UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

DESTINATION XL GROUP, INC.

Notice of Annual Meeting of Stockholders

to be held on August 8, 2024

Notice is hereby given that the 2024 Annual Meeting of Stockholders of Destination XL Group, Inc. (the “Company”) will be held at the corporate offices of the Company, 555 Turnpike Street, Canton, Massachusetts 02021 at 9:30 A.M., local time, on Thursday, August 8, 2024 for the following purposes:

These proposals are more fully described in the Proxy Statement following this Notice.

The Board of Directors recommends that you vote (i) FOR the election of all seven nominees to serve as directors of the Company, (ii) FOR the approval, on an advisory basis, of named executive officer compensation, (iii) FOR the approval of amendments to our 2016 Incentive Compensation Plan, including the increase in the total number of shares authorized for issuance under the plan and (iv) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending February 1, 2025

Along with the attached Proxy Statement, we are sending you a copy of our Annual Report on Form 10-K for the fiscal year ended February 3, 2024.

The Board of Directors has fixed the close of business on June 12, 2024 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. A list of the stockholders of record as of the close of business on June 12, 2024 will be available for inspection by any of our stockholders for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices, 555 Turnpike Street, Canton, Massachusetts 02021, beginning on July 24, 2024 and at the Annual Meeting.

Stockholders are cordially invited to attend the Annual Meeting in person. Regardless of whether you plan to attend the Annual Meeting, please mark, date, sign and return the enclosed proxy to ensure that your shares are represented at the Annual Meeting.

By order of the Board of Directors,

/s/ ROBERT S. MOLLOY

ROBERT S. MOLLOY

Secretary

Canton, Massachusetts

June 28, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on August 8, 2024: The Proxy Statement and 2024 Annual Report to Stockholders are available at:

https://investor.dxl.com/financial-information/annual-reports

TABLE OF CONTENTS

|

|

Page |

|

1 |

|

|

3 |

|

|

6 |

|

|

11 |

|

|

12 |

|

|

23 |

|

|

24 |

|

|

27 |

|

|

34 |

|

|

35 |

|

|

36 |

|

Proposal 2: Advisory Vote to Approve Named Executive Officer Compensation |

|

38 |

Proposal 3: Approval of Amendments to the 2016 Incentive Compensation Plan |

|

39 |

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm |

|

52 |

|

53 |

|

|

54 |

|

|

55 |

|

|

56 |

|

|

56 |

|

|

56 |

|

|

56 |

|

|

57 |

|

|

57 |

|

Appendix A - 2016 Incentive Compensation Plan, as proposed to be amended |

|

A-1 |

DESTINATION XL GROUP, INC.

555 Turnpike Street

Canton, Massachusetts 02021

(781) 828-9300

Proxy Statement

Annual Meeting of Stockholders

August 8, 2024

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Purpose and Distribution of Proxy Materials

This Proxy Statement and the enclosed form of proxy are being mailed to our stockholders on or about June 28, 2024, in connection with the solicitation by the Board of Directors (the “Board”) of Destination XL Group, Inc. (the “Company”) of proxies to be used at the Annual Meeting of Stockholders, to be held at the Company’s corporate headquarters located at 555 Turnpike Street, Canton, Massachusetts 02021 at 9:30 A.M., local time, on Thursday, August 8, 2024 and at any and all adjournments thereof (the “Annual Meeting”). This Proxy Statement describes the matters to be voted on at the Annual Meeting and contains other required information.

Stockholders Entitled to Vote

Only holders of record of our common stock, par value $0.01 per share, at the close of business on June 12, 2024, the record date for the Annual Meeting, will be entitled to notice of, and to vote at, the Annual Meeting. On that date, there were 58,235,323 shares of common stock issued and outstanding. Each share is entitled to one vote at the Annual Meeting.

How to Vote

Stockholders of record may vote by mail or in person at the meeting. If you choose to vote by mail, please complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. If your shares are held in a stock brokerage account or by a bank, you must follow the voting procedures of your broker or bank.

Voting Instructions

When a proxy is returned properly executed, the shares represented will be voted in accordance with the stockholder’s instructions.

Stockholders are encouraged to vote on the matters to be considered. If no instructions have been specified by a stockholder, however, the shares covered by an executed proxy will be voted (i) FOR the election of all seven nominees to serve as directors of the Company, (ii) FOR the approval, on an advisory basis, of named executive officer compensation, (iii) FOR the amendments to the 2016 Incentive Compensation Plan, (iv) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, for the fiscal year ending February 1, 2025 and (v) in the discretion of the proxies named in the proxy card with respect to any other matters properly brought before the Annual Meeting. We are not aware of any other matter that may be properly presented at the Annual Meeting.

