Table of Contents

As filed with the U.S. Securities and Exchange Commission on April 23, 2013Registration No. 333-100567

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-6

SEC File No 811-5130

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

POST EFFECTIVE AMENDMENT NO. 13 [X]

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

AMENDMENT NO. 21 [X]

John Hancock Life Insurance Company (U.S.A.) Separate Account N

(Exact Name of Registrant)

John Hancock Life Insurance Company (U.S.A.)

(Name of Depositor)

197 Clarendon Street

Boston, MA 02116

(Complete address of depositor’s principal executive offices)

Depositor’s Telephone Number: 617-572-6000

JAMES C. HOODLET

John

Hancock Life Insurance Company (U.S.A.)

U.S. INSURANCE LAW

JOHN HANCOCK PLACE

BOSTON, MA 02117

(Name and complete address of agent for service)

It is proposed that this filing will become effective (check appropriate box)

[ ] immediately upon filing pursuant to paragraph (b) of

Rule 485

[X ] on April 29, 2013 pursuant to paragraph (b) of Rule 485

[ ] 60 days after filing pursuant to paragraph (a) (1) of Rule 485

[ ] on (date) pursuant to paragraph (a) (1) of Rule 485

If appropriate check the following box

[ ] this post-effective amendment designates a new effective date for a previously filed amendment

Pursuant to the provisions of Rule 24f-2, Registrant has registered an indefinite amount of the securities under the Securities Act of 1933.

Table of Contents

Prospectus dated April 29, 2013

for interests in

John Hancock Life Insurance Company (U.S.A.) Separate Account N

Interests are made available under

CORPORATE VUL

JOHN HANCOCK LIFE INSURANCE COMPANY (U.S.A.)

(“John Hancock USA”)

| 500 Index B Active Bond All Cap Core All Cap Value Alpha Opportunities American Asset Allocation American Global Growth American Growth American Growth-Income American International American New World Blue Chip Growth Bond Capital Appreciation Capital Appreciation Value Core Allocation Plus Core Bond Core Strategy Disciplined Diversification Emerging Markets Value Equity-Income Financial Services Franklin Templeton Founding Allocation |

Fundamental All Cap Core Fundamental Holdings Fundamental Large Cap Value Fundamental Value Global Global Bond Global Diversification Health Sciences High Yield International Core International Equity Index B International Growth Stock International Opportunities International Small Company International Value Investment Quality Bond Lifestyle Aggressive Lifestyle Balanced Lifestyle Conservative Lifestyle Growth Lifestyle Moderate Mid Cap Index |

Mid Cap Stock Mid Value Money Market Natural Resources PIMCO VIT All Asset Real Estate Securities Real Return Bond Science & Technology Short Term Government Income Small Cap Growth Small Cap Index Small Cap Opportunities Small Cap Value Small Company Value Smaller Company Growth Strategic Income Opportunities Total Return Total Stock Market Index Ultra Short Term Bond U.S. Equity Utilities Value |

* * * * * * * * * * * *

Please note that the Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

CVUL03 4/2013

This prospectus does not constitute an offering in any jurisdiction in which such offering may not lawfully be made. No person is authorized to make any representations in connection with this offering other than those contained in this prospectus, the portfolios prospectuses, or the corresponding Statements of Additional Information.

The purpose of this variable life insurance policy is to provide insurance protection for the beneficiary named therein. No claim is made that this variable life insurance policy is in any way similar or comparable to a systematic investment plan of a mutual fund.

Examine this prospectus carefully. The Policy Summary will briefly describe the policy. More detailed information will be found further in the prospectus. You should rely on the information contained in this prospectus, the portfolio prospectuses, and the corresponding Statements of Additional Information, which contains the audited financial statements for John Hancock NY and Separate Account B. The portfolio prospectuses describe the investment objectives, policies and restrictions of, and the risks relating to, investment in the investment options. In the case of any of the portfolios that are operated as “feeder funds,” the prospectus for the corresponding “master fund” is also provided. We have not authorized anyone to provide you with information that is different from the information contained in the aforementioned documents.

Some of the benefits of purchasing the policy are described below. Death Benefit Protection. This prospectus describes a flexible premium variable life insurance policy, which provides for a death benefit payable to the beneficiary of the policy upon the death of the insured. Variable life insurance is a flexible tool for financial and investment planning for persons needing death benefit protection. You should consider other forms of investments if death benefit protection is not one of your financial planning objectives, as there are additional costs and expenses in providing the insurance.

Access To Your Policy Values. Variable life insurance offers access to Policy Value. You may borrow against your policy, or surrender all, or a portion of your policy through a partial withdrawal. There are limitations on partial withdrawals. See “Policy Surrender and Partial Withdrawals” for further information.

Tax Deferred Accumulation. Variable life insurance has several tax advantages under current tax laws. For example, Policy Value accumulates on a tax-deferred basis and a transfer of values from one sub-account to another within the policy generates no taxable gain or loss. Any investment income and realized capital gains within a sub-account or interest from the Fixed Account are automatically reinvested without current income taxation to the policy owner.

Investment Options. In addition to the Fixed Account, the policy provides for access to a number of variable investment options, which permit you to reallocate your Policy Value to meet your changing personal objectives, goals, and investment conditions. Information regarding each investment option may be found in the portfolio prospectuses.

Flexibility. The policy is a flexible premium variable life insurance policy in which varying premium payments are permitted. You may select death benefit options and an additional policy rider. You may increase or decrease the amount of death benefit. You are able to select, monitor, and change investment choices within your policy.

Some of the risks of purchasing the policy are described below.

Fluctuating Investment Performance. Policy Value invested in a sub-account is not guaranteed and will increase and decrease according to investment performance. You assume the investment risk of Policy Value allocated to the sub-accounts. A comprehensive discussion of each sub-account’s objective and risk is found in the portfolio prospectuses. You should review these prospectuses carefully before allocating Policy Value to any sub-accounts.

Unsuitable for Short-Term Investment. The Policy is intended for long-term financial planning, and is unsuitable for short-term goals. Your policy is not designed to serve as a vehicle for frequent trading.

Policy Lapse. Sufficient premiums must be paid to keep a policy in force. There is a risk of lapse if the Policy Value is too low in relation to the insurance amount, if investment results are less favorable than anticipated or if extensive policy loans are taken. A policy lapse could have adverse tax consequences since the amount received (including any loans) less the

investment in the policy may be treated as ordinary income subject to tax. Since withdrawals reduce your Policy Value, withdrawals increase the risk of lapse.Decreasing Death Benefit. Any outstanding policy loans and any amount that you have surrendered or withdrawn will reduce your policy’s death benefit.

Adverse Consequences of Early Surrender. There are surrender charges assessed if you surrender your policy in the first 10 years from the purchase of the policy or the effective date of a Face Amount increase. Depending on the amount of premium paid and the Policy Value at the time of surrender, there may be little or no Net Cash Surrender Value paid to you when the policy is surrendered. In addition, there are adverse consequences associated with partial withdrawals including potential policy lapse and adverse tax consequences. There may also be adverse consequences associated with full surrender of the policy.

Adverse Tax Consequences. You should always consult a tax adviser about the application of federal and state tax law to your individual situation. The federal income tax treatment of life insurance is complex and current tax treatment of life insurance may change.

