UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kathleen L. Prudhomme

Vice President and Secretary

901 Marquette Avenue

Minneapolis, Minnesota 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: May 31

Date of reporting period: May 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| Class / Ticker Symbol | ||||||||

| Fund Name | Class A | Class C | Class C1 | Class C2 | Class I | |||

| Nuveen Minnesota Intermediate Municipal Bond Fund | FAMAX | NIBCX | FACMX | NIBMX | FAMTX | |||

| Nuveen Minnesota Municipal Bond Fund | FJMNX | NTCCX | FCMNX | NMBCX | FYMNX | |||

| Nuveen Nebraska Municipal Bond Fund | FNTAX | NAAFX | FNTCX | NCNBX | FNTYX | |||

| Nuveen Oregon Intermediate Municipal Bond Fund | FOTAX | NAFOX | — | NIMOX | FORCX | |||

to Shareholders

Comments

CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.5% annual gain in

and Dividend Information

and Effective Leverage Ratios

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.88% | 2.69% | 4.07% |

| Class A Shares at maximum Offering Price | (2.15)% | 2.06% | 3.75% |

| S&P Municipal Bond Intermediate Index | 1.71% | 3.12% | 4.75% |

| Lipper Other States Intermediate Municipal Debt Funds Classification Average | 0.50% | 1.84% | 3.37% |

| Class I Shares | 1.06% | 2.88% | 4.21% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (0.02)% | N/A | 2.52% |

| Class C1 Shares | 0.42% | 2.23% | 3.49% |

| Class C2 Shares | 0.30% | 2.12% | 3.64% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | (0.82)% | 2.66% | 4.08% |

| Class A Shares at maximum Offering Price | (3.76)% | 2.03% | 3.77% |

| Class I Shares | (0.65)% | 2.85% | 4.22% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (1.62)% | N/A | 2.36% |

| Class C1 Shares | (1.27)% | 2.20% | 3.41% |

| Class C2 Shares | (1.39)% | 2.11% | 3.54% |

| Share Class | |||||

| Class A | Class C | Class C1 | Class C2 | Class I | |

| Expense Ratios | 0.82% | 1.61% | 1.27% | 1.37% | 0.62% |

| Effective Leverage Ratio | 0.00% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.92% | 3.54% | 4.67% |

| Class A Shares at maximum Offering Price | (3.35)% | 2.65% | 4.23% |

| S&P Municipal Bond Index | 1.57% | 3.42% | 4.47% |

| Lipper Minnesota Municipal Debt Funds Classification Average | 0.75% | 2.70% | 3.73% |

| Class C1 Shares | 0.46% | 3.07% | 4.19% |

| Class I Shares | 1.13% | 3.73% | 4.87% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | 0.19% | N/A | 4.05% |

| Class C2 Shares | 0.45% | 2.97% | 5.50% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | (0.84)% | 3.50% | 4.74% |

| Class A Shares at maximum Offering Price | (4.98)% | 2.62% | 4.29% |

| Class C1 Shares | (1.31)% | 3.03% | 4.25% |

| Class I Shares | (0.73)% | 3.70% | 4.92% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (1.73)% | N/A | 3.88% |

| Class C2 Shares | (1.48)% | 2.94% | 5.39% |

| Share Class | |||||

| Class A | Class C | Class C1 | Class C2 | Class I | |

| Expense Ratios | 0.82% | 1.62% | 1.28% | 1.38% | 0.62% |

| Effective Leverage Ratio | 0.00% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

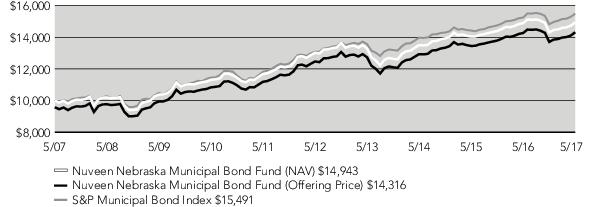

| Class A Shares at NAV | 0.32% | 2.79% | 4.13% |

| Class A Shares at maximum Offering Price | (3.93)% | 1.92% | 3.68% |

| S&P Municipal Bond Index | 1.57% | 3.42% | 4.47% |

| Lipper Other States Municipal Debt Funds Classification Average | 0.61% | 2.44% | 3.51% |

| Class C1 Shares | (0.18)% | 2.32% | 3.69% |

| Class I Shares | 0.48% | 2.98% | 4.36% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (0.51)% | N/A | 3.39% |

| Class C2 Shares | (0.35)% | 2.20% | 4.31% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | (1.38)% | 2.82% | 4.19% |

| Class A Shares at maximum Offering Price | (5.50)% | 1.94% | 3.74% |

| Class C1 Shares | (1.79)% | 2.36% | 3.74% |

| Class I Shares | (1.22)% | 3.01% | 4.40% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (2.20)% | N/A | 3.22% |

| Class C2 Shares | (1.95)% | 2.24% | 4.22% |

| Share Class | |||||

| Class A | Class C | Class C1 | Class C2 | Class I | |

| Gross Expense Ratios | 0.91% | 1.71% | 1.37% | 1.47% | 0.71% |

| Net Expense Ratios | 0.89% | 1.69% | 1.34% | 1.44% | 0.69% |

| Effective Leverage Ratio | 0.00% |

| Average Annual | |||

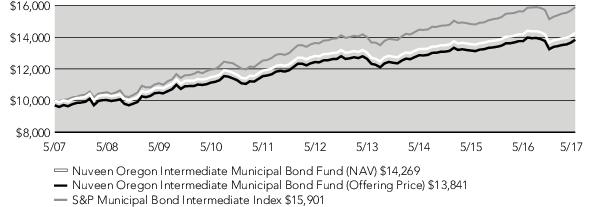

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.61% | 2.17% | 3.65% |

| Class A Shares at maximum Offering Price | (2.37)% | 1.54% | 3.34% |

| S&P Municipal Bond Intermediate Index | 1.71% | 3.12% | 4.75% |

| Lipper Other States Intermediate Municipal Debt Funds Classification Average | 0.50% | 1.84% | 3.37% |

| Class I Shares | 0.78% | 2.36% | 3.83% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (0.21)% | N/A | 2.09% |

| Class C2 Shares | 0.12% | 1.62% | 3.15% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | (1.30)% | 2.13% | 3.67% |

| Class A Shares at maximum Offering Price | (4.27)% | 1.50% | 3.36% |

| Class I Shares | (1.13)% | 2.32% | 3.85% |

| Average Annual | |||

| 1-Year | 5-Year | Since

Inception | |

| Class C Shares | (2.02)% | N/A | 1.92% |

| Class C2 Shares | (1.88)% | 1.56% | 3.03% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.83% | 1.62% | 1.38% | 0.62% |

| Effective Leverage Ratio | 0.00% |

| Share Class | |||||

| Class A1 | Class C | Class C1 | Class C2 | Class I | |

| Dividend Yield | 2.67% | 1.96% | 2.29% | 2.19% | 2.94% |

| SEC 30-Day Yield | 1.66% | 0.92% | 1.27% | 1.17% | 1.91% |

| Taxable-Equivalent Yield (35.1%)2 | 2.56% | 1.42% | 1.96% | 1.80% | 2.94% |

| Share Class | |||||

| Class A1 | Class C | Class C1 | Class C2 | Class I | |

| Dividend Yield | 2.89% | 2.20% | 2.57% | 2.45% | 3.22% |

| SEC 30-Day Yield | 2.14% | 1.45% | 1.80% | 1.70% | 2.44% |

| Taxable-Equivalent Yield (35.1%)2 | 3.30% | 2.23% | 2.77% | 2.62% | 3.76% |

| Share Class | |||||

| Class A1 | Class C | Class C1 | Class C2 | Class I | |

| Dividend Yield | 2.99% | 2.29% | 2.64% | 2.56% | 3.28% |

| SEC 30-Day Yield - Subsidized | 1.52% | 0.82% | 1.14% | 1.06% | 1.79% |

| SEC 30-Day Yield - Unsubsidized | 1.47% | 0.76% | 1.10% | 1.00% | 1.74% |

| Taxable-Equivalent Yield - Subsidized (32.9%)2 | 2.27% | 1.22% | 1.70% | 1.58% | 2.67% |

| Taxable-Equivalent Yield - Unsubsidized (32.9%)2 | 2.19% | 1.13% | 1.64% | 1.49% | 2.59% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 2.14% | 1.40% | 1.63% | 2.38% |

| SEC 30-Day Yield | 1.18% | 0.43% | 0.68% | 1.42% |

| Taxable-Equivalent Yield (35.1%)2 | 1.82% | 0.66% | 1.05% | 2.19% |

Examples

| Share Class | |||||

| Class A | Class C | Class C1 | Class C2 | Class I | |

| Actual Performance | |||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,041.90 | $1,036.90 | $1,039.40 | $1,039.10 | $1,042.00 |

| Expenses Incurred During the Period | $ 4.12 | $ 8.18 | $ 6.41 | $ 6.91 | $ 3.11 |

| Hypothetical

Performance (5% annualized return before expenses) |

|||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.89 | $1,016.90 | $1,018.65 | $1,018.15 | $1,021.89 |

| Expenses Incurred During the Period | $ 4.08 | $ 8.10 | $ 6.34 | $ 6.84 | $ 3.07 |

| Share Class | |||||

| Class A | Class C | Class C1 | Class C2 | Class I | |

| Actual Performance | |||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,054.10 | $1,050.70 | $1,051.80 | $1,051.90 | $1,055.20 |

| Expenses Incurred During the Period | $ 4.20 | $ 8.28 | $ 6.50 | $ 7.01 | $ 3.18 |

| Hypothetical

Performance (5% annualized return before expenses) |

|||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.84 | $1,016.85 | $1,018.60 | $1,018.10 | $1,021.84 |

| Expenses Incurred During the Period | $ 4.13 | $ 8.15 | $ 6.39 | $ 6.89 | $ 3.13 |

| Share Class | |||||

| Class A | Class C | Class C1 | Class C2 | Class I | |

| Actual Performance | |||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,044.50 | $1,040.20 | $1,041.20 | $1,040.50 | $1,045.40 |

| Expenses Incurred During the Period | $ 4.54 | $ 8.60 | $ 6.82 | $ 7.33 | $ 3.52 |

| Hypothetical

Performance (5% annualized return before expenses) |

|||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.49 | $1,016.50 | $1,018.25 | $1,017.75 | $1,021.49 |

| Expenses Incurred During the Period | $ 4.48 | $ 8.50 | $ 6.74 | $ 7.24 | $ 3.48 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,044.70 | $1,039.60 | $1,041.70 | $1,045.60 |

| Expenses Incurred During the Period | $ 4.18 | $ 8.24 | $ 6.97 | $ 3.16 |

| Hypothetical

Performance (5% annualized return before expenses) |

||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.84 | $1,016.85 | $1,018.10 | $1,021.84 |

| Expenses Incurred During the Period | $ 4.13 | $ 8.15 | $ 6.89 | $ 3.13 |

Independent Registered Public Accounting Firm

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| LONG-TERM INVESTMENTS – 98.9% | ||||||