If your shares are held in a stock brokerage account or by a bank, you must follow the voting procedures of your broker or bank. If you do not give voting instructions to your broker or bank, your broker or bank does not have discretion to vote your shares on the proposals in this Proxy Statement, except for Proposal 4 to ratify the appointment of our independent registered public accounting firm, which is considered a “routine” proposal. A broker “non-vote” occurs when the broker or bank who is the record holder of the shares does not vote on a particular proposal, either because it does not have discretionary voting power to vote the shares or has not received voting instructions from the beneficial owner.

As a result, if you are not the record holder of your shares, it is critical that you provide instructions to your broker or bank if you want your vote to count.

1

Revoking Your Proxy or Changing Your Vote

You may revoke your proxy at any time before it has been exercised as follows:

If you are not a record holder and your shares are held by your broker or bank, you must contact your broker or bank to change your vote or obtain a legal proxy to vote your shares if you wish to cast your vote in person at the Annual Meeting.

Quorum Requirements

In order to carry on the business of the Annual Meeting, we must have a quorum. This means at least a majority of the outstanding shares of common stock eligible to vote must be represented at the Annual Meeting, either by proxy or in person. Abstentions and broker non-votes will be counted as present or represented at the Annual Meeting for purposes of determining the presence or absence of a quorum.

Approval of a Proposal

A majority of the votes properly cast “FOR” a matter is required for all proposals. In addition, as described in more detail in Proposal 2 below, Proposal 2 is an advisory vote and is non-binding.

Votes cast means the votes actually cast “FOR” or “AGAINST” a particular proposal, whether in person or by proxy. With respect to all matters presented at the Annual Meeting, abstentions and non-votes will not be deemed to be votes “cast” with respect to such matters and will not count as votes “FOR” or “AGAINST” such matter. Votes will be tabulated by our transfer agent subject to the supervision of the person designated by the Board as an inspector.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board, in accordance with our Fourth Amended and Restated By-Laws (the “By-Laws”), has set the number of members at seven directors.

At the Annual Meeting, seven nominees will be elected to serve on the Board until the 2025 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified. Accordingly, the Nominating and Corporate Governance Committee has recommended, and our Board has nominated, Harvey S. Kanter, Carmen R. Bauza, Jack Boyle, Lionel F. Conacher, Willem Mesdag, Ivy Ross and Elaine K. Rubin as nominees, all of whom currently serve as members of our Board.

Unless a proxy shall specify that it is not to be voted for a nominee, it is intended that the shares represented by each duly executed and returned proxy will be voted in favor of the election as directors of Harvey S. Kanter, Carmen R. Bauza, Jack Boyle, Lionel F. Conacher, Willem Mesdag, Ivy Ross and Elaine K. Rubin. Although management expects all nominees to serve if elected, proxies will be voted for a substitute if a nominee is unable to accept nomination or election. Cumulative voting is not permitted.

Vote Needed for Approval

The affirmative vote of a majority of the shares of common stock properly cast at the Annual Meeting, in person or by proxy, is required for the election of each of the nominees.

Recommendation

The Board of Directors recommends that you vote “FOR”

the election of the seven individuals named above as directors of our Company.

The following table sets forth the names, ages as of June 28, 2024, and certain other information for each of our current directors, all terms expiring at the Annual Meeting.

Name |

|

Age |

|

Director |

|

Audit |

|

Compensation |

|

Nominating and |

|

Cybersecurity |

Lionel F. Conacher, Chairman of the Board and Director |

|

61 |

|

2018 |

|

C |

|

X |

|

|

|

|

Harvey S. Kanter, President and Chief Executive Officer and Director |

|

62 |

|

2019 |

|

|

|

|

|

|

|

|

Carmen R. Bauza, Director |

|

62 |

|

2021 |

|

|

|

|

|

X |

|

X |

Jack Boyle, Director |

|

56 |

|

2017 |

|

|

|

X |

|

C |

|

|

Willem Mesdag, Director |

|

70 |

|

2014 |

|

X |

|

C |

|

|

|

|

Ivy Ross, Director |

|

68 |

|

2013 |

|

X |

|

|

|

|

|

C |

Elaine K. Rubin, Director |

|

61 |

|

2021 |

|

|

|

|

|

X |

|

X |

C= current member and committee chairperson

X= current member of the committee

Board Nominees

Set forth below is certain information regarding our current board members being nominated for re-election at the Annual Meeting, and includes information furnished by them as to their principal occupations and business experience for the past five years and certain directorships held by each director within the past five years:

Lionel F. Conacher has been a director since June 2018 and became Chairman of the Board on August 12, 2020. Since September 2021, Mr. Conacher has served as a member of the board of directors for Better Choice Company Inc., a publicly traded company and served as a member of its audit committee from November 2021 until September 2022. From September 2022 until May 2023, he served as its interim chief executive officer. Mr. Conacher was a managing partner of Next Ventures, GP from August 2018 until February 2021. From January 2011 to June 2018, Mr. Conacher was a senior advisor for Altamont Capital Partners LLC (“ACP”), a private equity firm. Prior to joining ACP, from April 2008 until July 2010, Mr. Conacher was the president and chief operating officer of Thomas Weisel Partners, an investment bank. Additionally, Mr. Conacher served as the chairman of Wunderlich Securities, an investee company of ACP, from December 2013 until July 2017. Mr. Conacher previously served as a member of the board of directors for AmpHP Inc., a venture-backed human performance company. He also formerly served as a member of the board of directors of Mervin Manufacturing, a leading designer and manufacturer of snow boards and other board sports equipment, and PowerDot, Inc., a consumer electronics company that markets a muscle recovery and performance tool. Mr. Conacher brings extensive financial and operational experience to the Board.

