UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2012

Or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to _________

Commission File Number: 1-14447

AMCOL INTERNATIONAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

DELAWARE

|

36-0724340

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

2870 Forbs Avenue

Hoffman Estates, Illinois

(Address of principal executive offices)

|

60192

(Zip Code)

|

Registrant’s telephone number, including area code: (847) 851-1500

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Name of Exchange on which registered:

|

|

$0.01 par value Common Stock

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s $.01 par value Common Stock held by non-affiliates of the registrant (based upon the per share closing price of $27.68 per share on June 30, 2012, and, for the purpose of this calculation only, the assumption that all of the registrant’s directors and executive officers are affiliates) was approximately $715.8 million.

Registrant had 32,287,200 shares of $.01 par value Common Stock outstanding as of March 27, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive proxy statement, which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference into Part III hereof.

2

PART I

Item 1. Business

GENERAL

AMCOL International Corporation (together with its subsidiaries, “AMCOL,” “we,” “us” or “our”) is a leading international producer of specialty materials and related products and services for the industrial and consumer markets. AMCOL was originally incorporated in South Dakota in 1924, reincorporated in Delaware in 1959, and is listed on the New York Stock Exchange under the ticker symbol ACO.

We operate in five segments: performance materials, construction technologies, energy services, transportation and corporate. Our performance materials segment—previously referred to as our minerals and materials segment—is a leading supplier of bentonite related products. Our construction technologies segment—previously referred to as our environmental segment—provides products for non-residential construction, environmental and infrastructure projects worldwide. Our energy services segment—previously referred to as our oilfield services segment—offers a range of patented technologies, products and services for both upstream and downstream oil and gas production. Our transportation segment, which serves our domestic subsidiaries as well as third parties, is a dry van and flatbed carrier and freight brokerage service provider. Our corporate segment includes the elimination of intersegment revenues as well as certain expenses associated with research and development, management, employee benefits and information technology activities.

A significant portion of the products sold by our performance materials segment and, to a lesser extent, our construction technologies segment, utilize a mineral called bentonite. Bentonite has several valuable characteristics, including its ability to bind, swell, adsorb, control rheology, soften fabrics, and have its surface modified through chemical and physical reactions. We also develop applications for other specialty minerals, most significantly chromite and leonardite.

We earn revenues from the sale of finished products, provision of services, rental of equipment, and charges for shipping goods and materials to customers. Our service revenues are derived primarily from our construction technologies, energy services, and transportation segments; our transportation segment is purely service based.

The following table sets forth the percentage of our revenues generated from each segment for each of our last three fiscal years:

|

Percentage of Net Sales

|

||||||||||||

|

2012

|

2011

|

2010

|

||||||||||

|

Performance materials

|

50 | % | 51 | % | 50 | % | ||||||

|

Construction technologies

|

23 | % | 27 | % | 27 | % | ||||||

|

Energy services

|

26 | % | 21 | % | 19 | % | ||||||

|

Transportation

|

4 | % | 6 | % | 6 | % | ||||||

|

Intersegment sales

|

-3 | % | -5 | % | -2 | % | ||||||

| 100 | % | 100 | % | 100 | % | |||||||

Net revenues, operating profit, assets, depreciation, depletion and amortization, capital expenditures and research and development expenditures attributable to each of our segments are set forth in our Notes to Consolidated Financial Statements included later herein.

3

OUR SEGMENTS

Performance Materials Segment

Our performance materials segment is one of the world’s leading producers and suppliers of bentonite and bentonite-related products. It also supplies chromite and leonardite, and operates more than 25 mining or production facilities worldwide. We excel in transforming ordinary minerals and materials into extraordinary value, meeting the needs of our customers around the world.

Bentonite is a sedimentary deposit containing greater than 50% montmorillonite and is volcanic in origin. It is surface mined and then dried, crushed, sent through grinding mills where it is sized to customer requirements, and transferred to silos for automatic bagging or bulk shipment. The processed bentonite may also be chemically modified. Bentonite’s unique chemical structure gives it a diverse range of capabilities, enabling it to act as a thickener, sealant, binder, lubricant or absorption agent. From a commercial standpoint, there are two primary types of natural bentonite, sodium and calcium. Sodium-bentonite is characterized by its ability to absorb large amounts of water and form viscous, thixotropic suspensions. Calcium-bentonite, in contrast, is characterized by its low water absorption and swelling capabilities and its inability to stay suspended in water. Each type of bentonite has its own unique applications.

We mine chromite, an iron chromium oxide, from open cast mines in South Africa and transport it to our nearby processing facility. There, the chromite ore is further crushed, milled, washed, and separated from impurities. We are improving our chromite production process to manufacture a wider range of precisely specified materials to provide value to our customers’ operations and efficiency.

We mine leonardite, a form of oxidized lignite, in North Dakota and transport it to our nearby processing facility. Its primary uses include metalcasting, drilling fluid additive, and agricultural applications.

Our performance materials segment conducts its business through wholly-owned subsidiaries and investments in affiliates and joint ventures throughout the world. It is comprised of four key product lines: metalcasting; specialty materials; basic minerals; and pet products. Our principal products are marketed under various registered trade names, including VOLCLAY®, PANTHER CREEK®, PREMIUM GEL®, ADDITROL®, ENERSOL®, and Hevi-Sand®.

Performance Materials Product Lines

Metalcasting: In the formation of sand molds for metalcastings, sand is bonded with minerals and various other additives to yield desired casting form and surface finish. Our metalcasting products include blended mineral binders containing sodium and calcium bentonite and organic additives sold under the trade name ADDITROL®. We employ a consultative sales process to sell custom-blended mineral and non-mineral products to strengthen sand molds for casting auto parts, farm and construction equipment, oil and gas production equipment, power generation turbine castings and rail car components. Our products help our customers in the foundry and casting industry to reduce waste from metalcasting defects, improve the efficiency and recycling of sand blends in mold sand systems, and improve air quality by reducing volatile organic compound emissions.

In the ferrous casting market, we specialize in blending bentonite of various grades by themselves or with mineral binders containing sodium bentonite, calcium bentonite, seacoal and other ingredients. We also have a line of formulated additives that introduce silicon and carbon in the melt phase of the casting process.

In the steel alloy casting market, we sell a chromite product with a particle size distribution specific to a customer’s needs. One of chromite’s qualities is its ability to conduct heat. Thus, we market the product for use in making very large, high integrity, steel alloy castings where the chromite is better suited to withstand the high heat and pressure associated with the casting process.

Specialty Materials: Our specialty materials products contain bentonite and synthetic additives offering proprietary solutions for consumer and industrial applications. We also offer products for bio-agricultural applications. The key markets and applications of our specialty materials products include the following:

4

Fabric Care: We supply high-grade, agglomerated bentonite and other mineral additives used in fabric care products. We not only supply cost-effective products and additives but also provide product development capabilities to adapt to our customers’ product requirements. Bentonite performs as a softening agent in certain powdered-detergent formulations, and it can also act as a carrier for colorants and fragrances.

Personal Care: We manufacture adsorbent polymers and purified grades of bentonite for sale to manufacturers of personal skin care products. The adsorbent polymers are used to deliver high-value actives in skin-care products. Microsponge® and Poly-Pore® are the principal trade names under which these products are sold. Bentonite-based materials act as thickening, suspension and dispersion agent emollients.

