Exhibit 10.33(b)

SECOND AMENDMENT TO AGREEMENT OF PURCHASE AND SALE

AND ESCROW INSTRUCTIONS

THIS SECOND AMENDMENT TO AGREEMENT OF PURCHASE AND SALE AND ESCROW INSTRUCTIONS (“Second Amendment”) is made and entered into as of this 4th day of January, 2013 (the “Effective Date”), by and between SYNAPTICS INCORPORATED, a Delaware corporation (“Seller”), and ORCHARD PARTNERS, LLC, a California limited liability company (“Buyer”).

RECITALS

A. Seller and Buyer are parties to that certain Agreement of Purchase and Sale and Escrow Instructions dated as of October 19, 2012 (the “Original Agreement”), as amended by that certain First Amendment to Agreement of Purchase and Sale and Escrow Instructions dated as of November 19, 2012 (the “First Amendment,” together with the Original Agreement, the “Purchase Agreement”), pursuant to which Seller agreed to sell and convey to Buyer, and Buyer agreed to purchase from Seller, the Property (as defined in the Purchase Agreement).

B. As of November 30, 2012, Buyer elected not to deliver the Approval Notice to Seller in accordance with Section 2.2(b) of the Purchase Agreement, but the Title Company has retained the Deposit, in the amount of Two Hundred Thousand Dollars ($200,000), in escrow.

C. Seller and Buyer now desire to amend the Purchase Agreement as provided herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth below, and for other valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1. Recitals. The Recitals set forth above are true and correct and are hereby incorporated into the body of this Second Amendment as though fully set forth herein.

2. Defined Terms. Capitalized terms used herein, unless otherwise defined in this Second Amendment, shall have the meanings ascribed to them in the Purchase Agreement.

3. Purchase Agreement. Notwithstanding the effect of Buyer’s election not to deliver the Approval Notice to Seller in accordance with Section 2.2(b) of the Purchase Agreement, Buyer and Seller hereby renew, restore and reaffirm the terms and conditions of the Purchase Agreement, subject to and including the further terms, conditions and modifications thereto set forth in this Second Amendment.

4. Purchase Price. The Purchase Price, as defined in Section 1.2(a) of the Purchase Agreement, shall be decreased so that the new Purchase Price is the amount of Twelve Million Six Hundred Twenty-Six Thousand One Hundred Thirty Dollars ($12,626,130).

5. Feasibility Period. The Feasibility Period set forth in Section 2.2(b) of the Original Agreement is extended such that the Feasibility Period shall mean the period ending at 5:00 p.m. (Pacific Time) on January 31, 2013.

6. Closing Date. The Closing Date set forth in Section 10.2 of the Purchase Agreement is extended such that the Closing Date shall occur on February 28, 2013, or such earlier date as Buyer and Seller may mutually agree upon in writing, subject to the parties’ rights to extend the Closing Date as provided in Section 7 below.

7. Option to Extend Closing Date. Buyer shall, at its sole election and upon written notice to Seller and Title Company given no later than the date that is five (5) days prior to the Closing Date, have the right to extend the Closing Date for up to an additional thirty (30) days (the “Extended Closing Date”) for any reason whatsoever. In the event the Easement Condition (as defined in Section 9 below) is not satisfied on or before the Extended Closing Date, Buyer and Seller may, upon mutual agreement, extend the Extended Closing Date for up to an additional thirty (30) days to satisfy the Easement Condition in accordance with the terms contained in Section 9 below.

8. Title Contingency Period. The Title Contingency Period set forth in Section 2.2(a) of the Original Agreement has expired, and Buyer has approved of all matters described in Section 2.1(a) of the Original Agreement, subject to the Title Company’s agreement to insure the Easements (as hereinafter defined) in accordance with Section 9 below and any revisions to the Survey required by the Title Company resulting from the Easements.

9. Easement Condition. Section 2.1 of the Original Agreement is hereby amended to include the following as a new subsection (k):

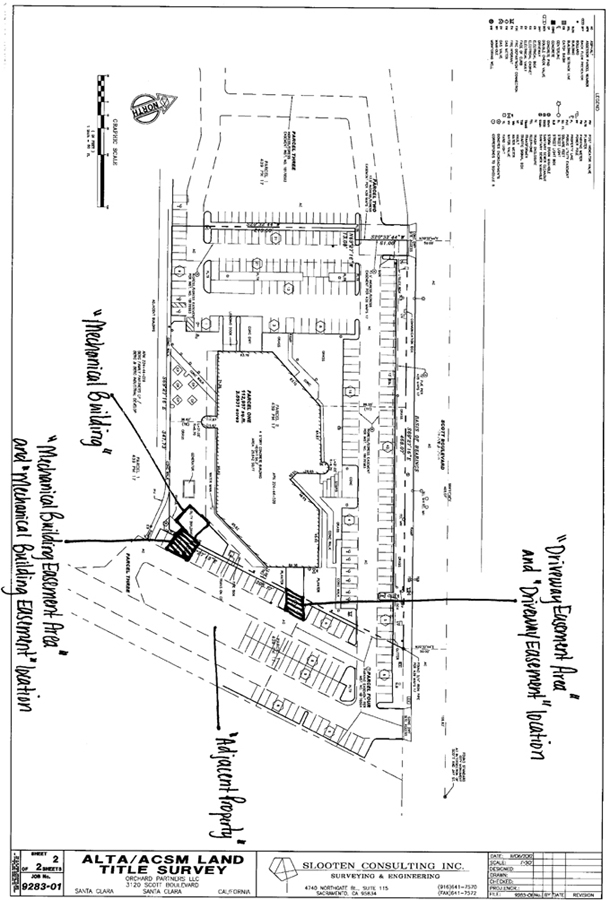

“(k) Buyer and Seller (at the sole cost and expense of Seller [but subject to Seller’s subsequent written approval of all such costs and expenses in Seller’s sole and absolute discretion], and with the reasonable cooperation of and using best efforts of each party), shall have obtained and delivered to the Title Company, on or before the Closing Date (i) an easement agreement (in a form reasonably acceptable to Buyer) (the “Driveway Easement Agreement”) from the owner of the Adjacent Property (as depicted on Exhibit A attached hereto) providing for a non-exclusive easement in the location depicted on Exhibit A and granting the owner of the Property, its agents, tenants, licensees, employees, customers, guests and invitees, vehicular and pedestrian ingress, egress and access, on, over and across the Driveway Easement Area (depicted on Exhibit A) (the “Driveway Easement”); and (ii) an easement agreement (in a form reasonably acceptable to Buyer) (the “Mechanical Building Easement Agreement”) from the owner of the Adjacent Property providing for a non-exclusive easement in the location depicted on Exhibit A and granting the owner of the Property, its agents, tenants, licensees, and employees, pedestrian ingress, egress and access, on, over and across the Mechanical Building Easement Area (depicted on Exhibit A) for the purpose of servicing, removing, replacing, and maintaining equipment stored in the Mechanical Building (depicted on Exhibit A) (the “Mechanical Building Easement”). The Driveway Easement and the Mechanical Building Easement (collectively, the “Easements”) shall (A) be binding upon and effective against any subsequent owner or other occupant of the Adjacent Property, (B) be insured as an appurtenant easement under the Title Policy as part of the insured estate and subject to no exceptions (including liens for deeds of trust, mortgages or similar instruments), other than those approved in writing by Buyer on or before the Closing Date, and (C) have priority over the lien of any deed of trust, mortgage or similar instrument that encumbers the Adjacent Property on the Closing Date. All of the foregoing in this Section 2.1(k) shall be referred to herein as the “Easement Condition.”

