| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State of incorporation) |

(I.R.S. Employer Identification No.) | |

| | ||

(Address of principal executive offices) |

(Zip Code) | |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

Large accelerated filer |

☐ |

☒ | ||||

Non-accelerated filer |

☐ |

Smaller reporting company |

||||

Emerging growth company |

| Item 1. |

Business | 1 | ||||

| Item 1A. |

Risk Factors | 15 | ||||

| Item 1B. |

Unresolved Staff Comments | 26 | ||||

| Item 2. |

Properties | 26 | ||||

| Item 3. |

Legal Proceedings | 26 | ||||

| Item 4. |

Mine Safety Disclosures | 26 | ||||

| Item 5. |

27 | |||||

| Item 6 |

Selected Financial Data | 28 | ||||

| Item 7. |

29 | |||||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk | 59 | ||||

| Item 8. |

Financial Statements and Supplementary Data | 61 | ||||

| Item 9. |

140 | |||||

| Item 9A. |

Controls and Procedures | 140 | ||||

| Item 9B. |

Other Information | 140 | ||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 141 | ||||

| Item 11. |

Executive Compensation | 141 | ||||

| Item 12. |

141 | |||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 142 | ||||

| Item 14. |

Principal Accounting Fees and Services | 142 | ||||

| Item 15. |

Exhibits, Financial Statement Schedules | 143 | ||||

| 147 | ||||||

| 148 | ||||||

| 149 | ||||||

| 154 | ||||||

| • | increased credit losses or impairments on public finance obligations that National Public Finance Guarantee Corporation (“National”) insures issued by state, local and territorial governments and finance authorities and other providers of public services, located in the U.S. or abroad, that are experiencing fiscal stress; |

| • | the possibility that loss reserve estimates are not adequate to cover potential claims; |

| • | a disruption in the cash flow from National or an inability to access the capital markets and our exposure to significant fluctuations in liquidity and asset values in the global credit markets as a result of collateral posting requirements; |

| • | our ability to fully implement our strategic plan; |

| • | the possibility that MBIA Insurance Corporation will have inadequate liquidity or resources to timely pay claims as a result of higher than expected losses on certain insured transactions or as a result of a delay or failure in collecting expected recoveries, which could lead the New York State Department of Financial Services (“NYSDFS”) to put MBIA Insurance Corporation into a rehabilitation or liquidation proceeding under Article 74 of the New York Insurance Law and/or take such other actions as the NYSDFS may deem necessary to protect the interests of MBIA Insurance Corporation’s policyholders; |

| • | the impact on our insured portfolios or business operations caused by the global spread of the novel coronavirus COVID-19; |

| • | deterioration in the economic environment and financial markets in the United States or abroad, real estate market performance, credit spreads, interest rates and foreign currency levels; and |

| • | the effects of changes to governmental regulation, including insurance laws, securities laws, tax laws, legal precedents and accounting rules. |

| • | U.S. Public Finance: |

| • | International Public Finance: |

| • | Global Structured Finance Transactions: |

| Name |

Age |

Position and Term of Office | ||||

| William C. Fallon |

61 | Chief Executive Officer and Director (executive officer since July 2005) | ||||

| Anthony McKiernan |

51 | Executive Vice President and Chief Financial Officer (executive officer since August 2011) | ||||

| Jonathan C. Harris |

49 | General Counsel and Secretary (executive officer since September 2017) | ||||

| Daniel M. Avitabile |

47 | Assistant Vice President, and President and Chief Risk Officer of MBIA Corp. (executive officer since September 2017) | ||||

| Adam T. Bergonzi |

57 | Assistant Vice President and Chief Risk Officer of National (executive officer since September 2017) | ||||

| Christopher H. Young |

48 | Assistant Vice President, and Chief Financial Officer of National (executive officer since September 2017) | ||||

| Joseph R. Schachinger |

52 | Controller (executive officer since May 2017) | ||||

| • | we may be unable to obtain additional financing, should such a need arise, which may limit our ability to satisfy obligations with respect to our debt; |

| • | a large portion of MBIA Inc.’s financial resources must be dedicated to the payment of principal and interest on our debt, thereby reducing the funds available to use for other purposes; |

| • | it may be more difficult for us to satisfy our obligations to our creditors, resulting in possible defaults on, and acceleration of, such debt; |

| • | we may be more vulnerable to general adverse economic and industry conditions; |

| • | our ability to refinance debt may be limited or the associated costs may increase; |

| • | our flexibility to adjust to changing market conditions could be limited; and |

| • | we are exposed to the risk of fluctuations in interest rates and foreign currency exchange rates because a portion of our liabilities are at variable rates of interest or denominated in foreign currencies. |

| • | MTNs issued by MBIA Global Funding LLC (“GFL”), which are insured by MBIA Insurance Corporation, would accelerate. To the extent GFL failed to pay the accelerated amounts under the GFL MTNs, the MTN holders would have policy claims against MBIA Insurance Corporation for scheduled payments of interest and principal; |

| • | An MBIA Insurance Corporation proceeding may accelerate certain investment agreements issued by MBIA Inc., including, in some cases, with make-whole payments. While the investment agreements are fully collateralized with high quality collateral, the settlements of these amounts could reduce MBIA Inc.’s liquidity resources, and to the extent MBIA Inc. fails to pay the accelerated amounts under these investment agreements or the collateral securing these investment agreements is deemed insufficient to pay the accelerated amounts due, the holders of the investment agreements would have policy claims against MBIA Insurance Corporation; |

| • | The payment of installment premiums due to National from MBIA Insurance Corporation under the reinsurance agreement between National and MBIA Insurance Corporation (Refer to Item 1, “Our Insurance Operations”, “Reinsurance” for a description of the agreement) could be disrupted, delayed or subordinated to the claims of policyholders of MBIA Insurance Corporation; |

| • | Derivative counterparties could seek to terminate derivative contracts insured by MBIA Insurance Corporation and make market-based damage claims (irrespective of whether actual credit-related losses are expected under the underlying exposure); |

| • | The rehabilitator or liquidator would replace the Board of Directors of MBIA Insurance Corporation and take control of the operations and assets of MBIA Insurance Corporation, which would result in the Company losing control of MBIA Insurance Corporation and possible changes to MBIA Insurance Corporation’s strategies and management; and |

| • | Unplanned costs on MBIA Inc., as well as significant additional expenses for MBIA Insurance Corporation arising from the appointment of a rehabilitator or liquidator, as receiver, and payment of the fees and expenses of the advisors to such rehabilitator or liquidator. |

| Month |

Total Number of Shares Purchased (1) |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan |

