UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: April 30

Date of reporting period: April 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Municipal Bond Funds

Dependable, tax-free income because it’s not what you earn, it’s what you keep.®

Annual Report

April 30, 2012

| Share Class / Ticker Symbol | ||||||

| Fund Name | Class A | Class C | Class I | |||

| Nuveen Short Term Municipal Bond Fund |

FSHAX | NSVCX | FSHYX | |||

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| Must be preceded by or accompanied by a prospectus. | NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 41 | ||||

| 45 | ||||

| 50 | ||||

| 51 | ||||

Letter to Shareholders

| 4 | Nuveen Investments |

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

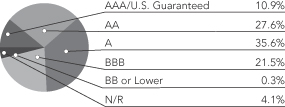

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

This Fund features portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments. Chris Drahn, CFA, manages the Nuveen Short Term Municipal Bond Fund. He has 32 years of investment experience and has been managing the Fund since 2002.

Effective August 31, 2011, the Fund changed its name from Nuveen Short Tax Free Fund to Nuveen Short Term Municipal Bond Fund. There have been no changes in the Fund’s investment objectives, policies or portfolio management personnel.

What factors affected the U.S. economy and the national municipal bond market during the twelve-month reporting period ending April 30, 2012?

During this period, the U.S. economy’s progress toward recovery from recession remained modest. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by continuing to hold the benchmark fed funds rate at the record low level of zero to 0.25% that it had established in December 2008. At its April 2012 meeting, the central bank reaffirmed its opinion that economic conditions would likely warrant keeping this rate at “exceptionally low levels” at least through late 2014. The Fed also stated that it would continue its program to extend the average maturity of its holdings of U.S. Treasury securities by purchasing $400 billion of these securities with maturities of six to thirty years and selling an equal amount of U.S. Treasury securities with maturities of three years or less. The goals of this program, which the Fed expects to complete by the end of June 2012, are to lower longer-term interest rates, support a stronger economic recovery, and help ensure that inflation remains at levels consistent with the Fed’s mandates of maximum employment and price stability.

In the first quarter of 2012, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew at an annualized rate of 1.9%, marking eleven consecutive quarters of positive growth. The Consumer Price Index (CPI) rose 2.3% year-over-year as of April 2012, the lowest 12-month rate of change since February 2011, while the core CPI (which excludes food and energy) also increased 2.3% during the period, edging above the Fed’s unofficial objective of 2.0% or lower for this inflation measure. Labor market conditions have shown some signs of improvement, as national unemployment stood at 8.1% in April 2012, the lowest level since January 2009, down from 9.0% in April 2011. However, some of this drop can be attributed to an increased number of discouraged workers leaving the labor market, rather than a significant gain in the number of new jobs. The housing market continued to be the major weak spot in the economy, beleaguered by a high level of distressed properties and difficult credit conditions. For the twelve months ended March 2012 (most recent data available at the time this report was

| Nuveen Investments | 5 |

prepared), the average home price in the Standard & Poor’s (S&P)/Case-Shiller Index of 20 major metropolitan areas lost 2.6%, as housing prices hit their lowest levels since mid-2002, down approximately 35% from their 2006 peak. In addition, the U.S. economic picture continued to be clouded by concerns about the European debt crisis and efforts to reduce the federal deficit.

Municipal bond prices generally rallied during this period, amid strong demand and lower yields. Although the availability of tax-exempt supply improved in recent months, the pattern of new issuance remained light compared with long-term historical trends. This served as a key driver of performance, as tight supply and strong demand combined to create favorable market conditions for municipal bonds. Concurrent with rising prices, yields declined across most maturities, especially at the longer end of the municipal yield curve. The depressed level of municipal bond issuance was due in part to the continuing impact of the taxable Build America Bonds (BAB) program. Even though the BAB program expired at the end of 2010, issuers had made extensive use of its favorable terms to issue almost $190 billion in taxable BAB bonds during 2009 and 2010, representing approximately 25% of all municipal issuance during that period. Some borrowers accelerated issuance into 2010 in order to take advantage of the program before its termination, fulfilling their capital program borrowing needs well into 2011 and 2012. The low level of municipal issuance during this period also reflected the current political distaste for additional borrowing by state and local governments and the prevalent atmosphere of municipal budget austerity. In recent months, we have seen more borrowers come to market seeking to take advantage of the current rate environment by calling existing debt and refinancing at lower rates.

Over the twelve months ended April 30, 2012, municipal bond issuance nationwide totaled $345 billion, a decrease of 5% compared with issuance during the twelve-month period ended April 30, 2011. During this period, demand for municipal bonds remained very strong, especially from individual investors.

How did the Fund perform during the twelve-month period ended April 30, 2012?

The table in the Fund Performance and Expense Ratios section of this report provides total return performance information for the Fund’s Class A Shares at net asset value (NAV) for the one-year, five-year and since inception periods ended April 30, 2012. Over this period, the Fund outperformed both the S&P Municipal Bond Short Index (prior to November 2011, the Fund’s benchmark was the Barclays 3-Year Municipal Bond Index) and the Lipper Short Municipal Debt Funds Classification Average. A more detailed discussion of the Fund’s relative performance is provided later in this report.

What strategies were used to manage the Fund during the twelve-month reporting period ended April 30, 2012? How did these strategies influence performance?

The Fund enjoyed strong performance relative to its benchmark during the reporting period primarily due to favorable duration positioning, meaning the portfolio benefited

| 6 | Nuveen Investments |

from being more sensitive than its benchmark to falling interest rates. Bonds with longer maturities tended to perform better than their shorter-dated counterparts. As compared to the benchmark, the Fund’s elevated exposure to bonds on the longer end of the short-term universe significantly helped the Fund’s performance. The Fund’s shortest dated bonds with maturities of less than one year modestly tempered the Fund’s results, but this was a minor impact in a period of otherwise positive performance overall.

Credit rating positioning also helped the Fund to a lesser extent. Among bonds with shorter dated maturities, those with lower credit ratings tended to outperform higher rated bonds during the reporting period. This was due both to the higher income levels produced by lower rated bonds as well as investor willingness to pay somewhat higher prices in exchange for those bonds in the current low interest rate environment. This situation put the Fund in a favorable position given the overweight allocation to securities with credit ratings of BBB and A. In addition, we were underweight in the highest rated issues or bonds with credit ratings of AAA and AA, which did not perform as well. Accordingly, having more exposure to the better performing lower rated bonds while maintaining a lesser allocation to the lagging higher rated bonds was helpful.

Another source of outperformance was the Fund’s sector allocation. Similar to credit ratings, many sectors with an abundance of lower rated issuers enjoyed better performance than other groups, and the Fund had added exposure on a relative basis to several of these favorable sectors. For example, the Fund was overweight in health care bonds, especially bonds issued by hospitals, senior-housing facilities and continuing care retirement communities. These types of issuers tended to offer relatively high yields and thus benefited during the reporting period. Another advantage was the Fund’s limited exposure to pre-refunded bonds, which have short durations and high quality. Although they provided positive performance, these bonds trailed the S&P Index, so the Fund’s limited weighting was beneficial to performance.

New purchase activity focused on adding BBB-rated and A-rated bonds to the portfolio. As the Fund’s higher rated bonds matured, proceeds were frequently reinvested in these bonds at the lower end of the investment grade universe.

New purchases also incrementally reduced the Fund’s exposure to longer maturity bonds, with a subtle shift in emphasis in the portfolio away from four- to five-year bonds and toward bonds with maturities up to three years. Because of this focus on shorter maturity investments, the Fund regularly received a steady stream of cash to reinvest as holdings reached their maturity dates. In our view, this shift was prudent given the flattening yield curve, meaning that yields on longer maturity bonds had declined more than those on shorter dated issues. Slightly decreasing the Fund’s exposure to these longer bonds could make the portfolio somewhat less vulnerable to a potential increase in interest rates in the future.

At the end of the reporting period, the Fund remained underweight in AAA-rated and AA-rated issues while overweight in BBB-rated and A-rated bonds as compared to the S&P Index. The Fund was overweight in hospital bonds and also had higher allocations to higher education and airport bonds, sectors in which it was possible to get slightly higher yields in the low interest rate environment. The Fund remained underweight in pre-refunded and state general obligation bonds, two higher credit quality sectors that

| Nuveen Investments | 7 |

tended to offer lower yields. Given the credit research capabilities of Nuveen, as well as the relatively limited duration risk of the short maturity bonds in the Fund’s diversified portfolio, we were comfortable increasing our focus on the lower end of the investment grade credit universe.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Credit risk refers to an issuers ability to make interest and principal payments when due. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. The Fund’s use of inverse floaters creates effective leverage. Leverage involves the risk that the Fund could lose more than its original investment and also increases the Fund’s exposure to volatility and interest rate risk.

Dividend Information

The Fund’s Class A and I Shares experienced an increase to their monthly dividend in May and August 2011. There were no dividend changes affecting the Fund’s Class C Shares.

