UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2014

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-10879

![]()

AMPHENOL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Delaware (State of Incorporation) |

|

22-2785165 (I.R.S. Employer Identification No.) |

358 Hall Avenue, Wallingford, Connecticut 06492

203-265-8900

Securities registered pursuant to Section 12(b) of the Act:

|

Class A Common Stock, $.001 par value |

|

New York Stock Exchange, Inc. |

|

(Title of each class) |

|

(Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large accelerated filer x |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Act). Yes o No x

The aggregate market value of Amphenol Corporation Class A Common Stock, $.001 par value, held by non-affiliates was approximately $13,355 million based on the reported last sale price of such stock on the New York Stock Exchange on June 30, 2014.

As of January 31, 2015, the total number of shares outstanding of Registrant’s Class A Common Stock was 310,195,600

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement, which is expected to be filed within 120 days following the end of the fiscal year covered by this report, are incorporated by reference into Part III hereof.

|

INDEX |

|

Page | ||

|

|

| |||

|

| ||||

|

|

2 | |||

|

|

|

2 | ||

|

|

|

3 | ||

|

|

|

4 | ||

|

|

|

6 | ||

|

|

|

6 | ||

|

|

|

7 | ||

|

|

|

7 | ||

|

|

|

8 | ||

|

|

|

8 | ||

|

|

|

8 | ||

|

|

|

8 | ||

|

|

|

8 | ||

|

|

|

8 | ||

|

|

|

Cautionary Information for Purposes of Forward Looking Statements |

8 | |

|

|

9 | |||

|

|

12 | |||

|

|

12 | |||

|

|

12 | |||

|

|

13 | |||

|

|

|

| ||

|

|

13 | |||

|

|

15 | |||

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 | ||

|

|

25 | |||

|

|

27 | |||

|

|

|

27 | ||

|

|

|

28 | ||

|

|

|

29 | ||

|

|

|

30 | ||

|

|

|

31 | ||

|

|

|

32 | ||

|

|

|

33 | ||

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

52 | ||

|

|

52 | |||

|

|

53 | |||

|

|

|

| ||

|

|

53 | |||

|

|

53 | |||

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

53 | ||

|

|

Certain Relationships and Related Transactions, and Director Independence |

53 | ||

|

|

53 | |||

|

|

|

| ||

|

|

54 | |||

|

|

|

Signature of the Registrant |

56 | |

|

|

|

Signatures of the Directors |

56 | |

Amphenol Corporation (together with its subsidiaries, “Amphenol” or the “Company”) is one of the world’s largest designers, manufacturers and marketers of electrical, electronic and fiber optic connectors, interconnect systems, antennas, sensors and sensor- based products and coaxial and high-speed specialty cable. The Company estimates, based on reports of industry analysts, that the worldwide sales of interconnect and sensor-related products were approximately $133 billion in 2014.

The Company was incorporated in 1987. Certain predecessor businesses, which now constitute part of the Company, have been in business since 1932.

The Company’s strategy is to provide its customers with comprehensive design capabilities, a broad selection of products and a high level of service on a world-wide basis while maintaining continuing programs of productivity improvement and cost control. The Company operates through two reporting segments: Interconnect Products and Assemblies and Cable Products and Solutions. The Interconnect Product and Assemblies segment primarily designs, manufacturers and markets a broad range of connector and connector systems, value-add products and other products, including antennas and sensors, used in a broad range of applications in a diverse set of end markets. Interconnect products include connectors, which when attached to an electrical, electronic or fiber optic cable, a printed circuit board or other device, facilitate transmission of power or signal. Value-add systems generally consist of a system of cable, flexible circuits or printed circuit boards and connectors for linking electronic equipment. The Cable Products and Solutions segment primarily designs, manufacturers and markets cable, value-added products and components for use primarily in the broadband communications and information technology markets as well as certain applications in other markets.

The table below provides a summary of our reporting segments, the 2014 net sales contribution of each segment, the primary industry and end markets that we service and our key products:

|

Reporting Segment |

|

Interconnect Products and Assemblies |

|

Cable Products and Solutions |

|

|

|

|

|

|

|

% of 2014 Net Sales: |

|

93% |

|

7% |

|

|

|

|

|

|

|

Primary End Markets |

|

· Automotive · Broadband Communications · Commercial Aerospace · Industrial · Information Technology and Data Communications · Military · Mobile Devices · Mobile Networks |

|

· Automotive · Broadband Communications · Industrial · Information Technology and Data Communications · Mobile Networks

|

|

|

|

|

|

|

|

Key Products |

|

Connector and Connector Systems: · fiber optic interconnect products · harsh environment interconnect products · high speed interconnect products · power interconnect products, bus bars and distribution systems · radio frequency interconnect products and antennas · other connectors

Value-Add Products: · backplane interconnect systems · cable assemblies and harnesses · cable management products

Other: · antennas · flexible and rigid printed circuit boards · hinges · installation accessories · molded parts · sensors and sensor-based products |

|

Cable: · coaxial cable · power cable · specialty cable

Value-Add Products: · cable assemblies

Components: · combiner/splitter products · connector and connector systems · fiber optic components

|

|

|

|

· switches · touch panels and lenses |

|

|

Information regarding our operations by reporting segment and the Company’s long-lived assets appears in Note 11 of the Notes to the Consolidated Financial Statements.

The Company’s overall strategy is to provide its customers with comprehensive design capabilities, a broad selection of products and a high level of service on a worldwide basis while maintaining continuing programs of productivity improvement and cost control. Specifically, our business strategy is as follows:

· Pursue broad diversification - The Company constantly drives to increase its diversity of markets, customers, applications and products. Due to the tremendous variety of opportunities in the electronics industry, management believes that it is very important to ensure participation wherever significant growth opportunities are available. This diversification positions us to proliferate our technologies across the broadest array of opportunities and reduces our exposure to any particular market, thereby reducing the variability of our financial performance. An overview of the Company’s market and product participation is described under “Markets”.

· Develop performance-enhancing interconnect solutions - The Company seeks to expand the scope and number of its preferred supplier relationships. The Company works closely with its customers at the design stage to create and manufacture innovative solutions. These products generally have higher value-added content than other interconnect products and have been developed across the Company’s markets. The Company is focused on technology leadership in the interconnect areas of radio frequency, power, harsh environment, high-speed and fiber optics, as well as sensors, as it views these technology areas to be of particular importance to our global customer base.

· Expand global presence - The Company intends to further expand its global manufacturing, engineering, sales and service operations to better serve its existing customer base, penetrate developing markets and establish new customer relationships. As the Company’s global customers expand their international operations to access developing world markets and lower manufacturing costs in certain regions, the Company is continuing to expand its international footprint in order to provide just-in-time capabilities to these customers. The majority of the Company’s international operations have broad capabilities including new product development. The Company is also able to take advantage of the lower manufacturing costs in some regions, and has established low-cost manufacturing and assembly facilities in the three major geographical markets of the Americas, Europe/Africa and Asia.

