UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5251

Fidelity Concord Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | February 28 |

|

|

Date of reporting period: | February 28, 2017 |

Item 1.

Reports to Stockholders

|

Fidelity® Total Market Index Fund (formerly Spartan® Total Market Index Fund) Fidelity® Extended Market Index Fund (formerly Spartan® Extended Market Index Fund) Fidelity® International Index Fund (formerly Spartan® International Index Fund) Annual Report February 28, 2017 |

|

Contents

|

Fidelity® Total Market Index Fund | |

|

Fidelity® Extended Market Index Fund | |

|

Fidelity® International Index Fund | |

|

Board Approval of Investment Advisory Contracts and Management Fees. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Fidelity and any related funds.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Fidelity® Total Market Index Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 28, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Investor Class | 26.22% | 13.73% | 7.69% |

| Premium Class | 26.28% | 13.77% | 7.73% |

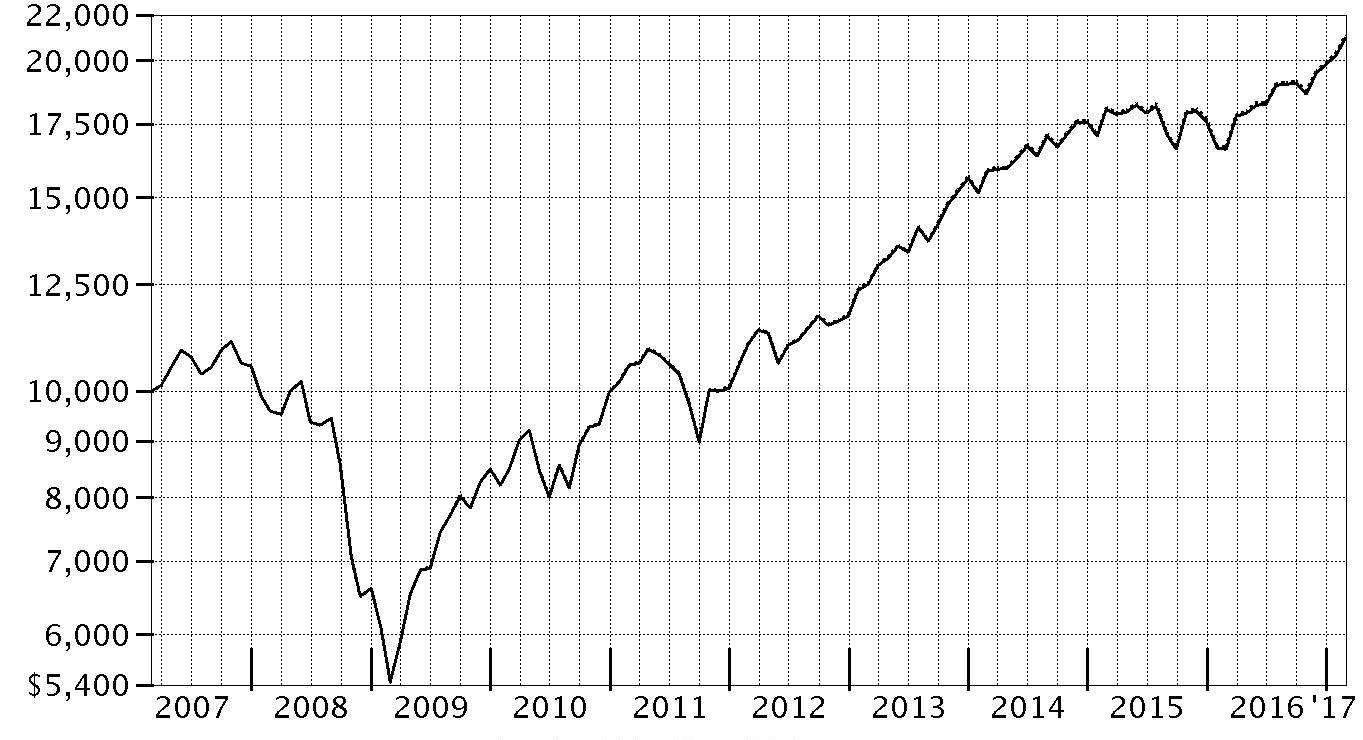

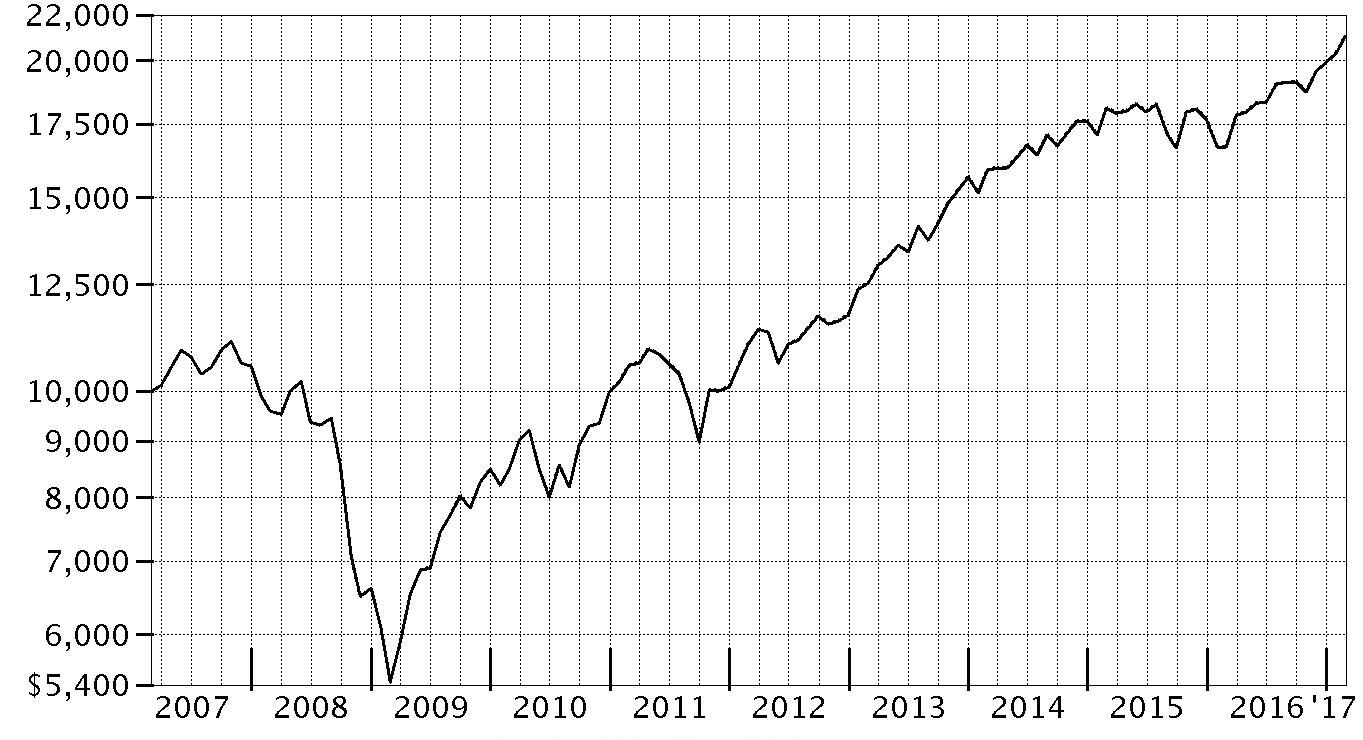

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Total Market Index Fund - Investor Class on February 28, 2007.

The chart shows how the value of your investment would have changed, and also shows how the Dow Jones U.S. Total Stock Market Index℠ performed over the same period.

| Period Ending Values | ||

|

| $20,974 | Fidelity® Total Market Index Fund - Investor Class |

|

| $21,083 | Dow Jones U.S. Total Stock Market Index℠ |

Fidelity® Total Market Index Fund

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500® index gained 24.98% for the year ending February 28, 2017, rising sharply in the period’s final four months on renewed optimism for economic growth. The beginning of the period saw improving investor sentiment amid U.S. job gains, a rally in energy, and other stimuli that helped keep the seven-year bull uptrend intact. Markets tumbled briefly following Brexit – the U.K.’s June vote to exit the European Union – recovering quickly to settle into a flattish stretch until the November U.S. presidential election. Stocks then broke out in response to Donald Trump’s surprise victory, surging to a series of new all-time highs on expectations for reflation and fiscal stimulus. For the year, financials (+47%) proved the top-performing sector by far, riding an uptick in bond yields and a rally in banks, especially post-election. Industrials (+27%), energy (+26%) and materials (+28%) also fared well, the latter two driven by a cyclical rebound in commodity prices. Information technology rose 33%, despite cooling off late in 2016. Conversely, real estate and health care each returned 15%, lagging the broad market on prospects of rising interest rates and an uncertain political and regulatory outlook, respectively. An improved backdrop for riskier assets curbed dividend-rich telecom services (+9%), consumer staples (+12%) and utilities (+16%). Comments from Patrick Waddell, Senior Portfolio Manager of the Geode Capital Management, LLC, investment management team: For the year, the fund’s share classes rose approximately 26%, straddling the results of the benchmark Dow Jones U.S. Total Stock Market Index℠, which gained 26.26%. During a very strong period of market performance, all 11 sectors in the index produced double-digit gains, led by financials. During the period, banks JPMorgan Chase (+66%), Bank of America (+100%), Citigroup (+56%) and Wells Fargo (+27%) benefited from rising interest rates as well as the prospect of post-election regulatory reform, a stated priority of President Trump and the Republican Congress. In the information technology sector, Apple (+45%) reported better-than-expected sales and earnings for its fiscal first quarter of 2017, while software manufacturer Microsoft particularly benefited from strong sales growth in its cloud-computing division. Internet retailer Amazon.com (+53%) and social media giant Facebook (+27%) also contributed to results. Conversely, many of the biggest detractors came from the health care sector this period. Gilead Sciences (-18%), a biotechnology company that issued a weak sales forecast, hampered performance. Pharmaceutical manufacturers Allergan (-15%) and Perrigo (-41%) also were big laggards, struggling amid growing pressure on drug pricing.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® Total Market Index Fund

Investment Summary (Unaudited)

Top Ten Stocks as of February 28, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Apple, Inc. | 2.9 | 2.5 |

| Microsoft Corp. | 2.0 | 2.0 |

| Exxon Mobil Corp. | 1.4 | 1.6 |

| Johnson & Johnson | 1.4 | 1.4 |

| Amazon.com, Inc. | 1.3 | 1.3 |

| Berkshire Hathaway, Inc. Class B | 1.3 | 1.2 |

| JPMorgan Chase & Co. | 1.3 | 1.1 |

| Facebook, Inc. Class A | 1.3 | 1.3 |

| General Electric Co. | 1.1 | 1.2 |

| Wells Fargo & Co. | 1.1 | 1.0 |

| 15.1 |

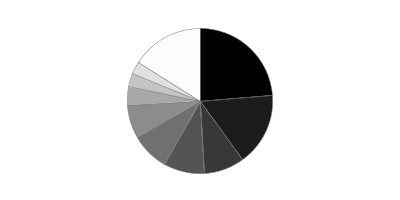

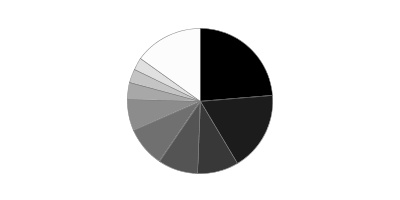

Top Market Sectors as of February 28, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Information Technology | 20.6 | 19.8 |

| Financials | 15.3 | 18.2 |

| Health Care | 13.3 | 14.0 |

| Consumer Discretionary | 12.4 | 12.7 |

| Industrials | 10.7 | 10.3 |

| Consumer Staples | 8.3 | 8.8 |

| Energy | 6.2 | 6.4 |

| Real Estate | 4.0 | 0.0 |

| Materials | 3.3 | 3.3 |

| Utilities | 3.2 | 3.2 |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Fidelity® Total Market Index Fund

