UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

FILED BY THE REGISTRANT x FILED BY A PARTY OTHER THAN THE REGISTRANT ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material under § 240.14a-12 | |

CASUAL MALE RETAIL GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

$

| (5) | Total fee paid: |

$

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

CASUAL MALE RETAIL GROUP, INC.

Notice of Annual Meeting of Stockholders

to be held on August 4, 2011

Notice is hereby given that the 2011 Annual Meeting of Stockholders of Casual Male Retail Group, Inc. (the “Company”) will be held at the corporate offices of the Company, 555 Turnpike Street, Canton, Massachusetts 02021 at 9:00 A.M., local time, on Thursday, August 4, 2011 for the following purposes:

| 1. | To elect eight directors to serve until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified. |

| 2. | To hold an advisory vote on named executive officer compensation. |

| 3. | To hold an advisory vote on the frequency of holding advisory votes on named executive officer compensation. |

| 4. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year ending January 28, 2012. |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

These proposals are more fully described in the Proxy Statement following this Notice.

The Board of Directors recommends that you vote (i) FOR the election of all eight nominees to serve as directors of the Company, (ii) FOR the advisory vote on named executive compensation, (iii) FOR the “one year” option with respect to the advisory vote on the preferred frequency of holding advisory votes on named executive officer compensation, and (iv) FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

Along with the attached Proxy Statement, we are sending you copies of our Annual Report on Form 10-K for the fiscal year ended January 29, 2011.

The Board of Directors has fixed the close of business on June 13, 2011 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. A list of the stockholders of record as of the close of business on June 13, 2011, will be available for inspection by any of our stockholders for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices, 555 Turnpike Street, Canton, Massachusetts 02021, beginning on July 25, 2011 and at the Annual Meeting.

Stockholders are cordially invited to attend the Annual Meeting in person. Regardless of whether you plan to attend the Annual Meeting, please mark, date, sign and return the enclosed proxy to ensure that your shares are represented at the Annual Meeting. Stockholders of record at the close of business on the record date whose shares are registered directly in their name, and not in the name of a broker or other nominee, may vote their shares in person at the Annual Meeting, even though they have sent in proxies.

By order of the Board of Directors,

/s/ DENNIS R. HERNREICH

DENNIS R. HERNREICH

Secretary

Canton, Massachusetts

June 21, 2011

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on August 4, 2011:

The Proxy Statement and 2011 Annual Report to Stockholders are available at www.casualmale.com/proxymaterials

IMPORTANT: Please mark, date, sign and return the enclosed proxy as soon as possible. The proxy is revocable and it will not be used if you give written notice of revocation to the Secretary of the Company at 555 Turnpike Street, Canton, Massachusetts 02021, prior to the vote to be taken at the Annual Meeting, if you lodge a later-dated proxy or if you attend and vote at the Annual Meeting.

CASUAL MALE RETAIL GROUP, INC.

555 Turnpike Street

Canton, Massachusetts 02021

(781) 828-9300

Proxy Statement

Annual Meeting of Stockholders

August 4, 2011

USE OF PROXIES

This Proxy Statement and the enclosed form of proxy are being mailed to stockholders on or about June 21, 2011, in connection with the solicitation by the Board of Directors of Casual Male Retail Group, Inc. (the “Company”) of proxies to be used at the Annual Meeting of Stockholders, to be held at the Company’s corporate headquarters located at 555 Turnpike Street, Canton, Massachusetts 02021 at 9:00 A.M, local time, on Thursday, August 4, 2011 and at any and all adjournments thereof (the “Annual Meeting”). When proxies are returned properly executed, the shares represented will be voted in accordance with the stockholders’ instructions.

Stockholders are encouraged to vote on the matters to be considered. However, if no instructions have been specified by a stockholder, the shares covered by an executed proxy will be voted (i) FOR the election of all eight nominees to serve as directors of the Company, (ii) FOR the advisory vote on named executive officer compensation, (iii) FOR the “one year” option with respect to the advisory vote on the preferred frequency of holding advisory votes on named executive officer compensation, (iv) FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, and (v) in the discretion of the proxies named in the proxy card with respect to any other matters properly brought before the Annual Meeting. Any stockholder may revoke such stockholder’s proxy at any time before it has been exercised by attending the Annual Meeting and voting in person or by filing with the Secretary of the Company either an instrument in writing revoking the proxy or another duly executed proxy bearing a later date.

Only holders of our common stock, par value $0.01 per share, of record at the close of business on June 13, 2011, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting. On that date, there were 48,460,485 shares of common stock issued and outstanding, excluding shares held by the Company in treasury. Each share is entitled to one vote at the Annual Meeting.

A plurality of the votes properly cast for the election of directors is required to elect directors. A majority of the votes properly cast is required for all other matters. With respect to Proposal 3, if none of the three frequency options receives the vote of the holders of a majority of the votes cast, the Company will consider the frequency option (one year, two years or three years) receiving the highest number of votes cast by stockholders to be the frequency that has been recommended by stockholders. However, as described in more detail in Proposal 3, because this proposal is advisory and non-binding, the Board of Directors may decide that it is in the best interest of the stockholders and the Company to hold future advisory votes on named executive officer compensation more or less frequently. Proposal 2 is also a non-binding proposal.

No votes may be taken at the Annual Meeting, other than a vote to adjourn, unless a quorum, consisting of a majority of the shares of our common stock outstanding as of the record date, is present in person or represented by proxy at the Annual Meeting. Any stockholder who attends the Annual Meeting may not withhold such stockholder’s shares from the quorum count by declaring such shares absent from the Annual Meeting. Shares voted to abstain or to withhold as to a particular matter, or as to which a nominee (such as a broker holding shares in street name for a beneficial owner) has no voting authority in respect of a particular matter, shall be deemed present for quorum purposes. With respect to all proposals presented at the Annual Meeting, such shares will not be deemed to be voting with respect to such matter and will not count as votes for or against such matter. Votes will be tabulated by our transfer agent subject to the supervision of persons designated by the Board of Directors as inspectors.

1

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information with respect to persons known to us to be the beneficial owners of more than five percent of the issued and outstanding shares of our common stock as of May 15, 2011. We were informed that, except as indicated, each person has sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by such person, subject to community property laws where applicable.

| Name and Address of Beneficial Owner |

Number of Shares Beneficially Owned |

Percent of Class(1) |

||||||

| Chilton Investment Company, LLC |

5,577,290 | (2) | 11.52 | % | ||||

| 1266 East Main Street, 7th Floor |

||||||||

| Stamford, Connecticut 06902 |

||||||||

| Seymour Holtzman |

5,653,769 | (3) | 11.30 | % | ||||

| 100 N. Wilkes Barre Blvd. |

||||||||

| Wilkes Barre, Pennsylvania 18702 |

||||||||

| FMR LLC |

4,116,928 | (4) | 8.50 | % | ||||

| 82 Devonshire Street |

||||||||

| Boston, Massachusetts 02109 |

||||||||

| Royce & Associates, LLC |

3,858,734 | (5) | 7.97 | % | ||||

| 745 Fifth Avenue |

||||||||

| New York, New York 10151 |

||||||||

| Glenhill Advisors, LLC |

3,783,690 | (6) | 7.81 | % | ||||

| Glenn J. Krevlin |

||||||||

| Glenhill Capital Management, LLC |

||||||||

| 156 West 56th Street, 17th Floor |

||||||||

| New York, New York 10019 |

||||||||

| RBC Global Asset Management (U.S.) Inc. |

2,998,203 | (7) | 6.19 | % | ||||

| 100 South Fifth Street |

||||||||

| Suite 2300 |

||||||||

| Minneapolis, Minnesota 55402 |

||||||||

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and generally includes voting or investment power with respect to securities. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of our common stock subject to options and warrants held by that person that are currently exercisable, or that become exercisable within 60 days, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Percentage ownership is based on 48,431,074 shares of our common stock outstanding as of May 15, 2011, plus securities deemed to be outstanding with respect to individual stockholders pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| (2) | Based on Amendment No. 7 to Schedule 13G, dated as of December 31, 2010, stating that Chilton Investment Company, LLC was the beneficial owner of the number of shares of common stock set forth opposite its name in the table. |

| (3) | Represents 4,043,769 outstanding shares of common stock and 1,610,000 shares subject to options exercisable within 60 days. |

| (4) | Based on Amendment No. 3 to Schedule 13G, dated as of December 31, 2010, stating that FMR LLC was the beneficial owner of the number of shares of common stock set forth opposite its name in the table. |

| (5) | Based on Amendment No. 4 to Schedule 13G, dated December 31, 2010, stating that Royce & Associates, LLC was the beneficial owner of the number of shares of common stock set forth opposite its name in the table. |

