Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-13200

AstroNova, Inc.

(Exact name of registrant as specified in its charter)

| Rhode Island | 05-0318215 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 600 East Greenwich Avenue, West Warwick, Rhode Island |

02893 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (401) 828-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.05 Par Value | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ | Smaller reporting company ☐ | |||

| (Do not check if a smaller reporting company) |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The aggregate market value of the registrant’s voting common equity held by non-affiliates at July 28, 2017 was approximately $94,686,969 based on the closing price on the Nasdaq Global Market on that date.

As of March 28, 2018 there were 6,799,166 shares of Common Stock (par value $0.05 per share) of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive Proxy Statement for the 2018 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

Table of Contents

ASTRONOVA, INC.

FORM 10-K ANNUAL REPORT

| Page | ||||

| PART I | ||||

| Item 1. | 3-6 | |||

| Item 1A. | 7-15 | |||

| Item 1B. | 15 | |||

| Item 2. | 16 | |||

| Item 3. | 16 | |||

| Item 4. | 16 | |||

| PART II | ||||

| Item 5. | 17-18 | |||

| Item 6. | 19 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19-29 | ||

| Item 7A. | 29-30 | |||

| Item 8. | 31 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

31 | ||

| Item 9A. | 31 | |||

| Item 9B. | 31 | |||

| PART III | ||||

| Item 10. | 32 | |||

| Item 11. | 33 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

33 | ||

| Item 13. | Certain Relationships, Related Transactions and Director Independence |

33 | ||

| Item 14. | 33 | |||

| PART IV | ||||

| Item 15. | 34 | |||

| Item 16. | 34 | |||

2

Table of Contents

ASTRONOVA, INC.

Forward-Looking Statements

Information included in this Annual Report on Form 10-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, but rather reflect our current expectations concerning future events and results. We generally use the words “believes,” “expects,” “intends,” “plans,” “anticipates,” “likely,” “continues,” “may,” “will,” and similar expressions to identify forward-looking statements. Such forward-looking statements, including those concerning our expectations, involve risks, uncertainties and other factors, some of which are beyond our control, which may cause our actual results, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These risks, uncertainties and factors include, but are not limited to, those factors set forth in this Annual Report on Form 10-K under “Item 1A. Risk Factors.” We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The reader is cautioned not to unduly rely on such forward-looking statements when evaluating the information presented in this Annual Report on Form 10-K.

General

Unless otherwise indicated, references to “AstroNova,” the “Company,” “we,” “our,” and “us” in this Annual Report on Form 10-K refer to AstroNova, Inc. and its consolidated subsidiaries.

AstroNova designs, develops, manufactures and distributes a broad range of specialty printers and data acquisition and analysis systems, including both hardware and software, which incorporate advanced technologies in order to acquire, store, analyze, and present data in multiple formats. Target markets for hardware and software products of the Company include aerospace, apparel, automotive, avionics, chemicals, computer peripherals, communications, distribution, food and beverage, general manufacturing, packaging and transportation.

The Company’s products are distributed through its own sales force and authorized dealers in the United States. We sell to customers outside of the United States primarily through our branch offices in Canada, Europe, and Asia as well as through independent dealers and representatives. In fiscal 2018, 38% of the Company’s revenue was from customers located outside the United States.

We operate the business through two operating segments, Product Identification (PI) and Test & Measurement (T&M). Financial information by business segment and geographic area appears in Note 15 to our audited consolidated financial statements included elsewhere in this report.

On September 28, 2017, AstroNova, Inc. entered into an Asset Purchase and License Agreement with Honeywell International, Inc. pursuant to which it acquired an exclusive perpetual world-wide license to manufacture Honeywell’s narrow-format flight deck printers for the Boeing 737 and Airbus 320 aircraft. Revenue related to that transaction has been included as part of the aerospace printer product line of the T&M segment since the acquisition date. On February 1, 2017, AstroNova completed its acquisition of TrojanLabel ApS (TrojanLabel) a European manufacturer of digital color label presses and specialty printing systems for a broad range of end user markets. TrojanLabel is reported as part of our PI segment beginning with the first quarter of fiscal year 2018. Additionally, on June 19, 2015, we completed the acquisition of the aerospace printer product line from Rugged Information Technology Equipment Corporation (RITEC). Our aerospace printer product line is part of the T&M product group and is reported as part of the T&M segment. We began shipment of the RITEC products in the third quarter of fiscal 2016. Refer to Note 2, “Acquisitions,” in our audited consolidated financial statements included elsewhere in this report.

The following description of our business should be read in conjunction with “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” on pages 19 through 29 of this Annual Report on Form 10-K.

3

Table of Contents

Description of Business

Product Overview

AstroNova leverages its expertise in data visualization technologies to design, manufacture and market specialty printing systems, test and measurement systems and related services for select growing markets on a global basis. The business consists of two segments, Product Identification (PI), which includes specialty printing systems sold under the brand name QuickLabel® and TrojanLabel®; and Test & Measurement (T&M), which includes test and measurement systems sold under the AstroNova® brand name. Refer to Note 15, “Nature of Operations, Segment Reporting and Geographical Information,” in our audited consolidated financial statements elsewhere in this report for financial information regarding the Company’s segments.

Products sold under the QuickLabel and TrojanLabel brands are used in industrial and commercial product packaging, branding and labeling applications to digitally print custom labels and corresponding visual content in house. Products sold under the AstroNova brand enable our customers to acquire and record visual and electronic signal data from local and networked data streams and sensors. The recorded data is processed and analyzed and then stored and presented in various visual output formats. In the aerospace market, the Company has a long history of using its data visualization technologies to provide high-resolution light-weight flight deck and cabin printers.

Product Identification

QuickLabel brand products include tabletop and work cell-ready digital color label printers and specialty OEM printing systems as well as a full line of supplies including labels, tags, inks, toner and thermal transfer ribbons. QuickLabel products are primarily sold to manufacturers, processors, and retailers who label products on a short-run basis. QuickLabel customers benefit from the efficiency, flexibility and cost-savings of digitally printing their own labels in house and on demand. Industry segments that commonly benefit from short-run digital label printing include chemicals, cosmetics, food and beverage, medical products, and pharmaceuticals, among many others.

Current QuickLabel models include the Kiaro! family of high-speed inkjet color label printers, the QL-111 industrial color label printer and the QL-800 wide format color label printer, as well as a family of high-end monochrome printers.

TrojanLabel brand products include tabletop and digital color label presses and specialty printing systems, as well as overprinting solutions. This highly innovative line of presses offers customers the ability to execute smaller runs with an affordable digital solution. It is commonly sold to larger brand owners, label converters, commercial printers and packaging manufacturers.

Current TrojanLabel models include the T2-C, an inkjet table top label press; the T2, the full size parent of the T2-C, allowing larger volumes and with a full-size PC display for comfortable use and fast turnaround; the T4, a complete label finisher which enables print, die cut and lamination all in one machine; and the T3, a highly customizable all-in-one label production and finishing press offered in multiple OEM integration options.

