Table of Contents

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2012, or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 0-16125

FASTENAL COMPANY

(Exact name of registrant as specified in its charter)

| Minnesota | 41-0948415 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 2001 Theurer Boulevard Winona, Minnesota |

55987-0978 | |

| (Address of principal executive offices) | (Zip Code) |

(507) 454-5374

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | x | Accelerated Filer | ¨ | |||

| Non-accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the last practicable date.

| Class |

Outstanding at July 10, 2012 | |

| Common Stock, par value $.01 per share |

296,153,949 |

Table of Contents

FASTENAL COMPANY

Table of Contents

ITEM 1. FINANCIAL STATEMENTS

FASTENAL COMPANY AND SUBSIDIARIES

(Amounts in thousands except share information)

| (Unaudited) June 30, 2012 |

December 31, 2011 |

|||||||

| Assets | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 185,916 | 117,676 | |||||

| Marketable securities |

27,166 | 27,165 | ||||||

| Trade accounts receivable, net of allowance for doubtful accounts of $5,934 and $5,647, respectively |

399,993 | 338,594 | ||||||

| Inventories |

662,689 | 646,152 | ||||||

| Deferred income tax assets |

13,741 | 16,718 | ||||||

| Other current assets |

88,591 | 89,833 | ||||||

|

|

|

|

|

|||||

| Total current assets |

1,378,096 | 1,236,138 | ||||||

| Property and equipment, less accumulated depreciation |

459,652 | 435,601 | ||||||

| Other assets, net |

12,999 | 13,209 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,850,747 | 1,684,948 | |||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 81,243 | 73,779 | |||||

| Accrued expenses |

119,279 | 111,962 | ||||||

| Income taxes payable |

9,997 | 2,077 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

210,519 | 187,818 | ||||||

|

|

|

|

|

|||||

| Deferred income tax liabilities |

39,331 | 38,154 | ||||||

|

|

|

|

|

|||||

| Stockholders’ equity: |

||||||||

| Preferred stock, 5,000,000 shares authorized |

0 | 0 | ||||||

| Common stock, 400,000,000 shares authorized, 296,150,999 and 295,258,674 shares issued and outstanding, respectively |

2,962 | 2,953 | ||||||

| Additional paid-in capital |

47,251 | 16,856 | ||||||

| Retained earnings |

1,536,342 | 1,424,371 | ||||||

| Accumulated other comprehensive income |

14,342 | 14,796 | ||||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

1,600,897 | 1,458,976 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 1,850,747 | 1,684,948 | |||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the consolidated financial statements.

- 1 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

Consolidated Statements of Earnings

(Amounts in thousands except earnings per share)

| (Unaudited) Six months ended June 30, |

(Unaudited) Three months ended June 30, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Net sales |

$ | 1,573,765 | 1,342,313 | 804,890 | 701,730 | |||||||||||

| Cost of sales |

764,437 | 642,700 | 389,739 | 335,497 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

809,328 | 699,613 | 415,151 | 366,233 | ||||||||||||

| Operating and administrative expenses |

469,508 | 420,560 | 236,538 | 215,868 | ||||||||||||

| (Gain) loss on sale of property and equipment |

(108 | ) | 284 | (282 | ) | 259 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

339,928 | 278,769 | 178,895 | 150,106 | ||||||||||||

| Interest income |

240 | 224 | 144 | 76 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings before income taxes |

340,168 | 278,993 | 179,039 | 150,182 | ||||||||||||

| Income tax expense |

127,668 | 105,334 | 66,733 | 56,070 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net earnings |

$ | 212,500 | 173,659 | 112,306 | 94,112 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic net earnings per share |

$ | 0.72 | 0.59 | 0.38 | 0.32 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net earnings per share |

$ | 0.72 | 0.59 | 0.38 | 0.32 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic weighted average shares outstanding |

295,826 | 294,918 | 296,110 | 294,974 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted weighted average shares outstanding |

297,021 | 295,690 | 297,130 | 295,916 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of the consolidated financial statements.

- 2 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income

(Amounts in thousands)

| (Unaudited) Six months ended June 30, |

(Unaudited) Three months ended June 30, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Net earnings |

$ | 212,500 | 173,659 | 112,306 | 94,112 | |||||||||||

| Other comprehensive income (loss), before tax: |

||||||||||||||||

| Foreign currency translation adjustments |

(444 | ) | 2,720 | (3,384 | ) | 589 | ||||||||||

| Change in marketable securities |

(10 | ) | 174 | (33 | ) | 32 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income (loss), before tax |

(454 | ) | 2,894 | (3,417 | ) | 621 | ||||||||||

| Income tax (expense) benefit attributable to other comprehensive income |

170 | (1,092 | ) | 1,275 | (232 | ) | ||||||||||

| Other comprehensive income (loss), net of tax |

(284 | ) | 1,802 | (2,142 | ) | 389 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income |

$ | 212,216 | 175,461 | 110,164 | 94,501 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of the consolidated financial statements.

- 3 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Amounts in thousands)

| (Unaudited) Six months ended June 30, |

||||||||

| 2012 | 2011 | |||||||

| Cash flows from operating activities: |

||||||||

| Net earnings |

$ | 212,500 | 173,659 | |||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: |

||||||||

| Depreciation of property and equipment |

25,712 | 21,363 | ||||||

| (Gain) loss on sale of property and equipment |

(108 | ) | 284 | |||||

| Bad debt expense |

4,791 | 4,258 | ||||||

| Deferred income taxes |

4,154 | 204 | ||||||

| Stock based compensation |

2,100 | 1,800 | ||||||

| Excess tax benefits from stock based compensation |

(8,103 | ) | 0 | |||||

| Amortization of non-compete agreements |

297 | 297 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Trade accounts receivable |

(66,190 | ) | (91,320 | ) | ||||

| Inventories |

(16,537 | ) | (51,288 | ) | ||||

| Other current assets |

1,242 | (2,359 | ) | |||||

| Accounts payable |

7,464 | 22,646 | ||||||

| Accrued expenses |

7,317 | 4,016 | ||||||

| Income taxes |

16,023 | 15,547 | ||||||

| Other |

(231 | ) | 2,170 | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

190,431 | 101,277 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchase of property and equipment |

(50,980 | ) | (56,324 | ) | ||||

| Proceeds from sale of property and equipment |

1,325 | 1,635 | ||||||

| Net (increase) decrease in marketable securities |

(1 | ) | 4,976 | |||||

| (Increase) decrease in other assets |

(87 | ) | 122 | |||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(49,743 | ) | (49,591 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from exercise of stock options |

20,201 | 5,353 | ||||||

| Excess tax benefits from stock based compensation |

8,103 | 0 | ||||||

| Payment of dividends |

(100,529 | ) | (112,047 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(72,225 | ) | (106,694 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash |

(223 | ) | 724 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in cash and cash equivalents |

68,240 | (54,284 | ) | |||||

| Cash and cash equivalents at beginning of period |

117,676 | 143,693 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 185,916 | 89,409 | |||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid during each period for income taxes |

$ | 113,810 | 89,583 | |||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the consolidated financial statements.

- 4 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

(1) Basis of Presentation

The accompanying unaudited consolidated financial statements of Fastenal Company and subsidiaries (collectively referred to as the Company, Fastenal, or by terms such as we, our, or us) have been prepared in accordance with United States generally accepted accounting principles for interim financial information. They do not include all information and footnotes required by United States generally accepted accounting principles for complete financial statements. However, except as described herein, there has been no material change in the information disclosed in the notes to consolidated financial statements included in our consolidated financial statements as of and for the year ended December 31, 2011. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included.