2

| (6) | Based on Amendment No. 2 to Schedule 13G, dated as of December 31, 2010, stating that Glenhill Advisors, LLC, Glenn J. Krevlin and Glenhill Capital Management, LLC were the beneficial owners of the number of shares of common stock set forth opposite their names in the table. Glenn J. Krevlin is the managing member and control person of Glenhill Advisors, LLC. Glenhill Advisors, LLC is the managing member of Glenhill Capital Management, LLC. Glenhill Capital Management, LLC is the general partner and investment advisor of Glenhill Capital LP, a security holder of the Company, managing member of Glenhill Concentrated Long Master Fund, LLC, a security holder of the Company, and sole shareholder of Glenhill Capital Overseas GP, Ltd. Glenhill Capital Overseas GP, Ltd. is general partner of Glenhill Capital Overseas Master Fund, LP, a security holder of the Company. |

| (7) | Based on Amendment No. 1 to Schedule 13G, dated December 31, 2010, stating that RBC Global Asset Management (U.S.) Inc. was the beneficial owner of the number of shares of common stock set forth opposite its name in the table. |

Security Ownership of Management

The following table sets forth certain information as of May 15, 2011, with respect to our directors, our Named Executive Officers (as defined below under “Executive Compensation”) and our directors and executive officers as a group. Except as indicated, each person has sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by such person, subject to community property laws where applicable.

| Name and Title |

Number of Shares Beneficially Owned |

Percent of Class(1) |

||||||

| Seymour Holtzman |

5,653,769 | (2) | 11.30 | % | ||||

| Chairman of the Board and Director |

||||||||

| David A. Levin |

1,660,555 | (3) | 3.4 | % | ||||

| Chief Executive Officer, President and Director |

||||||||

| Dennis R. Hernreich |

704,520 | (4) | 1.5 | % | ||||

| Chief Financial Officer, Executive Vice President, |

||||||||

| Chief Operating Officer, Treasurer and Secretary |

||||||||

| Robert S. Molloy |

95,836 | (5) | * | |||||

| Senior Vice President and General Counsel |

||||||||

| Doug Hearn |

13,332 | (6) | * | |||||

| Former Senior Vice President, General Merchandise Manager, |

||||||||

| Casual Male XL and Global Sourcing |

||||||||

| Henry J. Metscher |

38,833 | (7) | * | |||||

| Former Senior Vice President, General Merchandise Manager, |

||||||||

| Direct Businesses and President of Footwear |

||||||||

| Alan S. Bernikow, Director |

92,629 | (8) | * | |||||

| Jesse H. Choper, Director |

166,258 | (9) | * | |||||

| John E. Kyees, Director |

11,677 | (10) | * | |||||

| Ward K. Mooney, Director |

40,273 | (11) | * | |||||

| George T. Porter, Jr., Director |

137,224 | (12) | * | |||||

| Mitchell S. Presser, Director |

74,924 | (11) | * | |||||

| Directors and Executive Officers as a group (22 persons) |

9,229,976 | (13) | 18.0 | % | ||||

| * | Less than 1% |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of our common stock subject to options and warrants held by that person that are currently exercisable, or that become exercisable within 60 days, are |

3

| deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Percentage ownership is based on 48,431,074 shares of our common stock outstanding as of May 15, 2011, plus securities deemed to be outstanding with respect to individual stockholders pursuant to Rule 13d-3(d)(1) under the Exchange Act. |

| (2) | Mr. Holtzman may be deemed to have shared voting and investment power over 5,653,769 shares of common stock, which includes 1,610,000 shares subject to stock options exercisable within 60 days. |

| (3) | Includes 636,324 shares subject to stock options exercisable within 60 days, 204,232 shares of unvested restricted stock and 3,539 shares held pursuant to his 401(k) Plan account. |

| (4) | Includes 250,763 shares subject to stock options exercisable within 60 days, 234,867 shares of unvested restricted stock and 10,614 shares held pursuant to his 401(k) Plan account. |

| (5) | Includes 30,606 shares subject to stock options exercisable within 60 days and 44,897 shares of unvested restricted stock. |

| (6) | Includes 6,667 shares subject to stock options exercisable within 60 days. |

| (7) | Includes 10,000 shares subject to stock options exercisable within 60 days. |

| (8) | Includes 70,000 shares subject to stock options exercisable within 60 days. |

| (9) | Includes 85,000 shares subject to stock options exercisable within 60 days. |

| (10) | Includes 11,667 shares subject to stock options exercisable within 60 days. |

| (11) | Includes 25,000 shares subject to stock options exercisable within 60 days. |

| (12) | Includes 55,000 shares subject to stock options exercisable within 60 days. |

| (13) | Includes 2,921,037 shares subject to stock options exercisable within 60 days, 768,437 of unvested shares of restricted stock and 19,525 shares held pursuant to respective 401(k) Plan accounts. |

4

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors, in accordance with our By-Laws, as amended (the “By-Laws”), has set the number of members of our Board of Directors at nine. At the Annual Meeting, eight nominees are to be elected to serve on the Board until the 2012 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified (leaving one vacancy). All of the nominees currently serve as members of our Board of Directors. Unless a proxy shall specify that it is not to be voted for a nominee, it is intended that the shares represented by each duly executed and returned proxy will be voted in favor of the election as directors of Seymour Holtzman, David A. Levin, Alan S. Bernikow, Jesse Choper, John E. Kyees, Ward K. Mooney, George T. Porter Jr. and Mitchell S. Presser. Although the Board of Directors does not intend to nominate an individual to fill the vacancy at this time, in accordance with our By-Laws, a new director could be named at any time. Although management expects all nominees to accept nomination and to serve if elected, proxies will be voted for a substitute if a nominee is unable or unwilling to accept nomination or election. Cumulative voting is not permitted.

The Board of Directors recommends that you vote “FOR”

the election of the eight individuals named below as directors of our Company.

