UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Income Funds

(formerly First American Taxable Income Funds)

For investors seeking attractive income and portfolio diversification potential.

Annual Report

June 30, 2011

| Share Class / Ticker Symbol | ||||||||||

| Fund Name | Class A | Class B | Class C | Class R3 | Class I | |||||

| Nuveen Core Bond Fund |

FAFIX | FFIBX | FFAIX | FFISX | FFIIX | |||||

| Nuveen High Income Bond Fund |

FJSIX | FJSBX | FCSIX | FANSX | FJSYX | |||||

| Nuveen Inflation Protected Securities Fund |

FAIPX | — | FCIPX | FRIPX | FYIPX | |||||

| Nuveen Intermediate Government Bond Fund |

FIGAX | — | FYGCX | FYGRX | FYGYX | |||||

| Nuveen Intermediate Term Bond Fund |

FAIIX | — | NTIBX | — | FINIX | |||||

| Nuveen Short Term Bond Fund |

FALTX | — | FBSCX | — | FLTIX | |||||

| Nuveen Total Return Bond Fund |

FCDDX | FCBBX | FCBCX | FABSX | FCBYX | |||||

INVESTMENT ADVISER NAME CHANGE

Effective January 1, 2011, Nuveen Asset Management, the Funds’ investment adviser, changed its name to Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities.

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp — the parent of FAF Advisors — received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long-term investment business of FAF Advisors, including investment-management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

This combination does not affect the investment objectives or strategies of the Funds in this report. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $210 billion of assets as of June 30, 2011.

| Must be preceded by or accompanied by a prospectus. | NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 4 | ||||

| 5 | ||||

| 15 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 125 | ||||

| 127 | ||||

| 128 | ||||

| 132 | ||||

| 146 | ||||

| 173 | ||||

| 177 | ||||

| 182 | ||||

| 183 | ||||

Letter to Shareholders

| 4 | Nuveen Investments |

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: S&P, Moody’s or Fitch. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated NR are not rated by a national rating agency.

Nuveen Core Bond Fund

(formerly known as First American Core Bond Fund)

Nuveen High Income Bond Fund

(formerly known as First American High Income Bond Fund)

Nuveen Inflation Protected Securities Fund

(formerly known as First American Inflation Protected Securities Fund)

Nuveen Intermediate Government Bond Fund

(formerly known as First American Intermediate Government Bond Fund)

Nuveen Intermediate Term Bond Fund

(formerly known as First American Intermediate Term Bond Fund)

Nuveen Short Term Bond Fund

(formerly known as First American Short Term Bond Fund)

Nuveen Total Return Bond Fund

(formerly known as First American Total Return Bond Fund)

These Funds, all former First American taxable income funds, are now managed by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments.

Chris Neuharth, CFA, who has 30 years of investment experience, has managed the Nuveen Core Bond Fund since 2006. Timothy Palmer, CFA, with 25 years of investment experience, Wan-Chong Kung, CFA, with 27 years of financial experience, and Jeffrey Ebert, with 20 years of financial experience, have been part of the management team for the Fund since 2003, 2001, and 2005, respectively.

John Fruit, CFA, who has 23 years of investment experience, has managed the Nuveen High Income Bond Fund since 2006. Jeffrey Schmitz, CFA, with 24 years of investment experience, has been part of the management team for the Fund since 2008.

Wan-Chong Kung, CFA, has managed the Nuveen Inflation Protected Securities Fund since its inception in 2004. Effective October 28, 2010, Chad Kemper, with 12 years of investment experience, joined the Fund as a co-portfolio manager.

Wan-Chong Kung, CFA, has managed the Nuveen Intermediate Government Bond Fund and the Nuveen Intermediate Term Bond Fund since 2002. Chris Neuharth, CFA, and Jason O’Brien, CFA, with 18 years of investment experience, have been on the Intermediate Government Bond Fund’s management team since 2009. Jeffrey Ebert has served on the Intermediate Term Bond Fund’s management team since 2000.

Chris Neuharth, CFA, has been a co-portfolio manager of the Nuveen Short Term Bond Fund since 2004. Peter Agrimson, CFA, with six years of investment experience, joined the Fund as a co-portfolio manager on January 1, 2011.

| Nuveen Investments | 5 |

Timothy Palmer, CFA, has been the lead manager of the Nuveen Total Return Bond Fund since 2005. Jeffrey Ebert has been on the management team since 2000. Marie Newcome, CFA, with 19 years of investment experience, joined the Fund as a co-portfolio manager in January 2011.

Here the portfolio management teams for the Funds examine economic and bond market conditions, key investment strategies and the Funds’ performance for the twelve-month period ended June 30, 2011.

What factors affected the U.S. economic and fixed income market environments during the twelve-month reporting period ended June 30, 2011?

Global economic growth was quite uneven over the twelve-month reporting period. The second half of 2010 began with widespread concerns about financial contagion from several European countries and very slow growth, raising the probability of a double-dip recession in the United States. These fears seemed to be quelled in late 2010 and early 2011 as another round of quantitative easing was introduced by the Federal Reserve and consumer spending rebounded sharply. However, this relief was relatively short lived as renewed weakness in housing and higher food and energy prices put a damper on consumption at about the same time that supply chain disruptions from the Japanese tsunami and earthquake were distorting growth and suppressing job creation in the U.S. and many areas around the world.

Throughout the period, the Fed continued to hold the benchmark fed funds rate in a target range of zero to 0.25% since cutting it to this record low level in December 2008. At its June 2011 meeting, the central bank downgraded growth estimates for the year while reaffirming that it anticipated keeping the fed funds rate at “exceptionally low levels” for an “extended period.”

From a macro perspective, we ended the fiscal period facing many of the same uncertainties that we did one year earlier. The Greek bailout had yet to be finalized and fiscal concerns had spread to other European countries such as Ireland, Italy, Portugal and Spain. At the same time, fears about slowing U.S. economic growth bubbled to the surface again, causing consumer spending to pull back. The employment situation seemed to plateau, with the national jobless rate registering 9.2% in June 2011, the fourth monthly increase in a row and just slightly lower than one year earlier. Also, the overall housing market continued to flounder, weighed down by a backlog of distressed properties on the market and falling prices. For the twelve months ended May 2011 (the most recent data available at the time this report was prepared), property values in the Standard & Poor’s (S&P)/Case-Shiller index of 20 major metropolitan areas fell 4.5% from one year ago. U.S. gross domestic product (GDP), the broadest measure of the nation’s economic health, was revised downward to an anemic 0.4% annual growth rate for the first quarter of 2011 and estimated to be 1.3% for the second quarter, according to the Commerce Department.