Investments February 28, 2017

Showing Percentage of Net Assets

| Common Stocks - 99.5% | |||

| Shares | Value | ||

| CONSUMER DISCRETIONARY - 12.4% | |||

| Auto Components - 0.4% | |||

| Adient PLC (a) | 153,629 | $10,313,115 | |

| American Axle & Manufacturing Holdings, Inc. (a) | 132,676 | 2,629,638 | |

| Autoliv, Inc. (b) | 140,674 | 14,728,568 | |

| BorgWarner, Inc. | 322,234 | 13,595,052 | |

| Clean Diesel Technologies, Inc. (a)(b) | 8,475 | 23,476 | |

| Cooper Tire & Rubber Co. | 81,601 | 3,300,760 | |

| Cooper-Standard Holding, Inc. (a) | 27,202 | 3,046,624 | |

| Dana Holding Corp. | 219,929 | 4,154,459 | |

| Delphi Automotive PLC | 433,732 | 33,020,017 | |

| Dorman Products, Inc. (a) | 47,584 | 3,719,165 | |

| Fox Factory Holding Corp. (a) | 40,961 | 1,097,755 | |

| Gentex Corp. | 444,026 | 9,337,867 | |

| Gentherm, Inc. (a) | 58,309 | 2,113,701 | |

| Hertz Global Holdings, Inc. (a) | 113,057 | 2,568,655 | |

| Horizon Global Corp. (a) | 28,918 | 528,621 | |

| Lci Industries | 37,718 | 4,062,229 | |

| Lear Corp. | 114,527 | 16,261,689 | |

| Metaldyne Performance Group, Inc. | 30,783 | 717,244 | |

| Modine Manufacturing Co. (a) | 76,995 | 873,893 | |

| Motorcar Parts of America, Inc. (a)(b) | 32,435 | 920,181 | |

| Shiloh Industries, Inc. (a) | 7,922 | 122,236 | |

| Spartan Motors, Inc. | 44,931 | 298,791 | |

| Standard Motor Products, Inc. | 32,576 | 1,562,671 | |

| Stoneridge, Inc. (a) | 43,907 | 741,589 | |

| Strattec Security Corp. | 4,334 | 128,937 | |

| Superior Industries International, Inc. | 39,790 | 891,296 | |

| Sypris Solutions, Inc. (a) | 16,848 | 14,993 | |

| Tenneco, Inc. | 83,068 | 5,342,103 | |

| The Goodyear Tire & Rubber Co. | 412,766 | 14,467,448 | |

| Tower International, Inc. | 31,785 | 878,855 | |

| UQM Technologies, Inc. (a) | 38,648 | 17,585 | |

| Visteon Corp. (a) | 57,388 | 5,318,146 | |

| VOXX International Corp. (a) | 18,073 | 89,461 | |

| Workhorse Group, Inc. (a)(b) | 16,326 | 46,856 | |

| 156,933,676 | |||

| Automobiles - 0.6% | |||

| Ford Motor Co. | 6,270,789 | 78,572,986 | |

| General Motors Co. | 2,226,289 | 82,016,487 | |

| Harley-Davidson, Inc. | 286,768 | 16,167,980 | |

| Tesla, Inc. (a)(b) | 199,443 | 49,858,756 | |

| Thor Industries, Inc. | 78,500 | 8,699,370 | |

| Winnebago Industries, Inc. (b) | 39,123 | 1,291,059 | |

| 236,606,638 | |||

| Distributors - 0.1% | |||

| Core-Mark Holding Co., Inc. | 75,278 | 2,448,041 | |

| Educational Development Corp. | 2,866 | 27,370 | |

| Fenix Parts, Inc. (a) | 13,969 | 27,938 | |

| Genuine Parts Co. | 238,105 | 22,789,030 | |

| LKQ Corp. (a) | 475,833 | 15,026,806 | |

| Pool Corp. | 68,125 | 7,814,619 | |

| Weyco Group, Inc. | 5,169 | 141,527 | |

| 48,275,331 | |||

| Diversified Consumer Services - 0.1% | |||

| American Public Education, Inc. (a) | 20,589 | 497,224 | |

| Ascent Capital Group, Inc. (a) | 16,905 | 271,325 | |

| Bridgepoint Education, Inc. (a) | 19,443 | 181,403 | |

| Bright Horizons Family Solutions, Inc. (a) | 78,305 | 5,411,659 | |

| Cambium Learning Group, Inc. (a) | 12,514 | 60,943 | |

| Capella Education Co. | 17,991 | 1,369,115 | |

| Career Education Corp. (a) | 92,297 | 768,834 | |

| Carriage Services, Inc. | 24,048 | 619,717 | |

| Chegg, Inc. (a)(b) | 85,961 | 679,092 | |

| Collectors Universe, Inc. | 4,772 | 111,665 | |

| DeVry, Inc. (b) | 87,504 | 2,813,254 | |

| Graham Holdings Co. | 7,921 | 4,263,478 | |

| Grand Canyon Education, Inc. (a) | 82,727 | 5,077,783 | |

| H&R Block, Inc. | 339,125 | 6,972,410 | |

| Houghton Mifflin Harcourt Co. (a) | 170,821 | 1,887,572 | |

| K12, Inc. (a) | 59,099 | 1,055,508 | |

| Liberty Tax, Inc. | 8,571 | 128,136 | |

| Lincoln Educational Services Corp. (a) | 15,671 | 29,305 | |

| National American University Holdings, Inc. | 5,378 | 14,037 | |

| Regis Corp. (a) | 52,945 | 651,753 | |

| Service Corp. International | 317,953 | 9,770,696 | |

| ServiceMaster Global Holdings, Inc. (a) | 221,126 | 8,807,449 | |

| Sotheby's Class A (Ltd. vtg.) (a)(b) | 71,198 | 3,213,166 | |

| Strayer Education, Inc. | 17,939 | 1,390,990 | |

| Universal Technical Institute, Inc. | 29,419 | 102,084 | |

| Weight Watchers International, Inc. (a)(b) | 37,785 | 543,726 | |

| 56,692,324 | |||

| Hotels, Restaurants & Leisure - 1.9% | |||

| ARAMARK Holdings Corp. | 392,536 | 14,029,237 | |

| Belmond Ltd. Class A (a) | 136,912 | 1,773,010 | |

| Biglari Holdings, Inc. (a) | 2,475 | 1,062,839 | |

| BJ's Restaurants, Inc. (a) | 35,904 | 1,305,110 | |

| Bloomin' Brands, Inc. | 159,652 | 2,728,453 | |

| Bob Evans Farms, Inc. | 36,126 | 2,049,428 | |

| Bojangles', Inc. (a) | 24,608 | 517,998 | |

| Boyd Gaming Corp. (a) | 147,259 | 2,896,585 | |

| Bravo Brio Restaurant Group, Inc. (a) | 12,451 | 49,804 | |

| Brinker International, Inc. | 77,201 | 3,260,970 | |

| Buffalo Wild Wings, Inc. (a) | 29,848 | 4,626,440 | |

| Caesars Entertainment Corp. (a)(b) | 91,365 | 863,399 | |

| Carnival Corp. unit | 673,780 | 37,697,991 | |

| Carrols Restaurant Group, Inc. (a) | 61,598 | 973,248 | |

| Century Casinos, Inc. (a) | 28,742 | 196,595 | |

| Chipotle Mexican Grill, Inc. (a)(b) | 46,452 | 19,451,310 | |

| Choice Hotels International, Inc. | 66,238 | 4,014,023 | |

| Churchill Downs, Inc. | 21,995 | 3,305,849 | |

| Chuy's Holdings, Inc. (a)(b) | 26,361 | 751,289 | |

| ClubCorp Holdings, Inc. | 105,707 | 1,807,590 | |

| Cracker Barrel Old Country Store, Inc. (b) | 37,351 | 6,013,137 | |

| Darden Restaurants, Inc. | 199,550 | 14,902,394 | |

| Dave & Buster's Entertainment, Inc. (a) | 61,208 | 3,500,486 | |

| Del Frisco's Restaurant Group, Inc. (a) | 37,615 | 598,079 | |

| Del Taco Restaurants, Inc. (a) | 75,328 | 934,820 | |

| Denny's Corp. (a) | 117,334 | 1,473,715 | |

| DineEquity, Inc. | 27,200 | 1,627,104 | |

| Domino's Pizza, Inc. | 76,030 | 14,431,254 | |

| Dover Downs Gaming & Entertainment, Inc. (a) | 1,508 | 1,614 | |

| Dover Motorsports, Inc. | 9,993 | 21,985 | |

| Drive Shack, Inc. | 86,128 | 360,876 | |

| Dunkin' Brands Group, Inc. | 155,091 | 8,531,556 | |

| El Pollo Loco Holdings, Inc. (a)(b) | 42,298 | 528,725 | |

| Eldorado Resorts, Inc. (a)(b) | 30,709 | 500,557 | |

| Empire Resorts, Inc. (a)(b) | 4,022 | 93,512 | |

| Entertainment Gaming Asia, Inc. (a) | 2,060 | 3,440 | |

| Extended Stay America, Inc. unit | 171,686 | 2,970,168 | |

| Famous Dave's of America, Inc. (a) | 7,623 | 43,070 | |

| Fiesta Restaurant Group, Inc. (a) | 50,677 | 1,005,938 | |

| Fogo de Chao, Inc. (a)(b) | 4,278 | 59,892 | |

| Golden Entertainment, Inc. | 1,436 | 17,017 | |

| Good Times Restaurants, Inc. (a) | 7,939 | 23,817 | |

| Habit Restaurants, Inc. Class A (a) | 23,867 | 321,011 | |

| Hilton Grand Vacations, Inc. (a) | 88,399 | 2,646,666 | |

| Hilton Worldwide Holdings, Inc. | 308,331 | 17,636,533 | |

| Hyatt Hotels Corp. Class A (a) | 61,240 | 3,144,062 | |

| Ignite Restaurant Group, Inc. (a) | 4,841 | 2,077 | |

| Ilg, Inc. | 159,203 | 3,005,753 | |

| International Speedway Corp. Class A | 39,245 | 1,455,990 | |

| Intrawest Resorts Holdings, Inc. (a) | 22,150 | 521,854 | |

| Isle of Capri Casinos, Inc. (a) | 39,454 | 958,338 | |

| J. Alexanders Holdings, Inc. (a) | 20,559 | 191,199 | |

| Jack in the Box, Inc. | 50,437 | 4,726,451 | |

| Jamba, Inc. (a)(b) | 19,136 | 185,811 | |

| Kona Grill, Inc. (a)(b) | 8,466 | 53,759 | |

| La Quinta Holdings, Inc. (a) | 128,968 | 1,787,496 | |

| Las Vegas Sands Corp. | 589,616 | 31,220,167 | |

| Lindblad Expeditions Holdings (a) | 22,275 | 199,807 | |

| Luby's, Inc. (a) | 14,614 | 49,395 | |

| Marcus Corp. | 26,625 | 830,700 | |

| Marriott International, Inc. Class A | 509,412 | 44,313,750 | |

| Marriott Vacations Worldwide Corp. (b) | 38,724 | 3,637,345 | |

| McDonald's Corp. | 1,331,342 | 169,945,806 | |

| MGM Mirage, Inc. | 773,195 | 20,327,297 | |

| Monarch Casino & Resort, Inc. (a) | 14,995 | 382,073 | |

| Nathan's Famous, Inc. (a) | 3,561 | 220,782 | |

| Noodles & Co. (a)(b) | 28,579 | 108,600 | |

| Norwegian Cruise Line Holdings Ltd. (a) | 266,979 | 13,535,835 | |

| Panera Bread Co. Class A (a)(b) | 33,222 | 7,667,638 | |

| Papa John's International, Inc. (b) | 42,981 | 3,392,061 | |

| Papa Murphy's Holdings, Inc. (a)(b) | 22,690 | 96,886 | |

| Park Hotels & Resorts, Inc. | 176,799 | 4,515,446 | |

| Penn National Gaming, Inc. (a) | 107,531 | 1,555,974 | |

| Pinnacle Entertainment, Inc. | 94,638 | 1,642,916 | |

| Planet Fitness, Inc. (b) | 85,278 | 1,834,330 | |

| Popeyes Louisiana Kitchen, Inc. (a) | 35,356 | 2,793,478 | |

| Potbelly Corp. (a) | 30,614 | 399,513 | |

| Rave Restaurant Group, Inc. (a)(b) | 9,079 | 20,428 | |

| RCI Hospitality Holdings, Inc. | 5,726 | 97,514 | |

| Red Lion Hotels Corp. (a) | 6,989 | 52,068 | |

| Red Robin Gourmet Burgers, Inc. (a) | 21,139 | 964,995 | |

| Red Rock Resorts, Inc. (b) | 43,728 | 960,704 | |

| Royal Caribbean Cruises Ltd. | 268,436 | 25,796,700 | |

| Ruby Tuesday, Inc. (a) | 88,086 | 167,363 | |

