Exhibit 2.1

DATED JULY 28, 2013

ELAN CORPORATION, PLC

AND

PERRIGO COMPANY

AND

LEOPARD COMPANY

AND

HABSONT LIMITED

AND

BLISFONT LIMITED

TRANSACTION AGREEMENT

A&L Goodbody

2

THIS AGREEMENT is made on July 28, 2013 BETWEEN:

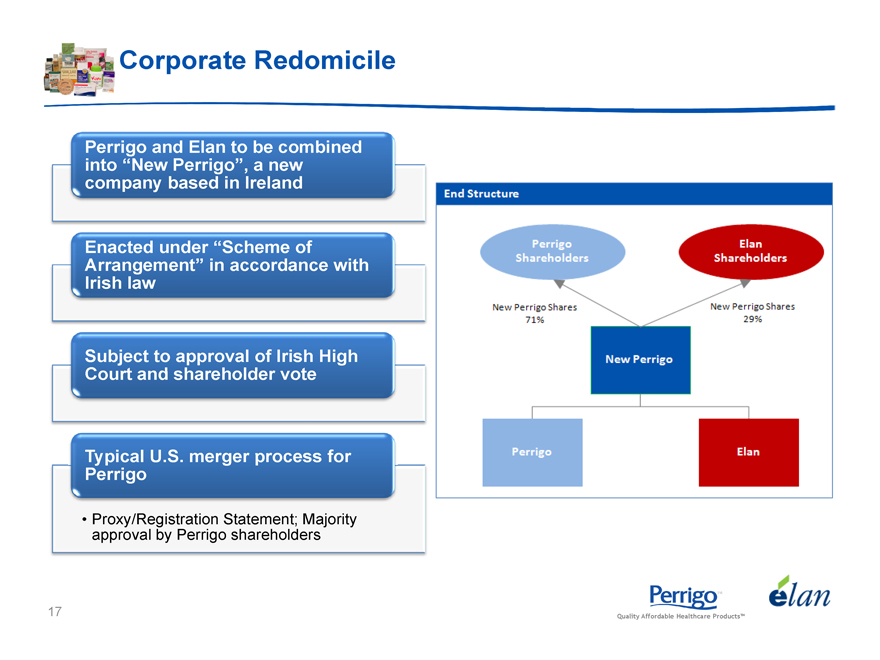

| (1) | ELAN CORPORATION, PLC, a public limited company incorporated in Ireland (registered number 30356), with registered address Treasury Building, Lower Grand Canal Street, Dublin 2 (hereinafter called “Elan”); |

| (2) | PERRIGO COMPANY, a Michigan corporation (hereinafter called “the Bidder”); |

| (3) | LEOPARD COMPANY, a Delaware corporation (hereinafter called “MergerSub”); |

| (4) | HABSONT LIMITED, a company incorporated in Ireland (registered number 529994), with registered address 33 Sir John Rogerson’s Quay, Dublin 2, Ireland (hereinafter called “Foreign Holdco”); and |

| (5) | BLISFONT LIMITED, a company incorporated in Ireland (registered number 529592), with registered address 33 Sir John Rogerson’s Quay, Dublin 2, Ireland (hereinafter called “Holdco”). |

RECITALS:

| 1. | The Bidder has agreed to cause Holdco to acquire Elan on the terms set out in the Rule 2.5 Announcement (as defined below). |

| 2. | This Agreement (this “Agreement”) sets out certain matters relating to the conduct of the Acquisition (as defined below) and the Merger (as defined below) that have been agreed by the Parties and MergerSub. |

| 3. | The Parties intend that the Acquisition will be implemented by way of the Scheme (as defined below), although this may, subject to the consent of the Panel (where required), be switched to the Takeover Offer in accordance with the terms set out in this Agreement. |

| 4. | The parties intend that for U.S. federal income tax purposes, (i) the receipt of the Scheme Consideration in exchange for the Elan Ordinary Shares pursuant to the Scheme will be taxable transactions to the holders of the Elan Ordinary Shares under Section 1001 of the United States Internal Revenue Code of 1986, as amended (the “Code”) and (ii) the receipt of cash and Holdco shares in exchange for the Bidder Shares pursuant to the Merger will be taxable transactions to the holders of the Bidder Shares under Section 1001 of the Code. |

THE PARTIES AGREE as follows:

| 1. | INTERPRETATION |

| 1.1. | Definitions |

In this Agreement the following words and expressions shall have the meanings set opposite them:

“Acquisition”, the proposed acquisition by Holdco of Elan by means of the Scheme or the Takeover Offer (and any such Scheme or Takeover Offer as it may be revised, amended or extended from time to time) pursuant to this Agreement (whether by way of the Scheme or the Takeover Offer) (including the issuance by Holdco of the aggregate Share Consideration and payment of the aggregate Cash Consideration pursuant to the Scheme or Takeover Offer) as described in the Rule 2.5 Announcement and provided for in this Agreement;

3

“Act”, the Companies Act 1963, as amended;

“Acting in Concert”, shall have the meaning given to that term in the Takeover Panel Act;

“Action”, any civil, criminal, or administrative actions, suits, demands, claims, hearings, notices of violation, investigations, proceedings, demand letters, settlements, or enforcement actions by, from or before any Relevant Authority;

“Affiliate”, in relation to any person, another person that, directly or indirectly, controls, is controlled by, or is under common control with, such first person (as used in this definition, “control” (including, with its correlative meanings, “controlled by” and “under common control with”) shall mean the possession, directly or indirectly, of the power to direct or cause the direction of management or policies of a person, whether through the ownership of securities or partnership or other ownership interests, by contract or otherwise);

“Agreed Form”, in relation to any document, the form of that document which has been initialled for the purpose of identification by or on behalf of each of the Parties;

“Agreement”, shall have the meaning given to that term in the Recitals;

“Antitrust Laws”, shall have the meaning given to that term in Clause 7.2.4;

“Antitrust Order”, shall have the meaning given to that term in Clause 7.2.4;

“Applicable Withholding Amount”, such amounts as are required to be withheld or deducted under the Code or any provision of state, local or non–U.S. Tax Law with respect to any payment made in connection with the cancellation or conversion of a Bidder Option or Bidder Share Award or the payment of any dividend equivalents with respect thereto, as applicable;

“Associate”, shall have the meaning given to that term in the Takeover Rules;

“Bidder”, shall have the meaning given to that term in the Preamble to the Agreement;

“Bidder Alternative Proposal”, any bona fide proposal or bona fide offer made by any person for (i) the acquisition of the Bidder by tender offer, scheme of arrangement, takeover offer or business combination transaction; (ii) the acquisition, lease or license by any person of any assets (including equity securities of Subsidiaries of Bidder) or businesses that constitute or contribute 25% or more of Bidder’s and its Subsidiaries’ consolidated revenue, net income or assets and measured, in the case of assets, by either book value or fair market value; (iii) the acquisition by any person including any person Acting in Concert with such person (or the stockholders of any person) of 25% or more of the outstanding Bidder Shares; or (iv) any merger, business combination, consolidation, share exchange, recapitalisation or similar transaction involving the Bidder as a result of which the holders of Bidder Shares immediately prior to such transaction do not, in the aggregate, own at least 75% of the outstanding voting power of the surviving or resulting entity in such transaction immediately after consummation thereof;

“Bidder Benefit Plan” each compensation, benefit, and other employee or director benefit plan, arrangement, agreement or understanding, whether or not written, including any “employee welfare benefit plan” within the meaning of Section 3(1) of ERISA and any “employee pension benefit plan” within the meaning of Section 3(2) of ERISA (whether or not any such plan is subject to ERISA), any pension plan, and any bonus, incentive, profit sharing, deferred compensation, vacation, stock purchase, stock option, equity, severance, employment, change of control or fringe benefit plan, program or agreement that is or has been sponsored, maintained or contributed to by the Bidder Group or to which the Bidder Group is a party;

“Bidder Board”, the board of directors of the Bidder;

“Bidder Book Entry Shares”, shall have the meaning given to that term in Clause 8.5.6;

4

“Bidder Bylaws”, shall have the meaning given to that term in Clause 6.2.1;

“Bidder Certificate of Incorporation”, shall have the meaning given to that term in Clause 6.2.1;

“Bidder Certificates”, shall have the meaning given to that term in Clause 8.5.6;

“Bidder Change of Recommendation”, shall have the meaning given to that term in Clause 5.4;

“Bidder Common Stock”, shall have the meaning given to that term in Clause 6.2.2;

“Bidder Directors”, the members of the board of directors of the Bidder;

“Bidder Disclosure Schedule”, shall have the meaning given to that term in Clause 6.2;

“Bidder Distributable Reserves Resolution”, shall have the meaning given to that term in Clause 7.9.1;

“Bidder Employees”, the employees of Bidder or any Subsidiary of Bidder;

“Bidder Exchange Fund” shall have the meaning given to that term in Clause 8.5.7;