Maximum Amount That May Be Purchased Under the Plan (in millions) |

||||||||||||

| October |

133 | 6.55 | — | $ | — | |||||||||||

| November |

174 | 6.23 | — | — | ||||||||||||

| December |

4,158 | 6.53 | — | — | ||||||||||||

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities (continued) |

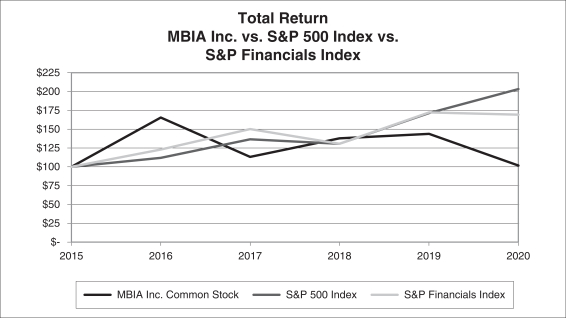

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||||

| MBIA Inc. Common Stock |

100.00 | 165.12 | 112.96 | 137.65 | 143.52 | 101.54 | ||||||||||||||||||

| S&P 500 Index |

100.00 | 111.95 | 136.38 | 130.39 | 171.44 | 202.96 | ||||||||||||||||||

| S&P Financials Index |

100.00 | 122.75 | 149.93 | 130.38 | 172.22 | 169.19 | ||||||||||||||||||

| • | During 2020, the Commonwealth of Puerto Rico and certain of its instrumentalities (“Puerto Rico”) defaulted on scheduled debt service for National insured bonds and National paid gross claims in the aggregate of $391 million. On January 1, 2021, Puerto Rico also defaulted on scheduled debt service for National insured bonds and National paid gross claim payments in the aggregate of $51 million. As of December 31, 2020, National had $2.9 billion of debt service outstanding related to Puerto Rico. |

| • | In February of 2020, the Financial Oversight and Management Board (“Oversight Board”) created under the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”) filed a plan and disclosure statement in the Puerto Rico Commonwealth GO (“GO”) Title III case based on the Plan Support Agreement (“PSA”) previously announced in mid-2019 with certain GO and Puerto Rico Public Buildings Authority (“PBA”) bondholders. National was not a party to the PSA. Throughout 2020 and into 2021, at the urging of the Court and the Oversight Board, the PSA parties, as well as additional parties including monoline insurance companies who were not prior parties to the PSA, engaged in discussions on new economics for the PSA. On February 10, 2021, the Oversight Board filed a motion stating it had an agreement in principle with certain PSA parties, not including the monoline insurance companies, representing approximately $7 billion in GO and PBA Bonds, and requested until March 8, 2021 to file an amended plan. The Court approved the request. On February 22, 2021, National agreed to join a revised PSA, dated as of February 22, 2021 (the “2021 PSA”), among the Oversight Board, certain holders of GO Bonds and PBA Bonds, Assured Guaranty Corp. and Assured Guaranty Municipal Corp, and Syncora Guarantee Inc. in connection with the GO and PBA Title III cases. The 2021 PSA provides that, among other things, National shall receive a pro rata share of allocable cash, newly issued General Obligation bonds, a contingent value instrument and certain fees. National has the right to unilaterally terminate its participation in the 2021 PSA on or prior to March 31, 2021. The 2021 PSA contemplates a plan becoming effective on or before December 15, 2021; however there can be no assurance that such a plan will ever become effective, or on the contemplated timeline. |

| • | In the Puerto Rico Highway and Transportation Authority (“HTA”) Title III case, in September of 2020, the Court entered an order denying the motion of National and other monolines seeking to lift the automatic stay to protect HTA bondholders’ property interests in certain designated cash flows. On February 4, 2021, the First Circuit Court of Appeals heard argument on the monolines’ appeal of the Bankruptcy Court’s ruling. A decision is pending. In the event that National does not terminate its participation in the 2021 PSA on or prior to March 31, 2021, the Oversight Board and National shall jointly request the entry of an order in the Title III court staying National’s actions to lift the automatic stay in the GO and HTA Title III cases currently before the First Circuit Court of Appeals, and National shall take no further action with respect to the lift stay subject to the Commonwealth plan becoming effective. |

| • | In the second half of 2020, the Oversight Board was reconstituted with the reappointment of three existing members and appointment of four new members for three year terms, with the newly elected Governor sitting as an ex officio |

Years Ended December 31, |

||||||||||||

| In millions except for per share amounts |

2020 |

2019 |

2018 |

|||||||||

| Net income (loss) |

$ | (578) | $ | (359) | $ | (296) | ||||||

| Net income (loss) per diluted share |

(9.78) | (4.43) | (3.33) | |||||||||

| Adjusted net income (loss) (1) |

(173) | (17) | (38) | |||||||||

| Adjusted net income (loss) per diluted share (1) |

(2.93) | (0.21) | (0.42) | |||||||||

| Cost of shares repurchased |

198 | 101 | 48 | |||||||||

Years Ended December 31, |

||||||||||||

| In millions except for per share amounts |

2020 |

2019 |

2018 |

|||||||||

| Total revenues |

$ | 282 | $ | 280 | $ | 162 | ||||||

| Total expenses |

860 | 637 | 458 | |||||||||

| |

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

(578) | (357) | (296) | |||||||||

| Provision (benefit) for income taxes |

— | 2 | — | |||||||||

| |

|

|

|

|

|

|||||||

| Net income (loss) |

$ | (578) | $ | (359) | $ | (296) | ||||||

| |

|

|

|

|

|

|||||||

| Net income (loss) per common share: |

||||||||||||

| Basic |

$ | (9.78) | $ | (4.43) | $ | (3.33) | ||||||

| Diluted |

$ | (9.78) | $ | (4.43) | $ | (3.33) | ||||||

| Weighted average number of common shares outstanding: |

||||||||||||

| Basic |

59,071,843 | 81,014,285 | 89,013,711 | |||||||||

| Diluted |

59,071,843 | 81,014,285 | 89,013,711 | |||||||||

| • | Mark-to-market gains (losses) on financial instruments |

| • | Foreign exchange gains (losses) |

| • | Net gains (losses) on sales of investments, impaired securities and extinguishment of debt |

| • | Income taxes |

Years Ended December 31, |

||||||||||||

| In millions, except share and per share amounts |

2020 |

2019 |

2018 |

|||||||||

| Net income (loss) |

$ | (578) | $ | (359) | $ | (296) | ||||||

| Less: adjusted net income adjustments: |

||||||||||||

| Income (loss) before income taxes of our international and structured finance insurance segment and eliminations |

(391) | (369) | (278) | |||||||||

| Adjustments to income before income taxes of our U.S. public finance insurance and corporate segments: |

||||||||||||

| Mark-to-market gains (losses) on financial instruments (1) |

(27) | (39) | 16 | |||||||||

| Foreign exchange gains (losses) (1) |

(34) | 8 | 21 | |||||||||

| Net gains (losses) on sales of investments (1) |

47 | 128 | (13) | |||||||||

| Net investment losses related to impairments of securities |

— | (67) | (5) | |||||||||

| Net gains (losses) on extinguishment of debt |

— | (1) | 3 | |||||||||

| Other net realized gains (losses) |

— | (2) | (2) | |||||||||

| Adjusted net income adjustment to the (provision) benefit for income tax (2) |

— | — | — | |||||||||

| |

|

|

|

|

|

|||||||

| Adjusted net income (loss) |

$ | (173) | $ | (17) | $ | (38) | ||||||

| |

|

|

|

|

|

|||||||

| Adjusted net income (loss) per diluted common share |

$ | (2.93 | ) (3) |

$ | (0.21 | ) (3) |

$ | (0.42 | ) (3) | |||

| • | Negative Book value of MBIA Corp. |

| • | Net unrealized (gains) losses on available-for-sale (“AFS”) securities excluding MBIA Corp. |

| • | Net unearned premium revenue in excess of expected losses of National |

As of December 31, |

As of December 31, |

|||||||

| In millions except share and per share amounts |

2020 |

2019 |

||||||

| Total shareholders’ equity of MBIA Inc. |

$ | 136 | $ | 826 | ||||

| Common shares outstanding |

53,677,148 | 79,433,293 | ||||||

| GAAP book value per share |

$ | 2.55 | $ | 10.40 | ||||

| Management’s adjustments described above: |

||||||||

| Remove negative book value per share of MBIA Corp. |

(31.97) | (16.81) | ||||||

| Remove net unrealized gains (losses) on available-for-sale securities included in other comprehensive income (loss) |