| Ruth's Hospitality Group, Inc. | 42,076 | 708,981 | |

| Scientific Games Corp. Class A (a) | 89,331 | 1,844,685 | |

| SeaWorld Entertainment, Inc. (b) | 103,555 | 1,995,505 | |

| Shake Shack, Inc. Class A (a)(b) | 22,232 | 796,573 | |

| Six Flags Entertainment Corp. | 140,263 | 8,501,340 | |

| Sonic Corp. | 74,649 | 1,887,127 | |

| Speedway Motorsports, Inc. | 23,497 | 500,956 | |

| Starbucks Corp. | 2,331,791 | 132,608,954 | |

| Texas Roadhouse, Inc. Class A | 113,067 | 4,782,734 | |

| The Cheesecake Factory, Inc. | 75,769 | 4,625,697 | |

| Town Sports International Holdings, Inc. (a) | 13,107 | 44,564 | |

| U.S. Foods Holding Corp. | 139,952 | 3,855,678 | |

| Vail Resorts, Inc. | 67,071 | 12,151,924 | |

| Wendy's Co. | 300,738 | 4,192,288 | |

| Wingstop, Inc. (b) | 38,268 | 1,006,448 | |

| Wyndham Worldwide Corp. | 171,061 | 14,239,118 | |

| Wynn Resorts Ltd. (b) | 129,188 | 12,421,426 | |

| Yum! Brands, Inc. | 553,358 | 36,145,345 | |

| Zoe's Kitchen, Inc. (a)(b) | 27,188 | 487,209 | |

| 777,167,447 | |||

| Household Durables - 0.6% | |||

| AV Homes, Inc. (a)(b) | 12,051 | 198,842 | |

| Bassett Furniture Industries, Inc. | 15,479 | 423,351 | |

| Beazer Homes U.S.A., Inc. (a) | 40,506 | 494,173 | |

| CalAtlantic Group, Inc. | 115,129 | 4,067,508 | |

| Cavco Industries, Inc. (a) | 13,938 | 1,662,107 | |

| Century Communities, Inc. (a) | 22,823 | 521,506 | |

| Comstock Holding Companies, Inc. (a) | 1,496 | 3,201 | |

| CSS Industries, Inc. | 16,118 | 396,180 | |

| D.R. Horton, Inc. | 542,686 | 17,365,952 | |

| Dixie Group, Inc. (a) | 11,105 | 39,423 | |

| Emerson Radio Corp. (a) | 23,724 | 29,655 | |

| Ethan Allen Interiors, Inc. (b) | 53,577 | 1,540,339 | |

| Flexsteel Industries, Inc. | 9,186 | 461,872 | |

| Garmin Ltd. | 180,689 | 9,325,359 | |

| GoPro, Inc. Class A (a)(b) | 148,905 | 1,399,707 | |

| Green Brick Partners, Inc. (a) | 37,398 | 353,411 | |

| Harman International Industries, Inc. | 110,094 | 12,288,692 | |

| Helen of Troy Ltd. (a) | 44,560 | 4,353,512 | |

| Hooker Furniture Corp. | 17,507 | 577,731 | |

| Hovnanian Enterprises, Inc. Class A (a)(b) | 177,163 | 419,876 | |

| Installed Building Products, Inc. (a) | 31,210 | 1,468,431 | |

| iRobot Corp. (a)(b) | 45,351 | 2,588,635 | |

| KB Home (b) | 112,206 | 1,991,657 | |

| Koss Corp. (a) | 2,669 | 6,326 | |

| La-Z-Boy, Inc. | 79,546 | 2,147,742 | |

| Leggett & Platt, Inc. | 221,974 | 10,916,681 | |

| Lennar Corp. Class A | 334,495 | 16,320,011 | |

| LGI Homes, Inc. (a)(b) | 24,556 | 712,370 | |

| Libbey, Inc. | 30,735 | 430,290 | |

| Lifetime Brands, Inc. | 14,046 | 203,667 | |

| M.D.C. Holdings, Inc. (b) | 59,641 | 1,740,921 | |

| M/I Homes, Inc. (b) | 33,201 | 783,544 | |

| Meritage Homes Corp. (a) | 64,418 | 2,290,060 | |

| Mohawk Industries, Inc. (a) | 100,622 | 22,776,796 | |

| NACCO Industries, Inc. Class A | 7,854 | 506,583 | |

| New Home Co. LLC (a) | 11,951 | 124,888 | |

| Newell Brands, Inc. | 774,925 | 37,994,573 | |

| Nova LifeStyle, Inc. (a)(b) | 26,136 | 52,011 | |

| NVR, Inc. (a) | 5,604 | 10,843,572 | |

| PulteGroup, Inc. | 477,718 | 10,533,682 | |

| Skyline Corp. (a) | 21,741 | 261,979 | |

| Stanley Furniture Co., Inc. | 5,699 | 4,502 | |

| Taylor Morrison Home Corp. (a) | 100,743 | 2,027,957 | |

| Tempur Sealy International, Inc. (a)(b) | 77,783 | 3,592,797 | |

| Toll Brothers, Inc. (a) | 242,096 | 8,265,157 | |

| TopBuild Corp. (a) | 69,281 | 2,908,416 | |

| TRI Pointe Homes, Inc. (a) | 234,174 | 2,796,038 | |

| Tupperware Brands Corp. | 86,145 | 5,202,297 | |

| Turtle Beach Corp. (a)(b) | 6,672 | 7,072 | |

| UCP, Inc. (a) | 9,479 | 102,847 | |

| Universal Electronics, Inc. (a) | 22,307 | 1,532,491 | |

| Vuzix Corp. (a)(b) | 22,003 | 141,919 | |

| Whirlpool Corp. | 119,406 | 21,324,718 | |

| William Lyon Homes, Inc. (a)(b) | 35,265 | 649,934 | |

| Zagg, Inc. (a) | 38,365 | 232,108 | |

| 229,405,069 | |||

| Internet & Direct Marketing Retail - 2.1% | |||

| 1-800-FLOWERS.com, Inc. Class A (a) | 52,658 | 526,580 | |

| Amazon.com, Inc. (a) | 632,338 | 534,350,904 | |

| Duluth Holdings, Inc. (a)(b) | 12,299 | 259,386 | |

| Etsy, Inc. (a) | 147,726 | 1,790,439 | |

| EVINE Live, Inc. (a) | 71,405 | 91,398 | |

| Expedia, Inc. | 193,757 | 23,064,833 | |

| FTD Companies, Inc. (a) | 25,393 | 613,495 | |

| Gaia, Inc. Class A (a) | 12,609 | 107,807 | |

| Groupon, Inc. (a)(b) | 645,768 | 2,731,599 | |

| HSN, Inc. | 48,658 | 1,834,407 | |

| Lands' End, Inc. (a)(b) | 26,352 | 488,830 | |

| Liberty Expedia Holdings, Inc. (a) | 85,283 | 3,691,048 | |

| Liberty Interactive Corp.: | |||

| (Venture Group) Series A (a) | 144,556 | 6,340,226 | |

| QVC Group Series A (a) | 704,430 | 13,299,638 | |

| Liberty TripAdvisor Holdings, Inc. (a) | 113,996 | 1,533,246 | |

| Netflix, Inc. (a) | 688,494 | 97,855,652 | |

| NutriSystem, Inc. | 46,905 | 2,181,083 | |

| Overstock.com, Inc. (a) | 24,847 | 458,427 | |

| PetMed Express, Inc. (b) | 32,292 | 680,070 | |

| Priceline Group, Inc. (a) | 78,974 | 136,161,443 | |

| Shutterfly, Inc. (a)(b) | 54,203 | 2,459,732 | |

| TripAdvisor, Inc. (a)(b) | 181,795 | 7,539,039 | |

| U.S. Auto Parts Network, Inc. (a) | 5,048 | 17,416 | |

| Wayfair LLC Class A (a)(b) | 50,248 | 1,899,877 | |

| 839,976,575 | |||

| Leisure Products - 0.1% | |||

| American Outdoor Brands Corp. (a)(b) | 87,581 | 1,702,575 | |

| Arctic Cat, Inc. (a) | 18,718 | 346,283 | |

| Black Diamond, Inc. (a) | 32,583 | 180,836 | |

| Brunswick Corp. | 144,134 | 8,632,185 | |

| Callaway Golf Co. | 134,839 | 1,363,222 | |

| Escalade, Inc. | 7,022 | 91,286 | |

| Hasbro, Inc. | 179,906 | 17,427,494 | |

| JAKKS Pacific, Inc. (a)(b) | 19,661 | 103,220 | |

| Johnson Outdoors, Inc. Class A | 6,349 | 222,723 | |

| Malibu Boats, Inc. Class A (a) | 23,351 | 480,097 | |

| Marine Products Corp. | 11,741 | 124,689 | |

| Mattel, Inc. | 552,142 | 14,206,614 | |

| MCBC Holdings, Inc. (a) | 21,350 | 313,418 | |

| Nautilus, Inc. (a) | 46,907 | 755,203 | |

| Polaris Industries, Inc. (b) | 94,246 | 8,030,702 | |

| Sturm, Ruger & Co., Inc. (b) | 33,314 | 1,660,703 | |

| Summer Infant, Inc. (a) | 32,605 | 59,341 | |

| Vista Outdoor, Inc. (a) | 94,769 | 1,917,177 | |

| 57,617,768 | |||

| Media - 3.1% | |||

| A.H. Belo Corp. Class A | 22,177 | 139,715 | |

| AMC Entertainment Holdings, Inc. Class A | 84,665 | 2,654,248 | |

| AMC Networks, Inc. Class A (a) | 101,098 | 6,046,671 | |

| Ballantyne of Omaha, Inc. (a) | 17,964 | 116,766 | |

| Cable One, Inc. | 7,371 | 4,609,971 | |

| CBS Corp. Class B | 637,303 | 42,011,014 | |

| Central European Media Enterprises Ltd. Class A (a)(b) | 87,763 | 250,125 | |

| Charter Communications, Inc. Class A (a) | 348,085 | 112,452,340 | |

| Cinedigm Corp. (a) | 5,614 | 8,477 | |

| Cinemark Holdings, Inc. | 164,899 | 6,904,321 | |

| Clear Channel Outdoor Holding, Inc. Class A (a) | 57,659 | 276,763 | |

| Comcast Corp. Class A | 7,645,483 | 286,093,974 | |

| Cumulus Media, Inc. Class A (a) | 17,877 | 11,978 | |

| Daily Journal Corp. (a) | 644 | 134,467 | |

| Discovery Communications, Inc.: | |||

| Class A (a)(b) | 247,368 | 7,114,304 | |

| Class C (non-vtg.) (a) | 354,211 | 9,942,703 | |

| DISH Network Corp. Class A (a) | 361,308 | 22,401,096 | |

| E.W. Scripps Co. Class A (a)(b) | 84,251 | 1,940,301 | |

| Emmis Communications Corp. Class A (a) | 1,993 | 5,521 | |

| Entercom Communications Corp. Class A (b) | 31,859 | 498,593 | |

| Entravision Communication Corp. Class A | 84,255 | 450,764 | |

| Gannett Co., Inc. | 167,355 | 1,459,336 | |

| Global Eagle Entertainment, Inc. (a)(b) | 84,431 | 369,808 | |

| Gray Television, Inc. (a) | 96,772 | 1,316,099 | |

| Harte-Hanks, Inc. | 45,482 | 70,497 | |

| Hemisphere Media Group, Inc. (a) | 10,964 | 127,182 | |

| Insignia Systems, Inc. | 5,038 | 7,204 | |

| Interpublic Group of Companies, Inc. | 639,799 | 15,419,156 | |

| John Wiley & Sons, Inc. Class A | 79,959 | 4,173,860 | |

| Lee Enterprises, Inc. (a) | 58,988 | 153,369 | |

| Liberty Broadband Corp.: | |||

| Class A (a) | 33,151 | 2,793,303 | |

| Class C (a)(b) | 119,352 | 10,257,111 | |

| Liberty Global PLC: | |||

| Class A (a)(b) | 432,377 | 15,435,859 | |

| Class C (a)(b) | 1,005,751 | 35,291,803 | |

| LiLAC Class A (a)(b) | 77,452 | 1,893,701 | |

| LiLAC Class C (a) | 204,855 | 5,037,384 | |

| Liberty Media Corp.: | |||

| Liberty Braves Class A (a) | 14,273 | 314,434 | |

| Liberty Braves Class C (a) | 68,302 | 1,501,961 | |

| Liberty Media Class A (a)(b) | 28,511 | 858,466 | |

| Liberty Media Class C (a)(b) | 79,458 | 2,439,361 | |

| Liberty SiriusXM Class A (a) | 131,422 | 5,168,827 | |

| Liberty SiriusXM Class C (a) | 298,286 | 11,612,274 | |

| Lions Gate Entertainment Corp.: | |||

| Class A | 84,439 | 2,260,432 | |

| Class B (a)(b) | 185,605 | 4,636,413 | |

| Live Nation Entertainment, Inc. (a) | 224,734 | 6,384,693 | |

| Loral Space & Communications Ltd. (a) | 17,760 | 726,384 | |

| Meredith Corp. | 55,681 | 3,491,199 | |

