UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: February 28

Date of reporting period: February 28, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Municipal Bond Funds

(formerly First American California Tax Free Fund)

Dependable, tax-free income because it’s not what you earn, it’s what you keep.®

Annual Report

February 28, 2011

| Share Class / Ticker Symbol | ||||||

| Class A | Class C1 | Class I | ||||

| Nuveen California Tax Free Fund |

FCAAX | FCCAX | FCAYX | |||

INVESTMENT ADVISER NAME CHANGE

Effective January 1, 2011, Nuveen Asset Management, the Fund’s investment adviser, changed its name to Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities.

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, LLC, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp – the parent of FAF Advisors – received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long term investment business of FAF Advisors, including investment-management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

This combination does not affect the investment objectives or strategies of this Fund. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $197 billion of assets as of December 31, 2010.

| Must be preceded by or accompanied by a prospectus. | NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 28 | ||||

| 37 | ||||

| 41 | ||||

| 46 | ||||

| 47 | ||||

Letter to Shareholders

| 4 | Nuveen Investments |

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Any reference to credit ratings for portfolio holdings denotes the highest rating assigned by a Nationally Recognized Statistical Rating Organization (NRSRO) such as Standard & Poor’s (S&P), Moody’s, or Fitch. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below investment grade. Holdings and ratings may change over time.

Nuveen California Tax Free Fund

(formerly known as First American California Tax Free Fund)

Recently, the Nuveen California Tax Free Fund changed its fiscal year end to February 28/29 from June 30. As a result, this annual report covers an eight-month period. Portfolio manager Scott Romans, PhD, reviews market conditions at the national and state levels, key investment strategies and the Fund’s performance during this period. Scott, who has twelve years of investment experience, assumed portfolio management responsibilities for the Fund in January 2011. The previous portfolio managers for the Fund, Christopher Drahn and Michael Hamilton, managed it from 2005 and 2002, respectively, until December 2010.

What factors affected the U.S. economy and the national and state municipal bond markets during the eight-month reporting period ended February 28, 2011?

The main drivers of municipal bond performance during the period were significant supply and demand issues in the marketplace. During the first half of this reporting period, fixed-income assets across the board continued to rally as investors migrated out of money market funds and into mutual funds. The market’s bullish nature was driven by the perception that short rates would stay low for an extended period as well as the possibility that quantitative easing would drive down long rates. The municipal market also participated in the rally with prices moving higher and yields continuing to grind lower until they reached historically low levels in August 2010. Throughout this period, municipal bond funds experienced strong inflows as investors felt more confident moving out on the yield curve and taking on additional credit and interest rate risk. At the same time, the supply of municipal bonds was scarce as a great deal of issuance continued to be taken out of the tax-exempt arena and offered through the Build America Bond (BAB) program. While tax-exempt fund managers had difficulty finding longer maturity bonds for their portfolios, the steepness of the yield curve caused detrimental income consequences if they purchased shorter maturity bonds.

The environment reversed very quickly in the final half of the period as valuations suffered due to several factors. First, rates began to climb across fixed-income markets as concerns about Federal stimulus programs and potential inflation drove Treasury rates higher. Valuations in the municipal market declined along with the Treasury market. Second, municipal bond funds, particularly high yield funds, began to experience a large volume of outflows starting in mid-November 2010 and the market became relatively illiquid. As high yield bond funds offered to sell bonds to meet redemptions, buyers were very cautious about what they would bid for these bonds. Consequently, trades that took

| Nuveen Investments | 5 |

place at lower levels impacted valuations across the market. Investors watched their fund values decrease, which in turn caused more outflows. The final element that played into the market downturn were the negative stories in the media about the fiscal struggles of states and municipalities. The fear of potential defaults caused more investors to exit the municipal marketplace. These events in the final months of the period disrupted the earlier positive performance of municipal bonds. Over the eight months ended February 2011, municipal bond issuance nationwide totaled $260.5 billion.

Supply and demand issues instead of credit factors drove performance at the state level as well. While California finally established a budget in October 2010 after an extended stalemate, the state remained in a fiscal predicament. Unemployment within the state lingered at 12.4% as of February 2011, which was the second highest rate in the country. Also, the state’s general obligation (GO) debt carried an A1 rating by Moody’s, the only state besides Illinois to have that rating. Despite ongoing fiscal concerns, state GO bonds rallied strongly during the period, outperforming the California market in general. The outperformance was not a result of improved credit quality for the state, but rather from a significant drop in the amount of municipal bonds California brought to market, especially compared to the record issuance in the fourth quarter of 2009. At the same time, investors became more comfortable owning California GOs, particularly with the attractive structures of the bonds issued in late 2009. This caused credit spreads – meaning the extra income investors demanded for investing in lower-rated securities – to narrow during the period and stay that way. Even when the overall market traded off and funds started to see redemptions, California GO bonds held up well.

Despite the fact that the BAB program was discontinued at the end of 2010, municipal bond issuance was extremely low early in 2011. Many issuers raced to get their 2011 deals done as BAB bonds in the fourth quarter of 2010 when it became clear that the program would not be re-established. Projections for issuance across the nation and in California for the remainder of 2011 are also very low as it does not appear that the expiration of the program will bring significant tax-exempt issuance back in the near term.

How did the Fund perform during the eight-month reporting period ended February 28, 2011?

The table within the Fund Performance section of this report provides total returns for the eight-month, one-year, five-year and ten-year reporting periods ending February 28, 2011. The Fund’s Class A Share total returns are compared with the performance of a corresponding index and an appropriate Lipper peer fund average. During the eight-month period, the Fund’s Class A Shares at net asset value (NAV) outpaced its peer group, the Lipper California Municipal Debt Funds Average, but lagged the Barclays Capital Municipal Bond Index.

Sector selection was the primary driver of the Fund’s underperformance relative to the index during the reporting period. First, the Fund’s results were hindered by its underweight position in California GO bonds. While the Fund had approximately a 4% weighting in these bonds, they constituted more than 25% of the index and dramatically outperformed the market in general as discussed earlier. We are not able to match a market-level position in California GOs due to the Fund’s diversification requirements as

| 6 | Nuveen Investments |

well as the ability to gain access to the bonds. To a lesser extent, the Fund’s performance was hurt by an overweight position in local GO bonds (unified school districts and community colleges) as concerns about state and local municipalities caused that sector to underperform. The Fund had approximately 29% in local GOs versus 11% for the index at period end. However, our strong security selection within the local GO sector partially offset the negative effects of the weighting. The same scenario took place in health care, where spreads remained wide because that sector was not eligible to participate in the BAB program. While the Fund’s overweight to health care proved detrimental as the sector underperformed the market, our positive security selection partially cancelled out the impact. Additionally, the Fund benefited from a lack of exposure to tobacco bonds, which performed extremely poorly near the end of the period as high yield funds unloaded them to meet redemptions.

Credit quality was a secondary, but much smaller, factor in the Fund’s performance. As has historically been the case, the Fund was positioned with an overweight to mid-grade and non-rated bonds. The BBB-rated sector in California performed poorly compared to the overall market during the period. As the high yield market traded off, spreads on lower rated bonds widened. However, we again benefited from security selection as the BBB-rated bonds we held tended to outperform the sector, helping to offset most of the negative effects of the overweight. At period end, BBB-rated bonds made up around 17% of the portfolio versus approximately 6% of the index.

What strategies did you use to manage the Fund?

The Fund continued to employ the same fundamental investment strategies and tactics used in previous years. Our focus remains on bottom-up security selection, evaluating potential opportunities one at a time based on thorough credit research. Now more than ever, the in-depth credit research performed by our team is important. In part, this is because relatively few new issues carrying municipal bond insurance. This is a change from several years ago when as much as 50% of new issuance was insured. In addition to bottom-up security selection, our long-term strategy in the Fund has been to emphasize mid grade and non-rated bonds due to the favorable returns these credits have historically generated. We have also tended to overweight select sectors – such as health care – where our research team has in-depth expertise. We continued to favor these areas in the Fund during the period. In addition, we made slight adjustments to the Fund’s yield curve positioning; however, we don’t believe these moves add as much value as security selection.