· Control costs - The Company recognizes the importance in today’s global marketplace of maintaining a competitive cost structure. Innovation, product quality and comprehensive customer service are not mutually exclusive with controlling costs. Controlling costs is part of a mindset. It is having the discipline to invest in programs that have a good return, maintaining a cost structure as flexible as possible to respond to changes in the marketplace, dealing with suppliers and vendors in a fair but prudent way to ensure a reasonable cost for materials and services and creating a mindset of managers to manage the Company’s assets as if they were their own.

· Pursue strategic acquisitions and investments - The Company believes that the fragmented interconnect industry continues to provide significant opportunities for strategic acquisitions. Accordingly, we continue to pursue acquisitions of high growth potential companies with strong management teams that complement our existing business while further expanding our product lines, technological capabilities and geographic presence. Furthermore, we seek to enhance the performance of acquired companies by leveraging Amphenol’s business strategy and access to low-cost manufacturing around the world. In 2014, the Company invested $518 million in two separate acquisitions in the automotive and industrial markets, which broadened and enhanced the Company’s customer base and product offerings in these markets.

· Foster collaborative, entrepreneurial management - Amphenol’s management system is designed to provide clear income statement and balance sheet responsibility in a flat organizational structure. Each general manager is incented to grow and develop his or her business and to think entrepreneurially in providing innovative, timely and cost-effective solutions to customer needs. In addition, Amphenol’s general managers have access to the resources of the larger organization and are encouraged to work collaboratively with other general managers to meet the needs of the expanding marketplace and to achieve common goals.

The Company sells products to customers in a diversified set of end markets.

Automotive - Amphenol is a leading supplier of advanced interconnect systems and sensors for a growing array of automotive applications. In addition, Amphenol has developed advanced technology solutions for hybrid-electric vehicles and is working with the leading global customers to proliferate these advanced interconnect products into next-generation automobiles. Sales into the automotive market represented approximately 15% of the Company’s net sales in 2014 with sales into the following primary end applications:

· engine management and control

· exhaust monitoring and cleaning

· hybrid-electric vehicles

· infotainment and communications

· lighting

· safety and security systems

· telematics systems

Broadband Communications - Amphenol is a world leader in broadband communication products for the cable, satellite and telco video and data networks, with industry-leading engineering, design and manufacturing expertise. The Company offers a wide range of products to service the broadband market, from customer premises cables and interconnect devices to distribution cable and fiber optic components, as well as interconnect products integrated into headend equipment. Sales into the broadband communications market represented approximately 7% of the Company’s net sales in 2014 with sales into the following primary end applications:

· cable modems

· cable, satellite and telco networks

· high-speed internet hardware

· network switching equipment

· satellite interface devices

· set top boxes

Commercial Aerospace - Amphenol is a leading provider of high-performance interconnect systems and components to the rapidly expanding commercial aerospace market. In addition to connector and assembly products, the Company also provides high technology cable management products. All of Amphenol’s products are specifically designed to operate in the harsh environments of commercial aerospace while also providing substantial weight reduction, simplified installation and minimal maintenance procedures. Sales into the commercial aerospace market represented approximately 6% of the Company’s net sales in 2014 with sales into the following primary end applications:

· aircraft and airframe power distribution

· avionics

· controls and instrumentation

· engines

· in-flight entertainment

· lighting and control systems

· wire bundling and cable management

Industrial - Amphenol is a technology leader in the design, manufacture and supply of high-performance interconnect systems and sensors for a broad range of industrial applications. Amphenol’s core competencies include application-specific industrial interconnect solutions utilizing integrated assemblies, including with both cable and flexible printed circuits, as well as high-power interconnects requiring advanced engineering and system integration. In particular, our innovative solutions facilitate the increasing demands of embedded computing and power distribution. Sales into the

industrial market represented approximately 17% of the Company’s net sales in 2014 with sales into the following primary end applications:

· alternative and traditional energy generation

· factory and machine tool automation

· geophysical

· heavy equipment

· instrumentation

· LED lighting

· marine

· medical equipment

· rail mass transit

Information Technology and Data Communications - Amphenol is a global provider of interconnect solutions to designers and manufacturers of internet-enabling systems. With our industry-leading high speed, power and fiber optic technologies, together with superior simulation and testing capability and cost effectiveness, Amphenol leads the way in interconnect development for the information technology (“IT”) and datacom market. Whether industry standard or application-specific designs are required, Amphenol provides customers with products that enable performance at the leading edge of next-generation, high-speed technology. Sales into the IT and datacom market represented approximately 16% of the Company’s net sales in 2014 with sales into the following primary end applications:

· data centers

· internet appliances

· optical and copper networking equipment

· servers

· storage systems

Military - Amphenol is a world leader in the design, manufacture and supply of high-performance interconnect systems and antennas for harsh environment military applications. Such products require superior performance and reliability under conditions of stress and in hostile environments such as rapid and severe temperature changes, vibration, pressure, humidity and nuclear radiation. Amphenol provides an unparalleled product breadth, from military specification connectors to customized high-speed board level interconnects; from flexible to rigid printed circuit boards; from backplane systems to completely integrated assemblies. Amphenol is a technology leader, participating in all major programs from the earliest inception across each phase of the production cycle. Sales into the military market represented approximately 11% of the Company’s net sales in 2014 with sales into the following primary end applications:

· avionics

· communications

· engines

· ground vehicles and tanks

· naval

· ordnance and missile systems

· radar systems

· rotorcraft

· satellite and space programs

· unmanned aerial vehicles

Mobile Devices - Amphenol designs and manufactures an extensive range of interconnect products, antennas and electromechanical components found in a wide array of mobile computing devices. Amphenol’s capability for high-volume production of these technically demanding, miniaturized products, combined with our speed of new product introduction, are critical drivers of the Company’s long-term success in this market. Sales into the mobile devices market represented approximately 17% of the Company’s net sales in 2014 with sales into the following primary end applications:

· mobile and smart phones, including wearable devices and other accessories

· mobile computing devices, including laptops, tablets, ultrabooks and e-readers

Mobile Networks - Amphenol is a leading global interconnect solutions provider to the mobile networks market. The Company offers a wide product portfolio. The Company’s products are used in virtually every wireless communications standard, including 3G, 3.5G, 4G, LTE, TD-LTE and other future IP-based solutions. In addition, the Company works with service providers around the world to offer an array of antennas and installation-related site solution interconnect products. Sales into the mobile

networks market represented approximately 11% of the Company’s net sales in 2014 with sales into the following primary end applications:

· cellular base stations

· cell site antenna systems

· combiners, filters and amplifiers

· core network controllers

· mobile switches

· radio links

· wireless routers

The Company manufactures and sells a broad portfolio of products on a global basis to customers in various industries. Our customers include many of the leaders in their respective industries, and our relationships with them typically date back many years. We believe that this diversified customer base provides us an opportunity to leverage our skills and experience across markets and reduces our exposure to particular end markets. Additionally, we believe that the diversity of our customer base is an important strength of the Company.