3

Harvey S. Kanter is the President, Chief Executive Officer and a director of the Company. Mr. Kanter joined the Company in February 2019 in a transition role as Advisor to the Acting CEO and assumed the role of President and Chief Executive Officer and a director of the Company in April 2019. Mr. Kanter served as a non-executive co-chair, Seattle University Center for Leadership Formation, Albers School of Business and Economics from February 2021 until February 2024. Mr. Kanter served as a director and a member of the compensation committee of Potbelly Corporation, a publicly traded company, from August 2015 until May 2019. Mr. Kanter has over 35 years of business experience, with an extensive background in the retail industry having served from March 2012 until June 2017 as the president and chief executive officer of Blue Nile, Inc., a leading online retailer of high-quality diamonds and fine jewelry and formerly a publicly traded company. From March 2012 until February 2020, Mr. Kanter also served as a member of the board of directors of Blue Nile, Inc. and, from January 2014 until February 2020 as its chairman. From January 2009 to March 2012, Mr. Kanter was the chief executive officer and president of Moosejaw Mountaineering and Backcountry Travel, Inc., a leading multi-channel retailer of premium outdoor apparel and gear. From April 2003 to June 2008, Mr. Kanter served in various executive positions at Michaels Stores, Inc. He was a former brand ambassador for the Fred Hutch Cancer Research Institute, and previously served as an advisory member to the Seattle University Executive MBA Program. Mr. Kanter brings an extensive knowledge of integrated-commerce retailing, with strong strategic and operational expertise.

Carmen R. Bauza was appointed a director of the Company in December 2021. In March 2023, Ms. Bauza joined the board of directors of OneWater Marine Inc., a publicly traded company, and serves as a member of its audit and compensation committees. Since May 2022, Ms. Bauza has also served on the board of directors of Zumiez, Inc., a publicly traded company, and serves as a member of its audit and governance and nominating committees. Ms. Bauza serves as a member of the board of managers of Claire’s Holdings LLC, which she joined in October 2018. Most recently, Ms. Bauza was the chief merchandising officer at Fanatics, Inc. from January 2019 until April 2021. Prior to that, she was the chief merchandising officer at HSN from November 2016 until December 2017 and the senior vice president, general merchandise manager consumables, health and wellness at Walmart from June 2007 to October 2016. She previously held roles at Bath & Body Works, Five Below and The Walt Disney Company. Ms. Bauza currently serves as a member of the board of trustees at Seton Hill University and as a member of the advisory board of RoundTable Healthcare Partners Council. Ms. Bauza brings extensive retail and merchandising experience to the Board.

Jack Boyle has been a director since August 2017. Since February 2024, Mr. Boyle has been the president, buying and North America for Fanatics, Inc., a market leader for officially licensed sports merchandise. From February 2019 to January 2024, Mr. Boyle was the global co-president of direct to consumer/omni-channel for Fanatics, Inc. Mr. Boyle originally joined Fanatics as president of merchandising in June 2012, and from December 2017 to February 2019, served as co-president of North America direct-to-consumer/omni-channel. From February 2005 to June 2012, Mr. Boyle was the executive vice president, general merchandising manager of women’s apparel, intimate, cosmetics and accessories for Kohl’s Corporation. From October 2003 to February 2005, he served as senior vice president, divisional merchandise manager of women’s apparel for Kohl’s Corporation, vice president of junior sportswear from July 2000 to October 2003 and vice president of planning/allocation for women's apparel from December 1999 to July 2000. From June 1990 to December 1999, Mr. Boyle held various merchandise positions, including divisional merchandise manager of women’s, at May Company. Mr. Boyle brings to the Board extensive experience in merchandising, brand management and omni-channel leadership.

Willem Mesdag has been a director since January 2014. Mr. Mesdag is the managing partner of Red Mountain Capital Partners LLC, an investment management firm, and since May 2019, has also served as a Senior Advisor for HPS Investment Partners, a global investment firm. Prior to founding Red Mountain in 2005, Mr. Mesdag was a partner and managing director of Goldman Sachs & Co., which he joined in 1981. Prior to Goldman Sachs, he was a securities lawyer at Ballard, Spahr, Andrews & Ingersoll, which he joined in 1978. He also currently serves on the board of Heidrick & Struggles International, Inc., a publicly traded company, for which he chairs the audit and finance committee and serves on the human resources and compensation committee. He previously served on the boards of 3i Group plc, Cost Plus, Inc., Encore Capital Group, Inc., Nature’s Sunshine Products, Inc., Skandia AB and Yuma Energy, Inc., all of which are or were publicly traded companies. Having had an extensive career in international investment banking and finance and having served on domestic and international public company boards, Mr. Mesdag brings to the Board significant knowledge and experience related to business and financial issues and corporate governance as well as an investor's perspective.

