UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5251

Fidelity Concord Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | April 30, 2018 |

Item 1.

Reports to Stockholders

|

Fidelity Advisor® Event Driven Opportunities Fund Class A, Class M, Class C and Class I Annual Report April 30, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended April 30, 2018 | Past 1 year | Life of fundA |

| Class A (incl. 5.75% sales charge) | 5.70% | 9.74% |

| Class M (incl. 3.50% sales charge) | 8.00% | 10.06% |

| Class C (incl. contingent deferred sales charge) | 10.39% | 10.41% |

| Class I | 12.50% | 11.53% |

A From December 12, 2013

Class C shares' contingent deferred sales charges included in the past one year and life of fund total return figures are 1% and 0%, respectively.

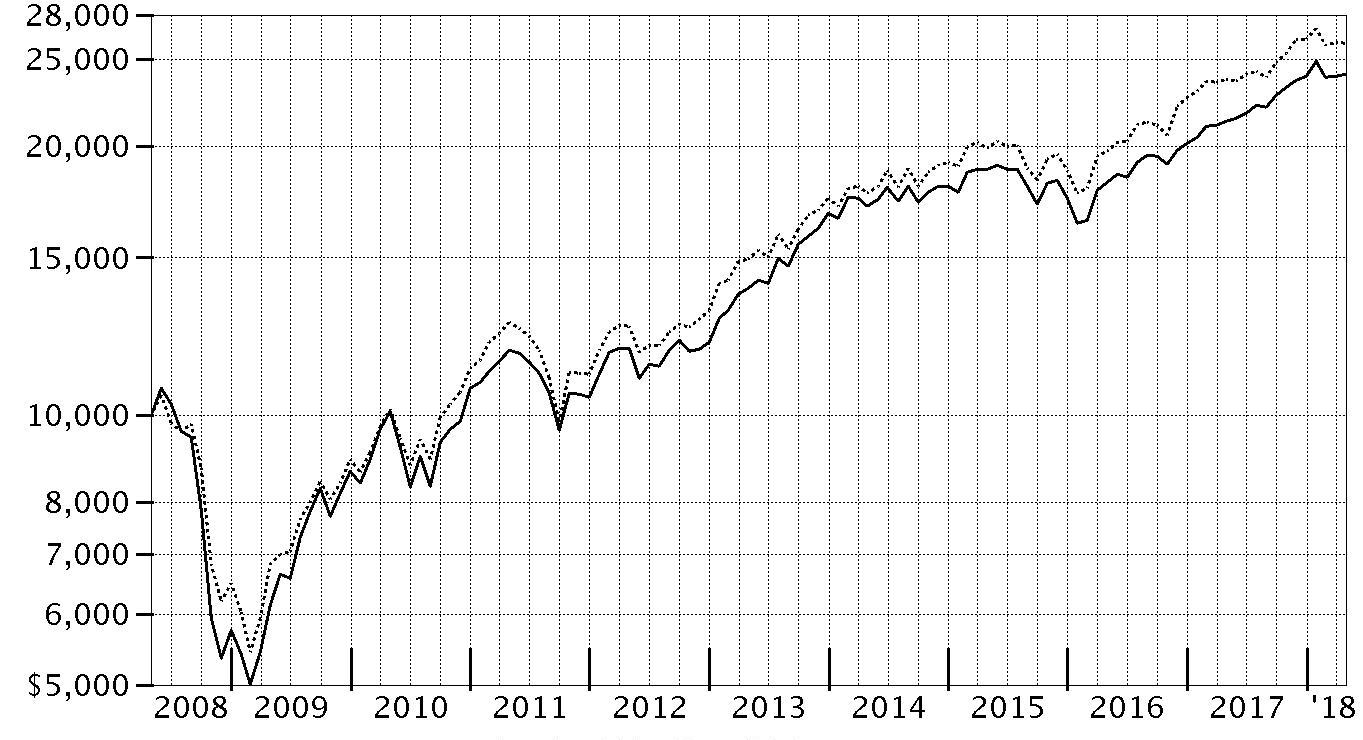

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Event Driven Opportunities Fund - Class A on December 12, 2013, when the fund started, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Index performed over the same period.

