UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: |

811-05186 | |

| Exact name of registrant as specified in charter: |

American Skandia Trust | |

| Address of principal executive offices: |

One Corporate Drive | |

| Shelton, Connecticut 06484 | ||

| Name and address of agent for service: |

Jonathan D. Shain | |

| Gateway Center 3, | ||

| 100 Mulberry Street, | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: |

973-802-6469 | |

| Date of fiscal year end: |

12/31/2004 | |

| Date of reporting period: |

12/31/2004 | |

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

AMERICAN SKANDIA

TRUST

Financial Statements

For the Annual Period Ended

December 31, 2004

This report has been prepared to provide information to owners of American Skandia Life Assurance Corporation’s annuities based on information provided by the underlying portfolios. Investors should consider the contract and the underlying portfolios’ investment objectives, risks, and charges and expenses carefully before investing. The contract’s prospectus and the underlying portfolios’ prospectuses contain information relating to investment objectives, risks, and charges and expenses as well as other important information. Contact your financial professional for the contract’s prospectus together with the prospectuses for the portfolios of American Skandia Trust (“Trust”). You should read the prospectuses carefully before investing or sending any money.

Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Current performance may be lower or higher than the past performance data quoted.

IFS-A087705

A description of the Trust’s proxy voting policies and procedures is available, without charge, upon request. Owners of variable annuity contracts should call 888-778-2888 to obtain descriptions of the Trust’s proxy voting policies and procedures. The description is also available on the website of the Securities and Exchange Commission (“the Commission”) at www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended December 31, 2004 is available on the website of the Commission at www.sec.gov and on the Trust’s website at www.irrc.com/prudential.

The Trust files with the Commission a complete listing of portfolio holdings as of its first and third quarter-end on Form N-Q. Form N-Q is available on the Commission’s website at www.sec.gov or by visiting the Commission’s Public Reference Room. For more information on the Commission’s Public Reference Room, please visit the Commission’s website or call 1-800-SEC-0330. Form N-Q is also available on the Trust’s website at www.americanskandia.prudential.com or by calling 888-778-2888.

| I. American Skandia Trust |

||

| Schedules of Investments: |

||

| 41 | ||

| 44 | ||

| 46 | ||

| 49 | ||

| 52 | ||

| 55 | ||

| 60 | ||

| 64 | ||

| 70 | ||

| 81 | ||

| 86 | ||

| 89 | ||

| 92 | ||

| 95 | ||

| 98 | ||

| 103 | ||

| 106 | ||

| 109 | ||

| 113 | ||

| 116 | ||

| 119 | ||

| 123 | ||

| 126 | ||

| 129 | ||

| 133 | ||

| 135 | ||

| 140 | ||

| 145 | ||

| 148 | ||

| 149 | ||

| 160 | ||

| 193 | ||

| 207 | ||

| 226 | ||

| 239 | ||

| 251 | ||

| 261 | ||

| 264 |

January 31, 2005

Dear Contract Holder:

We hope that you find the annual report for the American Skandia Trust to be a valuable source of information about your investments. Your success is important to us.

As the New Year begins, we are taking this opportunity to remind you of the importance of asset allocation, a strategy that takes a long-term, disciplined approach and can help minimize risk through a diversified portfolio. Investing in a strategic mix of assets can help you avoid the negative impact of a downturn in one asset class and can help better position your investments as asset classes rotate in and out of favor.

Your investment professional can help you create a diversified investment plan that considers your reasons for investing, personal investment horizon and risk tolerance. A carefully chosen and broad mix of assets — reviewed periodically over time — can help you stay focused on meeting your long-term objectives, despite fluctuations in the market.

At Prudential, we are committed to helping you grow and protect your wealth by providing financial solutions that meet your needs — today and in the future. We look forward to continuing our relationship with you and thank you for your confidence in our products.

Sincerely,

David R. Odenath, Jr.

President,

American Skandia Trust

IFS-A094832

Performance Information and Commentary

The following pages present information on the investment performance of each Portfolio, which had been in operation for six months or more at December 31, 2004, including comparisons with relevant market indexes. Commentary by each Portfolio’s sub-advisor regarding its performance and relevant market conditions is also provided.

Explanations of Market Indexes

Balanced Blended Index — The Balanced Blended Index is calculated by weighting the S&P 500 Index at 60% and the Lehman Brothers Aggregate Bond Index at 40%. The Lehman Brothers Aggregate Bond Index is an unmanaged index comprised of more than 5,000 government and corporate bonds.

Blended Index — The Blended Index is calculated by weighting the Russell 3000 Index at 50%, the Lehman Brothers Aggregate Bond Index at 40% and the MSCI EAFE Index at 10%. The Russell 3000 Index is an unmanaged capitalization-weighted index which is comprised of 3,000 of the largest capitalized U.S. domiciled companies whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and over-the-counter market.

Lehman Brothers Aggregate Bond Index — The Lehman Brothers Aggregate Bond Index is an unmanaged capitalization-weighted measure of treasury issues, agency issues, corporate bond issues and mortgage securities.

Lehman Brothers Global Aggregate Bond Index — The Lehman Brothers Global Aggregate Bond Index is an unmanaged measure of the global investment grade bond markets and is composed of the U.S. Aggregate Index, Pan European Aggregate Index, Asian-Pacific Aggregate Index and treasury obligations of Australia, Canada and New Zealand.

Lehman Brothers U.S. Corporate High Yield Index — The Lehman Brothers U.S. Corporate High Yield Index is an unmanaged index of fixed-rate, non-investment-grade debt securities with at least one year remaining to maturity. It gives a broad look at how high yield (“junk”) bonds have performed.

ML 1-3 Year Index — The Merrill Lynch 1-3 Year Treasury Index is an unmanaged index of treasury issues with maturities ranging from 1-2.99 years.

ML U.S. High Yield Master II Index — The Merrill Lynch U.S. High Yield Master II Index is an unmanaged index of publicly traded non-convertible U.S. bonds rated below investment grade.

MSCI EAFE Index — The Morgan Stanley Capital International Europe, Australasia, Far East Index is an unmanaged capitalization-weighted index generally accepted as a benchmark for major overseas markets.

MSCI World Index — The Morgan Stanley Capital International World Index is an unmanaged capitalization-weighted index which includes the equity markets of Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, United Kingdom and United States.