The following tables describe the fees and expenses that you will pay when buying, owning, and surrendering the policy. Except where necessary to show a rate greater than zero, all rates shown in the tables have been rounded to two decimal places as required by the prospectus disclosure rules. Consequently, the actual rates charged may be slightly higher or lower than those shown. The first table describes the fees and expenses that you will pay at the time that you buy the policy, surrender the policy, or transfer cash value between investment options.

| Transaction Fees | ||

| Charge | When Charge is Deducted | Amount Deducted |

| Maximum Premium Load ChargeImposed on Premium (Load) | Upon receipt of premium | 2% of each premium paid |

| Maximum Sales Load Charge Imposed on Premium1 | Upon receipt of premium | 8% (Coverage Year 1)2 |

| Maximum Surrender Charge (Load)1 | Upon termination or reduction of anyCoverage Amount that is subject to a surrender charge including surrender of the policy for its Net Cash Surrender Value, partial withdrawal in excess of the Free Withdrawal Amount, decrease in the Face Amount, or policy lapse. | 5% (Coverage Year 1)3 |

| Transfer Fees | Upon transfer | $25 (only applies to transfers in excess of 12 in a Policy Year) |

| Dollar Cost Averaging | Upon transfer | Guaranteed $5.00 |

| Current $0.00 | ||

| Asset Allocation Rebalancer | Upon transfer | Guaranteed $15.00 |

| Current $5.00 | ||

1 A policy is subject to either a Sales Charge or a Surrender Charge but not both. The policy indicates which charge is applicable.

2 The Sales Load Charge declines in subsequent Coverage Years as noted below:

| Coverage Year |

Percentage |

| 1 | 8.00% |

| 2 | 6.00% |

| 3 | 3.00% |

| 4 | 2.00% |

| 5 | 1.00% |

| 6+ | 0.00% |

3 The Surrender Charge declines in subsequent Policy Years as noted below:

| Coverage Year |

Percentage |

| 1 | 5.00% |

| 2 | 4.00% |

| 3 | 3.00% |

| 4 | 2.50% |

| 5 | 2.00% |

| 6 | 1.50% |

| 7 | 1.00% |

| 8 | 1.00% |

| 9 | 0.50% |

| 10+ | 0.00% |

The surrender charge are a percentage of the sum of all premium payments attributed to a Coverage Amount in the first five Coverage Years.

The next table describes the fees and expenses that you will pay periodically during the time that you own the policy, not including fees and expenses of the portfolios, the underlying variable investment options for your policy.

| Charges Other Than Those of the Portfolios | |||

| Charge | When Charge isDeducted | Amount Deducted | |

| Cost of Insurance1 | Monthly | Minimum and Maximum Charge | The possible range of the cost of insurance is from $0.00 to $83.33 per month per $1,000 of the net amount at risk. |

| Charge for a Representative policy owner (a 45 year old non-smoking male) (rating classification is for short form underwriting) | Policy Subject to Sales Charge: The Cost of Insurance rate is $0.16 per month per $1,000 of the net amount at risk. | ||

| Policy Subject to Surrender Charge: The Cost of Insurance rate is $0.35 per month per $1,000 of the net amount at risk. | |||

| Cost of Insurance - Optional FTIO Rider (Flexible Term Insurance Option)1 | Monthly | Minimum and Maximum Charges | The possible range of the cost of insurance is from $0.00 to $83.33 per month per $1,000 of the net amount at risk |

| Charge for a Representative policy owner (a 45 year old non-smoking male) rating classification is for short form underwriting) | The Cost of Insurance rate is $0.10 per month per $1,000 of the net amount at risk | ||

| Mortality and Expense Risk Fees | Monthly | 0.04% (0.50% annually)2 | |

| Administration Fees | Monthly | $12 per Policy Month | |

| Loan Interest Rate (Net) | Annually | 0.75%3 | |

1 The cost of insurance varies based on individual characteristics and the charges shown in the table may not be representative of the charge a particular policy owner will pay. A policy owner may obtain additional information regarding cost of insurance charge by contacting the Company. The election (or failure to elect) the optional FTIO rider will impact the total cost of insurance charges.

2 Currently the Company is charging the following rates:

| Policy Year | Annual Rate |

| 1-10 | 0.50% |

| 11+ | 0.20% |

3 The Loan Interest Rate (Net) is equal to the rate of interest charged on the policy loan less the interest credited to the Loan Account. Currently this rate is 0.75% for Policy Years 1-10 and 0.25% for Policy Years 11 and higher. The maximum loan rate is 4%.

The next table describes the minimum and maximum portfolio level fees and expenses charged by any of the portfolios underlying a variable investment option offered through this prospectus, expressed as a percentage of average net assets (rounded to two decimal places). These expenses are deducted from portfolio assets.

| Total Annual Portfolio Operating Expenses | Minimum | Maximum |

| Range of expenses, including management fees, distribution and/or service (12b-1) fees, and other expenses | 0.54% | 1.63% |

1 Certain of the portfolios’ advisers or subadvisers have contractually agreed to reimburse or waive certain portfolio level expenses. The minimum and maximum expenses shown do not reflect these contractual expense reimbursements or waivers. If such reimbursements or waivers were reflected, the minimum and maximum expenses would be 0.30% and 1.54%, respectively.

Table of Investment Options and Investment Subadvisers

When you select a Separate Account investment option, we invest your money in shares of a corresponding portfolio of the John Hancock Variable Insurance Trust (the “Trust” or “JHVIT”) (or the PIMCO Variable Insurance Trust (the “PIMCO Trust”) with respect to the PIMCO VIT All Asset portfolio) and hold the shares in a subaccount of the Separate Account. Fees and expenses of the portfolios are not fixed or specified under the terms of the policies and may vary from year to year. These fees and expenses differ for each portfolio and reduce the investment return of each portfolio. Therefore, they also indirectly reduce the return you will earn on any Separate Account investment options you select. For more information, please refer to the prospectus for the underlying portfolios.

The JHVIT and the PIMCO Trust are so-called “series” type mutual funds and each is registered under the Investment Company Act of 1940 (“1940 Act”) as an open-end management investment company. John Hancock Investment Management Services, LLC (“JHIMS”) provides investment advisory services to the Trust and receives investment management fees for doing so. JHIMS pays a portion of its investment management fees to other firms that manage the Trust’s portfolios. We are affiliated with JHIMS and may indirectly benefit from any investment management fees JHIMS retains. The PIMCO VIT All Asset portfolio of the PIMCO Trust receives investment advisory services from Pacific Investment Management Company LLC (“PIMCO”) and pays investment management fees to PIMCO.

Each of the American Asset Allocation, American Global Growth, American Growth, American Growth-Income, American International, American New World, Fundamental Holdings and Global Diversification portfolios invests in Series 1 shares of the corresponding investment portfolio of the Trust. The American Asset Allocation, American Global Growth, American Growth, American Growth-Income, American International, and American New World portfolios operate as “feeder funds,” which means that the portfolios do not buy investment securities directly. Instead, they invest in a “master fund” which in turn purchases investment securities. Each of the American feeder fund portfolios has the same investment objective and limitations as its master fund. The prospectus for the American Fund master fund is included with the prospectuses for the underlying funds. We pay American Funds Distributors, Inc., the principal underwriter for the American Funds Insurance Series, a percentage of some or all of the amounts allocated to the “American” portfolios of the Trust for the marketing support services it provides.

The portfolios pay us or certain of our affiliates compensation for some of the distribution, administrative, shareholder support, marketing and other services we or our affiliates provide to the portfolios. The amount of this compensation is based on a percentage of the assets of the portfolios attributable to the variable insurance products that we and our affiliates issue. These percentages may differ from portfolio to portfolio and among classes of shares within a portfolio. In some cases, the compensation is derived from the Rule 12b-1 fees that are deducted from a portfolio’s assets for the services we or our affiliates provide to that portfolio. These compensation payments do not, however, result in any charge to you in addition to what is shown in the Fee Tables.

