Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-16783

For the fiscal year ended December 31, 2011

VCA Antech, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4097995 | |

| (State or other jurisdiction of incorporation or organization)

12401 West Olympic Boulevard, Los Angeles, California (Address of principal executive offices) |

(I.R.S. employer identification no.)

90064-1022 (Zip code) | |

| Registrant’s telephone number, including area code: (310) 571-6500

Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share |

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ.

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2011, was approximately $1.8 billion, computed by reference to the price of $21.20 per share, the price at which the common equity was last sold on such date as reported on the NASDAQ Global Select Market. For purposes of this computation, it is assumed that the shares beneficially held by directors and officers of the registrant would be deemed to be stock held by affiliates. Non-affiliated common stock outstanding at June 30, 2011 was 83,394,675 shares.

Total common stock outstanding at February 23, 2012 was 87,328,090 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Parts of the definitive Proxy Statement to be delivered to stockholders in connection with the 2011 Annual Meeting of Stockholders are incorporated by reference into Items 10, 11, 12, 13 and 14 hereof.

Table of Contents

VCA Antech, Inc. and Subsidiaries

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

10 | |||||

| Item 1B. |

16 | |||||

| Item 2. |

16 | |||||

| Item 3. |

16 | |||||

| PART II | ||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 17 | ||||

| Item 6. |

19 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||||

| Item 7A. |

41 | |||||

| Item 8. |

42 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

89 | ||||

| Item 9A. |

89 | |||||

| Item 9B. |

89 | |||||

| PART III | ||||||

| Item 10. |

90 | |||||

| Item 11. |

90 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 90 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

90 | ||||

| Item 14. |

90 | |||||

| PART IV | ||||||

| Item 15. |

90 | |||||

| 95 | ||||||

Table of Contents

Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they materialize or prove incorrect, could cause our results and the results of our consolidated subsidiaries to differ materially from those expressed or implied by these forward-looking statements. We generally identify forward-looking statements in this report using words like “believe,” “intend,” “seek,” “expect,” “estimate,” “may,” “plan,” “should plan,” “project,” “contemplate,” “anticipate,” “predict,” “potential,” “continue,” or similar expressions. You may find some of these statements below and elsewhere in this report. These forward-looking statements are not historical facts and are inherently uncertain and outside of our control. Any or all of our forward-looking statements in this report may turn out to be wrong. They can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. Many factors mentioned in our discussion in this report will be important in determining future results. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially. Factors that may cause our plans, expectations, future financial condition and results to change include those items discussed in Risk Factors in Item 1A of this annual report.

PART I

| ITEM 1. | BUSINESS |

Company Overview

We are a leading national animal healthcare company operating in the United States and Canada. We provide veterinary services and diagnostic testing to support veterinary care, we sell diagnostic imaging equipment and other medical technology products and related services to the veterinary market and we provide various communication, marketing solutions and other services to the veterinary community.

Our animal hospitals offer a full range of general medical and surgical services for companion animals, as well as specialized treatments including advanced diagnostic services, internal medicine, oncology, ophthalmology, dermatology and cardiology. In addition, we provide pharmaceutical products and perform a variety of pet wellness programs including health examinations, diagnostic testing, routine vaccinations, spaying, neutering and dental care. Our network of animal hospitals is supported by more than 2,500 veterinarians and had approximately 7.1 million patient visits in 2011. Our network of veterinary diagnostic laboratories provides sophisticated testing and consulting services used by veterinarians in the detection, diagnosis, evaluation, monitoring, treatment and prevention of diseases and other conditions affecting animals. Our network of veterinary diagnostic laboratories provides diagnostic testing for over 16,000 clients, which includes standard animal hospitals, large animal practices, universities and other government organizations. Our medical technology business sells digital radiography and ultrasound imaging equipment, provides education and training on the use of that equipment, and provides consulting and mobile imaging services. Our VetStreet business, provides services to veterinary practices, pharmaceutical manufacturers, and the pet owning community. Our services to veterinary practices include subscriptions to both our Pro and Consumer Pet Portals. The Pro Pet Portal provides an online platform for the veterinarian to offer secure individualized portals for pet owners as well as practice websites that are branded to the individual veterinary clinic. We also sell appointment reminder notices that are sent to pet owners on behalf of their clinics. Our services to Manufacturers predominately involve targeted marketing programs that are based upon the detailed data extracted from animal hospitals whom are subscribers to our Pro Pet Portal.

Our principal executive offices are located at 12401 West Olympic Boulevard, Los Angeles, California. We can be contacted at (310) 571-6500.

1

Table of Contents

Company History

Our company was formed in 1986 as a Delaware corporation and has since established a position in the animal healthcare industry through both internal growth and by acquisitions. By our twentieth anniversary in 2006 we operated a total of 379 animal hospitals, 33 laboratories, and a supplier of digital radiography and ultrasound imaging equipment. Subsequent to 2006, our company continued to grow by adding, additional laboratories, independent animal hospitals, animal hospital chains and other ancillary businesses, the following of which were noteworthy:

| • | On June 1, 2007, we acquired Healthy Pet Corp. (“Healthy Pet”), which operated 44 animal hospitals and a small laboratory, which primarily serviced its own animal hospitals, as of the acquisition date. This acquisition allowed us to expand our animal hospital operations, particularly in Massachusetts, Connecticut, Virginia and Georgia. |

| • | On July 1, 2009, we acquired Eklin Medical Systems, Inc. (“Eklin”), a leading seller of digital radiography, ultrasound and practice management software systems in the veterinary market. We combined the operations of Eklin with our Sound Technologies, Inc (“STI”) business unit and the resulting combined company is the largest supplier of diagnostic imaging equipment and other medical technology products tailored specifically for the veterinary market. |

| • | On July 1 2010, we acquired Pet DRx Corporation (“Pet DRx”), which operated 23 animal hospitals as of the acquisition date. This acquisition allowed us to expand our animal hospital operations in California. |

| • | On July 11, 2011, we acquired BrightHeart Veterinary Centers (“BrightHeart”) which operated nine animal hospitals, eight of which focus on the delivery of specialty and emergency medicine. The acquisition will increase our level of market recognition in areas where we have an existing market presence. |

| • | On August 9, 2011, we acquired Vetstreet, Inc., formerly known as MediMedia Animal Health, LLC (“Vetstreet”), the nation’s largest provider of online communications, professional education and marketing solutions to the veterinary community. The acquisition of Vetstreet expands the breadth of our product offerings to the veterinary community and is expected to provide long-term synergies to our existing businesses. |

| • | On January 31, 2012 we expanded our operations into Canada with an increased investment in Associate Veterinary Clinics (1984) Limited, which operates 44 hospitals in three Canadian provinces. |

Industry Overview

According to American Pet Products Association, Inc’s. (“APPA”) 2011-2012 APPA National Pet Owners Survey, the United States population of companion animals is approximately 189 million, including about 165 million dogs and cats. APPA estimates that over $29 billion was spent in the United States on pets in 2011 for veterinary care, supplies, medicine and boarding and grooming. The survey indicated that the ownership of pets is widespread with approximately 73 million, or 62%, of U.S. households owning at least one pet, including companion and other animals. Specifically, 46 million households owned at least one dog and 39 million households owned at least one cat.