| MUNICIPAL BONDS – 98.9% | ||||||

| Education and Civic Organizations – 22.4% | ||||||

| $ 395 | Anoka County, Minnesota, Charter School Lease Revenue Bonds, Spectrum Building Company, Series 2012A, 5.000%, 6/01/32 | 6/20 at 102.00 | BBB- | $414,055 | ||

| Baytown Township, Minnesota Charter School Lease Revenue Bonds, Saint Croix Preparatory Academy, Refunding Series 2016A: | ||||||

| 425 | 3.000%, 8/01/23 | No Opt. Call | BB+ | 412,407 | ||

| 720 | 3.500%, 8/01/25 | No Opt. Call | BB+ | 702,238 | ||

| 130 | 4.000%, 8/01/28 | 8/26 at 100.00 | BB+ | 127,810 | ||

| City of Ham Lake, Minnesota, Charter School Lease Revenue Bonds, DaVinci Academy Project, Series 2016A: | ||||||

| 100 | 5.000%, 7/01/31 | 7/24 at 102.00 | N/R | 102,959 | ||

| 1,000 | 5.000%, 7/01/36 | 7/24 at 102.00 | N/R | 1,013,280 | ||

| 210 | City of Woodbury, Minnesota, Charter School Lease Revenue Bonds, Math and Science Academy Building Company, Series 2012A, 5.000%, 12/01/27 | 12/20 at 102.00 | BBB- | 222,812 | ||

| Deephaven, Minnesota, Charter School Lease Revenue Bonds, Eagle Ridge Academy Project, Series 2015A: | ||||||

| 190 | 5.000%, 7/01/30 | 7/25 at 100.00 | BB+ | 202,061 | ||

| 710 | 5.250%, 7/01/37 | 7/25 at 100.00 | BB+ | 749,661 | ||

| Deephaven, Minnesota, Charter School Lease Revenue Bonds, Eagle Ridge Academy Project, Series 2016A: | ||||||

| 200 | 4.000%, 7/01/22 | No Opt. Call | BB+ | 211,828 | ||

| 465 | 4.000%, 7/01/23 | No Opt. Call | BB+ | 492,309 | ||

| 150 | 4.000%, 7/01/24 | No Opt. Call | BB+ | 158,609 | ||

| 135 | 4.000%, 7/01/25 | No Opt. Call | BB+ | 141,612 | ||

| 130 | 4.000%, 7/01/26 | 7/25 at 100.00 | BB+ | 134,963 | ||

| 300 | 4.000%, 7/01/27 | 7/25 at 100.00 | BB+ | 309,105 | ||

| 370 | 4.000%, 7/01/28 | 7/25 at 100.00 | BB+ | 377,833 | ||

| 645 | Forest Lake, Minnesota, Charter School Lease Revenue Bonds, Lakes International Language Academy, Series 2014A, 5.500%, 8/01/36 | 8/22 at 102.00 | BB+ | 693,775 | ||

| Greenwood, Minnesota, Charter School Lease Revenue Bonds, Main Street School of Performing Arts Project, Series 2016A: | ||||||

| 1,010 | 4.500%, 7/01/26 | No Opt. Call | N/R | 985,689 | ||

| 40 | 5.000%, 7/01/36 | 7/26 at 100.00 | N/R | 37,924 | ||

| 1,820 | Ham Lake, Minnesota Charter School Lease Revenue Bonds, Parnassus Preparatory School Project, Series 2016A, 4.000%, 11/01/26 | No Opt. Call | BB | 1,793,264 | ||

| Independence, Minnesota, Charter School Lease Revenue Bonds, Beacon Academy Project, Series 2016A: | ||||||

| 1,000 | 4.750%, 7/01/31 | 7/26 at 100.00 | N/R | 993,870 | ||

| 500 | 5.000%, 7/01/36 | 7/26 at 100.00 | N/R | 494,525 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| Itasca County, Minnesota, Revenue Bonds, Charles K. Blandin Foundation, Series 2010: | ||||||

| $ 635 | 4.000%, 5/01/18 | No Opt. Call | A2 | $646,843 | ||

| 255 | 4.000%, 5/01/19 | No Opt. Call | A2 | 264,591 | ||

| 1,350 | Minneapolis, Minnesota, Charter School Lease Revenue Bonds, Hiawatha Academies Project, Series 2016A, 5.000%, 7/01/31 | 7/24 at 102.00 | N/R | 1,383,628 | ||

| 1,300 | Minneapolis, Minnesota, Charter School Lease Revenue Bonds, Yinghua Academy Project, Series 2013A, 6.000%, 7/01/33 | 7/23 at 100.00 | BB | 1,387,048 | ||

| Minneapolis, Minnesota, Revenue Bonds, Blake School Project, Refunding Series 2010: | ||||||

| 550 | 4.000%, 9/01/19 | No Opt. Call | A2 | 581,135 | ||

| 315 | 4.000%, 9/01/21 | 9/20 at 100.00 | A2 | 337,907 | ||

| 1,040 | Minneapolis, Minnesota, Revenue Bonds, University Gateway Project, Refunding Series 2015, 4.000%, 12/01/28 | 12/24 at 100.00 | Aa1 | 1,141,972 | ||

| Minneapolis, Minnesota, Revenue Bonds, YMCA of Greater Twin Cities Project, Series 2016: | ||||||

| 500 | 3.000%, 6/01/21 | No Opt. Call | Baa1 | 522,105 | ||

| 710 | 3.000%, 6/01/23 | No Opt. Call | Baa1 | 744,222 | ||

| 815 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Augsburg College, Refunding Series 2010-7-G, 4.000%, 10/01/21 | 10/18 at 100.00 | Baa3 | 835,285 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Bethel University, Refunding Series 2007-6-R: | ||||||

| 1,125 | 5.500%, 5/01/18 | 7/17 at 100.00 | N/R | 1,127,092 | ||

| 1,185 | 5.500%, 5/01/19 | 7/17 at 100.00 | N/R | 1,187,240 | ||

| 1,050 | 5.500%, 5/01/24 | 7/17 at 100.00 | N/R | 1,051,890 | ||

| 1,600 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Carleton College, Refunding Series 2017, 4.000%, 3/01/33 | 3/27 at 100.00 | Aa2 | 1,755,616 | ||

| 300 | Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Benedict, Series 2011-7M, 5.000%, 3/01/31 | 3/20 at 100.00 | Baa1 | 324,306 | ||

| 655 | Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Benedict, Series 2016-8K, 3.250%, 3/01/32 | 3/26 at 100.00 | Baa1 | 625,761 | ||

| 150 | Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Scholastica, Inc., Series 2011-7J, 6.000%, 12/01/28 | 12/19 at 100.00 | Baa2 | 162,207 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Scholastica, Inc., Series 2012-7R: | ||||||

| 200 | 4.000%, 12/01/20 | No Opt. Call | Baa2 | 212,248 | ||

| 310 | 3.375%, 12/01/22 | No Opt. Call | Baa2 | 325,608 | ||

| 380 | Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Scholastica, Series 2007-6S, 4.500%, 12/01/17 | No Opt. Call | Baa2 | 386,540 | ||

| 750 | Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Scholastica, Series 20107H, 5.125%, 12/01/30 | 12/19 at 100.00 | Baa2 | 787,575 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Gustavus Adolfus College, Series 2010-7B: | ||||||

| 1,040 | 5.000%, 10/01/23 | 10/19 at 100.00 | A3 | 1,125,134 | ||

| 175 | 4.250%, 10/01/24 | 10/19 at 100.00 | A3 | 185,038 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Gustavus Adolfus College, Series 2013-7W: | ||||||

| $ 350 | 4.000%, 10/01/21 | No Opt. Call | A3 | $381,797 | ||

| 250 | 5.000%, 10/01/22 | No Opt. Call | A3 | 287,550 | ||

| 500 | 5.000%, 10/01/23 | No Opt. Call | A3 | 584,505 | ||

| 990 | 4.250%, 10/01/28 | 10/23 at 100.00 | A3 | 1,087,060 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Hamline University of Minnesota, Refunding Series 2010E: | ||||||

| 1,000 | 4.125%, 10/01/18 | No Opt. Call | Baa3 | 1,034,710 | ||

| 1,385 | 4.375%, 10/01/20 | No Opt. Call | Baa3 | 1,497,739 | ||

| 500 | 4.500%, 10/01/21 | 10/20 at 100.00 | Baa3 | 539,510 | ||

| 250 | 5.000%, 10/01/29 | 10/20 at 100.00 | Baa3 | 266,372 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Hamline University, Series 2011-7K1: | ||||||

| 1,000 | 4.250%, 10/01/18 | No Opt. Call | Baa3 | 1,030,910 | ||

| 625 | 6.000%, 10/01/32 | 10/21 at 100.00 | Baa3 | 707,694 | ||

| 1,250 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Macalester College, Series 201528J, 3.250%, 3/01/29 | 3/25 at 100.00 | Aa3 | 1,294,087 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Saint Catherine University, Refunding Series 2012-7Q: | ||||||

| 740 | 5.000%, 10/01/23 | 10/22 at 100.00 | Baa1 | 846,412 | ||

| 490 | 5.000%, 10/01/24 | 10/22 at 100.00 | Baa1 | 560,129 | ||

| 700 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Saint John's University, Series 2015-8I, 3.375%, 10/01/30 | 10/25 at 100.00 | A2 | 724,703 | ||

| 1,000 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Saint Olaf College, Series 2015-8-G, 5.000%, 12/01/28 | 12/25 at 100.00 | A1 | 1,191,630 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, University of Saint Thomas, Series 2009-7A: | ||||||

| 1,125 | 4.500%, 10/01/18 | No Opt. Call | A2 | 1,177,234 | ||

| 1,975 | 4.500%, 10/01/19 | No Opt. Call | A2 | 2,128,043 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, University of Saint Thomas, Series 2013-7U: | ||||||

| 2,000 | 4.000%, 4/01/25 | 4/23 at 100.00 | A2 | 2,216,300 | ||

| 775 | 4.000%, 4/01/26 | 4/23 at 100.00 | A2 | 850,640 | ||

| 300 | 4.000%, 4/01/27 | 4/23 at 100.00 | A2 | 327,003 | ||

| 1,000 | Minnesota Higher Education Facilities Authority, Revenue Bonds, University of Saint Thomas, Series 2016-8L, 5.000%, 4/01/27 | 4/26 at 100.00 | A2 | 1,206,050 | ||

| Minnesota Higher Education Facilities Authority, Saint John's University Revenue Bonds, Series 2008-6U: | ||||||

| 290 | 4.200%, 10/01/19 | 10/18 at 100.00 | A2 | 301,922 | ||

| 385 | 4.300%, 10/01/20 | 10/18 at 100.00 | A2 | 400,369 | ||

| 145 | 4.500%, 10/01/22 | 10/18 at 100.00 | A2 | 151,318 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| Minnesota State Colleges and University, General Fund Revenue Bonds, Series 2009A: | ||||||

| $ 985 | 4.000%, 10/01/22 | 10/19 at 100.00 | AA- | $1,044,100 | ||

| 1,755 | 4.000%, 10/01/23 | 10/19 at 100.00 | AA- | 1,853,649 | ||

| Minnesota State Colleges and University, General Fund Revenue Bonds, Series 2011A: | ||||||

