UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09585

ABIOMED, INC.

(Exact name of registrant as specified in its charter)

|

DELAWARE |

|

04-2743260 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

22 CHERRY HILL DRIVE

DANVERS, MASSACHUSETTS 01923

(Address of principal executive offices, including zip code)

(978) 646-1400

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

Large accelerated filer |

☒ |

|

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

(Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

|

Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of January 31, 2018, 44,277,825 shares of the registrant’s common stock, $.01 par value, were outstanding.

ABIOMED, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

||

|

|

|

|

|

|

Item 1. |

|

3 |

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets as of December 31, 2017 and March 31, 2017 |

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows for the nine months ended December 31, 2017 and 2016 |

|

6 |

|

|

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements (unaudited) |

|

7 |

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

21 |

|

|

|

|

|

|

Item 3. |

|

31 |

|

|

|

|

|

|

|

Item 4. |

|

31 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Item 1. |

|

32 |

|

|

|

|

|

|

|

Item 1A. |

|

32 |

|

|

|

|

|

|

|

Item 2. |

|

32 |

|

|

|

|

|

|

|

Item 3. |

|

32 |

|

|

|

|

|

|

|

Item 4. |

|

32 |

|

|

|

|

|

|

|

Item 5. |

|

32 |

|

|

|

|

|

|

|

Item 6. |

|

33 |

|

|

|

|

|

|

|

|

34 |

||

NOTE REGARDING COMPANY REFERENCES

Throughout this report on Form 10-Q (the “Report”), “Abiomed, Inc.,” the “Company,” “we,” “us” and “our” refer to ABIOMED, Inc. and its consolidated subsidiaries.

NOTE REGARDING TRADEMARKS

ABIOMED, IMPELLA, IMPELLA 2.5, IMPELLA 5.0, IMPELLA LD, IMPELLA CP and IMPELLA RP are trademarks of ABIOMED, Inc., and are registered in the U.S. and certain foreign countries. AB5000 and cVAD REGISTRY are trademarks of ABIOMED, Inc.

2

ABIOMED, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share data)

|

|

|

December 31, 2017 |

|

|

March 31, 2017 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

50,502 |

|

|

$ |

39,040 |

|

|

Short-term marketable securities |

|

|

250,751 |

|

|

|

190,908 |

|

|

Accounts receivable, net |

|

|

64,862 |

|

|

|

54,055 |

|

|

Inventories |

|

|

46,891 |

|

|

|

34,931 |

|

|

Prepaid expenses and other current assets |

|

|

9,192 |

|

|

|

8,024 |

|

|

Total current assets |

|

|

422,198 |

|

|

|

326,958 |

|

|

Long-term marketable securities |

|

|

49,485 |

|

|

|

47,143 |

|

|

Property and equipment, net |

|

|

107,977 |

|

|

|

87,777 |

|

|

Goodwill |

|

|

34,814 |

|

|

|

31,045 |

|

|

In-process research and development |

|

|

16,241 |

|

|

|

14,482 |

|

|

Long-term deferred tax assets, net |

|

|

75,201 |

|

|

|

34,723 |

|

|

Other assets |

|

|

13,686 |

|

|

|

8,286 |

|

|

Total assets |

|

$ |

719,602 |

|

|

$ |

550,414 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

21,991 |

|

|

$ |

20,620 |

|

|

Accrued expenses |

|

|

41,565 |

|

|

|

37,703 |

|

|

Deferred revenue |

|

|

11,797 |

|

|

|

10,495 |

|

|

Current portion of capital lease obligation |

|

|

— |

|

|

|

799 |

|

|

Total current liabilities |

|

|

75,353 |

|

|

|

69,617 |

|

|

Other long-term liabilities |

|

|

466 |

|

|

|

3,251 |

|

|

Contingent consideration |

|

|

10,423 |

|

|

|

9,153 |

|

|

Long-term deferred tax liabilities |

|

|

878 |

|

|

|

783 |

|

|

Capital lease obligation, net of current portion |

|

|

— |

|

|

|

15,539 |

|

|

Total liabilities |

|

|

87,120 |

|

|

|

98,343 |

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Class B Preferred Stock, $.01 par value |

|

|

— |

|

|

|

— |

|

|

Authorized - 1,000,000 shares; Issued and outstanding - none |

|

|

|

|

|

|

|

|

|

Common stock, $.01 par value |

|

|

443 |

|

|

|

437 |

|

|

Authorized - 100,000,000 shares; Issued - 45,995,445 shares at December 31, 2017 and 45,249,281 shares at March 31, 2017 |

|

|

|

|

|

|

|

|

|

Outstanding - 44,271,905 shares at December 31, 2017 and 43,673,286 shares at March 31, 2017 |

|

|

|

|

|

|

|

|

|

Additional paid in capital |

|

|

605,697 |

|

|

|

565,962 |

|

|

Retained earnings (accumulated deficit) |

|

|

103,610 |

|

|

|

(46,959 |

) |

|

Treasury stock at cost - 1,723,540 shares at December 31, 2017 and 1,575,995 shares at March 31, 2017 |

|

|

(66,622 |

) |

|

|

(46,763 |

) |

|

Accumulated other comprehensive loss |

|

|

(10,646 |

) |

|

|

(20,606 |

) |

|

Total stockholders' equity |

|

|

632,482 |

|

|

|

452,071 |

|

|

Total liabilities and stockholders' equity |

|

$ |

719,602 |

|

|

$ |

550,414 |

|

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited)

