Table of Contents

Registration No. 333-100567

Washington, D.C. 20549

POST EFFECTIVE AMENDMENT NO. 16 [X]

AMENDMENT NO. 24 [X]

Boston, MA 02116

U.S. INSURANCE LAW

BOSTON, MA 02117

[X] on on May 2, 2016 pursuant to paragraph (b) of Rule 485

[ ] 60 days after filing pursuant to paragraph (a) (1) of Rule 485

[ ] on (date) pursuant to paragraph (a) (1) of Rule 485

Table of Contents

(“John Hancock USA”)

| Transaction Fees | ||

| Charge | When Charge is Deducted | Amount Deducted |

| Maximum Premium Load Charge Imposed on Premium (Load) | Upon receipt of premium | 2% of each premium paid |

| Maximum Sales Load Charge Imposed on Premium1 | Upon receipt of premium | 8% (Coverage Year 1)2 |

| Maximum Surrender Charge (Load)1 | Upon termination or reduction of any Coverage Amount that is subject to a surrender charge including surrender of the policy for its Net Cash Surrender Value, partial withdrawal in excess of the Free Withdrawal Amount, decrease in the Face Amount, or policy lapse. | 5% (Coverage Year 1)3 |

| Transfer Fees | Upon transfer | $25 (only applies to transfers in excess of 12 in a Policy Year) |

| Dollar Cost Averaging | Upon transfer | Guaranteed $5.00 |

| Current $0.00 | ||

| Asset Allocation Rebalancer | Upon transfer | Guaranteed $15.00 |

| Current $5.00 | ||

| Coverage

Year |

Percentage | |

|

1 |

8.00% | |

|

2 |

6.00% | |

|

3 |

3.00% | |

|

4 |

2.00% | |

|

5 |

1.00% | |

|

6+ |

0.00% |

| Coverage

Year |

Percentage | |

|

1 |

5.00% | |

|

2 |

4.00% | |

|

3 |

3.00% | |

|

4 |

2.50% | |

|

5 |

2.00% | |

|

6 |

1.50% | |

|

7 |

1.00% | |

|

8 |

1.00% | |

|

9 |

0.50% | |

|

10+ |

0.00% |

| Charges Other Than Those of the Portfolios | |||

| Charge | When Charge isDeducted | Amount Deducted | |

| Cost of Insurance1 | Monthly | Minimum and Maximum Charge | The possible range of the cost of insurance is from $0.00 to $83.33 per month per $1,000 of the net amount at risk. |

| Charge for a Representative policy owner (a 45 year old non-smoking male) (rating classification is for short form underwriting) | Policy Subject to Sales Charge: The Cost of Insurance rate is $0.16 per month per $1,000 of the net amount at risk. | ||

| Policy Subject to Surrender Charge: The Cost of Insurance rate is $0.35 per month per $1,000 of the net amount at risk. | |||

| Cost of Insurance - Optional FTIO Rider (Flexible Term Insurance Option)1 | Monthly | Minimum and Maximum Charges | The possible range of the cost of insurance is from $0.00 to $83.33 per month per $1,000 of the net amount at risk |

| Charge for a Representative policy owner (a 45 year old non-smoking male) rating classification is for short form underwriting) | The Cost of Insurance rate is $0.10 per month per $1,000 of the net amount at risk | ||

| Mortality and Expense Risk Fees | Monthly | 0.04% (0.50% annually)2 | |

| Administration Fees | Monthly | $12 per Policy Month | |

| Loan Interest Rate (Net) | Annually | 0.75% 3 | |

| Policy Year | Annual Rate | |

|

1-10 |

0.50% | |

|

11+ |

0.20% |

| Total Annual Portfolio Operating Expenses | Minimum | Maximum |

| Range of expenses, including management fees, distribution and/or service (12b-1) fees, and other expenses | 0.44% | 1.71% |

| Portfolio | Subadviser | Investment Objective |

| 500 Index B | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To approximate the aggregate total return of a broad-based U.S. domestic equity market index. |

| Active Bond | Declaration Management & Research LLC; and John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide income and capital appreciation. |

| All Cap Core | QS Investors, LLC | To seek to provide long-term growth of capital. |

| Alpha Opportunities | Wellington Management Company, LLP | To seek to provide long-term total return. |

| American Asset Allocation | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide high total return (including income and capital gains) consistent with preservation of capital over the long-term. |

| American Global Growth | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide long-term growth of capital. |

| American Growth | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide growth of capital. |

| American Growth–Income | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide growth of capital and income. |

| American International | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide long-term growth of capital. |

| American New World | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide long-term capital appreciation. |

| Blue Chip Growth | T. Rowe Price Associates, Inc. | To seek to provide long-term growth of capital. Current income is a secondary objective. |

| Bond | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide income and capital appreciation. |

| Capital Appreciation | Jennison Associates LLC | To seek to provide long-term growth of capital. |

| Capital Appreciation Value | T. Rowe Price Associates, Inc. | To seek to provide long-term capital appreciation. |

| Core Bond | Wells Capital Management, Incorporated | To seek to provide total return consisting of income and capital appreciation. |

| Core Strategy | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to provide long-term growth of capital. Current income is also a consideration. |

| Emerging Markets Value | Dimensional Fund Advisors LP | To seek to provide long-term capital appreciation. |

| Equity-Income | T. Rowe Price Associates, Inc. | To seek to provide substantial dividend income and also long-term growth of capital. |

| Financial Industries | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide growth of capital. |

| Franklin Templeton Founding Allocation | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide long-term growth of capital. |

| Fundamental All Cap Core | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide long-term growth of capital. |

| Portfolio | Subadviser | Investment Objective |

| Fundamental Large Cap Value | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide long-term capital appreciation. |

| Global | Templeton Global Advisors Limited | To seek to provide long-term capital appreciation. |

| Global Bond | Pacific Investment Management Company LLC | To seek to provide maximum total return, consistent with preservation of capital and prudent investment management. |

| Health Sciences | T. Rowe Price Associates, Inc. | To seek to provide long-term capital appreciation. |

| High Yield | Western Asset Management Company | To seek to provide an above-average total return over a market cycle of 3 to 5 years, consistent with reasonable risk. |

| International Core | Grantham, Mayo, Van Otterloo & Co. LLC | To seek to provide high total return. |

| International Equity Index B | SSgA Funds Management, Inc. | To seek to track the performance of a broad-based equity index of foreign companies primarily in developed countries and, to a lesser extent, in emerging markets. |

| International Growth Stock | Invesco Advisers, Inc. | To seek to provide long-term growth of capital. |

| International Small Company | Dimensional Fund Advisors LP | To seek to provide long-term capital appreciation. |

| International Value | Templeton Investment Counsel, LLC | To seek to provide long-term growth of capital. |

| Investment Quality Bond | Wellington Management Company, LLP | To seek to provide a high level of current income consistent with the maintenance of principal and liquidity. |

| Lifestyle Aggressive MVP | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to provide long-term growth of capital while seeking to both manage the volatility of return and limit the magnitude of portfolio losses. |

| Lifestyle Balanced MVP | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to provide growth of capital and current income while seeking to both manage the volatility of return and limit the magnitude of portfolio losses. |

| Lifestyle Conservative MVP | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to provide current income and growth of capital while seeking to both manage the volatility of return and limit the magnitude of portfolio losses. |

| Lifestyle Growth MVP | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to provide long-term growth of capital while seeking to both manage the volatility of return and limit the magnitude of portfolio losses. |

| Lifestyle Moderate MVP | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to provide current income and growth of capital while seeking to both manage the volatility of return and limit the magnitude of portfolio losses. |

| Mid Cap Index | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a medium-capitalization U.S. domestic equity market index. |

| Mid Cap Stock | Wellington Management Company, LLP | To seek to provide long-term growth of capital. |

| Mid Value | T. Rowe Price Associates, Inc. | To seek to provide long-term capital appreciation. |

| Portfolio | Subadviser | Investment Objective |

| Money Market | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to obtain maximum current income consistent with preservation of principal and liquidity. Certain market conditions may cause the return of the portfolio to become low or possibly negative. |