Set forth below is certain information regarding our directors, including information furnished by them as to their principal occupations and business experience for the past five years, certain directorships held by each director within the past five years, their respective ages as of May 15, 2011 and the year in which each became a director of our Company:

| NAME |

AGE | POSITION |

DIRECTOR SINCE |

|||||||

| Seymour Holtzman |

75 | Chairman of the Board and Director | 2000 | |||||||

| David A. Levin |

60 | President, Chief Executive Officer and Director | 2000 | |||||||

| Alan S. Bernikow |

70 | Director(1),(2) | 2003 | |||||||

| Jesse Choper |

75 | Director(1),(2),(3) | 1999 | |||||||

| John Edward Kyees |

64 | Director(1),(4) | 2010 | |||||||

| Ward K. Mooney |

62 | Director(3) | 2006 | |||||||

| George T. Porter, Jr. |

64 | Director(3),(5) | 1999 | |||||||

| Mitchell S. Presser |

46 | Director(2) | 2007 | |||||||

| (1) | Current member of the Audit Committee. |

| (2) | Current member of the Nominating and Corporate Governance Committee. |

| (3) | Current member of the Compensation Committee. |

| (4) | Mr. Kyees was appointed a director of the Company on May 3, 2010. Mr. Kyees was also appointed a member of the Audit Committee effective May 3, 2010. |

| (5) | Mr. Porter was a member of the Audit Committee until his seat was filled by Mr. Kyees effective May 3, 2010. |

Seymour Holtzman, has been a director since April 7, 2000 and Chairman of the Board since April 11, 2000. On May 25, 2001, the Board of Directors hired Mr. Holtzman as an employee. Mr. Holtzman has been involved in the retail business for over 35 years. For many years, he has been the President and Chief Executive Officer of Jewelcor, Incorporated, a former New York Stock Exchange listed company that operated a chain of retail stores. From 1986 to 1988, Mr. Holtzman was Chairman of the Board and Chief Executive Officer of Gruen Marketing Corporation, an American Stock Exchange listed company involved in the nationwide distribution of watches. For at least the last five years, Mr. Holtzman has served as Chairman and Chief Executive Officer of Jewelcor Management, Inc., a company primarily involved in investment and management services. Mr. Holtzman is owner and Chief Executive Officer of each of C.D. Peacock, Inc., a Chicago, Illinois retail jewelry establishment,

5

and Homeclick, LLC, a privately held internet retailer specializing in luxury brands for the home. Mr. Holtzman was the Chief Executive Officer and Co-Chairman of the Board of George Foreman Enterprises, Inc. (OTCBB: “GFME.PK”), formerly MM Companies, Inc., until his resignation in November 2010. Mr. Holtzman is a successful entrepreneur with extensive experience working with public companies and provides valuable insight to the Board with respect to strategic planning.

David A. Levin has been our President and Chief Executive Officer since April 10, 2000 and a director since April 11, 2000. From 1999 to 2000, he served as the Executive Vice President of eOutlet.com. Mr. Levin was President of Camp Coleman, a division of The Coleman Company, from 1998 to 1999. Prior to that, Mr. Levin was President of Parade of Shoes, a division of J. Baker, Inc., from 1995 to 1997. Mr. Levin was also President of Prestige Fragrance & Cosmetics, a division of Revlon, Inc., from 1991 to 1995. Mr. Levin has worked in the retail industry for over 30 years. Since joining the Company, Mr. Levin has been instrumental in transforming the Company from a company which exclusively operated Levi Strauss & Co. branded apparel to the largest specialty retailer of big & tall men’s apparel. In addition, Mr. Levin brings to the Board valuable experience in merchandising and marketing initiatives.

Alan S. Bernikow has been a director since June 29, 2003. From 1998 until his retirement in May 2003, Mr. Bernikow was the Deputy Chief Executive Officer at Deloitte & Touche LLP where he was responsible for assisting the firm on special projects such as firm mergers and acquisitions, litigation matters and partner affairs. He was a member of Deloitte & Touche’s Executive & Management Committees; Chairman for the Professional Asset Indemnity Limited (“PAIL” Bermuda) Big 4 Insurance Representatives; and President for the PAIL Vermont Insurance Company Big 4 Insurance Representatives. Mr. Bernikow joined Touche Ross, the predecessor firm of Deloitte & Touche LLP, in 1977, prior to which Mr. Bernikow was the National Administrative Partner in Charge for the accounting firm of J.K. Lasser & Company. Mr. Bernikow is a member of the Board of Directors of Revlon, Inc. and Revlon Consumer Products Corporation and serves as Chairman of the Audit Committee of Revlon, Inc.; as well as Chairman of the Revlon, Inc. Compensation and Stock Plan Committee; a member of the Board of Directors of Mack-Cali, as well as the Chairman of the Audit Committee of Mack-Cali; a member of the Board of Premier American Bank, as well a member of the Compensation Committee and Chairman of the Audit Committee of Premier American Bank; and serves as a Director of the Board of the UBS Global Asset Management (US) Inc.—a wholly owned subsidiary of UBS AG, including serving as Chairman of its Audit Committee. Mr. Bernikow has had extensive international experience in his role in Deloitte & Touche’s management/risk management group, as well as worldwide insurance responsibilities. Mr. Bernikow provides the Board with substantial financial expertise and strategic planning as a result of his years of experience at Deloitte & Touche LLP. His strong financial background qualifies him as an “audit committee financial expert”. Mr. Bernikow provides the Board with valuable insight with respect to financial reporting based on his experiences serving on the audit committees of several boards.

Jesse Choper has been a director since October 8, 1999. Mr. Choper is the Earl Warren Professor of Public Law at the University of California at Berkeley School of Law, where he has taught since 1965. From 1960 to 1961, Professor Choper was a law clerk for Supreme Court Chief Justice Earl Warren. Mr. Choper is a member of the California Horseracing Board. Mr. Choper was a member of the Board of Directors of George Foreman Enterprises, Inc. (OTCBB: “GFME.PK”) until his resignation in November 2010. Mr. Choper provides valuable legal expertise to the Board. His specific legal background makes him an authority on ethical behavior and he provides valuable insight with respect to corporate governance. Mr. Choper’s tenure and service as a director for over ten years is also considered a valuable asset to the Board.

John E. Kyees has been a director since May 3, 2010. From 2003 until his retirement in 2010, Mr. Kyees was the Chief Financial Officer of Urban Outfitters, Inc. Mr. Kyees continues to serve as the Chief of Investor Relations for Urban Outfitters. Prior to that, from 2002 to 2003, Mr. Kyees was the Chief Financial Officer and Chief Administrative Officer of bebe Stores, Inc. Mr. Kyees is a member of the Board of Directors of Vera Bradley and serves as Chairman of the Audit Committee and Compensation Committee and is a member of the Nominating and Corporate Governance Committee. Mr. Kyees brings to the Board extensive executive level retail experience

6

having served as Chief Financial Officer for several prominent retailers. His insight with respect to merchandising, operational activities and finance is an asset to our Board. Institutional Investor magazine selected Mr. Kyees as a top specialty retail chief financial officer on five separate occasions, evidencing his strong skills in corporate finance, strategic and accounting matters.

Ward K. Mooney has been a director since July 31, 2006. In 2005, Mr. Mooney was a founding partner of Crystal Financial LLC and since March 2010 has been the Chief Executive Officer. Prior to that, Mr. Mooney was the President of Bank of America Retail Finance Group and Chief Operating Officer of Back Bay Capital, both of which were formerly Bank of Boston businesses which Mr. Mooney founded. Mr. Mooney provides the Board with valuable insight with respect to his extensive experience as a lender in the apparel industry.

George T. Porter, Jr. has been a director since October 28, 1999. Mr. Porter was President of Levi’s USA for Levi Strauss & Co. from 1994 to 1997. Beginning in 1974, Mr. Porter held various positions at Levi Strauss & Co., including President of Levi’s Men’s Jeans Division. Mr. Porter was also Corporate Vice President and General Manager of Nike USA from 1997 to 1998. Mr. Porter provides the Board with extensive merchandising experience having worked at two highly prominent companies. Mr. Porter’s tenure and service as a director for over ten years is also considered a valuable asset to the Board.

Mitchell S. Presser has been a director since May 1, 2007. Since November 2006, Mr. Presser has been a founding partner of Paine & Partners, LLC, a private equity firm. Prior to that, Mr. Presser was a law partner with Wachtell, Lipton, Rosen & Katz, specializing in mergers & acquisitions. Mr. Presser serves as a director on the boards of three privately-held companies. Mr. Presser’s extensive experience in private equity and strategic planning provides valuable insight to the Board.

All directors hold office until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified or until their earlier death, resignation or removal.

