Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

| Commission |

Exact Name of Registrant as Specified in its Charter, |

I.R.S. Employer | ||

| 001-31403 | PEPCO HOLDINGS, INC. (Pepco Holdings or PHI), a Delaware corporation 701 Ninth Street, N.W. Washington, D.C. 20068 Telephone: (202)872-2000 |

52-2297449 | ||

| 001-01072 | POTOMAC ELECTRIC POWER COMPANY (Pepco), a District of Columbia and Virginia corporation 701 Ninth Street, N.W. Washington, D.C. 20068 Telephone: (202)872-2000 |

53-0127880 | ||

| 001-01405 | DELMARVA POWER & LIGHT COMPANY (DPL), a Delaware and Virginia corporation 500 North Wakefield Drive, 2nd Floor Newark, DE 19702 Telephone: (202)872-2000 |

51-0084283 | ||

| 001-03559 | ATLANTIC CITY ELECTRIC COMPANY (ACE), a New Jersey corporation 500 North Wakefield Drive, 2nd Floor Newark, DE 19702 Telephone: (202)872-2000 |

21-0398280 | ||

Securities registered pursuant to Section 12(b) of the Act:

| Registrant |

Title of Each Class |

Name of Each Exchange on Which Registered | ||

| Pepco Holdings | Common Stock, $.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

| Registrant |

Title of Each Class | |

| Pepco | Common Stock, $.01 par value | |

| DPL | Common Stock, $2.25 par value | |

| ACE | Common Stock, $3.00 par value |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Pepco Holdings | Yes x | No ¨ | Pepco | Yes ¨ | No x | |||||||

| DPL | Yes ¨ | No x | ACE | Yes ¨ | No x | |||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Pepco Holdings | Yes ¨ | No x | Pepco | Yes ¨ | No x | |||||||

| DPL | Yes ¨ | No x | ACE | Yes ¨ | No x | |||||||

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

| Pepco Holdings | Yes x | No ¨ | Pepco | Yes x | No ¨ | |||||||

| DPL | Yes x | No ¨ | ACE | Yes x | No ¨ | |||||||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Pepco Holdings | Yes x | No ¨ | Pepco | Yes x | No ¨ | |||||||

| DPL | Yes x | No ¨ | ACE | Yes x | No ¨ | |||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K (applicable to Pepco Holdings only). ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

Accelerated Filer |

Non- Accelerated Filer |

Smaller Reporting Company | |||||

| Pepco Holdings |

x | ¨ | ¨ | ¨ | ||||

| Pepco |

¨ | ¨ | x | ¨ | ||||

| DPL |

¨ | ¨ | x | ¨ | ||||

| ACE |

¨ | ¨ | x | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Pepco Holdings | Yes ¨ | No x | Pepco | Yes ¨ | No x | |||||||

| DPL | Yes ¨ | No x | ACE | Yes ¨ | No x | |||||||

Pepco, DPL, and ACE meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this Form 10-K with the reduced disclosure format specified in General Instruction I(2) of Form 10-K.

| Registrant |

Aggregate Market Value of Voting and Non-Voting Common Equity Held by Non-Affiliates of the Registrant at June 28, 2013 |

Number of Shares of Common Stock of the Registrant Outstanding at February 14, 2014 | ||

| Pepco Holdings | $ 5,010.3 million (a) | 250,517,109 ($.01 par value) | ||

| Pepco | None (b) | 100 ($.01 par value) | ||

| DPL | None (c) | 1,000 ($2.25 par value) | ||

| ACE | None (c) | 8,546,017 ($3.00 par value) |

| (a) | Solely for purposes of calculating this aggregate market value, PHI has defined its affiliates to include (i) those persons who were, as of June 28, 2013, its executive officers, directors and beneficial owners of more than 10% of its common stock, and (ii) such other persons who were deemed, as of June 28, 2013, to be controlled by, or under common control with, PHI or any of the persons described in clause (i) above. |

| (b) | All voting and non-voting common equity is owned by Pepco Holdings. |

| (c) | All voting and non-voting common equity is owned by Conectiv, LLC, a wholly owned subsidiary of Pepco Holdings. |

THIS COMBINED FORM 10-K IS SEPARATELY FILED BY PEPCO HOLDINGS, PEPCO, DPL AND ACE. INFORMATION CONTAINED HEREIN RELATING TO ANY INDIVIDUAL REGISTRANT IS FILED BY SUCH REGISTRANT ON ITS OWN BEHALF. EACH REGISTRANT MAKES NO REPRESENTATION AS TO INFORMATION RELATING TO THE OTHER REGISTRANTS.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Pepco Holdings, Inc. definitive proxy statement for the 2014 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after December 31, 2013 are incorporated by reference into Part III of this report.

Table of Contents

Table of Contents

The following is a glossary of terms, abbreviations and acronyms that are used in the Reporting Companies’ SEC reports. The terms, abbreviations and acronyms used have the meanings set forth below, unless the context requires otherwise.

| Term |

Definition | |

| 2012 LTIP | Pepco Holdings, Inc. 2012 Long-Term Incentive Plan | |

| ACE | Atlantic City Electric Company | |

| ACE Funding | Atlantic City Electric Transition Funding LLC | |

| AFUDC | Allowance for funds used during construction | |

| AOCL | Accumulated Other Comprehensive Loss | |

| AMI | Advanced metering infrastructure, a system that collects, measures and analyzes energy usage data from advanced digital electric and gas meters known as smart meters | |

| ASC | Accounting Standards Codification | |

| BGE | Baltimore Gas and Electric Company | |

| BGS | Basic Generation Service (the supply of electricity by ACE to retail customers in New Jersey who have not elected to purchase electricity from a competitive supplier) | |

| Bondable Transition Property | Principal and interest payments on the Transition Bonds and related taxes, expenses and fees | |

| BSA | Bill Stabilization Adjustment | |

| Budget Support Act | The Fiscal Year 2012 Budget Support Act of 2011, approved by the Council of the District of Columbia on June 14, 2011 | |

| CAA | Federal Clean Air Act | |

| Calpine | Calpine Corporation | |

| CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act of 1980 | |

| Conectiv | Conectiv, LLC, a wholly owned subsidiary of PHI and the parent of DPL and ACE | |

| Conectiv Energy | Subsidiaries of Conectiv Energy Holding Company, a disposition plan for which was approved by PHI’s Board of Directors in April 2010 and has been completed | |

| CRMC | PHI’s Corporate Risk Management Committee | |

| CTA | Consolidated tax adjustment | |

| CWIP | Construction work in progress | |

| DC Undergrounding Task Force | The District of Columbia Mayor’s Power Line Undergrounding Task Force | |

| DCPSC | District of Columbia Public Service Commission | |

| DDOE | District of Columbia Department of the Environment | |

| Default Electricity Supply | The supply of electricity by PHI’s electric utility subsidiaries at regulated rates to retail customers who do not elect to purchase electricity from a competitive supplier, and which, depending on the jurisdiction, is also known as Standard Offer Service or BGS | |

| DPL | Delmarva Power & Light Company | |

| DEDA | Delaware Economic Development Authority | |

| DEMEC | Delaware Municipal Electric Corporation, Inc. | |

| DOE | U.S. Department of Energy | |

| DPSC | Delaware Public Service Commission | |

| DRP | Direct Stock Purchase and Dividend Reinvestment Plan | |

| EBITDA | Earnings before interest, taxes, depreciation, and amortization | |

| EDC | Electricity Distribution Company | |

| EmPower Maryland | A Maryland demand-side management program for Pepco and DPL | |

| EPA | U.S. Environmental Protection Agency | |

| Exchange Act | Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| FERC | Federal Energy Regulatory Commission |