| PIMCO VIT All Asset (a series of PIMCO Variable Insurance Trust) (only Class M is available) | Pacific Investment Management Company LLC | To seek to provide maximum real return, consistent with preservation of real capital and prudent investment management. |

| Real Estate Securities | Deutsche Investment Management Americas Inc. | To seek to provide a combination of long-term capital appreciation and current income. |

| Science & Technology | T. Rowe Price Associates, Inc.; and Allianz Global Investors U.S. LLC | To seek to provide long-term growth of capital. Current income is incidental to the portfolio’s objective. |

| Short Term Government Income | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide a high level of current income consistent with preservation of capital. Maintaining a stable share price is a secondary goal. |

| Small Cap Growth | Wellington Management Company, LLP | To seek to provide long-term capital appreciation. |

| Small Cap Index | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a small-capitalization U.S. domestic equity market index. |

| Small Cap Opportunities | Dimensional Fund Advisors LP; and Invesco Advisers, Inc. | To seek to provide long-term capital appreciation. |

| Small Cap Value | Wellington Management Company, LLP | To seek to provide long-term capital appreciation. |

| Small Company Value | T. Rowe Price Associates, Inc. | To seek to provide long-term growth of capital. |

| Strategic Income Opportunities | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide a high level of current income. |

| Total Stock Market Index | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a broad U.S. domestic equity market index. |

| Ultra Short Term Bond | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide a high level of current income consistent with the maintenance of liquidity and the preservation of capital. |

| U.S. Equity | Grantham, Mayo, Van Otterloo & Co. LLC | To seek to provide long-term capital appreciation. |

| Utilities | Massachusetts Financial Services Company | To seek to provide capital growth and current income (income above that available from the portfolio invested entirely in equity securities). |

| Value | Invesco Advisers, Inc. | To seek to provide an above-average total return over a market cycle of 3 to 5 years, consistent with reasonable risk. |

| • | the policy will be continued until the earlier of the death of the Life Insured or the date the policy owner surrenders the policy; |

| • | no additional premium payments will be accepted although loan repayments will be accepted; |

| • | no additional charges or deductions (described under “Charges and Deductions”) will be assessed; |

| • | interest on any Policy Debt will continue to accrue; |

| • | the policy owner may continue to transfer portions of the Policy Value among the Investment Accounts and the Fixed Accounts as described in this prospectus. |

| Policy Year | Scheduled

Death Benefit | |

|

1 |

100,000 | |

|

2 |

105,000 | |

|

3 |

110,250 | |

|

4 |

115,763 | |

|

5 |

121,551 | |

|

6 |

127,628 | |

|

7 |

134,010 | |

|

8 |

140,710 | |

|

9 |

147,746 | |

|

10+ |

155,133 |

| Policy Year | Total

Death Benefit |

Face

Amount |

Flexible

Term Insurance Amount | |||

|

1 |

100,000 | 100000 | 0 | |||

|

2 |

105,000 | 100000 | 5,000 | |||

|

3 |

110,250 | 100000 | 10,250 | |||

|

4 |

115,763 | 100000 | 15,763 | |||

|

5 |

121,551 | 100000 | 21,551 | |||

|

6 |

127,628 | 100000 | 27,628 | |||

|

7 |

134,010 | 100000 | 34,010 | |||

|

8 |

140,710 | 100000 | 40,710 | |||

|

9 |

147,746 | 100000 | 47,746 | |||

|

10 |

155,133 | 100000 | 55,133 |

| • | Change from Option 1 to Option 2. The new Face Amount will be the Face Amount prior to the change less the Policy Value on the date of the change. |

| • | The Scheduled Death benefit amounts for dates on or after the date of the change will be the amounts scheduled prior to the change less the Policy Value on the date of the change. |

| • | Coverage Amounts will be reduced or eliminated in the order that they are listed in the policy until the total decrease in Coverage Amounts equals the decrease in Face Amount. |

| • | surrender charge will not be assessed for reductions that are solely due to a change in the death benefit Option. |

| Policy Year | Scheduled

Death Benefit | |

|

1 |

100,000 | |

|

2 |

125,000 | |

|

3 |

150,000 | |

|

4 |

175,000 | |

|

5+ |

200,000 |

| Policy Year | Scheduled

Death Benefit | |

|

3 |

140,000 | |

|

4 |

165,000 | |

|

5+ |

190,000 |

| Policy Year | Scheduled

Death Benefit | |

|

1 |

100,000 | |

|

2 |

125,000 | |

|

3 |

150,000 | |

|

4 |

175,000 | |

|

5+ |

200,000 |

| Policy Year | Scheduled

Death Benefit | |

|

3 |

160,000 | |

|

4 |

185,000 | |

|

5+ |

210,000 |

| • | At any time, you may request an increase or decrease to the Face Amount or any Scheduled Death Benefits effective on or after the date of change. We reserve the right to limit changes that could cause the policy to fail to qualify as life insurance for tax purposes. |

| • | Increases in Face Amount and Scheduled Death Benefits. Increases in Face Amount and Scheduled Death Benefits are subject to the following conditions: |

| • | Increases in Face Amount and Scheduled Death Benefits will require satisfactory evidence of the Life Insured’s insurability. |

| • | Increases will take effect at the beginning of the next Policy Month after we approve the request. |

| • | We may refuse a requested increase that would not meet our requirements for new policy issues at the time due to the Life Insured’s Attained Age or other factors. |

| • | If the Face Amount is increased (other than as required by a death benefit Option change) then all Scheduled Death Benefits effective on or after the date of the change will be increased by the amount of the Face Amount increase. |

| • | First, Coverage Amounts that were reduced or eliminated by a prior Face Amount decrease will be restored. |

| • | Second, if needed, a new Coverage Amount will be added to the policy with an Annual Premium Target and new surrender charge or Sales Loads. Any new Coverage Amount will be based on the Life Insured’s Attained Age and other relevant factors on the effective date of the increase. |

| • | Decreases in Face Amount and Scheduled Death Benefits will take effect at the beginning of the next policy Month which is at least 30 days after your written request is received at the Service Office. |

| • | If the Face Amount is decreased then all Scheduled Death Benefits effective on or after the date of the change will be decreased by the same amount. |

| • | If at any time the Scheduled Death Benefit decreases to less than the Face Amount, the Face Amount will be decreased to be equal to the Scheduled Death Benefit at that time. |

| • | Coverage Amounts equal to the amount of the Face Amount decrease will be reduced or eliminated in the reverse order that they are listed in the policy. surrender charge may be assessed (see “Charges and Deductions—Sales Load or Surrender Charge”). |

| • | Coverage Amounts equal to the amount of the Face Amount decrease will be reduced or eliminated in the reverse order that they are listed in the policy. |

| • | All Scheduled Death Benefits effective on or after the date of the partial withdrawal will be decreased by the amount of the Face Amount decrease, unless you request otherwise and we approve. |

| • | A Face Amount decrease due to a partial withdrawal will not incur any Surrender Charge in addition to that applicable to the partial withdrawal (see “Charges and Deductions—Sales Load or Surrender Charge”). |

| Policy Year | Scheduled

Death Benefit | |

|

1 |

100,000 | |

|

2 |

125,000 | |

|

3 |

150,000 | |

|

4 |

175,000 | |

|

5+ |

200,000 |

| Activity | Effect on Policy | Change in Benefit Schedule | |

| In Policy Year 2, the Face Amount is reduced to $80,000. | The initial Coverage amount is reduced to $80,000. | Policy Year | Scheduled Death Benefit |

| 2 | 105,000 | ||

| 3 | 130,000 | ||

| 4 | 155,000 | ||

| 5+ | 180,000 | ||

| In Policy Year 3, the Face Amount is increased to $120,000 | The initial Coverage Amount (which earlier was reduced to $80,000) is restored to its original level of $100,000. A new Coverage Amount for $20,000 is added to the policy. This new coverage amount will have its own Annual Premium Target, and if applicable, its own Sales Load or surrender charge. A portion of the future premiums paid will be attributed to this Coverage Amount to determine the amount of the Sales Load or Surrender Charge. | Policy Year | Scheduled Death Benefit |