10. Third-Party Reports. The penultimate sentence in Article 5 of the Original Agreement is hereby deleted in its entirety and restated as follows:

“Notwithstanding any provision to the contrary in this Agreement, in the event this Agreement terminates (i) as a result of Buyer’s failure to deliver the Approval Notice in accordance with Section 2.2(b) on or before expiration of the Feasibility Period, or (ii) as a result of Buyer’s breach or default, Buyer shall promptly deliver to Seller all Third Party Reports, at no cost to Seller and without representation or warranty of any kind whatsoever, express or implied, as to accuracy or completeness.”

-2-

11. Lease. The Lease attached as Exhibit H to the Original Agreement is hereby deleted in its entirety and replaced with Exhibit B attached hereto.

12. Out of Contract Period. Buyer and Seller acknowledge and agree that Buyer elected not to deliver the Approval Notice to Seller in accordance with Section 2.2(b) of the Purchase Agreement, and that the Purchase Agreement was not in effect during the period commencing at 5:01 p.m. (Pacific Time) on November 30, 2012 and ending on the Effective Date (the “Out of Contract Period”). Buyer and Seller acknowledge and agree that the covenants set forth in the Purchase Agreement were not and are not applicable to Buyer and Seller during the Out of Contract Period. Seller hereby represents and warrants to Buyer that (i) Seller did not enter into any new Contracts or leases, tenancies or third party occupancy agreements relating to or affecting the Property, or any extension, renewal, replacement or modification thereof, during the Out of Contract Period, and (ii) to Seller’s actual knowledge, none of the covenants made by Seller in the Purchase Agreement would have been breached had the Purchase Agreement been in effect during the Out of Contract Period. Seller hereby represents and warrants to Buyer that Seller has not entered into any other contracts for the sale of all or any portion of the Property during the Out of Contract Period. Buyer acknowledges and agrees that Buyer has not obtained actual knowledge that any of the representations or warranties made by Seller in the Purchase Agreement are untrue, inaccurate or incorrect. Seller acknowledges and agrees that Seller has not obtained actual knowledge that any of the representations or warranties made by Seller in the Purchase Agreement are untrue, inaccurate or incorrect.

13. Counterparts. This Second Amendment may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one instrument. The parties contemplate that they may be executing counterparts of this Second Amendment transmitted by facsimile or electronic mail in PDF format and agree and intend that a signature by either facsimile machine or electronic mail in PDF format shall bind the party so signing with the same effect as though the signature were an original signature.

14. No Further Modifications. Except as set forth herein, the terms of the Purchase Agreement shall remain unmodified and in full force and effect. In the event of any conflict or inconsistency between the terms of this Second Amendment and the Purchase Agreement, the terms of this Second Amendment shall control.

15. Governing Law. This Second Amendment shall be governed by, construed and enforced in accordance with the laws of the State of California.

[Remainder of Page Intentionally Left Blank; Signature Page(s) Immediately Follows]

-3-

IN WITNESS WHEREOF, the parties hereto have executed this Second Amendment as of the date and year first written above.

| SELLER: | SYNAPTICS INCORPORATED, a Delaware corporation | |||||

| By: | /s/ Kathleen Bayless | |||||

| Name: | Kathleen Bayless | |||||

| Title: | CFO | |||||

| BUYER: | ORCHARD PARTNERS, LLC, a California limited liability company | |||||

| By: | /s/ Michael J. Biggar | |||||

| Name: | Michael J. Biggar | |||||

| Title: | Manager | |||||

-4-

EXHIBIT A

Depiction of Access Easement Area

(See attached.)

-5-

6

EXHIBIT B

Lease

(See attached.)

-6-

OFFICE LEASE

LANDLORD:

a _________________________________

TENANT:

SYNAPTICS INCORPORATED,

a Delaware corporation

SUMMARY OF BASIC LEASE INFORMATION AND DEFINITIONS

THIS SUMMARY OF BASIC LEASE INFORMATION AND DEFINITIONS (“Summary”) is hereby incorporated into and made a part of the attached Office Lease (“Lease”). All references in the Lease to the Lease shall include this Summary. All references in the Lease to any term defined in this Summary shall have the meaning set forth in this Summary for such term. If there is any inconsistency between the Summary and the Lease, the provisions of the Lease shall control.

| 1.1 Landlord’s Address: | ||||||

| 615 National Avenue, Suite 200 | ||||||

| Mountain View, CA 94043 | ||||||

| Attn: | ||||||

| Facsimile: 650) 938-4318 | ||||||

| Email: | ||||||

| with a copy to: | ||||||

| Morrison & Foerster LLP | ||||||

| 755 Page Mill Road | ||||||

| Palo Alto, CA 94304 | ||||||

| Attn: Philip J. Levine, Esq. | ||||||

| Facsimile: (650) 251-3808 | ||||||

| Email: PLevine@mofo.com | ||||||

| Tenant’s Address: |

Synaptics Incorporated | |||||

| 3120 Scott Blvd. | ||||||

| Santa Clara, CA 95054 | ||||||

| Attn: Jim Harrington, Senior Vice President | ||||||

| Facsimile: (408) 454-5200 | ||||||

| Email: Jharrington@synaptics.com | ||||||

| with a copy to: | ||||||

| Synaptics Incorporated | ||||||

| 3120 Scott Blvd. | ||||||

| Santa Clara, CA 95054 | ||||||

| Attn: Greg DeWolf, General Counsel | ||||||

| Facsimile: (408) 454-5200 | ||||||

| Email: GDewolfe@synaptics.com | ||||||

| and a copy to: | ||||

| Greenberg Traurig, LLP | ||||

| 2375 East Camelback Road, Suite 700 | ||||

| Phoenix, AZ 85018 | ||||

| Attn: Kevin J. Morris | ||||

| Facsimile: (602) 445-8687 | ||||

| Email: morriskj@gtlaw.com | ||||

1.2 Premises. The “Premises” consist of approximately 2.59 acres of real property located at 3120 Scott Boulevard, City of Santa Clara, State of California, containing approximately 76,522 rentable square feet, as depicted on Exhibit A.

1.3 Term. The term of the Lease shall commence on the Closing Date as defined in that certain “Agreement for Purchase and Sale and Escrow Instructions” (“Purchase Agreement”) executed by the Tenant and the Landlord (or the Landlord’s predecessor in interest) (the “Commencement Date”) and terminate on May 31, 2013 (the “Expiration Date”) unless extended by the Extension Option (as defined in Section 2.1) or sooner terminated by the Early Termination Option (as defined in Section 2.2) or as otherwise provided herein (the “Term”).

