Exhibit 13

Annual Report to Stockholders

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

The following table provides selected consolidated financial and operating data of Security Federal Corporation at the dates and for the periods indicated. In conjunction with the data provided in the following tables and in order to more fully understand our historical consolidated financial and operating data, you should also read our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and the accompanying notes included in this report.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2021 | | 2020 | | 2019 | | 2018 | | 2017 |

| Balance Sheet Data at End of Period | (Dollars in Thousands, Except Per Share Data) |

| Total Assets | $ | 1,301,214 | | $ | 1,171,710 | | $ | 963,228 | | $ | 912,614 | | $ | 868,813 |

| Cash and Cash Equivalents | 27,623 | | 18,025 | | 12,536 | | 12,706 | | 10,320 |

| Certificates of Deposit with Other Banks | 1,100 | | 350 | | 950 | | 1,200 | | 1,950 |

| Investment and Mortgage-Backed Securities | 706,356 | | 607,579 | | 433,892 | | 409,894 | | 412,055 |

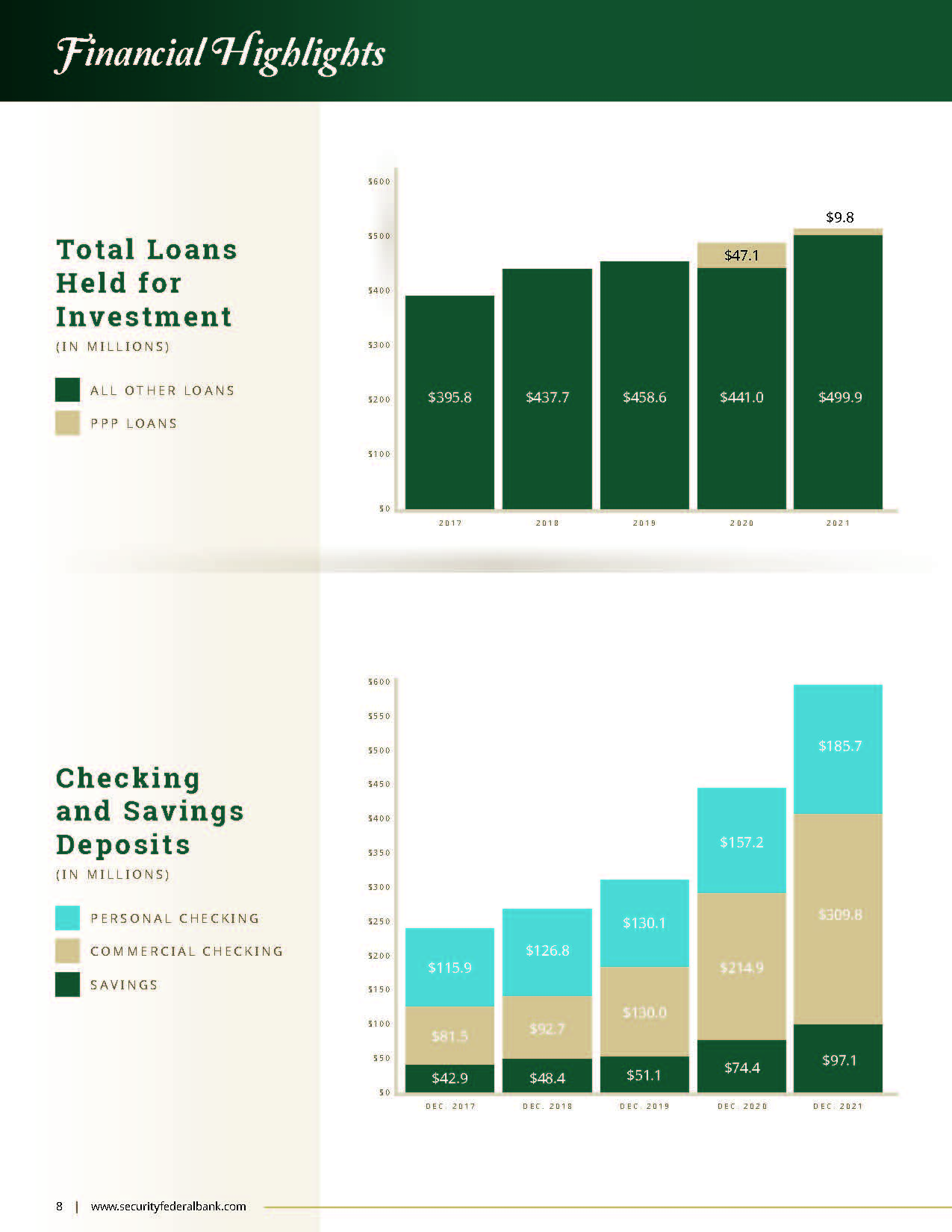

Total Loans Receivable, Net (1) | 499,497 | | 479,167 | | 452,859 | | 430,054 | | 390,493 |

| Deposits | 1,115,963 | | 918,096 | | 771,407 | | 767,497 | | 702,107 |

| Advances From Federal Home Loan Bank | — | | 35,000 | | 38,138 | | 34,030 | | 51,680 |

| Total Shareholders' Equity | 115,523 | | 111,906 | | 91,758 | | 80,518 | | 77,923 |

| | | | | | | | | |

| Income Data | | | | | | | | | |

| Total Interest Income | $ | 37,117 | | $ | 37,096 | | $ | 36,934 | | $ | 33,072 | | $ | 29,787 |

| Total Interest Expense | 3,824 | | 6,581 | | 8,311 | | 5,449 | | 4,175 |

| Net Interest Income | 33,293 | | 30,515 | | 28,623 | | 27,623 | | 25,612 |

| Provision For Loan Losses | (2,404) | | 3,600 | | 375 | | 925 | | 300 |

| Net Interest Income After Provision For Loan Losses | 35,697 | | 26,915 | | 28,248 | | 26,698 | | 25,312 |

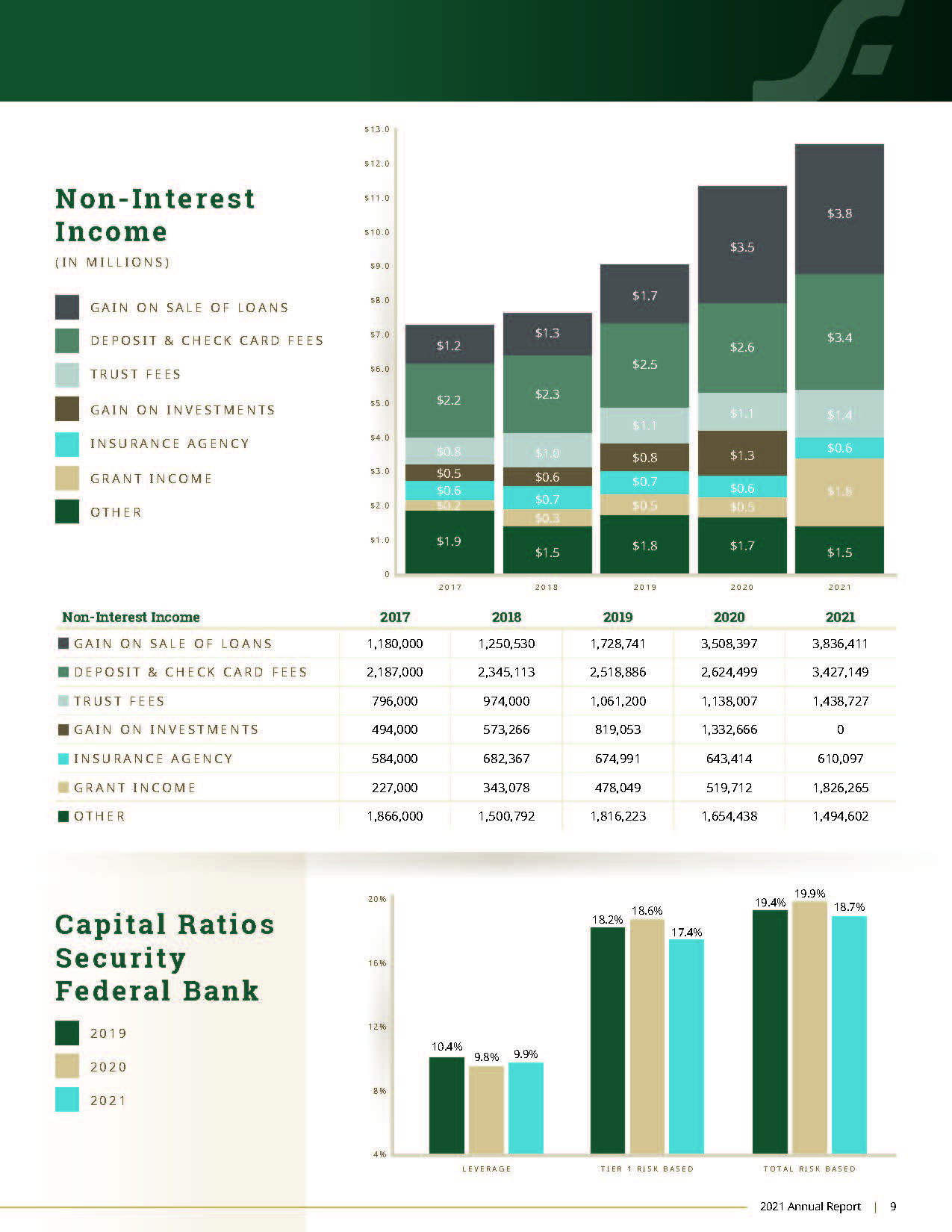

| Non-Interest Income | 12,633 | | 11,421 | | 9,097 | | 7,669 | | 7,344 |

| Non-Interest Expense | 32,047 | | 29,708 | | 27,871 | | 25,590 | | 24,302 |

Income Taxes (2) | 3,509 | | 1,577 | | 1,680 | | 1,570 | | 2,435 |

| Net Income | 12,774 | | 7,051 | | 7,794 | | 7,207 | | 5,919 |

| | | | | | | | | |

| Per Common Share Data | | | | | | | | | |

| Net Income Per Common Share (Basic) | $ | 3.93 | | $ | 2.19 | | $ | 2.64 | | $ | 2.44 | | $ | 2.01 |

| Cash Dividends | $ | 0.44 | | $ | 0.40 | | $ | 0.40 | | $ | 0.36 | | $ | 0.36 |

