UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One) | |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended | |

OR | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number

United States Lime & Minerals, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

Registrant’s telephone number, including area code: (

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of Common Stock held by non-affiliates computed as of the last business day of the Registrant’s quarter ended June 30, 2020: $

Number of shares of Common Stock outstanding as of February 24, 2021:

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the Registrant’s definitive Proxy Statement to be filed for its 2021 Annual Meeting of Shareholders. Part IV incorporates certain exhibits by reference from the Registrant’s previous filings.

TABLE OF CONTENTS

ii

PART I

ITEM 1. BUSINESS.

General.

United States Lime & Minerals, Inc. (the “Company,” the “Registrant,” “We” or “Our”), which was incorporated in 1950, conducts its business primarily through its Lime and Limestone Operations segment. During 2019, our natural gas interests did not reach any of the quantitative thresholds for a reportable segment, and we do not expect the results from our natural gas interests to be of significance in future periods. The revenues, gross profit and operating profit from our natural gas interests are included in Other for our reportable segment disclosures. Disclosures for 2018 have been recast to be consistent with the 2019 and 2020 presentation.

The Company’s principal corporate office is located at 5429 LBJ Freeway, Suite 230, Dallas, Texas 75240. The Company’s telephone number is (972) 991-8400 and its internet address is www.uslm.com. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as the Company’s definitive proxy statement filed pursuant to Section 14(a) of the Exchange Act, are available free of charge on the Company’s website as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission (the “SEC”).

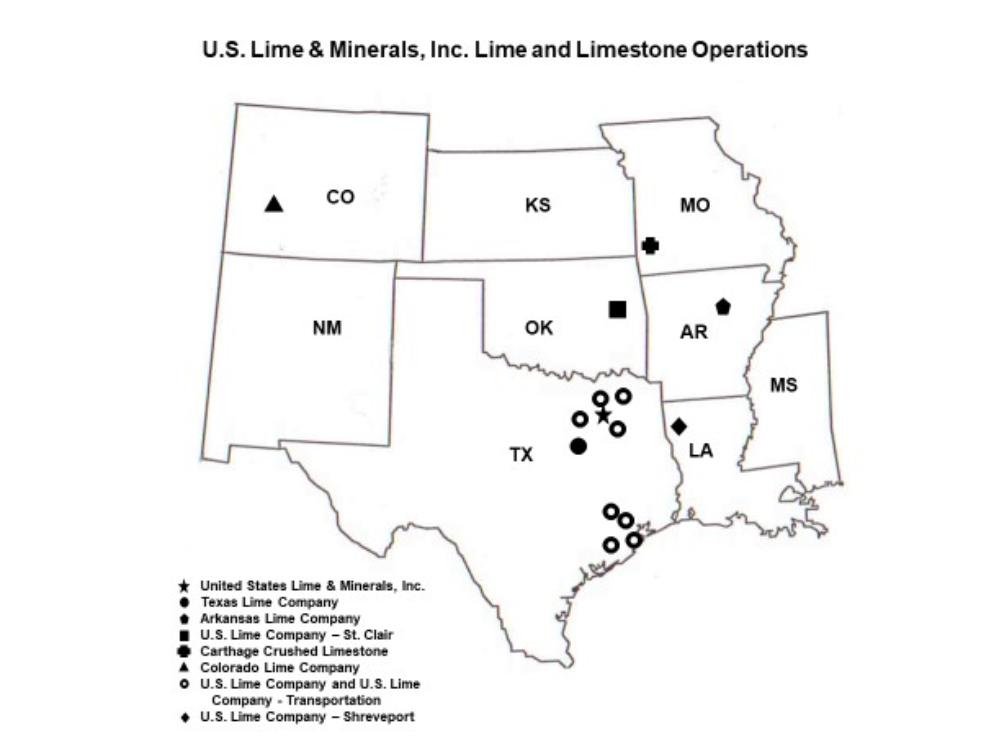

On July 1, 2020, the Company acquired ART Quarry TRS LLC (DBA Carthage Crushed Limestone) (“Carthage”), a limestone mining and production company located in Carthage, Missouri, for $8.4 million cash, subject to adjustment for working capital balances acquired. Carthage provides aggregate and pulverized limestone products that are used primarily in the agricultural, construction, roofing and industrial industries.

Lime and Limestone Operations.

Business and Products. The Company, through its Lime and Limestone Operations, is a manufacturer of lime and limestone products, supplying primarily the construction (including highway, road and building contractors), industrial (including paper and glass manufacturers), metals (including steel producers), environmental (including municipal sanitation and water treatment facilities and flue gas treatment processes), roof shingle manufacturers, agriculture (including poultry and cattle feed producers), and oil and gas services industries. The Company is headquartered in Dallas, Texas and operates lime and limestone plants and distribution facilities in Arkansas, Colorado, Louisiana, Missouri, Oklahoma and Texas through its wholly owned subsidiaries, Arkansas Lime Company, ART Quarry TRS LLC (DBA Carthage Crushed Limestone), Colorado Lime Company, Texas Lime Company, U.S. Lime Company, U.S. Lime Company—Shreveport, U.S. Lime Company—St. Clair and U.S. Lime Company—Transportation.

The Company extracts high-quality limestone from its open-pit quarries and an underground mine and then processes it for sale as pulverized limestone, aggregate, quicklime, hydrated lime and lime slurry. Pulverized limestone (also referred to as ground calcium carbonate) (“PLS”) is produced by applying heat to dry the limestone, which is then ground to granular and finer sizes. Quicklime (calcium oxide) is produced by heating limestone to very high temperatures in kilns in a process called calcination. Hydrated lime (calcium hydroxide) is produced by reacting quicklime with water in a controlled process. Lime slurry (milk of lime) is a suspended solution of calcium hydroxide produced by mixing quicklime with water in a lime slaker.

PLS is used in the production of construction materials such as roof shingles and asphalt paving, as an additive to agriculture feeds, in the production of glass, as a soil enhancement, in flue gas treatment for utilities and other industries requiring scrubbing of emissions for environmental purposes and for mine safety dust in coal mining operations. Quicklime is used primarily in metal processing, in flue gas treatment, in soil stabilization for highway, road and building construction, as well as for oilfield roads and drill sites, in the manufacturing of paper products and in municipal sanitation and water treatment facilities. Hydrated lime is used primarily in municipal sanitation and water treatment facilities, in soil stabilization for highway, road and building construction, in flue gas treatment, in asphalt as an anti-stripping agent, as a conditioning agent for oil and gas drilling mud and in the production of chemicals. Lime slurry is used primarily in soil stabilization for highway, road and building construction.

1

Product Sales. In 2020, the Company sold almost all of its lime and limestone products in the states of Arkansas, Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, Oklahoma, Tennessee and Texas. Sales were made primarily by the Company’s ten sales employees who call on current and potential customers and solicit orders, which are generally made on a purchase-order basis. The Company also receives orders in response to bids that it prepares and submits to current and potential customers.

Principal customers for the Company’s lime and limestone products are construction customers (including highway, road and building contractors), industrial customers (including paper manufacturers and glass manufacturers), metals producers (including steel producers), environmental customers (including municipal sanitation and water treatment facilities and flue gas treatment processes), roof shingle manufacturers, poultry and cattle feed producers, and oil and gas services companies.

Approximately 630 customers accounted for the Company’s sales of lime and limestone products during 2020. No single customer accounted for more than 10% of such sales. The Company is generally not subject to significant customer demand and credit risks as its customers are considerably diversified within our geographic region and by industry concentration. However, given the nature of the lime and limestone industry, the Company’s profits are very sensitive to changes in sales volume and prices.

