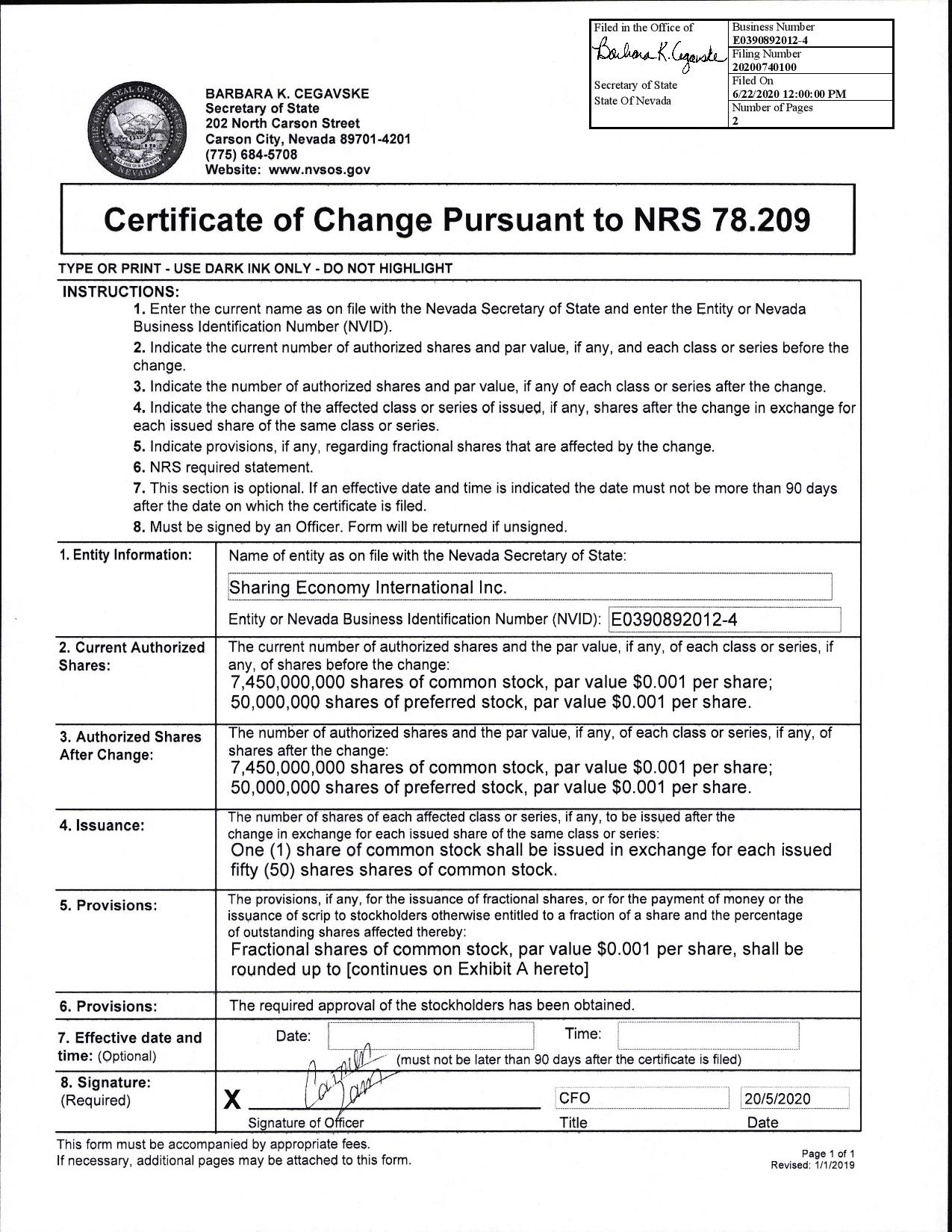

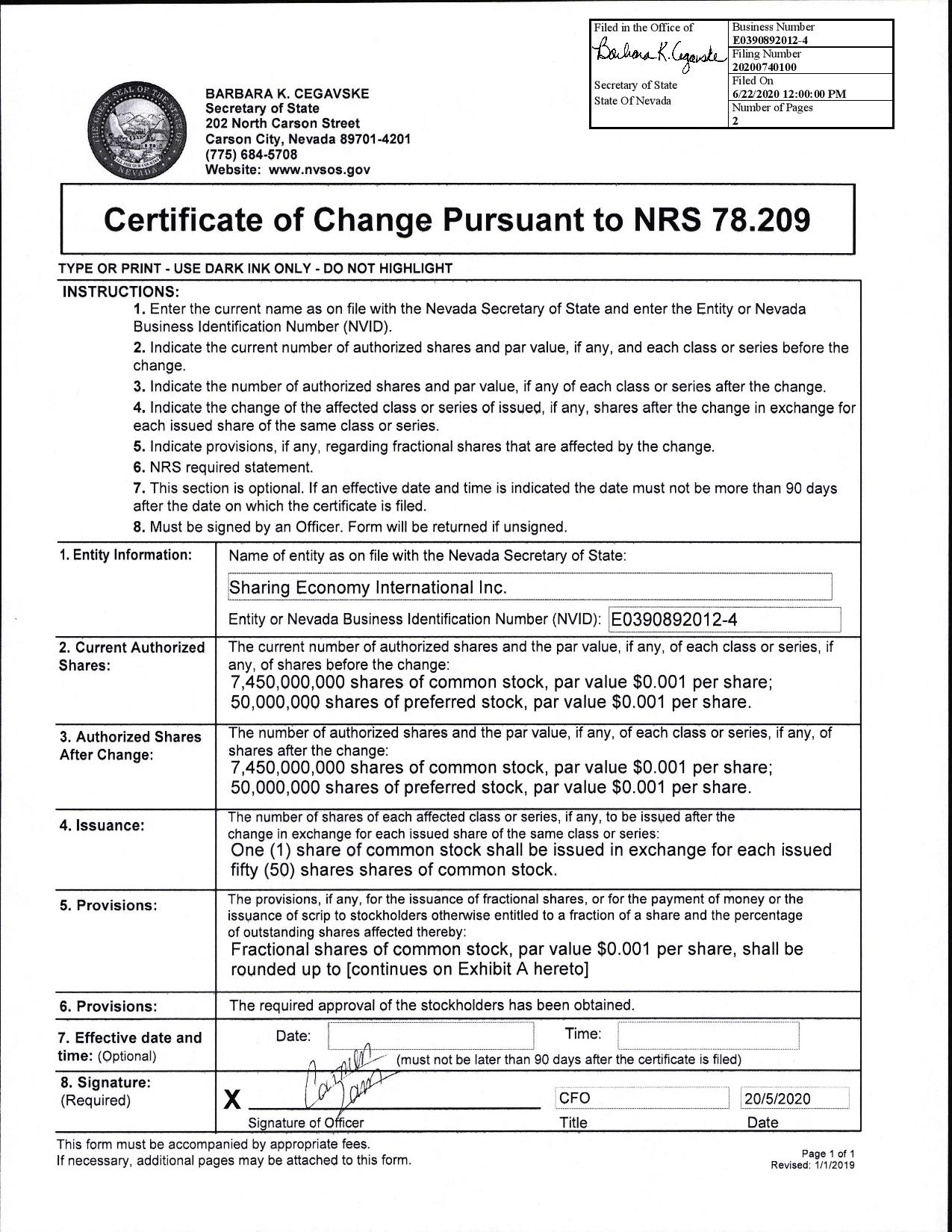

Exhibit 3.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 14, 2020

Sharing Economy International Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

001-34591

(Commission File Number)

90-0648920

(IRS Employer Identification No.)

M302, 3/F, Eton Tower,

8 Hysan Avenue,

Causeway Bay, Hong Kong

(Address of principal executive offices)(Zip Code)

+852 35832186

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward-looking Statements

Statements in Exhibit 99.1 to this Current Report on Form 8-K may be forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “estimate”, “expect”, “intend” and similar expressions, as they relate to Sharing Economy International Inc. (the “Company”) or its management, identify forward-looking statements. These statements are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and probably will, differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in the Company’s filings with the Securities and Exchange Commission. Factors which could cause actual results to differ materially from these forward-looking statements include such factors as (i) the development and protection of our brands and other intellectual property, (ii) the need to raise capital to meet business requirements, (iii) our ability to pay down existing debt, (iv) the ability to achieve and expand significant levels of revenues, or recognize net income, from the sale of our products and services, (v) the effect of the COVID-19 outbreak on our operations and political considerations, (vi) management’s ability to attract and maintain qualified personnel necessary for the development and commercialization of its planned products, (vii) general industry and market conditions and growth rates, and general economic conditions, and (viii) other information that may be detailed from time to time in the Company’s filings with the United States Securities and Exchange Commission. Any forward-looking statements speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of Form 8-K.

