Document

ANNUAL INFORMATION FORM

Dated March 30, 2021

TABLE OF CONTENTS

| | | | | |

GENERAL MATTERS | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | |

CAUTIONARY STATEMENT REGARDING THIRD PARTY INFORMATION | |

NON-IFRS FINANCIAL PERFORMANCE MEASURES | |

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION | |

| COMMODITY PRICE INFORMATION | |

GLOSSARY OF TERMS | |

CORPORATE STRUCTURE | |

GENERAL DEVELOPMENT OF NOMAD’S BUSINESS | |

DESCRIPTION OF BUSINESS | |

RISK FACTORS | |

DIVIDENDS | |

DESCRIPTION OF CAPITAL STRUCTURE | |

MARKET FOR SECURITIES | |

DIRECTORS AND OFFICERS | |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | |

TRANSFER AGENTS AND REGISTRARS | |

MATERIAL CONTRACTS | |

INTERESTS OF EXPERTS | |

ADDITIONAL INFORMATION | |

AUDIT COMMITTEE | |

| SCHEDULE A AUDIT COMMITTEE CHARTER | |

| SCHEDULE B TECHNICAL INFORMATION CONCERNING THE SOUTH ARTURO MINE | B-1 |

| SCHEDULE C TECHNICAL INFORMATION CONCERNING THE MERCEDES MINE | C-1 |

GENERAL MATTERS

The information contained in this annual information form (“AIF”), unless otherwise indicated, is given as of December 31, 2020. More current information may be available on our public website at www.nomadroyalty.com, or on our SEDAR profile at www.sedar.com.

All capitalized terms used in this AIF and not defined herein have the meaning ascribed in the “Glossary of Terms” or elsewhere in this AIF.

Unless otherwise noted or the context otherwise indicates, the term “Nomad” or the “Corporation” refers to Nomad Royalty Company Ltd. and its subsidiaries.

For reporting purposes, Nomad presents its financial statements in U.S. dollars and in conformity with IFRS.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This AIF contain “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking information may include, but is not limited to, information with respect to the Corporation’s objectives and the strategies to achieve these objectives, as well as information with respect to the Corporation’s beliefs, plans, expectations, anticipations, estimates, intentions, results, levels of activity, performance, goals and achievements. This forward-looking information is identified by the use of terms and phrases such as “may”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe”, “to its knowledge” or “continue”, the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking information contains these terms and phrases.

The forward-looking information contained in this AIF, is provided for the purpose of assisting the reader in understanding the Corporation’s financial performance and prospects and to present management’s assessment of future plans and operations. The reader is cautioned that such information may not be appropriate for other purposes.

Although the forward-looking information contained in this AIF, is based upon what the Corporation believes are reasonable assumptions in light of information currently available, investors are cautioned against placing undue reliance on this information since actual results may vary from the forward-looking information as a number of known and unknown risks, uncertainties and other important factors could cause the actual results to differ materially from the beliefs, plans, objectives, anticipations, estimates and intentions expressed in such forward-looking statements, including but not limited to: public health crises, including the COVID-19 pandemic, changes in commodity prices, limited or lack of control over the operation of properties and the operators’ failure to perform or decision to cease or suspend operations, adverse developments related to any Material Projects on Material Properties, failure to achieve commercial production by properties, changes in operators and any failure of such operator, acquisition of interests in respect of speculative properties, limited access to data and disclosure regarding the operation of properties, dependence on the operators for the calculation of certain payments, dependence on the payment or delivery by the owners and operators of the properties, global financial conditions, counterparty and liquidity risk, failure by operators to honour royalty, stream and other interests, unsecured or subordinated interests, foreign exchange, failure by operators to replace depleted Mineral Reserves and Mineral Resources, acquisitions involving the issuance of the Corporation’s securities or the incurrence of indebtedness, increased competition for royalties, streams and other interests, mergers and amalgamations, rights in favour of others or third

parties, failure to obtain adequate or favourable financing, attraction and retention of qualified management and technical personnel, conflicts of interest, interpretation of tax legislation and accounting rules, inability to repay indebtedness and comply with obligations under future credit facilities, dependence on information systems, reputational damage, indirect exposure to many of the same risks affecting the owners and operators of properties, dependence on operators’ employees, differences between actual and estimated Mineral Reserves and Mineral Resources, uncertainty relating to Inferred Mineral Resources, inaccuracy of production forecasts, exploration and development of mineral properties, defects in title to properties underlying the Corporation’s interests, litigation affecting the properties underlying the Corporation’s interests, defects or disputes relating to the Corporation’s interests, challenges and risks associated with an expansion of Corporation’s business beyond the acquisition of royalties, streams or other interests, delays or a failure by an operator to obtain, comply with or maintain property rights, permits and licences, construction, development and/or expansion in relation to the mines, projects and properties in respect of which the Corporation holds an interest, environmental and endangered species laws and regulations, international climate change initiatives, foreign jurisdictions and developing economies, changes in government regulation, operations in developing economies, corruption and anti-bribery law violations, availability of adequate infrastructure, indigenous peoples, environment, social and governance (ESG) matters, adverse tax consequences of foreign income, uninsured risks, loss of entire investment, market fluctuations, sale or issuance of a significant number of Common Shares into public markets, significant influence of the Orion Group, future offerings of debt securities, issuance of additional equity, discretionary issuance of dividends, no existing trading market for Preference Shares, Subscription Receipts, Warrants, Debt Securities or Units, issuance of unsecured debt, discretion concerning the use of proceeds, increased costs as a result of being a public company in Canada and the United States, and whether or not the Corporation is determined to be a “passive foreign investment company under applicable U.S. federal income tax rules. Further information regarding these risks and uncertainties may be found under the heading “Risk Factors”.

All of the forward-looking information contained in this AIF are expressly qualified by the foregoing cautionary statements. There can be no guarantee that the results or developments that the Corporation anticipates will be realized or, even if substantially realized, that they will have the expected consequences or effects on the Corporation’s business, financial condition or results of operations. The Corporation does not undertake to update or amend such forward-looking information whether as a result of new information, future events or otherwise, except as may be required by applicable law. Unless otherwise stated, the forward-looking information contained in AIF is made as of the date hereof.

CAUTIONARY STATEMENT REGARDING THIRD PARTY INFORMATION

The disclosure in this AIF relating to the properties in which Nomad holds royalties, streams or other interests and the operations on such properties is based on information publicly disclosed by the owners or operators of these properties and information or data available in the public domain as at March 26, 2021 (except where stated otherwise), and none of this information or data has been independently verified by Nomad. As a holder of royalties, streams and other interests, Nomad generally has limited, if any, access to the properties included in or relating to its asset portfolio. Nomad may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Therefore, in preparing disclosure pertaining to the properties in which Nomad holds royalties, streams or other interests and the operations on such properties, Nomad is dependent on information publicly disclosed by the owners or operators of these properties and information or data available in the public domain and generally has limited or no ability to independently verify such information or data. Although Nomad has no knowledge that such information or data is incomplete or inaccurate, there can be no assurance that such third party

information or data is complete or accurate. Additionally, some information or data publicly reported by the owners or operators may relate to a larger property than the area covered by the royalties, streams or other interests of Nomad.

Mineral reserves and mineral resources presented in this AIF have been estimated as at December 31, 2020 (unless otherwise noted) in accordance with NI 43-101 and the Canadian Institute of Mining and Metallurgy Classification System, as required by Canadian securities regulatory authorities. Mineral resources are reported on an inclusive basis and include all areas that form reserves. For United States reporting purposes, the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7 (“Guide 7”), which will be rescinded from and after the required compliance date of the SEC Modernization Rules. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured”, “indicated” and “inferred” mineral resources. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions, as required by NI 43-101. Under the MJDS, the Corporation is permitted to use its Canadian disclosures, including reserve and resource disclosures pursuant to NI 43-101, to satisfy certain United States periodic reporting obligations. As a result, Nomad does not report reserves and resources under the SEC Modernization Rules, and as such, Nomad’s mineral reserve and mineral resource disclosure may not be directly comparable to the disclosures made by domestic United States issuers or non-domestic United States issuers that do not rely on MJDS.