Performance Information and Commentary (Continued)

NAREIT Equity Index — The NAREIT Equity REIT Index is an unmanaged capitalization-weighted index comprised of all tax-qualifed Real Estate Investment Trusts listed on the New York Stock Exchange, American Stock Exchange and Nasdaq National Market System.

Russell 2000 Index — The Russell 2000 Index is an unmanaged capitalization-weighted index which is comprised of 2,000 of the smallest capitalized U.S. domiciled companies whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and over-the-counter market.

Russell 2000 Growth Index is a market cap-weighted index that measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

SB Extended Market Index — The Salomon Brothers Extended Market Index is an unmanaged capitalization-weighted index of the smallest 20%, based on market capitalization, of all institutionally available non-U.S. stocks.

S&P 500 Index — The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange, and over-the-counter market.

S&P MidCap 400 Index is a widely accepted, unmanaged total return index measuring the performance of the mid-size company segment of the U.S. stock market.

All index returns assume reinvestment of dividends and, unlike Portfolio returns, do not reflect any fees or expenses. It is not possible to invest directly in an index.

AST JPMorgan International Equity Portfolio

For the year ended December 31, 2004, the AST JPMorgan International Equity Portfolio had a total return of 17.11%, compared with the return of 20.25% for the unmanaged MSCI EAFE Index, and 17.94% for the Lipper (VIP) International Core Funds Average. Management of the Portfolio was transferred from Strong to JPMorgan Fleming on February 23, 2004.

JPMorgan managed the Portfolio for most of the year, and accounted for most of its underperformance of the MSCI EAFE Index. The Index ended on a strong note, gaining more than 15% in the fourth quarter of 2004. With oil drifting back from its highs and a clear victory in the U.S. general election, markets rallied. The dollar moderated its precipitous slide toward the end of the term, but still posted significant falls against major currencies. The Portfolio’s underperformance was due primarily to selection among consumer discretionary and industrial stocks. Within the consumer discretionary sector, Koninklijke Philips Electroniss hurt performance most. The stock was overweighted and posted a double-digit negative return. In industrials, positions in Adecco and Deutsche Post were the largest detractors. The Portfolio’s strongest performance was in healthcare and consumer staples. In consumer staples, overweight positions in Altadis and Tesco boosted performance. Altadis ended the year with better-than-expected third quarter earnings. Tesco shares rallied as the market reacted positively to its expansion into new markets such as South Korea. In healthcare, the Portfolio benefited from not having a position in AstraZeneca, as the stock plunged after the Food and Drug Administration announced plans to review several of its drugs.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

17.11 | % | –6.66 | % | 7.12 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

1

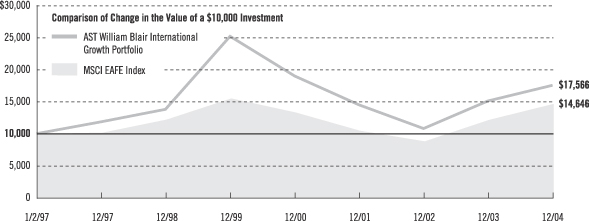

AST William Blair International Growth Portfolio

For the year ended December 31, 2004, the AST William Blair International Growth Portfolio had a total return of 16.15%, compared with a return of 20.25% for the unmanaged MSCI EAFE Index, and 17.36% for the Lipper (VIP) International Growth Funds Average.

Relative performance during 2004 was hampered by the Portfolio’s quality growth discipline, which was not rewarded in the value-led market, as value stocks outperformed their growth counterparts by approximately 8%. As a result, the Portfolio’s focus on Asian cyclical stocks at the expense of European value stocks was the largest driver of its underperformance. Conversely, the Portfolio’s emerging markets and Canadian holdings augmented both absolute and relative results. Overall stock selection was positive for the year, with selection in telecommunication services, financials, and energy adding the most value.

As of year end, the Portfolio remained tilted towards emerging markets and Canada at the expense of Europe and the United Kingdom, which is the direct result of the individual stock selection process. By sector, the Portfolio remained most overweighted in the information technology and consumer discretionary sectors and underweighted in materials, telecommunications, and financials.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

16.15 | % | –6.96 | % | 7.30 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

2

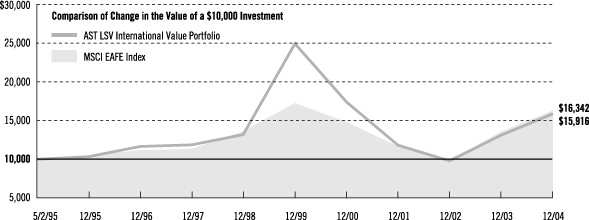

AST LSV International Value Portfolio

For the year ended December 31, 2004, the AST LSV International Value Portfolio (formerly AST DeAM International Equity Portfolio) had a total return of 21.04%, compared with the return of 20.25% for the unmanaged MSCI EAFE Index and 17.94% for the Lipper (VIP) International Core Funds Average. Management of the Portfolio was transferred from Deutsche to LSV on November 19, 2004.

The period Deutsche managed the Portfolio covered most of the year and accounted for its outperformance of the EAFE Index. Capital goods, food beverage & tobacco, and banks were the industry groups that contributed most. A position in SAB Miller rose after its fiscal first-half profit more than doubled. Its earnings in South Africa increased, demand for Miller Lite improved in the United States, and it sold a stake in a Chinese brewery. Amadeus Global Travel Distribution moved higher on news that it had good quarterly earnings and on rumors that the company was looking for potential buyers. Metals and mining-related holdings such as Rautaruukki and BHP Billiton benefited from rising commodity prices. On the negative side the transportation, retailing, and automobiles & components industry groups were the largest detractors from relative performance. Airline companies such as Deutsche Lufthansa and KLM-Kon Luchtwaart declined as higher oil prices hurt their profits.

LSV did not manage the Portfolio for long enough in 2004 to have a material impact on its return for the year. LSV seeks to buy undervalued companies that appear to be emerging from extended periods of poor financial and stock price performance. The Portfolio is kept broadly diversified by country, sector, and industry.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

21.04 | % | –8.67 | % | 4.93 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

3

AST MFS Global Equity Portfolio

For the year ended December 31, 2004, the AST MFS Global Equity Portfolio had a total return of 18.39%, compared with a return of 14.72% for the unmanaged MSCI World Index, 20.25% for the unmanaged MSCI EAFE Index, and 13.84% for the Lipper (VIP) Global Core Funds Average.