Ivy Ross has been a director since January 2013. In May 2014, Ms. Ross joined Google as head of glass and is currently a vice president of hardware design at Google. From July 2011 until April 2014, Ms. Ross was the chief marketing officer of Art.com where she oversaw the company's marketing, branding, merchandising and user-experience functions. Prior to Art.com, from June 2008 to June 2011, Ms. Ross was EVP of marketing for the Gap brand, and also acted as the creative catalyst for all brands within Gap, Inc. Ms. Ross also has held senior creative and product design positions at Disney Stores North America, Mattel, Calvin Klein, Coach, Liz Claiborne, Swatch Watch and Avon. She also has served on Proctor and Gamble’s design board since its inception. With her industry insight and marketing expertise, Ms. Ross provides a valuable perspective to the Board as we continue to build our DXL brand.

4

Elaine K. Rubin has been a director since April 2021. Since January 2010, Ms. Rubin has been the founder and president of Digital Prophets Network, LLC, a consulting, advisory and placement firm with a network of digital commerce experts that supports the growth of retail and direct-to-consumer businesses. Since October 2013, she has also served as an advisor to Hint, Inc., which produces fruit-infused water. Prior to that, Ms. Rubin previously held leadership positions at 1800flowers.com, iVillage.com and amazon.com. She previously served on the boards of Smart & Final Stores, Inc. and Blue Nile, Inc., both of which were formerly publicly traded companies. Ms. Rubin co-founded shop.org in February 1996 and served as its elected chair of the board of directors from February 1996 to October 2007 and served on the board of the National Retail Federation (NRF) from 2001 until 2010. Ms. Rubin brings extensive knowledge and experience of digital commerce business and provides valuable insights to the Board as we continue to grow our direct business.

All directors hold office until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified or until their earlier death, resignation or removal.

There are no family relationships between any of our directors and executive officers.

5

CORPORATE GOVERNANCE

Board Composition

Our Board is currently comprised of seven members and there are no vacancies.

Our Board met eight times during our fiscal year ended February 3, 2024 (“fiscal 2023”). All directors attended at least 75% of the Board meetings and meetings of the committees of the Board on which each director served. We believe that it is important for the members of the Board to attend our annual stockholder meetings. All members of the Board attended our 2023 Annual Meeting of Stockholders.

Board Diversity

We recognize the value of diversity at the Board level and believe that our Board currently comprises an appropriate mix of background, diversity and expertise. Although we do not have a formal separate written policy, our Nominating and Corporate Governance Committee is required under its charter to recommend nominees that ensure sufficient diversity of backgrounds on our Board.

The Board Diversity Matrix below presents the composition of our Board by gender identity and demographic background in accordance with Rule 5606(f) of The Nasdaq Stock Market (“Nasdaq”).

Board Diversity Matrix as of June 12, 2024 |

|||||||||

|

|

|

Female |

|

Male |

|

Non-Binary |

|

Did Not Disclose Gender |

Total number of directors: 7 |

|

|

|

|

|

|

|

|

|

Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

Directors |

|

|

3 |

|

4 |

|

- |

|

- |

Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

African American or Black |

|

|

- |

|

- |

|

- |

|

- |

Alaskan Native or Native American |

|

|

- |

|

- |

|

- |

|

- |

Asian |

|

|

- |

|

- |

|

- |

|

- |

Hispanic or Latinx |

|

|

1 |

|

- |

|

- |

|

- |

Asian |

|

|

- |

|

- |

|

- |

|

- |

Native Hawaiian or Pacific Islander |

|

|

- |

|

- |

|

- |

|

- |

White |

|

|

2 |

|

4 |

|

- |

|

- |

Two or more Races or Ethnicities |

|

|

- |

|

- |

|

- |

|

- |

LGBTQ+ |

|

|

- |

|

- |

|

- |

|

- |

Did not disclose demographic background |

|

|

- |

|

- |

|

- |

|

- |

Corporate Governance Highlights

We comply with the corporate governance requirements imposed by the Sarbanes-Oxley Act of 2002, the SEC and Nasdaq. To assist the Board in fulfilling its responsibilities, we have adopted certain Corporate Governance Guidelines (the "Governance Guidelines"). Many features of our corporate governance principles are discussed in other sections of this proxy statement, but some of the highlights are:

6

Stockholder Engagement

Members of our Board and senior management regularly engage with our stockholders throughout the year and welcome their feedback on our practices and policies.