Going into the reporting period, we were comfortable with the Fund’s positioning and were only able to make modest adjustments to its weightings due to the scarcity of bonds. We did actively search for opportunities in health care because of the wider spreads and stronger structures (higher coupons with longer call protections) available in that sector. We added one holding to the portfolio, Sutter Health, which is an AA–rated hospital system bond. For the purchase, we used cash on the Fund’s balance sheet and did not need to sell any positions. The Fund also owned several bonds that were called during the period.

| Nuveen Investments | 7 |

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities are subject to credit risk and interest rate risk. Market interest rate changes will cause the value of debt securities (and the value of shares of funds that invest in them) to fluctuate, and may also impact income over time. Credit risk refers to an issuer’s ability to make interest and principal payments when due.

Dividend Information

During the reporting period, all share classes of the Nuveen California Tax Free Fund remained stable.

Each Fund seeks to pay dividends at a rate that reflects the past and projected performance of the Fund. To permit a Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Fund during the period. If the Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if the Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders. As of February 28, 2011, the Fund had a positive UNII balance for tax purposes and positive UNII balances for financial reporting purposes.

| 8 | Nuveen Investments |

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between the Fund and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Fund’s investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and benchmark return information is provided for the Fund’s Class A Shares at net asset value (NAV) only.

Class A Shares – Average Annual Total Returns as of February 28, 2011*

| Cumulative | Average Annual | |||||||||||||||

| 8-Month | 1-Year | 5-Year | 10-Year | |||||||||||||

| Nuveen California Tax Free Fund |

||||||||||||||||

| A Shares at NAV |

-0.68% | 1.44% | 3.13% | 4.21% | ||||||||||||

| A Shares at Offer |

-4.87% | -2.79% | 2.25% | 3.77% | ||||||||||||

| Barclays Capital Municipal Bond Index** |

0.07% | 1.72% | 4.06% | 4.79% | ||||||||||||

| Lipper California Municipal Debt Funds Average** |

-1.86% | 0.17% | 2.12% | 3.49% | ||||||||||||

| Class C1 Shares |

-0.91% | 0.94% | 2.66% | 3.77% | ||||||||||||

| Class I Shares |

-0.57% | 1.60% | 3.30% | 4.43% | ||||||||||||

| Latest Calendar Quarter – Average Annual Total Returns as of March 31, 2011 | ||||||||||||

| Average Annual | ||||||||||||

| 1-Year | 5-Year | 10-Year | ||||||||||

| Class A Shares at NAV |

1.41% | 3.22% | 4.08% | |||||||||

| Class A Shares at Offer |

-2.85% | 2.33% | 3.64% | |||||||||

| Class C1 Shares |

0.91% | 2.75% | 3.65% | |||||||||

| Class I Shares |

1.57% | 3.39% | 4.31% | |||||||||

Class A Shares have a maximum 4.20% sales charge. Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C1 Shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

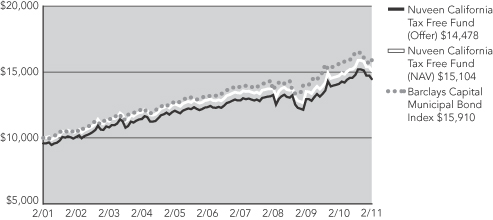

| Growth of an Assumed $10,000 Investment as of February 28, 2011 – Class A Shares |

The graphs do not reflect the deduction of taxes, such as state and local income taxes or capital gains taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| * | Eight-month returns are cumulative; all other returns are annualized. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. |

| Nuveen Investments | 9 |

Yields as of February 28, 2011 (Unaudited)

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of a Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the Fund’s portfolio. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The 30-Day Yield is computed under the same formula but is based on the net asset value (NAV) per share. Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

The Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis at a specified tax rate. With respect to investments that generate qualified dividend income that is taxable at a maximum rate of 15%, the Taxable-Equivalent Yield is lower.

The SEC 30-Day Yield and Taxable-Equivalent Yield on A Shares at NAV applies only to A Shares purchased at no-load pursuant to the Fund’s policy permitting waiver of the A Share load in certain specified circumstances.

| Dividend Yield |

30-Day Yield |

SEC 30-Day Yield |

Taxable- Equivalent Yield1 |

|||||||||||||

| Class A Shares at NAV |

4.35% | 4.48% | — | 6.86% | ||||||||||||

| Class A Shares at Offer |

4.17% | — | 4.29% | 6.57% | ||||||||||||

| Class C1 Shares |

3.94% | 3.98% | — | 6.09% | ||||||||||||

| Class I Shares |

4.58% | 4.62% | — | 7.08% | ||||||||||||

| 1 | The Taxable-Equivalent Yield is based on the Fund’s 30-Day Yield on the indicated date and a combined federal and state income tax rate of 34.7%. |

| 10 | Nuveen Investments |

Holding Summaries as of February 28, 2011 (Unaudited)

This data relates to the securities held in the Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Ratings shown are the highest of Standard & Poor’s Group, Moody’s Investor Service, Inc. or Fitch, Inc. AAA includes bonds with an implied AAA rating since they are backed by U.S. Government or agency securities. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below-investment grade. Holdings designated N/R are not rated by any of these national rating agencies.

| 1 | As a percentage of total municipal bonds as of February 28, 2011. Holdings are subject to change. |

| Nuveen Investments | 11 |

The expense ratios below reflect the Fund’s total operating expenses as shown in the Fund’s most recent prospectus. The expense ratios include management fees and other fees and expenses but exclude interest expense on self-deposited inverse floaters held by the Fund, if any.

| Share Class | Gross Expense Ratios |

Net Expense Ratios |

||||||

| Class A | 1.01% | 0.85% | ||||||

| Class C1 | 1.46% | 1.35% | ||||||

| Class I | 0.81% | 0.70% | ||||||

The Fund’s investment adviser has contractually agreed to waive fees and reimburse other Fund expenses through June 30, 2011 so that total annual fund operating expenses, after fee waivers and/or expense reimbursements and excluding Acquired Fund Fees and Expenses, do not exceed 0.65%, 1.15%, and 0.50% for Class A, Class C1, and Class I Shares, respectively, and waive fees and reimburse other Fund expenses through March 31, 2012 so that annual fund operating expenses, after fee waivers and/or expense reimbursements and excluding Acquired Fund Fees and Expenses, do not exceed 0.85%, 1.35%, and 0.70% for Class A, Class C1, and Class I Shares, respectively. Fee waivers and expense reimbursements will not be terminated prior to that time without the approval of the Fund’s board of directors.

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as up-front and back-end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

| Hypothetical Performance | ||||||||||||||||||||||||

| Actual Performance | (5% annualized return before expenses) | |||||||||||||||||||||||

| A Shares | C1 Shares | I Shares | A Shares | C1 Shares | I Shares | |||||||||||||||||||

| Beginning Account Value (9/01/10) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||

| Ending Account Value (2/28/11) | $ | 952.20 | $ | 949.90 | $ | 952.90 | $ | 1,021.57 | $ | 1,019.09 | $ | 1,022.32 | ||||||||||||

| Expenses Incurred During Period | $ | 3.15 | $ | 5.56 | $ | 2.42 | $ | 3.26 | $ | 5.76 | $ | 2.51 | ||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .65%, 1.15% and .50% for Classes A, C1 and I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the six month period).

| 12 | Nuveen Investments |

Shareholder Meeting Report (Unaudited)

A special meeting of shareholders was held in the offices of FAF Advisors, Inc. on December 17, 2010; at this meeting the shareholders were asked to vote on the election of Board Members, the approval of an Investment Advisory Agreement and the approval of an Investment Sub-Advisory Agreement.

