid agricultural nutrients, and pelleted lime and gypsum products annually. The major nutrient products sold by the business principally contain nitrogen, phosphate, potassium and sulfur. Product lines include base nutrients which are typically bought and sold as commodities and value add products which support more sustainable farming practices and command higher margins. The distribution and sales channels for both types of nutrients are shared within the Wholesale Nutrients business.

Farm Centers - The Farm Centers offer a variety of essential crop nutrients, crop protection chemicals and seed products in addition to application and agronomic services to commercial and family farmers. Soil and tissue sampling along with global satellite assisted services provide for pinpointing crop or soil deficiencies and prescriptive agronomic advice is provided to farmers.

Cob Products - Corncob-based products are manufactured for a variety of uses including laboratory animal bedding and private-label cat litter, as well as absorbents, blast cleaners, carriers and polishers. The products are distributed throughout the United States and Canada and into Europe and Asia. The principal sources for corncobs are seed corn producers.

Turf Products - Proprietary professional turf care products are produced for the golf course and professional turf care markets, serving both U.S. and international customers. These products are sold both directly and through distributors to golf courses and lawn service applicators. The Company also produces and sells fertilizer and control products to various markets.

Rail Group

The Company's Rail Group leases, repairs, and sells various types of railcars, locomotives and barges. In addition, the Rail Group offers fleet management services to private railcar owners.

The Company has a diversified fleet of car types (boxcars, gondolas, covered and open top hopper cars, tank cars and pressure differential cars), locomotives and barges serving a broad customer base. The Company operates in both the new and used car markets, allowing the Company to diversify its fleet both in terms of car types, industries and age of cars, as well as repairing and refurbishing used cars for specific markets and customers.

A significant portion of the railcars, locomotives and barges managed by the Company are included on the balance sheet as long-lived assets. The others are either in off-balance sheet operating leases (with the Company leasing assets from financial intermediaries and leasing those same assets to the end-users) or non-recourse arrangements (in which the Company is not subject to any lease arrangement related to the assets, but provides management services to the owner of the assets). The Company generally holds purchase options on most assets owned by financial intermediaries. We are under contract to provide maintenance services for many of the Rail Group assets that we own or manage. Refer to the Off-Balance Sheet Transactions section of Management's Discussion and Analysis for a breakdown of our railcar, locomotive and barge positions at December 31, 2016.

In the case of our off-balance sheet Rail Group assets, the Company's risk management philosophy is to match-fund the lease commitments where possible. Match-funding (in relation to lease transactions) means matching the terms of the financial intermediary funding arrangement with the lease terms of the customer where the Company is both lessee and sublessor. If the Company is unable to match-fund, it will attempt to get an early buyout provision within the funding arrangement to match the underlying customer lease. The Company does not attempt to match-fund lease commitments for Rail Group assets that are on our balance sheet.

Competition for marketing and fleet maintenance services is based primarily on price, service ability, and access to both used equipment and third-party financing. Repair facility competition is based primarily on price, quality and location.

Retail Group

The Company's Retail Group includes large retail stores operated as “The Andersons,” which are located in the Columbus and Toledo, Ohio markets. The retail concept is A Store Like No Other and the stores focus on providing significant product breadth with offerings in home improvement and other mass merchandise categories as well as specialty foods, wine and indoor and outdoor garden centers. Each store has 100,000 square feet or more of in-store display space plus 40,000 or more square feet of outdoor garden center space, and features do-it-yourself clinics, special promotions and varying merchandise displays. The majority of the Company's non-perishable merchandise is received at a distribution center located in Maumee, Ohio.

In January 2017, the Company announced the decision to close all remaining retail operations in the first half of 2017.

Employees

The Andersons offers a broad range of full-time and part-time career opportunities. Each position in the Company is important to our success, and we recognize the worth and dignity of every individual. We strive to treat each person with respect and utilize his or her unique talents. At December 31, 2016, the Company had 2,176 full-time and 822 part-time or seasonal employees.

Government Regulation

Grain sold by the Company must conform to official grade standards imposed under a federal system of grain grading and inspection administered by the United States Department of Agriculture (“USDA”).

The production levels, markets and prices of the grains that the Company merchandises are affected by United States government programs, which include acreage control and price support programs of the USDA. In regards to our investments in ethanol production facilities, the U.S. government has mandated a ten percent blend for motor fuel gasoline sold.

The U.S. Food and Drug Administration (“FDA”) has developed bioterrorism prevention regulations for food facilities, which require that we register our grain operations with the FDA, provide prior notice of any imports of food or other agricultural commodities coming into the United States and maintain records to be made available upon request that identifies the immediate previous sources and immediate subsequent recipients of our grain commodities.

The Company, like other companies engaged in similar businesses, is subject to a multitude of federal, state and local environmental protection laws and regulations including, but not limited to, laws and regulations relating to air quality, water quality, pesticides and hazardous materials. The provisions of these various regulations could require modifications of certain of the Company's existing facilities and could restrict the expansion of future facilities or significantly increase the cost of their operations. Compliance with environmental laws and regulations did not materially affect our earnings or competitive position in 2016.

In addition, the Company continues to assess the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and has concluded that the Company is not a major swap dealer or major swap participant. New federal regulations, studies and reports addressing all of the major areas of the new law, including the regulation of swaps and derivatives, are in the process of being finalized and adopted and we will continue to monitor these developments.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available on our Company website soon after filing with the Securities and Exchange Commission. Our Company

website is http://www.andersonsinc.com. The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. These reports are also available at the SEC's website: http://www.sec.gov.

Item 1A. Risk Factors

Our operations are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in this Form 10-K and could have a material adverse impact on our financial results. These risks can be impacted by factors beyond our control as well as by errors and omissions on our part. The following risk factors should be read carefully in connection with evaluating our business and the forward-looking statements contained elsewhere in this Form 10-K.

Certain of our business segments are affected by the supply and demand of commodities, and are sensitive to factors outside of our control. Adverse price movements could negatively affect our profitability and results of operations.