In June 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-06, Comprehensive Income (Topic 820). This accounting standard update eliminates the option to present components of other comprehensive income as part of the statement of equity and requires the total of comprehensive income, the components of net income, and the components of other comprehensive income be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements. It also requires presentation on the face of the financial statements of reclassification adjustments for items that are reclassified from other comprehensive income to net income in the statement(s) where the components of net income and the components of other comprehensive income are presented. This accounting standard update became effective beginning in our first quarter of fiscal 2012. In December 2011, the FASB issued ASU No. 2011-12 which indefinitely defers the guidance related to the presentation of reclassification adjustments only. The adoption of this accounting standard update resulted in financial statement presentation changes only.

Stock split – On April 19, 2011, our board of directors declared a two-for-one stock split with respect to our common stock. This stock split became effective at the close of business on May 20, 2011. All historical share and per share amounts in this report have been adjusted to reflect the impact of this stock split.

(2) Marketable Securities

We follow a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1) and the lowest priority to measurements involving unobservable inputs (Level 3). The three levels of the fair value hierarchy are as follows:

| • | Level 1 inputs are observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| • | Level 2 inputs include other inputs that are directly or indirectly observable in the marketplace. |

| • | Level 3 inputs are unobservable inputs which are supported by little or no market activity. |

The level in the fair value hierarchy within which a fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety.

(Continued)

- 5 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

The following table presents the placement in the fair value hierarchy of assets that are measured at fair value on a recurring basis at period end:

| June 30, 2012: |

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

| Common stock |

$ | 310 | 310 | 0 | 0 | |||||||||||

| Government and agency securities |

26,856 | 26,856 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 27,166 | 27,166 | 0 | 0 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2011: |

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

| Common stock |

$ | 320 | 320 | 0 | 0 | |||||||||||

| Government and agency securities |

26,845 | 26,845 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 27,165 | 27,165 | 0 | 0 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| June 30, 2011: |

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

| Common stock |

$ | 344 | 344 | 0 | 0 | |||||||||||

| Government and agency securities |

25,899 | 25,899 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 26,243 | 26,243 | 0 | 0 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

There were no transfers between levels during the three and six month periods ended June 30, 2012 and 2011.

As of June 30, 2012, December 31, 2011, and June 30, 2011, our financial assets that are measured at fair value on a recurring basis consisted of common stock and debt securities. The government and agency securities have a maturity of twelve months.

Marketable securities, all treated as available-for-sale securities at period end, consist of the following:

| June 30, 2012: |

Amortized cost |

Gross unrealized gains |

Gross unrealized losses |

Fair value | ||||||||||||

| Common stock |

$ | 197 | 113 | 0 | 310 | |||||||||||

| Government and agency securities |

26,862 | 0 | (6 | ) | 26,856 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 27,059 | 113 | (6 | ) | 27,166 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

(Continued)

- 6 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

| December 31, 2011: |

Amortized cost |

Gross unrealized gains |

Gross unrealized losses |

Fair value | ||||||||||||

| Common stock |

$ | 197 | 123 | 0 | 320 | |||||||||||

| Government and agency securities |

26,851 | 0 | (6 | ) | 26,845 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 27,048 | 123 | (6 | ) | 27,165 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| June 30, 2011: |

Amortized cost |

Gross unrealized gains |

Gross unrealized losses |

Fair value | ||||||||||||

| Common stock |

$ | 198 | 146 | 0 | 344 | |||||||||||

| Government and agency securities |

25,850 | 49 | 0 | 25,899 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 26,048 | 195 | 0 | 26,243 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The unrealized gains and losses recorded in accumulated other comprehensive income and the realized gains and losses recorded in earnings were immaterial during the periods reported in these consolidated financial statements.

Future maturities of our available-for-sale securities consist of the following:

| Less than 12 months | Greater than 12 months | |||||||||||||||

| Amortized | Fair | Amortized | Fair | |||||||||||||

| June 30, 2012: |

cost | value | cost | value | ||||||||||||

| Common stock |

$ | 197 | 310 | 0 | 0 | |||||||||||

| Government and agency securities |

26,862 | 26,856 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total available-for-sale securities |

$ | 27,059 | 27,166 | 0 | 0 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

(Continued)

- 7 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

(3) Stockholders’ Equity – See note (1) regarding our stock split.

Our authorized and issued shares (share amounts stated in whole numbers) consist of the following:

| June 30, | December 31, | June 30, | ||||||||||||||

| Par Value | 2012 | 2011 | 2011 | |||||||||||||

| Preferred Stock |

$ | .01/share | ||||||||||||||

| Shares authorized |

5,000,000 | 5,000,000 | 5,000,000 | |||||||||||||

| Shares issued |

0 | 0 | 0 | |||||||||||||

| Common Stock |

$ | .01/share | ||||||||||||||

| Shares authorized |

400,000,000 | 400,000,000 | 400,000,000 | |||||||||||||

| Shares issued |

296,150,999 | 295,258,674 | 295,099,324 | |||||||||||||

Dividends

On July 11, 2012, our board of directors declared a dividend of $0.19 per share of common stock. This dividend is to be paid in cash on August 24, 2012 to shareholders of record at the close of business on July 27, 2012. Historically, we have paid semi-annual dividends, which were typically paid in the first and third quarters. In 2010 and 2008, we paid a supplemental dividend in the fourth quarter. In 2011, our board of directors declared a semi-annual dividend in January, and then switched to a quarterly dividend in April, July, and October. Our board of directors expect to continue paying quarterly dividends, provided the future determination as to payment of dividends will depend on the financial needs of the Company and such other factors as deemed relevant by the board of directors.

The following table presents the dividends paid previously and declared by our board of directors for future payment by quarter:

| 2012 | 2011 | |||||||

| First quarter |

$ | 0.17 | 0.25 | |||||

| Second quarter |

$ | 0.17 | 0.13 | |||||

| Third quarter |

$ | 0.19 | 0.13 | |||||

| Fourth quarter |

$ | 0.14 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 0.53 | 0.65 | |||||

|

|

|

|

|

|||||

Stock Options

On April 17, 2012, the compensation committee of our board of directors approved and our board of directors ratified the grant under our employee stock option plan, effective at the close of business that day, of options to purchase approximately 1.2 million shares of our common stock at a strike price of $54.00 per share. The closing stock price on the date of grant was $49.01 per share.

(Continued)

- 8 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

The following tables summarize the details of grants made under our stock option plan of options that have been granted and are outstanding, and the assumptions used to value these options. All options granted were effective at the close of business on the date of grant.

| Option | Closing | |||||||||||||||||||

| exercise | stock price | June 30, 2012 | ||||||||||||||||||

| Options | (strike) | on date | Options | Options | ||||||||||||||||

| Date of grant |

granted | price | of grant | outstanding | vested | |||||||||||||||

| April 17, 2012 |

1,235,000 | $ | 54.00 | $ | 49.01 | 1,207,500 | 0 | |||||||||||||

| April 19, 2011 |

410,000 | $ | 35.00 | $ | 31.78 | 400,000 | 0 | |||||||||||||

| April 20, 2010 |

530,000 | $ | 30.00 | $ | 27.13 | 380,000 | 0 | |||||||||||||

| April 21, 2009 |

790,000 | $ | 27.00 | $ | 17.61 | 590,000 | 0 | |||||||||||||

| April 15, 2008 |

550,000 | $ | 27.00 | $ | 24.35 | 322,450 | 147,450 | |||||||||||||

| April 17, 2007 |

4,380,000 | $ | 22.50 | $ | 20.15 | 2,491,725 | 1,420,725 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Total |

7,895,000 | 5,391,675 | 1,568,175 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Date of grant |

Risk-free interest rate |

Expected life of option in years |

Expected dividend yield |

Expected stock volatility |

Estimated fair value of stock option |

|||||||||||||||

| April 17, 2012 |

0.9 | % | 5.00 | 1.4 | % | 39.25 | % | $ | 13.69 | |||||||||||

| April 19, 2011 |

2.1 | % | 5.00 | 1.6 | % | 39.33 | % | $ | 11.20 | |||||||||||

| April 20, 2010 |

2.6 | % | 5.00 | 1.5 | % | 39.10 | % | $ | 8.14 | |||||||||||

| April 21, 2009 |

1.9 | % | 5.00 | 1.0 | % | 38.80 | % | $ | 3.64 | |||||||||||

| April 15, 2008 |

2.7 | % | 5.00 | 1.0 | % | 30.93 | % | $ | 7.75 | |||||||||||

| April 17, 2007 |

4.6 | % | 4.85 | 1.0 | % | 31.59 | % | $ | 5.63 | |||||||||||

All of the options in the tables above vest and become exercisable over a period of up to eight years. Each option will terminate, to the extent not previously exercised, 13 months after the end of the relevant vesting period.