2.86 | 1.29 | ||||||

| Include net unearned premium revenue in excess of expected losses |

4.29 | 3.46 | ||||||

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Net premiums earned |

$ | 57 | $ | 66 | $ | 95 | -14% | -31% | ||||||||||||

| Net investment income |

70 | 98 | 111 | -29% | -12% | |||||||||||||||

| Fees and reimbursements |

3 | 3 | 2 | —% | 50% | |||||||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

39 | 139 | (21) | -72% | n/m | |||||||||||||||

| Net investment losses related to other-than-temporary impairments |

— | (67) | (5) | -100% | n/m | |||||||||||||||

| Other net realized gains (losses) |

(1) | 2 | — | -150% | n/m | |||||||||||||||

| Revenues of consolidated VIEs: |

||||||||||||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

— | 64 | — | -100% | n/m | |||||||||||||||

| Other net realized gains (losses) |

— | (43) | — | -100% | n/m | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

168 | 262 | 182 | -36% | 44% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Losses and loss adjustment |

163 | 53 | 91 | n/m | -42% | |||||||||||||||

| Amortization of deferred acquisition costs |

11 | 16 | 21 | -31% | -24% | |||||||||||||||

| Operating |

48 | 49 | 41 | -2% | 20% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

222 | 118 | 153 | 88% | -23% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

$ | (54) | $ | 144 | $ | 29 | -138% | n/m | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| In millions |

December 31, 2020 |

December 31, 2019 |

Percent Change |

|||||||||

| Assets: |

||||||||||||

| Insurance loss recoverable |

$ | 1,220 | $ | 911 | 34 | % | ||||||

| Reinsurance recoverable on paid and unpaid losses (1) |

6 | 14 | -57 | % | ||||||||

| Liabilities: |

||||||||||||

| Loss and LAE reserves |

469 | 432 | 9 | % | ||||||||

| Insurance loss recoverable—ceded (2) |

48 | 19 | n/m | |||||||||

| |

|

|

|

|

|

|||||||

| Net reserve (salvage) |

$ | (709 | ) | $ | (474 | ) | 50 | % | ||||

| |

|

|

|

|

|

|||||||

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Gross expenses |

$ | 48 | $ | 49 | $ | 41 | -2 | % | 20 | % | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Amortization of deferred acquisition costs |

$ | 11 | $ | 16 | $ | 21 | -31 | % | -24 | % | ||||||||||

| Operating |

48 | 49 | 41 | -2 | % | 20 | % | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total insurance expenses |

$ | 59 | $ | 65 | $ | 62 | -9 | % | 5 | % | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Gross Par Outstanding |

||||||||||||||||

In millions |

December 31, 2020 |

December 31, 2019 |

||||||||||||||

| Rating |

Amount |

% |

Amount |

% |

||||||||||||

| AAA |

$ | 2,080 | 5.0 | % | $ | 2,709 | 5.5 | % | ||||||||

| AA |

16,299 | 39.0 | % | 19,155 | 39.2 | % | ||||||||||

| A |

12,888 | 30.8 | % | 15,022 | 30.7 | % | ||||||||||

| BBB |

7,019 | 16.7 | % | 8,225 | 16.8 | % | ||||||||||

| Below investment grade |

3,570 | 8.5 | % | 3,809 | 7.8 | % | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 41,856 | 100.0 | % | $ | 48,920 | 100.0 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| In millions |

Gross Par Outstanding |

Debt Service Outstanding |

National Internal Rating | |||||||

| Puerto Rico Electric Power Authority (PREPA) |

$ | 903 | $ | 1,225 | d | |||||

| Puerto Rico Commonwealth GO |

290 | 378 | d | |||||||

| Puerto Rico Public Buildings Authority (PBA) (1) |

169 | 223 | d | |||||||

| Puerto Rico Highway and Transportation Authority Transportation Revenue (PRHTA) |

523 | 882 | d | |||||||

| Puerto Rico Highway and Transportation Authority—Subordinated Transportation Revenue (PRHTA) |

27 | 35 | d | |||||||

| Puerto Rico Highway and Transportation Authority Highway Revenue (PRHTA) |

41 | (2) |

61 | d | ||||||

| University of Puerto Rico System Revenue |

73 | 98 | d | |||||||

| Inter American University of Puerto Rico Inc. |

19 | 23 | a3 | |||||||

| |

|

|

|

|||||||

| Total |

$ | 2,045 | $ | 2,925 | ||||||

| |

|

|

|

|||||||

2021 |

2022 |

2023 |

2024 |

2025 |

Thereafter |

Total |

||||||||||||||||||||||

| Puerto Rico Electric Power Authority (PREPA) |

$ | 140 | $ | 140 | $ | 137 | $ | 137 | $ | 105 | $ | 566 | $ | 1,225 | ||||||||||||||

| Puerto Rico Commonwealth GO |

83 | 19 | 14 | 13 | 75 | 174 | 378 | |||||||||||||||||||||

| Puerto Rico Public Buildings Authority (PBA) |

24 | 9 | 27 | 43 | 36 | 84 | 223 | |||||||||||||||||||||

| Puerto Rico Highway and Transportation Authority Transportation Revenue (PRHTA) | 27 | 27 | 36 | 33 | 36 | 723 | 882 | |||||||||||||||||||||

| Puerto Rico Highway and Transportation Authority—Subordinated Transportation Revenue (PRHTA) | 1 | 9 | 1 | 1 | 1 | 22 | 35 | |||||||||||||||||||||

| Puerto Rico Highway and Transportation Authority Highway Revenue (PRHTA) | 4 | 2 | 4 | 2 | 2 | 47 | 61 | |||||||||||||||||||||

| University of Puerto Rico System Revenue |

7 | 7 | 12 | 11 | 16 | 45 | 98 | |||||||||||||||||||||

| Inter American University of Puerto Rico Inc. |

3 | 3 | 3 | 3 | 3 | 8 | 23 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 289 | $ | 216 | $ | 234 | $ | 243 | $ | 274 | $ | 1,669 | $ | 2,925 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Net investment income |

$ | 30 | $ | 37 | $ | 37 | -19% | —% | ||||||||||||

| Fees |

56 | 53 | 39 | 6% | 36% | |||||||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

(63) | (54) | 22 | 17% | n/m | |||||||||||||||

| Net gains (losses) on extinguishment of debt |

— | (1) | 3 | -100% | -133% | |||||||||||||||

| Other net realized gains (losses) |

— | (2) | (2) | -100% | —% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

23 | 33 | 99 | -30% | -67% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating |

72 | 73 | 50 | -1% | 46% | |||||||||||||||

| Interest |

84 | 92 | 95 | -9% | -3% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

156 | 165 | 145 | -5% | 14% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

$ | (133) | $ | (132) | $ | (46) | —% | n/m | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Net premiums earned |

$ | 24 | $ | 27 | $ | 78 | -11% | -65% | ||||||||||||

| Net investment income |

5 | 7 | 6 | -29% | 17% | |||||||||||||||

| Fees and reimbursements |

12 | 21 | 47 | -43% | -55% | |||||||||||||||

| Change in fair value of insured derivatives: |

||||||||||||||||||||

| Realized gains (losses) and other settlements on insured derivatives |

(1) | (10) | (56) | -90% | -82% | |||||||||||||||

| Unrealized gains (losses) on insured derivatives |

7 | 25 | 31 | -72% | -19% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in fair value of insured derivatives |