Investors are also cautioned that while NI 43-101 and subpart 1300 of SEC Regulation S-K recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources”, or “inferred mineral resources” disclosed in this AIF are or will be economically or legally mineable. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Vincent Cardin-Tremblay, P.Geo., Vice President, Geology of the Corporation and a “Qualified Person” under NI 43-101 has reviewed and approved the written scientific and technical disclosure contained in this AIF.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

The information presented in this AIF, may include non-IFRS measures that are used by us as indicators of financial performance. These financial measures do not have standardized meanings prescribed under IFRS and our computation may differ from similarly-named computations as reported by other entities and, accordingly, may not be comparable. These financial measures should not be considered as an alternative to, or more meaningful than, measures of financial performance as determined in accordance with IFRS as an indicator of performance. We believe these measures may be useful supplemental information to assist investors in assessing our operational performance and our ability to generate cash through operations. The non-IFRS measures also provide investors with insight into our decision making as we use these non-IFRS measures to make financial, strategic and operating decisions.

Because non-IFRS measures do not have a standardized meaning and may differ from similarly-named computations as reported by other entities, securities regulations require that non-IFRS measures be clearly defined and qualified, reconciled with their nearest IFRS measure and given no more prominence than the closest IFRS measure. If non-IFRS measures are included in documents incorporated by reference herein, information regarding these non-IFRS measures is presented in the sections dealing with these financial measures in such documents.

These non-IFRS measures have important limitations as analytical tools and investors are cautioned not to consider them in isolation or place undue reliance on ratios or percentages calculated using these non-IFRS measures.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

We report in United States dollars. Consequently, all amounts in this AIF are in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars, and references to “C$” are to Canadian dollars. See “Cautionary Statement Regarding Forward-Looking Statements”.

The following table sets out for each period indicated: (i) the daily exchange rates in effect at the end of the period; (ii) the high and low daily exchange rates during such period; and (iii) the average daily exchange rates for such period, for one United States dollar, expressed in Canadian dollars, as quoted by the Bank of Canada.

| | | | | | | | | | | | | | | | | |

| | | Year ended December 31 | |

| | 2020 | | 2019 |

| | C$ | | C$ |

| Closing | | 1.2732 | | 1.2988 |

| High | | 1.4496 | | 1.3600 |

| Low | | 1.2718 | | 1.2988 |

| Average | | 1.3415 | | 1.3269 |

The daily exchange rate on March 29, 2021 as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$1.00 equals C$1.2594.

COMMODITY PRICE INFORMATION

| | | | | | | | |

| Average Spot Commodity Prices |

| 2020 | 2019 |

| Gold (LBMA pm $/oz)................... | 1,771 | 1,393 |

| Silver (LBMA $/oz)........................ | 20.55 | 16.18 |

GLOSSARY OF TERMS

In this AIF, the following capitalized words and terms shall have the following meanings:

“affiliate” has the meaning ascribed in the Securities Act (Québec), unless stated otherwise.

“Ag” is the chemical symbol for silver.

“AIF” has the meaning ascribed under “General Matter”.

“associate” has the meaning ascribed in the Securities Act (Québec), unless stated otherwise.

“Artemis Gold” means Artemis Gold Inc.

“Au” is the chemical symbol for gold.

“AuEq” means gold equivalent.

“Blackwater Gold Project” means the development project located in central British Columbia, Canada and operated by Artemis Gold.

“Blackwater Report” means the NI 43-101 technical report entitled “Blackwater Gold Project British Columbia NI 43-101 Technical Report on Pre-Feasibility” with an effective date of August 26, 2020, prepared for Artemis Gold, and filed under Artemis Gold’s SEDAR profile at www.sedar.com.

“Blackwater Gold Royalty” means the 0.21% NSR royalty on the Blackwater Gold Project.

“Blyvoor Capital” means Blyvoor Gold Capital (Pty) Ltd.

“Blyvoor Gold” means Blyvoor Gold (Pty) Ltd.

“Blyvoor Gold Mine” means the Blyvoor gold mine located 75 kilometres southwest of Johannesburg in Gauteng Province, Republic of South Africa, owned and operated by Blyvoor Gold.

“Blyvoor Gold Stream” means the gold stream on the Blyvoor Gold Mine described under “Description of Business - Description of the Assets - Blyvoor Gold Stream – Witwatersrand Gold Belt, South Africa - Blyvoor Gold (Pty) Ltd.”.

“Board” means the board of directors of the Corporation.

“Bonikro Gold Mine” means the Bonikro gold mines located in Hiré, Côte d’Ivoire, approximately 250 kilometres north-west of the commercial capital Abidjan, operated by Allied Gold Corp.

“Bonikro Gold Stream” means the gold stream on the Bonikro Gold Mine described under “Description of Business - Description of the Assets - Bonikro Gold Stream – Hiré, Côte d’Ivoire – Allied Gold Corp.”.

“CBCA” means the Canada Business Corporations Act and the regulations made thereunder.

“CIM” means the Canadian Institute of Mining, Metallurgy and Petroleum.

“cm3” means cubic centimetre.

“Common Shares” means the common shares in the share capital of Nomad.

“Coral” means Coral Gold Resources Ltd., a company existing pursuant to the Business Corporations Act (British Columbia).

“Corporation” or “Nomad” means Nomad Royalty Company Ltd.

“Credit Facility” has the meaning ascribed thereto in section “General Development of the Nomad’s Business – New Revolving Credit Security”.

“DCP” means the exploitation of the sulphide orebody within the mining rights forming part of the Gualcamayo Mine set forth in the agreement providing for the commercial Production DCP Payment that extends below the current oxide Quebrada Del Diablo Lower West (QDD-LW) orebody and is primarily associated with the South West (SW) orebody.

“DCP Commercial Production” with respect to the DCP means mining on a commercial basis but shall not mean mining for the purposes of testing and, for greater certainty, excludes the milling or leaching by a pilot plant or during an initial tune-up period of a plant and also excludes bulk sampling. DCP Commercial Production is deemed to have commenced with respect to the DCP: (i) if a milling and treatment plant is located on the mining rights forming part of the Gualcamayo Mine set forth in the DCP Payment Agreement, on the first day of the month following the first period of 60 consecutive days during which products from the DCP have been processed through such plant at an average rate of not less than 70% of the initial rated capacity of such plant; or (ii) if no milling and treatment plant is located on the mining rights forming part of the Gualcamayo Mine set forth in the DCP Payment Agreement, on the first day of the month following the first period of 60 consecutive days during which products from the DCP have been produced at a tonnage representing not less than 70% of the targeted tonnage and shipped for custom milling on the basis of the mine plan for the DCP.

“DCP Commercial Production Payment” means the right of Nomad to receive a contingent payment of $30 million within five business days of the commencement of DCP Commercial Production on the mining right forming part of the Gualcamayo Mine set forth in the agreement providing for the DCP Commercial Production Payment.

“Deferred Payment” has the meaning ascribed under “General Development of the Nomad’s Business – Reverse Takeover”.

“development” means the preparation of a mineral deposit for commercial production including installations of plant and machinery and the construction of all related facilities.

“DSUs” means deferred share units of Nomad.

“Equinox Gold” means Equinox Gold Corp.

“ESG” means environmental, social and corporate governance.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“exploration” means the prospecting, mapping, sampling, remote sensing, geophysical surveying, diamond drilling and other work involved in the searching for ore bodies.

"ff" means feet.

“forward-looking information” has the meaning ascribed under the heading “Cautionary Statement Regarding Forward-Looking Statements”.

“FSE” means the Frankfurt Stock Exchange.

“GEOs” means gold equivalent ounces.

“GHRC Committee” means the Governance, Human Resources, Nominating and Compensation Committee of the Corporation.

“Gualcamayo Gold Royalty” means the NSR royalty on the Gualcamayo Mine described in the section “Description of Business - Description of the Assets - Gualcamayo Gold Royalty and DCP Commercial Production Payment – San Juan, Argentina – Mineros S.A.”.

“Gualcamayo Mine” means the Gualcamayo mine located in the Province of San Juan, Argentina and currently operated by Mineros S.A.

“Heron” means Heron Resources Limited.

“i-80” has the meaning ascribed under “Description of Business - Description of the Assets - Mercedes and South Arturo Silver Stream – Mexico & Nevada, U.S.A. – Premier Gold”.

“IFRS” means the International Financial Reporting Standards as issued by the International Accounting Standards Board.

“Investor Rights Agreement” has the meaning ascribed under “General Development of the Nomad’s Business – Reverse Takeover”.