Lime and limestone products are transported by truck and rail to customers generally within a radius of 400 miles of each of the Company’s plants. All of the Company’s 2020 sales were made within the United States.

Seasonality. The Company’s sales have typically reflected seasonal trends, with the largest percentage of total annual shipments and revenues normally being realized in the second and third quarters. Lower seasonal demand normally results in reduced shipments and revenues in the first and fourth quarters. Inclement weather conditions generally have a negative impact on the demand for lime and limestone products supplied to construction-related customers, as well as on the Company’s open-pit quarrying operations.

Limestone Reserves. The Company’s limestone reserves contain at least 96% calcium carbonate (CaCO3). The Company has two subsidiaries that extract limestone from open-pit quarries: Texas Lime Company (“Texas Lime”), which is located near Cleburne, Texas, and Arkansas Lime Company (“Arkansas Lime”), which is located near Batesville, Arkansas. U.S. Lime Company—St. Clair (“St. Clair”) extracts limestone from an underground mine located near Marble City, Oklahoma. Carthage extracts limestone from an underground mine located in Carthage, Missouri. Colorado Lime Company (“Colorado Lime”) owns property containing limestone deposits at Monarch Pass, Colorado. Existing crushed stone stockpiles on the property are being used to provide feedstock to the Company’s plant in Delta, Colorado. Access to all properties is provided by paved roads and, in the case of Arkansas Lime, St. Clair, and Carthage, also by rail.

Texas Lime operates a quarry and has lime, hydrated lime and limestone production facilities, located on approximately 4,100 acres of land that contains known high-quality limestone reserves in a bed averaging 28 feet in thickness, with an overburden that ranges from 0 to 50 feet. Texas Lime also has mineral interests in approximately 330 acres of land adjacent to the northwest boundary of its property. The Texas Lime reserves, as of December 31, 2020, were approximately 27 million tons of proven recoverable reserves plus approximately 78 million tons of probable recoverable reserves. Assuming the current level of production and recovery rate is maintained, the Company estimates that these reserves are sufficient to sustain operations for more than 70 years.

Arkansas Lime operates two quarries and has lime, hydrated lime and limestone production facilities on a second site linked to the quarries by its own railroad. The quarries cover approximately 1,050 acres of land located in Independence County, Arkansas containing a known deposit of high-quality limestone reserves (the “Batesville Quarry”). The average thickness of the high-quality limestone bed is approximately 60 feet, with an average overburden thickness of approximately 30 feet. The reserves for the Batesville Quarry, as of December 31, 2020, were approximately 7 million tons of proven recoverable reserves. In 2005, the Company acquired approximately 2,500 acres of land in nearby Izard County, Arkansas (the “Love Hollow Quarry”). The high-quality reserves on these 2,500 acres, as of December 31, 2020, were approximately 76 million tons of probable recoverable reserves. The Company is improving the transportation infrastructure between the Love Hollow Quarry and Arkansas Lime’s production facilities and incurring other development costs to prepare the Love Hollow Quarry for mining. Assuming the current level of

2

production and recovery rate is maintained, the Company estimates that its total reserves in Arkansas are sufficient to sustain operations for more than 60 years.

St. Clair operates an underground mine and has lime, hydrated lime and limestone production facilities located on approximately 1,400 acres that it owns containing high-quality limestone reserves. The reserves, as of December 31, 2020, were approximately 12 million tons of probable recoverable reserves on 410 acres. Assuming the current level of production and recovery rate is maintained, the Company estimates that the probable recoverable reserves are sufficient to sustain operations for approximately 25 years. In addition, St. Clair also has the right to mine the high-quality limestone contained in approximately 1,330 adjacent acres pursuant to long-term mineral leases. The Company has not conducted a drilling program to identify and categorize reserves on the 1,330 leased acres.

Carthage operates an underground mine and has limestone production facilities located on approximately 800 acres that it owns containing high-quality limestone reserves. In addition, Carthage has the right to mine the high-quality limestone contained in approximately 160 adjacent acres pursuant to long-term mineral leases. The owned and leased reserves, as of December 31, 2020, were approximately 14 million tons of probable recoverable reserves. Assuming the current level of production and recovery rate is maintained, the Company estimates that the probable recoverable reserves are sufficient to sustain operations for approximately 20 years. Additionally, the Company has an option to acquire the right to mine under long-term mineral leases on approximately 600 acres of adjacent land. The Company is drilling and assessing the quality of the reserves on the properties with options to lease.

During 2020, the Company produced approximately 3 million tons of limestone from its quarries and mines.

Colorado Lime acquired the Monarch Pass Quarry in November 1995 and has not carried out any mining on the property. A review of the potential limestone resources has been completed by independent geologists; however, the Company has not initiated a drilling program. Consequently, it is not possible to identify and categorize reserves. The Monarch Pass Quarry, which had been operated for many years until the early 1990s, contains a mixture of limestone types, including high-quality calcium limestone and dolomite. Assuming the current level of production is maintained, the Company estimates that the remaining crushed stone stockpiles on the property are sufficient to supply its Delta, Colorado plant for approximately 15 years.

Quarrying and Mining. The Company extracts limestone by the open-pit method at its Texas and Batesville quarries. The Monarch Pass Quarry is also an open-pit quarry but is not being mined at this time. The open-pit method consists of removing any overburden comprising soil and other substances, including inferior limestone, and then extracting the exposed high-quality limestone. The Company removes such overburden by utilizing both its own employees and equipment and those of outside contractors. Open-pit mining is generally less expensive than underground mining. The principal disadvantage of the open-pit method is that operations are subject to inclement weather and overburden removal. The limestone is extracted by drilling and blasting, utilizing standard mining equipment. At its St. Clair and Carthage underground mines, the Company mines limestone using room and pillar mining. We have no knowledge of any recent changes in the physical quarrying or mining conditions on any of our properties that have materially affected quarrying or mining operations.

Plants and Facilities. After extraction, limestone is crushed and screened and, in the case of PLS, ground and dried, or, in the case of quicklime, processed in kilns. Quicklime may then be further processed in hydrators and slakers to produce hydrated lime and lime slurry. The Company processes and distributes lime and/or limestone products at four plants, six lime slurry facilities and three terminal facilities. All of its plants and facilities are accessible by paved roads, and, in the case of the Arkansas Lime, St. Clair and Carthage plants and the terminal facilities, also by rail.

The Texas Lime plant has an annual capacity of approximately 470 thousand tons of quicklime from two preheater rotary kilns. The plant also has PLS equipment, which, depending on the product mix, has the capacity to produce approximately 800 thousand tons of PLS annually.

The Arkansas plant is situated at the Batesville Quarry. Utilizing three preheater rotary kilns, this plant has an annual capacity of approximately 630 thousand tons of quicklime. Arkansas Lime’s PLS and hydrating facilities are situated on a tract of 290 acres located approximately two miles from the Quarry, to which it is connected by a

3

Company-owned railroad. The PLS equipment, depending on the product mix, has the capacity to produce approximately 300 thousand tons of PLS annually.

The St. Clair plant has an annual capacity of approximately 250 thousand tons of quicklime from one preheater rotary kiln and one vertical kiln. The plant also has PLS equipment, which has the capacity to produce approximately 150 thousand tons of PLS annually.

The Carthage plant has facilities located next to the mine that produce both aggregates and PLS. The equipment has the capacity to produce approximately 900 thousand tons annually.

The Company also maintains lime hydrating and bagging equipment at the Texas, Arkansas and St. Clair plants. Storage facilities for lime and limestone products at each plant consist primarily of cylindrical tanks, which are considered by the Company to be adequate to protect its lime and limestone products and to provide an available supply for customers’ needs at the expected volumes of shipments. Equipment is maintained at each plant to load trucks and, at the Arkansas Lime and St. Clair plants, to load railroad cars.