i

Table of Contents

| Term |

Definition | |

| FLRP | Forward Looking Rate Plan | |

| FPA | Federal Power Act | |

| GAAP | Accounting principles generally accepted in the United States of America | |

| GCR | Gas Cost Rate | |

| GenOn | GenOn MD Ash Management, LLC | |

| GWh | Gigawatt hour | |

| HPS | Hourly Priced Service | |

| IMU | Interface management unit | |

| IRS | Internal Revenue Service | |

| ISDA | International Swaps and Derivatives Association Master Agreement | |

| ISRA | Industrial Site Recovery Act | |

| LIBOR | London Interbank Offered Rate | |

| LTIP | Pepco Holdings, Inc. Long-Term Incentive Plan | |

| MAPP | Mid-Atlantic Power Pathway | |

| Mcf | Thousand Cubic Feet | |

| MDC | MDC Industries, Inc. | |

| Medicare Act | Medicare Prescription Drug Improvement and Modernization Act of 2003 | |

| Medicare Part D | A prescription drug benefit under the Medicare Act | |

| MFVRD | Modified fixed variable rate design | |

| MMBtu | One Million British Thermal Units | |

| MPSC | Maryland Public Service Commission | |

| MW | Megawatt | |

| MWh | Megawatt hour | |

| NAV | Net Asset Value | |

| NERC | North American Electric Reliability Corporation | |

| New Jersey Societal Benefit Charge | A surcharge related to the New Jersey Societal Benefit Program | |

| New Jersey Societal Benefit Program | A New Jersey public interest program for low income customers | |

| NJ SOCA Law | The New Jersey law under which the SOCAs were established | |

| NJBPU | New Jersey Board of Public Utilities | |

| NPCC | Northeast Power Coordinating Council | |

| NPDES | National Pollutant Discharge Elimination System | |

| NUGs | Non-utility generators | |

| NYMEX | New York Mercantile Exchange | |

| OPC | Office of People’s Counsel | |

| OPEB | Other postretirement benefit | |

| PCI | Potomac Capital Investment Corporation and its subsidiaries | |

| Pepco | Potomac Electric Power Company | |

| Pepco Energy Services | Pepco Energy Services, Inc. and its subsidiaries | |

| Pepco Holdings or PHI | Pepco Holdings, Inc. | |

| PHI OPEB Plan | The Pepco Holdings, Inc. Welfare Plan for Retirees | |

| PJM | PJM Interconnection, LLC | |

| PJM RTO | PJM regional transmission organization | |

| Power Delivery | The transmission, distribution and default supply of electricity and, to a lesser extent, the distribution and supply of natural gas, conducted through Pepco, DPL and ACE, PHI’s regulated public utility subsidiaries | |

| PPA | Power purchase agreement | |

| PRP | Potentially responsible party | |

| PUHCA 2005 | Public Utility Holding Company Act of 2005 |

ii

Table of Contents

| Term |

Definition | |

| RECs | Renewable energy credits | |

| Regulated T&D Electric Revenue | Revenue from the transmission and the distribution of electricity to PHI’s customers within its service territories at regulated rates | |

| Regulatory Asset Recovery Charge | Costs associated with deferred, NJBPU-approved expenses incurred as part of ACE’s obligation to serve the public | |

| Reporting Company | PHI, Pepco, DPL or ACE | |

| Revenue Decoupling Adjustment | An adjustment equal to the amount by which revenue from distribution sales differs from the revenue that Pepco and DPL are entitled to earn based on the approved distribution charge per customer | |

| RFC | ReliabilityFirst Corporation | |

| RI/FS | Remedial investigation and feasibility study | |

| ROE | Return on equity | |

| RPS | Renewable Energy Portfolio Standards | |

| Sarbanes-Oxley Act | Sarbanes-Oxley Act of 2002 | |

| SEC | Securities and Exchange Commission | |

| SOCA | Standard Offer Capacity Agreement required to be entered into by ACE pursuant to the NJ SOCA Law | |

| SOS | Standard Offer Service, how Default Electricity Supply is referred to in Delaware, the District of Columbia and Maryland | |

| SPCC | Spill Prevention, Control, and Countermeasure plans, required pursuant to federal regulations requiring plans for facilities using oil-containing equipment in proximity to surface waters | |

| SRECs | Solar renewable energy credits | |

| T&D | Transmission and distribution | |

| TEFA | Transitional Energy Facility Assessment, a New Jersey tax surcharge providing a gradual transition from the previous franchise and gross receipts tax eliminated in 1997, to its new total liability under the corporation business tax and the sales-and-use tax (this surcharge was eliminated in 2013) | |

| Transition Bond Charge | Revenue ACE receives, and pays to ACE Funding, to fund the principal and interest payments on Transition Bonds and related taxes, expenses and fees | |

| Transition Bonds | Transition Bonds issued by ACE Funding | |

| USCG | U.S. Coast Guard | |

| VRDBs | Variable Rate Demand Bonds | |

| WACC | Weighted average cost of capital |

iii

Table of Contents

Some of the statements contained in this Annual Report on Form 10-K with respect to Pepco Holdings, Inc. (PHI or Pepco Holdings), Potomac Electric Power Company (Pepco), Delmarva Power & Light Company (DPL) and Atlantic City Electric Company (ACE), including each of their respective subsidiaries, are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), and Section 27A of the Securities Act of 1933, as amended, and are subject to the safe harbor created thereby under the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding the intents, beliefs, estimates and current expectations of one or more of PHI, Pepco, DPL or ACE (each, a Reporting Company) or their subsidiaries. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,” “believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue” or the negative of such terms or other variations thereof or comparable terminology, or by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause one or more Reporting Companies’ or their subsidiaries’ actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or assurances of future performance, and actual results could differ materially from those indicated by the forward-looking statements.

The forward-looking statements contained herein are qualified in their entirety by reference to the following important factors, which are difficult to predict, contain uncertainties, are beyond each Reporting Company’s or its subsidiaries’ control and may cause actual results to differ materially from those contained in forward-looking statements:

| • | Changes in governmental policies and regulatory actions affecting the energy industry or one or more of the Reporting Companies specifically, including allowed rates of return, industry and rate structure, acquisition and disposal of assets and facilities, operation and construction of transmission and distribution facilities and the recovery of purchased power expenses; |

| • | The outcome of pending and future rate cases and other regulatory proceedings, including (i) challenges to the base return on equity (ROE) and the application of the formula rate process previously established by the Federal Energy Regulatory Commission (FERC) for transmission services provided by Pepco, DPL and ACE; (ii) challenges to DPL’s 2011, 2012 and 2013 annual FERC formula rate updates; and (iii) other possible disallowances of recovery of costs and expenses or delays in the recovery of such costs; |

| • | The resolution of outstanding tax matters with the Internal Revenue Service (IRS), and the funding of any additional taxes, interest or penalties that may be due; |

| • | The expenditures necessary to comply with regulatory requirements, including regulatory orders, and to implement reliability enhancement, emergency response and customer service improvement programs; |

| • | Possible fines, penalties or other sanctions assessed by regulatory authorities against a Reporting Company or its subsidiaries; |

| • | The impact of adverse publicity and media exposure which could render one or more Reporting Companies or their subsidiaries vulnerable to negative customer perception and could lead to increased regulatory oversight or other sanctions; |

| • | Weather conditions affecting usage and emergency restoration costs; |

| • | Population growth rates and changes in demographic patterns; |

1

Table of Contents

| • | Changes in customer energy demand due to, among other things, conservation measures and the use of renewable energy and other energy-efficient products, as well as the impact of net metering and other issues associated with the deployment of distributed generation and other new technologies; |

| • | General economic conditions, including the impact on energy use caused by an economic downturn or recession, or by changes in the level of commercial activity in a particular region or service territory, or affecting a particular business or industry located therein; |

| • | Changes in and compliance with environmental and safety laws and policies; |

| • | Changes in tax rates or policies; |

| • | Changes in rates of inflation; |

| • | Changes in accounting standards or practices; |

| • | Unanticipated changes in operating expenses and capital expenditures; |

| • | Rules and regulations imposed by, and decisions of, federal and/or state regulatory commissions, PJM Interconnection, LLC (PJM), the North American Electric Reliability Corporation (NERC) and other applicable electric reliability organizations; |

| • | Legal and administrative proceedings (whether civil or criminal) and settlements that affect a Reporting Company’s or its subsidiaries’ business and profitability; |

| • | Pace of entry into new markets; |

| • | Interest rate fluctuations and the impact of credit and capital market conditions on the ability to obtain funding on favorable terms; and |

| • | Effects of geopolitical and other events, including the threat of terrorism or cyber attacks. |