| 3 | 170,000 | ||

| 4 | 195,000 | ||

| 5+ | 220,000 | ||

| In Policy Year 4, a Partial Withdrawal of $30,000 is made. | The Face Amount is reduced to $90,000. The most recent Coverage Amount of $20,000 is reduced to $0, and the initial Coverage Amount is reduced to $90,000. | Policy Year | Scheduled Death Benefit |

| 4 | 165,000 | ||

| 5 | 190,000 | ||

| Coverage Year | Percentage | Coverage Year | Percentage | |||

|

1 |

8% | 4 | 2% | |||

|

2 |

6% | 5 | 1% | |||

|

3 |

3% | 6+ | 0% |

| • | surrender of the policy for its Net Cash Surrender Value, |

| • | a partial withdrawal which exceeds the Free Partial Withdrawal Amount, |

| • | a Face Amount decrease that is not solely due to a death benefit Option change, or |

| • | lapse of the policy. |

| Coverage Year | Percentage | Coverage Year | Percentage | |||

|

1 |

5.0% | 6 | 1.5% | |||

|

2 |

4.0% | 7 | 1.0% | |||

|

3 |

3.0% | 8 | 1.0% | |||

|

4 |

2.5% | 9 | 0.5% | |||

|

5 |

2.0% | 10+ | 0.0% |

| • | Coverage Amounts having Sales Loads, |

| • | Coverage Amounts having surrender charge, and |

| • | The excess of the death benefit over the Face Amount, including any Term Insurance Benefit under the FTIO Rider. |

| • | the cost of insurance rate basis for the applicable death benefit amount, |

| • | the Life Insured’s Attained Age, sex (unless unisex rates are required by law) and smoking status on the effective date of the applicable death benefit amount, |

| • | the underwriting class of the applicable death benefit amount, |

| • | the Coverage Year, or Policy Year for the excess of the death benefit over the Face Amount, |

| • | any extra charges for substandard ratings, as stated in the policy. |

| PolicyYear | Annual Rate | |

|

1-10 |

0.50% | |

|

11+ |

0.25% |

| • | within eighteen months after the Issue Date; or |

| • | within 60 days of the effective date of a material change in the investment objectives of any of the sub-accounts; or |

| • | within 60 days of the date of notification of such change, whichever is later. |

| Policy

Years |

Current

Loan Interest Credited Rates |

Excess

of Loan Interest Charged Rate | ||

|

1-10 |

3.25% | 0.75% | ||

|

11+ |

3.75% | 0.25% |

| • | The policy must not have been surrendered for its Net Cash Surrender Value; |

| • | Evidence of the Life Insured’s insurability satisfactory to us must be provided; and |

| • | A premium equal to the payment required during the grace period following default to keep the policy in force is paid. |

| • | the portion of the Net Premiums allocated to it; plus |

| • | any amounts transferred to it; plus |

| • | interest credited to it; less |

| • | any charges deducted from it; less |

| • | any partial withdrawals from it; less |

| • | any amounts transferred from it. |

| • | Vary the premiums paid under the policy. |

| • | Change the death benefit Option. |

| • | Change the premium allocation for future premiums. |

| • | Transfer amounts between sub-accounts. |

| • | Take loans and/or partial withdrawals. |

| • | Surrender the contract. |

| • | Transfer ownership to a new owner. |

| • | Name a contingent owner that will automatically become owner if you die before the Life Insured. |

| • | Change or revoke a contingent owner. |

| • | Change or revoke a beneficiary. |

| • | First, all withdrawals from such a policy are treated as ordinary income subject to tax up to the amount equal to the excess (if any) of the policy value immediately before the withdrawal over the investment in the policy at such time. If you own any other modified endowment contracts issued to you in the same calendar year by the same insurance company or its affiliates, their values will be combined with the value of the policy from which you take the withdrawal for purposes of determining how much of the withdrawal is taxable as ordinary income. |

| • | Second, loans taken from or secured by such a policy and assignments or pledges of any part of its value are treated as partial withdrawals from the policy and taxed accordingly. Past-due loan interest that is added to the loan amount is treated as an additional loan. |

| • | Third, a 10% additional penalty tax is imposed on the portion of any distribution (including distributions on surrender) from, or loan taken from or secured by, such a policy that is included in income except where the distribution or loan: |

| • | is made on or after the date on which the policy owner attains age 59½; |

| • | is attributable to the policy owner becoming disabled; or |

| • | is part of a series of substantially equal periodic payments for the life (or life expectancy) of the policy owner or the joint lives (or joint life expectancies) of the policy owner and the policy owner’s beneficiary. |

| • | the amount of death benefit; |

| • | the Policy Value and its allocation among the Investment Accounts, the Fixed Account and the Loan Account; |

| • | the value of the units in each Investment Account to which the Policy Value is allocated; |

| • | the Policy Debt and any loan interest charged since the last report; |

| • | the premiums paid and other policy transactions made during the period since the last report; and |

| • | any other information required by law. |

| JOHN HANCOCK USA SERVICE OFFICE | |

| Overnight Express Delivery | Mail Delivery |

| Life

Post Issue - Specialty Products John Hancock Insurance Company 30 Dan Road, Suite #55979 Canton, MA 02021 |

Life

Post Issue - Specialty Products John Hancock Insurance Company PO Box 55979 Boston, MA 02205 |

| Phone: | Fax: |

| 1-800-521-1234 | 1-617-572-1571 |

Table of Contents

dated May 2, 2016

(Name of Registrant)

(“John Hancock USA”)

(Name of Depositor)

| Contents of this SAI | Page No. |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

4 |

|

Financial Statements of Registrant and Depositor

|

F-1 |

| • | Fixed dollar payments: The amount of these payments varies widely. JH Distributors may, for example, make one or more payments in connection with a firm’s conferences, seminars or training programs, seminars for the public, advertising and sales campaigns regarding the policies, to assist a firm in connection with its systems, operations and marketing expenses, or for other activities of a selling firm or wholesaler. JH Distributors may make these payments upon the initiation of a relationship with a firm, and at any time thereafter. |

| • | Payments based upon sales: These payments are based upon a percentage of the total amount of money received, or anticipated to be received, for sales through a firm of some or all of the insurance products that we and/or our affiliates offer. JH Distributors makes these payments on a periodic basis. |

| • | Payments based upon “assets under management”: These payments are based upon a percentage of the policy value of some or all of our (and/or our affiliates’) insurance products that were sold through the firm. JH Distributors makes these payments on a periodic basis. |

| 333-100567 |

| 333-126668 |

| 333-152409 |

Table of Contents

AUDITED STATUTORY-BASIS FINANCIAL STATEMENTS

John Hancock Life Insurance Company (U.S.A.)

For the Years Ended December 31, 2015, 2014 and 2013

With Report of Independent Auditors

Table of Contents

AUDITED STATUTORY-BASIS FINANCIAL STATEMENTS

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

Years Ended December 31, 2015, 2014 and 2013

| F-1 | ||||

| Statutory-Basis Financial Statements |

||||

|

Statutory-Basis |

F-3 | |||

|

Statutory-Basis |

F-5 | |||

| Statements of Changes in Capital and Surplus- Statutory-Basis |

F-6 | |||

|

Statutory-Basis |

F-7 | |||

| F-8 | ||||

Table of Contents

Report of Independent Auditors

The Board of Directors and Shareholder

John Hancock Life Insurance Company (U.S.A.)

We have audited the accompanying statutory-basis financial statements of John Hancock Life Insurance Company (U.S.A.) (the Company), which comprise the balance sheets as of December 31, 2015 and 2014, and the related statements of operations, changes in capital and surplus and cash flow for each of the three years in the period ended December 31, 2015, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in conformity with accounting practices prescribed or permitted by the Michigan Office of Financial and Insurance Regulation. Management also is responsible for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinions.