| 1,515 | 4.250%, 10/01/24 | 10/21 at 100.00 | AA- | 1,687,619 | ||

| 880 | 4.375%, 10/01/25 | 10/21 at 100.00 | AA- | 978,604 | ||

| 905 | 4.500%, 10/01/26 | 10/21 at 100.00 | AA- | 1,008,903 | ||

| 1,185 | Minnesota State Colleges and University, General Fund Revenue Bonds, Series 2015A, 3.000%, 10/01/26 | 4/25 at 100.00 | AA- | 1,259,442 | ||

| Moorhead, Minnesota, Educational Facilities Revenue Bonds, The Concordia College Corporation Project, Series 2016: | ||||||

| 980 | 4.000%, 12/01/30 | 12/25 at 100.00 | Baa1 | 1,034,331 | ||

| 1,060 | 4.000%, 12/01/32 | 12/25 at 100.00 | Baa1 | 1,107,403 | ||

| 935 | Otsego, Minnesota, Charter School Lease Revenue Bonds, Kaleidoscope Charter School Project, Series 2014A, 5.000%, 9/01/34 | 9/24 at 100.00 | BB+ | 969,436 | ||

| 450 | Ramsey, Anoka County, Minnesota, Lease Revenue Bonds, PACT Charter School Project, Refunding Series 2013A, 5.000%, 12/01/26 | 12/21 at 100.00 | BBB- | 477,576 | ||

| 680 | Rice County, Minnesota Educational Facility Revenue Bonds, Shattuck, Saint Mary's School Project, Series 2015, 5.000%, 8/01/22 | No Opt. Call | BB | 721,847 | ||

| 70 | Saint Cloud, Minnesota, Charter School Lease Revenue Bonds, Stride Academy Project, Series 2016A, 5.000%, 4/01/36 | 4/26 at 100.00 | CCC- | 45,500 | ||

| 2,005 | Saint Paul Housing & Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Hmong College Prep Academy Project, Series 2016A, 5.250%, 9/01/31 | 9/26 at 100.00 | BB+ | 2,055,045 | ||

| 730 | Saint Paul Housing and Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Nova Classical Academy, Series 2011A, 5.700%, 9/01/21 | No Opt. Call | BBB- | 792,269 | ||

| 885 | Saint Paul Housing and Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Twin Cities Academy Project, Series 2015A, 5.000%, 7/01/35 | 7/25 at 100.00 | BB | 903,249 | ||

| Saint Paul Housing and Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Twin Cities German Immersion School, Series 2013A: | ||||||

| 250 | 4.000%, 7/01/23 | No Opt. Call | BB+ | 255,278 | ||

| 700 | 5.000%, 7/01/33 | 7/23 at 100.00 | BB+ | 722,176 | ||

| 200 | Saint Paul Housing and Redevelopment Authority, Minnesota, Lease Revenue Bonds, Saint Paul Conservatory for Performing Artists Charter School Project, Series 2013A, 4.000%, 3/01/28 | 3/23 at 100.00 | BBB- | 201,320 | ||

| 2,395 | Saint Paul Housing and Redevelopment Authority, Minnesota, Revenue Bonds, Minnesota Public Radio Project, Refunding Series 2010, 5.000%, 12/01/25 | 12/20 at 100.00 | A2 | 2,660,941 | ||

| 2,770 | Savage, Minnesota Charter School Lease Revenue Bonds, Aspen Academy Project, Series 2016A, 5.000%, 10/01/36 | 10/26 at 100.00 | N/R | 2,722,633 | ||

| University of Minnesota, General Obligation Bonds, Series 2014B: | ||||||

| 1,000 | 4.000%, 1/01/31 | 1/24 at 100.00 | Aa1 | 1,094,970 | ||

| 1,000 | 4.000%, 1/01/32 | 1/24 at 100.00 | Aa1 | 1,087,980 | ||

| 1,000 | 4.000%, 1/01/34 | 1/24 at 100.00 | Aa1 | 1,077,910 | ||

| 1,020 | University of Minnesota, General Revenue Bonds, Series 2009C, 5.000%, 12/01/19 | 6/19 at 100.00 | Aa1 | 1,103,232 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| Winona Port Authority, Minnesota, Charter School Lease Revenue Bonds, Bluffview Montessori School Project, Refunding Series 2016: | ||||||

| $ 205 | 3.750%, 6/01/26 | 6/24 at 100.00 | N/R | $196,806 | ||

| 10 | 4.500%, 6/01/36 | 6/24 at 100.00 | N/R | 9,287 | ||

| 71,630 | Total Education and Civic Organizations | 75,738,773 | ||||

| Health Care – 16.3% | ||||||

| 3,000 | Chippewa County, Minnesota, Gross Revenue Hospital Bonds, Montevideo Hospital Project, Refunding Series 2016, 4.000%, 3/01/29 | 3/26 at 100.00 | N/R | 3,135,120 | ||

| City of Plato, Minnesota, Health Care Facilities Revenue Bonds, Glencoe Regional Health Services Project, Series 2017: | ||||||

| 1,140 | 4.000%, 4/01/29 | 4/27 at 100.00 | BBB | 1,232,648 | ||

| 1,040 | 4.000%, 4/01/32 | 4/27 at 100.00 | BBB | 1,102,462 | ||

| 685 | Cuyuna Range Hospital District, Minnesota, Health Care Facilities Gross Revenue Bonds, Refunding Series 2007, 5.000%, 6/01/17 | No Opt. Call | N/R | 685,000 | ||

| 400 | Fergus Falls, Minnesota, Health Care Facilities Revenue Bonds, Lake Region Healthcare Corporation Project, Series 2010, 4.750%, 8/01/25 | 8/17 at 100.00 | BBB- | 401,024 | ||

| Glencoe, Minnesota, Health Care Facilities Revenue Bonds, Glencoe Regional Health Services Project, Series 2013: | ||||||

| 100 | 4.000%, 4/01/21 | No Opt. Call | BBB | 107,593 | ||

| 660 | 4.000%, 4/01/25 | 4/22 at 100.00 | BBB | 707,447 | ||

| 400 | 4.000%, 4/01/26 | 4/22 at 100.00 | BBB | 425,556 | ||

| 2,000 | Maple Grove, Minnesota, Health Care Facilities Revenue Refunding Bonds, North Memorial Health Care, Series 2015, 5.000%, 9/01/28 | 9/25 at 100.00 | Baa1 | 2,334,840 | ||

| Maple Grove, Minnesota, Health Care Facility Revenue Bonds, North Memorial Health Care, Series 2017: | ||||||

| 410 | 5.000%, 5/01/31 | 5/27 at 100.00 | Baa1 | 480,262 | ||

| 405 | 5.000%, 5/01/32 | 5/27 at 100.00 | Baa1 | 472,133 | ||

| 1,000 | Meeker County, Minnesota, Gross Revenue Hospital Facilities Bonds, Meeker County Memorial Hospital Project, Series 2007, 5.625%, 11/01/22 | 11/17 at 100.00 | N/R | 1,010,970 | ||

| Minneapolis, Minnesota, Health Care System Revenue Bonds, Fairview Health Services, Series 2015A: | ||||||

| 1,010 | 5.000%, 11/15/28 | 11/25 at 100.00 | A+ | 1,202,849 | ||

| 1,000 | 5.000%, 11/15/29 | 11/25 at 100.00 | A+ | 1,181,850 | ||

| 1,000 | 5.000%, 11/15/30 | 11/25 at 100.00 | A+ | 1,176,340 | ||

| 2,000 | 5.000%, 11/15/32 | 11/25 at 100.00 | A+ | 2,332,500 | ||

| 1,000 | Minneapolis-Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Children's Health Care, Series 2010A, 5.250%, 8/15/25 | 8/20 at 100.00 | AA- | 1,112,360 | ||

| 500 | Minneapolis-Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care System Revenue Bonds, Allina Health System, Refunding Series 2017A, 5.000%, 11/15/29 | 5/27 at 100.00 | AA- | 607,535 | ||

| 1,085 | Minnesota Agricultural and Economic Development Board, Health Care Facilities Revenue Bonds, Essential Health Obligated Group, Refunding Series 2008C-1, 5.500%, 2/15/25 – AGC Insured | 2/20 at 100.00 | AA | 1,197,569 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| Northern Itasca Hospital District, Minnesota, Health Facilities Gross Revenue Bonds, Refunding Series 2013A: | ||||||

| $ 275 | 4.000%, 12/01/25 | 12/20 at 100.00 | N/R | $281,319 | ||

| 250 | 4.050%, 12/01/26 | 12/20 at 100.00 | N/R | 255,182 | ||

| 250 | 4.150%, 12/01/27 | 12/20 at 100.00 | N/R | 255,425 | ||

| 500 | Northern Itasca Hospital District, Minnesota, Health Facilities Gross Revenue Bonds, Series 2013C, 5.400%, 12/01/33 | 12/20 at 100.00 | N/R | 522,820 | ||

| 760 | Redwood Falls, Minnesota, Gross Revenue Hospital Facilities Bonds, Redwood Area Hospital Project, Series 2006, 5.000%, 12/01/21 | 7/17 at 100.00 | N/R | 761,657 | ||

| Rochester, Minnesota, Health Care Facilities Revenue Bonds, Mayo Clinic, Refunding Series 2016B: | ||||||

| 2,300 | 5.000%, 11/15/29 | No Opt. Call | AA | 2,914,629 | ||

| 1,000 | 5.000%, 11/15/33 | No Opt. Call | AA | 1,280,830 | ||

| 1,175 | Rochester, Minnesota, Health Care Facilities Revenue Bonds, Mayo Clinic, Series 2011, 4.500%, 11/15/38 (Mandatory Put 11/15/21) | No Opt. Call | AA | 1,334,659 | ||

| 905 | Rochester, Minnesota, Health Care Facilities Revenue Bonds, Olmsted Medical Center Project, Series 2010, 5.125%, 7/01/20 | No Opt. Call | A | 967,789 | ||

| 500 | Rochester, Minnesota, Health Care Facilities Revenue Bonds, Olmsted Medical Center Project, Series 2013, 3.000%, 7/01/25 | 7/23 at 100.00 | A | 523,535 | ||

| 80 | Saint Cloud, Minnesota, Health Care Revenue Bonds, CentraCare Health System Project, Series 2010A, 4.250%, 5/01/21 | 5/20 at 100.00 | A1 | 86,813 | ||

| Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Facility Revenue Bonds, HealthPartners Obligated Group, Refunding Series 2015A: | ||||||

| 3,225 | 5.000%, 7/01/28 | 7/25 at 100.00 | A | 3,811,724 | ||

| 1,240 | 5.000%, 7/01/30 | 7/25 at 100.00 | A | 1,446,832 | ||

| 4,500 | 5.000%, 7/01/32 | 7/25 at 100.00 | A | 5,190,525 | ||

| 1,000 | 4.000%, 7/01/35 | 7/25 at 100.00 | A | 1,048,560 | ||

| 1,200 | Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Allina Health System, Series 2007A, 5.000%, 11/15/19 – NPFG Insured | 11/17 at 100.00 | AA- | 1,222,260 | ||

| 1,540 | Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Allina Health System, Series 2009A-1, 5.000%, 11/15/24 | 11/19 at 100.00 | AA- | 1,683,143 | ||

| 1,025 | Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Gillette Children's Specialty Healthcare Project, Series 2009, 5.000%, 2/01/19 | No Opt. Call | A | 1,081,221 | ||