“IT” means information technology.

“July 2020 Warrants” means common share purchase warrants of the Corporation issued on July 31, 2020 in connection with the acquisition of the Troilus Gold Royalty. Each July 2020 Warrant entitles its holder thereof to purchase one Common Share at a price of C$1.75 until July 31, 2022. If the daily volume-weighted average trading price of the Common Shares on the TSX exceeds C$2.19 for any period of 20 consecutive trading days after December 4, 2020, the Corporation will have the right to give notice in writing to the holders of the July 2020 Warrants that the July 2020 Warrants will expire 30 days following such notice, unless exercised prior thereto.

“k” means thousand.

“km²” means square kilometre.

“Lead Marketing Fee Agreement” means the lead marketing agreement between Tarago and OMF LI dated June 29, 2017, relating to the Woodlawn Mine which was acquired by the Corporation in the context of the Orion Vend-In described in section “The Corporation – Nomad Portfolio Assets – Woodlawn Silver Stream and Lead Marketing Fee Agreement – New South Wales, Australia – Heron Resources Limited”.

“m” means metre.

“Mercedes and South Arturo Silver Stream” means the silver stream on the Mercedes Mine and the South Arturo Mine described in section “Description of Business - Description of the Assets - Mercedes and South Arturo Silver Stream – Mexico & Nevada, U.S.A. – Premier Gold”.

“Mercedes Mine” means the Mercedes mine located in the state of Sonora in Mexico, owned and operated by Premier Gold.

“MJDS” means the multi-jurisdictional disclosure system.

“Moss Gold Mine” means the Moss Gold Mine located in northwest Arizona, United States, owned and operated by Northern Vertex Mining Corp.

“Moss Gold Royalty” means the NSR royalty on the Moss Gold Mine described in section “Description of Business - Description of the Assets - Moss Gold Royalty – Arizona, U.S.A. - Northern Vertex Mining Corp.”.

“Moss Press Release” means the press release of Northern Vertex Mining Corp. dated March 17, 2020 entitled “Northern Vertex Reports Update to Mineral Resources Estimate at Moss Mine” filed under Vertex Mining Corp’s SEDAR profile at www.sedar.com.

“Mt” means million tonnes (metric tons).

“NI 51-102” means National Instrument 51-102 - Continuous Disclosure Obligations (or Regulation 51-102 respecting Continuous Disclosure Obligations in the Province of Québec).

“Nomad DSUs” means the deferred share units granted pursuant to the deferred share unit plan of the Corporation.

“Nomad Options” means options to purchase Common Shares granted pursuant to the stock option plan of the Corporation.

“Nomad RSUs” means the restricted share units granted pursuant to the restricted share unit and performance share unit plan of the Corporation.

“Northern Vertex Release” means the press release of Northern Vertex Mining Corp. dated March 17, 2020 entitled “Northern Vertex Reports Update to Mineral Resources Estimate at Moss Mine” filed under Vertex Mining Corp’s SEDAR profile at www.sedar.com.

“November 2020 Warrants” has the meaning ascribed under “General Development of the Nomad’s Business – Acquisition of Coral”

“NSR” means net smelter return, unless otherwise indicated.

“ore” means a natural aggregate of one or more minerals which, at a specified time and place may be mined, processed and sold at a profit, or from which some part may profitably be separated.

“OMF II” means Orion Mine Finance Fund II LP, a limited partnership existing under the laws of Bermuda.

“OMF III” means Orion Mine Finance Fund III LP, a limited partnership existing under the laws of the Cayman Islands.

“OMF LI” means OMF Fund II (LI) LP, a limited partnership existing under the laws of Bermuda.

“OMF (Mg)” means OMF Fund III (Mg) Ltd., a corporation continued pursuant to the CBCA.

“OMF SO” means OMF Fund II SO Ltd., a corporation continued pursuant the CBCA.

“Orion Group” means, collectively, OMF II, OMF III and OMF LI.

“Orion Portfolio Assets” means, collectively, (i) all of the issued and outstanding shares of OMF SO, which holds all rights, title and interests in and to the Mercedes and South Arturo Silver Stream, the Blyvoor Gold Stream, and the Premier Gold Prepay Loan, including, for greater certainty, all rights, title and interests in and to the agreements, security documents and other documents in respect thereof, (ii) all of the issued and outstanding shares of OMF (Mg), which holds all rights, title and interests in and to the Bonikro Gold Stream held, including, for greater certainty, all rights, title and interests in and to the agreements, security documents and other documents in respect thereof, and (iii) the Woodlawn Silver Stream and the Lead Marketing Fee Agreement, including, for greater certainty, all rights, title and interests in and to the agreements, security documents and other documents in respect thereof.

“Orion Vend In” means the acquisition by Nomad of the Orion Portfolio Assets from the Orion Group in exchange for the issuance of an aggregate of 396,455,965 Common Shares, the whole in accordance with the terms of the Orion Vend In Agreement.

“Orion Vend In Agreement” means the acquisition agreement dated February 23, 2020 entered into among Guerrero Ventures Inc. (now Nomad) and the Orion Group in respect of the Orion Vend In.

“OTCQX” means the OTCQX market of the OTC Markets Group platform.

“outcrop” means an exposure of rock or mineral deposit that can be seen on surface, not covered by soil or water.

“oz” means ounce.

“Preference Shares” means the preference shares in the share capital of Nomad.

“Premier Gold” means Premier Gold Mines Limited.

“Premier Gold Arrangement” has the meaning ascribed under "Description of Business - Description of the Assets - Mercedes and South Arturo Silver Stream – Mexico & Nevada, U.S.A. – Premier Gold".

“Premier Gold AIF” means the annual information form of Premier Gold for the year ended December 31, 2019, dated March 27, 2020 and filed under Premier Gold’s SEDAR profile at www.sedar.com on March 30, 2020.

“Premier Gold Prepay Loan” means the second amended and restated gold prepay credit agreement dated March 4, 2020 between, among others, Premier Gold Mines (Cayman) Ltd. and OMF SO.

“qualified person” has the meaning ascribed in NI 43-101.

“RDM Gold Mine” means the Riacho dos Machados Gold Mine located in the northern part of Minas Gerais, Brazil, operated by Mineração Riacho dos Machados, a wholly-owned subsidiary of Equinox Gold.

“RDM Gold Royalty” means the NSR Royalty on the RDM Gold Mine described in the section “Description of Business - Description of the Assets - RDM Gold Royalty – Minas Gerais, Brazil – Equinox Gold Corp.”.

“RDM Report” means the NI 43-101 technical report entitled “Technical Report on the Riacho Dos Machados Gold Mine, Minas Gerais, Brazil” dated March 27, 2020 with an effective date of May 31, 2018, prepared for Equinox Gold. and filed under Equinox’s SEDAR profile at www.sedar.com.

“Robertson Gold Royalty” means the sliding scale NSR royalty on the Robertson Property, described in the section “Description of Business - Description of the Assets - Robertson Gold Royalty – Nevada U.S.A – Barrick Gold Corporation”.

“Robertson Property” means the advanced-stage exploration property of Barrick Cortez Inc., a wholly-owned subsidiary of Barrick Gold Corporation, located in the Barrick-Cortez complex in Nevada, United States.

“RTO” has the meaning ascribed under “Corporate Structure”.

“SBMM” means Serra Da Borda Mineração E Metalurgia S.A., an affiliate of Yamana.

“SEC” means the United States Securities and Exchange Commission.

“SEDAR” means the System for Electronic Document Analysis and Retrieval.

“Shareholders” means the holders of Common Shares and Preference Shares.

“Shelf Prospectus” has the meaning ascribed thereto in section “General Development of the Nomad’s Business – Filing of Base Shelf Prospectus”.

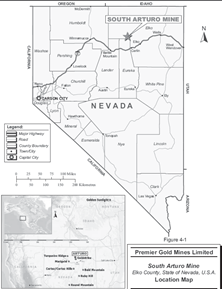

“South Arturo Mine” means the South Arturo Mine located Nevada, United States, which is 60% owned and operated by Nevada Gold Mines LLC, a joint venture between Barrick Gold Corporation and Newmont Corporation, and 40% owned by a Goldcorp Dee LLC, an indirect wholly-owned subsidiary of Premier Gold.