| Period Ending Values | ||

|

| $15,030 | Fidelity Advisor® Event Driven Opportunities Fund - Class A |

|

| $16,075 | Russell 3000® Index |

Management's Discussion of Fund Performance

Market Recap: U.S. equities gained 13.27% for the 12 months ending April 30, 2018, as the S&P 500® index moved steadily higher throughout 2017 and into 2018 until sharply reversing course in February. The drop was in stark contrast to the low volatility seen throughout 2017, along with consumer sentiment and other market indicators that stayed positive. Investors remained decidedly upbeat as the calendar turned, and the index rose 5.73% in January. February was a decidedly different story, though, as volatility spiked amid fear that rising inflation and the potential for the economy to overheat would prompt the U.S. Federal Reserve to pick up the pace of interest rate hikes. The index returned -3.69% for the month, its first negative result since October 2016, and lost further ground in March on fear of a global trade war after the U.S. announced plans to impose tariffs on Chinese imports. The index ended the period with a modest gain in April. For the full 12 months, growth stocks handily topped value, while large-caps bested small-caps. Information technology (+25%) was the top sector, rising amid strong earnings growth from several major index constituents. Financials added about 19%, riding the uptick in bond yields. Consumer discretionary (+17%) also stood out, largely driven by retailers. Notable laggards included the defensive consumer staples (-6%) and telecom services (-3%) sectors. Comments from Portfolio Manager Arvind Navaratnam: For the year, the fund’s share classes gained about 12%, trailing the 13.05% return of the benchmark Russell 3000® Index. Several notable detractors roughly balanced out the notable contributors this period, resulting in fund performance close to that of the Russell index. A sizable position in private-label credit card and loyalty program provider Alliance Data Systems detracted more than any other individual holding. Softness in Alliance’s loyalty business partly led to a string of lackluster financial results for the firm, including disappointing quarterly sales reported in July, as well as lowered full-year 2017 earnings guidance. An untimely position in mass media firm Twenty-First Century Fox also hurt. Conversely, the fund’s investment in U.K.-based online electronics and appliances retailer AO World contributed more than any other single position. Shares of AO surged notably in April after the firm reported solid annual revenue said it expected an increase in full-year sales despite a tough market backdrop. Elsewhere, a significant stake in security and protection company Brink's also outperformed meaningfully. Currency effects also provided a tailwind for some of the fund's overseas holdings this period, as the U.S. dollar weakened relative to other major currencies, including the euro, in late 2017.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of April 30, 2018

| % of fund's net assets | |

| JBG SMITH Properties | 11.0 |

| The Madison Square Garden Co. | 10.4 |

| Alliance Data Systems Corp. | 7.5 |

| AO World PLC | 7.3 |

| Zooplus AG | 7.1 |

| SLM Corp. | 2.9 |

| WisdomTree Investments, Inc. | 2.8 |

| Waddell & Reed Financial, Inc. Class A | 2.7 |

| KKR & Co. LP | 2.7 |

| Brighthouse Financial, Inc. | 2.7 |

| 57.1 |

Top Five Market Sectors as of April 30, 2018

| % of fund's net assets | |

| Information Technology | 30.2 |

| Consumer Discretionary | 26.2 |

| Financials | 17.4 |

| Real Estate | 11.0 |

| Industrials | 1.7 |

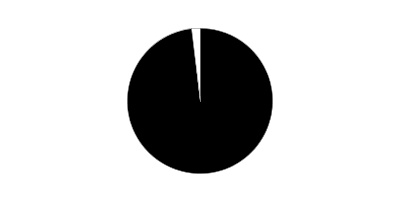

Asset Allocation (% of fund's net assets)

| As of April 30, 2018 * | ||

| Stocks and Equity Futures | 98.2% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.8% | |