Independent Directors

A majority of the members of the Board are “independent” under the rules of Nasdaq. The Board has determined that the following current directors are independent: Mses. Bauza, Ross and Rubin and Messrs. Boyle, Conacher and Mesdag.

Committees of the Board

Our Board has four standing committees: the Nominating and Corporate Governance Committee, the Audit Committee, the Compensation Committee and the Cybersecurity and Data Privacy Committee. Each committee is comprised of directors who are “independent.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the “Nominating Committee”) has a written charter, which can be found under “Corporate Governance– Charters & Policies” on the Investor Relations page of our website at https://investor.dxl.com. The Nominating Committee was established to perform functions related to governance of our Company, including, but not limited to, planning for the succession of our CEO and such other officers as the Nominating Committee shall determine from time to time, recommending to the Board individuals to stand for election as directors, overseeing and recommending the selection and composition of committees of the Board, and developing and recommending to the Board a set of corporate governance principles applicable to our Company. The Nominating Committee also has responsibility for overseeing the Company’s policies, practices and disclosures with respect to sustainability and environmental, social and governance (ESG) factors, including overseeing the assessment of climate risks. The Nominating Committee has the authority to retain independent advisors, with all fees and expenses to be paid by the Company. The current members of the Nominating Committee are Mr. Boyle and Mses. Bauza and Rubin, each of whom is “independent” under the rules of Nasdaq. The Nominating Committee met five times during fiscal 2023.

7

The Board's current policy with regard to the consideration of director candidates recommended by stockholders is that the Nominating Committee will review and consider any director candidates who have been recommended by stockholders in compliance with the procedures established from time to time by the Nominating Committee, and conduct inquiries it deems appropriate. The Nominating Committee will consider for nomination any such proposed director candidate who is deemed qualified by the Nominating Committee in light of the minimum qualifications and other criteria for Board membership approved by the Nominating Committee from time to time.

While the Nominating Committee does not have a formal diversity policy for Board membership and identifies qualified candidates without regard to race, color, disability, gender, national origin, religion or creed, it does seek to ensure the fair representation of all stockholder interests on the Board. In that regard, in considering candidates for the Board, the Nominating Committee considers, among other factors, diversity with respect to viewpoint, skills and experience. The Board believes that the use of these general criteria, along with the minimum qualifications listed below, will result in nominees who represent a mix of backgrounds and experiences that will enhance the quality of the Board.

At a minimum, the Nominating Committee must be satisfied that each nominee, both those recommended by the Nominating Committee and those recommended by stockholders, meets the following minimum qualifications:

The current procedures to be followed by stockholders in submitting recommendations for director candidates can be found in Section 4.15 of our By-Laws.

The Nominating Committee is responsible for identifying and evaluating individuals, including nominees recommended by stockholders, believed to be qualified to become Board members and recommending to the Board the persons to be nominated by the Board for election as directors at any annual or special meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board. The Nominating Committee may solicit recommendations from any or all of the following sources: non-management directors, the CEO, other executive officers, third-party search firms or any other source it deems appropriate. The Nominating Committee will review and evaluate the qualifications of any such proposed director candidate, and conduct inquiries it deems appropriate. The Nominating Committee will evaluate all such proposed director candidates in the same manner, with no regard to the source of the initial recommendation of such proposed director candidate. Accordingly, there are no differences in the manner in which the Nominating Committee evaluates director nominees recommended by stockholders. In identifying and evaluating candidates for membership on the Board, the Nominating Committee will take into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity, and the extent to which the candidate would fill a present need on the Board.

Audit Committee

We have a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee is currently comprised of Messrs. Conacher and Mesdag and Ms. Ross. Each of the members of the Audit Committee is independent, as independence for Audit Committee members is defined under the rules of Nasdaq. Messrs. Conacher and Mesdag each qualifies as an audit committee financial expert under the rules of the SEC.

The Audit Committee operates under a written charter, which can be found under “Corporate Governance- Charters & Policies” on the Investor Relations page of our website at https://investor.dxl.com.

8

The purpose of the Audit Committee is to (i) assist the Board in fulfilling its oversight responsibilities to the stockholders, potential stockholders and the investment community; (ii) oversee the audits of our financial statements and our relationship with our independent registered public accounting firm; (iii) promote and further the integrity of our financial statements and oversee the qualifications, independence and performance of our independent registered public accounting firm (including being solely responsible for appointing, determining the scope of, evaluating and, when necessary, terminating the relationship with the independent registered public accounting firm); and (iv) provide the Board and the independent registered public accounting firm, unfiltered access to each other on a regular basis. The Audit Committee has the authority to retain independent advisors, with all fees and expenses to be paid by the Company. The Audit Committee meets at least quarterly and as often as it deems necessary to perform its responsibilities. During fiscal 2023, the Audit Committee met six times.

For additional information regarding the Audit Committee, see the “Report of the Audit Committee” included elsewhere in this Proxy Statement.