(1) INCLUDES LOANS HELD FOR SALE

(2) FOR THE YEAR ENDED DECEMBER 31, 2017, INCLUDES $606,000 FOR THE DEFERRED TAX ASSET WRITEDOWN DUE TO THE COMPREHENSIVE TAX LEGISLATION ENACTED ON DECEMBER 22, 2017, COMMONLY REFERRED TO AS THE TAX CUTS AND JOBS ACT.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2021 | | 2020 | | 2019 | | 2018 | | 2017 |

| Other Data | | | | | | | | | |

| | | | | | | | | |

| Average Interest Rate Spread | 2.87 | % | | 2.91 | % | | 3.10 | % | | 3.27 | % | | 3.27 | % |

| | | | | | | | | |

| Net Interest Margin (Net Interest Income / Average Earning Assets) | 2.97 | % | | 3.04 | % | | 3.26 | % | | 3.38 | % | | 3.34 | % |

| Average Interest-Earning Assets to Average Interest-Bearing Liabilities | 128.62 | % | | 120.99 | % | | 116.83 | % | | 116.01 | % | | 113.80 | % |

| Common Equity to Total Assets | 8.88 | % | | 9.55 | % | | 9.53 | % | | 8.82 | % | | 8.97 | % |

Non-Performing Assets to Total Assets (3) | 0.22 | % | | 0.31 | % | | 0.43 | % | | 0.85 | % | | 0.79 | % |

| Return on Assets | 1.04 | % | | 0.63 | % | | 0.80 | % | | 0.81 | % | | 0.69 | % |

| Return on Common Equity | 11.20 | % | | 6.81 | % | | 8.90 | % | | 9.30 | % | | 7.87 | % |

| Average Common Equity to Average Assets Ratio | 9.27 | % | | 9.32 | % | | 9.05 | % | | 8.69 | % | | 8.77 | % |

Dividend Payout Ratio on Common Shares(4) | 11.20 | % | | 18.46 | % | | 14.41 | % | | 14.76 | % | | 17.92 | % |

| Number of Full-Service Offices | 17 | | | 17 | | | 17 | | | 16 | | | 15 | |

(3) NON-PERFORMING ASSETS CONSIST OF NON-ACCRUAL LOANS AND OTHER REAL ESTATE OWNED ("OREO")

(4) RATIO OF DIVIDENDS PAID ON COMMON SHARES TO NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

General

The following discussion and analysis is presented to provide the reader with an understanding of the financial condition and the results of operations of Security Federal Corporation and its subsidiaries. The investment and other activities of the parent company, Security Federal Corporation (the “Company”), have had no significant impact on the results of operations for the periods presented in the Consolidated Financial Statements included herein. Because we conduct all of our material business operations through Security Federal Bank (the "Bank"), a wholly owned subsidiary of the Company, the following discussion of financial results are primarily indicative of the activities of the Bank. The Bank was founded in 1922 as a mutual building and loan association. In 1987, the Bank converted to a federally chartered stock savings bank. On December 28, 2011, the Bank completed a charter conversion from a federally chartered stock savings bank to a South Carolina chartered commercial bank. In connection with this transaction, the Company reorganized from a savings and loan holding company into a bank holding company.

The Bank also has three wholly owned subsidiaries: Security Federal Insurance Inc. (“SFINS”), Security Federal Investments, Inc. ("SFINV"), and Security Financial Services Corporation (“SFSC”). SFINS is an insurance agency offering auto, business, health, and home insurance. SFINS has a wholly owned subsidiary, Collier Jennings Financial Corporation (“Collier Jennings”), which has three wholly owned subsidiaries: Security Federal Auto Insurance, The Auto Insurance Store Inc., and Security Federal Premium Pay Plans Inc. Security Federal Premium Pay Plans Inc. has one wholly owned premium finance subsidiary and also has an ownership interest in four other premium finance subsidiaries. SFINV was formed to hold investment securities and allow for better management of the securities portfolio. SFSC is currently inactive.

In addition to the Bank, the Company has another wholly owned subsidiary, Security Federal Statutory Trust (the “Trust”), which issued and sold fixed and floating rate capital securities of the Trust. Under current accounting guidance, however, the Trust is not consolidated in the Company’s financial statements. Unless the context indicates otherwise, references to the Company shall include the Bank and its subsidiaries.

The principal business of the Bank is accepting deposits from the general public and originating consumer and commercial business loans as well as mortgage loans that enable borrowers to purchase or refinance one-to-four family residential real estate. The Bank also originates construction loans on single-family residences, multi-family dwellings, and commercial real estate, as well as loans for the acquisition, development and construction of residential subdivisions, and commercial projects. The Bank also provides trust services and it offers property, casualty and health insurance products through its subsidiary, Security Federal Insurance Inc.

The Bank's net income depends primarily on its interest rate spread which is the difference between the average yield earned on its loan and investment portfolios and the average rate paid on its deposits and borrowings. When the rate earned on interest-earning assets equals or exceeds the rate paid on interest-bearing liabilities, this positive interest rate spread will generate net interest income. The Bank’s interest spread is influenced by interest rates, deposit flows, and loan demands. Levels of non-interest income and operating expense are also significant factors in earnings.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This document, including information contained therein or incorporated by reference, contents, and future filings by the Company on Form 10-K, Form 10-Q, and Form 8-K, and future oral and written statements by the Company and its management may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. Forward-looking statements are not statements of historical fact, are based on certain assumptions and are generally identified by use of the words "believes," "expects," "anticipates," "estimates," "forecasts," "intends," "plans," "targets," "potentially," "probably," "projects," "outlook" or similar expressions or future or conditional verbs such as "may," "will," "should," "would" and "could." Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, assumptions and statements about, among other things, expectations of the business environment in which we operate, projections of future performance or financial items, perceived opportunities in the market, potential future credit experience, and statements regarding our mission and vision. These forward-looking statements are based upon current management expectations and may, therefore, involve risk and uncertainties.

Our actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-looking statements as a result of a wide variety or range of factors, including, but not limited to:

•potential adverse impacts to economic conditions in our local market areas, other markets where the Company has lending relationships, or other aspects of the Company's business operations or financial markets, generally, resulting from the ongoing novel coronavirus of 2019 (“COVID-19”) and any governmental or societal responses thereto;

•the credit risks of lending activities, including changes in the level and trend of loan delinquencies and write-offs and changes in our allowance for loan losses and provision for loan losses that may be affected by deterioration in the housing and commercial real estate markets which may lead to increased losses and non-performing assets in our loan portfolio, and may result in our allowance for loan losses not being adequate to cover actual losses, and require us to materially increase our allowance for loan losses;

•changes in general economic conditions, either nationally or in our market areas;

•changes in the levels of general interest rates, and the relative differences between short and long term interest rates, deposit interest rates, our net interest margin and funding sources;

•uncertainty regarding the future of the London Interbank Offered Rate ("LIBOR"), and the potential transition away from LIBOR toward new interest rate benchmarks;

•fluctuations in the demand for loans, the number of unsold homes, land and other properties and fluctuations in real estate values in our market areas;

•secondary market conditions for loans and our ability to originate and sell loans in the secondary market;

•results of examinations of the Company by the Board of Governors of the Federal Reserve System ("Federal Reserve") and the Bank by the Federal Deposit Insurance Corporation ("FDIC") and the South Carolina State Board of Financial Institutions, or other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our reserve for loan losses, write-down assets, change our regulatory capital position or affect our ability to borrow funds or maintain or increase deposits, or impose additional requirements or restrictions on us, any of which could adversely affect our liquidity and earnings;

•legislative or regulatory changes that adversely affect our business, including the effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act; changes in regulatory policies and principles, or the interpretation of regulatory capital requirements or other rules, including as a result of Basel III;

•our ability to attract and retain deposits;

•our ability to control operating costs and expenses;

•our ability to implement our business strategies;

•the use of estimates in determining the fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation;

•difficulties in reducing risks associated with the loans on our balance sheet;

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

•staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our workforce and potential associated charges;

•disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems or on the third-party vendors who perform several of our critical processing;

•our ability to retain key members of our senior management team;

•costs and effects of litigation, including settlements and judgments;

•our ability to manage loan delinquency rates;

•increased competitive pressures among financial services companies;

•changes in consumer spending, borrowing and savings habits;

•the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions;

•our ability to pay dividends on our common stock;

•adverse changes in the securities markets;

•inability of key third-party providers to perform their obligations to us;

•changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board ("FASB"), including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods;

•other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services, including as a result of the Coronavirus Aid, Relief, and Economic Security Act of 2020 ("CARES Act") and the Consolidated Appropriations Act, 2021 (“CAA 2021”); and

•the other risks described elsewhere in this document.