These forward-looking statements are also qualified by, and should be read together with, the risk factors included in Part I, Item 1A. “Risk Factors” and other statements in this Annual Report on Form 10-K, and investors should refer to such risk factors and other statements in evaluating the forward-looking statements contained in this Annual Report on Form 10-K.

Any forward-looking statements speak only as to the date this Annual Report on Form 10-K for each Reporting Company was filed with the SEC and none of the Reporting Companies undertakes an obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for a Reporting Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on such Reporting Company’s or its subsidiaries’ business (viewed independently or together with the business or businesses of some or all of the other Reporting Companies or their subsidiaries), or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

2

Table of Contents

Part I

| Item 1. | BUSINESS |

Overview

Pepco Holdings, Inc. (Pepco Holdings or PHI) is a holding company that was incorporated in Delaware in 2001. Through its regulated public utility subsidiaries, PHI is engaged primarily in the transmission, distribution and default supply of electricity, and, to a lesser extent, the distribution and supply of natural gas. The principal executive offices of PHI are located at 701 Ninth Street, N.W., Washington, D.C. 20068.

PHI’s public utility subsidiaries are:

| Name of Utility |

State and Year of Incorporation |

Business |

Service Territories |

Address of Principal | ||||

| Potomac Electric Power Company (Pepco)

|

District of Columbia (1896)

Virginia (1949) |

Transmission, distribution and default supply of electricity | District of Columbia

Major portions of Montgomery and Prince George’s Counties, Maryland

|

701 Ninth Street, N.W., Washington, D.C. 20068 | ||||

| Delmarva Power & Light Company (DPL)

|

Delaware (1909)

Virginia (1979)

|

Transmission, distribution and default supply of electricity

Distribution and supply of natural gas |

Portions of Delaware and Maryland (electricity)

Portions of New Castle County, Delaware (natural gas)

|

500 North Wakefield Drive, Newark, Delaware 19702 | ||||

| Atlantic City Electric

|

New Jersey (1924) | Transmission, distribution and default supply of electricity

|

Portions of Southern New Jersey | 500 North Wakefield Drive, Newark, Delaware 19702 | ||||

3

Table of Contents

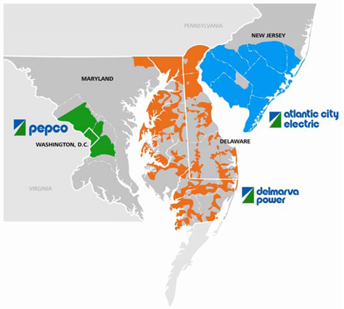

The service territories of each of Pepco Holdings’ utilities are depicted in the map below:

PHI’s three utility subsidiaries comprise a single operating segment for accounting purposes, which is referred to herein as “Power Delivery.”

In addition to its regulated utility operations, Pepco Holdings, through Pepco Energy Services, Inc. and its subsidiaries (collectively, Pepco Energy Services), is engaged in the following activities:

| • | providing energy savings performance contracting services principally to federal, state and local government customers; |

| • | designing, constructing and operating combined heat and power, and thermal energy plants; and |

| • | providing high voltage underground transmission construction and maintenance services and low voltage electric construction and maintenance services and streetlight construction services. |

The operations of Pepco Energy Services collectively comprise a separate, second operating segment for accounting purposes. During 2013, Pepco Energy Services completed the wind-down of its retail electricity and natural gas supply businesses, and, as a result, these businesses are being accounted for as discontinued operations, as described below under “Discontinued Operations.”

Through its wholly owned subsidiary, Potomac Capital Investment Corporation (PCI), PHI previously held a portfolio of cross-border energy lease investments. During 2013, Pepco Holdings completed the termination of its interests in its cross-border energy lease investments, and as a result, these investments are being accounted for as discontinued operations, as described below under “Discontinued Operations.”

The following table shows PHI’s consolidated operating revenue and net income from continuing operations derived from the Power Delivery and Pepco Energy Services segments over the three preceding fiscal years.

4

Table of Contents

| 2013 | 2012 | 2011 | ||||||||||

| (millions of dollars) | ||||||||||||

| Operating Revenue |

||||||||||||

| Power Delivery |

$ | 4,472 | $ | 4,378 | $ | 4,650 | ||||||

| Pepco Energy Services |

203 | 256 | 330 | |||||||||

| Net Income (Loss) from Continuing Operations |

||||||||||||

| Power Delivery |

$ | 289 | $ | 235 | $ | 210 | ||||||

| Pepco Energy Services |

3 | (8 | ) | 22 | ||||||||

For additional financial information with respect to PHI’s segments, see Note (5), “Segment Information,” to the consolidated financial statements of PHI.

PHI Service Company, a wholly owned subsidiary of PHI, provides a variety of support services, including legal, accounting, treasury, tax, purchasing and information technology services, to PHI and its operating subsidiaries. These services are provided pursuant to service agreements among PHI, PHI Service Company and the participating operating subsidiaries. The expenses of PHI Service Company are charged to PHI and the participating operating subsidiaries in accordance with cost allocation methodologies set forth in the service agreements.

Business Strategy

PHI’s business objective is to be a top-performing, regulated power delivery company that delivers safe and reliable electric and natural gas service to its customers and through its regulatory proceedings, earns a just and reasonable rate of return on, and receives timely recovery of, its utility investments.

In seeking to achieve this objective, Pepco Holdings’ business strategy is guided by its core values of safety, integrity and diversity and its mission of environmental stewardship, and is focused on the following initiatives:

| • | investing in its utilities’ transmission and distribution infrastructure; |

| • | building a smarter grid and implementing other technological enhancements designed to: |

| • | automate power delivery system functions and improve the reliability of the power distribution system; |

| • | enable its utilities to restore power more quickly and efficiently; |

| • | offer customers detailed information about, and options to help customers better manage, their energy usage; and |

| • | enhance the customer experience and PHI’s communications with customers; and |

| • | through Pepco Energy Services, providing comprehensive energy management solutions and developing, installing and operating renewable energy solutions. |

In furtherance of its business strategy, PHI may from time to time enter into various transactions involving its businesses. These transactions may include joint ventures, the disposition of existing businesses or the acquisitions of new businesses. PHI also may from time to time refine components of its business strategy as it deems necessary or appropriate in response to business factors and other conditions, including regulatory requirements.

5

Table of Contents

Overview of the Power Delivery Business

Distribution and Default Supply of Electricity

Each of PHI’s utility subsidiaries owns and operates a network of wires, substations and other equipment that are classified as transmission facilities, distribution facilities or common facilities (which are used for both transmission and distribution). Transmission facilities carry wholesale electricity into, out of and across the utilities’ service territories. Distribution facilities carry electricity from the transmission facilities to the customers located in the utilities’ service territories.