3

ABIOMED, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share data)

|

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

|

153,989 |

|

|

$ |

|

114,624 |

|

|

$ |

|

419,202 |

|

|

$ |

|

320,541 |

|

|

Funded research and development |

|

|

|

33 |

|

|

|

|

50 |

|

|

|

|

111 |

|

|

|

|

83 |

|

|

|

|

|

|

154,022 |

|

|

|

|

114,674 |

|

|

|

|

419,313 |

|

|

|

|

320,624 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue |

|

|

|

24,994 |

|

|

|

|

18,987 |

|

|

|

|

68,483 |

|

|

|

|

51,366 |

|

|

Research and development |

|

|

|

17,706 |

|

|

|

|

16,349 |

|

|

|

|

54,027 |

|

|

|

|

50,061 |

|

|

Selling, general and administrative |

|

|

|

66,556 |

|

|

|

|

53,935 |

|

|

|

|

187,233 |

|

|

|

|

158,053 |

|

|

|

|

|

|

109,256 |

|

|

|

|

89,271 |

|

|

|

|

309,743 |

|

|

|

|

259,480 |

|

|

Income from operations |

|

|

|

44,766 |

|

|

|

|

25,403 |

|

|

|

|

109,570 |

|

|

|

|

61,144 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income, net |

|

|

|

969 |

|

|

|

|

457 |

|

|

|

|

2,385 |

|

|

|

|

1,068 |

|

|

Other expense, net |

|

|

|

(81 |

) |

|

|

|

(34 |

) |

|

|

|

(25 |

) |

|

|

|

(225 |

) |

|

|

|

|

|

888 |

|

|

|

|

423 |

|

|

|

|

2,360 |

|

|

|

|

843 |

|

|

Income before income taxes |

|

|

|

45,654 |

|

|

|

|

25,826 |

|

|

|

|

111,930 |

|

|

|

|

61,987 |

|

|

Income tax provision |

|

|

|

32,208 |

|

|

|

|

10,394 |

|

|

|

|

36,607 |

|

|

|

|

24,770 |

|

|

Net income |

|

$ |

|

13,446 |

|

|

$ |

|

15,432 |

|

|

$ |

|

75,323 |

|

|

$ |

|

37,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

|

0.30 |

|

|

$ |

|

0.36 |

|

|

$ |

|

1.71 |

|

|

$ |

|

0.86 |

|

|

Basic weighted average shares outstanding |

|

|

|

44,247 |

|

|

|

|

43,431 |

|

|

|

|

44,095 |

|

|

|

|

43,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per share |

|

$ |

|

0.29 |

|

|

$ |

|

0.34 |

|

|

$ |

|

1.65 |

|

|

$ |

|

0.83 |

|

|

Diluted weighted average shares outstanding |

|

|

|

45,869 |

|

|

|

|

44,770 |

|

|

|

|

45,731 |

|

|

|

|

44,597 |

|

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited)

4

ABIOMED, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(in thousands)

|

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Net income |

|

$ |

13,446 |

|

|

$ |

15,432 |

|

|

$ |

75,323 |

|

|

$ |

37,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive gain (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gains (losses) |

|

|

1,557 |

|

|

|

(5,873 |

) |

|

|

10,406 |

|

|

|

(6,760 |

) |

|

Net unrealized losses on marketable securities |

|

|

(401 |

) |

|

|

(269 |

) |

|

|

(446 |

) |

|

|

(137 |

) |

|

Other comprehensive gain (loss) |

|

|

1,156 |

|

|

|

(6,142 |

) |

|

|

9,960 |

|

|

|

(6,897 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

$ |

14,602 |

|

|

$ |

9,290 |

|

|

$ |

85,283 |

|

|

$ |

30,320 |

|

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited)

5

ABIOMED, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

|

|

|

For the Nine Months Ended December 31, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

Operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

75,323 |

|

|

$ |

37,217 |

|

|

Adjustments required to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

8,100 |

|

|

|

4,488 |

|

|

Bad debt expense |

|

|

(8 |

) |

|

|

(12 |

) |

|

Stock-based compensation |

|

|

29,170 |

|

|

|

24,521 |

|

|

Write-down of inventory and other assets |

|

|

3,212 |

|

|

|

2,059 |

|

|

Excess tax benefit from stock-based awards |

|

|

— |

|

|

|

(4,595 |

) |

|

Deferred tax provision |

|

|

34,740 |

|

|

|

18,817 |

|

|

Change in fair value of contingent consideration |

|

|

1,270 |

|

|

|

612 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(10,342 |

) |

|

|

(7,555 |

) |

|

Inventories |

|

|

(11,974 |

) |

|

|

(8,615 |

) |

|

Prepaid expenses and other assets |

|

|

(1,033 |

) |

|

|

(3,923 |

) |

|

Accounts payable |

|

|

2,595 |

|

|

|

3,542 |

|

|

Accrued expenses and other liabilities |

|

|

3,874 |

|

|

|

11,040 |

|

|

Deferred revenue |

|

|

1,220 |

|

|

|

265 |

|

|

Net cash provided by operating activities |

|

|

136,147 |

|

|

|

77,861 |

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of marketable securities |

|

|

(209,834 |

) |

|

|

(177,591 |

) |

|

Proceeds from the sale and maturity of marketable securities |

|

|

148,095 |

|

|

|

144,670 |

|

|

Purchase of other investment |

|

|

(6,400 |

) |

|

|

(149 |

) |

|

Purchases of property and equipment |

|

|

(44,168 |

) |

|

|

(24,039 |

) |

|

Net cash used for investing activities |

|

|

(112,307 |

) |

|

|

(57,109 |

) |

|

Financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from the exercise of stock options |

|

|

7,626 |

|

|

|

8,265 |

|

|

Excess tax benefit from stock-based awards |

|

|

— |

|

|

|

4,595 |

|

|

Taxes paid related to net share settlement of vesting of stock awards |

|

|

(19,860 |

) |

|

|

(19,898 |

) |

|

Proceeds from the issuance of stock under employee stock purchase plan |

|

|

1,063 |

|

|

|

769 |

|

|

Principal payments on capital lease obligation |

|

|

(517 |

) |

|

|

(264 |

) |

|

Net cash used for financing activities |

|

|

(11,688 |

) |

|

|

(6,533 |

) |

|

Effect of exchange rate changes on cash |

|

|

(690 |

) |

|

|

(1,381 |

) |

|

Net increase in cash and cash equivalents |

|

|

11,462 |

|

|

|

12,838 |

|

|

Cash and cash equivalents at beginning of period |

|

|

39,040 |

|

|

|

48,231 |

|

|

Cash and cash equivalents at end of period |

|

$ |

50,502 |

|

|

$ |

61,069 |

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

845 |

|

|

$ |

735 |

|

|

Cash paid for interest on capital lease obligation |

|

|

302 |

|

|

|

223 |

|

|

Supplemental disclosure of non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Property and equipment under capital lease obligation |

|

|

— |

|

|

|

16,784 |

|

|

Property and equipment in accounts payable and accrued expenses |

|

|

3,836 |

|

|

|

3,717 |

|

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited)