Some of these and other factors are discussed in our Annual Report on Form 10-K for the year ended December 31, 2021 under Item 1A, “Risk Factors.” Such developments could have an adverse impact on our financial position and our results of operations.

Any of the forward-looking statements that we make may turn out to be inaccurate as a result of our beliefs and assumptions we make in connection with the factors set forth above or because of other unidentified and unpredictable factors. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements and you should not rely on such statements. The Company undertakes no obligation to publish revised forward-looking statements to reflect the occurrence of unanticipated events or circumstances after the date hereof. These risks could cause our actual results for 2022 and beyond to differ materially from those expressed in any forward-looking statements by or on behalf of us, and could negatively affect the Company’s consolidated financial condition and consolidated results of operations, liquidity and stock price performance.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Response to COVID-19

In March 2020, the outbreak of COVID-19 was recognized as a pandemic by the World Health Organization. The spread of COVID-19 has created a global public health crisis that has resulted in unprecedented uncertainty, volatility and disruption in financial markets and in governmental, commercial and consumer activity in the United States and globally, including the markets that we serve. Governmental responses to the pandemic have included orders to close businesses not deemed essential and directing individuals to restrict their movements, observe social distancing and shelter in place. These actions, together with responses to the pandemic by businesses and individuals, have resulted in rapid decreases in commercial and consumer activity, temporary, and some permanent, closures of many businesses that have led to a loss of revenues and a rapid increase in unemployment, material decreases in business valuations, disrupted global supply chains, market downturns and volatility, changes in consumer behavior related to pandemic fears, related emergency response legislation and the Federal Reserve maintaining a low interest rate environment throughout 2021. Although financial markets have rebounded from significant declines that occurred earlier in the pandemic and U.S. and global economic conditions have shown signs of improvement since the beginning of the pandemic, many of the effects that arose or became more pronounced after the onset of the COVID-19 pandemic persisted through the end of the year. These changes have had and are likely to continue to have a significant adverse effect on the markets in which we conduct our business and the demand for our products and services. In response to the current global situation surrounding the COVID-19 pandemic, the Bank has offered a variety of relief options designed to support our customers and the communities we serve.

Paycheck Protection Program ("PPP") Participation

The CARES Act, signed into law on March 27, 2020, authorized the U.S. Small Business Administration (“SBA”) to temporarily guarantee loans under Paycheck Protection Program, or PPP. The goal of the PPP was to avoid as many layoffs as possible, and to encourage small businesses to maintain payrolls. As a qualified SBA lender, the Bank was automatically authorized to originate PPP loans upon commencement of the program in April 2020. The SBA guarantees 100% of the PPP loans made to eligible borrowers. The entire principal amount of the borrower's PPP loan, including any accrued interest, is eligible to be forgiven and repaid by the SBA if the borrower meets the PPP conditions. Through the PPP, the Bank provided over $75 million in funding during the year ended December 31, 2020. The Bank began the process of working with customers through the SBA forgiveness process in the fourth quarter of 2020.

The CAA, 2021 renewed and extended the PPP until March 31, 2021 by authorizing an additional $284.5 billion for the program. As a result, in January 2021, the Bank began accepting and processing loan applications under this second PPP. The Bank earns 1% interest on PPP loans as well as a fee from the SBA to cover processing costs, which is amortized over the life of the loan. The maturity date of the PPP loan is either two or five years from the date of loan origination. Through the second round PPP, the Bank provided over $52 million in funding during the year ended December 31, 2021.

As a result of PPP loan repayments, the Bank recognized deferred PPP loan fees of $4.7 million during 2021 and $1.2 million during 2020, which increased net income in the periods recognized. At December 31, 2021 and 2020, the Bank had $9.8 million and $47.1 million in PPP loans remaining, respectively. The balance of unamortized net deferred fees on PPP loans was $441,000 at December 31, 2021 compared to $1.4 million at December 31, 2020.

Loan Modifications

According to the CARES Act, the CAA, 2021 and related regulatory guidance, banks are not required to designate as troubled debt restructurings (“TDRs”) the modification of loans as a result of the COVID-19 pandemic, made on a good faith basis to borrowers who were current, as defined under the CARES Act and related bank agency guidance prior to any relief through January 1, 2022.

Since March 31, 2020, the Bank approved modifications related to the COVID-19 pandemic on over 340 customer loans with a combined balance, net of deferred fees, of $114.9 million. The majority of these modifications were for commercial real estate loans. The primary method of relief was to allow the borrower a three to six month payment deferral. As of December 31, 2021, all loans on deferral due to COVID-19 had resumed regular principal and interest payments.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies

The Company has adopted various accounting policies which govern the application of accounting principles generally accepted in the United States in the preparation of the Company’s Consolidated Financial Statements. The significant accounting policies of the Company are described in Note 1 of the Notes to the Consolidated Financial Statements included herein.

Certain accounting policies involve significant judgments and assumptions by management, which have a material impact on the carrying value of certain assets and liabilities; management considers these accounting policies to be critical accounting policies. The judgments, estimates and assumptions used by management are based on historical experience and other factors, which are believed to be reasonable under the circumstances. Because of the nature of the judgments, estimates and assumptions made by management, actual results could differ from these judgments, estimates and assumptions, which could have a material impact on the carrying values of assets and liabilities and the results of operations of the Company.

The Company believes the allowance for loan losses is a critical accounting policy that requires the most significant judgments, estimates and assumptions used in preparation of the Consolidated Financial Statements. The impact of an unexpected large loss could deplete the allowance and potentially require increased provisions to replenish the allowance, which would negatively affect earnings. The Company provides for loan losses using the allowance method. Accordingly, all loan losses are charged to the related allowance and all recoveries are credited to the allowance for loan losses. Additions to the allowance for loan losses are provided by charges to operations based on various factors, which, in management’s judgment, deserve current recognition in estimating possible losses. Such factors considered by management include the fair value of the underlying collateral, stated guarantees by the borrower (if applicable), the borrower’s ability to repay from other economic resources, growth and composition of the loan portfolio, the relationship of the allowance for loan losses to the outstanding loans, loss experience, delinquency trends, and general economic conditions. Management evaluates the carrying value of the loan portfolio monthly and adjusts the allowance accordingly. Additional analysis was completed on the allowance for loan losses during 2020 and 2021 based on the significance of loan modifications in accordance with the CARES Act and regulatory guidance, loan risk rating downgrades as well as additional risk factors related to COVID-19. While management uses the best information available to make evaluations, future adjustments may be necessary if economic conditions differ substantially from the assumptions used in making these evaluations. The allowance for loan losses is subject to periodic evaluations by bank regulatory agencies that may require adjustments to the allowance based upon the information that is available at the time of their examination. For a further discussion of the Company’s estimation process and methodology related to the allowance for loan losses, see the discussion under the section entitled “Financial Condition” and “Comparison of the Years Ended December 31, 2021 and 2020-Provision for Loan Losses” included herein.

The Company values an impaired loan at the loan’s fair value if it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the original loan agreement. Impaired loans are measured at the present value of expected cash flows, the market price of the loan, if available, or the value of the underlying collateral. Expected cash flows are required to be discounted at the loan’s effective interest rate. When the ultimate collectability of an impaired loan’s principal is in doubt, wholly or partially, all payments received are applied to principal. Once the recorded principal balance has been reduced to zero, any additional payments received are applied to interest income to the extent that any interest has been foregone. Any additional payments received are recorded as recoveries of any amounts previously charged off. When the repayment of the loan is not in doubt, payments are applied under the contractual terms of the loan agreement first to interest and then to principal.

The Company uses assumptions and estimates in determining income taxes payable or refundable for the current year, deferred income tax liabilities and assets for events recognized differently in its financial statements and income tax returns, and income tax expense. Determining these amounts requires analysis of certain transactions and interpretation of tax laws and regulations.

The Company exercises considerable judgment in evaluating the amount and timing of recognition of the resulting tax liabilities and assets. These judgments and estimates are reevaluated on a continual basis as regulatory and business factors change.