Each utility subsidiary is responsible for the distribution of electricity to customers within its service territory or territories and for which it is paid tariff rates established by the applicable public service commissions. While the transmission and distribution of electricity is regulated, the law of each of these service territories allows for competition in the supply of electricity, which enables distribution customers to contract to purchase their electricity from a supplier approved by the applicable public service commission. PHI’s utility subsidiaries supply electricity at regulated rates to customers who do not elect to purchase their electricity from a competitive supplier. These “default” supply services are referred to generally in this Form 10-K as Default Electricity Supply. The regulatory term for Default Electricity Supply is Standard Offer Service (SOS) in Delaware, the District of Columbia and Maryland, and Basic Generation Service (BGS) in New Jersey. The results of operations of PHI’s utility subsidiaries are only minimally impacted when customers choose to obtain their electricity through competitive suppliers because the utilities earn their approved rates of return by providing distribution service, and not by supplying the electricity.

Transmission of Electricity and Relationship With PJM

Each of PHI’s utility subsidiaries provides transmission services within the jurisdictions that encompass its electricity distribution service territory. In the aggregate, PHI owns approximately 4,600 miles of interconnected transmission lines with voltages ranging from 115 kilovolts (kV) to 500 kV. Under the Open Access Transmission Tariff adopted by the FERC, each owner of transmission services is required to provide transmission customers with non-discriminatory access to its transmission facilities at tariff rates approved by FERC.

The transmission facilities owned by Pepco, DPL and ACE are interconnected with the transmission facilities of contiguous utilities and are part of an interstate power transmission grid over which electricity is transmitted throughout a region encompassing the mid-Atlantic portion of the United States and parts of the Midwest. PJM is the FERC-approved independent operator of this transmission grid and manages the wholesale electricity market within its region. Pepco, DPL and ACE each are members of the PJM Regional Transmission Organization (PJM RTO), the regional transmission organization designated by FERC to coordinate the movement of wholesale electricity in PJM’s region.

In accordance with FERC-approved rules, Pepco, DPL, ACE and the other transmission-owning utilities in the PJM region make their transmission facilities available to PJM, and PJM directs and controls the operation of these transmission facilities. Each transmission owner is compensated at transmission rates approved by FERC for the use of its transmission facilities. PJM provides billing and settlement services, collects transmission service revenue from transmission service customers and distributes the revenue to the transmission owners.

PJM also directs the regional transmission planning process within its region. The Board of Managers of PJM reviews and approves all transmission expansion plans within the PJM region, including the construction of new transmission facilities by PJM members. Changes in the current policies for building new transmission lines ordered by FERC and implemented by PJM could result in additional competition to build transmission lines in the PJM region, including in the service territories of PHI’s utility subsidiaries, and could allow PHI’s utility subsidiaries the opportunity to construct transmission facilities in other service territories.

6

Table of Contents

For a discussion of the regulation of transmission rates, see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Regulatory and Other Matters – Rate Proceedings – Transmission” and for a discussion of recently completed and pending FERC transmission rate proceedings, see Note (7), “Regulatory Matters – Rate Proceedings – Federal Energy Regulatory Commission,” to the consolidated financial statements of PHI.

Distribution and Supply of Natural Gas

DPL owns pipelines and other equipment for the distribution and supply of natural gas. DPL uses its natural gas distribution facilities to deliver natural gas to retail customers in its service territory and provides transportation-only services to customers that purchase natural gas from another supplier. Intrastate transportation customers pay DPL distribution service rates approved by the Delaware Public Service Commission (DPSC). Rates for the interstate transportation and sale of wholesale natural gas are regulated by FERC. DPL purchases natural gas supplies for resale to its retail service customers from marketers and producers through a combination of long-term agreements and next-day distribution arrangements.

PHI’s Utility Subsidiaries

Potomac Electric Power Company

Pepco’s electric distribution service territory consists of the District of Columbia and major portions of Prince George’s County and Montgomery County in Maryland. The service territory covers approximately 640 square miles and, as of December 31, 2013, had a population of approximately 2.2 million. This region is economically diverse and includes key industries that contribute to the regional economic base:

| • | Commercial activities in the region include professional and medical services, government and education, shopping malls, tourism and transportation. |

| • | Industrial activities in the region include chemical, glass, pharmaceutical, steel manufacturing, food processing and oil refining. |

The following table shows the number of Pepco distribution customers in each of its service territories as of the end of each of the preceding three years.

| 2013 | 2012 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| District of Columbia |

264 | 260 | 257 | |||||||||

| Maryland |

537 | 533 | 531 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

801 | 793 | 788 | |||||||||

|

|

|

|

|

|

|

|||||||

7

Table of Contents

Pepco distributed a total of 25,801,000, 26,006,000 and 26,895,000 megawatt (MW) hours (MWh) of electricity in 2013, 2012 and 2011, respectively. The following table shows the allocation by percentage among customer types of the total MWh of electricity delivered by Pepco in each of its service territories during each of the preceding three fiscal years:

| 2013 | 2012 | 2011 | ||||||||||

| District of Columbia: |

||||||||||||

| Residential |

13 | % | 13 | % | 13 | % | ||||||

| Commercial, industrial and other |

30 | % | 30 | % | 30 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

43 | % | 43 | % | 43 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Maryland: |

||||||||||||

| Residential |

17 | % | 17 | % | 17 | % | ||||||

| Commercial, industrial and other |

40 | % | 40 | % | 40 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

57 | % | 57 | % | 57 | % | ||||||

|

|

|

|

|

|

|

|||||||

Pepco has been designated as the default electricity supplier in its District of Columbia and Maryland service territories by the District of Columbia Public Service Commission (DCPSC) and the Maryland Public Service Commission (MPSC), respectively. Pepco purchases the electricity required to satisfy its SOS obligations from wholesale suppliers primarily under contracts entered into in accordance with competitive bid procedures approved and supervised by each of the DCPSC and the MPSC. For commercial customers in the District of Columbia and large commercial customers in Maryland that do not purchase their electricity from a competitive supplier, Pepco is obligated to provide Hourly Priced Service (HPS), a form of SOS service for which Pepco purchases the electricity in the next-day and other short-term PJM RTO markets.

Under orders issued by the DCPSC, Pepco is obligated to provide SOS to residential and small, medium-sized and large commercial customers in the District of Columbia indefinitely. Under orders issued by the MPSC, Pepco is obligated to provide SOS to residential and small commercial customers and to medium-sized commercial customers in Maryland through November 2014. As contracts expire, they are rebid annually by Pepco through the MPSC-approved request for proposal process. Pepco is paid tariff rates for the transmission and distribution of electricity over its transmission and distribution facilities to all electricity customers in its service territory, whether the customer receives SOS or HPS, or purchases electricity from a competitive supplier, and is entitled to recover from its SOS and HPS customers the costs of acquiring the electricity, plus an administrative charge that is intended to allow it to recover its administrative costs, plus a modest margin, which varies depending on the customer class.

The following table shows for Pepco customers in the District of Columbia and Maryland the percentage of distribution sales (measured by MWh) over the past three fiscal years to SOS customers.

| 2013 | 2012 | 2011 | ||||||||||

| District of Columbia |

25 | % | 25 | % | 27 | % | ||||||

| Maryland |

41 | % | 40 | % | 43 | % | ||||||

In the District of Columbia, under various acts of Congress, pursuant to Pepco’s corporate charter, and subject to the supervision of the DCPSC, Pepco has the non-exclusive authority to install and maintain overhead and underground transmission and distribution lines and other related facilities for the furnishing of electricity. Pepco’s right to occupy public space for utility purposes is by permit from the District of Columbia and the federal government. Pepco is the only public utility that distributes electricity for sale to the public in the District of Columbia.