Our Grain, Ethanol and Plant Nutrient businesses buy, sell and hold inventories of agricultural input and output commodities, some of which are readily traded on commodity futures exchanges. Unfavorable weather conditions, both local and worldwide, as well as other factors beyond our control, can affect the supply and demand of these commodities and expose us to liquidity pressures to finance hedges in the grain business in rapidly rising markets. In our Plant Nutrient business, changes in the supply and demand of these commodities can also affect the value of inventories that we hold, as well as the price of raw materials as we are unable to effectively hedge these commodities. Increased costs of inventory and prices of raw material would decrease our profit margins and adversely affect our results of operations.

Corn - The principal raw material that the ethanol LLCs use to produce ethanol and co-products is corn. As a result, an increase in the price of corn in the absence of a corresponding increase in petroleum based fuel prices will typically decrease ethanol margins thus adversely affecting financial results in the ethanol LLCs. At certain levels, corn prices may make ethanol uneconomical to produce for fuel markets. The price of corn is influenced by weather conditions and other factors affecting crop yields, shift in acreage allocated to corn versus other major crops and general economic and regulatory factors. These factors include government policies and subsidies with respect to agriculture and international trade, and global and local demand and supply. The significance and relative effect of these factors on the price of corn is difficult to predict. Any event that tends to negatively affect the supply of corn, such as adverse weather or crop disease, could increase corn prices and potentially harm our income generated from our investments in ethanol LLCs. In addition, we may also have difficulty, from time to time, in physically sourcing corn on economical terms due to supply shortages. High costs or shortages could require us to suspend ethanol operations until corn is available on economical terms, which would have an adverse effect on operating results.

Grains - While we attempt to manage the risk associated with commodity price changes for our grain inventory positions with derivative instruments, including purchase and sale contracts, we are unable to offset 100% of the price risk of each transaction due to timing, availability of futures and options contracts and third-party credit risk. Furthermore, there is a risk that the derivatives we employ will not be effective in offsetting all of the risks that we are trying to manage. This can happen when the derivative and the underlying value of grain inventories and purchase and sale contracts are not perfectly matched. Our grain derivatives, for example, do not perfectly correlate with the basis component of our grain inventory and contracts. (Basis is defined as the difference between the local cash price of a commodity and the corresponding exchange-traded futures price.) Differences can reflect time periods, locations or product forms. Although the basis component is smaller and generally less volatile than the futures component of our grain market price, basis moves on a large grain position can significantly impact the profitability of the Grain business.

Our futures, options and over-the-counter contracts are subject to margin calls. If there are large movements in the commodities market, we could be required to post significant levels of margin, which would impact our liquidity. There is no assurance that the efforts we have taken to mitigate the impact of the volatility of the prices of commodities upon which we rely will be successful and any sudden change in the price of these commodities could have an adverse effect on our business and results of operations.

Natural Gas - We rely on third parties for our supply of natural gas, which is consumed in the drying of wet grain, manufacturing of certain turf products, pelleted lime and gypsum, and manufacturing of ethanol within the LLCs. The prices for and availability of natural gas are subject to market conditions. These market conditions often are affected by factors beyond our control such as higher prices resulting from colder than average weather conditions and overall economic conditions. Significant disruptions in the supply of natural gas could impair the operations of the ethanol facilities.

Furthermore, increases in natural gas prices or changes in our natural gas costs relative to natural gas costs paid by competitors may adversely affect future results of operations and financial position.

Gasoline and oil - We market ethanol as a fuel additive to reduce vehicle emissions from gasoline, as an octane enhancer to improve the octane rating of gasoline with which it is blended and as a substitute for petroleum based gasoline. As a result, ethanol prices will be influenced by the supply and demand for gasoline and oil and our future results of operations and financial position may be adversely affected if gasoline and oil demand or price changes.

Potash, phosphate and nitrogen - Raw materials used by the Plant Nutrient business include potash, phosphate and nitrogen, for which prices can be volatile driven by global and local supply and demand factors. Significant increases in the price of these commodities may result in lower customer demand and higher than optimal inventory levels. In contrast, reductions in the price of these commodities may create lower-of-cost-or-market adjustments to inventories.

Some of our business segments operate in highly regulated industries. Changes in government regulations or trade association policies could adversely affect our results of operations.

Many of our business segments are subject to government regulation and regulation by certain private sector associations, compliance with which can impose significant costs on our business. Other regulations are applicable generally to all our businesses and corporate functions, including, without limitation, those promulgated under the Internal Revenue Code, the Affordable Care Act, the Employee Retirement Income Security Act (ERISA) and other employment and health care related laws, federal and state securities laws, and the US Patriot Act. Failure to comply with such regulations can result in additional costs, fines or criminal action.

A significant part of our operations is regulated by environmental laws and regulations, including those governing the labeling, use, storage, discharge and disposal of hazardous materials. Because we use and handle hazardous substances in our businesses, changes in environmental requirements or an unanticipated significant adverse environmental event could have an adverse effect on our business. We cannot assure that we have been, or will at all times be, in compliance with all environmental requirements, or that we will not incur costs or liabilities in connection with these requirements. Private parties, including current and former employees, could bring personal injury or other claims against us due to the presence of, or exposure to, hazardous substances used, stored or disposed of by us, or contained in our products. We are also exposed to residual risk because some of the facilities and land which we have acquired may have environmental liabilities arising from their prior use. In addition, changes to environmental regulations may require us to modify our existing plant and processing facilities and could significantly increase the cost of those operations.

Grain and Ethanol businesses - In our Grain and Ethanol businesses, agricultural production and trade flows can be affected by government programs and legislation. Production levels, markets and prices of the grains we merchandise can be affected by U.S. government programs, which include acreage controls and price support programs administered by the USDA and required levels of ethanol in gasoline through the Renewable Fuel Standards as administered by the EPA. Other examples of government policies that can have an impact on our business include tariffs, duties, subsidies, import and export restrictions and outright embargoes. Because a portion of our grain sales are to exporters, the imposition of export restrictions and other foreign countries' regulations could limit our sales opportunities and create additional credit risk associated with export brokers if shipments are rejected at their destination.