Relative to the MSCI World Index, technology, healthcare, retailing, and financial services were the Portfolio’s strongest-performing sectors. The Portfolio benefited from avoiding or underweighting several poor performers in the benchmark. A relative underweighting in the poor-performing technology sector also contributed to results. Positions in several fashion purveyors were among the Portfolio’s top contributors to relative performance, including Hong Kong-headquartered Esprit Holdings, U.K.-based Next, and Stockholm-based Hennes & Mauritz. Selection in the financial services area was helped by positions in OTP Bank in Hungary, Erste Bank in Austria, and Australian insurer QBE Insurance Group. The single largest contributor to relative performance was U.K.-based household products conglomerate Reckitt Benckiser. Since holdings of the Portfolio and its benchmark may be denominated in different currencies, shifts in currency valuations were a significant contributor to performance relative to the benchmark.

Leisure, utilities and communications, and industrial goods and services were the Portfolio’s weakest-performing sectors relative to its benchmark. Holdings in other sectors that held back relative performance included pharmaceutical firm AstraZeneca and financial services company AMVESCAP, both headquartered in the United Kingdom.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

18.39 | % | 1.99 | % | 3.87 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

4

AST State Street Research Small-Cap Growth Portfolio

For the year ended December 31, 2004, the AST State Street Research Small-Cap Growth Portfolio (formerly PBHG Small Cap Growth) had a total return of –6.94%, compared with a return of 10.87% for the unmanaged S&P 500 Index, 14.31% for the unmanaged Russell 2000 Growth Index, and 11.71% for the Lipper (VIP) Small-Cap Growth Funds Average. Management of the Portfolio transferred from PBHG to State Street Research (SSR) on May 1, 2004. During the period PBHG managed the Portfolio, it significantly underperformed the Russell 2000 Growth Index as stock selection across sectors and industries reduced its returns.

During the period SSR managed the Portfolio, its return continued to be very disappointing, hurt by substantial disappointments by several holdings, including Alliance Gaming, Corinthian Colleges, Career Education, eCollege.com, Nektar Therapeutics, and Autobytel. All but Nektar Therapeutics were sold from the Portfolio by period-end. Internet search provider Ask Jeeves also declined following the company’s third quarter earnings release. While earnings growth remained positive, investors had expected it to be higher and were disappointed by the company’s conservative forecasts for fourth-quarter sales. SSR remains invested in the position. In addition, the Portfolio’s energy and producer durables holdings lagged. However, many positions in gaming firms such as Boyd Gaming and Pinnacle Entertainment helped absolute and relative returns.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

–6.94 | % | –15.54 | % | 6.15 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

5

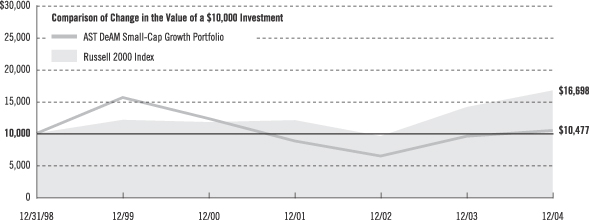

AST DeAM Small-Cap Growth Portfolio

For the year ended December 31, 2004, the AST DeAM Small-Cap Growth Portfolio had a total return of 9.44%, compared with a total return of 18.33% for the unmanaged Russell 2000 Index and 11.71% for the Lipper (VIP) Small-Cap Growth Funds Average.

Holdings in the capital goods, software & services, and transportation industry groups detracted most from performance. The largest individual detractors from relative performance were an underweight in OSI Pharmaceuticals and an overweight in Quidel. DeAm’s valuation model showed OSI’s fundamentals were poorer than its peers. Nevertheless the stock moved higher as OSI’s lung cancer drug, Tarceva, performed well in clinical tests. Quidel develops and markets point-of-care rapid diagnostic tests for the detection and management of a variety of medical conditions and illnesses. Its share price fell as patent infringement lawsuits led to downward revisions in earnings estimates.

On the positive side, stock selection in the internet, materials, and diversified financials industry groups added value. A position in Ameristar Casinos was a key contributor to returns with record financial results for the third quarter of 2004.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

9.44 | % | –7.64 | % | 0.78 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

6

AST Federated Aggressive Growth Portfolio

For the year ended December 31, 2004, the AST Federated Aggressive Growth Portfolio had a total return of 23.07%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 18.33% for the unmanaged Russell 2000 Index, 14.31% for the unmanaged Russell 2000 Growth Index, and 11.71% for the Lipper (VIP) Small-Cap Growth Funds Average.

The stock market as a whole rose substantially during 2004. Small-cap companies outperformed large-cap and small-cap value stocks outperformed small-cap growth stocks. Economic indicators during the year were mixed, but generally small-cap companies continued to report strong earnings growth. The best performing small-cap growth sectors were energy, materials, and industrials while, the information technology and utilities sectors lagged.

The Portfolio outperformed the Russell 2000 Growth Index primarily due to strong stock selection in the industrials, consumer discretionary, and healthcare sectors. Companies such as Abx Air, Egl, Innovative Solutions, and Forward Air added to performance in the industrials sector. Consumer discretionary companies Central European Media, Petco Animal Supplies, PetsMart, and Advance Auto Parts also contributed to returns. In the healthcare sector, Alexion Pharmaceuticals and Cytyc made the largest contributions. Although the Portfolio’s stock selection was weakest in the consumer staples and information technology sectors, it was underweight in both. Positions in underperforming stocks such as Quality Distribution, Genus, Conexant Systems, Talk America, and Netopia hurt relative performance.

At year-end, the Portfolio had overweights as compared with the Russell 2000 Growth Index in the consumer discretionary and industrials sectors and was underweight in the information technology, healthcare, and financials sectors. Nearly 72% was invested in three large sectors: consumer discretionary, healthcare, and information technology.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

23.07 | % | 1.56 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

7

AST Goldman Sachs Small-Cap Value Portfolio

For the year ended December 31, 2004, the AST Goldman Sachs Small-Cap Value Portfolio had a total return of 20.18%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 18.33% for the unmanaged Russell 2000 Index, 22.25% for the unmanaged Russell 2000 Value Index, and 17.47% for the Lipper (VIP) Small-Cap Core Funds Average.