* Foreign investments - 28.9%

Schedule of Investments April 30, 2018

Showing Percentage of Net Assets

| Common Stocks - 88.8% | |||

| Shares | Value | ||

| CONSUMER DISCRETIONARY - 26.2% | |||

| Internet & Direct Marketing Retail - 14.4% | |||

| AO World PLC (a)(b) | 1,595,918 | $3,427,477 | |

| Boohoo.Com PLC (a) | 1,305 | 3,293 | |

| Ocado Group PLC (a) | 600 | 4,447 | |

| Zooplus AG (a)(b) | 15,960 | 3,315,007 | |

| 6,750,224 | |||

| Media - 10.4% | |||

| The Madison Square Garden Co. (a) | 20,109 | 4,886,889 | |

| Twenty-First Century Fox, Inc. Class B | 73 | 2,633 | |

| 4,889,522 | |||

| Specialty Retail - 1.4% | |||

| Cars.com, Inc. | 23,910 | 680,957 | |

| TOTAL CONSUMER DISCRETIONARY | 12,320,703 | ||

| CONSUMER STAPLES - 1.1% | |||

| Food Products - 1.1% | |||

| SunOpta, Inc. (a) | 73,590 | 496,733 | |

| ENERGY - 1.2% | |||

| Energy Equipment & Services - 0.0% | |||

| Exterran Corp. (a) | 62 | 1,816 | |

| Oil, Gas & Consumable Fuels - 1.2% | |||

| International Seaways, Inc. (a) | 28,779 | 579,321 | |

| TOTAL ENERGY | 581,137 | ||

| FINANCIALS - 17.4% | |||

| Capital Markets - 10.9% | |||

| Brighthouse Financial, Inc. | 24,696 | 1,254,063 | |

| KKR & Co. LP | 60,503 | 1,266,933 | |

| Waddell & Reed Financial, Inc. Class A | 62,831 | 1,271,699 | |

| WisdomTree Investments, Inc. | 126,338 | 1,335,393 | |

| 5,128,088 | |||

| Consumer Finance - 2.9% | |||

| Encore Capital Group, Inc. (a) | 133 | 5,932 | |

| SLM Corp. (a) | 117,500 | 1,348,900 | |

| 1,354,832 | |||

| Diversified Financial Services - 3.6% | |||

| Donnelley Financial Solutions, Inc. (a) | 50,703 | 932,935 | |

| ECN Capital Corp. | 274,700 | 727,427 | |

| Rafael Holdings, Inc. (a) | 3,400 | 27,880 | |

| 1,688,242 | |||

| TOTAL FINANCIALS | 8,171,162 | ||

| HEALTH CARE - 0.0% | |||

| Pharmaceuticals - 0.0% | |||

| Perrigo Co. PLC | 34 | 2,657 | |

| INDUSTRIALS - 1.7% | |||

| Airlines - 0.9% | |||

| AirAsia Group BHD | 415,600 | 406,214 | |

| Spring Airlines Co. Ltd. Class A | 600 | 3,140 | |

| Wizz Air Holdings PLC (a)(c) | 100 | 4,397 | |

| 413,751 | |||

| Commercial Services & Supplies - 0.0% | |||

| The Brink's Co. | 36 | 2,657 | |

| Machinery - 0.8% | |||

| Momentum Group AB Class B | 35,566 | 400,067 | |

| TOTAL INDUSTRIALS | 816,475 | ||

| INFORMATION TECHNOLOGY - 30.2% | |||

| Electronic Equipment & Components - 1.7% | |||

| Cardtronics PLC (a) | 30,400 | 798,000 | |

| Internet Software & Services - 2.9% | |||

| comScore, Inc. (a) | 34,375 | 728,750 | |

| LogMeIn, Inc. | 5,708 | 629,022 | |

| 1,357,772 | |||

| IT Services - 13.5% | |||

| Alliance Data Systems Corp. | 17,376 | 3,528,197 | |

| Automatic Data Processing, Inc. | 6,306 | 744,612 | |

| Conduent, Inc. (a) | 36,704 | 714,260 | |

| DXC Technology Co. | 6,691 | 689,574 | |

| Gocompare.com Group PLC | 419,582 | 646,955 | |

| 6,323,598 | |||

| Semiconductors & Semiconductor Equipment - 4.5% | |||

| Marvell Technology Group Ltd. | 32,651 | 654,979 | |

| Mellanox Technologies Ltd. (a) | 9,607 | 755,110 | |

| Versum Materials, Inc. | 20,586 | 724,215 | |

| 2,134,304 | |||

| Software - 4.6% | |||

| Black Knight, Inc. (a) | 14,800 | 720,020 | |

| Micro Focus International PLC sponsored ADR | 38,991 | 675,324 | |

| Monotype Imaging Holdings, Inc. | 4,120 | 91,258 | |

| TiVo Corp. | 49,124 | 695,105 | |

| 2,181,707 | |||

| Technology Hardware, Storage & Peripherals - 3.0% | |||

| Diebold Nixdorf, Inc. (b) | 46,719 | 717,137 | |

| Seagate Technology LLC | 11,937 | 691,033 | |

| 1,408,170 | |||

| TOTAL INFORMATION TECHNOLOGY | 14,203,551 | ||

| REAL ESTATE - 11.0% | |||

| Equity Real Estate Investment Trusts (REITs) - 11.0% | |||

| JBG SMITH Properties | 140,012 | 5,162,242 | |

| TOTAL COMMON STOCKS | |||

| (Cost $38,905,484) | 41,754,660 | ||

| Principal Amount | Value | ||

| U.S. Treasury Obligations - 0.5% | |||

| U.S. Treasury Bills, yield at date of purchase 1.52% to 1.74% 5/10/18 to 6/14/18 (d) | |||