| MSG Network, Inc. Class A (a) | 103,460 | 2,255,428 | |

| National CineMedia, Inc. | 108,730 | 1,395,006 | |

| New Media Investment Group, Inc. | 89,861 | 1,386,555 | |

| News Corp.: | |||

| Class A | 686,011 | 8,794,661 | |

| Class B | 130,013 | 1,716,172 | |

| Nexstar Broadcasting Group, Inc. Class A | 68,341 | 4,712,112 | |

| Omnicom Group, Inc. | 374,948 | 31,908,075 | |

| Radio One, Inc. Class D (non-vtg.) (a) | 32,336 | 88,924 | |

| Reading International, Inc. Class A (a) | 17,900 | 285,326 | |

| Regal Entertainment Group Class A (b) | 155,625 | 3,358,388 | |

| RLJ Entertainment, Inc. (a) | 5,726 | 12,654 | |

| Saga Communications, Inc. Class A | 3,882 | 193,712 | |

| Salem Communications Corp. Class A | 10,842 | 77,520 | |

| Scholastic Corp. | 44,904 | 2,023,374 | |

| Scripps Networks Interactive, Inc. Class A | 148,773 | 12,016,395 | |

| Sinclair Broadcast Group, Inc. Class A | 97,962 | 3,908,684 | |

| Sirius XM Holdings, Inc. (b) | 2,845,102 | 14,481,569 | |

| Tegna, Inc. | 350,960 | 8,995,105 | |

| The Madison Square Garden Co. (a) | 25,883 | 4,642,375 | |

| The McClatchy Co. Class A (a) | 6,072 | 67,703 | |

| The New York Times Co. Class A | 193,567 | 2,787,365 | |

| The Walt Disney Co. | 2,346,123 | 258,284,681 | |

| Time Warner, Inc. | 1,235,113 | 121,300,448 | |

| Time, Inc. | 154,410 | 2,709,896 | |

| Townsquare Media, Inc. (a) | 1,285 | 13,968 | |

| Tribune Media Co. Class A | 123,479 | 4,262,495 | |

| tronc, Inc. (b) | 51,781 | 756,003 | |

| Twenty-First Century Fox, Inc.: | |||

| Class A | 1,706,227 | 51,050,312 | |

| Class B | 771,880 | 22,654,678 | |

| Viacom, Inc. Class B (non-vtg.) | 580,312 | 25,214,556 | |

| World Wrestling Entertainment, Inc. Class A (b) | 69,670 | 1,461,677 | |

| 1,230,080,045 | |||

| Multiline Retail - 0.4% | |||

| Big Lots, Inc. (b) | 72,215 | 3,707,518 | |

| Dillard's, Inc. Class A (b) | 40,152 | 2,189,087 | |

| Dollar General Corp. | 407,540 | 29,758,571 | |

| Dollar Tree, Inc. (a) | 377,759 | 28,966,560 | |

| Fred's, Inc. Class A (b) | 52,965 | 939,069 | |

| Gordmans Stores, Inc. (a)(b) | 10,233 | 6,037 | |

| JC Penney Corp., Inc. (a)(b) | 463,329 | 2,937,506 | |

| Kohl's Corp. | 277,907 | 11,844,396 | |

| Macy's, Inc. | 489,002 | 16,244,646 | |

| Nordstrom, Inc. (b) | 185,779 | 8,668,448 | |

| Ollie's Bargain Outlet Holdings, Inc. (a)(b) | 71,864 | 2,252,936 | |

| Sears Holdings Corp. (a)(b) | 72,471 | 568,173 | |

| Target Corp. | 896,360 | 52,679,077 | |

| The Bon-Ton Stores, Inc. (a)(b) | 19,775 | 23,730 | |

| Tuesday Morning Corp. (a) | 61,992 | 226,271 | |

| 161,012,025 | |||

| Specialty Retail - 2.3% | |||

| Aarons, Inc. Class A | 98,760 | 2,694,173 | |

| Abercrombie & Fitch Co. Class A | 93,188 | 1,114,528 | |

| Advance Auto Parts, Inc. | 118,546 | 18,565,489 | |

| America's Car Mart, Inc. (a) | 10,422 | 331,941 | |

| American Eagle Outfitters, Inc. (b) | 259,564 | 4,114,089 | |

| Armstrong Flooring, Inc. (a) | 37,094 | 792,699 | |

| Asbury Automotive Group, Inc. (a) | 40,476 | 2,637,011 | |

| Ascena Retail Group, Inc. (a)(b) | 266,405 | 1,225,463 | |

| AutoNation, Inc. (a)(b) | 105,216 | 4,829,414 | |

| AutoZone, Inc. (a) | 46,740 | 34,426,347 | |

| Barnes & Noble Education, Inc. (a) | 60,796 | 583,642 | |

| Barnes & Noble, Inc. (b) | 82,041 | 804,002 | |

| bebe stores, Inc. (a)(b) | 6,695 | 42,982 | |

| Bed Bath & Beyond, Inc. | 241,299 | 9,748,480 | |

| Best Buy Co., Inc. | 439,881 | 19,411,949 | |

| Big 5 Sporting Goods Corp. (b) | 23,104 | 310,749 | |

| Boot Barn Holdings, Inc. (a)(b) | 24,133 | 247,846 | |

| Build-A-Bear Workshop, Inc. (a) | 15,205 | 137,605 | |

| Burlington Stores, Inc. (a) | 113,839 | 10,132,809 | |

| Cabela's, Inc. Class A (a) | 85,519 | 4,005,710 | |

| Caleres, Inc. | 68,568 | 2,048,126 | |

| CarMax, Inc. (a)(b) | 309,825 | 19,996,106 | |

| Chico's FAS, Inc. | 193,672 | 2,804,371 | |

| Christopher & Banks Corp. (a) | 57,707 | 75,019 | |

| Citi Trends, Inc. | 19,731 | 328,916 | |

| Conn's, Inc. (a)(b) | 39,904 | 381,083 | |

| CST Brands, Inc. | 121,282 | 5,837,303 | |

| Destination Maternity Corp. (a) | 22,235 | 111,620 | |

| Destination XL Group, Inc. (a)(b) | 51,406 | 154,218 | |

| Dick's Sporting Goods, Inc. | 145,373 | 7,116,008 | |

| DSW, Inc. Class A | 145,417 | 3,058,120 | |

| Express, Inc. (a) | 127,643 | 1,434,707 | |

| Finish Line, Inc. Class A | 63,867 | 1,041,032 | |

| Five Below, Inc. (a)(b) | 100,983 | 3,892,895 | |

| Foot Locker, Inc. | 218,804 | 16,556,899 | |

| Francesca's Holdings Corp. (a) | 57,702 | 979,203 | |

| GameStop Corp. Class A (b) | 155,698 | 3,805,259 | |

| Gap, Inc. (b) | 347,127 | 8,615,692 | |

| Genesco, Inc. (a)(b) | 32,141 | 1,873,820 | |

| GNC Holdings, Inc. (b) | 120,441 | 999,660 | |

| Group 1 Automotive, Inc. | 30,918 | 2,402,019 | |

| Guess?, Inc. (b) | 102,345 | 1,299,782 | |

| Haverty Furniture Companies, Inc. | 30,217 | 701,034 | |

| hhgregg, Inc. (a)(b) | 15,184 | 1,974 | |

| Hibbett Sports, Inc. (a)(b) | 34,547 | 1,019,137 | |

| Home Depot, Inc. | 1,954,971 | 283,294,848 | |

| Kirkland's, Inc. (a) | 21,240 | 240,012 | |

| L Brands, Inc. | 390,917 | 20,570,053 | |

| Lithia Motors, Inc. Class A (sub. vtg.) | 38,999 | 3,731,034 | |

| Lowe's Companies, Inc. | 1,394,288 | 103,693,199 | |

| Lumber Liquidators Holdings, Inc. (a)(b) | 34,626 | 613,919 | |

| MarineMax, Inc. (a) | 36,815 | 828,338 | |

| Michaels Companies, Inc. (a) | 197,854 | 3,974,887 | |

| Monro Muffler Brake, Inc. | 59,370 | 3,413,775 | |

| Murphy U.S.A., Inc. (a) | 55,943 | 3,563,569 | |

| New York & Co., Inc. (a) | 34,393 | 79,104 | |

| O'Reilly Automotive, Inc. (a)(b) | 151,839 | 41,256,175 | |

| Office Depot, Inc. | 822,922 | 3,431,585 | |

| Party City Holdco, Inc. (a)(b) | 50,325 | 727,196 | |

| Penske Automotive Group, Inc. | 59,093 | 2,972,378 | |

| Perfumania Holdings, Inc. (a) | 876 | 1,533 | |

| Pier 1 Imports, Inc. | 118,802 | 799,537 | |

| Rent-A-Center, Inc. (b) | 93,716 | 812,518 | |

| RH (a)(b) | 68,112 | 2,073,329 | |

| Ross Stores, Inc. | 631,815 | 43,329,873 | |

| Sally Beauty Holdings, Inc. (a)(b) | 228,422 | 4,995,589 | |

| Sears Hometown & Outlet Stores, Inc. (a) | 10,000 | 37,000 | |

| Select Comfort Corp. (a)(b) | 68,724 | 1,614,327 | |

| Shoe Carnival, Inc. | 21,330 | 540,502 | |

| Signet Jewelers Ltd. (b) | 116,151 | 7,386,042 | |

| Sonic Automotive, Inc. Class A (sub. vtg.) | 40,396 | 876,593 | |

| Sportsman's Warehouse Holdings, Inc. (a)(b) | 48,606 | 235,739 | |

| Stage Stores, Inc. (b) | 38,699 | 90,169 | |

| Staples, Inc. | 1,008,899 | 9,070,002 | |

| Stein Mart, Inc. | 40,412 | 145,483 | |

| Tailored Brands, Inc. | 76,887 | 1,776,859 | |

| The Buckle, Inc. (b) | 40,527 | 804,461 | |

| The Cato Corp. Class A (sub. vtg.) | 36,544 | 913,965 | |

| The Children's Place Retail Stores, Inc. (b) | 27,695 | 2,805,504 | |

| The Container Store Group, Inc. (a)(b) | 22,029 | 92,522 | |

| Tiffany & Co., Inc. (b) | 172,395 | 15,837,929 | |

| Tile Shop Holdings, Inc. | 56,926 | 1,001,898 | |

| Tilly's, Inc. | 14,113 | 155,666 | |

| TJX Companies, Inc. | 1,051,937 | 82,524,458 | |

| Tractor Supply Co. | 212,302 | 15,054,335 | |

| Trans World Entertainment Corp. (a) | 2,977 | 8,038 | |

| Ulta Beauty, Inc. (a) | 93,980 | 25,696,951 | |

| Urban Outfitters, Inc. (a) | 143,484 | 3,734,889 | |

| Vitamin Shoppe, Inc. (a)(b) | 45,231 | 963,420 | |

| West Marine, Inc. (a) | 16,394 | 150,661 | |

| Williams-Sonoma, Inc. (b) | 125,525 | 6,099,260 | |

| Winmark Corp. | 1,991 | 225,879 | |

| Zumiez, Inc. (a)(b) | 31,066 | 633,746 | |

| 905,569,680 | |||

| Textiles, Apparel & Luxury Goods - 0.7% | |||

| Carter's, Inc. | 76,972 | 6,774,306 | |

| Cherokee, Inc. (a) | 20,319 | 190,999 | |

| Coach, Inc. | 439,225 | 16,730,080 | |

| Columbia Sportswear Co. | 42,368 | 2,327,698 | |

| Crocs, Inc. (a) | 126,644 | 842,183 | |

| Culp, Inc. | 12,256 | 416,704 | |

| Deckers Outdoor Corp. (a)(b) | 51,521 | 2,721,854 | |

| Delta Apparel, Inc. (a) | 4,312 | 75,503 | |

| Differential Brands Group, Inc. (a) | 1,083 | 2,437 | |

| Fossil Group, Inc. (a)(b) | 73,701 | 1,393,686 | |

| G-III Apparel Group Ltd. (a)(b) | 69,854 | 1,797,343 | |

| Hanesbrands, Inc. (b) | 627,279 | 12,551,853 | |

| Iconix Brand Group, Inc. (a) | 101,691 | 784,038 | |

| Kate Spade & Co. (a) | 209,113 | 4,989,436 | |

| Lakeland Industries, Inc. (a) | 6,813 | 68,471 | |

| lululemon athletica, Inc. (a) | 174,001 | 11,355,305 | |

| Michael Kors Holdings Ltd. (a) | 265,830 | 9,702,795 | |

| Movado Group, Inc. | 39,217 | 951,012 | |

| NIKE, Inc. Class B | 2,149,211 | 122,848,901 | |

| Oxford Industries, Inc. | 25,955 | 1,458,931 | |

| Perry Ellis International, Inc. (a) | 15,961 | 371,732 | |

| PVH Corp. | 125,591 | 11,504,136 | |

| Ralph Lauren Corp. | 91,187 | 7,233,865 | |

| Rocky Brands, Inc. | 8,326 | 89,921 | |

| Sequential Brands Group, Inc. (a)(b) | 63,961 | 251,367 | |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | 210,934 | 5,414,676 | |