(Continued)

- 9 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

The fair value of each share-based option is estimated on the date of grant using a Black-Scholes valuation method that uses the assumptions listed above. The expected life is the average length of time over which we expect the employee groups will exercise their options, which is based on historical experience with similar grants. Expected volatilities are based on the movement of our stock over the most recent historical period equivalent to the expected life of the option. The risk-free interest rate is based on the U.S. Treasury rate over the expected life at the time of grant. The dividend yield is estimated over the expected life based on our current dividend payout, historical dividends paid, and expected future cash dividends.

Compensation expense equal to the grant date fair value is recognized for all of these awards over the vesting period. The stock-based compensation expense for the six month periods ended June 30, 2012 and 2011 was $2,100 and $1,800, respectively. Unrecognized compensation expense related to outstanding stock options as of June 30, 2012 was $22,852 and is expected to be recognized over a weighted average period of 5.08 years. Any future changes in estimated forfeitures will impact this amount.

Earnings Per Share

The following tables present a reconciliation of the denominators used in the computation of basic and diluted earnings per share and a summary of the options to purchase shares of common stock which were excluded from the diluted earnings calculation because they were anti-dilutive:

| Six-month period | Three-month period | |||||||||||||||

| Reconciliation |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Basic-weighted average shares outstanding |

295,826,501 | 294,917,946 | 296,110,167 | 294,973,572 | ||||||||||||

| Weighted shares assumed upon exercise of stock options |

1,194,737 | 771,717 | 1,019,731 | 942,044 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted-weighted average shares outstanding |

297,021,238 | 295,689,663 | 297,129,898 | 295,915,616 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Six-month period | Three-month period | |||||||||||||||

| Summary of anti-dilutive options excluded |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Options to purchase shares of common stock |

501,566 | 588,785 | 1,353,132 | 740,879 | ||||||||||||

| Weighted-average exercise price of options |

$ | 54.00 | $ | 31.37 | $ | 49.09 | $ | 32.17 | ||||||||

Any dilutive impact summarized above would relate to periods when the average market price of our stock exceeded the exercise price of the potentially dilutive option securities then outstanding.

(Continued)

- 10 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

(4) Income Taxes

Fastenal, or one of its subsidiaries, files income tax returns in the United States federal jurisdiction, numerous states, and various local and foreign jurisdictions. With limited exceptions, we are no longer subject to income tax examinations by taxing authorities for taxable years before 2009 in the case of United States federal and non-United States examinations and 2008 in the case of state and local examinations.

As of June 30, 2012 and 2011, the Company had $5,321 and $4,268, respectively, of liabilities recorded related to unrecognized tax benefits. Included in this liability for unrecognized tax benefits is an immaterial amount for interest and penalties, both of which we classify as a component of income tax expense. The Company does not anticipate its total unrecognized tax benefits will change significantly during the next 12 months.

(5) Operating Leases

We lease certain pick-up trucks under operating leases. These leases have a non-cancellable lease term of one year, with renewal options for up to 72 months. The pick-up truck leases include an early buy out clause we generally exercise, thereby giving the leases an effective term of 28-36 months. Certain operating leases for vehicles contain residual value guarantee provisions which would become due at the expiration of the operating lease agreement if the fair value of the leased vehicles is less than the guaranteed residual value. The aggregate residual value guarantee related to these leases is approximately $53,006. We believe the likelihood of funding the guarantee obligation under any provision of the operating lease agreements is remote, except for a $397 loss on disposal reserve provided at June 30, 2012. Our fleet also contains vehicles we estimate will settle at a gain. Gains on these vehicles will be recognized when we sell or dispose of the vehicle or at the end of the lease term.

(Continued)

- 11 -

Table of Contents

FASTENAL COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except share and per share information and where otherwise noted)

June 30, 2012 and 2011

(Unaudited)

(6) Contingencies

In early February 2010, we received a letter from a California fastener supplier dated January 26, 2010. This letter threatened to sue us for an alleged violation of an exclusive distribution arrangement this supplier believes exists between our organizations. In addition to the letter, this supplier provided a press release and a video regarding the claim which they threatened to make public unless we agreed to mediation of the claim. Shortly after receipt of this letter, we performed a preliminary internal review to understand (1) who this supplier was and (2) the nature of our relationship with this supplier. Based on that review, we determined (1) this supplier manufactures a niche type of fastener and (2) the total volume of purchases by us, from all suppliers, over the purported term of the alleged exclusivity arrangement of this niche type of fastener did not exceed $1 million. Following completion of our preliminary internal review, we requested additional information and documentation from the supplier. The supplier’s response failed to provide the requested information and documentation. By letter dated February 26, 2010, we quantified for the supplier our total volume of purchases as discussed above and informed the supplier that we believed their claim was grossly exaggerated and completely unsupported. We have not received any direct response to our February 26, 2010 letter. On May 3, 2010, this supplier filed suit in Arkansas federal court alleging damages. In response, we filed a motion to dismiss. This motion to dismiss was denied on August 16, 2010. We subsequently filed two motions for summary judgment. The first summary judgment motion was partially denied.

On August 24, 2011, the court issued an order granting Fastenal’s second motion for summary judgment in its entirety, the supplier appealed this order on September 8, 2011. On December 16, 2011, the court issued an order granting, in part, Fastenal’s request to recover on its Bill of Costs and Petition for Attorney’s Fees from this supplier, the supplier appealed this order on January 9, 2012. Both appealed orders are pending. Based on current information, we believe the prospect that we will incur a material liability as a result of this claim is remote. While we are not required to disclose this matter under the rules of the Securities and Exchange Commission (‘SEC’), we initially disclosed the existence of this threat in February 2010 (in our 2009 annual report on Form 10-K) as we believed our disclosure was prudent due to the alleged amount ($180 million) of the claim and the threat to make these allegations public.

(7) Subsequent Events

On July 11, 2012, our board of directors declared a dividend of $0.19 per share. This dividend is discussed in footnote (3) ‘Stockholders’ Equity’.

- 12 -

Table of Contents

| ITEM 2 – | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following is management’s discussion and analysis of certain significant factors which have affected our financial position and operating results during the periods included in the accompanying consolidated financial statements. (Dollar amounts are stated in thousands except for per share amounts and where otherwise noted.)

BUSINESS AND OPERATIONAL OVERVIEW:

Fastenal is a North American leader in the wholesale distribution of industrial and construction supplies. We distribute these supplies through a network of approximately 2,600 company owned stores. Most of our customers are in the manufacturing and non-residential construction markets. The manufacturing market includes both original equipment manufacturers (OEM) and maintenance and repair operations (MRO). The non-residential construction market includes general, electrical, plumbing, sheet metal, and road contractors. Other users of our product include farmers, ranchers, truckers, railroads, mining companies, federal, state, and local governmental entities, schools, and certain retail trades. Geographically, our stores and customers are primarily located in North America.