The high level of uncertainty throughout the twelve-month period resulted in a schizophrenic investor appetite for risk. Volatility was high as the inability of Wall Street firms to buy assets for their own balance sheets contributed to swings in valuations. Virtually all non-government sectors of the market enjoyed strong performance from late

| 6 | Nuveen Investments |

2010 through the first quarter of 2011, as the liquidity provided by the Fed’s balance sheet expansion emboldened investor risk tolerance, causing a strong run in both equities and riskier fixed-income securities. This powerful positive technical rally came to an abrupt halt midway through the second quarter of 2011 as investors increasingly worried about a tightening of monetary policy in emerging markets, a Greek default, U.S. budget woes and a downshift in global growth. Despite second quarter’s give-back in relative performance, non-government bonds outperformed significantly overall for the reporting period, with sectors such as investment-grade corporate debt, high-yield corporate debt and commercial mortgage-backed securities (CMBS) beating U.S. Treasuries by considerable amounts.

The high-yield market, in particular, benefited from its high coupon levels in a low-interest rate market, leading to strong investor demand and record fund inflows into the asset class. Also, default rates continued to decrease as measured by Moody’s speculative-grade default rate, which finished the fiscal year at 2.2%, down from 6.4% a year ago. Across the high-yield sector, CCC-rated bonds were the best performers among the various quality tiers, returning 18.5% over the twelve-month period.

In the U.S. Treasury market, short and intermediate rates remained at historically low levels, falling even further during the fiscal year. For example, yields on one-year Treasury bills began the period at 0.32% and ended at 0.19%, while five-year Treasury notes went from 1.80% to 1.76%. Rates on longer term Treasury securities rose slightly over the year. For the majority of the period, U.S. Treasury Inflation-Protected Securities (TIPS) outpaced nominal Treasuries, particularly in the shorter maturity ranges, as stronger growth prospects, the rapid rise in energy prices and the expected flow-through of these prices to the consumer price index (CPI) fueled investors’ appetite for inflation protection. However, the TIPS market experienced somewhat of a reversal in performance in the second quarter of 2011 as inflation expectations lowered due to weaker-than-expected economic data, falling energy prices and an anticipated downturn in seasonal CPI reports.

How did the Funds perform during the twelve-month period ended June 30, 2011?

The tables in the Fund Performance and Expense Ratios section of this report provide total return performance information for the one-year, five-year, ten-year and since inception periods ending June 30, 2011. Each Fund’s returns are compared with the performance of the appropriate Barclays Capital bond index and Lipper peer fund category average.

What strategies were used to manage the Funds during the twelve-month reporting period? How did these strategies influence performance?

All of the Funds continued to employ the same fundamental investment strategies and tactics used in previous years, although our ability to implement those strategies depended on the individual characteristics of the portfolios, as well as market conditions. We use a highly collaborative, research-driven approach that we believe offers the best opportunity to achieve consistent, superior long-term performance on a risk-adjusted basis across the full range of market environments. Going into the reporting period, we were generally comfortable with the Funds’ positioning and saw little need to make large-scale shifts to the Funds’ weightings.

| Nuveen Investments | 7 |

The Funds also invested in various derivative instruments to manage foreign currency exposure, duration and yield curve, to manage views of volatility, to hedge against changes in rate spreads and to increase credit exposure. (Refer to the Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies for further details on the derivative instruments each Fund invested during this reporting period.)

Nuveen Core Bond Fund (formerly known as First American Core Bond Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Barclays Capital Aggregate Bond Index and the Lipper Intermediate Investment-Grade Debt Funds Category Average for the twelve-month period ended June 30, 2011. The majority of the Fund’s outperformance was driven by our sector positioning, specifically our overweights to investment-grade corporate bonds, CMBS and high-yield corporate bonds. We overweighted these sectors because of our view that the economy would recover to expand at a modest pace and that corporate credit fundamentals would continue to be extremely supportive of valuations within the sector. Furthermore, we anticipated that the Fed’s balance sheet expansion would be successful in moving cash off the sidelines and into riskier asset classes. Therefore, we increased the Fund’s overall risk level by adding exposure to both new-issue CMBS and high-yield corporates. These sectors were the strongest U.S. fixed-income performers during the reporting period.

We believed that positive bottom-up fundamentals and strong sector-specific technical factors would remain largely intact over the long run; however, as the last six months of the reporting period progressed, the combination of less attractive valuations and higher levels of macro uncertainty prompted us to reduce aggregate risk levels in the Fund. Specifically, we lowered the Fund’s exposure to investment-grade corporate bonds by about 9%, mostly by trimming exposure to the financial sector, which had enjoyed strong performance. As of June 30, 2011, the Fund’s investment-grade corporate credit exposure of approximately 30% was at its lowest level in several years. The proceeds of these sales were redeployed into the agency mortgage-backed securities sector as we felt that relative valuations were finally attractive enough to warrant a modest overweight. We also decreased the Fund’s overall risk within the CMBS sector by swapping into new-issue deals with stronger loan characteristics that came to market as the reporting period closed. At period end, the Fund’s CMBS weighting was approximately 13% of net assets.

Our duration policy, which focuses on the Fund’s sensitivity to interest rate changes, was close to neutral compared to the benchmark throughout most of the period. Therefore, it was not a major factor in the Fund’s performance.

Nuveen High Income Bond Fund (formerly known as First American High Income Bond Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Barclays Capital High Yield 2% Issuer Capped Index and the Lipper High Current Yield Funds Category Average for the twelve-month period ended June 30, 2011. The Fund’s relative performance was aided by our tactical overweights to higher-yielding securities, generally single B and CCC rated debt, and from overweighting cyclical industries. For example, we overweighted the oilfield services, paper and media sectors, benefiting from the higher yields and improving fundamentals in these areas. Overall, the high-yield market continued to benefit from the ability of high-yield issuers to successfully refinance debt

| 8 | Nuveen Investments |

and extend maturities. Indeed, defaults dropped significantly during the fiscal year, and the Fund experienced no new bankruptcies among its holdings. At the margin, the improvement in corporate liquidity benefited low-rated companies disproportionately more, which was a compelling reason for us to continue to overweight the single B and CCC rated segments in the Fund.

The Fund continued to maintain a roughly 10% allocation to emerging market corporate and sovereign debt. This was a small detractor to the Fund’s overall performance, as emerging market-related debt underperformed its domestic counterparts in the last three months of the reporting period. The reasons for the sector shortfall were both credit-specific, as in the case of Sino-Forest in Asia, and also reflected the growth uncertainty in the United States and the negative headlines surrounding Greece’s debt woes. While the Fund was not exposed to Sino-Forest and the accusations of faulty accounting, it did have other holdings in China that lost value in the resulting sell off of many Chinese securities. However, from a fundamental standpoint, we continued to anticipate strong fundamentals for emerging market corporates and plan to maintain or add to the Fund’s positions.