“South Arturo Report” means the NI 43-101 technical report entitled “Preliminary Feasibility Study for the South Arturo Mine, Elko County, NV” dated January 25, 2021, with an effective date of December 1, 2020, prepared for Premier Gold and i-80 and filed under Premier Gold’s SEDAR profile at www.sedar.com.

“Suruca Gold Royalty” means the 2% NSR royalty on the Suruca Project.

“Suruca Project” means the project to develop the Suruca gold deposit located in Goias State, Brazil, operated by Mineração Maracá Indústria e Comércio S.A., a subsidiary of Lundin Mining Corporation.

“Suruca Project Report” means the NI 43-101 technical report entitled “Technical Report on the Chapada Mine, Goias State, Brazil” dated October 10, 2019 with an effective date of June 30, 2019, prepared for Lundin Mining Corporation, and filed under Lundin Mining Corporation’s SEDAR profile at www.sedar.com.

“t” means tonne.

“Threshold Gold Price Clause” has the meaning ascribed under “Description of Business - Description of the Assets - Mercedes and South Arturo Silver Stream – Mexico & Nevada, U.S.A. – Premier Gold”.

“Troilus PEA” means the NI 43-101 technical report entitled “Preliminary Economic Assessment of the Troilus Gold Project, Quebec, Canada” dated October 14, 2020 with an effective date of August 31, 2020, prepared for Troilus Gold Corp., and filed under Troilus Gold Corp’s SEDAR profile at www.sedar.com

“Troilus Gold Project” means the advance gold exploration project of Troilus Gold Corp. comprised of 81 mining claims and one surveyed lease located within the Frotêt-Evans Greenstone Belt in the province of Québec, Canada.

“Troilus Gold Royalty” means the 1% NSR royalty on all metals and minerals produced from the Troilus Gold Project.

“TSX” means Toronto Stock Exchange.

“TSXV” means the TSX Venture Exchange.

“Valkyrie” means Valkyrie Royalty Inc.

“Woodlawn Mine” means the Woodlawn mine located north of Canberra in New South Wales, Australia, operated by Heron.

“Woodlawn Silver Stream” means the silver stream on the Woodlawn Mine described in section “Description of Business - Description of the Assets - Woodlawn Silver Stream and Lead Marketing Fee Agreement – New South Wales, Australia - Heron Resources Limited”.

“Yamana” means Yamana Gold Inc.

“Yamana Group” means, collectively, Yamana and SBMM.

“Yamana Vend In” means the acquisition of the RDM Gold Royalty, the Gualcamayo Gold Royalty, the DCP Commercial Production Payment, and the Suruca Gold Royalty by Nomad from the Yamana Group in exchange for (i) the issuance of an aggregate of 66,500,000 Common Shares, and (ii) a cash payment in the amount of $20 million (a maximum of $10 million of which may be deferred pursuant to the Yamana deferred payment agreement), the whole in accordance with the terms of the Yamana Vend In Agreement.

“Yamana Vend In Agreement” means the royalty and contingent payment purchase agreement dated February 23, 2020 entered into among Guerrero Ventures Inc. (now Nomad) and the Yamana Group in respect of the Yamana Vend In.

NI 43-101 Definitions

| | | | | |

“Indicated Mineral Resource” | Refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

“Inferred Mineral Resource” | Refers to that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

“Measured Mineral Resource” | Refers to that part of a Mineral Resource for which quantity grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

“Mineral Reserve” | Refers to the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that might occur when the material is mined. Mineral Reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit: probable Mineral Reserves and proven Mineral Reserves. |

“Modifying Factors” | Modifying Factors are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

| | | | | |

“NI 43-101” | National Instrument 43-101 - Standards of Disclosure for Mineral Projects. An instrument developed by the Canadian Securities Administrators (an umbrella group of Canada’s provincial and territorial securities regulators) that governs public disclosure by mining and mineral exploration issuers. The instrument establishes certain standards for all public disclosure of scientific and technical information concerning mineral projects. |

“pre-feasibility study” and “feasibility study” | Refers to a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. Feasibility studies have a greater degree of confidence associated with all aspects. |

“preliminary assessment” | The term “preliminary assessment” or “preliminary economic assessment”, commonly referred to as a scoping study, means a study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study. |

“Probable Mineral Reserve” | Refers to an economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. |

“Proven Mineral Reserve” | A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. |

“qualified person” | Means an individual who (a) is an engineer or geoscientist with at least five years experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; (b) has experience relevant to the subject matter of the mineral project and the technical report; and (c) is a member in good standing of a professional association that, among other things, is self-regulatory, has been given authority by statute, admits members based on their qualifications and experience, requires compliance with professional standards of competence and ethics and has disciplinary powers to suspend or expel a member, as defined in NI 43-101. |

The terms “Mineral Resource”, “Measured Mineral Resource”, “Modification Factors”, “Indicated Mineral Resource”, “Inferred Mineral Resource”, “Probable Mineral Reserve” and “Proven Mineral Reserve” used are Canadian mining terms as defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards.

Conversion Factors

| | | | | | | | | | | | | | |

| To Convert From | | To | | Multiply By |

| Feet | | Metres | | 0.305 |

| Metres | | Feet | | 3.281 |

| Acres | | Hectares | | 0.405 |

| Hectares | | Acres | | 2.471 |

| Grams | | Ounces (Troy) | | 0.03215 |

| Grams/Tonnes | | Ounces (Troy)/Short Ton | | 0.02917 |

| Tonnes (metric) | | Pounds | | 2,205 |

| Tonnes (metric) | | Short Tons | | 1.1023 |

CORPORATE STRUCTURE

Name, Address and Incorporation

The Corporation is governed by the CBCA, after having previously been continued from the Business Corporations Act (British Columbia) on December 20, 2019. It was originally incorporated as a special limited company in British Columbia on February 20, 1961 under the name Copper Soo Mining Company Limited (Non-Personal Liability) by Memorandum and Articles filed with the Registrar of Companies for British Columbia.

On July 22, 1969, the Corporation converted from a non-personal liability company to a limited company and changed its name to Beaumont Resources Limited. On July 23, 1973, November 22, 1978, December 3, 1984 and August 19, 2014, the Corporation changed its name to Consolidated Beaumont Resources Ltd., Conbeau Resources Ltd., Inlet Resources Ltd. and Guerrero Ventures Inc., respectively.

On December 20, 2019, the Corporation completed its continuance under the CBCA, and amended its authorized share capital to consist of an unlimited number of Common Shares and an unlimited number of Preference Shares issuable in one or more series.

On May 25, 2020, the Corporation changed its name from Guerrero Ventures Inc. to Nomad Royalty Company Ltd. in the context of the reverse takeover transaction completed by the Corporation on May 27, 2020 comprised of the Orion Vend-In and the Yamana Vend-In.

The Common Shares are listed and posted for trading on the TSX under the symbol “NSR”. The Common Shares are also quoted for trading in the United States on the OTCQX and in Germany on the FSE under the symbols “NSRXF” and “IRLB”, respectively.

As of the date of this AIF, Nomad is a reporting issuer in each of the provinces of Canada.

The head office and registered office of the Corporation is located at 1275 Avenue des Canadiens-de-Montréal, Suite 500, Montreal, Québec, H3B 0G4, Canada.

Intercorporate Relationships

A majority of the Corporation’s business is carried on through its various subsidiaries. The following table illustrates the Corporation’s material subsidiaries, including their respective jurisdiction of incorporation or continuance and the percentage of votes attaching to all voting securities of each subsidiary that are beneficially owned or controlled, directly or indirectly, by the Corporation.

| | | | | | | | |

| Name | Place of Incorporation | Ownership Percentage |

| Coral Gold Resources Ltd. | British Columbia | 100% |

Coral Resources Inc.(1) | Nevada, USA | 100% |

| OMF Fund II SO Ltd. | Canada | 100% |

| OMF Fund III (Mg) Ltd. | Canada | 100% |

| Valkyrie Royalty Inc. | British Columbia | 100% |

____________________

(1) Held by Coral Gold Resources Ltd.