There has been a trend on the part of original equipment manufacturer (“OEM”) customers to consolidate their lists of qualified suppliers to companies that have a broad portfolio of leading technology solutions, design capability, global presence, and the ability to meet quality and delivery standards while maintaining competitive prices. The Company has positioned its global resources to compete effectively in this environment. As an industry leader, the Company has established close working relationships with many of its customers on a global basis. These relationships allow the Company to better anticipate and respond to these customer needs when designing new products and new technical solutions. By working with customers in developing new products and technologies, the Company is able to identify and act on trends and leverage knowledge about next-generation technology across our products. In addition, the Company has concentrated its efforts on service, procurement and manufacturing improvements focused on increasing product quality and lowering product lead-time and cost. For a discussion of risks related to the Company’s foreign operations, see the risk factor titled “The Company is subject to the risks of political, economic and military instability in countries outside the United States” in Part I, Item 1A herein.

The Company’s products are sold to thousands of OEMs in approximately 70 countries throughout the world. The Company also sells certain products to electronic manufacturing services (“EMS”) companies, to original design manufacturers (“ODMs”) and to communication network operators. No single customer accounted for more than 10% of the Company’s net sales for the years ended December 31, 2014, 2013 or 2012.

The Company sells its products through its own global sales force, independent representatives and a global network of electronics distributors. The Company’s sales to distributors represented approximately 13% of the Company’s net sales in 2014. In addition to product design teams and customer collaboration arrangements, the Company uses key account managers to manage customer relationships on a global basis such that it can bring to bear its total resources to meet the worldwide needs of its multinational customers.

The Company is a global manufacturer employing advanced manufacturing processes including molding, stamping, plating, turning, extruding, die casting and assembly operations as well as proprietary process technology for specialty and coaxial cable production as well as sensor fabrication. Outsourcing of certain manufacturing processes is used when cost-effective. Substantially all of the Company’s manufacturing facilities are certified to the ISO9000 series of quality standards, and many of the Company’s manufacturing facilities are certified to other quality standards, including QS9000, ISO14000, TS16949 and TS16469.

The Company’s manufacturing facilities are generally vertically integrated operations from the initial design stage through final design and manufacturing. The Company has an established manufacturing presence in over 30 countries. Our global coverage positions us near many of our customers’ locations and allows us to assist them in consolidating their supply base and lowering their production costs. In addition, the Company generally relies on local general management in every region, which we believe creates a strong degree of organizational stability and deeper understanding of local markets. We believe our balanced geographic distribution lowers our exposure to any particular geography. The Company designs, manufactures and assembles its products at facilities in the Americas, Europe, Asia, Australia and Africa. The Company believes that its global presence is an important competitive advantage, as it allows the Company to provide quality products on a timely and worldwide basis to its multinational customers.

The Company employs a global manufacturing strategy to lower its production and logistics costs and to improve service to customers. The Company’s strategy is to maintain strong cost controls in its manufacturing and assembly operations. The Company is continually evaluating and adjusting its expense levels and workforce to reflect current business conditions and maximize the return on capital investments. The Company sources its products on a worldwide basis. To better serve certain high volume customers, the Company has established just-in-time facilities near these major customers. The Company’s international manufacturing and assembly facilities generally serve the respective local markets and coordinate product design and manufacturing responsibility with the Company’s other operations around the world. The Company has lower cost manufacturing and assembly facilities in China, Macedonia, Malaysia, Mexico, India, Indonesia, Eastern Europe and North Africa to serve regional and world markets. For a discussion of risks attendant to the Company’s foreign operations, see the risk factor titled “The Company is subject to the risks of political, economic and military instability in countries outside the United States” in Part I, Item 1A herein.

Net sales by geographic region as a percentage of our total net sales were as follows:

|

|

|

For the Years Ended |

| ||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|

United States |

|

31 |

% |

31 |

% |

32 |

% |

|

China |

|

27 |

% |

27 |

% |

25 |

% |

|

Other international locations |

|

42 |

% |

42 |

% |

43 |

% |

|

Total |

|

100 |

% |

100 |

% |

100 |

% |

Net sales by geographic area are based on the customer location to which the product is shipped.

The Company generally implements its product development strategy through product design teams and collaboration arrangements with customers, which result in the Company obtaining approved vendor status for its customers’ new products and programs. The Company focuses its research and development efforts primarily on those product areas that it believes have the potential for broad market applications and significant sales within a one to three year period. The Company seeks to have its products become widely accepted within the industry for similar applications and products manufactured by other potential customers, which the Company believes will provide additional sources of future revenue. By developing application specific products, the Company has decreased its exposure to standard products, which generally experience greater pricing pressure.

Our research, development, and engineering efforts are supported by approximately 1,700 people and are performed primarily by individual operating units focused on specific markets and technologies. The Company’s research and development expense for the creation of new and improved products and processes was $114.8 million, $103.4 million and $92.5 million for 2014, 2013 and 2012, respectively.

Patents and other proprietary rights are important to our business. We also rely upon trade secrets, manufacturing know-how, continuing technological innovations, and licensing opportunities to maintain and improve our competitive position. We review third-party proprietary rights, including patents and patent applications, as available, in an effort to develop an effective intellectual property strategy, avoid infringement of third-party proprietary rights, identify licensing opportunities, and monitor the intellectual property claims of others.

We own a large portfolio of patents that principally relate to electrical, optical, electronic, antenna and sensor products. We also own a portfolio of trademarks and are a licensee of various patents and trademarks. Patents for individual products extend for varying periods according to the date of patent filing or grant and the legal term of patents in the various countries where patent protection is obtained. Trademark rights may potentially extend for longer periods of time and are dependent upon national laws and use of the trademarks.

While we consider our patents and trademarks to be valued assets, we do not believe that our competitive position or our operations are dependent upon or would be materially impacted by the loss of any single patent or group of related patents.

The Company purchases a wide variety of raw materials for the manufacture of its products, including precious metals such as gold and silver used in plating, aluminum, steel, copper, titanium and metal alloy products used for cable, contacts and connector shells, certain rare earth metals used in sensors and plastic materials used for cable and connector bodies and inserts. Such raw materials are generally available throughout the world and are purchased locally from a variety of suppliers. The Company is generally not dependent upon any one source for raw materials, or if one source is used the Company attempts to protect itself through long-term supply agreements. Information regarding our purchasing obligations related to commitments to purchase certain goods and services is disclosed in Note 13 of the Notes to the Consolidated Financial Statements.

The Company encounters competition in substantially all areas of its business. The Company competes primarily on the basis of technology innovation, product quality, price, customer service and delivery time. Competitors within the Interconnect Products and Assemblies segment include TE Connectivity, Molex, Yazaki, Foxconn, Sensata, FCI, JST, Delphi, Hirose and JAE, among others. The primary competitors within the Cable Products and Solutions segment are Commscope and Belden, among others. In addition, the Company competes with a large number of smaller companies who compete in specific geographies, markets or products.

The Company estimates that its backlog of unfilled orders as of December 31, 2014 was approximately $1,043 million compared with backlog of approximately $1,032 million as of December 31, 2013. Orders typically fluctuate from quarter to quarter based on customer demand and general business conditions. Unfilled orders may generally be cancelled prior to shipment of goods. It is expected that all or a substantial portion of the backlog will be filled within the next 12 months. Significant elements of the Company’s business, such as sales to the communications related markets (including wireless communications, information technology and data communications) and broadband communications and sales to distributors, generally have short lead times. Therefore, backlog may not be indicative of future demand.