The Portfolio posted strong absolute results in 2004, but trailed the Russell 2000 Value Index. The Portfolio’s transportation, financial, and energy stocks contributed positively to relative returns, while its holdings in the industrials and consumer cyclicals sectors trailed the respective sectors of the Russell 2000 Value Index. The performance of its industrial stocks was hurt by the fall in GrafTech International, a manufacturer of graphite and carbon, after earnings estimates were reduced on lower expectations for the price increase on graphite electrodes. Consumer cyclical stocks such as Gymboree and Concord Camera also held down performance. Gymboree, a specialty retailer of children’s apparel, reported weaker-than-expected earnings. Concord Camera, an image capture manufacturer, experienced delays in product introductions that led to market share losses. We sold the position during the period.

On the positive side, energy holding Range Resources, an explorer and developer of oil and gas properties, emerged as a top contributor after it announced the purchase of Appalachian oil and gas properties. Accredited Home Lenders was another strong performer after it issued a better-than-expected 2005 outlook. The California-based mortgage bank benefited from exposure to less-volatile loan origination markets, internal cost discipline, and portfolio growth. OMI, an oil tanker company, was a top transportation performer. While continuing to expand its double hulled fleet, it announced record revenues for the period, benefiting from increased world oil demand.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

20.18 | % | 18.09 | % | 13.97 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

8

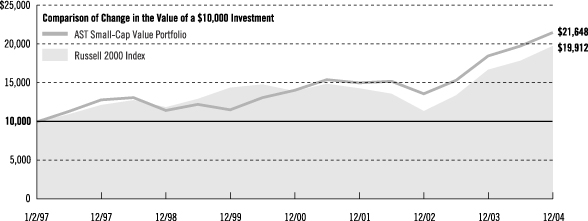

AST Small-Cap Value Portfolio

For the year ended December 31, 2004, the AST Small-Cap Value Portfolio had a total return of 16.44%, compared with the return of 10.87% for the S&P 500 Index and 14.62% for the Lipper (VIP) Multi-Cap Value Funds Average. The Portfolio was managed by Gabelli Asset Management Company (GAMCO) from January 1 through November 19, when the Portfolio’s assets were divided into three segments. JPMorgan manages the largest portion; Lee Munder Investments, and Integrity Asst Management manage smaller segments.

During the period GAMCO managed the Portfolio it outperformed the Russell 2000 Index of small-cap stocks. Positive contributions came from holdings in the industrial sector, many of which were up in excess of 30% (for example, Material Sciences, representing 0.5% of the portfolio was up 65%; GenCorp 0.8%, + 56%; Idex Corp. 0.7%, +44%; Precision Castparts 1.9%, + 43%; and Thomas & Betts 1.7%, + 38%). Several investments in utilities, gaming and wireless telephony had similar increases (XTO Energy 1.3%, +61%; Aztar 1.3%, +50%; Vimpel Communications 1.1%, +59%; Western Wireless 0.9%, +47%; Kerzner International 0.5%, +46%; and Devon Energy 0.6%, +45%).

November was the strongest month of 2004. Once the uncertainty of the Presidential election was behind us, investors refocused on fundamentals, including improving earnings and outlook, and the declines in oil prices.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

16.44 | % | 13.31 | % | 10.14 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

9

AST DeAM Small-Cap Value Portfolio

For the year ended December 2004, the AST DeAM Small-Cap Value Portfolio had a total return of 22.11%, compared with the return of 18.33% for the unmanaged Russell 2000 Index, 22.25% for the unmanaged Russell 2000 Value Index. and 20.64% for the Lipper (VIP) Small-Cap Value Funds Average.

Stock selection throughout the Portfolio was the key to outperformance. The healthcare equipment & services, energy, and utilities industry groups contributed most to relative performance. Oil and gas related holdings such as Southwestern Energy, Tesoro, and Range Resources added value. Southwestern Energy is an integrated energy company primarily engaged in the exploration and production of natural gas. Rising energy prices and increased production volumes resulted in surging company revenues. Range Resources is engaged in the exploration, development and acquisition of oil and gas properties. The company saw its cash flows reach a 9-year high during the period. In addition, acquisitions it made to increase production capacity were considered positively by investors.

On the negative side, the consumer durables & apparel, materials, and food & drug retailing industry groups detracted from performance. A position in Callaway Golf declined as a change in overall product mix and the need for competitive sales programs to match those being offered by other manufacturers caused a significant drop in its gross profits. A position in Win-Dixie Stores fell as increased competition from non-traditional grocery retailers such as mass-merchandisers (Wal-Mart), discount clubs, and warehouse stores have had a negative impact on its sales.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

22.11 | % | 12.14 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

10

AST Goldman Sachs Mid-Cap Growth Portfolio

For the year ended December 31, 2004, the AST Goldman Sachs Mid-Cap Growth Portfolio had a total return of 16.36%, compared with the return of 15.48% for the Russell Mid-Cap Growth Index, 16.48% for the unmanaged S&P Mid-Cap 400 Index, and 14.75% for the Lipper (VIP) Mid-Cap Growth Funds Average.

The Portfolio had strong absolute and relative performance, aided by its holdings in the technology, retail, and healthcare sectors. Technology stocks that enhanced results included FLIR Systems, Checkfree, and Tessera Technologies. Many of the Portfolio’s retail holdings, including Harman International Industries, Petco Animal Supplies, and Harrah’s Entertainment, also added significantly to its return. In the healthcare sector, positions in Caremark Rx, Biogen Idec, and Charles River Labs, were significant contributors. The Department of Justice approved Caremark’s proposed merger with Advance PCS and it won a large contract from Medco for the Federal Employee Health Benefit (FEHB) Plan. The merger made a difference as FEHB was attracted to the combined company. Caremark will handle the mail order business and Advance PCS currently handles the retail pharmacy business.