The Fund seeks to pay dividends at a rate that reflects the past and projected performance of the Fund. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Fund during the period. If the Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if the Fund has cumulatively paid in dividends more than it has earned, the excess will constitute negative UNII that will likewise be reflected in the Fund’s net asset value. The Fund will, over time, pay all its net investment income as dividends to shareholders. As of April 30, 2012, the Fund had a positive UNII balance for both tax purposes and financial reporting purposes.

| 8 | Nuveen Investments |

Fund Performance and Expense Ratios

The Fund Performance and Expense Ratios for the Fund are shown on the following two pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Income is generally exempt from regular federal income taxes. Some income may be subject to state and local income taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Returns may reflect a contractual agreement between the Fund and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Fund’s investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Fund’s Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Fund’s total operating expenses (before fee waivers or expense reimbursements, if any) as shown in the Fund’s most recent prospectus. The expense ratios include management fees and other fees and expenses.

| Nuveen Investments | 9 |

Fund Performance and Expense Ratios (continued)

Nuveen Short Term Municipal Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of April 30, 2012

|

|

Average Annual |

| ||||||||||

| 1-Year | 5-Year | Since Inception* |

||||||||||

| Class A Shares at NAV |

4.15% | 3.27% | 2.79% | |||||||||

| Class A Shares at maximum Offering Price |

1.50% | 2.75% | 2.51% | |||||||||

| Standard & Poor’s (S&P) Municipal Bond Short Index** |

2.45% | 3.66% | 3.07% | |||||||||

| Barclays 3-Year Municipal Bond Index** |

3.24% | 4.28% | 3.56% | |||||||||

| Lipper Short Municipal Debt Funds Classification Average** |

2.36% | 2.43% | 2.28% | |||||||||

| Class I Shares |

4.33% | 3.43% | 2.94% | |||||||||

| Cumulative | ||||

| Since Inception* |

||||

| Class C Shares |

1.61% | |||

Average Annual Total Returns as of March 31, 2012 (Most Recent Calendar Quarter)

|

|

Average Annual |

| ||||||||||

| 1-Year | 5-Year | Since Inception* |

||||||||||

| Class A Shares at NAV |

4.45% | 3.23% | 2.77% | |||||||||

| Class A Shares at maximum Offering Price |

1.88% | 2.70% | 2.49% | |||||||||

| Class I Shares |

4.63% | 3.39% | 2.93% | |||||||||

| Cumulative | ||||

| Since Inception* |

||||

| Class C Shares |

1.27% | |||

Class A Shares have a maximum 2.50% sales charge (Offering Price). Class A Share purchases of $250,000 or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Expense Ratios |

||||

| Class A Shares |

0.71% | |||

| Class C Shares |

1.06% | |||

| Class I Shares |

0.51% | |||

| * | Since inception returns for Class A Shares and I Shares, as well as for the comparative indexes and Lipper classification average, are from 10/25/02. Since inception returns for C Shares are from 8/31/11. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| 10 | Nuveen Investments |

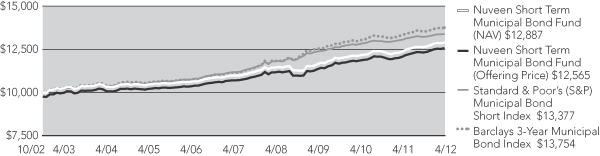

Growth of an Assumed $10,000 Investment as of April 30, 2012

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 11 |

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of a Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the Fund’s portfolio. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

The Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis at a specified tax rate. With respect to investments that generate qualified dividend income that is taxable at a maximum rate of 15%, the Taxable-Equivalent Yield is lower.

Nuveen Short Term Municipal Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

Taxable- Equivalent Yield1 |

||||||||||

| Class A Shares2 |

2.00% | 0.82% | 1.14% | |||||||||

| Class C Shares |

1.65% | 0.46% | 0.64% | |||||||||

| Class I Shares |

2.18% | 1.04% | 1.44% | |||||||||

| 1 | The Taxable-Equivalent Yield is based on the Fund’s 30-Day Yield on the indicated date and a combined federal and state income tax rate of 28.0%. |

| 2 | The SEC Yield for Class A shares quoted in the table reflects the maximum sales load. Investors paying a reduced load because of volume discounts, investors paying no load because they qualify for one of the several exclusions from the load, and existing shareholders who previously paid a load but would like to know the SEC Yield applicable to their shares on a going-forward basis, should understand that the SEC Yield effectively applicable to them would be higher than the figure quoted in the table. |

| 12 | Nuveen Investments |

Holding Summaries as of April 30, 2012

This data relates to the securities held in the Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

| 1 | As a percentage of total investments (excluding money market funds) as of April 30, 2012. Holdings are subject to change. |

| Nuveen Investments | 13 |

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

Nuveen Short Term Municipal Bond Fund

| Hypothetical Performance | ||||||||||||||||||||||||||

| Actual Performance | (5% annualized return before expenses) |

|||||||||||||||||||||||||

| A Shares | C Shares | I Shares | A Shares | C Shares | I Shares | |||||||||||||||||||||

| Beginning Account Value (11/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||

| Ending Account Value (4/30/12) | $ | 1,021.10 | $ | 1,018.30 | $ | 1,022.00 | $ | 1,021.28 | $ | 1,019.69 | $ | 1,022.33 | ||||||||||||||

| Expenses Incurred During Period | $ | 3.62 | $ | 5.22 | $ | 2.56 | $ | 3.62 | $ | 5.22 | $ | 2.56 | ||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .72%, 1.04% and .51% for Classes A, C and I, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

| 14 | Nuveen Investments |

Independent Registered

Public Accounting Firm

To the Board of Directors and Shareholders of

Nuveen Investment Funds, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations, of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Short Term Municipal Bond Fund (a series of the Nuveen Investment Funds, Inc., hereinafter referred to as the “Fund”) at April 30, 2012, the results of its operations, the changes in its net assets, and the financial highlights for the year ended April 30, 2012, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at April 30, 2012 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion. The financial statements of Nuveen Short Term Municipal Bond Fund for the periods ended April 30, 2011 and prior were audited by other independent auditors whose report dated June 24, 2011 expressed an unqualified opinion on those statements.

PRICEWATERHOUSECOOPERS LLP

Chicago, IL

June 27, 2012

| Nuveen Investments | 15 |

Nuveen Short Term Municipal Bond Fund (formerly Nuveen Short Tax Free Fund)

April 30, 2012

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| MUNICIPAL BONDS – 94.0% |

||||||||||||||||||

| Alaska – 0.5% |

||||||||||||||||||

| $ | 1,825 | Alaska Railroad Corporation, Capital Grant Receipts Bonds, Section 5307 and 5309 Formula Funds, Series 2007, 5.000%, 8/01/12 – NPFG Insured |

No Opt. Call | A+ | $ | 1,845,641 | ||||||||||||

| Arizona – 3.0% |

||||||||||||||||||

| 1,545 | Glendale Industrial Development Authority, Arizona, Revenue Bonds, Midwestern University, Refunding Series 2010, 5.000%, 5/15/19 |

No Opt. Call | A+ | 1,777,136 | ||||||||||||||

| 1,045 | Maricopa County School District 31 Balsz, Arizona, General Obligation Bonds, School Improvement Project 2011 Series 2012, 2.000%, 7/01/14 – AGM Insured |

No Opt. Call | AA– | 1,069,066 | ||||||||||||||

| 5,000 | Phoenix Civic Improvement Corporation, Arizona, Junior Lien Airport Revenue Bonds, Series 2010A, 5.000%, 7/01/17 |

No Opt. Call | A+ | 5,794,350 | ||||||||||||||

| Phoenix Mesa Gateway Airport Authority, Arizona, Special Facility Revenue Bonds, Mesa Project, Series 2012: |

||||||||||||||||||

| 200 | 3.000%, 7/01/14 (Alternative Minimum Tax) |

No Opt. Call | AA+ | 206,834 | ||||||||||||||

| 130 | 3.000%, 7/01/15 (Alternative Minimum Tax) |

No Opt. Call | AA+ | 134,479 | ||||||||||||||

| 300 | 3.000%, 7/01/16 (Alternative Minimum Tax) |

No Opt. Call | AA+ | 310,293 | ||||||||||||||

| 790 | Pinal County Electrical District 3, Arizona, Electric System Revenue Bonds, Refunding Series 2011, 2.500%, 7/01/15 |

No Opt. Call | A | 815,225 | ||||||||||||||

| 9,010 | Total Arizona |

10,107,383 | ||||||||||||||||

| Arkansas – 0.9% |

||||||||||||||||||

| 2,750 | North Little Rock Health Facilities Board, Arkansas, Healthcare Revenue Bonds, Baptist Health, Series 1996B, 5.375%, 12/01/19 |

12/18 at 100.00 | A+ | 3,186,590 | ||||||||||||||

| California – 10.5% |

||||||||||||||||||

| 870 | ABAG Finance Authority for Nonprofit Corporations, California, Revenue Bonds, Episcopal Senior Communities, Refunding Series 2011, 4.000%, 7/01/13 |

No Opt. Call | BBB+ | 882,050 | ||||||||||||||

| 4,000 | California Pollution Control Financing Authority, Solid Waste Disposal Revenue Bonds, Republic Services Inc., Refunding Series 2010B, 0.450%, 8/01/24 |

No Opt. Call | BBB | 4,000,240 | ||||||||||||||

| 8,000 | California Pollution Control Financing Authority, Solid Waste Disposal Revenue Bonds, Republic Services Inc., Series 2010A, 0.650%, 8/01/23 (Alternative Minimum Tax) |