Basis for Adverse Opinion on U.S. Generally Accepted Accounting Principles

As described in Note 2, to meet the requirements of Michigan the financial statements have been prepared in conformity with accounting practices prescribed or permitted by the Michigan Office of Financial and Insurance Regulation, which practices differ from U.S. generally accepted accounting principles. The variances between such practices and U.S. generally accepted accounting principles and the effects on the accompanying financial statements are described in Note 2.

Adverse Opinion on U.S. Generally Accepted Accounting Principles

In our opinion, because of the effects of the matter described in the preceding paragraph, the statutory-basis financial statements referred to above do not present fairly, in conformity with U.S. generally accepted accounting principles, the financial position of the Company at December 31, 2015 and 2014, or the results of its operations or its cash flows for each of the three years in the period ended December 31, 2015.

F-1

Table of Contents

Opinion on Statutory-Basis of Accounting

However, in our opinion, the statutory-basis financial statements referred to above present fairly, in all material respects, the financial position of the Company at December 31, 2015 and 2014, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2015 in conformity with accounting practices prescribed or permitted by the Michigan Office of Financial and Insurance Regulation.

/s/ Ernst & Young LLP

Boston, Massachusetts

April 5, 2016

F-2

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

BALANCE SHEETS – STATUTORY BASIS

| December 31, | ||||||||

| 2015 | 2014 | |||||||

|

|

|

|||||||

| (in millions) | ||||||||

| Admitted assets |

||||||||

| Cash and invested assets: |

||||||||

| Bonds |

$ | 44,463 | $ | 49,226 | ||||

| Stocks: |

||||||||

| Preferred stocks |

23 | 26 | ||||||

| Common stocks |

658 | 477 | ||||||

| Investments in affiliates |

3,205 | 2,911 | ||||||

| Mortgage loans on real estate |

10,475 | 11,519 | ||||||

| Real estate: |

||||||||

| Company occupied |

299 | 300 | ||||||

| Investment properties |

6,487 | 5,203 | ||||||

| Cash, cash equivalents and short-term investments |

4,528 | 7,702 | ||||||

| Policy loans |

3,718 | 5,039 | ||||||

| Derivatives |

11,001 | 10,458 | ||||||

| Receivable for collateral on derivatives |

26 | 400 | ||||||

| Receivable for securities |

5 | 10 | ||||||

| Other invested assets |

5,618 | 5,978 | ||||||

|

|

|

|

|

|||||

| Total cash and invested assets |

90,506 | 99,249 | ||||||

| Investment income due and accrued |

758 | 887 | ||||||

| Premiums due and deferred |

303 | 388 | ||||||

| Amounts recoverable from reinsurers |

162 | 196 | ||||||

| Funds held by or deposited with reinsured companies |

3,660 | 1,958 | ||||||

| Other reinsurance receivable |

670 | 439 | ||||||

| Amounts due from affiliates |

304 | 247 | ||||||

| Other assets |

1,755 | 2,364 | ||||||

| Assets held in separate accounts |

129,725 | 140,164 | ||||||

|

|

|

|

|

|||||

| Total admitted assets |

$ | 227,843 | $ | 245,892 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these statutory-basis financial statements.

F-3

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

BALANCE SHEETS – STATUTORY BASIS – (CONTINUED)

| December 31, | ||||||||

| 2015 | 2014 | |||||||

|

|

|

|||||||

| (in millions) | ||||||||

| Liabilities and capital and surplus |

||||||||

| Liabilities: |

||||||||

| Policy and contract obligations: |

||||||||

| Policy reserves |

$ | 66,516 | $ | 69,184 | ||||

| Policyholders’ and beneficiaries funds |

2,624 | 3,834 | ||||||

| Consumer notes |

265 | 411 | ||||||

| Dividends payable to policyholders |

428 | 574 | ||||||

| Policy benefits in process of payment |

499 | 556 | ||||||

| Other amount payable on reinsurance |

480 | 1,039 | ||||||

| Other policy obligations |

68 | 78 | ||||||

|

|

|

|

|

|||||

| Total policy and contract obligations |

70,880 | 75,676 | ||||||

| Payable to parent and affiliates |

1,816 | 3,073 | ||||||

| Transfers to (from) separate account, net |

(540 | ) | (1,390 | ) | ||||

| Asset valuation reserve |

1,844 | 1,927 | ||||||

| Reinsurance in unauthorized companies |

3 | 3 | ||||||

| Funds withheld from unauthorized reinsurers |

7,784 | 8,873 | ||||||

| Interest maintenance reserve |

1,630 | 1,745 | ||||||

| Net deferred tax liability |

387 | 456 | ||||||

| Derivatives |

6,094 | 5,229 | ||||||

| Payables for collateral on derivatives |

1,640 | 2,939 | ||||||

| Payables for securities |

42 | 26 | ||||||

| Other general account obligations |

1,094 | 1,843 | ||||||

| Obligations related to separate accounts |

129,725 | 140,164 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

222,399 | 240,564 | ||||||

| Capital and surplus: |

||||||||

| Preferred stock (par value $1; 50,000,000 shares authorized; 100,000 shares issued and outstanding at December 31, 2015 and 2014) |

- | - | ||||||

| Common stock (par value $1; 50,000,000 shares authorized; 4,728,939 shares issued and outstanding at December 31, 2015 and 2014) |

5 | 5 | ||||||

| Paid-in surplus |

3,196 | 3,196 | ||||||

| Surplus notes |

990 | 990 | ||||||

| Unassigned surplus |

1,253 | 1,137 | ||||||

|

|

|

|

|

|||||

| Total capital and surplus |

5,444 | 5,328 | ||||||

|

|

|

|

|

|||||

| Total liabilities and capital and surplus |

$ | 227,843 | $ | 245,892 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these statutory-basis financial statements.

F-4

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

STATEMENTS OF OPERATIONS – STATUTORY-BASIS

| Years Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

|

|

|

|||||||||||

| (in millions) | ||||||||||||

| Premiums and other revenues: |

||||||||||||

| Life, long-term care and annuity premiums |

$ | 16,323 | $ | 12,738 | $ | 12,882 | ||||||

| Consideration for supplementary contracts with life contingencies |

140 | 183 | 266 | |||||||||

| Net investment income |

4,387 | 4,297 | 4,551 | |||||||||

| Amortization of interest maintenance reserve |

181 | 176 | 183 | |||||||||

| Commissions and expense allowance on reinsurance ceded |

1,040 | 817 | 1,224 | |||||||||

| Reserve adjustment on reinsurance ceded |

(16,494 | ) | (10,652 | ) | (9,775 | ) | ||||||

| Separate account administrative and contract fees |

1,786 | 1,841 | 1,848 | |||||||||

| Other revenue |

415 | 467 | 188 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total premiums and other revenues |

7,778 | 9,867 | 11,367 | |||||||||

| Benefits paid or provided: |

||||||||||||

| Death, surrender and other contract benefits, net |

9,762 | 9,064 | 7,710 | |||||||||

| Annuity benefits |

1,796 | 1,733 | 1,784 | |||||||||

| Disability and long-term care benefits |

647 | 584 | 542 | |||||||||

| Interest and adjustments on policy or deposit-type funds |

91 | 125 | 132 | |||||||||

| Payments on supplementary contracts with life contingencies |

179 | 170 | 159 | |||||||||

| Increase (decrease) in life and long-term care reserves |

(2,506 | ) | 2,161 | 1,017 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total benefits paid or provided |

9,969 | 13,837 | 11,344 | |||||||||

| Insurance expenses and other deductions: |

||||||||||||

| Commissions and expense allowance on reinsurance assumed |

1,289 | 1,203 | 1,360 | |||||||||

| General expenses |

960 | 972 | 1,092 | |||||||||

| Insurance taxes, licenses and fees |

145 | 138 | 150 | |||||||||

| Net transfers to (from) separate accounts |

(6,554 | ) | (8,229 | ) | (6,388 | ) | ||||||

| Investment income ceded |

2,465 | 4,954 | (1,356 | ) | ||||||||

| Other deductions |

(160 | ) | 21 | 14 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total insurance expenses and other deductions |

(1,855 | ) | (941 | ) | (5,128 | ) | ||||||

| Income (loss) from operations before dividends to policyholders, federal income taxes and net realized capital gains (losses) |

(336 | ) | (3,029 | ) | 5,151 | |||||||

| Dividends to policyholders |

(36 | ) | 77 | 81 | ||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from operations before federal income taxes and net realized capital gains (losses) |

(300 | ) | (3,106 | ) | 5,070 | |||||||

| Federal income tax expense (benefit) |

(778 | ) | (716 | ) | 262 | |||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from operations before net realized capital gains (losses) |

478 | (2,390 | ) | 4,808 | ||||||||

| Net realized capital gains (losses) |

216 | (74 | ) | (1,793 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 694 | $ | (2,464 | ) | $ | 3,015 | |||||

|

|

|

|

|

|

|

|||||||

The accompanying notes are an integral part of these statutory-basis financial statements.