6 | 15 | (25) | -60% | n/m | |||||||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

(14) | (33) | (18) | -58% | 83% | |||||||||||||||

| Other net realized gains (losses) |

1 | 4 | 2 | -75% | 100% | |||||||||||||||

| Revenues of consolidated VIEs: |

||||||||||||||||||||

| Net investment income |

18 | 34 | 35 | -47% | -3% | |||||||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

108 | 41 | 25 | n/m | 64% | |||||||||||||||

| Other net realized gains (losses) |

37 | (20) | (171) | n/m | n/m | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

197 | 96 | (21) | 105% | n/m | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Losses and loss adjustment |

367 | 189 | (28) | 94% | n/m | |||||||||||||||

| Amortization of deferred acquisition costs |

16 | 21 | 31 | -24% | -32% | |||||||||||||||

| Operating |

27 | 26 | 21 | 4% | 24% | |||||||||||||||

| Interest |

116 | 131 | 129 | -11% | 2% | |||||||||||||||

| Expenses of consolidated VIEs: |

||||||||||||||||||||

| Operating |

5 | 9 | 11 | -44% | -18% | |||||||||||||||

| Interest |

57 | 89 | 93 | -36% | -4% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

588 | 465 | 257 | 26% | 81% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

$ | (391) | $ | (369) | $ | (278) | 6% | 33% | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Net premiums earned: |

||||||||||||||||||||

| Non-U.S. |

$ | 18 | $ | 21 | $ | 68 | -14% | -69% | ||||||||||||

| U.S. |

6 | 6 | 10 | —% | -40% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net premiums earned |

$ | 24 | $ | 27 | $ | 78 | -11% | -65% | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| VIEs (eliminated in consolidation) |

$ | (7) | $ | (3) | $ | 7 | 133% | -143% | ||||||||||||

December 31, |

December 31, |

Percent |

||||||||||

| In millions |

2020 |

2019 |

Change |

|||||||||

| Assets: |

||||||||||||

| Insurance loss recoverable |

$ | 457 | $ | 783 | -42% | |||||||

| Reinsurance recoverable on paid and unpaid losses (1) |

5 | 5 | —% | |||||||||

| Liabilities: |

||||||||||||

| Loss and LAE reserves |

521 | 469 | 11% | |||||||||

| |

|

|

|

|

|

|||||||

| Net reserve (salvage) |

$ | 59 | $ | (319) | -118% | |||||||

| |

|

|

|

|

|

|||||||

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Gross expenses |

$ | 28 | $ | 26 | $ | 22 | 8% | 18% | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Amortization of deferred acquisition costs |

$ | 16 | $ | 21 | $ | 31 | -24% | -32% | ||||||||||||

| Operating |

27 | 26 | 21 | 4% | 24% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total insurance expenses |

$ | 43 | $ | 47 | $ | 52 | -9% | -10% | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

In millions |

Gross Par Outstanding as of |

|||||||||||

December 31, |

December 31, |

Percent |

||||||||||

| Collateral Type |

2020 |

2019 |

Change |

|||||||||

| HELOC Second-lien |

$ | 269 | $ | 381 | -29% | |||||||

| CES Second-lien |

104 | 136 | -24% | |||||||||

| Alt-A First-lien (1) |

825 | 909 | -9% | |||||||||

| Subprime First-lien |

285 | 343 | -17% | |||||||||

| Prime First-lien |

6 | 7 | -14% | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

$ | 1,489 | $ | 1,776 | -16% | |||||||

| |

|

|

|

|

|

|||||||

Years Ended December 31, |

||||||||||||

| In millions |

2020 |

2019 |

2018 |

|||||||||

| Income (loss) before income taxes |

$ | (578) | $ | (357) | $ | (296) | ||||||

| Provision (benefit) for income taxes |

$ | — | $ | 2 | $ | — | ||||||

| Effective tax rate |

0.0% | -0.6% | 0.0% | |||||||||

As of December 31, |

As of December 31, |

|||||||

| In millions |

2020 |

2019 |

||||||

| Policyholders’ surplus |

$ | 1,526 | $ | 1,891 | ||||

| Contingency reserves |

445 | 485 | ||||||

| |

|

|

|

|||||

| Statutory capital |

1,971 | 2,376 | ||||||

| Unearned premiums |

355 | 411 | ||||||

| Present value of installment premiums (1) |

129 | 139 | ||||||

| |

|

|

|

|||||

| Premium resources (2) |

484 | 550 | ||||||

| Net loss and LAE reserves (1) |

(301) | (169) | ||||||

| Salvage reserves on paid claims (1) |

961 | 789 | ||||||

| |

|

|

|

|||||

| Gross loss and LAE reserves |

660 | 620 | ||||||

| |

|

|

|

|||||

| Total claims-paying resources |

$ | 3,115 | $ | 3,546 | ||||

| |

|

|

|

|||||

As of December 31, |

As of December 31, |

|||||||

| In millions |

2020 |

2019 |

||||||

| Policyholders’ surplus |

$ | 106 | $ | 282 | ||||

| Contingency reserves |

167 | 194 | ||||||

| |

|

|

|

|||||

| Statutory capital |

273 | 476 | ||||||

| Unearned premiums |

79 | 93 | ||||||

| Present value of installment premiums (1) (2) |

73 | 92 | ||||||

| |

|

|

|

|||||

| Premium resources |

152 | 185 | ||||||

| Net loss and LAE reserves (1) |

(478) | (669) | ||||||

| Salvage reserves on paid claims (1) (3) |

1,045 | 1,247 | ||||||

| |

|

|

|

|||||

| Gross loss and LAE reserves |

567 | 578 | ||||||

| |

|

|

|

|||||

| Total claims-paying resources |

$ | 992 | $ | 1,239 | ||||

| |

|

|

|

|||||

| • | principal and interest receipts on assets held in its investment portfolio, including proceeds from the sale of assets; |

| • | recoveries associated with insurance loss payments; and |

| • | installment premiums. |

| • | loss payments and LAE on insured transactions; |

| • | payments of dividends; and |

| • | payments of operating expenses, taxes and investment portfolio asset purchases. |

| • | dividends from National; |

| • | available cash and liquid assets not subject to collateral posting requirements; |

| • | principal and interest receipts on assets held in its investment portfolio, including proceeds from the sale of assets; and |

| • | access to capital markets. |

| • | servicing outstanding unsecured corporate debt obligations and MTNs; |

| • | meeting collateral posting requirements under investment agreements and derivative arrangements; |

| • | payments related to interest rate swaps; |

| • | payments of operating expenses; and |

| • | funding share repurchases and debt buybacks. |

| • | recoveries associated with insurance loss payments; |

| • | installment premiums and fees; and |

| • | principal and interest receipts on assets held in its investment portfolio, including the proceeds from the sale of assets. |

| • | loss and LAE or commutation payments on insured transactions; |

| • | repayment of the Refinanced Facility; and |

| • | payments of operating expenses. |

Years Ended December 31, |

Percent Change |

|||||||||||||||||||

| In millions |

2020 |

2019 |

2018 |

2020 vs. 2019 |

2019 vs. 2018 |

|||||||||||||||

| Statement of cash flow data: |

||||||||||||||||||||

| Net cash provided (used) by: |

||||||||||||||||||||

| Operating activities |

$ | (390) | $ | (368) | $ | (319) | 6% | 15% | ||||||||||||

| Investing activities |

1,738 | 1,267 | 1,206 | 37% | 5% | |||||||||||||||

| Financing activities |

(1,265) | (1,096) | (752) | 15% | 46% | |||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents |

1 | — | (1) | n/m | -100% | |||||||||||||||

| Cash and cash equivalents—beginning of year |

83 | 280 | 146 | -70% | 92% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash and cash equivalents—end of year |

$ | 167 | $ | 83 | $ | 280 | 101% | -70% | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

As of December 31, 2020 |

||||||||||||||||||||||||||||

| In millions |

2021 |

2022 |

2023 |

2024 |

2025 |

Thereafter |

Total |

|||||||||||||||||||||

| U.S. public finance insurance segment: |

||||||||||||||||||||||||||||

| Gross insurance claim obligations (1) |

$ | 5 | $ | 1 | $ | — | $ | — | $ | — | $ | — | $ | 6 | ||||||||||||||

| Lease liability |

3 | 3 | 3 | 3 | 3 | 14 | 29 | |||||||||||||||||||||

| Corporate segment: |

||||||||||||||||||||||||||||

| Long-term debt |

20 | 20 | 20 | 20 | 66 | 318 | 464 | |||||||||||||||||||||

| Investment agreements |

11 | 11 | 27 | 32 | 43 | 265 | 389 | |||||||||||||||||||||

| Medium-term notes |

5 | 67 | 17 | 128 | 66 | 692 | 975 | |||||||||||||||||||||

| International and structured finance insurance segment: |

||||||||||||||||||||||||||||

| Surplus notes |

1,066 | 108 | 108 | 108 | 108 | 1,724 | 3,222 | |||||||||||||||||||||

| Gross insurance claim obligations (1) |

117 | 34 | 28 | 23 | 22 | 878 | 1,102 | |||||||||||||||||||||

| Refinanced Facility |

33 | 277 | — | — | — | — | 310 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 1,260 | $ | 521 | $ | 203 | $ | 314 | $ | 308 | $ | 3,891 | $ | 6,497 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Change in Interest Rates |

||||||||||||||||||||||||

| In millions |

300 Basis Point Decrease |

200 Basis Point Decrease |

100 Basis Point Decrease |

100 Basis Point Increase |

200 Basis Point Increase |

300 Basis Point Increase |

||||||||||||||||||

| Estimated change in fair value |

$ | 226 | $ | 125 | $ | 53 | $ | (41) | $ | (76) | $ | (105) | ||||||||||||

Change in Foreign Exchange Rates |

||||||||||||||||

Dollar Weakens |

Dollar Strengthens |

|||||||||||||||

| In millions |

20% |

10% |

10% |

20% |

||||||||||||

| Estimated change in fair value |

$ | (72) | $ | (36) | $ | 36 | $ | 72 | ||||||||

Change in Credit Spreads |

||||||||||||

| In millions |

50 Basis Point Decrease |

50 Basis Point Increase |

200 Basis Point Increase |

|||||||||

| Estimated change in fair value |

$ | 42 | $ | (40) | $ | (138) | ||||||

| 62 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 74 | ||||

| 80 | ||||

| 81 | ||||

| 83 | ||||

| 85 | ||||

| 93 | ||||

| 106 | ||||

| 112 | ||||

| 116 | ||||

| 119 | ||||

| 122 | ||||

| 126 | ||||

| 129 | ||||

| 131 | ||||

| 133 | ||||

| 134 | ||||

| 135 | ||||

| 136 |

December 31, 2020 |

December 31, 2019 |

|||||||

| Assets |

||||||||

| Investments: |

||||||||

| Fixed-maturity securities held as available-for-sale, at fair value (amortized cost $ |

$ |

$ |

||||||

| Investments carried at fair value |

||||||||

| Investments pledged as collateral, at fair value (amortized cost $ |

||||||||

| Short-term investments, at fair value (amortized cost $ |

||||||||

| |

|

|

|

|||||

| Total investments |

||||||||

| Cash and cash equivalents |

||||||||

| Premiums receivable (net of allowance for credit losses $ |

||||||||

| Deferred acquisition costs |

||||||||

| Insurance loss recoverable |

||||||||

| Other assets |

||||||||

| Assets of consolidated variable interest entities: |

||||||||

| Cash |

||||||||

| Investments held-to-maturity, at amortized cost (fair value $ |

||||||||

| Investments carried at fair value |

||||||||

| Loans receivable at fair value |

||||||||

| Loan repurchase commitments |

||||||||

| Other assets |

||||||||

| |

|

|

|

|||||

| Total assets |

$ |

$ |

||||||

| |

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Liabilities: |

||||||||

| Unearned premium revenue |

$ |

$ |

||||||

| Loss and loss adjustment expense reserves |

||||||||

| Long-term debt |

||||||||

| Medium-term notes (includes financial instruments carried at fair value of $ |

||||||||

| Investment agreements |

||||||||

| Derivative liabilities |

||||||||

| Other liabilities |

||||||||

| Liabilities of consolidated variable interest entities: |

||||||||

| Variable interest entity notes (includes financial instruments carried at fair value of $ |

||||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| |

|

|

|

|||||

| Commitments and contingencies (Refer to Note 19) |

||||||||

| Equity: |

||||||||

| Preferred stock, par value $ |

||||||||

| Common stock, par value $ |

||||||||

| Additional paid-in capital |

||||||||

| Retained earnings (deficit) |

( |

|||||||

| Accumulated other comprehensive income (loss), net of tax of $ |

( |

|||||||

| Treasury stock, at cost— |

( |

( |

||||||

| |

|

|

|

|||||

| Total shareholders’ equity of MBIA Inc. |

||||||||

| Preferred stock of subsidiary |

||||||||

| |

|

|

|

|||||

| Total equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and equity |

$ |

$ |

||||||

| |

|

|

|

|||||

Years Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Revenues: |

||||||||||||

| Premiums earned: |

||||||||||||

| Scheduled premiums earned |

$ |

$ |

$ |

|||||||||

| Refunding premiums earned |

||||||||||||

| |

|

|

|

|

|

|||||||

| Premiums earned (net of ceded premiums of $ |

||||||||||||

| Net investment income |

||||||||||||

| Fees and reimbursements |

||||||||||||

| Change in fair value of insured derivatives: |

||||||||||||

| Realized gains (losses) and other settlements on insured derivatives |

( |

( |

( |

|||||||||

| Unrealized gains (losses) on insured derivatives |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net change in fair value of insured derivatives |

( |

|||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

( |

( |

||||||||||

| Net investment losses related to other-than-temporary impairments: |

||||||||||||

| Other-than-temporary impairments recognized in accumulated other comprehensive income (loss) |

( |

( |

||||||||||

| |

|

|

|

|

|

|||||||

| Net investment losses related to other-than-temporary impairments |

( |

( |

||||||||||

| Net gains (losses) on extinguishment of debt |

( |

|||||||||||

| Other net realized gains (losses) |

||||||||||||

| Revenues of consolidated variable interest entities: |

||||||||||||

| Net investment income |

||||||||||||

| Net gains (losses) on financial instruments at fair value and foreign exchange |

||||||||||||

| Other net realized gains (losses) |

( |

( |

||||||||||

| |

|

|

|

|

|

|||||||

| Total revenues |

||||||||||||

| Expenses: |

||||||||||||

| Losses and loss adjustment |

||||||||||||

| Amortization of deferred acquisition costs |

||||||||||||

| Operating |

||||||||||||

| Interest |

||||||||||||

| Expenses of consolidated variable interest entities: |

||||||||||||

| Operating |

||||||||||||

| Interest |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total expenses |

||||||||||||

| |

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

( |

( |

( |

|||||||||

| Provision (benefit) for income taxes |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net income (loss) |