| Shakopee, Minnesota, Health Care Facilities Revenue Bonds, Saint Francis Regional Medical Center, Refunding Series 2014: | ||||||

| 1,200 | 5.000%, 9/01/27 | 9/24 at 100.00 | A | 1,400,064 | ||

| 1,140 | 5.000%, 9/01/29 | 9/24 at 100.00 | A | 1,307,774 | ||

| St. Paul Housing and Redevelopment Authority, Minnesota, Hospital Revenue Bonds, HealthEast Inc., Series 2015A: | ||||||

| 1,000 | 5.000%, 11/15/29 | 11/25 at 100.00 | BBB- | 1,122,080 | ||

| 2,285 | 5.000%, 11/15/30 | 11/25 at 100.00 | BBB- | 2,553,899 | ||

| 1,250 | 5.250%, 11/15/35 | 11/20 at 100.00 | BBB- | 1,342,925 | ||

| 1,000 | Winona Health Care Facilities Revenue Refunding Bonds, Minnesota, Winona Health Obligated Group, Series 2007, 5.000%, 7/01/20 | 7/17 at 100.00 | BBB | 1,002,900 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| Winona, Minnesota, Health Care Facilities Revenue Bonds, Winona Health Obligated Group, Refunding Series 2012: | ||||||

| $ 485 | 4.500%, 7/01/24 | 7/21 at 100.00 | BBB | $521,938 | ||

| 260 | 5.000%, 7/01/34 | 7/21 at 100.00 | BBB | 276,955 | ||

| 49,180 | Total Health Care | 55,103,516 | ||||

| Housing/Multifamily – 0.5% | ||||||

| 500 | Anoka Housing and Redevelopment Authority, Minnesota, Multifamily Housing Revenue Bonds, Woodland Park Apartments Project, Series 2011A, 5.000%, 4/01/27 | 4/19 at 100.00 | Aaa | 520,510 | ||

| 1,150 | Minneapolis, Minnesota, Multi-Family Housing Revenue Bonds, Plymouth Stevens House Limited Partnership Project, Series 2016B, 2.000%, 12/01/17 | 7/17 at 100.00 | N/R | 1,150,196 | ||

| 1,650 | Total Housing/Multifamily | 1,670,706 | ||||

| Housing/Single Family – 0.7% | ||||||

| 610 | Dakota County Community Development Agency, Minnesota, Single Family Mortgage Revenue Bonds, Mortgage Backed Securities Program, Series 2011A, 4.400%, 12/01/26 | 12/20 at 100.00 | AA+ | 650,095 | ||

| 575 | Minnesota Housing Finance Agency, Homeownership Finance Bonds, Mortgage-Backed Securities Program, Series 2011D, 4.375%, 7/01/26 | 7/21 at 100.00 | Aaa | 603,871 | ||

| 425 | Minnesota Housing Finance Agency, Residential Housing Finance Bonds, Series 2012A, 3.750%, 7/01/22 (Alternative Minimum Tax) | 1/22 at 100.00 | AA+ | 459,357 | ||

| 140 | Minnesota Housing Finance Agency, Residential Housing Finance Bonds, Series 2012C, 3.750%, 1/01/22 (Alternative Minimum Tax) | No Opt. Call | AA+ | 152,666 | ||

| 275 | Minnesota Housing Finance Agency, Residential Housing Finance Bonds, Series 2014C, 3.100%, 7/01/26 | 7/24 at 100.00 | AA+ | 284,009 | ||

| 210 | Minnesota Housing Finance Agency, Residential Housing Finance Bonds, Series 2015F, 3.300%, 7/01/29 | 7/25 at 100.00 | AA+ | 218,553 | ||

| 2,235 | Total Housing/Single Family | 2,368,551 | ||||

| Industrials – 0.9% | ||||||

| 2,020 | Minneapolis, Minnesota, Limited Tax Supported Development Revenue Bonds, Common Bond Fund Series 2010-2A, 4.625%, 12/01/20 | No Opt. Call | A+ | 2,219,818 | ||

| 1,000 | Minneapolis, Minnesota, Limited Tax Supported Development Revenue Bonds, Common Bond Fund Series 2013-1, 4.000%, 6/01/28 | 6/21 at 100.00 | A+ | 1,054,840 | ||

| 3,020 | Total Industrials | 3,274,658 | ||||

| Long-Term Care – 8.4% | ||||||

| 1,000 | Center City, Minnesota, Health Care Facilities Revenue Bonds, Hazelden Betty Ford Foundation Project, Series 2014, 5.000%, 11/01/25 | 11/24 at 100.00 | A3 | 1,179,610 | ||

| 565 | Center City, Minnesota, Health Care Facilities Revenue Bonds, Hazelden Foundation Project, Series 2011, 4.550%, 11/01/26 | 11/19 at 100.00 | A3 | 594,521 | ||

| 815 | Chisago City, Minnesota, Housing and Health Care Revenue Bonds, CDL Homes, LLC Project, Series 2013B, 6.000%, 8/01/33 | 8/23 at 100.00 | N/R | 878,317 | ||

| 1,110 | City of Minneapolis, Minnesota, Senior Housing and Healthcare Facilities Revenue Bonds, Walker Minneapolis Campus Project, Series 2015, 4.625%, 11/15/31 | 11/22 at 100.00 | N/R | 1,115,295 | ||

| 325 | City of Vergas, Minnesota, Housing and Health Care Revenue Bonds, CDL Homes, LLC Project, Refunding Series 2016, 4.000%, 8/01/31 | 8/24 at 100.00 | N/R | 316,742 | ||

| 235 | Cold Spring, Minnesota, Health Care Facilities Revenue Bonds, Assumption Home, Inc., Refunding Series 2017, 4.450%, 3/01/31 | 3/22 at 101.00 | N/R | 239,162 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Long-Term Care (continued) | ||||||

| Columbus, Minnesota, Senior Housing Revenue Bonds, Richfield Senior Housing, Inc., Refunding Series 2015: | ||||||

| $ 1,000 | 4.600%, 1/01/27 | 1/23 at 100.00 | N/R | $1,016,010 | ||

| 500 | 5.000%, 1/01/34 | 1/23 at 100.00 | N/R | 507,025 | ||

| Dakota County Community Development Agency, Minnesota, Senior Housing Revenue Bonds, Walker Highview Hills LLC Project, Refunding Series 2016A: | ||||||

| 2,385 | 3.875%, 8/01/29 | 8/22 at 100.00 | N/R | 2,288,455 | ||

| 1,100 | 5.000%, 8/01/36 | 8/22 at 100.00 | N/R | 1,126,565 | ||

| 1,435 | Lake Crystal, Minnesota, Housing and Health Care Revenue Bonds, Ecumen-Second Century & Owatonna Senior Living Project, Refunding Series 2014A, 4.500%, 9/01/44 (Mandatory Put 9/01/24) | 9/18 at 100.00 | N/R | 1,438,128 | ||

| Minneapolis, Minnesota, Revenue Bonds, Walker Minneapolis Campus Project, Refunding Series 2012: | ||||||

| 1,400 | 5.000%, 11/15/24 | 11/22 at 100.00 | N/R | 1,496,544 | ||

| 1,650 | 4.750%, 11/15/28 | 11/22 at 100.00 | N/R | 1,695,012 | ||

| Minneapolis, Minnesota, Senior Housing and Healthcare Revenue Bonds, Ecumen-Abiitan Mill City Project, Series 2015: | ||||||

| 425 | 4.750%, 11/01/28 | 5/23 at 100.00 | N/R | 436,335 | ||

| 750 | 5.250%, 11/01/45 | 5/23 at 100.00 | N/R | 775,365 | ||

| 1,000 | Saint Louis Park, Minnesota, Health Care Facilities Revenue Bonds, Mount Olivet Careview Home Project, Series 2016B, 2.000%, 6/01/36 | 12/17 at 100.00 | N/R | 989,860 | ||

| Saint Louis Park, Minnesota, Health Care Facilities Revenue Bonds, Mount Olivet Careview Home Project, Series 2016C: | ||||||

| 210 | 2.000%, 6/01/19 | No Opt. Call | N/R | 209,989 | ||

| 230 | 2.125%, 6/01/20 | No Opt. Call | N/R | 230,097 | ||

| 250 | 2.500%, 6/01/22 | 6/21 at 101.00 | N/R | 250,345 | ||

| 250 | 3.050%, 6/01/27 | 6/21 at 101.00 | N/R | 250,170 | ||

| 2,500 | Saint Paul Housing and Redevelopment Authority Minnesota, Senior Housing and Health Care Revenue Bonds, Episcopal Homes Project, Series 2013, 5.000%, 5/01/33 | 5/23 at 100.00 | N/R | 2,540,825 | ||

| 1,000 | Saint Paul Housing and Redevelopment Authority, Minnesota, Senior Housing and Health Care Revenue Bonds, Episcopal Homes Project, Refunding Series 2012A, 4.000%, 11/01/22 | 11/20 at 100.00 | N/R | 1,012,460 | ||

| 2,000 | Saint Paul Port Authority, Minnesota, Revenue Bonds, Amherst H. Wilder Foundation Project, Series 2010-3, 5.000%, 12/01/24 | 12/20 at 100.00 | Baa2 | 2,156,740 | ||

| 1,020 | Sartell, Minnesota, Health Care and Housing Facilities Revenue Bonds, Country Manor Campus LLC Project, Series 2012A, 5.250%, 9/01/27 | 9/22 at 100.00 | N/R | 1,079,201 | ||

| Sauk Rapids, Minnesota, Health Care and Housing Facilities Revenue Bonds, Good Shepherd Lutheran Home, Refunding Series 2013: | ||||||

| 180 | 5.000%, 1/01/21 | No Opt. Call | N/R | 189,329 | ||

| 2,395 | 5.125%, 1/01/39 | 1/23 at 100.00 | N/R | 2,416,411 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Long-Term Care (continued) | ||||||

| Wayzata, Minnesota, Senior Housing Revenue Bonds, Folkestone Senior Living Community, Series 2012A: | ||||||

| $ 625 | 5.100%, 5/01/24 – AGM Insured | 5/19 at 102.00 | N/R | $662,925 | ||

| 310 | 5.300%, 5/01/27 | 5/19 at 102.00 | N/R | 327,075 | ||

| 500 | 5.300%, 11/01/27 | 5/19 at 102.00 | N/R | 527,490 | ||

| 515 | 5.500%, 11/01/32 | 5/19 at 102.00 | N/R | 544,443 | ||

| 27,680 | Total Long-Term Care | 28,490,446 | ||||

| Tax Obligation/General – 14.4% | ||||||

| 285 | Anoka County, Minnesota, General Obligation Bonds, Capital Improvement, Series 2008C, 4.100%, 2/01/18 | No Opt. Call | Aa1 | 291,373 | ||

| Bemidji, Minnesota, General Obligation Bonds, Refunding Sales Tax Series 2011: | ||||||