6

ABIOMED, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(In thousands, except share data)

Note 1. Nature of Business

Abiomed, Inc. (the “Company” or “Abiomed”) is a provider of mechanical circulatory support devices and offers a continuum of care to heart failure patients. The Company develops, manufactures and markets proprietary products that are designed to enable the heart to rest, heal and recover by improving blood flow and/or performing the pumping function of the heart. The Company’s products are used in the cardiac catheterization lab, or cath lab, by interventional cardiologists and in the heart surgery suite by heart surgeons for patients who are in need of hemodynamic support prophylactically or emergently before, during or after angioplasty or heart surgery procedures.

Note 2. Basis of Preparation and Summary of Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles, or GAAP, for interim financial reporting and in accordance with Article 10 of Regulation S-X. Accordingly, they do not include all of the information and note disclosures required by GAAP for complete financial statements. These statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2017 that has been filed with the Securities and Exchange Commission (the “SEC”).

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all normal and recurring adjustments that are necessary for a fair presentation of results for the interim periods presented. The results of operations for any interim period may not be indicative of results for the full fiscal year or any other subsequent period.

There have been no changes in the Company’s significant accounting policies for the three and nine months ended December 31, 2017 as compared to the significant accounting policies described in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2017 that has been filed with the SEC.

New Accounting Pronouncements Adopted

Effective April 1, 2017, the Company adopted the Financial Accounting Standards Board (“FASB”) standard update ASU 2016-09, “Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting” (“ASU 2016-09”) which simplifies several aspects of the accounting for share-based payment transactions, including income tax consequences, recognition of stock compensation award forfeitures, classification of awards as either equity or liabilities, the calculation of diluted shares outstanding and classification on the statement of cash flows.

7

The following table summarizes the most significant impacts of ASU 2016-09 for the three and nine months ended December 31, 2017:

|

Description of Change: |

|

Impact of Change Upon Adoption on April 1, 2017 and for the Three and Nine Months Ended December 31, 2017: |

|

Adoption Method: |

|

The new standard eliminates the requirement that excess tax benefits be realized through a reduction in income taxes payable before a company can recognize them in the statement of operations. |

|

As a result, on April 1, 2017, the Company recorded a cumulative-effect adjustment to increase retained earnings and deferred tax assets by $76.4 million for excess tax benefits not previously recognized. |

|

Modified-retrospective (required) |

|

|

|

|

|

|

|

Excess tax benefits related to restricted stock unit vestings or stock option exercises are recorded through the statement of operations.

|

|

The income tax benefit for the three and nine months ended December 31, 2017, included excess tax benefits of $3.2 million and $24.5 million, respectively. These recognized excess tax benefits resulted from restricted stock units that vested or stock options that were exercised during the three and nine months ended December 31, 2017. |

|

Prospective (required) |

|

|

|

|

|

|

|

Excess tax benefits related to restricted stock unit vestings or stock option exercises are classified as operating cash flows instead of financing cash flows. |

|

Increase in cash flow from operating activities and decrease in cash flow from financing activities by approximately $24.5 million for the nine months ended December 31, 2017. The statement of cash flows for the prior period has not been adjusted. |

|

Prospective (elected) |

|

|

|

|

|

|

|

Calculation of diluted weighted average shares outstanding under the treasury method no longer assume that tax benefits related to stock-based awards are used to repurchase common stock. |

|

The Company excluded the related tax benefits when applying the treasury stock method for computing diluted shares outstanding on a prospective basis as required by ASU 2016-09. |

|

Prospective (required) |

|

|

|

|

|

|

|

An accounting policy election can be made to reduce stock-based compensation expense for forfeitures as they occur instead of estimating forfeitures that are expected to occur. |

|

The Company made an accounting policy election to account for forfeitures as they occur with the change applied on a modified retrospective basis with a cumulative effect adjustment on April 1, 2017 to increase additional paid-in capital by $1.8 million, increase deferred tax assets by $0.7 million and decrease retained earnings by $1.1 million. The Company elected to make this accounting policy change to simplify the accounting for stock-based compensation and believes this method provides a more accurate reflection of periodic stock based compensation cost. Prior to the adoption of this accounting standard, the Company estimated at grant the likelihood that the award would ultimately vest, and revised the estimate, if necessary, in future periods if the actual forfeiture rate differed. |

|

Modified-retrospective (elected) |

|

|

|

|

|

|

|

Cash payments to tax authorities for shares withheld to meet employee tax withholding requirements on restricted stock units are classified as financing cash flow instead of operating cash flow.

|

|

No change since the Company has historically presented these amounts as a financing activity. Prior to ASU 2016-09, U.S. GAAP has not specified how these types of transactions should be classified in the statement of cash flows. |

|

N/A |

See table below for the changes in beginning stockholders' equity as a result of this implementation.