We believe that among pet owners there is a growing awareness of pet health and wellness, including the benefits of preventive care and specialized services. As technology continues to migrate from the human healthcare sector into the practice of veterinary medicine, more sophisticated treatments, diagnostic tests and equipment are becoming available to treat companion animals. These new and increasingly complex procedures, diagnostic tests, including laboratory testing and advanced imaging, and pharmaceuticals are gaining wider acceptance as pet owners are exposed to these previously unconsidered treatment programs through their exposure with this technology in human healthcare, and through literature and marketing programs sponsored by large pharmaceutical and pet nutrition companies.

Even as treatments available in veterinary medicine become more complex, prices for veterinary services typically remain a low percentage of a pet owner’s income, facilitating payment at the time of service. Unlike the

2

Table of Contents

human healthcare industry, providers of veterinary services are not dependent on third-party payers in order to collect fees. As such, providers of veterinary services typically do not have the problems of extended payment collection cycles or pricing pressures from third-party payers faced by human healthcare providers. Outsourced laboratory testing and diagnostic equipment sales are wholesale businesses that collect payments directly from animal hospitals under standard industry payment terms. Fees for services provided in our animal hospitals are due at the time of service. In 2011, over 99% of our animal hospital services were paid at the time of service. In addition, over the past three fiscal years our bad debt expense has averaged less than 1% of total revenue.

The practice of veterinary medicine is subject to seasonal fluctuation. In particular, demand for veterinary services is significantly higher during the warmer months because pets spend a greater amount of time outdoors, where they are more likely to be injured and are more susceptible to disease and parasites. In addition, use of veterinary services may be affected by levels of infestation of fleas, heartworms and ticks, and the number of daylight hours.

Animal Hospital Industry

Animal healthcare is provided predominately by the veterinarian practicing as a sole practitioner, or as part of a larger group practice or hospital. Veterinarians diagnose and treat animal illnesses and injuries, perform surgeries, provide routine medical exams and prescribe medication. Some veterinarians specialize by type of medicine, such as orthopedics, dentistry, ophthalmology or dermatology. Others focus on a particular type of animal. The principal factors in a pet owner’s decision as to which veterinarian to use include convenient location and hours, personal recommendations, reasonable fees and quality of care.

According to the American Veterinary Medical Association, the U.S. market for veterinary services is highly fragmented with more than 51,000 veterinarians practicing at the end of 2011. We have estimated that there are over 22,000 companion animal hospitals operating at the end of 2011. Although most animal hospitals are single-site, sole-practitioner facilities, we believe veterinarians are gravitating toward larger, multi-doctor animal hospitals that provide state-of-the-art facilities, treatments, methods and pharmaceuticals to enhance the services they can provide their clients.

Well-capitalized animal hospital operators have the opportunity to supplement their internal growth with selective acquisitions. We believe the extremely fragmented animal hospital industry is consolidating due to:

| • | the choice of some owners of animal hospitals to diversify their investment portfolio by selling all or a portion of their investment in the animal hospital; |

| • | the purchasing, marketing and administrative cost advantages that can be realized by a large, multiple location, multi-doctor veterinary provider; |

| • | the cost of financing equipment purchases and upgrading technology necessary for a successful practice; |

| • | the desire of veterinarians to focus on practicing veterinary medicine, rather than spending large portions of their time performing the administrative tasks necessary to operate an animal hospital; and |

| • | the appeal to many veterinarians of the benefits and flexible work schedule that is not typically available to a sole practitioner or single-site provider. |

Diagnostic Laboratory Industry

Veterinarians use laboratory tests to diagnose and monitor illnesses and conditions through the detection of substances in urine, tissue, fecal and blood samples, and other specimens. As is the case with the physician treating a human patient, laboratory diagnostic testing is becoming a routine diagnostic tool used by the veterinarian.

Veterinary laboratory tests are performed primarily at veterinary diagnostic laboratories, universities or at animal hospitals using on-site diagnostic equipment. For certain tests, on-site diagnostic equipment can provide more timely results than outside laboratories, but this in-house testing requires the animal hospital or veterinarian to purchase or lease the equipment, maintain and calibrate the equipment periodically to avoid testing errors,

3

Table of Contents

employ trained personnel to operate it and purchase testing supplies. Conversely, veterinary diagnostic laboratories can provide a wider range of tests than generally are available on-site at most animal hospitals and do not require any up-front investment on the part of the animal hospital or veterinarian. Leading veterinary diagnostic laboratories also employ highly trained individuals who specialize in the detection and diagnosis of diseases and thus are a valuable resource for the veterinarian.

Our laboratories offer a broad spectrum of standard and customized tests to the veterinary market, convenient sample pick-up times, rapid test reporting and access to professional consulting services provided by trained specialists. Providing the customer with this level of service at competitive prices requires high throughput volumes due to the operating leverage associated with the laboratory business. As a result, larger laboratories are likely to have a competitive advantage relative to smaller laboratories.

We believe that the outsourced laboratory testing market is an integral segment of the animal healthcare industry as a result of:

| • | the emphasis in veterinary education on diagnostic tests and the trend toward specialization in veterinary medicine, which are causing veterinarians to increasingly rely on tests for more accurate diagnoses; |

| • | the continued technological developments in veterinary medicine, which are increasing the breadth of tests offered; and |

| • | the continued focus on wellness, early detection and monitoring programs in veterinary medicine. |

Business Strategy

Our business strategy is to continue expanding our market leadership in animal healthcare through our Animal Hospital, Laboratory, Medical Technology and VetStreet operating segments. Key elements to our strategy include:

| • | Capitalizing on our Leading Market Position to Generate Revenue Growth. Our leading market position in the animal hospital, veterinary laboratory and the online communications markets position us to capitalize on favorable growth trends in the animal healthcare industry. In our animal hospitals, we seek to generate revenue growth by capitalizing on the growing emphasis on pet health and wellness. In our laboratories, we seek to generate revenue growth by taking advantage of the growing number of outsourced diagnostic tests, the opportunities to expand the testing that we provide and by increasing our market share. We continually educate veterinarians on new and existing technologies and tests available to diagnose medical conditions. Further, we leverage the knowledge of our specialists by providing veterinarians with extensive client support in utilizing and understanding these diagnostic tests. Our Medical Technology business seeks to leverage our strengths in the broader veterinary markets by introducing technologies, products and services to the veterinary market. We seek to generate revenue growth by increasing our market share and educating veterinarians on new and existing technologies. In our VetStreet business, we seek to generate revenue growth by capitalizing on the growing usage of online media to both aid pet owners in diagnosing illnesses and to purchase necessary medications and other pet related products. |

| • | Leveraging Established Infrastructure to Improve Margins. We intend to leverage our established Animal Hospital and Laboratory infrastructure to increase our operating margins. Due to our established networks and the fixed cost nature of our business model, we are able to realize high margins on incremental revenue from Animal Hospital and Laboratory customers. For example, given that our nationwide transportation network servicing our Laboratory customers is a relatively fixed cost, we are able to achieve significantly higher margins on most incremental tests ordered by the same customer when picked up by our couriers at the same time. |

| • | Utilizing Enterprise-Wide Information Systems to Improve Operating Efficiencies. Our Laboratory and the majority of our Animal Hospital operations utilize enterprise-wide management information systems. We believe that these common systems enable us to more effectively manage the key operating metrics that drive our business. With the aid of these systems, we seek to standardize pricing, expand the services we provide and increase volume through targeted marketing programs. |