In the past decade, we have experienced periods of inflation and deflation related to steel prices (this is meaningful to our business because approximately 50% of our sales consist of some type of fastener – nuts, bolts, screws, etc. – most of which are made of steel). In the period from 2003 to the fall of 2008, we experienced inflation in steel prices, this was most pronounced in 2008. In the fourth quarter of 2008, and throughout much of 2009, we experienced deflation in steel prices. When the swings are dramatic, this can hurt our gross margins because we are selling expensive inventory on the shelf at declining prices. This hurt our gross margins in 2009. The drop in energy costs (this is meaningful to our business because we are a store based distributor with a large trucking fleet) over the same period provided some relief, but it was small in comparison to the impact of the steel deflation. The deflation of 2009 ended and these conditions normalized and allowed our gross margins to recover into a more normal range beginning in 2010. (See later discussion on gross margins.)

Similar to previous quarters, we have included comments regarding several aspects of our business:

| (1) | Monthly sales changes, sequential trends, and end market performance – a recap of our recent sales trends and some insight into the activities with different end markets. |

| (2) | Growth drivers of our business – a recap of how we grow our business. |

| (3) | Profit drivers of our business – a recap of how we increase our profits. |

| (4) | Statement of earnings information – a recap of the components of our income statement. |

| (5) | Operational working capital, balance sheet, and cash flow – a recap of the operational working capital utilized in our business, and the related cash flow. |

While reading these items, it is helpful to appreciate several aspects of our marketplace: (1) it’s big, the North American marketplace for industrial supplies is estimated to be in excess of $160 billion per year (and we have expanded beyond North America), (2) no company has a significant portion of this market, (3) many of the products we sell are individually inexpensive, (4) when our customer needs something quickly or unexpectedly our local store is a quick source, and (5) the cost to manage and procure these products can be significant.

Our motto is Growth through Customer Service. This is important given the points noted above. We believe in efficient markets – to us, this means we can grow our market share if we provide the greatest value to the customer. We believe our ability to grow is amplified if we can service our customer at the closest economic point of contact.

The concept of growth is simple, find more customers every day and increase your activity with them. However, execution is hard work. First, we recruit service minded individuals to support our customers and their business. Second, we operate in a decentralized fashion to help identify the greatest value for our customers. Third, we build a great machine behind the store to operate efficiently and to help identify new business solutions. Fourth, we do these things every day. Finally, we strive to generate strong profits; these profits produce the cash flow necessary to fund the growth and to support the needs of our customers.

- 13 -

Table of Contents

SALES GROWTH:

Net sales and growth rates in net sales were as follows:

| Six-month period | Three-month period | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Net sales |

$ | 1,573,765 | 1,342,313 | $ | 804,890 | 701,730 | ||||||||||

| Percentage change |

17.2 | % | 22.9 | % | 14.7 | % | 22.9 | % | ||||||||

The increase in net sales in the first six months of 2012 and 2011 came primarily from higher unit sales. Our growth in net sales was impacted by inflationary price changes in our products, but the impact was limited. Our growth in net sales was not meaningfully impacted by the introduction of new products or services, with one exception, our FAST SolutionsSM (industrial vending) initiative did stimulate faster growth (discussed later in this document). The higher unit sales resulted primarily from increases in sales at older store locations (discussed below and again later in this document) and to a lesser degree the opening of new store locations in the last several years. The growth in net sales at the older store locations was due to the growth drivers of our business (discussed later in this document), and in the case of 2011, the moderating impacts of the recessionary environment. The change in currencies in foreign countries (primarily Canada) relative to the United States dollar lowered our daily sales growth rate by 0.4 % in the first six months of 2012 and increased our daily sales growth rate by 1.0% in the first six months of 2011. The change in currencies in foreign countries (primarily Canada) relative to the United States dollar lowered our daily sales growth rate by 0.6% in the second quarter of 2012 and increased our daily sales growth by 1.0% in the second quarter of 2011.

The stores opened greater than two years represent a consistent ‘same store’ view of our business (store sites opened as follows: 2012 group – opened 2010 and earlier, and 2011 group – opened 2009 and earlier). However, the impact of the economy is best reflected in the growth performance of our stores opened greater than five years (store sites opened as follows: 2012 group – opened 2007 and earlier, and 2011 group – opened 2006 and earlier) and opened greater than ten years (store sites opened as follows: 2012 group – opened 2002 and earlier, and 2011 group – opened 2001 and earlier). These two groups of stores are more cyclical due to the increased market share they enjoy in their local markets. The daily sales change for each of these groups was as follows:

| Six-month period | Three-month period | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Store Age |

||||||||||||||||

| Opened greater than 2 years |

14.5 | % | 18.7 | % | 11.8 | % | 19.4 | % | ||||||||

| Opened greater than 5 years |

13.4 | % | 18.0 | % | 10.9 | % | 18.5 | % | ||||||||

| Opened greater than 10 years |

11.6 | % | 15.8 | % | 9.1 | % | 16.6 | % | ||||||||

Note: The age groups above are measured as of the last day of each respective calendar year.

SALES BY PRODUCT LINE:

The mix of sales from the original fastener product line and from the other product lines was as follows:

| Six-month period | Three-month period | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Fastener product line |

45.4 | % | 47.7 | % | 45.2 | % | 47.9 | % | ||||||||

| Other product lines |

54.6 | % | 52.3 | % | 54.8 | % | 52.1 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

- 14 -

Table of Contents

MONTHLY SALES CHANGES, SEQUENTIAL TRENDS, AND END MARKET PERFORMANCE

Note – Daily sales are defined as the sales for the period divided by the number of business days (in the United States) in the period.

This section focuses on three distinct views of our business – monthly sales changes, sequential trends, and end market performance. The first discussion regarding monthly sales changes provides a good mechanical view of our business based on the age of our stores. The second discussion provides a framework for understanding the sequential trends (that is, comparing a period to the immediately preceding period) in our business. Finally, we believe the third discussion regarding end market performance provides insight into activities with our various types of customers.

MONTHLY SALES CHANGES:

All company sales – During the months in 2012, 2011, and 2010, all of our selling locations, when combined, had daily sales growth rates of (compared to the comparable month in the preceding year):

| Jan. | Feb. | Mar. | Apr. | May | June | July | Aug. | Sept. | Oct. | Nov. | Dec. | |||||||||||||||||||||||||||||||||||||

| 2012 |

21.3 | % | 20.0 | % | 19.3 | % | 17.3 | % | 13.1 | % | 14.0 | % | ||||||||||||||||||||||||||||||||||||

| 2011 |

18.8 | % | 21.5 | % | 22.8 | % | 23.2 | % | 22.6 | % | 22.5 | % | 22.4 | % | 20.0 | % | 18.8 | % | 21.4 | % | 22.2 | % | 21.2 | % | ||||||||||||||||||||||||

| 2010 |

2.4 | % | 4.4 | % | 12.1 | % | 18.6 | % | 21.1 | % | 21.1 | % | 24.4 | % | 22.1 | % | 23.5 | % | 22.4 | % | 17.9 | % | 20.9 | % | ||||||||||||||||||||||||

The growth in the first three months of 2012 generally continued the relative strength we saw in 2011 and in most of 2010. The April to June 2012 time frame experienced a reduction in our daily sales growth rate as the market we sell into slowed (see further discussion in sequential trends and end market performance). The change in currencies in foreign countries (primarily Canada) relative to the United States dollar lowered our daily sales growth rate by 0.4% during the first six months of 2012 (this lowered growth in the first and second quarters was 0.3% and 0.6% respectively, and was heavily weighted to May and June). This was a sharp contrast to 2011 and 2010, when changes in foreign currencies increased our growth in the first six months by 1.0% and 0.9%, respectively.

