UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December

26, 2020

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, for the transition period

from to

Commission file number: 0-16088

CPS TECHNOLOGIES CORP.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

04-2832509 (I.R.S. Employer Identification No.) |

| 111 South Worcester Street Norton, MA (Address of principal executive offices) |

02766-2102 (Zip Code) |

508-222-0614

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Trading Symbol(s) Name of each exchange

on which registered

Common Stock, $0.01 par value

CPSH

NASDAQ Capital Markets

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes

[X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period than the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X] Smaller reporting company [X]

Emerging growth company[ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

[ ]Yes [X] No

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act

[ ] Yes [X] No

The aggregate market value of the voting Common Stock held by non-affiliates of the Registrant was $15 million based on the average of the reported closing bid and asked prices for the Common Stock as of the last business day of the registrant’s most recently completed second fiscal quarter as reported on the NASDAQ Capital Market.

Number of shares of Common Stock outstanding as of March 5, 2021: 14,352,542 shares.

Documents incorporated by reference.

Part I

Item 1. Business.

CPS Technologies Corp. (the ‘Company’ or ‘CPS’) provides advanced material solutions to the transportation, automotive, energy, computing/internet, telecommunications, aerospace and defense markets. CPS products are important elements in electrifying the green economy.

Our primary material solution is metal matrix composites (MMCs). We design, manufacture and sell custom metal matrix composite components to the performance and reliability of systems in the end markets in which we participate.

The Company is an important participant in the growing movement towards alternative energy and green lifestyles.

The Company’s products are used in high-speed trains, mass transit, hybrid and electric cars, wind-turbines for electricity generation, routers, switches and fiber optic components for the internet backbone. The Company’s products are used in high reliability communications and power modules for avionics and satellite applications such as the current generation of GPS satellites. The Company also produces housings and heatspreaders for high-performance microprocessors, graphics processing chips, and application-specific integrated circuits. All of these applications involve electrical energy use or energy generation; the Company’s products allow higher performance and improved energy efficiency.

Using its proprietary MMC technology, the Company also produces light-weight vehicle armor, particularly for extreme environments and heavy threat levels.

Metal matrix composites (MMCs) are a class of materials consisting of a combination of metals and ceramics. Compared to conventional materials, MMCs provide superior thermal conductivity, improved thermal expansion matching, greater stiffness and lighter weight. These factors, in particular the lighter weight, are among the reasons CPS parts are on the last two Mars Rovers as well as many satellites.

CPS is a fully qualified manufacturer for many of the world’s largest electronics OEMs.

CPS management believes our business model of providing advanced material solutions to a portfolio of high growth end markets in various stages of the technology adoption lifecycle provides CPS with the opportunity for sustained growth and a diversified customer base. We believe we have validated this model as we are now supplying customers at all stages of the technology adoption lifecycle.

Our products are manufactured by proprietary processes we have developed including the QuicksetTM Injection Molding Process (‘Quickset Process’) and the QuickCastTM Pressure Infiltration Process (‘QuickCast Process’).

CPS was incorporated in Massachusetts in 1984 as Ceramics Process Systems Corporation and reincorporated in Delaware in April 1987 through a merger into a wholly-owned Delaware subsidiary organized for purposes of the reincorporation. In July 1987, CPS completed our initial public offering of 1.5 million shares of our Common Stock. In March 2007, the Company changed its name from Ceramics Process Systems Corporation to CPS Technologies Corp..

CPS website is http://www.alsic.com.

Overview of Markets and Products

Electronics Markets Overview

The electronics world can be divided into power processing and signal processing. Power processing consists of converting the electrical power provided by the power source into the appropriate voltage and amperage needed for the device using the power. Signal processing consists of the myriad ways digital and analog signals are used in computing, communications, etc.

In both power processing and signal processing end-user demand continues to motivate the electronics industry to produce products which:

- operate with lower losses and/or at higher speeds;

- are smaller in size; and

- operate with higher reliability.

While these three requirements result in products of ever-increasing performance, these requirements also create a fundamental challenge for the designer to manage the heat generated by the system operating at higher speeds and/or higher power. Smaller assemblies further concentrate the heat and increase the difficulty of removing it.

This challenge is found at each level in an electronic assembly: at the integrated circuit level speeds are increasing and line widths are decreasing; at the circuit board level higher density devices are placed closer together on circuit boards; and at the system level higher density circuit boards are being assembled closer together.

The designer must resolve the thermal management issues or the system will fail. For every 10 degree Celsius rise in temperature above a threshold level, the reliability of a integrated circuit is decreased by approximately half. In addition, heat usually causes changes in parameters which degrade the performance of both active and passive electronic components.

To resolve thermal management issues the designer is primarily concerned with two properties of the materials which comprise the system: 1) thermal conductivity, which is the rate at which heat moves through materials, and 2) thermal expansion rate (Coefficient of Thermal Expansion or CTE) which is the rate at which materials expand or contract as temperature changes. The designer must ensure that the temperature of an electronic assembly stays within a range in which the differences in the expansion rates of the materials in the assembly do not cause a failure from breaking, delaminating, etc.

CPS combines at the microstructural level a ceramic with a metal to produce a metal matrix composite which has the thermal conductivity needed to remove heat, and a thermal expansion rate which is sufficiently close to other components in the assembly to ensure the assembly is reliable. The ceramic is silicon carbide (SiC), the metal is aluminum (Al), and the composite is aluminum silicon carbide (AlSiC), a metal-matrix composite. CPS can adjust the thermal expansion rate of AlSiC components to match the specific application by modifying the amount of SiC compared to the amount of Al in the component. The Company also has the capability of encapsulating Pyrolytic Graphite inserts to enhance the thermal conductivity of the AlSiC composite.

CPS produces products made of AlSiC in the shapes and configurations required for each application, for example, in the form of lids, substrates, housings, etc. Every product is made to a customer’s blueprint. The CPS process technology allows most products to be made to net shape, requiring no or little final machining.

Although the Company’s focus today is on AlSiC components, it believes its proprietary Quickset- Quickcast process technology can be used to produce other metal-matrix composites to meet future market needs.

An important development in power processing is the emergence of wide-band gap semiconductors, particularly SiC semiconductors. SiC chips are more efficient than Si chips and are being used more frequently in power applications. Modules using SiC chips run at higher temperatures, increasing the need for improved thermal management, need which the Company’s products meet.

Armor and Structural Markets Overview

Vehicle armor has traditionally been steel panels. As threat levels have increased the amount of steel required to provide ballistic protection has reached a point where the weight degrades the vehicle’s performance. The U.S. military has increasingly used ceramic armor in weight sensitive applications. However, ceramic armor has several limitations, including limited multi-hit capability. By embedding ceramic armor tiles in a metal matrix, these problems are overcome; the result is vehicle armor that is light-weight, has excellent ballistic protection, and environmental durability.

The Company’s HybridTech Armor panels are particularly well suited for extreme environments – the panels don’t degrade in salt spray, or near heat, for example, and for high threat levels wherein steel does not provide the needed level of protection. The Company believes its armor panels will increasingly be used in these applications.

Structural applications perform primarily a mechanical rather than electrical function. In any mechanical assembly with moving parts the stiffness and weight of moving parts can have a significant impact on the performance and energy efficiency of the assembly. In particular, in equipment with reciprocating components increasing the stiffness and reducing the weight of reciprocating components improves the performance and energy efficiency of the equipment.