Non-Director Executive Officers

Dennis R. Hernreich, 54, has been our Executive Vice President, Chief Operating Officer, Chief Financial Officer, Treasurer and Secretary since September 2002. Prior to that, Mr. Hernreich served as our Senior Vice President, Chief Financial Officer and Treasurer upon joining us on September 5, 2000. Prior to joining our Company, from 1996 through 1999, Mr. Hernreich held the position of Senior Vice President and Chief Financial Officer of Loehmann’s, a national retailer of women’s apparel. From 1999 to August 2000, Mr. Hernreich was Senior Vice President and Chief Financial Officer of Pennsylvania Fashions, Inc., a 275-store retail outlet chain operating under the name Rue 21.

Francis Chane, 48, has been our Senior Vice President of Distribution & Logistics since June 2011. Prior to that, Mr. Chane was our Vice President of Distribution & Logistics since joining the Company in June 2008. Prior to joining our Company, Mr. Chane was Vice President Operations & Facilities for Redcats USA, a division of the French multi-national company PPR, from 1999 to April 2008.

Angela Chew, 44, has been our Vice President of Global Sourcing since May 2010. From October 2009 through May 2010, Ms. Chew was our Senior Director of Global Sourcing. Prior to that, Ms. Chew was our Director of Global Sourcing from February 2009 to October 2009. Prior to joining our Company, from October 2007 to December 2008 Ms. Chew was the Senior Product Merchant for Redcats USA. From 2007 to 2009, Ms. Chew was an Independent Retail Consultant and Analyst with the Gerson Lehrman Group and, from August 2006 to December 2006, the Executive Vice President of Global Sourcing for Rocawear.

Richard Della Bernarda, 49, has been our Senior Vice President and Chief Marketing Officer since June 2007. Mr. Della Bernarda began his career with Casual Male Corp. in 1992 and joined our Company in May 2002 as part of our acquisition of Casual Male Corp. as our Senior Vice President of Marketing.

7

Kenneth M. Ederle, 46, has been our Senior Vice President—General Merchandise Manager DXL since May 2011. Prior to that, Mr. Ederle was our Vice President, General Merchandise Manager of Rochester Clothing from August 2008 until May 2011. From January 2008 to August 2008, Mr. Ederle was our Merchandise Manager of Sportswear for Rochester Clothing and prior to that was one of our Merchandise Managers for Casual Male from November 2006 to December 2007. Prior to joining the Company in 2006, Mr. Ederle was a Senior Buyer and Senior Planner for Limited Brands.

Jack R. McKinney, 55, has been our Senior Vice President and Chief Information Officer since June 2002. Mr. McKinney began his career with Casual Male Corp. in 1997 and joined our Company in May 2002 as part of our acquisition of Casual Male Corp.

Robert S. Molloy, 51, has been our Senior Vice President and General Counsel since April 2010. Prior to that, Mr. Molloy was the Vice President and General Counsel since joining the Company in February 2008. Prior to joining the Company, Mr. Molloy served as Vice President, Assistant General Counsel at Staples, Inc. from May 1999 to February 2008. Prior to May 1999, Mr. Molloy served as a trial attorney.

Francie Nguyen, 46, joined our Company in May 2011 as Senior Vice President—CMRG Direct Business. Prior to that, Ms. Nguyen was the General Manager, President of Women’s, Men’s and Kids Apparel, Footwear and Home at Hanover Direct from May 2008 until May 2011. From October 2005 to May 2008, Ms. Nguyen was the Vice President of Merchandising, Women’s Fashion and Home at Spiegel.

Brian Reaves, 50, joined our Company in May 2010 as our Senior Vice President of Store Sales and Operations. Prior to joining our Company, Mr. Reaves was the Vice President—Outreach and Group Sales for David’s Bridal from 2007 to 2009. Before that, Mr. Reaves was the Senior Vice President of Sales for The Bridal Group from 2004 to 2007.

Peter E. Schmitz, 52, joined the Company in August 2007 as our Senior Vice President, Real Estate and Store Development. Prior to that, Mr. Schmitz was the Vice President of Real Estate for Brooks/Eckerd Pharmacy Chain since 1995.

Vickie S. Smith, 54, joined the Company in February 2008 as our Senior Vice President, Planning and Allocation. Prior to that, Ms. Smith worked at Urban Brands as Senior Vice President, Planning, Allocation and Marketing from May 2006 to November 2007. From May 2001 to December 2005, Ms. Smith was the Vice President, Corporate Planning and Allocation at JC Penney.

Peter H. Stratton, Jr., 39, has been our Senior Vice President of Finance, Corporate Controller and Chief Accounting Officer since August 2009. Mr. Stratton joined us in June 2009 as Vice President of Finance. From May 2007 to June 2009, he served as Senior Director of Corporate Accounting at BearingPoint, Inc. Prior to May 2007, Mr. Stratton held various finance and accounting leadership positions at Legal Sea Foods, Inc., Shaw’s Supermarkets, Inc. and Cintas Corporation.

Walter E. Sprague, 62, has been our Senior Vice President of Human Resources since May 2006. From August 2003 through April 2006, Mr. Sprague was our Vice President of Human Resources. Prior to joining our Company, Mr. Sprague was the Managing Director Northeast, for Marc-Allen Associates, a nationwide executive recruiting firm. From 1996 to 2002, Mr. Sprague was the Assistant Vice President—Senior Director of Human Resources for Foot Locker Inc. and prior to that, the Assistant Vice President—Senior Director of Human Resources for Woolworth Corporation, the predecessor company to Foot Locker Inc.

John R. Wagner, 56, has been our Vice President, Merchandise Manager for Tailored Clothing and Furnishings since November 2010. In April 2011, Mr. Wagner assumed the oversight responsibilities for Shoes XL and Accessories for Rochester Clothing and Casual Male XL. Prior to joining our company, Mr. Wagner was President of Innovative Sourcing Group, a New York based product development and sourcing firm specializing

8

in men’s apparel. From 2001 to 2007, Mr. Wagner held the positions of Vice President of Manufacturing and Product Development and Vice President of Tailored Clothing for S&K Famous Brands, a men’s specialty retail chain based in Richmond, Virginia.

There are no family relationships between any of our directors and executive officers.

CORPORATE GOVERNANCE

Board of Directors

Our Board of Directors is currently comprised of eight members (there is currently one vacancy which will not be filled at the Annual Meeting). A majority of the members of the Board are “independent” under the rules of the Nasdaq Global Select Market (“Nasdaq”). The Board has determined that the following directors are independent: Messrs. Bernikow, Choper, Kyees, Mooney, Porter and Presser.

Our Board of Directors met six times during our fiscal year ended January 29, 2011 (“fiscal 2010”). Each of the directors attended at least 75 percent of the aggregate of the total meetings of the Board and the total meetings of the committees of the Board on which each director served.

We believe that it is important for and we encourage the members of our Board of Directors to attend Annual Meetings of Stockholders. Last year, all members of the Board of Directors attended the Annual Meeting of Stockholders held on August 5, 2010.