As of December 31, 2014, the Company had approximately 50,700 employees worldwide, of which approximately 40,600 were located in lower cost regions. Of these employees, approximately 42,200 were hourly employees and the remainder were salaried employees. The Company believes that it has a good relationship with its unionized and non-unionized employees.

Certain operations of the Company are subject to environmental laws and regulations which govern the discharge of pollutants into the air and water, as well as the handling and disposal of solid and hazardous wastes. The Company believes that its operations are currently in substantial compliance with applicable environmental laws and regulations and that the costs of continuing compliance will not have a material effect on the Company’s financial condition, results of operations or cash flows.

The Company’s annual report on Form 10-K and all of the Company’s other filings with the Securities and Exchange Commission (“SEC”) are available to view, without charge, on the Company’s web site, www.amphenol.com, as soon as reasonably practicable after they are filed electronically with the SEC. Copies are also available without charge, from Amphenol Corporation, Investor Relations, 358 Hall Avenue, Wallingford, CT 06492.

Cautionary Information for Purposes of Forward Looking Statements

Statements made by the Company in written or oral form to various persons, including statements made in this annual report on Form 10-K and other filings with the SEC, that are not strictly historical facts are “forward looking” statements. Such statements should be considered as subject to uncertainties that exist in the Company’s operations and business environment. Certain of the risk factors, assumptions or uncertainties that could cause the Company to fail to conform with expectations and predictions are described below under the caption “Risk Factors” in Part I, Item IA and elsewhere in this annual report on Form 10-K. Should one or more of these risks or uncertainties occur, or should the Company’s assumptions

prove incorrect, actual results may vary materially from those described in this annual report on Form 10-K as anticipated, believed, estimated or expected. We do not intend to update these forward looking statements.

Investors should carefully consider the risks described below and all other information in this annual report on Form 10-K. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties not presently known to the Company or that it currently deems immaterial may also impair the Company’s business and operations.

If actions taken by management to limit, monitor or control financial enterprise risk exposures are not successful, the Company’s business and consolidated financial statements could be materially adversely affected. In such case, the trading price of the Company’s common stock could decline and investors may lose all or part of their investment.

The Company is dependent on the communications industry, including information technology and data communications, wireless communications and broadband communications.

Approximately 51% of the Company’s 2014 net sales came from sales to the communications industry, including information technology and data communication, wireless communications and broadband communications, with 17% of the Company’s 2014 net sales coming from sales to the mobile device market. Demand for these products is subject to rapid technological change (see below—“The Company is dependent on the acceptance of new product introductions for continued revenue growth”). These markets are dominated by several large manufacturers and operators who regularly exert significant price pressure on their suppliers, including the Company. There can be no assurance that the Company will be able to continue to compete successfully in the communications industry, and the Company’s failure to do so could have an adverse effect on the Company’s financial condition and results of operations.

Approximately 7% and 11% of the Company’s 2014 net sales came from sales to the broadband communications and mobile networks markets, respectively. Demand for the Company’s products in these markets depends primarily on capital spending by operators for constructing, rebuilding or upgrading their systems. The amount of this capital spending and, therefore, the Company’s sales and profitability will be affected by a variety of factors, including general economic conditions, consolidation within the communications industry, the financial condition of operators and their access to financing, competition, technological developments, new legislation and regulation of operators. There can be no assurance that existing levels of capital spending will continue or that spending will not decrease.

Changes in defense expenditures may reduce the Company’s sales.

Approximately 11% of the Company’s 2014 net sales came from sales to the military market. The Company participates in a broad spectrum of defense programs and believes that no one program accounted for more than 1% of its 2014 net sales. The substantial majority of these sales are related to both U.S. and foreign military and defense programs. The Company’s sales are generally to contractors and subcontractors of the U.S. or foreign governments or to distributors that in turn sell to the contractors and subcontractors. Accordingly, the Company’s sales are affected by changes in the defense budgets of the U.S. and foreign governments. A significant decline in U.S. defense expenditures and foreign government defense expenditures could adversely affect the Company’s business and have an adverse effect on the Company’s financial condition and results of operations.

The Company encounters competition in substantially all areas of its business.

The Company competes primarily on the basis of technology innovation, product quality, price, customer service and delivery time. Competitors include large, diversified companies, some of which have substantially greater assets and financial resources than the Company, as well as medium to small companies. There can be no assurance that additional competitors will not enter the Company’s existing markets, nor can there be any assurance that the Company will be able to compete successfully against existing or new competition, and the inability to do so could have an adverse effect on the Company’s business, financial condition and results of operations.

The Company is dependent on the acceptance of new product introductions for continued revenue growth.

The Company estimates that products introduced in the last two years accounted for approximately 20% of 2014 net sales. The Company’s long-term results of operations depend substantially upon its ability to continue to conceive, design, source and market new products and upon continuing market acceptance of its existing and future product lines. In the

ordinary course of business, the Company continually develops or creates new product line concepts. If the Company fails to or is significantly delayed in introducing new product line concepts or if the Company’s new products are not met with market acceptance, its business, financial condition and results of operations may be adversely affected.

Covenants in the Company’s credit agreements may adversely affect the Company.

The Credit Agreement, dated as of July 31, 2013, among the Company, certain subsidiaries of the Company and a syndicate of financial institutions (the “Revolving Credit Facility”), contains financial and other covenants, such as a limit on the ratio of debt to earnings before interest, taxes, depreciation and amortization, a limit on priority indebtedness and limits on incurrence of liens. Although the Company believes none of these covenants is presently restrictive to the Company’s operations, the ability to meet the financial covenants can be affected by events beyond the Company’s control, and the Company cannot provide assurance that it will meet those tests. A breach of any of these covenants could result in a default under the Revolving Credit Facility. Upon the occurrence of an event of default under any of the Company’s credit facilities, the lenders could elect to declare amounts outstanding thereunder to be immediately due and payable and terminate all commitments to extend further credit. If the lenders accelerate the repayment of borrowings, the Company may not have sufficient assets to repay the Revolving Credit Facility and other indebtedness.

Downgrades of the Company’s credit rating could adversely affect the Company’s results of operations and financial condition.

If the credit rating agencies that rate the Company’s debt were to downgrade the Company’s credit rating in conjunction with a deterioration of the Company’s performance, it may increase the Company’s cost of capital and make it more difficult for the Company to obtain new financing, which could adversely affect the Company’s business.

Inability to access capital markets may adversely affect the Company’s business.

The Company’s ability to invest in its business and make strategic acquisitions requires access to the capital markets. If general economic and capital market conditions deteriorate significantly, it could impact the Company’s ability to access the capital markets. While the Company has not encountered any financing difficulties, the capital and credit markets have experienced significant volatility in recent years. Market conditions could make it more difficult to access capital to finance investments and acquisitions. As such, this could adversely affect the results of operations, financial condition and cash flows.

The Company’s results may be negatively affected by changing interest rates.