“Bidder Financing Information” shall have the meaning given to that term in Clause 3.4.3;

“Bidder Group”, Bidder and all of its Subsidiaries;

“Bidder Material Adverse Effect”, such event, development, occurrence, state of facts or change that has a material adverse effect on the business, operations, properties, assets, liabilities, results of operations or financial condition of the Bidder and its Subsidiaries, taken as a whole, but shall not include (a) events, developments, occurrences, states of facts or changes to the extent (i) generally affecting the industries or the segments thereof in which the Bidder and its Subsidiaries operate (including changes to commodity prices) in the United States or elsewhere, (ii) generally affecting the economy or the financial, debt, credit or securities markets, in the United States or elsewhere, (iii) resulting from any political conditions or developments in general, or resulting from any outbreak or escalation of hostilities, declared or undeclared acts of war or terrorism (other than any of the foregoing to the extent that it causes any direct damage or destruction to or renders physically unusable or inaccessible any facility or property of the Bidder or any of its Subsidiaries), (iv) reflecting or resulting from changes or proposed changes in Law (including rules and regulations), interpretations thereof, regulatory conditions or US GAAP or other accounting standards (or interpretations thereof), or (v) resulting from actions of the Bidder or any of its Subsidiaries which Elan has expressly requested in writing or to which Elan has expressly consented in writing (provided, that with respect to each of the foregoing clauses (i)-(iv), such events, developments, occurrences, states of facts or changes may be taken into account in determining whether there is a Bidder Material Adverse Effect to the extent the Bidder and its Subsidiaries, taken as a whole, are disproportionately impacted relative to other companies operating in the industries in which Bidder and its Subsidiaries primarily operate); or (b) any decline in the stock price of the Bidder Shares on the NYSE or the TASE or any failure to meet internal or published projections, forecasts or revenue or earning predictions for any period (provided that the underlying causes of such decline or failure may, to the extent not otherwise excluded by clauses (a) or (c) of this definition, be considered in determining whether there is a Bidder Material Adverse Effect); or (c) any events, developments, occurrences, states of facts or changes resulting from the announcement or the existence of this Agreement or the transactions contemplated hereby or the performance of and the compliance with this Agreement including any litigation resulting from this Agreement or with respect to the transactions contemplated hereby (provided, however, that the exception in this sub-clause (c) shall not apply to any requirement of the Agreement to operate in the ordinary course consistent with past practice or with respect to the Bidder’s representations and warranties set forth in clauses 6.2.3(2) or 6.2.3(3) or any other representation or warranty of the Bidder the purpose of which is to address the consequences resulting from the execution and delivery of this Agreement or the performance or obligations or satisfaction of conditions under this Agreement);

“Bidder Material Contracts”, shall have the meaning given to that term in Clause 6.2.13;

5

“Bidder Merger Parties”, collectively Holdco, Foreign Holdco and MergerSub;

“Bidder Option”, shall have the meaning given to that term in Clause 8.6(1)(a);

“Bidder Permitted Liens”, Liens (A) for Taxes or governmental assessments, charges or claims of payment not yet due and payable, being contested in good faith or for which adequate accruals or reserves have been established, (B) which is a carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s or other similar lien arising in the ordinary course of business consistent with past practice, (C) which is disclosed on the most recent consolidated balance sheet of Bidder or notes thereto or securing liabilities reflected on such balance sheet, (D) which was incurred in the ordinary course of business consistent with past practice since the date of the most recent consolidated balance sheet of Bidder or (E) which would not reasonably be expected to materially impair the continued use of the applicable property for the purposes for which the property is currently being used;

“Bidder Preferred Stock”, shall have the meaning given to the term in Clause 6.2.2;

“Bidder Recommendation”, the recommendation of the Bidder Board that the Bidder Shareholders vote in favour of the adoption and approval of this Agreement;

“Bidder Reimbursement Payment”, shall have the meaning given to that term in the Expenses Reimbursement Agreement;

“Bidder Restricted Share”, shall have the meaning given to that term in Clause 8.6(1)(b);

“Bidder SEC Documents”, all forms, documents and reports (including exhibits and other information incorporated therein) required to be filed or furnished by the Bidder with the SEC;

“Bidder Share-Based Award”, shall have the meaning given to that term in Clause 8.6(1)(c);

“Bidder Shareholder Approval”, shall have the meaning given to that term in Clause 3.8.1;

“Bidder Shareholders”, the holders of Bidder Shares;

“Bidder Shareholders Meeting”, shall have the meaning given to that term in Clause 3.8.1;

“Bidder Share Plans”, (a) Panther Company 2008 Long-Term Incentive Plan, (b) Panther Company 2003 Long-Term Incentive Plan, (c) Panther Company Employee Stock Option Plan and (d) Panther Company Non-Qualified Stock Option Plan for Directors;

“Bidder Shares”, shall have the meaning given to the term in Clause 6.2.2;

“Bidder Superior Proposal”, an unsolicited written bona fide Bidder Alternative Proposal made by any person that the Bidder Board determines in good faith (after consultation with Bidder’s financial advisors and outside legal counsel) is (i) likely to be consummated in accordance with its terms, (ii) more favourable from a financial point of view to the Bidder Shareholders than the transactions contemplated by this Agreement, taking into account any revisions to the terms of the transaction contemplated by this Agreement proposed by Elan in respect of such Bidder Alternative Proposal in accordance with Clause 5.4.5 to this Agreement), and (iii) fully financed, in each case, taking into account the person making the Bidder Alternative Proposal and all of the all financial, regulatory, legal and other aspects of such proposal (it being understood that, for purposes of the definition of Bidder Superior Proposal, references to “25%” and “75%” in the definition of Bidder Alternative Proposal shall be deemed to refer to “80%” and “20%”, respectively;

“Biogen Idec”, Biogen Idec International Holding Ltd;

“Bribery Act” means the United Kingdom Bribery Act 2010;

6

“Bribery Legislation”, all and any of the following: the United States Foreign Corrupt Practices Act of 1977; the Organization For Economic Co–operation and Development Convention on Combating Bribery of Foreign Public Officials in International Business Transactions and related implementing legislation; the relevant common law or legislation in England and Wales relating to bribery and/or corruption, including, the Public Bodies Corrupt Practices Act 1889; the Prevention of Corruption Act 1906 as supplemented by the Prevention of Corruption Act 1916 and the Anti–Terrorism, Crime and Security Act 2001; the Bribery Act 2010; the Proceeds of Crime Act 2002; and any anti–bribery or anti–corruption related provisions in criminal and anti–competition laws and/or anti–bribery, anti–corruption and/or anti–money laundering laws of any jurisdiction in which Elan operates;

“Business Day”, any day, other than a Saturday, Sunday or a day on which banks in Ireland or in the County of New York are authorised or required by law or executive order to be closed;

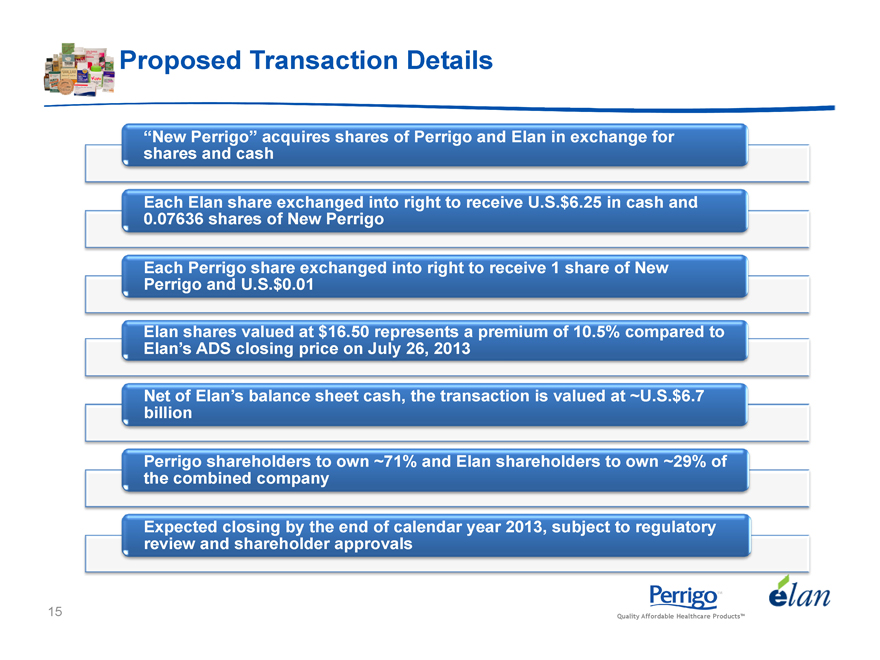

“Cash Consideration”, $6.25 per Elan Share;

“Certificates of Merger”, shall have the meaning given to that term in Clause 8.5.2;