F-5

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

STATEMENTS OF CHANGES IN CAPITAL AND SURPLUS – STATUTORY-BASIS

| Preferred and Common Stock |

Paid-in Surplus |

Surplus Notes |

Unassigned Surplus (Deficit) |

Total Capital and Surplus |

||||||||||||||||

|

|

|

|||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Balances at January 1, 2013 |

$ | 5 | $ | 3,196 | $ | 990 | $ | 1,603 | $ | 5,794 | ||||||||||

| Net income (loss) |

3,015 | 3,015 | ||||||||||||||||||

| Change in net unrealized capital gains (losses) |

(1,455 | ) | (1,455 | ) | ||||||||||||||||

| Change in net deferred income tax |

(347 | ) | (347 | ) | ||||||||||||||||

| Decrease (increase) in non-admitted assets |

(12 | ) | (12 | ) | ||||||||||||||||

| Change in liability for reinsurance in unauthorized reinsurance |

- | - | ||||||||||||||||||

| Decrease (increase) in asset valuation reserves |

(180 | ) | (180 | ) | ||||||||||||||||

| Dividend paid to Parent |

(300 | ) | (300 | ) | ||||||||||||||||

| Change in surplus as a result of reinsurance |

(573 | ) | (573 | ) | ||||||||||||||||

| Other adjustments, net |

- | (133 | ) | (133 | ) | |||||||||||||||

|

|

|

|||||||||||||||||||

| Balances at December 31, 2013 |

5 | 3,196 | 990 | 1,618 | 5,809 | |||||||||||||||

| Net income (loss) |

(2,464 | ) | (2,464 | ) | ||||||||||||||||

| Change in net unrealized capital gains (losses) |

2,389 | 2,389 | ||||||||||||||||||

| Change in net deferred income tax |

973 | 973 | ||||||||||||||||||

| Decrease (increase) in non-admitted assets |

56 | 56 | ||||||||||||||||||

| Change in liability for reinsurance in unauthorized reinsurance |

3 | 3 | ||||||||||||||||||

| Decrease (increase) in asset valuation reserves |

(553 | ) | (553 | ) | ||||||||||||||||

| Dividend paid to Parent |

(500 | ) | (500 | ) | ||||||||||||||||

| Change in surplus as a result of reinsurance |

(252 | ) | (252 | ) | ||||||||||||||||

| Other adjustments, net |

- | (133 | ) | (133 | ) | |||||||||||||||

|

|

|

|||||||||||||||||||

| Balances at December 31, 2014 |

5 | 3,196 | 990 | 1,137 | 5,328 | |||||||||||||||

| Net income (loss) |

694 | 694 | ||||||||||||||||||

| Change in net unrealized capital gains (losses) |

(394 | ) | (394 | ) | ||||||||||||||||

| Change in net deferred income tax |

(158 | ) | (158 | ) | ||||||||||||||||

| Decrease (increase) in non-admitted assets |

(43 | ) | (43 | ) | ||||||||||||||||

| Change in liability for reinsurance in unauthorized reinsurance |

- | - | ||||||||||||||||||

| Decrease (increase) in asset valuation reserves |

83 | 83 | ||||||||||||||||||

| Dividend paid to Parent |

(210 | ) | (210 | ) | ||||||||||||||||

| Change in surplus as a result of reinsurance |

107 | 107 | ||||||||||||||||||

| Other adjustments, net |

- | 37 | 37 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Balances at December 31, 2015 |

$ | 5 | $ | 3,196 | $ | 990 | $ | 1,253 | $ | 5,444 | ||||||||||

|

|

|

|||||||||||||||||||

The accompanying notes are an integral part of these statutory-basis financial statements.

F-6

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

STATEMENTS OF CASH FLOW – STATUTORY-BASIS

| Years Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

|

|

|

|||||||||||

| (in millions) | ||||||||||||

| Operations |

||||||||||||

| Premiums and other considerations collected, net of reinsurance |

$ | 19,961 | $ | 12,924 | $ | 13,205 | ||||||

| Net investment income received |

4,600 | 4,399 | 4,635 | |||||||||

| Separate account fees |

1,786 | 1,841 | 1,848 | |||||||||

| Commissions and expenses allowance on reinsurance ceded |

1,040 | 817 | 1,224 | |||||||||

| Miscellaneous income |

2,852 | 450 | (172 | ) | ||||||||

| Benefits and losses paid |

(29,836 | ) | (21,960 | ) | (20,462 | ) | ||||||

| Net transfers from (to) separate accounts |

7,404 | 8,206 | 6,493 | |||||||||

| Commissions and expenses (paid) recovered |

(5,153 | ) | (7,147 | ) | (1,572 | ) | ||||||

| Dividends paid to policyholders |

(250 | ) | (89 | ) | (91 | ) | ||||||

| Federal and foreign income and capital gain taxes (paid) recovered |

847 | (382 | ) | (1,195 | ) | |||||||

|

|

|

|||||||||||

| Net cash provided by (used in) operating activities |

3,251 | (941 | ) | 3,913 | ||||||||

| Investment activities |

||||||||||||

| Proceeds from sales, maturities, or repayments of investments: |

||||||||||||

| Bonds |

19,217 | 20,471 | 19,130 | |||||||||

| Stocks |

190 | 130 | 149 | |||||||||

| Mortgage loans on real estate |

1,834 | 1,789 | 1,660 | |||||||||

| Real estate |

8 | 1,053 | 22 | |||||||||

| Other invested assets |

955 | 941 | 498 | |||||||||

| Derivatives |

32 | - | - | |||||||||

| Net gains (losses) on cash, cash equivalents and short term investments |

(9 | ) | 3 | (2 | ) | |||||||

|

|

|

|||||||||||

| Total investment proceeds |

22,227 | 24,387 | 21,457 | |||||||||

| Cost of investments acquired: |

||||||||||||

| Bonds |

19,734 | 21,430 | 17,853 | |||||||||

| Stocks |

848 | 234 | 78 | |||||||||

| Mortgage loans on real estate |

1,715 | 1,088 | 1,813 | |||||||||

| Real estate |

1,155 | 539 | 743 | |||||||||

| Other invested assets |

905 | 1,281 | 882 | |||||||||

| Derivatives |

- | 739 | 1,916 | |||||||||

|

|

|

|||||||||||

| Total cost of investments acquired |

24,357 | 25,311 | 23,285 | |||||||||

| Net increase (decrease) in receivable/payable for securities and collateral on derivatives |

904 | (1,729 | ) | 1,197 | ||||||||

| Net increase (decrease) in policy loans |

56 | (150 | ) | 140 | ||||||||

|

|

|

|||||||||||

| Net cash provided by (used in) investment activities |

(3,090 | ) | 955 | (3,165 | ) | |||||||

| Financing and miscellaneous activities |

||||||||||||

| Borrowed funds |

(276 | ) | (232 | ) | (48 | ) | ||||||

| Net deposits (withdrawals) on deposit-type contracts |

(333 | ) | (85 | ) | (134 | ) | ||||||

| Dividend paid to Parent |

(210 | ) | (500 | ) | (300 | ) | ||||||

| Repurchase agreements |

- | - | (437 | ) | ||||||||

| Other cash provided (applied) |

(2,516 | ) | 3,756 | 14 | ||||||||

|

|

|

|||||||||||

| Net cash provided by (used in) financing and miscellaneous activities |

(3,335 | ) | 2,939 | (905 | ) | |||||||

| Net increase (decrease) in cash, cash equivalents and short-term investments |

(3,174 | ) | 2,953 | (157 | ) | |||||||

| Cash, cash equivalents and short-term investments at beginning of year |

7,702 | 4,749 | 4,906 | |||||||||

|

|

|

|||||||||||

| Cash, cash equivalents and short-term investments at end of year |

$ | 4,528 | $ | 7,702 | $ | 4,749 | ||||||

|

|

|

|||||||||||

| Non-cash investing activities during the year: |

||||||||||||

| Premium, deposit type contracts and other operating activity for New York Life (NYL) reinsurance transaction and other transactions, net |

$ | 8,357 | $ | - | $ | - | ||||||

| Transfer of invested assets for NYL reinsurance transaction and other affiliates, net |

(8,357 | ) | - | - | ||||||||

The accompanying notes are an integral part of these statutory-basis financial statements.