The Company is subject to interest rate volatility with regard to existing and future issuances of debt. The Company monitors the mix of fixed-rate and variable-rate debt, as well as the mix of short-term debt versus long-term debt. As of December 31, 2014, $676.3 million, or 25% of the Company’s outstanding borrowings were subject to floating interest rates, primarily due to changes in LIBOR. In 2014, the Company issued $750.0 million principal amount of unsecured 2.55% senior notes due January 2019, $375.0 million principal amount of unsecured 1.55% senior notes due September 2017 and $375.0 million principal amount of unsecured 3.125% senior notes due September 2021. The Company used all of the net proceeds of these offerings to repay the outstanding $600.0 million 4.75% senior notes that were due in November 2014 and to repay amounts outstanding under its Revolving Credit Facility and Credit Agreement, which reduced the Company’s interest expense.

As of December 31, 2014, the Company had the following unsecured Senior Notes outstanding:

|

Principal |

|

Fixed |

|

Maturity |

|

Issue Price as a |

| |

|

$ |

375.0 |

|

1.55 |

% |

September 2017 |

|

99.898 |

% |

|

750.0 |

|

2.55 |

|

January 2019 |

|

99.846 |

| |

|

375.0 |

|

3.125 |

|

September 2021 |

|

99.912 |

| |

|

500.0 |

|

4.00 |

|

February 2022 |

|

99.746 |

| |

A 10% change in LIBOR at December 31, 2014 would have no material effect on the Company’s interest expense. The Company does not expect changes in interest rates to have a material effect on income or cash flows in 2015, although there can be no assurances that interest rates will not change significantly.

The Company’s results may be negatively affected by foreign currency exchange rates.

The Company conducts business in many international currencies through its worldwide operations, and as a result is subject to foreign exchange exposure due to changes in exchange rates of the various currencies. Changes in exchange rates can positively or negatively affect the Company’s sales, gross margins and equity. The Company attempts to minimize currency exposure risk in a number of ways including producing its products in the same country or region in which the products are sold, thereby generating revenues and incurring expenses in the same currency, cost reduction and pricing actions, and working capital management. However, there can be no assurance that these actions will be fully effective in managing currency risk, especially in the event of a significant and sudden decline in the value of any of the international currencies of the Company’s worldwide operations, which could have an adverse effect on the Company’s results of operations and financial condition.

The Company is subject to the risks of political, economic and military instability in countries outside the United States.

Non-U.S. markets account for a substantial portion of the Company’s business. During 2014, non-U.S. markets constituted approximately 69% of the Company’s net sales, with China constituting approximately 27% of the Company’s net sales. The Company employs approximately 90% of its workforce outside the United States. The Company’s customers are located throughout the world and it has many manufacturing, administrative and sales facilities outside the United States. Because the Company has extensive non-U.S. operations as well as significant cash and cash investments held at institutions located outside of the U.S., it is exposed to risks that could negatively affect sales, profitability or the liquidity of such cash and cash investments including:

· tariffs, trade barriers and trade disputes;

· regulations related to customs and import/export matters;

· longer payment cycles;

· tax issues, such as tax law changes, examinations by taxing authorities, variations in tax laws from country to country as compared to the U.S. and difficulties in repatriating cash generated or held abroad in a tax-efficient manner;

· challenges in collecting accounts receivable;

· employment regulations and local labor conditions;

· difficulties protecting intellectual property;

· instability in economic or political conditions, including inflation, recession and actual or anticipated military or political conflicts; and

· the impact of each of the foregoing on outsourcing and procurement arrangements.

The Company may experience difficulties and unanticipated expense of assimilating newly acquired businesses, including the potential for the impairment of goodwill.

The Company has completed a number of acquisitions in the past few years and anticipates that it will continue to pursue acquisition opportunities as part of its growth strategy. The Company may experience difficulty and unanticipated expense in integrating such acquisitions and the acquisitions may not perform as expected. At December 31, 2014, the total assets of the Company were $7,027.0 million, which included $2,616.7 million of goodwill (the excess of fair value of consideration paid over the fair value of net identifiable assets of businesses acquired). The Company performs annual evaluations for the potential impairment of the carrying value of goodwill. Such evaluations have not resulted in the need to recognize an impairment. However, if the financial performance of the Company’s businesses were to decline significantly, the Company could incur a material non-cash charge to its income statement for the impairment of goodwill.

The Company may experience difficulties in obtaining a consistent supply of materials at stable pricing levels, which could adversely affect its results of operations.

The Company uses basic materials like aluminum, steel, copper, titanium, metal alloys, gold, silver, certain rare earth metals and plastic resins, in its manufacturing processes. Volatility in the prices of such materials and availability of supply may have a substantial impact on the price the Company pays for such materials. In addition, to the extent such cost increases cannot be recovered through sales price increases or productivity improvements, the Company’s margin may decline.

The Company may not be able to attract and retain key employees.

The Company’s continued success depends upon its continued ability to hire and retain key employees at its operations around the world. Any difficulties in obtaining or retaining the management and other human resource competencies that the Company needs to achieve its business objectives may have an adverse effect on the Company’s performance.

Changes in general economic conditions and other factors beyond the Company’s control may adversely impact its business.

The following factors could adversely impact the Company’s business:

· A global economic slowdown in any of the Company’s market segments;

· The effects of significant changes in monetary and fiscal policies in the U.S. and abroad including significant income tax changes, currency fluctuations and unforeseen inflationary pressures;

· Rapid material escalation of the cost of regulatory compliance and litigation;

· Unexpected government policies and regulations affecting the Company or its significant customers;

· Unforeseen intergovernmental conflicts or actions, including but not limited to armed conflict, trade wars, and acts of terrorism or war;

· Unforeseen interruptions to the Company’s business with its largest customers, distributors and suppliers resulting from but not limited to, strikes, financial instabilities, computer malfunctions, inventory excesses, natural disasters, or other disasters such as fires or explosions;

· Increases in employment costs, particularly in low-cost regions in which the Company currently operates;

· Changes in assumptions, such as discount rates and lower than expected investment performance related to the Company’s benefit plans; and

· Failures of our management information or other systems due to cyber-attacks, computer viruses and other security breaches despite the Company’s implementation of information technology security measures.

Item 1B. Unresolved Staff Comments

None.

The Company’s fixed assets include plants and warehouses and a substantial quantity of machinery and equipment, most of which is general purpose machinery and equipment using tools and fixtures and in many instances having automatic control features and special adaptations. The Company’s plants, warehouses, machinery and equipment are in good operating condition, are well maintained and substantially all of its facilities are in regular use. The Company considers the present level of fixed assets along with planned capital expenditures as suitable and adequate for operations in the current business environment. At December 31, 2014, the Company operated a total of 330 plants, warehouses and offices of which (a) the locations in the U.S. had approximately 3.2 million square feet, of which 1.7 million square feet were leased; (b) the locations outside the U.S. had approximately 10.3 million square feet, of which 7.4 million square feet were leased; and (c) the square footage by segment was approximately 12.6 million square feet and 0.9 million square feet for the Interconnect Products and Assemblies segment and the Cable Products and Solutions segment, respectively.