Corporate Governance Highlights

We comply with the corporate governance requirements imposed by the Sarbanes-Oxley Act of 2002, the SEC and Nasdaq. To assist the Board in fulfilling its responsibilities, it has adopted certain Corporate Governance Guidelines (the “Governance Guidelines”). Many features of our corporate governance principles are discussed in other sections of this proxy statement, but some of the highlights are:

| • | Published Governance Guidelines. A copy of the Governance Guidelines can be found under “Corporate Governance” on the Investor Relations page of our website at www.casualmaleXL.com. |

| • | Annual Election of Directors. Our directors are elected annually for a term of office to expire at the next Annual Meeting (subject to the election and qualification of their successors). |

| • | Independent Board. The vast majority of our Board is comprised of independent directors, with the exception only of our Chairman of the Board and our Chief Executive Officer. |

| • | Independent Board Committees. All members of our Audit, Compensation, and Nominating and Corporate Governance Committees are independent directors, and none of such members receives compensation from us other than for service on our Board of Directors or its committees. |

| • | Independent Executive Sessions. As contemplated by the Governance Guidelines, the Board of Directors is required to have at least semiannual executive sessions where independent directors meet without the Chairman (who does not qualify as “independent” under Nasdaq rules) and management. For fiscal 2010, the Board of Directors held two independent executive sessions. In addition, periodically throughout the year, the full Board of Directors, including the Chairman, may meet without management participation. |

| • | Committee Authority to Retain Independent Advisors. Each of the Audit, Compensation and Nominating and Corporate Governance Committees has the authority to retain independent advisors, with all fees and expenses to be paid by the Company. |

9

| • | Audit Committee Policies and Procedures. Under its charter, the Audit Committee’s prior approval is required for all audit services and permitted non-audit services (other than de minimis permitted non-audit services as defined and permitted by the Sarbanes-Oxley Act of 2002) to be provided by our independent registered public accounting firm. |

| • | Audit Committee Financial Expert. Our Board has determined that Mr. Bernikow is an “audit committee financial expert” under the rules of the SEC and is independent as defined by Nasdaq listing standards. |

| • | Stock Ownership Guidelines. While we do not have any specific guidelines for stock ownership, we do encourage our directors and members of senior management to invest in the Company. Through our Non-Employee Director Compensation Plan, which is described below under “Director Compensation,” each director may elect to receive any or all of his compensation in shares of our common stock or in options to purchase shares of our common stock. With respect to our senior management team, the Compensation Committee requires that each participant in our long-term incentive plan irrevocably elect to receive at least 50% of any award earned in the form of equity. A participant may choose shares of restricted stock or stock options, or any combination thereof. |

| • | Repricings Prohibited. Our 2006 Incentive Compensation Plan, as amended, prohibits the repricing of stock options or stock appreciation rights, or any action that may be treated as a repricing, without shareholder approval. |

| • | No Stockholder Rights Plan. We do not currently have a stockholder rights plan in effect and are not considering adopting one. |

| • | Clawback Policy. Our employment agreements with our members of senior management contain a clawback provision which provides for remedies in the event we learn after the senior executive is terminated by us other than for “justifiable cause” that the senior executive could have been terminated for “justifiable cause.” Although the final rules have not yet been promulgated, the Dodd-Frank Act will also require that we implement a policy providing for the recovery of erroneously paid incentive-based compensation following a required accounting restatement. Once the final rules are issued by the SEC, we will revise, in a timely manner, the clawback provision of our employment agreements. |

Committees of the Board

Our Board of Directors has three standing committees: the Nominating and Corporate Governance Committee, the Audit Committee and the Compensation Committee. The Nominating and Corporate Governance Committee, the Audit Committee and the Compensation Committee are each comprised of directors who are “independent” under the rules of Nasdaq.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has a written charter, which can be found under “Corporate Governance” on the Investor Relations page of our website at www.casualmaleXL.com. The Corporate Governance Guidelines are also posted on the Investor Relations page of our website. The Committee was established to perform functions related to governance of our Company, including, but not limited to, planning for the succession of our CEO and such other officers as the Committee shall determine from time to time, recommending to the Board of Directors individuals to stand for election as directors, overseeing and recommending the selection and composition of committees of the Board of Directors, and developing and recommending to the Board of Directors a set of corporate governance principles applicable to our Company. The present members of the Nominating and Corporate Governance Committee are Messrs. Choper, Bernikow and Presser, each of whom is “independent” under the rules of Nasdaq. Although Mr. Holtzman is not a member of the Nominating and Corporate Governance Committee and is not entitled to vote or receive compensation for his participation, he routinely attends all meetings of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee met ten times during fiscal 2010.

The Board’s current policy with regard to the consideration of director candidates recommended by stockholders is that the Nominating and Corporate Governance Committee will review and consider any director candidates

10

who have been recommended by stockholders in compliance with the procedures established from time to time by the Committee (the current procedures are described below), and conduct inquiries it deems appropriate. The Nominating and Corporate Governance Committee will consider for nomination any such proposed director candidate who is deemed qualified by the Nominating and Corporate Governance Committee in light of the minimum qualifications and other criteria for Board membership approved by the Committee from time to time.

While the Nominating and Corporate Governance Committee does not have a formal diversity policy for Board membership and identifies qualified candidates without regard to race, color, disability, gender, national origin, religion or creed, it does seek to ensure the fair representation of all stockholder interests on the Board. In that regard, in considering candidates for the Board, the Nominating and Corporate Governance Committee considers, among other factors, diversity with respect to viewpoint, skills and experience. The Board believes that the use of these general criteria, along with the minimum qualifications listed below, will result in nominees who represent a mix of backgrounds and experiences that will enhance the quality of the Board.

At a minimum, the Nominating and Corporate Governance Committee must be satisfied that each nominee, both those recommended by the Committee and those recommended by stockholders, meets the following minimum qualifications:

| • | The nominee should have a reputation for integrity, honesty and adherence to high ethical standards. |

| • | The nominee should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to our current and long-term objectives and should be willing and able to contribute positively to our decision-making process. |

| • | The nominee should have a commitment to understand our Company and our industry and to regularly attend and participate in meetings of the Board and its committees. |

| • | The nominee should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of ours, which includes stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all of our stakeholders. |

| • | The nominee should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all of our stockholders and to fulfill the responsibilities of a director. |

The current procedures to be followed by stockholders in submitting recommendations for director candidates are as follows:

1. All stockholder recommendations for director candidates must be submitted to the Secretary at our corporate offices located at 555 Turnpike Street, Canton, Massachusetts, 02021 who will forward all recommendations to the Nominating and Corporate Governance Committee.

2. All stockholder recommendations for director candidates must be submitted to us not less than 120 calendar days prior to the date on which our proxy statement was released to stockholders in connection with our previous year’s annual meeting.

3. All stockholder recommendations for director candidates must include the following information:

a. The name and address of record of the stockholder.

b. A representation that the stockholder is a record holder of our securities, or if the stockholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Exchange Act.

c. The name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five (5) full fiscal years of the proposed director candidate.

d. A description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership approved by the Board from time to time.

11

e. A description of all arrangements or understandings between the stockholder and the proposed director candidate.

f. The consent of the proposed director candidate (i) to be named in the proxy statement relating to our annual meeting of stockholders and (ii) to serve as a director if elected at such annual meeting.

g. Any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the SEC.

Except where we are legally required by contract or otherwise to provide third parties with the ability to nominate directors, the Nominating and Corporate Governance Committee is responsible for identifying and evaluating individuals, including nominees recommended by stockholders, believed to be qualified to become Board members and recommending to the Board the persons to be nominated by the Board for election as directors at any annual or special meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board. The Committee may solicit recommendations from any or all of the following sources: non-management directors, the CEO, other executive officers, third-party search firms or any other source it deems appropriate. The Committee will review and evaluate the qualifications of any such proposed director candidate, and conduct inquiries it deems appropriate. The Committee will evaluate all such proposed director candidates in the same manner, with no regard to the source of the initial recommendation of such proposed director candidate. Accordingly, there are no differences in the manner in which the Nominating and Corporate Governance evaluates director nominees recommended by stockholders. In identifying and evaluating candidates for membership on the Board of Directors, the Committee will take into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity, and the extent to which the candidate would fill a present need on the Board of Directors.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee is currently comprised of Messrs. Choper, Bernikow and Kyees. Mr. Kyees replaced Mr. Porter as a member of the Audit Committee on May 3, 2010. Each of the members of the Audit Committee is independent, as independence for Audit Committee members is defined under the rules of Nasdaq. In addition, the Board of Directors has determined that Mr. Bernikow is an “audit committee financial expert” under the rules of the SEC. No other directors attend audit committee meetings.