GENERAL DEVELOPMENT OF NOMAD’S BUSINESS

History of the Corporation

The Corporation was historically an exploration-stage company in the business of acquiring, exploring and developing mining properties. Throughout its existence, the Corporation held interests in various properties at the exploration stage located in Canada, Mexico and Indonesia. In 2014, the Corporation completed a plan of arrangement pursuant to which it indirectly acquired an interest in mineral exploration concessions located in Guerrero State, Mexico. In October 2019, the Corporation completed transactions pursuant to which it divested its indirect interest in the Biricu property located in Guerrero State, Mexico, and became a “shell” company whose principal activity was to identify and evaluate businesses or assets with the aim of completing a transaction to reactivate its activities.

Recent Transformational Transactions

Reverse Takeover

On May 27, 2020, Nomad completed an RTO comprised of two related vend-in transactions. The RTO involved the acquisition by Nomad of an aggregate of six stream and gold loan assets from the Orion Group for total consideration of $268 million as well as the acquisition of three royalties and a contingent payment on the commencement of commercial production of one project from the Yamana Group for total consideration of $65 million.

The Corporation satisfied the purchase price payable to the Orion Group by issuing 396,455,965 Common Shares at a price of C$0.90 per share and satisfied the purchase price payable to the Yamana Group by issuing 66,500,000 Common Shares at a price of C$0.90 per share and by paying $10 million in cash, with a further $10 million deferred pursuant to a deferred payment agreement between the Corporation and Yamana (the “Deferred Payment”). The Deferred Payment of $10 million has a two-year term (subject to an early redemption feature) and bears interest at an annual rate of 3%. The principal amount of the Deferred Payment and interest thereon is convertible, at any time, at the option of Yamana into Common Shares at a price of C$0.90 per share.

In connection with the RTO, Nomad graduated from the TSXV to the TSX. The Common Shares commenced trading on the TSX on May 29, 2020 under the symbol “NSR”. In addition, on May 22, 2020 the Corporation changed its name from Guerrero Ventures Inc. to Nomad Royalty Company Ltd.

In connection with the vend-in transactions with the Orion Group and the Yamana Group, the Corporation, the Orion Group and Yamana entered into an investor rights agreement (the “Investor Rights Agreement”) dated May 27, 2020, pursuant to which the Orion Group, Yamana and the Corporation agreed, among other things, that:

•the Orion Group is subject to a twelve-month lockup period in respect of its Common Shares and Yamana is subject to a similar six-month lockup period in respect of its Common Shares;

•for so long as the Orion Group holds at least 50% of the issued and outstanding Common Shares, it has the right to nominate for election 50% (rounded up to the nearest whole number) of the directors of the Corporation, provided that, the foregoing right will be reduced proportionately in increments of 10% commensurate with the Orion Group’s ownership, subject to the condition that the Orion Group must hold at least 10% of the Common Shares in order to have the right to propose nominees for election as directors;

•for so long as the Orion Group holds at least 50% of the issued and outstanding Common Shares, the Corporation may not increase the size of the board of directors of the Corporation above seven members without the prior written consent of the Orion Group;

•for so long as Yamana holds at least 10% of the issued and outstanding Common Shares, it has the right to propose one nominee for election as a director of the Corporation; and

•each of Yamana and the Orion Group have a participation right, for so long as each holds at least 10% of the issued and outstanding Common Shares, to maintain their respective percentage shareholding interest in the Corporation at the time of any financing by the Corporation, whether public or private. The foregoing right does not apply in the event of an issuance of Common Shares by the Corporation (a) upon the exercise of stock options or other incentive securities, (b) upon the conversion of outstanding convertible securities of the Corporation, (c) in connection with or pursuant to any merger, business combination, exchange offer, take-over bid, arrangement, asset purchase transaction or other acquisition of assets or shares of a third party by the Corporation, (d) issued pursuant to a rights offering that is offered to all of the Corporation’s shareholders, or (e) upon or resulting from a subdivision of the Common Shares (by a split of Common Shares or otherwise), payment of stock dividend, or any other recapitalization or reorganization transaction.

The Orion Group nominated Istvan Zollei and Matthew Gollat to be its director nominees and Yamana nominated Gerardo Fernandez to be its director nominee, both pursuant to the Investor Rights Agreement and upon the closing of the vend-in transactions with the Orion Group and the Yamana Group, Messrs. Zollei, Gollat and Fernandez were appointed to the Board, which was comprised of seven members at the closing of the RTO. In order to allow the Orion Group to exercise its nomination right in full as described above, the Investor Rights Agreement provides the Orion Group with the right to request that the size of the Board be increased to up to nine members. Furthermore, the Investor Rights Agreement provides the Orion Group with the right to cause the Corporation to reduce the number of management directors on the Board from two, as is currently the case, to one, provided that the Orion Group holds at least 50% of the issued and outstanding Common Shares and the Orion Group has caused the size of the Board to be increased to nine members. As a result of the foregoing, the Orion Group will be entitled to nominate five of the nine members of the Board if the size of the Board is increased from seven to nine members.

Following the completion of the RTO, the Board was composed of the following persons: Vincent Metcalfe, Robin Weisman, Istvan Zollei, Gerardo Fernandez, Jamie Porter, Matthew Gollat and Joseph de la Plante.

Concurrent Private Placement

In connection with the RTO, the Corporation completed an offering of subscriptions receipts for aggregate gross proceeds of up to C$13,300,000. A portion of the proceeds from the private placement was used to fund the cash component of the consideration payable to the Yamana Group. Upon completion of the vend-in transactions with the Orion Group and the Yamana Group, each subscription receipt was automatically exchanged for one Common Share. Following completion of the RTO and the private placement, the Corporation had 511,015,979 Common Shares issued and outstanding, of which the Orion Group held 396,455,965 Common Shares (representing 77.58% of the then-issued and outstanding Common Shares) and Yamana held 66,500,000 Common Shares (representing 13.01% of the then-issued and outstanding Common Shares).

Acquisition of the Troilus Gold Royalty

On July 31, 2020, Nomad completed the acquisition from a private vendor of an existing NSR royalty on the Troilus Gold Project. Consideration consisted of $1.9 million (C$2.5 million) in cash and 5,769,231 units of the Corporation, each comprised of one common share and one-half of one common share purchase warrant.

Continuation of OMF SO & OMF (Mg)

On August 11, 2020, the wholly-owned subsidiaries of the Corporation, OMF SO and OMF (Mg), were continued from the Companies Law (Cayman Islands) into the CBCA.

New Revolving Credit Facility

On August 17, 2020, the Corporation entered into a credit agreement with the Bank of Nova Scotia, Canadian Imperial Bank of Commerce, and the Royal Bank of Canada for a $50 million revolving credit facility (the “Credit Facility”) with an option to increase to $75 million, subject to the satisfaction of certain conditions. The Credit Facility is secured by all of the Corporation’s assets and has an 18-month term, extendable upon mutual agreement between the parties to the Credit Facility.

Adoption of an Annual Dividend Policy

On August 26, 2020, the Corporation announced that the Board adopted an annual dividend policy for the Corporation of C$0.02 per Common Share, payable quarterly. The first quarterly dividend of C$0.005 per Common Share was payable on October 15, 2020 to Nomad shareholders of record as of the close of business on September 30, 2020. In 2020, the dividend declared amounted to C$4.2 million and the dividend paid amounted to C$2.0 million.

Addition to the Board

On August 24, 2020, the Orion Group consented pursuant to the Investor Rights Agreement to increasing the size of the Board from seven members to eight members.

On August 27, 2020, Susan Kudzman was appointed as a director of the Corporation. Ms. Kudzman is a director nominee of the Orion Group pursuant to the Investor Rights Agreement.

Acquisition of the Moss Gold Royalty

On September 28, 2020, the Corporation closed its acquisition of all of the outstanding shares of Valkyrie, a private royalty company, that owns an NSR royalty on the Moss Gold Mine located in Arizona, United States. Consideration consisted of 7,399,970 Common Shares of the Corporation.

Filing of Base Shelf Prospectus

On September 30, 2020, the Corporation filed a short form base shelf prospectus (the “Shelf Prospectus") with the securities regulatory authorities in each of the provinces of Canada, pursuant to which the Corporation is allowed to make offerings of Common Shares, Preference Shares, subscription receipts, warrants, debt securities, units or any combination thereof, up to a maximum of $300 million during the 25-month period in which the Shelf Prospectus is effective.

Acquisition of Coral

On November 19, 2020, the Corporation acquired all of the issued and outstanding common shares of Coral pursuant to a statutory plan of arrangement under the Business Corporations Act (British Columbia). Coral shareholders received, for each common share of Coral held, consideration consisting of C$0.05 in cash and 0.80 of a unit of the Corporation.