| Nuveen California Tax Free Fund | ||||

| To approve an investment advisory agreement with Nuveen Fund Advisors (formerly Nuveen Asset Management) and an investment sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management, LLC. |

||||

| For |

7,628,557 | |||

| Against |

21,138 | |||

| Abstain |

2,990 | |||

| Broker Non-Votes |

1,953,316 | |||

| Total |

9,606,001 | |||

| Approval of the Board Members was reached as follows: |

||||

| John P. Amboian |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Robert P. Bremner |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Jack B. Evans |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| William C. Hunter |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| David J. Kundert |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| William J. Schneider |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Judith M. Stockdale |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Carole E. Stone |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Virginia L. Stringer |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Terence J. Toth |

||||

| For |

9,584,863 | |||

| Withhold |

21,138 | |||

| Total |

9,606,001 | |||

| Nuveen Investments | 13 |

Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

Nuveen California Tax Free Fund (formerly First American California Tax Free Fund)

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Nuveen California Tax Free Fund (formerly First American California Tax Free Fund) (the “Fund”) as of February 28, 2011, and the related statements of operations, changes in net assets, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of February 28, 2011, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Nuveen California Tax Free Fund (formerly First American California Tax Free Fund) at February 28, 2011, and the results of its operations, the changes in its net assets, and the financial highlights for each of the periods indicated therein in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

April 27, 2011

| 14 | Nuveen Investments |

Nuveen California Tax Free Fund

(formerly known as First American California Tax Free Fund)

February 28, 2011

| Principal Amount (000) |

Description p | Value | ||||||

| Municipal Bonds – 98.5% |

||||||||

| Certificates of Participation – 5.4% |

||||||||

| Eden Township Healthcare District |

||||||||

| $ | 1,000 | 6.000%, 06/01/2030 |

$ | 943,310 | ||||

| Escondido, Series A (FGIC) (NATL) |

||||||||

| 140 | 5.625%, 09/01/2020 |

141,919 | ||||||

| Los Angeles, Sonnenblick del Rio, West Los Angeles (AMBAC) |

||||||||

| 330 | 6.000%, 11/01/2019 |

333,844 | ||||||

| Oakdale Irrigation District, Water Facilities Project |

||||||||

| 805 | 5.500%, 08/01/2034 |

808,196 | ||||||

| Pasadena, Series C |

||||||||

| 50 | 4.500%, 02/01/2026 |

47,899 | ||||||

| Poway (AMBAC) |

||||||||

| 585 | 4.500%, 08/01/2016 |

619,380 | ||||||

| Ramona Unified School District (FGIC) (NATL) (Convertible CAB) |

||||||||

| 500 | 0.000% through 05/01/2012, thereafter 5.000%, 05/01/2032 g |

407,695 | ||||||

| Rowland Water District, Recycled Water Project |

||||||||

| 565 | 5.750%, 12/01/2024 |

607,064 | ||||||

| 480 | 5.750%, 12/01/2025 |

512,410 | ||||||

| 500 | 6.250%, 12/01/2039 |

520,810 | ||||||

| Travis Unified School District, (FGIC) (NATL) |

||||||||

| 300 | 4.500%, 09/01/2016 |

294,693 | ||||||

| 5,255 | Total Certificates of Participation |

5,237,220 | ||||||

| Continuing Care Retirement Communities – 0.9% |

||||||||

| Association of Bay Area Governments Financial Authority, Lincoln Glen Manor Senior Citizens (CMI) |

||||||||

| 240 | 6.100%, 02/15/2025 |

240,086 | ||||||

| Illinois Finance Authority, Franciscan Communities, Series A |

||||||||

| 300 | 5.500%, 05/15/2027 |

241,800 | ||||||

| La Verne, Brethren Hillcrest Homes, Series B (ACA) |

||||||||

| 500 | 5.600%, 02/15/2033 |

395,935 | ||||||

| 1,040 | Total Continuing Care Retirement Communities |

877,821 | ||||||

| Education – 11.6% |

||||||||

| California Educational Facilities Authority, Claremont Graduate University, Series A |

||||||||

| 655 | 4.750%, 03/01/2020 |

665,336 | ||||||

| 240 | 5.000%, 03/01/2020 |

246,446 | ||||||

| 865 | 5.000%, 03/01/2023 |

864,222 | ||||||

| 500 | 5.125%, 03/01/2028 |

468,950 | ||||||

| California Educational Facilities Authority, Fresno Pacific University, Series A |

||||||||

| 380 | 6.750%, 03/01/2019 |

380,798 | ||||||

| California Educational Facilities Authority, Golden Gate University |

||||||||

| 430 | 5.000%, 10/01/2020 |

403,435 | ||||||

| California Educational Facilities Authority, Lutheran University, Series C |

||||||||

| 675 | 4.750%, 10/01/2015 |

703,917 | ||||||

| California Educational Facilities Authority, Pitzer College |

||||||||

| 1,000 | 5.375%, 04/01/2034 |

916,540 | ||||||

| California Educational Facilities Authority, University of Redlands, Series A |

||||||||

| 1,000 | 5.000%, 08/01/2028 |

923,270 | ||||||

| California Educational Facilities Authority, University of the Pacific |

||||||||

| 1,000 | 5.000%, 11/01/2030 |

961,180 | ||||||

| California Educational Facilities Authority, Woodbury University |

||||||||

| 450 | 4.400%, 01/01/2015 |

444,969 | ||||||

| 470 | 4.500%, 01/01/2016 |

460,769 | ||||||

| Nuveen Investments | 15 |

Portfolio of Investments

Nuveen California Tax Free Fund (continued)

February 28, 2011

| Principal Amount (000) |

Description p | Value | ||||||

| Education (continued) |

||||||||

| California Municipal Finance Authority, American Heritage Education Foundation Project, Series A |

||||||||

| $ | 400 | 5.250%, 06/01/2026 |

$ | 329,080 | ||||

| California Municipal Finance Authority, Biola University |

||||||||

| 1,000 | 5.000%, 10/01/2018 |

1,032,460 | ||||||

| 500 | 5.625%, 10/01/2023 |

500,115 | ||||||

| California Municipal Finance Authority, Loma Linda University |

||||||||

| 300 | 4.250%, 04/01/2018 |

304,902 | ||||||

| 300 | 4.375%, 04/01/2019 |

303,267 | ||||||

| California State University, Series C (NATL) |

||||||||

| 1,000 | 5.000%, 11/01/2025 |

1,000,760 | ||||||

| California Statewide Communities Development Authority, Viewpoint School (ACA) |

||||||||

| 405 | 4.125%, 10/01/2014 |

414,011 | ||||||

| 11,570 | Total Education |

11,324,427 | ||||||

| General Obligations – 29.0% |

||||||||

| Acalanes Unified High School District, Election 2008, Series A |

||||||||

| 1,000 | 0.000%, 08/01/2026 |

394,020 | ||||||

| Baldwin Park Unified School District, Election of 2002 (AMBAC) |

||||||||

| 1,000 | 0.000%, 08/01/2020 |

582,440 | ||||||

| California |

||||||||

| 600 | 5.625%, 04/01/2026 |

631,608 | ||||||

| 1,000 | 5.500%, 11/01/2039 |

989,950 | ||||||

| Central Unified School District, Election of 2008, Series A (AGC) |

||||||||

| 500 | 5.625%, 08/01/2033 |

504,815 | ||||||

| College of the Sequoias, Visalia Area Improvement District #2, Election of 2008, Series A (AGC) |