| Steven Madden Ltd. (a) | 86,611 | 3,234,921 | |

| Superior Uniform Group, Inc. | 11,974 | 219,364 | |

| Under Armour, Inc.: | |||

| Class A (sub. vtg.) (a)(b) | 294,186 | 6,066,115 | |

| Class C (non-vtg.) (b) | 294,534 | 5,466,551 | |

| Unifi, Inc. (a) | 22,047 | 601,663 | |

| Vera Bradley, Inc. (a) | 29,957 | 313,350 | |

| VF Corp. | 535,523 | 28,088,181 | |

| Vince Holding Corp. (a)(b) | 26,763 | 46,835 | |

| Wolverine World Wide, Inc. | 157,560 | 3,965,785 | |

| 270,851,997 | |||

| TOTAL CONSUMER DISCRETIONARY | 4,970,188,575 | ||

| CONSUMER STAPLES - 8.3% | |||

| Beverages - 1.7% | |||

| Boston Beer Co., Inc. Class A (a)(b) | 14,791 | 2,346,592 | |

| Brown-Forman Corp.: | |||

| Class A | 40,918 | 2,039,762 | |

| Class B (non-vtg.) | 343,578 | 16,752,863 | |

| Castle Brands, Inc. (a) | 38,689 | 40,237 | |

| Coca-Cola Bottling Co. Consolidated | 6,914 | 1,189,692 | |

| Constellation Brands, Inc. Class A (sub. vtg.) | 285,421 | 45,327,709 | |

| Craft Brew Alliance, Inc. (a) | 14,306 | 210,298 | |

| Dr. Pepper Snapple Group, Inc. | 295,643 | 27,624,882 | |

| MGP Ingredients, Inc. | 19,078 | 843,820 | |

| Molson Coors Brewing Co. Class B | 293,231 | 29,437,460 | |

| Monster Beverage Corp. (a) | 654,829 | 27,136,114 | |

| National Beverage Corp. (b) | 22,740 | 1,328,243 | |

| PepsiCo, Inc. | 2,297,406 | 253,587,674 | |

| Primo Water Corp. (a) | 33,980 | 487,273 | |

| REED'S, Inc. (a) | 1,830 | 7,229 | |

| The Coca-Cola Co. | 6,225,391 | 261,217,406 | |

| 669,577,254 | |||

| Food & Staples Retailing - 1.7% | |||

| AdvancePierre Foods Holdings, Inc. | 59,749 | 1,730,331 | |

| Andersons, Inc. | 47,014 | 1,859,404 | |

| Casey's General Stores, Inc. | 65,556 | 7,511,406 | |

| Chefs' Warehouse Holdings (a)(b) | 22,894 | 320,516 | |

| Costco Wholesale Corp. | 698,979 | 123,845,099 | |

| CVS Health Corp. | 1,714,197 | 138,129,994 | |

| Ingles Markets, Inc. Class A | 19,385 | 908,187 | |

| Kroger Co. | 1,519,311 | 48,314,090 | |

| Manitowoc Foodservice, Inc. (a)(b) | 224,738 | 4,283,506 | |

| Natural Grocers by Vitamin Cottage, Inc. (a)(b) | 12,082 | 145,830 | |

| Performance Food Group Co. (a) | 109,601 | 2,586,584 | |

| PriceSmart, Inc. | 36,020 | 3,184,168 | |

| Rite Aid Corp. (a) | 1,692,492 | 10,154,952 | |

| Smart & Final Stores, Inc. (a)(b) | 46,551 | 649,386 | |

| SpartanNash Co. | 61,272 | 2,138,393 | |

| Sprouts Farmers Market LLC (a)(b) | 217,629 | 4,017,431 | |

| SUPERVALU, Inc. (a) | 422,858 | 1,598,403 | |

| Sysco Corp. | 803,985 | 42,386,089 | |

| United Natural Foods, Inc. (a) | 87,309 | 3,758,652 | |

| Village Super Market, Inc. Class A | 8,594 | 254,468 | |

| Wal-Mart Stores, Inc. | 2,419,821 | 171,637,904 | |

| Walgreens Boots Alliance, Inc. | 1,375,317 | 118,799,882 | |

| Weis Markets, Inc. | 29,625 | 1,777,500 | |

| Whole Foods Market, Inc. (b) | 497,207 | 15,249,339 | |

| 705,241,514 | |||

| Food Products - 1.6% | |||

| Alico, Inc. | 4,002 | 102,451 | |

| Amplify Snack Brands, Inc. (a)(b) | 47,704 | 477,994 | |

| Archer Daniels Midland Co. | 923,672 | 43,384,874 | |

| B&G Foods, Inc. Class A | 116,520 | 4,952,100 | |

| Blue Buffalo Pet Products, Inc. (a)(b) | 164,852 | 4,028,983 | |

| Bunge Ltd. | 226,009 | 18,498,837 | |

| Cal-Maine Foods, Inc. (b) | 58,088 | 2,204,440 | |

| Calavo Growers, Inc. (b) | 26,199 | 1,477,624 | |

| Campbell Soup Co. | 312,192 | 18,528,595 | |

| Coffee Holding Co., Inc. (a) | 3,401 | 17,005 | |

| ConAgra Foods, Inc. | 667,250 | 27,497,373 | |

| Darling International, Inc. (a) | 262,702 | 3,417,753 | |

| Dean Foods Co. | 156,497 | 2,854,505 | |

| Farmer Brothers Co. (a)(b) | 27,261 | 890,753 | |

| Flowers Foods, Inc. | 291,098 | 5,606,547 | |

| Fresh Del Monte Produce, Inc. | 55,694 | 3,223,012 | |

| Freshpet, Inc. (a)(b) | 24,280 | 245,228 | |

| General Mills, Inc. | 951,076 | 57,416,458 | |

| Hormel Foods Corp. | 427,140 | 15,056,685 | |

| Hostess Brands, Inc. Class A (a)(b) | 75,751 | 1,153,688 | |

| Ingredion, Inc. | 114,802 | 13,878,414 | |

| Inventure Foods, Inc. (a)(b) | 20,016 | 111,689 | |

| J&J Snack Foods Corp. | 22,542 | 3,016,120 | |

| John B. Sanfilippo & Son, Inc. | 17,222 | 1,057,431 | |

| Kellogg Co. | 408,401 | 30,250,262 | |

| Lamb Weston Holdings, Inc. | 217,534 | 8,525,157 | |

| Lancaster Colony Corp. | 32,520 | 4,286,136 | |

| Landec Corp. (a) | 35,757 | 450,538 | |

| Lifeway Foods, Inc. (a) | 1,962 | 20,621 | |

| Limoneira Co. | 13,723 | 252,092 | |

| McCormick & Co., Inc. (non-vtg.) | 186,850 | 18,389,777 | |

| Mead Johnson Nutrition Co. Class A | 295,104 | 25,907,180 | |

| Mondelez International, Inc. | 2,474,912 | 108,698,135 | |

| Omega Protein Corp. | 32,056 | 815,825 | |

| Pilgrim's Pride Corp. (b) | 94,260 | 1,921,019 | |

| Pinnacle Foods, Inc. | 187,264 | 10,698,392 | |

| Post Holdings, Inc. (a) | 105,120 | 8,606,174 | |

| Sanderson Farms, Inc. (b) | 34,070 | 3,238,013 | |

| Seaboard Corp. | 422 | 1,532,894 | |

| Seneca Foods Corp. Class A (a) | 9,032 | 339,152 | |

| Snyders-Lance, Inc. | 136,611 | 5,407,063 | |

| The Hain Celestial Group, Inc. (a) | 166,934 | 5,906,125 | |

| The Hershey Co. | 220,949 | 23,939,824 | |

| The J.M. Smucker Co. | 182,507 | 25,866,717 | |

| The Kraft Heinz Co. | 955,814 | 87,466,539 | |

| Tootsie Roll Industries, Inc. (b) | 45,637 | 1,786,689 | |

| TreeHouse Foods, Inc. (a)(b) | 91,984 | 7,825,999 | |

| Tyson Foods, Inc. Class A | 467,386 | 29,239,668 | |

| WhiteWave Foods Co. (a) | 274,103 | 15,097,593 | |

| 655,566,143 | |||

| Household Products - 1.6% | |||

| Central Garden & Pet Co. Class A (non-vtg.) (a) | 71,078 | 2,270,942 | |

| Church & Dwight Co., Inc. | 417,766 | 20,821,457 | |

| Clorox Co. | 206,985 | 28,317,618 | |

| Colgate-Palmolive Co. | 1,421,650 | 103,752,017 | |

| Energizer Holdings, Inc. | 94,615 | 5,190,579 | |

| HRG Group, Inc. (a) | 243,938 | 4,483,580 | |

| Kimberly-Clark Corp. | 575,485 | 76,280,537 | |

| Oil-Dri Corp. of America | 2,105 | 74,264 | |

| Orchids Paper Products Co. (b) | 12,438 | 354,607 | |

| Procter & Gamble Co. | 4,287,412 | 390,454,611 | |

| Spectrum Brands Holdings, Inc. (b) | 41,932 | 5,691,011 | |

| WD-40 Co. (b) | 22,073 | 2,425,823 | |

| 640,117,046 | |||

| Personal Products - 0.2% | |||

| Avon Products, Inc. (a) | 698,517 | 3,073,475 | |

| Coty, Inc. Class A | 765,961 | 14,384,748 | |

| Cyanotech Corp. (a) | 2,300 | 9,545 | |

| DS Healthcare Group, Inc. (a) | 14,476 | 9,554 | |

| Edgewell Personal Care Co. (a)(b) | 95,191 | 7,028,903 | |

| elf Beauty, Inc. (b) | 23,141 | 641,006 | |

| Estee Lauder Companies, Inc. Class A | 349,950 | 28,993,358 | |

| Herbalife Ltd. (a)(b) | 121,381 | 6,856,813 | |

| Inter Parfums, Inc. | 25,837 | 893,960 | |

| LifeVantage Corp. (a)(b) | 19,206 | 106,401 | |

| Mannatech, Inc. | 599 | 11,261 | |

| MediFast, Inc. | 40,989 | 1,837,947 | |

| Natural Health Trends Corp. (b) | 11,452 | 318,251 | |

| Nature's Sunshine Products, Inc. | 6,985 | 79,629 | |

| Nu Skin Enterprises, Inc. Class A | 81,268 | 4,026,017 | |

| Nutraceutical International Corp. | 24,247 | 817,124 | |

| Revlon, Inc. (a) | 25,388 | 853,037 | |

| Synutra International, Inc. (a)(b) | 26,200 | 150,650 | |

| The Female Health Co. (a) | 11,731 | 11,848 | |

| USANA Health Sciences, Inc. (a)(b) | 20,348 | 1,181,201 | |

| 71,284,728 | |||

| Tobacco - 1.5% | |||

| 22nd Century Group, Inc. (a)(b) | 98,310 | 94,378 | |

| Alliance One International, Inc. (a) | 8,945 | 128,361 | |

| Altria Group, Inc. | 3,103,679 | 232,527,631 | |

| Philip Morris International, Inc. | 2,487,301 | 271,986,364 | |

| Reynolds American, Inc. | 1,323,945 | 81,515,294 | |

| Universal Corp. | 43,930 | 2,974,061 | |

| Vector Group Ltd. (b) | 157,078 | 3,578,237 | |

| 592,804,326 | |||

| TOTAL CONSUMER STAPLES | 3,334,591,011 | ||

| ENERGY - 6.2% | |||

| Energy Equipment & Services - 1.2% | |||

| Archrock, Inc. | 117,660 | 1,606,059 | |

| Aspen Aerogels, Inc. (a) | 9,858 | 40,812 | |

| Atwood Oceanics, Inc. (a)(b) | 121,695 | 1,279,014 | |

| Baker Hughes, Inc. | 675,690 | 40,730,593 | |

| Bristow Group, Inc. | 47,191 | 741,371 | |

| Carbo Ceramics, Inc. (a)(b) | 26,245 | 336,723 | |

| Core Laboratories NV (b) | 67,691 | 7,745,204 | |

| Dawson Geophysical Co. (a) | 19,081 | 147,305 | |

| Diamond Offshore Drilling, Inc. (a)(b) | 99,661 | 1,678,291 | |

| Dril-Quip, Inc. (a)(b) | 70,873 | 4,348,059 | |

| ENGlobal Corp. (a) | 5,637 | 13,642 | |

| Ensco PLC Class A (b) | 494,916 | 4,820,482 | |

| Era Group, Inc. (a) | 30,759 | 423,859 | |

| Exterran Corp. (a) | 59,232 | 1,803,022 | |

| Fairmount Santrol Holidings, Inc. (a)(b) | 254,086 | 2,408,735 | |

| Forum Energy Technologies, Inc. (a)(b) | 122,886 | 2,666,626 | |

| Frank's International NV (b) | 90,617 | 1,105,527 | |

| Geospace Technologies Corp. (a)(b) | 25,924 | 428,005 | |

| Gulf Island Fabrication, Inc. | 17,861 | 203,615 | |

| Gulfmark Offshore, Inc. Class A (a)(b) | 30,820 | 43,148 | |

| Halliburton Co. | 1,371,865 | 73,339,903 | |

| Helix Energy Solutions Group, Inc. (a) | 241,675 | 1,996,236 | |

| Helmerich & Payne, Inc. (b) | 172,753 | 11,811,123 | |