4

Table of Contents

| • | Pursuing Selected Acquisitions. The fragmentation of the animal hospital industry provides us with significant expansion opportunities in our Animal Hospital segment. Depending upon the attractiveness of the candidates and the strategic fit with our existing operations, we intend to acquire independent animal hospitals each year with aggregate annual revenue of approximately $50 million to $85 million. Our overall acquisition strategy involves the identification of high-quality practices where we can create additional value through the services and scale we can provide. Our typical candidate mirrors the profile of our existing animal hospital base. These acquisitions will be used to both expand existing markets and to enter into new geographic areas. In addition, we also evaluate the acquisition of animal hospital chains, laboratories or related businesses if favorable opportunities are presented. We intend primarily to use cash in our acquisitions but, depending on the timing and amount of our acquisitions, we may use stock or debt. |

Business Segments

We report our results of operations through two reportable segments: Animal Hospital and Laboratory. Our Vetstreet and Medical Technology operating segments did not meet the materiality requirements to be presented as separate reportable segments. Accordingly, they are grouped into an “All Other” category.

Information regarding revenue and operating income, attributable to each of our reportable segments, is included in the Segment Results section within Management’s Discussion and Analysis of Financial Condition and Results of Operations, and within Note 14, Lines of Business, of our Notes to Consolidated Financial Statements, which are incorporated herein by reference.

Animal Hospital

At December 31, 2011, we operated 541 animal hospitals serving 41 states. Our Animal Hospital revenue accounted for 77%, 76% and 76% of total consolidated revenue in 2011, 2010 and 2009, respectively.

Services

In addition to general medical and surgical services, we offer specialized treatments for companion animals, including advanced diagnostic services, internal medicine, oncology, ophthalmology, dermatology and cardiology. We also provide pharmaceutical products for use in the delivery of treatments by our veterinarians and pet owners. Many of our animal hospitals offer additional services, including grooming, bathing and boarding. We also sell specialty pet products at our animal hospitals, including pet food, vitamins, therapeutic shampoos and conditioners, flea collars and sprays, and other accessory products.

Animal Hospital Network

We seek to provide quality care in clean, attractive facilities that are generally open between 10 to 15 hours per day, six to seven days per week. Our typical animal hospital:

| • | is located in a 4,000 to 6,000 square-foot, freestanding facility in an attractive location; |

| • | has annual revenue between $1 million and $3 million; |

| • | is supported by three to five veterinarians; and |

| • | has an operating history of over 10 years. |

5

Table of Contents

As of December 31, 2011, our network of freestanding, full-service animal hospitals had facilities located in the following states and one Canadian province:

| California |

106 | North Carolina* | 7 | |||

|

Texas* |

48 | Minnesota* | 6 | |||

| Washington* |

33 | New Mexico | 6 | |||

| Florida |

30 | Alaska | 5 | |||

| New York* |

26 | Delaware | 4 | |||

| Massachusetts |

25 | New Hampshire* | 4 | |||

| Pennsylvania |

23 | Wisconsin | 4 | |||

| Illinois |

19 | Hawaii | 3 | |||

| Virginia |

18 | Missouri | 3 | |||

| Georgia |

18 | Nebraska* | 3 | |||

| Colorado |

17 | Rhode Island* | 3 | |||

| Connecticut |

16 | South Carolina | 3 | |||

| Arizona |

14 | Louisiana* | 2 | |||

| Indiana |

13 | Vermont | 2 | |||

| New Jersey* |

13 | Kansas* | 2 | |||

| Ohio |

12 | Alabama* | 1 | |||

| Michigan* |

11 | Kentucky | 1 | |||

| Maryland |

11 | Tennessee | 1 | |||

| Oregon* |

10 | Utah | 1 | |||

| Oklahoma |

8 | West Virginia* | 1 | |||

| Nevada |

7 | |||||

| Alberta, Canada* |

1 |

| * | States and Canadian province with laws, rules and regulations which require that veterinary medical practices be owned by licensed veterinarians and that corporations which are not owned by licensed veterinarians refrain from providing, or holding themselves out as providers of, veterinary medical care. In these states/province we provide management and other administrative services to veterinary practices rather than owning such practices or providing such care. |

Marketing

We direct our marketing efforts toward increasing the number of annual visits from existing clients through customer education efforts and toward attracting new clients to our network of hospitals through online and offline initiatives. We inform and educate our clients about pet wellness and quality care through mailings of HealthyPet Magazine, which focuses on pet care and wellness. We also market through targeted demographic mailings regarding specific pet health issues and collateral health material made available at each animal hospital. With these internal marketing programs, we seek to leverage our existing customer base by increasing the number and intensity of the services received during each visit. We send reminder notices to increase awareness of the advantages of regular, comprehensive veterinary medical care, including preventive care such as early disease detection exams, vaccinations, dental screening and geriatric care. We also have expanded our online capabilities both internally and through our acquisition of VetStreet. Our internal efforts involve offering increased convenience for our clients to book appointments or find detailed health related materials on our hospital websites. We also enter into referral arrangements with local pet shops, humane societies and veterinarians to increase our client base. We seek to obtain referrals from veterinarians by promoting our specialized diagnostic and treatment capabilities to veterinarians and veterinary practices that cannot offer their clients these services. Through our acquisition and integration of VetStreet, we will be able to provide more robust health and wellness information to the pet owning community that we expect will attract additional clients to both VCA and non-VCA hospitals.

6

Table of Contents

Personnel

Our animal hospitals generally employ a staff of between 20 and 30 full-time-equivalent employees, depending upon the facility’s size and customer base. The staff includes administrative and technical support personnel, three to five veterinarians, and a hospital manager who supervises the day-to-day activities of the facility.

We actively recruit qualified veterinarians and technicians and are committed to supporting continuing education for our professional staff. We operate post-graduate teaching programs for veterinarians at 23 of our facilities, which train approximately 152 veterinarians each year. We believe that these programs enhance our reputation in the veterinary profession and further our ability to continue to recruit the most talented veterinarians.

We seek to establish an environment that supports the veterinarian in the delivery of quality medicine and fosters professional growth through increased patient flow and a diverse case mix, continuing education, state-of-the-art equipment and access to specialists. We believe our animal hospitals offer attractive employment opportunities to veterinarians because of our professional environment, competitive compensation, management opportunities, employee benefits not generally available to a sole practitioner, flexible work schedules that accommodate personal lifestyles and the ability to relocate to different regions of the country.

