QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

SOUTHWALL TECHNOLOGIES INC. |

||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

/ / |

Fee paid previously with preliminary materials. |

|||

/ / |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

SOUTHWALL TECHNOLOGIES INC.

1029 Corporation Way

Palo Alto, California 94303

October 18, 2001

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Southwall Technologies Inc. (the "Company"), a Delaware corporation, which will be held on Thursday, November 15, 2001 at 3:00 p.m., at the Company's principal executive offices at 1029 Corporation Way, Palo Alto, California.

The following Notice of Annual Meeting of Stockholders and Proxy Statement describe the items to be considered by the stockholders and contain certain information about the Company and its officers and directors.

Please sign and return the enclosed proxy card as soon as possible in the envelope provided so that your shares can be voted at the meeting in accordance with your instructions. Even if you plan to attend the meeting, we urge you to sign and promptly return the proxy card. You may revoke it at any time before it is exercised at the meeting or vote your shares personally if you attend the meeting.

We look forward to seeing you.

| /s/ THOMAS G. HOOD | ||

Sincerely, THOMAS G. HOOD President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF

SOUTHWALL TECHNOLOGIES INC.

1029 Corporation Way

Palo Alto, California 94303

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Southwall Technologies Inc. (the "Company"), a Delaware corporation, will be held on Thursday, November 15, 2001, at 3:00 p.m. at the Company's principal executive offices at 1029 Corporation Way, Palo Alto, California, for the following purposes:

- 1.

- To

elect directors to serve for the ensuing year;

- 2.

- To

ratify the appointment of PricewaterhouseCoopers LLP as independent accountants of the Company for the fiscal year ending December 31, 2001; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on October 11, 2001 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any continuation or adjournment thereof.

/s/ ROBERT R. FREEMAN

By

Order of the Board of Directors

ROBERT R. FREEMAN

Secretary

Palo Alto, California

October 18, 2001

ALL STOCKHOLDERS ARE INVITED TO ATTEND THE MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A POSTAGE-PREPAID ENVELOPE IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING.

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

SOUTHWALL TECHNOLOGIES INC.

1029 Corporation Way

Palo Alto, California 94303

General

The enclosed proxy is solicited on behalf of the Board of Directors of Southwall Technologies Inc. (the "Company") for use at the Annual Meeting of Stockholders (the "Annual Meeting") to be held on November 15, 2001 and at any adjournments of that meeting, at which stockholders of record on October 11, 2001 (the "record date") will be entitled to vote. The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice and are described in more detail in this Proxy Statement.

Each properly signed proxy will be voted in accordance with the instructions contained therein, and, if no choice is specified, the proxy will be voted in favor of the proposals set forth in the Notice of Annual Meeting. Only holders of the Company's common stock, $.001 par value (the "Common Stock"), of record on the stock transfer books of the Company at the close of business on the record date will be entitled to vote at the meeting. There were 8,247,924 shares of Common Stock issued, outstanding and entitled to vote on the record date. No shares of the Company's preferred stock were outstanding on the record date.

Each stockholder is entitled to one vote for each share of Common Stock held by said stockholder. For purposes of matters before the Annual Meeting, under the Company's By-Laws, a quorum consists of a majority of the issued and outstanding shares entitled to vote on such matters as of the record date. The affirmative vote of the holders of a plurality of the shares represented at the meeting, if a quorum is present, is required for the election of directors. If a quorum is present, approval of each other matter that is before the meeting will require the affirmative vote of the holders of a majority of votes cast with respect to such matter. With regard to the election of directors, votes may be cast in favor of or withheld from each nominee. Votes that are withheld will be excluded entirely from the vote and will have no effect. Abstentions may be specified on all proposals, except the election of directors, and will be counted as present for purposes of determining the existence of a quorum regarding the item on which the abstention is noted. If shares are not voted by the broker who is the record holder of the shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to any matter, these non-voted shares are not deemed to be present or represented for purposes of determining whether stockholder approval of that matter has been obtained.

The Company intends to mail this Proxy Statement and the accompanying proxy card on or about October 18, 2001 to all stockholders entitled to vote at the Annual Meeting. The Company's Annual Report to Stockholders for the year ended December 31, 2000 is being mailed together with this Proxy Statement.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by the holder of record by filing with the Secretary of the Company at the Company's principal executive office, 1029 Corporation Way, Palo Alto, California, 94303, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by the holder of record attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

SECURITY OWNERSHIP OF OFFICERS, DIRECTORS, NOMINEES

AND PRINCIPAL STOCKHOLDERS

The following table sets forth certain information known to the company regarding the ownership of the Company's Common Stock as of October 11, 2001 by (i) each stockholder known to the Company to be a beneficial owner of more than 5% of the Company's Common Stock, (ii) each director and nominee for director of the Company, (iii) each of the executive officers named in the Summary Compensation Table below, and (iv) all current executive officers and directors as a group. Except as otherwise indicated, each person has sole investment and voting power with respect to the shares shown as being beneficially owned by each person, based on the information provided by such owners. Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

| Name and Address |

Common Stock Beneficially Owned (1) |

Percent of Outstanding Shares (1) |

|||

|---|---|---|---|---|---|

| Teijin Limited 67, Minamihonmachi, 1chome Chuoku, Osaka 541, Japan |

667,000 | 8.1 | % | ||

| GMX Associates PTE LTD. PSB Science Park Annex 3 Science Park Drive #0-2-16 Singapore 18223 |