“Clearances”, all consents, clearances, approvals, permissions, permits, non-actions, orders and waivers to be obtained from, and all registrations, applications, notices and filings to be made with or provided to, any Relevant Authority or other third party, in connection with the implementation of the Merger, the Scheme and/or the Acquisition;

“Closing Price”, the average, rounded to the nearest cent of the closing sale prices of a Bidder Share on the NYSE as reported by The Wall Street Journal for the five trading days immediately preceding the day on which the Effective Time occurs;

“Code”, shall have the meaning given to that term in the Recitals;

“Committee”, the Leadership Development and Compensation Committee of Elan (formerly known as the Compensation Committee), or such other committee of the Elan Board as the Elan Board shall direct;

“Companies Acts”, the Irish Companies Acts 1963-2012 and every statutory extension, modification or re-enactment thereof from time to time in force;

“Competition Act”, the Competition Acts 2002-2012;

“Completion”, completion of the Acquisition and the Merger;

“Completion Date”, shall have the meaning given to that term in Clause 8.1.1;

“Conditions”, the conditions to the Scheme and the Acquisition set forth in Appendix I to the Rule 2.5 Announcement, and “Condition” means any one of the Conditions;

“Confidentiality Agreement”, the confidentiality agreement between Elan and Bidder dated 21 June 2013 as it may be amended from time to time;

“Contract”, shall have the meaning given to that term in Clause 6.1.3(3);

“Conversion Ratio” shall have the meaning given to that term in Clause 8.6(1);

“Corporate Integrity Agreement”, that certain Corporate Integrity Agreement between the OIG and Elan;

“Court Hearing”, the hearing by the High Court of the Petition to sanction the Scheme under Section 201 of the Act;

“Court Meeting”, the meeting or meetings of the Elan Ordinary Shareholders (and any adjournment thereof) convened by order of the High Court pursuant to Section 201 of the Act to consider and, if thought fit, approve the Scheme (with or without amendment);

7

“Court Meeting Resolution”, the resolution to be proposed at the Court Meeting for the purposes of approving and implementing the Scheme;

“Court Order”, the order or orders of the High Court sanctioning the Scheme under Section 201 of the Act and confirming the reduction of capital that forms part of it under Sections 72 and 74 of the Act;

“Depositary”, Citibank N.A.;

“DGCL”, the Delaware General Corporation Law, as it may be amended from time to time;

“Disclosure Schedules”, the Elan Disclosure Schedule and the Bidder Disclosure Schedule;

“Divestiture Action”, shall have the meaning given to that term in Clause 7.2.8;

“EC Merger Regulation”, Council Regulation (EC) No. 139/2004;

“Effective Date”, the date on which the Scheme becomes effective in accordance with its terms;

“Effective Time”, the time on the Effective Date at which the Court Order and a copy of the minute required by Section 75 of the Act are registered by the Registrar of Companies provided, that the Scheme shall become effective substantially concurrently with the effectiveness of the Merger, to the extent possible;

“EGM Resolutions”, such resolutions to be proposed at the EGM for the purposes of approving and implementing the Scheme, the reduction of capital of Elan, changes to the Elan Memorandum and Articles of Association and such other matters as Elan reasonably determines to be necessary for the purposes of implementing the Acquisition as have been approved by the Bidder (such approval not to be unreasonably withheld, conditioned or delayed), desirable for the purposes of implementing the Acquisition;

“Elan”, shall have the meaning given to that term in the Preamble;

“Elan ADS”, American Depositary Shares each representing one Elan Ordinary Share and which are admitted to trading on the NYSE;

“Elan Alternative Proposal”, any bona fide proposal or bona fide offer made by any person (other than a proposal or offer by the Bidder or any of its Associates or any person Acting in Concert with the Bidder pursuant to Rule 2.5 of the Takeover Rules) for (i) the acquisition of Elan by scheme of arrangement, takeover offer or business combination transaction; (ii) the acquisition, lease or license by any person of any assets (including equity securities of Subsidiaries of Elan) or businesses that constitute or contribute 25% or more of Elan’s and its Subsidiaries’ consolidated revenue, net income or assets and measured, in the case of assets, by either book value or fair market value; (iii) the acquisition by any person including any person Acting in Concert with such person (or the stockholders of any such person) of 25% or more of the outstanding Elan Shares; or (iv) any merger, business combination, consolidation, share exchange, recapitalisation or similar transaction involving Elan as a result of which the holders of Elan Shares immediately prior to such transaction do not, in the aggregate, own at least 75% of the outstanding voting power of the surviving or resulting entity in such transaction immediately after consummation thereof;

“Elan Benefit Plan”, each compensation, benefit and other employee or director benefit plan, arrangement, agreement or understanding, whether or not written, including any “employee welfare benefit plan” within the meaning of Section 3(1) of ERISA and any “employee pension benefit plan” within the meaning of Section 3(2) of ERISA (whether or not any such plan is subject to ERISA), any occupational pension scheme or bonus, incentive, profit sharing, deferred compensation, vacation, stock purchase, stock option, equity, severance (including the Elan Severance Plan), employment, change of control or fringe benefit plan, program or agreement that is or has been sponsored, maintained or contributed to by the Elan Group or to which the Elan Group is a party;

“Elan Board”, the board of directors of Elan;

8

“Elan Change of Recommendation”, shall have the meaning given to that term in Clause 5.3.4;

“Elan Directors”, the members of the board of directors of Elan;

“Elan Disclosure Schedule”, shall have the meaning given to that term in Clause 6.1;

“Elan Distributable Reserves Resolution” shall have the meaning given to that term in Clause 7.9.1;

“Elan Employees”, the employees of Elan or any Subsidiary of Elan who remain employed after the Effective Time;

“Elan Equity Award Holders”, the holders of Elan Options and/or Elan Share Awards;

“Elan Equity Award Holder Proposal”, the proposal of the Bidder to the Elan Equity Award Holders to be made in accordance with Rule 15(d) of the Takeover Rules and the terms of the Employee Share Plans;

“Elan Exchange Fund” shall have the meaning given to that term in Clause 8.4.1;

“Elan Group”, Elan and all of its Subsidiaries;

“Elan Leased Real Property”, shall have the meaning given to that term in Clause 6.1.21;

“Elan LLC”, Elan Pharmaceuticals, LLC (f/k/a Elan Pharmaceuticals, Inc.);

“Elan Material Adverse Effect”, such event, development, occurrence, state of facts or change that has a material adverse effect on (x) the business, operations, properties, assets, liabilities, results of operations or financial condition of Elan and its Subsidiaries, taken as a whole, or (y) the rights and obligations of Elan and its Affiliates under the TYSABRI Agreement, including the amount of Contingent Payments (as defined in the TYSABRI Agreement) payable thereunder, but shall not include: (a) events, developments, occurrences, states of facts or changes to the extent (i) generally affecting the industries or the segments thereof in which Elan and its Subsidiaries operate (including changes to commodity prices) in the United States or elsewhere, (ii) generally affecting the economy or the financial, debt, credit or securities markets, in the United States or elsewhere, (iii) resulting from any political conditions or developments in general, or resulting from any outbreak or escalation of hostilities, declared or undeclared acts of war or terrorism (other than any of the foregoing to the extent that it causes any direct damage or destruction to or renders physically unusable or inaccessible any facility or property of Elan or any of its Subsidiaries), (iv) reflecting or resulting from changes or proposed changes in Law (including rules and regulations), interpretations thereof, regulatory conditions or US GAAP or other accounting standards (or interpretations thereof), or (v) resulting from actions of Elan or any of its Subsidiaries which the Bidder has expressly requested in writing or to which the Bidder has expressly consented in writing (provided, that with respect to each of the foregoing clauses (i)-(iv), such events, developments, occurrences, states of facts or changes may be taken into account in determining whether there is an Elan Material Adverse Effect to the extent that Elan and its Subsidiaries, taken as a whole, are disproportionately impacted relative to other similarly-sized companies operating in the pharmaceutical industry); or (b) any decline in the stock price of the Elan Shares on the NYSE or any failure to meet internal or published projections, forecasts or revenue or earning predictions for any period (provided that the underlying causes of such decline or failure may, to the extent not otherwise excluded by clauses (a) or (c) of this definition, be considered in determining whether there is an Elan Material Adverse Effect); or (c) any events, developments, occurrences, states of facts or changes resulting from the announcement or the existence of this Agreement or the transactions contemplated hereby or the performance of and the compliance with this Agreement including any litigation resulting from this Agreement or with respect to the transactions contemplated hereby (provided, however, that the exception in this clause (c) shall not apply to any requirement of this Agreement to operate in the ordinary course consistent with past practice or with respect to Elan’s representations and warranties set forth in Clause 6.1.3(2) or Clause 6.1.3(3) or any other representation or warranty of Elan the purpose of which is to address the consequences resulting from the execution and delivery of this Agreement or the performance or obligations or satisfaction of conditions under this Agreement);