We have established a medical advisory board to support our operations. Our advisory board, under the direction of our Chief Medical Officer, recommends medical standards for our network of animal hospitals and is comprised of veterinarians recognized for their outstanding knowledge and reputations in the veterinary field. Our advisory board members represent both the different geographic regions in which we operate and the medical specialties practiced by our veterinarians; and three members are faculty members at highly-ranked veterinary colleges. Additionally, our regional medical directors, a group of highly experienced veterinarians, are also closely involved in the development and implementation of our medical programs.

Laboratory

We operate a full-service, veterinary diagnostic laboratory network serving all 50 states and certain areas in Canada. Our Laboratory revenue accounted for 18%, 20% and 21% of total consolidated revenue in 2011, 2010 and 2009, respectively. We service a diverse customer base of over 16,000 clients including animal hospitals we operate, which accounted for 14%, 12% and 10% of total Laboratory revenue in 2011, 2010 and 2009, respectively.

Services

Our diagnostic spectrum includes over 300 different tests in the area of chemistry, pathology, endocrinology, serology, hematology and microbiology, as well as tests specific to particular diseases. We do not conduct experiments on animals.

Although modified to address the particular requirements of the species tested, the tests performed in our veterinary laboratories are similar to those performed in human clinical laboratories and utilize similar laboratory equipment and technologies. We believe that the growing concern for animal health, combined with the movement of veterinary medicine toward increasing specialization, may result in the migration of additional areas of human testing into the veterinary field.

Given the recent advancements in veterinary medical technology and the increased breadth and depth of knowledge required for the practice of veterinary medicine, many veterinarians solicit the knowledge and experience of our specialists to interpret test results to aid in the diagnosis of illnesses and to suggest possible treatment alternatives. Our diagnostic experts include veterinarians, chemists and other scientists with expertise in pathology, internal medicine, oncology, cardiology, dermatology, neurology and endocrinology. Because of our specialists involvement, we believe the quality of our service further distinguishes our laboratory services as a premiere service provider.

7

Table of Contents

Laboratory Network

At December 31, 2011, we operated 53 veterinary diagnostic laboratories. Our laboratory network includes:

| • | primary hubs that are open 24 hours per day and offer a full-testing menu; |

| • | secondary laboratories that are open 24 hours per day and offer a wide-testing menu servicing large metropolitan areas; and |

| • | short-term assessment and treatment (“STAT”) laboratories that service other locations with demand sufficient to warrant nearby laboratory facilities and are open primarily during daytime hours. |

We connect our laboratories to our customers with what we believe is the industry’s largest transportation network, picking up requisitions daily through an extensive network of drivers and independent couriers. Customers outside our transportation network use FedEx to send specimens to our laboratory just outside of Memphis, Tennessee, which permits rapid and cost-efficient testing because of the proximity to the primary sorting facility of FedEx.

In 2011, we derived approximately 83% of our Laboratory revenue from major metropolitan areas, where we offer twice-a-day pick-up service and same-day results. In addition, in these areas we generally offer to report results within three hours of pick-up. Outside of these areas, we typically provide test results to veterinarians before 8:00 a.m. the day following pick-up.

Sales, Marketing and Client Service

Our full-time sales and field-service representatives market laboratory services and maintain relationships with existing customers. Our sales force is compensated via salary plus commission and organized along geographic regions. We support our sales efforts by strengthening our industry-leading team of specialists, developing marketing literature, attending trade shows, participating in trade associations and providing educational services to veterinarians. Our client-service representatives respond to customer inquiries, provide test results and, when appropriate, introduce the customer to other services offered by the laboratory.

Personnel

Each of our primary and secondary laboratory locations includes a manager, supervisors for each department and personnel for laboratory testing. In addition, we employ or contract with specialists to interpret test results to assist veterinarians in the diagnosis of illnesses and to suggest possible treatment alternatives.

We actively recruit qualified personnel and are committed to supporting continuing education for our professional staff. We have internal training programs for routine testing procedures to improve the skill level of our technicians and to improve the overall capacity of our existing staff. We sponsor various internship and certain other educational programs. These programs serve to build awareness of our company with students, who may seek employment with our company following graduation.

Systems

We use an enterprise-wide management information system to support our Animal Hospital operations. We decide whether or not to place newly acquired animal hospitals on this network based on a cost-benefit analysis. In addition, a majority of our animal hospitals utilize consistent patient accounting/point-of-sale software and we are able to track performance of hospitals on a per-service, per-veterinarian and per-client basis.

We use an enterprise-wide management information system to support our veterinary laboratories. All of our financial data, customer records and laboratory results are stored in computer databases. Laboratory technicians and specialists are able to electronically access test results from remote testing sites. Our software gathers data in a data warehouse enabling us to provide expedient results via fax or through our Internet online resulting system.

8

Table of Contents

Competition

The companion animal healthcare industry is highly competitive and subject to continual change in the manner in which services are delivered and providers are selected. We believe that the primary factors influencing a customer’s selection of an animal hospital are convenient location and hours, personal recommendations, reasonable fees and quality of care. Our primary competitors for our animal hospitals in most markets are individual practitioners or small, regional multi-clinic practices. In addition, some national companies in the pet care industry, including the operators of super-stores, are developing networks of animal hospitals in markets that include our animal hospitals. We also compete with sellers of pet-related products and diagnostic services delivered via the Internet. As we progress in our integration of VetStreet we expect to position ourselves and other independent animal hospitals to better compete in the online market.

Among veterinary diagnostic laboratories, we believe that quality, price, specialist support and the time required to deliver results are the major competitive factors. There are many clinical laboratories that provide a broad range of diagnostic testing services in the same markets serviced by us, and we also face competition from several providers of on-site diagnostic equipment that allows veterinarians to perform various testing. Our principal competitor in most geographic locations in the United States is IDEXX Laboratories.

Government Regulation

Certain states and provinces have laws, rules and regulations which require that veterinary medical practices be owned by licensed veterinarians and that corporations which are not owned by licensed veterinarians refrain from providing, or holding themselves out as providers of, veterinary medical care. In these states and provinces, we provide management and other administrative services to veterinary practices rather than owning such practices or providing such care. We provide management and other administrative services to veterinary practices located in these states and provinces. At December 31, 2011, we provided management and administrative services to 170 animal hospitals in 15 states, and 1 animal hospital in 1 Canadian province, under management agreements with these veterinary practices. We consolidate these veterinary practices for financial reporting purposes. Although we have structured our operations to comply with our understanding of the veterinary medicine laws of each state and province in which we operate, interpretive legal precedent and regulatory guidance varies by jurisdiction and is often sparse and not fully developed. A determination that we are in violation of applicable restrictions on the practice of veterinary medicine in any jurisdiction in which we operate could have a material adverse effect on our operations, particularly if we were unable to restructure our operations to comply with the requirements of that jurisdiction.

In addition, all of the states in which we operate impose various registration requirements. To fulfill these requirements, we have registered each of our facilities with appropriate governmental agencies and, where required, have appointed a licensed veterinarian to act on behalf of each facility. All veterinarians practicing in our animal hospitals are required to maintain valid state licenses to practice.