The Audit Committee operates under a written charter, which can be found under “Corporate Governance” on the Investor Relations page of our website at www.casualmaleXL.com.

The purpose of the Audit Committee is to (i) assist the Board of Directors in fulfilling its oversight responsibilities to the shareholders, potential shareholders and the investment community; (ii) oversee the audits of our financial statements and our relationship with our independent registered public accounting firm; (iii) promote and further the integrity of our financial statements and oversee the qualifications, independence and performance of our independent registered public accounting firm (including being solely responsible for appointing, determining the scope of, evaluating and, when necessary, terminating the relationship with the independent registered public accounting firm); and (iv) provide the Board of Directors and the independent registered public accounting firm, unfiltered access to each other on a regular basis. The Audit Committee meets at least quarterly and as often as it deems necessary in order to perform its responsibilities. During fiscal 2010, the Audit Committee met six times.

For additional information regarding the Audit Committee, see the “Report of the Audit Committee” included elsewhere in this Proxy Statement.

12

Compensation Committee

The primary purpose of the Compensation Committee is to discharge the Board’s responsibilities relating to executive compensation. The Compensation Committee also reviews and makes recommendations to the full Board, or independently approves, regarding all stock-based compensation awards to our executive officers under our equity incentive plans. The Compensation Committee met eleven times during fiscal 2010. The present members of the Compensation Committee are Messrs. Choper, Mooney and Porter, each of whom is “independent” under the rules of the Nasdaq. Although Mr. Holtzman is not a member of the Compensation Committee and is not entitled to vote or receive compensation for his participation, he routinely attends all meetings of the Compensation Committee, except those portions of meetings during which the Compensation Committee discusses the consulting agreement between the Company and Jewelcor Management, Inc. (“JMI”).

The Compensation Committee operates under a written charter, which can be found under “Corporate Governance” on the Investor Relations page of our website at www.casualmaleXL.com.

The Compensation Discussion and Analysis recommended by the Compensation Committee to be included in the Proxy Statement begins on page 17 of this Proxy Statement. Among other things, the Compensation Discussion and Analysis describes in greater detail the Compensation Committee’s role in the executive compensation process.

Board Leadership Structure

We currently separate the positions of Chief Executive Officer and Chairman of the Board of Directors. Since 2002, Mr. Holtzman has served as our Chairman. The responsibilities of the Chairman of the Board of Directors include setting the agenda for each meeting of the Board of Directors, in consultation with management; attending board of director sessions of the non-management directors; and facilitating communication with the Board of Directors, executive officers and stockholders.

Separating the positions of Chief Executive Officer and Chairman of the Board of Directors allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board of Directors to lead the Board of Directors in its fundamental role of providing independent advice to and oversight of management. Although Mr. Holtzman is not an independent director, the Board of Directors believes that having Mr. Holtzman serve as Chairman of the Board of Directors is the appropriate leadership structure for the Company, given his wealth of retail experience, his extensive knowledge of the Company and his history of innovative and strategic thinking.

In addition, as described above, our Board of Directors has three standing committees, each chairman and each member of which is an independent director. Our Board of Directors delegates substantial responsibility to each committee of the Board of Directors, which reports their activities and actions back to the full Board of Directors. We believe that the independent committees of our Board of Directors and their chairpersons are an important aspect of the leadership structure of our Board of Directors.

Risk Oversight

Our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. With the oversight of our full Board of Directors, our executive officers are responsible for the day-to-day management of the material risks we face. In its oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by our executive officers are adequate and functioning as designed. The involvement of the full Board of Directors in setting our business strategy is a key part of its oversight of risk management and in determining what constitutes an appropriate level of risk for us. The full Board of Directors receives updates from our executive officers and outside advisors regarding certain risks our Company faces, including various operating risks and corporate governance best practices.

13

In fiscal 2009, our Board of Directors engaged Ernst & Young LLP to assist our senior management team in completing a risk assessment. With Ernst & Young LLP as the facilitator, our senior management team identified, assessed and prioritized various risks throughout the Company. Management has identified compensating controls or recommendations for minimizing risk and meets periodically to review such controls and identify new potential risks. In the first quarter of fiscal 2011, Ernst & Young LLP met with senior management to re-assess and examine those risks and to review the current controls. The results of the risk reassessment were presented to the full Board of Directors.

In addition, our Board committees each oversee certain aspects of risk management. For example, our Audit Committee is responsible for overseeing the management of risks associated with the Company’s financial reporting, accounting and auditing matters; our Compensation Committee oversees risks associated with our compensation policies and programs; and our Nominating and Corporate Governance Committee oversees the management of risks associated with director independence, conflicts of interest, composition and organization of our Board of Directors, and director succession planning. Our Board committees report their findings to the full Board of Directors.

Our Chief Executive Officer and Chief Financial Officer attend all meetings of the Board of Directors, except executive sessions, and are available to address any questions or concerns raised by the Board of Directors on risk management-related and any other matters.

Director Compensation

The Compensation Committee is responsible for reviewing and making recommendations to our Board of Directors with respect to the compensation paid to our non-employee directors.

In January 2010, the Company established a Non-Employee Director Stock Purchase Plan to provide a convenient method for its non-employee directors to acquire shares of the Company’s common stock at fair market value by voluntarily electing to receive shares of common stock in lieu of cash for service as a director. The substance of this plan is now encompassed within the Casual Male Retail Group, Inc. Amended and Restated Non-Employee Director Compensation Plan (the “Non-Employee Director Compensation Plan”). As of January 29, 2011, there were 500,000 shares available for issuance under this plan for the sole purpose of satisfying elections to receive shares of common stock in lieu of cash for service as a director. The Non-Employee Director Compensation Plan is a stand-alone plan and is not a sub-plan under our 2006 Incentive Compensation Plan, as amended (the “2006 Plan”). Accordingly, shares issued under this plan do not reduce the shares available for issuance under the 2006 Plan.

In fiscal 2008, the Compensation Committee retained Sibson Consulting to review the compensation of directors at our peer companies. The following peer companies were used for this review:

| • Bebe |

• Citi Trends | |

| • The Buckle |

• Mothers Work | |

| • Cache |

• Hibbett | |

| • Cato Group |

• Hot Topic | |

| • Charlotte Russe |

• JoS A. Bank | |

| • Christopher Banks |

• The Wet Seal | |

The Compensation Committee has the authority to retain compensation consultants and other outside advisors, without Board or management approval, to assist it in carrying out its duties, including the evaluation of compensation for our non-employee directors. The Compensation Committee may accept, reject or modify any

14

recommendations by compensation consultants or other outside advisors. The purpose of the original study conducted by Sibson Consulting in fiscal 2008 was to assist the Compensation Committee in its goal of maintaining an appropriate level of compensation for our non-employee directors.

With respect to the compensation of our non-employee directors, the Compensation Committee’s goal is to maintain a level of compensation paid to our non-employee directors that is in the median of the companies within our peer group as well as similarly-sized companies. Pursuant to the Non-Employee Director Compensation Plan, non-employee directors receive an annual retainer of $20,000 which is paid in quarterly installments of $5,000. Each director receives $1,500 for participation in each meeting of the Board and its committees and $750 for participation in each telephonic meeting. In addition, the Chairmen of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee receive an annual payment of $10,000, $5,000 and $5,000, respectively, which is paid quarterly. Upon each non-employee director’s re-election to the Board, each director will receive $82,250. Upon the initial election to the Board, a non-employee director will receive a stock option grant of 15,000 shares under the 2006 Plan. We believe that our Non-Employee Director Compensation Plan will support our ongoing efforts to attract and retain exceptional directors to provide strategic guidance to our Company. We believe that the total compensation that our non-employee directors receive is in line with our peer group.