The compliance burden and impact on our operations and profitability as a result of the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations have imposed additional regulatory tasks which took effect in 2014, although the full burden of the Act is not yet fully-known as regulatory rule making is not yet completed. These efforts to change the regulation of financial markets may subject users of derivatives to extensive oversight and regulation by the Commodities Futures Trading Commission (CFTC). Such initiatives could impose significant additional costs on us, including operating and compliance costs, and could materially affect the availability, as well as the cost and terms, of certain transactions. New federal regulations have come into effect, while other anticipated regulations, studies and reports, including the regulation of swaps and derivatives, are still in the process of being finalized and adopted and we will continue to monitor these developments. Any of these matters could have an adverse effect on our business, financial condition, liquidity, results of operations and prospects.

Rail - Our Rail business is subject to regulation by the American Association of Railroads and the Federal Railroad Administration. These agencies regulate rail operations with respect to health and safety matters. New regulatory rulings could negatively impact financial results through higher maintenance costs or reduced economic value of railcar assets.

The Rail business is also subject to risks associated with the demands and restrictions of the Class I railroads, a group of rail companies owning a high percentage of the existing rail lines. These companies exercise a high degree of control over whether private railcars can be allowed on their lines and may reject certain railcars or require maintenance or improvements to the railcars. This presents risk and uncertainty for our Rail business and it can increase maintenance costs. In addition, a shift in the railroads' strategy to investing in new rail cars and improvements to existing railcars, instead of investing in locomotives and infrastructure, could adversely impact our business by causing increased competition and creating an oversupply of railcars. Our rail fleet consists of a range of railcar types (boxcars, gondolas, covered and open top hoppers, tank cars and pressure differential cars) and locomotives. However, a large concentration of a particular type of railcar could expose us to risk if demand were to decrease for that railcar type. Failure on our part to identify and assess risks and uncertainties such as these could negatively impact our business.

Similarly, our marine assets and operations are subject to rules and regulations relating to safety, citizenship, emissions, ballast discharges, and other environmental and operational matters enforced by various federal and state agencies, including the Maritime Administration of the U.S. Department of Transportation, the U.S. Coast Guard, and the U.S. Environmental Protection Agency (“EPA”). If we fail to comply with these rules and regulations, we could be prohibited from operating or leasing marine assets in the U.S. market, and under certain circumstances, could incur severe fines and penalties, including potential limitations on operations or forfeitures of assets.

Plant Nutrient - Our Plant Nutrient business manufactures certain agricultural nutrients and uses potentially hazardous materials. All products containing pesticides, fungicides and herbicides must be registered with the EPA and state regulatory bodies before they can be sold. The inability to obtain or the cancellation of such registrations could have an adverse impact on our business. In the past, regulations governing the use and registration of these materials have required us to adjust the raw material content of our products and make formulation changes. Future regulatory changes may have similar consequences. Regulatory agencies, such as the EPA, may at any time reassess the safety of our products based on new scientific knowledge or other factors. If it were determined that any of our products were no longer considered to be safe, it could result in the amendment or withdrawal of existing approvals, which, in turn, could result in a loss of revenue, cause our inventory to become obsolete or give rise to potential lawsuits against us. Consequently, changes in existing and future government or trade association polices may restrict our ability to do business and cause our financial results to suffer.

We are required to carry significant amounts of inventory across all of our businesses. If a substantial portion of our inventory becomes damaged or obsolete, its value would decrease and our profit margins would suffer.

We are exposed to the risk of a decrease in the value of our inventories due to a variety of circumstances in all of our businesses. For example, within our Grain and Ethanol businesses, there is the risk that the quality of our grain inventory could deteriorate due to damage, moisture, insects, disease or foreign material. If the quality of our grain were to deteriorate below an acceptable level, the value of our inventory could decrease significantly. In our Plant Nutrient business, planted acreage, and consequently the volume of fertilizer and crop protection products applied, is partially dependent upon government programs and the producer's perception of demand. Technological advances in agriculture, such as genetically engineered seeds that resist disease and insects, or that meet certain nutritional requirements, could also affect the demand for our crop nutrients and crop protection products. Either of these factors could render some of our inventory obsolete or reduce its value. Within our rail repair business, major design improvements to loading, unloading and transporting of certain products can render existing (especially old) equipment obsolete.

Our substantial indebtedness could negatively affect our financial condition, decrease our liquidity and impair our ability to operate the business.

If cash on hand is insufficient to pay our obligations or margin calls as they come due at a time when we are unable to draw on our credit facility, it could have an adverse effect on our ability to conduct our business. Our ability to make payments on and to refinance our indebtedness will depend on our ability to generate cash in the future. Our ability to generate cash is dependent on various factors. These factors include general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. Certain of our long-term borrowings include provisions that require minimum levels of working capital and equity, and impose limitations on additional debt. Our ability to satisfy these provisions can be affected by events beyond our control, such as the demand for and the fluctuating price of grain. Although we are and have been in compliance with these provisions, noncompliance could result in default and acceleration of long-term debt payments.

We face increasing competition and pricing pressure from other companies in our industries. If we are unable to compete effectively with these companies, our sales and profit margins would decrease, and our earnings and cash flows would be adversely affected.

The markets for our products in each of our business segments are highly competitive. While we have substantial operations in our region, some of our competitors are significantly larger, compete in wider markets, have greater purchasing power, and have considerably larger financial resources. We also may enter into new markets where our brand is not recognized and in which we do not have an established customer base. Competitive pressures in all of our businesses could affect the price of, and customer demand for, our products, thereby negatively impacting our profit margins and resulting in a loss of market share.

Our grain and ethanol businesses use derivative contracts to reduce volatility in the commodity markets. Non-performance by the counter-parties to those contracts could adversely affect our future results of operations and financial position.

A significant amount of our grain and ethanol purchases and sales are done through forward contracting. In addition, the Company uses exchange traded and to a lesser degree over-the-counter contracts to reduce volatility in changing commodity prices. A significant adverse change in commodity prices could cause a counter-party to one or more of our derivative contracts to not perform on their obligation.

Our grain, ethanol, and plant nutrient businesses are geographically concentrated in the Eastern Corn Belt. Localized weather and other market factors may have a disproportionate impact on our business compared to our competitors.