Our acquisitions may be subject to pre-merger or post-merger review by governmental authorities for anti-trust and other legal compliance. Adverse regulatory action could negatively affect our operations through the assessment of fines or penalties against us or the possible requirement of divestiture of one or more of our operations.

Employees

At December 31, 2011 we employed or managed on behalf of the professional corporations to which we provide services approximately 9,900 full-time-equivalent employees. At that date, none of these employees were a party to a collective bargaining agreement.

Availability of Our Reports Filed with the Securities and Exchange Commission (“SEC”)

We maintain a website with the address http://investor.vcaantech.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this annual report on Form 10-K. We

9

Table of Contents

make available free of charge through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file that material with, or furnish that material to, the SEC.

The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Copies of our reports filed electronically with the SEC may be accessed on the SEC’s website www.sec.gov. The public may also read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at (800) SEC-0330.

| ITEM 1A. | RISK FACTORS |

Various sections of this annual report contain forward-looking statements, all of which are based on current expectations and could be affected by the uncertainties and risk factors described below and throughout this annual report. Our actual results may differ materially from these forward-looking statements.

The current economic environment may continue to cause a decline in our Animal Hospital same-store revenue growth and the rate of our Laboratory internal revenue growth and have a material adverse effect on our profitability.

The continued economic uncertainty has had, and may continue to have, an adverse impact on our revenue and our profitability. Consumer spending habits, including spending for pet healthcare, are affected by, among other things, prevailing economic conditions, levels of employment, salaries and wage rates, consumer confidence and consumer perception of economic conditions. Recently, these factors have caused consumer spending to deteriorate significantly and may cause levels of spending to remain depressed for the foreseeable future. These factors may cause pet owners to elect to forgo expensive treatment options or to defer treatment for their pets altogether. We have experienced a decline in the frequency of visits to our animal hospitals and the number of orders placed in our animal hospitals. These factors have contributed to a decline in our Animal Hospital same-store revenue growth and the recovery rate of our Laboratory internal revenue growth. While we continue to employ cost control measures, our profit margins may continue to decline until our businesses return to historical growth rates.

In addition, the economic downturn may exacerbate the effect of the risks discussed below, including the impact on our growth strategy, changes in demand for our products and services, the carrying value of our goodwill and other intangibles, our ability to service our substantial indebtedness and sales of our medical imaging equipment.

If we are unable to effectively execute our growth strategy, we may not achieve our desired economies of scale and our profitability may decline.

Our success depends in part on our ability to increase our revenue and operating income through a balanced program of organic growth initiatives and selective acquisitions of established animal hospitals, laboratories and related businesses. If we cannot implement or effectively execute on this strategy, our results of operations will be adversely affected. Even if we effectively implement our growth strategy, we may not achieve the economies of scale that we have experienced in the past or that we anticipate occurring in the future. We experienced a decline in same-store revenue growth in our animal hospitals for ten consecutive quarters, which ended during 2011, when we experienced an increase in same-store revenue growth in our third and fourth quarters. Our Laboratory growth has also been affected and became negative during certain quarters of the three year period ending December 31, 2011. Our Animal Hospital same-store revenue, adjusted for differences in business days, has fluctuated between a decline of 3.2% and growth of 5.2% for 2007 through 2011. Our Laboratory internal revenue growth, adjusted for differences in billing days, has fluctuated between 0% and 13.5% over the same years. Our internal growth may continue to fluctuate and may be below our historical rates. Any reduction in the rate of our internal growth may cause our revenue and operating income to decrease. Investors should not assume that our historical growth rates are reliable indicators of results in future periods.

10

Table of Contents

Changes in the demand for our products and services could negatively affect our operating results.

The frequency of visits to our animal hospitals has declined and may continue to decline. We believe that the frequency of visits is impacted by several trends in the industry, in addition to the continuing financial crisis. Client visits may be negatively impacted as a result of preventative care and better pet nutrition. Demand for vaccinations will be impacted in the future as protocols for vaccinations change. Our veterinarians establish their own vaccine protocols. Some of our veterinarians have changed their protocols and others may change their protocols in light of recent and/or future literature. The demand for our products and services may also decline as a result of the eradication or substantial declines in the prevalence of certain diseases. Also, many pet-related products traditionally sold at animal hospitals have become more widely available in retail stores and other channels of distribution, including the Internet, resulting in a decline in demand for these products at our animal hospitals.

Due to the fixed cost nature of our business, fluctuations in our revenue could adversely affect our gross profit, operating income and margins.

A substantial portion of our expense, particularly rent and personnel costs, are fixed and are based in part on expectations of revenue. We may be unable to reduce spending in a timely manner to compensate for any significant fluctuations in our revenue. Accordingly, shortfalls in revenue may adversely affect our gross profit, operating income and margins.

Any failure in our information technology systems, disruption in our transportation network or failure to receive supplies could significantly increase testing turn-around time, reduce our production capacity and otherwise disrupt our operations.

Our Laboratory operations depend on the continued and uninterrupted performance of our information technology systems and transportation network, including overnight delivery services provided by FedEx. Sustained system failures or interruption in our transportation network could disrupt our ability to process laboratory requisitions, perform testing, provide test results in a timely manner and/or bill the appropriate party. We could lose customers and revenue as a result of a system or transportation network failure. In addition, any change in government regulation related to transportation samples or specimens could also have an impact on our business.

Our computer systems are vulnerable to damage or interruption from a variety of sources, including telecommunications failures, electricity brownouts or blackouts, malicious human acts and natural disasters. Moreover, despite network security measures, some of our servers are potentially vulnerable to digital break-ins, computer viruses and similar disruptive problems. Despite the precautions we have taken, unanticipated problems affecting our systems could cause interruptions in our information technology systems. Our insurance policies may not adequately compensate us for any losses that may occur due to any failures in our systems.

Our Laboratory operations depend on a limited number of employees to upgrade and maintain its customized computer systems. If we were to lose the services of some or all of these employees, it may be time-consuming for new employees to become familiar with our systems, and we may experience disruptions in service during these periods.

Our operations depend, in some cases, on the ability of single source suppliers or a limited number of suppliers, to deliver products and supplies on a timely basis. Some of these suppliers are smaller companies with limited capital resources and some of the products that we purchase from these suppliers are proprietary, and, therefore, cannot be readily or easily replaced by alternative suppliers. We have in the past experienced, and may in the future experience, shortages of or difficulties in acquiring products and/or supplies in the quantities and of the quality needed. Shortages in the availability of products and/or supplies for an extended period of time will disrupt our ability to deliver products and provide services in a timely manner, could result in the loss of customers, and could have a material adverse impact on our results of operations.

11

Table of Contents

Difficulties integrating new acquisitions may impose increased costs, loss of customers and a decline in operating margins and profitability and other risks that we may not anticipate.