The Product Identification segment also offers a full line of supplies including labels, tags, inks, toner and thermal transfer ribbons. In addition, the Product Identification segment sells various specialized software used to operate the printers and presses, design labels and manage printing on an automated basis and provides worldwide training and support.

T&M

Products sold under the AstroNova T&M brand acquire and record visual data from local and networked data streams and sensors. The recorded data is processed and analyzed and then stored and presented in various visual output formats. The Company supplies a range of products and services that include hardware, software and supplies to customers in a variety of industries.

4

Table of Contents

Our T&M products include the Daxus® distributed data acquisition system; TMX® high-speed data acquisition system; DDX100 SmartCorder® portable data acquisition system; EV-500 digital strip chart recording system; ToughWriter®, Miltope-brand and RITEC-brand airborne printers; the PTA-45B cockpit printer that is subject to the Asset Purchase and Licenses Agreement with Honeywell and ToughSwitch® ruggedized Ethernet switches.

AstroNova airborne printers are used in the flight deck and in the cabin of military, commercial and business aircraft to print hard copies of data required for the safe and efficient operation of aircraft, including navigation maps, arrival and departure procedures, flight itineraries, weather maps, performance data, passenger data, and various air traffic control data. ToughSwitch Ethernet switches are used in military aircraft and military vehicles to connect multiple computers or Ethernet devices. The airborne printers and Ethernet switches are ruggedized to comply with rigorous military and commercial flightworthiness standards for operation under extreme environmental conditions. The Company is currently furnishing ToughWriter airborne printers for numerous aircraft made by Airbus, Boeing, Embraer, Bombardier, Lockheed, Gulfstream and others.

The Company’s family of portable data acquisition systems is used in research and development (R&D), field testing, production and maintenance applications in a wide range of industries including aerospace and defense, energy, industrial and transportation. The TMX data acquisition system is an all-in-one solution for applications in which the ability to monitor high channel counts and view a wide variety of input signals, including time-stamped and synchronized video capture data and audio notation is essential. The DDX100 SmartCorder is an ultra-portable all-in-one solution for facilities maintenance and field testing. The Daxus is a distributed data acquisition platform that can be connected to the DDX100 SmartCorder to increase channel count or networked as part of a distributed measurement system spanning large distances.

Technology

Our core technologies are data visualization technologies that relate to (1) acquiring data, (2) conditioning the data, (3) displaying the data on hard copy, monitor or electronic storage media, and (4) analyzing the data.

Patents and Copyrights

We hold a number of product patents in the United States and in foreign countries. We rely on a combination of copyright, patent, trademark and trade secret laws in the United States and other jurisdictions to protect our technology and brand name. While we consider our intellectual property to be important to the operation of our business, we do not believe that any existing patent, license, trademark or other intellectual property right is of such importance that its loss or termination would have a material adverse effect on the Company’s business taken as a whole.

Manufacturing and Supplies

We manufacture many of the products that we design and sell. Raw materials and supplies are typically available from a wide variety of sources. We manufacture many of the sub-assemblies and parts in-house including printed circuit board assemblies, harnesses, machined parts and general final assembly. Many not manufactured in-house parts are standard electronic items available from multiple sources. Other parts are designed by us and manufactured by outside vendors. We purchase certain components, assembled products and supplies used in the manufacture of our products from a single source or limited supplier source, but these components, products and supplies could be sourced elsewhere with appropriate changes in the design of our products.

Product Development

We maintain an active program of product research and development. During fiscal 2018, 2017 and 2016, we spent $7.5 million, $6.3 million and $6.9 million, respectively, on Company-sponsored product development. We are committed to continuous product development as essential to our organic growth and expect to continue our focus on research and development efforts in fiscal 2019 and beyond.

5

Table of Contents

Marketing and Competition

The Company competes worldwide in multiple markets. In the specialty printing field, we believe we are a market leader in tabletop digital color label printing technology and in aerospace printers. In the data acquisition area, we believe that we are one of the leaders in portable high speed data acquisition systems.

We retain a leadership position by virtue of proprietary technology, product reputation, delivery, technical assistance, and service to customers. The number of competitors varies by product line. Our management believes that we have a market leadership position in many of the markets we serve. Key competitive factors vary among our product lines, but include technology, quality, service and support, distribution network, and breadth of product and service offerings.

Our products are sold by direct field salespersons as well as independent dealers and representatives. In the United States, the Company has factory-trained direct field salespeople located in major cities from coast to coast specializing in either Product Identification or AstroNova T&M products. We also have direct field sales or service centers in Canada, China, Denmark, France, Germany, India, Malaysia, Mexico, Singapore, Spain and the United Kingdom staffed by our own employees and dedicated third party contractors. Additionally, we utilize over 200 independent dealers and representatives selling and marketing our products in over 75 countries.

No single customer accounted for 10% or more of our net revenue in any of the last three fiscal years.

International Sales

In fiscal 2018, 2017 and 2016, revenue from customers in various geographic areas outside the United States, primarily in Canada and Western Europe, amounted to $43.6 million, $28.6 million and $26.3 million, respectively. Refer to Note 15, “Nature of Operations, Segment Reporting and Geographical Information,” in our audited consolidated financial statements elsewhere in this report for further financial information by geographic areas.

Order Backlog

Our backlog varies regularly. It consists of a blend of orders for end-user customers as well as original equipment manufacturer customers. Manufacturing production is designed to meet forecasted demands and customer requirements. Accordingly, the amount of order backlog may not indicate future sales trends. Backlog at January 31, 2018, 2017 and 2016 was $21.4 million, $17.6 million and $18.2 million, respectively.

Employees

As of January 31, 2018, we employed 352 people. We are generally able to satisfy our employment requirements. No employees are represented by a union. We believe that employee relations are good.

Other Information

The Company’s business is not seasonal in nature. However, our revenue is impacted by the size of certain individual transactions, which can cause fluctuations in revenue from quarter to quarter.

Available Information

We make available on our website (www.astronovainc.com) the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission (SEC). These filings are also accessible on the SEC’s website at http://www.sec.gov.

6

Table of Contents

The following risk factors should be carefully considered in evaluating AstroNova, because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements. Additional risks and uncertainties not presently known to us, or that we currently consider to be immaterial, may also impact our business operations.

AstroNova’s operating results and financial condition could be harmed if the markets into which we sell our products decline or do not grow as anticipated.

Any decline in our customers’ markets or in their general economic conditions would likely result in a reduction in demand for our products. For example, although we have continued to experience measured progress, as sales have increased steadily from prior years, we are still affected by the continued global economic uncertainty. Some of our customers may be reluctant to make capital equipment purchases or may defer certain of these purchases to future quarters. Some of our customers may also limit consumable product purchases to quantities necessary to satisfy immediate needs with no provisions to stock supplies for future use. Also, if our customers’ markets decline, we may not be able to collect on outstanding amounts due to us. Such declines could harm our results of operations, financial position and cash flows and could limit our ability to continue to remain profitable.

AstroNova’s future revenue growth depends on our ability to develop and introduce new products and services on a timely basis and achieve market acceptance of these new products and services.