No Opt. Call | BBB | 8,001,440 | ||||||||||||||

| 1,000 | California Pollution Control Financing Authority, Solid Waste Disposal Revenue Bonds, USA Waste Services Inc., Refunding Series 1998A, 2.625%, 6/01/18 (Mandatory put 6/02/14) (Alternative Minimum Tax) |

No Opt. Call | BBB | 1,023,460 | ||||||||||||||

| 2,330 | California State Public Works Board, Lease Revenue Bonds, Department of Corrections & Rehabilitation, Series 2011C, 4.000%, 10/01/15 |

No Opt. Call | A2 | 2,534,830 | ||||||||||||||

| 3,000 | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2011A, 4.000%, 10/01/15 |

No Opt. Call | A2 | 3,263,730 | ||||||||||||||

| 2,500 | California Statewide Communities Development Authority, Revenue Bonds, Adventist Health System West, Series 2005A, 5.000%, 3/01/16 |

3/15 at 100.00 | A | 2,757,075 | ||||||||||||||

| 2,500 | Inland Valley Development Agency, California, Tax Allocation Bonds, Series 2011B, 4.250%, 3/01/41 (Mandatory put 3/01/15) |

No Opt. Call | A | 2,616,900 | ||||||||||||||

| 3,750 | Long Beach Community College District, California, General Obligation Bonds, Series 2010A, 9.850%, 1/15/13 |

No Opt. Call | Aa2 | 3,999,713 | ||||||||||||||

| 500 | Northern California Power Agency, Hydroelectric Project Number One Revenue Bonds, Refunding Series 2010A, 5.000%, 7/01/16 |

No Opt. Call | A | 578,915 | ||||||||||||||

| Pittsburg Infrastructure Financing Authority, California, Reassessment Revenue Refunding Bonds, Series 2011A: |

||||||||||||||||||

| 200 | 2.000%, 9/02/13 – AGM Insured |

No Opt. Call | AA– | 200,660 | ||||||||||||||

| 400 | 3.000%, 9/02/14 – AGM Insured |

No Opt. Call | AA– | 408,424 | ||||||||||||||

| 1,400 | Port of Oakland, California, Revenue Refunding Bonds, Series 2011-O, 4.000%, 5/01/13 (Alternative Minimum Tax) |

No Opt. Call | A+ | 1,443,120 | ||||||||||||||

| 16 | Nuveen Investments |

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| California (continued) |

||||||||||||||||||

| $ | 475 | South Monterey County Joint Union High School District, Monterey and San Benito Counties, California, General Obligation Bonds, Series 2012, 2.000%, 8/01/12 |

No Opt. Call | BBB | $ | 476,173 | ||||||||||||

| 985 | Union City Community Redevelopment Agency, California, Tax Allocation Revenue Bonds, Redevelopment Project, Subordinate Lien Series 2011, 5.000%, 12/01/18 |

No Opt. Call | A | 1,066,932 | ||||||||||||||

| West Kern Water District, California, Certificates of Participation, Series 2011: |

||||||||||||||||||

| 350 | 3.000%, 6/01/13 |

No Opt. Call | AA– | 357,200 | ||||||||||||||

| 630 | 3.000%, 6/01/14 |

No Opt. Call | AA– | 650,620 | ||||||||||||||

| 860 | 3.000%, 6/01/15 |

No Opt. Call | AA– | 896,688 | ||||||||||||||

| 600 | 3.000%, 6/01/16 |

No Opt. Call | AA– | 626,328 | ||||||||||||||

| 34,350 | Total California |

35,784,498 | ||||||||||||||||

| Colorado – 3.5% |

||||||||||||||||||

| 3,345 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health Initiatives, Series 2009A, 5.000%, 7/01/15 |

No Opt. Call | AA | 3,782,091 | ||||||||||||||

| 2,400 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Evangelical Lutheran Good Samaritan, Series 2009B, 5.000%, 6/01/39 (Mandatory put 12/01/14) |

No Opt. Call | A– | 2,592,216 | ||||||||||||||

| 1,000 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Yampa Valley Medical Center, Series 2007, 5.000%, 9/15/13 |

No Opt. Call | BBB | 1,030,710 | ||||||||||||||

| 1,010 | Colorado Health Facilities Authority, Hospital Improvement Revenue Bonds, NCMC Inc., Series 2003A, 5.000%, 5/15/13 – AGM Insured |

No Opt. Call | AA+ | 1,052,844 | ||||||||||||||

| Colorado Health Facilities Authority, Revenue Bonds, National Jewish Medical and Research Center, Series 2012: |

||||||||||||||||||

| 300 | 3.000%, 1/01/13 |

No Opt. Call | BBB | 302,010 | ||||||||||||||

| 350 | 4.000%, 1/01/14 |

No Opt. Call | BBB | 360,700 | ||||||||||||||

| 505 | 4.000%, 1/01/15 |

No Opt. Call | BBB | 527,962 | ||||||||||||||

| Eagle County Air Terminal Corporation, Colorado, Airport Terminal Project Revenue Bonds, Refunding Series 2011A: |

||||||||||||||||||

| 115 | 3.000%, 5/01/12 (Alternative Minimum Tax) |

No Opt. Call | Baa2 | 115,005 | ||||||||||||||

| 125 | 3.000%, 5/01/13 (Alternative Minimum Tax) |

No Opt. Call | Baa2 | 126,223 | ||||||||||||||

| 235 | 3.000%, 5/01/14 (Alternative Minimum Tax) |

No Opt. Call | Baa2 | 237,834 | ||||||||||||||

| 345 | 3.500%, 5/01/15 (Alternative Minimum Tax) |

No Opt. Call | Baa2 | 354,115 | ||||||||||||||

| 1,240 | Meridian Metropolitan District, Douglas County, Colorado, General Obligation Refunding Bonds, Series 2011A, 3.000%, 12/01/15 |

No Opt. Call | A | 1,308,659 | ||||||||||||||

| 10,970 | Total Colorado |

11,790,369 | ||||||||||||||||

| Connecticut – 1.3% |

||||||||||||||||||

| 1,235 | Connecticut Development Authority, Pollution Control Revenue Bonds, Connecticut Light and Power Company, Refunding Series 2011B, 1.250%, 9/01/28 (Mandatory put 9/03/13) |

No Opt. Call | A | 1,243,917 | ||||||||||||||

| Connecticut Health and Educational Facilities Authority, Revenue Bonds, Sacred Heart University, Series 2011G: |

||||||||||||||||||

| 505 | 2.250%, 7/01/14 |

No Opt. Call | BBB | 511,262 | ||||||||||||||

| 765 | 4.000%, 7/01/15 |

No Opt. Call | BBB | 807,274 | ||||||||||||||

| Connecticut Health and Educational Facilities Authority, Revenue Bonds, Sacred Heart University, Series 2012H: |

||||||||||||||||||

| 500 | 3.000%, 7/01/13 – AGM Insured |

No Opt. Call | AA– | 512,540 | ||||||||||||||

| 1,150 | 4.000%, 7/01/14 – AGM Insured |

No Opt. Call | AA– | 1,218,862 | ||||||||||||||

| 4,155 | Total Connecticut |

4,293,855 | ||||||||||||||||

| Delaware – 0.9% |

||||||||||||||||||

| 3,000 | Wilmington, Delaware, Multifamily Rental Housing Revenue Bonds, Lincoln Towers Associates, LLC Project, Series 2011A and Series 2011B, 4.000%, 7/15/13 |

No Opt. Call | N/R | 3,010,410 | ||||||||||||||

| Nuveen Investments | 17 |

Portfolio of Investments

Nuveen Short Term Municipal Bond Fund (continued)

April 30, 2012

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| District of Columbia – 0.7% |

||||||||||||||||||

| District of Columbia, Revenue Bonds, Gallaudet University, Series 2011: |

||||||||||||||||||

| $ | 200 | 3.000%, 4/01/13 |

No Opt. Call | A+ | $ | 203,092 | ||||||||||||

| 250 | 3.000%, 4/01/14 |

No Opt. Call | A+ | 256,915 | ||||||||||||||

| 1,740 | District of Columbia, Revenue Bonds, Georgetown University, Refunding Series 2009A, 5.000%, 4/01/14 |

No Opt. Call | A– | 1,868,012 | ||||||||||||||

| 2,190 | Total District of Columbia |

2,328,019 | ||||||||||||||||

| Florida – 8.8% |

||||||||||||||||||

| 1,250 | Broward County, Florida, Port Facilities Revenue Bonds, Refunding Series 2011B, 5.000%, 9/01/15 (Alternative Minimum Tax) |

No Opt. Call | A2 | 1,376,700 | ||||||||||||||

| 5,100 | Citizens Property Insurance Corporation, Florida, High-Risk Account Revenue Bonds, Coastal Account Senior Secured Series 2011A-1, 5.000%, 6/01/15 |