F-7

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

NOTES TO STATUTORY-BASIS FINANCIAL STATEMENTS

1. Organization and Nature of Operations

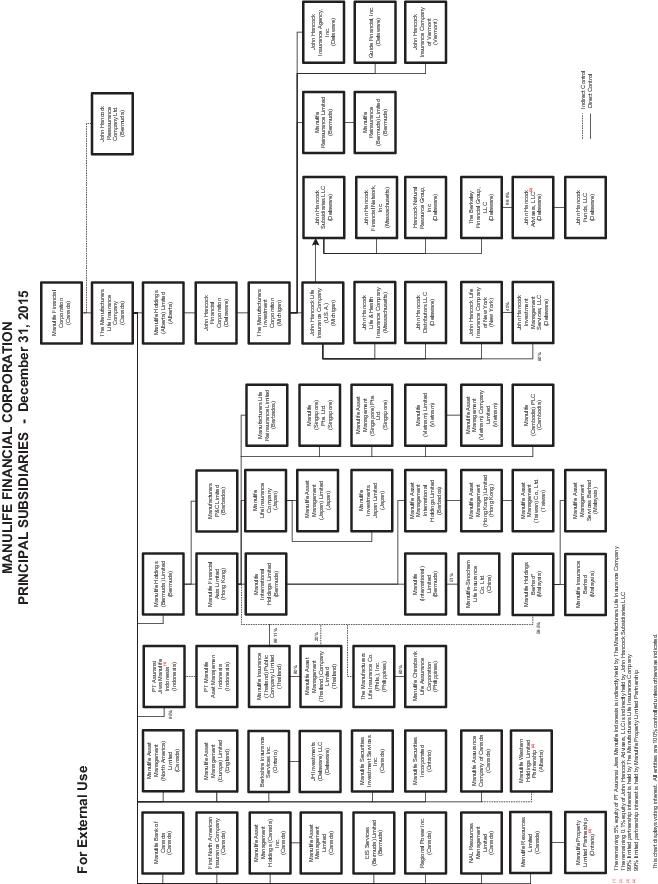

John Hancock Life Insurance Company (U.S.A.) (“JHUSA” or the “Company”) is a wholly-owned subsidiary of The Manufacturers Investment Corporation (“MIC”). MIC is a wholly-owned subsidiary of John Hancock Financial Corporation (“JHFC”), which is an indirect, wholly-owned subsidiary of The Manufacturers Life Insurance Company (“MLI”). MLI, in turn, is a wholly-owned subsidiary of Manulife Financial Corporation (“MFC”), a Canadian-based, publicly traded financial services holding company.

The Company provides a wide range of financial protection and wealth management products and services to both individual and institutional customers located primarily in the United States. Through its insurance operations, the Company offers a variety of individual life insurance and individual and group long-term care insurance products that are distributed through multiple distribution channels, including insurance agents, brokers, banks, financial planners, and direct marketing. The Company also offers mutual fund products and services which include a variety of retirement products to retirement plans. The Company distributes these products through multiple distribution channels, including insurance agents and affiliated brokers, securities brokerage firms, financial planners, pension plan sponsors, pension plan consultants, and banks. In 2013, the Company discontinued sales of its structured settlements and single premium immediate annuity products. The Company is licensed to sell insurance in 49 states, the District of Columbia, Guam, Puerto Rico and the U.S. Virgin Islands.

Pursuant to a distribution agreement with the Company, John Hancock Distributors LLC (“JHD”), a registered broker-dealer and a wholly-owned subsidiary of the Company, acts as the principal underwriter of variable life contracts and other products issued by the Company.

The Company has two wholly-owned life insurance subsidiaries, John Hancock Life Insurance Company of New York (“JHNY”) and John Hancock Life & Health Insurance Company (“JHLH”).

2. Significant Accounting Policies

Use of Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect amounts reported in the financial statements and accompanying notes. Such estimates and assumptions could change in the future as more information becomes known and may impact the amounts reported and disclosed herein.

Basis of Presentation

These financial statements have been prepared in conformity with accounting practices prescribed or permitted by the Michigan Department of Insurance and Financial Services (the “Insurance Department”). The National Association of Insurance Commissioners’ (“NAIC”) Accounting Practices and Procedures Manual (“NAIC SAP”) has been adopted as a component of practices prescribed or permitted by the State of Michigan. The Michigan Director of the Department of Insurance and Financial Services (the “Director”) has the authority to prescribe or permit other specific practices that deviate from prescribed practices. NAIC SAP practices differ from accounting principles generally accepted in the United States (“GAAP”) as described below.

Investments: Investments in bonds not backed by other loans are principally stated at amortized cost using the constant yield (interest) method. Bonds can also be stated at the lesser of amortized cost or fair value based on their NAIC designated rating. Non-redeemable preferred stocks, which have characteristics of equity securities, are reported at cost or lower of cost or market value as determined by the Securities Valuation Office of the NAIC (“SVO”) rating, and the related net unrealized capital gains (losses) are reported in unassigned surplus along with any adjustment for federal income taxes. Redeemable preferred stocks, which have characteristics of debt securities and are rated as medium quality or better, are reported at cost or amortized cost. All other redeemable preferred stocks are reported at the lower of cost, amortized cost, or fair value.

For bonds other than loan-backed and structured securities, the Company has a process in place to identify securities that could potentially have an impairment that is other-than-temporary. The Company recognizes other-than-temporary impairment losses on bonds with unrealized losses when either of the following two conditions exist: the entity either (1) has the intent to sell the debt security or (2) is more likely than not to be required to sell the debt security before its anticipated recovery. Declines in value due to credit difficulties are also considered to be other-than-temporarily impaired when the Company does not have the intent and ability to hold the security for a period of time sufficient to allow for any anticipated

F-8

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

NOTES TO STATUTORY-BASIS FINANCIAL STATEMENTS – (CONTINUED)

2. Significant Accounting Policies - (continued)

recovery in value. The entire difference between amortized cost and fair value on such bonds with credit difficulties is recognized as an impairment loss in income.

Loan-backed and structured securities (i.e., collateralized mortgage obligations) are adjusted for the effects of changes in prepayment assumptions on the related accretion of discounts or amortization of premiums of such securities using either the retrospective or prospective methods. The retrospective adjustment method is used to value all such securities, except principal-only and interest-only securities and such securities with NAIC designations of 3-6, which are valued using the prospective method. If it is determined that a decline in fair value is other-than-temporary, the cost basis of the security is written down to the present value of estimated future cash flows using the original effective interest rate inherent in the security.

Common stocks are primarily reported at fair value based on quoted market prices and the related net unrealized capital gains (losses) are reported in unassigned surplus, net of any adjustment for federal income taxes. There are no restrictions on common and preferred stocks.

Insurance subsidiaries are reported at their underlying statutory equity. Non-insurance subsidiaries, which have significant ongoing operations other than for the benefit of the Company and its affiliates, are reported at GAAP equity. Non-insurance subsidiaries, which have no significant ongoing operations other than for the benefit of the Company and its affiliates, are reported based on the underlying equity, plus the admitted portion of goodwill. Dividends from subsidiaries are included in net investment income. The remaining net change in the subsidiaries’ equity is included in the change in net unrealized capital gains (losses).