Colorado Lime operates a limestone grinding and bagging facility with an annual capacity of approximately 125 thousand tons, located on approximately three and one-half acres of land in Delta, Colorado.

During 2020, the Company’s utilization rate was approximately 57% of its aggregate annual production capacity for the plants in its Lime and Limestone Operations.

U.S. Lime Company (“US Lime”) uses quicklime to produce lime slurry and has four Houston area facilities, including two distribution terminals connected to railroads, to serve the Greater Houston area construction market and four facilities to serve the Dallas-Ft. Worth Metroplex. The Company established U.S. Lime Company—Transportation (“Transportation”) to deliver some of the Company’s products to its customers and facilities primarily in the Dallas-Ft. Worth Metroplex.

U.S. Lime Company — Shreveport operates a distribution terminal in Shreveport, Louisiana, which is connected to a railroad, to provide lime storage, hydrating, slurrying and distribution capacity to service markets in Louisiana and East Texas.

The Company believes that its plants and facilities are adequately maintained and insured.

Human Capital Resources. The Company is committed to attracting and retaining the best and brightest talent to meet the current and future needs of its business. Attracting, retaining, motivating, and investing in the development of human capital resources is a critical part of the Company’s commitment to environmental, social, and governance (“ESG”) and sustainability issues.

At December 31, 2020, the Company employed 317 persons, 110 of whom were represented by unions. The Company is a party to three collective bargaining agreements. The collective bargaining agreement for the Texas facilities expires in November 2023. The collective bargaining agreement for the Arkansas facilities expires in January 2023. The collective bargaining agreement for the Carthage facilities expires in May 2022. Overall, the Company believes that its employee relations are generally good.

Employee Retention and Incentivization. The Company has entered into an employment agreement with Timothy W. Byrne, its President and Chief Executive Officer. Mr. Byrne’s employment agreement became effective as of January 1, 2020 for a five-year term and will continue for successive one-year periods unless the Company or Mr. Byrne gives at least one-year’s prior written notice of intent not to renew. Under the employment agreement, in addition to the possibility of a discretionary cash bonus, Mr. Byrne is entitled each year to an EBITDA cash bonus opportunity under the United States Lime & Minerals, Inc. Amended and Restated 2001 Long-Term Incentive Plan (the “Plan”), and he is also entitled to grants of equity awards under the Plan.

Mr. Byrne’s employment agreement provides that Mr. Byrne is subject to certain forfeiture/clawback and share ownership provisions designed to align Mr. Byrne’s financial interests with those of the Company’s long-term shareholders, and to ensure that he is incentivized not to take actions that may benefit the Company and its shareholders

4

in the short-term at the expense of long-term corporate value creation and sustainability. In particular, in entering into the employment agreement with Mr. Byrne, the Company’s Board of Directors and Compensation Committee were sensitive to how Mr. Byrne’s leadership and actions could further the Company’s various objectives, including human capital resources development and executive succession planning.

With respect to the Company’s broader employee base, certain employees are eligible to receive annual cash bonuses based on discretionary determinations. Except in the case of Mr. Byrne, the Company has not adopted a formal or informal annual bonus arrangement with pre-set performance goals. Rather, the determination to pay a cash bonus, if any, is made in December each year based on the past performance of the individual and the Company or on the attainment of non-quantified performance goals during the year. In either such case, the discretionary bonus may be based on the specific accomplishments of the individual and/or on the overall performance of the Company. The amounts of the discretionary bonuses for 2020 were based on each employee’s individual performance and accomplishments, as well as those of the Company, including productivity, sales, and contributions made to special projects.

In addition to cash bonuses, the Company makes equity awards to certain individuals under the Plan. The Company uses equity awards granted under the Plan as a means to attract, retain, and motivate the Company’s directors, officers, employees, and consultants. The Company views the use of equity awards under the Plan as an important means of aligning the interests of its employees with those of its shareholders.

Employee Health and Safety. The Company believes that it is responsible to its employees to provide a safe and healthy workplace environment. The Company seeks to accomplish this by: training employees in safe work practices; openly communicating with employees; following safety standards and establishing and improving safe work practices; involving employees in safety processes; and recording, reporting and investigating accidents, incidents and losses to avoid reoccurrence.

In response to the COVID-19 pandemic, the Company is continuing to focus on the health and safety of its employees and other individuals at its facilities that produce lime and limestone products to the essential businesses and communities that it serves. In addition to its standard health and safety protocols, the Company has implemented enhanced protocols at all of its locations. These protocols include reduced access to facilities, screening of individuals on all sites, and the enforcement of social distancing and other practices that are consistent with, or exceed, the guidelines of the Center for Disease Control and state and local authorities.

Employee Development and Training. The Company encourages and supports the growth and development of its employees. It advances continual learning and career development through ongoing performance and development conversations or evaluations with employees and internally and externally developed training programs. The Company also provides reimbursement for certain educational programs relating to the Company’s business.

Employee Diversity and Inclusion. The Company is committed to fostering a work environment that values and promotes diversity and inclusion. This commitment includes providing equal access to, and participation in, equal employment opportunities, programs, and services, without regard to a person’s gender, nationality, race, and ethnicity. The Company is focused on the development and fair treatment of its employees, including equal employment hiring practices and policies, anti-harassment, and anti-retaliation policies. The Company is continuing to invest in and take actions in an effort to create a more diverse and inclusive workforce and workplace environment.

Competition. The lime industry is highly regionalized and competitive, with price, quality, ability to meet customer demands and specifications, proximity to customers, personal relationships and timeliness of deliveries being the prime competitive factors. The Company’s competitors are predominantly private companies.

The lime industry is characterized by high barriers to entry, including: the scarcity of high-quality limestone deposits on which the required zoning and permitting for extraction can be obtained; the need for lime plants and facilities to be located close to markets, paved roads and railroad networks to enable cost-effective production and distribution; clean air and anti-pollution regulations, including those related to greenhouse gas emissions, which make it more difficult to obtain permitting for new sources of emissions, such as lime kilns; and the high capital cost of the

5

plants and facilities. These considerations reinforce the premium value of operations having permitted, long-term, high-quality limestone reserves and good locations and transportation relative to markets.

Lime producers tend to be concentrated on known high-quality limestone formations where competition takes place principally on a regional basis. While the steel industry and environmental-related users, including utility plants, are the largest market sectors, the lime industry also counts chemical users and other industrial users, including paper manufacturers, oil and gas services and highway, road and building contractors, among its major customers.

In recent years, the lime industry has experienced reduced demand from certain industries as they experience cyclical or secular downturns. For example, demand from the Company’s steel and oil and gas services customers tends to vary with the demand for their products and services, which has continued to be cyclical. In addition, utility plants are continuing to use more natural gas and renewable sources for power generation instead of coal, which reduces their demand for lime and limestone for flue gas treatment processes. These reductions in demand have resulted in increased competitive pressures, including pricing and competition for certain customer accounts, in the industry.

Consolidation in the lime industry has left the three largest companies accounting for more than two-thirds of North American production capacity. In addition to the consolidations, and often in conjunction with them, many lime producers have undergone modernization and expansion and development projects to upgrade their processing equipment in an effort to improve operating efficiency. We believe that our modernization and expansion projects in Texas and Arkansas, the kiln project at our St. Clair operations in Oklahoma, and the July 2020 Carthage acquisition, along with our lime slurry operations in Texas, should allow us to continue to remain competitive, protect our markets and position ourselves for the future. In addition, we will continue to evaluate internal and external opportunities for expansion, growth and increased profitability, as conditions warrant, or opportunities arise. We may have to revise our strategy or otherwise consider ways to enhance the value of the Company, including by entering into strategic partnerships, mergers or other transactions.