Stores opened greater than two years – Our stores opened greater than two years (store sites opened as follows: 2012 group – opened 2010 and earlier, 2011 group – opened 2009 and earlier, and 2010 group – opened 2008 and earlier) represent a consistent ‘same-store’ view of our business. During the months in 2012, 2011, and 2010, the stores opened greater than two years had daily sales growth rates of (compared to the comparable month in the preceding year):

| Jan. | Feb. | Mar. | Apr. | May | June | July | Aug. | Sept. | Oct. | Nov. | Dec. | |||||||||||||||||||||||||||||||||||||

| 2012 |

18.8 | % | 17.1 | % | 16.8 | % | 14.5 | % | 10.1 | % | 11.1 | % | ||||||||||||||||||||||||||||||||||||

| 2011 |

16.0 | % | 18.4 | % | 19.4 | % | 19.6 | % | 19.2 | % | 19.1 | % | 18.7 | % | 16.5 | % | 15.2 | % | 18.0 | % | 18.5 | % | 17.5 | % | ||||||||||||||||||||||||

| 2010 |

0.6 | % | 2.3 | % | 9.6 | % | 16.3 | % | 18.5 | % | 18.3 | % | 21.3 | % | 19.2 | % | 19.8 | % | 18.8 | % | 14.1 | % | 16.8 | % | ||||||||||||||||||||||||

Stores opened greater than five years – The impact of the economy, over time, is best reflected in the growth performance of our stores opened greater than five years (store sites opened as follows: 2012 group – opened 2007 and earlier, 2011 group – opened 2006 and earlier, and 2010 group – opened 2005 and earlier). This group is more cyclical due to the increased market share they enjoy in their local markets. During the months in 2012, 2011, and 2010, the stores opened greater than five years had daily sales growth rates of (compared to the comparable month in the preceding year):

| Jan. | Feb. | Mar. | Apr. | May | June | July | Aug. | Sept. | Oct. | Nov. | Dec. | |||||||||||||||||||||||||||||||||||||

| 2012 |

17.4 | % | 15.8 | % | 15.7 | % | 13.7 | % | 9.0 | % | 10.2 | % | ||||||||||||||||||||||||||||||||||||

| 2011 |

15.3 | % | 17.9 | % | 19.2 | % | 19.1 | % | 17.9 | % | 18.2 | % | 17.3 | % | 15.2 | % | 14.5 | % | 17.0 | % | 17.4 | % | 16.9 | % | ||||||||||||||||||||||||

| 2010 |

-2.1 | % | -0.5 | % | 7.4 | % | 14.9 | % | 17.3 | % | 16.2 | % | 19.8 | % | 18.2 | % | 18.9 | % | 17.9 | % | 13.2 | % | 16.0 | % | ||||||||||||||||||||||||

- 15 -

Table of Contents

SEQUENTIAL TRENDS:

We find it helpful to think about the monthly sequential changes in our business using the analogy of climbing a stairway – This stairway has several predictable landings where there is a pause in the sequential gain (i.e. April, July, and October to December), but generally speaking, climbs from January to October. The October landing then establishes the benchmark for the start of the next year.

History has identified these landings in our business cycle. They generally relate to months with impaired business days (certain holidays). The first landing centers on Easter, which alternates between March and April (Easter occurred in April in 2012, 2011, and 2010), the second landing centers on July 4th, and the third landing centers on the approach of winter with its seasonal impact on primarily our construction business and with the Christmas / New Year holidays. The holidays we noted impact the trends because they either move from month-to-month or because they move around during the week.

The table below shows the pattern to our sequential change in our daily sales. The line labeled ‘Past’ is an historical average of our sequential daily sales change for the period 1998 to 2003. We chose this time frame because it had similar characteristics, a weaker industrial economy in North America, and could serve as a benchmark for a possible trend line. The ‘2012’, ‘2011’, and ‘2010’ lines represent our actual sequential daily sales changes. The ‘12Delta’, ‘11Delta’, and ’10Delta’ lines indicate the difference between the ‘Past’ and the actual results in the respective year.

| Jan.(1) | Feb. | Mar. | Apr. | May | June | July | Aug. | Sept. | Oct. | Cumulative change from Jan. to June |

||||||||||||||||||||||||||||||||||

| Past |

0.9 | % | 3.3 | % | 2.9 | % | -0.3 | % | 3.4 | % | 2.8 | % | -2.3 | % | 2.6 | % | 2.6 | % | -0.7 | % | 12.6 | % | ||||||||||||||||||||||

| 2012 |

-0.3 | % | 0.5 | % | 6.4 | % | -0.8 | % | 0.5 | % | 2.5 | % | 9.3 | % | ||||||||||||||||||||||||||||||

| 12Delta |

-1.2 | % | -2.8 | % | 3.5 | % | -0.5 | % | -2.9 | % | -0.3 | % | -3.3 | % | ||||||||||||||||||||||||||||||

| 2011 |

-0.2 | % | 1.6 | % | 7.0 | % | 0.9 | % | 4.3 | % | 1.7 | % | -1.0 | % | 1.4 | % | 3.4 | % | 0.7 | % | 16.3 | % | ||||||||||||||||||||||

| 11Delta |

-1.1 | % | -1.7 | % | 4.1 | % | 1.2 | % | 0.9 | % | -1.1 | % | 1.3 | % | -1.2 | % | 0.8 | % | 1.4 | % | 3.7 | % | ||||||||||||||||||||||

| 2010 |

2.9 | % | -0.7 | % | 5.9 | % | 0.6 | % | 4.8 | % | 1.7 | % | -1.0 | % | 3.5 | % | 4.5 | % | -1.5 | % | 12.7 | % | ||||||||||||||||||||||

| 10Delta |

2.0 | % | -4.0 | % | 3.0 | % | 0.9 | % | 1.4 | % | -1.1 | % | 1.3 | % | 0.9 | % | 1.9 | % | -0.8 | % | 0.1 | % | ||||||||||||||||||||||

| (1) | The January figures represent the percentage change from the previous October, whereas the remaining figures represent the percentage change from the previous month. |

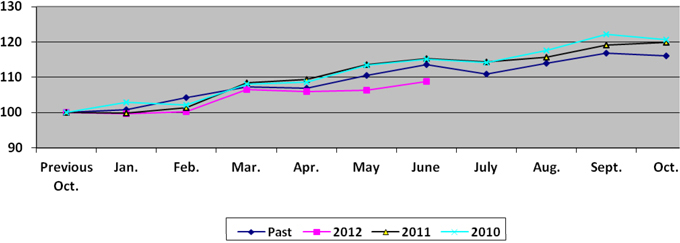

A graph of the sequential daily sales change pattern discussed above, starting with a base of ‘100’ in the previous October and ending with the next October, would be as follows:

- 16 -

Table of Contents

Several observations stand out while viewing the 2012 sequential pattern: (1) The historical sequential pattern (increased daily sales on a sequential basis in February, March, May, and June and decreased daily sales on a sequential basis in April) has played out each month; however, the cumulative growth in the daily sales from January to June has fallen short of the benchmark figure and of the actual results in 2011 and 2010. (2) The magnitude of the February and May ‘12Delta’ of approximately -2.8% was similar. This fact, as well as the choppiness of the year in general, has caused us to approach the year with a conservative tone. (3) The recent weakness has been amplified by changes in foreign currencies (primarily Canada) relative to the U.S. dollar.