| 635 | 5.500%, 2/01/23 | 2/21 at 100.00 | Aa3 | 730,377 | ||

| 750 | 5.500%, 2/01/24 | 2/21 at 100.00 | Aa3 | 858,877 | ||

| 875 | 5.500%, 2/01/25 | 2/21 at 100.00 | Aa3 | 1,000,002 | ||

| 1,010 | 5.500%, 2/01/26 | 2/21 at 100.00 | Aa3 | 1,150,794 | ||

| 1,150 | 5.500%, 2/01/27 | 2/21 at 100.00 | Aa3 | 1,310,310 | ||

| 2,000 | Buffalo-Hanover-Montrose Independent School District 877, Minnesota, General Obligation Bonds, Refunding Series 2012A, 4.000%, 2/01/23 | 2/22 at 100.00 | Aa2 | 2,235,900 | ||

| 450 | Chatfield Independent School District 227, Olmstead County, Minnesota, General Obligation Bonds, Series 2007A, 4.000%, 2/01/18 – AGM Insured | No Opt. Call | AA+ | 459,612 | ||

| 1,000 | Cloquet Independent School District 94, Carlton and Saint Louis Counties, Minnesota, General Obligation Bonds, School Building Series 2015B, 4.000%, 2/01/36 | 2/25 at 100.00 | Aa2 | 1,052,580 | ||

| 1,845 | Forest Lake Independent School District 831, Washington County, Minnesota, General Obligation Bonds, School Building Series 2016A, 3.000%, 2/01/31 | 2/26 at 100.00 | AA+ | 1,887,472 | ||

| 2,220 | Fridley Independent School District 14, Anoka County, Minnesota, General Obligation Bonds, Series 2016A, 4.000%, 2/01/29 | 2/26 at 100.00 | Aa2 | 2,482,382 | ||

| 665 | Goodhue County, Minnesota, General Obligation Bonds, Capital Improvement Plan, Series 2015A, 3.000%, 2/01/27 | 2/23 at 100.00 | Aa2 | 689,346 | ||

| 455 | Greenway Independent School District 316, Itasca County, Minnesota, General Obligation Bonds, Alternate Facilities, Series 2011C, 4.250%, 2/01/25 | 2/19 at 100.00 | AA+ | 476,522 | ||

| 2,025 | Independent School District 833, South Washington County, Minnesota, General Obligation Bonds, Crossover Refunding School Building Series 2010A, 4.000%, 2/01/22 | 2/19 at 100.00 | AA+ | 2,121,309 | ||

| Jordan Independent School District 717, Scott County, Minnesota, General Obligation Bonds, School Building Series 2014A: | ||||||

| 1,000 | 4.000%, 2/01/26 | 2/23 at 100.00 | Aa2 | 1,109,540 | ||

| 1,275 | 4.000%, 2/01/27 | 2/23 at 100.00 | Aa2 | 1,405,420 | ||

| 1,710 | Minneapolis Special School District 1, Hennepin County, Minnesota, General Obligation Bonds, Alternate Facility Series 2015B, 3.000%, 2/01/29 | 2/24 at 100.00 | AA+ | 1,763,660 | ||

| 1,000 | Minneapolis, Minnesota, Limited Tax Supported Development Revenue Bonds, Common Bond Fund Series 2007-2A, 5.125%, 6/01/22 (Alternative Minimum Tax) | 6/17 at 100.00 | A+ | 1,000,000 | ||

| 1,000 | Minnesota State, General Obligation Bonds, Various Purpose Refunding Series 2013F, 4.000%, 10/01/25 | 10/23 at 100.00 | AAA | 1,137,210 | ||

| 2,000 | Minnesota State, General Obligation Bonds, Various Purpose Series 2013A, 5.000%, 8/01/25 | 8/23 at 100.00 | AAA | 2,417,120 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/General (continued) | ||||||

| $ 2,000 | Minnesota State, General Obligation Bonds, Various Purpose Series 2013D, 3.500%, 10/01/28 | 10/23 at 100.00 | AAA | $2,141,740 | ||

| Minnetonka Independent School District 276, Hennepin County, Minnesota, General Obligation Bonds, Refunding Series 2013H: | ||||||

| 525 | 4.000%, 2/01/25 | 2/23 at 100.00 | Aaa | 592,326 | ||

| 600 | 4.000%, 2/01/26 | 2/23 at 100.00 | Aaa | 674,292 | ||

| 1,475 | Moose Lake Independent School District 97, Carlton and Pine Counties, Minnesota, General Obligation Bonds, School Building Series 2015A, 4.000%, 2/01/30 | 2/25 at 100.00 | Aa2 | 1,624,034 | ||

| Northland Independent School District 118, Minnesota, General Obligation Bonds, Series 2016A: | ||||||

| 560 | 3.000%, 2/01/27 | 2/24 at 100.00 | Aa2 | 586,678 | ||

| 655 | 3.000%, 2/01/28 | 2/24 at 100.00 | Aa2 | 680,460 | ||

| 1,185 | 3.000%, 2/01/29 | 2/24 at 100.00 | Aa2 | 1,222,185 | ||

| 620 | OtterTail County, Minnesota, General Obligation Bonds, Disposal System - Prairie Lakes Municipal Authority, Series 2011, 4.750%, 5/01/27 (Alternative Minimum Tax) | 5/21 at 100.00 | AA+ | 680,239 | ||

| 1,880 | Perham Independent School District 549, Minnesota, General Obligation Bonds, Series 2016A, 3.000%, 2/01/30 | 2/24 at 100.00 | Aa2 | 1,912,900 | ||

| 500 | Robbinsdale Independent School District 281, Hennepin County, Minnesota, General Obligation Bonds, Series 2008B, 4.500%, 2/01/21 | 2/18 at 100.00 | Aa2 | 512,290 | ||

| 1,595 | Rushford Peterson Independent School District 239, Minnesota, General Obligation Bonds, School Building Series 2015A, 4.000%, 2/01/29 | 2/25 at 100.00 | Aa2 | 1,760,242 | ||

| 1,100 | Saint Cloud Independent School District 742, Stearns County, Minnesota, General Obligation Bonds, Series 2015A, 4.000%, 2/01/30 | 2/25 at 100.00 | Aa2 | 1,222,485 | ||

| 600 | Saint Louis County Independent School District 2142, Minnesota, General Obligation Bonds, Refunding School Building Series 2014A, 3.500%, 2/01/23 | 2/22 at 100.00 | AA+ | 650,184 | ||

| 1,565 | Saint Michael Independent School District 885, Wright County, Minnesota, General Obligation Bonds, Refunding Series 2014A, 4.000%, 2/01/26 | 2/24 at 100.00 | Aa2 | 1,761,642 | ||

| Saint Michael Independent School District 885, Wright County, Minnesota, General Obligation Bonds, School Building Series 2017A: | ||||||

| 750 | 3.125%, 2/01/31 | 2/26 at 100.00 | Aa2 | 768,578 | ||

| 1,225 | 3.200%, 2/01/32 | 2/26 at 100.00 | Aa2 | 1,257,683 | ||

| 1,215 | Shakopee Independent School District 720, Scott County, Minnesota, General Obligation Bonds, School Building Series 2015A, 5.000%, 2/01/23 | No Opt. Call | Aa2 | 1,448,730 | ||

| 1,240 | South Washington County Independent School District 833, Minnesota, General Obligation Bonds, Alternate Facilities Series 2014A, 3.500%, 2/01/27 | 2/24 at 100.00 | Aa2 | 1,347,706 | ||

| 2,000 | Stillwater Independent School District 834, Washington County, Minnesota, General Obligation Bonds, School Building Series 2015A, 4.000%, 2/01/28 | 2/24 at 100.00 | Aa2 | 2,216,040 | ||

| 44,640 | Total Tax Obligation/General | 48,640,240 | ||||

| Tax Obligation/Limited – 4.8% | ||||||

| 780 | Government of Guam, Business Privilege Tax Bonds, Series 2011A, 5.000%, 1/01/31 | 1/22 at 100.00 | A | 830,146 | ||

| Hennepin County, Minnesota, Sales Tax Revenue Bonds, Ballpark Project, Second Lien Series 2008B: | ||||||

| 690 | 4.375%, 12/15/22 | 12/17 at 100.00 | AA+ | 702,330 | ||

| 1,000 | 5.000%, 12/15/29 | 12/17 at 100.00 | AA+ | 1,021,830 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 2,685 | Minneapolis Special School District 1, Hennepin County, Minnesota, Certificates of Participation, Full Term Series 2015D, 3.000%, 2/01/29 | 2/24 at 100.00 | AA+ | $2,736,096 | ||

| Minneapolis, Minnesota, Tax Increment Revenue Bonds, Grant Park Project, Refunding Series 2015: | ||||||

| 215 | 3.050%, 3/01/21 | No Opt. Call | N/R | 215,849 | ||

| 495 | 3.650%, 3/01/24 | 3/23 at 100.00 | N/R | 501,103 | ||

| 200 | 3.800%, 3/01/25 | 3/23 at 100.00 | N/R | 202,976 | ||

| 200 | 4.000%, 3/01/27 | 3/23 at 100.00 | N/R | 203,996 | ||

| Minneapolis, Minnesota, Tax Increment Revenue Bonds, Ivy Tower Project, Series 2015: | ||||||

| 1,115 | 4.000%, 3/01/25 | 3/24 at 100.00 | N/R | 1,121,032 | ||

| 500 | 5.000%, 3/01/29 | 3/24 at 100.00 | N/R | 524,580 | ||

| 340 | Minneapolis, Minnesota, Tax Increment Revenue Bonds, Village at St. Anthony Falls Project, Refunding Series 2015, 4.000%, 3/01/24 | 3/23 at 100.00 | N/R | 341,680 | ||

| 1,170 | Minnesota Housing Finance Agency, Housing Infrastructure State Appropriation Bonds, Series 2015C, 4.000%, 8/01/27 | 8/24 at 100.00 | AA | 1,293,646 | ||

| 350 | Minnesota Housing Finance Agency, Housing Infrastructure State Appropriation Bonds, Series 2016A, 4.000%, 8/01/32 | 8/25 at 100.00 | AA | 376,225 | ||

| 1,185 | Minnesota Housing Finance Agency, Nonprofit Housing Bonds, State Appropriation Series 2011, 5.250%, 8/01/27 | 8/21 at 100.00 | AA | 1,346,326 | ||

| Northeast Metropolitan Intermediate School District 916, White Bear Lake, Minnesota, Certificates of Participation, Series 2015B: | ||||||

| 605 | 3.125%, 2/01/29 | 2/25 at 100.00 | A1 | 614,662 | ||

| 350 | 3.250%, 2/01/30 | 2/25 at 100.00 | A1 | 356,626 | ||

| 630 | Saint Cloud Independent School District 742, Stearns County, Minnesota, Certificates of Participation, Saint Cloud Area Public Schools, Series 2017A, 5.000%, 2/01/30 | 2/25 at 100.00 | A1 | 735,336 | ||

| 735 | Saint Paul, Minnesota, Sales Tax Revenue Bonds, Series 2014G, 5.000%, 11/01/29 | 11/24 at 100.00 | A+ | 856,591 | ||

| 1,895 | University of Minnesota, Special Purpose Revenue Bonds, State Supported Biomedical Science Research Facilities Funding Program, Series 2011B, 5.000%, 8/01/23 | 8/21 at 100.00 | AA | 2,174,285 | ||

| 15,140 | Total Tax Obligation/Limited | 16,155,315 | ||||

| Transportation – 6.9% | ||||||

| Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Refunding Senior Lien Series 2009A: | ||||||