| Hornbeck Offshore Services, Inc. (a)(b) | 41,835 | 187,839 | |

| Independence Contract Drilling, Inc. (a) | 45,769 | 272,326 | |

| ION Geophysical Corp. (a)(b) | 10,360 | 55,426 | |

| Mammoth Energy Services, Inc. | 11,194 | 240,671 | |

| Matrix Service Co. (a) | 47,813 | 774,571 | |

| McDermott International, Inc. (a) | 356,208 | 2,621,691 | |

| Mitcham Industries, Inc. (a) | 23,287 | 112,709 | |

| Nabors Industries Ltd. | 457,542 | 6,698,415 | |

| National Oilwell Varco, Inc. (b) | 619,107 | 25,024,305 | |

| Natural Gas Services Group, Inc. (a) | 21,602 | 562,732 | |

| Newpark Resources, Inc. (a) | 122,453 | 942,888 | |

| Noble Corp. (b) | 421,660 | 2,816,689 | |

| Oceaneering International, Inc. | 170,909 | 4,840,143 | |

| Oil States International, Inc. (a) | 74,010 | 2,723,568 | |

| Parker Drilling Co. (a)(b) | 180,331 | 342,629 | |

| Patterson-UTI Energy, Inc. | 259,957 | 7,180,012 | |

| PHI, Inc. (non-vtg.) (a) | 18,377 | 266,283 | |

| Pioneer Energy Services Corp. (a) | 120,721 | 633,785 | |

| Profire Energy, Inc. (a) | 14,213 | 17,766 | |

| RigNet, Inc. (a) | 15,376 | 271,386 | |

| Rowan Companies PLC (a)(b) | 205,609 | 3,725,635 | |

| RPC, Inc. (b) | 95,956 | 1,919,120 | |

| Schlumberger Ltd. | 2,233,013 | 179,444,925 | |

| SEACOR Holdings, Inc. (a)(b) | 30,397 | 2,092,833 | |

| Smart Sand, Inc. | 41,295 | 709,035 | |

| Superior Energy Services, Inc. (b) | 236,252 | 3,898,158 | |

| Synthesis Energy Systems, Inc. (a)(b) | 138,081 | 117,341 | |

| TechnipFMC PLC (a) | 753,666 | 24,358,485 | |

| Tesco Corp. (a) | 127,576 | 1,065,260 | |

| TETRA Technologies, Inc. (a) | 186,418 | 837,017 | |

| Tidewater, Inc. (a)(b) | 65,412 | 88,960 | |

| Transocean Ltd. (United States) (a)(b) | 611,108 | 8,445,513 | |

| U.S. Silica Holdings, Inc. | 114,850 | 5,807,965 | |

| Unit Corp. (a) | 78,525 | 2,131,169 | |

| Weatherford International PLC (a)(b) | 1,561,649 | 8,838,933 | |

| Willbros Group, Inc. (a) | 69,552 | 208,656 | |

| 459,992,193 | |||

| Oil, Gas & Consumable Fuels - 5.0% | |||

| Abraxas Petroleum Corp. (a) | 181,293 | 384,341 | |

| Adams Resources & Energy, Inc. | 2,090 | 84,645 | |

| Aemetis, Inc. (a)(b) | 10,055 | 11,563 | |

| Alon U.S.A. Energy, Inc. | 48,399 | 588,532 | |

| Amyris, Inc. (a) | 58,883 | 30,001 | |

| Anadarko Petroleum Corp. | 896,963 | 57,988,658 | |

| Antero Resources Corp. (a) | 238,361 | 5,715,897 | |

| Apache Corp. | 609,029 | 32,028,835 | |

| Approach Resources, Inc. (a)(b) | 60,041 | 159,109 | |

| Arch Coal, Inc. (a)(b) | 38,738 | 2,783,713 | |

| Ardmore Shipping Corp. (b) | 32,573 | 223,125 | |

| Barnwell Industries, Inc. (a) | 2,847 | 6,776 | |

| Bill Barrett Corp. (a)(b) | 120,934 | 666,346 | |

| Bonanza Creek Energy, Inc. (a)(b) | 47,310 | 81,373 | |

| Cabot Oil & Gas Corp. | 752,287 | 16,475,085 | |

| California Resources Corp. (a)(b) | 64,079 | 1,145,092 | |

| Callon Petroleum Co. (a) | 315,265 | 3,978,644 | |

| Camber Energy, Inc. (a)(b) | 376 | 270 | |

| Carrizo Oil & Gas, Inc. (a)(b) | 92,100 | 2,997,855 | |

| Centennial Resource Development, Inc. Class A (a)(b) | 95,841 | 1,802,769 | |

| Cheniere Energy, Inc. (a) | 377,804 | 18,153,482 | |

| Chesapeake Energy Corp. (a)(b) | 1,212,527 | 6,608,272 | |

| Chevron Corp. | 3,028,914 | 340,752,825 | |

| Cimarex Energy Co. | 152,386 | 19,157,968 | |

| Clayton Williams Energy, Inc. (a)(b) | 12,847 | 1,738,841 | |

| Clean Energy Fuels Corp. (a)(b) | 142,581 | 349,323 | |

| Cloud Peak Energy, Inc. (a)(b) | 86,697 | 432,618 | |

| Cobalt International Energy, Inc. (a)(b) | 562,082 | 399,078 | |

| Comstock Resources, Inc. (a)(b) | 24,083 | 225,658 | |

| Concho Resources, Inc. (a) | 234,758 | 31,093,697 | |

| ConocoPhillips Co. | 1,987,204 | 94,531,294 | |

| CONSOL Energy, Inc. (b) | 279,949 | 4,358,806 | |

| Contango Oil & Gas Co. (a) | 51,306 | 380,691 | |

| Continental Resources, Inc. (a)(b) | 138,323 | 6,252,200 | |

| CVR Energy, Inc. (b) | 23,933 | 548,544 | |

| Delek U.S. Holdings, Inc. | 94,831 | 2,282,582 | |

| Denbury Resources, Inc. (a)(b) | 635,481 | 1,722,154 | |

| Devon Energy Corp. | 837,762 | 36,325,360 | |

| Diamondback Energy, Inc. (a) | 143,444 | 14,467,762 | |

| Earthstone Energy, Inc. (a)(b) | 10,660 | 137,514 | |

| Eclipse Resources Corp. (a) | 169,538 | 366,202 | |

| Enbridge, Inc. | 11,082 | 463,782 | |

| Energen Corp. (a) | 155,700 | 8,174,250 | |

| EOG Resources, Inc. | 924,260 | 89,643,977 | |

| EP Energy Corp. (a)(b) | 55,228 | 260,676 | |

| EQT Corp. | 274,571 | 16,444,057 | |

| Evolution Petroleum Corp. | 53,534 | 468,423 | |

| EXCO Resources, Inc. (a)(b) | 316,810 | 176,463 | |

| Extraction Oil & Gas, Inc. | 65,143 | 1,153,031 | |

| Exxon Mobil Corp. | 6,656,343 | 541,293,813 | |

| Gastar Exploration, Inc. (a) | 285,601 | 522,650 | |

| Gener8 Maritime, Inc. (a) | 186,799 | 911,579 | |

| Gevo, Inc. (a)(b) | 7,805 | 7,883 | |

| Green Plains, Inc. | 56,901 | 1,425,370 | |

| Gulfport Energy Corp. (a) | 242,209 | 4,199,904 | |

| Halcon Resources Corp. (a)(b) | 43,182 | 349,774 | |

| Hallador Energy Co. | 19,418 | 162,723 | |

| Harvest Natural Resources, Inc. (a)(b) | 21,137 | 140,138 | |

| Hess Corp. | 424,560 | 21,839,366 | |

| HollyFrontier Corp. | 276,639 | 8,099,990 | |

| Houston American Energy Corp. (a) | 36,485 | 8,392 | |

| International Seaways, Inc. (a) | 26,698 | 500,588 | |

| Isramco, Inc. (a) | 123 | 14,945 | |

| Jones Energy, Inc. (a)(b) | 84,184 | 269,389 | |

| Kinder Morgan, Inc. | 3,102,943 | 66,123,715 | |

| Kosmos Energy Ltd. (a)(b) | 286,209 | 1,757,323 | |

| Laredo Petroleum, Inc. (a)(b) | 215,486 | 2,980,171 | |

| Lonestar Resources U.S., Inc. (a) | 18,853 | 107,462 | |

| Marathon Oil Corp. | 1,346,406 | 21,542,496 | |

| Marathon Petroleum Corp. | 847,177 | 42,019,979 | |

| Matador Resources Co. (a)(b) | 153,132 | 3,685,887 | |

| Murphy Oil Corp. (b) | 253,055 | 7,158,926 | |

| Newfield Exploration Co. (a) | 312,482 | 11,393,094 | |

| Noble Energy, Inc. | 692,407 | 25,210,539 | |

| Northern Oil & Gas, Inc. (a)(b) | 93,777 | 281,331 | |

| Oasis Petroleum, Inc. (a) | 373,501 | 5,288,774 | |

| Occidental Petroleum Corp. | 1,223,274 | 80,185,611 | |

| ONEOK, Inc. (b) | 328,542 | 17,757,695 | |

| Overseas Shipholding Group, Inc. | 80,103 | 400,515 | |

| Pacific Ethanol, Inc. (a) | 51,285 | 402,587 | |

| Panhandle Royalty Co. Class A | 32,305 | 636,409 | |

| Par Pacific Holdings, Inc. (a)(b) | 53,028 | 774,209 | |

| Parsley Energy, Inc. Class A (a) | 349,405 | 10,618,418 | |

| PBF Energy, Inc. Class A (b) | 170,889 | 4,185,072 | |

| PDC Energy, Inc. (a)(b) | 89,317 | 6,036,936 | |

| Petroquest Energy, Inc. (a)(b) | 17,737 | 67,755 | |

| Phillips 66 Co. | 708,130 | 55,368,685 | |

| Pioneer Natural Resources Co. | 271,521 | 50,494,760 | |

| QEP Resources, Inc. (a) | 388,809 | 5,350,012 | |

| Range Resources Corp. | 300,719 | 8,305,859 | |

| Renewable Energy Group, Inc. (a)(b) | 48,243 | 429,363 | |

| Resolute Energy Corp. (a)(b) | 30,507 | 1,420,101 | |

| Rex American Resources Corp. (a) | 9,008 | 749,646 | |

| Rex Energy Corp. (a)(b) | 63,386 | 38,856 | |

| Rice Energy, Inc. (a) | 262,106 | 4,888,277 | |

| Ring Energy, Inc. (a) | 84,537 | 1,044,877 | |

| RSP Permian, Inc. (a) | 170,757 | 6,743,194 | |

| Sanchez Energy Corp. (a)(b) | 110,256 | 1,267,944 | |

| SandRidge Energy, Inc. (a) | 37,708 | 707,025 | |

| SemGroup Corp. Class A (b) | 87,119 | 3,062,233 | |

| SM Energy Co. | 152,521 | 3,759,643 | |

| Southwestern Energy Co. (a) | 779,274 | 5,852,348 | |

| Synergy Resources Corp. (a)(b) | 317,379 | 2,592,986 | |

| Syntroleum Corp. (a)(b) | 15,037 | 0 | |

| Targa Resources Corp. | 306,749 | 17,331,319 | |

| Teekay Corp. (b) | 68,637 | 674,015 | |

| Tellurian, Inc. (a)(b) | 12,706 | 226,929 | |

| Tengasco, Inc. (a)(b) | 1,261 | 731 | |

| Tesoro Corp. | 188,895 | 16,091,965 | |

| The Williams Companies, Inc. | 1,309,119 | 37,100,432 | |

| TransAtlantic Petroleum Ltd. (a) | 18,382 | 20,404 | |

| Triangle Petroleum Corp. (a)(b) | 83,126 | 22,028 | |

| U.S. Energy Corp. (a) | 2,263 | 1,878 | |

| Uranium Energy Corp. (a)(b) | 246,510 | 367,300 | |

| Uranium Resources, Inc. (a) | 2,190 | 4,380 | |

| VAALCO Energy, Inc. (a) | 68,248 | 76,438 | |

| Valero Energy Corp. | 724,744 | 49,246,355 | |

| Vertex Energy, Inc. (a) | 17,824 | 24,241 | |

| W&T Offshore, Inc. (a)(b) | 37,319 | 93,671 | |

| Western Refining, Inc. | 132,827 | 4,850,842 | |

| Westmoreland Coal Co. (a) | 31,012 | 447,813 | |

| Whiting Petroleum Corp. (a) | 451,901 | 4,903,126 | |

| World Fuel Services Corp. | 116,948 | 4,230,009 | |

| WPX Energy, Inc. (a) | 612,395 | 7,899,896 | |

| Zion Oil & Gas, Inc. (a) | 27,782 | 36,117 | |

| 2,008,309,265 | |||

| TOTAL ENERGY | 2,468,301,458 | ||

| FINANCIALS - 15.3% | |||

| Banks - 6.9% | |||

| 1st Source Corp. | 33,223 | 1,551,846 | |

| Access National Corp. (b) | 1,270 | 35,065 | |

| ACNB Corp. | 3,789 | 109,881 | |

| Allegiance Bancshares, Inc. (a)(b) | 20,938 | 772,612 | |

| American National Bankshares, Inc. | 2,748 | 100,439 | |

| Ameris Bancorp | 53,161 | 2,567,676 | |