Realized capital gains (losses) on sales of securities are recognized using the first in, first out (“FIFO”) method. The cost basis of bonds and common and preferred stocks is adjusted for impairments in value deemed to be other-than-temporary and such adjustments are reported as a component of net realized capital gains (losses).

Mortgage loans on real estate are reported at unpaid principal balances, less an allowance for impairments. Valuation allowances, if necessary, are established for mortgage loans on real estate based on the difference between the net value of the collateral, determined as the fair value of the collateral less estimated costs to obtain and sell, and the recorded investment in the mortgage loan. The initial valuation allowance and subsequent changes in the allowance for mortgage loans are charged or credited directly to unassigned surplus. A mortgage loan is considered to be impaired when, based on current information and events, it is probable that the Company will be unable to collect all principal and interest amounts due according to the contractual terms of the mortgage agreement. When management determines foreclosure is probable and the impairment is other-than-temporary, the mortgage loan is written down and a realized loss is recognized.

Real estate occupied by the Company and real estate held for the production of income are reported at depreciated cost, net of related obligations. Real estate that the Company has the intent to sell is reported at the lower of depreciated cost or fair value, net of related obligations. Depreciation is calculated on a straight-line basis over the estimated useful lives of the properties. Investment income and operating expenses include rent for the Company’s occupancy of Company-owned properties.

Cash equivalents are short-term highly liquid investments with original maturities of three months or less and are principally stated at amortized cost. Short-term investments include investments with maturities of one year or less and greater than three months at the date of acquisition and are principally stated at amortized cost.

Policy loans are reported at unpaid principal balances.

Derivative instruments that meet the criteria to qualify for hedge accounting are accounted for in a manner consistent with the item hedged (i.e., amortized cost or fair value with the related net unrealized capital gains (losses) reported in unassigned surplus along with any adjustment for federal income taxes). Derivative instruments that are entered into for other than hedging purposes or that do not meet the criteria to qualify for hedge accounting are accounted for at fair value, and the related changes in fair value are recognized as net unrealized capital gains (losses) reported in unassigned surplus, net of any adjustments for federal income taxes. Embedded derivatives are not accounted for separately from the host contract.

Other invested assets consist of ownership interests in partnerships and limited liability corporations (“LLCs”) which are carried based on the underlying GAAP equity, with the exception of affordable housing tax credit properties, which are carried at amortized cost. The related net unrealized capital gains (losses) are reported in unassigned surplus, net of any

F-9

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

NOTES TO STATUTORY-BASIS FINANCIAL STATEMENTS – (CONTINUED)

2. Significant Accounting Policies - (continued)

adjustments for federal income taxes. The Company records its share of income using the most recent financial information available, which is generally on a three month lag. Depending on the timing of receipt of the audited financial statements of these other invested assets, the investee level financial data may be up to one year in arrears.

Interest Maintenance and Asset Valuation Reserves: Under a formula prescribed by the NAIC, the Company defers the portion of realized capital gains (losses) on sales of fixed income investments, principally bonds and mortgage loans, and interest-related hedging activities that are attributable to changes in the general level of interest rates and amortizes those deferrals over the remaining period to maturity based on groupings of individual securities sold in five-year bands. That net deferral is reported as the interest maintenance reserve (“IMR”) in the accompanying Balance Sheets. Realized capital gains (losses) are reported in income, net of federal income tax and transferred to the IMR. The asset valuation reserve (“AVR”) provides a valuation allowance for invested assets. The AVR is determined by an NAIC prescribed formula with changes reflected directly in unassigned surplus.

Subsidiaries: The accounts and operations of the Company’s subsidiaries are not consolidated with the accounts and operations of the Company.

Goodwill: Goodwill is admitted subject to an aggregate limitation of 10% of the capital and surplus in the most recently filed quarterly statement, excluding EDP equipment, operating system software, net deferred tax assets, and net positive goodwill. Goodwill is amortized over the period the Company benefits economically, not to exceed 10 years. Goodwill held by non-insurance subsidiaries is assessed in accordance with GAAP, subject to certain limitations for holding companies and foreign insurance subsidiaries.

Separate Accounts: Separate account assets and liabilities reported in the accompanying Balance Sheets represent funds that are separately administered, principally for annuity contracts and variable life insurance policies, and for which the contract holder, rather than the Company, bears the investment risk. Separate account obligations are intended to be satisfied from separate account assets and not from assets of the general account. Separate accounts are generally reported at fair value. The operations of the separate accounts are not included in the Statements of Operations; however, income earned on amounts initially invested by the Company in the formation of new separate accounts is included in other revenue. Fees charged to contract holders, principally mortality, policy administration, and surrender charges are included in separate account administrative and contract fees. The assets in the separate accounts are not pledged to others as collateral or otherwise restricted. For the years ended December 31, 2015, 2014 and 2013, there were no gains (losses) on transfers of assets from the general account to the separate account.

Nonadmitted Assets: Certain assets designated as nonadmitted, principally furniture and equipment, past due agents’ balances, and other assets not specifically identified as an admitted asset within the NAIC SAP are excluded from the accompanying Balance Sheets and are charged directly to unassigned surplus.

Policy Acquisition Costs: The costs of acquiring and renewing business are expensed when incurred.

Policy Reserves: Reserves for life, long-term care, annuity, and deposit-type contracts are developed by actuarial methods and are determined based on interest rates, mortality tables and valuation methods prescribed by the NAIC that will provide, in the aggregate, reserves that are greater than or equal to the maximum of guaranteed policy cash values or the amounts required by the Insurance Department.

| • | The Company waives deduction of deferred fractional premiums on the death of lives insured and annuity contract holders and returns any premium beyond the date of death. Surrender values on policies do not exceed the corresponding benefit reserves. Additional reserves are established when the results of asset adequacy testing indicate the need for such reserves or the net premiums exceed the gross premiums on any insurance in-force. This includes asset adequacy testing required under NAIC Actuarial Guideline 38 Section 8D (“AG 38 8D”). The Company recorded gross reserves of $791 million and $641 million for the calculation required under AG 38 8D, of which $465 million and $446 million was ceded to Manulife Reinsurance Limited (“MRL”) under an existing coinsurance transaction at December 31, 2015 and 2014, respectively. At December 31, 2015 and 2014, the Company held reserves of $920 million and $1,030 million, respectively, on insurance in-force for which gross premiums were less than net premiums according to the standard of valuation set by the State of Michigan. |

F-10

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

NOTES TO STATUTORY-BASIS FINANCIAL STATEMENTS – (CONTINUED)

2. Significant Accounting Policies - (continued)

| • | Reserves for individual life insurance policies are maintained using the 1941, 1958, 1980, and 2001 Commissioner’s Standard Ordinary and American Experience Mortality Tables. Methods used include the net level premium method principally for policies issued prior to 1978, a modified preliminary term method, and the Commissioner’s Reserve Valuation Method. |

| • | Annuity and supplementary contracts with life contingency reserves are based principally on modifications of the 1937 Standard Annuity Table, the Group Annuity Mortality Tables for 1951, 1971, 1983, and 1994, the 1971 and 1983 Individual Annuity Mortality Tables, the 2000 Individual Annuity Mortality Table, and the 2012 Individual Annuity Mortality Table. |

| • | Liabilities related to policyholder funds left on deposit with the Company are generally equal to fund balances. |

| • | Long-term care reserves are generally calculated using the one-year preliminary term method based on various mortality, morbidity, and lapse tables. |

| • | The mean reserve method is used to adjust the calculated terminal reserve to the appropriate reserve at December 31, 2015 or 2014. Mean reserves are determined by computing the terminal reserve for the plan at the rated age and assuming annual premiums have been paid as of the valuation date. For certain policies with substandard table ratings, mean reserves are based on rated mortality from 125% to 500% of standard rating; for certain policies with flat extra ratings, mean reserves are based on standard mortality rates increased by 1 to 25 deaths per thousand. An asset is recorded for deferred premiums, net of loading, to adjust the reserve for modal premium payments. |

| • | For long-term care, the interpolated reserve method is used to adjust the calculated terminal reserve, and in addition an unearned premium reserve is held. |

| • | Tabular interest, tabular less actual reserve released, and tabular costs have been determined by formula. Tabular interest on funds not involving life contingencies is calculated as one percent of the product of such valuation rate of interest times the mean of the amount of funds subject to such valuation rate of interest held at the beginning and end of the valuation year. |

| • | From time to time, the Company finds it appropriate to modify certain required policy reserves because of changes in actuarial assumptions. Reserve modifications resulting from such determinations are recorded directly to unassigned surplus. |

| • | Reserves for variable deferred annuity contracts are calculated in accordance with NAIC Actuarial Guideline 43, and primarily use the 1994 Minimum Guaranteed Death Benefit or Annuity 2000 tables. The reserve is based on the present value of accumulated losses from the perspective of the Company. The liability is evaluated under both a standard scenario and stochastic scenario, and the Company holds the higher of the standard or stochastic values. |