||||||||

| 1,000 | 5.250%, 08/01/2029 |

994,120 | ||||||

| Corona-Norco Unified School District, Election of 2006 (Convertible CAB) |

||||||||

| 500 | 0.000% through 08/01/2017, thereafter 6.800%, 08/01/2039 g |

332,310 | ||||||

| Corona-Norco Unified School District, Election of 2006, Series B (AGC) |

||||||||

| 500 | 5.375%, 02/01/2034 |

494,455 | ||||||

| Cupertino Unified School District, Election of 2001, Series D |

||||||||

| 1,705 | 0.000%, 08/01/2030 |

479,361 | ||||||

| Desert Sands Unified School District, Election of 2001 |

||||||||

| 350 | 5.250%, 08/01/2023 |

365,613 | ||||||

| Grossmont Union High School District, Election of 2008, Series A |

||||||||

| 950 | 5.500%, 08/01/2031 |

973,104 | ||||||

| Hemet Unified School District, Election of 2006, Series B (AGC) |

||||||||

| 600 | 5.000%, 08/01/2030 |

599,238 | ||||||

| Jefferson Union High School District, San Mateo County, Series A (NATL) |

||||||||

| 300 | 6.250%, 02/01/2014 |

328,821 | ||||||

| 460 | 6.250%, 08/01/2020 |

519,078 | ||||||

| Long Beach Unified School District, Election of 2008, Series A |

||||||||

| 500 | 5.500%, 08/01/2029 |

515,610 | ||||||

| Los Angeles Community College District, Election of 2008, Series C |

||||||||

| 3,000 | 5.250%, 08/01/2039 |

2,956,290 | ||||||

| Los Angeles Unified School District, Series D |

||||||||

| 100 | 5.000%, 01/01/2034 |

95,410 | ||||||

| Los Angeles Unified School District, Election of 2002 Series B (AMBAC) |

||||||||

| 240 | 4.500%, 07/01/2025 |

227,453 | ||||||

| Lucia Mar Unified School District (FGIC) (NATL) |

||||||||

| 100 | 5.250%, 08/01/2022 |

107,612 | ||||||

| Oakland, Series A (NATL) |

||||||||

| 435 | 5.000%, 01/15/2026 |

435,361 | ||||||

| 16 | Nuveen Investments |

| Principal Amount (000) |

Description p | Value | ||||||

| General Obligations (continued) |

||||||||

| Pittsburg Unified School District, Election of 2006, Series B (AGM) |

||||||||

| $ | 1,155 | 5.500%, 08/01/2034 |

$ | 1,181,057 | ||||

| Pomona Unified School District, Series A (NATL) |

||||||||

| 855 | 5.950%, 02/01/2017 |

952,162 | ||||||

| Poway Unified School District, Election of 2008, District 2007-1-A |

||||||||

| 5,000 | 0.000%, 08/01/2029 |

1,458,450 | ||||||

| Puerto Rico Commonwealth, Series B (AGM) |

||||||||

| 1,000 | 6.500%, 07/01/2015 |

1,120,710 | ||||||

| Puerto Rico Commonwealth, Government Development, Series B |

||||||||

| 50 | 5.000%, 12/01/2014 |

52,946 | ||||||

| San Bernardino Community College District, Election of 2002, Series A |

||||||||

| 1,265 | 6.500%, 08/01/2027 |

1,416,370 | ||||||

| San Diego Unified School District, Election of 2008, Series A (Convertible CAB) |

||||||||

| 2,000 | 0.000% through 07/01/2019, thereafter 6.000%, 07/01/2033 g |

1,143,160 | ||||||

| Santa Ana Union School District, Election of 2008, Series A |

||||||||

| 1,000 | 5.250%, 08/01/2028 |

1,000,570 | ||||||

| Santa Barbara Community College District, Election of 2008, Series A |

||||||||

| 1,000 | 5.250%, 08/01/2027 |

1,037,270 | ||||||

| Tulare Local Health Care District, Election 2005, Series B |

||||||||

| 500 | 6.375%, 08/01/2025 |

540,280 | ||||||

| 1,005 | 6.500%, 08/01/2026 |

1,083,500 | ||||||

| Victor Valley Community College District, Election of 2008, Series A (AGC) |

||||||||

| 1,530 | 5.000%, 08/01/2031 |

1,476,787 | ||||||

| Victor Valley Joint Union High School District, Election of 2008, Series A (AGC) (Convertible CAB) |

||||||||

| 2,000 | 0.000% through 08/01/2019, thereafter 5.750%, 08/01/2031 g |

1,116,660 | ||||||

| West Contra Costa Unified School District, Election of 2005, Series B |

||||||||

| 1,100 | 6.000%, 08/01/2024 |

1,178,386 | ||||||

| West Covina Unified School District, Series A (NATL) |

||||||||

| 770 | 5.350%, 02/01/2020 |

818,633 | ||||||

| Whittier Unified High School District |

||||||||

| 1,000 | 0.000%, 08/01/2034 |

197,750 | ||||||

| 36,070 | Total General Obligations |

28,301,360 | ||||||

| Health Care – 19.5% |

||||||||

| Association of Bay Area Governments Financial Authority, Children’s Hospital & Research, Series A |

||||||||

| 425 | 4.500%, 12/01/2019 |

426,696 | ||||||

| 350 | 4.750%, 12/01/2022 |

345,695 | ||||||

| California Health Facilities Financing Authority, Adventist Health System West, Series C |

||||||||

| 500 | 5.250%, 03/01/2021 |

512,140 | ||||||

| California Health Facilities Financing Authority, Casa Colina |

||||||||

| 350 | 5.500%, 04/01/2013 |

358,085 | ||||||

| California Health Facilities Financing Authority, Catholic Healthcare West, Series G |

||||||||

| 1,000 | 5.500%, 07/01/2025 |

1,004,710 | ||||||

| California Health Facilities Financing Authority, Marshall Medical Center, Series A (CMI) |

||||||||

| 1,760 | 4.750%, 11/01/2019 |

1,763,467 | ||||||

| California Health Facilities Financing Authority, Scripps Health, Series A |

||||||||

| 200 | 5.000%, 10/01/2022 |

203,722 | ||||||

| California Health Facilities Financing Authority, Stanford Hospital, Series A |

||||||||

| 1,000 | 5.000%, 11/15/2025 |

1,001,680 | ||||||

| California Health Facilities Financing Authority, Sutter Health, Series A |

||||||||

| 250 | 5.000%, 08/15/2038 |

212,102 | ||||||

| California Health Facilities Financing Authority, Sutter Health, Series B |

||||||||

| 1,000 | 6.000%, 08/15/2042 |

990,200 | ||||||

| Nuveen Investments | 17 |

Portfolio of Investments

Nuveen California Tax Free Fund (continued)

February 28, 2011

| Principal Amount (000) |

Description p | Value | ||||||

| Health Care (continued) |

||||||||

| California Statewide Communities Development Authority, Adventist Health, Series A |

||||||||

| $ | 300 | 5.000%, 03/01/2030 |

$ | 272,577 | ||||

| California Statewide Communities Development Authority, Catholic Healthcare West, Series C |

||||||||

| 1,000 | 5.625%, 07/01/2035 |

958,400 | ||||||

| California Statewide Communities Development Authority, Daughters of Charity Health, Series A |

||||||||

| 100 | 5.250%, 07/01/2030 |

86,144 | ||||||

| California Statewide Communities Development Authority, Daughters of Charity Health, Series G |

||||||||

| 400 | 5.250%, 07/01/2013 |

414,312 | ||||||

| California Statewide Communities Development Authority, Elder Care Alliance, Series A (ETM) |

||||||||

| 140 | 7.250%, 11/15/2011 |

146,755 | ||||||

| California Statewide Communities Development Authority, Enloe Medical Center, Series A (CMI) |

||||||||

| 125 | 5.250%, 08/15/2019 |

129,858 | ||||||

| 500 | 5.500%, 08/15/2023 |

503,910 | ||||||

| California Statewide Communities Development Authority, Henry Mayo Newhall Memorial Hospital Series A (CMI) |

||||||||

| 500 | 5.000%, 10/01/2020 |

499,975 | ||||||

| 400 | 5.000%, 10/01/2027 |

359,476 | ||||||

| California Statewide Communities Development Authority, Henry Mayo Newhall Memorial Hospital Series B (AMBAC) (CMI) |

||||||||

| 500 | 5.200%, 10/01/2037 |

431,165 | ||||||

| California Statewide Communities Development Authority, Jewish Home (CMI) |

||||||||

| 560 | 4.500%, 11/15/2019 |

549,679 | ||||||

| 500 | 5.000%, 11/15/2037 |

418,140 | ||||||

| California Statewide Communities Development Authority, Redlands Community Hospital, Series A (RAAI) |