1.4 Monthly Basic Rent. During the Term of this Lease, Tenant shall pay Landlord an amount equal to One Hundred Thirty-Three Thousand Nine Hundred Thirteen and 50/100 Dollars ($133,913.50) per month (the “Monthly Basic Rent”). The Monthly Basic Rent shall be paid by Tenant to Landlord in advance of the first day of each month during the Term of this Lease, without offset, deduction or demand. On the Commencement Date, Tenant shall pay to Landlord Monthly Basic Rent for the first full month of the Term, and, if the Commencement Date falls on a date other than the first day of the month, the prorated Monthly Basic Rent for such initial partial month.

1.5 Triple Net Lease. This Lease is intended to be a “Net-Net-Net” lease. Tenant shall pay all expenses associated with maintaining and operating the Premises during the Term, including, without limitation, taxes, utilities, maintenance costs, repair costs and insurance premiums (collectively, the “Triple Net Expenses”) and Additional Rent as set forth in Section 3.2. Under no circumstances or conditions, whether now or hereafter arising, or whether within or beyond the present contemplation of the parties, shall Landlord or its successors or assigns be expected or required to make any payment of any kind whatsoever, or be under any other obligation or liability hereunder, except as otherwise specifically set forth in this Lease. To the extent that Landlord pays any such costs or expenses that are otherwise required to be paid by Tenant pursuant to this Lease, Tenant shall reimburse Landlord within twenty (20) days of Landlord’s written demand therefor.

1.6 Additional Rent. In addition to the Monthly Basic Rent and the Triple Net Expenses, Tenant shall pay the Real Property Taxes and Assessments, Operating Expenses, Management Fee, and all other amounts required under this Lease (the “Additional Rent”).

2

1.7 Security Deposit. One Hundred Thirty-Three Thousand Nine Hundred Thirteen and 50/100 Dollars ($133,913.50) (the “Security Deposit”). The Security Deposit shall be returned to the Tenant at the end of the Term, less any amount reasonably necessary to repair any damage done to the Premises by Tenant, its agents or employees during the Term of this Lease, and less any Rent or other charges owed by Tenant to Landlord under this Lease.

1.8 Permitted Use. Tenant’s current business use including all existing uses, to the extent permitted by applicable laws (“Permitted Use”).

1.9 Parking. Tenant to have the exclusive use of parking at the Premises at no charge throughout the Lease Term. Tenant shall not park nor permit to be parked any inoperative vehicle or equipment on any portion of the Premises.

1.10 Broker. None. (“Broker”).

3

OFFICE LEASE

This Lease, which includes the Summary attached hereto and incorporated herein by this reference, is made as of the [ ] day of [ ], 2012 (“Effective Date”), by and between [ ], a [ ] (“Landlord”), and Synaptics Incorporated, a Delaware corporation (“Tenant”).

| 1. | Premises. |

1.1 Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises described in Section 1.2 of the attached Summary. Such Lease is upon, and subject to, the terms, covenants and conditions herein set forth.

| 2. | Term. |

2.1 Term; Notice of Lease Dates. The Term of this Lease shall be for the period designated in Section 1.3 of the Summary commencing on the Commencement Date and ending on the Expiration Date, unless extended or sooner terminated as provided herein. Provided Tenant is not in default under this Lease, Tenant shall have the option to extend the Term of this Lease for one (1) additional period of thirty (30) days commencing on the date following the Expiration Date (the “First Extended Term”), upon the same terms and conditions contained in this Lease and by giving Landlord written notice of its intention to exercise its extension option thirty (30) days prior to the Expiration Date (the “First Extension Option”). Provided Tenant is not in default under the Lease, Tenant shall have the option to extend the Term of the Lease for one (1) additional period of thirty (30) days commencing on the date following the expiration date of the First Extended Term, upon the same terms and conditions contained in this Lease and by giving Landlord written notice of its intention to exercise its extension option thirty (30) days prior to the expiration date of the First Extended Term (the “Second Extension Option,” together with the First Extension Option, collectively the “Extension Option”). Tenant shall have no additional rights to extend the Term of this Lease, other than as set forth in this Section 2.1.

2.2 Early Termination Option. Tenant shall have the option (the “Early Termination Option”) to terminate this Lease by giving thirty (30) days prior written notice to Landlord at any time after February 1, 2013 (the “Early Termination Notice”), time being of the essence. If Tenant exercises the Early Termination Option, the Lease shall terminate thirty (30) days following Landlord’s receipt of Tenant’s Early Termination Notice; provided, however, the Lease shall in no event terminate before March 3, 2013.

4

| 3. | Rent. |

3.1 Monthly Basic Rent. During the Term of the Lease, Tenant shall pay Landlord, as Monthly Basic Rent for the Premises, the Monthly Basic Rent in the amounts designated in Section 1.4 of the Summary. The Monthly Basic Rent shall be paid by Tenant in monthly installments in advance on the first day of each and every calendar month during the Term, without demand, notice, deduction or offset, except as will be paid upon Tenant’s execution and delivery of this Lease to Landlord. Monthly Basic Rent for any partial month shall be prorated in the proportion that the number of days this Lease is in effect during such month bears to the actual number of days in such month.

3.2 Additional Rent. In addition to Tenant’s payment of the Triple Net Expenses related to the Premises, as designated in Section 1.5 of the Summary, Tenant shall pay as Additional Rent to Landlord the following: Real Property Taxes and Assessments (as hereinafter defined), all operating expenses of any kind or nature which are necessary, ordinary or customarily incurred in connection with the operation, maintenance or repair of the Premises, including but not limited to Landlord’s cost of insurance, utilities and maintenance service for the Premises, as determined by Landlord (collectively, the “Operating Expenses”), and the costs of the property management fee paid by Landlord to the property manager in an amount not to exceed three percent (3%) of Rent (including Monthly Basic Rent and Additional Rent, but excluding the cost of the property management fee itself) (the “Management Fee”). Notwithstanding the foregoing, the Management Fee shall include only 1.5% of real property taxes and assessments, rather than the full 3%, as provided above. During the Term of this Lease, Tenant shall pay (i) the Management Fee and Operating Expenses, as reasonably estimated by Landlord, in monthly installments, in the amount of Landlord’s estimate, in advance on the first day of each and every calendar month, without demand, notice, deduction or offset, and together with the Monthly Basic Rent; and (ii) the Real Property Taxes and Assessments within ten (10) days after delivery of an invoice by Landlord. Landlord shall endeavor to furnish to Tenant within a reasonable period after the end of the Term, a statement (a “Reconciliation Statement”) indicating in reasonable detail the actual cost of the Operating Expenses, the Management Fee and any additional Real Property Taxes and Assessments attributable to the Term, and the parties shall, within thirty (30) days thereafter, make any payment or allowance necessary to adjust Tenant’s estimated payments to the actual cost thereof, as indicated by such Reconciliation Statement.