Also, the Fund’s below-market exposure to the technology and financial sectors was a slight detractor to results versus the index. Within the financial sector, many of the issuers were new entrants into the high-yield universe coming out of the financial crisis and did well as balance sheets were repaired in the banking and insurance sectors. While we were active in adding securities within the sector to the Fund, the powerful rally still left us and the majority of high-yield investors behind as it was difficult to gain exposure in a timely manner. In all, financials were among the top performers during the fiscal year, registering a 20.7% gain versus the broad high-yield market return of 15.5%, as measured by the Barclays Capital High Yield 2% Issuer Capped Index.

We added to the Fund’s holdings in energy, refining and oilfield services, which were some of the better-performing industries throughout the period. Specifically, the oilfield services sector continued to benefit from increased spending on exploration and production in North America and other areas of the world. Oil and natural gas companies are expected to spend $122 billion in the United States alone this year on exploration and production, a 22% increase from 2010. We also continued to overweight such areas as media, basic materials and industrials, all expected to benefit from a gradual acceleration in economic activity.

We used the more favorable environment for financials to add to select closed-end funds and preferred stocks. The Fund carried a roughly 10% allocation to out-of-index securities, consisting predominately of preferred stocks, various closed-end funds and dividend-paying stocks. Our allocation to preferred securities and equities increased marginally during the period, which was mainly a function of relative value opportunities versus traditional high-yield securities.

Fund flows into the high-yield asset class continued to be brisk until a quick reversal occurred in May and June 2011 when the markets began the process of analyzing the second mid-cycle slowdown in this reporting period. Market technical factors, however, still appear rather balanced despite the record amount of issuance. The pricing of $262 billion in high-yield bonds in 2010 and roughly $180 billion through the second quarter of 2011 has been met with strong investor demand. Nonetheless, as the more volatile financial market conditions spilled into the high-yield market, it experienced a bout of

| Nuveen Investments | 9 |

outflows and selling pressure. However, we believed that the still-steep yield curve and the high base of current income left the high-yield sector positioned relatively well among competing asset classes.

Nuveen Inflation Protected Securities Fund (formerly known as First American Inflation Protected Securities Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed the Lipper U.S. Treasury Inflation-Protected Securities Category Average, but fell short of the Barclays Capital U.S. TIPS Index for the twelve-month period ended June 30, 2011. We began the Fund’s fiscal year with a modest underweight position in all TIPS segments, particularly 5-year maturities, which proved beneficial as TIPS underperformed. During the middle portion of the reporting period, improvements in economic data supported a more optimistic outlook for growth, which in turn increased investors’ appetite for inflation protection. The Fund’s continued underweight position in TIPS hindered performance as they outperformed nominal U.S. Treasuries. However, within the Fund’s TIPS exposure, we made an advantageous reallocation out of 10-year and longer maturity TIPS and overweighted 5-year maturities in the fourth quarter of 2010 and first quarter of 2011, which helped the Fund capture the relative outperformance of the 5-year securities on the TIPS yield curve. As the outlook for economic growth and inflation lowered toward the end of the reporting period, the Fund also benefited from a rotation out of 5-year maturities. This underweight at the front end of the TIPS yield curve aided results as the shortest maturities underperformed the most in the final months of the fiscal year.

The Fund’s performance also benefited from our allocations to non-TIPS spread sectors, which produced solid excess returns in the strong-performing environment for risk assets. For example, the Fund’s positions in the high-yield and CMBS sectors, which were 1.4% and 7.2% of Fund assets as of period end, respectively, contributed positively to performance. Foreign exposure also added to results with positions in non-dollar bonds and currency exposures performing well. The Fund particularly benefited from positions in growth-sensitive currencies such as the Canadian and Australian dollar.

At the end of the reporting period, the Fund was positioned for TIPS yields to move higher and for the continued relative outperformance of longer maturity TIPS over shorter maturity TIPS out to five years. Because we remained fundamentally constructive on high-yield corporate bonds and CMBS, we maintained the Fund’s positions in both sectors. We are also maintaining the Fund’s foreign exposure.

Our duration policy, which focuses on the Fund’s sensitivity to interest rate changes, was close to neutral compared to the benchmark throughout most of the period. Therefore, it was not a major factor in the Fund’s performance.

Nuveen Intermediate Government Bond Fund (formerly known as First American Intermediate Government Bond Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Barclays Capital Intermediate Government Bond Index and the Lipper Intermediate U.S. Government Funds Category Average for the twelve-month period ended June 30, 2011. The majority of the Fund’s outperformance was driven by our sector positioning, specifically our overweights to CMBS, mortgage-backed securities (MBS) and agency debt. We emphasized these sectors because of our view that the economy would recover

| 10 | Nuveen Investments |

to expand at a modest pace and that non-U.S. Treasury fundamental and technical factors would continue to be extremely supportive of valuations. The Fund’s corresponding underweight to nominal U.S. Treasuries also was beneficial as the Treasury market underperformed other fixed-income asset classes over the year.

During the twelve-month period, we reduced the Fund’s U.S. Treasury exposure by about 17% because we believed we could find more compelling opportunities in other sectors. MBS, in particular, enjoyed continued strong underpinnings, given investors’ appetite for high-quality assets that offer incremental yield to Treasuries and low prepayment risk due to the constrained refinancing housing environment. At period end, the Fund’s MBS weighting had increased to approximately 39% of net assets. We also modestly increased our overall exposure to agency debt and asset-backed securities, ending the period with approximately 41% and 6% in these two sectors, respectively. Agency bonds offer incremental yield over U.S. Treasuries while asset-backed securities are high-quality securities that provide additional yield in the shorter maturity section of the yield curve.

Throughout the period, we made a number of tactical changes to the Fund’s duration (its price sensitivity to interest-rate movements), but overall did not stray far from a neutral position relative to the benchmark.

Nuveen Intermediate Term Bond Fund (formerly known as First American Intermediate Term Bond Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Barclays Capital Intermediate Government/Credit Index and the Lipper Short-Intermediate Investment-Grade Debt Funds Category Average for the twelve-month period ended June 30, 2011. The Fund’s strong outperformance was mainly driven by our sector positioning, specifically overweights to CMBS, investment-grade corporate bonds and mortgage-backed securities. We emphasized these sectors because of our view that the economy would recover and expand at a modest pace and that corporate credit fundamentals would continue to be extremely supportive of valuations. Furthermore, we anticipated that the Fed’s balance sheet expansion would be successful in moving cash off the sidelines and into riskier asset classes.