The following table provides a general description of the portfolios that underlie the variable investment options we make available under the policy. You bear the investment risk of any portfolio you choose as an investment option for your policy. You can find a full description of each portfolio, including the investment objectives, policies, restrictions, and risks, in the prospectus for that portfolio. You should read the portfolio’s prospectus carefully before investing in the corresponding variable investment option.

The investment options in the Separate Account are not publicly traded mutual funds. The investment options are only available to you as investment options in the policies, or in some cases through other variable annuity contracts or variable life insurance policies issued by us or by other life insurance companies. In some cases, the investment options also may be available through participation in certain qualified pension or retirement plans. The portfolios’ investment advisers and managers (i.e. subadvisers) may manage publicly traded mutual funds with similar names and investment objectives. However, the portfolios are not directly related to any publicly traded mutual fund. You should not compare the performance of any investment option described in this prospectus with the performance of a publicly traded mutual fund. The performance of any publicly traded mutual fund could differ substantially from that of any of the investment options of our Separate Account.

The portfolios available under the policies are as described in the following table:

| Portfolio | Portfolio Manager | Investment Objective |

| 500 Index B | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a broad-based U.S. domestic equity market index. Under normal market conditions, the portfolio seeks to approximate the aggregate total return of a broad-based U.S. domestic equity market index. |

| Active Bond | Declaration Management & Research LLC; and John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek income and capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified mix of debt securities and instruments. The portfolio seeks to invest its assets in debt securities and instruments with an average duration of between 4 to 6 years; however, there is no limit on the portfolio’s average maturity. |

| All Cap Core | QS Investors, LLC | To seek long-term growth of capital. Under normal market conditions, the portfolio invests in common stocks and other equity securities within all asset classes (small, medium and large-capitalization) of those included in the Russell 3000 Index.* |

| All Cap Value | Lord, Abbett & Co. LLC | To seek capital appreciation. Under normal market conditions, the portfolio primarily purchases equity securities of U.S. and multinational companies in all capitalization ranges that the subadviser believes are undervalued. |

| Alpha Opportunities | Wellington Management Company, LLP | To seek long-term total return. The portfolio employs a “multiple sleeve structure,” which means the portfolio has several components that are managed separately in different styles. The portfolio seeks to obtain its objective by combining these different component styles in a single portfolio. |

| American Asset Allocation | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide high total return (including income and capital gains) consistent with preservation of capital over the long-term. The portfolio invests all of its assets in Class 1 shares of its master fund, the Asset Allocation Fund, a series of the American Funds Insurance Series. The master fund invests in a diversified portfolio of common stocks and other equity securities, bonds and other intermediate and long-term debt securities, and money market instruments. |

| American Global Growth | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide long-term growth of capital. The portfolio invests all of its assets in Class 1 shares of its master fund, the Global Growth Fund, a series of the American Funds Insurance Series. The master fund invests primarily in common stocks of companies located around the world that the adviser believes have potential for growth. |

| American Growth | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide growth of capital. The portfolio invests all of its assets in Class 1 shares of its master fund, the Growth Fund, a series of the American Funds Insurance Series. The master fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. The master fund may also invest a portion of its assets in common stocks and other securities of issuers domiciled outside the U.S. |

| American Growth–Income | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide growth of capital and income. The portfolio invests all of its assets in Class 1 shares of its master fund, the Growth-Income Fund, a series of the American Funds Insurance Series. The master fund invests primarily in common stocks or other securities that the master fund’s adviser believes demonstrate the potential for appreciation and/or dividends. Although the master fund focuses on investments in medium-to large-capitalization companies, the master fund’s investments are not limited to a particular capitalization size. |

| American International | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek to provide long-term growth of capital. The portfolio invests all of its assets in Class 1 shares of its master fund, the International Fund, a series of the American Funds Insurance Series. The master fund invests primarily in common stocks of companies domiciled outside the U.S., including companies domiciled in developing countries, that the adviser believes have the potential for growth. Although the master fund focuses on investments in medium-to large-capitalization companies, the master fund’s investments are not limited to a particular capitalization size. |

| Portfolio | Portfolio Manager | Investment Objective |

| American New World | Capital Research and Management Company (Adviser to the American Funds Insurance Series) | To seek long-term capital appreciation. The portfolio invests all of its assets in Class 1 shares of its master fund, the New World Fund, a series of the American Funds Insurance Series. The master fund invests primarily in stocks of companies with significant exposure to countries with developing economies and/or markets that the adviser believes have potential of providing capital appreciation. The master fund may also invest in companies without regard to market capitalization, including companies with small market capitalizations. |

| Blue Chip Growth | T. Rowe Price Associates, Inc. | To seek to provide long-term growth of capital. Current income is a secondary objective. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in the common stocks of large- and medium-sized blue chip growth companies. |

| Bond | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek to provide income and capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified mix of debt securities and instruments. |

| Capital Appreciation | Jennison Associates LLC | To seek long-term growth of capital. Under normal market conditions, the portfolio invests at least 65% of its total assets in equity and equity-related securities of companies that, at the time of investment, that exceed $1 billion in market capitalization and that the subadviser believes have above-average growth prospects. These companies are generally medium- to large-capitalization companies. |

| Capital Appreciation Value | T. Rowe Price Associates, Inc. | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests primarily in common stocks of established U.S. companies that have above-average potential for capital growth. Common stocks typically constitute at least 50% of the portfolio’s total assets. The remaining assets are generally invested in other securities, including convertible securities, corporate and government debt, bank loans (which represent an interest in amounts owed by a borrower to a syndicate of lenders), foreign securities, futures and options. The portfolio may invest up to 20% of its total assets in foreign securities. |

| Core Allocation Plus | Wellington Management Company, LLP | To seek total return, consisting of long-term capital appreciation and current income. Under normal market conditions, the portfolio invests in equity and fixed-income securities of issuers located within and outside the U.S. The portfolio will allocate its assets between fixed-income securities, which may include investment-grade and below investment-grade debt securities with maturities that range from short to longer term, and equity securities based upon the subadviser’s targeted asset mix, which may change over time. Under normal market conditions, the targeted asset mix may range between 75%-50% equity instruments and 50%-25% fixed-income instruments and will generally reflect the subadviser’s long-term, strategic asset allocation analysis. |

| Core Bond | Wells Capital Management, Incorporated | To seek total return consisting of income and capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in a broad range of investment-grade debt securities, including U.S. Government obligations, corporate bonds, mortgage-backed and other asset-backed securities and money market instruments. |

| Core Strategy | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek long-term growth of capital. Current income is also a consideration. Under normal market conditions, the portfolio invests in other portfolios of JHVIT and other investment companies (including exchange traded funds) as well as other types of investments. The portfolio invests approximately 70% of its total assets in equity securities and underlying funds that invest primarily in equity securities, and approximately 30% of its total assets in fixed-income securities and underlying funds that invest primarily in fixed-income securities. |

| Disciplined Diversification | Dimensional Fund Advisors LP | To seek total return consisting of capital appreciation and current income. Under normal market conditions, the portfolio invests primarily in equity

securities and fixed-income securities of domestic and international issuers, including equities of issuers in emerging markets, in accordance with the following range of allocations: Target Allocation Range of Allocation Equity Securities: 70% 65% – 75% Fixed-Income Securities: 30% 25% – 35% |