422,119 | 5.1 | % | ||

Bruce J. Alexander (2) |

159,842 |

1.8 |

% |

||

| Eric Buonassisi (3) | 14,800 | * | |||

| Bill Finley | 1,883 | * | |||

| Vahid Ghassemian (4) | 24,800 | * | |||

| Thomas G. Hood (5) | 170,991 | 2.0 | % | ||

| Nasser Lama (6) | 20,000 | * | |||

| Tadahiro Murakami (7) | 5,000 | * | |||

| Joseph B. Reagan (8) | 90,813 | 1.0 | % | ||

| Walter C. Segwick (9) | 229,309 | 2.6 | % | ||

| Robert C. Stempel (10) | 5,000 | * | |||

| Sicco Westra (11) | 51,950 | * | |||

| All current officers and directors as a Group (16 persons) (12) | 909,255 | 10.5 | % |

- *

- Less

than one percent.

- (1)

- The

table is based upon information supplied by officers, directors and principal stockholders. Unless otherwise indicated, each of the stockholders

named in the table has a sole voting and investment power with respect to all securities shown as beneficially owned, subject to community property laws where applicable and the information contained

in the footnotes to the table.

- (2)

- Includes

options to purchase 22,920 shares that are exercisable within 60 days of October 1, 2001.

- (3)

- Consists

of options to purchase shares that are exercisable within 60 days of October 1, 2001.

- (4)

- Consists

of options to purchase shares that are exercisable within 60 days of October 1, 2001.

- (5)

- Includes

options to purchase 137,266 shares that are exercisable within 60 days of October 1, 2001.

- (6)

- Includes

options to purchase 16,500 shares that are exercisable within 60 days of October 1, 2001.

- (7)

- Consists of options to purchase shares that are exercisable within 60 days of October 1, 2001.

2

- (8)

- Includes

options to purchase 59,746 shares that are exercisable within 60 days of October 1, 2001.

- (9)

- Includes

options to purchase 55,244 shares that are exercisable within 60 days of October 1, 2001.

- (10)

- Consists

of options to purchase shares that are exercisable within 60 days of October 1, 2001.

- (11)

- Includes

options to purchase 49,550 shares that are exercisable within 60 days of October 1, 2001.

- (12)

- Includes options to purchase an aggregate of 479,176 shares that are exercisable within 60 days of October 1, 2001 held by executive officers and directors of the Company.

PROPOSAL 1

ELECTION OF DIRECTORS

Each director to be elected will hold office until the next Annual Meeting of Stockholders and until his successor is elected and has qualified, or until such director's earlier death, resignation or removal.

The Company's Board of Directors has fixed the number of directors for the ensuing year at six and has nominated for such positions the six persons listed below. Teijin Limited has the right to nominate one of the six directors each year. This year Teijin Limited has nominated Tadahiro Murakami. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the six nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose.

Set forth below is information regarding the nominees, including information furnished by them as to their principal occupations for at least the last five years, certain other directorships held by them, and their ages as of October 11, 2001.

| Name |

Age |

|

|---|---|---|

| Bruce J. Alexander(1) | 57 | |

| Thomas G. Hood | 46 | |

| Tadahiro Murakami(1) | 60 | |

| Joseph B. Reagan(1)(2) | 66 | |

| Walter C. Sedgwick(2) | 54 | |

| Robert C. Stempel(2) | 68 |

- (1)

- Member

of the Human Resources Committee.

- (2)

- Member of the Audit Committee.

Mr. Alexander has served as a member of the Board of Directors of the Company since May 1981. In April 1999, he joined Needham & Co., Inc., an investment bank, as its Managing Director. From June 1997 until April 1999 he served as President and Chief Executive Officer for Black & Company, an investment bank. From May 1994 to June 1997 he was with Needham & Co., Inc., an investment bank, most recently serving as a Managing Director. From January 1992 to May 1994 he was a General Partner with Materia Ventures, L.P., a venture capital firm investing in advanced materials companies. From March 1987 to July 1991 he was President and Chief Executive Officer of the Company. From February 1982 to March 1987 he held various offices within the Company, including Executive Vice President, Vice Chairman of the Board, Chairman and acting Chief Executive Officer, and Chief Financial Officer.

Mr. Hood has served as the Company's President and Chief Executive officer since July 1998 and as a member of the Board of Directors of the Company since March 1998. From March 1998 until

3

July 1998 he served as Interim President and Chief Executive Officer. From July 1996 to March 1998 he served as Senior Vice President, General Manager, Energy Products Division. From January 1995 to July 1996 he was Vice President, General Manager, International Operations, and from October 1991 to January 1995 he was Vice President, Marketing and Sales. From September 1990 to October 1991 he was Vice President, Business Development. From June 1989 to September 1990 Mr. Hood served as Vice President, Glazing Laminates. Previously, From July 1981 to June 1989, he served in various positions within the Company including Director of New Product Development and Director of Engineering Development.

Mr. Murakami has served as a member of the Company's Board of Directors since May 2000. He presently is the President of Teijin-Bayer Polytec Ltd., a producer of plastic products, and a subsidiary of Teijin Limited. He served, from February 1997 until April 1999, as Director of the Plastics Division for Teijin DuPont Films S.A., a subsidiary of Teijin Limited, and was the General Manager of the Sales Department for Teijin DuPont Films S.A., a subsidiary of Teijin Limited, from December 1994 until February 1997.