Compliance with Government Regulations. The Company is subject to various federal, state, and local laws and regulations that may materially impact the Company’s financial condition, results of operations, cash flows and competitive position. These include laws and regulations relating to the environment, mine permitting and operations, mine safety, and reclamation and remediation.

Environmental Laws. The Company owns or controls large areas of land on which it operates limestone quarries, two underground mines, lime plants and other facilities with inherent environmental responsibilities, compliance costs and liabilities. These include maintenance and operating costs for pollution control equipment, the cost of ongoing monitoring and reporting programs, the cost of reclamation efforts and other similar environmental costs and liabilities.

The Company’s operations are subject to various federal, state and local laws and regulations relating to the environment, health and safety and other regulatory matters, including the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act and analogous state and local laws (“Environmental Laws”). These Environmental Laws grant the United States Environmental Protection Agency (the “EPA”) and state governmental agencies the authority to promulgate and enforce regulations that could result in substantial expenditures on pollution control, waste management, permitting compliance activities, and mining reclamation. Many Environmental Laws also authorize private citizens and interest groups to file lawsuits in court to enforce alleged violations. Changes in policy or political leadership may affect how Environmental Laws are interpreted or enforced by the EPA and state governmental agencies. The failure to comply with Environmental Laws may result in administrative and civil penalties, injunctive relief and criminal prosecution. The Company has not been named as a potentially responsible party in any federal superfund cleanup site or state-led cleanup site.

The rate of change of Environmental Laws continues to be rapid, and compliance can require significant expenditures. For example, the Clean Air Act required the Company’s lime plants to obtain Title V operating permits that have significant ongoing compliance costs. In addition to the Title V permits, other environmental operating permits are required for the Company’s operations, and such permits are subject to modification during the permit renewal process and, in rare instances, could be revoked. Over time, the EPA has increased the stringency of the National

6

Ambient Air Quality Standards (“NAAQS”), which are used to establish permitting limits under the Clean Air Act.

The EPA has lowered ozone standards and reclassified areas where State Implementation Plans (the “SIPs”) exist. In October 2015, the EPA issued a final rule lowering the ground-level ozone NAAQS to 70 parts per billion. In December 2018, the EPA issued a final rule affecting SIP requirements for attainment demonstrations, planning and implementation deadlines for reasonably available control technology, emissions inventories and emissions standards, and the timing of required SIP revisions. State environmental agencies in the states in which we operate are currently in the process of revising their SIPs to comply. For example, the Texas Commission on Environmental Quality adopted a rule package in June 2020 to incorporate the 2015 ozone NAAQS into the emission inventory provisions of the Texas SIP. This and similar rulemakings could increase the cost of future plant modifications or expansions, increase compliance costs and have a material adverse effect on the Company’s financial condition, results of operations, cash flows and competitive position.

EPA regulations require large emitters of greenhouse gases, including the Company’s plants, to collect and report greenhouse gas emissions data. The EPA has previously indicated that it will use the data collected through the greenhouse gas reporting rules to decide whether to promulgate future greenhouse gas emission limits. The EPA and delegated states also regulate greenhouse gas emissions under the New Source Review permitting and Federal Operating Permit programs for facilities that are otherwise subject to permitting based on their emissions of conventional, non-greenhouse gas pollutants. Thus, any new facilities or major modifications to existing facilities that exceed the federal New Source Review emission thresholds for conventional pollutants may be required to use “best available control technology” and energy efficiency measures to minimize greenhouse gas emissions.

Although the timing and impact of climate change legislation and of regulations limiting greenhouse gas emissions are uncertain, the consequences of such legislation and regulation are potentially significant for the Company because the production of CO2 is inherent in the manufacture of lime through the calcination of limestone and combustion of fossil fuels. In February 2021, the new Administration rejoined the Paris Agreement. The Agreement commits the United States to reduce greenhouse gas emissions by 26 to 28 percent below 2005 levels by 2025. Future regulation related to the Paris Agreement or other greenhouse gas rulemakings could affect New Source Review permitting or other permitting programs and, thereby, increase the time and costs of plant upgrades and expansions. The passage of climate change legislation, and other regulatory initiatives by the Congress, the states or the EPA that restrict or tax emissions of greenhouse gases, could also adversely affect the Company. There is no assurance that changes in the law or regulations will not be adopted, such as the imposition of greenhouse gas emission limits, a carbon tax, a cap-and-trade program requiring the Company to purchase carbon credits or other measures that would require reductions in emissions or changes to raw materials, fuel use or production rates. Such changes, if adopted, could have a material adverse effect on the Company’s financial condition, results of operations, cash flows and competitive position.

In addition to regulation, several court cases have been filed and decisions issued that may increase the risk of claims being filed by third parties against companies for their greenhouse gas emissions. Such cases may seek to challenge air permits, to force reductions in greenhouse gas emissions or to recover damages for alleged climate change impacts to the environment, people and property.

In July 2020, the EPA adopted a final revision to a federal regulation that establishes national standards to meet the maximum achievable control technology (“MACT”) within the lime industry. Also known as the “Lime MACT,” this rulemaking is the second revision to the initial Lime MACT promulgated in 2004. The revision included changes to the startup, shutdown and malfunction provisions contained in the prior Lime MACT rule, but otherwise did not impose more stringent standards. In September 2020, a non-governmental organization filed a petition for reconsideration asking the EPA to reconsider the Lime MACT and arguing the EPA’s decision to not set limits for hazardous air pollutants was unlawful. The non-governmental organization also initiated litigation in September 2020 before the D.C. Circuit Court of Appeals to challenge the Lime MACT. It is uncertain how the petition for reconsideration, the litigation, or changes in policy and political leadership may affect the Lime MACT rulemaking.

There is no assurance that the final Lime MACT rule will not be withdrawn, revised or overturned by a judicial decision, or that a replacement regulation will not incorporate more stringent standards. Changes in the Lime MACT rule could have a material adverse effect on the Company’s financial condition, results of operations, cash flows and competitive position.

7

The Company also holds permits for process water and storm water discharges and must comply with the Clean Water Act and analogous state laws and regulations. Any failure to comply with these permits could result in fines or other penalties. Material changes to the terms of these permits or changes to regulations affecting water discharges in the future could also increase compliance costs.

The manufacturing of lime and hydrated lime requires significant volumes of water. The Company operates multiple groundwater wells to provide water to its plants. Groundwater pumping is subject to increased regulation, and in some areas the Company is required to obtain permits from groundwater conservation districts to pump groundwater. Any failure to comply with these permits could result in fines or other penalties and future changes that restrict the quantities of groundwater that may be pumped may increase compliance costs.

The Company incurred capital expenditures related to environmental matters of $0.7 million, $1.2 million, and $1.2 million in 2020, 2019, and 2018, respectively. The Company’s recurring costs associated with managing environmental permitting and waste recycling and disposal (e.g., used oil and lubricants) and maintaining pollution control equipment amounted to $0.5 million, $0.5 million and $0.6 million in 2020, 2019 and 2018, respectively.

Mine Safety. The Company’s mining operations are also subject to regulation under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). The Mine Act has been construed as authorizing the Mine Safety and Health Administration (“MSHA”) to issue citations and orders pursuant to the legal doctrine of strict liability, or liability without fault. If, in the opinion of an MSHA inspector, a condition that violates the Mine Act or regulations promulgated pursuant to it exists, then a citation or order will be issued regardless of whether the operator had any knowledge of, or fault in, the existence of that condition. Many of the Mine Act standards include one or more subjective elements, so that issuance of a citation or order often depends on the opinions or experience of the MSHA inspector involved and the frequency and severity of citations and orders will vary from inspector to inspector.