Basic Minerals: Our basic minerals product line supplies minerals to a variety of key markets and industrial applications, including the following:

Drilling Fluid Additives: Sodium bentonite and leonardite are components of drilling fluids used in oil and gas well drilling. Bentonite imparts thickening and suspension properties that facilitate the transport of rock cuttings to the surface during the drilling process. It also contributes to a drilling fluid’s ability to lubricate the drill bit and coat the underground formations to prevent hole collapse and drill-bit seizing. We market our drilling fluid addtives under our own and private-label trade names. At least two drilling fluid service competitors have captive bentonite operations while others are party to long-term bentonite supply agreements. The potential customers for our products, therefore, are generally limited to those service organizations that neither are vertically integrated nor have long-term supply arrangements with other bentonite producers. Our primary trademark for this application is the trade name PREMIUM GEL®.

Ferro Alloys: A by-product of our chromite processing operations for foundry products includes a chromite ore which has physical properties suited for use in producing ferrochrome. The ore generally needs to have a chromite content in excess of 42% to meet metallurgical grade specifications. Manufacturers of stainless steel are the primary users of ferrochrome.

Other Industrial: We produce bentonite and bentonite blends for the construction industry to be used as a plasticizing agent in cement, plaster and bricks, and as an emulsifier in asphalt. We also supply bentonite to help pelletize other materials for ease of use. Examples of this application include the pelletizing of iron ore and livestock feed.

Pet Products: Our pet products include sodium bentonite-based scoopable (clumping), traditional and alternative cat litters as well as specialty pet products sold to grocery and drug stores, mass merchandisers, wholesale clubs and pet specialty stores throughout the U.S. Our scoopable products’ clump-forming capability traps urine, thereby reducing waste by allowing for easy removal of only the odor-producing elements from the litter box. We are primarily a private-label producer of cat litter, and our products are marketed under various trade names. These products are sold solely in the U.S. from three principal sites from which we package and distribute finished goods. Our transportation segment provides logistics services and is a key component of our capability in supplying customers on a national basis.

Sales and Distribution

In 2012, the top ten customers of our performance materials segment accounted for approximately 30% of this segment’s sales worldwide.

5

The following table sets forth the percentage of our net sales generated from each product line in 2012:

|

2012 Percentage of Net Sales

|

||||

|

Metalcasting

|

54.0 | % | ||

|

Specialty materials

|

22.3 | % | ||

|

Pet products

|

10.8 | % | ||

|

Basic minerals

|

11.2 | % | ||

|

Other product lines

|

1.7 | % | ||

|

Total

|

100.0 | % | ||

The following table sets forth the percentage of our performance material segment’s 2012 net sales attributable to our different geographic regions:

|

Americas

|

61.1 | % | ||

|

EMEA(1)

|

17.4 | % | ||

|

Asia Pacific

|

21.5 | % | ||

| 100.0 | % | |||

|

(1) Europe, Middle East and Africa

|

||||

Our performance materials segment sells products not only to third party customers but also to our other segments, principally our construction technologies segment. Bentonite is a material included within several products in our construction technologies segment, most notably within our lining technologies product line.

Sales and distribution of products is conducted primarily by our own employees. Our industry-specialized sales groups and technically-oriented sales persons serve each of our major markets. Certain of our products are distributed through networks of distributors and representatives, who warehouse specific products at strategic locations.

We believe our strong, global market position in the metalcasting industry is largely due to our technical service capabilities and our distribution network. We provide training courses and laboratory testing for customers who use our products and blends in the metalcasting process. Our technical sales personnel provide expertise not only to educate our customers on the bentonite blend properties but also to aid them in producing castings efficiently and productively.

Seasonality

We do not consider our performance materials segment to be seasonal in nature.

Construction Technologies Segment

Our construction technologies segment serves customers engaged in a broad range of construction projects, including site remediation, concrete waterproofing for underground structures, liquid containment on projects ranging from landfills to flood control, and drilling applications including foundation, slurry wall, tunneling, water well, and horizontal drilling.

Our construction technologies segment conducts its business through wholly-owned subsidiaries and joint ventures throughout the world. This segment is comprised of four key product lines: building materials; contracting services; drilling products; and lining technologies.

6

Construction Technologies Product Lines

Lining Technologies: We sell lining and other products for a variety of applications, most of which are directed to preserving or remediating environmental issues. We help customers protect ground water and soil through the sale of geosynthetic clay liner products containing bentonite. We market these products under the BENTOMAT® and CLAYMAX® trade names principally for lining and capping landfills, mine waste disposal sites, water and wastewater lagoons, secondary containments in tank farms, and other contaminated sites. We also provide associated geosynthetic materials for these applications, including geotextiles and drainage geocomposites.

Our lining technologies product line also includes specialized technologies to mitigate vapor intrusion in new building construction. Our innovative vapor barrier systems prevent potentially harmful vapors from entering occupied space, thus facilitating low-risk redevelopment. We also provide reactive capping technologies and solutions to effectively contain residual contamination, reduce costs associated with ex-situ remedies, and aid in environmental protection. Products offered include Liquid Boot®, a liquid applied vapor barrier system; REACTIVE CORE-MAT™, an in-situ sediment capping material; ORGANOCLAY®, which absorbs organic containments; and QUIK-SOLID®, a super absorbent media

Building Materials: We offer a wide variety of active and passive waterproofing and greenroof technologies for use in protecting the building envelope of non-residential constructions, including buildings, subways, and parkway systems. Our products include VOLTEX®, a waterproofing composite comprised of two polypropylene geotextiles filled with sodium bentonite; ULTRASEAL®, an advanced membrane using a unique active polymer core; and COREFLEX®, featuring heat-welded seams for protection of critical infrastructure. In addition to these membrane materials, we also provide roofing products and a variety of sealants and other accessories required to create a functional waterproofing system.

Drilling Products: Our drilling products are used in environmental and geotechnical drilling applications, horizontal directional drilling, mineral exploration and foundation construction. The products are used to install monitoring wells, facilitate horizontal and water well drilling, and seal abandoned exploration drill holes. VOLCLAY GROUT™, HYDRAUL-EZ®, BENTOGROUT® and VOLCLAY TABLETS™ are among the trade names for products used in these applications. Ground source heat loop systems utilizing GEOTHERMAL GROUT™ represent a developing area for drilling products. We also offer a range of drilling products used in the excavation of foundations for large buildings, bridges and dams; these products include SHORE PAC® and PREMIUM GEL®.

Contracting Services: Contracting services, which involve installation of products, are occasionally offered to customers for select projects.

Sales and Distribution

On an individual customer basis, we generated less than $5 million of sales from each of the top five customers in the construction technologies segment.

The following table sets forth the percentage of our net sales generated from each product line in 2012:

|

2012 Percentage of Net Sales

|

||||

|

Lining technologies

|

41.2 | % | ||

|

Building materials

|

34.0 | % | ||

|

Drilling products

|

16.4 | % | ||

|

Contracting services

|

8.4 | % | ||

|

Total

|

100.0 | % | ||

7

The following table sets forth the percentage of our construction technologies segment’s 2012 net sales attributable to our different geographic regions:

|

Americas

|

48.7 | % | ||

|

EMEA

|

41.1 | % | ||

|

Asia Pacific

|

10.2 | % | ||

| 100.0 | % | |||

Our building materials products are sold through our own sales professionals as well as through an integrated distributor and dealer network. The end-users of these products are generally building sub-contractors who are responsible for installing the products. These products include a longer term warranty in instances where we can control or monitor the installation of the final product on the job site. Our sales and technical staff typically assist project designers by providing technical data to engineers and architects who specify our products in the design of building structures.

Our drilling products are generally sold through an extensive distribution network coordinated by our regional sales managers. The end customers for these products are typically small well drilling companies and general contractors.

Sales and distribution of our lining technologies products are primarily performed through our own personnel and facilities. Our staff includes sales professionals and technical support engineers who analyze the suitability of our products in relation to the customer’s specific application and the conditions that products will endure or the environment in which they will operate.