Dr. Reagan has served as a member of the Board of Directors of the Company since June 1993, and previously served as a Director from October 1987 through May 1992. Dr. Reagan is a technology and senior management consultant to industry and to the United States Government. He retired in 1996 after 37 years with the Lockheed Martin Corporation where he was a corporate officer and Corporate Vice President and General Manager of the Research and Development Division of the Missiles and Space Company.

Mr. Sedgwick has served as a member of the Board of Directors of the Company since January 1979. Mr. Sedgwick has worked as a private investor for the past seven years.

Mr. Stempel has served as a member of the Board of Directors since May 2000. He presently is Chairman of Energy Conversion Devices, Inc. (ECD), an energy and information company headquartered in Troy, Michigan. Mr. Stempel retired as Chairman and Chief Executive Officer from General Motors Corporation in November 1992. He was named Chairman and CEO in August 1990. Prior to serving as Chairman, he had been President and Chief Operating Officer of General Motors since September 1987.

The Board of Directors recommends a vote "FOR" the election of all of the above nominees for election as directors.

The Board of Directors of the Company held eight meetings during 2000 and currently has two standing committees; the Audit Committee and the Human Resources Committee. During 2000, each nominee for director, who is currently a director, attended more than 75% of the aggregate of the meetings of the Board and of the committees on which he served.

The Audit Committee recommends engagement of the Company's independent accountants, approves the services performed by such accountants, reviews the results of the annual audit, and evaluates the Company's accounting systems and internal financial controls. The Audit Committee held nine meetings during 2000.

The Human Resources Committee is authorized to periodically make and review recommendations regarding employee compensation and to perform other duties regarding compensation for employees as the Board may delegate to such Committee from time to time. The Human Resources Committee is also authorized to administer the Company's stock option plans. The Human Resources Committee held five meetings during 2000.

4

During 2000, the Company paid each of its non-employee directors an annual retainer fee of $8,000, a fee of $800 for each Board meeting attended and a fee of $600 for each Committee meeting attended: Mr. Alexander—$18,401; Mr. Murakami—$9,867; Dr. Reagan—$29,234; Mr. Sedgwick—$23,801; and Mr. Stempel—$11,667.

Board members are also eligible to receive options to purchase shares of Common Stock under the Company's 1997 Stock Incentive Plan. During 2000, the non-employee Board members received options to purchase the following number of shares: Mr. Alexander—8,920 shares at an average exercise price of $7.09 per share; Mr. Murakami—20,000 shares at an exercise price of $7.75 per share; Dr. Reagan—8,920 shares at an average exercise price of $7.09 per share; Mr. Sedgwick—8,920 shares at an average exercise price of $7.09 per share; and Mr. Stempel—20,000 shares at an exercise price of $7.75 per share.

CERTAIN RELATIONSHIPS AND OTHER TRANSACTIONS

On April 9, 1997, the Company signed a comprehensive set of collaborative agreements with a major supplier of raw materials to the Company, Teijin Limited of Osaka, Japan ("Teijin"). The agreements provided for, among other things, the purchase by Teijin of 667,000 shares of the Company's Common Stock at a price of $7.50 per share; a guarantee by Teijin of a $10 million loan for the Company; and an agreement to collaborate to achieve closer marketing and product development ties between the two companies. The Company agreed to pay a loan guarantee fee to Teijin at the rate of .5625% per year on the outstanding balance of the loan guaranteed by Teijin. The Company paid a loan guarantee fee of $56,875 to Teijin during 2000. Pursuant to the Company's agreements with Teijin, Teijin is entitled to nominate one member to the Company's board. In May 2000, Mr. Tadahiro Murakami, President of Teijin-Bayer Polytec Ltd., a subsidiary of Teijin Limited, was appointed to the Board of Directors of the Company and will be presented at the Annual meeting for re-election. Teijin has become a customer of the Company for certain of its products, and the Company has acquired a license from Teijin for rights to manufacture and sell under certain patents owned by Teijin in Japan. During 2000 the Company paid Teijin approximately $10,300,000 for purchases of raw material substrates.

Under an agreement dated June 22, 1999, as amended, the Company engaged Needham & Company as the exclusive financial advisor to the Company in connection with certain financial transactions, including a merger, sale of assets or stock or other business combination involving the Company. Bruce J. Alexander, a director of the Company, is a Managing Director of Needham & Company. Under the agreement, the Company would be obligated to pay Needham in connection with certain transactions and for Needham's services under the agreement.

In 1999, the Company entered into an agreement with Energy Conversion Devices (ECD) to purchase Production Machine 7 (PM7), located in the Company's Tempe facility. In May 2000, Robert C. Stempel was appointed to the Board of Directors of the Company. Mr. Stempel is presently Chairman of ECD, headquartered in Troy, Michigan. As of September 30, 2001, the Company had an outstanding payable balance to ECD of $819,770 for PM7.

The Company has lent certain amounts to Thomas G. Hood, the Company's President and Chief Executive Officer and Ted L. Larsen, the Company's Vice President of Business Development, Display to permit them to exercise Company stock options held by each of them. In each case, the indebtedness is represented by a note payable to the Company due December 31, 2001 bearing interest at the rate of 7.0% per annum. Interest is payable at the time the loan is due. Loans may be extended for one-year terms if approved by the Board of Directors. As of September 30, 2001, the amount of indebtedness outstanding under such notes was $87,937 in the case of Mr. Hood, and $18,750 in the case of Mr. Larsen.