Our success depends in part on our ability to timely and cost-effectively acquire, and integrate into our business, additional animal hospitals, laboratories and related businesses. In 2011, we acquired 27 animal hospitals, including nine with the acquisition of BrightHeart, one laboratory and Vetstreet. In 2010, we acquired 50 animal hospitals, including 23 with the acquisition of Pet DRx. In 2009, we acquired 27 animal hospitals, two laboratories and Eklin. We expect to continue our animal hospital acquisition program and, if presented with favorable opportunities, we may acquire animal hospital chains, laboratories or related businesses. Our expansion into new territories and new business segments creates the risk that we will be unsuccessful in the integration of the acquired businesses that are new to our operations. Any difficulties in the integration process could result in increased expense, loss of customers and a decline in operating margins and profitability. In some cases, we have experienced delays and increased costs in integrating acquired businesses, particularly where we acquire a large number of animal hospitals in a single region at or about the same time. We also could experience delays in converting the systems of acquired businesses into our systems, which could result in increased staff and payroll expense to collect our results as well as delays in reporting our results, both for a particular region and on a consolidated basis. Further, the legal and business environment prevalent in new territories and with respect to new businesses may pose risks that we do not anticipate and adversely impact our ability to integrate newly acquired operations. In addition, our field management may spend a greater amount of time integrating these new businesses and less time managing our existing businesses. During these periods, there may be less attention directed to marketing efforts or staffing issues, which could affect our revenue and expense. For all of these reasons, our historical success in integrating acquired businesses is not a reliable indicator of our ability to do so in the future.

The significant competition in the companion animal healthcare industry could result in a decrease in our prices, an increase in our acquisition costs, a loss of market share and could materially affect our revenue and profitability.

The companion animal healthcare industry is highly competitive with few barriers to entry. To compete successfully, we may be required to reduce prices, increase our acquisition and operating costs or take other measures that could have an adverse effect on our financial condition, results of operations, margins and cash flow. In addition, if we are unable to compete successfully, we may lose market share.

A significant component of our annual growth strategy includes the acquisition of independent animal hospitals. The competition for animal hospital acquisitions from small national and regional multi-clinic companies may cause us to increase the amount we pay to acquire additional animal hospitals and may result in fewer acquisitions than anticipated by our growth strategy. If we are unable to acquire a requisite number of animal hospitals annually or if our acquisition costs increase, we may be unable to effectively implement our growth strategy and realize anticipated economies of scale.

Some national companies in the pet care industry, including the operators of super-stores, are developing networks of animal hospitals in markets that include our animal hospitals; this may cause us to reduce prices to remain competitive. Reducing prices may have an adverse effect on our Animal Hospital revenue, alternatively not reducing prices may cause us to lose market share.

We compete with clinical laboratory companies in the same markets we service. These companies have acquired additional laboratories in the markets in which we operate and may continue their expansion, and aggressively “bundle” their products and services to compete with us. Increased competition may adversely affect our Laboratory revenue and margins. Several other national companies develop and sell on-site diagnostic equipment that allows veterinarians to perform their own laboratory tests. Growth of the on-site diagnostic testing market may have an adverse effect on our Laboratory revenue.

Our medical technology business is a leader in the market for medical imaging equipment in the animal healthcare industry. Our primary competitors are companies that are much larger than us and have substantially greater capital, manufacturing, marketing and research and development resources than we do, including companies such as Siemens Medical Systems, Philips Medical Systems and Canon Medical Systems. The success of

12

Table of Contents

our medical technology business, in part, is due to its focus on the veterinary market, which allows it to differentiate its products and services to meet the unique needs of this market. If this market receives more focused attention from these larger competitors, we may find it difficult to compete and as a result our revenues and operating margins from this business could decline.

The carrying value of our goodwill and other intangible assets could be subject to an impairment write-down.

At December 31, 2011, our consolidated balance sheet reflected $1.2 billion of goodwill and $92.4 million of other intangible assets, constituting a substantial portion of our total assets of $2.0 billion at that date. We expect that the aggregate amount of goodwill and other intangible assets on our consolidated balance sheet will increase as a result of future acquisitions. We continually evaluate whether events or circumstances have occurred that suggest that the fair value of our other intangible assets or each of our reporting units are below their respective carrying values. The determination that the fair value of our intangible assets or one of our reporting units is less than its carrying value would result in an impairment write-down. The impairment write-down would be reflected as expense and could have a material adverse effect on our results of operations during the period in which we recognize the expense. During the quarter ended December 31, 2011, we recorded a $21.3 million impairment charge related to our Medical Technology reporting unit.

Our estimated fair values are calculated in accordance with generally accepted accounting principles related to fair value and utilize valuation methods consisting primarily of discounted cash flow techniques, and market comparables, where applicable. These valuation methods involve the use of significant assumptions and estimates such as forecasted growth rates, valuation multiples, the weighted-average cost of capital, and risk premiums, which are based upon the best available market information and are consistent with our long-term strategic plans. We provide no assurance that forecasted growth rates, valuation multiples, and discount rates will not deteriorate. We will continue to analyze changes to these assumptions in future periods.

We require a significant amount of cash to service our debt and expand our business as planned.

We have, and will continue to have, a substantial amount of debt. Our substantial amount of debt requires us to dedicate a significant portion of our cash flow from operations to service interest and principal payments on our debt, thereby reducing the funds available for use for working capital, capital expenditures, acquisitions and general corporate purposes.

Our failure to satisfy covenants in our debt instruments will cause a default under those instruments.

In addition to imposing restrictions on our business and operations, our debt instruments include a number of covenants relating to financial ratios and tests. Our ability to comply with these covenants may be affected by events beyond our control, including prevailing economic, financial and industry conditions. The breach of any of these covenants would result in a default under these instruments. An event of default would permit our lenders and other debtholders to declare all amounts borrowed from them to be due and payable, together with accrued and unpaid interest. If we are unable to repay debt to our senior lenders, these lenders and other debtholders could proceed against our assets.

Our debt instruments may adversely affect our ability to run our business.

Our substantial amount of debt, as well as the guarantees of our subsidiaries and the security interests in our assets and those of our subsidiaries, could impair our ability to operate our business effectively and may limit our ability to take advantage of business opportunities. For example, our senior credit facility may:

| • | limit our ability to borrow additional funds or to obtain other financing in the future for working capital, capital expenditures, acquisitions, investments and general corporate purposes; |

| • | limit our ability to dispose of our assets, create liens on our assets or to extend credit; |

| • | make us more vulnerable to economic downturns and reduce our flexibility in responding to changing business and economic conditions; |

13

Table of Contents

| • | limit our flexibility in planning for, or reacting to, changes in our business or industry; |

| • | place us at a competitive disadvantage to our competitors with less debt; and |

| • | restrict our ability to pay dividends, repurchase or redeem our capital stock or debt, or merge or consolidate with another entity. |

The terms of our senior credit facility allow us, under specified conditions, to incur further indebtedness, which would heighten the foregoing risks. If compliance with our debt obligations materially hinders our ability to operate our business and adapt to changing industry conditions, we may lose market share, our revenue may decline and our operating results may suffer.