| (Cost $239,624) | 240,000 | 239,634 | |

| Shares | Value | ||

| Money Market Funds - 14.1% | |||

| Fidelity Cash Central Fund, 1.74% (e) | 4,768,180 | $4,769,134 | |

| Fidelity Securities Lending Cash Central Fund 1.74% (e)(f) | 1,881,165 | 1,881,353 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $6,650,407) | 6,650,487 | ||

| Equity Funds - 0.2% | |||

| Domestic Equity Funds - 0.2% | |||

| iShares Russell 3000 Index ETF | |||

| (Cost $87,133) | 706 | 110,729 | |

| TOTAL INVESTMENT IN SECURITIES - 103.6% | |||

| (Cost $45,882,648) | 48,755,510 | ||

| NET OTHER ASSETS (LIABILITIES) - (3.6)% | (1,714,471) | ||

| NET ASSETS - 100% | $47,041,039 |

| Futures Contracts | |||||

| Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini Russell 2000 Index Contracts (United States) | 8 | June 2018 | $617,520 | $(13,580) | $(13,580) |

| CME E-mini S&P 500 Index Contracts (United States) | 28 | June 2018 | 3,705,800 | (114,783) | (114,783) |

| TOTAL FUTURES CONTRACTS | $(128,363) |

The notional amount of futures sold as a percentage of Net Assets is 9.2%

For the period, the average monthly underlying face amount at value for futures contracts in the aggregate was $3,516,658.

Security Type Abbreviations

ETF – Exchange-Traded Fund

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $4,397 or 0.0% of net assets.

(d) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $239,634.

(e) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(f) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $51,070 |

| Fidelity Securities Lending Cash Central Fund | 30,120 |

| Total | $81,190 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equities: | ||||

| Consumer Discretionary | $12,320,703 | $12,320,703 | $-- | $-- |

| Consumer Staples | 496,733 | 496,733 | -- | -- |

| Energy | 581,137 | 581,137 | -- | -- |

| Financials | 8,171,162 | 8,171,162 | -- | -- |

| Health Care | 2,657 | 2,657 | -- | -- |

| Industrials | 816,475 | 407,121 | 409,354 | -- |

| Information Technology | 14,203,551 | 14,203,551 | -- | -- |

| Real Estate | 5,162,242 | 5,162,242 | -- | -- |

| U.S. Government and Government Agency Obligations | 239,634 | -- | 239,634 | -- |

| Money Market Funds | 6,650,487 | 6,650,487 | -- | -- |

| Equity Funds | 110,729 | 110,729 | -- | -- |

| Total Investments in Securities: | $48,755,510 | $48,106,522 | $648,988 | $-- |

| Derivative Instruments: | ||||

| Liabilities | ||||

| Futures Contracts | $(128,363) | $(128,363) | $-- | $-- |

| Total Liabilities | $(128,363) | $(128,363) | $-- | $-- |

| Total Derivative Instruments: | $(128,363) | $(128,363) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of April 30, 2018. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value | |

| Asset | Liability | |

| Equity Risk | ||

| Futures Contracts(a) | $0 | $(128,363) |

| Total Equity Risk | 0 | (128,363) |

| Total Value of Derivatives | $0 | $(128,363) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in net unrealized appreciation (depreciation).

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 71.1% |

| United Kingdom | 11.8% |

| Germany | 7.1% |

| Canada | 2.6% |

| Israel | 1.6% |

| Ireland | 1.5% |

| Bermuda | 1.4% |

| Marshall Islands | 1.2% |

| Others (Individually Less Than 1%) | 1.7% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| April 30, 2018 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $1,778,959) — See accompanying schedule: Unaffiliated issuers (cost $39,232,241) | $42,105,023 | |

| Fidelity Central Funds (cost $6,650,407) | 6,650,487 | |

| Total Investment in Securities (cost $45,882,648) | $48,755,510 | |

| Receivable for investments sold | 218,556 | |

| Receivable for fund shares sold | 141,792 | |

| Dividends receivable | 13,902 | |

| Distributions receivable from Fidelity Central Funds | 17,066 | |

| Prepaid expenses | 14 | |

| Receivable from investment adviser for expense reductions | 853 | |

| Other receivables | 1,880 | |

| Total assets | 49,149,573 | |

| Liabilities | ||

| Payable for investments purchased | $82,966 | |

| Payable for fund shares redeemed | 11,275 | |

| Accrued management fee | 32,751 | |

| Distribution and service plan fees payable | 7,953 | |

| Payable for daily variation margin on futures contracts | 40,200 | |

| Other affiliated payables | 8,735 | |

| Other payables and accrued expenses | 43,240 | |

| Collateral on securities loaned | 1,881,414 | |

| Total liabilities | 2,108,534 | |

| Net Assets | $47,041,039 | |

| Net Assets consist of: | ||

| Paid in capital | $43,469,090 | |

| Undistributed net investment income | 626 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 826,714 | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 2,744,609 | |