Today many mechanical components are made of steel because steel has the stiffness required for the particular application. AlSiC has approximately the same stiffness as steel, but is only one-third the weight of steel. AlSiC is higher cost than steel. However, we believe there are many mechanical applications where the customer will pay the higher cost for AlSiC because of significant improvements in performance resulting from the superior stiffness-to-weight ratio of AlSiC.

Examples of structural applications for which we have developed and supplied components include robotic arms for semiconductor manufacturing equipment, and stiffeners for satellites.

Specific Markets and Products

Motor Controller Applications (Insulated Gate Bipolar Transistor ("IGBT") Applications)

The electrification of the economy – particularly the use of electric motors and power modules to control electric motors of all sizes - is growing. This growth is the result of several factors including emerging high-power applications which demand power controllers such as trains, subways and certain industrial equipment, and cost declines in power modules which increasingly make variable speed drives cost effective. Power semiconductors are a very significant portion of the cost of variable speed drives, and the cost of the module housing and thermal management system are also significant; declines in the costs of all these components is driving increased use of variable speed drives.

We provide baseplates and heat spreaders on which power semiconductors are mounted to produce modules for motor control. The power semiconductors are typically IGBTs and these applications are often referred to as IGBT applications. Our AlSiC baseplates have sufficient thermal conductivity to allow for removal of heat through the baseplate and have a thermal expansion rate sufficiently similar to the other components in the assembly to ensure reliability over time as the assembly thermally cycles. We believe this market will continue to grow as the use of power modules penetrates additional motor applications, and as electric motors themselves penetrate new applications such as the hybrid and electric vehicles.

Today our primary products for IGBT applications are used in electric trains, subway cars, wind turbines and hybrid and electric vehicles.

Major automobile companies around the world are introducing hybrid electric vehicles (HEVs) and electric vehicle (EVs) at an increasing rate. This focus on more energy efficient vehicles is being driven by concerns about climate change. There are many varieties of HEVs and EVs, but all HEVs and EVs contain an electric motor and contain one or more motor controller modules. The Company provides baseplates on which motor controller modules are assembled; these baseplates are lighter weight and provide greater reliability than baseplates made from more conventional materials.

The Company is working with multiple tier one and tier two suppliers to the automobile industry on several new designs for future introduction. The Company believes the HEV and EV markets will be the source of significant and long-term growth for the Company.

Lids and Heat Spreaders for High-Performance Microprocessors, Application-Specific Integrated Circuits and Other Integrated Circuits ("Flip-chip Applications")

Increases in speed, circuit density, and the number of connections in graphics processors (GPUs), microprocessor chips (CPUs) and application-specific integrated circuits (ASICs) are accelerating a transition in the way in which these circuits are packaged. Packages provide mechanical protection to the integrated circuit (IC), enable the IC to be connected to other circuits via pins, solder bumps or other connectors, and allow attachment of a heat sink or fan to ensure the IC does not overheat. In the past most high-performance ICs were electrically connected to the package by fine wires in a process known as wire bonding. Today, most high-performance semiconductors are connected to the package by placing metal bumps on the connection points of the die, turning the die upside down in the package, and directly connecting the bumps on the die with corresponding bumps on the package base by reflowing the bumps. This is referred to as a "flip-chip package". Flip chip packages allow for connection of a larger number of leads in a smaller space, and can provide other electrical performance advantages compared to wire bonded packages.

In many flip chip configurations a lid or heat spreader is placed over the die to protect the die from mechanical damage and to facilitate the removal of heat from the die. Often a heat sink or fan is then attached to the lid. For a high-density die the package designer must ensure that the lid has sufficient thermal conductivity to remove heat from the die and that all components of the package assembly - the die itself, the package base, and the package lid - are made from materials with sufficiently similar thermal expansion rates to ensure the assembly will not break apart over time as it thermally cycles.

Our composite material, AlSiC, has been developed to meet these two needs: it is engineered to have sufficient thermal conductivity to allow the heat generated by the die to be removed through the lid, and it is engineered to expand upon heating at a rate similar to other materials used in the package assembly in order to ensure reliability of the package over time as it thermally cycles. We produce lids made of AlSiC for high performance microprocessors and application-specific integrated circuits used in servers, internet switches and other applications.

Most participants in the semiconductor industry believe the densities of ICs will continue to increase following the well-known "Moore’s Law". As IC densities increase, generally so does the IC size, and the amount of heat generated by the IC. We believe the need for thermal management will continue to grow rapidly.

Customers

We sell primarily to major microelectronics systems houses in the United States, Europe and Asia. Our customers typically purchase prototype and evaluation quantities of our products over a one to three year period before purchasing production volumes.

In 2020, our three largest customers accounted for 36%, 21%, and 16% of revenues, respectively. In 2020, approximately 87% of our revenues were derived from commercial applications and 13% from defense-related applications.

Availability of Raw Materials

We use a variety of raw materials from numerous domestic and foreign suppliers. These materials are primarily aluminum ingots, ceramic powders and chemicals. The raw materials we use are available from domestic and foreign sources and none is believed to be scarce or restricted for national security reasons. We use no conflict metals.

Patents and Trade Secrets

As of December 26, 2020, the Company had 11 United States patents. In addition the Company had several international patents covering the same subject matter as the U.S. patents. Licensees of these patents have rights to use certain patents as defined in their respective license agreements.

We intend to continue to apply for domestic and foreign patent protection in appropriate cases. In other cases, we believe we are better served by reliance on trade secret protection. In all cases, we seek protection for our technological developments to preserve our competitive position.

Backlog and Contracts

Over 90% of the Company's product sales are custom in that they are based on customers’ drawings and the large majority of these sales are "designed in" and are sold over multiple years. Major customers typically give the Company a non-binding forecast of demand for a one-year period and then negotiate a pricing agreement with the Company valid for that one-year period. Each week customers then issue releases or authorizations to ship under the pricing agreements. At any point in time the contractually binding backlog represented by the releases in hand does not necessarily reflect underlying demand. Given this situation, the Company does not believe backlog data are meaningful.

Competition

We have developed and expect to continue to develop products for a number of different end markets and we will encounter competition from different producers of metal-matrix composites and other competing materials.

We believe that the principal competitive

factors in our end markets today include technical competence, product performance, quality, reliability, price, delivery

performance, corporate reputation, and strength of sales and marketing resources. We believe our proprietary processes,

reputation, and the price at which we can offer products for sale will enable us to compete successfully in the many

electronics end markets.

Our primary direct competitor in metal matrix composites is Denka, a large chemical company

based in Japan. We see manufacturers in China seeking to penetrate our markets. We believe they offer their products at

lower prices but have generally not yet been to be able to provide the delivery, performance, quality and reliability

required by the market.

Government Regulation

We produce non-nuclear, non-medical hazardous waste in our development and manufacturing operations. The disposal of such waste is governed by state and federal regulations. Various customers, vendors, and collaborative development agreement partners of CPS may reside abroad, thereby possibly requiring export and import of raw materials, intermediate products, and finished products, as well as potential technology transfer abroad under collaborative development agreements. These types of activities are regulated by bureaus within the Departments of Commerce, State and Treasury.