3.3 Rent. Monthly Basic Rent, the Triple Net Expenses, and Additional Rent and any other amounts which Tenant is or becomes obligated to pay Landlord under this Lease are herein referred to collectively as “Rent,” and all remedies applicable to the nonpayment of Rent shall be applicable thereto. Landlord may apply payments received from Tenant to any obligations of Tenant then accrued, without regard to such obligations as may be designated by Tenant.

| 4. | Landlord’s Rights; Real Property Taxes and Assessments; Maintenance, Insurance and Utilities Costs. |

4.1 Definitions. During the Term of this Lease, except as otherwise provided herein, Tenant shall have the exclusive right to use the Premises including, without limitation, any fixtures, systems, décor and facilities used in connection therewith, and landscaping and parking contained, maintained or used in connection with the Premises.

5

4.2 Landlord’s Reserved Rights. Tenant shall permit the Landlord and its authorized representatives to enter the Premises, upon at least one (1) business day’s prior written (including by electronic mail) notice to Tenant (except in the event of an emergency, in which case no notice shall be required), during Tenant’s normal business hours, to inspect and show the Premises. Furthermore, Landlord shall have the right, but not the obligation, to make repairs, improvements, alterations or additions in the Premises as Landlord may deem necessary or appropriate at Landlord’s expense and in a manner so as not to unreasonably interfere with Tenant’s use. In addition, Landlord reserves the right from time to time (upon at least one (1) business day’s prior written notice to Tenant) to do any of the following on the Premises, as long as such acts do not unreasonably interfere with Tenant’s use of or access to the Premises: to conduct testing, measuring, surveying, soils tests and other inspections, or to access as needed for its planning or governmental approvals related to the remediation of hazardous materials or the future use of the Premises, or to perform such other acts with respect to the Premises, as Landlord may, in the exercise of good faith business judgment, deemed to be appropriate or necessary. Landlord shall be responsible for any damage or destruction to the Premises caused by Landlord or its agents, employees, invitees, property manager and contractors who enter the Premises for any purpose during the Term of this Lease.

4.3 Maintenance and Utilities Costs. Tenant shall, at Tenant’s sole cost and expense, keep and maintain the Premises, including the building and the heating, ventilation and air conditioning (the “HVAC) system located on the Premises, in good working order and in good, clean, sanitary, neat and operative condition and repair, reasonable wear and tear and casualties excepted. Tenant shall also pay or reimburse Landlord for (or, at Landlord’s option, perform) the repair or replacement of any waste or excessive or unreasonable wear and tear to the Premises caused or permitted by Tenant’s actions or omissions during the Term of this Lease. Any repairs performed by Tenant pursuant to this Section 4.3 must be in accordance with all applicable laws. Landlord shall not be required or expected to perform or pay for any maintenance or repairs to the Premises, or furnish or pay for any utilities or services to the Premises, and Tenant shall have the use of all services and utilities to the Premises at no cost to Landlord. To the extent changes or alterations to the Premises are required by any governmental authority in compliance with law and not caused by or related to Tenant’s specific use, alterations or work at the Premises, Tenant shall not be responsible to make such changes or alterations or to pay for such work; provided, however, that in such event, if Tenant is unwilling to pay the cost of such changes or alterations, then Landlord shall have the right, in its sole and absolute discretion, to either make such changes or alterations, or to terminate this Lease with forty-five (45) days prior written notice to Tenant.

4.4 Definition of Real Property Taxes and Assessments. “Real Property Taxes and Assessments” means: all real property taxes and general, special or district assessments or other governmental impositions, of whatever kind, nature or origin, imposed on or by reason of the ownership or use of the Premises; governmental charges, fees or assessments for transit or traffic mitigation (including area-wide traffic improvement assessments and transportation system management fees), housing, police, fire or other governmental service or purported benefits to the Premises; taxes levied against the rents in use of or in addition to taxes levied against the Premises; personal property taxes assessed on the personal property of Landlord or

6

Tenant used in the operation of the Premises; service payments in lieu of taxes and taxes and assessments of every kind and nature whatsoever levied or assessed in addition to, in lieu of or in substitution for existing or additional real or personal property taxes on the Premises or the personal property described above; any increases or decreases in the foregoing caused by changes in assessed valuation, tax rate or other factors or circumstances; and the reasonable cost of contesting by appropriate proceedings the amount or validity of any taxes, assessments or charges described above (provided that Tenant receives its share (based on the period of its tenancy) of any refund plus its share of any interest awarded by the taxing authority).

Notwithstanding the foregoing provisions of this Section 4.4 above to the contrary, Real Property Taxes and Assessments shall not include Landlord’s federal or state income, franchise, inheritance or estate taxes, and shall be paid as Additional Rent in accordance with Section 3.2.

4.5 Insurance Costs. Tenant shall pay the costs of its own insurance and shall pay the costs of any insurance maintained by Landlord with respect to the Premises and the improvements located thereon as Additional Rent in accordance with Section 3.2.

4.6 Utilities Costs. Tenant shall pay its own utility costs for use of the Premises and the utility costs incurred for the Premises.

| 5. | Use. |

5.1 General. Tenant shall use the Premises solely for the Permitted Use specified in Section 1.8 of the Summary, and shall not use or permit the Premises to be used for any other use or purpose whatsoever. Tenant shall, at its sole cost and expense, observe and comply with all requirements of any board of fire underwriters or similar body relating to the Premises, and all laws, statutes, codes, rules and regulations now or hereafter in force relating to or affecting the condition, use, occupancy, alteration or improvement of the Premises during the Term of this Lease, including, without limitation, the provisions of Title III of the Americans with Disabilities Act of 1990, as amended (“ADA”), as it pertains to Tenant’s use, occupancy, improvement and alteration of the Premises, whether structural or nonstructural, including unforeseen and/or extraordinary alterations and/or improvements to the Premises, regardless of the period of time remaining in the Term. Tenant reserves the right to apply for waiver of any ADA requirements and is only subject to requirements mandated by the appropriate governmental agency. Tenant shall not cause, maintain or permit any nuisance in, on or about the Premises, nor commit or suffer to be committed any waste in, on or about the Premises.

| 5.2 | Parking. |

During the Term of the Lease, and provided Tenant is not in default hereunder (after taking into consideration all applicable notice and cure periods), Tenant shall have the right to use, at no extra cost, all of the parking spaces located on the Premises.