Each whole unit was comprised of one Common Share and one-half of one Common Share purchase warrant of the Corporation. Each full warrant (the “November 2020 Warrants”) entitles the holder thereof to purchase one Common Share at a price of C$1.71 until November 19, 2022. If the daily volume-weighted average trading price of Common Shares on the TSX exceeds the warrant exercise price by at least 25% for any period of 20 consecutive trading days after November 19, 2021, the Corporation will have the right to give notice in writing to the holders of the November 2020 Warrants that the November 2020 Warrants will expire 30 days following such notice, unless exercised prior thereto. As a result of the acquisition of Coral, the common shares of Coral have been delisted from the TSXV as of the close of business on November 20, 2020 and Coral ceased shortly after to be a reporting issuer in every province of Canada in which it was a reporting issuer. The November 2020 Warrants were listed for trading on the TSX under the symbol “NSR.WT” at the opening of trading on November 26, 2020.

Pursuant to the acquisition of Coral, the Corporation paid to Coral shareholders an aggregate of $1.9 million (C$2,5 million) in cash, issued 39,994,252 Common Shares and 19,997,118 November 2020 Warrants.

Prior to the completion of the arrangement of Coral, the Coral common shares were registered pursuant to Section 12(g) of the Exchange Act. Upon effectiveness of the arrangement, the common shares of Nomad were deemed registered under Section 12(g) of the Exchange Act, with Nomad deemed to be a successor issuer to Coral pursuant to Rule 12g-3(a) under the Exchange Act. As such, Nomad has become a successor issuer to Coral pursuant to Rule 12g-3(a) under the Exchange Act and is now a reporting issuer in the United States.

Filing of Prospectus Supplement and Secondary Bought Deal Offering of Yamana Common Shares

On December 7, 2020, the Corporation filed a prospectus supplement qualifying the distribution of 22,750,000 Common Shares (the “Offered Shares”) to be sold by Yamana at a price of C$1.10 per Common Share by way of Secondary Offering (as defined below).

On December 11, 2020, the Corporation and Yamana completed a public offering of the Offered Shares held by Yamana for gross proceeds to Yamana of C$25,025,000 (the "Secondary Offering"). The net proceeds of the Secondary Offering were paid directly to Yamana, and the Corporation did not receive any proceeds from the Secondary Offering.

Prior to the completion of the Secondary Offering, Yamana owned 66,500,000 Common Shares, representing approximately 11.78% of the then issued and outstanding Common Shares, excluding the Common Shares that could potentially be issued upon the conversion of the Deferred Payment. Following the completion of the Secondary Offering, Yamana’s ownership of the Corporation was 43,750,000 Common Shares, representing approximately 7.75% of the then issued and outstanding Common Shares, excluding the Common Shares that could potentially be issued upon the conversion of the Deferred Payment.

Acquisition of the Blackwater Gold Royalty

On December 23, 2020, the Corporation completed the acquisition of a 0.21% NSR royalty on the Blackwater Gold Project, a development project located in central British Columbia, Canada and operated by Artemis Gold Inc. The Corporation satisfied the first tranche of the purchase price payable to private vendors by issuing an aggregate of 791,854 Common Shares and by paying an aggregate amount of $0.9 million in cash. On January 11, 2021, the Corporation satisfied the second and last tranche of the purchase price by issuing an aggregate of 791,856 Common Shares and by paying and aggregate amount of $0.9 million in cash to the vendors.

Significant Acquisitions

In the most recently completed financial year, there were no significant acquisitions for which the Corporation was required to file a business acquisition report (BAR) under NI 51-102.

Subsequent Events to December 31, 2020

On February 19, 2021, the Board declared a quarterly dividend of C$0.005 per Common Share payable on April 15, 2021 to shareholders of record as of the close of business on March 31, 2021.

COVID-19

Nomad continues to monitor and assess the impacts of COVID-19 on its employees and business. At this time, all employees continue to work remotely. Nomad is closely monitoring the unpredictable impact of the COVID-19 pandemic on its portfolio of assets.

DESCRIPTION OF BUSINESS

Description of the Business

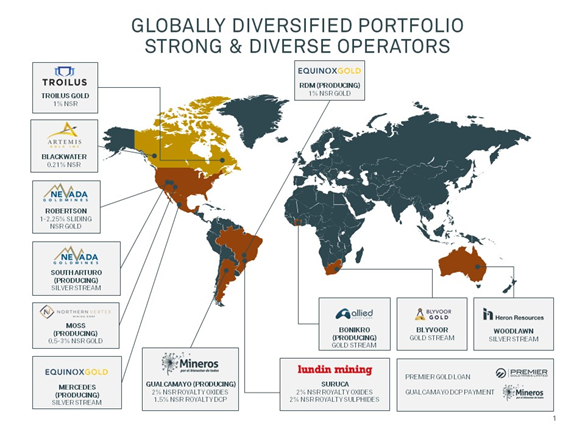

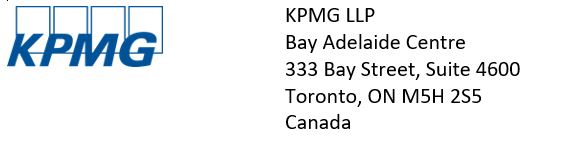

Nomad is a gold and silver stream and royalty company that purchases rights to a certain percentage of the gold or silver produced from a mine, generally for the life of the mine. Nomad owns a portfolio of 14 royalty, stream and gold loan assets, of which six are on currently producing mines and one which is on a project expected to begin production in the first half of 2021. Nomad plans to grow its low-cost production profile through the acquisition of additional producing and near-term producing gold and silver streams and royalties and intends to focus on a high degree of diversification both in terms of the number of assets and jurisdictions.

Royalty and Streaming Business

A royalty is a payment to a royalty holder by an operator or owner of a property and is typically based on a percentage of the minerals produced or the revenues or profits generated from the property. In a stream, the holder makes an upfront deposit and ongoing payments in exchange for an amount of specified metals (often a by-product of the mine) determined with reference to metals produced from a mine, at a pre-agreed price or percentage of market price. Stream interests and, typically, royalty interests, are established through a contract between the holder and the property owner. Royalties and streams are not typically working interests in a property and, therefore, the holder is generally not responsible for contributing additional funds for any purpose, including operating or capital costs or environmental or reclamation liabilities.

Stream interests and royalty interests, which are revenue-based as opposed to profit-based, have limited exposure to operating and capital costs incurred at the operating level. However, the holders share in the upside provided by exploration success, mine life extensions and operational expansions. A royalty and streaming business model facilitates greater diversification than is typical for mining companies. Royalty and streaming companies generally hold a portfolio of assets (often diversified by mine, jurisdiction or commodity), whereas mining companies generally are dependent on only one or a few key mines. The strength of the streaming and royalty business model relative to alternative precious metals investment vehicles has been demonstrated by the equity performance of peer companies across multiple gold price cycles.

Business Model and Strategy

Nomad seeks to acquire other metal purchase agreements and royalties from companies which have advanced stage development projects or operating mines and does not operate mines or develop/explore projects. In return for making a one-time upfront payment to acquire a precious metal streams or royalties, Nomad receives the right to purchase precious metals at a fixed price per unit, a percentage of a mine’s production for the operating life of the asset or a fixed percentage of the NSRs from a mine’s sales of produced metals. Nomad focuses on precious metal streams and royalties on mines with low production costs, significant exploration potential and strong management teams. Nomad targets investments in the Americas, Australia and Africa; however, Nomad pursues assets globally for appropriate risk-adjusted returns where it can ensure adequate protections and where the asset quality justifies it. Nomad also focuses on investing in mines and projects where ESG issues are believed to be well-managed by its counterparties. Nomad uses a differentiated approach to assessing new investment opportunities, supplementing its team with highly-specific third-party experts drawn from an extensive global network. The expertise employed and focus on diligence is tailored for each investment. Nomad’s due diligence process includes an assessment of its counterparties’ environmental and local stakeholder management, as good management of these matters promotes the long-term prosperity of operations for all stakeholders. Nomad expects to operate with a lean core team of professionals in order to maintain low overhead costs in pursuit of its growth-oriented strategy.