We believed that positive bottom-up fundamentals and strong sector-specific technical factors would remain largely intact over the long run; however, as the final six months of the reporting period progressed, the combination of less attractive valuations and higher levels of macro uncertainty prompted us to reduce aggregate risk levels in the Fund. Specifically, we lowered the Fund’s exposure to corporate bonds by approximately 5% over the twelve-month period, mostly by trimming its exposure to the financial sector, which had enjoyed extremely strong performance. As of June 30, 2011, the Fund’s corporate credit exposure of approximately 46% was at its lowest level in several years. We increased the Fund’s exposure to CMBS during the fiscal year, ending with an approximately 11% weighting in the sector. Within that sector, however, we decreased the Fund’s overall risk by swapping into new-issue deals with stronger loan characteristics that came to market as the reporting period closed. The Fund’s allocations to the mortgage-backed securities and asset-backed securities sectors remained fairly unchanged, closing the fiscal year at approximately 16% and 15%, respectively. We continued to have only a small allocation to U.S. Treasuries (approximately 2% at the end of the period) because we saw more attractive opportunities in other asset classes.

| Nuveen Investments | 11 |

Our duration policy, which focuses on the Fund’s sensitivity to interest rate changes, was close to neutral compared to its benchmark throughout most of the period. Therefore, it was not a major factor in the Fund’s performance.

Nuveen Short Term Bond Fund (formerly known as First American Short Term Bond Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Barclays Capital 1-3 Year Government/Credit Bond Index and the Lipper Short Investment-Grade Debt Funds Category Average for the twelve-month period ended June 30, 2011. The Fund’s outperformance relative to its peers and benchmark was driven by our sector positioning and security selection. From a sector perspective, our main investment theme was to position the Fund with an underweight to government-related bonds and a large overweight to short duration securities in the asset-backed security and corporate bond sectors. From a macro perspective, our view has been that the global expansion would continue at a pace that was fundamentally supportive of continued improvement in credit fundamentals for corporate bonds and some segments of the structured assets market. As loan performance stabilized and corporate earnings improved, this certainly proved true. At the same time, we expected that liquidity would improve after the late 2010 balance sheet expansion by the Fed and that supply/demand dynamics would also be quite supportive. This strategy paid off as many investors expressed a preference for short duration, higher credit quality securities while issuance in certain sectors was historically light.

Security selection was also a strong positive for the Fund. Our bias toward owning issues from the financial sector, which performed well, was beneficial to the Fund as was our addition of short duration, non-agency mortgage assets. Additionally, the investment policy of the Fund was expanded in early 2011 to allow for greater flexibility with regard to credit quality, raising the maximum limit for non-investment grade securities from 10% to 20% of assets. We took advantage of this increased flexibility by selectively adding slightly less than 5% in non-rated holdings from the asset-backed securities and tax-exempt sectors. These sectors periodically offer interesting opportunities for investors who have ratings flexibility and strong research capabilities. We expect a “bottom up” approach focused on in-depth research to be an important performance driver in the investment environment going forward.

Elsewhere in the Fund, we tactically managed risk exposure in the CMBS and high-yield sectors as valuations changed and the fundamental backdrop shifted. We increased the Fund’s weighting to CMBS and high yield in late 2010, and subsequently brought its high-yield weighting way down in April 2011. Late in the period, we took advantage of the subsequent sharp repricing in the high-yield segment to add slightly to the Fund’s weighting.

On a negative note, we positioned the Fund’s duration (its price sensitivity to interest-rate movements), toward the lower end of the one- to three-year policy range. This positioning was a drag on performance against both our peers and the benchmark as rates dropped and prices rose amid the global macro uncertainty in the second quarter of 2011.

Nuveen Total Return Bond Fund (formerly known as First American Total Return Bond Fund)

The Fund’s Class A Shares at net asset value (NAV) outperformed both the Barclays Capital Aggregate Bond Index and the Lipper Intermediate Investment-Grade Debt Funds Category Average for the twelve-month period ended June 30, 2011. The largest

| 12 | Nuveen Investments |

contributors to the Fund’s outperformance were its sector overweights in investment-grade and high-yield corporates as well as positions in foreign bonds and currencies. The Fund particularly benefited from positions in growth-sensitive currencies such as the Canadian and Australian dollars. The Fund’s overweights to CMBS also added value, as did credit selection within the corporate sector, particularly our overweight to financial issuers. The Fund’s positioning during the year was driven by our view that the economy would recover to expand at a modest pace and that corporate credit fundamentals would continue to be extremely supportive of valuations within the sector. Financial conditions were further supported by the Fed’s ongoing commitment to provide an extraordinary level of monetary accommodation through low rates and asset purchases. Heading into the period, we judged that valuations for non-government bond market sectors provided ample compensation to long-term investors.

During the period, we took advantage of market strength and strong valuations to reduce exposure to some of the Fund’s overweights, even though we believed that positive bottom-up fundamentals and strong sector-specific technical factors would remain largely intact over the long run. As 2011 progressed, the combination of less attractive valuations and higher levels of macro uncertainty also prompted us to reduce the Fund’s aggregate risk level. We lowered the Fund’s exposure to investment-grade corporate bonds (including financials) by approximately 9%, cut its high-yield weight and moderated foreign currency exposure. Although we generally maintained these lower overall exposures, we did take advantage of the subsequent sharp repricing in the high-yield segment to add slightly to the Fund’s weighting at the end of the period. The bulk of the proceeds from these sales went into mortgage-backed securities as that sector cheapened, bringing the Fund’s weighting to approximately 29%, which is closer to the index weight. We also continued to underweight U.S. Treasuries and agencies in the portfolio.

Our duration positioning, which focuses on the Fund’s sensitivity to interest rate changes, was generally neutral to defensive during the period, detracting marginally from performance.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities are subject to credit risk and interest rate risk. The value of, and income generated by debt securities will decrease or increase based on changes in market interest rates. As interest rates rise, bond prices fall. Credit risk refers to an issuer’s ability to make interest and principal payments when due. The guarantee provided by the U.S. government to treasury inflation protected securities (TIPS) relates only to the prompt payment of principal and interest and does not remove the market risks of investing in the fund shares. Below investment grade securities carry heightened credit risk and potential for default. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments. The potential use of derivative instruments involves a high degree of financial risk, including the risk that the loss on a derivative may be greater than the principal amount invested.

| Nuveen Investments | 13 |

[THIS PAGE INTENTIONALLY LEFT BLANK]

| 14 | Nuveen Investments |

Fund Performance and Expense Ratios (Unaudited)

The Fund Performance and Expense Ratios for each Fund are shown on the following fourteen pages.