9

“Elan Material Contract” shall have the meaning given to that term in Clause 6.1.13;

“Elan Memorandum and Articles of Association”, means Elan’s memorandum and articles of association as filed with the Companies Registration office in Dublin;

“Elan Option”, an option to purchase Elan Shares;

“Elan Ordinary Shareholders”, the holders of Elan Ordinary Shares;

“Elan Ordinary Shares”, the ordinary shares of €0.05 each in the capital of Elan;

“Elan Permitted Liens”, Liens (A) for Taxes or governmental assessments, charges or claims of payment not yet due and payable, being contested in good faith or for which adequate accruals or reserves have been established, (B) which is a carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s or other similar lien arising in the ordinary course of business consistent with past practice, (C) which is disclosed on the most recent consolidated balance sheet of Elan or notes thereto or securing liabilities reflected on such balance sheet, (D) which was incurred in the ordinary course of business consistent with past practice since the date of the most recent consolidated balance sheet of Elan or (E) which would not reasonably be expected to materially impair the continued use of the applicable property for the purposes for which the property is currently being used;

“Elan Pharma”, Elan Pharma International Limited;

“Elan SEC Documents”, all forms, documents and reports (including exhibits and other information incorporated therein) required to be filed or furnished by Elan with the SEC;

“Elan Share Award”, each right of any kind, contingent or accrued, to receive Elan Shares or benefits measured in whole or in part by the value of a number of Elan Shares (including restricted stock units, performance stock units, phantom stock units and deferred stock units), other than Elan Options;

“Elan Shareholder Approval”, (i) the approval of the Scheme by a majority in number of the Elan Ordinary Shareholders representing three-fourths (75 per cent.) or more in value of the Elan Ordinary Shares held by such holders, present and voting either in person or by proxy, at the Court Meeting (or at any adjournment of such meeting) and (ii) the EGM Resolutions being duly passed by the requisite majorities of Elan Ordinary Shareholders at the Extraordinary General Meeting (or at any adjournment of such meeting);

“Elan Shareholders”, the holders of Elan Ordinary Shares and Elan ADSs;

“Elan Shares”, Elan Ordinary Shares and Elan ADSs;

“Elan Superior Proposal”, an unsolicited written bona fide Elan Alternative Proposal made by any person that the Elan Board determines in good faith (after consultation with Elan’s financial advisors and outside legal counsel) is (i) likely to be consummated in accordance with its terms, (ii) more favourable from a financial point of view to the Elan Shareholders than the transactions contemplated by this Agreement (taking into account any revisions to the terms of the transactions contemplated by this Agreement proposed by the Bidder in respect of such Elan Alternative Proposal in accordance with Clauses 5.3.5 and/or 5.3.8), and (iii) fully financed, in each case, taking into account the person making the Elan Alternative Proposal and all of the financial, regulatory, legal, and other aspects of such proposal (it being understood that, for purposes of the definition of “Elan Superior Proposal”, references to “25%” and “75%” in the definition of Elan Alternative Proposal shall be deemed to refer to “80%” and “20%” respectively);

“Elan’s Severance Plan”, the Elan Irish Severance Programme and the Elan US Severance Plan;

“Employee Share Plans”,

| 1. | Elan Corporation, plc 1996 Long Term Incentive Plan, |

| 2. | Elan Corporation, plc 1996 Consultant Option Plan, |

10

| 3. | Elan Corporation, plc 1999 Stock Option Plan, |

| 4. | Elan Corporation, plc 2006 Long Term Incentive Plan, |

| 5. | Elan Corporation, plc 2012 Long Term Incentive Plan, and |

| 6. | Elan Corporation, plc Employee Equity Purchase Plan; |

“End Date”, the date that is nine months after the date of this Agreement; provided, that if as of such date all Conditions (other than Condition 3.3, 3.4 and 3.5) have been satisfied (or, in the sole discretion of the applicable Party, waived (where applicable)) or would be satisfied (or, in the sole discretion of the applicable Party, waived (where applicable)) if the Acquisition were completed on such date, the “End Date” shall be the date that is one year after the date of this Agreement;

“ERISA”, the United States Employee Retirement Income Security Act of 1974, as amended;

“ERISA Affiliate”, means any entity which is considered one employer with either Elan or Bidder, as appropriate, under Section 4001 of ERISA or Section 414 of the Code;

“EUR”, “€” or “euro”, the single currency unit provided for in Council Regulation (EC) NO974/98 of 8 May 1990, being the lawful currency of Ireland;

“EU Merger Regulation”, Council Regulation (EC) No. 139/2004;

“Exchange Act”, the United States Securities Exchange Act of 1934, as amended;

“Exchange Agent”, a bank or trust company appointed by Bidder (and reasonably acceptable to Elan) to act as exchange agent for the payment of the Scheme Consideration and Merger Consideration;

“Exchange Ratio”, .07636;

“Expenses Reimbursement Agreement”, the expenses reimbursement agreement dated July 28, 2013 between the Bidder and Elan, the terms of which have been approved by the Panel;

“Extraordinary General Meeting” or “EGM”, the extraordinary general meeting of the Elan Ordinary Shareholders (and any adjournment thereof) to be convened in connection with the Scheme, expected to be convened as soon as the preceding Court Meeting shall have been concluded or adjourned (it being understood that if the Court Meeting is adjourned, the EGM shall be correspondingly adjourned);

“Financing”, third-party debt financing provided to the Bidder, Holdco or any of their respective Subsidiaries for the purposes of financing the transactions contemplated by this Agreement;

“Financing Extension Notice”, shall have the meaning given to that term in Clause 5.3.8;

“Financing Sources”, the entities that have committed to provide or otherwise arrange the Financing (including any entities that will serve as underwriters or initial purchasers with respect to any capital markets Financing) or other financings in connection with the transactions contemplated hereby, including the parties to any joinder agreements or credit agreements entered pursuant thereto or relating thereto, but excluding in each case for the avoidance of doubt the Parties and their Subsidiaries, together with their respective Affiliates, and their respective Affiliates’ officers, directors, employees, agents and Representatives and their respective successors and assigns;

“Foreign Holdco”, shall have the meaning given to that term in the Preamble;

“Form S-4”, shall have the meaning given to that term in Clause 3.7;

“Fractional Entitlements”, shall have the meaning given to that term in Clause 8.3.1;

11

“GMP Regulations”, shall have the meaning given to that term in Clause 6.1.18(8);

“Government Official” means (i) any official, officer, employee, or representative of, or any Person acting in an official capacity for or on behalf of, any Relevant Authority, (ii) any political party or party official or candidate for political office or (iii) any company, business, enterprise or other entity owned, in whole or in part, or controlled by any Person described in the foregoing clause (i) or (ii) of this definition;

“Group”, in relation to any Party, such Party and its Subsidiaries;

“High Court”, the High Court of Ireland;

“Holdco”, shall have the meaning given to that term in the Preamble;

“Holdco Board”, the board of directors of Holdco;

“Holdco Distributable Reserves Creation”, shall have the meaning given to that term in Clause 7.9.1;

“Holdco Memorandum and Articles of Association”, shall have the meaning given to that term in Clause 6.2.1(2)(c);

“Holdco Shares”, the ordinary shares of €0.05 each in the capital of Holdco;

“Holdco Subscriber Shares”, the 2000 Holdco Shares in issue at the date of this Agreement;

“HSR Act”, the United States Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder;

“Indemnified Parties”, shall have the meaning given to that term in Clause 7.3.2;

“Intellectual Property”, shall have the meaning given to that term in Clause 6.1.12;

“Intervening Event”, with respect to Elan or the Bidder, as applicable, a material event, development, occurrence, state of facts or change that was not known or reasonably foreseeable to the Elan Board or the Bidder Board, as applicable, on the date of this Agreement, which event, development, occurrence, state of facts or change becomes known to the Elan Board or the Bidder Board, as applicable, before the Elan Shareholder Approval or the Bidder Shareholder Approval, as applicable, is obtained; provided, that (i) in no event shall any action taken by either Party pursuant to and in compliance with the affirmative covenants set forth in Clause 7.2 of this Agreement, and the consequences of any such action, constitute an Intervening Event, (ii) in no event shall any event, development, occurrence, state of facts or change that has had or would reasonably be expected to have an adverse effect on the business, operations, properties, assets, liabilities, results of operations or financial condition of, or the market price of the securities of, a Party or any of its Subsidiaries constitute an Intervening Event with respect to the other Party unless such event, development, occurrence, state of facts or change has had or would reasonably be expected to have an Elan Material Adverse Effect (if such other Party is the Bidder) or a Bidder Material Adverse Effect (if such other Party is Elan), (iii) in no event shall the receipt, existence of or terms of any Elan Alternative Proposal or any enquiry relating thereto or the consequences thereof constitute an Intervening Event with respect to Elan and (iv) in no event shall the receipt, existence of or terms of any Bidder Alternative Proposal or any enquiry relating thereto or the consequences thereof constitute an Intervening Event with respect to the Bidder;

“Ireland”, the island of Ireland, excluding Northern Ireland and the word “Irish” shall be construed accordingly;

“IRFS”, international financial reporting standards;

“Irish Competition Authority”, the body corporate known as the Irish Competition Authority as established under the Competition Act;

12

“Janssen AI”, Janssen Alzheimer Immunotherapy;

“Joint Proxy Statement”, shall have the meaning given to that term in Clause 3.7;

“knowledge”, with respect to Elan, the knowledge, after reasonable due inquiry, of the persons listed in Section 1.1(a) of the Elan Disclosure Schedule, and, with respect to the Bidder, the knowledge, after reasonable due inquiry, of the persons listed in Section 1.1(a) of the Bidder Disclosure Schedule;

“LARA”, shall have the meaning given to that term in Clause 8.5.2.