| 1,000 | 4.000%, 1/01/19 | No Opt. Call | AA- | 1,047,970 | ||

| 1,000 | 5.000%, 1/01/20 | 1/19 at 100.00 | AA- | 1,064,800 | ||

| 500 | 5.000%, 1/01/21 | 1/19 at 100.00 | AA- | 532,400 | ||

| 2,330 | Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Refunding Subordinate Lien Series 2011A, 5.000%, 1/01/25 | 1/21 at 100.00 | A+ | 2,622,135 | ||

| Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Refunding Subordinate Lien Series 2012B: | ||||||

| 2,550 | 5.000%, 1/01/29 | 1/22 at 100.00 | A+ | 2,911,029 | ||

| 2,750 | 5.000%, 1/01/30 | 1/22 at 100.00 | A+ | 3,089,020 | ||

| 2,000 | Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Refunding Subordinate Lien Series 2014A, 5.000%, 1/01/30 | 1/24 at 100.00 | A+ | 2,342,760 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Transportation (continued) | ||||||

| Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Senior Lien Series 2016C: | ||||||

| $ 650 | 5.000%, 1/01/34 | 1/27 at 100.00 | AA- | $776,087 | ||

| 1,940 | 5.000%, 1/01/35 | 1/27 at 100.00 | AA- | 2,309,085 | ||

| 1,325 | 5.000%, 1/01/37 | 1/27 at 100.00 | AA- | 1,568,495 | ||

| 1,630 | Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Subordinate Lien Series 2010D, 4.000%, 1/01/23 (Alternative Minimum Tax) | 1/20 at 100.00 | A+ | 1,712,087 | ||

| St Paul Housing and Redevelopment Authority, Minnesota, Parking Revenue Bonds, Parking Facilities Project, Refunding Series 2010A: | ||||||

| 805 | 4.000%, 8/01/21 | 8/18 at 102.00 | A+ | 846,562 | ||

| 895 | 4.125%, 8/01/23 | 8/18 at 102.00 | A+ | 942,283 | ||

| 935 | 4.250%, 8/01/24 | 8/18 at 102.00 | A+ | 985,855 | ||

| 575 | 4.250%, 8/01/25 | 8/18 at 102.00 | A+ | 605,791 | ||

| 20,885 | Total Transportation | 23,356,359 | ||||

| U.S. Guaranteed – 8.7% (4) | ||||||

| 1,000 | Anoka County, Minnesota, General Obligation Bonds, Capital Improvement, Series 2008A, 5.000%, 2/01/20 (Pre-refunded 2/01/18) | 2/18 at 100.00 | Aa1 (4) | 1,024,970 | ||

| 595 | Anoka County, Minnesota, General Obligation Bonds, Capital Improvement, Series 2008C, 4.200%, 2/01/19 (Pre-refunded 2/01/18) | 2/18 at 100.00 | Aa1 (4) | 606,710 | ||

| 1,200 | Burnsville Independent School District 191, Dakota and Scott Counties, Minnesota, General Obligation Bonds, Series 2008A, 4.250%, 2/01/20 (Pre-refunded 2/01/18) | 2/18 at 100.00 | Aa2 (4) | 1,225,632 | ||

| Dakota County Community Development Agency, Minnesota, Governmental Housing Development General Obligation Bonds, Senior Housing Facilities, Series 2007A: | ||||||

| 510 | 4.375%, 1/01/19 (Pre-refunded 7/01/17) | 7/17 at 100.00 | Aaa (4) | 511,515 | ||

| 215 | 4.500%, 1/01/20 (Pre-refunded 7/01/17) | 7/17 at 100.00 | Aaa | 215,664 | ||

| 1,910 | Duluth Independent School District 709, Minnesota, Certificates of Participation, Series 2008B, 4.000%, 2/01/19 (ETM) | No Opt. Call | AA+ (4) | 2,005,748 | ||

| 1,185 | Duluth Independent School District 709, Saint Louis County, Minnesota, General Obligation Bonds, Series 2008A, 4.250%, 2/01/22 (Pre-refunded 2/01/18) – AGM Insured | 2/18 at 100.00 | Aa2 (4) | 1,211,591 | ||

| Duluth, Minnesota, General Obligation Bonds, DECC Improvement Series 2008A: | ||||||

| 1,160 | 4.500%, 2/01/21 (Pre-refunded 2/01/18) | 2/18 at 100.00 | AA (4) | 1,188,513 | ||

| 465 | 4.500%, 2/01/22 (Pre-refunded 2/01/18) | 2/18 at 100.00 | AA (4) | 476,430 | ||

| 1,100 | 4.625%, 2/01/24 (Pre-refunded 2/01/18) | 2/18 at 100.00 | AA (4) | 1,127,940 | ||

| 4,575 | Minneapolis, Minnesota, Health Care System Revenue Bonds, Fairview Hospital and Healthcare Services, Series 2008A, 6.375%, 11/15/23 (Pre-refunded 11/15/18) | 11/18 at 100.00 | A+ (4) | 4,936,013 | ||

| 3,495 | Minneapolis, Minnesota, Revenue Bonds, National Marrow Donor Program Project, Series 2010, 4.250%, 8/01/20 (Pre-refunded 8/01/18) | 8/18 at 100.00 | N/R (4) | 3,629,278 | ||

| 1,140 | Rochester, Minnesota, General Obligation Bonds, Waste Water Series 2007A, 4.000%, 12/01/18 (Pre-refunded 6/01/17) | 6/17 at 100.00 | AAA | 1,140,000 | ||

| 1,000 | Saint Cloud, Minnesota, Health Care Revenue Bonds, CentraCare Health System Project, Series 2008D, 5.375%, 5/01/31 (Pre-refunded 5/01/19) – AGC Insured | 5/19 at 100.00 | A1 (4) | 1,084,040 | ||

| 965 | Saint Cloud, Minnesota, Health Care Revenue Bonds, CentraCare Health System Project, Series 2010A, 4.250%, 5/01/21 (Pre-refunded 5/01/20) | 5/20 at 100.00 | N/R (4) | 1,053,471 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| U.S. Guaranteed (4) (continued) | ||||||

| $ 2,500 | Saint Louis Park, Minnesota, Health Care Facilities Revenue Bonds, Park Nicollet Health Services, Refunding Series 2008C, 5.625%, 7/01/26 (Pre-refunded 7/01/18) | 7/18 at 100.00 | Aaa | $2,628,150 | ||

| 1,480 | Saint Louis Park, Minnesota, Health Care Facilities Revenue Bonds, Park Nicollet Health Services, Refunding Series 2009, 5.500%, 7/01/29 (Pre-refunded 7/01/19) | 7/19 at 100.00 | Aaa | 1,618,573 | ||

| 1,595 | Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Allina Health System, Series 2009A-1, 5.000%, 11/15/24 (Pre-refunded 11/15/19) | 11/19 at 100.00 | N/R (4) | 1,749,476 | ||

| Saint Paul Housing and Redevelopment Authority, Minnesota, Recreational Facility Lease Revenue Bonds, Jimmy Lee Recreational Center, Series 2008: | ||||||

| 190 | 4.500%, 12/01/19 (Pre-refunded 12/01/17) | 12/17 at 100.00 | AA+ (4) | 193,507 | ||

| 290 | 4.500%, 12/01/20 (Pre-refunded 12/01/17) | 12/17 at 100.00 | AA+ (4) | 295,353 | ||

| Stevens County Housing and Redevelopment Authority, Minnesota, Public Project Revenue Bonds, Series 2009A: | ||||||

| 325 | 4.000%, 2/01/19 (ETM) | No Opt. Call | AA- (4) | 341,237 | ||

| 340 | 4.100%, 2/01/20 (ETM) | No Opt. Call | AA- (4) | 367,037 | ||

| 640 | Wright County, Minnesota, General Obligation Bonds, Jail Series 2007A, 4.500%, 12/01/20 (Pre-refunded 12/01/17) | 12/17 at 100.00 | AA+ (4) | 651,846 | ||

| 200 | Zumbrota-Mazeppa Independent School District 2805, Wabasha County, Minnesota, General Obligation Bonds, Alternate Facilities Series 2008A, 4.000%, 2/01/19 (Pre-refunded 2/01/18) | 2/18 at 100.00 | AA+ (4) | 203,900 | ||

| 28,075 | Total U.S. Guaranteed | 29,486,594 | ||||

| Utilities – 13.6% | ||||||

| Brainerd, Minnesota, Electric Utility Revenue Bonds, Series 2014A: | ||||||

| 395 | 3.500%, 12/01/22 – AGM Insured | No Opt. Call | AA | 432,399 | ||

| 475 | 4.000%, 12/01/28 | 12/24 at 100.00 | AA | 516,501 | ||

| 495 | 4.000%, 12/01/29 | 12/24 at 100.00 | AA | 532,358 | ||

| 1,140 | Guam Power Authority, Revenue Bonds, Series 2012A, 5.000%, 10/01/25 – AGM Insured | 10/22 at 100.00 | AA | 1,301,777 | ||

| Hutchinson, Minnesota, Public Utility Revenue Bonds, Refunding Series 2012A: | ||||||

| 500 | 5.000%, 12/01/25 | 12/22 at 100.00 | A1 | 582,330 | ||

| 670 | 5.000%, 12/01/26 | 12/22 at 100.00 | A1 | 775,639 | ||

| 500 | Litchfield, Minnesota, Electric Utility Revenue Bonds, Series 2009C, 5.000%, 2/01/29 – AGC Insured | 2/18 at 100.00 | AA | 513,880 | ||

| 340 | Marshall, Minnesota, Public Utility Revenue Bonds, Series 2009A, 3.750%, 7/01/18 – AGC Insured | No Opt. Call | AA | 350,047 | ||

| Minnesota Municipal Power Agency, Electric Revenue Bonds, Refunding Series 2007: | ||||||

| 420 | 4.125%, 10/01/17 | No Opt. Call | A2 | 424,557 | ||

| 1,000 | 5.250%, 10/01/22 | 10/17 at 100.00 | A2 | 1,014,380 | ||

| Minnesota Municipal Power Agency, Electric Revenue Bonds, Refunding Series 2014: | ||||||

| 500 | 5.000%, 10/01/29 | 10/24 at 100.00 | A2 | 582,080 | ||

| 500 | 5.000%, 10/01/30 | 10/24 at 100.00 | A2 | 580,175 | ||

| 1,000 | Minnesota Municipal Power Agency, Electric Revenue Bonds, Refunding Series 2014A, 3.500%, 10/01/28 | 10/24 at 100.00 | A2 | 1,037,670 | ||

| 1,050 | Northern Municipal Power Agency, Minnesota, Electric System Revenue Bonds, Refunding Series 2007A, 5.000%, 1/01/19 – AGC Insured | 1/18 at 100.00 | AA | 1,075,106 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Utilities (continued) | ||||||

| $ 2,155 | Northern Municipal Power Agency, Minnesota, Electric System Revenue Bonds, Refunding Series 2008A, 5.000%, 1/01/21 – AGC Insured | 1/18 at 100.00 | AA | $2,204,350 | ||

| 2,940 | Northern Municipal Power Agency, Minnesota, Electric System Revenue Bonds, Series 2010A-1, 5.000%, 1/01/20 | No Opt. Call | A- | 3,233,588 | ||