A significant portion of the assets in the Company have exposure to conditions in the Eastern Corn Belt. In this region, adverse weather during the fertilizer application, planting, and harvest seasons can have negative impacts on our Grain and Plant Nutrient businesses. Higher basis levels in the Eastern Corn Belt can increase the input costs of our Ethanol facilities relative to other market participants that do not have the same geographic concentration.

We rely on a limited number of suppliers for certain of our raw materials and other products and the loss of one or several of these suppliers could increase our costs and have a material adverse effect on any one of our business segments.

We rely on a limited number of suppliers for certain of our raw materials and other products. If we were unable to obtain these raw materials and products from our current vendors, or if there were significant increases in our supplier's prices, it could significantly increase our costs and reduce our profit margins.

Our investments in limited liability companies and equity method investments are subject to risks beyond our control.

We currently have investments in numerous limited liability companies. By operating a business through this arrangement, we do not have control over operating decisions as we would if we owned the business outright. Specifically, we cannot act on major business initiatives without the consent of the other investors, who may not always be in agreement with our ideas.

The Company may not be able to effectively integrate future businesses it acquires.

We continuously look for opportunities to enhance our existing businesses through strategic acquisitions. The process of integrating an acquired business into our existing business and operations may result in unforeseen operating difficulties and expenditures as well as require a significant amount of management resources. There is also the risk that our due diligence efforts may not uncover significant business flaws or hidden liabilities. In addition, we may not realize the anticipated benefits of an acquisition and they may not generate the anticipated financial results. Additional risks may include the inability to effectively integrate the operations, products, technologies and personnel of the acquired companies. The inability to maintain uniform standards, controls, procedures and policies would also negatively impact operations.

Our business involves considerable safety risks. Significant unexpected costs and liabilities would have an adverse effect on our profitability and overall financial position.

Due to the nature of some of the businesses in which we operate, we are exposed to significant operational hazards such as grain dust explosions, fires, malfunction of equipment, abnormal pressures, blowouts, pipeline and tank ruptures, chemical spills or run-off, transportation accidents and natural disasters. Some of these operational hazards may cause personal injury or loss of life, severe damage to or destruction of property and equipment or environmental damage, and may result in suspension of operations and the imposition of civil or criminal penalties. If grain dust were to explode at one of our elevators or if one of our pieces of equipment were to fail or malfunction due to an accident or improper maintenance, it could put our employees and others at serious risk.

The Company's information technology systems may impose limitations or failures, or may face external threats, which may affect the Company's ability to conduct its business.

The Company's information technology systems, some of which are dependent on services provided by third parties, provide critical data connectivity, information and services for internal and external users. These interactions include, but are not limited to, ordering and managing materials from suppliers, converting raw materials to finished products, inventory management, shipping products to customers, processing transactions, summarizing and reporting results of operations, complying with regulatory, legal or tax requirements, human resources and other processes necessary to manage the business. The Company has put in place business continuity plans for its critical systems. However, if the Company's information technology systems are damaged, or cease to function properly due to any number of causes, such as catastrophic events or power outages, and the Company's business continuity plans do not effectively recover on a timely basis, the Company may suffer interruptions in the ability to manage its operations, which may adversely impact the Company's revenues and operating results. Our security measures may also be breached due to employee error, malfeasance, or otherwise. In addition, although the systems have been refreshed periodically, portions of the infrastructure are outdated and may not be adequate to support new business processes, accounting for new transactions, or implementation of new accounting standards if requirements are complex or materially different than what is currently in place.

Additionally, outside parties may attempt to destroy critical information, or fraudulently induce employees, third-party service providers, or users to disclose sensitive information in order to gain access to our data or our users' data. As a response, the Company requires user names and passwords in order to access its information technology systems. The Company also uses encryption and authentication technologies designed to secure the transmission and storage of data and prevent access to Company data or accounts. On an annual basis, these technologies and processes that relate to credit card information are reviewed by a third-party Payment Card Industry qualified security assessor. As with all companies, these security measures are subject to third-party security breaches, employee error, malfeasance, faulty password management, or other irregularities. We cannot assure our ability to prevent, repel or mitigate the effects of such an attack by outside parties. The Company relies on third parties to maintain and process certain information which could be subject to breach or unauthorized access to Company or employee information. Any such breach or unauthorized access could result in an inability to perform critical functions, significant legal and financial exposure, damage to our reputation, and a loss of confidence in the security of our services that could potentially have an adverse effect on our business.

The Company's design and implementation of a new Enterprise Resource Planning system could face significant difficulties.

In early 2012, the Company began the design and implementation of a new Enterprise Resource Planning ("ERP") system, requiring significant capital and human resources to deploy. The system will be more expensive and take longer to fully implement than originally planned, including increased capital investment, higher fees and expenses of third parties, delayed deployment scheduling, and more on-going maintenance expense once implemented. The ultimate costs and schedules are not yet known. If for any reason this implementation is not successful, the Company could be required to expense rather than capitalize related amounts. Beyond cost and scheduling, potential flaws in the implementation of an ERP system may pose risks to the Company's ability to operate successfully and efficiently. These risks include, without limitation, inefficient use of employees, distractions to the Company's core businesses, adverse customer reactions, loss of key information, delays in decision making, as well as unforeseen additional costs due to the inability to integrate vital information processes.

Unauthorized disclosure of sensitive or confidential customer information could harm the Company's business and standing with our customers.

The protection of our customer, employee and Company data is critical to us. The Company relies on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential customer information, such as payment card and personal information. Despite the security measures the Company has in place, its facilities and systems, and those of its third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors, or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by the Company or its vendors, could damage our reputation, expose us to risk of litigation and liability, disrupt our operations and harm our business.

Item 1B. Unresolved Staff Comments

The Company has no unresolved staff comments.

Item 2. Properties

The Company's principal agriculture, rail, retail and other properties are described below.