“Law”, any federal, state, local, foreign or supranational law, statute, ordinance, rule, regulation, judgment, order, injunction, decree, agency requirement, license or permit of any Relevant Authority;

“Lien”, shall have the meaning given to that term in Clause 6.1.3(3) to the Agreement;

“Marketing Material”, shall have the meaning given to that term in Clause 7.8.1 to the Agreement;

“MBCA”, Michigan Business Corporation Act, as amended;

“Merger”, the merger of MergerSub with and into Bidder in accordance with Clause 8.5;

“Merger Consideration”, shall have the meaning given to that term in Clause 8.5.6;

“Merger Effective Time”, shall have the meaning given to that term in Clause 8.5.2; provided that the Merger shall become effective substantially concurrently with the effectiveness of the Scheme, to the extent possible;

“MergerSub”, shall have the meaning given to that term in the Preamble;

“New Plans”, shall have the meaning given to that term in Clause 7.4.3;

“Northern Ireland”, the counties of Antrim, Armagh, Derry, Down, Fermanagh and Tyrone on the island of Ireland;

“Notice Period”, shall have the meaning given to that term in Clause 5.3.8;

“NYSE”, the New York Stock Exchange;

“OIG”, the Office of Inspector General of the United States Department of Health and Human Services;

“Old Plans”, shall have the meaning given to that term in Clause 7.4.3;

“Organisational Documents”, articles of association, articles of incorporation, certificate of incorporation or by-laws or other equivalent organisational document, as appropriate;

“Other Bidder Merger Party Organisational Documents”, shall have the meaning given to that term in Clause 6.2.1(2)(c);

“Panel”, the Irish Takeover Panel;

“Parties”, Elan and the Bidder and each a “Party”;

“Pensions Act” means the Pensions Act 1990 as amended;

“Person” or “person”, an individual, group (including a “group” under Section 13(d) of the Exchange Act), corporation, partnership, limited liability company, joint venture, association, trust, unincorporated organisation or other entity or any Relevant Authority or any department, agency or political subdivision thereof;

13

“Per Share Option Consideration”, the sum of the (i) Cash Consideration and (ii) the product of (x) the Exchange Ratio and (y) the Closing Price;

“Petition”, the petition to the High Court seeking the Court Order;

“Prothena”, shall have the meaning given to that term in Clause 6.1.1(3);

“Recoverable VAT”, in relation to any person, any amount in respect of VAT which that person (or a member of the same VAT Group as that person) has incurred and in respect of which that person or any other member of the same VAT Group as that person is entitled to a refund (by way of credit or repayment) from any relevant Tax Authority pursuant to and determined in accordance with section 59 of the Value Added Tax Consolidation Act 2010 and any regulations made under that Act;

“Registrar of Companies”, the Registrar of Companies in Dublin, Ireland as defined in Section 2 of the Act;

“Regulatory Authorities”, shall have the meaning given to that term in Clause 6.1.18(2);

“Regulatory Information Service”, a regulatory information service as defined in the Takeover Rules;

“Regulatory Permits”, shall have the meaning given to that term in Clause 6.1.18(2);

“Release”, shall have the meaning given to that term in Clause 6.1.19;

“Relevant Authority”, any Irish, United States, foreign or supranational, federal, state or local governmental commission, board, body, bureau, or other regulatory authority, agency, including courts and other judicial bodies, or any competition, antitrust or supervisory body or other governmental, trade or regulatory agency or body, securities exchange or any self-regulatory body or authority, including any instrumentality or entity designed to act for or on behalf of the foregoing, in each case, in any jurisdiction, including the Panel and the SEC;

“Removal, Remedial or Response”, shall have the meaning given to that term in Clause 6.1.19;

“Representatives”, in relation to any person, the directors, officers, employees, agents, investment bankers, financial advisors, legal advisors, accountants, brokers, finders, consultants or representatives of such person;

“Resolutions”, the Court Meeting Resolutions, the EGM Resolutions, and such other resolutions to be proposed at the EGM and Court Meeting required to effect the Scheme, which will be set out in the Scheme Document;

“Reverse Termination Payment”, shall have the meaning given to that term in Clause 9.2;

“Revised Acquisition”, shall have the meaning given to that term in Clause 5.3.8;

“Rule 2.5 Announcement”, the announcement in the Agreed Form to be made by the Parties pursuant to Rule 2.5 of the Takeover Rules, a copy of which is annexed to this Agreement;

“Sarbanes-Oxley Act”, shall have the meaning given to that term in Clause 6.1.4;

“Scheme” or “Scheme of Arrangement”, the proposed scheme of arrangement under Section 201 of the Act and the capital reduction under Sections 72 and 74 of the Act to effect the Acquisition pursuant to this Agreement, in such terms and form consistent with the terms of this Agreement or as the Parties, acting reasonably, mutually agree, including any revision thereof as may be agreed between the Parties in writing;

“Scheme Consideration”, in respect of each Elan Share subject to the Scheme, the Cash Consideration and the Share Consideration, together with any cash in lieu of Fractional Entitlements (if applicable);

14

“Scheme Document”, a document (or the relevant sections of the Joint Proxy Statement comprising the scheme document) (including any amendment or supplements thereto) to be distributed to Elan Shareholders and to the holders of the Elan Options or Elan Share Awards for information only containing (i) the Scheme, (ii) the notice or notices of the Court Meeting and EGM, (iii) an explanatory statement as required by Section 202 of the Act with respect to the Scheme, (iv) such other information as may be required or necessary pursuant to the Act or the Takeover Rules and (v) such other information as Elan and the Bidder shall agree;

“Scheme Recommendation”, the recommendation of the Elan Board that Elan Shareholders vote in favour of the Resolutions;

“SEC”, the United States Securities and Exchange Commission;

“Securities Act”, the United States Securities Act of 1933, as amended;

“Share Consideration”, a number of Holdco Shares per Elan Share equal to the Exchange Ratio;

“Significant Subsidiary”, a significant subsidiary as defined in Rule 1-02(w) of Regulation S-X of the Securities Act;

“Stock Option Agreement”, means the agreement between Elan and the holder of an Elan Option that contains the terms, conditions and restrictions pertaining to his or her Elan Option;

“Subsidiary”, in relation to any person, any corporation, partnership, association, trust or other form of legal entity of which such person directly or indirectly owns securities or other equity interests representing more than 50% of the aggregate voting power (provided that the Bidder Merger Parties shall be deemed to be Subsidiaries of the Bidder for purposes of this Agreement);

“Superior Proposal Notice”, shall have the meaning given to that term in Clause 5.3.8;

“Surviving Corporation”, shall have the meaning given to that term in Clause 8.5.1;

“Takeover Offer”, means an offer in accordance with Clause 3.6 for the entire issued share capital of Elan (other than any Elan Ordinary Shares beneficially owned by the Bidder or any member of the Bidder Group (if any)) including any amendment or revision thereto pursuant to this Agreement, the full terms of which would be set out in the Takeover Offer Document;

“Takeover Offer Document”, means, if following the date of this Agreement, the Bidder elects to implement the Acquisition by way of the Takeover Offer in accordance with Clause 3.6, the document to be despatched to Elan Shareholders and others by the Bidder or Holdco containing, amongst other things, the Takeover Offer, the Conditions (save insofar as not appropriate in the case of a Takeover Offer) and certain information about the Bidder and Elan and, where the context so admits, includes any form of acceptance, election, notice or other document reasonably required in connection with the Takeover Offer;

“Takeover Panel Act”, the Irish Takeover Panel Act 1997 (as amended);

“Takeover Regulations”, the European Communities (Takeover Bids (Directive 2004/25/EC)) Regulations 2006;

“Takeover Rules”, the Irish Takeover Panel Act 1997 (as amended), Takeover Rules, 2007, as amended;

“TASE”, the Tel Aviv Stock Exchange;