| Portfolio | Portfolio Manager | Investment Objective |

| Emerging Markets Value | Dimensional Fund Advisors LP | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in companies associated with emerging markets designated from time to time by the subadviser. |

| Equity-Income | T. Rowe Price Associates, Inc. | To seek to provide substantial dividend income and also long-term growth of capital. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities, with at least 65% in common stocks of well-established companies paying above-average dividends. |

| Financial Services | Davis Selected Advisers, L.P. | To seek growth of capital. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in companies that, at the time of investment, are principally engaged in financial services, and the portfolio invests primarily in common stocks of financial services companies. |

| Franklin Templeton Founding Allocation | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek long-term growth of capital. The portfolio invests in other funds and in other investment companies, as well as other types of investments. The portfolio currently invests primarily in three underlying funds: Global Fund, Income Fund and Mutual Shares Fund. |

| Fundamental All Cap Core | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek long-term growth of capital. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities. Market capitalizations of these companies will span the capitalization spectrum. Equity securities include common, convertible, and preferred securities and their equivalents. |

| Fundamental Holdings | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek long-term growth of capital. The portfolio invests in other funds and other investment companies as well as other types of investments. Underlying funds may include other JHVIT funds and funds of the American Funds Insurance Series. However, the portfolio is authorized to invest without limitation in other underlying funds and in other types of investments. |

| Fundamental Large Cap Value | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets in equity securities of large-capitalization companies. The portfolio considers large-capitalization companies to be those that at the time of purchase have a market capitalization equal to or greater than that of the top 80% of the companies that comprise the Russell 1000 Index.* |

| Fundamental Value | Davis Selected Advisers, L.P. | To seek growth of capital. Under normal market conditions, the portfolio invests primarily in common stocks of U.S. companies with market capitalizations of at least $10 billion. The portfolio may also invest in companies with smaller capitalizations. |

| Global | Templeton Global Advisors Limited | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests primarily in the equity securities of companies located throughout the world, including emerging markets. |

| Global Bond | Pacific Investment Management Company LLC | To seek maximum total return, consistent with preservation of capital and prudent investment management. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in fixed-income instruments that are economically tied to at least three countries (one of which may be the U.S.), which may be represented by futures contracts (including related options) with respect to such securities, and options on such securities. These fixed-income instruments may be denominated in foreign currencies or in U.S. dollars, which may be represented by forwards or derivatives, such as options, futures contracts, or swap agreements. |

| Global Diversification | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek long-term growth of capital. The portfolio invests in other funds and other investment companies as well as other types of investments. Underlying funds may include other JHVIT funds and funds of American Fund Insurance Series. The portfolio is authorized to invest without limitation in other underlying funds. Under normal market conditions, the portfolio intends to invest a portion of its assets in funds that invest primarily in foreign securities or in foreign securities directly. |

| Portfolio | Portfolio Manager | Investment Objective |

| Health Sciences | T. Rowe Price Associates, Inc. | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks of companies engaged, at the time of investment, in the research, development, production, or distribution of products or services related to health care, medicine, or the life sciences. While the portfolio may invest in companies of any size, the majority of its assets are expected to be invested in large and medium-capitalization companies. |

| High Yield | Western Asset Management Company | To seek to realize an above-average total return over a market cycle of three to five years, consistent with reasonable risk. Under normal market

conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) at the time of investment in high yield securities. The portfolio’s investments may include corporate bonds, preferred stocks, U.S.

Government and foreign securities, mortgage-backed securities, loan assignments or participations and convertible securities that have the following ratings (or, if unrated, are considered by the subadviser to be of equivalent quality): Rating Agency Moody’s: Ba through C S&P’s: BB through D |

| International Core | Grantham, Mayo, Van Otterloo & Co. LLC | To seek high total return. Under normal market conditions, the portfolio invests at least 80% of its total assets in equity investments. The portfolio typically invests in equity investments in companies from developed markets outside the U.S. |

| International Equity Index B | SSgA Funds Management, Inc. | To seek to track the performance of a broad-based equity index of foreign companies primarily in developed countries and, to a lesser extent, in emerging markets. Under normal market conditions, the portfolio invests at least 80% of its assets in securities listed in the Morgan Stanley Capital International All Country World Excluding U.S. Index* or American Depositary Receipts or Global Depositary Receipts representing such securities. |

| International Growth Stock | Invesco Advisers, Inc. | To seek to achieve long-term growth of capital. The portfolio invests primarily in a diversified portfolio of international securities whose issuers are considered by the portfolio’s subadviser to have potential for earnings or revenue growth. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in stocks of any market capitalization. |

| International Small Company | Dimensional Fund Advisors LP | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities of small capitalization companies in the particular markets in which the portfolio invests. The portfolio primarily invests in a broad and diverse group of equity securities of non-U.S. small companies of developed markets, but may also hold equity securities of companies located in emerging markets. |

| International Value | Templeton Investment Counsel, LLC | To seek long-term growth of capital. Under normal market conditions, the portfolio invests primarily in equity securities of companies located outside the U.S., including in emerging markets. |

| Investment Quality Bond | Wellington Management Company, LLP | To seek to provide a high level of current income consistent with the maintenance of principal and liquidity. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in bonds rated investment-grade at the time of investment. The portfolio will tend to focus on corporate bonds and U.S. Government bonds with intermediate to longer-term maturities. |

| Lifestyle Aggressive | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek long-term growth of capital. Current income is not a consideration. The portfolio normally invests approximately 100% of its assets in underlying funds that invest primarily in equity securities. |

| Portfolio | Portfolio Manager | Investment Objective |

| Lifestyle Balanced | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek a balance between a high level of current income and growth of capital, with a greater emphasis on growth of capital. The portfolio normally invests approximately 50% of its assets in underlying funds that invest primarily in equity securities and approximately 50% of its assets in underlying funds that invest primarily in fixed-income securities. |

| Lifestyle Conservative | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek a high level of current income with some consideration given to growth of capital. The portfolio normally invests approximately 80% of its assets in underlying funds that invest primarily in fixed-income securities and approximately 20% in underlying funds that invest primarily in equity securities. |

| Lifestyle Growth | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek long-term growth of capital. Current income is also a consideration. The portfolio normally invests approximately 70% of its assets in underlying funds that invest primarily in equity securities and approximately 30% of its assets in underlying funds that invest primarily in fixed-income securities. |

| Lifestyle Moderate | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek a balance between a high level of current income and growth of capital, with a greater emphasis on income. The portfolio normally invests approximately 60% of its assets in underlying funds that invest primarily in fixed-income securities and approximately 40% in underlying funds that invest primarily in equity securities. |

| Mid Cap Index | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a medium-capitalization U.S. domestic equity market index. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) at the time of investment in (a) the common stocks that are included in the S&P MidCap 400 Index* and (b) securities (which may or may not be included in the S&P MidCap 400 Index) that the subadviser believes as a group will behave in a manner similar to the index. |

| Mid Cap Stock | Wellington Management Company, LLP | To seek long-term growth of capital. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of medium-sized companies with significant capital appreciation potential. For the portfolio, “medium-sized companies” are those with market capitalizations within the collective market capitalization range of companies represented in either the Russell Midcap Index* or the S&P MidCap 400 Index.* |