Seasonality

Most of the products in our construction technologies segment are impacted by weather and soil conditions. Many of the products cannot be applied in wet or winter weather conditions and, as such, sales and profits tend to be greater during the period from April through October. As a result, we consider the business of this segment to be seasonal.

Energy Services Segment

Our energy services segment provides services to improve the production, costs, compliance, and environmental impact of activities performed in the oil and gas industry. Operating as CETCO Energy Services, we offer a range of patented technologies, products and services for all phases of oil and gas production, transportation, refining, and storage throughout the world. We provide both land-based and offshore water treatment, well testing, pipeline separation, nitrogen, coil tubing and other services to the oil and gas industry. We provide our services through subsidiaries located in Australia, Brazil, Malaysia, Nigeria, the United Kingdom, and the U.S., principally in the Gulf of Mexico and the surrounding on-shore area.

Principal Services. The following are the principal services we provide:

Water Treatment: We help customers comply with regulatory requirements by providing equipment, technologies, personnel and filtration media to treat waste water generated during oil production.

Coil Tubing: Our coil tubing services utilize metal piping which comes spooled on a large reel. We provide both equipment and operating personnel to perform services ranging from acid stimulation, reverse circulation, cementing, pressure control, nitrogen injection, and other operations that involve pumping fluids into a well. Horizontal wells and shale completions are a large component of our operations.

8

Well Testing: We provide equipment and personnel to help customers control well production as well as to clean up, unload, separate, measure component flow, and dispose of fluids from oil and gas wells.

Nitrogen Services: Liquid nitrogen is commonly used in the pipeline, refinery, and oil and natural gas industry. By providing liquid nitrogen that is then changed into nitrogen gas with our personnel and mobile equipment, we help customers perform maintenance activities in a safe environment on their production platforms, pipeline operations, and refineries. These services are provided in jetting wells that are loaded with fluid; stimulating wells, including fracturizing and acidizing; displacing completion fluids prior to perforating; inflating flotation devices for offshore installations; and pressure testing and other maintenance activities.

Pipeline: Our personnel utilize engineered equipment that separates, filters, cleans and allows treatment of effluents arising from pipeline testing and maintenance activities.

Sales and Distribution

The top ten customers in our energy services segment accounted for 47% of the segment sales worldwide in 2012 with no individual customer greater than 10% of this segment’s sales. However, the composition of customers within this group varies from year to year and is significantly dependent on the type of activities each customer is undertaking within the year, regulations, and overall dynamics of the oil and gas industry. Approximately 80% of sales are in the Americas. Our largest geographical market is the U.S., and more specifically the Gulf of Mexico region. Approximately 14% of sales are in the Asia-Pacific region and 6% are in EMEA.

Employees in this segment primarily sell our services on a direct basis. Our principal customers are companies who maintain substantial drilling and production operations for both oil and natural gas.

Seasonality

Much of the business in the energy services segment is impacted by weather conditions. Our business is concentrated in the Gulf of Mexico and surrounding states where our customers’ oil and gas production facilities are subject to natural disasters, such as hurricanes. Given this, our sales could be lower in the June to November months. It can also experience periods of growth after a hurricane as customers require our services to start their operations back up.

Transportation Segment

We operate a long-haul trucking business—Ameri-Co Carriers, Inc.— and a freight brokerage business—Ameri-Co Logistics, Inc.—primarily for delivery of finished products throughout the continental U.S. These services are provided to our subsidiaries as well as third-party customers. By having a captive transportation business, we are better able to control costs, maintain delivery schedules and assure equipment availability in the delivery of our products. In 2012, approximately 50% of the revenues of this operation involved domestic services provided to our performance materials and construction technologies segments.

MINERAL RESERVES AND MINING

Mineral Reserves

We have reserves of sodium and calcium bentonite at various locations in the U.S., including Wyoming, South Dakota, Montana and Alabama, as well as in Australia, China, and Turkey. Through our investments in affiliates and joint ventures, we also have access to bentonite deposits in Egypt, India, and Mexico. Assuming the continuation of our 2012 consumption rates and product mix, we have proven, assigned reserves of commercially usable sodium bentonite for the next 35 years. Under the same assumptions, we have proven, assigned reserves of commercially usable calcium bentonite for the next 10 years. While we believe that our reserve estimates are reasonable and our title and mining rights to our reserves are valid, we have not obtained any independent verification of such reserve estimates or such title or mining rights.

9

We own or control the properties on which our reserves are located through long-term leases, royalty agreements (including easement and right of way agreements) and patented and unpatented mining claims. A majority of our bentonite reserves are owned. No single or group of mining claims or leases is significant or material to the financial condition or operations of our Company or our segments.

The majority of our current bentonite mining in the U.S. occurs on reserves where our rights to such reserves accrues to us through over eighty mining lease and royalty agreements and 2,000 mining claims. The majority of these are with private parties and located in Montana, South Dakota and Wyoming. The bentonite deposits underlying these claims and leases generally lie in parcels of land varying between 20 and 40 acres.

In general, our bentonite reserves are immediately adjacent to, or within sixty miles of, one of seven related processing plants. All of the properties on which our reserves are located are either physically accessible for the purposes of mining and hauling or the cost of obtaining physical access would not be material. Access to processing facilities from the mining areas is generally by private road, public highways, or railroads. For each leased property and mining claim, there are multiple means of access.

To retain possessory rights in unpatented mining claims in North America, a fee of $140 per year per 20 acres for each unpatented mining claim is required. The validity of title to unpatented mining claims is dependent upon numerous factual matters. We believe that the unpatented mining claims that we own are in compliance with all applicable federal, state and local mining laws, rules and regulations. We are not aware of any material conflicts with other parties concerning our claims. From time to time, members of Congress and members of the executive branch of the federal government have proposed amendments to existing federal mining laws. The various amendments would have had a prospective effect on mining operations on federal lands and include, among other things, the imposition of royalty fees on the mining of unpatented claims, the elimination or restructuring of the patent system and an increase in fees for the maintenance of unpatented claims. To the extent that future proposals may result in the imposition of royalty fees on unpatented lands, the mining of our unpatented claims may become uneconomic and royalty rates for privately leased lands may be affected. We cannot predict the effect any potential amendments may have or whether or when any such amendments might be adopted.

We maintain a continuous program of worldwide exploration for additional reserves and attempt to acquire reserves sufficient to replenish our consumption each year, but we cannot assure that additional reserves will continue to become available.

We oversee all of our mining operations, including our exploration activity and securing the necessary permits from appropriate government agencies.