| 1,430 | Northern Municipal Power Agency, Minnesota, Electric System Revenue Bonds, Series 2013A, 5.000%, 1/01/30 | 1/23 at 100.00 | A- | 1,620,776 | ||

| 570 | Rochester, Minnesota, Electric Utility Revenue Bonds, Refunding Series 2013B, 5.000%, 12/01/33 | 12/23 at 100.00 | Aa3 | 664,671 | ||

| 750 | Rochester, Minnesota, Electric Utility Revenue Bonds, Refunding Series 2015E, 3.000%, 12/01/29 | 12/25 at 100.00 | Aa3 | 765,600 | ||

| Rochester, Minnesota, Electric Utility Revenue Bonds, Refunding Series 2017A: | ||||||

| 1,000 | 5.000%, 12/01/33 | 12/26 at 100.00 | Aa3 | 1,198,080 | ||

| 450 | 5.000%, 12/01/34 | 12/26 at 100.00 | Aa3 | 536,634 | ||

| 580 | 5.000%, 12/01/35 | 12/26 at 100.00 | Aa3 | 688,988 | ||

| 295 | Shakopee Public Utilities Commission, Minnesota, Public Utilities Crossover Refunding Revenue Bonds, Series 2006A, 4.250%, 2/01/18 – AGM Insured | 7/17 at 100.00 | A1 | 295,829 | ||

| 2,500 | Southern Minnesota Municipal Power Agency Power Supply System Revenue Bonds, Series 2015A, 4.000%, 1/01/30 | 1/26 at 100.00 | A+ | 2,733,425 | ||

| Southern Minnesota Municipal Power Agency, Power Supply System Revenue Bonds, Series 1994A: | ||||||

| 3,500 | 0.000%, 1/01/20 – NPFG Insured | No Opt. Call | AA- | 3,364,445 | ||

| 5,000 | 0.000%, 1/01/21 – NPFG Insured | No Opt. Call | AA- | 4,721,650 | ||

| Western Minnesota Municipal Power Agency, Power Supply Revenue Bonds, Refunding Series 2012A: | ||||||

| 1,000 | 3.000%, 1/01/28 | 1/23 at 100.00 | Aa3 | 1,032,750 | ||

| 1,250 | 5.000%, 1/01/29 | 1/23 at 100.00 | Aa3 | 1,455,050 | ||

| Western Minnesota Municipal Power Agency, Power Supply Revenue Bonds, Refunding Series 2015A: | ||||||

| 1,335 | 5.000%, 1/01/31 | 1/26 at 100.00 | Aa3 | 1,586,821 | ||

| 1,000 | 5.000%, 1/01/33 | 1/26 at 100.00 | Aa3 | 1,176,810 | ||

| Western Minnesota Municipal Power Agency, Power Supply Revenue Bonds, Series 2014A: | ||||||

| 2,850 | 5.000%, 1/01/29 | 1/24 at 100.00 | Aa3 | 3,325,123 | ||

| 2,750 | 5.000%, 1/01/30 | 1/24 at 100.00 | Aa3 | 3,188,405 | ||

| 1,000 | 5.000%, 1/01/31 | 1/24 at 100.00 | Aa3 | 1,153,490 | ||

| 1,150 | 5.000%, 1/01/32 | 1/24 at 100.00 | Aa3 | 1,321,235 | ||

| 42,490 | Total Utilities | 45,986,619 | ||||

| Water and Sewer – 1.3% | ||||||

| Buffalo, Minnesota, Water and Sewer Revenue Bonds, Refunding Series 2014A: | ||||||

| 1,905 | 4.000%, 11/01/24 – BAM Insured | 11/23 at 100.00 | AA | 2,144,516 | ||

| 2,000 | 4.000%, 11/01/28 – BAM Insured | 11/23 at 100.00 | AA | 2,171,840 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Water and Sewer (continued) | ||||||

| $ 250 | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series 2016, 5.000%, 7/01/22 | No Opt. Call | A- | $ 283,105 | ||

| 4,155 | Total Water and Sewer | 4,599,461 | ||||

| $ 310,780 | Total Long-Term Investments (cost $320,117,487) | 334,871,238 | ||||

| Other Assets Less Liabilities – 1.1% | 3,627,105 | |||||

| Net Assets – 100% | $ 338,498,343 | |||||

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. | |

| (2) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm. | |

| (3) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. | |

| (4) | Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. | |

| (ETM) | Escrowed to maturity. |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| LONG-TERM INVESTMENTS – 95.8% | ||||||

| MUNICIPAL BONDS – 95.8% | ||||||

| Consumer Staples – 0.6% | ||||||

| $ 1,800 | Moorhead, Minnesota, Recovery Zone Facility Revenue Bonds, American Crystal Sugar Company Project, Series 2010, 5.650%, 6/01/27 | 6/20 at 100.00 | BBB+ | $ 1,956,222 | ||

| Education and Civic Organizations – 19.1% | ||||||

| 660 | Anoka County, Minnesota, Charter School Lease Revenue Bonds, Spectrum Building Company, Series 2012A, 5.000%, 6/01/43 | 6/20 at 102.00 | BBB- | 684,341 | ||

| 1,680 | Anoka County, Minnesota, Charter School Lease Revenue Bonds, Spectrum Building Company, Series 2014A, 5.000%, 6/01/47 | 6/20 at 102.00 | BBB- | 1,738,128 | ||

| 65 | Baytown Township, Minnesota Charter School Lease Revenue Bonds, Saint Croix Preparatory Academy, Refunding Series 2016A, 4.250%, 8/01/46 | 8/26 at 100.00 | BB+ | 59,511 | ||

| 800 | Chaska, Minnesota, Lease Revenue Bonds, World Learner School Project, Series, 8.000%, 12/01/43 | 12/21 at 100.00 | BB+ | 926,312 | ||

| City of Ham Lake, Minnesota, Charter School Lease Revenue Bonds, DaVinci Academy Project, Series 2016A: | ||||||

| 100 | 5.000%, 7/01/36 | 7/24 at 102.00 | N/R | 101,328 | ||

| 1,000 | 5.000%, 7/01/47 | 7/24 at 102.00 | N/R | 1,002,330 | ||

| 1,515 | City of Woodbury, Minnesota, Charter School Lease Revenue Bonds, Math and Science Academy Building Company, Series 2012A, 5.000%, 12/01/43 | 12/20 at 102.00 | BBB- | 1,571,979 | ||

| Deephaven, Minnesota, Charter School Lease Revenue Bonds, Eagle Ridge Academy Project, Series 2015A: | ||||||

| 405 | 5.250%, 7/01/37 | 7/25 at 100.00 | BB+ | 427,623 | ||

| 500 | 5.500%, 7/01/50 | 7/25 at 100.00 | BB+ | 530,070 | ||

| 300 | Deephaven, Minnesota, Charter School Lease Revenue Bonds, Eagle Ridge Academy Project, Series 2016A, 4.000%, 7/01/37 | 7/25 at 100.00 | BB+ | 284,097 | ||

| Duluth Housing & Redevelopment Authority, Minnesota, Lease Revenue Bonds, Duluth Public Schools Academy, Series 2010A: | ||||||

| 1,750 | 5.600%, 11/01/30 | 11/18 at 102.00 | BB+ | 1,808,922 | ||

| 875 | 5.875%, 11/01/40 | 11/18 at 102.00 | BB+ | 905,336 | ||

| 1,000 | Forest Lake, Minnesota, Charter School Lease Revenue Bonds, Lakes International Language Academy, Series 2014A, 5.750%, 8/01/44 | 8/22 at 102.00 | BB+ | 1,081,290 | ||

| 100 | Greenwood, Minnesota, Charter School Lease Revenue Bonds, Main Street School of Performing Arts Project, Series 2016A, 5.000%, 7/01/36 | 7/26 at 100.00 | N/R | 94,811 | ||

| 5,350 | Ham Lake, Minnesota Charter School Lease Revenue Bonds, Parnassus Preparatory School Project, Series 2016A, 5.000%, 11/01/47 | 11/26 at 100.00 | BB | 5,397,454 | ||

| Hugo, Minnesota, Charter School Lease Revenue Bonds, Noble Academy Project, Series 2014A: | ||||||

| 600 | 5.000%, 7/01/29 | 7/24 at 100.00 | BB+ | 626,136 | ||

| 1,000 | 5.000%, 7/01/34 | 7/24 at 100.00 | BB+ | 1,023,910 | ||

| 525 | 5.000%, 7/01/44 | 7/24 at 100.00 | BB+ | 530,906 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| $ 3,805 | Independence, Minnesota, Charter School Lease Revenue Bonds, Beacon Academy Project, Series 2016A, 5.000%, 7/01/46 | 7/26 at 100.00 | N/R | $3,670,645 | ||

| 100 | Minneapolis, Minnesota, Charter School Lease Revenue Bonds, Hiawatha Academies Project, Series 2016A, 5.000%, 7/01/47 | 7/24 at 102.00 | N/R | 98,731 | ||

| Minneapolis, Minnesota, Charter School Lease Revenue Bonds, Yinghua Academy Project, Series 2013A: | ||||||

| 2,740 | 6.000%, 7/01/43 | 7/23 at 100.00 | BB | 2,923,470 | ||

| 1,260 | 6.125%, 7/01/48 | 7/23 at 100.00 | BB | 1,335,953 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Augsburg College, Series 2014-8-C: | ||||||

| 440 | 3.350%, 5/01/22 | 5/21 at 100.00 | Baa3 | 451,220 | ||

| 395 | 3.500%, 5/01/23 | 5/21 at 100.00 | Baa3 | 405,377 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Bethel University, Refunding Series 2007-6-R: | ||||||

| 1,725 | 5.500%, 5/01/26 | 7/17 at 100.00 | N/R | 1,727,846 | ||

| 820 | 5.500%, 5/01/27 | 7/17 at 100.00 | N/R | 821,304 | ||

| 1,545 | 5.500%, 5/01/37 | 7/17 at 100.00 | N/R | 1,545,819 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Carleton College, Refunding Series 2017: | ||||||

| 1,000 | 4.000%, 3/01/37 | 3/27 at 100.00 | Aa2 | 1,076,940 | ||

| 1,000 | 4.000%, 3/01/39 | 3/27 at 100.00 | Aa2 | 1,069,110 | ||

| 1,835 | Minnesota Higher Education Facilities Authority, Revenue Bonds, College of St. Scholastica, Inc., Series 2011-7J, 6.300%, 12/01/40 | 12/19 at 100.00 | Baa2 | 1,986,718 | ||

| 1,000 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Gustavus Adolfus College, Series 2010-7B, 5.000%, 10/01/31 | 10/19 at 100.00 | A3 | 1,072,660 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Hamline University, Series 2011-7K1: | ||||||

| 625 | 6.000%, 10/01/32 | 10/21 at 100.00 | Baa3 | 707,694 | ||

| 2,000 | 6.000%, 10/01/40 | 10/21 at 100.00 | Baa3 | 2,245,480 | ||

| 1,000 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Macalester College, Series 201528J, 3.250%, 3/01/30 | 3/25 at 100.00 | Aa3 | 1,026,800 | ||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Saint John's University, Series 2015-8I: | ||||||