The markets for our products are characterized by rapidly changing technologies and accelerating product introduction cycles. Our future success depends largely upon our ability to address the rapidly changing needs of our customers by developing and supplying high-quality, cost-effective products, product enhancements and services on a timely basis and by keeping pace with technological developments and emerging industry standards. The success of our new products will also depend on our ability to differentiate our offerings from our competitors’ offerings, price our products competitively, anticipate our competitors’ development of new products, and maintain high levels of product quality and reliability. AstroNova spends a significant amount of time and effort related to the development of our airborne and color printer products as well as our Test and Measurement data recorder products. Failure to further develop any of our new products and their related markets as anticipated could adversely affect our future revenue growth and operating results.

As we introduce new or enhanced products, we must also successfully manage the transition from older products to minimize disruption in customers’ ordering patterns, avoid excessive levels of older product inventories and provide sufficient supplies of new products to meet customer demands. The introduction of new or enhanced products may shorten the life cycle of our existing products, or replace sales of some of our current products, thereby offsetting the benefit of even a successful product introduction and may cause customers to defer purchasing existing products in anticipation of the new products. Additionally, when we introduce new or enhanced products, we face numerous risks relating to product transitions, including the inability to accurately forecast demand, manage excess and obsolete inventories, address new or higher product cost structures, and manage different sales and support requirements due to the type or complexity of the new products. Any customer uncertainty regarding the timeline for rolling out new products or AstroNova’s plans for future support of existing products may cause customers to delay purchase decisions or purchase competing products which would adversely affect our business and operating results.

7

Table of Contents

AstroNova is dependent upon contract manufacturers for some of our products. If these manufacturers do not meet our requirements, either in volume or quality, then we could be materially harmed.

We subcontract the manufacturing and assembly of certain of our products to independent third parties at facilities located in various countries. Relying on subcontractors involves a number of significant risks, including:

| • | Limited control over the manufacturing process; |

| • | Potential absence of adequate production capacity; |

| • | Potential delays in production lead times; |

| • | Unavailability of certain process technologies; and |

| • | Reduced control over delivery schedules, manufacturing yields, quality and costs. |

If one of our significant subcontractors becomes unable or unwilling to continue to manufacture these products in required volumes or fails to meet our quality standards, we will have to identify qualified alternate subcontractors or we will have to take over the manufacturing ourselves. Additional qualified subcontractors may not be available, or may not be available on a timely or cost competitive basis. Any interruption in the supply or increase in the cost of the products manufactured by third party subcontractors or failure of a subcontractor to meet quality standards could have a material adverse effect on our business, operating results and financial condition.

For certain components, assembled products and supplies, AstroNova is dependent upon single or limited source suppliers. If these suppliers do not meet demand, either in volume or quality, then we could be materially harmed.

Although we use standard parts and components for our products where possible, we purchase certain components, assembled products and supplies used in the manufacture of our products from a single source or limited supplier sources. If the supply of a key component, assembled products or certain supplies were to be delayed or curtailed or, in the event a key manufacturing or sole supplier delays shipment of such components or assembled products, our ability to ship products in desired quantities and in a timely manner would be adversely affected. Our business, results of operations and financial position could also be adversely affected, depending on the time required to obtain sufficient quantities from the original source or, if possible, to identify and obtain sufficient quantities from an alternative source. Additionally, if any single or limited source supplier becomes unable or unwilling to continue to supply these components, assembled products or supplies in required volumes, we will have to identify and qualify acceptable replacements or redesign our products with different components. Alternative sources may not be available, or product redesign may not be feasible on a timely basis. Any interruption in the supply of or increase in the cost of the components, assembled products and supplies provided by single or limited source suppliers could have a material adverse effect on our business, operating results and financial condition.

AstroNova faces significant competition, and our failure to compete successfully could adversely affect our results of operations and financial condition.

We operate in an environment of significant competition, driven by rapid technological advances, evolving industry standards, frequent new product introductions and the demands of customers to become more efficient. Our competitors range from large international companies to relatively small firms. We compete on the basis of technology, performance, price, quality, reliability, brand, distribution and customer service and support. Our success in future performance is largely dependent upon our ability to compete successfully in the markets we currently serve and to expand into additional market segments. Additionally, current competitors or new market entrants may develop new products with features that could adversely affect the competitive position of our products. To remain competitive, we must develop new products, services and applications and periodically

8

Table of Contents

enhance our existing offerings. If we are unable to compete successfully, we could lose market share and important customers to our competitors which could materially adversely affect our business, results of operations and financial position.

AstroNova’s profitability is dependent upon our ability to obtain adequate pricing for our products and to control our cost structure.

Our success depends on our ability to obtain adequate pricing for our products and services which provides a reasonable return to our shareholders. Depending on competitive market factors, future prices we obtain for our products and services may decline from previous levels. In addition, pricing actions to offset the effect of currency devaluations may not prove sufficient to offset further devaluations or may not hold in the face of customer resistance and/or competition. If we are unable to obtain adequate pricing for our products and services, our results of operations and financial position could be materially adversely affected.

We are continually reviewing our operations with a view towards reducing our cost structure, including but not limited to downsizing our employee base, improving process and system efficiencies and outsourcing some internal functions. From time to time we also engage in restructuring actions to reduce our cost structure. If we are unable to maintain process and systems changes resulting from cost reduction and prior restructuring actions, our results of operations and financial position could be materially adversely affected.

AstroNova has significant inventories on hand.

We maintain a significant amount of inventory. Although we have provided an allowance for slow-moving and obsolete inventory, any significant unanticipated changes in future product demand or market conditions, including obsolescence or the uncertainty in the global market, could have an impact on the value of inventory and adversely impact our business, operating results and financial condition.

Economic, political and other risks associated with international sales and operations could adversely affect AstroNova’s results of operations and financial position.

Because we sell our products worldwide, our business is subject to risks associated with doing business internationally. Revenue from international operations, which includes both direct and indirect sales to customers outside the U.S., accounted for 38% of our total revenue for fiscal year 2018, and we anticipate that international sales will continue to account for a significant portion of our revenue. In addition, we have employees, suppliers, job functions and facilities located outside the U.S. Accordingly, our business, operating results and financial condition could be harmed by a variety of factors, including:

| • | Interruption to transportation flows for delivery of parts to us and finished goods to our customers; |

| • | Customer and vendor financial stability; |

| • | Fluctuations in foreign currency exchange rates; |

| • | Changes in a specific country’s or region’s environment including political, economic, monetary, regulatory or other conditions; |

| • | Trade protection measures and import or export licensing requirements; |

| • | Negative consequences from changes in tax laws; |

| • | Difficulty in managing and overseeing operations that are distant and remote from corporate headquarters; |

| • | Difficulty in obtaining and maintaining adequate staffing; |

| • | Differing labor regulations; |

9

Table of Contents

| • | Differing protection of intellectual property; |

| • | Unexpected changes in regulatory requirements; and |

| • | Geopolitical turmoil, including terrorism and war. |

AstroNova could incur liabilities as a result of installed product failures due to design or manufacturing defects.