No assurance can be given that either the tax returns submitted by the Company or the income tax reported on the Consolidated Financial Statements will not be adjusted by either adverse rulings by the United States Tax Court, changes in the tax code, or assessments made by the Internal Revenue Service.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Asset and Liability Management

The objective of the Bank’s program of asset and liability management is to limit the Bank’s vulnerability to material and prolonged increases or decreases in interest rates, or "interest rate risk." As a financial institution, interest rate risk is the Company’s most significant market risk. The earnings and economic value of our shareholders’ equity varies in relation to changes in interest rates and the corresponding impact on the market values of our assets and liabilities. The Bank has an Asset Liability Management Committee (“ALCO”) who monitors the Bank’s asset liability strategy.

The asset/liability management process is designed to achieve relatively stable net interest margins and assure liquidity by coordinating the volumes, maturities or re-pricing opportunities of interest-earning assets, deposits and borrowed funds. It is the responsibility of the ALCO to determine and achieve the most appropriate volume and mix of interest-earning assets and interest-bearing liabilities, as well as ensure an adequate level of liquidity and capital, within the context of corporate performance goals. The ALCO meets regularly to review interest rate risk and liquidity in relation to present and potential market conditions and evaluate funding and balance sheet management strategies to ensure the level of risk is consistent with our asset/liability objectives.

Simulation is the principal tool used by the Bank in its ongoing effort to measure interest rate risk. Simulation involves the use of a financial modeling system that provides reports showing the current and future impact of changes in interest rates, strategies and tactics. The Bank uses two dynamic methods; net interest income (“NII”) simulation and economic value of equity (“EVE”) analysis. The NII simulation models the impact that changes in interest rates will have on our earnings while EVE models the impact those changes will have on the net present value of our asset and liability portfolios. These models take into account our contractual agreements with regard to investments, loans, deposits, and borrowings but also include assumptions surrounding market and customer behavior under different rate scenarios. The assumptions we use are based upon a combination of proprietary and market data that reflect historical results and current market conditions. These assumptions relate to interest rates, prepayments, deposit decay rates and the market value of certain assets and liabilities under the various interest rate scenarios. We use market data to determine prepayments and maturities of loans, investments and borrowings and use our own assumptions on deposit decay rates except for time deposits. Time deposits are modeled to reprice to market rates upon their stated maturities. We also assume that non-maturity deposits can be maintained with rate adjustments not directly proportionate to the change in market interest rates, based upon our historical deposit rates. We have demonstrated in the past that the tiering structure of our deposit accounts during changing rate environments results in relatively lower volatility and less than market rate changes in our interest expense for deposits. These assumptions are based upon our analysis of our customer base, competitive factors, and historical experience. While these models are dependent on the accuracy of the assumptions that underlie the process, we believe that such modeling provides a better illustration of our sensitivity to interest rate risk than does a traditional static gap analysis. These tools provide our ALCO with the capability to estimate and manage the amount of earnings at risk in future periods and in selected interest rate risk environments. In response to the COVID-19 pandemic the Federal Reserve reduced the targeted federal funds rate 150 basis points to a range of 0.00% to 0.25%. Given that the targeted Fed Funds rate at December 31, 2021 was a range of 0.00% to 0.25%, a 200 or 300 basis point reduction in rates is not reported in the tables below.

NII Simulation- The Bank’s primary focus is on NII simulation. Using NII simulation, the Bank measures earnings exposure over both a twelve and twenty-four month period under multiple instantaneous rate shock scenarios. The Bank’s policy provides the maximum acceptable negative impact on net interest income and return on assets over each time horizon associated with each respective change in interest rates. Our ALCO monitors compliance with these policy limits and reports them to the Board of Directors quarterly.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following table indicates the NII simulation scenarios modeled and the applicable policy parameters.

| | | | | | | | | | | | | | | | | | | | |

| Change in Market Rates | | Maximum Allowable Change in NII Over | | Maximum Allowable Change in ROA Over |

| (in Basis Points) | | 12 Months | 24 Months | | 12 Months | 24 Months |

| 400 | | (20)% | (20)% | | (40)% | (40)% |

| 300 | | (15)% | (15)% | | (30)% | (30)% |

| 200 | | (10)% | (10)% | | (20)% | (20)% |

| 100 | | (7.5)% | (7.5)% | | (10)% | (10)% |

| — | | —% | —% | | —% | —% |

| (100) | | (7.5)% | (7.5)% | | (10)% | (10)% |

| | | | | | |

| | | | | | |

| | | | | | |

EVE simulation- The EVE analysis serves as an indicator of the extent to which the present value of our capital could change, given potential changes in interest rates. The difference represented by the present value of assets minus the present value of liabilities is defined as the economic value of equity. This measure assumes a static balance sheet and does not incorporate any growth assumptions, but does assume loan prepayments and certain other cash flows occur. It provides a measure of rate risk extending beyond the twelve or twenty - four month time horizon contained in the NII simulation analyses.

While an instantaneous and severe shift in interest rates is used in this analysis to provide an estimate of exposure under an extremely adverse scenario, a gradual shift in interest rates would have a much more modest impact. Since EVE measures the discounted present value of cash flows over the estimated lives of instruments, the change in EVE does not directly correlate to the degree that earnings would be impacted over a shorter time horizon, i.e., the next fiscal year. Further, EVE does not take into account factors such as future balance sheet growth, changes in product mix, change in yield curve relationships, and changing product spreads that could mitigate the adverse impact of changes in interest rates.

The following table indicates the EVE simulation scenarios modeled and the applicable policy parameters.

| | | | | | | | |

| Change in Market Rates (In Basis Points) | | Maximum Change in Economic Value of Equity |

| 400 | | (40)% |

| 300 | | (30)% |

| 200 | | (20)% |

| 100 | | (10)% |

| — | | —% |

| (100) | | (10)% |

| | |

| | |

| | |

In evaluating the Bank's exposure to interest rate risk, certain shortcomings inherent in the method of analysis described above are considered. No assurance can be given that changing economic conditions and other relevant factors impacting our net interest income will not cause actual occurrences to differ from underlying assumptions. For example, loan repayment rates and withdrawals of deposits will likely differ substantially from the assumptions used in the simulation models in the event of significant changes in interest rates due to the option of borrowers to prepay their loans and the ability of depositors to withdraw funds prior to maturity. In addition, this analysis does not consider any strategic changes to our balance sheet which management may consider as a result of changes in market conditions.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Financial Condition - Assets

Total assets increased $129.5 million or 11.1% to $1.3 billion at December 31, 2021 from $1.2 billion at December 31, 2020. This increase was primarily due to increases in both investments and mortgage-backed securities ("MBS") available for sale ("AFS") and held to maturity ("HTM") and net loans receivable.

Cash and cash equivalents increased $9.6 million or 53.2% to $27.6 million at December 31, 2021 compared to $18.0 million at December 31, 2020. Total investments and MBS increased $98.8 million or 16.3% to $706.4 million at December 31, 2021 from $607.6 million at December 31, 2020 as purchases of investment and MBS AFS exceeded maturities, sales and principal paydowns during the year. The Bank purchased 84 investment and MBS for a total purchase price of $217.6 million during the year ended December 31, 2021 compared to purchases of 125 investment and MBS for a total purchase price of $256.6 million during the prior year, most of which were for our investment and MBS AFS portfolio. There were no sales of investment and MBS AFS during 2021 compared to sales of $25.0 million during 2020.

Loans receivable, net, including loans held for sale, increased $20.3 million or 4.2% to $499.5 million at December 31, 2021 from $479.2 million at December 31, 2020 primarily due to increases in both commercial real estate and commercial business loans. Loan balances in the commercial business, commercial real estate and consumer loan categories all increased while residential real estate, loans held for sale and PPP loan balances all decreased since the prior year end. During the year ended December 31, 2021, the Bank originated $367.7 million in new and renewed consumer and commercial loans. The Bank's portfolio of consumer and commercial loans had a combined balance of $451.7 million at December 31, 2021 and $430.3 million at December 31, 2020. Consumer and commercial loans combined were 88.3% and 85.6% of total loans at December 31, 2021 and 2020, respectively. Consumer loans increased $3.9 million or 7.1% to $59.3 million at December 31, 2021 from $55.3 million at December 31, 2020. Commercial business loans (excluding PPP loans) increased $9.6 million or 48.6% to $29.3 million at December 31, 2021 from $19.7 million at December 31, 2020 while commercial real estate loans increased $54.1 million or 18.1% to $353.4 million at December 31, 2021 from $299.3 million at December 31, 2020.

Residential real estate loans held for investment decreased $10.7 million or 16.1% to $56.0 million at December 31, 2021 from $66.7 million at December 31, 2020. During the year ended December 31, 2021, the Bank originated $37.8 million in adjustable rate residential real estate loans (“ARMs”) for investment purposes. Loans held for sale, comprised of fixed rate residential loans, decreased $1.7 million or 29.1% to $4.0 million at December 31, 2021 from $5.7 million at December 31, 2020.