The Corporation’s Assets

Summary of Principal Royalties, Streams and Other Interests

As at December 31 2020, the portfolio consists of 14 assets comprised of 7 royalties, 4 streams and 3 other assets, of which six are on currently producing mines and one which is on a project expected to begin production in the first half of 2021.

Portfolio by Asset Stage

| | | | | | | | | | | | | | |

| Asset Stage | Royalties | Streams | Other Interest | Total Number of Assets |

| Producing | 3(1) | 2 | 1 | 6 |

| Development (construction) | 3 | 2(2) | 2(2) | 7 |

| Exploration and Evaluation | 1 | — | — | 1 |

| Total | 7 | 4 | 3 | 14 |

(1) One of these NSR royalties is on a producing mine for which the minimum production threshold has not yet been reached in order for Nomad to receive royalty payment.

(2) Assets on a project which is currently on care and maintenance.

Summary of Assets

Description of the Assets

Blackwater Gold Royalty – British Columbia, Canada – Artemis Gold Inc.

The Blackwater Gold Royalty consists of a 0.21% NSR royalty on all metals and minerals produced from a specific mineral tenure which covers a portion of the Blackwater Gold Project. The Blackwater Gold Project is a development project located in central British Columbia, Canada and operated by Artemis Gold.

On February 9, 2021, Artemis Gold announced that it had submitted applications to the Government of British Columbia to undertake an early works construction program in respect of its Blackwater Gold Project in British Columbia, Canada. The construction program is designed to focus on clearing of key infrastructure areas including haul roads, the stage 1 tailing storage facility and camp areas. In addition, construction of the mine access road and plant-site bulk earthworks will be fast-tracked to facilitate early mobilization of the Engineering, Procurement and Construction contractor to site upon receipt of major works permits. The permitting process in respect of the construction program is expected to take several months with approvals anticipated in late in the second quarter of 2021.

On March 1, 2021, Artemis Gold further announced that in support of the definitive feasibility study and in preparation for commencement of construction for Blackwater Gold Project, Artemis Gold has been conducting the following activities: (i) ore grade control drilling to refine the detailed grade schedule and mine plan for the first year of production; (ii) metallurgical test work; (iii) geotechnical drilling as part of site preparation work; (iv) work advancing the guaranteed maximum price proposals associated with the process plant and powerline; and (v) a B.C. Hydro study. Artemis Gold also announced that the work program in the first six months of 2021 is on track to culminate with the completion of the definitive feasibility study on the Blackwater Gold Project by mid 2021.

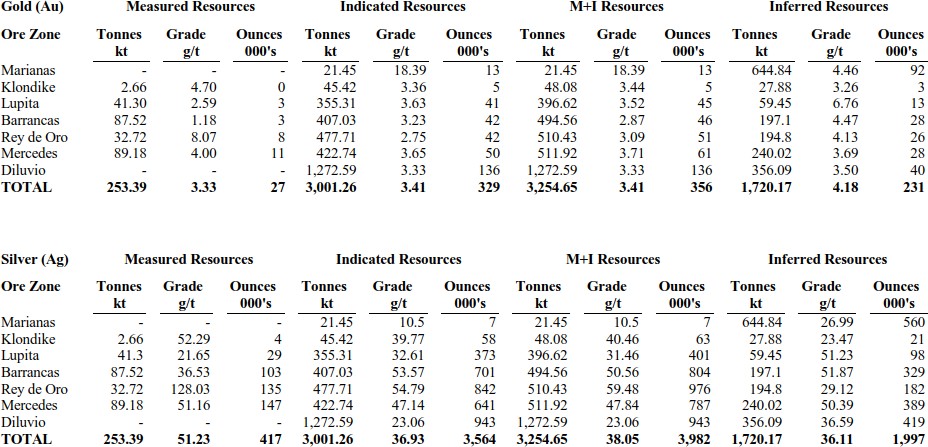

The Mineral Resource and Mineral Reserve estimates for the Blackwater Gold Project reported as at May 5, 2020 and August 26, 2020, respectively, are listed in the table below:

Blackwater Gold Project Mineral Resources Statement (100%)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Grade | | Contained Metal |

| Category | | Tonnage

(kt) | | Gold Grade

(g/t Au) | | Silver Grade

(g/t Ag) | | Contained Gold

(000 oz) | | Contained Silver

(000 oz) |

| Measured | | 427,123 | | 0.65 | | 5.5 | | 8,905 | | 75,802 |

| Indicated | | 169,642 | | 0.51 | | 8.5 | | 2,766 | | 46,578 |

| Measured & Indicated | | 596,765 | | 0.61 | | 6.4 | | 11,672 | | 122,381 |

| Inferred | | 16,935 | | 0.45 | | 12.8 | | 246 | | 6,953 |

____________________ •Source: Blackwater Project Report. •Mineral Resources have an effective date of May 5, 2020. •The following assumptions have been made in estimating Mineral Resources: •Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines. •Mineral Resources are reported inclusive of Mineral Reserves. •Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. •The Mineral Resource has been confined by a “reasonable prospects of eventual economic extraction” pit using the following assumptions: $2,000/oz. Au and $21.43/oz Ag at a currency exchange rate of $0.75 per C$1.00; 99.9% payable Au; 95.0% payable Ag; $8.50/oz Au and $0.25/oz Ag offsite costs (refining, transport and insurance); a 1.5% NSR royalty; and uses a 93% metallurgical recovery for gold and 55% recovery for silver. Pit slope angles are assumed at 40º. •The AuEq values were calculated using $1,400/oz Au, $15/oz Ag, a gold metallurgical recovery of 93%, silver metallurgical recovery of 55%, and mining smelter terms for the following equation: AuEq = Au g/t + (Ag g/t x 0.006). •The specific gravity of the deposit has been determined by lithology as being between 2.6 and 2.74. •Numbers may not add due to rounding. •Nomad Royalty owns a 0.21% NSR on mineral tenure 515809 which covers a portion of the Blackwater Gold Project and the higher-grade starter pit. •See “Cautionary Statement Regarding Third Party Information”. |

Blackwater Gold Project Mineral Reserves Statement (100%)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Grade | | Contained Metal |

| Category | | Tonnage

(Mt) | | Gold Grade

(g/t Au) | | Silver Grade

(g/t Ag) | | Contained Gold

(Moz) | | Contained Silver

(Moz) |

| Proven | | 325 | | 0.74 | | 5.8 | | 7.8 | | 60.7 |

| Probable | | 9.1 | | 0.80 | | 5.5 | | 0.2 | | 1.6 |

| Proven & Probable | | 334 | | 0.75 | | 5.8 | | 8.0 | | 62.3 |

____________________ •Source: Blackwater Project Report. •Information Mineral Reserves have an effective date of August 18, 2020. •The following assumptions have been made in estimating Mineral Reserves: •Mineral Reserves are based on the 2020 Pre-Feasibility Study life of mine plan. •Mineral Reserves are mined tonnes and grade, the reference point is the mill feed at the primary crusher and includes consideration for operational modifying factors. •Mineral Reserves are reported at an NSR cut-off of $13.00/t. •NSR cut-off assumes $1,400/oz Au and $15/oz Ag at a currency exchange rate of $0.75 per C$1.00; 99.9% payable gold; 95.0% payable silver; $8.50/o. Au and $0.25/oz Ag offsite costs (refining, transport and insurance); a 1.5% NSR royalty; and uses a 93% metallurgical recovery for gold and 55% recovery for silver. •The NSR cut off- covers processing costs of $10.00/t and administrative (G&A) costs of $3.00/t. •The AuEq values were calculated using the same parameters as NSR listed above, resulting in the following equation: AuEq = Au g/t + (Ag g/t x 0.006). •Numbers have been rounded as required by reporting guidelines. •Nomad Royalty owns a 0.21% NSR on mineral tenure 515809 which covers a portion of the Blackwater Gold project and the higher -grade starter pit. •See “Cautionary Statement Regarding Third Party Information”. |

Blyvoor Gold Stream – Witwatersrand Gold Belt, South Africa - Blyvoor Gold (Pty) Ltd.

The Blyvoor Gold Stream is a gold stream interest on the Blyvoor Gold Mine located 75 kilometres southwest of Johannesburg in Gauteng Province, Republic of South Africa. The Blyvoor Gold Mine is owned and operated by Blyvoor Gold, and is in its final construction and restart phase with initial production currently expected to commence in the first half of 2021. Blyvoor Gold acquired the No. 5 Shaft underground gold mining operations of the old Blyvooruitzicht Gold Mine.