No Opt. Call | A+ | 5,648,199 | ||||||||||||||

| Citizens Property Insurance Corporation, Florida, High-Risk Account Senior Secured Bonds Series 2010A-1: |

||||||||||||||||||

| 120 | 3.000%, 6/01/13 |

No Opt. Call | A+ | 123,367 | ||||||||||||||

| 200 | 5.000%, 6/01/14 |

No Opt. Call | A+ | 215,932 | ||||||||||||||

| 650 | Cityplace Community Development District, Florida, Special Assessement and Revenue Bonds, Refunding Series 2012, 5.000%, 5/01/14 |

No Opt. Call | A | 693,778 | ||||||||||||||

| Florida Higher Educational Facilities Financing Authority, Revenue and Revenue Refunding Bonds, University of Tampa Project, Series 2012A: |

||||||||||||||||||

| 250 | 3.000%, 4/01/13 |

No Opt. Call | BBB+ | 254,248 | ||||||||||||||

| 300 | 4.000%, 4/01/14 |

No Opt. Call | BBB+ | 313,977 | ||||||||||||||

| 300 | 4.000%, 4/01/15 |

No Opt. Call | BBB+ | 318,024 | ||||||||||||||

| 4,315 | Florida Hurricane Catastrophe Fund, Financial Corporation Revenue Bonds, Series 2006A, 5.250%, 7/01/12 |

No Opt. Call | AA | 4,351,548 | ||||||||||||||

| 1,000 | Highlands County Health Facilities Authority, Florida, Hospital Revenue Bonds, Adventist Health System/Sunbelt Obligated Group, Refunding Series 2009E, 5.000%, 11/15/15 |

No Opt. Call | AA– | 1,132,230 | ||||||||||||||

| 2,000 | Highlands County Health Facilities Authority, Florida, Hospital Revenue Bonds, Adventist Health System/Sunbelt Obligated Group, Variable Rate Demand Series 2005I, 5.000%, 11/15/16 |

No Opt. Call | AA– | 2,306,500 | ||||||||||||||

| 500 | Lakeland, Florida, Hospital System Revenue Bonds, Lakeland Regional Health, Refunding Series 2011, 3.000%, 11/15/12 |

No Opt. Call | A2 | 505,605 | ||||||||||||||

| 180 | Lee County, Florida, Airport Revenue Refunding Bonds, Series 2011A, 4.000%, 10/01/13 (Alternative Minimum Tax) |

No Opt. Call | A2 | 185,557 | ||||||||||||||

| 1,000 | Miami, Florida, Special Obligation Non-Ad Valorem Revenue Refunding Bonds, Series 2011A, 5.000%, 2/01/17 |

No Opt. Call | AA– | 1,097,040 | ||||||||||||||

| 500 | Miami-Dade County Industrial Development Authority, Florida, Solid Waste Revenue Bonds, Waste Management Inc. of Florida Project, Series 2008, 2.625%, 8/01/23 (Mandatory put 8/01/14) (Alternative Minimum Tax) |

No Opt. Call | BBB | 507,860 | ||||||||||||||

| Pinellas County Educational Facilities Authority, Florida, General Revenue Bonds, Barry University, Refunding Series 2011: |

||||||||||||||||||

| 590 | 3.000%, 10/01/12 |

No Opt. Call | BBB | 593,670 | ||||||||||||||

| 605 | 4.000%, 10/01/13 |

No Opt. Call | BBB | 628,589 | ||||||||||||||

| 1,175 | 5.000%, 10/01/15 |

No Opt. Call | BBB | 1,297,494 | ||||||||||||||

| 1,060 | 4.000%, 10/01/16 |

No Opt. Call | BBB | 1,131,158 | ||||||||||||||

| 305 | Pinellas County Educational Facilities Authority, Florida, General Revenue Bonds, Barry University, Refunding Series 2012, 4.000%, 10/01/15 |

No Opt. Call | BBB | 324,956 | ||||||||||||||

| 225 | Port Saint Lucie, Florida, Special Assessment Revenue Bonds, Water and Sewer Utility Service Area 3 & 4, Refunding Series 2011A, 1.250%, 9/01/12 – AGM Insured |

No Opt. Call | AA– | 225,495 | ||||||||||||||

| 2,000 | South Miami Health Facilities Authority, Florida, Hospital Revenue, Baptist Health System Obligation Group, Series 2007, 5.000%, 8/15/12 |

No Opt. Call | AA | 2,027,220 | ||||||||||||||

| 1,000 | Tallahassee, Florida, Energy System Revenue Bonds, Series 2007, 5.000%, 10/01/12 – NPFG Insured |

No Opt. Call | AA | 1,019,020 | ||||||||||||||

| 18 | Nuveen Investments |

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Florida (continued) |

||||||||||||||||||

| Volusia County Educational Facilities Authority, Florida, Educational Facilities Revenue Bonds, Embry-Riddle Aeronautical University, Inc. Project, Refunding Series 2011: |

||||||||||||||||||

| $ | 2,380 | 2.000%, 10/15/14 – AGM Insured |

No Opt. Call | AA– | $ | 2,388,758 | ||||||||||||

| 1,275 | 4.000%, 10/15/15 – AGM Insured |

No Opt. Call | AA– | 1,361,509 | ||||||||||||||

| 28,280 | Total Florida |

30,028,434 | ||||||||||||||||

| Georgia – 2.3% |

||||||||||||||||||

| 1,300 | Atlanta, Georgia, Airport General Revenue Refunding Bonds, Series 2011B, 5.000%, 1/01/14 |

No Opt. Call | A+ | 1,387,542 | ||||||||||||||

| 1,300 | Burke County Development Authority, Georgia, Pollution Control Revenue Bonds, Georgia Power Company, Ninth Series 1994, 1.200%, 10/01/32 (Mandatory put 4/01/14) |

No Opt. Call | A+ | 1,308,593 | ||||||||||||||

| 3,200 | DeKalb County Hospital Authority, Georgia, Anticipation Certificates Revenue Bonds, DeKalb Medical Center, Inc. Project, Series 2010, 4.000%, 9/01/15 |

No Opt. Call | BBB | 3,327,104 | ||||||||||||||

| Private Colleges and Universities Authority, Georgia, Revenue Bonds, Mercer University, Series Series 2012A: |

||||||||||||||||||

| 755 | 4.000%, 10/01/12 |

No Opt. Call | Baa2 | 764,438 | ||||||||||||||

| 585 | 4.000%, 10/01/14 |

No Opt. Call | Baa2 | 614,905 | ||||||||||||||

| 330 | Private Colleges and Universities Authority, Georgia, Revenue Bonds, Mercer University Project, Refunding Series 2012C, 4.000%, 10/01/14 (WI/DD, Settling 5/15/12) |

No Opt. Call | Baa2 | 348,114 | ||||||||||||||

| 7,470 | Total Georgia |

7,750,696 | ||||||||||||||||

| Hawaii – 0.4% |

||||||||||||||||||

| 1,500 | Hawaii Department of Budget and Finance, Special Purpose Senior Living Revenue Bonds, 15 Craigside Project, Series 2009C-1, 7.500%, 11/15/15 |

5/12 at 100.00 | N/R | 1,522,875 | ||||||||||||||

| Illinois – 4.9% |

||||||||||||||||||

| 700 | Board of Trustees of Southern Illinois University, Housing and Auxiliary Facilities System Revenue Bonds, Series 2011A, 3.000%, 4/01/13 |

No Opt. Call | A+ | 712,327 | ||||||||||||||

| 4,000 | Illinois Finance Authority, Revenue Bonds, Art Institute of Chicago, Refunding Series 2010A, 5.000%, 3/01/15 |

No Opt. Call | A+ | 4,443,160 | ||||||||||||||

| 500 | Illinois Finance Authority, Revenue Bonds, Illinois Institute of Technology, Series 2009, 6.250%, 2/01/19 |

No Opt. Call | Baa3 | 517,730 | ||||||||||||||

| Illinois Finance Authority, Revenue Bonds, Rush University Medical Center Obligated Group, Series 2009A: |

||||||||||||||||||

| 1,655 | 5.000%, 11/01/13 |

No Opt. Call | A2 | 1,738,925 | ||||||||||||||

| 1,105 | 5.000%, 11/01/14 |

No Opt. Call | A2 | 1,192,030 | ||||||||||||||

| 300 | Illinois Finance Authority, Revenue Bonds, The Clare at Water Tower Project, Capitol Appreciation Series 2010B, 0.000%, 5/15/50 (5) |

7/12 at 15.43 | N/R | 56,694 | ||||||||||||||

| 700 | Illinois Finance Authority, Revenue Bonds, The Clare at Water Tower Project, Refunding Series 2010A, 5.100%, 5/15/14 (5) |

No Opt. Call | N/R | 156,086 | ||||||||||||||

| 305 | Illinois State, General Obligation Bonds, Refunding Series 2006, 5.000%, 1/01/15 |

No Opt. Call | A+ | 332,950 | ||||||||||||||

| 125 | Illinois State, General Obligation Bonds, Series 2006A, 5.000%, 6/01/15 |