| Net Assets | $47,041,039 | |

| Calculation of Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($11,752,225 ÷ 840,974 shares) | $13.97 | |

| Maximum offering price per share (100/94.25 of $13.97) | $14.82 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($3,149,351 ÷ 226,408 shares) | $13.91 | |

| Maximum offering price per share (100/96.50 of $13.91) | $14.41 | |

| Class C: | ||

| Net Asset Value and offering price per share ($5,290,450 ÷ 385,288 shares)(a) | $13.73 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($26,849,013 ÷ 1,911,487 shares) | $14.05 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended April 30, 2018 | ||

| Investment Income | ||

| Dividends | $315,109 | |

| Interest | 1,936 | |

| Income from Fidelity Central Funds (including $30,120 from security lending) | 81,190 | |

| Total income | 398,235 | |

| Expenses | ||

| Management fee | ||

| Basic fee | $291,981 | |

| Performance adjustment | 5,609 | |

| Transfer agent fees | 69,310 | |

| Distribution and service plan fees | 81,474 | |

| Accounting and security lending fees | 13,800 | |

| Custodian fees and expenses | 18,002 | |

| Independent trustees' fees and expenses | 128 | |

| Registration fees | 69,173 | |

| Audit | 52,023 | |

| Legal | 55 | |

| Miscellaneous | 289 | |

| Total expenses before reductions | 601,844 | |

| Expense reductions | (78,286) | 523,558 |

| Net investment income (loss) | (125,323) | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 2,950,259 | |

| Fidelity Central Funds | (62) | |

| Foreign currency transactions | (1,190) | |

| Futures contracts | 406,094 | |

| Total net realized gain (loss) | 3,355,101 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 506,566 | |

| Assets and liabilities in foreign currencies | 103 | |

| Futures contracts | (154,941) | |

| Total change in net unrealized appreciation (depreciation) | 351,728 | |

| Net gain (loss) | 3,706,829 | |

| Net increase (decrease) in net assets resulting from operations | $3,581,506 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended April 30, 2018 | Year ended April 30, 2017 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $(125,323) | $(67,985) |

| Net realized gain (loss) | 3,355,101 | 598,740 |

| Change in net unrealized appreciation (depreciation) | 351,728 | 2,218,189 |

| Net increase (decrease) in net assets resulting from operations | 3,581,506 | 2,748,944 |

| Distributions to shareholders from net investment income | – | (31,399) |

| Distributions to shareholders from net realized gain | (2,300,863) | (289,817) |

| Total distributions | (2,300,863) | (321,216) |

| Share transactions - net increase (decrease) | 19,977,448 | 15,225,962 |

| Total increase (decrease) in net assets | 21,258,091 | 17,653,690 |

| Net Assets | ||

| Beginning of period | 25,782,948 | 8,129,258 |

| End of period | $47,041,039 | $25,782,948 |

| Other Information | ||

| Undistributed net investment income end of period | $626 | $173 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Event Driven Opportunities Fund Class A

| Years ended April 30, | 2018 | 2017 | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $13.39 | $10.87 | $11.26 | $10.58 | $10.00 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.05) | (.06) | .08C | .01 | .02D |

| Net realized and unrealized gain (loss) | 1.62 | 2.95 | (.36)E | .89F | .56G |

| Total from investment operations | 1.57 | 2.89 | (.28) | .90 | .58 |

| Distributions from net investment income | – | (.04) | – | (.01) | – |

| Distributions from net realized gain | (.99) | (.32) | (.11) | (.20) | – |

| Total distributions | (.99) | (.37)H | (.11) | (.22)I | – |

| Net asset value, end of period | $13.97 | $13.39 | $10.87 | $11.26 | $10.58 |

| Total ReturnJ,K,L | 12.15% | 26.97% | (2.49)%E | 8.55%F | 5.80%G |

| Ratios to Average Net AssetsM,N | |||||

| Expenses before reductions | 1.80% | 2.34% | 2.76% | 2.82% | 4.76%O |

| Expenses net of fee waivers, if any | 1.55% | 1.55% | 1.55% | 1.55% | 1.55%O |

| Expenses net of all reductions | 1.53% | 1.54% | 1.54% | 1.53% | 1.55%O |

| Net investment income (loss) | (.38)% | (.53)% | .74%C | .10% | .59%D,O |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $11,752 | $6,407 | $2,513 | $2,983 | $1,389 |

| Portfolio turnover rateP | 86% | 120% | 113% | 150% | 57%Q |

A For the period December 12, 2013 (commencement of operations) to April 30, 2014.