“Tax” (or “Taxes” and, with correlative meaning, the term “Taxable”) means all national, federal, state, local or other Taxes imposed by the United States, Ireland, and any other Relevant Authority or Tax Authority, including, without limitation, income, gain, profits, windfall profits, franchise, gross receipts, environmental, customs duty, capital stock, severances, stamp, payroll, universal social charge, pay related social

15

insurance and other similar contributions, sales, employment, unemployment, disability, use, property, gift tax, inheritance tax, unclaimed property, escheat, withholding, excise, production, value added, goods and services, trading, occupancy and other taxes, duties or assessments of any nature whatsoever, together with all interest, penalties, surcharges and additions imposed with respect to such amounts and any interest in respect of such penalties and additions, whether disputed or not;

“Tax Authority” means any Relevant Authority responsible for the assessment, collection or enforcement of laws relating to Taxes or for making any decision or ruling on any matter relating to Tax (including, without limitation, the U.S. Internal Revenue Service and the Irish Revenue Commissioners);

“Tax Return” means any returns and reports (including elections, declarations, disclosures, schedules, estimates and information returns) filed or required to be filed with a Tax Authority relating to Taxes, including any attachment thereto and any amendment thereof;

“Transaction Challenge”, shall have the meaning given to that term in Clause 7.12.1;

“TYSABRI Agreement” that certain Asset Purchase Agreement, dated as of February 5, 2013, by and among Elan Pharma, Elan LLC and Biogen Idec.;

“US dollar”, “US$”, “$” or “USD”, United States dollars, the lawful currency of the United States of America;

“US” or “United States”, the United States, its territories and possessions, any State of the United States and the District of Columbia, and all other areas subject to its jurisdiction;

“US GAAP”, U.S. generally accepted accounting principles;

“VAT”, any Tax imposed by any member state of the European Community in conformity with the Directive of the Council of the European Union on the common system of value added tax (2006/112/EC); and

“VAT Group”, a group as defined in Section 15 of the Value Added Tax Consolidation Act 2010.

| 1.2. | Construction |

| 1.2.1. | In this Agreement, words such as “hereunder”, “hereto”, “hereof” and “herein” and other words commencing with “here” shall, unless the context clearly indicates to the contrary, refer to the whole of this Agreement and not to any particular section or clause thereof. |

| 1.2.2. | In this Agreement, save as otherwise provided herein, any reference herein to a section, clause, schedule or paragraph shall be a reference to a section, subsection, clause, sub-clause, paragraph or sub-paragraph (as the case may be) of this Agreement. |

| 1.2.3. | In this Agreement, any reference to any provision of any legislation shall include any amendment, modification, re-enactment or extension thereof and shall also include any subordinate legislation made from time to time under such provision, and any reference to any provision of any legislation, unless the context clearly indicates to the contrary, shall be a reference to legislation of Ireland. |

| 1.2.4. | In this Agreement, the masculine gender shall include the feminine and neuter and the singular number shall include the plural and vice versa. |

| 1.2.5. | In this Agreement, unless the context indicates to the contrary, any reference to an Irish legal term for any action, remedy, method of judicial proceeding, legal document, legal status, court, official or any legal concept or thing shall, in respect of any jurisdiction other than Ireland, be deemed to include a reference to what most nearly approximates in that jurisdiction to the Irish legal term. |

16

| 1.2.6. | In this Agreement, any phrase introduced by the terms “including”, “include”, “in particular” or any similar expression shall be construed as illustrative and shall not limit the sense of the words preceding those terms. |

| 1.2.7. | In this Agreement, any agreement or instrument defined or referred to herein or in any agreement or instrument that is referred to herein means such agreement or instrument as from time to time amended, modified or supplemented, including by waiver or consent, and all attachments thereto and instruments incorporated therein. |

| 1.3. | Captions |

The table of contents and the headings or captions to the clauses in this Agreement are inserted for convenience of reference only and shall not affect the interpretation or construction thereof.

| 1.4. | Time |

References to times are to Irish times unless otherwise specified.

| 2. | RULE 2.5 ANNOUNCEMENT AND SCHEME DOCUMENT |

| 2.1. | Rule 2.5 Announcement |

| 2.1.1. | Each Party confirms that its respective board of directors (or a duly authorised committee thereof) has approved the contents and release of the Rule 2.5 Announcement. |

| 2.1.2. | Forthwith upon the execution of this Agreement, the Parties shall jointly, in accordance with, and for the purposes of, the Takeover Rules, procure the release of the Rule 2.5 Announcement to a Regulatory Information Service by no later than 7.00 a.m., Irish time on 29 July, 2013, or such later time as may be agreed between the Parties in writing. |

| 2.1.3. | The obligations of Elan and the Bidder under this Agreement, other than the obligations under Clause 2.1.2, shall be conditional on the release of the Rule 2.5 Announcement to a Regulatory Information Service on 29 July, 2013. |

| 2.1.4. | Elan confirms that, as of the date hereof, the Elan Board considers that the terms of the Scheme as contemplated by this Agreement are fair and reasonable and that the Elan Board has resolved to recommend to the Elan Shareholders that they vote in favour of the Resolutions. The recommendation of the Elan Board that the Elan Shareholders vote in favour of the Resolutions, and the related opinion of the financial advisers to the Elan Board, are set out in the Rule 2.5 Announcement and, subject to Clause 5.3, shall be incorporated in the Scheme Document and any other document sent to Elan Shareholders in connection with the Acquisition to the extent required by the Takeover Rules or the rules of the SEC. |

| 2.1.5. | The Conditions are hereby incorporated in and shall constitute a part of this Agreement. |

| 2.2. | Scheme |

| 2.2.1. | Elan agrees that it will put the Scheme to the Elan Shareholders in the manner set out in Clause 3 and, subject to the satisfaction or, in the sole discretion of the applicable Party, waiver (where applicable) of the Conditions (with the exception of Conditions 2.3 and 2.4), will, in the manner set out in Clause 3, petition the High Court to sanction the Scheme so as to facilitate the implementation of the Acquisition. |

17

| 2.2.2. | Each of the Bidder and Holdco agrees that it will participate in the Scheme and agree to be bound by its terms, as proposed by Elan to the Elan Shareholders, and that it shall, subject to the satisfaction or, in the sole discretion of the applicable Party, waiver (where applicable) of the Conditions (with the exception of Conditions 2.3 and 2.4), effect the Acquisition through the Scheme on the terms set out in this Agreement and the Scheme. |

| 2.2.3. | Each of the Parties agrees that it will fully and promptly perform all of the obligations required of it in respect of the Acquisition on the terms set out in this Agreement and/or the Scheme, and each will, subject to the terms and conditions of this Agreement, use all of its reasonable endeavours to take such other steps as are within its power and are reasonably required of it for the proper implementation of the Scheme, including those required of it pursuant to this Agreement in connection with Completion. |

| 2.3. | Change in Shares |

If at any time during the period between the date of this Agreement and the Effective Time, the outstanding Elan Shares or Bidder Shares shall have been changed into, or exchanged for, a different number of shares or a different class, by reason of any subdivision, reclassification, reorganisation, recapitalisation, split, combination, contribution or exchange of shares, or a stock dividend or dividend payable in any other securities shall be declared with a record date within such period, or any similar event shall have occurred, the Share Consideration and the Merger Consideration and any payments to be made under Clause 4 and any other number or amount contained in this Agreement which is based upon the price or number of the Elan Shares or the Bidder Shares, as the case may be, shall be correspondingly adjusted to provide the holders of Elan Shares and Bidder Shares the same economic effect as contemplated by this Agreement prior to such event. For the avoidance of doubt, pursuant to Section 701(2)(b) of the MBCA, the Parties acknowledge that, without limiting Schedules 1 or 2 hereof, the number of Bidder Shares and Elan Shares is subject to change prior to the Merger Effective Time by reason of any such subdivision, reclassification, reorganization, recapitalisation, split, combination, contribution or dividend of the type referred to in the preceding sentence.

| 2.4. | Elan Equity Award Holder Proposal |

| 2.4.1. | Subject to the posting of the Scheme Document in accordance with Clause 3.1, the Parties agree that the Elan Equity Award Holder Proposal will be made to Elan Equity Award Holders in respect of their respective holdings of Elan Options and/or Elan Share Awards in accordance with Rule 15(d) of the Takeover Rules and the terms of the Employee Share Plans. |

| 2.4.2. | The Elan Equity Award Holder Proposal shall be issued as a joint letter from Elan and the Bidder, and the Parties shall agree the final form of the letter to be issued in respect of the Elan Equity Award Holder Proposal and all other documentation necessary to effect the Elan Equity Award Holder Proposal. |

| 2.4.3. | Save as required by Law, the High Court and/or the Panel, neither Party shall amend the Elan Equity Award Holder Proposal after its despatch without the consent of the other Party (such consent not to be unreasonably withheld, conditioned or delayed). |

| 3. | IMPLEMENTATION OF THE SCHEME; BIDDER SHAREHOLDERS MEETING |

| 3.1. | Responsibilities of Elan in Respect of the Scheme |

Elan shall:

| 3.1.1. | be responsible for the preparation of the Scheme Document and all other documentation necessary to effect the Scheme and to convene the EGM and Court Meeting; |