The Portfolio’s position in Adtran fell after the company warned that fourth-quarter earnings and sales would be below expectations. Adtran, which supplies products that enable phone companies to deliver DSL high-speed Internet service, said bookings have been weak in recent months. Goldman Sachs Asset Management, L.P. (GSAM) believes this weakness may be short-lived as consumer demand for broadband services continues to grow and business spending begins to improve. Adtran remains a healthy business with sound management. While several holdings in the media sector have not yet been recognized due to a sluggish radio advertising market, GSAM is encouraged by the sector’s attractive valuations and enduring growth prospects.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

16.36 | % | –16.07 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

11

AST Neuberger Berman Mid-Cap Growth Portfolio

For the year ended December 31, 2004, the AST Neuberger Berman Mid-Cap Growth Portfolio had a total return of 16.07%, compared with a return of 10.87% for the unmanaged S&P 500 Index, 16.48% for the unmanaged S&P Mid-Cap 400 Index, 15.48% for the unmanaged Russell Mid-Cap Growth Index, and 14.75% for the Lipper (VIP) Mid-Cap Value Funds Average.

Security selection within the consumer discretionary, information technology, financials, and industrials sectors provided the largest contributions to total returns. In the consumer discretionary sector, an emphasis on casinos and gaming added particularly. In technology, the Portfolio benefited from positions in Alliance Data Systems and Apple Computer Inc. An emphasis on the services area within the financials sector helped results, with strong performers such as Capitalsource. Outperforming industrial stocks included JB Hunt Transport Services and Corporate Executive Board. Energy holdings benefited from companies such as XTO Energy, which are able to increase reserves or the production of oil and gas. An overweight in telecommunication services, one of the strongest performing sectors, added to performance. Overall, however, the Portfolio’s sector allocations detracted from its results.

On the downside, stock selection within healthcare had the most negative impact on relative performance. The environment for generic pharmaceuticals was particularly weak given the lack of pricing power in the industry. Stock selection within the materials sector, a relatively small one, also hurt returns.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

16.07 | % | –6.59 | % | 8.17 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

12

AST Neuberger Berman Mid-Cap Value Portfolio

For the year ended December 31, 2004, the AST Neuberger Berman Mid-Cap Value Portfolio had a total return of 22.84%, compared with a return of 10.87% for the unmanaged S&P 500 Index, 16.48% for the unmanaged S&P 400 Index, 23.70% for the unmanaged Russell Mid-Cap Value Index, and 19.03% for the Lipper (VIP) Mid-Cap Value Funds Average.

The Portfolio’s strong return was driven by the performance of its consumer discretionary and financial holdings. Positions in the healthcare and energy sectors also made substantial contributions. No sectors detracted from total return. The Portfolio had no exposure to the materials or telecommunication services sectors during the year.

The strongest performance relative to the Russell Mid-Cap Value Index was in the energy and healthcare sectors. Not only was there an overweight allocation to the top-performing energy sector, the Portfolio’s energy stocks outperformed their Index counterparts. The overweight in the sector was eliminated because Neuberger Berman believes much of the potential gains were already realized. The Portfolio’s selection in healthcare was strong, producing its second-highest sector return whereas the healthcare sector return was the lowest in the Index. However, the Portfolio’s selection of stocks in industrials and financials underperformed their index sector counterparts, the primary reason for its underperformance.

The Portfolio continues to trade at a P/E discount to the Russell Mid-Cap Value Index and has superior growth and a higher return on equity. In Neuberger Berman’s opinion, it has greater return potential than the Index with less risk.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

22.84 | % | 13.12 | % | 13.01 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

13

AST Alger All-Cap Growth Portfolio

For the year ended December 31, 2004, the AST Alger All-Cap Growth Portfolio had a total return of 8.47%, compared with the return of 10.87% for the S&P 500 Index and 10.40% for the Lipper (VIP) Multi-Cap Growth Funds Average.

The Portfolio’s growth-stock strategy was at a disadvantage in a period in which value stocks outperformed growth. However, it benefited from solid security selection in the consumer staples and information technology sectors, beating the Russell 3000 Growth Index, a broad measure of growth stocks. Yahoo!, eBay, and Research In Motion contributed most. Yahoo! benefited from the rise in Internet advertising. Pay-for-Performance advertising has been a significant revenue driver for Yahoo! and there has been continued strength in core advertising. The eBay position was purchased before their seasonally strongest quarter and benefited from rising revenue and earnings. Research In Motion make the Blackberry. The growing need for mobile communication (including data transfer) has benefited such innovative companies that are providing solutions for wireless connectivity. In the past year, it has doubled its subscriber base by entering new markets and channels, and has continued to introduce compelling new products.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

8.47 | % | –11.66 | % | –11.66 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

14

AST Gabelli All-Cap Value Portfolio

For the year ended December 31, 2004, the AST Gabelli All-Cap Value Portfolio had a total return of 15.32%, compared with the return of 10.87% for the S&P 500 Index and 16.9% for the unmanaged Russell 3000 Value.

Investor uncertainty depressed equity returns for most of the first ten months of 2004. Early in the year it was the economy, as anemic job growth caused investors to question the strength and endurance of the recovery. As we headed into the spring it was interest rates, as surprisingly strong March employment data convinced investors the Federal Reserve would soon begin tightening. Then the economy remained soft through early fall. Throughout this period, rapidly rising oil prices and political uncertainty also undermined investor confidence. Late in October, the market started to improve. Oil prices declined significantly and the economy regained momentum. The conclusive Republican victory eliminated uncertainty regarding certain government policies. Investors focused on the sturdy economy and respectable corporate earnings growth and stocks took off.

Almost 90% of the Portfolio’s holdings posted positive returns, with nearly 60% gaining 10% or more. In general, investments in the hotel/gaming, housing, and utilities industries performed very well. In addition, eleven holdings were the subject of merger and acquisition activity (completed deals, pending deals, and companies putting themselves up for sale) or major restructurings. This had a direct impact on Portfolio performance and helped increase the values of other holdings in the same industry groups as well. The lackluster performance of advertising-supported media stocks, a sector in which the Portfolio has substantial commitments, prevented it from achieving even better returns.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

15.32 | % | 4.99 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

15

AST T. Rowe Price Natural Resources Portfolio

For the year ended December 31, 2004, The AST T. Rowe Price Natural Resources Portfolio had a total return of 31.19%, compared with a return of 10.87% for the unmanaged S&P 500 Index, and 20.32%% for the Lipper (VIP) Natural Resources Funds Average.