7

| 5.3 | Signs. |

Existing signs may remain during the Term of this Lease and Landlord’s approval is only needed for any change in signage by Tenant (which changes must also comply with all applicable laws); provided, however, Tenant shall be responsible for (i) the repair and maintenance of all existing signage, and any additional signage approved by Landlord, during the Term of this Lease, and (ii) the removal of all existing signage, and any additional signage approved by Landlord, upon expiration of the Term or earlier termination of this Lease.

| 5.4 | Hazardous Materials. |

Tenant shall (i) obtain and maintain in full force and effect all Environmental Permits that may be required from time to time under any Environmental Laws applicable to Tenant or the Premises, and (ii) be and remain in compliance in all material respects with all terms and conditions of all such Environmental Permits and with all other limitations, restrictions, conditions, standards, prohibitions, requirements, obligations, schedules and timetables contained in all Environmental Laws applicable to Tenant or the Premises. As used in this Lease, the term “Environmental Law” means any past, present or future federal, state, local or foreign statutory or common law, or any regulation, ordinance, code, plan, order, permit, grant, franchise, concession, restriction or agreement issued, entered, promulgated or approved there under, relating to (a) the environment, human health or safety, including, without limitation, emissions, discharges, releases or threatened releases of Hazardous Materials (as defined below) into the environment (including, without limitation, air, surface water, groundwater or land), or (b) the manufacture, generation, refining, processing, distribution, use, sale, treatment, receipt, storage, disposal, transport, arranging for transport, or handling of Hazardous Materials. “Environmental Permits” means, collectively, any and all permits, consents, licenses, approvals and registrations of any nature at any time required pursuant to, or in order to comply with, any Environmental Law. Except for ordinary and general office supplies, such as copier toner, liquid paper, glue, ink and common household and office cleaning materials (some or all of which may constitute “Hazardous Materials” as defined in this Lease) used in compliance with Environmental Laws, Tenant agrees during the Term of this Lease not to cause or permit any Hazardous Materials to be brought upon, stored, used, handled, generated, released or disposed of on, in, under or about the Premises in violation of any Environmental Laws or without the prior written consent of Landlord, which consent Landlord may not unreasonably withhold. Upon the expiration or earlier termination of this Lease, Tenant agrees to promptly remove from the Premises, at its sole cost and expense, any and all Hazardous Materials, including any equipment or systems containing Hazardous Materials which are installed, brought upon, stored, used, generated or released upon, in, under or about the Premises or any portion thereof by Tenant or its agents, employees, invitees, or contractors during the Term of this Lease (except to the extent such Hazardous Materials migrate on or under the Premises from any adjacent property and such migration is not caused by Tenant or its employees, agents or contractors), and to secure any closures of any Environmental Permits that require a closure by the issuer of the Environmental Permit. Tenant agrees to indemnify, protect, defend and hold harmless Landlord and its members, employees, agents, successors and assigns from and against any and all claims, actual damages, judgments, suits, causes of action, losses,

8

liabilities, penalties, fines, expenses and costs (including, without limitation, clean-up, removal, remediation and restoration costs, sums paid in settlement of claims, reasonable attorneys’ fees, consultant fees and expert fees and court costs), which arise or result from the presence of Hazardous Materials brought upon, stored, used, generated or released upon, in, under or about the Premises or any portion thereof by Tenant or its agents, employees, invitees, or contractors during the Term of this Lease (except to the extent such Hazardous Materials migrate on or under the Premises from any adjacent property and such migration is not caused by Tenant or its employees, agents or contractors). Tenant agrees to promptly notify Landlord of any release of Hazardous Materials in or on the Premises which Tenant becomes aware of during the Term of this Lease, whether caused by Tenant or any other persons or entities. As used in this Lease, the term “Hazardous Materials” shall mean and include any hazardous or toxic materials, substances or wastes as now or hereafter designated under any law, statute, ordinance, rule, regulation, order or ruling of any agency of the State, the United States Government or any local governmental authority, including, without limitation, asbestos, petroleum, petroleum hydrocarbons and petroleum based products, urea formaldehyde foam insulation, polychlorinated biphenyls, and freon and other chlorofluorocarbons. Landlord shall be responsible for any Hazardous Materials brought upon, stored, used, generated or released upon, in, under or about the Premises or any portion thereof by Landlord and its agents, employees, invitees, property manager and contractors. The provisions of this Section 5.4 shall survive the expiration or earlier termination of this Lease.

| 6. | Payments and Notices. |

6.1 All Rent and other sums payable by Tenant to Landlord hereunder shall be paid to Landlord at the first address designated in Section 1.1 of the Summary, or to such other persons or at such other places as Landlord may hereafter designate in writing. Any notice required or permitted to be given hereunder must be in writing and may be given by personal delivery (including delivery by nationally recognized overnight courier or express mailing service), or by registered or certified mail, postage prepaid, return receipt requested, addressed as designated in Section 1.1 of the Summary. Either party may, by written notice to the other, specify a different address for notice purposes. Notice given in the foregoing manner shall be deemed given (i) when actually received or refused by the party to whom sent if delivered by a carrier or personally served or (ii) if mailed, on the day of actual delivery or refusal as shown by the certified mail return receipt or the expiration of three (3) business days after the day of mailing, whichever first occurs.

6.2 When this Lease requires service of a notice, that notice shall replace rather than supplement any equivalent or similar statutory notice, including any notices required by California Code of Civil Procedure Section 1161 or any similar or successor statute. When a statute requires service of a notice in a particular manner, service of that notice pursuant to Section 6.1 above shall replace and satisfy the statutory service-of-notice procedures, including those required by California Code of Civil Procedure Section 1162 or any similar or successor statute.

9

| 7. | Brokers. |

Landlord and Tenant each warrant to the other that it has had no dealing with any real estate broker or agent in connection with this Lease and that Landlord and Tenant know of no other real estate broker who is entitled to or can claim a commission in connection with this Lease. Landlord and Tenant each agree to indemnify, defend and hold the other harmless from and against any and all claims, demands, losses, liabilities, lawsuits, judgments, and costs and expenses (including, without limitation, reasonable attorneys’ fees and expenses), with respect to any alleged leasing commission or equivalent compensation alleged to be owing on account of each indemnifying party’s dealings with any real estate broker or agent. This Section 7 shall survive expiration or early termination of the Lease.

| 8. | Surrender; Holding Over. |

8.1 Surrender of Premises. Upon the expiration of the Term or sooner termination of this Lease, Tenant shall surrender all keys for the Premises to Landlord and exclusive possession of the Premises to Landlord, broom clean, in substantially the same good condition as existed on the Commencement Date, normal wear and tear and casualty excepted, with all of Tenant’s personal property and trade fixtures and equipment removed therefrom, including, but not limited to, the removal of any cubicles or other office furniture; provided, however, the HVAC system and diesel generator located on the Premises shall remain at the Premises upon surrender and shall be surrendered in good working order. In addition, Tenant shall repair any damage or alterations made to the Premises by Tenant; provided, however, that this obligation may be waived by written notice from Landlord to Tenant prior to the termination of the Lease. If such written notice is given, Tenant may surrender the Premises in its then “as is” condition, subject to Section 5.4 herein.

8.2 Hold Over. Tenant shall have no right to holdover possession of the Premises. Any holding over after the expiration or earlier termination of the Lease, without the express written consent of Landlord, shall constitute a default under this Lease. If Tenant does not surrender and vacate the Premises upon the termination of this Lease, Tenant shall be a tenant at sufferance and the parties having agreed, without limiting Landlord’s remedies provided in this Lease, that the daily rental rate shall be one hundred fifty percent (150%) of the Monthly Basic Rent, plus Additional Rent, and shall be due the first of each month, and shall otherwise be on the terms and conditions herein specified. If Tenant holds over without Landlord’s prior written consent, Tenant shall indemnify, protect and hold Landlord harmless from and against all Indemnified Claims (defined below) resulting from Tenant’s hold over.