Whenever MSHA believes that a violation of the Mine Act, any health or safety standard, or any regulation has occurred, it may issue a citation or order which describes the violation and fixes a time within which the operator must abate the violation. In some situations, such as when MSHA believes that conditions pose a hazard to miners, MSHA may issue an order requiring cessation of operations, or removal of miners from the area of the mine, affected by the condition until the hazards are corrected. Whenever MSHA issues a citation or order, it has authority to propose a civil penalty or fine, as a result of the violation, that the operator is ordered to pay.

Citations and orders can be contested before the Federal Mine Safety and Health Review Commission (the “Commission”), and as part of that process, are often reduced in severity and amount, and are sometimes dismissed. The Commission is an independent adjudicative agency that provides administrative trial and appellate review of legal disputes arising under the Mine Act. These cases may involve, among other questions, challenges by operators to citations, orders and penalties they have received from MSHA, or complaints of discrimination by miners under section 105 of the Mine Act.

Reclamation and Remediation. The Company recognizes legal reclamation and remediation obligations associated with the retirement of long-lived assets at their fair value at the time the obligations are incurred (“Asset Retirement Obligations” or “AROs”). Some of the states the Company operates in have reclamation regulations to properly reclaim the surface mines. These regulations require permitting with the respective state to ensure reclamation obligations are met. Over time, the liability for AROs is recorded at its present value each period through accretion expense, and the capitalized cost is amortized over the useful life of the related asset. Upon settlement of the liability, the Company either settles the ARO for its recorded amount or recognizes a gain or loss. AROs are estimated based on studies and the Company’s process knowledge and estimates and are discounted using an appropriate interest rate. The AROs are adjusted when further information warrants an adjustment. The Company believes its accrual of $1.5 million for AROs at December 31, 2020 is reasonable.

8

Map of United States Lime & Minerals, Inc. Lime and Limestone Operations.

Other.

Our Other operations, consisting of our natural gas interests, are conducted through our wholly owned subsidiary, U.S. Lime Company – O&G, LLC (“U.S. Lime – O&G”) and consist principally of a lease with respect to oil and gas rights on our Cleburne, Texas property, located in the Barnett Shale Formation. Pursuant to the lease, we have royalty interests ranging from 15.4% to 20% in oil and gas produced from any successful wells drilled on the leased property and an option to participate in any well drilled on the leased property as a 20% non-operated working interest owner. At December 31, 2020, our overall average interest under the oil and gas rights lease was 34.7% on 33 producing wells.

U.S. Lime – O&G has also entered into a drillsite agreement with an operator that has an oil and gas lease covering approximately 538 acres of land contiguous to our Johnson County, Texas property. Pursuant to the drillsite agreement, we have a 3% royalty interest and a 12.5% non-operated working interest. At December 31, 2020, we had a combined 12.4% royalty and non-operated working interest on 6 active wells drilled on a padsite located on our Johnson County, Texas property.

No new wells have been completed since 2011, and there are no plans to drill additional wells under either the oil and gas lease or the drillsite agreement. The carrying values of the long-lived assets related to our natural gas interests were $2.0 million as of December 31, 2020.

9

ITEM 1A. RISK FACTORS.

COVID-19 Risks

Our financial condition, results of operations, cash flows, and competitive position could be materially adversely impacted by the COVID-19 pandemic. The extent to which COVID-19, and measures taken in response thereto, could materially adversely affect our financial condition, results of operations, cash flows and competitive position will depend on future developments, which are highly uncertain and cannot be predicted, including the scope and duration of the pandemic and actions taken by governmental authorities, including the effectiveness and administration of vaccines, to contain the business, financial and economic impact of the pandemic.

While we are continuing to execute our business continuity plans in response to the COVID-19 pandemic, there is the potential for increased disruptions to our lime and limestone business and operations from the pandemic. Federal, state, and local governmental responses to the COVID-19 pandemic, which include restrictions requiring social distancing and pandemic-related restrictions on business activities and movement of people in the markets for our lime and limestone products, began to take effect the last two weeks of March 2020. In the second quarter 2020, the pandemic and related restrictions on business activities resulted in a general economic slowdown, which has disproportionately impacted certain industries that purchase our lime and limestone products, including oil and gas services, environmental and steel. In the third quarter 2020, business activity began to resume, and restrictions were eased. In the fourth quarter 2020, we saw demand return from certain industries, most notably our environmental and steel customers, after being down the previous quarters. However, the United States has seen multiple surges of COVID-19 cases in the fourth quarter 2020 and the first quarter 2021, which could impact the economic recovery that has occurred to date. Until there are successful implementations of COVID-19 vaccination programs, we expect a continued slowdown in economic activity as restrictions continue, or even expand, which we anticipate will have an adverse impact on the demand for our lime and limestone products and increase our costs. In addition, a continued economic slowdown may put downward pressure on the prices we are able to realize for our products.

The continued impact of COVID-19 may limit our ability to produce, sell and deliver our lime and limestone products to our customers; cause key management and plant-level employees not to be available to us; result in plant shutdowns due to contagion, in which case we may not be able to shift production to our other plants; cause disruptions to our supply chain as it relates to our suppliers and other vendors, as well as disrupt the supply chains of our customers; impede our ability to maintain and repair our plants and equipment; negatively impact our modernization, expansion, and development plans; negatively impact our ability to integrate acquisitions; as well as adversely impact demand and prices for our lime and limestone products and increase our costs. Although we cannot predict future developments, which are highly uncertain, including the scope and duration of the pandemic, the effectiveness of vaccines, and actions taken by governmental authorities, including the effective administration of vaccination programs, to contain the pandemic, COVID-19 could have a material adverse effect on our financial condition, results of operations, cash flows and competitive position.

Industry Risks

Our Lime and Limestone Operations are affected by general economic conditions in the U.S. and specific economic conditions in particular industries.

General and industry specific economic conditions in the United States have reduced demand for our lime and limestone products. Specifically, demand from our utility customers has decreased due to the continuing trend in the United States to retire coal-fired utility plants. Our steel and oil and gas services customers reduce their purchase volumes, at times, due to cyclical economic conditions in their industries. The overall reduction in demand for lime and limestone products has also resulted in increased competitive pressures, including pricing pressure and competition for certain customer accounts, from other lime producers.

For us to maintain or increase our profitability, we must maintain or increase our revenues and improve cash flows, manage our capital expenditures and control our operational and selling, general and administrative expenses. If we are unable to maintain our revenues and control our costs in these uncertain economic and regulatory times, our financial condition, results of operations, cash flows and competitive position could be materially adversely affected.

10

Our mining and other operations are subject to operating risks that are beyond our control, which could result in materially increased operating expenses and decreased production and shipment levels that could materially adversely affect our Lime and Limestone Operations and their profitability.

We mine limestone in open pit and underground mining operations and process and distribute that limestone through our plants and other facilities. Certain factors beyond our control could disrupt our operations, adversely affect production and shipments and increase our operating costs, all of which could have a material adverse effect on our results of operations. These include geological formation problems that may cause poor mining conditions, variability of chemical or physical properties of our limestone, an accident or other major incident at a site that may cause all or part of our operations to cease for some period of time and increase our expenses, mining, processing and plant equipment failures and unexpected maintenance problems that may cause disruptions and added expenses, strikes, job actions or other work stoppages that may disrupt our operations or those of our suppliers, contractors or customers and increase our expenses, and adverse weather conditions and natural disasters, such as hurricanes, tornadoes, heavy rains, flooding, ice storms, freezing weather, such as the February 2021 winter storms in the southern United States, drought and other natural events, that may affect operations, transportation or customers.