10

The following table shows a summary of our mineral sales from active mining areas for the last 3 years in short tons, as well as mineral reserves by major mineral category.

|

Tons Sold (000s)

|

Wet Tons

|

Assigned

|

Unassigned

|

Mining Claims

|

||||||||||||||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

of Reserves

|

Reserves

|

Reserves

|

Conversion

|

Owned

|

Unpatented

|

Leased

|

|||||||||||||||||||||||||||||||

| (000s) | (000s) | (000s) |

Factor

|

** | ||||||||||||||||||||||||||||||||||||

|

Sodium Bentonite

|

||||||||||||||||||||||||||||||||||||||||

|

Assigned

|

||||||||||||||||||||||||||||||||||||||||

|

Australia

|

17 | 13 | 9 | 1,427 | 1,427 | - | 80 | % | - | - | 1,427 | |||||||||||||||||||||||||||||

|

Belle/Colony, WY/SD

|

1,144 | 1,125 | 1,121 | 44,652 | 44,652 | - | 77 | % | 4,521 | 2,157 | 37,974 | |||||||||||||||||||||||||||||

|

Lovell, WY

|

590 | 598 | 605 | 29,477 | 29,477 | - | 86 | % | 14,915 | 11,437 | 3,125 | |||||||||||||||||||||||||||||

|

TOTAL ASSIGNED

|

1,751 | 1,736 | 1,735 | 75,556 | 75,556 | - | 19,436 | 13,594 | 42,526 | |||||||||||||||||||||||||||||||

|

Unassigned

|

||||||||||||||||||||||||||||||||||||||||

|

SD, WY, MT

|

- | - | - | 61,373 | - | 61,373 | 82 | % | 54,811 | 3,594 | 2,968 | |||||||||||||||||||||||||||||

|

TOTAL UNASSIGNED

|

- | - | - | 61,373 | - | 61,373 | 54,811 | 3,594 | 2,968 | |||||||||||||||||||||||||||||||

|

TOTAL SODIUM BENTONITE

|

1,751 | 1,736 | 1,735 | 136,929 | 75,556 | 61,373 | 74,247 | 17,188 | 45,494 | |||||||||||||||||||||||||||||||

| 55 | % | 45 | % | 54 | % | 13 | % | 33 | % | |||||||||||||||||||||||||||||||

|

Calcium Bentonite

|

||||||||||||||||||||||||||||||||||||||||

|

Assigned

|

||||||||||||||||||||||||||||||||||||||||

|

Chao Yang, Liaoning, China

|

374 | 351 | 261 | 1,507 | 1,507 | - | 78 | % | - | - | 1,507 | |||||||||||||||||||||||||||||

|

Nevada

|

- | 2 | 2 | 535 | 35 | 500 | 75 | % | 35 | 500 | - | |||||||||||||||||||||||||||||

|

Sandy Ridge, AL

|

82 | 91 | 89 | 5,959 | 5,959 | - | 76 | % | 1,707 | - | 4,252 | |||||||||||||||||||||||||||||

|

Turkey

|

160 | 140 | 134 | 972 | 972 | - | 77 | % | - | - | 972 | |||||||||||||||||||||||||||||

|

TOTAL ASSIGNED

|

616 | 584 | 486 | 8,973 | 8,473 | 500 | 1,742 | 500 | 6,731 | |||||||||||||||||||||||||||||||

|

Unassigned

|

||||||||||||||||||||||||||||||||||||||||

|

Vici, OK

|

- | - | - | 99 | - | 99 | 76 | % | - | - | 99 | |||||||||||||||||||||||||||||

|

TOTAL UNASSIGNED

|

- | - | - | 99 | - | 99 | - | - | 99 | |||||||||||||||||||||||||||||||

|

TOTAL CALCIUM BENTONITE

|

616 | 584 | 486 | 9,072 | 8,473 | 599 | 1,742 | 500 | 6,830 | |||||||||||||||||||||||||||||||

| 93 | % | 7 | % | 19 | % | 6 | % | 75 | % | |||||||||||||||||||||||||||||||

|

Leonardite

|

||||||||||||||||||||||||||||||||||||||||

|

Gascoyne, ND

|

50 | 52 | 52 | 719 | 719 | - | 73 | % | - | - | 719 | |||||||||||||||||||||||||||||

| 100 | % | 100 | % | |||||||||||||||||||||||||||||||||||||

|

Chromite

|

||||||||||||||||||||||||||||||||||||||||

|

South Africa

|

145 | 121 | 122 | 1,355 | 1,355 | - | 75 | % | 1,355 | - | - | |||||||||||||||||||||||||||||

|

Other

|

||||||||||||||||||||||||||||||||||||||||

|

Nevada

|

- | - | - | 2,997 | - | 2,997 | 80 | % | - | 2,997 | ||||||||||||||||||||||||||||||

|

GRAND TOTALS

|

2,562 | 2,493 | 2,395 | 151,072 | 86,103 | 64,969 | 77,344 | 17,688 | 56,040 | |||||||||||||||||||||||||||||||

| 57 | % | 43 | % | 51 | % | 12 | % | 37 | % | |||||||||||||||||||||||||||||||

** Quantity of reserves that would be owned if patent was granted.

Assigned reserves are reserves which could be reasonably expected to be processed in existing plants. Unassigned reserves are reserves which will require additional expenditures for processing facilities. Conversion factor is the percentage of reserves that will be available for sale after processing. Our estimates of assigned and unassigned reserves in the above table require us to make certain key assumptions. These assumptions relate to consistency of clay beds in relation to drilling samples obtained with respect to both quantity and quality of reserves contained therein; the ratio of overburden to mineral deposits; any environmental or social impact of mining the minerals; and profitability of extracting those minerals, including haul distance to processing plants, applicability of minerals to various end markets and selling prices within those markets, and our past experiences in the mineral beds, several of which we have been operating in for over 80 years. We estimate that available supplies of other materials utilized in our performance materials business are sufficient to meet our production requirements for the foreseeable future.

11

Mining and Processing

Bentonite is surface mined, generally with large earthmoving scrapers, and then loaded into trucks and off-highway-haul wagons for movement to processing plants. The mining and hauling of our clay is done by us and by independent contractors.

At the processing plants, bentonite is dried, crushed and sent through grinding mills, where it is sized to customer requirements, then chemically modified where needed and transferred to silos for automatic bagging or bulk shipment. Most of the production is shipped as processed rather than stored for inventory.

Chromite is mined from open cast pits from our property in South Africa and transported to our nearby processing facility. In our facility, the ore is further crushed, milled, washed, and separated from impurities. We are improving our South African production facility to give it the ability to manufacture a range of precisely specified materials, such as ones with specific particle sizes, that provide value to our customer’s operations and efficiency.

COMPETITION

We believe that we are one of the largest global producers of bentonite products. Our performance materials segment competes with our substantial domestic and international competition on the basis of product quality, price, logistics, service and technical support. There are numerous major producers of competing products and various regional suppliers in the areas we serve. Some of our competitors, especially in the chromite market, are companies primarily in other lines of business with substantially greater financial resources than ours.

Our lining technologies product line competes with geosynthetic clay liner manufacturers worldwide, several suppliers of alternative lining technologies, and providers of soil and environmental remediation solutions and products. The building materials product line competes in a highly fragmented market comprised of a wide variety of alternative technologies. A number of integrated bentonite companies compete with our drilling products. Competition for all product lines is based on product quality, service, price, technical support and product availability.

Our energy services segment competes with other oil and gas services companies. Several of these competitors have significantly more resources than we do and consequently may be better able to compete in periods of economic downturn, especially in terms of selling prices. However, we believe we offer several competitive advantages, especially in the area of water treatment services, due to superior and innovative technologies that we have developed internally and the combination of services that we can provide.

INTELLECTUAL PROPERTY

We hold a number of U.S. and international patents, and we obtain patents on new technologies and applications when appropriate. However, we do not believe that any one or any combination of such patents is material to our business as a whole.

ENVIRONMENTAL, HEALTH AND SAFETY MATTERS

Our operations are subject to a variety of national (including federal, state, and local) and international laws and regulations relating to environmental, health and safety (“EHS”) matters. Numerous governmental departments issue rules and regulations to implement and enforce such regulations that are often complex and costly to comply with and that carry substantial administrative, civil and possibly criminal penalties for noncompliance. Under these evolving laws and regulations, we may be liable for remediation or removal costs, damages and other costs associated with releases of hazardous materials into the environment, and such liability may be imposed on us even if the acts that resulted in the releases were in compliance with all applicable laws at the time such acts were performed. In particular, we are subject to certain requirements under the Clean Air Act. Our production processes involve the grinding and handling of dried clay, which generates dust. All of our plants are equipped with dust collection systems. We have not had, and do not presently anticipate, any significant regulatory problems in connection with our dust emission, though we expect ongoing expenditures for the maintenance of our dust collection systems and required annual fees. We have expended, and anticipate that we will continue to expend, financial and managerial resources to comply with EHS regulations.