||||||||

| 500 | 5.000%, 04/01/2015 |

518,395 | ||||||

| California Statewide Communities Development Authority, St. Joseph, Series B (FGIC) |

||||||||

| 1,100 | 5.500%, 07/01/2027 |

1,071,015 | ||||||

| California Statewide Communities Development Authority, St. Joseph, Series C (FGIC) |

||||||||

| 500 | 5.500%, 07/01/2027 |

486,825 | ||||||

| Loma Linda University Medical Center, Series A |

||||||||

| 1,000 | 5.000%, 12/01/2015 |

974,750 | ||||||

| 1,000 | 8.250%, 12/01/2038 |

1,075,120 | ||||||

| Northern Inyo County Hospital District |

||||||||

| 500 | 6.375%, 12/01/2025 |

487,590 | ||||||

| Sierra View Health Care District |

||||||||

| 1,000 | 5.250%, 07/01/2024 |

959,170 | ||||||

| 1,000 | 5.300%, 07/01/2026 |

933,680 | ||||||

| Turlock Health Facilities Revenue, Emanuel Medical Center |

||||||||

| 1,000 | 5.000%, 10/15/2024 |

869,910 | ||||||

| 19,460 | Total Health Care |

18,965,343 | ||||||

| Housing – 1.2% |

||||||||

| California Statewide Communities Development Authority, UCI East Campus |

||||||||

| 410 | 5.500%, 05/15/2026 |

392,448 | ||||||

| Ventura County Area Housing Authority, Mira Vista Senior Apartments Series A (AMBAC) (AMT) |

||||||||

| 1,000 | 5.150%, 12/01/2031 |

756,210 | ||||||

| 1,410 | Total Housing |

1,148,658 | ||||||

| Lease Revenue – 12.2% |

||||||||

| Apple Valley Public Financing Authority, Town Hall Annex Project Series A (AMBAC) |

||||||||

| 485 | 4.500%, 09/01/2017 |

519,716 | ||||||

| 500 | 5.000%, 09/01/2027 |

500,270 | ||||||

| California Public Works Board, California Community Colleges, Series A |

||||||||

| 200 | 4.875%, 12/01/2018 |

200,938 | ||||||

| California Public Works Board, California Community Colleges, Series B |

||||||||

| 1,035 | 5.500%, 06/01/2019 |

1,081,627 | ||||||

| 18 | Nuveen Investments |

| Principal Amount (000) |

Description p | Value | ||||||

| Lease Revenue (continued) |

||||||||

| California Public Works Board, California State University, Series B-1 |

||||||||

| $ | 500 | 5.400%, 03/01/2026 |

$ | 493,425 | ||||

| California Public Works Board, California State University, Series J |

||||||||

| 695 | 5.500%, 11/01/2026 |

692,776 | ||||||

| California Public Works Board, Department of Corrections & Rehabilitation, Series F (FGIC) (NATL) |

||||||||

| 1,500 | 5.000%, 11/01/2016 |

1,605,495 | ||||||

| California Public Works Board, Department of Mental Health Coalinga, Series A |

||||||||

| 540 | 5.500%, 06/01/2016 |

566,752 | ||||||

| California Public Works Board, Regents University of California, Series E |

||||||||

| 1,250 | 5.000%, 04/01/2034 |

1,157,988 | ||||||

| California Public Works Board, Various Capital Projects, Series G-1 |

||||||||

| 1,500 | 5.750%, 10/01/2030 |

1,477,395 | ||||||

| Golden State Tobacco Securitization Corporation, California Tobacco Settlement, Series A (AGM) |

||||||||

| 1,650 | 4.550%, 06/01/2022 |

1,520,904 | ||||||

| Los Angeles Community Redevelopment Agency, Manchester Social Services Project (AMBAC) |

||||||||

| 1,200 | 5.000%, 09/01/2016 |

1,260,156 | ||||||

| Lynwood Public Financing Authority, Lease Revenue, Civic Center Improvement Project, Series A |

||||||||

| 500 | 5.375%, 09/01/2030 |

441,320 | ||||||

| 150 | 5.500%, 09/01/2040 |

123,676 | ||||||

| Yuba Levee Financing Authority Project, Series A (AGC) |

||||||||

| 250 | 5.000%, 09/01/2038 |

229,730 | ||||||

| 11,955 | Total Lease Revenue |

11,872,168 | ||||||

| Miscellaneous – 2.8% |

||||||||

| Golden West Schools Financing Authority, Series A (NATL) |

||||||||

| 440 | 0.000%, 02/01/2012 |

430,553 | ||||||

| 670 | 5.700%, 02/01/2013 |

720,612 | ||||||

| 770 | 5.750%, 02/01/2014 |

847,886 | ||||||

| 320 | 5.800%, 08/01/2022 |

364,234 | ||||||

| 345 | 5.800%, 08/01/2023 |

390,236 | ||||||

| 2,545 | Total Miscellaneous |

2,753,521 | ||||||

| Recreational Facility Authority – 0.1% |

||||||||

| California Infrastructure & Economic Development, Performing Arts Center |

||||||||

| 100 | 4.000%, 12/01/2015 |

103,600 | ||||||

| Tax Revenue – 8.4% |

||||||||

| Antioch Area Public Facilities Financing Agency, Special Tax, Community Facilities District #1989-1 (AMBAC) |

||||||||

| 1,000 | 4.000%, 08/01/2018 |

949,410 | ||||||

| Los Angeles County Community Facilities District #3, Special Tax, Improvement Area B, Series A (AMBAC) |

||||||||

| 715 | 5.250%, 09/01/2018 |

708,880 | ||||||

| Murrieta Community Facilities, Special Tax, District #2, The Oaks Improvement Area, Series A |

||||||||

| 350 | 5.750%, 09/01/2020 |

345,968 | ||||||

| Norco, Special Tax, Community Facilities District #97-1 (AGC) |

||||||||

| 300 | 4.875%, 10/01/2030 |

267,426 | ||||||

| Palm Desert Financing Authority, Tax Allocation, Project Area #4, Series A (NATL) |

||||||||

| 1,000 | 5.000%, 10/01/2029 |

863,640 | ||||||

| Poway Unified School District, Special Tax, Community Facilities District #6 4S Ranch |

||||||||

| 650 | 5.000%, 09/01/2023 |

607,100 | ||||||

| Puerto Rico Sales Tax Financing Corporation, Series C |

||||||||

| 1,000 | 5.250%, 08/01/2041 |

900,780 | ||||||

| Rancho Cucamonga Redevelopment Agency, Tax Allocation, Series A (NATL) |

||||||||

| 310 | 4.125%, 09/01/2018 |

299,649 | ||||||

| 500 | 5.000%, 09/01/2034 |

399,080 | ||||||

| San Bernardino Redevelopment Agency, Tax Allocation, San Sevaine Redevelopment Project, Series A (RAAI) |

||||||||

| 850 | 5.000%, 09/01/2016 |

845,554 | ||||||

| Nuveen Investments | 19 |

Portfolio of Investments

Nuveen California Tax Free Fund (continued)