B Calculated based on average shares outstanding during the period.

C Net Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .22%.

D Net Investment income per share reflects large, non-recurring dividends which amounted to $.03 per share. Excluding these non-recurring dividends, the ratio of net investment income (loss) to average net assets would have been (.25) %.

E Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been (2.52)%.

F Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 8.47%.

G Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 5.70%.

H Total distributions of $.37 per share is comprised of distributions from net investment income of $.043 and distributions from net realized gain of $.323 per share.

I Total distributions of $.22 per share is comprised of distributions from net investment income of $.014 and distributions from net realized gain of $.201 per share.

J Total returns for periods of less than one year are not annualized.

K Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

L Total returns do not include the effect of the sales charges.

M Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

N Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

O Annualized

P Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

Q Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Event Driven Opportunities Fund Class M

| Years ended April 30, | 2018 | 2017 | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $13.33 | $10.83 | $11.25 | $10.57 | $10.00 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.09) | (.09) | .05C | (.02) | .01D |

| Net realized and unrealized gain (loss) | 1.63 | 2.93 | (.36)E | .89F | .56G |

| Total from investment operations | 1.54 | 2.84 | (.31) | .87 | .57 |

| Distributions from net investment income | – | (.03) | – | (.01) | – |

| Distributions from net realized gain | (.96) | (.31) | (.11) | (.18) | – |

| Total distributions | (.96) | (.34) | (.11) | (.19) | – |

| Net asset value, end of period | $13.91 | $13.33 | $10.83 | $11.25 | $10.57 |

| Total ReturnH,I,J | 11.91% | 26.59% | (2.76)%E | 8.35%F | 5.70%G |

| Ratios to Average Net AssetsK,L | |||||

| Expenses before reductions | 2.10% | 2.60% | 2.98% | 3.18% | 4.95%M |

| Expenses net of fee waivers, if any | 1.80% | 1.80% | 1.80% | 1.80% | 1.80%M |

| Expenses net of all reductions | 1.78% | 1.79% | 1.79% | 1.78% | 1.80%M |

| Net investment income (loss) | (.63)% | (.78)% | .49%C | (.15)% | .34%D,M |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $3,149 | $2,568 | $966 | $1,977 | $1,631 |

| Portfolio turnover rateN | 86% | 120% | 113% | 150% | 57%O |

A For the period December 12, 2013 (commencement of operations) to April 30, 2014.

B Calculated based on average shares outstanding during the period.

C Net Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.03) %.

D Net Investment income per share reflects large, non-recurring dividends which amounted to $.03 per share. Excluding these non-recurring dividends, the ratio of net investment income (loss) to average net assets would have been (.50) %.

E Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been (2.79)%.

F Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 8.27%.

G Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 5.60%.

H Total returns for periods of less than one year are not annualized.

I Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

J Total returns do not include the effect of the sales charges.

K Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

L Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

M Annualized

N Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

O Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Event Driven Opportunities Fund Class C

| Years ended April 30, | 2018 | 2017 | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $13.18 | $10.72 | $11.19 | $10.55 | $10.00 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.15) | (.15) | –C,D | (.07) | (.01)E |

| Net realized and unrealized gain (loss) | 1.61 | 2.90 | (.36)F | .88G | .56H |

| Total from investment operations | 1.46 | 2.75 | (.36) | .81 | .55 |

| Distributions from net investment income | – | (.02) | – | – | – |

| Distributions from net realized gain | (.91) | (.28) | (.11) | (.17) | – |

| Total distributions | (.91) | (.29)I | (.11) | (.17) | – |

| Net asset value, end of period | $13.73 | $13.18 | $10.72 | $11.19 | $10.55 |

| Total ReturnJ,K,L | 11.39% | 25.96% | (3.23)%F | 7.75%G | 5.50%H |

| Ratios to Average Net AssetsM,N | |||||

| Expenses before reductions | 2.55% | 3.03% | 3.46% | 3.63% | 5.38%O |

| Expenses net of fee waivers, if any | 2.30% | 2.30% | 2.30% | 2.30% | 2.30%O |

| Expenses net of all reductions | 2.28% | 2.29% | 2.29% | 2.29% | 2.30%O |

| Net investment income (loss) | (1.13)% | (1.28)% | (.01)%C | (.65)% | (.16)%E,O |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $5,290 | $3,663 | $1,046 | $1,846 | $3,011 |

| Portfolio turnover rateP | 86% | 120% | 113% | 150% | 57%Q |

A For the period December 12, 2013 (commencement of operations) to April 30, 2014.