Compensation Committee

The primary purpose of the Compensation Committee is to discharge the Board’s responsibilities relating to executive compensation. The Compensation Committee also reviews and independently approves, or makes recommendations to the full Board, all stock-based compensation awards to our executive officers under our equity incentive plans. The Compensation Committee has the authority to retain independent advisors, with all fees and expenses to be paid by the Company. The Compensation Committee met five times during fiscal 2023. The current members of the Compensation Committee are Messrs. Mesdag, Boyle and Conacher, each of whom is “independent” under the rules of Nasdaq.

The Compensation Committee operates under a written charter, which can be found under “Corporate Governance – Charters & Policies” on the Investor Relations page of our website at https://investor.dxl.com.

The Compensation Discussion and Analysis recommended by the Compensation Committee to be included in the Proxy Statement is included in this Proxy Statement. Among other things, the Compensation Discussion and Analysis describes in greater detail the Compensation Committee’s role in the executive compensation process.

Cybersecurity and Data Privacy Committee

The Cybersecurity and Data Privacy Committee (the “Cybersecurity Committee”) oversees the monitoring and management of cyber risk and data privacy in the Company. The Cybersecurity Committee has the authority to retain independent advisors, with all fees and expenses to be paid by the Company. The current members of the Cybersecurity Committee are Mses. Bauza, Ross and Rubin. The Cybersecurity Committee met four times during fiscal 2023.

Pursuant to its charter, our Cybersecurity Committee (i) assists our Board in fulfilling its risk oversight responsibilities with respect to the protection of the Company’s assets, including confidential, proprietary and personal information, reputation and goodwill in all forms; (ii) supervises and monitors the soundness of our cybersecurity and data protection strategies and practices; (iii) oversees and monitors our material compliance with applicable information security, privacy and data protection laws, industry standards and contractual requirements; (iv) promotes and furthers the integrity, adoption and coordination of our data security processes across the Company to help ensure that data and system security is a Company-wide business objective and priority; and (v) oversees our cybersecurity and data protection performance and the overall implementation of our cybersecurity and data protection strategy.

The Cybersecurity Committee operates under a written charter, which can be found under “Corporate Governance –Charters & Policies” on the Investor Relations page of our website at https://investor.dxl.com.

Board Leadership Structure

The Board believes that the Company and its stockholders are best served by maintaining flexibility to have any director serve as Chairperson of the Board. Under our Corporate Governance Guidelines, if the Chairperson is not independent, the Board appoints an independent Lead Director.

Our Board delegates substantial responsibility to its committees, including as described below. We believe that the independent committees of our Board and their chairpersons are an important aspect of the leadership structure of our Board.

9

Risk Oversight

Our Board, as a whole and through its committees, has responsibility for the oversight of enterprise risk management. With the oversight of our full Board, our executive officers are responsible for the day-to-day management of the material risks we face. The involvement of the full Board in setting our business strategy is a key part of its oversight of risk management and in determining what constitutes an appropriate level of risk for us. The full Board receives updates from our executive officers and outside advisors regarding certain risks our Company faces, including various operating risks and corporate governance best practices. At least annually, our senior management team meets to review our identified risks and compensating controls as well as any potential new risks and, when appropriate, presents to the full Board.

In addition, our Board committees each oversee certain aspects of risk management. Our Audit Committee is responsible for overseeing the management of risks associated with the Company’s financial reporting, accounting and auditing matters; our Compensation Committee oversees risks associated with our human capital and compensation policies and programs; our Cybersecurity Committee oversees the management of risks associated with cyber risk and data privacy issues; and our Nominating Committee oversees the management of risks associated with director independence, conflicts of interest, composition and organization of our Board, and overall governance structure, director succession planning and our environmental, sustainability and social programs. Our Board committees report their findings to the full Board.

Sustainability

Our Company recognizes the importance of addressing and prioritizing environmental, social and governance (ESG) issues throughout our business. In fiscal 2021, we engaged with a third-party firm to assist us in the development of the Company's initial ESG strategy and initiatives. Our Sustainability Committee, consisting of a cross-disciplinary team from corporate management, reports to the Nominating and Corporate Governance Committee and, when appropriate, presents to our full Board. Our senior management team is working with our Sustainability Committee to develop short- and long-term ESG goals and a related action plan. Information regarding our current efforts, and our ongoing ESG initiatives can be found on our corporate website at https://investor.dxl.com. The information included in, referenced to, or otherwise accessible through our website, is not incorporated by reference in, or considered to be part of, this document or any document unless expressly incorporated by reference therein.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines that set forth our governance principles relating to, among other things, director independence, director qualifications and responsibilities, board structure and meetings, and management succession.

A copy of the Corporate Governance Guidelines can be found under “Corporate Governance – Charters & Policies” on the Investor Relations page of our corporate website, which is at https://investor.dxl.com.