At December 31, 2021, the Bank’s residential real estate loans held for investment included $9.7 million in longer term fixed rate residential mortgage loans. Typically, long term, newly originated fixed rate residential real estate loans are not retained in the portfolio but are sold immediately in contrast to ARMs, which are generally retained in the portfolio. The Bank sells all its fixed rate residential loans on a service-released basis. Fixed rate residential loans sold to institutional investors, on a service-released basis totaled $112.9 million during the year ended December 31, 2021, $111.1 million during the year ended December 31, 2020 and $61.9 million during the year ended December 31, 2019. At December 31, 2021, the Bank held $67.7 million or 83.2% of its residential real estate loans held for investment in ARMs and $13.7 million, or 16.8%, in fixed rate residential loans. The Bank's remaining loan portfolio included $88.6 million of adjustable rate and $363.0 million of fixed rate consumer, commercial business (including $9.8 million in PPP loans) and commercial real estate loans, or 16.6% and 68.1% of total loans, respectively, at December 31, 2021.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Financial Condition - Non-Performing Assets

The Bank’s non-performing assets, which consist of non-accrual loans and OREO, decreased $811,000 or 22.4% to $2.8 million at December 31, 2021 from $3.6 million at December 31, 2020. Non-performing assets represented 0.2% and 0.3% of total assets at December 31, 2021 and 2020, respectively. The Bank did not designate loans with payment deferrals granted due to the COVID-19 pandemic as delinquent in accordance with provisions of the CARES Act, the CAA, 2021 and related regulatory guidance. The table below summarizes our non-performing assets for those periods.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | At December 31, 2021 | | At December 31, 2020 | | $ | | % |

| | Amount | | Percent (1) | | Amount | | Percent (1) | | Change | | Change |

| Loans 90 Days or More Past Due or Non-Accrual Loans: | | | | | | | | | | | |

| Residential Real Estate | $ | 1,332,106 | | 0.3% | | $ | 1,682,240 | | 0.4% | | $ | (350,134) | | | (20.8) | % |

| Commercial Business | 64,479 | | — | | 100,408 | | — | | (35,929) | | | (35.8) | |

| Commercial Real Estate | 1,136,322 | | 0.2 | | 939,946 | | 0.2 | | 196,376 | | | 20.9 | |

| Consumer | 150,480 | | — | | 402,878 | | 0.1 | | (252,398) | | | (62.6) | |

| Total Non-Performing Loans | 2,683,387 | | 0.5% | | 3,125,472 | | 0.7% | | (442,085) | | | (14.1) | % |

| | | | | | | | | | | |

| Other Non-Performing Assets: | | | | | | | | | | | |

| OREO | 129,700 | | —% | | 498,610 | | 0.1% | | (368,910) | | | (74.0) | % |

| | | | | | | | | | | |

| Total Non-Performing Assets | $ | 2,813,087 | | 0.5% | | $ | 3,624,082 | | 0.8% | | $ | (810,995) | | | (22.4) | % |

| Total Non-Performing Assets as a Percentage of Total Assets | 0.2 | % | | | | 0.3 | % | | | | | | |

(1) PERCENT OF GROSS LOANS RECEIVABLE HELD FOR INVESTMENT, NET OF DEFERRED FEES AND LOANS IN PROCESS

The largest decrease in non-performing loans was in the non-performing residential real estate loan category, which decreased $350,000 or 20.8% to $1.3 million at December 31, 2021 from $1.7 million at December 31, 2020. Non-performing residential real estate loans at December 31, 2021 consisted of 11 loans to 11 borrowers with an average loan balance of $121,000, the largest of which was $274,000, compared to 14 loans to 14 borrowers with an average loan balance of $120,000, the largest of which was $301,000, at December 31, 2020.

Non-performing consumer loans decreased $252,000 or 62.6% to $150,000 at December 31, 2021 from $403,000 at December 31, 2020. Non-performing consumer loans at December 31, 2021 consisted of seven loans to seven borrowers with an average loan balance of $22,000, the largest of which was $55,000, compared to 16 loans to 16 borrowers with an average loan balance of $25,000, the largest of which was $74,000, at December 31, 2020.

Non-performing commercial real estate loans increased $196,000 or 20.9% to $1.1 million at December 31, 2021 from $940,000 at December 31, 2020. The balance in non-performing commercial real estate loans consisted of eight loans to six borrowers with an average loan balance of $151,000 at December 31, 2021 compared to eight loans to seven borrowers with an average loan balance of $117,000 at December 31, 2020.

In addition, potential problem loans, which are loans rated substandard or special mention and not included in nonperforming loans or TDRs, totaled approximately $19.6 million, or 3.9% of gross loans at December 31, 2021, compared to $24.0 million, or 4.9% of gross loans at December 31, 2020. Potential problem loans represent those loans with a well-defined weakness and where information about possible credit problems of borrowers has caused management to have serious doubts about the borrower's ability to comply with present repayment terms.

Our strategy is to work with our borrowers to reach acceptable payment plans while protecting our interests in the underlying collateral. In the event an acceptable arrangement cannot be reached, we may have to acquire these properties through foreclosure or other means and subsequently sell, develop, or liquidate them.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The balance of loans classified as TDRs increased $379,000 or 120.5% during the year ended December 31, 2021. The Bank had three TDRs totaling $694,000 at December 31, 2021 compared to three TDRs totaling $315,000 at December 31, 2020. The three TDRs at December 31, 2021 were commercial real estate loans to separate borrowers and secured by first mortgages on single family residences. The largest TDR had a balance of $403,000 at December 31, 2021. In comparison, the three TDRs at December 31, 2020 included two commercial real estate loans to two separate borrowers, the largest of which had a balance of $288,000 and one unsecured consumer loan with a balance of $2,000. At both December 31, 2021 and 2020, all TDRs were non-accruing.

All TDRs are reviewed for impairment loss and included in impaired loans until paid off. TDR loans can be classified as either accrual or non-accrual. TDR loans are classified as non-performing loans unless they have been performing in accordance with their modified terms for a period of at least six months in which case they are placed on accrual status. At December 31, 2021, the Bank had $2.3 million of impaired loans, including $694,000 in TDRs, compared to $2.2 million impaired loans, including $315,000 in TDRs, at December 31, 2020.

OREO decreased $369,000 or 74.0% to $130,000 at December 31, 2021 from $499,000 at December 31, 2020. At December 31, 2021, the balance of OREO consisted of five acres of commercial land in Aiken, South Carolina.

The Bank reviews its loan portfolio and allowance for loan losses on a monthly basis. When determining the appropriate allowance for loan losses during the years ended December 31, 2021 and 2020, management took into consideration the impact of the COVID-19 pandemic on such additional factors as the national and state unemployment rates and related trends, national and state unemployment benefit claim levels and related trends, the amount of and timing of financial assistance provided by the government, consumer spending levels and trends, industries significantly impacted by the COVID-19 pandemic, a review of the Bank's largest commercial loan relationships, and the Bank's COVID-19 loan modification program.

Management decreased historical loss factors and qualitative factors for all loan categories at December 31, 2021, reflecting a decline in the probable loan losses due to the COVID-19 pandemic as the economic and business conditions at both the national and regional levels continued to improve as of December 31, 2021. The decrease in the factors resulted in a significant decrease in the allowance for loan losses during the current year through the reversal of provision for loan losses recorded during the year ended December 31, 2020. For further discussion, see “Comparison of the Years Ended December 31, 2021 and 2020-Provision for Loan Losses” included herein.

Management will continue to closely monitor economic conditions and will work with borrowers as necessary to assist them through this challenging economic climate. Future additions to the Bank's allowance for loan losses are dependent on, among other things, the performance of the Bank's loan portfolio, the economy, changes in real estate values, and interest rates. There can be no assurance that additions to the allowance will not be required in future periods. The determination of the appropriate level of the allowance for loan losses inherently involves a high degree of subjectivity and requires us to make significant estimates of current credit risks and future trends, all of which may undergo material changes.

Deterioration in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. Uncertainties relating to our allowance for loan losses are heightened as a result of the risks surrounding the COVID-19 pandemic. The ultimate impact will depend on future developments, which are highly uncertain and cannot be predicted, including the scope and duration of the pandemic and actions taken by governmental authorities in response to the pandemic. In addition, bank regulatory agencies periodically review our allowance for loan losses and may require an increase in the provision for possible loan losses or the recognition of further loan charge-offs, based on judgments different than those of management. If charge-offs in future periods exceed the allowance for loan losses, we will need additional provisions to increase the allowance for loan losses. Any increases in the allowance for loan losses will result in a decrease in net income and, possibly, capital, and may have a material adverse effect on our financial condition and results of operations. Management continually monitors its loan portfolio for the impact of local economic changes. The ratio of the allowance for loan losses to total loans was 2.19% and 2.64% at December 31, 2021 and 2020, respectively. The Bank closely monitors its past due loans and loans subjected to a COVID-19 loan modification.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Financial Condition - Liabilities and Shareholders Equity

Total deposits increased $197.9 million or 21.6% to $1.12 billion at December 31, 2021 from $918.1 million at December 31, 2020. This growth was primarily due to proceeds from PPP loans and government stimulus checks deposited directly into customer accounts, organic growth in customer relationships and reduced withdrawals from deposit accounts due to a change in spending habits as a result of the COVID-19 pandemic. The majority of the Bank’s deposits are originated within the Bank’s immediate market area. The Bank had brokered time deposits of $10.0 million and $16.0 million at December 31, 2021 and 2020, respectively. The Bank uses brokered time deposits to manage interest rate risk because they are accessible in bulk at rates typically only slightly higher than those in our market areas. A portion of these brokered time deposits give the Bank a call option that allows the Bank the choice to redeem them early should rates change. In addition, the Bank had $5.0 million in other brokered deposits at December 31, 2021. Total deposits at December 31, 2021, excluding brokered deposits, increased $198.9 million or 22.0% to $1.1 billion from $902.1 million at December 31, 2020. Brokered deposits were 1.3% of total deposits at December 31, 2021 and 1.7% of total deposits at December 31, 2020.