5

EXECUTIVE OFFICER COMPENSATION

The following Summary Compensation Table sets forth certain information concerning compensation earned for services rendered in 2000, 1999 and 1998 by the Chief Executive Officer and each of the other executive officers of the Company who earned salary and bonus for the 2000 fiscal year in excess of $100,000 (collectively, the "Named Executive Officers").

| |

|

|

|

Long-Term Compensation Awards Securities |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Year |

Annual Compensation Salary(1) |

Bonus(1) |

Stock Awards(2) |

Stock Underlying Options |

All Other Compensation(3) |

||||||||||

| Thomas G. Hood(4) President and Chief Executive Officer |

2000 1999 1998 |

$ |

265,192 257,288 198,365 |

$ |

19,120 — 32,924 |

— — — |

28,550 125,000 30,000 |

$ |

1,000 1,000 1,000 |

|||||||

| Sicco W. T. Westra(5) Senior Vice President, Engineering and Product Development |

2000 1999 1998 |

$ |

176,144 177,817 162,672 |

$ |

12,620 — 1,324 |

— — — |

17,300 12,000 50,000 |

$ |

1,000 1,000 1,000 |

|||||||

| Bill R. Finley(6) Vice President & Chief Financial Officer |

2000 1999 1998 |

$ |

155,323 190,446 181,158 |

$ |

9,058 — 5,696 |

$ |

— — 3,562 |

17,983 12,000 50,000 |

$ |

1,000 1,000 1,000 |

||||||

| Eric Buonassissi(7) Senior Vice President, Sales & Marketing |

2000 | $ | 194,250 | $ | 8,977 | $ | 3,197 | 2,983 | $ | 1,000 | ||||||

| Vahid Ghassemian(8) Senior Vice President, Operations |

2000 1999 |

$ |

215,457 125,513 |

$ |

15,920 — |

— — |

27,300 50,000 |

$ |

1,000 1,000 |

|||||||

| Nasser Lama(9) Vice President, U.S. Operations |

2000 1999 |

$ |

154,240 26,052 |

$ |

22,800 15,000 |

— — |

21,500 20,000 |

$ |

1,000 479 |

|||||||

- (1)

- The amounts listed under Salary and Bonus include amounts deferred pursuant to the Company's 401(k) Plan.

- (2)

- The amounts listed represent bonuses paid in shares of the Company's common stock, rather than cash. These shares are not subject to any vesting or repurchase restrictions.

- (3)

- The amounts listed under "All Other Compensation" for 2000 consist of the Company's matching contributions under the Company's 401(k) Plan.

- (4)

- Mr. Hood was promoted to the position of President and Chief Executive Officer in July 1998.

- (5)

- Mr. Westra joined the Company in 1998 as the Senior Vice President, Engineering and Product Development.

- (6)

- Mr. Finley joined the Company in June 1998 as the Vice President & Chief Financial Officer. Effective August 31, 2000, Southwall Technologies terminated Mr. Finley's employment.

- (7)

- Mr. Buonassissi joined the Company in 1999 as the Senior Vice President, Sales & Marketing. Effective January 2001, Mr. Buonassissi was no longer employed by Southwall Technologies, but he is retained as a consultant to the Company.

- (8)

- Mr. Ghassemian joined the Company in May 1999 as Senior Vice President, Operations. Effective November 2000, Mr. Ghassemian was no longer employed by Southwall Technologies.

- (9)

- Mr. Lama joined the Company in September 1999, and was promoted to the position of Vice President, U.S. Operations in March 2000.

6

OPTION GRANTS IN LAST FISCAL YEAR

The following table contains information concerning the grant of stock options during 2000 to the Named Executive Officers.

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of Securities Underlying Options Granted(1) |

Percent of Options Granted to Employees in Fiscal Year |

|

|

|||||||||||

| Name |

Exercise Price ($/Sh)(2) |

Expiration Date |

|||||||||||||

| 5% |

10% |

||||||||||||||

| Thomas G. Hood | 28,550 | 3.8 | % | $ | 7.06 | 1/21/2010 | $ | 126,816 | $ | 321,376 | |||||

| Sicco W.T. Westra | 17,300 | 2.3 | % | 7.06 | 1/21/2010 | 76,845 | 194,739 | ||||||||

| Bill R. Finley(4) | 17,983 | 2.4 | % | 7.17 | 9/1/2004 | — | — | ||||||||

| Eric Bounassissi | 2,983 | 0.4 | % | 7.71 | 1/1/2007 | 3,624 | 4,828 | ||||||||

| Vahid Ghassemian(5) | 27,300 | 3.6 | % | 8.09 | 6/2/2006 | 16,847 | 34,246 | ||||||||

| Nasser Lama | 21,500 | 2.9 | % | 7.06 | 1/21/2010 | 95,500 | 242,017 | ||||||||

- (1)

- Option

grants were made under the Company's 1997 Stock Incentive Plan. The options vest in four annual installments, with the first such 25% installment vesting one year after the

grant date. In the event of certain corporate transactions such as an acquisition or sale of assets of the Company, the outstanding options of the Company's Named Executive Officers will become

immediately exercisable for fully vested shares of common stock, unless the options are assumed or substituted with a comparable option by the acquiring company or its parent. In any event, the Human

Resources Committee has the discretion to accelerate the vesting of outstanding options upon certain corporate transactions or involuntary terminations following a corporate transaction. See also

"Severance Agreements."