12

We are also subject to land reclamation requirements. Because reclamation of exhausted mining sites has been a regular component of our surface mining operations since 1973, maintaining compliance with current reclamation-related regulation has not materially affected our mining costs. Our reclamation costs are included in the cost of the bentonite sold.

While the costs of compliance with, and penalties imposed under, these EHS laws historically have not had a material adverse effect on us, future events, such as changes in or modified interpretations of existing laws and regulations, enforcement policies, or further investigation or evaluation of potential health hazards of certain products, may give rise to additional compliance and other costs that could have a material adverse effect on us.

EXPORT SALES AND FOREIGN OPERATIONS

Approximately 36% of our 2012 net sales were generated in countries outside the Americas. Our foreign operations have typically comprised about a third of our income from continuing operations before income taxes, income from affiliates and joint-ventures, and non-controlling interests. Of our tons sold from our domestic mineral deposits in 2012, approximately 24% of these shipments were made to our sister companies and third party customers located outside the United States as compared to 17% and 21% in 2011 and 2010, respectively.

We maintain mineral processing plants in the United Kingdom, China, Australia, South Korea, Poland, Thailand, South Africa and Turkey. Chartered vessels deliver large quantities of our bulk, dried U.S. sodium bentonite to the plants outside the U.S. where it is processed and mixed with other clays and distributed throughout EMEA and the Asia-Pacific region. We manufacture geosynthetic clay liners in the United Kingdom, Spain, Poland, China, South Korea and India. These international operations provide a cost-effective means of supplying the EMEA and Asia-Pacific markets. In addition, we maintain a worldwide network of independent dealers, distributors, and representatives to support sales and distribution.

Our Energy Services segment maintains offices and operations centers in Australia, Brazil, Malaysia, Nigeria and Scotland to service customers in those local markets.

See Notes to our Consolidated Financial Statements included in Item 8 of this report for additional geographic data relating to our business.

EMPLOYEES

As of December 31, 2012, we employed 2,824 people in our global organization, 1,363 of whom were employed outside of the United States. Operating plants are adequately staffed, and no significant labor shortages are presently foreseen. Labor relations have been satisfactory.

AVAILABLE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements and other information filed by the Company at the SEC’s Public Reference Room at 100 F. Street N.E., Washington, D.C., 20549. Please call (800) SEC-0330 for further information on the Public Reference Room. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our filings are available to the public at this website, www.sec.gov.

Our principal Internet address is www.amcol.com. Our annual, quarterly and current reports, and amendments to those reports, are available free of charge on www.amcol.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

13

Item 1A. Risk Factors

Certain statements we make from time to time, including statements in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section hereafter, constitute “forward-looking statements” made in reliance upon the safe harbor contained in Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include statements relating to our Company or our operations that are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions, and statements relating to anticipated growth, acquisitions, levels of capital expenditures, future dividends, expansion into global markets and the development of new products. Such forward-looking statements speak only as of the date hereof and are not guarantees of future performance and involve risks and uncertainties. Our actual results, performance or achievements could differ materially from the results, performance or achievements expressed in, or implied by, these forward-looking statements as a result of various factors. We undertake no duty to update any forward-looking statements to conform the statements to actual results or changes in our expectations.

A number of risks will challenge us in meeting our long-term profit and strategic objectives, and there can be no assurance that we will achieve success in implementing any one or more of them. Specifically, the risks outlined below could affect the achievement of our expected results. In addition, political, economic, or credit crises occur from time to time in our geographic markets, and these crises could affect or heighten the risks outlined below, especially with regard to our reliance on key industries, the volatility of our stock price, and increased exchange rate sensitivity. The credit crisis may also affect our ability to obtain capital or finance acquisitions or other activities on terms substantially similar to our current debt facilities should that need arise in the future. Any of these factors or the risks outlined below could affect our business opportunities and results:

Reliance on Metalcasting & Construction Markets

Approximately 54% of our performance materials segment’s sales in 2012 were to the metalcasting market. Our construction technologies segment’s sales are predominantly derived from the commercial construction and infrastructure markets. All of these markets depend heavily upon the strength of the domestic and international economies. If these economies weaken, demand for our products sold to these markets may decline and our business or future financial results may be adversely affected.

Susceptibility to Oil and Natural Gas Markets

Revenues from our energy services segment in 2012 represent 26% of consolidated revenues and 29% of consolidated operating income. Oil and natural gas production activities are heavily influenced by the benchmark price of these commodities, which can be influenced by both economic and political events and, in turn, affect our customers’ demand for our products and services. Thus, the benchmark prices of oil and natural gas may ultimately affect the performance of this segment.

In addition, oil and natural gas exploration and production activities depend heavily on the location of these natural resources within the earth’s geology and geographic location as well as technologies available to profitably extract them. For example, the recent application of horizontal drilling technologies allow oil and natural gas production companies to extract significantly greater amounts of oil and natural gas in geological deposits located in areas where we currently do not have a significant presence. Thus, the performance of our energy services segment is affected by changes in technologies, locations of customers’ targeted reserves, and competition in various geographic markets.

Sensitivity to Energy and Petroleum Related Products

We purchase a significant amount of raw materials which are derived from petrochemical products. Our production processes also consume a significant amount of energy, primarily electricity, diesel fuel, natural gas and coal. We use diesel fuel to operate our mining and processing equipment and our freight costs are heavily dependent upon fuel prices and surcharges.

14

On a combined basis, these factors represent a large exposure to petrochemical and energy products which may be subject to significant price fluctuations. While we have been successful in attaining price increases in certain markets to offset some of these rising costs, there can be no assurance that we will be successful in continuing to achieve these price increases or protecting our margins.

Availability and Cost of Shipping

We rely on shipping bulk cargos of bentonite from the United States and China to customers, as well as our own subsidiaries, and we are sensitive to our ability to recover these shipping costs. In the last few years, bulk cargo shipping rates have been very volatile, and, to a lesser extent, the availability of bulk cargo containers has been suspect. If we can not secure our container requirements or offset additional shipping costs with price increases to customers, our profitability could be impacted.

Seasonality of Our Energy Services and Construction Technologies Segments

Our energy services and construction technologies segments are affected by seasonal weather patterns. A majority of our energy services revenues are derived from the Gulf of Mexico and surrounding states, which are susceptible to hurricanes that typically occur June 1st through November 30th. In addition, it is affected by customers’ demands for natural gas. Natural gas is affected by weather patterns as colder winters increase the demand for natural gas to heat homes and warmer summers increase the demand for natural gas to fuel generators providing electricity to run air conditioners. Actual or threatened hurricanes or changes in the demand for natural gas can result in volatile demand for services provided by our energy services segment.

Our construction technologies segment is affected by weather patterns which determine the feasibility of construction activities. Typically, less construction activity occurs in winter months and thus this segment’s revenues tend to be greatest in the second and third quarters when weather patterns in our geographic markets are more conducive to construction activities.

Cyclicality of Our Segments

All of our segments are affected by economic cycles. During periods of economic slowdown, our customers often reduce their capital expenditures and defer or cancel pending projects. Such developments occur even amongst customers that are not experiencing financial difficulties. These risks are more predominant in our construction technology and performance materials segments.