Any failure by the manufacturers of our medical imaging equipment, failure in our ability to develop functional and cost-effective software for our products, or any product malfunctions could result in a decline in customer purchases and a reduction in our revenue and profitability.

We do not develop or manufacture the medical imaging equipment that we distribute, except for the software component of our digital radiography machines. Our business in large part is dependent upon distribution agreements with the manufacturers of the equipment, the ability of those manufacturers to produce desirable equipment and to keep pace with advances in technology, our ability to develop cost-effective, functional, and user-friendly software for the digital radiography machines, and the overall rate of new development within the industry. If the distribution agreements terminate or are not renewed, if the manufacturers breach their covenants under these agreements, if the equipment manufactured by these manufacturers or our software becomes less competitive or if there is a general decrease in the rate of new development within the industry, demand for our products and services would decrease.

Manufacturing flaws, component failures, design defects, or inadequate disclosure of product-related information could result in an unsafe condition or injury. These problems could result in product liability claims and lawsuits alleging that our products have resulted or could result in an unsafe condition or injury. In addition, an adverse event involving one of our products could result in reduced market acceptance and demand for all of our products, and could harm our reputation and our ability to market our products in the future. Any of the foregoing problems could disrupt our business and have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our use of self-insurance, self-insured retention and high-deductible insurance programs to cover certain claims for losses suffered and costs or expenses incurred could negatively impact our business upon the occurrence of an uninsured and/or significant event.

We self-insure and use high retention or high-deductible insurance programs with regard to property risks, general, professional and employment practice liabilities, health benefits, and workers’ compensation. In the event that the frequency of losses we experience increases unexpectedly, the aggregate of those losses could materially increase our liability and adversely affect our financial condition, liquidity, cash flows and results of operations. In addition, we have made certain judgments as to the limits on our existing insurance coverage that we believe are in line with industry standards, as well as in light of economic and availability considerations. If we experience losses above these limits it could materially adversely affect our financial and business condition.

We may experience difficulties hiring skilled veterinarians due to shortages that could disrupt our business.

If we are unable to retain an adequate number of skilled veterinarians, we may lose customers, our revenue may decline and we may need to sell or close animal hospitals. At December 31, 2011, there were 28 veterinary schools in the country accredited by the American Veterinary Medical Association. These schools graduate approximately 2,500 veterinarians per year. From time to time we experience shortages of skilled veterinarians in some regional markets in which we operate animal hospitals. During shortages in these regions, we may be unable to hire enough qualified veterinarians to adequately staff our animal hospitals, in which event we may lose market share and our revenue and profitability may decline.

14

Table of Contents

If we fail to comply with governmental regulations applicable to our business, various governmental agencies may impose fines, institute litigation or preclude us from operating in certain states.

Certain states and provinces have laws, rules and regulations which require that veterinary medical practices be owned by licensed veterinarians and that corporations which are not owned by licensed veterinarians refrain from providing, or holding themselves out as providers of, veterinary medical care. At December 31, 2011, we provided management and administrative services to 170 animal hospitals in 15 states and 1 animal hospital in 1 Canadian province, under management agreements with these veterinary practices, including 48 practices in Texas, 33 in Washington, 26 in New York. We may experience difficulty in expanding our operations into other states or provinces with similar laws, rules and regulations. Although we have structured our operations to comply with our understanding of the veterinary medicine laws of each state and province in which we operate, interpretive legal precedent and regulatory guidance varies by jurisdiction and is often sparse and not fully developed. A determination that we are in violation of applicable restrictions on the practice of veterinary medicine in any jurisdiction in which we operate, could have a material adverse effect on us, particularly if we are unable to restructure our operations to comply with the requirements of that jurisdiction.

All of the states in which we operate impose various registration requirements. To fulfill these requirements, we have registered each of our facilities with appropriate governmental agencies and, where required, have appointed a licensed veterinarian to act on behalf of each facility. All veterinarians practicing in our animal hospitals are required to maintain valid state licenses to practice.

MediMedia USA, Inc. provides services to us pursuant to the Transition Services Agreement. When that Agreement terminates, we will be required to replace MediMedia’s services internally or through third parties on terms that may be less favorable to us.

Under the terms of the Transition Services Agreement that we entered into with MediMedia in connection with our acquisition of Vetstreet, MediMedia is providing to us, for a fee, specified support services for the Vetstreet business relating to finance and accounting, information technology and communications, human resources and facilities for periods of up to 12 months following the date of acquisition. When the Transition Services Agreement terminates, MediMedia will no longer be obligated to provide any of these services to us or pay us, and we will be required to either enter into a new agreement with MediMedia or another services provider, or assume the responsibility for these functions ourselves. At that time, the economic terms of the new arrangement may be less favorable than the arrangement with MediMedia under the Transition Services Agreement, which may have a material adverse effect on our business, results of operations and financial condition.

Fluctuations in foreign currency exchange rates could adversely affect our business, financial condition, operating results and cash flows.

We are exposed to foreign currency fluctuation risk in Canada as we recently expanded our animal hospital operations and now operate over 40 animal hospitals in three provinces, and operate four laboratories, that create market risk associated with changes in the value of the Canadian dollar. Currency exchange rates fluctuate on a daily basis as a result of a number of factors and cannot easily be predicted. To date, we have not hedged against foreign currency fluctuations; however, we may pursue hedging alternatives in the future. Our business, financial condition, operating results and cash flows therefore could be materially adversely affected by fluctuations in the exchange rate between the Canadian dollar and the U.S. dollar.

Our international operations may result in additional market risks, which may harm our business.

We operate over 40 animal hospitals and four laboratories in Canada as of February 29, 2012. As these operations grow, they may require greater management and financial resources. Internal operations require the integration of personnel with varying cultural and business backgrounds and an understanding of the relevant

15

Table of Contents

differences in the cultural, legal and regulatory environments. Our results may be increasingly affected by the risks of our international operations, including:

| • | Fluctuations in currency exchange rates; |

| • | Changes in internal staffing and employment issues, |

| • | Failure to understand the local culture and market, and |

| • | The burden of complying with foreign laws, including tax laws and financial accounting standards. |

Changes in regulations or user concerns regarding privacy and protection of user data could adversely affect our business.

Vetstreet offers e-commerce services to veterinary practices through the Pro Pet Portal, and engages in e-commerce through the vetstreet.com website. Federal, state and international laws and regulations may govern the collection, use, retention, sharing and security of data that we receive from customers, visitors to the websites of our customers, and others. In addition, we have and post on our website our own privacy policy concerning the collection, use and disclosure of user data. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any privacy-related laws, government regulations or directives, or industry self-regulatory principles could result in damage to our reputation, or proceedings or actions against us by governmental entities or otherwise, which could potentially have an adverse effect on our business.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Our corporate headquarters and principal executive offices are located in Los Angeles, California, in approximately 50,000 square feet of leased space. At February 29, 2012, we leased or owned facilities at 639 other locations that house our animal hospitals, laboratories, our medical technology business, and our Vetstreet business. We own 140 facilities and the remainder are leased. We believe that our real property facilities are adequate for our current needs.

| ITEM 3. | LEGAL PROCEEDINGS |

We are currently not subject to any legal proceedings other than ordinarily routine litigation incidental to the conduct of our business.