|

|

|

Common Stock |

|

|

Treasury Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Number of shares |

|

|

Par value |

|

|

Number of shares |

|

|

Amount |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

Total Stockholders' Equity |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, March 31, 2017 |

|

|

43,673,286 |

|

$ |

|

437 |

|

|

|

1,575,995 |

|

$ |

|

(46,763 |

) |

$ |

|

565,962 |

|

$ |

|

(46,959 |

) |

$ |

|

(20,606 |

) |

$ |

|

452,071 |

|

|

Cumulative effect of adoption of new accounting standard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,835 |

|

|

|

75,246 |

|

|

|

|

|

|

|

77,081 |

|

|

Balance, April 1, 2017 |

|

|

43,673,286 |

|

$ |

|

437 |

|

|

|

1,575,995 |

|

$ |

|

(46,763 |

) |

$ |

|

567,797 |

|

$ |

|

28,287 |

|

$ |

|

(20,606 |

) |

$ |

|

529,152 |

|

8

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers to provide updated guidance on revenue recognition. This new standard will replace most of the existing revenue recognition guidance in U.S. GAAP when it becomes effective and permits the use of either the retrospective or cumulative effect transition method. ASU 2014-09 requires a company to recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies may need to use more judgment and make more estimates than under the current accounting guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. The guidance also requires expanded disclosures relating to the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. Additionally, qualitative and quantitative disclosures are required about customer contracts, significant judgments and changes in judgments, and assets recognized from the costs to obtain or fulfill a contract.

The Company is assessing all of the potential impacts of the revenue recognition guidance. Although the Company has not yet completed its assessment of the new revenue recognition guidance, the Company believes that the new revenue recognition guidance generally supports the recognition of revenue at a point-in-time for product sales and over an extended period of time for preventative maintenance service agreements, which is consistent with its current revenue recognition model. The Company does anticipate that the new revenue standard will result in expanded financial statement disclosures relating to the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The Company is reviewing and updating its internal controls and processes over revenue recognition in order to prepare for the adoption of and ongoing accounting under the new standard. As the Company completes its evaluation of this new accounting standard, new information may arise that could change the Company’s current understanding of the impact to revenue and expense recognized and financial statement disclosures. Additionally, the Company will continue to monitor industry activities and any additional guidance provided by regulators, standards setters, or the accounting profession and adjust the Company’s assessment and implementation plans accordingly, if required. ASU 2014-09 can be applied retrospectively to each prior reporting period presented, or retrospectively with the cumulative effect of the change recognized at the date of the initial application. The Company will apply the new guidance effective April 1, 2018 using the modified retrospective method to contracts that are not completed as of April 1, 2018. The Company does not expect the adoption of this standard, including the cumulative effect of any adjustment to the opening balance of retained earnings, to have a material impact to its consolidated financial statements.

In January 2016, the FASB issued ASU 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities. This guidance changes accounting for financial assets and financial liabilities under the fair value option and includes additional presentation and disclosure requirements for financial instruments. ASU 2016-01 requires certain financial assets to be measured at fair value with changes in fair value recognized in the statement of operations. ASU 2016-01 eliminates the available-for-sale classification for marketable securities in which changes in fair value are currently recorded as a component of other comprehensive income. ASU 2016-01 also impacts the recognition and measurement of equity investments, which are currently carried at cost, but will be measured at fair value in the Company’s consolidated statement of operations. ASU 2016-01 is effective for annual reporting periods beginning after December 15, 2017, with early adoption permitted with specific application guidance. ASU 2016-01 will become effective for the Company beginning in fiscal 2019. The Company is evaluating the impact to its consolidated financial statements but ASU 2016-01 could have a significant impact, including additional volatility in other income (expense) within its statement of operations in future periods if there are measurable changes in fair value of equity investments.

In February 2016, the FASB issued ASU 2016-02, Leases. The new guidance significantly impacts lessee accounting and financial statement disclosures. Specifically, this guidance requires lessees to identify arrangements that should be accounted for as leases. Under this guidance, for lease arrangements exceeding a one year term, a right-of-use asset and lease obligation is recorded by the lessee for all leases on the balance sheet, whether operating or financing, while the statement of operations includes lease expense for operating leases and amortization and interest expense for financing leases. The balance sheet amount recorded at the date of adoption of this guidance must be calculated using the applicable incremental borrowing rate at the date of adoption. Leases with a term of one year or less will be accounted for similar to existing guidance for operating leases. The Company is currently in the process of evaluating its lessee arrangements to determine the impact of ASU 2016-02 on its consolidated financial statements. This evaluation includes a review of the Company’s existing leasing arrangements on its facilities. ASU 2016-02 must be adopted using a modified retrospective approach for all leases existing at, or entered into after the date of initial adoption, with an option to elect to use certain transition relief. ASU 2016-02 will become effective for the Company beginning in fiscal 2020.

9

Basic net income per share is computed by dividing net income by the weighted average number of common shares outstanding during the period. Diluted net income per share is computed by dividing net income by the weighted average number of dilutive common shares outstanding during the period. Diluted shares outstanding are calculated by adding to the weighted average shares outstanding any potential dilutive securities outstanding for the period. Potential dilutive securities include stock options, restricted stock units, performance-based stock awards and shares to be purchased under the Company’s employee stock purchase plan. The Company’s basic and diluted net income per share for the three and nine months ended December 31, 2017 and 2016 were as follows (in thousands, except per share data):

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||||||

|

Basic Net Income Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

|

13,446 |

|

|

$ |

|

15,432 |

|

|

$ |

|

75,323 |

|

|

$ |

|

37,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing basic net income per share |

|

|

44,247 |

|

|

|

|

43,431 |

|

|

|

|

44,095 |

|

|

|

|

43,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share - basic |

$ |

|

0.30 |

|

|

$ |

|

0.36 |

|

|

$ |

|

1.71 |

|

|

$ |

|

0.86 |

|

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||||||

|

Diluted Net Income Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

|

13,446 |

|

|

$ |

|

15,432 |

|

|

$ |

|

75,323 |

|

|

$ |

|

37,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing basic net income per share |

|

|

44,247 |

|

|

|

|

43,431 |

|

|

|

|

44,095 |

|

|

|

|

43,125 |

|

|

Effect of dilutive securities |

|

|

1,622 |

|

|

|

|

1,339 |

|

|

|

|

1,636 |

|

|

|

|

1,472 |

|

|

Weighted average shares used in computing diluted net income per share |

|

|

45,869 |

|

|

|

|

44,770 |

|

|

|

|

45,731 |

|

|

|

|

44,597 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share - diluted |

$ |

|

0.29 |

|

|

$ |

|

0.34 |

|

|

$ |

|

1.65 |

|

|

$ |

|

0.83 |

|

For the three and nine months ended December 31, 2017, approximately 2,600 and 4,800 shares underlying out-of-the-money stock options, respectively, were excluded in the computation of diluted earnings per share because their effect would have been anti-dilutive. Also, approximately 128,000 restricted shares in each of the three and nine months ended December 31, 2017, respectively, related to performance-based and market-based awards for which milestones have not been met, were not included in the computation of diluted earnings per share.