18

| 3.1.2. | for the purpose of implementing the Scheme, instruct a barrister (of senior counsel standing) and provide the Bidder and its advisers with the opportunity to attend any meetings with such barrister to discuss substantive matters pertaining to the Scheme and any issues arising in connection with it (except to the extent the barrister is to advise on matters relating to the fiduciary duties of the directors of Elan, any Elan Alternative Proposal or their responsibilities under the Takeover Rules); |

| 3.1.3. | as promptly as reasonably practicable after the definitive Joint Proxy Statement is filed with the SEC, or, if the preliminary Joint Proxy Statement is reviewed and commented upon by the SEC, after the filing of the first amendment to the preliminary Joint Proxy Statement with the SEC, cause to be filed with the Panel the Joint Proxy Statement (in definitive or preliminary form, as the case may be); |

| 3.1.4. | keep the Bidder reasonably informed and consult with the Bidder as to the performance of the obligations and responsibilities required of Elan pursuant to the Agreement and/or the Scheme and as to any material developments relevant to the proper implementation of the Scheme including the satisfaction of the Conditions; |

| 3.1.5. | as promptly as reasonably practicable, notify the Bidder of any matter of which Elan becomes aware which would reasonably be expected to materially delay or prevent filing of the Scheme Document or implementation of the Scheme, the Acquisition or the Merger, as the case may be; |

| 3.1.6. | as promptly as reasonably practicable, notify the Bidder upon the receipt of any comments from the Panel on, or any request from the Panel for amendments or supplements to, the Scheme Document and the related forms of proxy, insofar as lies within its powers of procurement, to be so filed or furnished; |

| 3.1.7. | prior to filing or despatch of any amendment or supplement to the Scheme Document requested by the Panel, or responding in writing to any comments of the Panel with respect thereto, Elan shall: |

| (1) | as promptly as reasonably practicable provide the Bidder with a reasonable opportunity to review and comment on such document or response; and |

| (2) | as promptly as reasonably practicable discuss with the Bidder and include in such document or response all comments reasonably proposed by the Bidder; |

| 3.1.8. | provide the Bidder with drafts of any and all pleadings, affidavits, petitions and other filings prepared by Elan for submission to the High Court in connection with the Scheme prior to their filing, and afford the Bidder reasonable opportunities to review and make comments on all such documents and accommodate such comments reasonably proposed by the Bidder; |

| 3.1.9. | as promptly as reasonably practicable make all necessary applications to the High Court in connection with the implementation of the Scheme (including issuing appropriate proceedings requesting the High Court to order that the Court Meeting be convened as promptly as practicable following the declaration of effectiveness of the Form S-4), and use all reasonable endeavours so as to ensure that the hearing of such proceedings occurs as promptly as practicable in order to facilitate the despatch of the Scheme Document and seek such directions of the High Court as it considers necessary or desirable in connection with such Court Meeting; |

| 3.1.10. | procure the publication of the requisite advertisements and despatch of the Scheme Document (in a form acceptable to the Panel) and the forms of proxy for the use at the Court Meeting and the EGM (the form of which shall be agreed between the Parties) (a) to Elan Shareholders on the register of members of Elan on the record date as agreed with the High Court, as promptly |

19

| as reasonably practicable after the approval of the High Court to despatch the documents being obtained and (b) to the holders of the Elan Options or Elan Share Awards on such date, for information only, as promptly as reasonably practicable after the approval of the High Court to despatch the documents being obtained and thereafter shall publish and/or post such other documents and information (the form of which shall be agreed between the Parties) as the High Court and/or the Panel may approve or direct from time to time in connection with the implementation of the Scheme in accordance with applicable Law as promptly as reasonably practicable after the approval or direction of the High Court and/or the Panel to publish or post such documents being obtained; |

| 3.1.11. | except to the extent that the Elan Board has effected an Elan Change of Recommendation pursuant to Clause 5.3, and subject to the obligations of the Elan Board under the Takeover Rules, procure that the Scheme Document shall include the Scheme Recommendation; |

| 3.1.12. | include in the Scheme Document, a notice convening the EGM to be held immediately following the Court Meeting to consider and, if thought fit, approve the EGM Resolutions; |

| 3.1.13. | keep the Bidder reasonably informed in the two (2) weeks prior to the Court Meeting of the number of proxy votes received in respect of resolutions to be proposed at the Court Meeting and/or the EGM, and in any event shall provide such number promptly upon the written request of the Bidder or its Representatives; |

| 3.1.14. | except to the extent the Elan Board has effected an Elan Change of Recommendation pursuant to Clause 5.3 or this Agreement has been terminated pursuant to Clause 9, hold the Court Meeting and the EGM on the date set out in the Scheme Document, or such later date as may be agreed in writing between the Parties, and in such a manner as shall be approved, if necessary, by the High Court and/or the Panel and propose the Resolutions without any amendments, unless such amendments have been agreed to in writing with the Bidder, such agreement not to be unreasonably withheld, conditioned or delayed; |

| 3.1.15. | afford all such cooperation and assistance as may reasonably be requested of it by the Bidder in respect of the preparation and verification of any document or in connection with any Clearance or confirmation required for the implementation of the Scheme including the provision to the Bidder of such information and confirmation relating to it, its Subsidiaries and any of its or their respective directors or employees as the Bidder may reasonably request (including for purposes of preparing the Joint Proxy Statement or Form S-4) and to do so in a timely manner and assume responsibility only for the information relating to it contained in the Scheme Document or any other document sent to Elan Shareholders or filed with the High Court or in any announcement; |

| 3.1.16. | review and provide comments (if any) in a reasonably timely manner on all documentation submitted to it; |

| 3.1.17. | following the Court Meeting and EGM, assuming the Resolutions are duly passed (including by the requisite majorities required under Section 201 of the Act in the case of the Court Meeting) and all other Conditions are satisfied or, in the sole discretion of the applicable Party, waived (where applicable) (with the exception of Conditions 2.3 and 2.4), take all necessary steps on the part of Elan to prepare and issue, serve and lodge all such court documents as are required to seek the sanction of the High Court to the Scheme as soon as possible thereafter; and |

| 3.1.18. | give such undertakings as are required by the High Court in connection with the Scheme as Elan determines to be reasonable and otherwise take all such steps, insofar as lies within its power, as are reasonably necessary or desirable in order to implement the Scheme. |

20

| 3.2. | Responsibilities of the Bidder and Holdco in Respect of the Scheme |

Unless a Bidder Change of Recommendation has occurred, the Bidder and Holdco shall:

| 3.2.1. | instruct counsel to appear on its behalf at the Court Hearing and undertake to the High Court to be bound by the terms of the Scheme insofar as it relates to the Bidder; |

| 3.2.2. | if, and to the extent that, it or any of its Associates owns or is interested in Elan Shares, exercise all of its rights, and, insofar as lies within its powers, procure that each of its Associates shall exercise all of its rights, in respect of such Elan Shares so as to implement, and otherwise support the implementation of, the Scheme, including by voting (and, in respect of interests in Elan held via contracts for difference or other derivative instruments, insofar as lies within its powers, procuring that instructions are given to the holder of the underlying Elan Shares to vote) in favour of the Resolutions or, if required by Law, the High Court, the Takeover Rules or other rules, refraining from voting, at any Court Meeting and/or EGM as the case may be; |

| 3.2.3. | procure that the other members of the Bidder Group and, insofar as lies within its power or procurement, their Representatives, take all such steps as are necessary or desirable in order to implement the Scheme; |

| 3.2.4. | keep Elan reasonably informed and consult with Elan as to the performance of the obligations and responsibilities required of the Bidder pursuant to this Agreement and/or the Scheme and as to any material developments relevant to the proper implementation of the Scheme including the satisfaction of the Conditions; |

| 3.2.5. | afford (and shall procure that its Associates shall afford) all such cooperation and assistance as may reasonably be requested of it by Elan in respect of the preparation and verification of any document or in connection with any Clearance or confirmation required for the implementation of the Scheme including the provision to Elan of such information and confirmation relating to it, its Subsidiaries and any of its or their respective directors or employees as Elan may reasonably request and to do so in a timely manner and assume responsibility only for the information relating to it contained in the Scheme Document or any other document sent to Elan Shareholders or filed with the High Court or in any announcement; |

| 3.2.6. | review and provide comments (if any) in a reasonably timely manner on all documentation submitted to it; and |

| 3.2.7. | as promptly as reasonably practicable, notify Elan of any other matter of which it becomes aware which would reasonably be expected to materially delay or prevent filing of the Scheme Document or implementation of the Scheme or the Acquisition as the case may be. |

| 3.3. | Mutual Responsibilities of the Parties |

| 3.3.1. | If any of the Parties becomes aware of any information that, pursuant to the Takeover Rules, the Act, the Securities Act or the Exchange Act, should be disclosed in an amendment or supplement to the Scheme Document, the Joint Proxy Statement or the Form S-4, then the Party becoming so aware shall promptly inform the other Party thereof and the Parties shall cooperate with each other in submitting or filing such amendment or supplement with the Panel, and, if required, the SEC and/or the High Court and, if required, in mailing such amendment or supplement to the Elan Shareholders and, for information only, if required, to the holders of the Elan Options or Elan Share Awards; |