Returns quoted represent past performance, which not predictive of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and benchmark return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

Effective January 18, 2011, Class R Shares and Class Y Shares previously offered by FAF Advisors, Inc. were renamed Class R3 Shares and Class I Shares, respectively.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waivers or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

| Nuveen Investments | 15 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Core Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios Section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2011

| Average Annual | ||||||||||||

| 1-Year | 5-Year | 10-Year | ||||||||||

| Class A Shares at NAV |

5.73% | 6.25% | 5.16% | |||||||||

| Class A Shares at maximum Offering Price |

1.22% | 5.34% | 4.70% | |||||||||

| Barclays Capital Aggregate Bond Index* |

3.90% | 6.52% | 5.74% | |||||||||

| Lipper Intermediate Investment Grade Debt Funds Category Average* |

5.10% | 6.01% | 5.25% | |||||||||

| Class B Shares w/o CDSC |

4.97% | 5.45% | 4.38% | |||||||||

| Class B Shares w/CDSC |

-0.03% | 5.29% | 4.38% | |||||||||

| Class C Shares |

4.97% | 5.46% | 4.38% | |||||||||

| Class I Shares |

6.09% | 6.52% | 5.43% | |||||||||

| 1-Year | 5-Year | Since Inception** |

||||||||||

| Class R3 Shares |

5.54% | 6.04% | 4.72% | |||||||||

Class A Shares have a maximum 4.25% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an upfront sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios

| Share Class | Expense Ratios |

|||

| Class A |

0.96% | |||

| Class B |

1.71% | |||

| Class C |

1.71% | |||

| Class R3 |

1.21% | |||

| Class I |

0.71% | |||

| * | Refer to the Glossary of Terms Used in the Report for definitions. |

| ** | Since inception returns for Class R3 Shares are from 9/24/01. |

| 16 | Nuveen Investments |

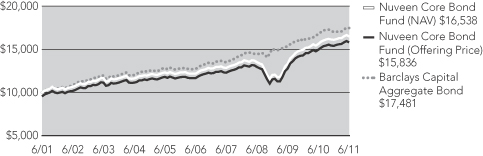

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 17 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen High Income Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2011

| Average Annual | ||||||||||||

| 1-Year | 5-Year | Since Inception* |

||||||||||

| Class A Shares at NAV |

17.61% | 8.19% | 7.21% | |||||||||

| Class A Shares at maximum Offering Price |

12.06% | 7.14% | 6.68% | |||||||||

| Barclays Capital High Yield 2% Issuer Capped Index** |

15.53% | 9.42% | 8.98% | |||||||||

| Lipper High Current Yield Funds Category Average** |

14.96% | 7.02% | 7.19% | |||||||||

| Class B Shares w/o CDSC |

16.59% | 7.35% | 6.43% | |||||||||

| Class B Shares w/CDSC |

11.59% | 7.21% | 6.43% | |||||||||

| Class C Shares |

16.67% | 7.39% | 6.43% | |||||||||

| Class R3 Shares |

17.28% | 7.90% | 7.59% | |||||||||

| Class I Shares |

17.77% | 8.43% | 7.48% | |||||||||

Class A Shares have a maximum 4.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| Expense Ratios | ||||||||

| Share Class | Gross Expense Ratios |

Net Expense Ratios |

||||||

| Class A |

1.27% | 1.14% | ||||||

| Class B |

2.02% | 1.89% | ||||||

| Class C |

2.02% | 1.89% | ||||||

| Class R3 |

1.52% | 1.39% | ||||||

| Class I |

1.02% | 0.89% | ||||||

The Fund’s adviser has contractually agreed to waive fees and reimburse other Fund expenses through March 31, 2012, so that total annual Fund operating expenses, after fee waivers and/or expense reimbursements and excluding acquired Fund fees and expenses, do not exceed 1.10%, 1.85%, 1.85%, 1.35%, and 0.85% for Class A, Class B, Class C, Class R3, and Class I Shares, respectively. Fee waivers and expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors.

| * | Since inception returns for Class A, B, C and I Shares, and for the comparative index and average, are from 8/30/01. Since inception return for Class R3 Shares is from 9/24/01. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. |

| 18 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 19 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Inflation Protected Securities Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2011

| Average Annual | ||||||||||||

| 1-Year | 5-Year | Since Inception* |

||||||||||

| Class A Shares at NAV |

7.30% | 6.27% | 5.10% | |||||||||

| Class A Shares at maximum Offering Price |

2.73% | 5.36% | 4.43% | |||||||||

| Barclays Capital U.S. TIPs Index** |

7.74% | 6.91% | 5.71% | |||||||||

| Lipper Treasury Inflation Protected Securities Funds Category Average** |

7.03% | 5.74% | 5.07% | |||||||||

| Class C Shares |

6.59% | 5.45% | 4.29% | |||||||||

| Class R3 Shares |

6.31% | 5.85% | 4.75% | |||||||||

| Class I Shares |

7.62% | 6.51% | 5.35% | |||||||||

Class A Shares have a maximum 4.25% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios

| Share Class | Gross Expense Ratios |

Net Expense Ratios |

||||||

| Class A |

1.17% | 0.86% | ||||||

| Class C |

1.92% | 1.61% | ||||||

| Class R3 |

1.42% | 1.11% | ||||||

| Class I |

0.92% | 0.61% | ||||||

The Fund’s adviser has contractually agreed to waive fees and reimburse other Fund expenses through March 31, 2012, so that total annual fund operating expenses, after fee waivers and/or expense reimbursements and excluding acquired Fund fees and expenses, do not exceed 0.85%, 1.60%, 1.10%, and 0.60% for Class A, Class C, Class R3, and Class I Shares, respectively. Fee waivers and expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors.

| * | Since inception returns are from 10/1/04. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. |

| 20 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 21 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Intermediate Government Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2011

| Average Annual | ||||||||||||

| 1-Year | 5-Year | Since Inception* |

||||||||||

| Class A Shares at NAV |

3.10% | 5.48% | 3.82% | |||||||||

| Class A Shares at maximum Offering Price |

0.02% | 4.83% | 3.46% | |||||||||

| Barclays Capital Intermediate Government Bond Index** |

2.65% | 5.85% | 4.31% | |||||||||

| Lipper Intermediate U.S. Government Funds Category Average** |

2.35% | 5.58% | 4.05% | |||||||||

| Class C Shares |

2.32% | N/A | 3.20% | |||||||||

| Class R3 Shares |

2.75% | N/A | 3.65% | |||||||||

| Class I Shares |

3.25% | 5.64% | 3.98% | |||||||||

Class A Shares have a maximum 3.00% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| Expense Ratios | ||||||||

| Share Class | Gross Expense Ratios |

Net Expense Ratios |

||||||

| Class A |

1.20% | 0.75% | ||||||

| Class C |

1.95% | 1.60% | ||||||

| Class R3 |

1.45% | 1.10% | ||||||

| Class I |

0.95% | 0.60% | ||||||

The Fund’s adviser has contractually agreed to waive fees and reimburse other Fund expenses through March 31, 2012, so that total annual Fund operating expenses, after fee waivers and/or expense reimbursements and excluding acquired Fund fees and expenses, do not exceed 0.75%, 1.60%, 1.10%, and 0.60% for Class A, Class C, Class R3, and Class I Shares, respectively. Fee waivers and expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors. In addition, the Fund’s distributor has contractually agreed to limit its Class A Share 12b-1 fees to 0.15% of average daily net assets through March 31, 2012.