$ |

( |

$ |

( |

$ |

( |

||||||

| |

|

|

|

|

|

|||||||

| Net income (loss) per common share: |

||||||||||||

| Basic |

$ |

( |

$ |

( |

$ |

( |

||||||

| Diluted |

$ |

( |

$ |

( |

$ |

( |

||||||

| Weighted average number of common shares outstanding: |

||||||||||||

| Basic |

||||||||||||

| Diluted |

||||||||||||

Years Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Net income (loss) |

$ | ( |

$ | ( |

$ | ( |

||||||

| Other comprehensive income (loss): |

||||||||||||

| Available-for-sale securities with no credit losses: |

||||||||||||

| Unrealized gains (losses) arising during the period |

( |

|||||||||||

| Provision (benefit) for income taxes |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total |

( |

|||||||||||

| Reclassification adjustments for (gains) losses included in net income (loss) |

( |

( |

( |

|||||||||

| Available-for-sale securities with credit losses: |

||||||||||||

| Unrealized gains (losses) arising during the period |

||||||||||||

| Reclassification adjustments for (gains) losses included in net income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total |

||||||||||||

| Foreign currency translation: |

||||||||||||

| Foreign currency translation gains (losses) |

( |

|||||||||||

| |

|

|

|

|

|

|||||||

| Total |

( |

|||||||||||

| Instrument-specific credit risk of liabilities measured at fair value: |

||||||||||||

| Unrealized gains (losses) arising during the period |

( |

|||||||||||

| Reclassification adjustments for (gains) losses included in net income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total other comprehensive income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Comprehensive income (loss) |

$ |

( |

$ |

( |

$ |

( |

||||||

| |

|

|

|

|

|

|||||||

2020 |

2019 |

2018 |

||||||||||

| Common shares |

||||||||||||

| Balance at beginning of year |

||||||||||||

| Common shares issued (cancelled), net |

( |

( |

( |

|||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

||||||||||||

| Common stock amount |

||||||||||||

| Balance at beginning and end of year |

$ | $ | $ | |||||||||

| Period change |

( |

|||||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of period |

$ | $ | $ | |||||||||

| Additional paid-in capital |

||||||||||||

| Balance at beginning of year |

$ | $ | $ | |||||||||

| Treasury shares issued for warrant exercises |

( |

|||||||||||

| Share-based compensation |

( |

( |

( |

|||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

$ | $ | $ | |||||||||

| Retained earnings (deficit) |

||||||||||||

| Balance at beginning of year |

$ | $ | $ | |||||||||

| ASU 2016-13 transition adjustment |

( |

|||||||||||

| ASU 2016-01 transition adjustment |

||||||||||||

| ASU 2018-02 transition adjustment |

||||||||||||

| Net income (loss) |

( |

( |

( |

|||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

$ | ( |

$ | $ | ||||||||

| Accumulated other comprehensive income (loss) |

||||||||||||

| Balance at beginning of year |

$ | ( |

$ | ( |

$ | ( |

||||||

| ASU 2016-01 transition adjustment |

( |

|||||||||||

| ASU 2018-02 transition adjustment |

( |

|||||||||||

| Other comprehensive income (loss) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

$ | $ | ( |

$ | ( |

|||||||

| Treasury shares |

||||||||||||

| Balance at beginning of year |

( |

( |

( |

|||||||||

| Treasury shares issued for warrant exercises |

||||||||||||

| Treasury shares acquired under share repurchase program |

( |

( |

( |

|||||||||

| Share-based compensation |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

( |

( |

( |

|||||||||

| Treasury stock amount |

||||||||||||

| Balance at beginning of year |

$ | ( |

$ | ( |

$ | ( |

||||||

| Treasury shares issued for warrant exercises |

||||||||||||

| Treasury shares acquired under share repurchase program |

( |

( |

( |

|||||||||

| Share-based compensation |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

$ | ( |

$ | ( |

$ | ( |

||||||

| Total shareholders’ equity of MBIA Inc. |

||||||||||||

| Balance at beginning of year |

$ | $ | $ | |||||||||

| Period change |

( |

( |

( |

|||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

| Preferred stock of subsidiary shares |

||||||||||||

| Balance at beginning and end of year |

||||||||||||

| Preferred stock of subsidiary amount |

||||||||||||

| Balance at beginning of year |

$ | $ | $ | |||||||||

| Period change |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at end of year |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total equity |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

Years Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Cash flows from operating activities: |

||||||||||||

| Premiums, fees and reimbursements received |

$ |

$ |

$ |

|||||||||

| Investment income received |

||||||||||||

| Insured derivative commutations and losses paid |

( |

( |

( |

|||||||||

| Financial guarantee losses and loss adjustment expenses paid |

( |

( |

( |

|||||||||

| Proceeds from recoveries and reinsurance |

||||||||||||

| Operating and employee related expenses paid |

( |

( |

( |

|||||||||

| Interest paid, net of interest converted to principal |

( |

( |

( |

|||||||||

| Income taxes (paid) received |

( |

|||||||||||

| |

|

|

|

|

|

|||||||

| Net cash provided (used) by operating activities |

( |

( |

( |

|||||||||

| |

|

|

|

|

|

|||||||

| Cash flows from investing activities: |

||||||||||||

| Purchases of available-for-sale investments |

( |

( |

( |

|||||||||

| Sales of available-for-sale investments |

||||||||||||

| Paydowns and maturities of available-for-sale investments |

||||||||||||

| Purchases of investments at fair value |

( |

( |

( |

|||||||||

| Sales, paydowns and maturities of investments at fair value |

||||||||||||

| Sales, paydowns and maturities (purchases) of short-term investments, net |

( |

|||||||||||

| Sales, paydowns and maturities of held-to-maturity investments |

||||||||||||

| Paydowns and maturities of loans receivable and other instruments at fair value |

||||||||||||

| Consolidation of variable interest entities |

||||||||||||

| Deconsolidation of variable interest entities |

( |

( |

||||||||||

| (Payments) proceeds for derivative settlements |

( |

( |

( |

|||||||||

| Capital expenditures |

( |

|||||||||||

| |

|

|

|

|

|

|||||||

| Net cash provided (used) by investing activities |

||||||||||||

| |

|

|

|

|

|

|||||||

| Cash flows from financing activities: |

||||||||||||

| Proceeds from investment agreements |

||||||||||||

| Principal paydowns of investment agreements |

( |

( |

( |

|||||||||

| Principal paydowns of medium-term notes |

( |

( |

||||||||||

| Principal paydowns of variable interest entity notes |

( |

( |

( |

|||||||||

| Principal paydowns of long-term debt |

( |

( |

||||||||||

| Purchases of treasury stock |

( |

( |

( |

|||||||||

| Other financing |

( |

|||||||||||

| |

|

|

|

|

|

|||||||

| Net cash provided (used) by financing activities |

( |

( |

( |

|||||||||

| |

|

|

|

|

|

|||||||

| Effect of exchange rate changes on cash and cash equivalents |

( |

|||||||||||

| Net increase (decrease) in cash and cash equivalents |

( |

|||||||||||

| Cash and cash equivalents—beginning of year |

||||||||||||

| |

|

|

|

|

|

|||||||

| Cash and cash equivalents—end of year |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

| Reconciliation of net income (loss) to net cash provided (used) by operating activities: |

||||||||||||

| Net income (loss) |

$ |

( |

$ |

( |

$ |

( |

||||||

| Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: |

||||||||||||

| Change in: |

||||||||||||

| Premiums receivable |

||||||||||||

| Deferred acquisition costs |

||||||||||||

| Accrued investment income |

||||||||||||

| Unearned premium revenue |

( |

( |

( |

|||||||||

| Loss and loss adjustment expense reserves |

( |

|||||||||||

| Insurance loss recoverable |

( |

( |

||||||||||

| Accrued interest payable |

||||||||||||

| Accrued expenses |

( |

|||||||||||

| Net investment losses related to other-than-temporary impairments |

||||||||||||

| Unrealized (gains) losses on insured derivatives |

( |

( |

( |

|||||||||

| Net (gains) losses on financial instruments at fair value and foreign exchange |