In Maryland, Pepco operates pursuant to state-wide franchises granted by Maryland’s General Assembly that are unlimited in duration. These franchises were granted to Pepco or to predecessor companies acquired by Pepco, and confer, among other things, the ability to construct electric transmission and distribution lines. Pursuant to statute, public service companies in Maryland may exercise a franchise to the extent authorized by the MPSC. The service territories for Pepco, as well as for other electric utilities in the state, were precisely delineated in 1966 by the MPSC and have been modified in minor ways over the years.

Delmarva Power & Light Company

DPL is engaged in the transmission, distribution and default supply of electricity in portions of Delaware and Maryland. In northern Delaware, DPL also supplies and delivers natural gas to retail customers and provides transportation-only services to retail customers that purchase natural gas from another supplier.

In Maryland, DPL operates pursuant to state-wide franchises that are substantially similar in nature to those described above with respect to Pepco’s Maryland operations. DPL’s exclusive and continuing authority to distribute electricity and natural gas in its non-municipal service territories in Delaware is derived from legislation, through which the DPSC has established exclusive service territories. With respect to municipalities that it serves, DPL provides service under various franchises granted to DPL and predecessor companies, which franchises are generally either unlimited as to time or renew automatically.

8

Table of Contents

Distribution and Supply of Electricity

DPL’s electric distribution service territory consists of the state of Delaware, and Caroline, Cecil, Dorchester, Harford, Kent, Queen Anne’s, Somerset, Talbot, Wicomico and Worcester counties in Maryland. This territory covers approximately 5,000 square miles and, as of December 31, 2013, had a population of approximately 1.4 million. This region is economically diverse and includes the following key industries that contribute to the regional economic base:

| • | Commercial activities in the region include banking, government, insurance, shopping malls, casinos and tourism. |

| • | Industrial activities in the region include chemical, pharmaceutical, steel manufacturing and oil refining. |

The following table shows the number of DPL electricity distribution customers in each of its service territories as of the end of each of the preceding three fiscal years.

| 2013 | 2012 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Delaware |

305 | 303 | 301 | |||||||||

| Maryland |

201 | 200 | 200 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

506 | 503 | 501 | |||||||||

|

|

|

|

|

|

|

|||||||

DPL distributed a total of 12,465,000, 12,641,000 and 12,688,000 MWh of electricity in 2013, 2012 and 2011, respectively. The following table shows the allocation by percentage among customer types of the total MWh of electricity delivered by DPL in each of its service territories during each of the preceding three fiscal years:

| 2013 | 2012 | 2011 | ||||||||||

| Delaware: |

||||||||||||

| Residential |

27 | % | 27 | % | 27 | % | ||||||

| Commercial and industrial |

39 | % | 40 | % | 39 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

66 | % | 67 | % | 66 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Maryland: |

||||||||||||

| Residential |

14 | % | 13 | % | 14 | % | ||||||

| Commercial and industrial |

20 | % | 20 | % | 20 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

34 | % | 33 | % | 34 | % | ||||||

|

|

|

|

|

|

|

|||||||

DPL has been designated as the default electricity supplier in its Delaware and Maryland service territories by the DPSC and the MPSC, respectively. DPL purchases the electricity required to satisfy its SOS obligations from wholesale suppliers primarily under contracts entered into in accordance with competitive bid procedures approved and supervised by each of the DPSC and the MPSC. DPL also has an obligation to provide HPS for its largest customers in Delaware and its large customers in Maryland. DPL acquires power to supply its HPS customers in the next-day and other short-term PJM RTO markets.

Under orders issued by the DPSC, DPL is obligated to provide SOS to residential, small commercial and industrial customers in Delaware through May 2017, and to medium, large and general service commercial customers in Delaware through May 2015. Under orders issued by the MPSC, DPL is obligated to provide SOS to residential and small commercial customers in Maryland until further action of the Maryland General Assembly, and to medium-sized commercial customers in Maryland through November 2014. As contracts expire, they are rebid annually by DPL through the MPSC approved request for proposal process. In Delaware and Maryland, DPL is paid tariff rates for the transmission and

9

Table of Contents

distribution of electricity over its transmission and distribution facilities to all electricity customers in its service territories, whether the customer receives SOS or HPS, or purchases electricity from a competitive supplier. In Delaware, DPL is also entitled to recover from its SOS and HPS customers the associated costs of acquiring the electricity (including transmission, capacity and ancillary services costs and costs to satisfy renewable energy requirements), plus an amount referred to as a Reasonable Allowance for Retail Margin. In Maryland, DPL is entitled to recover from its SOS and HPS customers the costs of acquiring the electricity, plus an administrative charge that is intended to allow it to recover its administrative costs, plus a modest margin, which varies depending on the customer class.

The following table shows for DPL customers in Delaware and Maryland the percentage of distribution sales (measured in MWh) over the past three fiscal years to SOS customers.

| 2013 | 2012 | 2011 | ||||||||||

| Delaware |

44 | % | 47 | % | 51 | % | ||||||

| Maryland |

51 | % | 53 | % | 58 | % | ||||||

Distribution and Supply of Natural Gas

DPL provides regulated natural gas supply and distribution service to customers in a service territory consisting of a major portion of New Castle County in Delaware. This service territory covers approximately 275 square miles and, as of December 31, 2013, had a population of approximately 500,000.

Large volume commercial, institutional, and industrial natural gas customers may purchase natural gas from DPL. Alternatively, a customer receiving a “transportation-only” service from DPL will purchase natural gas from a competitive supplier and have the natural gas delivered through DPL’s distribution facilities. The following table provides certain information regarding DPL’s natural gas distribution business for each of the last three fiscal years.

| 2013 | 2012 | 2011 | ||||||||||

| (in thousands, except percentages) | ||||||||||||

| Number of natural gas customers |

126 | 125 | 124 | |||||||||

| Thousand cubic feet (Mcf) of natural gas delivered |

19,796 | 16,815 | 18,754 | |||||||||

| Percentage of natural gas supplied and Delivered by DPL |

64 | % | 60 | % | 64 | % | ||||||

The following table shows on a percentage basis the allocation among customer types of the Mcf of natural gas delivered by DPL in Delaware in each of the preceding three fiscal years.

| 2013 | 2012 | 2011 | ||||||||||

| Residential |

40 | % | 38 | % | 39 | % | ||||||

| Commercial and industrial |

25 | % | 22 | % | 24 | % | ||||||

| Transportation and other |

35 | % | 40 | % | 37 | % | ||||||

10

Table of Contents

Atlantic City Electric Company

Electricity Distribution and Supply

ACE’s electric distribution service territory consists of Gloucester, Camden, Burlington, Ocean, Atlantic, Cape May, Cumberland and Salem counties in southern New Jersey. The service territory covers approximately 2,700 square miles and had, as of December 31, 2013, a population of approximately 1.1 million. This region is economically diverse and includes key industries that contribute to the regional economic base:

| • | Commercial activities in the region include professional services, government, shopping malls, casinos, and tourism. |

| • | Industrial activities in the region include chemical, glass, food processing and oil refining. |

The following table provides certain information regarding ACE’s electric distribution business for each of the last three fiscal years.

| 2013 | 2012 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Number of electric distribution customers |

545 | 545 | 547 | |||||||||

| MWh of electricity delivered |

9,231 | 9,495 | 9,683 | |||||||||

The following table shows the allocation by percentage among customer types of the total MWh of electricity delivered by ACE during each of the preceding three fiscal years.