The Bank had no outstanding FHLB advances or borrowings from the "discount window" of the Federal Reserve Bank of Atlanta ("FRB") at December 31, 2021 compared to FHLB advances and FRB borrowings of $35.0 million and $48.7 million, respectively, at December 31, 2020. Depository institutions may borrow from the discount window for periods as long as 90 days, and borrowings are prepayable and renewable by the borrower on a daily basis. Effective March 16, 2020 the borrowing rate was set at the top of the targeted Federal Funds Rate, or 0.25%, where it remained at December 31, 2021.

Other borrowings increased $13.7 million or 104.2% to $26.8 million at December 31, 2021 from $13.1 million at December 31, 2020. These borrowings consist of short-term repurchase agreements with certain commercial demand deposit customers for sweep accounts. The repurchase agreements typically mature within one to three days and the interest rate paid on these borrowings floats monthly with money market type rates. The interest rate paid on the repurchase agreements was 0.15% at both December 31, 2021 and 2020. The Bank had pledged as collateral for these repurchase agreements investment and MBS with amortized costs and fair values of $45.3 million and $45.2 million, respectively, at December 31, 2021 and $26.6 million and $26.8 million, respectively, at December 31, 2020.

In September 2006, Security Federal Statutory Trust issued and sold capital securities of the Trust (the “Capital Securities”). The Trust used the net proceeds from the sale of the Capital Securities to purchase a like amount of junior subordinated debentures (the “Debentures”) of the Company which are reported on the Consolidated Balance Sheet as junior subordinated debentures. The Capital Securities accrue and pay distributions at a floating rate of three month LIBOR plus 170 basis points annually which was equal to 1.90% at December 31, 2021. The distribution rate payable on the Capital Securities is cumulative and payable quarterly in arrears. The Capital Securities mature or are mandatorily redeemable upon maturity on December 15, 2036, or upon earlier optional redemption as provided in the indenture. The Company has the right to redeem the Capital Securities in whole or in part.

On November 22, 2019, the Company sold and issued to certain institutional investors $17.5 million in aggregate principal amount of 5.25% fixed-to-floating rate subordinated notes due 2029 (the “10-Year Notes”) and $12.5 million in aggregate principal amount of 5.25% fixed-to-floating rate subordinated notes due 2034 (the “15-Year Notes”, and together with the 10-Year Notes, the “Notes”). The 10-Year Notes have a stated maturity of November 22, 2029, and bear interest at a fixed rate of 5.25% per year, from and including November 22, 2019 but excluding November 22, 2024. From and including November 22, 2024 to but excluding the maturity date or early redemption date, the interest rate shall reset semi-annually to an interest rate equal to the then-current three-month LIBOR rate plus 369 basis points.

The 15-Year Notes have a stated maturity of November 22, 2034, and bear interest at a fixed rate of 5.25% per year, from and including November 22, 2019 but excluding November 22, 2029. From and including November 22, 2029 to but excluding the maturity date or early redemption date, the interest rate for the 15-Year Notes shall reset semi-annually to an interest rate equal to the then-current three-month LIBOR rate plus 357 basis points. The Notes are payable semi-annually in arrears on June 1 and December 1 of each year commencing June 1, 2020. The Notes are not subject to redemption at the option of the holder and may be redeemed by the Company only under certain limited circumstances prior to November 22, 2024, with respect to the 10-Year Notes, and November 22, 2029, with respect to the 15-Year Notes. The Company may redeem the 10-Year Notes and the 15-Year Notes at its option, in whole at any time, or in part from time to time, after November 22, 2024 and November 22, 2029, respectively.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The Notes are unsecured, subordinated obligations of the Company and rank junior in right to payment to the Company’s current and future senior indebtedness, and each Note is equal in right to payment with respect to the other Notes. The Company used the net proceeds from the sale of the Notes to fund the redemption of the convertible senior debentures and for general corporate purposes. For additional information, refer to Note 14 of the Notes to Consolidated Financial Statements included herein.

Total shareholders' equity increased $3.6 million or 3.2% to $115.5 million at December 31, 2021 from $111.9 million at December 31, 2020. The increase was attributable to net income of $12.8 million, which was partially offset by $1.4 million in dividends paid to common shareholders combined with a $7.7 million decrease in accumulated other comprehensive income, net of tax, related to the unrecognized loss in value of investment and MBS during the year ended December 31, 2021. Book value per common share was $35.51 at December 31, 2021 compared to $34.40 at December 31, 2020.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

The following table presents the dollar amount of changes in interest income and interest expense for major components of interest-earning assets and interest-bearing liabilities. The table also distinguishes between the changes related to higher or lower outstanding balances and the changes related to the volatility of interest rates. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to: (1) changes in rate (multiplied by prior year volume); (2) changes in volume (multiplied by prior year rate); and (3) net change (the sum of the prior columns). For purposes of this table, changes attributable to both rate and volume, which cannot be segregated, have been allocated proportionately to the change attributable to volume and the change attributable to rate. Changes in income are calculated on a tax equivalent basis using the effective tax rate for the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

| | 2021 vs. 2020 | | 2020 vs. 2019 |

| (Decrease) Increase Due to

Change in | | (Decrease) Increase Due to Change in |

| (Dollars in Thousands) | Volume | | Rate | | Net | | Volume | | Rate | | Net |

| Interest-Earning Assets: | | | | | | | | | | | |

Loans: (1) | | | | | | | | | | | |

| Residential Mortgage | $ | (690) | | | $ | (166) | | | $ | (856) | | | $ | (50) | | | $ | (150) | | | $ | (200) | |

| Other Loans | 688 | | | 1,090 | | | 1,778 | | | 3,824 | | | (2,019) | | | 1,805 | |

| Total Loans | (2) | | | 924 | | | 922 | | | 3,774 | | | (2,169) | | | 1,605 | |

| Mortgage-Backed Securities | 1,311 | | | (2,110) | | | (799) | | | 529 | | | (1,047) | | | (518) | |

| Taxable Investment Securities | 865 | | | (838) | | | 27 | | | 874 | | | (1,982) | | | (1,108) | |

Non-taxable Investment Securities (2) | 283 | | | (327) | | | (44) | | | (186) | | | 390 | | | 204 | |

| Deposits in Other Banks | (38) | | | (31) | | | (69) | | | 10 | | | (29) | | | (19) | |

| Total Interest-Earning Assets | $ | 2,419 | | | $ | (2,382) | | | $ | 37 | | | $ | 5,001 | | | $ | (4,837) | | | $ | 164 | |

| Interest-Bearing Liabilities: | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | |

| Certificate Accounts | $ | (474) | | | $ | (1,414) | | | $ | (1,888) | | | $ | (607) | | | $ | (935) | | | $ | (1,542) | |

| NOW Accounts | 54 | | | (117) | | | (63) | | | 57 | | | 88 | | | 145 | |

| Money Market Accounts | 130 | | | (462) | | | (332) | | | 139 | | | (1,269) | | | (1,130) | |

| Savings Accounts | 25 | | | (37) | | | (12) | | | 20 | | | (10) | | | 10 | |

| Total Deposits | (265) | | | (2,030) | | | (2,295) | | | (391) | | | (2,126) | | | (2,517) | |

| Borrowings | (125) | | | (337) | | | (462) | | | 940 | | | (152) | | | 788 | |

| Total Interest-Bearing Liabilities | (390) | | | (2,367) | | | (2,757) | | | 549 | | | (2,278) | | | (1,729) | |

Effect on Net Tax Equivalent Interest Income (2) | $ | 2,809 | | | $ | (15) | | | $ | 2,794 | | | $ | 4,452 | | | $ | (2,559) | | | $ | 1,893 | |

(1) INTEREST ON NON-ACCRUAL LOANS IS NOT INCLUDED IN INCOME, ALTHOUGH THEIR LOAN BALANCES ARE INCLUDED IN AVERAGE LOANS OUTSTANDING.