Agriculture Facilities

|

| | | | | | | | | |

| | | | Agricultural Fertilizer |

(in thousands) | | Grain Storage | | Dry Storage | | Liquid Storage |

Location | | (bushels) | | (tons) | | (tons) |

Canada | | 140 |

| | — |

| | — |

|

Florida | | — |

| | 3 |

| | 22 |

|

Illinois | | 10,831 |

| | 55 |

| | 11 |

|

Indiana | | 26,544 |

| | 145 |

| | 141 |

|

Iowa | | 2,600 |

| | — |

| | 69 |

|

Michigan | | 28,789 |

| | 70 |

| | 48 |

|

Minnesota | | — |

| | — |

| | 47 |

|

Nebraska | | 12,272 |

| | — |

| | 45 |

|

Ohio | | 42,483 |

| | 186 |

| | 65 |

|

Puerto Rico | | — |

| | — |

| | 23 |

|

Tennessee | | 16,135 |

| | — |

| | — |

|

Texas | | 1,412 |

| | — |

| | — |

|

Wisconsin | | — |

| | 29 |

| | 77 |

|

| | 141,206 |

| | 488 |

| | 548 |

|

The grain facilities are mostly concrete and steel tanks, with some flat storage, which is primarily cover-on-first temporary storage. The Company also owns grain inspection buildings and dryers, maintenance buildings and truck scales and dumps. Approximately 90% of the total storage capacity is owned, while the remaining 10% of the total capacity is leased from third parties.

The Plant Nutrient Group's wholesale nutrient and farm center properties consist mainly of fertilizer warehouse and formulation and packaging facilities for dry and liquid fertilizers. The Company owns 98% of the dry and liquid storage facilities.

Retail Store Properties

|

| | | | |

Name | | Location | | Square Feet |

Maumee Store | | Maumee, OH | | 166,000 |

Toledo Store | | Toledo, OH | | 162,000 |

Sawmill Store | | Columbus, OH | | 169,000 |

Brice Store | | Columbus, OH | | 159,000 |

Distribution Center (1) | | Maumee, OH | | 245,000 |

(1) Facility leased

The lease for the distribution center is an operating lease with several renewal options and provides for minimum aggregate annual lease payments approximating $0.8 million for 2017. This lease expires in 2018 and we do not intend to renew it.

In January 2017, the Company announced the planned closure of all four retail stores in the first half of 2017. These properties are owned by the Company so no lease termination charges apply. These properties will continue to be held until suitable buyers can be identified or alternate uses can be found.

Other Properties

The Company owns an ethanol facility in Denison, Iowa with a nameplate capacity of 55 million gallons. The Company owns lawn fertilizer production facilities in Maumee, Ohio, Bowling Green, Ohio, Montgomery, Alabama, and Mocksville, North Carolina. It also owns a corncob processing and storage facility in Delphi, Indiana and two cob facilities located in Central Illinois which were closed in the fourth quarter of 2016. The Company leases a lawn fertilizer warehouse facility in Toledo,

Ohio. The Company operates 16 railcar repair facilities and one fabrication shop throughout the country, primarily in the Midwest, South, and West.

The Company also owns an auto service center that is leased to its former venture partner. The Company's administrative office building is leased under a build-to-suit financing arrangement. The lease on our previous administrative building expired at the end of 2016. The Company owns approximately 2,084 acres of land on which the above properties and facilities are located and approximately 412 acres of farmland and land held for future use.

The Company believes that its properties are adequate for its business, well maintained and utilized, suitable for their intended uses and adequately insured.

Item 3. Legal Proceedings

The Company is currently subject to various claims and suits arising in the ordinary course of business, which include environmental issues, employment claims, contractual disputes, and defensive counter claims. The Company accrues liabilities where litigation losses are deemed probable and estimable. The Company believes it is unlikely that the results of its current legal proceedings, even if unfavorable, will be materially different from what it currently has accrued. There can be no assurance, however, that any claims or suits arising in the future, whether taken individually or in the aggregate, will not have a material adverse effect on our financial condition or results of operations.

Item 4. Mine Safety

Not applicable.

Executive Officers of the Registrant

The information is furnished pursuant to Instruction 3 to Item 401(b) of Regulation S-K. The executive officers of The Andersons, Inc., their positions and ages (as of March 1, 2017) are presented in the table below.

|

| | | |

Name | Position | Age | Year Assumed |

| | | |

Daniel T. Anderson | President, Retail Group President, Retail Group and Vice President, Corporate Operations Services | 61 | 2015 2009 |

Valerie Blanchett | Vice President, Human Resources Vice President, Human Resources, Food Ingredients and Systems (Cargill) | 55 | 2016 2010 |

Patrick E. Bowe | President and Chief Executive Officer Corporate Vice President, Food Ingredients and Systems (Cargill) | 58 | 2015 2007 |

Naran U. Burchinow | Senior Vice President, General Counsel and Secretary | 63 | 2005 |

James C. Burmeister | Vice President, Finance and Treasurer Vice President of Finance, Roofing and Asphalt Business (Owens-Corning) Vice President, Internal Audit (Owens-Corning) | 49 | 2015 2013 2011 |

John Granato | Chief Financial Officer Principal - Finance & Operations (Global Infrastructure Partners) | 51 | 2012 2009 |

Michael S. Irmen | President, Ethanol Group Vice President and General Manager, Ethanol Group Vice President, Commodities and Risk, Ethanol Group | 63 | 2016 2015 2012 |

Corbett Jorgenson | President, Grain Group Vice President, Transportation and Logistics Americas (Cargill) Senior Vice President, Commercial Lead, AgHorizons USA (Cargill) | 42 | 2016 2015 2014 |

Anthony Lombardi | Chief Information Officer Vice President, Global Business Services and Chief Information Officer (Armstrong World Industries) | 58 | 2016 2010

|

Anne G. Rex | Vice President, Corporate Controller Assistant Controller | 52 | 2012 2002 |

Rasesh H. Shah | President, Rail Group | 62 | 1999 |

Tamara S. Sparks | Vice President, Financial Planning & Analysis Vice President, Corporate Business /Financial Analysis | 48 | 2015 2007 |

William J. Wolf | President, Plant Nutrient Group Vice President of Supply & Merchandising, Plant Nutrient Group | 59 | 2012 2008 |

Part II.