The Company believes that its facilities are suitable and adequate for the business conducted therein and are being appropriately utilized for their intended purposes. Utilization of the facilities varies based on demand for the products. The Company continuously reviews its anticipated requirements for facilities and, based on that review, may from time to time acquire or lease additional facilities and/or dispose of existing facilities.

The Company and its subsidiaries have been named as defendants in several legal actions in which various amounts are claimed arising from normal business activities. Although the amount of any ultimate liability with respect to such matters cannot be precisely determined, in the opinion of management, such matters are not expected to have a material adverse effect on the Company’s financial condition or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company effected the initial public offering of its Class A Common Stock in November 1991. The Company’s common stock has been listed on the New York Stock Exchange since that time under the symbol “APH.” The following table sets forth on a per share basis the high and low sales prices for the common stock for both 2014 and 2013 as reported on the New York Stock Exchange. The Company effected a two-for-one stock split in the form of a stock dividend, payable to stockholders of record as of October 2, 2014, which was paid on October 9, 2014. The per share information reflected below has been retroactively restated to reflect the effect of the stock split for all periods presented.

|

|

|

2014 |

|

2013 |

| ||||||||

|

|

|

High |

|

Low |

|

High |

|

Low |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

First Quarter |

|

$ |

46.85 |

|

$ |

42.30 |

|

$ |

37.33 |

|

$ |

33.35 |

|

|

Second Quarter |

|

49.38 |

|

45.78 |

|

41.65 |

|

35.75 |

| ||||

|

Third Quarter |

|

52.92 |

|

47.47 |

|

42.69 |

|

37.06 |

| ||||

|

Fourth Quarter |

|

55.50 |

|

45.73 |

|

44.59 |

|

37.42 |

| ||||

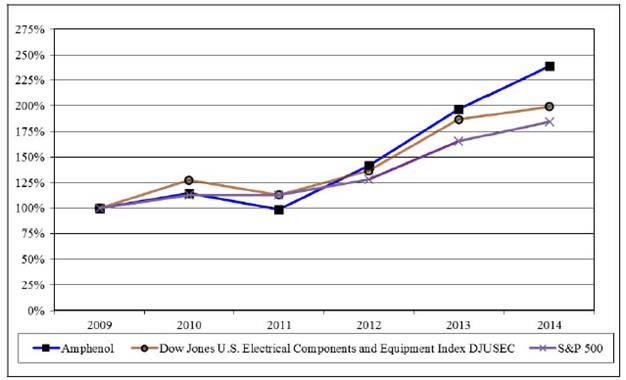

The below graph compares the performance of Amphenol over a period of five years ending December 31, 2014 with the performance of the Standard & Poor’s 500 Stock Index and the Dow Jones U.S. Electrical Components and Equipment (“DJUSEC”) Index.

Total Daily Compounded Return indices reflect reinvested dividends and are weighted on a market capitalization basis at the time of each reported data point. The comparisons in the graph below are based upon historical data and are not indicative of, nor intended to forecast future performance.

As of January 31, 2015, there were 36 holders of record of the Company’s common stock. A significant number of outstanding shares of common stock are registered in the name of only one holder, which is a nominee of The Depository Trust Company, a securities depository for banks and brokerage firms. The Company believes that there are a significant number of beneficial owners of its common stock.

Contingent upon declaration by the Board of Directors, the Company generally pays a quarterly dividend on its common stock. In July 2013, the Board of Directors approved an increase in the quarterly dividend rate from $0.0525 to $0.10 per share effective with the third quarter 2013 dividend and in July 2014 approved a further increase in the quarterly dividend rate from $0.10 to $0.125 per share effective with the third quarter 2014 dividend. Total dividends declared during 2014, 2013 and 2012 were $140.6 million, $96.8 million and $67.7 million, respectively. Total dividends paid in 2014, 2013 and 2012 were $101.9 million, $96.8 million and $70.1 million, respectively, including those declared in the prior year and paid in the current year. The Company intends to retain the remainder of its earnings not used for dividend payments to provide funds for the operation and expansion of the Company’s business (including acquisition-related activity), to repurchase shares of its common stock and to repay outstanding indebtedness.

The Company’s Revolving Credit Facility contains financial covenants and restrictions, some of which may limit the Company’s ability to pay dividends, and any future indebtedness that the Company may incur could limit its ability to pay dividends.

The following table summarizes the Company’s equity compensation plan information as of December 31, 2014.

|

|

|

Equity Compensation Plan Information |

| |||||

|

Plan category |

|

Number of securities to |

|

Weighted average |

|

Number of securities |

| |

|

|

|

|

|

|

|

|

| |

|

Equity compensation plans approved by security holders |

|

27,806,260 |

|

$ |

31.61 |

|

25,290,502 |

|

|

Equity compensation plans not approved by security holders |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

| |

|

Total |

|

27,806,260 |

|

$ |

31.61 |

|

25,290,502 |

|

Repurchase of Equity Securities

In January 2013, the Company’s Board of Directors authorized a stock repurchase program under which the Company could repurchase up to 20 million shares of its common stock during the two year period ending January 31, 2015 (the “2013 Stock Repurchase Program”). During the year ended December 31, 2014, the Company repurchased 11.4 million shares of its common stock for $539.4 million. These treasury shares have been retired by the Company and common stock and retained earnings were reduced accordingly. At December 31, 2014, the Company had repurchased all shares authorized under the 2013 Stock Repurchase Program. The table below reflects the Company’s stock repurchases for the year ended December 31, 2014:

|

Period |

|

Total |

|

Average Price Paid |

|

Total Number of |

|

Maximum Number |

| |

|

January 1 to January 31, 2014 |

|

1,386,000 |

|

$ |

43.07 |

|

1,386,000 |

|

10,042,610 |

|

|

February 1 to February 28, 2014 |

|

1,418,778 |

|

42.77 |

|

1,418,778 |

|

8,623,832 |

| |

|

March 1 to March 31, 2014 |

|

17,188 |

|

43.88 |

|

17,188 |

|

8,606,644 |

| |

|

April 1 to April 30, 2014 |

|

— |

|

— |

|

— |

|

8,606,644 |

| |

|

May 1 to May 31, 2014 |

|

2,455,228 |

|

47.61 |

|

2,455,228 |

|

6,151,416 |

| |

|

June 1 to June 30, 2014 |

|

254,400 |

|

47.70 |

|

254,400 |

|

5,897,016 |

| |

|

July 1 to July 31, 2014 |

|

47,800 |

|

48.14 |

|

47,800 |

|

5,849,216 |

| |

|

August 1 to August 31, 2014 |

|

1,348,490 |

|

48.55 |

|

1,348,490 |

|

4,500,726 |

| |

|

September 1 to September 30, 2014 |

|

1,600,000 |

|

51.80 |

|

1,600,000 |

|

2,900,726 |

| |

|

October 1 to October 31, 2014 |

|

2,900,726 |

|

47.78 |

|

2,900,726 |

|

— |

| |

|

November 1 to November 30, 2014 |

|

— |

|

— |

|

— |

|

— |

| |

|

December 1 to December 31, 2014 |

|

— |

|

— |

|

— |

|

— |

| |

|

Total |

|

11,428,610 |

|

$ |

47.20 |

|

11,428,610 |

|

— |

|

In January 2015, the Board of Directors authorized a stock repurchase program under which the Company may repurchase up to 10 million shares of common stock during the two year period ending January 20, 2017 (the “2015 Stock Repurchase Program”). The price and timing of any such purchases under the 2015 Stock Repurchase Program will depend on factors such as levels of cash generation from operations, the volume of stock option exercises by employees, cash requirements for acquisitions, economic and market conditions and stock price.