( |

( |

( |

|||||||||

| Other net realized (gains) losses |

( |

|||||||||||

| Deferred income tax provision (benefit) |

||||||||||||

| Interest on variable interest entities, net |

( |

|||||||||||

| Other operating |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total adjustments to net income (loss) |

( |

( |

||||||||||

| |

|

|

|

|

|

|||||||

| Net cash provided (used) by operating activities |

$ |

( |

$ |

( |

$ |

( |

||||||

| |

|

|

|

|

|

|||||||

| • | Level 1—Valuations based on quoted prices in active markets for identical assets or liabilities that the Company can access. Valuations are based on quoted prices that are readily and regularly available in an active market, with significant trading volumes. |

| • | Level 2—Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly. Level 2 assets include debt securities with quoted prices that are traded less frequently than exchange-traded instruments, securities which are priced using observable inputs and derivative contracts whose values are determined using a pricing model with inputs that are observable in the market or can be derived principally from or corroborated by observable market data. |

| • | Level 3—Valuations based on inputs that are unobservable or supported by little or no market activity, and that are significant to the overall fair value measurement. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques where significant inputs are unobservable, as well as instruments for which the determination of fair value requires significant management judgment or estimation. |

December 31, 2020 |

||||||||||||||||||||||||

Carrying Value of Assets |

Carrying Value of Liabilities |

|||||||||||||||||||||||

| In millions |

Maximum Exposure to Loss |

Investments |

Premiums Receivable |

Insurance Loss Recoverable |

Unearned Premium Revenue |

Loss and Loss Adjustment Expense Reserves |

||||||||||||||||||

| Insurance: |

||||||||||||||||||||||||

| Global structured finance: |

||||||||||||||||||||||||

| Mortgage-backed residential |

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Consumer asset-backed |

||||||||||||||||||||||||

| Corporate asset-backed |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total global structured finance |

||||||||||||||||||||||||

| Global public finance |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total insurance |

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

December 31, 2019 |

||||||||||||||||||||||||

Carrying Value of Assets |

Carrying Value of Liabilities |

|||||||||||||||||||||||

| In millions |

Maximum Exposure to Loss |

Investments |

Premiums Receivable |

Insurance Loss Recoverable |

Unearned Premium Revenue |

Loss and Loss Adjustment Expense Reserves |

||||||||||||||||||

| Insurance: |

||||||||||||||||||||||||

| Global structured finance: |

||||||||||||||||||||||||

| Mortgage-backed residential |

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Mortgage-backed commercial |

||||||||||||||||||||||||

| Consumer asset-backed |

||||||||||||||||||||||||

| Corporate asset-backed |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total global structured finance |

||||||||||||||||||||||||

| Global public finance |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total insurance |

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| In millions |

Adjustments |

|||||||||||||||||||||||

| Premiums Receivable as of December 31, 2019 |

Premium Payments Received |

Premiums from New Business Written |

Changes in Expected Term of Policies |

Accretion of Premiums Receivable Discount (1) |

Other (2) |

Premiums Receivable as of December 31, 2020 |

||||||||||||||||||

| $ |

$ | ( |

$ | $ | ( |

$ | $ | ( |

$ | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| In millions |

Adjustments |

|||||||||||||||||||||||

| Premiums Receivable as of December 31, 2018 |

Premium Payments Received |

Premiums from New Business Written |

Changes in Expected Term of Policies |

Accretion of Premiums Receivable Discount (1) |

Other (2) |

Premiums Receivable as of December 31, 2019 |

||||||||||||||||||

| $ |

$ | ( |

$ | $ | ( |

$ | $ | ( |

$ | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| In millions |

Expected Collection of Premiums |

|||

| Three months ending: |

||||

| March 31, 2021 |

$ | |||

| June 30, 2021 |

||||

| September 30, 2021 |

||||

| December 31, 2021 |

||||

| Twelve months ending: |

||||

| December 31, 2022 |

||||

| December 31, 2023 |

||||

| December 31, 2024 |

||||

| December 31, 2025 |

||||

| Five years ending: |

||||

| December 31, 2030 |

||||

| December 31, 2035 |

||||

| December 31, 2040 and thereafter |

||||

| |

|

|||

| Total |

$ |

|||

| |

|

|||

| In millions |

Unearned Premium Revenue |

Expected Future Premium Earnings |

Accretion |

Total Expected Future Premium Earnings |

||||||||||||||||

Upfront |

Installments |

|||||||||||||||||||

| December 31, 2020 |

$ | |||||||||||||||||||

| Three months ending: |

||||||||||||||||||||

| March 31, 2021 |

$ | $ | $ | $ | ||||||||||||||||

| June 30, 2021 |

||||||||||||||||||||

| September 30, 2021 |

||||||||||||||||||||

| December 31, 2021 |

||||||||||||||||||||

| Twelve months ending: |

||||||||||||||||||||

| December 31, 2022 |

||||||||||||||||||||

| December 31, 2023 |

||||||||||||||||||||

| December 31, 2024 |

||||||||||||||||||||

| December 31, 2025 |

||||||||||||||||||||

| Five years ending: |

||||||||||||||||||||

| December 31, 2030 |

||||||||||||||||||||

| December 31, 2035 |

||||||||||||||||||||

| December 31, 2040 and thereafter |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ |

$ |

$ |

$ |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

As |

As |

|||||||||||||||

| In millions |

Balance Sheet Line Item |

Balance Sheet Line Item |

||||||||||||||

Insurance loss recoverable |

Loss LAE reserves (2) |

Insurance loss recoverable |

Loss LAE reserves (2) |

|||||||||||||

| U.S. Public Finance Insurance |

$ | $ | $ | $ | ||||||||||||

| International and Structured Finance Insurance: |

||||||||||||||||

| Before VIE eliminations (1) |

||||||||||||||||

| VIE eliminations (1) |

( |

( |

( |

( |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total international and structured finance insurance |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| In millions |