| * | Since inception returns for Class A and I Shares, and for the comparative index and average are from 10/25/02. Since inception returns for Class C and R3 Shares are from 10/28/09. |

| ** | Refer to the Glossary of Terms Used in the Report for definitions. |

| 22 | Nuveen Investments |

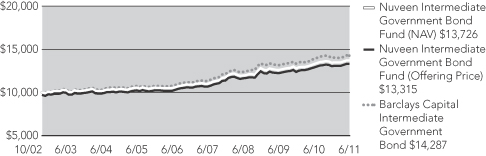

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 23 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Intermediate Term Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2011

| Average Annual | ||||||||||||

| 1-Year | 5-Year | 10-Year | ||||||||||

| Class A Shares at NAV |

4.70% | 6.00% | 4.91% | |||||||||

| Class A Shares at maximum Offering Price |

1.55% | 5.35% | 4.59% | |||||||||

| Barclays Capital Intermediate Government/Credit Bond Index* |

3.77% | 6.08% | 4.91% | |||||||||

| Lipper Short-Intermediate Investment Grade Debt Funds Category Average* |

3.98% | 5.08% | 4.04% | |||||||||

| Class I Shares |

4.76% | 6.13% | 5.07% | |||||||||

| Since Inception** |

||||

| Class C Shares |

1.76% | |||

Class A Shares have a maximum 3.00% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| Expense Ratios | ||||||||

| Share Class | Gross Expense Ratios |

Net Expense Ratios |

||||||

| Class A |

0.96% | 0.86% | ||||||

| Class C |

1.71% | 1.71% | ||||||

| Class I |

0.71% | 0.71% | ||||||

The Fund’s distributor has contractually agreed to limit its Class A Share 12b-1 fees to 0.15% of average daily net assets through March 31, 2012.

| * | Refer to the Glossary of Terms Used in the Report for definitions. |

| ** | Since inception return for Class C Shares is from 1/18/11. |

| 24 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 25 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Short Term Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2011

| Average Annual | ||||||||||||

| 1-Year | 5-Year | 10-Year | ||||||||||

| Class A Shares at NAV |

3.00% | 4.17% | 3.48% | |||||||||

| Class A Shares at maximum Offering Price |

0.68% | 3.69% | 3.25% | |||||||||

| Barclays Capital 1-3 Year Government/Credit Bond Index* |

1.90% | 4.52% | 4.01% | |||||||||

| Lipper Short Investment-Grade Debt Funds Category Average* |

2.80% | 3.84% | 3.50% | |||||||||

| Class I Shares |

3.16% | 4.34% | 3.65% | |||||||||

| 1-Year | Since Inception** |

|||||||

| Class C Shares |

2.22% | 2.47% | ||||||

Class A Shares have a maximum 2.25% sales charge (Offering Price). Class A Share purchases of $250,000 or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios

| Share Class | Expense Ratios |

|||

| Class A |

0.84% | |||

| Class C |

1.59% | |||

| Class I |

0.59% | |||

| * | Refer to the Glossary of Terms Used in the Report for definitions. |

| ** | Since inception return for Class C Shares is from 10/28/09. |

| 26 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 27 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Total Return Bond Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of 6/30/11

| Average Annual | ||||||||||||

| 1-Year | 5-Year | 10-Year | ||||||||||

| Class A Shares at NAV |

8.69% | 7.58% | 6.24% | |||||||||

| Class A Shares at maximum Offering Price |

4.03% | 6.64% | 5.77% | |||||||||

| Barclays Capital Aggregate Bond Index* |

3.90% | 6.52% | 5.74% | |||||||||

| Lipper Intermediate Investment-Grade Debt Funds Category Average* |

5.10% | 6.01% | 5.25% | |||||||||

| Class B Shares w/o CDSC |

7.84% | 6.76% | 5.42% | |||||||||

| Class B Shares w/CDSC |

2.84% | 6.61% | 5.42% | |||||||||

| Class C Shares |

7.85% | 6.77% | 5.42% | |||||||||

| Class I Shares |

8.99% | 7.84% | 6.49% | |||||||||

| 1-Year | 5-Year | Since Inception** |

||||||||||

| Class R3 Shares |

8.40% | 7.27% | 6.00% | |||||||||

Class A Shares have a maximum 4.25% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an upfront sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within eighteen months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available only to certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios

| Share Class | Gross Expense Ratios |

Net Expense Ratios |

||||||

| Class A |

0.98% | 0.90% | ||||||

| Class B |

1.73% | 1.73% | ||||||

| Class C |

1.73% | 1.73% | ||||||

| Class R3 |

1.23% | 1.23% | ||||||

| Class I |

0.73% | 0.73% | ||||||

The Fund’s adviser has contractually agreed to reimburse Class A Share 12b-1 fees through March 31, 2012, to the extent necessary so that total annual Fund operating expenses, after fee waivers and/or expense reimbursement and excluding acquired Fund fees and expenses, do not exceed 0.89% for Class A Shares. Fee waivers and/or expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors.

| * | Refer to the Glossary of Terms Used in the Report for definitions. |

| ** | Since inception return for Class R3 Shares is from 9/24/01. |

| 28 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2011

The graph does not reflect the deduction of taxes, that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 29 |

Yields (Unaudited) as of June 30, 2011

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of a Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the Fund’s portfolio. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

Nuveen Core Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

3.51% | 3.31% | ||||||

| Class B Shares |

2.91% | 2.70% | ||||||

| Class C Shares |

2.95% | 2.73% | ||||||

| Class R3 Shares |

3.44% | 3.21% | ||||||

| Class I Shares |

3.91% | 3.71% | ||||||

Nuveen High Income Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

6.82% | 7.32% | ||||||

| Class B Shares |

6.41% | 6.92% | ||||||

| Class C Shares |

6.39% | 6.94% | ||||||

| Class R3 Shares |

6.89% | 7.44% | ||||||

| Class I Shares |

7.43% | 7.94% | ||||||

Nuveen Inflation Protected Securities Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