| 2013 | 2012 | 2011 | ||||||||||

| Residential |

46 | % | 46 | % | 46 | % | ||||||

| Commercial and industrial |

54 | % | 54 | % | 54 | % | ||||||

ACE has been designated as the default electricity supplier in its service territory by the New Jersey Board of Public Utilities (NJBPU). In New Jersey, each of the state’s electric distribution companies, including ACE, jointly obtains the electricity to meet such companies’ collective BGS obligations from competitive suppliers selected through auctions authorized by the NJBPU for the supply of New Jersey’s total BGS requirements. Each winning bidder is required to supply its committed portion of the BGS customer load with full requirements service, consisting of power supply and transmission service. ACE provides two types of BGS:

| • | fixed price BGS, which is provided to smaller commercial and residential customers at seasonally-adjusted fixed prices (which as of December 31, 2013, had a peak load of approximately 1,429 MW and represented approximately 97% of ACE’s total BGS load); and |

| • | commercial and industrial energy price BGS, which is provided to large customers at hourly PJM RTO real-time market prices for a term of 12 months (which as of December 31, 2013, had a peak load of approximately 42 MW and represented approximately 3% of ACE’s total BGS load). |

11

Table of Contents

ACE is paid tariff supply rates established by the NJBPU that compensate it for the cost of obtaining the BGS supply. These rates are set such that ACE does not make any profit or incur any loss with respect to the supply component of its BGS obligations. ACE is also paid tariff rates for the transmission and distribution of electricity over its transmission and distribution facilities to all electricity customers in its service territory, whether the customer receives BGS or purchases electricity from a competitive supplier.

For the year ended December 31, 2013, 48% of ACE’s total distribution sales (measured in MWh) were to BGS customers, as compared to 51% and 56% in 2012 and 2011, respectively.

ACE operates under non-exclusive franchises that have been granted by the NJBPU and under certain non-exclusive consents from municipalities in which ACE provides service. While most of the municipal consents were granted in perpetuity, two of the municipal consents require renewal on a periodic basis in accordance with their terms, and are subject to the ultimate review and approval of the NJBPU. All of the franchises and consents are currently in full force and effect.

Atlantic City Electric Transition Funding LLC

In 2001, ACE established Atlantic City Electric Transition Funding LLC (ACE Funding) solely for the purpose of securitizing authorized portions of ACE’s recoverable stranded costs through the issuance and sale of bonds (Transition Bonds). The proceeds of the sale of each series of Transition Bonds were transferred to ACE in exchange for the transfer by ACE to ACE Funding of the right to collect a non-bypassable transition bond charge (Transition Bond Charge) from ACE customers pursuant to bondable stranded costs rate orders issued by the NJBPU in an amount sufficient to fund the principal and interest payments on the Transition Bonds and related taxes, expenses and fees (Bondable Transition Property). The assets of ACE Funding, including the Bondable Transition Property, and the Transition Bond Charges (representing revenue ACE receives, and pays to ACE Funding, to fund the principal and interest payments on Transition Bonds and related taxes, expenses and fees) collected from ACE’s customers, are not available to creditors of ACE. The holders of Transition Bonds have recourse only to the assets of ACE Funding.

Smart Grid Initiatives

PHI’s utility subsidiaries are engaged in transforming the power grid that they own and operate into a “smart grid,” a network of automated digital devices capable of collecting and communicating large amounts of real-time data. PHI believes that the smart grid benefits its customers by:

| • | improving service reliability of the energy distribution system; |

| • | automating specific distribution system functions; |

| • | enabling its utilities to restore energy to customers more quickly and efficiently; |

| • | facilitating more efficient use of energy to meet the challenges of rising energy costs and governmental energy reduction goals; |

| • | permitting its utilities to obtain and communicate to their customers timely and accurate information regarding energy usage and outages; and |

| • | enhancing communications with its customers and the overall customer experience. |

A central component of the smart grid is advanced metering infrastructure (AMI), a system that collects, measures and analyzes energy usage data from advanced digital meters, known as “smart meters.” Also critical to the operation of the smart grid is distribution automation technology, which is comprised of automated devices that have internal intelligence and can be controlled remotely to better manage power flow and restore service quickly and more safely. Both the AMI system and distribution automation are enabled by advanced technology that communicates with devices installed on the energy delivery system and transmits energy usage data to the host utility. The implementation of the AMI system and distribution automation involves an integration of technologies provided by multiple vendors.

12

Table of Contents

The installation of smart meters in the service territories of each of PHI’s utility subsidiaries is subject to approval by the applicable public service commissions. The regulatory and implementation status of Pepco Holdings’ AMI smart meter activities as of December 31, 2013 was as follows:

| Utility |

Jurisdiction |

Regulatory Status |

Installation and Activation Status | |||||

| Pepco | Maryland | Approved | Complete | |||||

| District of Columbia | Approved

|

Complete | ||||||

| DPL (Electric) | Delaware | Approved | Complete | |||||

| Maryland | Approved | Estimated Completion 3Q 2014 | ||||||

| DPL (Natural Gas) | Delaware | Approved

|

Substantially Complete | |||||

| ACE | New Jersey | Not approved | N/A | |||||

The DCPSC, the MPSC and the DPSC have approved the creation by PHI’s utility subsidiaries of regulatory assets to defer AMI costs between rate cases and to accrue returns on the deferred costs. Thus, these costs will be recovered in the future through base rates; however, for AMI costs incurred by Pepco in Maryland with respect to test years after 2011, pursuant to an MPSC order, the recovery of such costs will be allowed when Pepco demonstrates that the AMI system is cost-effective. The MPSC’s July 2013 order in Pepco’s November 2012 electric distribution base rate application excluded the cost of AMI meters from Pepco’s rate base until such time as Pepco demonstrates the cost effectiveness of the AMI system. As a result, costs for AMI meters incurred with respect to the 2012 test year and beyond will be treated as other incremental AMI costs incurred in conjunction with the deployment of the AMI system that are deferred and on which a return is earned, but only until such cost effectiveness has been demonstrated and such costs are included in rates.

In 2010, two of PHI’s utility subsidiaries were granted cash awards in the aggregate amount of $168 million by the U.S. Department of Energy to support their smart grid initiatives.

| • | Pepco was awarded $149 million for AMI, direct load control, distribution automation and communications infrastructure, of which $145 million has been received through December 31, 2013. |

| • | ACE was awarded $19 million for direct load control, distribution automation and communications infrastructure, of which $17 million has been received through December 31, 2013. |

For a discussion of the projected capital expenditures of each utility subsidiary associated with PHI’s smart grid initiatives over the period 2014 through 2018, see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Capital Resources and Liquidity – Capital Requirements.”

Utility Capital Expenditures

PHI’s utility subsidiaries devote a substantial portion of their total capital expenditures to improving the reliability of their electrical transmission and distribution systems and replacing aging infrastructure throughout their service territories. These activities include:

| • | identifying and upgrading under-performing feeder lines; |

| • | adding new facilities to support load; |

| • | installing distribution automation systems on both the overhead and underground network systems; and |

| • | rejuvenating and replacing underground residential cables. |

13

Table of Contents

In addition, PHI’s utility subsidiaries devote capital expenditures to increasing transmission and distribution system capacity, providing resiliency against major storm events, providing operating and system flexibility and installing and upgrading facilities for new and existing customers. For a discussion of PHI’s consolidated capital expenditure plan for 2014 through 2018, see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Capital Resources and Liquidity – Capital Requirements – Capital Expenditures.”