Reinsurance: Reinsurance ceded contracts do not relieve the Company from its obligations to policyholders. The Company remains liable to its policyholders for the portion reinsured to the extent that any reinsurer does not meet its obligations for reinsurance ceded to it under the reinsurance agreements. Failure of the reinsurers to honor their obligations could result in losses to the Company; consequently, estimates are established for amounts deemed or estimated to be uncollectible. To minimize its exposure to significant losses from reinsurance insolvencies, the Company evaluates the financial condition of its reinsurers and monitors concentration of credit risk arising from similar characteristics of the insurer.

Premiums, commissions, expense reimbursements, benefits, and reserves related to reinsured business are accounted for on bases consistent with those used in accounting for the original policies issued and the terms of the reinsurance contracts. Premiums ceded to other companies have been reported as a reduction of premium income. Amounts applicable to reinsurance ceded for future policy benefits, unearned premium reserves, and claim liabilities have been reported as reductions of these items.

The Company records a liability for unsecured policy reserves ceded to reinsurers not authorized in the State of Michigan to assume such business. Changes to those amounts are credited or charged directly to unassigned surplus. Policy and contract liabilities ceded to reinsurers have been reported as reductions of the related reserves. Commissions allowed by reinsurers on business ceded are reported as income when received. Investment income ceded includes separate account fee income, net

F-11

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

NOTES TO STATUTORY-BASIS FINANCIAL STATEMENTS – (CONTINUED)

2. Significant Accounting Policies - (continued)

investment income and realized investment and other gains (losses), which was ceded to the affiliated reinsurers. NAIC SAP prescribes that no gain be recognized upon inception of a reinsurance treaty. The initial consideration is recorded directly to unassigned surplus and released into income over the life of the treaty.

Federal Income Taxes: Total federal income taxes are based upon the Company’s best estimate of its current and deferred tax assets or liabilities. Current tax expense is reported in the Statements of Operations as federal income tax expense if resulting from operations and within net unrealized capital gains (losses) if resulting from capital transactions. Changes in the balances of deferred taxes, which provide for book versus tax temporary differences, are subject to limitations and are reported within various lines within surplus. Accordingly, the reporting of statutory to tax temporary differences, such as reserves and policy acquisition costs, and of statutory to tax permanent differences, such as tax-exempt interest and tax credits, results in effective tax rates in the Statements of Operations that differ from the federal statutory tax rate.

Participating Insurance and Policyholder Dividends: Participating business represented approximately 15% and 26% of the Company’s aggregate reserve for life contracts at December 31, 2015 and 2014. The amount of policyholders’ dividends to be paid is approved annually by the Company’s Board of Directors. Policyholder dividends are recognized when declared rather than over the term of the related policies. The determination of the amount of policyholder dividends is complex and varies by policy type. In general, the aggregate amount of policyholders’ dividends is calculated based upon actual interest, mortality, morbidity, persistency, and expense experience for the year, as well as management’s judgment as to the appropriate level of statutory surplus to be retained by the Company. John Hancock Life Insurance Company (“JHLICO”) was a predecessor company that was merged into JHUSA on December 31, 2009. For additional information on the closed blocks, see the Closed Blocks Note.

Surplus Notes: Surplus notes are reported in capital and surplus, and the interest expense is not accrued unless approved for payment by the Insurance Department.

Statements of Cash Flow: Cash, cash equivalents and short-term investments in the Statements of Cash Flow represent movements of cash and highly liquid debt investments with initial maturities of one year or less.

Premiums and Benefits: Premiums for whole, term, and universal life, long-term care, annuity policies, guaranteed interest, and group annuity contracts with any mortality and morbidity risk are recognized as revenue when due. Revenues for universal life and annuity policies with mortality or morbidity risk, except for guaranteed interest, term certain supplementary contracts, and funding agreements, consist of the entire premium received. Premiums received for annuity policies, guaranteed interest, funding agreements, variable universal life, and group annuity contracts without mortality or morbidity risk are recorded using deposit accounting and are credited directly to an appropriate policy reserve account, without recognizing premium revenue. Benefits incurred represent the total of death benefits paid, annuity benefits paid and the change in policy reserves.

Policy and Contract Claims: Policy and contract claims are determined on an individual-case basis for reported losses. Estimates of incurred but not reported losses are developed on the basis of past experience.

Guaranty Fund Assessments: Guaranty fund assessments are accrued when the Company receives knowledge of an insurance insolvency.

Variances Between NAIC SAP and GAAP: The more significant variances from GAAP are: (a) bonds would generally be reported at fair value; (b) changes in the fair value of derivative financial instruments would generally be reported as revenue unless deemed an effective hedge; (c) embedded derivatives would be bifurcated from the underlying contract or security and accounted for separately at fair value; (d) income recognition on partnerships and LLCs, which are accounted for under the equity method, would not be limited to the amount of cash distribution; (e) majority-owned noninsurance subsidiaries, variable interest entities where the Company is the primary beneficiary, and certain other controlled entities would be consolidated; (f) changes in the balances of deferred income taxes would generally be included in net income; (g) market value adjusted (“MVA”) annuity products would be reported in the general account of the Company; (h) all assets, subject to valuation allowances, would be recognized; (i) reserves would generally be based upon the net level premium method or the estimated gross margin method with estimates of future mortality, morbidity, persistency and interest; (j) reinsurance ceded, unearned ceded premium and unpaid ceded claims would be reported as an asset; (k) AVR and IMR would not be recorded; (l) changes to the mortgage loan valuation allowance would be reported in income; (m) surplus notes would be reported as liabilities; (n) premiums received in excess of policy charges for universal life and annuity policies would not be recognized as premium revenue and benefits would represent the excess of benefits paid over the policy account value and interest

F-12

Table of Contents

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

NOTES TO STATUTORY-BASIS FINANCIAL STATEMENTS – (CONTINUED)

2. Significant Accounting Policies - (continued)

credited to the account values; (o) certain acquisition costs, such as commissions and other variable costs, directly related to acquiring new business are charged to current operations as incurred, would generally be capitalized and amortized based on profit emergence over the expected life of the policies or over the premium payment period; and (p) changes in unrealized capital gains (losses) and foreign currency translations would be presented as other comprehensive income.

3. Permitted Statutory Accounting Practices

The financial statements of the Company are presented in conformity with accounting practices prescribed or permitted by the Insurance Division.

For determining the Company’s solvency under the State of Michigan’s insurance laws and regulations, the Insurance Department recognizes only statutory accounting practices prescribed or permitted by the State of Michigan for determining and reporting the financial condition and results of operations of the Company. NAIC SAP has been adopted as a component of practices prescribed or permitted by the State of Michigan. The Director has the authority to prescribe or permit other specific practices that deviate from prescribed practices.

As of December 31, 2015 and 2014, the Director had not prescribed or permitted the Company to use any accounting practices that would result in the Company’s income or financial position to deviate from NAIC SAP.

4. Accounting Changes