No Opt. Call | A+ | 137,758 | ||||||||||||||

| 255 | Illinois State, General Obligation Bonds, Series 2006, 5.000%, 1/01/15 |

No Opt. Call | A+ | 278,368 | ||||||||||||||

| Illinois, General Obligation Bonds, Illinois FIRST Program, Series 2002: |

||||||||||||||||||

| 125 | 5.500%, 4/01/13 – AGM Insured |

No Opt. Call | AA– | 130,531 | ||||||||||||||

| 1,075 | 5.500%, 8/01/15 – SYNCORA GTY Insured |

No Opt. Call | A+ | 1,205,817 | ||||||||||||||

| Macon County School District 61 Decatur, Illinois, General Obligation Bonds, Series 2011A: |

||||||||||||||||||

| 300 | 2.000%, 1/01/13 – AGM Insured |

No Opt. Call | Aa3 | 302,145 | ||||||||||||||

| 320 | 2.000%, 1/01/15 – AGM Insured |

No Opt. Call | Aa3 | 326,493 | ||||||||||||||

| Waukegan, Illinois, General Obligation Bonds, Refunding Series 2012A: |

||||||||||||||||||

| 1,200 | 3.000%, 12/30/13 – AGM Insured |

No Opt. Call | Aa3 | 1,233,612 | ||||||||||||||

| Nuveen Investments | 19 |

Portfolio of Investments

Nuveen Short Term Municipal Bond Fund (continued)

April 30, 2012

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Illinois (continued) |

||||||||||||||||||

| $ | 1,145 | 4.000%, 12/30/14 – AGM Insured |

No Opt. Call | Aa3 | $ | 1,219,688 | ||||||||||||

| 885 | 4.000%, 12/30/15 – AGM Insured |

No Opt. Call | Aa3 | 955,570 | ||||||||||||||

| 790 | Western Illinois University, Auxillary Facilities Revenue Bonds, Series 2012, 3.000%, 4/01/14 |

No Opt. Call | A | 816,718 | ||||||||||||||

| Williamson & Johnson Counties Community Unit School District 2, Marion, Illinois, General Obligation Bonds, Series 2011: |

||||||||||||||||||

| 395 | 5.750%, 12/01/14 – AGM Insured |

No Opt. Call | AA– | 430,763 | ||||||||||||||

| 450 | 5.750%, 12/01/15 – AGM Insured |

No Opt. Call | AA– | 501,723 | ||||||||||||||

| 16,330 | Total Illinois |

16,689,088 | ||||||||||||||||

| Indiana – 0.8% |

||||||||||||||||||

| 990 | Anderson, Indiana, Economic Development Revenue Bonds, Anderson University, Series 2007, 5.000%, 10/01/12 |

No Opt. Call | BB+ | 988,901 | ||||||||||||||

| 1,000 | Indiana Health and Educational Facilities Financing Authority, Revenue Bonds, Baptist Homes of Indiana, Series 2005, 5.000%, 11/15/13 |

No Opt. Call | A– | 1,041,480 | ||||||||||||||

| 610 | Knox County, Indiana, Economic Development Revenue and Refunding Bonds, Good Samaritan Hospital Project, Series 2012A, 3.000%, 4/01/15 (WI/DD, Settling 5/03/12) |

No Opt. Call | A3 | 635,327 | ||||||||||||||

| 2,600 | Total Indiana |

2,665,708 | ||||||||||||||||

| Iowa – 3.4% |

||||||||||||||||||

| Ames, Iowa, Hospital Revenue Bonds, Mary Greeley Medical Center, Series 2011: |

||||||||||||||||||

| 100 | 3.000%, 6/15/13 |

No Opt. Call | A2 | 102,034 | ||||||||||||||

| 230 | 4.000%, 6/15/14 |

No Opt. Call | A2 | 243,703 | ||||||||||||||

| 500 | 4.000%, 6/15/15 |

No Opt. Call | A2 | 536,145 | ||||||||||||||

| Iowa Finance Authority, Healthcare Revenue Bonds, Gensisi Health System, Refunding Series 2010: |

||||||||||||||||||

| 1,150 | 5.000%, 7/01/16 |

No Opt. Call | A1 | 1,304,342 | ||||||||||||||

| 2,285 | 5.000%, 7/01/20 |

No Opt. Call | A1 | 2,659,717 | ||||||||||||||

| 220 | Iowa Higher Education Loan Authority, Private College Facility Revenue Bonds, University of Dubuque Project, Refunding Series 2011, 4.000%, 10/01/14 |

No Opt. Call | BBB– | 226,235 | ||||||||||||||

| Iowa Student Loan Liquidity Corporation Student Loan Revenue Bonds, Senior Lien Series 2011A-1: |

||||||||||||||||||

| 375 | 2.600%, 12/01/13 (Alternative Minimum Tax) |

No Opt. Call | A | 380,374 | ||||||||||||||

| 2,000 | 3.100%, 12/01/14 (Alternative Minimum Tax) |

No Opt. Call | A | 2,058,640 | ||||||||||||||

| 3,900 | Iowa Student Loan Liquidity Corporation, Student Loan Revenue Bonds, Refunding Series 2009-1, 5.000%, 12/01/13 |

No Opt. Call | A1 | 4,136,574 | ||||||||||||||

| 10,760 | Total Iowa |

11,647,764 | ||||||||||||||||

| Kansas – 1.6% |

||||||||||||||||||

| 1,000 | Kansas State Power Pool, Electric Utility Revenue Bonds, Dogwood Energy Facility, Series 2012A, 3.000%, 12/01/14 |

No Opt. Call | Baa1 | 1,034,390 | ||||||||||||||

| 1,150 | Olathe, Kansas, Health Facilities Revenue Bonds, Olathe Medical Center, Series 2008, 4.000%, 9/01/12 |

No Opt. Call | A+ | 1,164,226 | ||||||||||||||

| 1,000 | Wichita, Kansas, Hospital Facilities Revenue Bonds, Via Christi Health System, Inc., Refunding Series 2009X, 5.000%, 11/15/15 |

No Opt. Call | A+ | 1,120,390 | ||||||||||||||

| Wichita, Kansas, Hospital Facilities Revenue Refunding and Improvement Bonds, Via Christi Health System Inc., Series 2009A-III: |

||||||||||||||||||

| 1,000 | 5.000%, 11/15/14 |

No Opt. Call | A+ | 1,100,800 | ||||||||||||||

| 1,000 | 5.000%, 11/15/16 |

No Opt. Call | A+ | 1,144,020 | ||||||||||||||

| 5,150 | Total Kansas |

5,563,826 | ||||||||||||||||

| Kentucky – 1.1% |

||||||||||||||||||

| 3,000 | Pikeville, Kentucky, Educational Facilities Revenue Bond, Pikeville College of Osteopathic Medicine, Bond Anticipation Notes, Series 2011, 4.000%, 5/01/13 |

No Opt. Call | MIG2 | 3,050,850 | ||||||||||||||

| 20 | Nuveen Investments |

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Kentucky (continued) |

||||||||||||||||||

| $ | 750 | Pikeville, Kentucky, Hospital Revenue Bonds, Pikeville Medical Center, Inc. Project, Improvement and Refunding Series 2011, 4.000%, 3/01/13 |

No Opt. Call | A3 | $ | 764,138 | ||||||||||||

| 3,750 | Total Kentucky |

3,814,988 | ||||||||||||||||

| Louisiana – 1.0% |

||||||||||||||||||

| Calcasieu Parish Public Trust Authority, Louisiana, Student Lease Revenue Bonds, McNeese State Univeristy Student Housing-Cowboy Facilities, Inc. Project, Refunding Series 2011: |

||||||||||||||||||

| 200 | 2.000%, 5/01/12 – AGM Insured |

No Opt. Call | Aa3 | 200,008 | ||||||||||||||

| 535 | 2.000%, 5/01/13 – AGM Insured |

No Opt. Call | Aa3 | 541,773 | ||||||||||||||

| 305 | 2.000%, 5/01/14 – AGM Insured |

No Opt. Call | Aa3 | 310,453 | ||||||||||||||

| 315 | 3.000%, 5/01/15 – AGM Insured |

No Opt. Call | Aa3 | 329,855 | ||||||||||||||

| 315 | 3.000%, 5/01/16 – AGM Insured |

No Opt. Call | Aa3 | 329,225 | ||||||||||||||

| Louisiana Citizens Property Insurance Corporation, Assessment Revenue Bonds, Refunding Series 2012: |

||||||||||||||||||

| 260 | 2.000%, 6/01/13 |

No Opt. Call | A– | 262,785 | ||||||||||||||

| 300 | 2.000%, 6/01/14 |

No Opt. Call | A– | 304,176 | ||||||||||||||

| 1,000 | Louisiana Citizens Property Insurance Corporation, Assessment Revenue Bonds, Series 2006B, 5.000%, 6/01/15 – AMBAC Insured |

No Opt. Call | A– | 1,103,780 | ||||||||||||||

| 3,230 | Total Louisiana |

3,382,055 | ||||||||||||||||

| Massachusetts – 1.2% |

||||||||||||||||||

| Massachusetts Development Finance Agency, Revenue Bonds, Lasell College, Series 2011: |

||||||||||||||||||

| 220 | 2.000%, 7/01/12 |

No Opt. Call | BBB | 220,198 | ||||||||||||||

| 600 | 2.250%, 7/01/13 |

No Opt. Call | BBB | 604,320 | ||||||||||||||

| 580 | Massachusetts Development Finance Agency, Senior Living Facility Revenue Bonds, The Groves in Lincoln Issue, Series 2009B-2, 6.250%, 6/01/14 |