| Mid Value | T. Rowe Price Associates, Inc. | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets in companies with market capitalizations that are within the Russell Midcap Value Index.* The portfolio invests in a diversified mix of common stocks of mid-size U.S. companies that are believed to be undervalued by various measures and offer good prospects for capital appreciation. |

| Money Market |

John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to obtain maximum current income consistent with preservation of principal and liquidity. Under normal market conditions, the portfolio invests in high quality, U.S. dollar-denominated money market instruments. Certain market conditions may cause the return of the portfolio to become low or possibly negative. |

| Natural Resources | RS Investment Management Co. LLC; andWellington Management Company, LLP | To seek long-term total return. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity and equity-related securities of natural resource-related companies worldwide, including emerging markets. Natural resource-related companies include companies that own or develop energy, metals, forest products and other natural resources, or supply goods and services to such companies. |

| PIMCO VIT All Asset (a series of PIMCO Variable Insurance Trust) (only Class M is available) | Pacific Investment Management Company LLC | To seek maximum real return consistent with preservation of real capital and prudent investment management. The portfolio is a fund of funds and normally invests substantially all of its assets in Institutional Class shares or, as applicable, Class M shares of underlying PIMCO funds. |

| Portfolio | Portfolio Manager | Investment Objective |

| Real Estate Securities | Deutsche Investment Management Americas Inc. | To seek to achieve a combination of long-term capital appreciation and current income. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of real estate investment trusts and real estate companies. Equity securities include common stock, preferred stock and securities convertible into common stock. |

| Real Return Bond | Pacific Investment Management Company LLC | To seek maximum real return, consistent with preservation of real capital and prudent investment management. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in inflation-indexed bonds of varying maturities issued by the U.S. and non-U.S. Governments, their agencies or instrumentalities and corporations, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. |

| Science & Technology | Alliance Global Investors U.S. LLC; and T. Rowe Price Associates, Inc. | To seek long-term growth of capital. Current income is incidental to the portfolio’s objective. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in the common stocks of companies expected to benefit from the development, advancement, and/or use of science and technology. For purposes of satisfying this requirement, common stock may include equity-linked notes and derivatives relating to common stocks, such as options on equity-linked notes. |

| Short Term Government Income | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek a high level of current income consistent with preservation of capital. Maintaining a stable share price is a secondary goal. Under normal market conditions, the portfolio invests at least 80% of its net assets in obligations issued or guaranteed by the U.S. Government and its agencies, authorities or instrumentalities. Under normal circumstances, the portfolio’s effective duration is no more than 3 years. |

| Small Cap Growth | Wellington Management Company, LLP | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in small-capitalization companies. For the purposes of the portfolio, “small-capitalization companies” are those with market capitalizations, at the time of investment, not exceeding the maximum market capitalization of any company represented in either the Russell 2000 Index* or the S&P SmallCap 600 Index.* |

| Small Cap Index | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a small-capitalization U.S. domestic equity market index. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) at the time of investment in (a) the common stocks that are included in the Russell 2000 Index* and (b) securities (which may or may not be included in the Russell 2000 Index) that the subadviser believes as a group will behave in a manner similar to the index. |

| Small Cap Opportunities | Dimensional Fund Advisors LP; and Invesco Advisers, Inc. | To seek long-term capital appreciation. Under normal market conditions, Invesco Advisers, Inc. invests at least 80% of its subadvised net assets (plus any borrowings for investment purposes) in equity securities, including convertible securities, of small-capitalization companies. Dimensional Fund Advisors LP generally invests its subadvised net assets in a broad and diverse group of common stocks of small and medium-capitalization companies traded on a U.S. national securities exchange or on the over-the-counter market that Dimensional Fund Advisors LP determines to be value stocks at the time of purchase. |

| Small Cap Value | Wellington Management Company, LLP | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in small-capitalization companies that are believed to be undervalued by various measures and offer good prospects for capital appreciation. For the purposes of the portfolio, “small-capitalization companies” are those with market capitalizations, at the time of investment, not exceeding the maximum market capitalization of any company represented in either the Russell 2000 Index* or the S&P SmallCap 600 Index.* |

| Portfolio | Portfolio Manager | Investment Objective |

| Small Company Value | T. Rowe Price Associates, Inc. | To seek long-term growth of capital. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in companies with market capitalizations, at the time of investment, that do not exceed the maximum market capitalization of any security in the Russell 2000 Index.* The portfolio invests in small companies whose common stocks are believed to be undervalued. |

| Smaller Company Growth | Frontier Capital Management Company, LLC; Perimeter Capital Management; and John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited |

To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its assets in small-capitalization equity securities. |

| Strategic Income Opportunities | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek a high level of current income. Under normal market conditions, the portfolio invests primarily in the following types of securities: non-U.S. government and corporate debt securities from developed and emerging markets, U.S. Government and agency securities, and high-yield bonds. The portfolio may also invest in preferred stock and other types of debt securities. |

| Total Return | Pacific Investment Management Company LLC | To seek to maximum total return, consistent with preservation of capital and prudent investment management. Under normal market conditions, the portfolio invests at least 65% of its net assets in a diversified portfolio of fixed-income instruments of varying maturities, which may be represented by forwards or derivatives, such as options, futures contracts, or swap agreements. |

| Total Stock Market Index | John Hancock Asset Management, a division of Manulife Asset Management (North America) Limited | To seek to approximate the aggregate total return of a broad U.S. domestic equity market index. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) at the time of investment in (a) the common stocks that are included in the Wilshire 5000 Total Market Index* and (b) securities (which may or may not be included in the Wilshire 5000 Total Market Index) that the subadviser believes as a group will behave in a manner similar to the index. |

| Ultra Short Term Bond | John Hancock Asset Management, a division of Manulife Asset Management (US) LLC | To seek a high level of current income consistent with the maintenance of liquidity and the preservation of capital. Under normal market conditions, the portfolio invests at least 80% of its net assets in a diversified portfolio of domestic, investment-grade, debt securities. Debt securities may be issued by governments, companies or special purpose entities and may include notes, discount notes, bonds, debentures, commercial paper, repurchase agreements, mortgage-backed and other asset-backed securities and assignments, participations and other interests in bank loans. The portfolio may also invest in cash and cash equivalents. |

| U.S. Equity | Grantham, Mayo, Van Otterloo & Co. LLC | To seek long-term capital appreciation. Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities. To achieve the objective, the portfolio will be invested in equity investments that the subadviser believes will provide higher returns than the Russell 3000 Index.* |

| Utilities | Massachusetts Financial Services Company | To seek capital growth and current income (income above that available from the portfolio invested entirely in equity securities). Under normal market conditions, the portfolio invests at least 80% of its net assets (plus any borrowing for investment purposes) in securities of companies in the utilities industry. The subadviser considers a company to be in the utilities industry if, at the time of investment, the subadviser determines that a substantial portion (i.e., at least 50%) of the company’s assets or revenues are derived from one or more utilities. |

| Value | Invesco Advisers, Inc. | To seek to realize an above-average total return over a market cycle of 3 to 5 years, consistent with reasonable risk. Under normal market conditions, the portfolio invests in equity securities of companies with capitalizations, at the time of investment, similar to the market capitalization of companies in the Russell Midcap Value Index.* |

*Wilshire 5000 Total Market Index® is a trademark of Wilshire Associates. MSCI All Country World Excluding U.S. Index is a trademark of Morgan Stanley & Co. Incorporated. Russell 1000,® Russell 2000,® Russell 3000,® Russell Midcap,® and Russell Midcap Value® are

trademarks of Frank Russell Company. S&P MidCap 400,® and S&P SmallCap 600® are trademarks of The McGraw-Hill Companies, Inc. None of the portfolios are sponsored, endorsed, managed, advised, sold or promoted by any of these companies, and none of these companies make any representation regarding the advisability of investing in the portfolios.The indices referred to in the portfolio objectives track companies having the approximate market capitalization, as of February 28, 2013 (except as otherwise indicated), set out below:

MSCI All Country World Ex US Index — $676 million to $215.6 billion

Russell

1000 Index — minimum of $315 million

Russell 2000 Index — less than $1 million to $6.1 billion

Russell 3000 Index — less than $1 million to $414.5 billion

Russell

Midcap Index — $315 million to $42 billion

Russell Midcap Value Index — $315 million to $42 billion

S&P MidCap 400 Index — $322 million to $16.2 billion

S&P SmallCap 600 Index — $4 billion

Wilshire 5000 Total Market Index — less than $1 million to $415.2 billion

**The U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-enominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS.