February 28, 2011

| Principal Amount (000) |

Description p | Value | ||||||

| Tax Revenue (continued) |

||||||||

| San Francisco City & County Redevelopment Financing Authority, Tax Allocation, Mission Bay North Redevelopment Project, Series B (RAAI) |

||||||||

| $ | 325 | 4.100%, 08/01/2014 |

$ | 327,889 | ||||

| 250 | 4.250%, 08/01/2016 |

249,285 | ||||||

| 380 | 4.375%, 08/01/2018 |

369,584 | ||||||

| Sand City Redevelopment Agency, Tax Allocation, Series A (AGC) |

||||||||

| 315 | 4.000%, 11/01/2019 |

292,421 | ||||||

| Soledad Redevelopment Agency, Tax Allocation, Series A (SGI) |

||||||||

| 205 | 4.500%, 12/01/2016 |

211,236 | ||||||

| South Tahoe Redevelopment Agency, Special Tax, Community Facilities District #2001-1 |

||||||||

| 120 | 4.400%, 10/01/2015 |

121,019 | ||||||

| 125 | 4.500%, 10/01/2016 |

124,873 | ||||||

| 280 | 4.600%, 10/01/2018 |

269,287 | ||||||

| 8,675 | Total Tax Revenue |

8,153,081 | ||||||

| Transportation – 1.0% |

||||||||

| Alameda Corridor Transportation Authority (AMBC) |

||||||||

| 1,000 | 0.000%, 10/01/2014 |

841,590 | ||||||

| Puerto Rico Commonwealth, Highway & Transportation Authority, Series X (IBC) (NATL) |

||||||||

| 100 | 5.500%, 07/01/2015 |

106,168 | ||||||

| 1,100 | Total Transportation |

947,758 | ||||||

| Utilities – 6.4% |

||||||||

| Banning Utility Authority, Water Enterprise, Refunding and Improvement Projects, (FGIC) (NATL) |

||||||||

| 1,025 | 5.000%, 11/01/2020 |

1,069,905 | ||||||

| 1,040 | 5.000%, 11/01/2023 |

1,058,949 | ||||||

| California Pollution Control Financing Authority, Solid Waste Disposal, Waste Management Incorporated Project, Series A-2 (AMT) (GTY) |

||||||||

| 500 | 5.400%, 04/01/2025 |

500,195 | ||||||

| California Pollution Control Financing Authority, Solid Waste Disposal, Waste Management Incorporated Project, Series B (AMT) (GTY) |

||||||||

| 500 | 5.000%, 07/01/2027 |

473,030 | ||||||

| Compton Sewer (IBC) (NATL) |

||||||||

| 1,150 | 5.375%, 09/01/2023 |

1,150,138 | ||||||

| Imperial, Wastewater Treatment Facility (FGIC) (NATL) |

||||||||

| 1,000 | 5.000%, 10/15/2020 |

1,007,700 | ||||||

| Norco, Financing Authority, Enterprise Revenue (AGM) |

||||||||

| 1,000 | 5.625%, 10/01/2034 |

1,004,330 | ||||||

| 6,215 | Total Utilities |

6,264,247 | ||||||

| $ | 105,395 | Total Municipal Bonds (cost $97,692,948) |

95,949,204 | |||||

| Shares | Description p | Value | ||||||

| Short-Term Investments – 1.2% |

||||||||

| Money Market Fund – 1.2% |

||||||||

| 1,128,903 | First American Tax Free Obligations Fund, 0.000% W |

$ | 1,128,903 | |||||

| Total Short-Term Investment (cost $1,128,903) |

1,128,903 | |||||||

| Total Investments (cost $98,821,851) – 99.7% |

97,078,107 | |||||||

| Other Assets Less Liabilities – 0.3% |

315,404 | |||||||

| Net Assets – 100.0% |

$ | 97,393,511 | ||||||

| 20 | Nuveen Investments |

| p | All percentages shown in the Portfolio of Investments are based on net assets. |

| g | Convertible Capital Appreciation Bonds (Convertible CABs) – These bonds initially pay no interest but accrete in value from the date of issuance through the conversion date, at which time the bonds start to accrue and pay interest on a semiannual basis until final maturity. |

| W | The rate shown is the annualized seven-day effective yield as of February 28, 2011. |

| (ETM) | Escrowed to maturity. |

| Nuveen Investments | 21 |

Statement of Assets and Liabilities

February 28, 2011 (all dollars and shares are rounded to thousands (000), except for per share data)

| Assets |

||||

| Investments, at value (cost $98,822) |

$ | 97,078 | ||

| Receivables: |

||||

| Interest |

1,193 | |||

| From Adviser |

2 | |||

| Shares sold |

32 | |||

| Other assets |

7 | |||

| Total assets |

98,312 | |||

| Liabilities |

||||

| Payables: |

||||

| Dividends |

307 | |||

| Shares redeemed |

514 | |||

| Accrued expenses: |

||||

| 12b-1 distribution and service fees |

5 | |||

| Other |

91 | |||

| Total liabilities |

918 | |||

| Net assets |

$ | 97,394 | ||

| Class A Shares |

||||

| Net assets |

$ | 16,453 | ||

| Shares outstanding |

1,570 | |||

| Net asset value per share |

$ | 10.48 | ||

| Offering price per share (net asset value per share plus |

$ | 10.95 | ||

| Class C1 Shares |

||||

| Net assets |

$ | 5,762 | ||

| Shares outstanding |

549 | |||

| Net asset value and offering price per share |

$ | 10.50 | ||

| Class I Shares |

||||

| Net assets |

$ | 75,179 | ||

| Shares outstanding |

7,175 | |||

| Net asset value and offering price per share |

$ | 10.48 | ||

| Net Assets Consist of: |

||||

| Capital paid-in |

$ | 98,995 | ||

| Undistributed (Over-distribution of) net investment income |

44 | |||

| Accumulated net realized gain (loss) |

99 | |||

| Net unrealized appreciation (depreciation) |

(1,744 | ) | ||

| Net assets |

$ | 97,394 | ||

| Authorized shares |

$ | 2 billion | ||

| Par value per share |

$ | 0.0001 |

See accompanying notes to financial statements.

| 22 | Nuveen Investments |

Statement of Operations (all dollars are rounded to thousands (000))

| Eight Months Ended 2/28/11 |

Year Ended 6/30/10 |

|||||||

| Dividend and Interest Income |

$ | 3,449 | $ | 5,002 | ||||

| Expenses |

||||||||

| Management fees |

371 | 499 | ||||||

| 12b-1 service fees – Class A |

28 | 42 | ||||||

| 12b-1 distribution and service fees – Class C1 |

25 | 26 | ||||||

| Administration fees |

129 | 231 | ||||||

| Shareholders’ servicing agent fees and expenses |

44 | 80 | ||||||

| Custodian’s fees and expenses |

4 | 5 | ||||||

| Directors’ fees and expenses |

17 | 31 | ||||||

| Professional fees |

26 | 51 | ||||||

| Shareholders’ reports – printing and mailing expenses |

63 | 7 | ||||||

| Federal and state registration fees |

5 | 7 | ||||||

| Other expenses |

10 | 20 | ||||||

| Total expenses before expense reimbursement |

722 | 999 | ||||||

| Expense reimbursement |

(334) | (449) | ||||||

| Net expenses |

388 | 550 | ||||||

| Net investment income |

$ | 3,061 | $ | 4,452 | ||||

| Realized and Unrealized Gain (Loss) |

||||||||

| Net realized gain (loss) from investments |

130 | 499 | ||||||

| Change in net unrealized appreciation (depreciation) of investments |

(3,828) | 5,413 | ||||||

| Net realized and unrealized gain (loss) |

(3,698) | 5,912 | ||||||

| Net increase (decrease) in net assets from operations |

$ | (637) | $ | 10,364 | ||||

See accompanying notes to financial statements.