AstroNova has incurred and could incur additional liabilities as a result of installed product failures due to design or manufacturing defects. Our products may have defects despite testing internally or by current or potential customers. These defects could result in among other things, a delay in recognition of sales, loss of sales, loss of market share, failure to achieve market acceptance or substantial damage to our reputation. We could be subject to material claims by customers, and may incur substantial expenses to correct any product defects.

In addition, through our acquisitions, we have assumed, and may in the future assume, liabilities related to products previously developed by an acquired company that have not been subjected to the same level of product development, testing and quality control processes used by us, and may have known or undetected errors. Some types of errors may not be detected until the product is installed in a user environment. This may cause AstroNova to incur significant warranty and repair or re-engineering costs, may divert the attention of engineering personnel from product development efforts, and may cause significant customer relations problems such as reputational problems with customers resulting in increased costs and lower profitability.

Certain of our products require certifications by regulators or standards organizations, and our failure to obtain or maintain such certifications could negatively impact our business.

In certain industries and for certain products, such as those used in aircraft, we must obtain certifications for our products by regulators or standards organizations. If we fail to obtain required certifications for our products, or if we fail to maintain such certifications on our products after they have been certified, our business, financial condition, results of operations and cash flows could be materially and adversely affected.

Changes in our tax rates or exposure to additional income tax liabilities or assessments could affect our profitability. In addition, audits by tax authorities could result in additional tax payments for prior periods.

On December 22, 2017, the Tax Cuts and Jobs Act (“TCJA” or “Tax Act”) was signed into law. The Tax Act significantly revises the U.S. federal corporate income tax law and includes a broad range of tax reform measures affecting business including among other things, the reduction of the corporate income tax rate from 35% to 21%, the loss of certain business deductions, the acceleration of first-year expensing of certain capital expenditures and a one-time tax imposed on unremitted cumulative non-U.S. earnings of foreign subsidiaries. The U.S. Treasury Department and IRS have not yet issued regulations with respect to the Tax Act.

Changes to tax laws and regulations or changes to the interpretation thereof (including regulations and interpretations pertaining to the Tax Act), the ambiguity of tax laws and regulations, the subjectivity of factual interpretations, uncertainties regarding the geographic mix of earnings in any particular period, and other factors, could have a material impact on our estimates of the effective tax rate and deferred tax assets and liabilities. For example, our estimate of the net one-time charge we have incurred related to the Tax Act could differ materially from our actual liability, due to, among other things, further refinement of our calculations, changes in interpretations and assumptions that we have made, additional guidance that may be issued by the U.S. Treasury Department and IRS, and actions we may take as a result of the Tax Act. The impact of the factors referenced in the first sentence of this paragraph may be substantially different from period-to-period.

In addition, the amount of income taxes we pay is subject to ongoing audits by U.S. federal, state and local tax authorities. If audits result in payments or assessments different from our reserves, our future results may include

10

Table of Contents

unfavorable adjustments to our tax liabilities and our financial statements could be adversely affected. Any further significant changes to the tax system in the United States or in other jurisdictions (including changes in the taxation of international income as further described below) could adversely affect our financial statements.

The agreements governing our indebtedness subject us to various restrictions that may limit our ability to pursue business opportunities.

The agreement governing our current credit facility contains, and any future debt agreements may include, a number of restrictive covenants that impose significant operating and financial restrictions on us and our subsidiaries. Such restrictive covenants may significantly limit our ability to:

| • | Incur future indebtedness; |

| • | Place liens on assets; |

| • | Pay dividends or distributions on our and our subsidiaries’ capital stock; |

| • | Repurchase or acquire our capital stock; |

| • | Conduct mergers or acquisitions; |

| • | Sell assets; and/or |

| • | Alter our or our subsidiaries’ capital structure, to make investments and loans, to change the nature of their business, and to prepay subordinated indebtedness. |

Such agreements also require us to satisfy other requirements, including maintaining certain financial ratios and condition tests. Our ability to meet these requirements can be affected by events beyond our control, and we may be unable to meet them. To the extent we fail to meet any such requirements and are in default under our debt obligations, our financial condition may be materially adversely affected. These restrictions may limit our ability to engage in activities that could otherwise benefit us. To the extent that we are unable to engage in activities that support the growth, profitability and competitiveness of our business, our business, results of operations and financial condition could be adversely affected.

AstroNova may not realize the anticipated benefits of past or future acquisitions, divestitures and strategic partnerships, and integration of acquired companies or divestiture of businesses may negatively impact AstroNova’s overall business.

We have made strategic investments in other companies, products and technologies, including our September 2017 Asset Purchase and License Agreement with Honeywell International, Inc.; our February 2017 acquisition of the digital color label press and specialty printing systems business of the Danish company, TrojanLabel and the June 2015 acquisition of the aerospace printer business from RITEC. We may continue to identify and pursue acquisitions of complementary companies and strategic assets, such as customer bases, products and technology. However, there can be no assurance that we will be able to identify suitable acquisition opportunities. In any acquisition that we complete we cannot be certain that:

| • | We will successfully integrate the operations of the acquired business with our own; |

| • | All the benefits expected from such integration will be realized; |

| • | Management’s attention will not be diverted or divided, to the detriment of current operations; |

| • | Amortization of acquired intangible assets or possible impairment of acquired intangibles will not have a negative effect on operating results or other aspects of our business; |

| • | Delays or unexpected costs related to the acquisition will not have a detrimental effect on our business, operating results and financial condition; |

| • | Customer dissatisfaction with, or performance problems at, an acquired company will not have an adverse effect on our reputation; and |

| • | Respective operations, management and personnel will be compatible. |

11

Table of Contents

In certain instances as permitted by applicable law and NASDAQ rules, acquisitions may be consummated without seeking and obtaining shareholder approval, in which case shareholders will not have an opportunity to consider and vote upon the merits of such an acquisition. Although we will endeavor to evaluate the risks inherent in a particular acquisition, there can be no assurance that we will properly ascertain or assess such risks.

We may also divest certain businesses from time to time. Divestitures will likely involve risks, such as difficulty splitting up businesses, distracting employees, potential loss of revenue and negatively impacting margins, and potentially disrupting customer relationships. A successful divestiture depends on various factors, including our ability to:

| • | Effectively transfer assets, liabilities, contracts, facilities and employees to the purchaser; |

| • | Identify and separate the intellectual property to be divested from the intellectual property that we wish to keep; and |

| • | Reduce fixed costs previously associated with the divested assets or business. |

All of these efforts require varying levels of management resources, which may divert our attention from other business operations. Further, if market conditions or other factors lead us to change our strategic direction, we may not realize the expected value from such transactions.

If we are not able to successfully integrate or divest businesses, products, technologies or personnel that we acquire or divest, or able to realize expected benefits of our acquisitions, divestitures or strategic partnerships, AstroNova’s business, results of operations and financial condition could be adversely affected.

Adverse conditions in the global banking industry and credit markets may adversely impact the value of our investments or impair our liquidity.