Employees

As of December 26, 2020, we had 104 permanent full-time employees. 95 were engaged in manufacturing and engineering and 9 in sales and administration, including finance, HR and general management.

None of our employees are covered by a collective bargaining agreement. We consider our relations with our employees to be excellent.

Item 1A. Risk Factors.

Smaller reporting companies are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments.

Smaller reporting companies are not required to provide the information required by this item.

Item 2. Properties

As of December 26, 2020, all our manufacturing, engineering, sales and administrative operations were located in leased facilities in Norton, Massachusetts and Attleboro, Massachusetts.

The Company completed a move out of the Attleboro facility on December 31,2020 and now has fully consolidated operations in the Norton facility,

In February 2021, the Company extended the lease for the Norton facility through February 2026. The leased facilities comprise approximately 38 thousand square feet. The lease is a triple net lease wherein the Company is responsible for payment of all real estate taxes, operating costs and utilities. The Company also has an option to buy the property and a first right of refusal during the term of the lease. Annual rental payments continue at $152 thousand.

Item 3. Legal Proceedings

We are not a party to any litigation which could have a material adverse effect on us or on our business.

Item 4. Mine Safety Disclosures

Not applicable

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities.

CPS Technologies Corp. shares have traded on The Nasdaq Capital Market, under the symbol “CPSH”. On December 26, 2020, we had approximately 2,000 shareholders. We have never paid cash dividends on our Common Stock. We currently plan to reinvest our earnings, if any, for use in the business and do not intend to pay cash dividends in the foreseeable future. Future dividend policy will depend, among other factors, upon our earnings and financial condition.

Item 6. Selected Financial Data

Smaller reporting companies are not required to provide the information required by this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This document contains forward-looking statements, based on numerous assumptions, subject to risks and uncertainties. Although we believe that the forward-looking statements are reasonable, we do not and cannot give any assurance that our beliefs and expectations will prove to be correct. Many factors could significantly affect our operations and cause our actual results to be substantially different from our expectations. Those factors include, but are not limited to: (i) general economic and business conditions; (ii) customer acceptance of our products; (iii) materials and manufacturing costs; (iv) the financial condition of customers, competitors and suppliers; (v) technological developments; (vi) increased competition; (vii) changes in capital market conditions; (viii) governmental and business conditions in countries where our products are manufactured and sold; (ix) changes in trade regulations; (x) the effect of acquisition activity; (xi) changes in our plans, strategies, objectives, expectations or intentions; and (xii) other risks and uncertainties indicated from time to time in our filings with the Securities and Exchange Commission. Actual results might differ materially from results suggested by any forward-looking statements in this report. We do not have an obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise.

Overview

The Company’s products contribute to the electrification of the green economy. The products we provide include baseplates for motor controllers used in high-speed electric trains, subway cars, wind turbines, and hybrid and electric vehicles. We provide baseplates and housings used in radar, satellite and avionics applications. We provide lids and heatspreaders used with high performance integrated circuits for in internet switches and routers.

We provide baseplates and housings used in modules built with Wide Band Gap Semiconductors like SiC and GaN. CPS also assembles housings and packages for hybrid circuits. These housings and packages may include MMC components; they may include components made of more traditional materials such as aluminum, copper-tungsten, etc.

CPS’s products are custom rather than catalog items. They are made to customers’ designs and are used as components in systems built and sold by our customers. At any point in time our product mix will consist of some products with on-going production demand, and some products which are in the prototyping or evaluation stages at our customers. The Company seeks to have a portfolio of products which include products in every stage of the technology adoption lifecycle at our customers. CPS’ growth is dependent upon the level of demand for those products already in production, as well as its success in achieving new "design wins" for future products.

As a manufacturer of highly technical and custom products, the Company incurs fixed costs needed to support the business, but which do not vary significantly with changes in sales volume. These costs include the fixed costs of applications engineering, tooling design and fabrication, process engineering, etc. Accordingly, particularly given our current size, changes in sales volume generally result in even greater changes in financial performance on a percentage basis as fixed costs are spread over a larger or smaller base. Sales volume is therefore a key financial metric used by management.

The Company believes the underlying demand for metal matrix composites is growing as the electronics and other industries seek higher performance, higher reliability, and reduced costs. CPS believes that the Company is well positioned to offer our solutions to current and new customers as these demands grow. In 2020 the Company’s top three customers accounted for 73% of revenue and the remaining 27% of revenue was derived from 61 other customers. In 2019 the top three customers accounted for 70% of revenue and the remaining 30% of revenue was derived from approximately 60 customers.

COVID-19 Pandemic

As a provider of essential services products and services, CPS has been open and operating throughout the novel coronavirus pandemic. To date most of our customers remain open and operational. In the second half of 2020 we saw significant increased volatility on the part of some of our customers, while for others it has been business as usual. We expect that this volatility will continue for at least the next several quarters. Unexpected significant reductions in demand by our largest customer led to a reduction in third and fourth quarter revenue. As these reductions were originally unexpected, by both CPS and our customer, inventory at various stages of production was built to meet expected demand, remains in inventory. This inventory was somewhat reduced in Q4, but will likely continue to remain somewhat inflated over the next quarter or two until it reaches equilibrium with current demand.

CPS continues to follow CDC and OSHA guidance in our workplace. Employees’ temperatures are taken at the beginning of each shift, shifts have been staggered to reduce employee overlap, workstations have been rearranged to ensure social distancing, all employees are using facemasks, etc. The pandemic has had very little impact on our ability to produce and ship customer orders.

Application of Critical Accounting Policies

Financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. As such, the Company is required to make certain estimates, judgments and assumptions that it believes are reasonable based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods presented. CPS’s significant accounting policies are presented within Note 2 to the financial statements; the significant accounting policies which management believes are most critical to aid in fully understanding and evaluating its reported financial results include the following:

a) Allowance for doubtful accounts

The Company performs ongoing monitoring of the status of its receivables based on the payment history and the credit worthiness of our customers, as determined by a review of their current credit information. Management continuously monitors collections and payments from customers and maintains a provision for estimated credit losses based upon historical experience and any specific customer collection issues that have been identified. While such credit losses have historically been low and within expectations, there is no guarantee that we will continue to experience the same credit loss rates as in the past. Although the Company’s major customers are large and have a favorable payment history, a significant change in the liquidity or financial position of one of them could have a material adverse impact on the collectability of accounts receivable and future operating results. To further mitigate the potential for credit losses the Company has acquired a credit insurance policy covering most of our sales to non-US accounts.

b) Inventory valuation

The Company has a build-to-order business model and manufactures product to ship against specific purchase orders; occasionally CPS manufactures product in advance of anticipated purchase orders to level load production or prepare for a ramp-up in demand. In addition, 100% of the Company’s products are custom, meaning they are produced to a customer’s design and generally cannot be used for any other purpose. Purchase orders generally have cancellation provisions which vary from customer to customer, but which can result occasionally in CPS producing product which the customer is not obligated to purchase. However, once a product has gone into production, most customer orders are recurring and order cancellations are rare. The Company’s general obsolescence policy is to write off obsolete inventory when there has been no activity on a particular part for a twelve month period and there are no pending customer orders.