Director Compensation Table

The following table sets forth the compensation paid to our Chairman and non-employee directors during fiscal 2010. David A. Levin is not included in the following table as he was a Named Executives Officer and, accordingly, received no compensation for his services as a director. The compensation received by Mr. Levin as an employee of our Company is shown below in the “Summary Compensation Table.”

2010 DIRECTOR COMPENSATION TABLE

| Name |

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Seymour Holtzman, Chairman(3) |

$ | — | — | — | — | — | $ | 575,000 | (3) | $ | 575,000 | |||||||||||||||||

| Alan S. Bernikow |

$ | 124,750 | — | — | — | — | — | $ | 124,750 | |||||||||||||||||||

| Jesse Choper |

$ | 150,250 | — | — | — | — | $ | 32,813 | (4) | $ | 183,063 | |||||||||||||||||

| John E. Kyees(5) |

$ | 105,500 | — | 63,600 | — | — | — | $ | 169,100 | |||||||||||||||||||

| Ward K. Mooney |

$ | 120,250 | — | — | — | — | — | $ | 120,250 | |||||||||||||||||||

| George T. Porter, Jr. |

$ | 127,500 | — | — | — | — | — | $ | 127,500 | |||||||||||||||||||

| Mitchell S. Presser |

$ | 118,750 | — | — | — | — | — | $ | 118,750 | |||||||||||||||||||

| (1) | All non-employee directors, with the exception of Mr. Presser, elected to receive all fees paid during fiscal 2010 in cash. Mr. Presser elected to receive all fees paid during fiscal 2010 in unrestricted shares of our common stock. The number of shares issued as payment for an earned director fee is determined by taking the director fee earned and dividing by the closing price of our common stock on the grant date. For quarterly retainer fees, the grant date is the first business day of each respective quarter. For meetings, the grant date is the last business day of the month in which the meeting occurred and for a director’s re-election to the board, the grant date is the last business day of the month in which such re-election occurs. In addition to compensation received for board meetings and committee meetings, Mr. Choper also received a cash payment of $15,000 for serving as Chairman of both the Audit Committee and the Nominating and Corporate Governance Committee. Mr. Porter also received a cash payment of $5,000 for serving as Chairman of the Compensation Committee. Mr. Holtzman did not receive any payment for director meetings. |

15

| (2) | Mr. Kyees was appointed a director of the Company on May 3, 2010 and, accordingly, received a stock option grant of 15,000 shares. The amount in the Option Awards column reflects the aggregate grant date fair value of this stock option award computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The fair value of this stock option award is estimated as of the date of grant using a Black-Scholes valuation model. Additional information regarding the assumptions used to estimate the fair value of all stock option awards is included in Note A to Consolidated Financial Statements contained in our Annual Report on Form 10-K for the fiscal year ended January 29, 2011. There were no additional Stock Awards or Options Awards to any of the directors for fiscal 2010. Each director has the following number of stock options outstanding at January 29, 2011: Mr. Holtzman: 1,660,000; Mr. Bernikow: 70,000; Mr. Choper: 85,000; Mr. Kyees: 15,000; Mr. Mooney: 25,000; Mr. Porter: 55,000; and Mr. Presser: 25,000. |

| (3) | During fiscal 2010, Mr. Holtzman received compensation from us both directly (as an employee of our Company) and indirectly (as a consultant pursuant to a consulting agreement we have with JMI). Mr. Holtzman is the president and chief executive officer and, together with his wife, indirectly, the majority shareholder of JMI. There were no services performed on behalf of the Company by JMI, other than those performed by Mr. Holtzman. See below for our discussion of the compensation paid to Mr. Holtzman under “Chairman Compensation.” All Other Compensation for Mr. Holtzman includes annual compensation paid to Mr. Holtzman of $551,000 pursuant to a consulting agreement with the Company and salary of $24,000. |

| (4) | In August 2010, Mr. Choper was granted a cash award of $32,813 due to an oversight with respect to exercising his options and for his years of dedicated service to the Board in his capacity as a member of the Board. |

| (5) | Mr. Kyees was appointed a director of our Company on May 3, 2010. |

Chairman Compensation

Pursuant to an employment agreement as well as a consulting agreement with JMI, which was most recently amended in April 2011, Mr. Holtzman receives, in aggregate, annual employment and consulting compensation of $575,000, payable in cash. Mr. Holtzman is the president and chief executive officer and, together with his wife, indirectly, the majority shareholder of JMI. If we engage Mr. Holtzman’s services to assist us in a specific and significant corporate transaction or event, the Compensation Committee, at its discretion, has the right to grant Mr. Holtzman a bonus for his additional services. No such bonus was granted during fiscal 2010. As Chairman of the Board of Directors, in his ex officio capacity pursuant to the Company’s by-laws, Mr. Holtzman regularly attends meetings of the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Holtzman does not receive compensation for attending these meetings.

Compensation Committee Interlocks and Insider Participation

For fiscal 2010, the members of the Compensation Committee were Messrs. Choper, Mooney and Porter. Persons serving on the Compensation Committee had no relationships with our Company in fiscal 2010 other than their relationship to us as directors entitled to the receipt of standard compensation as directors and members of certain committees of the Board and their relationship to us as beneficial owners of shares of our common stock and options exercisable for shares of common stock. No person serving on the Compensation Committee or on the Board of Directors is an executive officer of another entity for which an executive officer of ours serves on such entity’s board of directors or compensation committee.

Code of Ethics

We have adopted a Code of Ethics which applies to our directors, Chief Executive Officer and Chief Financial Officer, as well as our other senior officers. The full text of the Code of Ethics can be found under “Corporate Governance” on the Investor Relations page of the our corporate web site, which is at www.casualmaleXL.com.

16

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis discusses the compensation paid to our key executives which includes our Chief Executive Officer and our Chief Financial Officer (“Key Executives”) as well as our other executive officers (the “Senior Executives”). For the purposes of this Proxy Statement, the Key Executives and our next three most highly-compensated Senior Executives for fiscal 2010 are collectively referred to herein as our “Named Executive Officers.”

The Named Executive Officers for fiscal 2010 are: David A. Levin, President and Chief Executive Officer, Dennis R. Hernreich, Executive Vice President, Chief Financial Officer, Chief Operating Officer, Treasurer and Secretary, Robert S. Molloy, Senior Vice President and General Counsel, Douglas Hearn, Former Senior Vice President, General Merchandise Manager of Casual Male XL and Global Sourcing, and Henry J. Metscher, Former Senior Vice President, General Merchandise Manager, Direct Businesses and President of Footwear. Messrs. Hearn and Metscher were Senior Executives while employed with us prior to their departures on April 25, 2011 and May 14, 2011, respectively.

Our Key Executives are Messrs. Levin and Hernreich. Our Senior Executives are listed above under “Proposal 1. Election of Directors—Non-Director Executive Officers,” with the exception of Dennis R. Hernreich who is a Key Executive.

The Compensation Committee of our Board of Directors determines the compensation for our Named Executive Officers. The responsibility of our Compensation Committee is to establish, implement and continually monitor adherence to our compensation philosophy, as well as ensure that the total compensation is fair, reasonable, competitive and consistent with the interests of the Company’s stockholders.

Executive Summary

We believe that our executive compensation policies and practices appropriately balance the interests of our executives with those of our stockholders. Performance is a key component of our philosophy for executive compensation. Accordingly, our executive’s compensation, specifically our compensation for our Key Executives, is heavily weighted toward “at risk” performance-based compensation. Our executives’ compensation for 2010 consisted of base salary (“guaranteed compensation”) and performance-based compensation (“at-risk compensation”). The performance-based compensation consisted of: (i) an annual cash incentive based on achievement of a specified performance goal for fiscal 2010 and (ii) a long-term incentive which is also based on achievement of specified performance goals for fiscal 2010, but which vests ratably over a three-year period starting on the first anniversary of the date of grant. See “Components of Executive Compensation” below for a full description of these two incentive plans.