If any of these conditions or events occurs, our operations may be disrupted, we could experience a delay or halt of production or shipments, our operating costs could increase significantly, and we could be exposed to fines, penalties, assessments and other liabilities. If our insurance coverage is limited or excludes a given condition or event, we may not be able to recover in full the losses that we may incur as a result of such conditions or events, some of which may be substantial.

The lime and limestone industry is highly regionalized and competitive.

Our competitors are predominately large private companies. The primary competitive factors in the lime industry are price, quality, ability to meet customer demands and specifications, proximity to customers, personal relationships and timeliness of deliveries, with varying emphasis on these factors depending upon the specific product application. To the extent that one or more of our competitors becomes more successful with respect to any key competitive factor, we may find it difficult to increase or maintain our prices or to retain certain customer accounts, and our financial condition, results of operations, cash flows and competitive position could be materially adversely affected.

Business and Financial Risks

In the normal course of our Lime and Limestone Operations, we face various business and financial risks that could have a material adverse effect on our financial position, results of operations, cash flows and competitive position. Not all risks are foreseeable or within our ability to control.

These risks arise from various factors, including, but not limited to, fluctuating demand and prices for our lime and limestone products, including as a result of downturns in the economy and in the construction, industrial, steel and oil and gas services industries, and reduced demand from coal-fired utility plants, increased competitive pressures from other lime producers, changes in legislation and regulations, including Environmental Laws, health and safety regulations and requirements to renew or obtain operating permits, our ability to produce and store quantities of lime and limestone products sufficient in amount and quality to meet customer demands and specifications, the success of our modernization, expansion and development strategies, the uncertainty of our ability to sell our increased lime capacity from the kiln at our St. Clair facility at acceptable prices, our ability to execute our strategies and complete projects on time and within budget, our ability to integrate, refurbish and/or improve acquired facilities, including the facilities acquired as a result of the Carthage acquisition, our access to capital, volatile costs, especially fuel, electricity, transportation and freight costs, inclement weather and the effects of seasonal trends.

We receive most of our coal and petroleum coke by rail, so the availability of sufficient solid fuels to run our plants could be diminished significantly in the event of major rail disruptions. Domestic coal and petroleum coke may also be exported, which can increase competition and prices for the domestic supply. In addition, our freight costs to deliver our lime and limestone products are high relative to the value of our products, and they have generally increased in recent years. Our costs for delivery of solid fuels, as well as our products, also increase as demand for rail and trucking by other industries increases, and changes to Department of Transportation rules and regulations can reduce the

11

availability of trucks, truck drivers and rail cars to deliver solid fuels to our plants and deliver our products to our customers. If we are unable to continue to pass along our variable coal, petroleum coke, diesel, natural gas, electricity, transportation and freight costs to our customers through higher prices or surcharges, our financial condition, results of operations, cash flows and competitive position could be materially adversely affected.

We quote our lime and limestone products on a delivered price basis to certain customers, which requires us to estimate future delivery costs. Our actual delivery costs may exceed these estimates, which would reduce our profitability.

Delivery costs are impacted by the price of diesel. When diesel prices increase, we incur additional fuel surcharges from freight companies that cannot be passed on to our customers that have been quoted a delivered price. Material increases in the price of diesel could have a material adverse effect on the Company’s profitability.

To maintain our competitive position in the lime and limestone industry, we may need to continue to increase the efficiency of our operations and expand production capacity, obtain financing for any such projects and acquisitions at reasonable interest rates and acceptable terms and sell any resulting increased production at acceptable prices.

We may in the future undertake additional modernization and expansion and development projects and acquisitions. Such projects and acquisitions may require that we incur substantial debt, which may not be available to us at all or at reasonable interest rates or on acceptable terms. Given current and projected demand for lime and limestone products, we cannot guarantee that any such project or acquisition would be successful, that we would be able to sell any resulting increased production at acceptable prices or that any such sales would be profitable.

Although prices for our lime and limestone products have been relatively firm in past years, pricing competition has increased in recent years. We are unable to predict future demand and prices, given the current economic and regulatory uncertainties in the U.S. economy as a whole and in particular industries, and cannot provide any assurance that current levels of demand and prices will continue or that any future increases in demand or prices can be maintained.

We may be adversely affected by our ability to insure against certain risk of our operations.

Mining limestone and producing lime and limestone products involves risks which could result in damage to our facilities, personal injury, and environmental damage. Although we maintain insurance in an amount that we consider adequate, liabilities might exceed policy limits, in which event we could incur significant costs that could adversely affect our financial position, results of operations, cash flows and competitive position. Additionally, the risks inherent in mining limestone and the production of lime and limestone products may significantly increase the cost of obtaining adequate insurance coverage, or make some coverage unavailable.

We may be adversely affected by any disruption in, or failure of, our information technology systems, including due to cyber-security risks and incidents.

We rely upon the capacity, reliability and security of our information technology (“IT”) systems for our mining, manufacturing, sales, financial and administrative functions. We also face the challenge of supporting our IT systems and implementing upgrades when necessary, including the prompt detection and remediation of any cyber-security breaches.

Our IT systems security measures are focused on the prevention, detection and remediation of damage from computer viruses, natural disasters, unauthorized access, cyber-attack and other similar disruptions. However, our IT systems protection measures may not be successful in preventing unauthorized access, intrusion and damage. Threats to our systems can derive from human error, fraud or malice on the part of employees or third parties, encryption by ransomware, or may result from technological failure. Any failure, accident or security breach involving our IT systems could result in disruption to our operations. A material breach in the security of our IT systems could negatively impact our mining and manufacturing operations, sales or financial and administrative functions or result in the compromise of personal information of our employees, customers or suppliers. To the extent any such failure, accident or security breach results in disruption to our operations or sales or loss or disclosure of, or damage to, our data or confidential information, our costs could increase, and our reputation, business, results of operations, competitive position, and

12

financial condition could be materially adversely affected. Additionally, should we experience a cyber-security event, we may incur substantial costs, including remediation costs, such as liability for stolen assets or information, repairs of system damage, legal costs and costs associated with regulatory actions.

Governmental, Legal and Regulatory Risks

Our Lime and Limestone Operations are subject to general and industry specific regulations. Changes to the regulatory environment could increase our cost of compliance and adversely impact our financial condition, results of operations, cash flows and competitive position.

We are in a period of regulatory uncertainty, which has been heightened by the change in the United States federal government Administration and Congress. The new Administration and Congress may initiate actions to increase regulation of certain industries, including the lime industry, and may take other steps to restrict oil and gas drilling, reduce the use of coal or regulate domestic manufacturing. There can be no assurance that any of these actions, if adopted, will not increase the costs for our customers or increase the Company’s cost of compliance with Environmental Laws. In addition, a variety of factors, including uncertainty with respect to governmental budgetary constraints, legislative impasses, extended government shutdowns, pandemics, trade wars, tariffs, social unrest, and increased inflationary pressures, could have a material adverse effect on our financial condition, results of operations, cash flows and competitive position.

Governmental fiscal and budgetary constraints, changes to tax law, legislative impasses and extended government shutdowns have in the past, and may in the future, adversely impact our financial condition and results of operations in various ways.

Governmental fiscal and budgetary constraints, changes to tax law, legislative impasses and extended government shutdowns may adversely impact our financial condition and results of operations in various ways, including possibly reduced highway construction and infrastructure funding by federal, state and local governmental agencies, which could reduce demand for our lime and limestone products from our construction customers.

We incur environmental compliance costs and liabilities in our Lime and Limestone Operations, including capital, maintenance and operating costs, with respect to pollution control equipment, the cost of ongoing monitoring programs, the cost of reclamation and remediation efforts and other similar costs and liabilities relating to our compliance with Environmental Laws. We expect these costs and liabilities to continue or increase, such as possible new costs, taxes and limitations on operations, including regulation of greenhouse gas emissions. Similar environmental costs and liabilities may also be faced by some of our customers.