21

| 3.3.2. | Elan, the Bidder and Holdco each shall take, or cause to be taken, such other steps as are reasonably required of it for the proper implementation of the Scheme, including those required of it pursuant to Clause 8 in connection with Completion; and |

| 3.3.3. | Each Party shall, as promptly as reasonably practicable, notify the other of any matter of which it becomes aware which would reasonably be expected to materially delay or prevent filing of the Scheme Document or implementation of the Scheme, the Acquisition or the Merger as the case may be. |

| 3.4. | Dealings with the Panel |

| 3.4.1. | Each of the Parties will promptly provide such assistance and information as may reasonably be requested by the other Party for the purposes of, or in connection with, any correspondence or discussions with the Panel in connection with the Acquisition and/or the Scheme. |

| 3.4.2. | Each of the Parties will give the other reasonable prior notice of any proposed meeting or material substantive discussion or correspondence between it or its Representatives with the Panel, or amendment to be proposed to the Scheme in connection therewith and afford the other reasonable opportunities to review and make comments and suggestions with respect to the same and accommodate such comments and suggestions to the extent that such Party, acting reasonably, considers these to be appropriate and keep the other reasonably informed of all such meetings, discussions or correspondence that it or its Representative(s) have with the Panel and not participate in any meeting or discussion with the Panel concerning this Agreement or the transactions contemplated by this Agreement unless it consults with the other Party in advance, and, unless prohibited by the Panel, gives such other Party the opportunity to attend and provide copies of all written submissions it makes to the Panel and copies (or, where verbal, a verbal or written summary of the substance) of the Panel responses thereto provided always that any correspondence or other information required to be provided under this Clause 3.4.2 may be redacted: |

| (1) | to remove references concerning the valuation of the business of Elan or Bidder; |

| (2) | as necessary to comply with contractual obligations; and |

| (3) | as necessary to address reasonable privilege or confidentiality concerns. |

| 3.4.3. | Elan undertakes, if so reasonably requested by Bidder, to issue as promptly as reasonably practicable its written consent to Bidder and to the Panel in respect of any application made by Bidder to the Panel: |

| (1) | to redact any commercially sensitive or confidential information specific to Bidder’s financing arrangements for the Acquisition (“Bidder Financing Information”) from any documents that Bidder is required to display pursuant to Rule 26(b)(xi) of the Takeover Rules; and |

| (2) | for a derogation from the requirement under the Takeover Rules to disclose Bidder Financing Information in the Scheme Document, any supplemental document or other document sent to Elan Shareholders, the holders of Elan Options or Elan Share Awards pursuant to the Takeover Rules. |

| 3.4.4. | Notwithstanding the foregoing provisions of this Clause 3.4, neither Elan nor the Bidder shall be required to take any action pursuant to such provisions if (i) such action is prohibited by the Panel, (iii) with respect to Elan, if Elan has made an Elan Change of Recommendation pursuant to and in accordance with Clause 5.3, for so long as such Elan Change of Recommendation |

22

| continues in effect or (iv) with respect to Bidder, if Bidder has made a Bidder Change of Recommendation pursuant to and in accordance with Clause 5.4, for so long as such Bidder change of Recommendation continues in effect. |

| 3.4.5. | Nothing in this Agreement shall in any way limit the Parties’ obligations under the Takeover Rules. |

| 3.5. | No Scheme Amendment by Elan |

Save as required by Law, the High Court and/or the Panel, Elan shall not:

| 3.5.1. | amend the Scheme; |

| 3.5.2. | adjourn or postpone the Court Meeting or the EGM (provided, however, that Elan may, without the consent of the Bidder, adjourn or postpone the Court Meeting or EGM |

| (1) | in the case of adjournment |

| (a) | where there has been an Elan Change of Recommendation pursuant to and in accordance with Clause 5.3, for so long as such Elan Change of Recommendation continues in effect, |

| (b) | to the extent reasonably necessary to ensure that any required supplement or amendment to the Joint Proxy Statement or Form S-4 is provided to the Elan Shareholders, |

| (c) | to permit dissemination of information which is material to shareholders voting at the Court Meeting or the EGM, but only for so long as the Elan Board determines in good faith, after having consulted with outside counsel, that such action is reasonably necessary or advisable to give Elan Shareholders sufficient time to evaluate any such disclosure or information so provided or disseminated; or |

| (d) | if as of the time the Court Meeting or EGM is scheduled (as set forth in the Joint Proxy Statement), there are insufficient Elan Shares represented (either in person or by proxy) (A) to constitute a quorum necessary to conduct the business of the Court Meeting or the EGM, but only until a meeting can be held at which there are a sufficient number of Elan Shares represented to constitute a quorum or (B) voting for the approval of the Court Resolutions or the EGM Resolutions, as applicable, but only until a meeting can be held at which there are a sufficient number of votes of holders of Elan Shares to approve the Court Meeting Resolutions or the EGM Resolutions, as applicable); or |

| 3.5.3. | amend the Resolutions (in each case, in the form set out in the Scheme Document) after despatch of the Scheme Document without the consent of the Bidder (such consent not to be unreasonably withheld, conditioned or delayed). |

| 3.6. | Switching to a Takeover Offer |

| 3.6.1. | In the event (and only in the event) that the Bidder reasonably considers (in its good faith discretion) that a competitive situation exists or, based on facts known at the time, may reasonably be expected to arise in connection with the Acquisition, the Bidder may elect (and with the Panel’s consent, if required) to implement the Acquisition by way of the Takeover Offer (rather than the Scheme), whether or not the Scheme Document has been posted, subject to the terms of this Clause 3.6. |

23

| 3.6.2. | Save to the extent there has been an Elan Change of Recommendation, which Elan Change of Recommendation continues in effect, if the Bidder elects to implement the Acquisition by way of the Takeover Offer, Elan undertakes to provide the Bidder as promptly as reasonably practicable with all such information about the Elan Group (including directors and their connected persons) as may reasonably be required for inclusion in the Takeover Offer Document and to provide all such other assistance as may reasonably be required by the Takeover Rules in connection with the preparation of the Takeover Offer Document, including reasonable access to, and ensuring the provision of reasonable assistance by, its management and relevant professional advisers. |

| 3.6.3. | If the Bidder elects to implement the Acquisition by way of a Takeover Offer, Elan agrees: |

| (1) | that the Takeover Offer Document will contain provisions in accordance with the terms and conditions set out in the Rule 2.5 Announcement, the relevant Conditions and such other further terms and conditions as agreed (including any modification thereto) between the Bidder and Elan; provided, however, that the terms and conditions of the Takeover Offer shall be at least as favourable to the Elan Shareholders (except for the 90 per cent acceptance condition); |

| (2) | save to the extent there has been an Elan Change of Recommendation, which Elan Change of Recommendation continues in effect, to reasonably co-operate and consult with the Bidder in the preparation of the Takeover Offer Document or any other document or filing which is required for the purposes of implementing the Acquisition; |

| (3) | that, subject to the obligations of the Elan Board under the Takeover Rules, and unless the Elan Board determines in good faith after consultation with its outside legal counsel and its financial advisors that, to do otherwise, would reasonably be expected to be inconsistent with the fiduciary duties of the directors of Elan or the Takeover Rules, with respect to the Takeover Offer shall incorporate in the Rule 2.5 Announcement and the Takeover Offer Document a recommendation to the holders of Elan Shares from the Elan Board to accept the Takeover Offer, and such recommendation will not be withdrawn, adversely modified or qualified except as contemplated by Clause 5.3. |

| 3.6.4. | Save to the extent there has been an Elan Change of Recommendation, for so long as such Elan Change of Recommendation continues in effect, if the Bidder elects to implement the Acquisition by way of the Takeover Offer in accordance with Clause 3.6.1, the Parties mutually agree: |

| (1) | to prepare and file with, or submit to, the SEC all documents, amendments and supplements required to be filed therewith or submitted thereto pursuant to the Securities Act or the Exchange Act, and each party shall have reasonable opportunities to review and make comments on all such documents, amendments and supplements and, following accommodation of such comments and approval of such documents, amendments and supplements by the other party, which shall not be unreasonably withheld, conditioned or delayed, file or submit, as the case may be, such documents, amendments and supplements with or to the SEC; |

| (2) | to provide the other party with any comments received from the SEC on any documents filed by it with the SEC promptly after receipt thereof; and |