Maryland Grid Resiliency Task Force

In September 2012, a Grid Resiliency Task Force established through an executive order issued by the Governor of Maryland issued a report containing 11 recommendations on improving the resiliency and reliability of the electric distribution system in Maryland. In October 2012, the Governor of Maryland forwarded the report to the MPSC and urged the MPSC to implement quickly four of the Grid Resiliency Task Force’s recommendations:

| • | strengthen existing reliability and storm restoration regulations; |

| • | accelerate the investment necessary to meet the enhanced metrics; |

| • | allow surcharge recovery for the accelerated investment; and |

| • | implement clearly defined performance metrics into the traditional ratemaking scheme. |

Components of Pepco’s electric distribution base rate case filed with the MPSC in November 2012 and DPL’s electric distribution base rate case filed with the MPSC in March 2013 were intended to address the Grid Resiliency Task Force recommendations. In July and August 2013, the MPSC issued orders in these base rate cases that only partially approved these components. See Note (7), “Regulatory Matters – Rate Proceedings – Maryland” to the consolidated financial statements of PHI for more information about these base rate cases.

District of Columbia Proposed Undergrounding Legislation

In August 2012, the Mayor of the District of Columbia issued an Executive Order establishing the Mayor’s Power Line Undergrounding Task Force (the DC Undergrounding Task Force). In May 2013, the DC Undergrounding Task Force issued a written recommendation endorsing a $1 billion plan to underground 60 of the District of Columbia’s most outage-prone power lines, which lines would be owned and maintained by Pepco. The legislation providing for implementation of the DC Undergrounding Task Force recommendations contemplates that:

| • | $500 million of the estimated cost would be funded by Pepco, with recovery of its investment to be made through surcharges to be billed to Pepco District of Columbia customers; |

| • | $375 million of the estimated cost would be financed by the District of Columbia’s issuance of securitized bonds, which bonds would be repaid through surcharges to be billed to Pepco District of Columbia customers (Pepco would not earn a return on or of the cost of the assets funded with the proceeds of these securitized bonds); and |

| • | the remaining $125 million would be funded through the District of Columbia Department of Transportation’s existing capital projects program. |

This legislation was approved by the Council of the District of Columbia on February 4, 2014 and is awaiting the signature of the Mayor of the District of Columbia. Once signed by the Mayor and transmitted to Congress, the legislation will undergo a 30-day Congressional review period before becoming law, which is expected to be completed in the second quarter of 2014. The final step would be for the DCPSC to approve the underground project plan and issue financing orders to establish the customer surcharges contemplated by the undergrounding law. A decision by the DCPSC on such actions would likely occur during the fourth quarter of 2014.

14

Table of Contents

NERC Reliability Standards

NERC has established, and FERC has approved, reliability standards with regard to the bulk power system that impose certain operating, planning and cyber security requirements on Pepco, DPL and ACE. There are eight NERC regional oversight entities, including ReliabilityFirst Corporation (RFC), of which Pepco, DPL, ACE and Pepco Energy Services are members. These oversight entities are charged with the day-to-day implementation and enforcement of NERC’s reliability standards, which impose certain operating, planning and cybersecurity requirements on the bulk power systems of each utility. RFC performs compliance audits on entities registered with NERC based on reliability standards and criteria established by NERC. NERC and RFC also conduct compliance investigations in response to a system disturbance, complaint, or possible violation of a reliability standard identified by other means. Each of PHI’s utility subsidiaries are subject to routine audits and monitoring for compliance with applicable NERC reliability standards, including standards requested by FERC to increase the number of assets designated as “critical assets” (including cybersecurity assets) subject to NERC’s cybersecurity standards. NERC is empowered to impose financial penalties, fines and other sanctions for non-compliance with certain rules and regulations.

Energy Efficiency Initiatives

Dynamic Pricing

Dynamic pricing provides customers with incentives to reward them for decreasing their energy use during peak energy demand periods, when energy demand and consequently, the cost of supplying electricity, are higher. PHI’s dynamic pricing rate structures, implemented in tandem with PHI’s smart grid, provide customers with billing credits when they reduce their power usage in response to their utility’s request.

Dynamic pricing has been approved by the respective public service commissions and is in place for Pepco customers in Maryland and DPL customers in Delaware. As of December 31, 2013, approximately 625,000 Pepco customers in Maryland and 293,000 DPL customers in Delaware have received dynamic pricing program credits. Dynamic pricing has been approved in concept pending AMI deployment for DPL’s Maryland SOS customers. Pepco’s dynamic pricing proposal in the District of Columbia was rejected by the DCPSC on February 7, 2014. Pepco is considering its options in that jurisdiction with respect to dynamic pricing. Dynamic pricing has not been approved at this time by the NJBPU for ACE’s customers in New Jersey.

Utility Energy Efficiency Programs

Each of Pepco, DPL and ACE has implemented the Energy Wise Rewards™ program, which allows participating customers to reduce energy usage and costs by authorizing the utility to cycle their air conditioner compressors off and on during high energy demand periods. Customers participating in this program are eligible to receive a credit on their bill. Pepco and DPL have also implemented a portfolio of energy efficiency programs designed to reduce energy consumption in Maryland, including appliance rebate and recycling, home energy check-ups, rebates on the purchase of energy efficiency equipment and services and discounts on energy efficient light bulbs and lighting fixtures. The MPSC has approved a customer surcharge through 2014 to recover Pepco’s and DPL’s costs associated with these energy efficiency programs.

15

Table of Contents

Pepco Energy Services

Pepco Energy Services is engaged in the following:

| • | Energy savings performance contracting business: designing, constructing and operating energy efficiency projects and distributed generation equipment, including combined heat and power plants, principally for federal, state and local government customers; |

| • | Underground transmission and distribution business: providing underground transmission and distribution construction and maintenance services for electric utilities in North America; and |

| • | Thermal business: providing steam and chilled water under long-term contracts through systems owned and operated by Pepco Energy Services, primarily to hotels and casinos in Atlantic City, New Jersey. |

The energy savings performance contracting business is highly competitive, and Pepco Energy Services competes with other energy services companies primarily with respect to contracts with federal, state and local governments and independent agencies. Many of these energy services companies are subsidiaries of larger building controls and equipment providers or utility holding companies. Competitive offerings include a wide range of electrical and thermal system upgrades, improved controls, and generation equipment such as combined heat and power units. Among the factors as to which companies in this business compete are the amount and duration of the guarantees provided in energy savings performance contracts and the quality and value of service provided to customers. In connection with many of Pepco Energy Services’ energy savings performance contracts, Pepco Energy Services provides performance guarantees, including guarantees of a certain level of energy savings. This business is affected by new entrants into the market, the financial strength of customers, governmental directives regarding energy efficiency, energy prices, and general economic conditions. Pepco Energy Services’ backlog of construction contracts in this business increased to $91 million at year-end 2013 from $82 million at year-end 2012. Pepco Energy Services estimates that it will complete $88 million of the construction contracts in its backlog in 2014 and $3 million in 2015.

Most of Pepco Energy Services’ energy savings performance contracts with federal, state and local governments, as well as those with independent agencies, such as housing and water authorities, contain provisions authorizing the governmental authority or independent agency to terminate the contract at any time. Those provisions include explicit mechanisms which, if exercised, would require the other party to pay Pepco Energy Services for work performed through the date of termination and for additional costs incurred as a result of the termination.

Through its wholly owned subsidiary, W.A. Chester, L.L.C., Pepco Energy Services constructs and maintains underground transmission and distribution projects for electric utilities in North America. W.A. Chester is one of the two largest North American contractors that specializes in the installation and maintenance of pipe-type cable systems, a technology that W.A. Chester believes currently accounts for the majority of existing underground transmission circuit miles in North America. W.A. Chester’s primary competitor in the pipe-type cable system market is UTEC Constructors Corporation, and there are several other contractors that do not specialize in this cable system but rather undertake installation projects on a more limited basis. W.A. Chester also competes in the market for the installation and maintenance of solid dielectric cable, which is a relatively newer technology compared to pipe-type cable systems. The solid dielectric cable installation and maintenance market is highly competitive and composed of numerous different competitors, and the barriers to entry in this market are relatively low. The principal factors for competition in both of these markets are price, experience, customer service and ability to handle a wide range of utility applications. W.A. Chester believes its competitive strengths in both of these markets are the breadth of its experience in working with both technologies in various utility applications (including new installations, modifications, upgrades and maintenance of existing systems), its in-depth knowledge of the U.S. and Canadian utility industries and utility customers’ needs, and its ability to manage successfully all phases of these projects for the customer. W.A. Chester’s backlog of construction contracts increased to $84 million at year-end 2013 from $38 million at year-end 2012. W.A. Chester estimates that it will complete $73 million of the construction contracts in its backlog in 2014 and $11 million in 2015.