| Ames National Corp. | 2,652 | 85,394 | |

| Arrow Financial Corp. | 16,949 | 591,520 | |

| Associated Banc-Corp. | 269,062 | 6,928,347 | |

| Atlantic Capital Bancshares, Inc. (a) | 21,164 | 380,952 | |

| Banc of California, Inc. (b) | 80,001 | 1,556,019 | |

| BancFirst Corp. | 17,711 | 1,688,744 | |

| Bancorp, Inc., Delaware (a) | 84,963 | 440,108 | |

| BancorpSouth, Inc. | 133,469 | 4,137,539 | |

| Bank of America Corp. | 16,207,885 | 400,010,602 | |

| Bank of Hawaii Corp. | 74,301 | 6,275,462 | |

| Bank of Marin Bancorp | 5,058 | 346,473 | |

| Bank of the Ozarks, Inc. (b) | 148,023 | 8,101,299 | |

| BankUnited, Inc. | 158,862 | 6,295,701 | |

| Banner Corp. | 51,093 | 2,969,525 | |

| Bar Harbor Bankshares | 6,297 | 268,315 | |

| BB&T Corp. | 1,295,845 | 62,485,646 | |

| BCB Bancorp, Inc. | 2,814 | 41,366 | |

| Berkshire Hills Bancorp, Inc. | 55,545 | 1,963,516 | |

| Blue Hills Bancorp, Inc. | 49,471 | 907,793 | |

| BNC Bancorp | 84,382 | 3,033,533 | |

| BOK Financial Corp. | 49,801 | 4,106,590 | |

| Boston Private Financial Holdings, Inc. | 128,855 | 2,216,306 | |

| Bridge Bancorp, Inc. | 53,457 | 1,905,742 | |

| Brookline Bancorp, Inc., Delaware | 111,120 | 1,761,252 | |

| Bryn Mawr Bank Corp. | 27,092 | 1,112,127 | |

| C & F Financial Corp. | 1,992 | 94,620 | |

| Camden National Corp. | 22,138 | 939,979 | |

| Capital Bank Financial Corp. Series A | 43,923 | 1,792,058 | |

| Capital City Bank Group, Inc. | 7,146 | 145,993 | |

| Cardinal Financial Corp. | 51,939 | 1,622,574 | |

| Carolina Financial Corp. (b) | 15,721 | 471,944 | |

| Cascade Bancorp (a) | 37,243 | 307,255 | |

| Cathay General Bancorp | 122,996 | 4,831,283 | |

| Centerstate Banks of Florida, Inc. | 74,327 | 1,836,620 | |

| Central Pacific Financial Corp. | 46,756 | 1,476,554 | |

| Central Valley Community Bancorp | 3,159 | 64,886 | |

| Century Bancorp, Inc. Class A (non-vtg.) | 686 | 43,424 | |

| Chemical Financial Corp. | 114,631 | 6,106,393 | |

| CIT Group, Inc. | 324,789 | 13,933,448 | |

| Citigroup, Inc. | 4,565,189 | 273,043,954 | |

| Citizens & Northern Corp. | 8,777 | 205,996 | |

| Citizens Financial Group, Inc. | 812,976 | 30,380,913 | |

| City Holding Co. | 22,173 | 1,452,332 | |

| CNB Financial Corp., Pennsylvania | 18,512 | 444,843 | |

| CoBiz, Inc. | 48,540 | 827,607 | |

| Columbia Banking Systems, Inc. | 85,736 | 3,420,009 | |

| Comerica, Inc. | 274,217 | 19,546,188 | |

| Commerce Bancshares, Inc. | 144,354 | 8,519,773 | |

| Community Bank System, Inc. | 88,502 | 5,257,904 | |

| Community Trust Bancorp, Inc. | 30,823 | 1,414,776 | |

| ConnectOne Bancorp, Inc. | 44,434 | 1,115,293 | |

| CU Bancorp (a) | 27,578 | 1,083,815 | |

| Cullen/Frost Bankers, Inc. | 95,722 | 8,851,413 | |

| Customers Bancorp, Inc. (a) | 47,427 | 1,628,169 | |

| CVB Financial Corp. | 147,873 | 3,511,984 | |

| Eagle Bancorp, Inc. (a) | 47,619 | 2,964,283 | |

| East West Bancorp, Inc. | 226,282 | 12,246,382 | |

| Eastern Virginia Bankshares, Inc. | 969 | 10,300 | |

| Enterprise Bancorp, Inc. | 15,551 | 515,360 | |

| Enterprise Financial Services Corp. | 30,725 | 1,350,364 | |

| Farmers Capital Bank Corp. | 12,316 | 478,477 | |

| Farmers National Banc Corp. | 66,489 | 917,548 | |

| FCB Financial Holdings, Inc. Class A (a) | 62,415 | 3,033,369 | |

| Fidelity Southern Corp. | 33,831 | 797,397 | |

| Fifth Third Bancorp | 1,219,702 | 33,468,623 | |

| Financial Institutions, Inc. | 20,978 | 717,448 | |

| First Bancorp, North Carolina | 30,448 | 914,962 | |

| First Bancorp, Puerto Rico (a) | 301,460 | 1,923,315 | |

| First Busey Corp. | 54,682 | 1,690,767 | |

| First Business Finance Services, Inc. | 3,936 | 99,266 | |

| First Citizen Bancshares, Inc. | 15,636 | 5,570,950 | |

| First Commonwealth Financial Corp. | 139,377 | 1,941,522 | |

| First Community Bancshares, Inc. | 12,848 | 347,153 | |

| First Connecticut Bancorp, Inc. | 11,897 | 287,313 | |

| First Financial Bancorp, Ohio | 103,444 | 2,870,571 | |

| First Financial Bankshares, Inc. (b) | 106,325 | 4,678,300 | |

| First Financial Corp., Indiana | 17,277 | 802,517 | |

| First Financial Northwest, Inc. | 2,197 | 44,709 | |

| First Foundation, Inc. (a) | 39,781 | 652,408 | |

| First Hawaiian, Inc. | 77,725 | 2,462,328 | |

| First Horizon National Corp. | 346,669 | 6,912,580 | |

| First Internet Bancorp | 6,364 | 195,693 | |

| First Interstate Bancsystem, Inc. | 38,967 | 1,708,703 | |

| First Merchants Corp. | 71,357 | 2,862,843 | |

| First Mid-Illinois Bancshares, Inc. | 15,730 | 520,348 | |

| First Midwest Bancorp, Inc., Delaware | 122,035 | 2,981,315 | |

| First NBC Bank Holding Co. (a)(b) | 23,508 | 104,611 | |

| First Northwest Bancorp (a) | 5,375 | 82,990 | |

| First of Long Island Corp. | 32,168 | 884,620 | |

| First Republic Bank | 249,797 | 23,438,453 | |

| First United Corp. (a) | 3,018 | 44,214 | |

| First United Corp. rights 3/17/17 (a) | 3,018 | 1,026 | |

| Flushing Financial Corp. | 47,044 | 1,314,409 | |

| FNB Corp., Pennsylvania | 352,576 | 5,489,608 | |

| Franklin Financial Network, Inc. (a) | 20,997 | 827,282 | |

| Fulton Financial Corp. | 269,904 | 5,161,914 | |

| German American Bancorp, Inc. | 18,768 | 890,542 | |

| Glacier Bancorp, Inc. | 124,637 | 4,601,598 | |

| Great Southern Bancorp, Inc. | 15,318 | 766,666 | |

| Great Western Bancorp, Inc. | 87,025 | 3,719,449 | |

| Green Bancorp, Inc. (a) | 40,300 | 687,115 | |

| Guaranty Bancorp | 27,816 | 688,446 | |

| Hancock Holding Co. | 130,273 | 6,181,454 | |

| Hanmi Financial Corp. | 52,514 | 1,753,968 | |

| HarborOne Bancorp, Inc. | 41,736 | 823,869 | |

| Heartland Financial U.S.A., Inc. | 36,703 | 1,818,634 | |

| Heritage Commerce Corp. | 59,915 | 850,793 | |

| Heritage Financial Corp., Washington | 51,567 | 1,289,175 | |

| Heritage Oaks Bancorp | 32,593 | 448,480 | |

| Hilltop Holdings, Inc. | 136,474 | 3,873,132 | |

| Home Bancshares, Inc. | 191,474 | 5,388,078 | |

| HomeTrust Bancshares, Inc. (a) | 24,994 | 599,856 | |

| Hope Bancorp, Inc. | 216,598 | 4,635,197 | |

| Horizon Bancorp Industries | 29,396 | 762,532 | |

| Huntington Bancshares, Inc. | 1,739,179 | 24,591,991 | |

| IBERIABANK Corp. | 81,864 | 6,937,974 | |

| Independent Bank Corp. | 26,504 | 567,186 | |

| Independent Bank Corp., Massachusetts | 41,598 | 2,703,870 | |

| Independent Bank Group, Inc. | 18,321 | 1,159,719 | |

| International Bancshares Corp. | 94,450 | 3,593,823 | |

| Investors Bancorp, Inc. | 516,646 | 7,558,531 | |

| JPMorgan Chase & Co. | 5,737,001 | 519,887,031 | |

| KeyCorp | 1,753,127 | 32,906,194 | |

| Lakeland Bancorp, Inc. | 60,320 | 1,188,304 | |

| Lakeland Financial Corp. | 43,110 | 1,956,763 | |

| LegacyTexas Financial Group, Inc. | 64,665 | 2,754,082 | |

| Live Oak Bancshares, Inc. (b) | 47,360 | 1,086,912 | |

| M&T Bank Corp. | 252,688 | 42,191,315 | |

| Macatawa Bank Corp. | 22,839 | 231,131 | |

| MainSource Financial Group, Inc. | 34,621 | 1,185,769 | |

| MB Financial, Inc. | 124,722 | 5,614,984 | |

| MBT Financial Corp. | 19,637 | 208,152 | |

| Mercantile Bank Corp. | 17,364 | 580,652 | |

| Merchants Bancshares, Inc. | 10,090 | 519,131 | |

| Middleburg Financial Corp. | 4,711 | 168,230 | |

| Midland States Bancorp, Inc. | 6,212 | 218,414 | |

| Midsouth Bancorp, Inc. | 7,208 | 105,958 | |

| MidWestOne Financial Group, Inc. | 9,068 | 330,710 | |

| MutualFirst Financial, Inc. | 20,181 | 638,729 | |

| National Bank Holdings Corp. | 40,043 | 1,321,019 | |

| National Bankshares, Inc. (b) | 5,803 | 219,934 | |

| National Commerce Corp. (a) | 16,217 | 607,327 | |

| NBT Bancorp, Inc. | 92,219 | 3,723,803 | |

| Nicolet Bankshares, Inc. (a) | 7,917 | 385,875 | |

| Northrim Bancorp, Inc. | 6,518 | 190,000 | |

| OFG Bancorp (b) | 71,939 | 928,013 | |

| Old Line Bancshares, Inc. | 8,031 | 225,270 | |

| Old National Bancorp, Indiana | 272,863 | 5,007,036 | |

| Old Second Bancorp, Inc. | 18,605 | 203,725 | |

| Opus Bank | 31,202 | 673,963 | |

| Orrstown Financial Services, Inc. | 5,669 | 123,868 | |

| Pacific Continental Corp. | 35,872 | 902,181 | |

| Pacific Mercantile Bancorp (a) | 10,321 | 75,859 | |

| Pacific Premier Bancorp, Inc. (a) | 40,332 | 1,613,280 | |

| PacWest Bancorp | 207,277 | 11,420,963 | |

| Park National Corp. | 21,902 | 2,353,370 | |

| Park Sterling Corp. | 75,635 | 897,031 | |

| Peapack-Gladstone Financial Corp. | 20,893 | 654,787 | |

| Penns Woods Bancorp, Inc. | 3,854 | 183,258 | |

| People's Utah Bancorp | 31,031 | 825,425 | |

| Peoples Bancorp, Inc. | 27,844 | 905,487 | |

| Peoples Financial Corp., Mississippi (a) | 2,667 | 40,805 | |

| Peoples Financial Services Corp. | 12,111 | 503,575 | |

| Peoples United Financial, Inc. (b) | 535,736 | 10,286,131 | |

| Pinnacle Financial Partners, Inc. | 83,847 | 5,818,982 | |

| PNC Financial Services Group, Inc. | 780,464 | 99,298,435 | |

| Popular, Inc. | 171,035 | 7,535,802 | |

| Preferred Bank, Los Angeles | 21,681 | 1,217,171 | |

| Premier Financial Bancorp, Inc. | 4,507 | 82,839 | |

| PrivateBancorp, Inc. | 128,395 | 7,267,157 | |

| Prosperity Bancshares, Inc. | 109,880 | 8,190,455 | |

| QCR Holdings, Inc. | 31,102 | 1,349,827 | |