At the end of fiscal 2018, we had approximately $11.7 million of cash, cash equivalents and investments held for sale. Our cash and cash equivalents are held in a mix of money market funds, bank demand deposit accounts and foreign bank accounts. Disruptions in the financial markets may, in some cases, result in an inability to access assets such as money market funds that traditionally have been viewed as highly liquid. Any failure of our counterparty financial institutions or funds in which we have invested may adversely impact our cash and cash equivalent positions and, in turn, our financial position. Our investment portfolio consists of state and municipal securities with various maturity dates, all of which have a credit rating of AA or above at the original purchase date; however, defaults by the issuers of any of these securities may result in an adverse impact on our portfolio.

AstroNova could experience disruptions in, or breach in security of our information technology system or fail to implement new systems or software successfully which could harm our business and adversely affect our results of operations.

We employ information technology systems to support our business. Any security breaches or other disruptions to our information technology infrastructure could interfere with operations, compromise our information and that of our customers and suppliers, and expose us to liability which could adversely impact our business and reputation. In the ordinary course of business, we rely on information technology networks and systems, some of which are managed by third parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities. While we continually work to safeguard our systems and mitigate potential risks, there is no assurance that such actions will be sufficient to prevent cyber attacks or security breaches and our information technology networks and infrastructure may still be vulnerable to damage, disruptions or shutdowns due to attack by hackers or breaches, employee error, power outages, computer viruses, telecommunication or utility failures, systems failures, natural disasters, catastrophic events or other unforeseen events. While we have experienced, and expect to continue to experience, these types of threats to our information technology networks and infrastructure, none of them to date has had a material impact. Any

12

Table of Contents

such events could result in legal claims or proceedings, liability or penalties under privacy laws, disruption in operations, and damage to the Company’s brand and reputation, which could adversely affect our business, operating results and financial condition.

AstroNova depends on our key employees and other highly qualified personnel and our ability to attract and develop new, talented professionals. Our inability to attract and retain key employees could compromise our future success and our business could be harmed.

Our future success depends upon our ability to attract and retain professional and executive employees, including sales, operating, marketing, and financial management personnel. There is substantial competition for skilled personnel, and the failure to attract, develop, retain and motivate qualified personnel could negatively impact our business, financial condition, results of operations and future prospects. In order to retain or replace our key personnel, we may be required to increase compensation, which would decrease net income. Additionally, a number of key employees have special knowledge of customers, supplier relationships, business processes, manufacturing operations, and financial management issues and the loss of any of these employees could harm the company’s ability to perform efficiently and effectively until their knowledge and skills are replaced, which might be difficult to do quickly, and as a result could have a material adverse effect on our business, financial condition, and results of operations.

AstroNova is subject to laws and regulations; failure to address or comply with these laws and regulations could harm our business and adversely affect our results of operations.

Our operations are subject to laws, rules, regulations, including environmental regulations, government policies and other requirements in each of the jurisdictions in which we conduct business. Changes in laws, rules, regulations, policies or requirements could result in the need to modify our products and could affect the demand for our products, which may have an adverse impact on our future operating results. In addition, we must comply with regulations restricting our ability to include lead and certain other substances in our products. If we do not comply with applicable laws, rules and regulations we could be subject to costs and liabilities and our business may be adversely impacted.

Certain of our operations and products are subject to environmental, health and safety laws and regulations, which may result in substantial compliance costs or otherwise adversely affect our business.

Our operations are subject to numerous federal, state, local and foreign laws and regulations relating to protection of the environment, including those that impose limitations on the discharge of pollutants into the air and water, establish standards for the use, treatment, storage and disposal of solid and hazardous materials and wastes, and govern the cleanup of contaminated sites. We have used and continue to use various substances in our products and manufacturing operations, and have generated and continue to generate wastes, which have been or may be deemed to be hazardous or dangerous. As such, our business is subject to and may be materially and adversely affected by compliance obligations and other liabilities under environmental, health and safety laws and regulations. These laws and regulations affect ongoing operations and require capital costs and operating expenditures in order to achieve and maintain compliance.

Our operations are subject to anti-corruption laws, including the U.S. Foreign Corrupt Practices Act, and any determination that the Company or any of its subsidiaries has violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

The U.S. Foreign Corrupt Practices Act (FCPA), the UK Bribery Act and similar worldwide anti-corruption laws generally prohibit companies and their intermediaries from making improper payments to government officials and others for the purpose of obtaining or retaining business. Our internal policies mandate compliance with these anti-corruption laws. We operate in parts of the world that have experienced governmental corruption to some degree, and in certain circumstances, strict compliance with anti-corruption laws may conflict with local

13

Table of Contents

customs and practices. Despite our training and compliance programs, there can be no assurance that our internal control policies and procedures will protect us from reckless or criminal acts committed by those of our employees or agents who violate our policies.

Unauthorized access of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or differing views of personal privacy rights and compliance with laws designed to prevent unauthorized access of personal data could be costly.

AstroNova collects and stores certain data, including proprietary business information, and may have access to confidential or personal information that is subject to privacy and security laws, regulations and customer-imposed controls. Security breaches or other unauthorized access to, or the use or transmission of, personal user information could result in a variety of claims against us, including privacy-related claims. There are numerous laws in the countries in which we operate regarding privacy and the storage, sharing, use, processing, disclosure and protection of this kind of information, the scope of which are changing, inconsistent and conflicting and subject to differing interpretations, and new laws of this nature are adopted from time to time. For example, in 2016 the European Commission adopted the General Data Protection Regulation, a comprehensive privacy and data protection reform that becomes enforceable in May 2018. At the same time, certain developing countries in which we do business are also currently considering adopting privacy and data protection laws and regulations and legislative proposals concerning privacy and the protection of user information are often pending before the U.S. Congress and various U.S. state legislatures.

While we believe that we comply with industry standards and applicable laws and industry codes of conduct relating to privacy and data protection in all material respects, there is no assurance that we will not be subject to claims that we have violated applicable laws or codes of conduct, that we will be able to successfully defend against such claims or that we will not be subject to significant fines and penalties in the event of non-compliance.

Any failure or perceived failure by us (or any third parties with whom we have contracted to store such information) to comply with applicable privacy and security laws, policies or related contractual obligations or any compromise of security that results in unauthorized access to personal information may result in governmental enforcement actions, significant fines, litigation, claims of breach of contract and indemnity by third parties and adverse publicity. In the case of such an event, our reputation may be harmed, we could lose current and potential users and the competitive positions of our various brands could be diminished, any or all of which could adversely affect our business, financial condition and results of operations.

We may record future goodwill impairment charges or other intangible asset impairment charges related to one or more of our reporting units, which could materially adversely impact our results of operations.

We test our goodwill balances annually, or more frequently if indicators are present or changes in circumstances suggest that impairment may exist. We assess goodwill for impairment at the reporting unit level and, in evaluating the potential for impairment of goodwill, we make assumptions regarding estimated revenue projections, growth rates, cash flows and discount rates. We monitor the key drivers of fair value to detect events or other changes that would warrant an interim impairment test of our goodwill and intangible assets. Relatively small declines in the future performance and cash flows of a reporting unit or asset group, changes in our reporting units or in the structure of our business as a result of future reorganizations, acquisitions or divestitures of assets or businesses, or small changes in other key assumptions, may result in the recognition of significant asset impairment charges, which could have a material adverse impact on our results of operations.