Item 6. Selected Financial Data

|

(dollars in millions, except per share data) |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Operations |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net sales |

|

$ |

5,345.5 |

|

$ |

4,614.7 |

|

$ |

4,292.1 |

|

$ |

3,939.8 |

|

$ |

3,554.1 |

|

|

Net income attributable to Amphenol Corporation |

|

709.1 |

(1) |

635.7 |

(2) |

555.3 |

(3) |

524.2 |

(4) |

496.4 |

(5) | |||||

|

Net income per common share—Diluted |

|

2.21 |

(1) |

1.96 |

(2) |

1.69 |

(3) |

1.53 |

(4) |

1.41 |

(5) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Financial Condition |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Cash, cash equivalents and short-term investments |

|

$ |

1,329.6 |

|

$ |

1,192.2 |

|

$ |

942.5 |

|

$ |

648.9 |

|

$ |

624.2 |

|

|

Working capital |

|

2,458.5 |

|

1,547.7 |

|

1,818.4 |

|

1,538.8 |

|

1,337.1 |

| |||||

|

Total assets |

|

7,027.0 |

|

6,168.0 |

|

5,215.5 |

|

4,445.2 |

|

4,015.9 |

| |||||

|

Long-term debt, including current portion |

|

2,673.9 |

|

2,132.8 |

|

1,706.5 |

|

1,377.1 |

|

800.0 |

| |||||

|

Shareholders’ equity attributable to Amphenol Corporation |

|

2,907.4 |

|

2,859.5 |

|

2,430.0 |

|

2,171.8 |

|

2,320.9 |

| |||||

|

Weighted average shares outstanding—Diluted |

|

320,430,140 |

|

324,548,998 |

|

327,894,222 |

|

343,651,176 |

|

352,651,986 |

| |||||

|

Cash dividends declared per share |

|

$ |

0.45 |

|

$ |

0.305 |

|

$ |

0.21 |

|

$ |

0.03 |

|

$ |

0.03 |

|

(1) Includes (a) acquisition-related expenses of $4.3 ($4.1 after-tax) relating to 2014 acquisitions and (b) $9.8 ($6.2 after-tax) relating to the acquired backlogs of completed acquisitions for an aggregate impact of $0.04 per share. Net income per common share-diluted for the year ended December 31, 2014, excluding the effect of these items is $2.25.

(2) Includes (a) acquisition-related expenses of $6.0 ($4.6 after tax) or $0.01 per share, relating to 2013 acquisitions, (b) $3.6, or $0.01 per share, income tax benefit due primarily to the favorable completion of prior year audits, and (c) an income tax benefit of $11.3, or $0.03 per share, resulting from the delay, by the U.S. government, in the reinstatement of certain federal income tax provisions for the year 2012 relating primarily to research and development credits and certain U.S. taxes on foreign income. Such tax provisions were reinstated on January 2, 2013 with retroactive effect to 2012. Under U.S. GAAP, the benefit to the Company of $11.3, or $0.03 per share, relating to the 2012 tax year was recorded as a benefit in the first quarter of 2013 at the date of reinstatement. Net income per common share-diluted for the year ended December 31, 2013, excluding the effect of these items is $1.93.

(3) Includes (a) acquisition-related expenses of $2.0 ($2.0 after tax) or $0.01 per share, relating to 2012 acquisitions and (b) income tax costs of $11.3, or $0.03 per share, relating to a delay, by the U.S. government, in the reinstatement of certain federal income tax provisions for the year 2012 relating primarily to research and development credits and certain U.S. taxes on foreign income. Such tax provisions were reinstated on January 2, 2013 with retroactive effect to 2012. Net income per common share-diluted for the year ended December 31, 2012, excluding the effect of these items is $1.73.

(4) Includes (a) a tax benefit related to reserve adjustments from the favorable settlement of certain international tax positions and the completion of prior year audits of $4.5, or $0.01 per share, (b) a contingent payment adjustment of approximately $17.8 ($11.2 after tax) or $0.03 per share, (c) a charge for expenses incurred in connection with a flood at the Company’s Sidney, New York facility of $21.5 ($13.6 after tax) or $0.04 per share and (d) acquisition-related

expenses of $2.0 ($1.8 after tax) relating to 2011 acquisitions. Net income per common share-diluted for the year ended December 31, 2011, excluding the effect of these items is $1.53.

(5) Includes a tax benefit related to reserve adjustments from the favorable settlement of certain international tax positions and the completion of prior year audits of $20.7, or $0.06 per share. Net income per common share-diluted for the year ended December 31, 2010, excluding the effect of this item is $1.35.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of the results of operations for the three years ended December 31, 2014, 2013 and 2012 has been derived from and should be read in conjunction with the consolidated financial statements included in Part II, Item 8 herein (dollars in millions except per share data).

Overview

The Company is a global designer, manufacturer and marketer of electrical, electronic and fiber optic connectors, interconnect systems, antennas, sensor and sensor-based products and coaxial and high-speed specialty cable. The Company operates through two reporting segments: (i) Interconnect Products and Assemblies and (ii) Cable Products and Solutions. In 2014, approximately 69% of the Company’s sales were outside the U.S. The primary end markets for our products are:

· information technology and communication devices and systems for the converging technologies of voice, video and data communications;

· a broad range of industrial applications and traditional and hybrid-electric automotive applications; and

· commercial aerospace and military applications.

The Company’s products are used in a wide variety of applications by numerous customers. The Company encounters competition in its markets and competes primarily on the basis of technology innovation, product quality, price, customer service and delivery time. There has been a trend on the part of OEM customers to consolidate their lists of qualified suppliers to companies that have a global presence, can meet quality and delivery standards, have a broad product portfolio and design capability and have competitive prices. The Company has focused its global resources to position itself to compete effectively in this environment. The Company believes that its global presence is an important competitive advantage as it allows the Company to provide quality products on a timely and worldwide basis to its multinational customers.

The Company’s strategy is to provide comprehensive design capabilities, a broad selection of products and a high level of service on a worldwide basis while maintaining continuing programs of productivity improvement and cost control in the areas in which it competes. The Company focuses its research and development efforts through close collaboration with its OEM customers to develop highly-engineered products that meet customer needs and have the potential for broad market applications and significant sales within a one-to-three year period. The Company is also focused on controlling costs. The Company does this by investing in modern manufacturing technologies, controlling purchasing processes and expanding into lower cost areas.

The Company’s strategic objective is to further enhance its position in its served markets by pursuing the following success factors:

· Pursue broad diversification;

· Develop performance-enhancing interconnect solutions;

· Expand global presence;

· Control costs;

· Pursue strategic acquisitions and investments; and

· Foster collaborative, entrepreneurial management.