In some cases, customers place blanket purchase orders and request the Company to maintain inventory sufficient to respond quickly upon receiving a shipment request. The Company manufactures to specifications and the products typically have a life which extends over several years and does not deteriorate over time. Therefore, the risk of obsolescence due to the passage of time, per se, is minimal. However, in order to more efficiently schedule production or to meet agreements with customers to have inventory in the pipeline, the Company occasionally manufactures products in advance of purchase orders. In these instances, the Company bears the risk that it will be left with product manufactured to specification for which there are no customer purchase orders. The Company scrutinizes its inventory and, in the absence of pending orders or strong evidence of future sales, establishes an obsolescence reserve when there has been no activity on a particular part for a twelve month period.

In determining inventory cost, the Company uses the first-in, first-out method and states inventory at the lower of cost or net realizable value. Virtually, all of the Company’s inventory is customer specific; as a result, if a customer’s order is cancelled, it is unlikely that CPS would be able to sell that inventory to another customer. Likewise, if the Company chooses to manufacture product in advance of anticipated purchase orders and those orders do not materialize, it is unlikely that it would be able to sell that inventory to another customer. The value of CPS’s work in process and finished goods is based on the assumption that specific customers will take delivery of specific items of inventory. The Company has not experienced losses to date as a result of customer cancellations and has not established a reserve for such cancellations.

The Company typically buys ‘lots’ of components for its hermetic packaging products. Often all the components in a lot are not necessary to complete the order. Annually the company reviews this unused material and establishes an obsolescence reserve for the amount it does not expect to use over the next three years.

c) Valuation of deferred tax assets

Deferred tax assets and liabilities are based on the net tax effects of tax credits, operating loss carryforwards and temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The Company considers many factors in assessing whether or not a valuation allowance for its Deferred Tax Asset is warranted and has concluded that it is more likely than not that a portion or all of the Deferred Tax Asset will not be used before they expire. As a result a valuation reserve has been established as of December 28, 2019 and December 26, 2020.

At December 26, 2020 the Company’s Deferred Tax Asset and other temporary differences will require taxable income of approximately $15 million and reversals of existing temporary differences to fully utilize the Deferred Tax Asset, assuming a statutory corporate tax rate of 21%.

Results of Operations (all $ in millions unless noted)

Results of Operations for the year 2020 (“2020”) compared with the year 2019 (“2019”):

Total revenue was $20.9 million in 2020, a 3% decrease compared with total revenue of $21.4 million in 2019. This decrease was due primarily to a decrease in the sales from our largest customer because of the impact of the Covid-19 pandemic on their business. Our second and third largest customers showed increased sales, but not enough to offset the reduction from the largest customer. Much of our largest customer’s sales go to railroad companies who experienced significant reductions in ridership due to the pandemic.

Gross margin in 2020 totaled $4.2 million or 20% of sales. This compares with $2.5 million, or 12% of sales, generated during 2019. The improvement in margin was primarily due to price increases which were fully in effect throughout 2020.

Selling, general and administrative (SG&A) expenses were $3.3 million during 2020, an increase of 3% compared with SG&A expenses of $3.1 million incurred during 2019. The primary reason for this increase was increased professional fees, including costs incurred during our search for a Chief Operating Officer. This search was concluded in 2020; our new Chief Operating Officer began work on January 4, 2021.

The Company generated operating income of $0.9 million in 2020, compared with an operating loss of $0.6 in 2019. This improvement was due primarily to the price increases, as discussed above; secondarily to operating efficiencies. The net income in 2020 totaled $0.9 versus a net loss of $0.6 in 2019.

Significant Fourth Quarter Activity in 2020:

Revenues totaled $4.2 million in the fourth quarter of 2020 versus $5.4 million in the fourth quarter of 2019, a decrease of 24%. This decrease was due primarily to a decrease in the sales of baseplates with our two largest customers. Both of these customers were negatively affected in the fourth quarter by Covid-19, although one showed growth for the year, but was down in the fourth quarter.

Gross margin decreased in the fourth quarter of 2020 compared with the fourth quarter of 2019 to $0.5 million from $1.0 million. This decrease was directly associated with the decrease in revenue.

SG&A expenses totaled $0.8 million during the quarter, an increase of 29% compared to $0.6 million in the same quarter of 2019. The primary reason for this increase was increased professional fees, including costs incurred during our search for a Chief Operating Officer.

Primarily as a result of the revenue decrease, the Company recorded an operating loss of $0.3 million in the fourth quarter of 2020 compared to a income of $0.4 million in the fourth quarter of 2019.

The Company recorded a net loss of $0.2 million in the fourth quarter of 2020 compared to a net earnings of $0.4 million in the fourth quarter of 2019. The operating loss in the fourth quarter of 2020 was reduced due to the sales of equipment as a result of the closing of the Attleboro facility.

Liquidity and Capital Resources (all $ in millions unless noted)

The Company’s cash and cash equivalents at December 26, 2020 totaled $0.2 compared with cash and cash equivalents at December 28, 2019 of $0.1. The Company’s net cash (cash and equivalents offset by borrowings under its line of credit) increased to $0.2 at December 26, 2020 from negative $1.1 at December 28, 2019. The increase was primarily due to the Company’s profitability for the year.

Accounts receivable at December 26, 2020 totaled $2.9 compared to $4.1 at December 28, 2019. Days Sales Outstanding (DSO) decreased to 62 days at the end of 2020 compared to 67 days at the end of Q4 2019. This change was due in large part to the fact that sales were more front-end loaded in the quarter in 2020 and, as a result, a higher percentage of sales were collected during the quarter. The accounts receivable balances at December 26, 2020, and December 28, 2019 were both net of an allowance for doubtful accounts of $10 thousand.

Inventories increased to $3.7 at December 26, 2020 from $3.1 at December 28, 2019. The inventory turnover in the most recent four quarters ending was 4.5 times, down from 6.2 times averaged during the four quarters of 2019 (each based on a 5 point average). The majority of our inventory is for our two largest customers, both of whom significantly decreased their projected purchases in the fourth quarter of 2020.

The Company had no inventory on consignment at any customers at the end of 2019 or 2020. At December 26, 2020 and December 28, 2019 inventory of, $1.6 and $1.2, respectively, was located at vendor locations pursuant to inventory agreements.

The Company funded its operations from its profit in 2020. The Company expects it will continue to be able to fund its operations during 2021 from existing cash balances, the existing credit facility and profits.

The Company continues to sell to a limited number of customers and the loss of any one of these customers or vendors could cause the Company to require additional external financing. Failure to generate sufficient revenues, raise additional capital or reduce certain discretionary spending could have a material adverse effect on the Company’s ability to achieve its business objectives.

Contractual Obligations

In September 2019, the Company entered into revolving line of credit (LOC) with Massachusetts Business Development Corporation (BDC) in the amount of $2.5 million. The agreement includes a demand note allowing the Lender to call the loan at any time. The Company may terminate the agreement without a termination fee after 3 years. The LOC is secured by the accounts receivable and other assets of the Company and has an interest rate of LIBOR plus 650 basis points. BDC requires that the total earnings before taxes for 2020 be at least $749 thousand, which was achieved. BDC also required a $201 thousand earnings before taxes for the fourth quarter of 2020. A blanket waiver of compliance was issued by BDC for this and any other 2020 activity. At December 26, 2020 the Company had $0 borrowings under this LOC and its borrowing base at the time would have permitted an additional $2.2 to have been borrowed.