8.3 No Effect on Landlord’s Rights. The foregoing provisions of this Section 8 are in addition to, and do not effect, Landlord’s right of re-entry or any other rights of Landlord hereunder or otherwise provided by law or equity.

10

| 9. | Taxes on Tenant’s Property. |

Tenant shall be liable for, and shall pay before delinquency, all taxes and assessments (real and personal) levied against any personal property, improvements or trade fixtures in or about the Premises (including any increase in the assessed value of the Premises based upon the value of any such personal property, improvements or trade fixtures) owned by Tenant. If any such taxes or assessments are levied against Landlord, Landlord may, after written notice to Tenant (and under proper protest if requested by Tenant) pay such taxes and assessments, and Tenant shall reimburse Landlord therefor upon demand by Landlord; provided, however, Tenant, at its sole cost and expense, shall have the right to bring suit in any court of competent jurisdiction to recover the amount of any such taxes and assessments so paid under protest.

| 10. | Condition of Premises; Repairs. |

Tenant hereby acknowledges that Tenant is currently occupying the Premises and agrees that the Premises is taken “AS-IS,” “with all faults,” “without any representations or warranties,” and Tenant further acknowledges and agrees that it has investigated and inspected the condition of the Premises and the suitability of same for Tenant’s purposes, and Tenant does hereby waive and disclaim any objection to, cause of action based upon, or claim that its obligations hereunder should be reduced or limited because of the condition of the Premises or the suitability of same for Tenant’s purposes.

| 11. | Alterations. |

Tenant shall not have any right to make any alterations to the Premises without in each event obtaining Landlord’s prior written consent, which consent may not be unreasonably withheld. Any such alterations shall be removed from the Premises at Tenant’s sole cost and expense upon the expiration or earlier termination of this Lease, subject to Section 8.1 above.

| 12. | Liens. |

Tenant shall not permit any mechanic’s, materialmen’s or other liens to be filed against all or any part of the Premises by reason of or in connection with any repairs, alterations, improvements or other work contracted for or undertaken by Tenant or any other act or omission of Tenant or Tenant’s agents, employees, contractors, licensees or invitees. NOTICE IS HEREBY GIVEN THAT LANDLORD SHALL NOT BE LIABLE FOR ANY LABOR, SERVICES OR MATERIALS FURNISHED OR TO BE FURNISHED TO TENANT, OR TO ANYONE HOLDING THE PREMISES THROUGH OR UNDER TENANT, AND THAT NO MECHANICS’ OR OTHER LIENS FOR ANY SUCH LABOR, SERVICES OR MATERIALS SHALL ATTACH TO OR AFFECT THE INTEREST OF LANDLORD IN THE PREMISES. Tenant shall indemnify, protect and hold Landlord harmless from and against all Indemnified Claims resulting from any mechanic’s, materialmen’s or other liens to be filed against all or any part of the Premises by reason of or in connection with any repairs, alterations, improvements or other work contracted for or undertaken by Tenant or any other act or omission of Tenant or Tenant’s agents, employees, contractors, licensees or invitees

11

| 13. | Assignment and Subletting. |

This Lease is personal to Tenant and Tenant shall not otherwise assign or sublease this Lease without Landlord’s written consent, which may be withheld in Landlord’s sole discretion. Notwithstanding the foregoing, Tenant may (without the consent of Landlord) assign this Lease, or sublet any portion of the Premises, to any entity that controls, is controlled by, or is under common control with, Tenant, and to any entity in connection with any merger, acquisition, reorganization of Tenant or its parent company, and to any entity that acquires all or substantially all of the ownership interest in (or assets of) Tenant or its parent company (each, a “Permitted Transfer”); provided (i) Tenant remains primarily liable for all obligations of Tenant under this Lease, and (ii) Tenant provides at least ten (10) business days prior written notice of any Permitted Transfer to Landlord.

| 14. | Indemnification and Exculpation. |

14.1 Assumption of Risk and Waiver. Unless caused by the negligence or willful misconduct of Landlord, its agents, employees or contractors, Landlord shall not be liable to Tenant, Tenant’s employees, agents or invitees for: (i) any damage to property of Tenant, or of others, located in, on or about the Premises, (ii) the loss of or damage to any property of Tenant or of others by theft or otherwise, (iii) any injury or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water, rain or leaks from any part of the Premises or from the pipes, appliance of plumbing works or from the roof, street or subsurface or from any other places or by dampness or by any other cause of whatsoever nature, or (iv) any such damage caused by others. Landlord shall in no event be liable to Tenant for any consequential damages or for loss of revenue or income and Tenant waives any and all claims for any such damages.

14.2 Indemnification.

(a) Except to the extent caused by the negligence or willful misconduct of Landlord, its agents, employees or contractors, Tenant shall be liable for, and shall indemnify, defend, protect and hold Landlord and its employees, contractors, agents and assigns harmless from and against, any and all claims, actual damages, judgments, suits, causes of action, losses, liabilities and expenses, including reasonable attorneys’ fees and court costs (collectively, “Indemnified Claims”), arising or resulting from (a) any occurrence at the Premises during the Term of this Lease, (b) the use of the Premises and conduct of Tenant’s business or any other activity, work or thing done, permitted or suffered by Tenant or its employees, contractors or agents, or (c) any default by Tenant of any obligations on Tenant’s part to be performed under the terms of this Lease or the terms of any contract or agreement to which Tenant is a party or by which it is bound, affecting this Lease or the Premises. The foregoing indemnification shall include, but shall not be limited to, any injury to, or death of, any person, or any loss of, or damage to, any property on the Premises, or on adjoining sidewalks, streets or ways, or connected with the use, condition or occupancy thereof. If any action or proceeding is brought against Landlord by reason of any such Indemnified Claims, Tenant, upon notice from Landlord, shall defend the same at Tenant’s expense by counsel reasonably acceptable to Landlord.

12

(b) Except with respect to Indemnified Claims for which Tenant is providing indemnification under Section 14.2(a) above, Landlord shall be liable for, and shall indemnify, defend, protect and hold Tenant and its employees, contractors, agents and assigns harmless from and against, any and all claims, actual damages, judgments, suits, causes of action, losses, liabilities and expenses, including reasonable attorneys’ fees and court costs to the extent arising or resulting from any negligent act or omission or willful misconduct of Landlord or its agents, employees, invitees, property manager and contractors. If any action or proceeding is brought against Tenant by reason of any such indemnified claims, Landlord, upon notice from Tenant, shall defend the same at Landlord’s expense by counsel reasonably acceptable to Tenant.