Changes in accounting standards and subjective assumptions, estimates, and judgments by management related to complex accounting matters could significantly affect our financial results or financial condition.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines, and interpretations with regard to a wide range of matters that are relevant to our business, such as

14

Table of Contents

revenue recognition, asset impairment and fair value determinations, inventories, business combinations and intangible asset valuations, leases, and litigation, are highly complex and involve many subjective assumptions, estimates and judgments. Changes in these rules or their interpretation or changes in underlying assumptions, estimates, or judgments could significantly change our reported or expected financial performance or financial condition.

Compliance with rules governing “conflict minerals” could adversely affect the availability of certain product components and our costs and results of operations could be materially harmed.

SEC rules require disclosures regarding the use of “conflict minerals” mined from the Democratic Republic of the Congo and adjoining countries necessary to the functionality or production of products manufactured or contracted to be manufactured. We have determined that we use gold, tin and tantalum, each of which is considered a “conflict mineral” under the SEC rules, as they occur in electronic components supplied to us in the manufacture of our products. Because of this finding, we are required to conduct inquiries designed to determine whether any of the conflict minerals contained in our products originated or may have originated in the conflict region or come from recycled or scrap sources. There are costs associated with complying with these disclosure requirements, including performing due diligence in regards to the source of any conflict minerals used in our products, in addition to the cost of remediation or other changes to products, processes or services of supplies that may be necessary as a consequence of such verification activities. As we use contract manufacturers for some of our products, we may not be able to sufficiently verify the origins of the relevant minerals used in our products through the due diligence procedures that we implement. We may also encounter challenges to satisfy those customers who require that all of the components of our products be certified as conflict-free, which could place us at a competitive disadvantage if we are unable to do so. As a result, our business, operating results and financial condition could be harmed.

The decision by British voters to exit the European Union may negatively impact our operations.

In June 2016 the United Kingdom held a referendum in which the British voted in favor of exiting the European Union. This referendum has caused and may continue to cause political and economic uncertainty, including significant volatility in global stock markets and currency exchange rate fluctuations. Although it is unknown what the full terms of the United Kingdom’s future relationship with the EU will be, it is possible that there will be greater restrictions on imports and exports between the United Kingdom and other countries, including the United States, and increased regulatory complexities. Any of these factors could adversely affect customer demand, our relationships with customers and suppliers and our business and financial statements.

Item 1B. Unresolved Staff Comments

None.

15

Table of Contents

The following table sets forth information regarding the Company’s principal owned properties, all of which are included in the consolidated balance sheet appearing elsewhere in this annual report.

| Location |

Approximate Square Footage |

Principal Use | ||||

| West Warwick, Rhode Island, USA |

135,500 | Corporate headquarters, research and development, manufacturing, sales and service | ||||

AstroNova also leases facilities in various other locations. The following information pertains to each location:

| Location |

Approximate Square Footage |

Principal Use | ||||

| Dietzenbach, Germany |

18,630 | Manufacturing, sales and service | ||||

| Brossard, Quebec, Canada |

4,500 | Manufacturing, sales and service | ||||

| Elancourt, France |

4,500 | Sales and service | ||||

| Copenhagen, Denmark |

4,000 | R&D and sales | ||||

| Maidenhead, England |

1,000 | Sales and service | ||||

| Schaumburg, Illinois, USA |

3,428 | Sales (Product Identification only) | ||||

| Shanghai, China |

461 | Sales (Product Identification only) | ||||

| Newport Beach, California, USA |

150 | Sales (Product Identification only) | ||||

| Tambauam Chennai, India |

70 | Sales (Product Identification only) | ||||

| Mexico City, Mexico |

65 | Sales (Product Identification only) | ||||

We believe our facilities are well maintained, in good operating condition and generally adequate to meet our needs for the foreseeable future.

There are no pending or threatened legal proceedings against the Company believed to be material to the financial position or results of operations of the Company.

Item 4. Mine Safety Disclosures

Not applicable.

16

Table of Contents

| Item 5. | Market for the Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities |

AstroNova common stock trades on the NASDAQ Global Market under the symbol “ALOT.” The following table sets forth the range of high and low sales prices and dividend data, as furnished by NASDAQ, for each quarter in the years ended January 31:

| High | Low | Dividends Per Share |

||||||||||

| 2018 |

||||||||||||

| First Quarter |

$ | 15.65 | $ | 12.85 | $ | 0.07 | ||||||

| Second Quarter |

$ | 15.15 | $ | 12.69 | $ | 0.07 | ||||||

| Third Quarter |

$ | 14.05 | $ | 11.00 | $ | 0.07 | ||||||

| Fourth Quarter |

$ | 15.00 | $ | 11.96 | $ | 0.07 | ||||||

| 2017 |

||||||||||||

| First Quarter |

$ | 15.69 | $ | 11.18 | $ | 0.07 | ||||||

| Second Quarter |

$ | 16.17 | $ | 13.49 | $ | 0.07 | ||||||

| Third Quarter |

$ | 16.41 | $ | 14.40 | $ | 0.07 | ||||||

| Fourth Quarter |

$ | 14.60 | $ | 12.50 | $ | 0.07 | ||||||

AstroNova had approximately 277 shareholders of record as of March 28, 2018, which does not reflect shareholders with beneficial ownership in shares held in nominee name.

17

Table of Contents

Stock Performance Graph

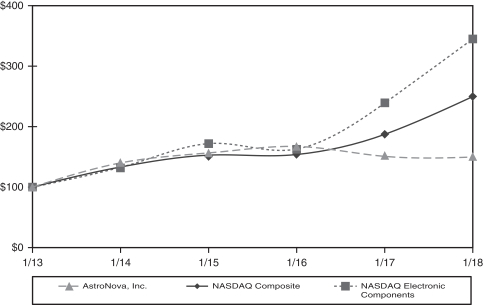

The graph below shows a comparison of the cumulative total return on the Company’s common stock against the cumulative total returns for the NASDAQ Composite Index and the NASDAQ Electronic Components Index for the period of five fiscal years ended January 31, 2018. The NASDAQ Total Return Composite Index is calculated using all companies trading on the NASDAQ Global Select, NASDAQ Global Market and the NASDAQ Capital Markets. The Index is weighted by the current shares outstanding and assumes dividends are reinvested. The NASDAQ Electronic Components Index, designated as the Company’s peer group index, is comprised of companies classified as electronic equipment manufacturers.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among AstroNova, Inc., the NASDAQ Composite Index

and the NASDAQ Electronic Components Index

| Cumulative Total Returns* | ||||||||||||||||||||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | |||||||||||||||||||

| AstroNova, Inc. |

$ | 100.00 | $ | 139.95 | $ | 156.23 | $ | 167.27 | $ | 150.65 | $ | 149.66 | ||||||||||||

| NASDAQ Composite |

$ | 100.00 | $ | 133.35 | $ | 152.66 | $ | 153.70 | $ | 187.33 | $ | 249.85 | ||||||||||||

| NASDAQ Electronic Components |

$ | 100.00 | $ | 132.48 | $ | 172.07 | $ | 162.80 | $ | 239.21 | $ | 344.98 | ||||||||||||

| * | $100 invested on 1/31/13 in stock or index, including reinvestment of dividends. |

| Fiscal | year ending January 31. |

Dividend Policy

AstroNova began a program of paying quarterly cash dividends in fiscal 1992 and has paid a dividend for 106 consecutive quarters. During fiscal 2018, 2017 and 2016, we paid a dividend of $0.07 per share in each quarter and anticipate that we will continue to pay comparable cash dividends on a quarterly basis.