In our construction technologies segment, the construction and infrastructure markets are heavily dependent upon the strength of domestic and international economies. In our performance materials segment, the metalcasting market is dependent upon the demand for castings for automobile components, farm and construction equipment, oil and gas production equipment, power generation turbine castings, and rail car components. Many of these types of equipment are sensitive to fluctuations in demand during periods of recession or tough economies, which ultimately may affect the demand for our construction technologies and performance materials segments’ products and services.

Moreover, in periods of lower economic productivity or recession, oil and natural gas prices tend to decrease, which in turn causes exploration companies to reduce their capital expenditures and production and exploration activities. This has the effect of decreasing the demand and increasing competition for the services that our energy services segment provides.

Risks of International Expansion & Operation

An important part of our business strategy is to expand internationally by establishing a presence in new markets when possible or through acquisitions, joint ventures or other strategic alliances. Sales and earnings from our overseas operations have increased considerably in recent years and comprise a significant portion of our financial results, including our joint ventures. As we expand and operate internationally, we will be subject to a myriad of risks, especially in less developed countries whose economies increase at rates faster than more developed nations. These risks relate to currency exchange rates, political and economic environments, business and trade laws, and regulatory and compliance issues. These risks are beyond our control and can lead to sudden, and potentially prolonged, changes in demand for our products, difficulty in enforcing agreements, losses in the realizability of our assets, or fluctuations in our earnings due to the impact from our joint ventures.

15

Regulatory and Legal Matters

Our operations are subject to various federal, state, local and foreign laws and regulations, including those related to EHS matters. Substantial penalties may be imposed if we violate certain of these laws and regulations, even if the violation was inadvertent or unintentional. If these laws or regulations are changed or interpreted differently in the future, it may become more difficult or expensive for us to comply. In addition, investigations or evaluations of our products by government agencies may require us to adopt additional safety measures or precautions. If our costs to comply with such laws and regulations in the future materially increase, our business and future financial results could be materially and adversely affected. We may also be subject to adverse litigation results in addition to increased compliance costs arising from future changes in laws and regulations that may negatively impact our operations and profits. Last, certain of our customers are subject to various federal and foreign laws and regulations relating to environmental and health and safety matters, especially our energy services customers who are subject to drilling permits, wastewater disposal and other regulations. To the extent that these laws and regulations affecting our customers change, demand for our products and services could also change and thereby affect our financial results.

Ability to Complete, Integrate & Finance Acquisitions

Our business strategy includes pursuing acquisitions of complementary businesses, through either our own wholly-owned subsidiaries or our investments in affiliates and joint ventures. The success of any future acquisitions or investments will be dependent upon our ability to locate attractive businesses at a reasonable price and our ability to successfully integrate them into our existing operations.

In addition, we have typically financed our acquisitions and investments with debt available to us under our various credit facilities and our ability to issue new debt. We may or may not be able to secure such debt financing on terms substantially similar to our current facilities. In the future, we may even decide to pay all or a portion of the purchase price of any future acquisition or investment with shares of our common stock. If we use our common stock in this way, the price of our stock may decrease.

Ability to Pay Dividends

We currently declare and pay regular cash dividends on our common stock. Any future payment of cash dividends will depend upon our financial condition, earnings, legal requirements, restrictions in our debt agreements and other factors deemed relevant by our board of directors. Our board of directors may decrease or discontinue payment of dividends at any time.

Impact of Competition

Our businesses have many competitors, some of whom are larger and have more resources than we do. We also face competition for some of our products from alternative products, and some of the competition we face comes from competitors in lower-cost production countries like China and India. Many factors could change the level of competition we face in our markets, which could result in decreased demand for our products and services and negatively affect our financial performance.

16

Item 1B. Unresolved Staff Comments

We have received no written comments regarding our periodic or current reports from the staff of the SEC that were issued 180 days or more preceding the end of our 2012 fiscal year and that remain unresolved.

Item 2. Properties

We operate the following principal plants, mines and other facilities, all of which are owned, except as noted below. We also have numerous other facilities which blend ADDITROL ®, package cat litter and chromite sand, warehouse products and serve as sales offices.

|

PRINCIPAL FUNCTION

|

|

|

PERFORMANCE MATERIALS

|

|

|

Colony, WY (two plants)

|

Mine and manufacture sodium bentonite, package cat litter

|

|

Lovell, WY (1)

|

Mine and manufacture sodium bentonite

|

|

Sandy Ridge, AL

|

Mine and manufacture calcium bentonite; blend ADDITROL®

|

|

Chao Yang, Liaoning, China

|

Mine and manufacture calcium bentonite

|

|

Enez, Turkey

|

Mine and manufacture calcium bentonite

|

|

Laemchabang, Thailand

|

Manufacture sodium and calcium bentonite and laundry care products

|

|

Ruighoek Farm, Northwest Province, South Africa

|

Mine and manufacture chromite ore

|

|

Yangbuk-Myeun, Kyeung-buk, South Korea

|

Manufacture metalcasting products

|

|

Tianjin, China

|

Manufacture metalcasting and laundry care products

|

|

Winsford, Cheshire, U.K.

|

Manufacture bentonite, other minerals, and laundry care products

|

|

CONSTRUCTION TECHNOLOGIES

|

|

|

Cartersville, GA

|

Manufacture components for geosynthetic clay liners; manufacture Bentomat® and Claymax® geosynthetic clay liners; manufactures other building materials products

|

|

Lovell, WY (1)

|

Manufacture Bentomat® and Claymax® geosynthetic clay liners and other building materials products

|

|

Birkenhead, Merseyside, U.K. (1)(2)

|

Manufacture Bentomat® geosynthetic clay liner; research laboratory; headquarters for CETCO (Europe) Ltd.

|

|

Segovia, Spain

|

Manufacture Bentomat® geosynthetic clay liners

|

|

Suzhou, China

|

Center for China operations; manufactures lining and waterproofing products for China and greater Asian markets

|

|

Szczytno, Poland

|

Manufacture Bentomat® and Claymax® geosynthetic clay liners

|

|

ENERGY SERVICES

|

|

|

Beckville, TX (2)

|

Well testing services

|

|

Broussard, LA (2)

|

Central operations and distribution

|

|

Covington, LA (2)

|

Headquarters

|

|

Driscoll, TX (2)

|

Coil tubing services

|

|

Harvey, LA (2)

|

Nitrogen sales and service

|

|

Kenamen, Malaysia (2)

|

Filtration services and sales

|

|

New Iberia, LA (2)

|

Coil tubing services

|

|

Springtown, TX (2)

|

Well testing services

|

|

TRANSPORTATION

|

|

|

Scottsbluff, NE

|

Transportation headquarters and terminal

|

|

CORPORATE

|

|

|

Hoffman Estates, IL (2)

|

Corporate headquarters; Construction Technologies headquarters; Performance Materials headquarters; research laboratory

|

(1) Shared facilities between performance materials and construction technologies segments.

(2) Certain offices and facilities are leased.

We consider our plants in the Western U.S. to be of strategic importance given their production capacity, products manufactured, and proximity to our mineral reserves. All of our pet products are manufactured either in our Lovell, WY plant or one of our Colony, WY plants given their granularization capabilities and the fact that their location provides freight cost savings to key customers. Our Sandy Ridge, AL facility supplies calcium bentonite to our U.S. blending plants as an ingredient for production of ADDITROL®. The blending plants have collective importance since they produce customized products for metalcasting customers.

17

Item 3. Legal Proceedings

We are party to a number of lawsuits arising in the normal course of our business. Our energy services segment is also party to two lawsuits alleging damages caused by our coiled tubing operations in Louisiana; one lawsuit alleges damages of $28 million and the other of $9 million. To date, we have not incurred significant costs in defending these matters. We believe we have adequate insurance coverage and do not believe that any of the aforementioned pending litigation will have a material adverse impact on our financial condition, liquidity or results of our operations.