- (2)

- All

options were granted at an exercise price equal to the fair market value of the Common Stock on the date of the grant. The exercise price may be paid in cash or cash

equivalents, in shares of the Common Stock valued at fair market value on the exercise date or in a same-day sale program with the assistance of a designated brokerage firm.

- (3)

- As

required by the rules of the Securities and Exchange Commission, potential realizable values stated are based on the prescribed assumption that the Common Stock will

appreciate in value from the date of grant to the end of the option term at rates (compounded annually) of 5% and 10%, respectively, and therefore are not intended to forecast future appreciation, if

any, in the price of the Common Stock.

- (4)

- The

Company cancelled options to purchase 79,300 shares of stock including the options listed in the table above, held by Mr. Finley upon his termination.

- (5)

- The Company cancelled options to purchase 52,500 shares of stock including the options listed in the table above, held by Mr. Ghassemian upon his resignation.

7

Fiscal Year-end Option Values

The following table provides information with respect to the Named Executive Officers concerning unexercised options held as of the end of 2000.

| |

Number of Securities Underlying Unexercised Options at Fiscal Year-End |

Value of Unexercised In-the-Money Options at Fiscal Year-End |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name |

||||||||||

| Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||

| Thomas G. Hood | 106,850 | 156,666 | $ | — | $ | — | ||||

| Sicco W.T. Westra | 30,300 | 49,000 | — | — | ||||||

| Bill R. Finley | — | — | — | — | ||||||

| Eric Bounassissi | 14,800 | 37,500 | — | — | ||||||

| Vahid Ghassemian | 24,800 | — | — | — | ||||||

| Nasser Lama | 6,500 | 35,000 | — | — | ||||||

Severance Agreements

The Company has entered into a severance agreement with all of its officers, and nine other key employees, pursuant to which they may become entitled to special benefits in connection with certain changes in control of the Company affected by merger, liquidation or tender offer, as described below.

The officers and other employees who are parties to severance agreement are as follows:

| Name |

Title |

Effective Date |

||

|---|---|---|---|---|

| Thomas G. Hood | President, Chief Executive Officer | December 14, 1999 | ||

| Sicco W.T. Westra | Senior Vice President, Engineering and Product Development | December 14, 1999 | ||

| Robert R. Freeman | Senior Vice President, Chief Financial Officer | August 31, 2000 | ||

| Nasser Lama | Vice President, U.S. Operations | December 14, 1999 | ||

| Robert Cormia | Vice President, Quality | December 14, 1999 | ||

| Wolfgang Heinze | Vice President, Dresden Operations | December 8, 2000 | ||

| Ted Larsen | Vice President, Business Development, Display | December 14, 1999 | ||

| John Lipscomb | Vice President, Corporate Controller | November 8, 2000 | ||

| David Niehous | Vice President, Sales, XIR | October 23, 2000 | ||

| Floyd E. Woodard | Vice President, Research and Development | December 14, 1999 | ||

| Graig Young | Vice President, Sales, Heat Mirror | December 14, 1999 |

Under each of the agreements, a liquidation or acquisition of the Company may result in the immediate acceleration of vesting of the Named Executive Officers' outstanding options granted under the Company's option plans. Accordingly, should there occur a sale of substantially all of the Company's assets or an acquisition of the Company by merger or consolidation, then all options at the time held by each such officer will become immediately exercisable for the fully vested shares of Common Stock. However, such vesting acceleration will not occur to the extent the options are assumed by the acquiring entity.

In the event that (i) the outstanding options are so assumed or the change in control is effected through the acquisition of 50% or more of the Company's outstanding voting stock pursuant to a hostile tender offer and (ii) the officer's employment is involuntarily terminated (other than for cause) within 18 months following such assumption or acquisition, then the vesting of any options at the time held by each officer granted under the Company's option plans will immediately accelerate.

Involuntary termination is defined in each severance agreement as the officer's discharge or dismissal (other than for cause) or other termination of employment, whether voluntary or involuntary,

8

following a material reduction in the officer's compensation or level of responsibilities, a change in the officer's job location without his or her consent or a material reduction in the officer's benefits and perquisites. Termination for cause includes any involuntary termination triggered by the executive officer's willful misconduct, gross negligence or unauthorized use or disclosure of trade secrets or other confidential information.

In addition to the acceleration of vesting of each named executive officer's outstanding options, such individual may become entitled to a lump sum severance payment upon his or her involuntary termination within 18 months after a change in control. Accordingly, to the extent that the spread on the officer's accelerated options (the excess of the market price, at the time of acceleration, of the shares of Common Stock for which the options are accelerated over the aggregate exercise price payable for such shares) does not exceed 2.99 times the officer's average W-2 wages from the Company for the five fiscal years preceding the fiscal year in which the change in control occurs, a cash severance payment will be provided to the officer. However, the cash payment will in no event exceed the lesser of (i) two times the sum of the executive officer's annual rate of base salary in effect at the time of his or her involuntary termination plus the bonuses earned by him or her for the immediately preceding fiscal year or (ii) the amount necessary to bring the total benefit package (acceleration plus severance) up to the "2.99 times average W-2 wages" limitation.