In 2014, the Company reported net sales, operating income and net income attributable to Amphenol Corporation of $5,345.5, $1,034.6 and $709.1, respectively, up 16%, 15% and 12%, respectively, from 2013. Sales and profitability trends are discussed in detail in “Results of Operations” below. In addition, a strength of the Company has been its ability to consistently generate cash. The Company uses cash generated from operations to fund capital expenditures and acquisitions,

repurchase shares of its common stock, pay dividends and reduce indebtedness. In 2014, the Company generated operating cash flow of $880.9.

Results of Operations

The Company effected a two-for-one stock split in the form of a stock dividend, payable to stockholders of record as of October 2, 2014, which was paid on October 9, 2014. The share and per share information included herein has been retroactively restated to reflect the effect of the stock split for all periods presented.

The following table sets forth the components of net income attributable to Amphenol Corporation as a percentage of net sales for the periods indicated.

|

|

|

Year Ended December 31, |

| ||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|

Net sales |

|

100.0 |

% |

100.0 |

% |

100.0 |

% |

|

Cost of sales |

|

68.3 |

|

68.5 |

|

68.7 |

|

|

Acquisition-related expenses |

|

0.2 |

|

0.2 |

|

— |

|

|

Selling, general and administrative expenses |

|

12.1 |

|

11.9 |

|

12.0 |

|

|

Operating income |

|

19.4 |

|

19.4 |

|

19.3 |

|

|

Interest expense |

|

(1.5 |

) |

(1.4 |

) |

(1.4 |

) |

|

Other income, net |

|

0.3 |

|

0.3 |

|

0.2 |

|

|

Income before income taxes |

|

18.2 |

|

18.3 |

|

18.1 |

|

|

Provision for income taxes |

|

(4.8 |

) |

(4.5 |

) |

(5.1 |

) |

|

Net income |

|

13.4 |

|

13.8 |

|

13.0 |

|

|

Net income attributable to noncontrolling interests |

|

(0.1 |

) |

— |

|

(0.1 |

) |

|

Net income attributable to Amphenol Corporation |

|

13.3 |

% |

13.8 |

% |

12.9 |

% |

2014 Compared to 2013

Net sales were $5,345.5 for the year ended December 31, 2014 compared to $4,614.7 for the year ended December 31, 2013, an increase of 16% in both U.S. dollars and in local currencies and 8% organically (excluding both currency and acquisition impacts) over the prior year. Sales in the Interconnect Products and Assemblies segment (approximately 93% of net sales) increased 17% in 2014 in both U.S. dollars and in local currencies and 8% organically compared to 2013 ($4,992.6 in 2014 versus $4,269.0 in 2013). The sales growth was driven by increases in nearly all of our served markets with contributions from both organic growth and the Company’s acquisition program; partially offset by a small decrease in sales in the information technology and data communications equipment market. Sales to the industrial market increased (approximately $276.2) reflecting particular growth within the energy and heavy equipment markets driven by the impact of organic growth and acquisitions. Sales to the automotive market increased (approximately $271.2), driven primarily by ongoing ramp ups of new, high-technology programs as well as higher vehicle production volumes and acquisitions. Sales to the mobile networks market increased (approximately $112.4), primarily due to an increase in worldwide network build-outs. Sales to the commercial aerospace market increased (approximately $49.7) primarily due to increased demand resulting from higher production levels of next generation jetliners and acquisitions. Sales to the mobile devices market increased (approximately $46.6) primarily due to growth in smartphones and accessories. Sales to the military market increased slightly (approximately $3.5). This was partially offset by reductions in sales to the information technology and data communications equipment market (approximately $20.2) due to declining networking product sales partially offset by growth in storage and server products. Sales in the Cable Products and Solutions segment (approximately 7% of net sales) increased 2% in 2014 in U.S. dollars and 3% in both local currencies and organically compared to 2013 ($352.9 in 2014 versus $345.7 in 2013) primarily due to growth in international markets. Cable Products and Solutions sales are primarily in the broadband communications market.

Geographically, sales in the U.S. in 2014 increased approximately 17% ($1,673.5 in 2014 versus $1,430.6 in 2013) compared to 2013. International sales for 2014 increased approximately 15% in U.S. dollars and in local currencies ($3,672.0 in 2014 versus $3,184.1 in 2013) compared to 2013 with particular strength in Europe. The comparatively stronger U.S. dollar in 2014 had the effect of decreasing net sales by approximately $3.1 when compared to foreign currency translation rates in 2013.

The gross profit margin as a percentage of net sales was 31.7% in 2014 compared to 31.5% in 2013. The increase in gross profit margin as a percentage of sales relates primarily to higher gross profit margins in the Interconnect Products and Assemblies segment due to increased volume and cost reduction actions.

Selling, general and administrative expenses were $645.1 and $548.0 and represented approximately 12.1% and 11.9% of net sales for 2014 and 2013, respectively. The increase in Selling, general and administrative expenses as a percentage of sales in 2014 compared to 2013 is partially due to higher selling, general and administrative expenses on a percent of net sales basis arising from the inclusion in 2014 of an acquisition in the interconnect product and assemblies segment completed late in 2013 that has higher selling, general and administrative expenses on a percent of net sales basis compared to the average of the Company. Administrative expenses increased approximately $46.7 in 2014 primarily related to increases in employee related benefits, stock-based compensation expense and amortization of acquisition-related identified intangible assets and represented approximately 4.8% and 4.6% of net sales in 2014 and 2013, respectively. Research and development expenses increased approximately $11.4 in 2014 reflecting increases in expenses for new product development and represented approximately 2.1% of net sales in 2014 and 2.2% of net sales in 2013. Selling and marketing expenses increased approximately $39.0 in 2014 primarily related to the increase in sales volume and represented approximately 5.1% of net sales for both 2014 and 2013.

On a consolidated basis, operating income margin was 19.4% for 2014 and 2013 and included the impact of acquisition-related expenses discussed below. Operating margin in the Interconnect Products and Assemblies segment was 21.8% for both 2014 and 2013 reflecting higher gross profit margin offset by higher selling, general and administrative expense as described above. Operating margin in the Cable Products and Solutions segment decreased to 12.4% in 2014 from 13.4% in 2013, primarily as a result of market pricing and product mix.

As separately presented in the Consolidated Statements of Income, the Company incurred $14.1 and $6.0 of acquisition-related expenses in 2014 and 2013, respectively, in connection with acquisitions made during each of these respective years. These expenses include amortization of the value associated with acquired backlog, professional fees, transaction-related fees, and other external expenses incurred in connection with acquisitions. For the years ended December 31, 2014 and 2013, these expenses had the impact on net income of $10.2, or $0.04 per share, and $4.6, or $0.01 per share, respectively. Excluding the effect of these expenses, operating income margin in 2014 and 2013 was 19.6% for both years.

Interest expense was $80.4 for 2014 compared to $63.6 for 2013. The increase is primarily attributable to higher average debt levels related to the Company’s stock repurchase program as well as acquisition activity.