END MARKET PERFORMANCE:

Fluctuations in end market business – The sequential trends noted above were directly linked to fluctuations in our end markets. To place this in perspective – approximately 50% of our business has historically been with customers engaged in some type of manufacturing. The daily sales to these customers grew in the first, second, third, and fourth quarters (when compared to the same quarter in the previous year), and for the year, as follows:

| Q1 | Q2 | Q3 | Q4 | Annual | ||||||||||||||||

| 2012 |

20.3 | % | 15.8 | % | ||||||||||||||||

| 2011 |

15.5 | % | 18.5 | % | 18.3 | % | 21.0 | % | 20.0 | % | ||||||||||

| 2010 |

15.7 | % | 29.8 | % | 30.6 | % | 17.7 | % | 22.4 | % | ||||||||||

Our manufacturing business consists of two subsets: the industrial production business (this is business where we supply products that become part of the finished goods produced by our customers) and the maintenance portion (this is business where we supply products that maintain the facility or the equipment of our customers engaged in manufacturing). The industrial business is more fastener centered, while the maintenance portion is represented by all product categories.

In the second quarter of 2012, the decrease in the rate of growth was more pronounced in our industrial production business. This is in sharp contrast to the first quarter of 2012 where the growth was more pronounced in the industrial production business, a trend that had also existed in 2011 and 2010. The first quarter and prior quarters were a direct counter to the 2009 contraction, which was more severe in our industrial production business and less severe in the maintenance portion of our manufacturing business.

The best way to understand the change in our industrial production business is to examine the results in our fastener product line. In the first three months of 2012, the daily sales growth in our fastener product line was approximately 15.4%. This dropped to 10.5%, 6.1%, and 8.6% in April, May, and June, respectively. By contrast, the best way to understand the change in the maintenance portion of the manufacturing business is to examine the results in our non-fastener product lines. In the first three months of 2012, the daily sales growth in our non-fastener business was approximately 25.1%. This dropped to 24.4%, 19.0%, and 19.6% in April, May, and June, respectively.

The patterns related to the industrial production business, as noted above, are influenced by the movements noted in the Purchasing Manufacturers Index (‘PMI’) published by the Institute for Supply Management (http://www.ism.ws/), which is a composite index of economic activity in the manufacturing sector. The PMI in 2012, 2011, and 2010 was as follows:

| Jan. | Feb. | Mar. | Apr. | May | June | July | Aug. | Sept. | Oct. | Nov. | Dec. | |||||||||||||||||||||||||||||||||||||

| 2012 |

54.1 | 52.4 | 53.4 | 54.8 | 53.5 | 49.7 | ||||||||||||||||||||||||||||||||||||||||||

| 2011 |

59.9 | 59.8 | 59.7 | 59.7 | 54.2 | 55.8 | 51.4 | 52.5 | 52.5 | 51.8 | 52.2 | 53.1 | ||||||||||||||||||||||||||||||||||||

| 2010 |

56.7 | 55.8 | 59.3 | 59.0 | 58.8 | 56.0 | 55.7 | 57.4 | 56.4 | 57.0 | 58.0 | 57.3 | ||||||||||||||||||||||||||||||||||||

- 17 -

Table of Contents

Our non-residential construction customers have historically represented 20% to 25% of our business. The daily sales to these customers grew or contracted in the first, second, third, and fourth quarters (when compared to the same quarter in the previous year), and for the year, as follows:

| Q1 | Q2 | Q3 | Q4 | Annual | ||||||||||||||||

| 2012 |

17.1 | % | 12.7 | % | ||||||||||||||||

| 2011 |

17.7 | % | 15.8 | % | 15.8 | % | 17.4 | % | 17.1 | % | ||||||||||

| 2010 |

-14.7 | % | 0.5 | % | 6.3 | % | 10.3 | % | -0.3 | % | ||||||||||

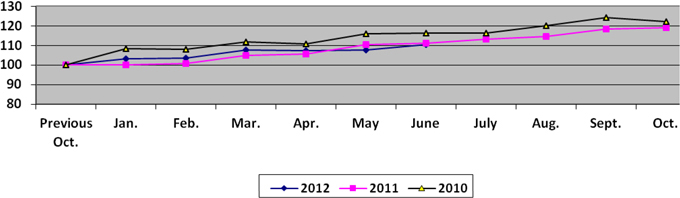

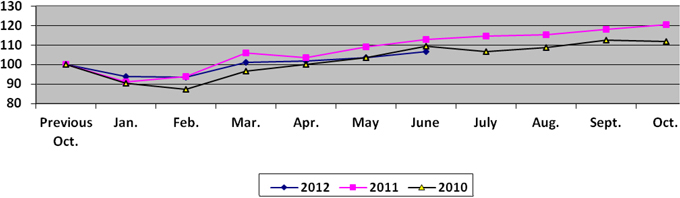

A graph of the sequential daily sales trends to these two end markets in 2012, 2011, and 2010, starting with a base of ‘100’ in the previous October and ending with the next October, would be as follows:

Manufacturing

Non-Residential Construction

- 18 -

Table of Contents

GROWTH DRIVERS OF OUR BUSINESS

We grow by continuously adding customers and by increasing the activity with each customer. We believe this growth is enhanced by our close proximity to our customers, which allows us to provide a range of services and product availability that our competitors can’t easily match. Historically, we expanded our reach by opening stores at a very fast pace. These openings were initially in the United States, but expanded beyond the United States beginning in the mid 1990’s.

In our first ten years of being public (1987 to 1997), we opened stores at a rate approaching 30% per year. In the next ten years, we opened stores at an annual rate of approximately 10% to 15% and, over the last five years, at a rate of approximately 3% to 8% (we currently expect approximately 4% for 2012). As we gained proximity to more customers, we continued to diversify our growth drivers – this was done to provide existing store personnel with more tools to grow their business organically – the results of this are reflected in our earlier discussion on sales growth at stores opened greater than five years. In the early 1990’s, we began to expand our product lines, and we added new product knowledge to our bench. This was our first big effort to diversify our growth drivers. The next step began in the mid to late 1990’s when we began to add sales personnel with certain specialties or focus. This began with our National Accounts group in 1995, and, over time, has expanded to include individuals dedicated to: (1) sales related to our internal manufacturing division, (2) government sales, (3) internet sales, (4) specific products (most recently metalworking), and (5) FAST SolutionsSM (industrial vending). The other step occurred at our sales locations (this includes Fastenal stores as well as strategic account stores and in-plant locations) and at our distribution centers, and began with a targeted merchandising and inventory placement strategy that included our ‘Customer Service Project’ approximately ten years ago and our ‘Master Stocking Hub’ initiative approximately five years ago. This strategy allowed us to target where to stock certain products (local store, regional distribution center, master stocking hub, or supplier) and allowed us to improve our fulfillment and our ability to serve a broader range of customers.

The FAST SolutionsSM (industrial vending) noted above is a rapidly expanding component of our business. We believe industrial vending is the next logical chapter in the Fastenal story, we also believe it has the potential to be transformative to industrial distribution, and that we have a ‘first mover’ advantage. We are investing aggressively to maximize this advantage. At our investor day in May 2011, we discussed our progress with industrial vending. In addition to our discussion regarding progress, we discussed our goals with the rollout of the vending machines. One of the goals we identified related to our rate of ‘machine signings’ (the first category below) – our goal was simple, sign 2,500+ machines per quarter (or an annualized run rate of 10,000 machines).