16

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock trades on the NASDAQ Global Select Market under the symbol “WOOF.” The following table sets forth the range of high and low sales prices per share for our common stock as quoted on the NASDAQ Global Select Market for the periods indicated.

| High | Low | |||||||

| Fiscal 2011 by Quarter |

||||||||

| Fourth |

$ | 21.55 | $ | 14.73 | ||||

| Third |

$ | 22.09 | $ | 15.00 | ||||

| Second |

$ | 25.57 | $ | 19.05 | ||||

| First |

$ | 26.29 | $ | 22.44 | ||||

| Fiscal 2010 by Quarter |

||||||||

| Fourth |

$ | 24.04 | $ | 19.88 | ||||

| Third |

$ | 26.03 | $ | 19.12 | ||||

| Second |

$ | 29.28 | $ | 24.63 | ||||

| First |

$ | 28.09 | $ | 23.52 | ||||

At February 23, 2012, there were 291 holders of record of our common stock.

17

Table of Contents

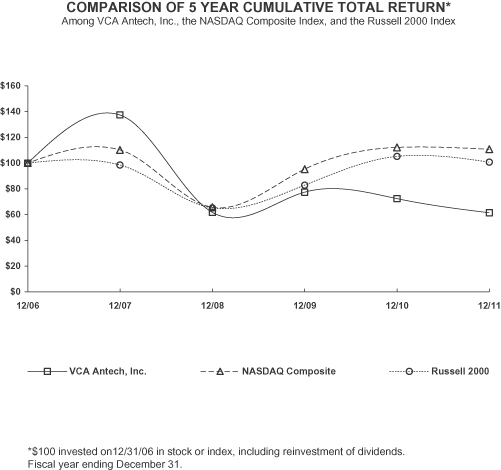

The following graph sets forth the percentage change in cumulative total stockholder return on our common stock from December 31, 2006 to December 31, 2011. These periods are compared with the cumulative returns of the NASDAQ Stock Market (U.S. Companies) Index and the Russell 2000 Index. The comparison assumes $100 was invested on December 31, 2006 in our common stock and in each of the foregoing indices. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

| 12/06 | 12/07 | 12/08 | 12/09 | 12/10 | 12/11 | |||||||||||||||||||

| VCA Antech, Inc. |

100.00 | 137.40 | 61.76 | 77.42 | 72.35 | 61.35 | ||||||||||||||||||

| NASDAQ Composite |

100.00 | 110.26 | 65.65 | 95.19 | 112.10 | 110.81 | ||||||||||||||||||

| Russell 2000 |

100.00 | 98.43 | 65.18 | 82.89 | 105.14 | 100.75 | ||||||||||||||||||

Dividends

We have not paid cash dividends on our common stock, and we do not anticipate paying cash dividends in the foreseeable future. In addition, our senior credit facility places limitations on our ability to pay cash dividends in respect of our common stock. Specifically, our senior credit facility dated August 16, 2011 prohibits us from declaring, ordering, paying, or setting apart any sum for any dividends or other distributions on account of any shares of any class of stock, other than dividends payable solely in shares of stock to holders of such class of stock. Any future determination as to the payment of dividends on our common stock will be restricted by these limitations, will be at the discretion of our Board of Directors and will depend on our results of operations, financial condition, capital requirements and other factors deemed relevant by the Board of Directors, including the General Corporation Law of the State of Delaware, which provides that dividends are only payable out of surplus or current net profits.

18

Table of Contents

Transactions in Our Equity Securities

For the period covered by this report, we have not engaged in any sales of our unregistered equity securities that were not disclosed in a quarterly report on Form 10-Q or a current report on Form 8-K, and we have not repurchased any of our equity securities in the fourth quarter.

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table provides our selected consolidated financial data as of and for each of the years in the five- year period ended December 31, 2011. The income statement and cash flow data and the other data for each of the three years ended December 31, 2011, and the balance sheet data as of December 31, 2011 and 2010 has been derived from our financial statements included elsewhere in this Form 10-K. The other periods presented were derived from our financial statements that are not included in this Form 10-K.

The selected financial data presented below is not necessarily indicative of results of future operations and should be read in conjunction with the Management’s Discussion and Analysis of Financial Condition and Results of Operations section and our consolidated financial statements and related notes included elsewhere in this 10-K.

| December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Animal Hospital revenue(2)(4) |

$ | 1,150,120 | $ | 1,052,462 | $ | 994,215 | $ | 959,395 | $ | 844,344 | ||||||||||

| Laboratory revenue |

316,797 | 310,654 | 310,057 | 306,891 | 297,690 | |||||||||||||||

| All Other revenue(1)(7) |

80,430 | 64,013 | 48,557 | 49,238 | 44,828 | |||||||||||||||

| Intercompany revenue |

(61,986 | ) | (45,661 | ) | (38,322 | ) | (38,054 | ) | (30,717 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

1,485,361 | 1,381,468 | 1,314,507 | 1,277,470 | 1,156,145 | |||||||||||||||

| Direct costs |

1,146,904 | 1,050,304 | 973,275 | 934,996 | 835,462 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

338,457 | 331,164 | 341,232 | 342,474 | 320,683 | |||||||||||||||

| Selling, general and administrative expense(5) |

121,112 | 123,541 | 95,669 | 90,564 | 86,139 | |||||||||||||||

| Goodwill impairment(3) |

21,310 | — | — | — | — | |||||||||||||||

| Net loss on sale of assets(8) |

382 | 374 | 4,035 | 234 | 1,323 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income(3)(5)(8) |

195,653 | 207,249 | 241,528 | 251,676 | 233,221 | |||||||||||||||

| Interest expense, net |

16,884 | 13,630 | 21,466 | 28,559 | 29,503 | |||||||||||||||

| Debt retirement costs |

2,764 | 2,131 | — | — | — | |||||||||||||||

| Other expense (income) |

118 | (772 | ) | (104 | ) | (212 | ) | 220 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before provision for income taxes |

175,887 | 192,260 | 220,166 | 223,329 | 203,498 | |||||||||||||||

| Provision for income taxes(6) |

76,027 | 78,102 | 84,580 | 86,219 | 78,636 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

99,860 | 114,158 | 135,586 | 137,110 | 124,862 | |||||||||||||||

| Net income attributable to noncontrolling interests |

4,455 | 3,915 | 4,158 | 4,126 | 3,850 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to VCA Antech, Inc |

$ | 95,405 | $ | 110,243 | $ | 131,428 | $ | 132,984 | $ | 121,012 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per share |

$ | 1.10 | $ | 1.28 | $ | 1.54 | $ | 1.57 | $ | 1.44 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings per share |

$ | 1.09 | $ | 1.27 | $ | 1.53 | $ | 1.55 | $ | 1.41 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares outstanding for basic earnings per share |

86,606 | 86,049 | 85,077 | 84,455 | 83,893 | |||||||||||||||

|

|

|