| Nuveen Investments | 23 |

Statement of Changes in Net Assets (all dollars are rounded to thousands (000))

| Eight Months Ended 2/28/11 |

Year Ended 6/30/10 |

Year Ended 6/30/09 |

||||||||||

| Operations |

||||||||||||

| Net investment income |

$ | 3,061 | $ | 4,452 | $ | 3,079 | ||||||

| Net realized gain (loss) from investments |

130 | 499 | 82 | |||||||||

| Change in net unrealized appreciation (depreciation) of investments |

(3,828 | ) | 5,413 | (3,078 | ) | |||||||

| Net increase (decrease) in net assets from operations |

(637 | ) | 10,364 | 83 | ||||||||

| Distributions to Shareholders |

||||||||||||

| From net investment income: |

||||||||||||

| Class A |

(505 | ) | (722 | ) | (622 | ) | ||||||

| Class C1 |

(143 | ) | (153 | ) | (115 | ) | ||||||

| Class I |

(2,396 | ) | (3,542 | ) | (2,343 | ) | ||||||

| From accumulated net realized gains: |

||||||||||||

| Class A |

(38 | ) | (44 | ) | — | |||||||

| Class C1 |

(12 | ) | (11 | ) | — | |||||||

| Class I |

(166 | ) | (211 | ) | — | |||||||

| Decrease in net assets from distributions to shareholders |

(3,260 | ) | (4,683 | ) | (3,080 | ) | ||||||

| Fund Share Transactions |

||||||||||||

| Proceeds from Fund merger |

— | — | 59,132 | |||||||||

| Proceeds from sale of shares |

17,541 | 20,363 | 18,191 | |||||||||

| Proceeds from shares issued to shareholders due to reinvestment of distributions |

532 | 674 | 544 | |||||||||

| 18,073 | 21,037 | 77,867 | ||||||||||

| Cost of shares redeemed |

(20,380 | ) | (21,217 | ) | (21,814 | ) | ||||||

| Net increase (decrease) in net assets from Fund share transactions |

(2,307 | ) | (180 | ) | 56,053 | |||||||

| Net increase (decrease) in net assets |

(6,204 | ) | 5,501 | 53,056 | ||||||||

| Net assets at the beginning of period |

103,598 | 98,097 | 45,041 | |||||||||

| Net assets at the end of period |

$ | 97,394 | $ | 103,598 | $ | 98,097 | ||||||

| Undistributed (Over-distribution of) net investment income at the end of period |

$ | 44 | $ | 28 | $ | (7 | ) | |||||

See accompanying notes to financial statements.

| 24 | Nuveen Investments |

Financial Highlights

| Nuveen Investments | 25 |

| Selected data for a share outstanding throughout each period: | ||||||||||||||||||||||||||||||||

| Class (Commencement Date) | ||||||||||||||||||||||||||||||||

| Investment Operations | Less Distributions | |||||||||||||||||||||||||||||||

| Beginning Net Asset Value |

Net Invest- ment Income(a) |

Net (Loss) |

Total | Net Invest- ment Income |

Capital Gains(b) |

Total | Ending Net Asset Value |

|||||||||||||||||||||||||

| Class A (2/00) |

|

|||||||||||||||||||||||||||||||

| Year Ended 2/28: |

|

|||||||||||||||||||||||||||||||

| 2011(e) |

$ | 10.88 | $ | .31 | $ | (.38 | ) | $ | (.07 | ) | $ | (.31 | ) | $ | (.02 | ) | $ | (.33 | ) | $ | 10.48 | |||||||||||

| Year Ended 6/30: |

|

|||||||||||||||||||||||||||||||

| 2010 |

10.27 | .47 | .63 | 1.10 | (.46 | ) | (.03 | ) | (.49 | ) | 10.88 | |||||||||||||||||||||

| 2009 |

10.71 | .46 | (.44 | ) | .02 | (.46 | ) | — | (.46 | ) | 10.27 | |||||||||||||||||||||

| 2008 |

10.98 | .46 | (.23 | ) | .23 | (.46 | ) | (.04 | ) | (.50 | ) | 10.71 | ||||||||||||||||||||

| 2007 |

10.96 | .45 | .06 | .51 | (.45 | ) | (.04 | ) | (.49 | ) | 10.98 | |||||||||||||||||||||

| 2006(f) |

11.24 | .33 | (.26 | ) | .07 | (.33 | ) | (.02 | ) | (.35 | ) | 10.96 | ||||||||||||||||||||

| Class C1 (2/00)(g) |

|

|||||||||||||||||||||||||||||||

| Year Ended 2/28: |

|

|||||||||||||||||||||||||||||||

| 2011(e) |

10.89 | .28 | (.38 | ) | (.10 | ) | (.27 | ) | (.02 | ) | (.29 | ) | 10.50 | |||||||||||||||||||

| Year Ended 6/30: |

|

|||||||||||||||||||||||||||||||

| 2010 |

10.28 | .41 | .64 | 1.05 | (.41 | ) | (.03 | ) | (.44 | ) | 10.89 | |||||||||||||||||||||

| 2009 |

10.72 | .41 | (.44 | ) | (.03 | ) | (.41 | ) | — | (.41 | ) | 10.28 | ||||||||||||||||||||

| 2008 |

10.99 | .40 | (.22 | ) | .18 | (.41 | ) | (.04 | ) | (.45 | ) | 10.72 | ||||||||||||||||||||

| 2007 |

10.97 | .41 | .05 | .46 | (.40 | ) | (.04 | ) | (.44 | ) | 10.99 | |||||||||||||||||||||

| 2006(f) |

11.25 | .30 | (.26 | ) | .04 | (.30 | ) | (.02 | ) | (.32 | ) | 10.97 | ||||||||||||||||||||

| Class I (2/00)(g) |

|

|||||||||||||||||||||||||||||||

| Year Ended 2/28: |

|

|||||||||||||||||||||||||||||||

| 2011(e) |

10.88 | .32 | (.38 | ) | (.06 | ) | (.32 | ) | (.02 | ) | (.34 | ) | 10.48 | |||||||||||||||||||

| Year Ended 6/30: |

|

|||||||||||||||||||||||||||||||

| 2010 |

10.27 | .48 | .64 | 1.12 | (.48 | ) | (.03 | ) | (.51 | ) | 10.88 | |||||||||||||||||||||

| 2009 |

10.71 | .48 | (.45 | ) | .03 | (.47 | ) | — | (.47 | ) | 10.27 | |||||||||||||||||||||

| 2008 |

10.98 | .48 | (.23 | ) | .25 | (.48 | ) | (.04 | ) | (.52 | ) | 10.71 | ||||||||||||||||||||

| 2007 |

10.97 | .47 | .05 | .52 | (.47 | ) | (.04 | ) | (.51 | ) | 10.98 | |||||||||||||||||||||

| 2006(f) |

11.25 | .35 | (.26 | ) | .09 | (.35 | ) | (.02 | ) | (.37 | ) | 10.97 | ||||||||||||||||||||

| 26 | Nuveen Investments |

| Ratios/Supplemental Data | ||||||||||||||||||||||||||

| Ratios to Average Net Assets Before Reimbursement |

Ratios to Average Net Assets After Reimbursement(d) |

|||||||||||||||||||||||||

| Total Return(c) |

Ending Net Assets (000) |

Expenses | Net Invest- ment Income |

Expenses | Net Invest- ment Income |

Portfolio Turnover Rate |

||||||||||||||||||||

| (.68 | )% | $ | 16,453 | 1.20 | %* | 3.76 | %* | .65 | %* | 4.31 | %* | 8 | % | |||||||||||||

| 10.89 | 17,315 | 1.18 | 3.83 | .65 | 4.36 | 16 | ||||||||||||||||||||

| .29 | 16,417 | 1.28 | 3.88 | .65 | 4.51 | 27 | ||||||||||||||||||||

| 2.11 | 12,076 | 1.46 | 3.40 | .67 | 4.19 | 45 | ||||||||||||||||||||

| 4.62 | 11,375 | 1.46 | 3.29 | .75 | 4.00 | 36 | ||||||||||||||||||||

| .63 | 10,783 | 1.34 | * | 3.40 | * | .75 | * | 3.99 | * | 24 | ||||||||||||||||

| (.91 | ) | 5,762 | 1.62 | * | 3.36 | * | 1.15 | * | 3.83 | * | 8 | |||||||||||||||

| 10.33 | 4,674 | 1.58 | 3.43 | 1.15 | 3.86 | 16 | ||||||||||||||||||||

| (.21 | ) | 4,064 | 1.68 | 3.48 | 1.15 | 4.01 | 27 | |||||||||||||||||||

| 1.61 | 2,480 | 1.85 | 2.98 | 1.15 | 3.68 | 45 | ||||||||||||||||||||

| 4.17 | 1,507 | 1.98 | 2.77 | 1.15 | 3.60 | 36 | ||||||||||||||||||||

| .33 | 3,592 | 2.09 | * | 2.66 | * | 1.15 | * | 3.60 | * | 24 | ||||||||||||||||