B Calculated based on average shares outstanding during the period.

C Net Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.53) %.

D Amount represents less than $.005 per share.

E Net Investment income per share reflects large, non-recurring dividends which amounted to $.03 per share. Excluding these non-recurring dividends, the ratio of net investment income (loss) to average net assets would have been (1.00) %.

F Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been (3.26)%.

G Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 7.67%.

H Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 5.40%.

I Total distributions of $.29 per share is comprised of distributions from net investment income of $.015 and distributions from net realized gain of $.275 per share.

J Total returns for periods of less than one year are not annualized.

K Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

L Total returns do not include the effect of the contingent deferred sales charge.

M Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

N Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

O Annualized

P Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

Q Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Event Driven Opportunities Fund Class I

| Years ended April 30, | 2018 | 2017 | 2016 | 2015 | 2014 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $13.45 | $10.91 | $11.28 | $10.59 | $10.00 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.02) | (.03) | .11C | .04 | .03D |

| Net realized and unrealized gain (loss) | 1.64 | 2.96 | (.37)E | .89F | .56G |

| Total from investment operations | 1.62 | 2.93 | (.26) | .93 | .59 |

| Distributions from net investment income | – | (.05) | – | (.03) | – |

| Distributions from net realized gain | (1.02) | (.34) | (.11) | (.21) | – |

| Total distributions | (1.02) | (.39) | (.11) | (.24) | – |

| Net asset value, end of period | $14.05 | $13.45 | $10.91 | $11.28 | $10.59 |

| Total ReturnH,I | 12.50% | 27.33% | (2.31)%E | 8.86%F | 5.90%G |

| Ratios to Average Net AssetsJ,K | |||||

| Expenses before reductions | 1.46% | 1.97% | 2.17% | 2.63% | 4.50%L |

| Expenses net of fee waivers, if any | 1.30% | 1.30% | 1.30% | 1.30% | 1.30%L |

| Expenses net of all reductions | 1.28% | 1.29% | 1.28% | 1.28% | 1.30%L |

| Net investment income (loss) | (.13)% | (.28)% | 1.00%C | .35% | .84%D,L |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $26,849 | $13,145 | $3,604 | $1,990 | $1,962 |

| Portfolio turnover rateM | 86% | 120% | 113% | 150% | 57%N |

A For the period December 12, 2013 (commencement of operations) to April 30, 2014.

B Calculated based on average shares outstanding during the period.

C Net Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .47%.

D Net Investment income per share reflects large, non-recurring dividends which amounted to $.03 per share. Excluding these non-recurring dividends, the ratio of net investment income (loss) to average net assets would have been (.01) %.

E Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been (2.34)%.

F Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 8.78%.

G Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 5.80%.

H Total returns for periods of less than one year are not annualized.

I Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

J Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

K Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

L Annualized

M Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

N Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended April 30, 2018

1. Organization.

Fidelity Advisor Event Driven Opportunities Fund (the Fund) is a non-diversified fund of Fidelity Concord Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C and Class I shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

ETFs are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2018 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of April 30, 2018, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, foreign currency transactions, partnerships, market discount and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $4,580,565 |

| Gross unrealized depreciation | (1,817,046) |

| Net unrealized appreciation (depreciation) | $2,763,519 |

| Tax Cost | $45,991,991 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $439,959 |

| Undistributed long-term capital gain | $368,362 |

| Net unrealized appreciation (depreciation) on securities and other investments | $2,763,629 |

The tax character of distributions paid was as follows:

| April 30, 2018 | April 30, 2017 | |

| Ordinary Income | $458,567 | $ 321,216 |

| Long-term Capital Gains | 1,842,296 | – |

| Total | $2,300,863 | $ 321,216 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $42,184,431 and $26,424,255, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .60% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .10% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Class I of the Fund as compared to its benchmark index, the Russell 3000 Index, over the same 36 month performance period. For the reporting period, the total annual management fee rate, including the performance adjustment, was .86% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | -% | .25% | $22,210 | $947 |

| Class M | .25% | .25% | 13,865 | 220 |

| Class C | .75% | .25% | 45,399 | 15,932 |

| $81,474 | $17,099 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained by FDC | |

| Class A | $16,031 |

| Class M | 1,198 |

| Class C(a) | 1,619 |

| $18,848 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each applicable class were as follows:

| Amount | % of Class-Level Average Net Assets | |

| Class A | $21,782 | .25 |

| Class M | 7,708 | .28 |

| Class C | 10,126 | .22 |

| Class I | 29,694 | .16 |

| $69,310 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions. For the period, the fees were equivalent to an annual rate of .04%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $1,433 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser FMR or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $94 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. During the period, there were no securities loaned to FCM.