Revenues associated with Pepco Energy Services’ combined heat and power thermal generating plant and operations are concentrated with a few major customers in the Atlantic City hotel and casino industry. Pepco Energy Services has long-term contracts with these customers, and for the largest customer, the contracts expire in 2017. The Atlantic City hotel and casino industry has been experiencing a decrease in gaming revenues and overcapacity, as well as potential future competition from casinos that are being constructed in nearby markets. As a result, Pepco Energy Services is exposed to the risk that it may not be able to renew these contracts or that the contract counterparties may fail to perform their obligations thereunder.

16

Table of Contents

PHI guarantees the obligations of Pepco Energy Services under certain contracts in its energy savings performance contracting business and underground transmission and distribution construction business. At December 31, 2013, PHI’s guarantees of Pepco Energy Services’ obligations under these contracts totaled $190 million. PHI also guarantees the obligations of Pepco Energy Services under surety bonds obtained by Pepco Energy Services for construction projects in these businesses. These guarantees totaled $229 million at December 31, 2013.

During 2012, Pepco Energy Services deactivated its Buzzard Point oil-fired generation facility and its Benning Road oil-fired generation facility, and in 2013 began work to demolish the Benning Road facility. This demolition is expected to be completed by the end of 2014. At December 31, 2013, Pepco Energy Services owned five renewable energy generating facilities, with an aggregate generating capacity of 17,400 KW. See Part I, Item 2. “Properties – Generating Facilities” for more information about these facilities.

Discontinued Operations

Through its subsidiary Potomac Capital Investment Corporation, PHI maintained a portfolio of cross-border energy lease investments. During the third quarter of 2013, PHI completed the termination of its interests in its cross-border energy lease investments. These activities, which previously comprised substantially all of the operations of the Other Non-Regulated segment, are being accounted for as discontinued operations. The remaining operations of the Other Non-Regulated segment, which no longer meet the definition of a separate segment for financial reporting purposes, are being included in Corporate and Other. Substantially all of the information in the notes to the consolidated financial statements of PHI with respect to the cross-border energy lease investments has been consolidated in Note (19), “Discontinued Operations – Cross-Border Energy Lease Investments.”

In 2013, Pepco Energy Services completed a previously announced wind-down of its retail electric and retail natural gas supply businesses. These operations are being accounted for as discontinued operations and are no longer a part of the Pepco Energy Services segment for financial reporting purposes. Substantially all of the information in the notes to the consolidated financial statements of PHI with respect to Pepco Energy Services’ retail electric and retail natural gas supply businesses has been consolidated in Note (19), “Discontinued Operations – Retail Electric and Natural Gas Supply Businesses of Pepco Energy Services.”

Seasonality

Power Delivery

The operating results of Power Delivery historically have been directly related to the volume of electricity delivered to its customers, producing higher revenues and net income during periods when customers consumed higher amounts of electricity (usually during periods of extreme temperatures) and lower revenues and net income during periods when customers consumed lower amounts of electricity (usually during periods of mild temperatures). This has been due in part to the longstanding practice of tying the distribution charges paid by customers to kilowatt-hours of electricity used. Because most of the costs associated with the distribution of electricity do not vary with the volume of electricity delivered, this pricing mechanism also contributed to seasonal variations in net income.

As a result of the implementation of a bill stabilization adjustment (BSA) for retail customers of Pepco and DPL in Maryland and for customers of Pepco in the District of Columbia, distribution revenues from utility customers in these jurisdictions have been decoupled from the amount of electricity delivered. Under the BSA, utility customers pay an approved distribution charge for their electric service which does not vary by electricity usage. This change has had the effect of aligning annual distribution revenues more closely with annual distribution costs. In addition, the change has had the effect of eliminating changes in customer electricity usage, whether due to weather conditions or for any other reason, as a factor having an impact on annual distribution revenue and net income in those jurisdictions. The BSA also eliminates what otherwise might be a disincentive for the utility to aggressively develop and promote efficiency

17

Table of Contents

programs. A comparable revenue decoupling mechanism proposed for DPL electricity and natural gas customers in Delaware is under consideration by the DPSC although there was little activity in this matter in 2013. Distribution revenues are not decoupled for the distribution of electricity by ACE in New Jersey, and thus are subject to variability due to changes in customer consumption.

In contrast to electricity distribution costs, the cost of the electricity supplied, which is the largest component of a customer’s bill, does vary directly in relation to the volume of electricity used by a customer. Accordingly, whether or not a BSA is in effect for the jurisdiction, the revenues of Pepco, DPL and ACE from the supply of electricity and natural gas vary based on consumption and on this basis are seasonal. Because the revenues received by each of the utility subsidiaries for the default supply of electricity and natural gas closely approximate the supply costs, the impact on net income is immaterial, and therefore is not seasonal.

Pepco Energy Services

The energy services business of Pepco Energy Services is not seasonal, except with respect to its thermal operations. The thermal operations of Pepco Energy Services provide steam and chilled water to customers year-round. Steam usage peaks during months with colder temperatures and chilled water usage peaks during months with warmer temperatures. The rates charged customers adjust quarterly for the cost of natural gas used to produce steam and electricity used to produce chilled water. Pepco Energy Services’ revenues and gross profit from its thermal operations will fluctuate based on the volumes of steam and chilled water delivered to customers.

Regulation

The operations of PHI’s utility subsidiaries, including the rates and tariffs they are permitted to charge customers for the transmission and distribution of electricity, and, in the case of DPL, the distribution and transportation of natural gas, are subject to regulation by governmental agencies in the jurisdictions in which the subsidiaries provide utility service as described above in “ – PHI’s Utility Subsidiaries.” Rates and tariffs are established by these regulatory commissions. PHI’s utility subsidiaries have filed or plan to file rate cases in each of its jurisdictions as further described in Note (7), “Regulatory Matters – Rate Proceedings,” to the consolidated financial statements of PHI.

In addition to the other regulatory matters described elsewhere in this section and in Note (7), “Regulatory Matters,” to the consolidated financial statements of PHI, provided below are summary descriptions of certain regulatory matters involving PHI’s utility subsidiaries.

Mitigation of Regulatory Lag

An important factor in the ability of PHI’s utility subsidiaries to earn their authorized ROE is the willingness of applicable public service commissions to adequately address the shortfall in revenues in a utility’s rate structure due to the delay in time or “lag” between when costs are incurred and when they are reflected in rates. This delay is commonly known as “regulatory lag.” Pepco, DPL and ACE are currently experiencing significant regulatory lag because investments in rate base and operating expenses are increasing more rapidly than their revenue growth.

In an effort to minimize the effects of regulatory lag, PHI’s utility subsidiaries are:

| • | filing electric distribution base rate cases every nine to twelve months in each of their jurisdictions, |

| • | pursuing alternative ratemaking mechanisms, |

| • | evaluating potential reductions in planned capital expenditures, and |

| • | continuing outreach to the regulatory community and other stakeholders, to discuss the changing regulatory model economics that are causing regulatory lag. |

18

Table of Contents