The policy is a flexible premium variable universal life insurance policy. This summary provides a general description of the important features of the policy. It is not comprehensive and is qualified in its entirety by the more detailed information contained in this prospectus. Unless otherwise stated or implied by the context, the discussions in this prospectus assume that the policy has not gone into default, there is no outstanding Policy Debt and the death benefit is not determined by the Minimum Death Benefit percentage. The policy’s provisions may vary in some states. The terms of the policy and any endorsements or riders will supersede the disclosure in this prospectus.

The policy provides a death benefit in the event of the death of the Life Insured while the policy is in force. The basic death benefit amount is the Face Amount, which is provided for the lifetime of the Life Insured with no maturity or expiration date. There may be other amounts added to the death benefit as described below.

Flexible Term Insurance Option. You may add a flexible term insurance option rider (the “FTIO Rider”) to the policy to provide additional term life insurance coverage on the Life Insured. Cost of insurance rates are less than or equal to those of the policy and no Sales Loads or surrender charge will apply. However, unlike the Face Amount of the policy, the FTIO Rider will terminate at the Life Insured’s Attained Age 100. The FTIO Rider also offers the flexibility to schedule varying death benefit amounts on future dates (the “Scheduled Death Benefits”).

Death Benefit Options. There are two death benefit Options. Option 1 provides a death benefit equal to the Face Amount of the policy and the Scheduled Death Benefits of the FTIO Rider or, if greater, the Minimum Death Benefit. Option 2 provides a death benefit equal to the Face Amount and the Scheduled Death Benefits, plus the Policy Value or, if greater, the Minimum Death Benefit. You may change the death benefit Option and increase or decrease the Face Amount and Scheduled Death Benefits.

Age 100 Advantage. If the Life Insured is alive on the Policy Anniversary when the Life Insured reaches Attained Age 100, the policy will continue in force subject to the following unless the policy owner chooses to surrender the policy for its Net Cash Surrender Value:

- the policy will be continued until the earlier of the death of the Life Insured or the date the policy owner surrenders the policy;

- no additional premium payments will be accepted although loan repayments will be accepted;

- no additional charges or deductions (described under “Charges and Deductions”) will be assessed;

- interest on any Policy Debt will continue to accrue;

- the policy owner may continue to transfer portions of the Policy Value among the Investment Accounts and the Fixed Accounts as described in this prospectus.

Premium payments may be made at any time prior to Attained Age 100 and in any amount, subject to certain limitations (see “Premium Payments—Premium Limitations”). Net Premiums will be allocated to one or more of the Fixed Account and the sub-accounts of the Separate Account. You may change allocations and make transfers among the accounts subject to limitations described below.

The Policy Value is the accumulation of premiums paid, less charges and deductions we take for expenses and cost of insurance, plus or minus the investment returns of the accounts to which the Policy Value has been allocated. You may obtain a portion of the Policy Value by taking a policy loan or a partial withdrawal or by full surrender of the policy.

You may borrow against the Net Cash Surrender Value of the policy. Loan interest will accrue daily and be payable in arrears on each Policy Anniversary. The Policy Debt will be deducted from amounts payable at the Life Insured’s death or upon surrender.

Surrender and Partial Withdrawals

You may make a partial withdrawal of Policy Value. It may result in a decrease in the Face Amount and Scheduled Death Benefits and assessment of a portion of the surrender charge. You may surrender the policy for its Net Cash Surrender Value at any time.

A policy will lapse and terminate without value when the Net Cash Surrender Value is insufficient to pay the next monthly deduction and a grace period of 61 days expires without an adequate premium payment from you. You may reinstate a lapsed policy within five years following lapse if the policy was not surrendered for its Net Cash Surrender Value. Evidence of insurability is required, along with a premium payment described under “Reinstatement.”

The policy differs in two important ways from a conventional life insurance policy. First, failure to make planned premium payments will not itself cause the policy to lapse. Second, the policy can lapse even if planned premiums have been paid.

We assess charges and deductions in connection with the policy, in the form of monthly deductions for the cost of insurance and administrative expenses, charges assessed daily against amounts in the Investment Accounts and loads deducted from premiums paid.

For more information, please refer to the prospectus for the underlying portfolio.

Sales Load or Surrender Charge. You may choose Coverage Amounts with one of two alternative charge structures representing different ways to cover a portion of our marketing and distribution costs. Generally, policy benefits will be approximately equal in present value under either alternative. However, there is no guarantee each alternative will perform the same in all circumstances. Therefore, you should obtain individualized illustrations for both charge structures.

Sales Load coverage features a load deducted immediately from premiums paid and no surrender charge. Surrender Charge coverage features no added sales load with surrender charges assessed upon early surrender, lapse, partial withdrawal or coverage decrease. Current cost of insurance charges in early years are higher for Surrender Charge coverage.

Reduction in Charges and Enhancement of Surrender Values. The policy is designed for employers and other sponsoring organizations that may purchases multiple policies as a Case. The size or nature of the Case may result in

expected savings of sales, underwriting, administrative or other costs. If so, we may offer reductions of policy charges and enhancements of surrender value. We may change the nature and amount of reductions and enhancements available from time to time. They will be determined in a way that is not unfairly discriminatory to policyholders.Investment Options and Investment Subadvisers

You may allocate Net Premiums to the Fixed Account or to one or more of the sub-accounts of the Separate Account. Each of the sub-accounts invests in the shares of one of the portfolios described in the Table of Investment Options and Investment Subadvisers.

The portfolios also employ subadvisers. The Table of Investment Options and Investment Subadvisers shows the subadvisers that provide investment subadvisory services to the indicated portfolios.

Allocating Net Premiums only to one or a small number of the investment options (other than the Lifestyle Trusts) should not be considered a balanced investment strategy. In particular, allocating Net Premiums to a small number of investment options that concentrate their investments in a particular business or market sector will increase the risk that the value of your policy will be more volatile since these investment options may react similarly to business or market specific events. Examples of business or market sectors where this risk historically has been and may continue to be particularly high include: (a) technology related businesses, including internet related businesses, (b) small cap securities and © foreign securities. The Company does not provide advice regarding appropriate investment allocations. Please discuss this matter with your financial adviser.