| (.57 | ) | 75,179 | .96 | * | 4.00 | * | .50 | * | 4.46 | * | 8 | |||||||||||||||

| 11.06 | 81,609 | .93 | 4.08 | .50 | 4.51 | 16 | ||||||||||||||||||||

| .44 | 77,616 | 1.03 | 4.09 | .50 | 4.62 | 27 | ||||||||||||||||||||

| 2.28 | 30,485 | 1.20 | 3.66 | .50 | 4.36 | 45 | ||||||||||||||||||||

| 4.78 | 24,835 | 1.21 | 3.54 | .50 | 4.25 | 36 | ||||||||||||||||||||

| .82 | 21,767 | 1.09 | * | 3.65 | * | .50 | * | 4.24 | * | 24 | ||||||||||||||||

| * | Annualized. |

| (a) | Per share Net Investment Income is calculated using the average daily shares method. |

| (b) | Distributions from Capital Gains include short-term capital gains, if any. |

| (c) | Total return is the combination of changes in net asset value without any sales charge, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total returns are not annualized. |

| (d) | After expense reimbursement from the Adviser, where applicable. Ratios do not reflect the effect of custodian fee credits earned on the Fund’s net cash on deposit with the custodian bank, where applicable. |

| (e) | For the period July 1, 2010 to February 28, 2011. |

| (f) | For the period October 1, 2005 to June 30, 2006. |

| (g) | Effective January 18, 2011, Class C Shares were renamed Class C1 Shares and Class Y Shares were renamed Class I Shares. |

See accompanying notes to financial statements.

| Nuveen Investments | 27 |

Notes to Financial Statements (all dollars and shares are rounded to thousands (000))

1. General Information and Significant Accounting Policies

General Information

On July 28, 2010, U.S. Bancorp, the indirect parent company of FAF Advisors, Inc. (“FAF Advisors”), entered into an agreement to sell a portion of FAF Advisors’ asset management business to Nuveen Investments, Inc. (“Nuveen”). Included in the sale was the part of FAF Advisors’ asset management business that advises the fund included in this report. The sale closed on December 31, 2010.

In connection with the transaction, the fund’s Board of Directors was asked to consider and approve new investment advisory agreements for the fund with Nuveen Asset Management, a wholly-owned subsidiary of Nuveen. The new investment advisory agreements for the fund was submitted to the fund’s shareholders for approval and took effect on January 1, 2011. The fund’s Board of Directors also approved new distribution agreements with Nuveen Investments, LLC. There was no change in the fund’s investment objectives or policies as a result of the transaction. The transition did result in a change to the fund’s name effective January 1, 2011.

Effective January 1, 2011, the fund’s adviser, Nuveen Asset Management, changed its name to Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors” or the “Adviser”). Concurrently, the Adviser formed a wholly-owned subsidiary, Nuveen Asset Management, LLC (the “Sub-Adviser”), to house its portfolio management capabilities and to serve as the fund’s sub-adviser pursuant to a sub-advisory agreement that had been approved by shareholders. The fund’s portfolio manager has become an employee of the Sub-Adviser. The Adviser will compensate the Sub-Adviser for the portfolio management services it provides to the fund from the fund’s management fee.

First American Investment Funds, Inc., known as Nuveen Investment Funds, Inc. effective April 4, 2011 (the “Trust” or “FAIF”), is an open-end investment company registered under the Investment Company Act of 1940, as amended. The Trust is comprised the Nuveen California Tax Free Fund (the “Fund”), formerly known as First American California Tax Free Fund, among others. After the close of business on January 16, 2009, the Fund acquired all the net assets of the First American California Intermediate Tax Free Fund (“California Intermediate Tax Free”). California Intermediate Tax Free’s net assets of $59,132 at that date included $86 of net unrealized appreciation which was combined with that of the Fund. The combined net assets of the Fund after the merger were $97,848. For accounting and performance reporting purposes, the Fund is the survivor.

The investment objective of the Fund is to provide maximum current income that is exempt from both federal income tax and California state income tax to the extent consistent with prudent investment risk.

Under normal market conditions, as a fundamental policy, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in municipal securities that pay interest that is exempt from federal and California income tax, including the federal and state alternative minimum tax. The Fund normally may invest up to 20% of its net assets in taxable obligations, including obligations the interest on which is subject to the federal and state alternative minimum tax. The Fund may invest up to 20% of its total assets in securities that, at the time of purchase, are rated lower than investment grade or are unrated and of comparable quality (securities commonly referred to as “high-yield” securities or “junk bonds”). The Fund’s most recent prospectus provides further descriptions of the Fund’s investment objective, principal investment strategies, and principal risks.

During the current fiscal period, the Fund’s Board of Directors approved a change in the Fund’s fiscal and tax year end from June 30 to February 28/29.

Effective January 18, 2011, Class C Shares were renamed Class C1 Shares and Class Y Shares were renamed Class I Shares.

Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Investment Valuation

Security valuations for the Fund’s investments are furnished by an independent pricing service that has been approved by the Fund’s Board of Directors. These securities are generally classified as Level 2. Debt obligations exceeding 60 days to maturity are valued by an independent pricing service. The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings, and general market conditions. Securities for which prices are not available from an independent pricing service, but where an active market exists, are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. These securities are generally classified as Level 2 or Level 3 depending on the priority of significant inputs. Investment grade debt obligations with 60 days or less remaining until maturity will be valued at their amortized cost, which approximates fair value. These securities are generally classified as Level 2. Investments in open-end funds are valued at their respective net asset values on the valuation date. These investment vehicles are generally classified as Level 1. The following investment vehicles, when held by a Fund, are priced as follows: Exchange listed futures and options on futures are priced at their last sale price on the exchange on which they are principally traded, as determined by the Adviser, on the day the valuation is made. These investment vehicles are generally classified as Level 1. If there were no sales on that day, futures and options on futures will be valued at the last reported bid price. Options on securities, indices, and currencies traded on NASDAQ National Market (“NASDAQ”) or listed on a domestic stock exchange are valued at the last sale

| 28 | Nuveen Investments |

price on NASDAQ or on any exchange on the day the valuation is made. If there were no sales on that day, the options will be valued at the last sale price on the previous valuation date. Last sale prices are obtained from an independent pricing service. Forward contracts, swaps, and over-the-counter options on securities and indices are valued at the quotations received from an independent pricing service, if available. These investment vehicles are generally classified as Level 2.

When market quotations are not readily available, securities are internally valued at fair value as determined in good faith by procedures established and approved by the Fund’s Board of Directors. Some of the factors which may be considered in determining fair value are fundamental analytical data relating to the investment; the nature and duration of any restrictions on disposition; trading in similar securities of the same issuer or comparable companies; information from broker-dealers; and an evaluation of the forces that influence the market in which the securities are purchased and sold. If events occur that materially affect the value of securities between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, the securities will be valued at fair value. The use of fair value pricing by a Fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without fair value pricing. These securities are generally classified as Level 2 or Level 3 depending on the priority of significant inputs.

Refer to Footnote 2 – Fair Value Measurements for further details on the leveling of securities held by the Fund as of the end of the reporting period.

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from transactions are determined on the specific identification method, which is the same basis used for federal income tax purposes. Investments purchased on a when-issued/delayed delivery basis may have extended settlement periods. Any investments so purchased are subject to market fluctuation during this period. The Fund has instructed the custodian to segregate assets with a current value at least equal to the amount of the when-issued/delayed delivery purchase commitments. At February 28, 2011, the Fund had no such outstanding purchase commitments.

Investment Income

Interest income, which reflects the amortization of premiums and includes accretion of discounts for financial reporting purposes, is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date. Investment income also reflects paydown gains and losses, if any.

Income Taxes