Item 3.03 Material Modification to Rights of Security Holders

Effective May 20, 2020, the Board of Directors of the Company and one stockholder holding an aggregate of 4,679,260,000 shares of common stock on such date approved an amendment to the Company’s Articles of Incorporation effecting a fifty-for-one (50:1) reverse split (the “Reverse Stock Split”) of the Company’s outstanding shares of common stock. The Reverse Stock Split was effective on the OTC Markets Group, Inc. as of the opening of business on October 13, 2020. As a result of the Reverse Stock Split, each 50 shares of the Company’s common stock outstanding on such date was exchanged for one share of the Company’s common stock. The new CUSIP number for shares of common stock of the Company in connection with the forward split is 819534207.

A copy of the Certificate of Change filed with the Secretary of State of the State of Nevada, effecting the amendment to the Company’s Articles of Incorporation is filed herewith as Exhibit 3.1.

Certain Risks Associated with the Reverse Stock Split

The Reverse Stock Split will have possible anti-takeover effects.

Management of the Company may use the shares that will result from the effective increase in the number of authorized shares that will result from the approved Reverse Stock Split to resist a third-party transaction by, for example, diluting stock ownership of persons seeking to obtain control of the Company.

There can be no assurance that the total projected market capitalization of the Company’s common stock after the proposed Reverse Stock Split will be equal to or greater than the total projected market capitalization before the proposed Reverse Stock Split or that the price per share of the Company’s common stock following the Reverse Stock Split will either exceed or remain higher than the current anticipated per share.

There can be no assurance that the market price per new share of the Company common stock (the “New Shares”) after the Reverse Stock Split will rise or remain constant in proportion to the reduction in the number of old shares of the Company common stock (the “Old Shares”) outstanding before the Reverse Stock Split.

1

Accordingly, the total market capitalization of the Company’s common stock after the proposed Reverse Stock Split may be lower than the total market capitalization before the proposed Reverse Stock Split and, in the future, the market price of the Company’s common stock following the Reverse Stock Split may not exceed or remain higher than the market price prior to the proposed Reverse Stock Split. In many cases, the total market capitalization of a company following a Reverse Stock Split is lower than the total market capitalization before the Reverse Stock Split.

There can be no assurance that the Reverse Stock Split will result in a per share price that will attract investors, and a decline in the market price for the Company’s common stock after the Reverse Stock Split may result in a greater percentage decline than would occur in the absence of a Reverse Stock Split, and the liquidity of the Company’s common stock could be adversely affected following a Reverse Stock Split.

The market price of the Company’s common stock will also be based on the Company’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of the Company’s common stock declines, the percentage decline as an absolute number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. In many cases, both the total market capitalization of a company and the market price of a share of such company’s common stock following a Reverse Stock Split are lower than they were before the Reverse Stock Split. Furthermore, the liquidity of the Company’s common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

The Company’s common stock trades as a “penny stock” classification which limits the liquidity for the Company’s common stock.

The Company’s stock is subject to “penny stock” rules as defined in Rule 3a51-1, promulgated pursuant to the Securities Exchange Act of 1934, as amended. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. the Company’s common stock is subject to these penny stock rules. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity securities with a price of less than U.S. $5.00 (other than securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

As a result, all brokers or dealers involved in a transaction in which the Company’s shares are sold to any buyer, other than an established customer or “accredited investor,” must make a special written determination. These Exchange Act rules may limit the ability or willingness of brokers and other market participants to make a market in our shares and may limit the ability of the Company’s stockholders to sell in the secondary market, through brokers, dealers or otherwise. The Company also understands that many brokerage firms will discourage their customers from trading in shares falling within the “penny stock” definition due to the added regulatory and disclosure burdens imposed by these Exchange Act rules. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the common shares in the United States and stockholders may find it more difficult to sell their shares. An orderly market is not assured or implied as to the Company’s common stock. Nor are there any assurances as to the existence of market makers or broker/dealers for the Company’s common stock.