Energy was a strong sector for the Portfolio. Several deep-water drilling holdings, including Diamond Offshore Drilling and Transocean, benefited from improving fundamentals and better pricing. Amerada Hess, a domestic integrated oil company, rebounded from earlier weakness to post strong results. The company is in the midst of revitalizing its asset portfolio, and its Gulf of Mexico exploration program showed increased promise. Management is also taking steps to improve its credibility with investors. The agriculture sector was a significant contributor to performance, reflecting continued good fundamentals and strong commodity prices. Fertilizer company Potash Corp./Saskatchewan was the Portfolio’s largest contributor, rising over 90% for the one-year period. Agricultural products maker IMC Global benefited from lower input costs and better margins. In addition, the company signed an agreement to combine with Cargill Crop Nutrition to create a new publicly traded company (Mosaic - a stock we now own), which we expect will bolster earnings and cash flow over the next several years.

Positions in metal stocks were top contributors as well. Expanding demand from China, along with a pick-up in world-wide economic activity, has pushed up commodity prices and significantly aided those firms whose earnings are closely tied to them. Nucor, a steel stock with excellent fundamentals and sustainable earnings trends, advanced almost 90%. The Russian government’s intervention into the future of oil giant Yukos was disturbing, and the Portfolio’s position detracted from performance. It was sold.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

31.19 | % | 16.14 | % | 14.12 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

16

AST Alliance Growth Portfolio

For the year ending December 31, 2004, the AST Alliance Growth Portfolio had a total return of 5.75%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 6.30% for the unmanaged Russell 1000 Growth Index and 8.04% for the Lipper (VIP) Large-Cap Growth Funds Average.

The Portfolio lost most ground relative to the Russell 1000 Growth Index in the healthcare sector due to poor stock selection. A mid-sized position in Forest Laboratories (–27.4%) detracted most. The Portfolio gained most relative performance in the consumer discretionary stocks due to both good stock selection and overweighting this outperforming sector. It held, on average, about 26% in the sector compared with about 18% in the Russell 1000 Growth Index. Large positions in eBay (+80.1%) and Yahoo (+67.4%) accounted for most of the outperformance. The Portfolio also benefited from good selection in the technology sector, where a mid-sized position in Marvell Technology Group (+87.0%) contributed most. Good stock selection in the financial services sector also helped. A small position in Franklin Resources (+34.6%) accounted for most of the outperformance.

Alliance believes that investors are underestimating the outlook for the U.S. economy and corporate profitability, providing us with an unusual opportunity to buy superior growth companies at little valuation premium. In an environment that seems conducive to further economic and earnings expansion, the premium for growth stocks relative to the broad market is as low as it has been in the past 25 years.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

5.75 | % | –7.86 | % | 4.21 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

17

AST MFS Growth Portfolio

For the year ended December 31, 2004, the AST MFS Growth Portfolio had a total return of 10.69%, compared with a return of 10.87% for the unmanaged S&P 500 Index, 6.30% for the unmanaged Russell 1000 Growth Index, and 8.04% for the Lipper (VIP) Large-Cap Growth Funds Average.

Selection in the healthcare, technology, and retailing sectors were the strongest contributors to the Portfolio’s outperformance of the Russell 1000 Growth Index. In healthcare, an underweight in the pharmaceutical company Pfizer (which was sold entirely from the Portfolio by period-end) contributed to relative performance, as did a slightly overweighted position in Caremark Rx. In technology, overweighted positions in software company Symantec and internet giant eBay, and an underweight in Intel (which was sold entirely from the Portfolio by period-end) helped relative returns. The Portfolio was helped by a position in Marvell Technology Group, a stock not in the Russell 1000 Growth Index. Other individual contributors to relative performance included Monsanto, Tyco International, and Carnival, none of which were in the benchmark, and an underweight position in The Coca-Cola Company (which was sold by period-end).

The chief detractors from relative performance were a slight underweighting and poor stock selection in the financial services and miscellaneous sectors. Losses on March & McLennan and Corinthian Colleges (both since sold) hurt performance. An overweighting and stock selection in the leisure sector also detracted from relative performance. Not having a position in Starbucks particularly hurt. The largest individual detractors were VERITAS Software, IAC/InterActiveCorp (sold by period-end), and an underweight position in QUALCOMM.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

10.69 | % | –6.48 | % | –4.01 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

18

AST Marisco Capital Growth Portfolio

For the year ending December 31, 2004, the AST Marsico Capital Growth Portfolio had a total return of 15.67%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 6.30% for the unmanaged Russell 1000 Growth Index, and 8.04% for the Lipper (VIP) Large-Cap Growth Funds Average.

The Portfolio’s strong performance as compared to the Russell 1000 Growth Index was primarily due to its stock selection in the healthcare, consumer discretionary, information technology, and financials sectors and in the capital goods industry, while selection in telecommunications services and an underweight in the top-performing energy sector hurt. In healthcare, it overweighted the equipment & services industry and underweighted the pharmaceuticals & biotechnology industry. This significantly enhanced its return. UnitedHealth Group (+51%) and Genentech (+16%) were among its largest holdings and the largest positive contributors to overall performance. Its strength in the consumer discretionary sector was largely due to holdings in the hotels, restaurants & leisure industry, including Wynn Resorts (+139%). Having little exposure to semiconductors helped its technology performance. It also had a good selection of hardware & equipment stocks, including QUALCOMM (+58%) and Dell (+24%). Among capital goods stocks, General Electric (+21%), Tyco International (+36%), and Caterpillar (+20%) were among the largest contributors, while SLM Corp. (+44%), Countrywide Financial (+48%), and Chicago Mercantile Exchange (+38%) were the main reasons for strength in financials.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

15.67 | % | –2.88 | % | 9.34 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

19

AST Goldman Sachs Concentrated Growth Portfolio

For the year ended December 31, 2004, the AST Goldman Sachs Concentrated Growth Portfolio had a total return of 3.69%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 6.30% for the Russell 1000 Growth Index, and 8.04% for the Lipper (VIP) Large-Cap Growth Funds Average.