For the three and nine months ended December 31, 2016, approximately 28,000 and 17,000 shares underlying out-of-the-money stock options, respectively, were excluded in the computation of diluted earnings per share because their effect would have been anti-dilutive. Also, approximately 185,000 restricted shares in each of the three and nine months ended December 31, 2016, respectively, related to performance-based and market-based awards for which milestones have not been met, were not included in the computation of diluted earnings per share.

Note 4. Marketable Securities and Fair Value Measurements

Marketable Securities

The Company’s marketable securities are classified as available-for-sale securities and, accordingly, are recorded at fair value. The difference between amortized cost and fair value is included in stockholders’ equity. At December 31, 2017 and March 31, 2017, the Company’s financial instruments consist primarily of cash and cash equivalents, marketable securities, accounts receivable, accounts payable and contingent consideration. The carrying amounts of accounts receivable and accounts payable are considered reasonable estimates of their fair value, due to the short maturity of these investments.

The Company’s marketable securities at December 31, 2017 and March 31, 2017 are invested in the following:

10

|

|

|

Amortized |

|

|

Gross Unrealized |

|

|

Gross Unrealized |

|

|

Fair Market |

|

||||

|

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Value |

|

||||

|

|

|

(in $000's) |

|

|||||||||||||

|

December 31, 2017: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term U.S. Treasury mutual fund securities |

|

$ |

21,068 |

|

|

$ |

— |

|

|

$ |

(25 |

) |

|

$ |

21,043 |

|

|

Short-term government-backed securities |

|

|

152,586 |

|

|

|

— |

|

|

|

(343 |

) |

|

|

152,243 |

|

|

Short-term corporate debt securities |

|

|

77,592 |

|

|

|

3 |

|

|

|

(130 |

) |

|

|

77,465 |

|

|

Long-term government-backed securities |

|

|

47,587 |

|

|

|

— |

|

|

|

(96 |

) |

|

|

47,491 |

|

|

Long-term corporate debt securities |

|

|

1,997 |

|

|

|

— |

|

|

|

(3 |

) |

|

|

1,994 |

|

|

|

|

$ |

300,830 |

|

|

$ |

3 |

|

|

$ |

(597 |

) |

|

$ |

300,236 |

|

|

|

|

Amortized |

|

|

Gross Unrealized |

|

|

Gross Unrealized |

|

|

Fair Market |

|

||||

|

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Value |

|

||||

|

|

|

(in $000's) |

|

|||||||||||||

|

March 31, 2017: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term U.S. Treasury mutual fund securities |

|

$ |

45,199 |

|

|

$ |

— |

|

|

$ |

(13 |

) |

|

$ |

45,186 |

|

|

Short-term government-backed securities |

|

|

90,199 |

|

|

|

1 |

|

|

|

(87 |

) |

|

|

90,113 |

|

|

Short-term corporate debt securities |

|

|

55,465 |

|

|

|

— |

|

|

|

(31 |

) |

|

|

55,434 |

|

|

Long-term U.S. Treasury mutual fund securities |

|

|

1,998 |

|

|

|

— |

|

|

|

(3 |

) |

|

|

1,995 |

|

|

Long-term government-backed securities |

|

|

43,484 |

|

|

|

5 |

|

|

|

(18 |

) |

|

|

43,471 |

|

|

Long-term corporate debt securities |

|

|

1,853 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

1,852 |

|

|

|

|

$ |

238,198 |

|

|

$ |

6 |

|

|

$ |

(153 |

) |

|

$ |

238,051 |

|

Fair Value Hierarchy

Fair value is defined as the price that would be received upon the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Financial assets and liabilities carried at fair value are to be classified and disclosed in one of the following three categories:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data.

Level 3: Unobservable inputs that are not corroborated by market data.

Level 1 primarily consists of financial instruments whose values are based on quoted market prices such as exchange-traded instruments and listed equities.

Level 2 includes financial instruments that are valued using models or other valuation methodologies. These models are primarily industry-standard models that consider various assumptions, including time value, yield curve, volatility factors, prepayment speeds, default rates, loss severity, current market and contractual prices for the underlying financial instruments, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace.

Level 3 is comprised of unobservable inputs that are supported by little or no market activity. Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flows, or similar techniques, and at least one significant model assumption or input is unobservable.

11

The following table presents the Company’s financial instruments recorded at fair value in the condensed consolidated balance sheets, classified according to the three categories described above:

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

December 31, 2017: |

|

(in $000's) |

|

|||||||||||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term U.S. Treasury mutual fund securities |

|

$ |

— |

|

|

$ |

21,043 |

|

|

$ |

— |

|

|

$ |

21,043 |

|

|

Short-term government-backed securities |

|

|

— |

|

|

|

152,243 |

|

|

|

— |

|

|

|

152,243 |

|

|

Short-term corporate debt securities |

|

|

— |

|

|

|

77,465 |

|

|

|

— |

|

|

|

77,465 |

|

|

Long-term government-backed securities |

|

|

— |

|

|

|

47,491 |

|

|

|

— |

|

|

|

47,491 |

|

|

Long-term corporate debt securities |

|

|

— |

|

|

|

1,994 |

|

|

|

— |

|

|

|

1,994 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

10,423 |

|

|

|

10,423 |

|

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

March 31, 2017: |

|

(in $000's) |

|

|||||||||||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term U.S. Treasury mutual fund securities |

|

$ |

— |

|

|

$ |

45,186 |

|

|

$ |

— |

|

|

$ |

45,186 |

|

|

Short-term government-backed securities |

|

|

— |

|

|

|

90,113 |

|

|

|

— |

|

|

|

90,113 |

|

|

Short-term corporate debt securities |

|

|

— |

|

|

|

55,434 |

|

|

|

— |

|

|

|

55,434 |

|

|

Long-term U.S. Treasury mutual fund securities |

|

|

— |

|

|

|

1,995 |

|

|

|

— |

|

|

|

1,995 |

|

|

Long-term government-backed securities |

|

|

— |

|

|

|

43,471 |

|

|

|

— |

|

|

|

43,471 |

|

|

Long-term corporate debt securities |

|

|

— |

|

|

|

1,852 |

|

|

|

— |

|

|

|

1,852 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

9,153 |

|

|

|

9,153 |

|

The Company has determined that the estimated fair value of its investments in U.S. Treasury mutual fund securities, government-backed securities, and corporate debt securities are reported as Level 2 financial assets as they are not exchange-traded instruments.

The Company’s financial liabilities consisted of contingent consideration potentially payable related to the acquisition of ECP Entwicklungsgesellschaft mbH (“ECP”) and AIS GmbH Aachen Innovative Solutions (“AIS”), in July 2014. The Company acquired ECP for $13.0 million in cash, with additional potential payouts totaling $15.0 million based on the achievement of certain clinical and regulatory and revenue-based milestones related to the development of the future Impella ECPTM expandable catheter pump technology. These potential milestone payments may be made, at the Company’s option, by a combination of cash or Abiomed common stock. The Company uses a combination of an income approach, based on various revenue and cost assumptions and applying a probability to each outcome and a Monte-Carlo valuation model. For the clinical and regulatory milestone, probabilities were applied to each potential scenario and the resulting values were discounted using a rate that considers weighted average cost of capital as well as a specific risk premium associated with the riskiness of the earn out itself, the related projections, and the overall business. The revenue-based milestone is valued using a Monte-Carlo valuation model, which simulates estimated future revenues during the earn out-period using management's best estimates. Projected revenues are based on our most recent internal operational budgets and long-range strategic plans.

12

This liability is reported as Level 3 as the estimated fair value of the contingent consideration related to the acquisition of ECP requires significant management judgment or estimation and is calculated using the following valuation methods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value at December 31, 2017 (in $000's) |

|

|

Valuation Methodology |

|

Significant Unobservable Input |

|

Weighted Average (range, if applicable) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical and regulatory milestone |

|

$ |

5,654 |

|

|

Probability weighted income approach |

|

Projected fiscal year of milestone payments |

|

2019 to 2022 |

|

|

|

|

|

|

|

|

|

|

|

Discount rate |

|

2.8% to 3.3% |

|

|

|

|

|

|

|

|

|

|

|

Probability of occurrence |

|

Probability adjusted level of 40% for the base case scenario and 12% to 30% for various upside and downside scenarios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue-based milestone |

|

|

4,769 |

|

|

Monte Carlo simulation model |

|

Projected fiscal year of milestone payments |

|

2023 to 2035 |

|

|

|

|

|

|

|

|

|

|

|

Discount rate |

|

|

18% |

|

|

|

|

|

|

|

|

|

|

Expected volatility for forecasted revenues |

|

|

50% |

|

|

|

|

$ |

10,423 |

|

|

|

|

|

|

|

|

|

The following table summarizes the change in fair value, as determined by Level 3 inputs, of the contingent consideration for the three and nine months ended December 31, 2017 and 2016:

|

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

(in $000's) |

|

|

(in $000's) |

|

||||||||||

|

Level 3 liabilities, beginning balance |

|

$ |

9,835 |

|

|

$ |

7,749 |

|

|

$ |

9,153 |

|

|

$ |

7,563 |

|

|

Additions |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Payments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Change in fair value |

|

|

588 |

|

|

|

426 |

|

|

|

1,270 |

|

|

|

612 |

|

|

Level 3 liabilities, ending balance |

|

$ |

10,423 |

|

|

$ |

8,175 |

|

|

$ |

10,423 |

|

|

$ |

8,175 |

|

The change in fair value of the contingent consideration was primarily due to the passage of time on the fair value measurement of milestones related to the ECP acquisition. Adjustments associated with the change in fair value of contingent consideration are included in research and development expenses in the Company’s condensed consolidated statements of operations. Significant increases or decreases in any of the probabilities of success or changes in expected timelines for achievement of any of these milestones could result in a significantly higher or lower fair value of the liability. The fair value of the contingent consideration at each reporting date is updated by reflecting the changes in fair value reflected in the Company’s statement of operations. There is no assurance that any of the conditions for the milestone payments will be met.

Other Investments

The Company periodically makes investments in private medical device companies that focus on heart failure, heart pump and other medical device technologies. The aggregate carrying amount of the Company’s other investments was $12.6 million and $7.2 million at December 31, 2017 and March 31, 2017, respectively, and is classified within other assets in the unaudited condensed consolidated balance sheets. During the nine months ended December 31, 2017, the Company made investments of $6.4 million in private medical device companies. These investments are accounted for using the cost method and are evaluated for impairment and measured at fair value only if there are identified events or changes in circumstances that may have a significant adverse effect on the fair value of these investments.