Item 7.01 Regulation FD Disclosure.

On October 14, 2020, the Company issued a press release relating to the Reverse Stock Split. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 7.01, and in Exhibit 99.1, referenced herein is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act or incorporated by reference in any filing under the Securities Act, unless the Company expressly so incorporates such information by reference.

2

Item 9.01 Financial Statements and Exhibits

| (d) | Exhibits: |

| Exhibit | Description | |

| 3.1 | Certificate of Change | |

| 99.1 | Press Release, dated October 14, 2020. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Sharing Economy International Inc. | ||

| Date: October 20, 2020 | By: | /s/ Anthony Che Chung Chan |

| Name: | Anthony Che Chung Chan | |

| Title: | Chief Executive Officer | |

4

Exhibit 3.1

Exhibit 99.1

Sharing Economy International 1-50 Reverse Split Effected

HONG KONG, Oct. 14, 2020 /PRNewswire/ -- The board of SEII announces that a 1-50 reverse split of its issued and outstanding shares of common stock has been effected. Every fifty issued existing shares has been consolidated into one share, effective from 13 October 2020.

The SEII's board of directors considers that the primary driver behind the share consolidation is that it will result in an upward adjustment to the share price of the company. The board is aware that certain brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced shares or tend to discourage individual brokers from recommending low-priced shares to their customers.

The board believes that the higher trading price of the new shares will also enhance the company's corporate image and therefore attract a broader range of institutional and professional investors to invest in the new shares, broadening the shareholder base of the company. This has multiple benefits for the company and its existing shareholders. More financing opportunities may become available for the company if the new shares become an acceptable investment option for institutional investors. This would allow the company to pursue additional profit-generating ventures to support the company's long term development. Greater investment by institutional investors, if the company can attract such investors, is also likely to reduce the volatility of and stabilize the price of shares of the company, as such investors tend to have longer investment horizons.

It is anticipated that a more stable and less volatile trading share price will serve to facilitate trading activities and improve market efficiency by boosting the liquidity of the new shares.

About Sharing Economy International Inc.

Sharing Economy International Inc., through its affiliated companies, designs, manufactures and distributes a line of proprietary high and low temperature dyeing and finishing machinery to the textile industry. The Company's latest business initiatives are focused on targeting the technology and global sharing economy markets, by developing online platforms and rental business partnerships that will drive the global development of sharing through economical rental business models. Moreover, the Company will actively pursue blockchain technology in its existing and to-be-acquired business, enabling the general public to realize the beauty of resource sharing.

For more information visit www.seii.com

Cautionary Warning Regarding Forward-Looking Statements:

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "expects," "plans," "intends," "anticipates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in any forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may, and probably will, differ materially from the predictions discussed in these forward-looking statements. Changes in the circumstances upon which we base our predictions and/or forward-looking statements could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: (1) our ability to raise additional capital to continue our operations; (2) our ability to pay down existing debt; (3) our ability to attract and retain key executive officers and the professional advisors; (4) the effect of the COVID-19 outbreak on our operations; (5) potential litigation with our shareholders, creditors and/or former or current investors; (6) the effect of political instability on our operations; and (7) other factors over which we have little or no control. Any forward-looking statements speak only as of the date on which they are made, and Sharing Economy International does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this release. Information on Sharing Economy International's website does not constitute a part of this release.

SOURCE Sharing Economy International, Inc.

2/$A3C@G)R1[^] 'K,FN:5%:6MU)J-HEO=LJ6\K3*%F9N5"G

MH21TQ6@#FO _!$-YJ?C#1_!^H!S%X3EN;B0L,B4AP(3^&[(]J]FTKQ%IFLW^

MHV%C.9+C39!%=*8V78QSQDC!Z'I2 XWQU\39/!/C'2=-GM87TZZ0/<3'/F1@

ML5R!G&!@'\ZU;OQA