| 350 | 5.000%, 10/01/33 | 10/25 at 100.00 | A2 | 405,454 | ||

| 385 | 5.000%, 10/01/34 | 10/25 at 100.00 | A2 | 443,532 | ||

| 1,950 | Moorhead, Minnesota, Educational Facilities Revenue Bonds, The Concordia College Corporation Project, Series 2016, 5.000%, 12/01/40 | 12/25 at 100.00 | Baa1 | 2,187,822 | ||

| 1,130 | Otsego, Minnesota, Charter School Lease Revenue Bonds, Kaleidoscope Charter School Project, Series 2014A, 5.000%, 9/01/44 | 9/24 at 100.00 | BB+ | 1,156,815 | ||

| 650 | Ramsey, Anoka County, Minnesota, Lease Revenue Bonds, PACT Charter School Project, Series 2004A, 5.500%, 12/01/33 | 12/21 at 100.00 | BBB- | 693,927 | ||

| 560 | Rice County, Minnesota Educational Facility Revenue Bonds, Shattuck, Saint Mary's School Project, Series 2015, 5.000%, 8/01/22 | No Opt. Call | BB | 594,462 | ||

| 130 | Saint Cloud, Minnesota, Charter School Lease Revenue Bonds, Stride Academy Project, Series 2016A, 5.000%, 4/01/46 | 4/26 at 100.00 | CCC- | 84,500 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| $ 2,940 | Saint Paul Housing & Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Nova Classical Academy, Series 2016A, 4.125%, 9/01/47 | 9/24 at 102.00 | BBB- | $2,887,433 | ||

| Saint Paul Housing and Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Hmong Education Reform Company, Series 2012A: | ||||||

| 1,560 | 5.250%, 9/01/32 | 9/20 at 101.00 | BB+ | 1,581,996 | ||

| 1,695 | 5.500%, 9/01/43 | 9/20 at 101.00 | BB+ | 1,718,730 | ||

| Saint Paul Housing and Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Twin Cities Academy Project, Series 2015A: | ||||||

| 625 | 5.300%, 7/01/45 | 7/25 at 100.00 | BB | 641,156 | ||

| 1,030 | 5.375%, 7/01/50 | 7/25 at 100.00 | BB | 1,058,830 | ||

| 1,450 | Saint Paul Housing and Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Twin Cities German Immersion School, Series 2013A, 5.000%, 7/01/44 | 7/23 at 100.00 | BB+ | 1,479,653 | ||

| 2,000 | Saint Paul Housing and Redevelopment Authority, Minnesota, Educational Facility Revenue Refunding Bonds, Saint Paul Academy and Summit School Project, Series 2007, 5.000%, 10/01/24 | 10/17 at 100.00 | A3 | 2,026,200 | ||

| 185 | Saint Paul Housing and Redevelopment Authority, Minnesota, Lease Revenue Bonds, Saint Paul Conservatory for Performing Artists Charter School Project, Series 2013A, 2.600%, 3/01/18 | No Opt. Call | BBB- | 184,451 | ||

| Savage, Minnesota Charter School Lease Revenue Bonds, Aspen Academy Project, Series 2016A: | ||||||

| 2,010 | 5.000%, 10/01/41 | 10/26 at 100.00 | N/R | 1,891,309 | ||

| 205 | 5.125%, 10/01/48 | 10/26 at 100.00 | N/R | 192,218 | ||

| 1,435 | St. Paul Housing and Redevelopment Authority, Minnesota, Charter School Revenue Bonds, Higher Ground Academy Charter School, Series 2013A, 5.000%, 12/01/33 | 12/22 at 100.00 | BBB- | 1,498,987 | ||

| 430 | St. Paul Housing and Redevelopment Authority, Minnesota, Performing Arts Facility Revenue Bonds, Ordway Center for the Performing Arts, Series 2012, 2.200%, 7/01/18 | 7/17 at 100.00 | N/R | 430,168 | ||

| University of Minnesota, General Obligation Bonds, Series 2014B: | ||||||

| 2,235 | 4.000%, 1/01/33 | 1/24 at 100.00 | Aa1 | 2,418,940 | ||

| 1,185 | 4.000%, 1/01/34 | 1/24 at 100.00 | Aa1 | 1,277,323 | ||

| 1,540 | University of Minnesota, General Revenue Bonds, Series 2011A, 5.250%, 12/01/29 | 12/20 at 100.00 | Aa1 | 1,753,521 | ||

| 20 | Winona Port Authority, Minnesota, Charter School Lease Revenue Bonds, Bluffview Montessori School Project, Refunding Series 2016, 4.750%, 6/01/46 | 6/24 at 100.00 | N/R | 18,408 | ||

| 65,215 | Total Education and Civic Organizations | 67,586,086 | ||||

| Health Care – 14.3% | ||||||

| Chippewa County, Minnesota, Gross Revenue Hospital Bonds, Montevideo Hospital Project, Refunding Series 2016: | ||||||

| 500 | 4.000%, 3/01/32 | 3/26 at 100.00 | N/R | 515,255 | ||

| 2,000 | 4.000%, 3/01/37 | 3/26 at 100.00 | N/R | 1,999,900 | ||

| City of Plato, Minnesota, Health Care Facilities Revenue Bonds, Glencoe Regional Health Services Project, Series 2017: | ||||||

| 550 | 3.000%, 4/01/26 | No Opt. Call | BBB | 557,909 | ||

| 485 | 5.000%, 4/01/41 | 4/27 at 100.00 | BBB | 538,243 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| Glencoe, Minnesota, Health Care Facilities Revenue Bonds, Glencoe Regional Health Services Project, Series 2013: | ||||||

| $ 375 | 4.000%, 4/01/22 | No Opt. Call | BBB | $406,684 | ||

| 500 | 4.000%, 4/01/27 | 4/22 at 100.00 | BBB | 528,560 | ||

| 760 | 4.000%, 4/01/31 | 4/22 at 100.00 | BBB | 796,374 | ||

| 2,500 | Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaii Pacific Health Obligated Group, Series 2010B, 5.750%, 7/01/40 | 7/20 at 100.00 | A1 | 2,731,050 | ||

| 1,000 | Maple Grove, Minnesota, Health Care Facilities Revenue Refunding Bonds, North Memorial Health Care, Series 2015, 4.000%, 9/01/35 | 9/25 at 100.00 | Baa1 | 1,036,970 | ||

| Maple Grove, Minnesota, Health Care Facility Revenue Bonds, North Memorial Health Care, Series 2017: | ||||||

| 425 | 5.000%, 5/01/31 | 5/27 at 100.00 | Baa1 | 497,832 | ||

| 430 | 5.000%, 5/01/32 | 5/27 at 100.00 | Baa1 | 501,277 | ||

| Minneapolis, Minnesota, Health Care System Revenue Bonds, Fairview Health Services, Series 2015A: | ||||||

| 485 | 4.000%, 11/15/40 | 11/25 at 100.00 | A+ | 505,860 | ||

| 2,000 | 5.000%, 11/15/44 | 11/25 at 100.00 | A+ | 2,264,820 | ||

| 130 | Minneapolis-Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Children's Health Care, Series 2004A-1 Remarketed, 4.625%, 8/15/29 – AGM Insured | 8/20 at 100.00 | AA | 139,270 | ||

| 2,435 | Minneapolis-Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Children's Health Care, Series 2010A, 5.250%, 8/15/35 | 8/20 at 100.00 | AA- | 2,679,450 | ||

| 500 | Minneapolis-Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care System Revenue Bonds, Allina Health System, Refunding Series 2017A, 5.000%, 11/15/29 | 5/27 at 100.00 | AA- | 607,535 | ||

| 1,005 | Minnesota Agricultural and Economic Development Board, Health Care Facilities Revenue Bonds, Essential Health Obligated Group, Refunding Series 2008C-1, 5.000%, 2/15/30 – AGC Insured | 2/20 at 100.00 | AA | 1,079,792 | ||

| 2,400 | Rochester, Minnesota, Health Care Facilities Revenue Bonds, Mayo Clinic, Refunding Series 2016B, 5.000%, 11/15/33 | No Opt. Call | AA | 3,073,992 | ||

| 1,700 | Rochester, Minnesota, Health Care Facilities Revenue Bonds, Olmsted Medical Center Project, Series 2010, 5.875%, 7/01/30 | 7/20 at 100.00 | A | 1,893,290 | ||

| 60 | Saint Cloud, Minnesota, Health Care Revenue Bonds, CentraCare Health System Project, Series 2010A, 5.125%, 5/01/30 | 5/20 at 100.00 | A1 | 65,524 | ||

| 675 | Saint Cloud, Minnesota, Health Care Revenue Bonds, CentraCare Health System, Series 2016A, 5.000%, 5/01/46 | 5/26 at 100.00 | A1 | 769,709 | ||

| Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Facility Revenue Bonds, HealthPartners Obligated Group, Refunding Series 2015A: | ||||||

| 8,030 | 5.000%, 7/01/30 | 7/25 at 100.00 | A | 9,369,404 | ||

| 4,500 | 4.000%, 7/01/35 | 7/25 at 100.00 | A | 4,718,520 | ||

| 1,505 | Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Allina Health System, Series 2009A-1, 5.250%, 11/15/29 | 11/19 at 100.00 | AA- | 1,652,821 | ||

| 2,060 | Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Gillette Children's Specialty Healthcare Project, Series 2009, 5.000%, 2/01/29 | 2/19 at 100.00 | A | 2,155,007 | ||

| 1,375 | Saint Paul Port Authority, Minnesota, Lease Revenue Bonds, Regions Hospital Parking Ramp Project, Series 2007-1, 5.000%, 8/01/36 | 7/17 at 100.00 | N/R | 1,375,825 |

| Portfolio of Investments | May 31, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| Shakopee, Minnesota, Health Care Facilities Revenue Bonds, Saint Francis Regional Medical Center, Refunding Series 2014: | ||||||

| $ 1,980 | 4.000%, 9/01/31 | 9/24 at 100.00 | A | $2,117,412 | ||

| 1,410 | 5.000%, 9/01/34 | 9/24 at 100.00 | A | 1,588,534 | ||

| St. Paul Housing and Redevelopment Authority, Minnesota, Hospital Revenue Bonds, HealthEast Inc., Series 2015A: | ||||||

| 110 | 5.250%, 11/15/35 | 11/20 at 100.00 | BBB- | 118,178 | ||

| 1,615 | 5.000%, 11/15/40 | 11/25 at 100.00 | BBB- | 1,745,508 | ||

| Winona, Minnesota, Health Care Facilities Revenue Bonds, Winona Health Obligated Group, Refunding Series 2012: | ||||||

| 500 | 3.750%, 7/01/21 | No Opt. Call | BBB | 532,315 | ||

| 350 | 4.000%, 7/01/22 | 7/21 at 100.00 | BBB | 373,625 | ||

| 1,270 | 4.500%, 7/01/24 | 7/21 at 100.00 | BBB | 1,366,723 | ||

| 45,620 | Total Health Care | 50,303,168 | ||||

| Housing/Multifamily – 0.8% | ||||||

| 2,500 | Rochester, Minnesota, Multifamily Housing Revenue Bonds, Essex Place Apartments Project, Series 2012A, 3.750%, 6/01/29 | 6/22 at 100.00 | Aaa | 2,625,700 | ||

| Housing/Single Family – 1.0% | ||||||