In March 2020, the company acquired a scanning acoustic microscope for a price of $208 thousand. The full amount was financed through a 5 year note payable with a financing company. The note is collateralized by the microscope and is being paid in monthly installments of $4 thousand, consisting of principal plus interest at a rate of 6.47%

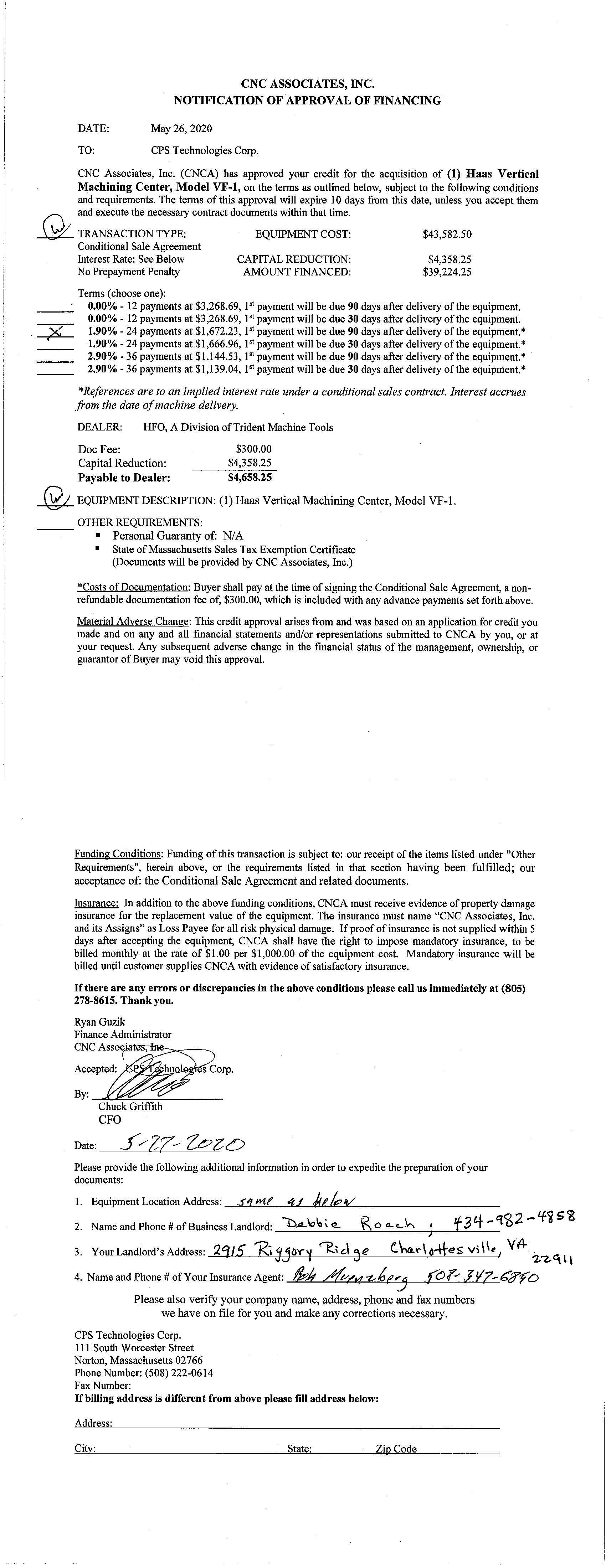

In July 2020 CPS placed into service a piece of manufacturing equipment which it financed with the machine’s vendor. The equipment cost of $40 thousand will be paid at the rate of $2 thousand per month over 2 years with an interest rate of 1.9%.

As of December 26, 2020 the Company had $61 thousand of construction in progress and no outstanding commitments to purchase production equipment.

During 2020 our leasing arrangements consisted of the Norton, MA and Attleboro, MA facility leases. The Norton facility lease expires in February 2021 and is a triple net lease wherein the Company is responsible for payment of all real estate taxes, operating costs and utilities. In January 2021 the company entered into an amendment to the lease, extending its term for five years to February 2026. The Company also has an option to buy the property and a first right of refusal during the term of the lease. Annual rental payments continue at $152 thousand. The Attleboro lease expired December 31, 2020 and has not been renewed.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Inflation

Inflation had no material effect on the results of operations or financial condition during the last few years. There can be no assurance however, that inflation will not affect our operations or business in the future.

Item 7A. Quantitative and Qualitative Disclosure about Market Risk

Smaller reporting companies are not required to provide the information required by this item.

Item 8. Financial Statements and Supplementary Data

See Index to the Company’s Financial Statements and the accompanying notes which are filed as part of this Annual Report on Form 10-K.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in Securities and Exchange Commission reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including the Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

Under the direction of our Chief Executive Officer and Chief Financial Officer, management has carried out an evaluation of the effectiveness of the Company’s disclosure controls and procedures as such item is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Based on that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that these disclosure controls and procedures were effective as of December 26, 2020.

Changes in Internal Control over Financial Reporting

There were no material changes in the Company’s internal control over financial reporting during fiscal 2020.

Management’s Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company, as such term is defined in Rule 13a-15(f) of the Exchange Act. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States and includes those policies and procedures that (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company’s assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States, and that receipts and expenditures of the Company are being made only in accordance with authorizations of the Company’s management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the direction of our Chief Executive Officer and Chief Financial Officer, management has assessed the effectiveness of the Company’s internal control over financial reporting as of December 26, 2020. In making this assessment, management used the criteria set forth in the "Internal Control Integrated Framework" issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) (2013). Based on this assessment, management concluded that the Company’s internal control over financial reporting was effective as of December 26, 2020.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

Item 9B. Other Information

The Company had no information required to be disclosed in a report on Form 8-K during the fourth quarter of the year covered by this Form 10-K that has not been so reported.

Part III

Item 10. Directors, Executive Officer and Corporate Governance

The information required by this Item 10 is incorporated herein by reference to our Definitive Proxy Statement, under the captions “Members of the Board of Directors, Nominees and Executive Officers,” “Certain Relationships and Related Person Transactions; Legal Proceedings,” “Section 16(a) Beneficial Ownership Reporting Compliance,” “Code of Conduct” and “Corporate Governance” and with respect to our 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the Company’s 2020 fiscal year.

The Company has adopted the CPS Code of Conduct, which applies to all directors, officers (including the principal executive officer, principal financial officer and treasurer) and employees. A copy of this code can be found on the Company’s website at www.alsic.com/investor-relations.

Item 11. Executive Compensation

The information required by this Item 11 is incorporated herein by reference to our Definitive Proxy Statement, under the captions “Compensation” and “Compensation Discussion and Analysis” with respect to our 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the Company’s 2020 fiscal year.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The information required by this Item 12 is incorporated herein by reference to our Definitive Proxy Statement, under the caption “Equity Compensation Plan Information” and “Security Ownership of Certain Beneficial Owners and Management” with respect to our 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the Company’s 2020 fiscal year.

Item 13. Certain Relationships and Related Transactions, and Director Independence

The information required by this Item 13 is incorporated herein by reference to our Definitive Proxy Statement, under the captions “Certain Relationships and Related Person Transactions; Legal Proceedings” and “Corporate Governance” with respect to our 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the Company’s 2020 fiscal year.