Item 5. Market for the Registrant's Common Equity and Related Stockholder Matters

The Common Shares of The Andersons, Inc. trade on the Nasdaq Global Select Market under the symbol “ANDE.” On February 18, 2014, the Company effected a three-for-two stock split to its outstanding shares as of January 21, 2014. All share, dividend and per share information set forth in this 10-K has been retroactively adjusted to reflect the stock split.

Shareholders

At February 13, 2017, there were approximately 28.2 million common shares outstanding, 1,244 shareholders of record and approximately 11,676 shareholders for whom security firms acted as nominees.

The following table sets forth the high and low bid prices for the Company's Common Shares for the four fiscal quarters in each of 2016 and 2015.

|

| | | | | | | |

| 2016 | | 2015 |

| High | | Low | | High | | Low |

Quarter Ended | | | | | | | |

March 31 | $32.24 | | $24.01 | | $53.33 | | $39.41 |

June 30 | $36.46 | | $25.94 | | $47.10 | | $39.00 |

September 30 | $38.30 | | $34.40 | | $39.22 | | $31.97 |

December 31 | $44.80 | | $34.50 | | $38.49 | | $30.70 |

The Company's transfer agent and registrar is Computershare Investor Services, LLC, 2 North LaSalle Street, Chicago, IL 60602. Telephone: 312-588-4991.

Dividends

The Company has declared and paid consecutive quarterly dividends since the end of 1996, its first year of trading on the Nasdaq market. Dividends paid from January 2015 to January 2017 are as follows:

|

| | |

Payment Date | | Amount |

1/23/2015 | | $0.1400 |

4/22/2015 | | $0.1400 |

7/22/2015 | | $0.1400 |

10/22/2015 | | $0.1400 |

1/25/2016 | | $0.1550 |

4/22/2016 | | $0.1550 |

7/22/2016 | | $0.1550 |

10/24/2016 | | $0.1550 |

1/25/2017 | | $0.1600 |

While the Company's objective is to pay a quarterly cash dividend, dividends are subject to Board of Director approval.

Equity Plans

The following table gives information as of December 31, 2016 about the Company's Common Shares that may be issued upon the exercise of options under all of its existing equity compensation plans.

|

| | | | | | | |

| Equity Compensation Plan Information |

Plan category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders | 969,457 (1) |

| $ | 35.33 |

| 945,367 (2) |

|

Equity compensation plans not approved by security holders | — |

| — |

| — |

|

| |

(1) | This number includes 325,000 Non-Qualified Stock Options (“Options”), 117,868 total shareholder return-based performance share units, 303,854 earnings per share-based performance share units, and 222,735 restricted shares outstanding under The Andersons, Inc. 2014 Long-Term Performance Compensation Plan. This number does not include any shares related to the Employee Share Purchase Plan. The Employee Share Purchase Plan allows employees to purchase common shares at the lower of the market value on the beginning or end of the calendar year through payroll withholdings. These purchases are completed as of December 31. |

| |

(2) | This number includes 137,394 Common Shares available to be purchased under the Employee Share Purchase Plan and 807,973 shares available under equity compensation plans. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In October 2014, the Board approved the repurchase of shares at a value not to exceed $50.0 million. The Company repurchased approximately 1.2 million shares, exhausting the October 2014 authorization amount in 2015.

No shares were repurchased in 2016.

Performance Graph

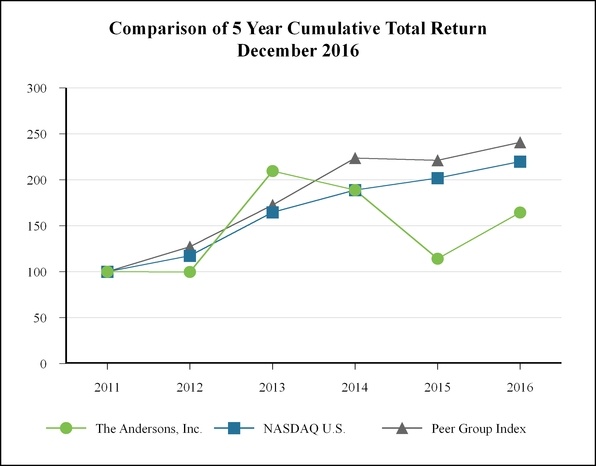

The graph below compares the total shareholder return on the Corporation's Common Shares to the cumulative total return for the Nasdaq U.S. Index and a Peer Group Index. The indices reflect the year-end market value of an investment in the stock of each company in the index, including additional shares assumed to have been acquired with cash dividends, if any. The Peer Group Index, weighted for market capitalization, includes the following companies:

|

| |

Agrium, Inc. | Lowe's Companies, Inc. |

Archer-Daniels-Midland Co. | The Greenbrier Companies, Inc. |

GATX Corp. | The Scott's Miracle-Gro Company |

Ingredion Incorporated | |

The graph assumes a $100 investment in The Andersons, Inc. Common Shares on December 31, 2011 and also assumes investments of $100 in each of the Nasdaq U.S. and Peer Group indices, respectively, on December 31 of the first year of the graph. The value of these investments as of the following calendar year-ends is shown in the table below the graph.

|

| | | | | | | | | | | | | | | | | | |

| Base Period | Cumulative Returns |

| December 31, 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

The Andersons, Inc. | $ | 100.00 |

| $ | 99.69 |

| $ | 209.39 |

| $ | 188.75 |

| $ | 114.18 |

| $ | 164.28 |

|

NASDAQ U.S. | 100.00 |

| 117.45 |

| 164.57 |

| 188.84 |

| 201.98 |

| 219.89 |

|

Peer Group Index | 100.00 |

| 127.21 |

| 172.59 |

| 223.57 |

| 221.29 |

| 240.72 |

|

Item 6. Selected Financial Data

The following table sets forth selected consolidated financial data of the Company. The data for each of the five years in the period ended December 31, 2016 are derived from the Consolidated Financial Statements of the Company. The data presented below should be read in conjunction with “Management's Discussion and Analysis of Financial Condition and Results of Operations,” included in Item 7, and the Consolidated Financial Statements and notes thereto included in Item 8.