In the event benefits had become due as of December 31, 2000 under the severance agreement currently in affect for the Named Executive Officers, the maximum cash amounts payable would be as follows: Mr. Hood, $675,000; Mr. Westra, $264,000; and Mr. Lama, $232,875.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company's Human Resources Committee consists of Joseph B. Reagan, Walter C. Sedgwick, Tadahiro Murakami and Bruce J. Alexander. Neither Dr. Reagan nor Mr. Sedgwick has at any time since our formation been an officer or employee of Southwall. From February 1982 to March 1987, Mr. Alexander held various positions with us, including Executive Vice President, Vice Chairman of the Board, Chairman and acting Chief Executive Officer, and Chief Financial Officer. None of our executive officers currently serves, or in the past has served as a member of the Board of Directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or compensation committee.

HUMAN RESOURCES COMMITTEE REPORT ON EXECUTIVE COMPENSATION

It is the duty of the members of the Company's Board to set the base salary of certain executive officers and to administer the Company's benefit plans. In addition, the Board approves the individual bonus programs to be in effect for certain executive officers each fiscal year. The Board acts pursuant to recommendations of the Human Resources Committee. The Human Resources Committee administers the Company's 1997 Stock Incentive Plan, under which stock option grants may be made to such officers and other key employees.

For 2000, the Board established the compensation payable to Mr. Hood, President and Chief Executive Officer; Mr. Freeman, Vice President and Chief Financial Officer; Mr. Ghassemian, Vice President of Operations; and all other executive officers of the Company.

General Compensation Policy. The Company's executive compensation policy is competitive in order to recruit, retain and motivate people of needed capabilities. For executives, the Company strives to link total compensation to performance. Base compensation, benefits and perquisites are intended to be competitive. Incentive compensation is provided in the form of cash bonuses and stock options. The Company anticipates that the compensation levels of its executive officers will generally be reviewed in the early part of each fiscal year.

9

Factors. Several of the more important factors that were considered in establishing the components of each executive officer's compensation package for 2000 are summarized below.

Base Salary. The base salary for each executive officer is set on the basis of personal performance and salary levels for comparable positions at companies with revenue levels comparable to that of the Company. Information regarding comparable salary levels is obtained from published surveys of companies that may or may not be in industries comparable to that of the Company. Generally, the Company targets base salaries at the mid-point of such market data.

Annual Incentive Compensation. The annual pool of bonuses for executive officers is determined solely on the basis of the Company's achievement of the financial performance targets established at the start of the fiscal year. Actual bonuses paid reflect an individual's accomplishment of both corporate and functional objectives, with substantially greater weight being given to achievement of corporate rather than functional objectives. In particular, approximately 70% of an executive's target bonus is based on achieving corporate objectives and the balance on achieving the executive's functional objectives, such as profitability improvement, asset management, market position, product leadership and key projects. These factors are evaluated on a subjective basis without specific weighting.

Long-Term Incentive Compensation. In 2000, the Human Resources Committee approved stock option grants to each of the Named Executive Officers under the Company's 1997 Stock Incentive Plan. The grants are designed to align the interests of each of the Named Executive Officers with those of the stockholders and provide each such individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company. The decision to award options to certain officers and the number of shares subject to each such option grant was based upon the officer's type and level of function, criticality of function, contribution and performance against objectives as described above. The Committee considers the number of options already held by executives when approving new options to executives. Each option grant allows the officer to acquire shares of Common Stock at a fixed price per share (the market price on the grant date) over a specified period of time (up to seven years). Accordingly, the option will provide a return to the executive officer only if the market price of the Common Stock appreciates over the option term.

CEO Compensation. The annual base salary for 2000 for the Company's President and Chief Executive Officer, Mr. Hood, was established primarily on the basis of Mr. Hood's personal performance and the range of base salaries paid to the chief executive officers of companies with comparable revenue levels. Mr. Hood's 2000 salary was within the range of base salaries paid to the chief executive officers of comparable companies. The option grants made to Mr. Hood that were based upon his position and a subjective evaluation of his performance, were intended to place a significant portion of his total compensation at risk, since the options will have no value unless there is appreciation in the value of the Common Stock over the option term.

Deduction Limit for Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended, limits federal income tax deductions for compensation paid after 1993 to the chief executive officer and the four other most highly compensated officers of a public company to $1 million per year, but contains an exception for performance-based compensation that satisfies certain conditions. The Company does not believe that the components of the Company's compensation will be likely to exceed $1 million per year for any executive officer in the foreseeable future and, therefore, concluded that no further action with respect to qualifying such compensation for federal income tax deductibility was necessary at this time. In the future, the Company will continue to evaluate the

10

advisability of qualifying its executive compensation for such deductibility. The Company's policy is to qualify its executive compensation for deductibility under applicable tax laws as practicable.

The Human Resources Committee

Joseph

B. Reagan, Chairman

Bruce J. Alexander

Walter C. Sedgwick

Tadahiro Murakami

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systemsd of internal controls.

The Audit Committee consists of three members, each of whom is independent (as defined by listing standards that govern companies the shares of which are listed on Nasdaq). The Audit Committee operates under a written charter, approved by the Board of Directors, which is attached as Appendix A to the Proxy Statement.

In fulfilling its oversight responsibilities regarding the 2000 financial statements, the Audit Committee reviewed with management the audited financial statements in the Annual Report, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The Audit Committee's review included discussion with the outside auditors of matters required to be discussed pursuant to Statement of Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgment as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and received by the Committee.