- 19 -

Table of Contents

The following table includes some statistics regarding this business:

| Q1 | Q2 | Q3 | Q4 | |||||||||||||||||

| Number of vending machines in |

2012 | 4,568 | 4,669 | |||||||||||||||||

| contracts signed during the period1 |

2011 | 1,405 | 2,107 | 2,246 | 2,084 | |||||||||||||||

| 2010 | 257 | 420 | 440 | 792 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cumulative machines installed2 |

2012 | 9,798 | 13,036 | |||||||||||||||||

| 2011 | 2,659 | 3,867 | 5,642 | 7,453 | ||||||||||||||||

| 2010 | 892 | 1,184 | 1,515 | 1,925 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Percent of total net sales to |

2012 | 17.8 | % | 20.8 | % | |||||||||||||||

| customers with vending machines3 |

2011 | 8.9 | % | 10.5 | % | 13.1 | % | 15.7 | % | |||||||||||

| 2010 | 3.4 | % | 4.6 | % | 6.1 | % | 7.5 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Daily sales growth to customers |

2012 | 33.9 | % | 34.3 | % | |||||||||||||||

| with vending machines4 |

2011 | 50.6 | % | 43.9 | % | 42.5 | % | 40.7 | % | |||||||||||

| 2010 | 37.4 | % | 54.0 | % | 56.4 | % | 60.2 | % | ||||||||||||

| 1 | This represents the gross number of machines signed during the quarter, not the number of contracts. |

| 2 | This represents the number of machines installed and producing revenue on the last day of the quarter. |

| 3 | The percentage of total sales (vended and traditional) to customers currently using a vending solution. |

| 4 | The growth in total sales (vended and traditional) to customers currently using a vending solution compared to the comparable period in the preceding year. |

We are pleased with the increases in the number of vending machine contracts signed, and with our ability to install machines. We increased our installed machine base by 3,238 machines (13,036 versus 9,798) in the second quarter of 2012, by 1,208 machines (3,867 versus 2,659) in the second quarter of 2011, and by 292 machines (1,184 versus 892) in the second quarter of 2010.

- 20 -

Table of Contents

PROFIT DRIVERS OF OUR BUSINESS

We grow our profits by continuously working to grow sales and to improve our relative profitability. We also grow our profits by allowing our inherent profitability to shine through – we refer to this as the ‘pathway to profit’. The distinction is important.

We achieve improvements in our relative profitability by increasing our gross margin, by structurally lowering our operating expenses, or both. We advance on the ‘pathway to profit’ by increasing the average store size (measured in terms of monthly sales), and allowing the store mix to improve our profits. This is best explained by comparing the varying profitability of our ‘traditional’ stores in the table below. The average store size for the group, and the average age, number of stores, and pre-tax earnings data by store size for the second quarter of 2012, 2011, and 2010, respectively, were as follows:

| Sales per Month |

Average Age (Years) |

Number of Stores |

Percentage of Stores |

Pre-Tax Earnings Percentage |

||||||||||||

| Three months ended June 30, 2012 |

Average store sales = $89,169 | |||||||||||||||

| $0 to $30,000 |

4.2 | 266 | 10.1 | % | -11.8 | % | ||||||||||

| $30,001 to $60,000 |

7.3 | 769 | 29.2 | % | 12.6 | % | ||||||||||

| $60,001 to $100,000 |

10.0 | 757 | 28.7 | % | 22.3 | % | ||||||||||

| $100,001 to $150,000 |

12.1 | 419 | 15.9 | % | 26.1 | % | ||||||||||

| Over $150,000 |

15.2 | 316 | 12.0 | % | 29.3 | % | ||||||||||

| Strategic Account/Overseas Store |

108 | 4.1 | % | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Company Total |

2,635 | 100.0 | % | 22.2 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Three months ended June 30, 2011 |

Average store sales = $80,191 | |||||||||||||||

| $0 to $30,000 |

3.6 | 338 | 13.2 | % | -12.8 | % | ||||||||||

| $30,001 to $60,000 |

7.1 | 842 | 32.9 | % | 13.5 | % | ||||||||||

| $60,001 to $100,000 |

9.7 | 700 | 27.4 | % | 22.6 | % | ||||||||||

| $100,001 to $150,000 |

11.9 | 352 | 13.8 | % | 26.7 | % | ||||||||||

| Over $150,000 |

15.2 | 243 | 9.5 | % | 28.3 | % | ||||||||||

| Strategic Account/Overseas Store |

83 | 3.2 | % | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Company Total |

2,558 | 100.0 | % | 21.4 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Three months ended June 30, 2010 |

Average store sales = $68,980 | |||||||||||||||

| $0 to $30,000 |

4.3 | 421 | 17.5 | % | -10.2 | % | ||||||||||

| $30,001 to $60,000 |

6.9 | 880 | 36.6 | % | 13.4 | % | ||||||||||

| $60,001 to $100,000 |

9.7 | 602 | 25.0 | % | 23.1 | % | ||||||||||

| $100,001 to $150,000 |

11.8 | 293 | 12.2 | % | 26.5 | % | ||||||||||

| Over $150,000 |

16.2 | 143 | 5.9 | % | 28.3 | % | ||||||||||

| Strategic Account/Overseas Store |

68 | 2.8 | % | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Company Total |

2,407 | 100.0 | % | 19.6 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

Note – Amounts may not foot due to rounding difference.

There are two aspects of our business that can be noted. First, by improving our relative profitability of the various store categories, we amplify the ‘pathway to profit’. Second, as our stores grow their sales, the level of profitability improves due to the natural leverage of the business. This creates what we call the ‘pathway to profit’. When we originally announced the ‘pathway to profit’ strategy in 2007, our goal was to increase our pre-tax earnings, as a percentage of sales, from 18% to 23%. This goal was to be accomplished by slowly moving the mix from the first three categories ($0 to $30,000, $30,001 to $60,000, and $60,001 to $100,000, these groups represented 76.5% of our store base in the first three months of 2007, the last quarter before we announced the ‘pathway to profit’) to the last three categories ($60,001 to $100,000, $100,001 to $150,000, and over $150,000, these groups represented 56.6% of our store base in the second quarter of 2012) and by increasing the average store sales to approximately

- 21 -

Table of Contents

$125,000 per month. The weak economic environment in 2009 caused our average store size to decrease, and consequently lowered our level of profitability; however, subsequent to this period we improved our gross margin and lowered our operating expenses. This improvement allowed us to amplify the ‘pathway to profit’ and effectively lowered the average store size required to hit our 23% goal. Today we believe we can accomplish our ‘pathway to profit’ goal with an average store size of approximately $100,000 to $110,000 per month.

Note – Dollar amounts in this section are presented in whole dollars, not thousands.

Store Count and Full-Time Equivalent (FTE) Headcount – The table that follows highlights certain impacts on our business of the ‘pathway to profit’ since its introduction in 2007. Under the ‘pathway to profit’ we increased both our store count and our store FTE headcount during 2007 and 2008. However, the rate of increase in store locations slowed and our FTE headcount for all types of personnel was reduced when the economy weakened late in 2008. In the table that follows, we refer to our ‘store’ net sales, locations, and personnel. When we discuss ‘store’ net sales, locations, and personnel, we are referring to (1) ‘Fastenal’ stores and (2) strategic account stores. ‘Fastenal’ stores are either a ‘traditional’ store, the typical format in the United States or Canada, or an ‘overseas’ store, which is the typical format outside the United States and Canada. This is discussed in greater detail in our 2011 annual report on Form 10-K. Strategic account stores are stores that are focused on selling to a group of large customers in a limited geographic market. The sales, outside of our ‘store’ group, relate to either (1) our in-plant locations, (2) the portion of our internally manufactured product that is sold directly to a customer and not through a store (including our Holo-Krome business acquired in December 2009), or (3) our direct import business.