|

| | | | | | | | | | | | | | | | | | | |

(in thousands, except for per share and ratios and other data) | For the years ended December 31, |

| 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

Operating results | | | | | | | | | |

Sales and merchandising revenues (a) | $ | 3,924,790 |

| | $ | 4,198,495 |

| | $ | 4,540,071 |

| | $ | 5,604,574 |

| | $ | 5,272,010 |

|

Gross profit | 345,506 |

| | 375,838 |

| | 397,139 |

| | 365,225 |

| | 358,005 |

|

Equity in earnings of affiliates | 9,721 |

| | 31,924 |

| | 96,523 |

| | 68,705 |

| | 16,487 |

|

Other income, net (b) | 14,775 |

| | 46,472 |

| | 31,125 |

| | 14,876 |

| | 14,725 |

|

Net income (loss) | 14,470 |

| | (11,322 | ) | | 122,645 |

| | 95,702 |

| | 75,565 |

|

Net income (loss) attributable to The Andersons, Inc. | 11,594 |

| | (13,067 | ) | | 109,726 |

| | 89,939 |

| | 79,480 |

|

|

| | | | | | | | | | | | | | |

Financial position | | | | | | | | | |

Total assets | 2,232,849 |

| | 2,359,101 |

| | 2,364,692 |

| | 2,273,556 |

| | 2,182,304 |

|

Working capital | 258,350 |

| | 241,485 |

| | 226,741 |

| | 229,451 |

| | 304,346 |

|

Long-term debt (c) | 397,065 |

| | 436,208 |

| | 298,638 |

| | 371,150 |

| | 407,176 |

|

Long-term debt, non-recourse (c) | — |

| | — |

| | — |

| | 4,063 |

| | 20,067 |

|

Total equity | 790,697 |

| | 783,739 |

| | 824,049 |

| | 724,421 |

| | 611,445 |

|

| | | | | | | | | |

Cash flows / liquidity | | | | | | | | | |

Cash flows from (used in) operations | 39,585 |

| | 154,134 |

| | (10,071 | ) | | 337,188 |

| | 328,482 |

|

Depreciation and amortization | 84,325 |

| | 78,456 |

| | 62,005 |

| | 55,307 |

| | 48,977 |

|

Cash invested in acquisitions (d) | — |

| | (128,549 | ) | | (20,037 | ) | | (15,252 | ) | | (220,257 | ) |

Purchase of investments (e) | (2,523 | ) | | (938 | ) | | (238 | ) | | (49,251 | ) | | — |

|

Investments in property, plant and equipment | (77,740 | ) | | (72,469 | ) | | (59,675 | ) | | (46,786 | ) | | (69,274 | ) |

Net proceeds from (investment in) Rail Group assets (f) | (28,579 | ) | | (38,407 | ) | | (57,968 | ) | | 4,648 |

| | (20,397 | ) |

EBITDA (g) | 123,949 |

| | 85,219 |

| | 254,992 |

| | 219,917 |

| | 195,180 |

|

| | | | | | | | | |

Per share data (h) | | | | | | | | | |

Net income (loss) - basic | 0.41 |

| | (0.46 | ) | | 3.85 |

| | 3.20 |

| | 2.85 |

|

Net income (loss) - diluted | 0.41 |

| | (0.46 | ) | | 3.84 |

| | 3.18 |

| | 2.82 |

|

Dividends declared | 0.6250 |

| | 0.5750 |

| | 0.4700 |

| | 0.4300 |

| | 0.4000 |

|

Year-end market value | 44.70 |

| | 31.63 |

| | 53.14 |

| | 59.45 |

| | 28.60 |

|

| | | | | | | | | |

Ratios and other data | | | | | | | | | |

Net income attributable to The Andersons, Inc. return on beginning equity attributable to The Andersons, Inc. | 1.5 | % | | (1.6 | )% | | 15.6 | % | | 15.1 | % | | 15.2 | % |

Funded long-term debt to equity ratio (i) | 0.5-to-1 |

| | 0.6-to-1 |

| | 0.4-to-1 |

| | 0.5-to-1 |

| | 0.7-to-1 |

|

Weighted average shares outstanding (000's) | 28,193 |

| | 28,288 |

| | 28,367 |

| | 27,986 |

| | 27,784 |

|

Effective tax rate | 32.3 | % | | 2.1 | % | | 33.4 | % | | 36.0 | % | | 37.1 | % |

(a) Includes sales of $854.6 million in 2016, $872.1 million in 2015, $1,064.4 million in 2014, $1,333.2 million in 2013, and $1,359.4 million in 2012 pursuant to marketing and origination agreements between the Company and the unconsolidated ethanol LLCs.

(b) Includes $23.1 million for the gain on dilution and partial share redemption of the LTG investment in 2015 and $17.1 million for the gain on partial share redemption of LTG in 2014.

(c) Excludes current portion of long-term debt. The increase in non-recourse debt in 2012 is related to the debt issued by TADE.

(d) During 2015, the Company acquired 100% of the stock of Kay Flo Industries, Inc. During 2012, the Company acquired the assets of Green Plains Grain, TADE, Mt. Pulaski and 100% of the stock of New Eezy Gro.

(e) During 2013, the Company and LTG established 50/50 joint ventures to acquire 100% of the stock of Thompsons Limited and its related U.S. operating company.

(f) Represents the net of purchases of Rail Group assets offset by proceeds on sales of Rail Group assets.

(g) Earnings before interest, taxes, depreciation and amortization, or EBITDA, is a non-GAAP measure. It is one of the measures the Company uses to evaluate its liquidity. The Company believes that EBITDA provides additional information important to investors and others

in determining its ability to meet debt service obligations. EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations as determined by generally accepted accounting principles. EBITDA does not necessarily indicate whether cash flow will be sufficient to meet cash requirements for debt service obligations or otherwise. Because EBITDA, as determined by the Company, excludes some, but not all, items that affect net income, it may not be comparable to EBITDA or similarly titled measures used by other companies.

(h) Earnings per share are calculated based on Income attributable to The Andersons, Inc.

(i) Calculated by dividing long-term debt by total year-end equity as stated under “Financial position.”