Item 14. Principal Accountant Fees and Services

The information required by this Item 14 is incorporated herein by reference to our Definitive Proxy Statement, under the caption “Accounting Matters” with respect to our 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the Company’s 2020 fiscal year.

Part IV

Item 15.

Exhibits, Financial Statement Schedules.

(a) Documents filed as part of this Form 10-K.

1. Financial Statements

The financial statements filed as part of this Form 10-K are listed on the Index to Financial Statements of this Form 10-K.

2. Exhibits

The exhibits to this Form 10-K are listed on the Exhibit Index of this Form 10-K.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CPS TECHNOLOGIES CORP. | |

| By: | /s/

Grant C. Bennett President and Chief Executive Officer March 16, 2021 |

Pursuant to the Requirements of the Securities Act of 1934, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Signature | Title | Date |

| /s/ Grant C. Bennett | President and Chief Executive Officer | March 16, 2021 |

| Grant C. Bennett | ||

| /s/ Charles K. Griffith Jr. | Chief Financial Officer | March 16, 2021 |

| Charles K. Griffith Jr. | ||

| /s/ Francis J. Hughes, Jr. | Director | March 16, 2021 |

| Francis J. Hughes | ||

| /s/ Daniel C. Snow | Director | March 16, 2021 |

| Daniel C. Snow | ||

| /s/ Thomas M. Culligan | Director | March 16, 2021 |

Thomas M. Culligan |

||

| /s/ Ralph M. Norwood | Director | March 16, 2021 |

| Ralph M. Norwood |

CPS TECHNOLOGIES CORP.

EXHIBIT INDEX

Exhibit No. |

Description |

| 3.1* | Restated Certificate of Incorporation of the Company, as amended, is incorporated herein by reference to Exhibit 3 to the Company’s Registration Statement on Form 8-A (File No. 0-16088) |

| 3.2* | By-laws of the Company, as amended, are incorporated herein by reference to Exhibit 3.2 to the Company’s Registration Statement on Form S-1 (File No. 33-14616)(the ‘1987 S-1Registration Statement’) |

| 3.3* | Certificate of Amendment of Restated Certificate of Incorporation of the Company dated May 14, 2014 |

| 3.4* | Certificate of Ownership and Merger Merging CPS Superconductor Corporation into Ceramics Process Systems Corporation dated March 15, 2007 |

| 4.1* | Specimen certificate for shares of Common Stock of the Company is incorporated herein by reference to Exhibit 4 to the 1987 S-1 Registration Statement |

| 4.2* | Description of Capital Stock contained in the Restated Certificate of Incorporation of the Company, as amended, filed as Exhibit 3.1 |

| 4.3 | Amendment dated May 12, 2020 to Credit and Security Agreement by and between CPS Technologies Corp. and The Massachusetts Business Development Corporation dated September 25, 2019 |

| 4.5 | CNC Associates, Inc. Notification of Approval of Financing dated May 26, 2020. |

| 4.6 | Credit and Security Agreement by and between CPS Technologies Corp. and The Massachusetts Business Development September 25, 2019 |

| 10.2* | Amendment No. 1 dated November 7, 2008 to Standard Form Commercial Lease by and between Gifford Investments, Inc.(lessor) and Ceramics Process Systems Corporation dated July 19, 2006 |

| 10.5*(1) | Retirement Savings Plan, effective September 1, 1987 is incorporated by reference to Exhibit 10.35 to the Company’s 1989 S-1 Registration Statement |

| 10.6* | Amendment No. 2 dated May 7, 2009 to Standard Form Commercial Lease by and between Gifford Investments, Inc.(lessor) and Ceramics Process Systems dated July 19, 2006. |

| 10.7* | Third Amendment dated January 6, 2015 to Standard Form Commercial Lease by and between Gifford Investments, Inc.(lessor) and CPS Technologies Corp. dated July 19, 2006 |

| 10.8* | Fourth Amendment dated February 28, 2018 to Standard Form Commercial Lease by and between Gifford Investments, Inc. and CPS Technologies Corp. dated July 19, 2006 |

| 10.9* | Fifth Amendment dated January 25, 2021 to Standard Form Commercial Lease by and between Gifford Investments, Inc. and CPS Technologies Corp. dated July 19, 2006 |

| 10.21* | 1999 Stock Incentive Plan adopted by the Company’s Board of Directors on January 22, 1999 |

| 10.22* |

2009 Stock Incentive Plan ("2009 Plan") on December 10, 2009. |

| 10.23*(1) | 2020 Stock Incentive Plan (“2020 Plan”) on March 3, 2020 |

| 10.24*(1) | Amended and Restated 2009 Stock Incentive Plan |

| 10.26*(1) | Form of Stock Option Agreement for 2020 Equity Incentive Plan and Amended and Restated 2009 Stock Option Plan |

| 23.1 | Consent of Wolf & Company, P.C. |

| 31.1 | Certification Pursuant to Exchange Act Rule 13a-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1 | Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

* Incorporated herein by reference.

(1) Management Contract or compensatory plan or arrangement filed as an exhibit to this Form pursuant to Items 14(a) and 14(c) of Form 10-K.

INDEX TO FINANCIAL STATEMENTS

OF

CPS TECHNOLOGIES CORP.

Report of Independent Registered Public Accounting Firm |

|

Balance Sheets as of December 26, 2020 and December 28, 2019 |

|

Statements of Operations for the years ended December 26, 2020 and December 28, 2019 |

|

Statements of Stockholders’ Equity for the years ended December 26, 2020 and December 28, 2019 |

|

Statements of Cash Flows for the years ended December 26, 2020 and December 28, 2019 |

|

Notes to Financial Statements |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of CPS Technologies Corp.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of CPS Technologies Corp. (the "Company") as of December 26, 2020 and December 28, 2019, the related statements of operations, stockholders’ equity and cash flows for each of the two years in the period ended December 26, 2020, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 26, 2020 and December 28, 2019, and the results of its operations and its cash flows for each of the two years in the period ended December 26, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

/s/ Wolf & Company, P.C.

Boston, Massachusetts

March 16, 2021

We have served as the Company's auditor since 2005.

CPS TECHNOLOGIES CORP.

BALANCE SHEETS

| December 26, | December 28, | |||||||

| 2020 | 2019 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 195,203 | $ | 133,965 | ||||

| Accounts receivable-trade, net | 2,914,800 | 4,086,945 | ||||||

| Inventories | 3,709,471 | 3,099,824 | ||||||

| Prepaid expenses and other current assets | 71,506 | 147,786 | ||||||

| Total current assets | 6,890,980 | 7,468,520 | ||||||

| Property and equipment: | ||||||||

| Production equipment | 10,265,471 | 9,649,169 | ||||||

| Furniture and office equipment | 568,846 | 508,423 | ||||||

| Leasehold improvements | 951,384 | 934,195 | ||||||

| Total cost | 11,785,701 | 11,091,787 | ||||||

| Accumulated depreciation | ||||||||

| and amortization | (10,558,816) | (10,110,663) | ||||||

| Construction in progress | 61,062 | 255,754 | ||||||

| Net property and equipment | 1,287,947 | 1,236,878 | ||||||

| Right-of-use lease asset (note 4, leases) | 25,000 | 171,000 | ||||||

| Deferred taxes, net | 117,000 | 147,873 | ||||||

| Total assets | $ | 8,320,927 | $ | 9,024,271 |

(continued)

See accompanying notes to financial statements.