Stock Repurchases

Pursuant to an authorization approved by AstroNova’s Board of Directors in August 2011, the Company is currently authorized to repurchase up to 390,000 shares of common stock, subject to any increase or decrease by the Board of Directors at any time. This is an ongoing authorization without any expiration date.

There were no stock repurchases during the quarter ended January 31, 2018.

18

Table of Contents

Item 6. Selected Financial Data

Historical Financial Summary

Income Statement Data

| (In thousands, except per share data) | For the Fiscal Years Ended January 31, | |||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Revenue |

$ | 113,401 | $ | 98,448 | $ | 94,658 | $ | 88,347 | $ | 68,592 | ||||||||||

| Gross profit |

44,002 | 39,489 | 38,158 | 36,977 | 26,983 | |||||||||||||||

| Operating income |

5,412 | 6,281 | 5,934 | 7,231 | 1,533 | |||||||||||||||

| Income from continuing operations before taxes |

5,157 | 6,605 | 6,909 | 6,932 | 1,412 | |||||||||||||||

| Taxes on continuing operations |

1,871 | 2,377 | 2,384 | 2,270 | 175 | |||||||||||||||

| Income from discontinued operations, net of taxes |

— | — | — | — | 1,975 | |||||||||||||||

| Net income |

3,286 | 4,228 | 4,525 | 4,662 | 3,212 | |||||||||||||||

| Net income per Common Share—Basic : |

||||||||||||||||||||

| Continuing operations |

$ | 0.48 | $ | 0.57 | $ | 0.62 | $ | 0.61 | $ | 0.17 | ||||||||||

| Discontinued operations |

— | — | — | — | 0.26 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per Common Share – Basic |

$ | 0.48 | $ | 0.57 | $ | 0.62 | $ | 0.61 | $ | 0.43 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per Common Share – Diluted : |

||||||||||||||||||||

| Continuing operations |

$ | 0.47 | $ | 0.56 | $ | 0.61 | $ | 0.60 | $ | 0.16 | ||||||||||

| Discontinued operations |

— | — | — | — | 0.26 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per Common Share—Diluted |

$ | 0.47 | $ | 0.56 | $ | 0.61 | $ | 0.60 | $ | 0.42 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends Declared per Common Share |

$ | 0.28 | $ | 0.28 | $ | 0.28 | $ | 0.28 | $ | 0.28 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data

(In thousands) |

As of January 31, | |||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Cash and Marketable Securities |

$ | 11,688 | $ | 24,821 | $ | 20,419 | $ | 23,132 | $ | 27,107 | ||||||||||

| Current Assets |

63,780 | 61,423 | 54,514 | 59,289 | 65,034 | |||||||||||||||

| Total assets |

122,313 | 83,665 | 77,963 | 74,330 | 77,964 | |||||||||||||||

| Current liabilities |

25,912 | 11,985 | 9,548 | 9,569 | 9,892 | |||||||||||||||

| Debt, including short term portion |

23,146 | — | — | — | — | |||||||||||||||

| Shareholders’ equity |

63,647 | 70,537 | 67,373 | 63,511 | 66,614 | |||||||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

AstroNova is a multi-national enterprise that leverages its proprietary data visualization technologies to design, develop, manufacture, distribute and service a broad range of products that acquire, store, analyze and present data in multiple formats. The Company organizes its structure around a core set of competencies, including research and development, manufacturing, service, marketing and distribution. It markets and sells its products and services through the following two segments:

| • | Product Identification – offers product identification and digital label printer hardware, software, servicing contracts, and supplies. |

| • | Test and Measurement Product Group (T&M) – offers a suite of products and services that acquire data from local and networked data streams and sensors as well as wired and wireless networks. The recorded data is processed and analyzed and then stored and presented in various visual output formats. The T&M segment also includes a line of aerospace printers that are used to print hard copies of data |

19

Table of Contents

| required for the safe and efficient operation of aircraft including navigation maps, arrival and departure procedures, flight itineraries, weather maps, performance data, passenger data, and various air traffic control data. Aerospace products also include Ethernet switches which are used in military aircraft and military vehicles to connect multiple computers or Ethernet devices. |

The Company markets and sells its products and services globally through a diverse distribution structure of direct sales personnel, manufacturers’ representatives and authorized dealers that deliver a full complement of branded products and services to customers in our respective markets. Our growth strategy centers on organic growth through product innovation made possible by research and development initiatives, as well as strategic acquisitions that fit into or complement existing core businesses. Research and development activities were funded and expensed by the Company at approximately 6.6% of annual revenue for fiscal 2018. We also continue to invest in sales and marketing initiatives by expanding the existing sales force and using various marketing campaigns to achieve our goals of sales growth and increased profitability notwithstanding today’s challenging economic environment.

On September 28, 2017, AstroNova entered into an Asset Purchase and License Agreement with Honeywell International, Inc. pursuant to which it acquired the exclusive perpetual world-wide license to manufacture Honeywell’s narrow format flight deck printers for the Boeing 737 and Airbus 320 aircraft. Revenue from the sales of these printers is reported as part of our Test & Measurement segment beginning in the third quarter of fiscal year 2018. Refer to Note 2, “Acquisitions,” in the audited consolidated financial statements included elsewhere in this report.

On February 1, 2017, AstroNova completed its acquisition of TrojanLabel ApS (TrojanLabel), a European manufacturer of digital color label presses and specialty printing systems for a broad range of end user markets. TrojanLabel is reported as part of our Product Identification segment beginning with the first quarter of fiscal year 2018. Refer to Note 2, “Acquisitions,” in the audited consolidated financial statements included elsewhere in this report.

On June 19, 2015, AstroNova completed the acquisition of the aerospace printer product line from RITEC. AstroNova’s aerospace printer product line is part of the T&M product group and is reported as part of the T&M segment. The Company began shipment of the RITEC products in the third quarter of fiscal year 2016. Refer to Note 2, “Acquisitions,” in the audited consolidated financial statements included elsewhere in this report.