We have neither been nor expect to be assessed any tax shelter penalties by the United States Internal Revenue Service for tax shelter transactions that either the IRS deems abusive or have significant tax avoidance penalties.

Item 4. Mine Safety Disclosures

The information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K is included in Exhibit 95.1 to this Form 10-K.

18

Executive Officers of Registrant

|

NAME

|

AGE

|

PRINCIPAL OCCUPATION FOR LAST FIVE YEARS

|

|

James W. Ashley

|

63

|

Vice President and General Counsel of the Company since January 2012; prior thereto, Partner at Locke Lord LLP since 2008; prior thereto, Partner at Lord Bissell & Brook LLP.

|

|

Patrick E. Carpenter

|

50

|

Vice President of the Company and President of the construction technologies segment since January 2012; prior thereto, Vice President of Business Development of Colloid Environmental Technologies Company from January 2010 through December 2011, and its Vice President of Construction Materials from January 2007 through December 2009.

|

|

Gary L. Castagna

|

51

|

Senior Vice President of the Company and President of our performance materials segment since May 2008; prior thereto, Senior Vice President, Chief Financial Officer and Treasurer of the Company since February 2001; prior thereto, a consultant to AMCOL since June 2000; prior thereto, Vice President of the Company and President of Chemdal International Corporation (this business is a former subsidiary of AMCOL, and consisted of the absorbent polymers business that was sold to BASF AG in June 2000) since August 1997; since January 2000, Director of M~Wave Incorporated, a manufacturer and distributor of printed circuit boards.

|

|

Michael R. Johnson

|

54

|

Vice President of the Company since January 2010; President of the energy services segment since 2003; prior thereto, Vice President of CETCO Oilfield Services since 2000.

|

|

Ryan F. McKendrick

|

61

|

Chief Executive Officer of the Company since January 1, 2011; prior thereto, Chief Operating Officer of the Company since January 1, 2010; prior thereto, Senior Vice President of the Company and President of our environmental segment since November 1998; and President of Volclay International Corporation since 2002.

|

|

Donald W. Pearson

|

51

|

Senior Vice President, Chief Financial Officer and Treasurer of the Company since May 2008; prior thereto, Vice President Finance, UPM - Kymmene Corporation North America (a large forest products company), May 2006 through May 2008; Financial Controller UPM - Kymmene Corporation North America, February 2004 through May 2006; prior thereto, Senior Vice President, Business Planning, Information Resources, Inc. (an information services provider), August 2000 through February 2004.

|

All executive officers of the Company are elected annually by the Board of Directors for a term expiring at the annual meeting of directors following their election or when their respective successors are elected and shall have qualified.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock trades on the New York Stock Exchange under the symbol “ACO.” The following table sets forth, for the periods indicated, the high and low sale prices of the common stock, as reported by the New York Stock Exchange, and cash dividends declared per share.

19

|

Stock Price

|

Cash Dividends | ||||||||||||

|

High

|

Low

|

Declared Per Share

|

|||||||||||

|

1st Quarter

|

$ | 30.96 | $ | 25.93 | $ | 0.18 | |||||||

|

Fiscal Year Ended December 31, 2012:

|

2nd Quarter

|

34.27 | 26.63 | 0.18 | |||||||||

|

3rd Quarter

|

36.23 | 27.70 | 0.20 | ||||||||||

|

4th Quarter

|

34.68 | 28.26 | 0.20 | ||||||||||

|

1st Quarter

|

$ | 36.00 | $ | 28.92 | $ | 0.18 | |||||||

|

Fiscal Year Ended December 31, 2011:

|

2nd Quarter

|

38.62 | 32.45 | 0.18 | |||||||||

|

3rd Quarter

|

39.85 | 23.37 | 0.18 | ||||||||||

|

4th Quarter

|

35.09 | 21.60 | 0.18 | ||||||||||

We have paid cash dividends every year since 1938. As of February 13, 2013, there were approximately 10,794 holders of record of the common stock, including shares held in street name.

Purchases of Equity Securities

We did not repurchase any of our outstanding common stock in 2012.

Equity Compensation Plan Information

The following table summarizes information about our equity compensation plans as of December 31, 2012. All outstanding awards relate to our common stock. Shares issued under all of the following plans may be from the Company’s treasury, newly issued or both.

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column)

|

|||||||||

|

Equity compensation plans approved by security holders

|

1,633,405 | (1) | $ | 26.22 | 1,174,137 | (2) | ||||||

|

Equity compensation plans not approved by security holders

|

N/A | N/A | N/A | |||||||||

|

Total

|

1,633,405 | (1) | $ | 26.22 | 1,174,137 | (2) | ||||||

(1) Includes stock options and stock settled appreciation rights issued and outstanding under the following AMCOL plans: 1998 Long-Term Incentive Plan; 2006 Long-Term Incentive Plan; and 2010 Long-Term Incentive Plan.

(2) Subject to issuance pursuant to our 2010 Long-Term Incentive Plan.

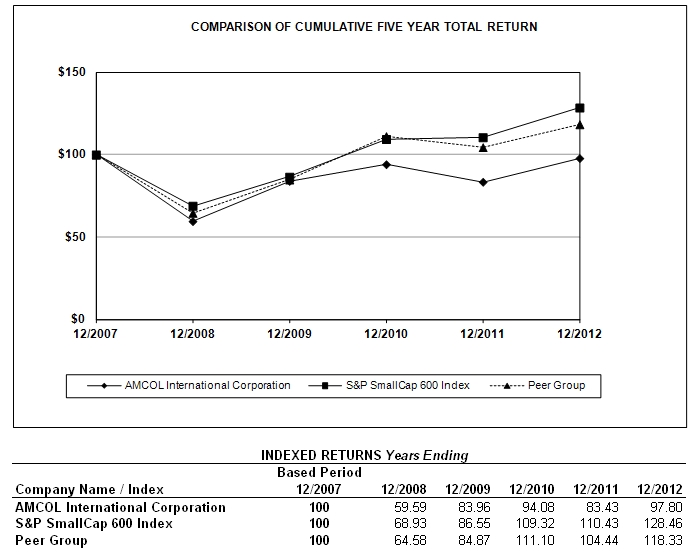

Performance Graph

The graph below sets forth a comparison of cumulative total shareholder returns for the past five years for: (i) our stock as traded on the NYSE, (ii) the S&P SmallCap600 Index, and (iii) a custom peer group of publicly traded companies selected in good faith by us (the “Peer Group”). The graph assumes that $100 was invested at the close of business on December 31, 2007. All returns were calculated assuming dividend reinvestment on a quarterly basis. The returns of each company in the Peer Group have been weighted according to market capitalization. We believe the Peer Group is representative of companies whose businesses, sales sizes, market capitalization and stock trading volumes are similar to AMCOL. The Peer Group consists of the following companies: Compass Minerals International, Inc., Dycom Industries, Inc., Lufkin Industries, Inc., Martin Marietta Materials Inc., Minerals Technologies Inc., Oil-Dri Corporation, Rockwood Holdings Inc., RPM International Inc., and Superior Energy Services Inc.

20

21

Item 6. Selected Financial Data

The following is selected financial data for the Company for each of the below annual periods ending December 31st.