The rate of change of Environmental Laws has been rapid over the last decade, and we may face possible new uncertainties, costs and liabilities, taxes and limitations on operations, including those related to climate change initiatives. Changes in policy or political leadership may affect how Environmental Laws are interpreted or enforced by the EPA and state governmental agencies. The new Administration has signaled its intent to increase regulation under Environmental Laws and has issued multiple executive orders reversing prior deregulation. We expect our expenditure requirements for future environmental compliance, including complying with nitrogen dioxide, sulfur dioxide, ozone and particulate matter emission limitations under the NAAQS and regulation of greenhouse gas emissions, to continue or increase. Discovery of currently unknown conditions and unforeseen costs and liabilities could require additional expenditures.

The regulation of greenhouse gas emissions remains an issue for the Company and some of its customers. In February 2021, the new Administration rejoined the Paris Agreement, under which the United States committed to reduce greenhouse gas emissions. There is no assurance that changes in the law or regulations will not be adopted, such as the imposition of a carbon tax, a cap-and-trade program requiring companies to purchase carbon credits, the imposition of greenhouse gas emission limits or other measures that would require reductions in emissions or changes to raw materials, fuel use or production rates. These changes, if adopted, could have a material adverse effect on the Company’s financial condition, results of operations, cash flows and competitive position.

More stringent regulation of greenhouse gas emissions could also adversely affect the competitiveness of some

13

of the Company’s customers, including coal-fired power plants, and indirectly the demand for our lime and limestone products. For example, our utility customers are continuing to switch from coal to natural gas or renewable sources for power generation for environmental and regulatory as well as cost reasons, thus reducing demand for our lime and limestone products for flue gas treatment processes.

We intend to comply with all Environmental Laws and believe our accrual for environmental costs and liabilities at December 31, 2020 is reasonable. Because many of the requirements are subjective and therefore not quantifiable or presently determinable, or may be affected by additional legislation and rulemaking, including those related to climate change and greenhouse gas emissions, there is no assurance that we will be able to successfully secure new permits in connection with our future modernization and expansion and development projects, and it is not possible to accurately predict the aggregate future costs and liabilities relating to environmental compliance and their effect on our financial condition, results of operations, cash flows and competitive position.

Our lime and limestone operations are subject to various regulatory risks, including those relating to mine safety, and reclamation and remediation obligations.

Our mining operations are subject to mine safety regulation under the Mine Act. The Mine Act has been construed as authorizing MSHA to issue citations and orders pursuant to the legal doctrine of strict liability, or liability without fault. Citations and orders can be contested before the Commission, and as part of that process, are often reduced in severity and amount, and are sometimes dismissed.

We also have legal reclamation and remediation obligations associated with the retirement of AROs. Over time, the liability for AROs is recorded at its present value each period through accretion expense, and the capitalized cost is amortized over the useful life of the related asset. Upon settlement of the liability, we either settle the ARO for its recorded amount or recognize a gain or loss. We believe our accrual for AROs is reasonable, but there can be no assurance that any amounts accrued will be sufficient to meet our reclamation and remediation obligations at any point in time.

We intend to comply with all mining regulations and all of our reclamation and remediation obligations. Our failure to comply with such regulations and obligations may adversely impact our financial condition, results of operations, cash flows and competitive position.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Reference is made to Item 1 of this Report for a description of the properties of the Company, and such description is hereby incorporated by reference in answer to this Item 2. As disclosed in Note 3 of Notes to Consolidated Financial Statements, the Company’s plants and facilities and reserves are subject to encumbrances to secure any Company loans under its credit agreement.

ITEM 3. LEGAL PROCEEDINGS.

Information regarding any legal proceedings is set forth in Note 10 of Notes to Consolidated Financial Statements and is hereby incorporated by reference in answer to this Item 3.

ITEM 4. MINE SAFETY DISCLOSURES.

Under Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K, each operator of a coal or other mine is required to include disclosures regarding certain mine safety results in its periodic reports filed with the SEC. The operation of the Company’s quarries, underground mine and plants is subject to regulation by MSHA. The required information regarding certain mining safety and health matters, broken down by mining complex, for the year ended December 31, 2020 is presented in Exhibit 95.1 to this Report.

14

As discussed in Item 1 above, the Company believes it is responsible to employees to provide a safe and healthy workplace environment. The Company seeks to accomplish this by: training employees in safe work practices; openly communicating with employees; following safety standards and establishing and improving safe work practices; involving employees in safety processes; and recording, reporting and investigating accidents, incidents and losses to avoid reoccurrence.

Following passage of the Mine Improvement and New Emergency Response Act of 2006, MSHA significantly increased the enforcement of mining safety and health standards on all aspects of mining operations. There has also been an increase in the dollar penalties assessed for citations and orders issued in recent years.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company’s common stock is listed on the Nasdaq Global Market® under the symbol “USLM.” As of February 24, 2021, the Company had approximately 325 shareholders of record.

As of February 24, 2021, the Company had 500,000 shares of $5.00 par value preferred stock authorized; however, none has been issued.

15

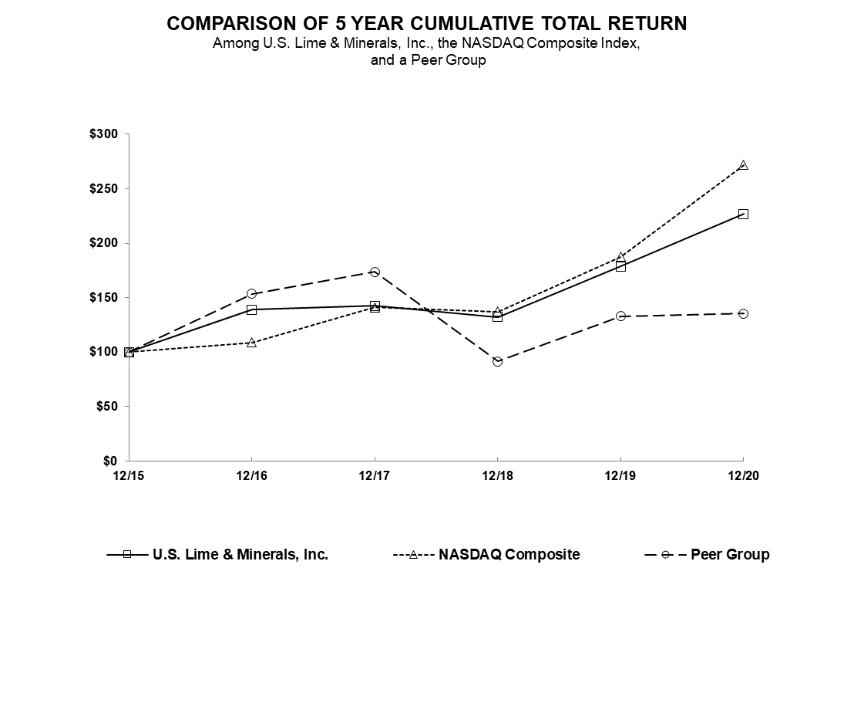

PERFORMANCE GRAPH

The graph below compares the cumulative 5-year total shareholders’ return on the Company’s common stock with the cumulative total return on the NASDAQ Composite Index and a peer group index consisting of Eagle Materials, Inc., Mineral Technologies, Inc., Summit Materials Inc. and U.S. Concrete, Inc. The graph assumes that the value of the investment in the Company’s common stock and each index was $100 on December 31, 2015, and that all cash dividends, including the special cash dividend paid in the fourth quarter 2019, have been reinvested.

| 2015 |

| 2016 |

| 2017 |

| 2018 |

| 2019 |

| 2020 |

| |

U.S. LIME & MINERALS, INC. |

| 100.00 |

| 139.01 |

| 142.45 |

| 132.11 |

| 178.45 |

| 226.92 | |

NASDAQ COMPOSITE INDEX |

| 100.00 |

| 108.87 |

| 141.13 |

| 137.12 |

| 187.44 |

| 271.64 | |

PEER GROUP | 100.00 | 153.48 | 173.61 | 91.42 | 133.07 | 135.32 |

16

The Company’s Amended and Restated 2001 Long-Term Incentive Plan allows employees and directors to pay the exercise price upon the exercise of stock options and the tax withholding liability upon exercise of stock options or the lapse of restrictions on restricted stock by payment in cash and/or withholding or delivery of shares of the Company’s common stock to the Company. Pursuant to these provisions, the Company repurchased 2,459 shares at a price of $114.00 per share, the fair market value of one share on the date they were tendered to the Company, in the fourth quarter 2020 for payment of tax withholding liability upon the lapse of restrictions on restricted stock.