CPS TECHNOLOGIES CORP.

BALANCE SHEETS

| December 26, | December 28, | ||||||||||

| 2020 | 2019 | ||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Borrowings against line of credit | $ | — | 1,249,588 | ||||||||

| Notes payable, current portion | 58,134 | — | |||||||||

| Accounts payable | 909,291 | 1,436,417 | |||||||||

| Accrued expenses | 804,091 | 815,166 | |||||||||

| Deferred revenue | 12,177 | 21,110 | |||||||||

| Lease liability, current portion | 25,000 | 148,000 | |||||||||

| Total current liabilities | 1,808,693 | 3,670,281 | |||||||||

| Notes payable less current portion | 154,570 | — | |||||||||

| Long term lease liability | — | 23,000 | |||||||||

| Total liabilities | 1,963,263 | 3,693,281 | |||||||||

| Commitments & Contingencies | |||||||||||

| Stockholders’ Equity: | |||||||||||

| Common stock, $0.01 par value, | |||||||||||

| authorized 20,000,000 shares; | |||||||||||

| issued 13,746,242 and 13,427,492 shares; | |||||||||||

| outstanding 13,313,790 and 13,207,436; | |||||||||||

| at December 26, 2020 and December 28, 2019, respectively | 137,462 | 134,275 | |||||||||

| Additional paid-in capital | 36,688,894 | 36,094,201 | |||||||||

| Accumulated deficit | (29,472,369) | (30,380,433) | |||||||||

| Less cost of 432,452 and 220,056 common shares repurchased | |||||||||||

| at December 26, 2020 and December 28, 2019, respectively | (996,323) | (517,053) | |||||||||

| Total stockholders’ equity | 6,357,664 | 5,330,990 | |||||||||

| Total liabilities and stockholders’ equity | $ | 8,320,927 | $ | 9,024,271 | |||||||

See accompanying notes to financial statements.

CPS TECHNOLOGIES CORP.

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 26, 2020 AND DECEMBER 28, 2019

| 2020 | 2019 | |||||||

| Product sales | $ | 20,872,611 | $ | 21,468,414 | ||||

| Cost of product sales | 16,702,848 | 18,928,173 | ||||||

| Gross margin | 4,169,763 | 2,540,241 | ||||||

| Selling, general, and | ||||||||

| Administrative expenses | 3,255,527 | 3,137,440 | ||||||

| Income (loss) from operations | 914,236 | (597,199) | ||||||

| Other income (expense) | (14,720) | (35,547) | ||||||

| Income (loss) before income tax | 899,516 | (632,746) | ||||||

| Income tax provision (benefit) | (8,548) | 5,456 | ||||||

| Net income (loss) | $ | 908,064 | $ | (638,202) | ||||

| Net income (loss) per | ||||||||

| basic common share | $ | 0.07 | $ | (0.05) | ||||

| Weighted average number of | ||||||||

| basic common shares | ||||||||

| outstanding | 13,251,521 | 13,207,097 | ||||||

| Net income (loss) per | ||||||||

| diluted common share | $ | 0.07 | $ | (0.05) | ||||

| Weighted average number of | ||||||||

| diluted common shares | ||||||||

| outstanding | 13,348,582 | 13,207,097 |

See accompanying notes to financial statements.

CPS TECHNOLOGIES CORP.

STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 26, 2020 AND DECEMBER 28, 2019

| Common stock | ||||||||||||||||||||||||

| Additional | Stock- | |||||||||||||||||||||||

| Number of | Par | Paid-in | Accumulated | Stock | holders’ | |||||||||||||||||||

| shares issued | Value | capital | deficit | repurchased | equity | |||||||||||||||||||

| Balance at | ||||||||||||||||||||||||

| December 29, 2018 | 13,425,992 | $ | 134,260 | $ | 35,960,545 | $ | (29,742,231) | $ | (517,053) | $ | 5,835,521 | |||||||||||||

| Share-based | ||||||||||||||||||||||||

| compensation expense | — | — | 131,421 | — | — | 131,421 | ||||||||||||||||||

| Issuance of Common Stock | 1,500 | 15 | 2,235 | — | — | 2,250 | ||||||||||||||||||

| Net (loss) | — | — | — | (638,202) | — | (638,202) | ||||||||||||||||||

| Balance at | ||||||||||||||||||||||||

| December 28, 2019 | 13,427,492 | $ | 134,275 | 36,094,201 | $ | (30,380,433 | ) | $ | (517,053) | $ | 5,330,990 | |||||||||||||

| Share-based | ||||||||||||||||||||||||

| compensation expense | — | — | 117,842 | — | — | 117,842 | ||||||||||||||||||

| Issuance of common | ||||||||||||||||||||||||

| stock | 500 | 5 | 763 | — | — | 768 | ||||||||||||||||||

| Employee option exercises | 318,250 | 3,182 | 476,088 | — | (479,270) | — | ||||||||||||||||||

| Net income | — | — | — | 908,064 | — | 908,064 | ||||||||||||||||||

| Balance at | ||||||||||||||||||||||||

| December 26, 2020 | 13,746,242 | $ | 137,462 | 36,688,894 | $ | (29,472,369) | $ | (996,323) | $ | 6,357,664 | ||||||||||||||

See accompanying notes to financial statements.

CPS TECHNOLOGIES CORP.

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 26, 2020 AND DECEMBER 28, 2019

| 2020 | 2019 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income (loss) | $ | 908,064 | $ | (638,202) | ||||

| Adjustments to reconcile net income (loss) | ||||||||

| to cash provided (used) by operating | ||||||||

| activities: | ||||||||

| Share-based compensation | 117,842 | 133,671 | ||||||

| Depreciation and amortization | 530,420 | 525,783 | ||||||

| Deferred taxes | 30,873 | 38,874 | ||||||

| Gain on sale of property and equipment | (11,000) | (6,946) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable – trade | 1,172,145 | (1,033,854) | ||||||

| Inventories | (609,647) | 93,109 | ||||||

| Prepaid expenses and other current assets | 76,280 | 8,552 | ||||||

| Accounts payable | (527,126) | (243,846) | ||||||

| Accrued expenses | (11,075) | (160,149) | ||||||

| Deferred revenue | (8,933) | 21,110 | ||||||

| Net cash provided (used) by operating activities | 1,667,843 | (1,261,898) | ||||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (322,991) | (489,475) | ||||||

| Proceeds from sale of property and equipment | 11,000 | 6,946 | ||||||

| Net cash used by | ||||||||

| investing activities | (311,991) | (482,529) | ||||||

| Cash flows from financing activities: | ||||||||

| Net borrowings (repayments) on line of credit | (1,249,588) | 1,249,588 | ||||||

| Proceeds from employee stock options | 768 | — | ||||||

| Payment on notes payable | (45,794) | — | ||||||

| Net cash provided by financing activities | (1,294,614) | 1,249,588 | ||||||

| Net increase (decrease) in cash and cash equivalents | 61,238 | (494,839) | ||||||

| Cash and cash equivalents at beginning of year | 133,965 | 628,804 | ||||||

| Cash and cash equivalents at end of year | $ | 195,203 | $ | 133,965 | ||||

| Supplemental cash flow information: | ||||||||

| Cash paid (refunded) for income taxes | $ | (8,548) | $ | (67,311) | ||||

| Cash paid for interest | $ | 104,488 | $ | 44,113 | ||||

| Supplemental disclosures of non-cash activity: | ||||||||

| Net exercise of stock options | $ | 479,270 | — | |||||

| Issuance of long term debt to finance equipment purchases | $ | 247,807 | — | |||||

See accompanying notes to financial statements.