Code of Ethics

We have adopted a Code of Ethics for Directors, Officers and Financial Professionals (the “Code of Ethics”). The full text of the Code of Ethics can be found under “Corporate Governance – Charters & Policies” on the Investor Relations page of our corporate web site, which is at https://investor.dxl.com. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of our Code of Ethics by posting such information on our website. We also have a Code of Ethics for all of our associates. Annually, our directors and associates, including our officers, certify that they have read and are in compliance with our Code of Ethics.

Compensation Committee Interlocks and Insider Participation

Each of Willem Mesdag, Jack Boyle and Lionel F. Conacher served as a member of the Compensation Committee during fiscal 2023, none of whom was at any time during fiscal 2023 or at any other time an officer or employee of our Company. During fiscal 2023, none of our executive officers served as a member of the board of directors or compensation committee of any other entity that had one or more executive officers serving as a member of our Board or Compensation Committee.

10

DIRECTOR COMPENSATION

The Compensation Committee is responsible for reviewing and making recommendations to our Board with respect to the compensation paid to our non-employee directors.

The Company's Non-Employee Director Compensation Plan, as amended to date (the "Director Plan"), sets forth the compensation to be paid to our non-employee directors, including in the form of equity. The plan has a minimum equity ownership requirement that requires each director to receive at least 60% of their annual retainers in shares of common stock until the value of their equity ownership is equal to at least three times the annual retainer. Any shares issued to satisfy the minimum equity ownership requirement are issued under the Company’s 2016 Plan. The Director Plan also permits the Company’s non-employee directors to acquire shares of the Company’s common stock at fair market value by voluntarily electing to receive shares of common stock in lieu of cash fees for service as a director. In November 2023, the Director Plan was amended to permit directors the ability to select shares of deferred stock beginning in fiscal 2024. Any shares of deferred stock will be issued from the 2016 Plan.

The Director Plan is a stand-alone plan and is not a sub-plan under the 2016 Plan. Accordingly, shares issued under the Director Plan for voluntary elections to receive shares of common stock in lieu of cash fees do not reduce the shares available for issuance under the 2016 Plan. The maximum number of shares that can be issued in any quarter pursuant to the Director Plan is limited to 250,000 shares in the aggregate, with the shortfall paid in cash.

We believe that our Director Plan will support our ongoing efforts to attract and retain exceptional directors to provide strategic guidance to our Company. We believe that the total compensation that our non-employee directors receive is in line with our current peer group. Our non-employee directors were compensated under the plan as follows in fiscal 2023:

Director Compensation Table

The following table sets forth the compensation paid to our directors during fiscal 2023. Mr. Kanter is not included in the following table as he is a Named Executive Officer and, accordingly, received no compensation for his services as a director. Compensation earned by Mr. Kanter is included below in the “Summary Compensation Table.”

2023 DIRECTOR COMPENSATION TABLE

Name |

|

Fees Earned or |

|

|

Stock |

|

|

Option |

|

|

All Other |

|

|

Total |

|

|||||

Lionel F. Conacher, Chairman |

|

$ |

195,000 |

|

|

$ |

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

195,000 |

|

Carmen R. Bauza |

|

|

54,000 |

|

|

|

80,996 |

|

|

|

— |

|

|

|

— |

|

|

|

134,996 |

|

Jack Boyle |

|

|

72,500 |

|

|

|

72,484 |

|

|

|

— |

|

|

|

— |

|

|

|

144,984 |

|

Willem Mesdag |

|

|

— |

|

|

|

144,991 |

|

|

|

— |

|

|

|

— |

|

|

|

144,991 |

|

Ivy Ross |

|

|

77,500 |

|

|

|

67,495 |

|

|

|

— |

|

|

|

— |

|

|

|

144,995 |

|

Elaine K. Rubin |

|

|

57,375 |

|

|

|

77,620 |

|

|

|

— |

|

|

|

— |

|

|

|

134,995 |

|

11

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis provides a summary of our executive compensation philosophy and programs, and discusses the compensation paid to our Chief Executive Officer (“CEO”), our Chief Financial Officer (“CFO”) and certain of our other executive officers who served in fiscal 2023 (collectively, our “Named Executive Officers”).

Our Named Executive Officers for fiscal 2023 were:

Fiscal 2023 Financial and Executive Compensation Highlights

Fiscal 2023 proved to be a challenging year as uncertainty about the economy grew during the year, directly impacting the apparel retail market. The resulting decrease in consumer discretionary spending negatively impacted customer traffic and, as a result, our sales performance fell short of our expectations.

When we approved the plan for fiscal 2023, we had just completed two record years of sales and earnings and, while we expected our sales growth to slow slightly, we did not expect the slowdown in customer traffic that we began to see in the second quarter of fiscal 2023. Despite these headwinds, fiscal 2023 was the second highest year of sales in the history of our Company, only behind fiscal 2022. Furthermore, our operational discipline allowed us to maintain a solid gross margin, manage our operating expenses, resulting in $27.9 million of net income and an adjusted EBITDA margin (a non-GAAP measure) of 10.7%.