13

Note 5. Property and Equipment

The components of property and equipment are as follows:

|

|

|

December 31, 2017 |

|

|

March 31, 2017 |

|

||

|

|

|

(in $000's) |

|

|||||

|

Land |

|

$ |

7,550 |

|

|

$ |

4,046 |

|

|

Building and building improvements |

|

|

61,086 |

|

|

|

10,900 |

|

|

Capital lease asset |

|

|

— |

|

|

|

16,784 |

|

|

Leasehold improvements |

|

|

2,173 |

|

|

|

34,854 |

|

|

Machinery and equipment |

|

|

38,336 |

|

|

|

27,989 |

|

|

Furniture and fixtures |

|

|

7,503 |

|

|

|

3,899 |

|

|

Construction in progress |

|

|

15,958 |

|

|

|

9,257 |

|

|

Total cost |

|

|

132,606 |

|

|

|

107,729 |

|

|

Less accumulated depreciation |

|

|

(24,629 |

) |

|

|

(19,952 |

) |

|

|

|

$ |

107,977 |

|

|

$ |

87,777 |

|

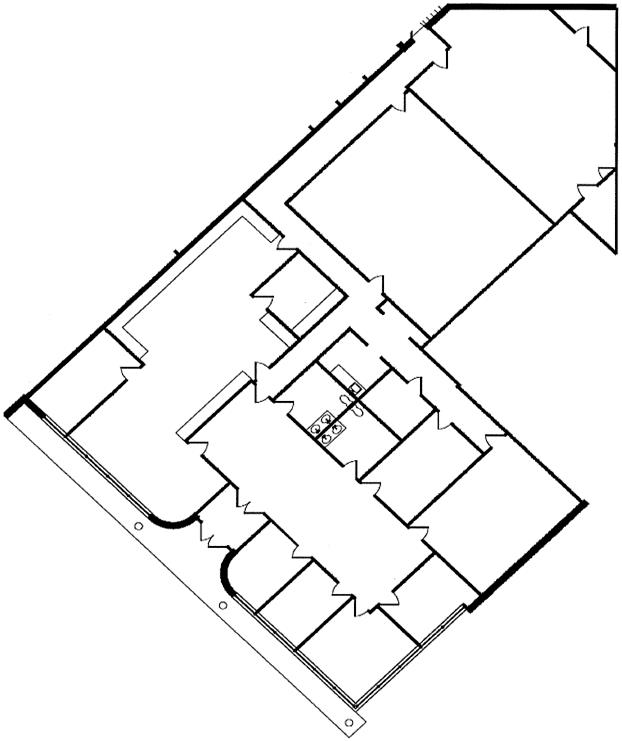

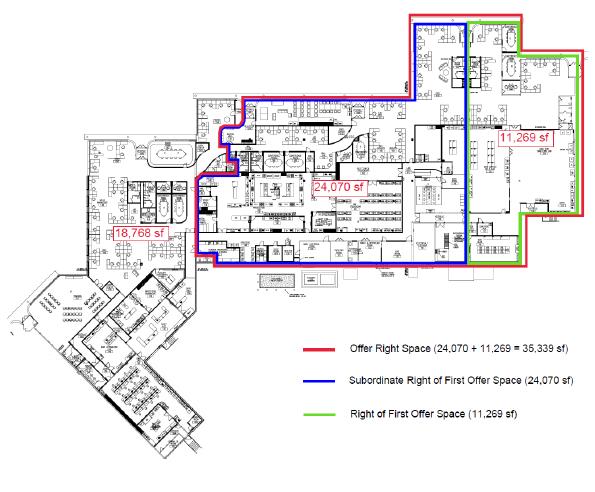

In October 2017, the Company entered into a purchase and sale agreement to acquire the Company’s headquarters that it had been leasing in Danvers, Massachusetts. The total acquisition cost for the land and building was approximately $16.5 million, with $3.0 million being recorded to land and $13.0 million being recorded to building and building improvements. In addition, the Company reclassified $32.6 million in leasehold improvements to building and building improvements due to the termination of the lease agreement upon the property acquisition.

In December 2016, the Company entered into a purchase and sale agreement to acquire its existing European headquarters in Aachen, Germany, consisting of 33,000 square feet of space. The Company acquired the property in February 2017. The original acquisition cost for the land and building was approximately $12.6 million, with $4.0 million being recorded to land and $8.6 million being recorded to the building and building improvements.

Note 6. Goodwill and In-Process Research and Development

The carrying amount of goodwill at December 31, 2017 and March 31, 2017 was $34.8 million and $31.0 million, respectively, and has been recorded in connection with the Company’s acquisition of Impella Cardiosystems AG, in May 2005 and ECP and AIS in July 2014. The goodwill activity is as follows:

|

|

|

(in $000's) |

|

|

|

Balance at March 31, 2017 |

|

$ |

31,045 |

|

|

Foreign currency translation impact |

|

|

3,769 |

|

|

Balance at December 31, 2017 |

|

$ |

34,814 |

|

The Company evaluates goodwill and in-process research and development (“IPR&D”) assets at least annually at October 31, as well as whenever events or changes in circumstances suggest that the carrying amount may not be recoverable. The Company has no accumulated impairment losses on goodwill or IPR&D assets.

14

The carrying amount of IPR&D assets at December 31, 2017 and March 31, 2017 was $16.2 million and $14.5 million, respectively, and was recorded in conjunction with the Company’s acquisition of ECP and AIS, in July 2014. The estimated fair value of IPR&D assets at the acquisition date was determined using a probability-weighted income approach, which discounts expected future cash flows to present value. The projected cash flow estimates for the future Impella ECPTM expandable catheter pump technology were based on certain key assumptions, including estimates of future revenue and expenses, taking into account the stage of development of the technology at the acquisition date and the time and resources needed to complete development. The Company used a discount rate of 21% and cash flows that have been probability adjusted to reflect the risks of product commercialization, which the Company believes are appropriate and representative of market participant assumptions.