(2)THE TAX-EQUIVALENT INTEREST INCOME ADJUSTMENT RELATES TO THE TAX EXEMPT MUNICIPAL BONDS

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Average Balances, Interest Income and Expenses, and Average Yields and Rates

The following table sets forth information related to our average balance sheet, average yields on interest earning assets, and average costs of interest earning liabilities at December 31, 2021, 2020 and 2019. The average balances were derived from the daily balances throughout the periods indicated. The average yields or costs were calculated by dividing the income or expense by the average balance of the corresponding assets or liabilities. Nonaccrual loans are included in earning assets in the following tables. Loan yields have been reduced to reflect the negative impact on our earnings of loans on nonaccrual status.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended December 31, |

| | | 2021 | | 2020 |

| (Dollars in thousands) | | Average Balance | | Interest | | Yield/Rate | | Average Balance | | Interest | | Yield/Rate |

| Interest-Earning Assets: | | | | | | | | | | | | |

| Residential Mortgage | | $ | 64,016 | | | $ | 3,058 | | | 4.78 | % | | $ | 78,353 | | | $ | 3,914 | | | 5.00 | % |

| Other Loans | | 449,971 | | | 24,138 | | | 5.36 | % | | 437,034 | | | 22,360 | | | 5.12 | % |

Total Loans (1) | | 513,987 | | | 27,196 | | | 5.29 | % | | 515,387 | | | 26,274 | | | 5.10 | % |

| Mortgage-Backed Securities | | 304,234 | | | 5,341 | | | 1.76 | % | | 243,841 | | | 6,140 | | | 2.52 | % |

Taxable Investment Securities | | 287,153 | | | 3,881 | | | 1.35 | % | | 229,340 | | | 3,855 | | | 1.68 | % |

Non-taxable Investments (2) | | 23,351 | | | 955 | | | 4.09 | % | | 17,490 | | | 999 | | | 5.71 | % |

| Deposits in Other Banks | | 1,639 | | | 14 | | | 0.87 | % | | 4,535 | | | 83 | | | 1.83 | % |

| Total Interest-Earning Assets | | $ | 1,130,364 | | | $ | 37,387 | | | 3.31 | % | | $ | 1,010,593 | | | $ | 37,351 | | | 3.70 | % |

| Interest-Bearing Liabilities: | | | | | | | | | | | | |

| Certificate Accounts | | $ | 172,995 | | | $ | 879 | | | 0.51 | % | | $ | 216,619 | | | $ | 2,767 | | | 1.28 | % |

| NOW Accounts | | 204,869 | | | 219 | | | 0.11 | % | | 166,115 | | | 282 | | | 0.17 | % |

| Money Market Accounts | | 325,349 | | | 461 | | | 0.14 | % | | 274,124 | | | 793 | | | 0.29 | % |

| Savings Accounts | | 85,880 | | | 72 | | | 0.08 | % | | 63,374 | | | 84 | | | 0.13 | % |

| Total Interest-Bearing Deposits | | 789,093 | | | 1,631 | | | 0.21 | % | | 720,232 | | | 3,926 | | | 0.55 | % |

| Other Borrowings | | 23,608 | | | 38 | | | 0.15 | % | | 18,125 | | | 55 | | | 0.30 | % |

| | | | | | | | | | | | |

| Junior Subordinated Debt | | 5,155 | | | 97 | | | 1.88 | % | | 5,155 | | | 127 | | | 2.46 | % |

| Senior Convertible Debt | | — | | | — | | | — | % | | 1,123 | | | 82 | | | 7.30 | % |

| Subordinated Debt | | 30,000 | | | 1,575 | | | 5.25 | % | | 30,000 | | | 1,575 | | | 5.25 | % |

| FHLB Advances & FRB Borrowings | | 30,985 | | | 483 | | | 1.56 | % | | 60,600 | | | 817 | | | 1.35 | % |

| Total Interest-Bearing Liabilities | | $ | 878,841 | | | $ | 3,824 | | | 0.44 | % | | $ | 835,235 | | | $ | 6,582 | | | 0.79 | % |

| Net Interest Rate Spread | | | | | | 2.87 | % | | | | | | 2.91 | % |

Tax Equivalent Net Interest Income/Margin (2) | | | | $ | 33,563 | | | 2.97 | % | | | | $ | 30,769 | | | 3.04 | % |

Less: tax equivalent adjustment (2) | | | | 270 | | | | | | | 254 | | | |

| Net Interest Income | | | | $ | 33,293 | | | | | | | $ | 30,515 | | | |

(1) INTEREST INCOME FROM OTHER LOANS INCLUDED IN THE TABLES ABOVE AND BELOW INCLUDES DEFERRED PPP LOAN FEES OF $4.7 MILLION AND $1.2 MILLION RECOGNIZED DURING THE YEARS ENDED DECEMBER 31, 2021 AND 2020, RESPECTIVELY.

(2)TAX EQUIVALENT BASIS RECOGNIZES THE INCOME TAX SAVINGS WHEN COMPARING TAXABLE AND TAX-EXEMPT ASSETS AND WAS CALCULATED USING THE EFFECTIVE TAX RATE IN PLACE FOR THE YEARS ENDED DECEMBER 31, 2021, 2020 AND 2019. THE TAX-EQUIVALENT INTEREST INCOME ADJUSTMENT RELATES TO THE TAX EXEMPT MUNICIPAL BONDS INCLUDED IN OUR INVESTMENT PORTFOLIO DURING THE PERIODS INDICATED.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| | 2020 | | 2019 |

| (Dollars in thousands) | | Average Balance | | Interest | | Yield/Rate | | Average Balance | | Interest | | Yield/Rate |

| Interest-Earning Assets: | | | | | | | | | | | | |

| Residential Mortgage Loans | | $ | 78,353 | | | $ | 3,914 | | | 5.00 | % | | $ | 79,334 | | | $ | 4,114 | | | 5.19 | % |

| Other Loans | | 437,034 | | | 22,360 | | | 5.12 | % | | 364,527 | | | 20,555 | | | 5.64 | % |

Total Loans (1) | | 515,387 | | | 26,274 | | | 5.10 | % | | 443,861 | | | 24,669 | | | 5.56 | % |

| Mortgage-Backed Securities | | 243,841 | | | 6,140 | | | 2.52 | % | | 224,860 | | | 6,658 | | | 2.96 | % |

Taxable Investment Securities | | 229,340 | | | 3,855 | | | 1.68 | % | | 190,760 | | | 4,962 | | | 2.60 | % |

Non-taxable Investments (2) | | 17,490 | | | 999 | | | 5.71 | % | | 22,732 | | | 795 | | | 3.50 | % |

| Deposits in Other Banks | | 4,535 | | | 83 | | | 1.83 | % | | 4,087 | | | 103 | | | 2.52 | % |

| Total Interest-Earning Assets | | $ | 1,010,593 | | | $ | 37,351 | | | 3.70 | % | | $ | 886,300 | | | $ | 37,187 | | | 4.20 | % |

| Interest-Bearing Liabilities: | | | | | | | | | | | | |

| Certificate Accounts | | $ | 216,619 | | | $ | 2,767 | | | 1.28 | % | | $ | 256,194 | | | $ | 4,309 | | | 1.68 | % |

| NOW Accounts | | 166,115 | | | 282 | | | 0.17 | % | | 122,453 | | | 137 | | | 0.11 | % |

| Money Market Accounts | | 274,124 | | | 793 | | | 0.29 | % | | 254,723 | | | 1,923 | | | 0.75 | % |

| Savings Accounts | | 63,374 | | | 84 | | | 0.13 | % | | 50,635 | | | 74 | | | 0.15 | % |

| Total Interest-Bearing Deposits | | 720,232 | | | 3,926 | | | 0.55 | % | | 684,005 | | | 6,443 | | | 0.94 | % |

| Other Borrowings | | 18,125 | | | 55 | | | 0.30 | % | | 14,182 | | | 70 | | | 0.49 | % |

| Note Payable | | — | | | — | | | — | % | | 675 | | | 36 | | | 5.33 | % |

| Junior Subordinated Debt | | 5,155 | | | 127 | | | 2.46 | % | | 5,155 | | | 216 | | | 4.19 | % |

| Senior Convertible Debt | | 1,123 | | | 82 | | | 7.30 | % | | 6,045 | | | 483 | | | 7.99 | % |

| Subordinated Debt | | 30,000 | | | 1,575 | | | 5.25 | % | | 2,630 | | | 171 | | | 6.50 | % |

| FHLB Advances & FRB Borrowings | | 60,600 | | | 817 | | | 1.35 | % | | 45,900 | | | 892 | | | 1.94 | % |

| Total Interest-Bearing Liabilities | | $ | 835,235 | | | $ | 6,582 | | | 0.79 | % | | $ | 758,592 | | | $ | 8,311 | | | 1.10 | % |

| Net Interest Rate Spread | | | | | | 2.91 | % | | | | | | 3.10 | % |

Tax Equivalent Net Interest Income/Margin (2) | | | | $ | 30,769 | | | 3.04 | % | | | | $ | 28,876 | | | 3.26 | % |

Less: tax equivalent adjustment (2) | | | | 254 | | | | | | 253 | | | |

| Net Interest Income | | | | $ | 30,515 | | | | | | | $ | 28,623 | | | |

.