During fiscal 2010, with the exception of the reinstatement of a 5% salary reduction that all of senior management took in fiscal 2009, base salary for our Key Executives and Senior Executives remained flat for fiscal 2010. Accordingly, the only opportunity for our Key Executives and Senior Executives to achieve compensation above 2009 levels was to exceed the performance targets established for our annual and long-term incentive plans to the same degree as in fiscal 2009.

17

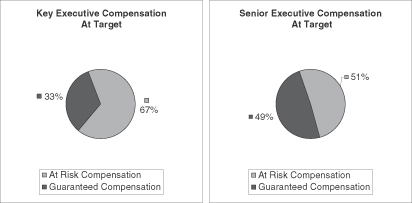

The following charts show the breakdown of compensation for our Key Executives and Senior Executives, assuming performance under our annual and long-term incentive plans were achieved at “target” levels.

Summary of Fiscal 2010 Performance Compared to Fiscal 2009

We exceeded our original expectations for earnings in fiscal 2010, despite the slow economic recovery. With an essentially flat sales base in fiscal 2010, we were able to double our operating income from $8.0 million in fiscal 2009 to $16.2 million for fiscal 2010, resulting in diluted earnings per share of $0.32 per share as compared to $0.14 per share in fiscal 2009.

| % Change |

For the fiscal year ending: | |||||||||||

| January 29, 2011 (Fiscal 2010) |

January 30, 2010 (Fiscal 2009) |

|||||||||||

| (in millions except per share and percentages) | ||||||||||||

| Sales |

(0.3 | )% | $ | 393.6 | $ | 395.2 | ||||||

| Operating Income |

102.5 | % | $ | 16.2 | $ | 8.0 | ||||||

| Operating Margin Percentage |

105.0 | % | 4.1 | % | 2.0 | % | ||||||

| Net income |

152.5 | % | $ | 15.4 | $ | 6.1 | ||||||

| Adjusted EBITDA, a non-GAAP measure(1) |

25.5 | % | $ | 29.5 | $ | 23.5 | ||||||

| Earnings per share—diluted |

128.6 | % | $ | 0.32 | $ | 0.14 | ||||||

| (1) | EBITDA, which is defined as income from continuing operations before interest, taxes, depreciation and amortization, is adjusted each period to exclude other income (which represents the deferred gain related to the sale of our loss prevention subsidiary in fiscal 2006) (“Adjusted EBITDA”). EBITDA and Adjusted EBITDA are non-GAAP measures and should not be considered superior to or as a substitute for net income derived in accordance with GAAP. We use Adjusted EBITDA because: (i) it measures performance over the periods in which executives can have significant impact, (ii) is directly linked to our long-term growth plan, and (iii) is a key metric used by management and the board to assess our operating performance. Adjusted EBITDA for fiscal 2010 is calculated as net income of $15.4 million, plus interest of $0.7 million, taxes of $0.7 million and depreciation and amortization of $13.2 million minus other income (related to the deferred gain) of $0.5 million. Adjusted EBITDA for fiscal 2009 is calculated as net income of $6.1 million, plus interest of $1.0 million, taxes of $1.5 million and depreciation and amortization of $15.5 million minus other income (related to the deferred gain) of $0.6 million. |

18

Summary of Total Compensation Earned for Fiscal 2010 Compared to Fiscal 2009

The compensation earned by the Key Executives and Senior Executives recognized these financial achievements. However, on a comparative basis, the compensation earned by our Named Executive Officers for fiscal 2010 was slightly less than compensation earned for fiscal 2009. Because of the economic recession in fiscal 2009, the financial targets for fiscal 2009 did not include any sales growth and, instead, focused on strengthening gross margins and liquidity and reducing overhead. We exceeded these goals for fiscal 2009 by improving our gross margins through strong inventory control and negotiated rent reductions and by reducing our selling, general and administrative expenses by $30.0 million on an annualized basis. As a result, incentive payouts for fiscal 2009 under our annual and long-term incentive plans exceeded target levels. For fiscal 2010, the performance targets, which represented an increase of approximately 20% over fiscal 2009 actual results, were based on an expectation that retail sales would start to rebound. However, sales throughout the retail industry were much slower to recover than planned, resulting in an essentially flat sales base for us in fiscal 2010. Despite the sales shortfall against expectations, we were able to further improve our merchandise margins and control expenses. In addition, through improved sales productivity, we were able to improve our conversion rates in our stores (the number of people who visit a store and make a purchase) and average dollars per transaction metrics. These improvements helped us to offset the continued weak traffic flow. The combination of these achievements in fiscal 2010 enabled us to exceed slightly the performance targets established for fiscal 2010, but were insufficient to reach the level achieved in fiscal 2009. See the “Summary Compensation Table” on page 30 for a detail breakdown of compensation for each Named Executive Officer. Based on our results for fiscal 2010, we achieved our performance targets for our annual and long-term incentive plans for fiscal 2010.

The following table summarizes total compensation earned by each Named Executive Officer for fiscal 2010 as compared to fiscal 2009.

| Named Executive Officer |

% Change 2010 vs. 2009 |

January 29, 2011 (Fiscal 2010)(1) |

January 30, 2010 (Fiscal 2009)(1) |

|||||||||

| David A. Levin, President and Chief Operating Officer |

(1.2 | )% | $ | 2,922,629 | $ | 2,959,541 | ||||||

| Dennis R. Hernreich Executive Vice President, Chief Financial Officer, Chief Operating Officer, Treasurer and Secretary |

(13.5 | )% | $ | 1,969,221 | $ | 2,275,693 | ||||||

| Robert S. Molloy Senior Vice President and General Counsel |

(11.8 | )% | $ | 697,952 | $ | 791,122 | ||||||

| Douglas Hearn Former Senior Vice President, General Merchandise Manager, Casual Male XL and Global Sourcing(2) |

(9.1 | )% | $ | 592,795 | $ | 652,445 | ||||||

| Henry J. Metscher Former Senior Vice President, General Merchandise Manager, Direct Businesses and President of Footwear(2) |

(11.3 | )% | $ | 644,711 | $ | 726,977 | ||||||

| (1) | Includes performance-based awards, see table below for components of performance-based compensation. |

| (2) | Unvested long-term incentive awards for Messrs. Hearn and Metscher were forfeited due to their employment terminations. See “Summary Compensation Table” for additional information. |

19

Total Performance-Based Compensation Earned for Fiscal 2010 and Fiscal 2009

| Named Executive Officer |

Annual Incentive Plan– Cash |

Long-Term

Incentive Cash/Equity Subject to 3-yr vesting(1) |

Total

Performance-Based Compensation Earned |

|||||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | |||||||||||||||||||

| David A. Levin |

$ | 867,984 | $ | 1,173,510 | $ | 859,872 | $ | 975,578 | $ | 1,727,856 | $ | 2,149,088 | ||||||||||||

| Dennis R. Hernreich |

$ | 665,454 | $ | 899,691 | $ | 659,234 | $ | 747,944 | $ | 1,324,688 | $ | 1,647,635 | ||||||||||||

| Robert S. Molloy |

$ | 121,713 | $ | 164,555 | $ | 241,150 | $ | 273,600 | $ | 362,863 | $ | 438,155 | ||||||||||||

| Douglas Hearn |

$ | 102,987 | $ | 134,405 | $ | 204,050 | $ | 223,471 | $ | 307,037 | $ | 357,876 | ||||||||||||

| Henry J. Metscher |

$ | 112,350 | $ | 151,897 | $ | 222,600 | $ | 252,553 | $ | 334,950 | $ | 404,450 | ||||||||||||