.79% | 5.60% | ||||||

| Class C Shares |

.11% | 5.10% | ||||||

| Class R3 Shares |

.61% | 5.60% | ||||||

| Class I Shares |

1.09% | 6.09% | ||||||

Nuveen Intermediate Government Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

2.11% | 1.66% | ||||||

| Class C Shares |

1.29% | .87% | ||||||

| Class R3 Shares |

1.83% | 1.37% | ||||||

| Class I Shares |

2.31% | 1.87% | ||||||

Nuveen Intermediate Term Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

3.11% | 2.24% | ||||||

| Class C Shares |

2.36% | 1.69% | ||||||

| Class I Shares |

3.34% | 2.47% | ||||||

| 30 | Nuveen Investments |

Nuveen Short Term Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

2.16% | 1.85% | ||||||

| Class C Shares |

1.37% | 1.05% | ||||||

| Class I Shares |

2.38% | 2.04% | ||||||

Nuveen Total Return Bond Fund

| Dividend Yield |

SEC 30-Day Yield |

|||||||

| Class A Shares(1) |

3.75% | 3.49% | ||||||

| Class B Shares |

3.15% | 2.80% | ||||||

| Class C Shares |

3.15% | 2.82% | ||||||

| Class R3 Shares |

3.62% | 3.32% | ||||||

| Class I Shares |

4.12% | 3.82% | ||||||

| (1) | The SEC Yield for Class A Shares quoted in the table reflects the maximum sales load. Investors paying a reduced load because of volume discounts, investors paying no load because they qualify for one of the several exclusions from the load, and existing shareholders who previously paid a load but would like to know the SEC Yield applicable to their shares on a going-forward basis, should understand that the SEC Yield effectively applicable to them would be higher than the figure quoted in the table. |

| Nuveen Investments | 31 |

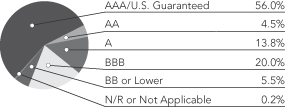

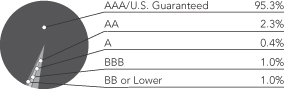

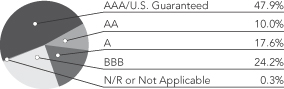

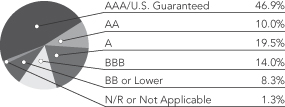

Holding Summaries (Unaudited) as of June 30, 2011

This data relates to the securities held in each Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investor Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated NR are not rated by a national rating agency.

| 1 | As a percentage of total investments (excluding investments in derivatives) as of June 30, 2011. Holdings are subject to change. |

| 2 | Represents investments purchased with proceeds from securities lending. |

| 32 | Nuveen Investments |

| 1 | As a percentage of total investments (excluding investments in derivatives) as of June 30, 2011. Holdings are subject to change. |

| 2 | Represents investments purchased with proceeds from securities lending. |

| Nuveen Investments | 33 |

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. Since the expense examples for Class C Shares of Intermediate Term Bond reflect only the first 164 days of the Class’s operations they may not provide a meaningful understanding of the Class’s ongoing expenses.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

Nuveen Core Bond Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||||||||||||||||||

| A Shares |

B Shares |

C Shares |

R3 Shares | I Shares | A Shares |

B Shares |

C Shares |

R3 Shares | I Shares | |||||||||||||||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,026.60 | $ | 1,023.70 | $ | 1,023.80 | $ | 1,026.20 | $ | 1,028.80 | $ | 1,020.13 | $ | 1,016.36 | $ | 1,016.36 | $ | 1,018.84 | $ | 1,021.32 | ||||||||||||||||||||||

| Expenses Incurred During Period | $ | 4.77 | $ | 8.53 | $ | 8.53 | $ | 6.03 | $ | 3.52 | $ | 4.71 | $ | 8.50 | $ | 8.50 | $ | 6.01 | $ | 3.51 | ||||||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .94%, 1.70%, 1.70%, 1.20%, and ..70% for Classes A, B, C, R3, and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Nuveen High Income Bond Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||||||||||||||||||

| A Shares |

B Shares |

C Shares |

R3 Shares |

I Shares | A Shares |

B Shares |

C Shares |

R3 Shares |

I Shares | |||||||||||||||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,048.60 | $ | 1,044.90 | $ | 1,044.80 | $ | 1,048.00 | $ | 1,049.90 | $ | 1,019.34 | $ | 1,015.62 | $ | 1,015.62 | $ | 1,018.10 | $ | 1,020.58 | ||||||||||||||||||||||

| Expenses Incurred During Period | $ | 5.59 | $ | 9.38 | $ | 9.38 | $ | 6.91 | $ | 4.32 | $ | 5.51 | $ | 9.25 | $ | 9.25 | $ | 6.76 | $ | 4.26 | ||||||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.10%, 1.85%, 1.85%, 1.35% and ..85% for Classes A, B, C, R3, and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Nuveen Inflation Protected Securities Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||||||||||

| A Shares |

C Shares |

R3 Shares |

I Shares |

A Shares |

C Shares |

R3 Shares |

I Shares |

|||||||||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,051.50 | $ | 1,048.00 | $ | 1,049.60 | $ | 1,053.70 | $ | 1,020.58 | $ | 1,016.86 | $ | 1,019.34 | $ | 1,021.82 | ||||||||||||||||||

| Expenses Incurred During Period | $ | 4.32 | $ | 8.12 | $ | 5.59 | $ | 3.06 | $ | 4.26 | $ | 8.00 | $ | 5.51 | $ | 3.01 | ||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .85%, 1.60%, 1.10%, and .60% for Classes A, C, R3, and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| 34 | Nuveen Investments |

Nuveen Intermediate Government Bond Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||||||||||

| A Shares |

C Shares |

R3 Shares |

I Shares | A Shares | C Shares |

R3 Shares |

I Shares |

|||||||||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,020.20 | $ | 1,016.80 | $ | 1,019.60 | $ | 1,020.90 | $ | 1,021.08 | $ | 1,016.86 | $ | 1,019.34 | $ | 1,021.82 | ||||||||||||||||||

| Expenses Incurred During Period | $ | 3.76 | $ | 8.00 | $ | 5.51 | $ | 3.01 | $ | 3.76 | $ | 8.00 | $ | 5.51 | $ | 3.01 | ||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .75%, 1.60%, 1.10%, and .60% for Classes A, C, R3, and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Nuveen Intermediate Term Bond Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||

| A Shares |

C Shares |

I Shares |

A Shares |

C Shares |

I Shares |

|||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,024.90 | $ | 1,017.60 | $ | 1,024.70 | $ | 1,020.58 | $ | 1,016.36 | $ | 1,021.32 | ||||||||||||||

| Expenses Incurred During Period | $ | 4.27 | $ | 8.50 | $ | 3.51 | $ | 4.26 | $ | 8.50 | $ | 3.51 | ||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .85% and .70% for Classes A and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). For Class C of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.70% multiplied by the average account value over the period, multiplied by 164/365 (to reflect the 164 days in the period since class commencement of operations).