7/12 at 100.00 | N/R | 580,070 | ||||||||||||||

| 2,115 | Massachusetts Educational Financing Authority, Student Loan Revenue Bonds, Issue I Series 2010B, 4.500%, 1/01/16 (Alternative Minimum Tax) |

No Opt. Call | AA | 2,257,382 | ||||||||||||||

| 325 | Massachusetts Health and Educational Facilities Authority, Revenue Bonds, Springfield College, Series 2010, 4.000%, 10/15/13 |

No Opt. Call | Baa1 | 334,568 | ||||||||||||||

| 3,840 | Total Massachusetts |

3,996,538 | ||||||||||||||||

| Michigan – 4.3% |

||||||||||||||||||

| Bridgeport Spaulding Community School District, Saginaw County, Michigan, General Obligation Bonds, Refunding Series 2011: |

||||||||||||||||||

| 675 | 2.500%, 5/01/14 – AGM Insured |

No Opt. Call | Aa2 | 687,852 | ||||||||||||||

| 1,250 | 3.000%, 5/01/15 – AGM Insured |

No Opt. Call | Aa2 | 1,293,613 | ||||||||||||||

| Kalamazoo Hospital Finance Authority, Michigan, Hospital Revenue Bonds, Bronson Healthcare Group, Series 2011A: |

||||||||||||||||||

| 175 | 3.000%, 5/15/13 |

No Opt. Call | A2 | 177,737 | ||||||||||||||

| 430 | 4.000%, 5/15/15 |

No Opt. Call | A2 | 455,357 | ||||||||||||||

| 500 | Lake Superior State University Board of Trustees, Michigan, General Revenue Refunding Bonds, Series 2012, 2.000%, 11/15/14 – AGM Insured |

No Opt. Call | AA– | 506,825 | ||||||||||||||

| 2,030 | Michigan Hospital Finance Authority, Revenue Bonds, Ascension Health Group, Series 2010B, 5.000%, 11/15/16 |

No Opt. Call | AA+ | 2,343,980 | ||||||||||||||

| 4,455 | Walled Lake Consolidated School District, Oakland County, Michigan, General Obligation Bonds, Refunding Series 2011, 2.000%, 5/01/13 |

No Opt. Call | AAA | 4,499,416 | ||||||||||||||

| 1,200 | Warren Consolidated Schools, Counties of Macomb and Oakland, Michigan, General Obligation Bonds, Series 2003, 5.000%, 5/01/12 – NPFG Insured |

No Opt. Call | AA | 1,200,156 | ||||||||||||||

| 225 | Wayne County Airport Authority, Michigan, Revenue Bonds, Detroit Metropolitan Airport, Refunding Series 2010A, 5.000%, 12/01/16 (Alternative Minimum Tax) |

No Opt. Call | A | 249,298 | ||||||||||||||

| 1,315 | Wayne County Airport Authority, Michigan, Revenue Bonds, Detroit Metropolitan Wayne County Airport, Series 2005, 5.250%, 12/01/13 – NPFG Insured (Alternative Minimum Tax) |

No Opt. Call | A | 1,392,927 | ||||||||||||||

| Nuveen Investments | 21 |

Portfolio of Investments

Nuveen Short Term Municipal Bond Fund (continued)

April 30, 2012

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Michigan (continued) |

||||||||||||||||||

| Williamston Community Schools School District, Ingham County, Michigan, General Obligation Bonds, Refunding Series 2011: |

||||||||||||||||||

| $ | 610 | 2.000%, 5/01/13 |

No Opt. Call | AA– | $ | 616,637 | ||||||||||||

| 1,120 | 3.000%, 5/01/14 |

No Opt. Call | AA– | 1,158,629 | ||||||||||||||

| 13,985 | Total Michigan |

14,582,427 | ||||||||||||||||

| Minnesota – 3.5% |

||||||||||||||||||

| 2,500 | Minneapolis, Minnesota, Revenue Bonds, National Marrow Donor Program Project, Series 2010, 5.000%, 8/01/17 |

No Opt. Call | BBB | 2,769,150 | ||||||||||||||

| 1,000 | Minneapolis-St. Paul Housing and Redevelopment Authority, Minnesota, Revenue Bonds, HealthPartners Inc., Series 2003, 5.250%, 12/01/12 |

No Opt. Call | A3 | 1,027,390 | ||||||||||||||

| 2,500 | Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Refunding Senior Lien Series 2009B, 5.000%, 1/01/15 (Alternative Minimum Tax) |

No Opt. Call | AA– | 2,767,275 | ||||||||||||||

| 1,335 | Minnesota Agricultural and Economic Development Board, Health Care Facilities Revenue Bonds, Essentia Health Obligated Group, Series 2008C-1, 5.000%, 2/15/15 – AGC Insured |

No Opt. Call | AA– | 1,469,581 | ||||||||||||||

| Minnesota Higher Education Facilities Authority, Revenue Bonds, Bethel University, Refunding Series 2007-6-R: |

||||||||||||||||||

| 910 | 5.500%, 5/01/16 |

No Opt. Call | N/R | 961,060 | ||||||||||||||

| 1,065 | 5.500%, 5/01/17 |

No Opt. Call | N/R | 1,130,838 | ||||||||||||||

| 500 | Minnesota Higher Education Facilities Authority, Revenue Bonds, Hamline University, Series 2011-7K1, 3.000%, 10/01/13 |

No Opt. Call | Baa2 | 508,755 | ||||||||||||||

| 1,000 | Saint Cloud, Minnesota, Health Care Revenue Bonds, CentraCare Health System Project, Series 2010A, 5.000%, 5/01/15 |

No Opt. Call | A+ | 1,113,060 | ||||||||||||||

| 10,810 | Total Minnesota |

11,747,109 | ||||||||||||||||

| Mississippi – 1.0% |

||||||||||||||||||

| 3,235 | Mississippi Development Bank, Special Obligation Bonds, Jackson County Limited Tax Note, Series 2009B-1, 4.000%, 7/01/15 – AGC Insured |

No Opt. Call | AA- | 3,532,749 | ||||||||||||||

| Missouri – 2.4% |

||||||||||||||||||

| Joplin Industrial Development Authority, Missouri, Health Facilities Revenue Bonds, Freeman Health System, Series 2011: |

||||||||||||||||||

| 250 | 2.500%, 2/15/13 |

No Opt. Call | BBB+ | 250,753 | ||||||||||||||

| 360 | 2.750%, 2/15/14 |

No Opt. Call | BBB+ | 361,296 | ||||||||||||||

| 320 | Joplin Industrial Development Authority, Missouri, Revenue Bonds, Christian Homes Inc., Series 2007F, 5.500%, 5/15/17 |

No Opt. Call | BBB– | 339,613 | ||||||||||||||

| 2,020 | Missouri Development Finance Board, Independence, Infrastructure Facilities Revenue Bonds, Water System Improvement Projects, Series 2009E, 4.000%, 11/01/16 |

11/14 at 100.00 | A– | 2,114,354 | ||||||||||||||

| 100 | Missouri Development Finance Board, Infrastructure Facilities Revenue Bonds, St. Joseph Sewer System Improvements Projects, Series 2011E, 2.000%, 5/01/12 |

No Opt. Call | N/R | 100,003 | ||||||||||||||

| 150 | Missouri Development Finance Board, Infrastructure Facilities Leasehold Revenue Bonds, City of Independence, Missouri, Annual Appropriation Electric System Revenue Bonds – Dogwood Project, Series 2012A, 2.000%, 6/01/13 |

No Opt. Call | A– | 151,358 | ||||||||||||||

| Missouri Health and Educational Facilities Authority, Revenue Bonds, Rockhurst University, Series 2011A: |

||||||||||||||||||

| 460 | 3.000%, 10/01/12 |

No Opt. Call | BBB | 463,013 | ||||||||||||||

| 475 | 3.000%, 10/01/13 |

No Opt. Call | BBB | 484,225 | ||||||||||||||

| 200 | Missouri Joint Municipal Electric Utility Commission, Plum Point Project, Revenue Bonds, Series 2006, 5.000%, 1/01/16 – NPFG Insured |

No Opt. Call | A– | 220,040 | ||||||||||||||

| 2,435 | Saint Louis, Missouri, Airport Revenue Bonds, Lambert-St. Louis International Airport, Refunding Series 2011B, 5.000%, 7/01/14 |

No Opt. Call | A– | 2,598,924 | ||||||||||||||

| 22 | Nuveen Investments |

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Missouri (continued) |

||||||||||||||||||

| $ | 950 | St. Louis, Missouri, Airport Revenue Bonds, Series 1970, 5.000%, 7/01/15 |

No Opt. Call | A– | $ | 1,039,680 | ||||||||||||

| 7,720 | Total Missouri |

8,123,259 | ||||||||||||||||

| Montana – 0.6% |

||||||||||||||||||

| 1,740 | Montana Facilities Finance Authority, Revenue Bonds, Sisters of Charity of Leavenworth Health Services Corporation, Camposite Deal Series 2010B, 5.000%, 1/01/19 |

No Opt. Call | AA | 2,056,610 | ||||||||||||||

| Nebraska – 0.1% |

||||||||||||||||||

| 250 | Central Plains Energy Project, Nebraska, Gas Project 1 Revenue Bonds, Series 2007A, 5.250%, 12/01/21 |