Description of John Hancock (USA)

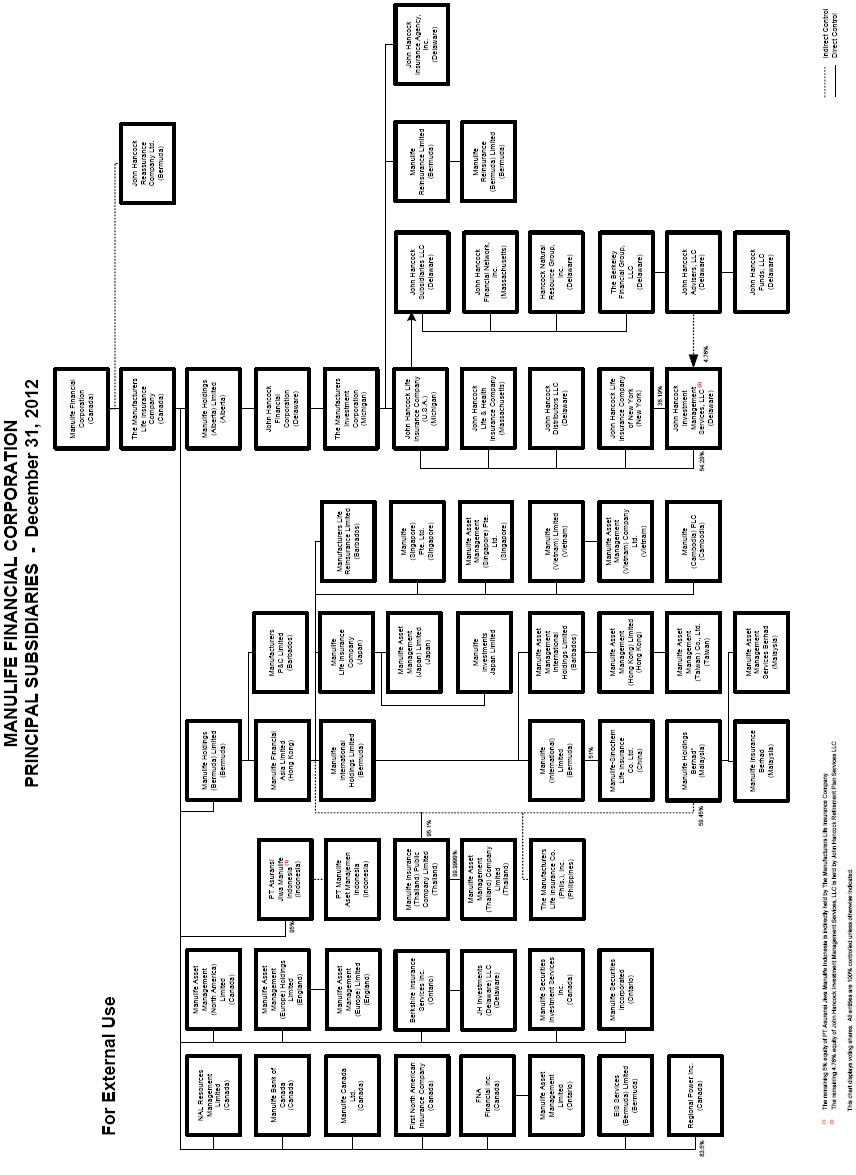

We are a stock life insurance company incorporated in Maine on August 20, 1955 by a special act of the Maine legislature and redomesticated under the laws of Michigan. We are a licensed life insurance company in the District of Columbia and all states of the United States except New York. Our ultimate parent is Manulife Financial Corporation (“MFC”), a publicly traded company based in Toronto, Canada. MFC is the holding company of John Hancock USA and its subsidiaries. However, neither John Hancock USA nor any of its affiliated companies guarantees the investment performance of the Separate Account.

We are ranked and rated by independent financial rating services, which may include Moody’s, Standard & Poor’s, Fitch and A.M. Best. The purpose of these ratings is to reflect the financial strength or claims-paying ability of the company, but they do not specifically relate to its products, the performance (return) of these products, the value of any investment in these products upon withdrawal or to individual securities held in any portfolio. These ratings do not apply to the safety and performance of the Separate Account.

Description of Separate Account N

The investment accounts shown on page 1 are in fact subaccounts of the John Hancock Life Insurance Company (U.S.A.) Separate Account N, a separate account operated by us under Michigan law. The Separate Account meets the definition of “separate account” under the Federal securities laws and is registered as a unit investment trust under the 1940 Act. Such registration does not involve supervision by the SEC of the management of the Separate Account or of us.

The Separate Account’s assets are our property. Each policy provides that amounts we hold in the Separate Account pursuant to the policies cannot be reached by any other persons who may have claims against us and can’t be used to pay any indebtedness of John Hancock USA other than those arising out of policies that use the Separate Account. Income, gains and losses credited to, or charged against, the Separate Account reflect the Separate Account’s own investment experience and not the investment experience of John Hancock USA’s other assets. John Hancock USA is obligated to pay all amounts promised to policy owners under the policies.

New subaccounts may be added and made available to policy owners from time to time. Existing subaccounts may be modified or deleted at any time.

The policy is designed to provide employers or other organizations with life insurance coverage on employees or other individuals in whose lives they have an insurable interest. The policy may be owned by an individual or a corporation, trust, association, or similar entity. The policy may be used for such purposes as funding non-qualified executive deferred compensation or salary continuation liabilities or death benefit liabilities of executive retirement plans, or as a source for funding cash flow obligations under such plans.

To purchase a policy, an applicant must submit a completed application. A policy will not be issued until the underwriting process is completed to our satisfaction and we approve issuance of the policy.

Policies may be issued on a basis that does not distinguish between the Life Insured’s sex and/or smoking status, with prior approval from us. A policy will only be issued on the lives of insureds from Issue Ages 20 through 80. Each policy has a Policy Date, an Effective Date and an Issue Date. The Policy Date is the date from which the first monthly deductions are calculated and from which Policy Years, Policy Months and Policy Anniversaries are measured. The Policy Date is also the effective date of the initial Coverage Amount. The Policy Date is the same date as the Effective Date unless the policy is backdated (see “Backdating a Policy”). The Effective Date is the date we become obligated under the policy and when the first monthly deductions are taken. It is the later of the date we approve issuance of the policy and the date we receive at least the Minimum Initial Premium. The Issue Date is the date from which the Suicide and Incontestability provisions of the policy are measured.

If we approve issuance of a policy before we receive the Minimum Initial Premium then the Effective Date will be later than the Issue Date. The Minimum Initial Premium must be received by us within 60 days after the Issue Date and the Life Insured must be in good health on the Effective Date. If the Minimum Initial Premium is not paid or if the application is rejected, the policy will be canceled and any premiums paid will be returned to the applicant.

Net Premiums received prior to the Effective Date will be credited with interest at the rate of return earned on amounts allocated to the Money Market portfolio. On the Effective Date, Net Premiums received plus any interest credited will be allocated to Investment Accounts and the Fixed Account according to your instructions, unless first allocated to the Money Market Trust for the duration of the right to examine period (see “Right to Examine the Policy”).

Minimum Face Amount and Scheduled Death Benefit. The minimum Face Amount is $50,000 unless the FTIO Rider is added to the policy. With an FTIO Rider, the minimum Face Amount is $25,000 and the minimum Scheduled Death Benefit is $50,000 at all times.

Backdating a Policy. You may request that we backdate the policy by assigning a Policy Date earlier than the date the application is signed. We will not backdate the policy to a date earlier than that allowed by state law, which is generally three months to one year prior to the date of application for the policy. Monthly deductions will be made for the period the Policy Date is backdated.

Temporary insurance coverage may be provided under the terms of a Temporary Insurance Agreement, subject to our underwriting practices. Generally, temporary life insurance may not exceed $1,000,000 and may not be in effect for more than 90 days. It is issued on a conditional receipt basis, which means that benefits would only be paid if the Life Insured met our usual and customary underwriting standards for the coverage applied for.