CPS Technologies Corp.

Years Ended December 26, 2020 and December 28, 2019

Notes to Financial Statements

(1) Nature of Business

CPS Technologies Corp. (the ‘Company’ or ‘CPS’) provides advanced material solutions to the transportation, automotive, energy, computing/internet, telecommunications, aerospace, defense and oil and gas end markets.

Our primary material solution is metal matrix composites. We design, manufacture and sell custom metal matrix composite components which improve the performance and reliability of systems in these end markets.

(2) Summary of Significant Accounting Policies

(2)(a) Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less at the date of purchase to be cash equivalents.

(2)(b) Accounts Receivable

The Company reports its accounts receivable at the invoiced amount less an allowance for doubtful accounts. The Company’s management provides appropriate provisions for uncollectible accounts based upon factors surrounding the credit risk and activity of specific customers, historical trends, economic conditions and other information. Adjustments to the allowance are charged to operations in the period in which information becomes available that may affect the allowance. The Company maintains an allowance for doubtful accounts of $10,000 as of December 26, 2020 and December 28, 2019.

(2)(c) Inventories

Inventories are stated at the lower of cost, as determined under the first-in, first-out method (FIFO), or net realizable value. A reserve for obsolete inventories is based on factors regarding the sales and usage of such inventories, including inventories manufactured for specific customers. The Company’s general obsolescence policy is to write off obsolete inventory when there has been no activity on a particular part for a twelve month period and there are no pending customer orders.

(2)(d) Property and Equipment

Property and equipment are stated at cost. Depreciation of equipment is calculated on a straight-line basis over the estimated useful life, generally five years for production equipment and three to five years for furniture and office equipment. Leasehold improvements are depreciated over the shorter of the lease term or their useful life. Maintenance and repairs are charged to expense as incurred. Upon retirement or sale, the cost and related accumulated depreciation or amortization are removed from their respective accounts. Any gains or losses on the disposition of property and equipment are included in the results of operations in the period in which they occur.

(2)(e) Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment whenever circumstances and situations change such that there is an indication that the carrying amounts may not be recovered. Recoverability is assessed based on estimated undiscounted future cash flows. As of December 26, 2020 and December 28, 2019, the Company believes that there has been no impairment of its long-lived assets.

(2)(f) Revenue Recognition

Revenue is recognized in accordance with the five-step method under Accounting Standards Codification (ASC) 606, “Revenue from Contracts with Customers.”

Identifying the Contract with the Customer

The Company identifies contracts with customers as agreements that create enforceable rights and obligations. In the case of a few large customers the Company has executed long-term Master Sales Agreements (“MSA”). These are umbrella agreements which typically define the terms and conditions under which a customer can order goods from CPS. These in themselves do not constitute a contract as no products are committed to be transferred and the customer has no obligation to make payments.

The Company contract is only enforceable once both parties have approved it, and is usually in the form of a written purchase order from a customer combined with acknowledgement from the Company.

In cases without an MSA, the customer submits a blueprint for a product, the Company provides a quote and the customer responds with a purchase order. In these cases the Company’s acceptance of the purchase order constitutes an enforceable contract.

Identifying the Performance Obligations in the Contract

For each contract, the Company considers the promise to transfer products, each of which are distinct, to be the identified performance obligations.

Shipping and handling activities for which the Company is responsible are not a separate promised service but instead are activities to fulfill the entity’s promise to transfer goods. Shipping and handling fees will be recognized at the same time as the related performance obligations are satisfied.

The Company provides an assurance-type warranty. This guarantees that the product functions as promised and meets specifications. Under its terms and conditions the Company offers a 30 day warranty and replaces defective or non-conforming products. The expense of replacement is recorded at the time the Company agrees to replace a defective or non-conforming product. This assurance type warranty is not considered to be a distinct performance obligation.

Determining the Transaction Price

The Company determines the transaction price as the amount of consideration specified in the contract that it expects to receive in exchange for transferring promised goods to the customer. Amounts collected from customers for sales value added and other taxes are excluded from the transaction prices. Product sales are recorded net of trade discounts and sales returns.

If a contract includes a variable amount, such as a rebate, then the Company estimates the transaction price using either the expected value or the most likely amount of consideration to be received, depending upon the specific facts and circumstances. The Company includes estimated variable consideration in the transaction price only to the extent it is probable that a significant reversal of revenue will not occur when the uncertainty is resolved. The Company updates its estimate of variable consideration at the end of each reporting period to reflect changes in facts and circumstances. As of December 26, 2020 there are no contracts with variable consideration.

When credit is granted to customers, payment is typically due 30 to 90 days from billing and accordingly our contracts with customers do not include a significant financing component.

Allocating the Transaction Price to the Performance Obligations

In virtually all cases the transaction price is tied to a specific product in the contract obviating the need for any allocation.

Recognizing Revenue When (or as) the Performance Obligations are Satisfied

The Company recognizes revenue at the point in time when it transfers control of the promised goods or services to the customer, which typically occurs once the product has shipped or has been delivered to the customer. Occasionally, for the purpose of ensuring a steady flow of product, the Company ships products on consignment. In these instances, delivery is deemed to have occurred when the customer pulls inventory out of the warehouse for use in their production, or upon a specified period of time as agreed upon by both parties. As of December 26, 2020 there are no products on consignment.

The Company generally expenses sales commissions when incurred because the amortization period would have been one year or less. The costs are recorded within, selling, general and administrative expenses.

The Company does not disclose the value of unsatisfied performance obligations for contracts with an original expected length of one year or less

(2)(g) Income Taxes

The Company uses the liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recorded for the expected future tax consequences of temporary differences between the financial reporting and income tax bases of assets and liabilities and are measured using the enacted tax rates and laws that are expected to be in affect when the differences reverse. A valuation allowance is established to reduce net deferred tax assets to the amount expected to be realized.

The Company’s policy is to recognize interest and penalties related to income tax matters in income tax expense. As of December 26, 2020 and December 28, 2019, the Company has no accruals for interest or penalties related to income tax matters. The Company does not have any uncertain tax positions at December 26, 2020 or December 28, 2019 which required accrual or disclosure.

(2)(h) Net Income (Loss) Per Common Share

Basic net income (loss) per common share is calculated by dividing net income (loss) by the weighted average number of common shares outstanding during the period. Diluted net income (loss) per common share is calculated by dividing net income (loss) by the sum of the weighted average number of common shares plus additional common shares that would have been outstanding if potential dilutive common shares had been issued for granted stock option and stock purchase rights. Common stock equivalents are excluded from the diluted calculations when a net loss is incurred as they would be anti-dilutive.

(2)(i) Reclassification

Certain amounts in prior year’s financial statements have been reclassified to conform to the current year’s presentation.

(2)(j) Recent Accounting Pronouncements