The following table sets forth (1) our calculation of EBITDA and (2) a reconciliation of EBITDA to our net cash flow provided by (used in) operations.

|

| | | | | | | | | | | | | | | | | | | |

| For the years ended December 31, |

(in thousands) | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

Net income (loss) attributable to The Andersons, Inc. | $ | 11,594 |

| | $ | (13,067 | ) | | $ | 109,726 |

| | $ | 89,939 |

| | $ | 79,480 |

|

Add: | | | | | | | | | |

Provision for income taxes | 6,911 |

| | (242 | ) | | 61,501 |

| | 53,811 |

| | 44,568 |

|

Interest expense | 21,119 |

| | 20,072 |

| | 21,760 |

| | 20,860 |

| | 22,155 |

|

Depreciation and amortization | 84,325 |

| | 78,456 |

| | 62,005 |

| | 55,307 |

| | 48,977 |

|

EBITDA | 123,949 |

| | 85,219 |

| | 254,992 |

| | 219,917 |

| | 195,180 |

|

Add/(subtract): | | | | | | | | | |

Benefit (provision) for income taxes | (6,911 | ) | | 242 |

| | (61,501 | ) | | (53,811 | ) | | (44,568 | ) |

Interest expense | (21,119 | ) | | (20,072 | ) | | (21,760 | ) | | (20,860 | ) | | (22,155 | ) |

Goodwill impairment | — |

| | 56,166 |

| | — |

| | — |

| | — |

|

Asset impairment | 9,107 |

| | 285 |

| | 3,090 |

| | — |

| | — |

|

Realized gains on Rail Group assets and related leases | (11,019 | ) | | (13,281 | ) | | (15,830 | ) | | (19,366 | ) | | (23,665 | ) |

Gain on sale of investments in affiliates | (685 | ) | | (22,881 | ) | | (17,055 | ) | | — |

| | — |

|

Deferred income taxes | 6,030 |

| | 27,279 |

| | 21,815 |

| | 40,374 |

| | 16,503 |

|

Excess tax benefit from share-based payment arrangement | 13 |

| | (1,299 | ) | | (1,806 | ) | | (1,001 | ) | | (162 | ) |

Equity in earnings of unconsolidated affiliates, net of distributions received | 14,766 |

| | (677 | ) | | 28,749 |

| | (50,953 | ) | | 8,134 |

|

Noncontrolling interest in income (loss) of affiliates | 2,876 |

| | 1,745 |

| | 12,919 |

| | 5,763 |

| | (3,915 | ) |

Changes in working capital and other | (77,422 | ) | | 41,408 |

| | (213,684 | ) | | 217,125 |

| | 203,130 |

|

Net cash provided by (used in) operations | $ | 39,585 |

| | $ | 154,134 |

| | $ | (10,071 | ) | | $ | 337,188 |

| | $ | 328,482 |

|

The Company has included its Computation of Earnings to Fixed Charges in Item 15. Exhibits, Financial Statement Schedules, and Reports on Form 10-K as Exhibit 12.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

The following “Management's Discussion and Analysis of Financial Condition and Results of Operations” contains forward-looking statements which relate to future events or future financial performance and involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by these forward-looking statements. You are urged to carefully consider these risks and factors, including those listed under Item 1A, “Risk Factors.” In some cases, you can identify forward-looking statements by terminology such as “may,” “anticipates,” “believes,” “estimates,” “predicts,” or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. These forward-looking statements relate only to events as of the date on which the statements are made and the Company undertakes no obligation, other than any imposed by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Executive Overview

Our operations are organized, managed and classified into five reportable business segments: Grain, Ethanol, Plant Nutrient, Rail, and Retail. Each of these segments is based on the nature of products and services offered.

The agricultural commodity-based business is one in which changes in selling prices generally move in relationship to changes in purchase prices. Therefore, increases or decreases in prices of the agricultural commodities that the business deals in will have a relatively equal impact on sales and cost of sales and a much less significant impact on gross profit. As a result, changes in sales for the period may not necessarily be indicative of the overall performance of the business and more focus should be placed on changes to gross profit.

Grain Group

Total grain storage capacity is approximately 150 million bushels as of December 31, 2016 compared to 164 million bushels at December 31, 2015. Storage decreased due to the sale of assets in Iowa during 2016. Grain inventories on hand at December 31, 2016 were 108.4 million bushels, of which 0.9 million bushels were stored for others. This compares to 119.8 million bushels on hand at December 31, 2015, of which 3.4 million bushels were stored for others.

2016 performance in the Grain Group reflected challenges in core grain assets, as well as lower returns from affiliates. The 2015 harvest saw significant challenges in the Eastern Corn Belt where many of our facilities are located and the limited opportunities for space income during the first nine months of 2016. In the fourth quarter of 2016, we saw significantly better production in our core regions which has allowed us to purchase grain at more typical prices.

Additionally, performance at one of our equity method grain affiliates was challenged due to weakness in the export market for DDGs as well as losses on trading positions during periods of market volatility in the first half of the year.

Corn acre planting estimates for 2017 are approximately 90 to 93 million acres, which is down modestly from the 94 million planted in 2016. Soybean acres to be planted are estimated at approximately 87 to 90 million acres, which is up compared to the 83 million planted in 2016. Additionally, we are expecting a decline in acres dedicated to wheat in 2017. The high wheat stocks on hand in domestic storage facilities, combined with wheat's ability to be stored for long periods of time have provided strong storage rates for the Company in 2016 which shifts incentive for production to other grains.

Assuming yields in the areas the Company does business are consistent with trends, this should create a good base for the Company's Grain Group in 2017 with combined corn and soybean acreage ranging from flat to a small increase. In 2017, our Grain Group will also continue its focus on driving profitable growth and enhancing risk management and grain marketing services.

Ethanol Group

The Ethanol Group continued to execute well, realizing high levels of production and exercising effective risk management throughout the year. Some weakness in margins on co-products, such as DDG, occurred in the second half of the year due to lower international demand as well as localized elevated levels of vomitoxin in the 2016 corn crop. Higher gasoline demand, improved demand and prices for DDG in relation to corn price, and an ample corn supply are factors that could potentially improve margins going into 2017.

Volumes shipped for the years ended December 31, 2016 and 2015 were as follows:

|

| | | | | |