The policies are offered on three underwriting classes that require different types and amounts of information from the applicant and prospective Life Insured. Current cost of insurance charges in early Policy Years will vary by the type of underwriting and charges will generally be lower where underwriting information is more extensive. Under any of the underwriting bases, the acceptance of an application is subject to our underwriting rules and we may request additional information or reject an application for any reason.

Short Form Underwriting. The proposed Life Insured must answer qualifying questions in the application but is not required to provide detailed medical history, submit records or undergo examinations or tests unless requested to do so by us. Availability of Short Form underwriting depends on characteristics of the Case, such as the number of lives to be insured, the amounts of insurance and other factors, and it is generally available only up to Issue Age 65.

Simplified Underwriting. The proposed Life Insured must satisfactorily answer certain health questions in the application and may be required to submit existing medical records, but requirements to undergo examinations and tests are minimized. Availability of Simplified underwriting and the nature of the requirements will depend on characteristics of the Case and the proposed lives to be insured.

Regular (Medical) Underwriting. Where Short Form or Simplified underwriting is unavailable we require satisfactory evidence of insurability under our regular underwriting guidelines for individual applicants. This may include medical exams and other information. A proposed Life Insured who fails to qualify for a standard risk classification may be eligible to be insured with an additional substandard rating.

A policy may be returned for a refund within 10 days after you receive it. Some states provide a longer period of time for this right, which will be stated in the policy if applicable. The policy can be mailed or delivered to the John Hancock USA agent who sold it or to the Service Office. Immediately upon such delivery or mailing, the policy shall be deemed void from the beginning. Within seven days after receipt of the returned policy at the Service Office we will refund an amount equal to the value of amounts in the Investment Accounts and the Fixed Account on the date we receive the returned policy, plus all charges deducted prior to that date, not including fees and expenses of the portfolios, minus any partial withdrawals and policy loans.

Some state laws require the refund of premiums paid without adjustment for investment gains and losses of the Separate Account. In these states, all Net Premiums will be allocated to the Money Market Trust during the right to examine period and the refund amount will be equal to all premiums received less any partial withdrawals and policy loans.

If you request a Face Amount increase that results in new surrender charge or sales loads, you will have the same rights described above to cancel the increase. If canceled, the premiums paid during this right to examine period will be refunded, and the Policy Value and surrender charge or sales loads will be recalculated to be as they would have been had the premiums not been paid.

We reserve the right to delay the refund of any premium paid by check until the check has cleared.

(Applicable to Residents of California Only)

Residents in California age 60 and greater may return the policy for a refund at any time within 30 days after receiving it. The policy can be mailed or delivered to the Company’s agent who sold it or to the Service Office. If you cancel the policy during this 30 day period and your premiums were allocated to a Fixed Account or the Money-Market investment option, we will refund you the amount of all premiums paid. If your premiums were allocated to one or more of the Investment Accounts (other than the Money Market portfolio), we will refund you the value of amounts in the Investment Accounts and the Fixed Account on the date we receive the returned policy plus all charges deducted prior to that date, not including fees and expenses of the portfolios; minus any partial withdrawals and policy loans.

Your premiums will be placed in either (a) the Fixed Account, (b) the Money Market investment option or © in one or more of the Investment Accounts, based upon your instructions. If no instructions are given, your premiums will be placed in the Money Market investment option.

A policy must satisfy either of two tests to qualify as a life insurance contract as defined in Section 7702 of the Internal Revenue Code of 1986, as amended (the “Code”). At the time of application, you must choose either the Cash Value Accumulation Test (“CVA Test”) or the Guideline Premium Test (“GP Test”) and the test cannot be changed once the policy is issued.

Cash Value Accumulation Test. The CVA Test requires the death benefit at any time to be at least a certain ratio of the Policy Value, based on prescribed calculations. The Minimum Death Benefit provision described below will ensure that the CVA Test is met. There is no restriction on the amount of premiums you may pay, but we will require you to provide

satisfactory evidence of insurability before we accept an amount of premium that would increase the death benefit by more than the increase in Policy Value.Guideline Premium Test. The GP Test limits the amount of premiums you may pay into the policy, given its death benefit, based on prescribed calculations. In addition, the GP Test requires the death benefit at any time to be at least a prescribed ratio of the Policy Value. These prescribed multiples are generally lower than those calculated under the CVA Test. The Minimum Death Benefit provision described below will ensure that this second requirement is met.

Changes to the policy or FTIO Rider, such as changes in Face Amount, Scheduled Death Benefit, death benefit Option or partial withdrawals, may affect the premium limits under the GP Test. Some changes will reduce future premium limits and may cause premiums already paid to exceed the new limits and force you to make a partial withdrawal.

If the policy is in force at the time of the Life Insured’s death we will pay an insurance benefit to the beneficiary. The policy may remain in force for the Life Insured’s entire lifetime and there is no specified maturity or expiration date.

Insurance benefits are only payable when we receive due proof of death at the Service Office, in the form of either a certified copy of the death certificate, a certified copy of a decree of a court of competent jurisdiction as to the finding of death or other proof satisfactory to us.

The amount of the insurance benefit payable will be the death benefit on the date of death, as described below, less any Policy Debt and outstanding monthly deductions on the date of death. The insurance benefit will be paid in one lump sum unless another form of settlement is agreed to by the beneficiary and us. If the insurance benefit is paid in one sum, we will pay interest from the date of death to the date of payment. If the Life Insured should die after our receipt of a request for surrender, no insurance benefit will be payable, and we will pay only the Net Cash Surrender Value.

Minimum Death Benefit. Both the CVA Test and the GP Test require the death benefit to be at least a prescribed ratio of the Policy Value at all times. The Policy’s Minimum Death Benefit ensures that these requirements are met by providing that the death benefit shall be at least equal to the Policy Value multiplied by the applicable Minimum Death Benefit Percentage for the Attained Age of the Life Insured. Tables of Minimum Death Benefit Percentages appear below.

Table of Minimum Death Benefit Percentages.

| Age | GP Test Percent |

Male | CVA Test Female |

Unisex |

| 20 | 250% | 653% | 779% | 67.4% |

| 21 | 250% | 634% | 754% | 654% |

| 22 | 250% | 615% | 730% | 635% |

| 23 | 250% | 597% | 706% | 616% |

| 24 | 250% | 580% | 684% | 598% |

| 25 | 250% | 562% | 662% | 579% |

| 26 | 250% | 545% | 640% | 561% |

| 27 | 250% | 528% | 619% | 544% |

| 28 | 250% | 511% | 599% | 526% |

| 29 | 250% | 494% | 580% | 509% |

| 30 | 250% | 479% | 561% | 493% |

| 31 | 250% | 463% | 542% | 477% |

| 32 | 250% | 448% | 525% | 461% |

| 33 | 250% | 433% | 507% | 446% |

| 34 | 250% | 419% | 491% | 432% |

| 35 | 250% | 406% | 475% | 418% |

| 36 | 250% | 392% | 459% | 404% |

| 37 | 250% | 380% | 444% | 391% |

| 38 | 250% | 367% | 430% | 378% |

| 39 | 250% | 356% | 416% | 366% |

| 40 | 250% | 344% | 403% | 355% |

| 41 | 243% | 333% | 390% | 343% |

| 42 | 236% | 323% | 378% | 333% |

| 43 | 229% | 313% | 366% | 322% |