No Opt. Call | A | 270,900 | ||||||||||||||

| New Jersey – 4.7% |

||||||||||||||||||

| New Jersey Educational Facilities Authority, Revenue Bonds, Rider University, Series 2012A: |

||||||||||||||||||

| 1,000 | 5.000%, 7/01/14 |

No Opt. Call | BBB+ | 1,085,500 | ||||||||||||||

| 1,500 | 4.000%, 7/01/15 |

No Opt. Call | BBB+ | 1,621,935 | ||||||||||||||

| 1,000 | New Jersey Health Care Facilities Financing Authority, New Jersey, Revenue Bonds, Saint Peters University Hospital, Refunding Series 2011, 5.000%, 7/01/13 |

No Opt. Call | BBB– | 1,032,770 | ||||||||||||||

| 4,000 | New Jersey Health Care Facilities Financing Authority, Revenue Bonds, Saint Barnabas Health Care System, Refunding Series 2011A, 5.000%, 7/01/15 |

No Opt. Call | BBB | 4,298,320 | ||||||||||||||

| 4,000 | New Jersey Higher Education Assistance Authority, Student Loan Revenue Bonds, Series 2011-1, 5.000%, 12/01/14 (Alternative Minimum Tax) |

No Opt. Call | Aa3 | 4,306,360 | ||||||||||||||

| 3,100 | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2010D, 5.000%, 12/15/18 |

No Opt. Call | A+ | 3,706,360 | ||||||||||||||

| 14,600 | Total New Jersey |

16,051,245 | ||||||||||||||||

| New Mexico – 0.7% |

||||||||||||||||||

| 2,050 | New Mexico Educational Assistance Foundation, Education Loan Bonds, Senior Lien Series 2009A, 3.900%, 9/01/14 (Alternative Minimum Tax) |

No Opt. Call | Aaa | 2,158,527 | ||||||||||||||

| New York – 2.4% |

||||||||||||||||||

| 1,390 | Indian River Central School District, Philadephia, New York, General Obligation Bonds, Refunding Series 2012, 2.000%, 6/01/12 |

No Opt. Call | Aa3 | 1,391,612 | ||||||||||||||

| 500 | Long Island Power Authority, New York, Electric System Revenue Bonds, Series 2006F, 5.000%, 5/01/12 |

No Opt. Call | N/R | 500,065 | ||||||||||||||

| 830 | Nassau Health Care Corporation, New York, Revenue Anticipation Notes, Series 2012, 3.125%, 12/15/12 – AGC Insured |

No Opt. Call | AA– | 842,309 | ||||||||||||||

| 2,000 | New York State Energy Research and Development Authority, Pollution Control Revenue Bonds, New York State Electric and Gas Corporation, Series 2011A, 2.125%, 3/15/15 |

No Opt. Call | A– | 2,034,060 | ||||||||||||||

| 300 | Niagara Area Development Corporation, New York, Niagara University Project, Series 2012A, 3.000%, 5/01/13 (WI/DD, Settling 5/03/12) |

No Opt. Call | BBB+ | 305,826 | ||||||||||||||

| 1,265 | Yonkers, New York, General Obligation Bonds, Series 2005A, 5.000%, 8/01/13 – NPFG Insured |

No Opt. Call | BBB+ | 1,321,343 | ||||||||||||||

| 1,500 | Yonkers, New York, General Obligation Bonds, Series 2011A, 5.000%, 10/01/14 |

No Opt. Call | BBB+ | 1,614,675 | ||||||||||||||

| 7,785 | Total New York |

8,009,890 | ||||||||||||||||

| North Dakota – 1.1% |

||||||||||||||||||

| Burleigh County, North Dakota, Health Care Revenue Refunding Bonds, St. Alexius Medical Center Project, Series 2012A: |

||||||||||||||||||

| 125 | 2.000%, 7/01/12 |

No Opt. Call | A– | 125,121 | ||||||||||||||

| 225 | 2.500%, 7/01/13 |

No Opt. Call | A– | 226,746 | ||||||||||||||

| 300 | 2.500%, 7/01/14 |

No Opt. Call | A– | 303,324 | ||||||||||||||

| 3,040 | Fargo, North Dakota, Health System Revenue Bonds, Sanford Health, Refunding Series 2011, 3.500%, 11/01/16 |

No Opt. Call | AA– | 3,242,859 | ||||||||||||||

| 3,690 | Total North Dakota |

3,898,050 | ||||||||||||||||

| Nuveen Investments | 23 |

Portfolio of Investments

Nuveen Short Term Municipal Bond Fund (continued)

April 30, 2012

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Ohio – 1.0% |

||||||||||||||||||

| $ | 785 | Cleveland State University, Ohio, General Receipts Bonds, Series 2007A, 5.750%, 6/01/14 – FGIC Insured |

No Opt. Call | A+ | $ | 862,794 | ||||||||||||

| Cleveland, Ohio, Airport System Revenue Bonds, Series 2011A: |

||||||||||||||||||

| 560 | 3.000%, 1/01/13 |

No Opt. Call | A– | 566,866 | ||||||||||||||

| 1,000 | 3.000%, 1/01/14 |

No Opt. Call | A– | 1,026,050 | ||||||||||||||

| 1,000 | Ohio Air Quality Development Authority, Ohio, Air Quality Revenue Refunding Bonds, Ohio Power Company Project, Series 2010A, 3.250%, 6/01/41 (Mandatory put 6/02/14) |

No Opt. Call | Baa1 | 1,024,260 | ||||||||||||||

| 3,345 | Total Ohio |

3,479,970 | ||||||||||||||||

| Oklahoma – 1.0% |

||||||||||||||||||

| 2,000 | Cleveland County Public Facilities Authority, Oklahoma, Educational Facilities Lease Revenue Bonds, Norman Public Schools Project, Series 2010, 3.500%, 6/01/12 |

No Opt. Call | A+ | 2,005,400 | ||||||||||||||

| 1,125 | Tulsa County Industrial Authority, Oklahoma, Educational Facilities Lease Revenue Bonds, Jenks Public Schools Project, Series 2009, 5.000%, 9/01/14 |

No Opt. Call | AA– | 1,239,683 | ||||||||||||||

| 3,125 | Total Oklahoma |

3,245,083 | ||||||||||||||||

| Oregon – 1.0% |

||||||||||||||||||

| 2,850 | Medford Hospital Facilities Authority, Oregon, Hospital Revenue Bonds, Asante Health System, Refunding Series 2010, 5.000%, 8/15/15 – AGM Insured |

No Opt. Call | AA– | 3,202,403 | ||||||||||||||

| Pennsylvania – 6.9% |

||||||||||||||||||

| 1,000 | Allegheny County Airport Authority, Pennsylvania, Airport Revenue Bonds, Pittsburgh International Airport, Refunding Series 2010A, 5.000%, 1/01/16 – AGM Insured (Alternative Minimum Tax) |

No Opt. Call | AA– | 1,108,790 | ||||||||||||||

| 3,000 | Pennsylvania Economic Development Financing Authority, Solid Waste Disposal Revenue Bonds, Republic Services Inc Project, Refunding Series 2010B, 0.450%, 12/01/30 (Mandatory put 7/01/12) |

No Opt. Call | BBB | 3,000,120 | ||||||||||||||

| 3,000 | Pennsylvania Economic Development Financing Authority, Solid Waste Disposal Revenue Bonds, Waste Management Inc., Project, Series 2011, 2.625%, 7/01/41 (Mandatory put 7/01/14) |

No Opt. Call | BBB | 3,054,630 | ||||||||||||||

| 725 | Pennsylvania Higher Educational Facilities Authority, Revenue Bonds, AICUP Financing Program-Mount Aloysius College Project, Series 2011R-1, 2.000%, 11/01/41 (Mandatory put 4/30/13) |

11/12 at 100.00 | A– | 727,197 | ||||||||||||||

| Pennsylvania Higher Educational Facilities Authority, Revenue Bonds, Foundation for Student Housing at Indiana University, Project Series 2012A: |

||||||||||||||||||

| 100 | 3.000%, 7/01/13 |

No Opt. Call | BBB+ | 101,364 | ||||||||||||||

| 100 | 3.000%, 7/01/14 |

No Opt. Call | BBB+ | 102,015 | ||||||||||||||

| 320 | 3.000%, 7/01/15 |

No Opt. Call | BBB+ | 327,542 | ||||||||||||||

| 110 | Philadelphia Gas Works, Pennsylvania, Revenue Bonds, General Ordinance, Fourth Series 1998, 5.000%, 8/01/12 – AGM Insured |

No Opt. Call | AA– | 111,150 | ||||||||||||||

| 1,780 | Philadelphia Gas Works, Pennsylvania, Revenue Bonds, Refunding Tenth Series 2011B, 4.000%, 7/01/13 |

No Opt. Call | BBB+ | 1,839,167 | ||||||||||||||

| 1,000 | Philadelphia Redevelopment Authority, Pennsylvania, Revenue Bonds, Philadelphia Neighborhood Transformation Initiative, Series 2012, 5.000%, 4/15/14 (WI/DD, Settling 5/01/12) |