The breakdown of our sales, the average monthly sales per store, the number of stores at quarter end, the average headcount at our stores during a quarter, the average FTE headcount during a quarter, and the percentage change were as follows for the first quarter of 2007 (the last completed quarter before we began the ‘pathway to profit’), for the third quarter of 2008 (our peak quarter before the economy weakened), and for each of the last five quarters:

| Q1 2007 |

Q3 2008 |

Q2 2011 |

Q3 2011 |

Q4 2011 |

Q1 2012 |

Q2 2012 |

||||||||||||||||||||||

| Total net sales reported |

$ | 489,157 | $ | 625,037 | $ | 701,730 | $ | 726,742 | $ | 697,804 | $ | 768,875 | $ | 804,890 | ||||||||||||||

| Less: Non-store sales (approximate) |

40,891 | 57,267 | 85,535 | 88,500 | 86,737 | 92,459 | 98,735 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Store net sales (approximate) |

$ | 448,266 | $ | 567,770 | $ | 616,195 | $ | 638,242 | $ | 611,067 | $ | 676,416 | $ | 706,155 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| % change since Q1 2007 |

26.7 | % | 37.5 | % | 42.4 | % | 36.3 | % | 50.9 | % | 57.5 | % | ||||||||||||||||

| % change (twelve months) |

17.5 | % | 23.6 | % | 21.1 | % | 21.0 | % | 20.2 | % | 14.6 | % | ||||||||||||||||

| Percentage of sales through a store |

92 | % | 91 | % | 88 | % | 88 | % | 88 | % | 88 | % | 88 | % | ||||||||||||||

| Average monthly sales per store |

$ | 72 | $ | 82 | $ | 80 | $ | 83 | $ | 79 | $ | 86 | $ | 89 | ||||||||||||||

| % change since Q1 2007 |

13.9 | % | 11.1 | % | 15.3 | % | 9.7 | % | 19.4 | % | 23.6 | % | ||||||||||||||||

| % change (twelve months) |

9.3 | % | 15.9 | % | 15.3 | % | 16.2 | % | 16.2 | % | 11.3 | % | ||||||||||||||||

- 22 -

Table of Contents

| Q1 2007 |

Q3 2008 |

Q2 2011 |

Q3 2011 |

Q4 2011 |

Q1 2012 |

Q2 2012 |

||||||||||||||||||||||

| Store locations—quarter end count |

2,073 | 2,300 | 2,558 | 2,566 | 2,585 | 2,611 | 2,635 | |||||||||||||||||||||

| % change since Q1 2007 |

11.0 | % | 23.4 | % | 23.8 | % | 24.7 | % | 26.0 | % | 27.1 | % | ||||||||||||||||

| % change (twelve months) |

7.2 | % | 6.3 | % | 4.6 | % | 3.8 | % | 3.5 | % | 3.0 | % | ||||||||||||||||

| Store personnel—absolute headcount |

6,849 | 9,123 | 9,734 | 10,057 | 10,328 | 10,486 | 10,637 | |||||||||||||||||||||

| % change since Q1 2007 |

33.2 | % | 42.1 | % | 46.8 | % | 50.8 | % | 53.1 | % | 55.3 | % | ||||||||||||||||

| % change (twelve months) |

17.9 | % | 15.9 | % | 16.4 | % | 14.1 | % | 12.2 | % | 9.3 | % | ||||||||||||||||

| Store personnel—FTE |

6,383 | 8,280 | 8,254 | 8,629 | 8,684 | 8,900 | 9,126 | |||||||||||||||||||||

| Non-store selling personnel—FTE |

616 | 599 | 850 | 920 | 953 | 998 | 1,054 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Sub-total of all sales personnel—FTE |

6,999 | 8,879 | 9,104 | 9,549 | 9,637 | 9,898 | 10,180 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Distribution personnel-FTE |

1,646 | 1,904 | 1,757 | 1,830 | 1,820 | 1,815 | 1,881 | |||||||||||||||||||||

| Manufacturing personnel—FTE 1 |

316 | 340 | 492 | 513 | 516 | 527 | 545 | |||||||||||||||||||||

| Administrative personnel-FTE |

767 | 805 | 783 | 811 | 796 | 796 | 794 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Sub-total of non-sales personnel—FTE |

2,729 | 3,049 | 3,032 | 3,154 | 3,132 | 3,138 | 3,220 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total—average FTE headcount |

9,728 | 11,928 | 12,136 | 12,703 | 12,769 | 13,036 | 13,400 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| % change since Q1 2007 |

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| Store personnel—FTE |

29.7 | % | 29.3 | % | 35.2 | % | 36.0 | % | 39.4 | % | 43.0 | % | ||||||||||||||||

| Non-store selling personnel—FTE |

-2.8 | % | 38.0 | % | 49.4 | % | 54.7 | % | 62.0 | % | 71.1 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Sub-total of all sales personnel—FTE |

26.9 | % | 30.1 | % | 36.4 | % | 37.7 | % | 41.4 | % | 45.4 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Distribution personnel-FTE |

15.7 | % | 6.7 | % | 11.2 | % | 10.6 | % | 10.3 | % | 14.3 | % | ||||||||||||||||

| Manufacturing personnel-FTE 1 |

7.6 | % | 55.7 | % | 62.3 | % | 63.3 | % | 66.8 | % | 72.5 | % | ||||||||||||||||

| Administrative personnel-FTE |

5.0 | % | 2.1 | % | 5.7 | % | 3.8 | % | 3.8 | % | 3.5 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Sub-total of non-sales personnel—FTE |

11.7 | % | 11.1 | % | 15.6 | % | 14.8 | % | 15.0 | % | 18.0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total—average FTE headcount |

22.6 | % | 24.8 | % | 30.6 | % | 31.3 | % | 34.0 | % | 37.7 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| % change (twelve months) |

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| Store personnel—FTE |

15.2 | % | 16.0 | % | 15.8 | % | 14.1 | % | 13.7 | % | 10.6 | % | ||||||||||||||||

| Non-store selling personnel—FTE |

-2.4 | % | 43.8 | % | 44.0 | % | 33.8 | % | 28.1 | % | 24.0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Sub-total of all sales personnel—FTE |

13.8 | % | 18.1 | % | 18.0 | % | 15.8 | % | 15.0 | % | 11.8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Distribution personnel-FTE |

6.0 | % | 19.7 | % | 16.1 | % | 14.1 | % | 12.9 | % | 7.1 | % | ||||||||||||||||

| Manufacturing personnel—FTE 1 |

1.8 | % | 18.3 | % | 19.0 | % | 16.2 | % | 14.3 | % | 10.8 | % | ||||||||||||||||

| Administrative personnel—FTE |

7.9 | % | 10.7 | % | 11.7 | % | 7.0 | % | 4.7 | % | 1.4 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Sub-total of non-sales personnel—FTE |

6.0 | % | 17.0 | % | 15.4 | % | 12.5 | % | 10.9 | % | 6.2 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total—average FTE headcount |

11.7 | % | 17.8 | % | 17.4 | % | 15.0 | % | 14.0 | % | 10.4 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 1 | The distribution and manufacturing headcount was impacted by the addition of 92 employees with the acquisition of Holo-Krome in December 2009. |

- 23 -

Table of Contents

STATEMENT OF EARNINGS INFORMATION (percentage of net sales) for the periods ended June 30:

| Six-month period | Three-month period | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||

| Gross profit |

51.4 | % | 52.1 | % | 51.6 | % | 52.2 | % | ||||||||

| Operating and administrative expenses |

29.8 | % | 31.3 | % | 29.4 | % | 30.8 | % | ||||||||

| (Gain) loss on sale of property and equipment |

(0.0 | %) | 0.0 | % | (0.0 | %) | 0.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

21.6 | % | 20.8 | % | 22.2 | % | 21.4 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest income |

0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings before income taxes |

21.6 | % | 20.8 | % | 22.2 | % | 21.4 | % | ||||||||

|

|

|

|

|