The Portfolio’s exposure to the Media sector detracted from its return. Clear Channel Communications and Viacom were weak as companies exposed to the radio market underperformed. A sluggish national radio market hurt these businesses as automotive, retailers, and telecommunications companies spent less money in 2004 in comparison to 2003. We remain confident that Clear Channel’s business can rebound as it is making changes to its advertising structure, which should result in less ad time and firmer pricing. The Portfolio’s underweight in the energy and cyclical sectors also hurt its relative performance. Typically, businesses in these sectors do not have the pricing power and strong business franchises that GSAM prefers, but their stocks were very strong this year.

The Portfolio’s positions in high-quality technology companies performed well, including QUALCOMM, Dell, Yahoo!, and eBay. QUALCOMM’s stock enjoyed a strong run in 2004. Demand for third generation (3G) wireless capability, which wholly depends on the Code-Division Multiple Access (CDMA) technology QUALCOMM licenses, continues to increase. The Portfolio’s consumer staples holdings PepsiCo and Wm. Wrigley Jr. were also top contributors.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

3.69 | % | –15.54 | % | 9.83 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

20

AST DeAM Large-Cap Value Portfolio

For the year ended December 31, 2004, the AST DeAM Large-Cap Value Portfolio had a total return of 18.17% compared with the return of 10.87% for the unmanaged S&P 500 Index, 16.49% for the unmanaged Russell 1000 Value Index, and 14.62% for the Lipper (VIP) Multi-Cap Value Funds Average.

The Portfolio outperformed the Russell 1000 Value Index primarily because of good stock selection, particularly in the materials, diversified financials, and media industry groups. Holdings such as Monsanto and United States Steel added value in the materials group. Monsanto provides agricultural products and integrated solutions for farmers worldwide. A weakening U.S. dollar substantially aided its overseas sales. It increased the dividend payment, as well as its earnings projections for 2005. United States Steel increased net sales through all four quarters of 2004 due to the impact of strong global economic growth on demand for steel.

On the negative side, the pharmaceuticals & biotechnology and healthcare equipment & services industry groups detracted most from relative performance. The Portfolio’s underweight in Humana hurt its relative performance in healthcare. Humana is one of the nation’s largest publicly traded health benefits companies. Its stock price increased as launch of a new product, a high-deductible health insurance plan, helped it capture market share.

The individual position that hurt relative performance most was an underweight in ChevronTexaco, which benefited from higher oil prices. However, energy positions such as Occidental Petroleum and Apache, which appeared more attractive on DeAm’s valuation model, more than offset the impact of not holding ChevronTexaco.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

18.17 | % | 4.01 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

21

AST Hotchkis & Wiley Large-Cap Value Portfolio

For the year ended December 31, 2004, the AST Hotchkis & Wiley Large-Cap Value Portfolio had a total return of 15.45%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 16.49% for the unmanaged Russell 1000 Value Index, and 13.64% for the Lipper (VIP) Equity Income Funds Average. Management of the Portfolio was transferred from INVESCO to Hotchkis & Wiley on May 1, 2004.

During the period INVESCO advised the Portfolio, it trailed the broad S&P 500 Index and the style-specific Russell 1000 Value Index, which differed only immaterially in total return. It underperformed the Russell 1000 Value Index primarily because of poor stock selection, including positions in Fannie Mae and Radian Group Cisco Systems, and Amgen. The Portfolio also emphasized underperforming industries within sectors, particularly in the technology sector, and large companies during a period when stocks of smaller firms performed better.

During the period Hotchkis & Wiley advised the Portfolio, it benefited from stock selection within the consumer discretionary sector. The Portfolio’s strongest contributor during this period, Sears Roebuck, initially surged in November after Vornado Realty Trust took a significant stake in the company. Following this, Kmart announced its plan to acquire/merge with Sears, increasing the stock’s price another 20%. Other contributors to performance included Aetna and Electronic Data Systems. The latter beat third quarter earnings expectations and also benefited from news of improvements on its Navy contract.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

15.45 | % | 1.81 | % | 10.04 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

22

AST Alliance/Bernstein Growth + Value Portfolio

For the year ended December 31, 2004, the AST Alliance/Bernstein Growth + Value Portfolio had a total return of 10.07%, compared with the return of 10.87% for the S&P 500 Index and 8.59% for the Lipper (VIP) Large-Cap Core Funds Average.

Energy stocks led the market as record high oil prices lifted industry profits. Technology and consumer growth stocks were the major underperforming sectors. The market favored value rather than growth in 2004. Much of this can be attributed to the outsized outperformance for most of the year of commodity- and interest-rate-sensitive sectors, which make up a much bigger proportion of the value benchmark than the growth. With technology and consumer-growth stocks rallying strongly in the fourth quarter, however, the relative performance of the two style indexes was much closer.

The value component of the Portfolio outperformed the S&P 500 Stock Index while the growth component trailed the Index. The late year rally in technology stocks was particularly beneficial to the Portfolio’s relative returns in the fourth quarter, as both value and growth segments had significant commitments to the sector. For the year, strong stock selection in technology and energy was offset by the underperformance of large holdings in the media, Internet-related, and health care industries.

Notable contributors to performance during the year included Yahoo, Ebay, UnitedHealth Group, Nortel Networks and Norfolk Southern. Detractors included Veritas Software, Viacom, Avon Products, Broadcom and Comcast.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

10.07 | % | 0.32 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

23

AST Sanford Bernstein Core Value Portfolio

For the year ended December 31, 2004, the AST Sanford Bernstein Core Value Portfolio had a total return of 13.92%, compared with the return of 10.87% for the S&P 500 Index and 14.62% for the Lipper (VIP) Multi-Cap Value Funds Average.

Equity markets enjoyed another strong year in 2004. Value and smaller company stocks outperformed growth and large company stocks, resulting in the Portfolio’s outperformance of the S&P 500 Index. Late in the year, electronics manufacturing services stocks came under pressure due to cautious guidance statements or weak sales. Bernstein believes that the industry’s earnings growth will improve as these companies streamline operations, improve capacity utilization, and benefit from a recovery in spending for technology. An overweight in consumer cyclicals, particularly General Motors and several auto-parts companies, also hurt returns. Bernstein’s research suggests that investors are overly gloomy about GM’s long-term earnings power and they continue to expect auto-parts suppliers to benefit from continued growth in content per vehicle and market-share gains outside of the US.