Results of Operations

Fiscal 2018 compared to Fiscal 2017

The following table presents the revenue of each of the Company’s segments, as well as the percentage of total revenue and change from prior year.

| ($ in thousands) | 2018 | 2017 | ||||||||||||||||||

| Revenue | As a % of Total Revenue |

% Change Over Prior Year |

Revenue | As a % of Total Revenue |

||||||||||||||||

| Product Identification |

$ | 81,681 | 72.0 | % | 16.9 | % | $ | 69,862 | 71.0 | % | ||||||||||

| T&M |

31,720 | 28.0 | % | 11.0 | % | 28,586 | 29.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 113,401 | 100.0 | % | 15.2 | % | $ | 98,448 | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Net revenue in fiscal 2018 was $113.4 million, a 15.2% increase compared to prior year revenue of $98.4 million. Revenue through domestic channels of $69.8 million was consistent with prior year domestic revenue of $69.8 million. International revenue of $43.6 million increased 52.4% over prior year international revenue of $28.6 million primarily due to the impact on revenue from the Honeywell and TrojanLabel acquisitions. The current year’s international revenue includes a favorable foreign exchange rate impact of $0.6 million.

Hardware revenue in fiscal 2018 was $37.5 million, a 10.9% increase compared to prior year’s revenue of $33.8 million. Hardware revenue in the Product Identification segment increased 23.5% compared to prior year

20

Table of Contents

due to the integration of TrojanLabel, but was tempered by lower OEM bar code printer sales. Hardware revenue in the T&M segment increased 4.6% primarily due to the Honeywell acquisition and the introduction of the EV-5000 data recorder. These revenue increases were partially offset by lower sales from the Aerospace ToughWriter 4 product line.

Revenue from supplies in fiscal 2018 was $65.3 million, representing a 16.2% increase compared to prior year revenue of $56.2 million. This increase is primarily attributable to double-digit growth from Product Identification inkjet printer inks and labels. Also contributing to the revenue increase were the impact of Honeywell and TrojanLabel paper and ink sales.

Service and other revenue in fiscal 2018 was $10.6 million, a 26.2% increase compared to prior year revenue of $8.4 million. Product Identification and Test & Measurement segments both generated double-digit growth in service and other revenue as a result of the TrojanLabel and Honeywell acquisitions.

The Company achieved gross profit of $44.0 million for fiscal 2018, reflecting an 11.4% improvement compared to the prior year’s gross profit of $39.5 million. The Company’s gross profit margin of 38.8% in the current year reflects a decrease from the prior year’s gross profit margin of 40.1%. The higher gross profit for the current year compared to the prior year is primarily attributable to increased revenue; the current year’s decrease in gross margin is due to product mix and higher manufacturing and period costs.

Operating expenses for the current year were $38.6 million, representing a 16.2% increase from the prior year’s operating expenses of $33.2 million. Specifically, selling and marketing expenses of $22.2 million in fiscal 2018 increased 17.3% from prior year’s amount of $19.0 million. The increase in selling and marketing expenses for the current year primarily relates to increases in wages and amortization related to the TrojanLabel and Honeywell acquisitions. Selling and marketing expenses represent 19.6% and 19.3% of net revenue for fiscal 2018 and 2017, respectively. Current year general and administrative (G&A) expenses increased by 12.1% from prior year to $8.9 million primarily as a result of an increase in share-based compensation expenses, as well as outside and professional service costs, including non-recurring costs related to expenses incurred pursuant to a transition service agreement we entered into with Honeywell. The increase in G&A was offset by income of $1.4 million due to the change in the fair value of the Company’s contingent earn out liability related to the TrojanLabel acquisition. Research & development (R&D) costs in fiscal 2018 of $7.5 million increased 18.0% from $6.3 million in fiscal 2017, primarily due to the increase related to the absorption of the TrojanLabel R&D team, as well as an increase in wages. This increase was slightly tempered by a decrease in outside service costs and prototype expenses. The R&D spending level for fiscal 2018 represents 6.6% of net revenue, an increase compared to the prior year’s level of 6.4%.

Other expense in fiscal 2018 was $0.3 million compared to other income of $0.3 million in fiscal 2017. Current year other expense includes interest expense on debt of $0.4 million and foreign exchange loss of $0.2 million, offset by investment income of $0.2 and income related to a settlement of a trademark infringement litigation. Other income in fiscal 2017 includes a gain on sale of a property we owned in England of $0.4 million and $0.1 million related to an amount retained from the RITEC escrow partially offset by foreign exchange loss of $0.2 million.

Net income for fiscal 2018 was $3.3 million, or $0.47 per diluted share, a decrease from $4.2 million, or $0.56 per diluted share in fiscal 2017. Current year results were impacted by income of $1.4 million ($1.1 million net of tax or $0.16 per diluted share) related to change in the fair value of the Company’s contingent earn out liability and $1.1 million, or $0.16 per diluted share, in taxes as a result of the enactment of the Tax Act. The $1.1 million increase in tax provision includes $1.0 million related to revaluation of our deferred tax assets at the new lower corporate tax rate and $0.1 million related to the transition tax on the un-repatriated earnings of our foreign subsidiaries also included in the Tax Act. During fiscal 2017 the Company recognized a $2.4 million income tax expense and had an effective tax rate of 36.0%. Fiscal 2017 income tax expense included a $0.2 million tax expense related to non-deductible transaction costs for the TrojanLabel acquisition and a $0.2 million tax expense related to the increase for unrecognized tax benefits.

21

Table of Contents

Fiscal 2017 compared to Fiscal 2016

The following table presents the revenue of each of the Company’s segments, as well as the percentage of total revenue and change from prior year.

| ($ in thousands) | 2017 | 2016 | ||||||||||||||||||

| Revenue | As a % of Total Revenue |

% Change Over Prior Year |

Revenue | As a % of Total Revenue |

||||||||||||||||

| Product Identification |

$ | 69,862 | 71.0 | % | 4.1 | % | $ | 67,127 | 70.9 | % | ||||||||||

| T&M |

28,586 | 29.0 | % | 3.8 | % | 27,531 | 29.1 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 98,448 | 100.0 | % | 4.0 | % | $ | 94,658 | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Net revenue in fiscal 2017 was $98.4 million, a 4.0% increase compared to prior year revenue of $94.7 million. Revenue through domestic channels of $69.9 million was a slight increase compared to prior year domestic revenue of $68.3 million. International revenue of $28.6 million increased 8.6% over prior year international revenue of $26.4 million somewhat as a result of the earlier release of new QuickLabel products. Fiscal 2017 international revenue includes an unfavorable foreign exchange rate impact of $0.5 million.

Hardware revenue in fiscal 2017 was $33.8 million, a 2.9% decrease compared to prior year’s revenue of $34.8 million. Hardware revenue in the Product Identification segment decreased 8.8% compared to prior year due to the anticipation of the introduction of new products in the third quarter of the fiscal 2017 and delayed traction for new products introduced. Hardware revenue in the T&M segment for fiscal 2017 increased slightly to $22.5 million from $22.4 million in the prior year, as the overall decline in sales of data recorders was offset by a 6.0% increase in sales of the Aerospace product line due to fulfillment during fiscal 2017 of orders received in previous years.