.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Comparison of the Years Ended December 31, 2021 and 2020

Net Income

Net income increased $5.7 million or 81.2% to $12.8 million or $3.93 per common share for the year ended December 31, 2021, compared to $7.1 million or $2.19 per common share for the year ended December 31, 2020. The increase in net income during 2021 was primarily the result of higher net interest income and non-interest income, specifically grant income, combined with the reversal of provision of loan losses during 2021 following significantly higher loan loss provisions during 2020 in response to the ongoing COVID-19 pandemic.

Net Interest Income

Net interest income increased $2.8 million or 9.1% to $33.3 million for the year ended December 31, 2021, compared to $30.5 million in 2020. The increase in net interest income was primarily due to higher interest income from loans and lower interest expense. The net interest margin on a tax equivalent basis decreased 22 basis points to 3.04% for the year ended December 31, 2021 from 3.26% for the year ended December 31, 2020. Loan yields in 2021 were impacted favorably as a result of recognition of unamortized deferred fee income on PPP loans forgiven and repaid by the SBA.

Total average interest-earning assets increased $119.8 million or 11.9% to $1.13 billion for the year ended December 31, 2021 from $1.01 billion for the year ended December 31, 2020 with a 39 basis point decrease in the average yield earned on these assets. Average interest-bearing liabilities increased $43.6 million or 5.2% to $878.8 million for the year ended December 31, 2021 from $835.2 million for the year ended December 31, 2020 with a decrease of 33 basis points in the average cost. The interest rate spread on a tax equivalent basis decreased four basis points to 2.87% for the year ended December 31, 2021 from 2.91% in 2020.

Total interest income increased $21,000 or 0.1% to $37.1 million for the year ended December 31, 2021, compared to $37.1 million for the year ended December 31, 2020 as a result of increased interest income from loans which was nearly offset by lower interest income from investments and other interest earning assets. Interest income from loans increased $922,000 or 3.5% to $27.2 million for the year ended December 31, 2021 compared to $26.3 million for the year ended December 31, 2020. The increase was attributable to an increase of 19 basis points in the average yield earned on the Bank's loan portfolio during 2021, which was partially offset by a $1.4 million decrease in average total loans outstanding during the year ended December 31, 2021. The Bank recognized $4.7 million and $1.2 million in deferred loan fees on PPP loans during the years ended December 31, 2021 and 2020, respectively.

Total tax equivalent interest income on investment securities, mortgage-backed securities, and other investments decreased $886,000, or 8.0%, due to a decrease of 59 basis points in the average yield earned on these assets, which was partially offset by a $121.2 million, or 24.5%, increase in the aggregate average balance of these interest earning assets during 2021.

Total interest expense decreased $2.8 million or 41.9% to $3.8 million for the year ended December 31, 2021, compared to $6.6 million for the year ended December 31, 2020 due to a 35 basis point decline in the average cost of interest bearing liabilities, which was partially offset by a $43.6 million or 5.2% increase in the average balance of these liabilities. The largest decrease was in interest expense on deposits, which decreased $2.3 million or 58.5% to $1.6 million in 2021 compared to $3.9 million in 2020. Average interest bearing deposits increased $68.9 million or 9.6% to $789.1 million during the year ended December 31, 2021 compared to $720.2 million during 2020, while the average cost of those deposits decreased 34 basis points to 0.21% during 2021 from 0.55% in 2020.

Interest expense on FHLB advances and all other borrowings decreased $463,000 or 17.4% to $2.2 million during the year ended December 31, 2021 from $2.7 million during the prior year. The decrease was attributable to a $25.3 million, or 22.0% decrease in the average balance of these liabilities, which was partially offset by an increase of 24 basis points in the average cost to 2.44% in 2021 from 2.20% during 2020.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Provision for Loan Losses

The Company recorded a negative provision for loan losses of $2.4 million for the year ended December 31, 2021 compared to provision expense of $3.6 million for the year ended December 31, 2020. The reversal of loan loss provisions during 2021 was the result of a reduction in historical loss and qualitative adjustment factors related to improvement in the economic and business conditions at both the national and regional levels as of December 31, 2021. Non-performing assets decreased $811,000, or 22.4%, to $2.8 million at December 31, 2021 from $3.6 million at December 31, 2020. Non-performing assets represented 0.22% and 0.31% of total assets at December 31, 2021 and 2020, respectively.

The amount of the provision is determined by management’s on-going monthly analysis of the loan portfolio and the adequacy of the allowance for loan losses. The Company has established policies and procedures for evaluating and monitoring the credit quality of the loan portfolio and for the timely identification of potential problem loans including internal and external loan reviews. The adequacy of the allowance for loan losses is reviewed monthly by the Asset Classification Committee and quarterly by the Board of Directors.

Management’s monthly review of the adequacy of the allowance includes three main components. The first component is an analysis of loss potential in various homogeneous segments of the portfolio based on historical trends and the risk inherent in each category. The historical loss periods used to calculate these ratios can range from one to ten years depending on which period is deemed a more relevant indicator of future losses. Currently, management applies a ten-year historical loss ratio to each loan category to estimate the inherent loss in these pooled loans.

The second component of management’s monthly analysis is the specific review and evaluation of significant problem credits identified through the Company’s internal monitoring system, including but not limited to classified loans, non-accrual loans and TDRs. These loans are evaluated for impairment and recorded in accordance with accounting guidance. All TDRs and substantially all non-accrual loans are individually evaluated for impairment. In accordance with our policy, non-accrual commercial loans with a balance less than $200,000 and non-accrual consumer loans with a balance less than $100,000 are deemed immaterial and therefore excluded from the individual impairment review. For each loan deemed impaired, management calculates a specific reserve for the amount in which the recorded investment in the loan exceeds the fair value. This estimate is based on a thorough analysis of the most probable source of repayment, which is typically liquidation of the collateral.

The third component is an analysis of changes in qualitative factors that may affect the portfolio, including but not limited to: relevant economic trends that could impact borrowers’ ability to repay, industry trends, changes in the volume and composition of the portfolio, credit concentrations, or lending policies and the experience and ability of the staff and Board of Directors. Management also reviews and incorporates certain ratios such as percentage of classified loans, average historical loan losses by loan category, delinquency percentages, and the assignment of percentage targets of reserves in each loan category when evaluating the allowance. Once the analysis is completed, the three components are combined and compared to the allowance amount. Based on this, charges are made to the provision as needed.

Management believes the allowance for loan losses at December 31, 2021 is adequate based on its best estimates of the losses inherent in the loan portfolio, although there can be no guarantee as to these estimates. In addition, bank regulatory agencies may require additional provisions to the allowance for loan losses based on their judgments and estimates as part of their examination process. Because the allowance for loan losses is an estimate, there can be no guarantee that actual loan losses will not exceed the allowance for loan losses, or that additional increases in the allowance for loan losses will not be required in the future. A further decline in national and local economic conditions, as a result of the COVID-19 pandemic or other factors, could result in a material increase in the allowance for loan losses and may adversely affect the Company’s financial condition and results of operations.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Non-Interest Income

Non-interest income increased $1.2 million or 10.6% to $12.6 million for the year ended December 31, 2021 from $11.4 million for the year ended December 31, 2020. The increase in non-interest income was primarily attributable to increases in grant income, ATM and check card fee income, trust income and gain on sale of mortgage loans. These increases in non-interest income were partially offset by a decrease of $1.3 million in net gain on sale of investments due to no investments sold during 2021 compared to 16 AFS investment securities sold for a total gain of $1.3 million in 2020.

The Bank received $1.8 million and $520,000 in grant income during the years ended December 31, 2021 and 2020, respectively. The Bank was awarded a $1.8 million grant during the third quarter of 2021 by the Community Development Financial Institutions (CDFI) Fund Rapid Response Program (RRP) created to provide certified CDFIs with resources to help counter the economic impact of COVID-19 in distressed and underserved communities. The grant proceeds were used to fund qualified loans within the Bank’s target market areas, which satisfied the performance obligation of the grant. A portion of the grant income received in 2020 was awarded by the Bank Enterprise Award (BEA) Program in recognition of the Bank’s investments in distressed communities and its continued commitment to community development.

Gain on sale of loans increased $328,000 or 9.3% to $3.8 million for the year ended December 31, 2021 compared to $3.5 million in 2020 as the dollar volume of loans sold to investors increased. The Company sold 486 loans to investors with a total balance of $112.9 million in 2021 compared to 514 loans to investors with a total balance of $111.1 million during 2020.

Income from BOLI increased $62,000 or 10.8% to $635,000 during the year ended December 31, 2021 from $573,000 during the year ended December 31, 2020. All BOLI income recognized in 2021 and 2020 was related to an increase in the cash surrender value of the BOLI policies.

Trust income increased $301,000 or 26.4% to $1.4 million during the year ended December 31, 2021 due to an increase in assets under management. ATM and check card fee income increased $787,000 or 46.8% to $2.5 million for the year ended December 31, 2021 compared to $1.7 million in 2020 reflecting higher transaction volume.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Non-Interest Expense

Non-interest expense increased $2.3 million or 7.9% to $32.0 million during the year ended December 31, 2021 compared to $29.7 million during 2020. The increase in non-interest expense was primarily due to increases in compensation and employee benefits expense and consulting expense.