SUMMARY OF OPERATIONS

(In thousands, except ratios and share and per share amounts)

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Operations Data

|

||||||||||||||||||||

|

Net sales

|

$ | 985.6 | $ | 943.8 | $ | 826.3 | $ | 687.5 | $ | 851.6 | ||||||||||

|

Gross profit

|

271.1 | 252.3 | 214.2 | 184.3 | 219.2 | |||||||||||||||

|

Selling, general and administrative expenses

|

173.0 | 166.2 | 145.2 | 135.0 | 143.5 | |||||||||||||||

|

Operating profit

|

98.1 | 86.1 | 69.0 | 49.3 | 75.7 | |||||||||||||||

|

Net interest expense

|

(10.4 | ) | (11.0 | ) | (9.6 | ) | (12.0 | ) | (12.2 | ) | ||||||||||

|

Net other income (expense)

|

(3.4 | ) | 0.2 | 1.3 | (0.3 | ) | (5.5 | ) | ||||||||||||

|

Pretax income

|

84.3 | 75.3 | 60.7 | 37.0 | 58.0 | |||||||||||||||

|

Income taxes

|

23.3 | 20.8 | 20.3 | 5.4 | 13.9 | |||||||||||||||

|

Income (loss) from affiliates and joint ventures

|

3.9 | 5.2 | (11.0 | ) | - | (21.7 | ) | |||||||||||||

|

Income from continuing operations

|

64.9 | 59.7 | 29.4 | 31.6 | 22.4 | |||||||||||||||

|

Discontinued operations

|

- | (1.2 | ) | (0.9 | ) | 0.3 | 1.9 | |||||||||||||

|

Net income

|

64.9 | 58.5 | 28.5 | 31.9 | 24.3 | |||||||||||||||

|

Net income attributable to AMCOL shareholders

|

65.1 | 58.5 | 29.2 | 32.0 | 24.5 | |||||||||||||||

|

Per Share Data

|

||||||||||||||||||||

|

Basic earnings (loss) per share attributable to AMCOL shareholders

|

||||||||||||||||||||

|

Continuing operations

|

2.03 | 1.89 | 0.97 | 1.03 | 0.75 | |||||||||||||||

|

Discontinued operations

|

- | (0.04 | ) | (0.03 | ) | 0.01 | 0.06 | |||||||||||||

|

Net income

|

2.03 | 1.85 | 0.94 | 1.04 | 0.81 | |||||||||||||||

|

Diluted earnings (loss) per share attributable to AMCOL shareholders

|

||||||||||||||||||||

|

Continuing operations

|

2.01 | 1.86 | 0.96 | 1.02 | 0.73 | |||||||||||||||

|

Discontinued operations

|

- | (0.04 | ) | (0.03 | ) | 0.01 | 0.06 | |||||||||||||

|

Net income

|

2.01 | 1.82 | 0.93 | 1.03 | 0.79 | |||||||||||||||

|

Dividends

|

0.76 | 0.72 | 0.72 | 0.72 | 0.68 | |||||||||||||||

Continued…

22

SUMMARY OF OPERATIONS

(In thousands, except ratios and share and per share amounts)

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Shares Outstanding Data

|

||||||||||||||||||||

|

End of period

|

32,184,110 | 31,728,969 | 31,032,791 | 30,773,908 | 30,437,984 | |||||||||||||||

|

Weighted average for the period-basic

|

32,050,538 | 31,708,949 | 31,178,813 | 30,764,282 | 30,445,882 | |||||||||||||||

|

Incremental impact of stock equivalents

|

347,827 | 436,824 | 368,778 | 269,432 | 543,751 | |||||||||||||||

|

Weighted average for the period-diluted

|

32,398,365 | 32,145,773 | 31,547,591 | 31,033,714 | 30,989,633 | |||||||||||||||

|

Balance Sheet Data (at end of period)

|

||||||||||||||||||||

|

Current assets

|

$ | 429.5 | $ | 406.5 | $ | 355.1 | $ | 293.1 | $ | 371.3 | ||||||||||

|

Net property and equipment

|

301.9 | 273.5 | 271.7 | 248.3 | 191.5 | |||||||||||||||

|

Other long-term assets

|

179.2 | 169.1 | 180.5 | 205.4 | 182.4 | |||||||||||||||

|

Total assets

|

910.6 | 849.1 | 807.3 | 746.8 | 745.2 | |||||||||||||||

|

Current liabilities

|

114.5 | 118.0 | 112.5 | 92.1 | 109.8 | |||||||||||||||

|

Long-term debt

|

248.8 | 260.7 | 235.7 | 207.0 | 256.8 | |||||||||||||||

|

Other long-term liabilities

|

82.2 | 75.5 | 65.0 | 72.2 | 51.2 | |||||||||||||||

|

Total equity

|

465.1 | 394.9 | 394.1 | 375.5 | 327.4 | |||||||||||||||

|

Other Statistics for Continuing Operations

|

||||||||||||||||||||

|

Depreciation, depletion and amortization

|

$ | 45.3 | $ | 42.1 | $ | 36.3 | $ | 36.7 | $ | 34.1 | ||||||||||

|

Capital expenditures

|

74.5 | 61.0 | 47.3 | 50.7 | 44.0 | |||||||||||||||

|

Capital expenditures - corporate building

|

- | - | - | 9.7 | 16.7 | |||||||||||||||

|

Gross profit margin

|

27.5 | % | 26.7 | % | 25.9 | % | 26.8 | % | 25.7 | % | ||||||||||

|

Operating profit margin

|

10.0 | % | 9.1 | % | 8.4 | % | 7.2 | % | 8.9 | % | ||||||||||

|

Pretax profit margin

|

8.6 | % | 8.0 | % | 7.3 | % | 5.4 | % | 6.8 | % | ||||||||||

|

Effective tax rate

|

27.6 | % | 27.6 | % | 33.4 | % | 14.6 | % | 24.0 | % | ||||||||||

|

Net profit from continuing operations margin

|

6.6 | % | 6.3 | % | 3.6 | % | 4.6 | % | 2.6 | % | ||||||||||

|

Return on average equity

|

15.1 | % | 14.8 | % | 7.6 | % | 9.1 | % | 7.2 | % | ||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We are a global company focused on long term profitability growth through the development and application of minerals and technology products and services to various industrial and consumer markets. The majority of our revenue growth has been achieved by sustaining our products’ technological advantages, developing new products and applying them in innovative ways, bringing additional products and services to markets we already serve, and overall growth in the industries we serve. We focus our research and development activities in areas where we can either leverage our current customer relationships and mineral reserves or enhance existing or related products and services.

The principal mineral that we utilize to generate revenues is bentonite. We own or lease bentonite reserves in the U.S., Australia, China and Turkey. Additionally, through our affiliates and joint ventures, we have access to bentonite reserves in Egypt, India, and Mexico. We also develop applications for other minerals, including chromite ore from our mine in South Africa.

Bentonite is surface mined when it is commercially feasible to have it shipped to a plant for further processing, including crushing, drying, milling and packaging. Bentonite deposits have varying physical properties which require us to identify which markets our reserves can serve. Nicknamed the mineral of a thousand uses, bentonite’s unique characteristics include its ability to bind, swell, adsorb, control rheology, soften fabrics, and have its surface modified through chemical and physical reactions. Our research and development activities, including our understanding of bentonite properties, mining methods, processing and application to markets are some of the core components of our longevity and future prospects.

23

We operate in five segments: performance materials, construction technologies, energy services, transportation and corporate. Both our performance materials and construction technologies segments operate manufacturing facilities in North America, Europe, and the Asia-Pacific region. Our performance materials segment also owns and operates a chrome mine in South Africa. Our energy services segment principally operates in the Gulf of Mexico and surrounding states and also has a growing presence in South America, Africa and Asia. Additionally, we have a transportation segment that provides trucking services for our domestic performance materials and construction technologies segments as well as third parties.