The carrying value of the Company’s IPR&D assets and the change in the balance for the nine months ended December 31, 2017 are as follows:

|

|

|

(in $000's) |

|

|

|

Balance at March 31, 2017 |

|

$ |

14,482 |

|

|

Foreign currency translation impact |

|

|

1,759 |

|

|

Balance at December 31, 2017 |

|

$ |

16,241 |

|

Note 7. Accrued Expenses

Accrued expenses consist of the following:

|

|

|

December 31, 2017 |

|

|

March 31, 2017 |

|

||

|

|

|

(in $000's) |

|

|||||

|

Employee compensation |

|

$ |

26,077 |

|

|

$ |

23,290 |

|

|

Sales and income taxes |

|

|

4,612 |

|

|

|

3,180 |

|

|

Professional, legal and accounting fees |

|

|

3,294 |

|

|

|

2,019 |

|

|

Research and development |

|

|

2,271 |

|

|

|

2,349 |

|

|

Marketing |

|

|

2,254 |

|

|

|

1,827 |

|

|

Warranty |

|

|

1,010 |

|

|

|

717 |

|

|

Accrued capital expenditures |

|

|

— |

|

|

|

2,300 |

|

|

Other |

|

|

2,047 |

|

|

|

2,021 |

|

|

|

|

$ |

41,565 |

|

|

$ |

37,703 |

|

Employee compensation consists primarily of accrued bonuses, accrued commissions and accrued employee benefits at December 31, 2017 and March 31, 2017.

Note 8. Stock-Based Compensation

The following table summarizes stock-based compensation expense by financial statement line item in the Company’s condensed consolidated statements of operations for the three and nine months ended December 31, 2017 and 2016:

|

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

(in $000's) |

|

|

(in $000's) |

|

||||||||||

|

Cost of product revenue |

|

$ |

489 |

|

|

$ |

234 |

|

|

$ |

1,221 |

|

|

$ |

754 |

|

|

Research and development |

|

|

1,673 |

|

|

|

900 |

|

|

|

4,217 |

|

|

|

4,793 |

|

|

Selling, general and administrative |

|

|

9,070 |

|

|

|

5,340 |

|

|

|

23,732 |

|

|

|

18,974 |

|

|

|

|

$ |

11,232 |

|

|

$ |

6,474 |

|

|

$ |

29,170 |

|

|

$ |

24,521 |

|

15

The following table summarizes the stock option activity for the nine months ended December 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

Average |

|

|

Aggregate |

|

|||

|

|

|

|

|

|

|

Average |

|

|

Remaining |

|

|

Intrinsic |

|

|||

|

|

|

Options |

|

|

Exercise |

|

|

Contractual |

|

|

Value |

|

||||

|

|

|

(in thousands) |

|

|

Price |

|

|

Term (years) |

|

|

(in thousands) |

|

||||

|

Outstanding at beginning of period |

|

|

1,646 |

|

|

$ |

32.09 |

|

|

|

5.46 |

|

|

|

|

|

|

Granted |

|

|

152 |

|

|

|

140.41 |

|

|

|

|

|

|

|

|

|

|

Exercised |

|

|

(371 |

) |

|

|

20.54 |

|

|

|

|

|

|

|

|

|

|

Cancelled and expired |

|

|

(55 |

) |

|

|

100.57 |

|

|

|

|

|

|

|

|

|

|

Outstanding at end of period |

|

|

1,372 |

|

|

$ |

44.49 |

|

|

|

5.42 |

|

|

$ |

196,132 |

|

|

Exercisable at end of period |

|

|

1,048 |

|

|

$ |

24.03 |

|

|

|

4.42 |

|

|

$ |

171,235 |

|

|

Options vested and expected to vest at end of period |

|

|

1,347 |

|

|

$ |

43.85 |

|

|

|

5.37 |

|

|

$ |

193,386 |

|

The aggregate intrinsic value of options exercised was $46.1 million for the nine months ended December 31, 2017. The total fair value of options that vested during the nine months ended December 31, 2017 was $4.8 million.

The remaining unrecognized stock-based compensation expense for unvested stock option awards at December 31, 2017 was approximately $10.6 million and the estimated weighted-average period over which this cost will be recognized is 2.4 years.

The Company estimates the fair value of each stock option granted at the grant date using the Black-Scholes option valuation model. The weighted average grant-date fair values and weighted average assumptions used in the calculation of fair value of options granted during the three and nine months ended December 31, 2017 and 2016 was as follows:

|

|

|

For the Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

||||||||||

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

Weighted average grant-date fair value |

|

$ |

70.14 |

|

|

$ |

48.15 |

|

|

$ |

51.20 |

|

|

$ |

42.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valuation assumptions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk-free interest rate |

|

|

2.13 |

% |

|

|

1.37 |

% |

|

|

1.86 |

% |

|

|

1.32 |

% |

|

Expected option life (years) |

|

|

4.08 |

|

|

|

4.17 |

|

|

|

4.07 |

|

|

|

4.14 |

|

|

Expected volatility |

|

|

42.2 |

% |

|

|

48.5 |

% |

|

|

43.6 |

% |

|

|

49.5 |

% |

Restricted Stock Units

The following table summarizes activity of restricted stock units for the nine months ended December 31, 2017:

|

|

|

Number of Shares |

|

|

Weighted Average Grant Date Fair Value |

|

||

|

|

|

(in thousands) |

|

|

(per share) |

|

||

|

Restricted stock units at beginning of period |

|

|

1,056 |

|

|

$ |

80.50 |

|

|

Granted |

|

|

295 |

|

|

$ |

136.80 |

|

|

Vested |

|

|

(363 |

) |

|

$ |

53.16 |

|

|

Forfeited |

|

|

(94 |

) |

|

$ |

98.08 |

|

|

Restricted stock units at end of period |

|

|

894 |

|

|

$ |

108.35 |

|

The remaining unrecognized compensation expense for outstanding restricted stock units, including performance and market-based awards, as of December 31, 2017 was $38.5 million and the estimated weighted-average period over which this cost will be recognized is 2.0 years.

16

In May 2017, performance-based awards of restricted stock units for the potential issuance of approximately 159,000 shares of common stock were issued to certain executive officers and employees, which vest upon achievement of prescribed service milestones by the award recipients and performance milestones by the Company. As of December 31, 2017, the Company is recognizing compensation expense based on the probable outcome related to the prescribed performance targets on the outstanding awards.

Note 9. Income Taxes