The following is a summary of the material terms of the Blyvoor Gold Stream:

•Pursuant to the terms of the Blyvoor Stream, OMF SO, as purchaser, prepaid an amount of $37 million to Blyvoor Capital, as seller, to purchase such amount of refined gold to be produced at the Blyvoor Gold Mine, as set forth below, with the proceeds of the prepayment being used to fund the final construction of the mine and the re-entry into service of the mine:

•for the first 300 koz of gold delivered under the stream, a 10% gold stream on the first 160 koz of gold produced within a calendar year, then a 5% stream on any additional gold produced within the calendar year;

•following delivery of the first 300 koz of gold, but until the production of the first 10.32 million ounces of gold, a 0.5% stream on the first 100 koz of gold produced in each calendar year; and

•the gold production at the Blyvoor Gold Mine is subject to an ongoing payment at the price of $572/oz.

The Blyvoor Gold Stream is secured by first ranking security over all of the present and after acquired property of Blyvoor Gold and the guarantors party to the Blyvoor Gold Stream agreement, against the property and assets of Blyvoor Gold.

Blyvoor Gold informed Nomad that following the visit of the Department of Minerals Resources and Energy relating to the inspection of the #5 sub-vertical shaft in September 2020, Blyvoor Gold received its final license which will allow them to access the deeper mining levels. Blyvoor Gold is now fully permitted. Blyvoor Gold expects to complete the plant construction and to commence processing operations in the first half of 2021. Mining operations have commenced on the upper levels and ore is currently being hauled to the surface. Blyvoor Gold continues to ramp up mining operations at the Blyvoor Gold Mine. Blasting activities are now fully operational and taking place daily. The process plant construction is complete and ore processing has commenced. Nomad has commissioned a NI 43-101 technical report on the Blyvoor Gold Mine, which is expected to be completed in the first half of 2021.

Bonikro Gold Stream – Hiré, Côte d’Ivoire – Allied Gold Corp.

The Bonikro Gold Stream is a gold stream interest on the Bonikro Gold Mine, located in Hiré, Côte d’Ivoire, approximately 250 kilometres north-west of the commercial capital Abidjan. The Bonikro Gold Mine is operated by Allied Gold Corp. The Bonikro Gold Mine consists of two primary areas, namely Bonikro (37 km2 mining licence) and Hiré (195 km2 mining licence). A third area, Dougbafla, is in the process of being converted from an exploration licence to a mining licence. Gold has been produced from the Bonikro open pit mine and through the Bonikro carbon-in-leach plant since 2008.

Allied Gold Corp. informed Nomad that that they have been producing from the Akissi-So, Chapelle and Chapelle West extension pits.

The following is a summary of the material terms of the Bonikro Gold Stream:

•Pursuant to the terms of the Bonikro Stream, OMF (Mg) prepaid an amount of $20 million to the sellers under the Bonikro Stream, to purchase such amount of refined gold to be produced at the Bonikro Gold Mine, as set forth below:

▪initially, 6% in respect of each lot, until both (i) 650,000 ounces of refined gold have been out-turned following the closing date of the stream agreement; and (ii) 39,000 ounces of refined gold have been delivered;

▪thereafter, 3.5% in respect of each lot, until both (i) 1,300,000 ounces of refined gold have been out-turned; and (ii) 61,750 ounces of refined gold have been delivered;

▪thereafter, 2% in respect of each lot; and

▪subject to an ongoing payment at the lesser of the $400/oz and the gold market price on the business day immediately preceding the date of delivery.

The Bonikro Gold Stream is secured by first ranking security over all present and after acquired property of the seller and the guarantors party under the Bonikro Gold Stream agreement dated October 7, 2019, subject to certain permitted encumbrances and an intercreditor agreement.

Deliveries under the Bonikro Gold Stream were settled on a net cash basis as opposed to physical settlement until the beginning of June 2020. Since then, the Corporation has been receiving physical delivery of gold. During the fiscal year ended December 31, 2020, the Corporation earned 6,678 gold ounces under the Bonikro Stream, of which 4,044 ounces have been delivered since the closing of the RTO.

Gualcamayo Gold Royalty and DCP Commercial Production Payment – San Juan, Argentina – Mineros S.A.

The Gualcamayo Gold Royalty is an NSR Royalty on the Gualcamayo Mine which is located in the Province of San Juan, Argentina and is currently operated by Mineros S.A. The Gualcamayo Mine is in production and has produced 2.01 million ounces of gold from both open pit and underground operations between the commencing of commercial production in 2009 and 2019, according to a NI 43-101 technical report entitled “Technical Report on the Gualcamayo Property, San Juan and La Rioja Provinces, Argentina” dated August 15, 2020 with an effective date of July 10, 2020, prepared for Mineros S.A. The DCP component of the mine consists of a Mineral Resource located mainly to the west at the depth of the current mining operations and is at the pre-feasibility study stage of development.

Mineros S.A. has informed Nomad that it is investing $8 million annually in near-mine exploration and infill drilling to increase mine life. Only 20% of the 20,000-hectare land package has been explored. On March 24, 2021, Mineros S.A. filed a preliminary prospectus with the securities regulatory authorities in each provinces of Canada, other than Québec, in connection with an initial public offering of certain of its common shares.

The details of the Gualcamayo Gold Royalty and DCP Commercial Production Payment are as follows:

•2% NSR royalty based on the production from the oxides, excluding the first 396,000 ounces of gold contained in product produced from the non-DCP component of the mine; the maximum aggregate amount payable under the Gualcamayo Gold Royalty is capped at $50 million;

•1.5% NSR royalty on production from the DCP in perpetuity; and

•DCP Commercial Production Payment of $30 million upon commencement of DCP Commercial Production.

Mercedes and South Arturo Silver Stream – Mexico & Nevada, U.S.A. – Premier Gold

The Mercedes and South Arturo Silver Stream is a silver stream interest on the Mercedes Mine and South Arturo Mine, which are located in Mexico and Nevada, U.S.A., respectively. The Mercedes Mine is wholly-owned and operated by Premier Gold, while the South Arturo Mine is 60% owned by Nevada Gold Mines LLC, a joint venture between Barrick Gold Corporation and Newmont Corporation, and 40% by Premier Gold. Both mines are in production.

On December 16, 2020, Equinox Gold and Premier Gold announced the friendly acquisition of Premier Gold by Equinox Gold and that the interest of Premier Gold in the South Arturo Mine will be spun out to a newly created company called i-80 Gold Corp (“i-80”), pursuant to a statutory plan of arrangement pursuant to Section 182 of the Business Corporations Act (Ontario) (the "Premier Gold Arrangement"). At the same time they announced that there is expansion potential to increase production to 80,000 to 90,000 ounces of gold annually at the Mercedes Mine. It is expected that Equinox Gold will become the owner and operator of the Mercedes Mine. Equinox Gold operates seven mines globally, is very well capitalized and is led by a reputable management team with the ability to drive further productivity increases at the mine site.

On January 19, 2021, Premier Gold reported increased mineral reserves and resources and released a positive pre-feasibility study on the South Arturo project, which includes the underground El Niño mine and a proposed Phase 1 open pit.

On February 23, 2021, Premier Gold announced that its securityholders have approved the acquisition by Equinox Gold of all of the issued and outstanding common shares of Premier Gold pursuant to the Premier Gold Arrangement as well as the spin-off of certain asset of Premier Gold in i-80, including the interest of Premier in the South Arturo Mine.

In connection with the Premier Gold Arrangement, Equinox Gold, Premier and i-80 are negotiating with the Corporation certain amendments to the Mercedes and South Arturo Silver Stream and the Premier Gold Prepay Loan to give effect to the separation of i-80's business and commercial arrangements from those of Premier Gold’s.

Nomad considers the stream interests on the Mercedes Mine and South Arturo Mine and the Premier Gold Prepay Loan to be currently its only interest in material mineral properties for the purposes of NI 43 101. Information with respect to the Mercedes Mine and South Arturo Mine has been prepared in accordance with NI 43-101 and may be reviewed under Schedule “B” – Information Concerning the South Arturo Mine and Schedule “C” – Information Concerning the Mercedes Mine to this AIF.