ITEM 6. SELECTED FINANCIAL DATA.

Years Ended December 31, |

| |||||||||||

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| ||

(dollars in thousands, except per share amounts) |

| |||||||||||

Operating results | ||||||||||||

Lime and limestone revenues | $ | 159,707 |

| 156,981 |

| 141,922 |

| 142,612 |

| 137,190 | ||

Other revenues |

| 997 |

| 1,296 |

| 2,513 |

| 2,232 |

| 2,092 | ||

Total revenues | $ | 160,704 |

| 158,277 |

| 144,435 |

| 144,844 |

| 139,282 | ||

Gross profit | $ | 47,587 |

| 41,676 |

| 30,486 |

| 34,380 |

| 33,092 | ||

Operating profit (1) | $ | 33,869 |

| 29,246 |

| 20,002 |

| 24,227 |

| 23,480 | ||

Income before income tax expense (benefit) | $ | 34,072 |

| 30,900 |

| 21,568 |

| 24,943 |

| 23,618 | ||

Income tax expense (benefit) (2) | $ | 5,849 | 4,844 | 1,883 | (2,205) | 5,864 | ||||||

Net income | $ | 28,223 |

| 26,056 |

| 19,685 |

| 27,148 |

| 17,754 | ||

Net income per share of common stock: | ||||||||||||

Basic | $ | 5.01 |

| 4.64 |

| 3.52 |

| 4.87 |

| 3.19 | ||

Diluted | $ | 5.00 |

| 4.64 |

| 3.51 |

| 4.86 |

| 3.19 | ||

| (1) | Operating profit for the years ended December 31, 2020 and 2019 was adversely impacted by impairment charges of $1,550 and $930 to adjust the carrying value of the long-lived assets related to the Company’s natural gas interests. |

| (2) | Income tax expense (benefit) for the year ended December 31, 2017 includes the one-time effect of a $7,447 income tax benefit resulting from reduced federal income tax rates under the Tax Cuts and Jobs Act of 2017. |

As of December 31, |

| |||||||||||

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| ||

Total assets | $ | 279,098 |

| 247,037 |

| 244,671 |

| 228,446 |

| 210,159 | ||

Stockholders’ equity per outstanding common share | $ | 43.06 |

| 38.62 |

| 39.76 |

| 36.73 |

| 32.23 | ||

Employees |

| 317 |

| 282 |

| 287 |

| 318 |

| 321 | ||

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD-LOOKING STATEMENTS.

Any statements contained in this Report that are not statements of historical fact are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this Report, including without limitation statements relating to the Company’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are identified by such words as “will,” “could,” “should,” “would,” “believe,” “possible,” “potential,” “expect,” “intend,” “plan,” “schedule,” “estimate,” “anticipate” and “project.” The Company undertakes no obligation to publicly update or revise any forward-looking statements. The Company cautions that forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations, including without limitation the following: (i) the Company’s plans, strategies, objectives, expectations, and intentions are subject to change at any time at the Company’s discretion; (ii) the Company’s plans and results of operations will be affected by its ability to maintain and increase its revenues and manage its growth; (iii) the Company’s ability to meet short-term and long-term liquidity demands, including meeting the Company’s operating and capital needs, including possible acquisitions and paying dividends, and conditions in the credit and equity markets, including the ability of the Company’s customers to meet their obligations; (iv) interruptions to operations and increased expenses at the Company’s facilities resulting from changes in mining methods or conditions, variability of chemical or physical properties of the

17

Company’s limestone and its impact on process equipment and product quality, inclement weather conditions, natural disasters, accidents, IT systems failures or disruptions, including due to cyber-security incidents or ransomware attacks, utility disruptions, or regulatory requirements; (v) volatile coal, petroleum coke, diesel, natural gas, electricity, transportation and freight costs and the consistent availability of trucks, truck drivers and rail cars to deliver the Company’s products to its customers and solid fuels to its plants on a timely basis at competitive prices; (vi) unanticipated delays or cost overruns in completing modernization and expansion and development projects; (vii) the Company’s ability to expand its lime and limestone operations through projects and acquisitions of businesses with related or similar operations, including the Carthage acquisition, and the Company’s ability to obtain any required financing for such projects and acquisitions, and to sell any resulting increased production at acceptable prices; (viii) inadequate demand and/or prices for the Company’s lime and limestone products due to increased competition from competitors, increasing competition for certain customer accounts, conditions in the U.S. economy, recessionary pressures in, and the impact of government policies on, particular industries, including oil and gas services, utility plants, steel, construction, and industrial, effects of governmental fiscal and budgetary constraints, including the level of highway construction and infrastructure funding, changes to tax law, legislative impasses, extended governmental shutdowns, trade wars, tariffs, economic and regulatory uncertainties under state governments and the recently elected United States Administration and Congress, and inability to continue to maintain or increase prices for the Company’s products, including passing through the increased costs of transportation; (ix) ongoing and possible new regulations, investigations, enforcement actions and costs, legal expenses, penalties, fines, assessments, litigation, judgments and settlements, taxes and disruptions and limitations of operations, including those related to climate change, health and safety, and other ESG and sustainability considerations, and those that could impact the Company’s ability to continue or renew its operating permits or successfully secure new permits in connection with its modernization and expansion and development projects; (xi) estimates of reserves and remaining lives of reserves; (xii) the ongoing impact of the COVID-19 pandemic, including decreased demand, lower prices, and increased costs, and the risk of non-compliance with health and safety protocols and social distancing guidelines, on the Company’s financial condition, results of operations, cash flows, and competitive position; (xiii) the impact of social or political unrest; (xiv) risks relating to mine safety, and reclamation and remediation; and (xv) other risks and uncertainties set forth in this Report or indicated from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the Company’s Quarterly Reports on Form 10-Q.

OVERVIEW.

General.

We have identified one reportable business segment based on the distinctness of our activities and products: Lime and Limestone Operations. All operations are in the United States. Operating profit from our Lime and Limestone Operations includes all of our selling, general and administrative costs. We do not allocate interest expense and interest and other income to our Lime and Limestone Operations.

Our Lime and Limestone Operations represent our principal business. Our Other revenues are from natural gas interests, consisting of royalty and non-operated working interests under an oil and gas lease and a drillsite agreement with two separate operators related to our Johnson County, Texas property, located in the Barnett Shale Formation, on which Texas Lime conducts its lime and limestone operations. While we may participate in future natural gas wells drilled and workovers of existing wells under the oil and gas lease and drillsite agreement, if any, we are not in the business of drilling for or producing natural gas and have no personnel with expertise in that field.