(c) The indemnification obligations under this Section 14.2 shall survive the expiration or earlier termination of this Lease.

| 15. | Damage or Destruction. |

15.1 Termination Rights. In the event the Premises are damaged by fire or other casualty in any material respect, then Landlord may, at its sole discretion, terminate this Lease immediately upon notice to Tenant; provided, however, that Landlord shall be entitled to retain all insurance proceeds obtained from the insurance relating to such casualty (and Tenant shall assign all such insurance proceeds to Landlord, if applicable). In the event Landlord elects not to terminate this Lease, Landlord shall repair, reconstruct and restore the Premises damaged by such casualty, in which event this Lease shall continue in full force and effect, without any abatement of rent and Tenant shall remain liable for all rents, covenants and obligations contained in this Lease.

| 16. | Eminent Domain. |

16.1 Taking. In case the whole of the Premises, or such part thereof as shall substantially interfere with Tenant’s use and occupancy of the Premises, shall be taken for any public or quasi-public purpose by any lawful power or authority by exercise of the right of appropriation, condemnation or eminent domain, or sold to prevent such taking, either party shall have the right to terminate this Lease effective as of the date possession is required to be surrendered to said authority and Landlord shall be entitled to any award paid in connection with such condemnation or eminent domain.

| 17. | Tenant’s Insurance. |

17.1 Types of Insurance. On or before the earlier of the Commencement Date and continuing during the entire Term, Tenant shall obtain and keep in full force and effect, the following insurance:

(a) Commercial general liability insurance coverage on an occurrence basis, including personal injury, bodily injury (including wrongful death), broad form property damage, operations hazard, owner’s protective coverage, contractual liability (including Tenant’s indemnification obligations under this Lease), and liquor liability (if Tenant serves alcohol on the Premises), with an initial combined single limit of liability of not less than Five Million Dollars ($5,000,000.00) . This coverage may be obtained through a separate policy or in combination with another excess liability or umbrella policy.

13

(b) Worker’s compensation and employer’s liability insurance, in statutory amounts and limits, covering all persons employed in connection with any work done on or about the Premises for which claims for death or bodily injury could be asserted against Landlord, Tenant or the Premises.

17.2 Requirements. Each policy required to be obtained by Tenant hereunder shall: (a) be issued by insurers authorized to do business in the State of California and rated not less than financial class VIII, and not less than policyholder rating A- in the most recent version of Best’s Key Rating Guide; and (b) name Tenant as named insured thereunder and Landlord as additional insureds there under, except with respect to the worker’s compensation and employer’s liability insurance policy, for which the Landlord shall not be named as an additional insured. Tenant shall provide Landlord with certificates of insurance, confirming the above as of the Commencement Date and shall cause replacement policies or certificates to be delivered to Landlord not less than ten (10) days prior to the expiration of any such policy or policies.

| 18. | Landlord’s Insurance. |

During the Term of this Lease, Landlord shall carry special form insurance, including fire and extended coverage, sprinkler leakage, flood, earthquake, vandalism, and malicious mischief upon the Premises, along with commercial general liability insurance, in such reasonable amounts and with such reasonable deductibles as would be carried by a prudent owner of a similar site, as determined in Landlord’s reasonable discretion. At Landlord’s option, such insurance may be carried under any blanket or umbrella policies which Landlord has in force for other projects. Tenant shall pay the costs of any insurance maintained by Landlord with respect to the Premises and the improvements located thereon as Additional Rent in accordance with Section 3.2.

| 19. | Default. |

19.1 Tenant’s Default. The occurrence of any one or more of the following events shall constitute a default under this Lease by Tenant:

(a) the failure by Tenant to make any payment of Rent or Additional Rent or any other payment required to be made by Tenant hereunder, when such failure continues for five (5) days after written notice thereof from Landlord that such payment was not received when due;

(b) the failure by Tenant to observe or perform any of the express or implied covenants or provisions of this Lease to be observed or performed by Tenant, other than as specified in Section 19.1(a) above and Sections 20(b) and 21 hereafter, where such failure shall continue for a period of thirty (30) days after written notice thereof from Landlord to Tenant; provided, however, that, if the nature of Tenant’s default is such that more than thirty (30) days are reasonably required for its cure, then Tenant shall not be deemed to be in default if Tenant shall commence such cure within said thirty (30) day period and thereafter diligently prosecute such cure to completion, which completion shall occur not later than sixty (60) days from the date of such notice from Landlord;

14

(c) (i) the making by Tenant of any general assignment for the benefit of creditors, (ii) the filing by or against Tenant of a petition to have Tenant adjudged a bankrupt or a petition for reorganization or arrangement under any law relating to bankruptcy (unless, in the case of a petition filed against the Tenant, the same is dismissed within sixty (60) days), (iii) the appointment of a trustee or receiver to take possession of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease where possession is not restored to Tenant within sixty (60) days, or (iv) the attachment, execution or other judicial seizure of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease where such seizure is not discharged within sixty (60) days;

(d) Any insurance required to be maintained by Tenant pursuant to this Lease shall be canceled or terminated or shall expire or be reduced or materially changed, except as permitted in this Lease; and

(e) Any failure by Tenant to discharge any lien or encumbrance placed on the Premises or any part thereof due to Tenant’s work of improvements within thirty (30) days after the date such lien or encumbrance is filed or recorded against the Premises or any part thereof.

Any notice sent by Landlord to Tenant pursuant to this Section 19 shall be in lieu of, and not in addition to, any notice required under California Code of Civil Procedure, Section 1161.

19.2 Remedies. In the event of any such default by Tenant, Landlord shall have any and all remedies available pursuant to this Lease and at law or in equity, subject to Landlord’s duty to mitigate its damages.In addition to any other remedies available to Landlord under this Lease, at law, or in equity, Landlord shall have the immediate option to terminate this Lease and all rights of Tenant hereunder. In the event that Landlord shall elect to so terminate this Lease, then Landlord may recover from Tenant:

(a) the worth at the time of award of any unpaid Rent which had been earned at the time of such termination; plus

(b) the worth at the time of the award of the amount by which the unpaid Rent which would have been earned after termination until the time of award exceeds the amount of such rental loss that Tenant proves could have been reasonably avoided; plus

(c) the worth at the time of award of the amount by which the unpaid Rent for the balance of the term after the time of award exceeds the amount of such rental loss that Tenant proves could be reasonably avoided; plus

(d) any other amount necessary to compensate Landlord for all detriment proximately caused by Tenant’s failure to perform its obligations under this Lease or which, in the ordinary course of things, would be likely to result there from.

As used in Sections 19.2(a) and 19.2(b) above, the “worth at the time of award” is computed by allowing interest at the legal rate. As used in Section 19.2(c) above, the “worth at the time of award” is computed by discounting such amount at the discount rate of the Federal Reserve Bank of San Francisco at the time of award plus one percent (1%).

15

19.3 Late Charges. Tenant acknowledges that, in addition to interest costs, the late payments by Tenant to Landlord of any Monthly Basic Rent or other sums due under this Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount of such costs being extremely difficult and impractical to fix. Accordingly, if any monthly installment of Monthly Basic Rent or any other amount payable by Tenant hereunder is not received by Landlord within five (5) days of the due date thereof, Tenant shall pay to Landlord an additional sum of five percent (5%) of the overdue amount as a late charge. The parties agree that such late charge represents a fair and reasonable estimate of the costs that Landlord will incur by reason of any late payment. Acceptance of a late charge shall not constitute a waiver of Tenant’s default with respect to the overdue amount or prevent Landlord from exercising any of the other rights and remedies available to Landlord under this Lease or at law or in equity now or hereafter in effect.

| 20. | Subordination. |

(a) This Lease shall be subordinate to any mortgage, deed of trust, or any other hypothecation or security now or hereafter placed upon the Premises and to any and all advances made on the security thereof and to all renewals, modifications, consolidations, replacements and extensions thereof. Notwithstanding such subordination, but subject to Tenant’s delivery of an attornment, subordination and non-disturbance pursuant to Section 20(b) below, Tenant’s right to quiet possession of the Premises shall not be disturbed if Tenant is not in default (subject to all applicable notice and cure periods) and so long as Tenant shall pay Rent and observe and perform all of the provisions of this Lease, unless this Lease is otherwise terminated pursuant to its terms.