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their audits in 2001. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Audit Committee held nine meetings during 2000.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Annual Report on Form 10-K/A for the year ended December 31, 2000, for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended, subject to shareholder approval, the selection of the Company's independent auditors for 2001.

The Audit Committee

Joseph

B. Reagan

Walter C. Sedgwick

Robert C. Stempel

11

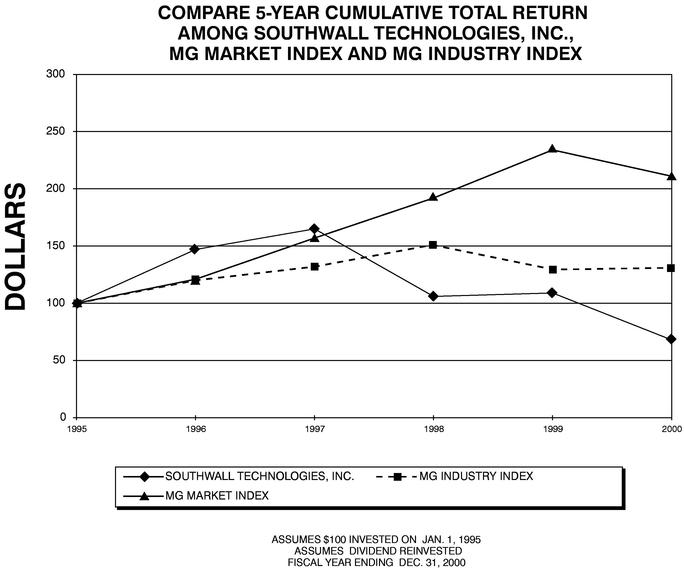

COMPARISON OF CUMULATIVE TOTAL STOCKHOLDER RETURN

The following performance graph assumes an investment of $100 on January 1, 1995 and compares the changes thereafter in the market price of the Company's common stock with a broad market index (Media General Financial Services—Composite Market Value) and an industry index (MGFS Group—General Building Materials). MGFS no longer supports the industry group index previously used for comparison (Other Building Materials) and the Company is now using the index MGFS Group—General Building Materials for industry comparison. The Company paid no dividends during the periods shown; the performance of the indexes is shown on a total return (dividend reinvestment) basis. The graph lines merely connect fiscal year-end dates and do not reflect fluctuations between those dates.

| |

1995 |

1996 |

1997 |

1998 |

1999 |

2000 |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Southwall Technologies, Inc. | 100.00 | 147.06 | 164.71 | 105.88 | 108.82 | 67.65 | ||||||

| MG Industry Index | 100.00 | 120.14 | 131.87 | 150.56 | 128.82 | 131.49 | ||||||

| MG Market Index | 100.00 | 120.77 | 156.82 | 191.71 | 233.83 | 211.11 |

The Human Resources Committee Report on Executive Compensation, the Report of the Audit Committee and the Comparison of Cumulative Total Stockholder Return information above shall not be deemed "soliciting material" or incorporated by reference into any of the Company's filings with the Securities and Exchange Commission by implication or by any reference in any such filing to this Proxy Statement.

12

PROPOSAL 2

RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS

The Board has selected PricewaterhouseCoopers LLP as the Company's independent accountant for the year ending December 31, 2001 and has further directed that management submit the selection of independent accountants for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited the Company's financial statements since 1983. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent accountants is not required by the Company's By-Laws or otherwise. Nonetheless, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the selection, the Board will reconsider whether to retain PricewaterhouseCoopers LLP. Even if the selection is ratified, the Board in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Board determines that such a change would be in the best interests of the Company and its stockholders. The affirmative vote of the holders of a majority of the shares represented and voting at the meeting will be required to ratify the selection of PricewaterhouseCoopers LLP.

Audit Fee. Fees of PricewaterhouseCoopers LLP for the audit of the Company's financial statements, 401(k) plan and statutory audits for the fiscal year ended December 31, 2000 and the reviews of quarterly reports on Form 10-Q were $1,066,658, of which an aggregate amount of $775,500 had been billed through December 31, 2000.

Financial Information Systems Design and Implementations Fees. PricewaterhouseCoopers LLP assessed the company no fees for any financial information systems design or implementation during the fiscal year ended December 31, 2000.

Review of Revenue Cycle Internal Controls were $125,000 during the fiscal year ended December 31, 2000.

All Other Fees. Aggregate fees billed for all other services rendered by PricewaterhouseCoopers LLP during the fiscal year ended December 31, 2000 were $200,000. These services included:

- •

- reviews

of certain financial and statistical information in connection with contracts and other agreements;

- •

- assistance

with 1933 Securities Act filings and accounting technical advice;

- •

- employee

benefit advisory and administration services; and

- •

- litigation support services.

All audit and non-audit services provided by PricewaterhouseCoopers LLP are approved by the Audit Committee, which considers whether the provision of non-audit services is compatible with maintaining the auditor's independence.

The Board of Directors recommends a vote "FOR" the ratification of the selection of Pricewaterhouse Coopers LLP to serve as the Company's independent accountants for the fiscal year ending December 31, 2001.

13

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act, requires the Company's officers and directors and persons who own more than ten percent of its common stock to file reports with the Securities and Exchange Commission disclosing their ownership of stock in the Company and changes in such ownership. The Company requires copies of such reports to be furnished to them as well. Based solely on a review of the copies of such reports received by it and the written representations received from one or more such persons, the Company believes that, during 2000 all such filing requirements were complied with.