No Opt. Call | A2 | 1,075,170 | ||||||||||||||

| 915 | Philadelphia School District, Pennsylvania, General Obligation Bonds, Series 2011B, 3.000%, 9/01/13 |

No Opt. Call | Aa2 | 946,320 | ||||||||||||||

| 920 | Philadelphia School District, Pennsylvania, General Obligation Bonds, Series 2011C, 3.000%, 9/01/13 |

No Opt. Call | Aa2 | 951,492 | ||||||||||||||

| 500 | Philadelphia, Pennsylvania, Airport Revenue Bonds, Refunding Series 2011A, 4.000%, 6/15/13 (Alternative Minimum Tax) |

No Opt. Call | A+ | 516,575 | ||||||||||||||

| 5,000 | Philadelphia, Pennsylvania, General Obligation Bonds, Refunding Series 2011, 5.000%, 8/01/14 |

No Opt. Call | A2 | 5,377,900 | ||||||||||||||

| 24 | Nuveen Investments |

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Pennsylvania (continued) |

||||||||||||||||||

| $ | 455 | Pittsburgh, Pennsylvania, General Obligation Bonds, Series 2012A, 3.000%, 9/01/14 |

No Opt. Call | A1 | $ | 473,755 | ||||||||||||

| Scranton, Pennsylvania, Sewer Authority Revenue Bonds, Series 2011A: |

||||||||||||||||||

| 250 | 2.250%, 12/01/13 – AGM Insured |

No Opt. Call | AA– | 253,768 | ||||||||||||||

| 540 | 3.500%, 12/01/14 – AGM Insured |

No Opt. Call | AA– | 568,474 | ||||||||||||||

| Union County Hospital Authority, Pennsylvania, Hospital Revenue Bonds, Evangelical Community Hospital Project, Refunding and Improvement Series 2011: |

||||||||||||||||||

| 1,385 | 4.000%, 8/01/15 |

No Opt. Call | BBB+ | 1,440,663 | ||||||||||||||

| 1,440 | 4.250%, 8/01/16 |

No Opt. Call | BBB+ | 1,510,776 | ||||||||||||||

| 22,540 | Total Pennsylvania |

23,486,868 | ||||||||||||||||

| Puerto Rico – 1.3% |

||||||||||||||||||

| 1,010 | Puerto Rico Government Development Bank, Senior Note Revenue Bonds, Series 2011C, 1.000%, 10/15/12 |

7/12 at 100.00 | Baa1 | 1,009,798 | ||||||||||||||

| 2,500 | Puerto Rico Infrastructure Financing Authority, Revenue Bonds, Ports Authority Project, Series 2011C, 3.000%, 12/15/26 (Mandatory put 12/16/13) (Alternative Minimum Tax) |

No Opt. Call | Baa1 | 2,518,175 | ||||||||||||||

| 500 | Puerto Rico Municipal Finance Agency, Series 2005B, 5.000%, 7/01/14 – CIFG Insured |

No Opt. Call | Baa1 | 534,000 | ||||||||||||||

| 370 | Puerto Rico, General Obligation and Public Improvement Bonds, Series 2002A, 5.500%, 7/01/14 – NPFG Insured |

No Opt. Call | Baa1 | 399,078 | ||||||||||||||

| 4,380 | Total Puerto Rico |

4,461,051 | ||||||||||||||||

| South Carolina – 0.7% |

||||||||||||||||||

| 1,100 | Richland County, South Carolina, Environmental Improvement Revenue Bonds, International Paper Company Project, Series 2007, 4.600%, 9/01/12 |

No Opt. Call | BBB | 1,112,320 | ||||||||||||||

| 590 | South Carolina JOBS Economic Development Authority, Economic Development Revenue, Waste Management of South Carolina, Inc. Project, Series 2008, 2.875%, 2/01/15 |

No Opt. Call | BBB | 599,635 | ||||||||||||||

| 500 | South Carolina Jobs-Economic Development Authority, Hospital Revenue Bonds, Palmetto Health, Refunding & Improvement Series 2009, 5.000%, 8/01/15 |

No Opt. Call | BBB+ | 547,490 | ||||||||||||||

| 2,190 | Total South Carolina |

2,259,445 | ||||||||||||||||

| South Dakota – 0.5% |

||||||||||||||||||

| 325 | South Dakota Health and Educational Facilities Authority, Revenue Bonds, Vocational Education Program, Series 2012A, 0.500%, 8/01/12 |

No Opt. Call | Aa2 | 325,091 | ||||||||||||||

| 1,305 | South Dakota Health and Educational Facilities Authority, Revenue Bonds, Sanford Health, Series 2009, 4.500%, 11/01/15 |

No Opt. Call | AA– | 1,451,578 | ||||||||||||||

| 1,630 | Total South Dakota |

1,776,669 | ||||||||||||||||

| Tennessee – 1.4% |

||||||||||||||||||

| 1,000 | Memphis-Shelby County Airport Authority, Tennessee, Airport Revenue Bonds, Series 2010B, 5.000%, 7/01/16 (Alternative Minimum Tax) |

No Opt. Call | A+ | 1,121,330 | ||||||||||||||

| 1,270 | Memphis-Shelby County Sports Authority, Tennessee, Revenue Bonds, Memphis Arena, Refunding Series 2009B, 5.500%, 11/01/20 |

11/19 at 100.00 | AA– | 1,519,669 | ||||||||||||||

| 1,800 | Metropolitan Nashville Airport Authority, Tennessee, Airport Revenue Bonds, Refunding & Improvement Series 2010A, 5.000%, 7/01/16 |

No Opt. Call | A | 2,062,710 | ||||||||||||||

| 4,070 | Total Tennessee |

4,703,709 | ||||||||||||||||

| Texas – 5.4% |

||||||||||||||||||

| 3,000 | BB&T Municipal Trust Pool, Texas, Series 2011, 1.120%, 4/30/12 |

No Opt. Call | AA | 2,999,160 | ||||||||||||||

| 1,000 | Dallas-Fort Worth International Airport, Texas, Joint Revenue Bonds, Refunding Series 2009A, 5.000%, 11/01/21 |

11/16 at 100.00 | A+ | 1,114,190 | ||||||||||||||

| Nuveen Investments | 25 |

Portfolio of Investments

Nuveen Short Term Municipal Bond Fund (continued)

April 30, 2012

| Principal Amount (000) |

Description (1) | Optional Call Provisions (2) |

Ratings (3) | Value | ||||||||||||||

| Texas (continued) |

||||||||||||||||||

| $ | 1,000 | Harrison County Health Facilities Development Corporation, Texas, Hospital Revenue Bonds, Good Shepherd Health System, Refunding Series 2010, 4.000%, 7/01/15 |

No Opt. Call | BBB+ | $ | 1,027,390 | ||||||||||||

| 400 | Houston, Texas, First Lien Combined Utility System Revenue Bonds, Series 2009, 3.000%, 4/01/14 |

No Opt. Call | A+ | 414,532 | ||||||||||||||

| 1,100 | Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Refunding Series 2011A, 5.000%, 9/01/13 |

No Opt. Call | A2 | 1,164,581 | ||||||||||||||

| 1,000 | Houston, Texas, Subordinate Lien Airport System Revenue Refunding Bonds, Series 2011A, 5.000%, 7/01/13 (Alternative Minimum Tax) |

No Opt. Call | A+ | 1,053,140 | ||||||||||||||

| Lower Colorado River Authority, Texas, Revenue Refunding and Improvement Bonds, Series 2003: |

||||||||||||||||||

| 70 | 5.000%, 5/15/12 – AMBAC Insured (ETM) |

No Opt. Call | A1 | (4) | 70,141 | |||||||||||||

| 10 | 5.000%, 5/15/12 – AMBAC Insured (ETM) |

No Opt. Call | A1 | (4) | 10,020 | |||||||||||||

| 10 | 5.000%, 5/15/12 – AMBAC Insured (ETM) |

No Opt. Call | A1 | (4) | 10,020 | |||||||||||||

| 5 | Lower Colorado River Authority, Texas, Revenue Refunding and Improvement Bonds, Series 2003, 5.000%, 5/15/12 – AMBAC Insured |

No Opt. Call | A1 | 5,010 | ||||||||||||||

| 55 | Lower Colorado River Authority, Texas, Revenue Refunding and Improvement Bonds, Series 2003, 5.000%, 5/15/12 – AMBAC Insured |

No Opt. Call | A1 | 55,110 | ||||||||||||||

| 2,005 | Midtown Redevelopment Authority, Texas, Tax Increment Contract Revenue, Refunding Series 2011, 4.000%, 1/01/15 |

No Opt. Call | A– | 2,125,621 | ||||||||||||||

| Tarrant County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Hendrick Medical Center, Series 2009A: |

||||||||||||||||||

| 1,425 | 4.000%, 9/01/15 – AGC Insured |

No Opt. Call | AA– | 1,544,116 | ||||||||||||||

| 1,070 | 4.000%, 9/01/16 – AGC Insured |

No Opt. Call | AA– | 1,178,937 | ||||||||||||||

| 1,355 | 4.375%, 9/01/18 – AGC Insured |

No Opt. Call | AA– | 1,550,621 | ||||||||||||||