Changes in Loss and LAE Reserves for the Year Ended December 31, 2020 |

|||||||||||||||||||||||||||

| Gross Loss and LAE Reserves as of December 31, 2019 (1) |

Loss Payments |

Accretion of Claim Liability Discount |

Changes in Discount Rates |

Changes in Assumptions |

Changes in Unearned Premium Revenue |

Other |

Gross Loss and LAE Reserves as of December 31, 2020 (1) |

|||||||||||||||||||||

| $ |

$ | ( |

$ | $ | ( |

$ | $ | $ |

( |

$ | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| In millions |

Changes in Loss and LAE Reserves for the Year Ended December 31, 2019 |

|||||||||||||||||||||||||||||||

| Gross Loss and LAE Reserves as of December 31, 2018 (1) |

Loss Payments |

Accretion of Claim Liability Discount |

Changes in Discount Rates |

Changes in Assumptions |

Changes in Unearned Premium Revenue |

Changes in LAE Reserves |

Other |

Gross Loss and LAE Reserves as of December 31, 2019 (1) |

||||||||||||||||||||||||

| $ |

$ | ( |

$ | $ | ( |

$ | $ |

$ | ( |

$ | ( |

$ | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Changes in Insurance Loss Recoverable for the Year Ended December 31, 2020 |

||||||||||||||||||||||||||||

| In millions |

Gross Reserve as of December 31, 2019 |

Collections for Cases |

Accretion of Recoveries |

Changes in Discount Rates |

Changes in Assumptions (1) |

Other |

Gross Reserve as of December 31, 2020 |

|||||||||||||||||||||

| Insurance loss recoverable |

$ | $ | ( |

$ | $ | $ | ( |

$ | ( |

$ | ||||||||||||||||||

Changes in Insurance Loss Recoverable for the Year Ended December 31, 2019 |

||||||||||||||||||||||||||||

| In millions |

Gross Reserve as of December 31, 2018 |

Collections for Cases |

Accretion of Recoveries |

Changes in Discount Rates |

Changes in Assumptions (1) |

Other (2) |

Gross Reserve as of December 31, 2019 |

|||||||||||||||||||||

| Insurance loss recoverable |

$ | $ | ( |

$ | $ | $ | $ | $ | ||||||||||||||||||||

Surveillance Categories |

||||||||||||||||||||

Caution |

Caution |

Caution |

||||||||||||||||||

List |

List |

List |

Classified |

|||||||||||||||||

| $ in millions |

Low |

Medium |

High |

List |

Total |

|||||||||||||||

| Number of policies |

||||||||||||||||||||

| Number of issues (1) |

||||||||||||||||||||

| Remaining weighted average contract period (in years) |

— | |||||||||||||||||||

| Gross insured contractual payments outstanding: (2) |

||||||||||||||||||||

| Principal |

$ | $ | $ | $ | $ | |||||||||||||||

| Interest |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | $ | $ | $ | $ | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross Claim Liability (3) |

$ | $ | $ | $ | $ | |||||||||||||||

| Less: |

||||||||||||||||||||

| Gross Potential Recoveries (4) |

||||||||||||||||||||

| Discount, net (5) |

( |

( |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net claim liability (recoverable) |

$ | $ | $ | $ | ( |

$ | ( |

|||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Unearned premium revenue |

$ | $ | $ | $ | $ | |||||||||||||||

| Reinsurance recoverable on paid and unpaid losses (6) |

$ | |||||||||||||||||||

Surveillance Categories |

||||||||||||||||||||

Caution |

Caution |

Caution |

||||||||||||||||||

List |

List |

List |

Classified |

|||||||||||||||||

| $ in millions |

Low |

Medium |

High |

List |

Total |

|||||||||||||||

| Number of policies |

||||||||||||||||||||

| Number of issues (1) |

||||||||||||||||||||

| Remaining weighted average contract period (in years) |

— | |||||||||||||||||||

| Gross insured contractual payments outstanding: (2) |

||||||||||||||||||||

| Principal |

$ | $ | $ | $ | $ | |||||||||||||||

| Interest |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | $ | $ | $ | $ | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross Claim Liability (3) |

$ | $ | $ | $ | $ | |||||||||||||||

| Less: |

||||||||||||||||||||

| Gross Potential Recoveries (4) |

||||||||||||||||||||

| Discount, net (5) |

( |

( |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net claim liability (recoverable) |

$ | $ | $ | $ | ( |

$ | ( |

|||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Unearned premium revenue |

$ | $ | $ | $ | $ | |||||||||||||||

| Reinsurance recoverable on paid and unpaid losses (6) |

|

$ | ||||||||||||||||||

In millions |

Fair Value as of December 31, 2020 |

Valuation Techniques |

Unobservable Input |

Range (Weighted Average) | ||||||

Assets |

||||||||||

Loans receivable at fair value |

$ | Market prices adjusted for financial guarantees provided to VIE obligations | Impact of financial guarantee (2) |

- (1) | ||||||

Loan repurchase commitments |

Discounted cash flow | Recovery value (3) |

||||||||

Liabilities of consolidated VIEs: |

||||||||||

Variable interest entity notes |

Market prices of VIE assets adjusted for financial guarantees provided | Impact of financial guarantee |

(1) | |||||||

Other derivative liabilities |

Discounted cash flow | Cash flows | $ | |||||||

In millions |

Fair Value as of December 31, 2019 |

Valuation Techniques |

Unobservable Input |

Range (Weighted Average) | ||||||

Assets of consolidated VIEs: |

||||||||||

Loans receivable at fair value |

$ |

Market prices adjusted for financial guarantees provided to VIE obligations |

Impact of financial guarantee (1) |

- | ||||||

Loan repurchase commitments |

Discounted cash flow |

Recovery rates (2) Breach rates(2) |

||||||||

Liabilities of consolidated VIEs: |

||||||||||

Variable interest entity notes |

Market prices of VIE assets adjusted for financial guarantees provided | Impact of financial guarantee | ||||||||

Credit derivative liabilities—CMBS |

Direct Price Model | Nonperformance risk | ||||||||

Other derivative liabilities |

Discounted cash flow | Cash flows | $ (3) | |||||||

Fair Value Measurements at Reporting Date Using |

||||||||||||||||

In millions |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Balance as of December 31, 2020 |

||||||||||||

Assets: |

||||||||||||||||

Fixed-maturity investments: |

||||||||||||||||

U.S. Treasury and government agency |

$ | $ | $ | $ | ||||||||||||

State and municipal bonds |

||||||||||||||||

Foreign governments |

||||||||||||||||

Corporate obligations |

||||||||||||||||

Mortgage-backed securities: |

||||||||||||||||

Residential mortgage-backed agency |

||||||||||||||||

Residential mortgage-backed non-agency |

||||||||||||||||

Commercial mortgage-backed |

||||||||||||||||

Asset-backed securities: |

||||||||||||||||

Collateralized debt obligations |

||||||||||||||||

Other asset-backed |

||||||||||||||||

Total fixed-maturity investments |

||||||||||||||||

Money market securities |

||||||||||||||||

Perpetual debt and equity securities |

||||||||||||||||

Cash and cash equivalents |

||||||||||||||||

Derivative assets: |

||||||||||||||||

Non-insured derivative assets: |

||||||||||||||||

Interest rate derivatives |

||||||||||||||||

Fair Value Measurements at Reporting Date Using |

||||||||||||||||

In millions |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Balance as of December 31, 2020 |

||||||||||||

Assets of consolidated VIEs: |

||||||||||||||||

Corporate obligations |

||||||||||||||||

Mortgage-backed securities: |

||||||||||||||||

Residential mortgage-backed non-agency |

||||||||||||||||

Commercial mortgage-backed |

||||||||||||||||

Asset-backed securities: |

||||||||||||||||

Collateralized debt obligations |

||||||||||||||||

Other asset-backed |

||||||||||||||||

Cash |

||||||||||||||||

Loans receivable at fair value: |

||||||||||||||||

Residential loans receivable |

||||||||||||||||

Loan repurchase commitments |

||||||||||||||||

Other assets: |

||||||||||||||||

Currency derivatives |

||||||||||||||||

Other |

||||||||||||||||

Total assets |

$ | $ | $ | $ | ||||||||||||

Liabilities: |

||||||||||||||||

Medium-term notes |

$ | $ | $ | $ | ||||||||||||

Derivative liabilities: |

||||||||||||||||