STOCKHOLDER PROPOSALS FOR 2002 ANNUAL MEETING

Proposals of stockholders intended to be presented at the 2002 Annual Meeting of Stockholders must be presented on or before January 11, 2002 for inclusion in the proxy materials relating to that meeting and on or before March 3, 2002 for matters to be considered timely such that, pursuant to Rule 14a-4 under the Exchange Act, the Company may not exercise its discretionary authority to vote on such matters at that meeting. Any such proposals should be sent to the Company at its principal offices addressed to the Secretary of the Company. Other requirements for inclusion are set forth in Rules 14a-4 and 14a-8 under the Exchange Act.

The Company knows of no other business that may be presented for consideration at the Annual Meeting. If any other matters are properly presented to the Annual Meeting, however, it is the intention of the persons named in the accompanying proxy card to vote, or otherwise to act, in accordance with their best judgment on such matters.

The Company will bear the entire cost of proxy solicitation, including costs of preparing, assembling, printing and mailing this Proxy Statement, the proxy card, and any additional material furnished to stockholders. Copies of the solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by telephone, telegram, telefax or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

The Board hopes that Stockholders will attend the Annual Meeting. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. A prompt response will greatly facilitate arrangements for the meeting, and your cooperation will be appreciated. Stockholders who attend the Annual Meeting may vote their shares personally even though they have sent in their proxies.

/s/ ROBERT R. FREEMAN

By

Order of the Board of Directors

ROBERT R. FREEMAN

Secretary

Palo Alto, California

October 18, 2001

14

DETACH HERE

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

SOUTHWALL TECHNOLOGIES INC.

Annual Meeting of Stockholders

November 15, 2001

The undersigned hereby appoints Thomas G. Hood and Robert R. Freeman, and each of them, as attorneys and proxies of the undersigned, with power of substitution, to vote all of the shares of stock of Southwall Technologies Inc. (the "Company") which the undersigned may be entitled to vote at the Annual Meeting of Stockholders of the Company to be held at the Company's principal executive offices at 1029 Corporation Way, Palo Alto, California on November 15, 2001 at 3:00 p.m. PDT, and at all continuations, and adjournments or postponements thereof, with all of the powers the undersigned would possess if personally present, upon and in respect of the following matters and in accordance with the following instructions, with the discretionary authority as to all other matters that may properly come before the meeting.

Receipt is hereby acknowledged of the Notice of Annual Meeting of Stockholders and Proxy Statement dated October 18, 2001 (the "Proxy Statement").

UNLESS A CONTRARY DIRECTION IS INDICATED, THIS PROXY WILL BE VOTED FOR ALL NOMINEES LISTED IN PROPOSAL 1 AND FOR PROPOSAL 2 AS MORE SPECIFICALLY SET FORTH IN THE PROXY STATEMENT. IF SPECIFIC INSTRUCTIONS ARE INDICATED, THIS PROXY WILL BE VOTED IN ACCORDANCE THEREWITH.

PLEASE VOTE, DATE, SIGN, AND PROMPTLY RETURN THIS PROXY CARD USING THE ENCLOSED POSTAGE PAID ENVELOPE.

SEE REVERSE SIDE |

CONTINUED AND TO BE SIGNED ON REVERSE SIDE | SEE REVERSE SIDE |

DETACH HERE

- /x/

- Please mark

votes as in

this example.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE NOMINEES FOR DIRECTORS LISTED BELOW AND "FOR" PROPOSAL 2.

| 1. | Election of Directors to hold office until the 2002 Annual Meeting of Stockholders and until their successors are elected. | ||||||

Nominees: (01) Bruce J. Alexander, (02) Thomas G. Hood, (03) Tadahiro Murakami, (04) Joseph B. Reagan, (05) Walter C. Sedgwick and (06) Robert C. Stempel |

|||||||

FOR ALL NOMINEES / / |

WITHHELD FROM ALL / / NOMINEES |

||||||

/ / |

|||||||

For all nominees except as noted above |

|||||||

2. |

Ratification of the selection of PricewaterhouseCoopers LLP as independent public accountants of the Company for fiscal year ending December 31, 2001. |

||||||

FOR / / |

AGAINST / / |

ABSTAIN / / |

|||||

3. |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting and at any adjournment or postponement thereof. |

||||||

MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT |

/ / |

||||||

Please sign exactly as your name appears hereon. If the stock is registered in the names of two or more persons, each should sign. If signer is a corporation, please give full corporate name and have a duly authorized officer sign stating title. If signer is a partnership, please sign in partnership name by authorized person. |

|||||||

| Signature: | |

Date: | |

Signature: | |

Date: | |

SECURITY OWNERSHIP OF OFFICERS, DIRECTORS, NOMINEES AND PRINCIPAL STOCKHOLDERS

PROPOSAL 1 ELECTION OF DIRECTORS

BOARD MEETINGS AND COMMITTEES

DIRECTOR COMPENSATION

CERTAIN RELATIONSHIPS AND OTHER TRANSACTIONS

EXECUTIVE OFFICER COMPENSATION

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

HUMAN RESOURCES COMMITTEE REPORT ON EXECUTIVE COMPENSATION

REPORT OF THE AUDIT COMMITTEE

COMPARISON OF CUMULATIVE TOTAL STOCKHOLDER RETURN

PROPOSAL 2 RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

STOCKHOLDER PROPOSALS FOR 2002 ANNUAL MEETING

OTHER BUSINESS