The Utilities sector contributed significantly to performance, led by Sprint Corp, Bellsouth and SBC Communications. Positions in railroad companies Norfolk Southern and Burlington Northern also strongly outperformed; they continue to benefit from insufficient capacity in the trucking industry and strong demand for transportation in the US.

| 1 Year |

Since Inception |

|||||

| AVERAGE ANNUAL TOTAL RETURNS |

13.92 | % | 7.09 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

24

AST Cohen & Steers Realty Portfolio

For the year ended December 31, 2004, the AST Cohen & Steers Realty Portfolio had a total return of 37.95%, compared with the return of 10.87% for the unmanaged S&P 500 Index, 31.58% for the NAREIT Index, and 33.71% for the Lipper (VIP) Real Estate Funds Average.

The Portfolio’s major theme all year, and the primary driver of REIT stock price appreciation, has been the resurgence in both cash flow and dividend growth. Cohen & Steers’s believes that performance this year demonstrated that real estate fundamentals are what matter most. Within the REIT sector, regional mall companies continued to lead the industry. It was the greatest single contributor to the Portfolio’s outperformance because of the Portfolio was overweight in this sector selected stocks well within it. The apartment sector was the second largest contributor because of stock selection and also the decision to move from an underweight to an overweight earlier in the year. Manufactured housing was the weakest sector, as lower apartment rents and affordable housing for sale continued to disadvantage this low-priced housing alternative.

Looking ahead, Cohen & Steers anticipates that economic fundamentals in 2005 will be substantially similar to 2004 and even better in a few ways. This should provide a continued positive backdrop for real estate, producing higher occupancies, rents, and cash flows for most property types in most regions of the country.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

37.95 | % | 20.36 | % | 11.71 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

25

AST Sanford Bernstein Managed Index 500 Portfolio

For the year ended December 31, 2004, the AST Sanford Bernstein Managed Index 500 Portfolio had a total return of 9.98%, compared with a return of 10.87% for the unmanaged S&P 500 Index, and 8.59% for the Lipper (VIP) Large-Cap Core Funds Average.

The Portfolio performed well on an absolute basis, but lagged the broad market due to a combination of sector and security selection. Selection among consumer cyclical stocks was the largest contributor to the Portfolio’s relative performance over the period. It had large positions in eBay (+80.1%) and Yahoo (+67.4%). Finance and industrial commodities holdings also performed well. UnitedHealth Group (+51.4%), Wellpoint Health (+43.1%), and US Steel (+47.2%) were noteworthy positive performers. The largest detractors were investments in medical stocks such as Pfizer and Forest Labs. In the capital equipment sector, General Motors also hurt performance.

Although the Portfolio’s sector weightings were generally close to those of the S&P 500 Index, differences in sector weights nonetheless detracted from performance. Because the energy sector had by far the Index’s highest return, almost 31%, the Portfolio’s underweight of energy was the largest detractor from its relative performance.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

9.98 | % | –1.83 | % | 5.08 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

26

AST American Century Income & Growth Portfolio

For the year ended December 31, 2004, the AST American Century Income & Growth Portfolio had a total return of 12.59%, compared with the return of 10.87% for the S&P 500 Index, and 14.62% for the Lipper (VIP) Multi-Cap Value Funds Average.

The year 2004 marked the second straight year of positive performance for the U.S. stock market — the first time that has happened since 1998-99. Stocks were mired in a narrow trading range for most of the year, held in check by concerns ranging from soaring oil prices and weak job growth to terrorism and a potentially contentious presidential election. However, a number of these concerns were resolved during the last three months of the year, allowing stocks to finish the year with a strong rally.

The top contributors to the Portfolio’s return were sectors that typically benefit from a strong economy, including financial, energy, and consumer-oriented stocks. The only two sectors of the portfolio to decline during the year were healthcare and information technology. Stock selection was the key to the Portfolio’s outperformance of the S&P 500. It worked best in the consumer staples and materials sectors where selections among beverage and chemicals stocks provided the greatest lift to relative performance. The financial sector also contributed positively to relative results thanks to favorable stock selection in commercial banks and insurance. On the downside, stock selection detracted from relative performance in the healthcare and information technology sectors.

| 1 Year |

5 Year |

Since Inception |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

12.59 | % | –1.02 | % | 6.09 | % |

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Performance is historical, assumes reinvestment of all dividends and capital gains, and is not indicative of future results.

For a complete listing of holdings, please refer to the Schedule of Investments section of this report.

27

AST Alliance Growth & Income Portfolio

For the year ending December 31, 2004, the AST Alliance Growth & Income Portfolio had a total return of 11.01%, compared with the return of 10.87% for the unmanaged S&P 500 Index and 16.49% for the unmanaged Russell 1000 Value Index.

The Russell 1000 Value Index showed remarkable strength in 2004. It is heavily skewed to the commodity-related and interest-sensitive stock groups that led the market in 2004, areas of the market that Alliance’s high quality bias typically avoids. The Portfolio’s underperformance was attributed to both sector and security selection. Overweights in media (notably Viacom), property and casualty insurance (American International Group and ACE), and healthcare (Pfizer and Boston Scientific) were the primary detractors from relative performance. These groups were hit by intense negative publicity throughout the year. Underweights in financials and utilities also held back relative performance. The largest individual detractors included Viacom, Pfizer, Clear Channel Communications, Forest Laboratories and Union Pacific. On the other hand, the Portfolio benefited from not being exposed to Merck, the worst-performing drug stock in 2004, and from several energy and managed-care positions. Notable individual contributors to performance included, Bank One, WellPoint Health Networks, Burlington Northern and ConocoPhillips.

Alliance believes that style and size anomalies such as we saw in 2004 cannot persist indefinitely. Markets return to emphasizing fundamentals, and the Portfolio’s holdings, on average, have better earnings stability, higher dividend growth, and healthier balance sheets than the Russell 1000 Value Index. Moreover, after the long-running outperformance of smaller-cap, lower-quality companies, the stocks it favors are selling at unusually low valuations.

| 1 Year |

5 Year |

10 Year |

|||||||

| AVERAGE ANNUAL TOTAL RETURNS |

11.01 | % | 3.44 | % | 11.35 | % |