9. Expense Reductions.

The investment adviser contractually agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of class-level average net assets as noted in the table below. This reimbursement will remain in place through June 30, 2019. Some expenses, for example the compensation of the independent Trustees, and certain miscellaneous expenses such as proxy and shareholder meeting expenses, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| Expense Limitations | Reimbursement | |

| Class A | 1.55% | $22,454 |

| Class M | 1.80% | 8,282 |

| Class C | 2.30% | 11,365 |

| Class I | 1.30% | 29,972 |

| $72,073 |

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $5,845 for the period. Through arrangements with the Fund's custodian credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $138.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $230.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Year ended April 30, 2018 | Year ended April 30, 2017 |

|

| From net investment income | ||

| Class A | $– | $10,330 |

| Class M | – | 2,826 |

| Class C | – | 1,451 |

| Class I | – | 16,792 |

| Total | $– | $31,399 |

| From net realized gain | ||

| Class A | $593,053 | $84,205 |

| Class M | 184,264 | 27,568 |

| Class C | 298,372 | 28,743 |

| Class I | 1,225,174 | 149,301 |

| Total | $2,300,863 | $289,817 |

11. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| Shares | Shares | Dollars | Dollars | |

| Year ended April 30, 2018 | Year ended April 30, 2017 | Year ended April 30, 2018 | Year ended April 30, 2017 | |

| Class A | ||||

| Shares sold | 450,756 | 329,237 | $6,238,605 | $4,248,581 |

| Reinvestment of distributions | 44,180 | 7,724 | 591,573 | 92,311 |

| Shares redeemed | (132,477) | (89,665) | (1,823,574) | (1,144,335) |

| Net increase (decrease) | 362,459 | 247,296 | $5,006,604 | $3,196,557 |

| Class M | ||||

| Shares sold | 94,566 | 122,115 | $1,299,217 | $1,560,300 |

| Reinvestment of distributions | 13,813 | 2,549 | 184,264 | 30,394 |

| Shares redeemed | (74,588) | (21,285) | (1,015,070) | (253,056) |

| Net increase (decrease) | 33,791 | 103,379 | $468,411 | $1,337,638 |

| Class C | ||||

| Shares sold | 164,128 | 211,525 | $2,231,576 | $2,717,355 |

| Reinvestment of distributions | 22,465 | 2,503 | 296,504 | 29,673 |

| Shares redeemed | (79,141) | (33,769) | (1,067,604) | (414,161) |

| Net increase (decrease) | 107,452 | 180,259 | $1,460,476 | $2,332,867 |

| Class I | ||||

| Shares sold | 1,360,275 | 702,861 | $18,956,142 | $9,059,018 |

| Reinvestment of distributions | 57,819 | 11,485 | 777,083 | 137,676 |

| Shares redeemed | (483,947) | (67,262) | (6,691,268) | (837,794) |

| Net increase (decrease) | 934,147 | 647,084 | $13,041,957 | $8,358,900 |

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Fidelity Concord Street Trust and Shareholders of Fidelity Advisor Event Driven Opportunities Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Fidelity Advisor Event Driven Opportunities Fund (one of the funds constituting Fidelity Concord Street Trust, referred to hereafter as the "Fund") as of April 30, 2018, the related statement of operations for the year ended April 30, 2018, the statement of changes in net assets for each of the two years in the period ended April 30, 2018, including the related notes, and the financial highlights for for each of the four years in the period ended April 30, 2018 and for the period December 12, 2013 (commencement of operations) through April 30, 2014 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended April 30, 2018 and the financial highlights for for each of the four years in the period ended April 30, 2018 and for the period December 12, 2013 (commencement of operations) through April 30, 2014 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of April 30, 2018 by correspondence with the custodian, and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

June 18, 2018

We have served as the auditor of one or more investment companies in the Fidelity group of funds since 1932.

Trustees and Officers

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Jonathan Chiel, each of the Trustees oversees 284 funds. Mr. Chiel oversees 145 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.