(b) Tenant agrees to execute any documents required to effectuate an attornment, subordination and non-disturbance. Tenant’s failure to execute such documents within ten (10) business days after written demand shall constitute a material default by Tenant hereunder without the applicability of any notice and cure periods.

| 21. | Estoppel Certificate. |

Within ten (10) business days following Landlord’s written request, Tenant shall execute and deliver to Landlord an estoppel certificate certifying: (a) the Commencement Date of this Lease; (b) that this Lease is unmodified and in full force and effect (or, if modified, that this Lease is in full force and effect as modified, and stating the date and nature of such modifications); (c) the date to which the Rent and other sums payable under this Lease have been paid; (d) that there are not, to the best of Tenant’s knowledge, any defaults under this Lease by either party, except as specified in such certificate; and (e) such other matters relating to this Lease as are reasonably requested by Landlord. Any such estoppel certificate delivered pursuant to this Section 21 may be relied upon by any mortgagee, beneficiary, purchaser or prospective purchaser of any portion of the Premises, as well as their assignees. Tenant’s failure to deliver such estoppel certificate within such time shall constitute a material default hereunder without the applicability of any notice and cure periods.

16

| 22. | Quiet Use and Enjoyment. |

Landlord covenants, in lieu of any implied covenant of quiet possession or quiet enjoyment, that so long as Tenant is in compliance with the covenants and conditions set forth in this Lease, Tenant shall have the right to quiet use and enjoyment of the Premises without hindrance or interference from Landlord or those claiming through Landlord, subject to the covenants and conditions set forth in this Lease.

| 23. | Transfer of Landlord’s Interest. |

Landlord shall have the absolute right to transfer all or any portion of its respective title and interest in the Premises or this Lease without the consent of or prior notice to Tenant, and such transfer or subsequent transfer shall not be deemed a violation on Landlord’s part of any of the terms and conditions of this Lease, provided that Tenant’s unapplied Security Deposit is transferred to such transferee, as the new landlord, and the new landlord agrees in writing to assume the obligations of Landlord under this Lease.

| 24. | Limitation on Landlord’s Liability. |

Notwithstanding anything contained in this Lease to the contrary, the obligations of Landlord under this Lease (including any actual or alleged breach or default by Landlord) do not constitute personal obligations of the individual partners, directors, officers, members or shareholders of Landlord and Tenant shall not seek recourse against the individual partners, directors, officers, members or shareholders of Landlord, or any of their personal assets for satisfaction of any liability with respect to this Lease. In addition, in consideration of the benefits accruing hereunder to Tenant and notwithstanding anything contained in this Lease to the contrary, Tenant hereby covenants and agrees for itself and all of its successors and assigns that the liability of Landlord for its obligations under this Lease (including any liability as a result of any actual or alleged failure, breach or default hereunder by Landlord), shall be limited solely to Landlord’s interest in the Premises and no other assets of Landlord.

| 25. | Miscellaneous. |

25.1 Governing Law. This Lease shall be construed and interpreted in accordance with the laws of the State of California. The parties acknowledge and agree that no rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall be employed in the interpretation of this Lease, including the Exhibits and any Addenda attached hereto. All captions in this Lease are for reference only and shall not be used in the interpretation of this Lease. Whenever required by the context of this Lease, the singular shall include the plural, the masculine shall include the feminine, and vice versa.

25.2 Successors and Assigns. Subject to Section 13 above, all of the covenants, conditions and provisions of this Lease shall be binding upon, and shall inure to the benefit of, the parties hereto and their respective heirs, personal representatives and permitted successors and assigns.

17

25.3 Professional Fees. If either party should bring suit against the other with respect to this Lease, including for unlawful detainer or any other relief against the other hereunder, then all reasonable costs and expenses incurred by the prevailing party therein (including, without limitation, its reasonable appraisers’, accountants’, attorneys’ and other professional fees and court costs), shall be paid by the other party.

25.4 Waiver. The waiver by either party of any breach by the other party of any term, covenant or condition herein contained shall not be deemed to be a waiver of any subsequent breach of the same or any other term, covenant and condition herein contained, nor shall any custom or practice which may become established between the parties in the administration of the terms hereof be deemed a waiver of, or in any way affect, the right of any party to insist upon the performance by the other in strict accordance with said terms.

25.5 Time. Time is of the essence with respect to performance of every provision of this Lease in which time or performance is a factor. All references in this Lease to “days” shall mean calendar days unless specifically modified herein to be “business day,” which is any day which falls on Monday through Friday, excluding holidays observed by the United States Postal Service.

25.6 Prior Agreements; Amendments. This Lease (and the Exhibits attached hereto) contain all of the covenants, provisions, agreements, conditions and understandings between the parties concerning the leasing of the Premises and any other matter covered or mentioned in this Lease, and no prior agreement or understanding, oral or written, express or implied, pertaining to the Premises or any such other matter shall be effective for any purpose. No provision of this Lease may be amended or added to except by an agreement in writing signed by the parties hereto or their respective successors in interest. The parties acknowledge that all prior agreements, representations and negotiations are deemed superseded by the execution of this Lease to the extent they are not expressly incorporated herein.

25.7 Exhibits. All Exhibits attached to this Lease are hereby incorporated in this Lease as though set forth at length herein.

25.8 Accord and Satisfaction. No payment by Tenant or receipt by Landlord of a lesser amount than the Rent payment herein stipulated shall be deemed to be other than on account of the Rent, nor shall any endorsement or statement on any check or any letter accompanying any check or payment as Rent be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of such Rent or pursue any other remedy provided in this Lease.

25.9 Counterparts. This Lease may be executed in one or more counterparts, each of which shall constitute an original and all of which shall be one and the same agreement. The parties contemplate that they may be executing counterparts of this Lease transmitted by facsimile machine or electronic mail in PDF format, and agree and intend that a signature by either facsimile machine or electronic mail in PDF format shall bind the party so signing with the same effect as though the signature were an original signature.

[Remainder of Page Intentionally Left Blank; Signature Page Follows]

18

IN WITNESS WHEREOF, the parties have executed this Lease as of the day and year first above written.

| TENANT:

|

LANDLORD:

| |||||||

| Synaptics Incorporated, | , | |||||||

| a Delaware corporation | a | |||||||

| By: | By: | |||||||

| Print Name: | Print Name: | |||||||

| Print Title: | Print Title: | |||||||

19

EXHIBIT A

PREMISES

EXHIBIT A