| Regions Financial Corp. | 1,990,677 | 30,397,638 | |

| Renasant Corp. | 71,564 | 2,936,987 | |

| Republic Bancorp, Inc., Kentucky Class A | 18,205 | 629,529 | |

| Republic First Bancorp, Inc. (a)(b) | 116,122 | 928,976 | |

| Royal Bancshares of Pennsylvania, Inc. Class A (a) | 5,400 | 21,978 | |

| S&T Bancorp, Inc. | 72,150 | 2,567,819 | |

| Sandy Spring Bancorp, Inc. | 42,176 | 1,816,099 | |

| Seacoast Banking Corp., Florida (a) | 55,503 | 1,289,335 | |

| ServisFirst Bancshares, Inc. (b) | 88,788 | 3,690,917 | |

| Shore Bancshares, Inc. | 6,745 | 117,161 | |

| Sierra Bancorp | 8,792 | 251,803 | |

| Signature Bank (a) | 92,531 | 14,574,558 | |

| Simmons First National Corp. Class A | 56,478 | 3,247,485 | |

| South State Corp. | 41,590 | 3,722,305 | |

| Southern First Bancshares, Inc. (a) | 3,669 | 122,912 | |

| Southern National Bancorp of Virginia, Inc. | 3,574 | 60,758 | |

| Southside Bancshares, Inc. | 40,565 | 1,429,105 | |

| Southwest Bancorp, Inc., Oklahoma | 34,097 | 908,685 | |

| State Bank Financial Corp. | 55,381 | 1,502,487 | |

| Sterling Bancorp | 235,339 | 5,824,640 | |

| Stock Yards Bancorp, Inc. | 30,796 | 1,361,183 | |

| Stonegate Bank | 22,048 | 1,022,366 | |

| Suffolk Bancorp (b) | 17,277 | 734,964 | |

| Summit Financial Group, Inc. (b) | 7,690 | 184,252 | |

| Sun Bancorp, Inc. | 15,520 | 401,192 | |

| SunTrust Banks, Inc. | 784,599 | 46,675,795 | |

| SVB Financial Group (a) | 85,200 | 16,263,828 | |

| Synovus Financial Corp. | 198,807 | 8,393,632 | |

| TCF Financial Corp. | 303,183 | 5,275,384 | |

| Texas Capital Bancshares, Inc. (a) | 74,662 | 6,656,117 | |

| The First Bancorp, Inc. | 2,896 | 78,511 | |

| Tompkins Financial Corp. | 22,580 | 2,025,878 | |

| TowneBank | 102,762 | 3,344,903 | |

| Trico Bancshares | 37,499 | 1,362,339 | |

| TriState Capital Holdings, Inc. (a) | 31,167 | 733,983 | |

| Triumph Bancorp, Inc. (a) | 20,156 | 542,196 | |

| Trustmark Corp. | 109,424 | 3,615,369 | |

| U.S. Bancorp | 2,564,488 | 141,046,840 | |

| UMB Financial Corp. | 69,076 | 5,444,570 | |

| Umpqua Holdings Corp. | 368,620 | 6,933,742 | |

| Union Bankshares Corp. | 76,873 | 2,787,415 | |

| Union Bankshares, Inc. (b) | 1,824 | 75,514 | |

| United Bankshares, Inc., West Virginia (b) | 126,684 | 5,669,109 | |

| United Community Bank, Inc. | 111,127 | 3,210,459 | |

| Unity Bancorp, Inc. | 5,913 | 99,930 | |

| Univest Corp. of Pennsylvania | 38,712 | 1,078,129 | |

| Valley National Bancorp | 416,825 | 5,156,125 | |

| Veritex Holdings, Inc. (a) | 16,602 | 475,647 | |

| Washington Trust Bancorp, Inc. | 22,987 | 1,245,895 | |

| WashingtonFirst Bankshares, Inc. | 8,428 | 231,517 | |

| Webster Financial Corp. | 144,402 | 7,932,002 | |

| Wells Fargo & Co. | 7,259,799 | 420,197,166 | |

| WesBanco, Inc. | 73,993 | 2,986,357 | |

| West Bancorp., Inc. | 59,222 | 1,311,767 | |

| Westamerica Bancorp. (b) | 45,279 | 2,619,390 | |

| Westbury Bancorp, Inc. (a) | 4,860 | 101,866 | |

| Western Alliance Bancorp. (a) | 148,029 | 7,644,218 | |

| Wintrust Financial Corp. | 85,979 | 6,336,652 | |

| Xenith Bankshares, Inc. (a)(b) | 13,287 | 353,833 | |

| Yadkin Financial Corp. | 84,601 | 2,839,210 | |

| Zions Bancorporation | 308,583 | 13,855,377 | |

| 2,740,478,622 | |||

| Capital Markets - 2.7% | |||

| Affiliated Managers Group, Inc. | 86,762 | 14,569,943 | |

| Ameriprise Financial, Inc. | 252,712 | 33,231,628 | |

| Arlington Asset Investment Corp. (b) | 25,721 | 379,128 | |

| Artisan Partners Asset Management, Inc. | 74,438 | 2,117,761 | |

| Ashford, Inc. (a) | 1,254 | 70,287 | |

| Associated Capital Group, Inc. | 6,083 | 226,896 | |

| Bank of New York Mellon Corp. | 1,697,601 | 80,024,911 | |

| BGC Partners, Inc. Class A | 329,503 | 3,716,794 | |

| BlackRock, Inc. Class A | 194,377 | 75,313,312 | |

| CBOE Holdings, Inc. | 128,219 | 10,007,493 | |

| Charles Schwab Corp. | 1,927,034 | 77,871,444 | |

| CME Group, Inc. | 544,510 | 66,136,185 | |

| Cohen & Steers, Inc. | 39,455 | 1,483,903 | |

| Cowen Group, Inc. Class A (a)(b) | 42,436 | 606,835 | |

| Diamond Hill Investment Group, Inc. | 4,388 | 879,882 | |

| E*TRADE Financial Corp. (a) | 446,303 | 15,401,917 | |

| Eaton Vance Corp. (non-vtg.) | 189,531 | 8,837,831 | |

| Evercore Partners, Inc. Class A | 60,285 | 4,795,672 | |

| FactSet Research Systems, Inc. | 63,521 | 11,300,386 | |

| FBR & Co. | 6,019 | 109,245 | |

| Federated Investors, Inc. Class B (non-vtg.) | 166,109 | 4,513,182 | |

| Financial Engines, Inc. (b) | 81,760 | 3,621,968 | |

| Franklin Resources, Inc. | 551,204 | 23,723,820 | |

| Gain Capital Holdings, Inc. | 33,946 | 266,137 | |

| GAMCO Investors, Inc. Class A | 6,083 | 181,213 | |

| Global Brokerage, Inc. Class A (a)(b) | 5,137 | 14,127 | |

| Goldman Sachs Group, Inc. | 592,737 | 147,034,340 | |

| Great Elm Capital Group, Inc. | 8,360 | 27,588 | |

| Greenhill & Co., Inc. | 46,751 | 1,381,492 | |

| Houlihan Lokey | 31,923 | 1,005,255 | |

| Institutional Financial Markets, Inc. | 6,881 | 8,601 | |

| Interactive Brokers Group, Inc. | 119,445 | 4,384,826 | |

| IntercontinentalExchange, Inc. | 955,371 | 54,580,345 | |

| INTL FCStone, Inc. (a) | 23,975 | 905,056 | |

| Invesco Ltd. | 646,137 | 20,799,150 | |

| Investment Technology Group, Inc. | 55,680 | 1,114,714 | |

| Janus Capital Group, Inc. | 234,715 | 2,971,492 | |

| KCG Holdings, Inc. Class A (a) | 107,133 | 1,483,792 | |

| Ladenburg Thalmann Financial Services, Inc. (a)(b) | 146,974 | 326,282 | |

| Lazard Ltd. Class A | 207,047 | 8,915,444 | |

| Legg Mason, Inc. | 154,159 | 5,814,877 | |

| LPL Financial | 130,560 | 5,162,342 | |

| Manning & Napier, Inc. Class A | 21,800 | 136,250 | |

| MarketAxess Holdings, Inc. | 60,934 | 11,896,145 | |

| Moelis & Co. Class A | 40,629 | 1,495,147 | |

| Moody's Corp. | 266,625 | 29,694,026 | |

| Morgan Stanley | 2,302,520 | 105,156,088 | |

| Morningstar, Inc. | 31,944 | 2,562,867 | |

| MSCI, Inc. | 152,851 | 14,458,176 | |

| Northern Trust Corp. | 341,857 | 29,861,209 | |

| Oppenheimer Holdings, Inc. Class A (non-vtg.) | 13,547 | 224,880 | |

| Piper Jaffray Companies | 20,940 | 1,481,505 | |

| PJT Partners, Inc. | 43,421 | 1,607,011 | |

| Pzena Investment Management, Inc. | 4,972 | 49,919 | |

| Raymond James Financial, Inc. | 201,698 | 15,845,395 | |

| S&P Global, Inc. | 415,977 | 53,856,542 | |

| Safeguard Scientifics, Inc. (a)(b) | 26,745 | 338,324 | |

| SEI Investments Co. | 229,425 | 11,551,549 | |

| Silvercrest Asset Management Group Class A | 6,008 | 80,207 | |

| State Street Corp. | 583,623 | 46,520,589 | |

| Stifel Financial Corp. (a) | 108,208 | 5,838,904 | |

| T. Rowe Price Group, Inc. | 389,230 | 27,717,068 | |

| TD Ameritrade Holding Corp. | 389,290 | 15,221,239 | |

| The NASDAQ OMX Group, Inc. | 185,532 | 13,193,181 | |

| TheStreet.com, Inc. (a) | 3,696 | 2,864 | |

| U.S. Global Investments, Inc. Class A | 7,637 | 14,052 | |

| Vector Capital Corp. rights (a) | 4,280 | 0 | |

| Virtu Financial, Inc. Class A | 77,143 | 1,338,431 | |

| Virtus Investment Partners, Inc. (b) | 8,765 | 961,082 | |

| Waddell & Reed Financial, Inc. Class A | 123,074 | 2,367,944 | |

| Westwood Holdings Group, Inc. | 10,927 | 621,309 | |

| WisdomTree Investments, Inc. (b) | 170,101 | 1,549,620 | |

| 1,090,959,019 | |||

| Consumer Finance - 0.8% | |||

| Ally Financial, Inc. | 759,577 | 17,082,887 | |

| American Express Co. | 1,229,777 | 98,455,947 | |

| Asta Funding, Inc. (a)(b) | 4,468 | 41,552 | |

| Atlanticus Holdings Corp. (a) | 35,598 | 96,115 | |

| Capital One Financial Corp. | 783,296 | 73,520,163 | |

| Consumer Portfolio Services, Inc. (a) | 11,930 | 61,678 | |

| Credit Acceptance Corp. (a)(b) | 19,841 | 3,977,327 | |

| Discover Financial Services | 624,763 | 44,445,640 | |

| Encore Capital Group, Inc. (a)(b) | 36,545 | 1,216,949 | |

| Enova International, Inc. (a) | 32,960 | 472,976 | |

| EZCORP, Inc. (non-vtg.) Class A (a) | 86,606 | 762,133 | |

| First Cash Financial Services, Inc. | 90,535 | 4,015,227 | |

| Green Dot Corp. Class A (a) | 74,413 | 2,181,045 | |

| Imperial Holdings, Inc. warrants 4/11/19 (a) | 1,880 | 0 | |

| LendingClub Corp. (a)(b) | 543,864 | 2,904,234 | |

| Navient Corp. | 480,094 | 7,398,249 | |

| Nelnet, Inc. Class A | 31,753 | 1,422,217 | |

| Nicholas Financial, Inc. (a) | 5,705 | 63,326 | |

| OneMain Holdings, Inc. (a) | 91,372 | 2,560,243 | |

| PRA Group, Inc. (a) | 79,585 | 3,247,068 | |

| Regional Management Corp. (a) | 12,187 | 255,805 | |

| Santander Consumer U.S.A. Holdings, Inc. (a) | 199,933 | 2,955,010 | |

| SLM Corp. | 671,589 | 8,052,352 | |

| Synchrony Financial | 1,253,880 | 45,440,611 | |

| World Acceptance Corp. (a)(b) | 10,919 | 572,592 | |

| 321,201,346 | |||

| Diversified Financial Services - 1.4% | |||

| Acushnet Holdings Corp. (b) | 49,208 | 861,632 | |

| At Home Group, Inc. | 11,583 | 174,092 | |

| Bats Global Markets, Inc. | 48,975 | 1,720,492 | |

| Berkshire Hathaway, Inc. Class B (a) | 3,041,273 | 521,335,018 | |

| Bioverativ, Inc. (a) | 171,891 | 8,952,083 | |

| Camping World Holdings, Inc. | 32,678 | 1,149,285 | |