Nuveen Short Term Bond Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||

| A Shares | C Shares | I Shares | A Shares | C Shares | I Shares | |||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,015.10 | $ | 1,010.90 | $ | 1,016.00 | $ | 1,021.27 | $ | 1,017.06 | $ | 1,022.02 | ||||||||||||||

| Expenses Incurred During Period | $ | 3.55 | $ | 7.78 | $ | 2.80 | $ | 3.56 | $ | 7.80 | $ | 2.81 | ||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .71%, 1.56%, and .56% for Classes A, C and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Nuveen Total Return Bond Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) |

|||||||||||||||||||||||||||||||||||||||||

| A Shares | B Shares | C Shares | R3 Shares | I Shares | A Shares | B Shares | C Shares | R3 Shares | I Shares | |||||||||||||||||||||||||||||||||

| Beginning Account Value (1/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||||||

| Ending Account Value (6/30/11) | $ | 1,032.30 | $ | 1,029.40 | $ | 1,028.40 | $ | 1,031.70 | $ | 1,034.40 | $ | 1,020.38 | $ | 1,016.27 | $ | 1,016.27 | $ | 1,018.74 | $ | 1,021.22 | ||||||||||||||||||||||

| Expenses Incurred During Period | $ | 4.48 | $ | 8.65 | $ | 8.65 | $ | 6.15 | $ | 3.63 | $ | 4.46 | $ | 8.60 | $ | 8.60 | $ | 6.11 | $ | 3.61 | ||||||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .89%, 1.72%, 1.72%, 1.22%, and ..72% for Classes A, B, C, R3, and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| Nuveen Investments | 35 |

Shareholder Meeting Report (Unaudited)

A special meeting of shareholders was held in the offices of FAF Advisors, Inc. on December 17, 2010; at this meeting the shareholders were asked to vote on the election of Board Members, the approval of an Investment Advisory Agreement and the approval of an Investment Sub-Advisory Agreement.

| Nuveen Core Bond Fund |

Nuveen High Income Bond Fund |

Nuveen Inflation Protected Securities Fund |

Nuveen Intermediate Government Bond Fund |

Nuveen Intermediate Term Bond Fund |

Nuveen Short Term Bond Fund |

Nuveen Total Return Bond Fund |

||||||||||||||||||||||

| To approve an investment advisory agreement with Nuveen Asset Management and an investment sub-advisory agreement between Nuveen Asset Management and Nuveen Asset Management, LLC. | ||||||||||||||||||||||||||||

| For |

84,701,158 | 39,254,456 | 13,211,937 | 14,025,405 | 52,914,467 | 50,401,541 | 50,264,660 | |||||||||||||||||||||

| Against |

167,783 | 69,703 | 48,188 | 12,995 | 110,514 | 150,981 | 74,869 | |||||||||||||||||||||

| Abstain |

874,527 | 68,372 | 9,817 | 15,586 | 62,269 | 86,129 | 145,615 | |||||||||||||||||||||

| Broker Non-Votes |

5,514,543 | 3,527,657 | 1,337,477 | 1,281,497 | 1,701,659 | 5,907,413 | 3,304,660 | |||||||||||||||||||||

| Total |

91,258,011 | 42,920,188 | 14,607,419 | 15,335,483 | 54,788,909 | 56,546,064 | 53,789,804 | |||||||||||||||||||||

| Approval of the Board Members was reached as follows: |

||||||||||||||||||||||||||||

| John P. Amboian |

||||||||||||||||||||||||||||

| For |

90,308,630 | 42,812,258 | 14,584,473 | 15,296,054 | 54,573,090 | 56,316,726 | 53,714,191 | |||||||||||||||||||||

| Withhold |

949,381 | 107,930 | 22,946 | 39,429 | 215,819 | 229,338 | 75,613 | |||||||||||||||||||||

| Total |

91,258,011 | 42,920,188 | 14,607,419 | 15,335,483 | 54,788,909 | 56,546,064 | 53,789,804 | |||||||||||||||||||||

| Robert P. Bremner |

||||||||||||||||||||||||||||

| For |

90,293,138 | 42,823,479 | 14,582,087 | 15,298,205 | 54,565,920 | 56,297,504 | 53,708,705 | |||||||||||||||||||||

| Withhold |

964,873 | 96,709 | 25,332 | 37,278 | 222,989 | 248,560 | 81,099 | |||||||||||||||||||||

| Total |

91,258,011 | 42,920,188 | 14,607,419 | 15,335,483 | 54,788,909 | 56,546,064 | 53,789,804 | |||||||||||||||||||||

| Jack B. Evans |

||||||||||||||||||||||||||||

| For |

90,328,064 | 42,775,323 | 14,584,473 | 15,263,028 | 54,574,661 | 56,340,828 | 53,672,984 | |||||||||||||||||||||

| Withhold |

929,947 | 144,865 | 22,946 | 72,455 | 214,248 | 205,236 | 116,820 | |||||||||||||||||||||

| Total |

91,258,011 | 42,920,188 | 14,607,419 | 15,335,483 | 54,788,909 | 56,546,064 | 53,789,804 | |||||||||||||||||||||

| William C. Hunter |

||||||||||||||||||||||||||||

| For |

90,333,839 | 42,823,814 | 14,584,473 | 15,298,781 | 54,579,109 | 56,340,828 | 53,672,984 | |||||||||||||||||||||

| Withhold |

924,172 | 96,374 | 22,946 | 36,702 | 209,800 | 205,236 | 116,820 | |||||||||||||||||||||

| Total |

91,258,011 | 42,920,188 | 14,607,419 | 15,335,483 | 54,788,909 | 56,546,064 | 53,789,804 | |||||||||||||||||||||

| David J. Kundert |

||||||||||||||||||||||||||||

| For |

90,290,839 | 42,828,452 | 14,582,163 | 15,298,205 | 54,526,189 | 56,283,360 | 53,711,404 | |||||||||||||||||||||

| Withhold |

967,172 | 91,736 | 25,256 | 37,278 | 262,720 | 262,704 | 78,400 | |||||||||||||||||||||

| Total |

91,258,011 | 42,920,188 | 14,607,419 | 15,335,483 | 54,788,909 | 56,546,064 | 53,789,804 | |||||||||||||||||||||

| William J. Schneider |

||||||||||||||||||||||||||||

| For |