A significant accomplishment in fiscal 2023 was the development and finalization of our long-range plan. In connection with our long-range plan, we renegotiated Mr. Kanter's employment agreement, extending the initial term of the agreement until August 11, 2026. We believe that this was an important step to ensure Mr. Kanter will oversee the execution of our long-range plan.

We believe that the compensation earned by our Named Executive Officers in fiscal 2023 was aligned with our operating performance. The following table shows total compensation earned and total realized pay for each of the Named Executive Officers (NEOs) in fiscal 2023 as compared to fiscal 2022:

|

|

Total Compensation(1) |

|

|

Total Realized Pay (2) |

|

||||||||||||||||||

Named Executive Officer |

|

Fiscal 2023 |

|

|

Fiscal 2022 |

|

|

% Change |

|

|

Fiscal 2023 |

|

|

Fiscal 2022 |

|

|

% Change |

|

||||||

Harvey S. Kanter |

|

$ |

5,959,023 |

|

|

$ |

4,221,881 |

|

|

|

41.1 |

% |

|

$ |

4,269,385 |

|

|

$ |

6,881,634 |

|

|

|

(38.0 |

)% |

Peter H. Stratton, Jr. |

|

$ |

1,048,280 |

|

|

$ |

1,153,866 |

|

|

|

(9.2 |

)% |

|

$ |

1,124,903 |

|

|

$ |

1,287,281 |

|

|

|

(12.6 |

)% |

Anthony J. Gaeta |

|

$ |

872,760 |

|

|

$ |

831,020 |

|

|

|

5.0 |

% |

|

$ |

993,374 |

|

|

$ |

899,072 |

|

|

|

10.5 |

% |

Robert S. Molloy |

|

$ |

948,334 |

|

|

$ |

1,014,167 |

|

|

|

(6.5 |

)% |

|

$ |

1,320,125 |

|

|

$ |

1,088,916 |

|

|

|

21.2 |

% |

Allison Surette |

|

$ |

847,626 |

|

|

$ |

818,948 |

|

|

|

3.5 |

% |

|

$ |

904,688 |

|

|

$ |

850,290 |

|

|

|

6.4 |

% |

Executive Compensation Philosophy and Objectives

Our Compensation Committee is responsible for establishing, implementing and monitoring adherence to the Board’s compensation philosophy, which is to ensure that executive compensation is fair, reasonable, competitive and aligned with the interests of the Company’s stockholders.

12

The Compensation Committee believes that an effective executive compensation program will:

When reviewing compensation, the Compensation Committee emphasizes Direct Compensation, which consists of total cash compensation (base salary and annual performance-based cash incentive awards) plus long-term incentive awards. Every year, the Compensation Committee assesses the effectiveness of our compensation plans with the goal of strengthening our overall compensation program as appropriate, including by setting performance metrics to ensure that compensation is aligned with performance that drives stockholder value. We also compare our performance metrics to those used by our peers and take into consideration the recommendations of proxy advisory services.

Key Features of Our Executive Compensation Program

We believe that the Company’s executive compensation program includes key features that align the compensation for our executive officers with the interests of our stockholders.

What We Do |

What We Don’t Do |

Focus on performance-based pay |

No re-pricing of underwater options |

Balance short-term and long-term incentives |

No hedging or pledging of Company stock |

Use multiple targets for performance awards |

No tax gross-up on severance payments |

Provide executives with very limited perquisites |

No supplemental executive retirement plan |

Require “double-trigger” change-in-control provisions |

|

Maintain a “clawback” policy covering incentive cash and equity programs |

|

Seek to mitigate undue risk in compensation plans |

|

Utilize an independent compensation consultant |

|

Use of Compensation Consultants

The Compensation Committee has the authority to retain any compensation consultant, legal counsel and/or other adviser to assist in carrying out its duties, including the review of compensation of our Named Executive Officers. The Compensation Committee may accept, reject or modify any recommendations by compensation consultants or other outside advisors.

The Compensation Committee periodically consults with the Segal Group ("Segal"), formerly Sibson Consulting, an independent firm that specializes in benefits and compensation, with respect to the structure and competitiveness of the Company’s executive compensation program compared to its proxy peer group. The Compensation Committee has assessed Segal’s independence, and has concluded that no conflict of interest exists with respect to the services that it performs.

In August 2023, the Compensation Committee and Mr. Kanter agreed to extend the "initial term" of his employment agreement from April 1, 2025 to August 11, 2026. In connection with this extension, the Compensation Committee engaged Segal to review Mr. Kanter's base salary and total direct compensation as well as provide guidance on the terms, conditions and value of a performance award that served both as a retention award to extend his employment to August 2026 and satisfy the commitment in the employment agreement to grant Mr. Kanter a new performance award if the third tranche of his initial new-hire performance award did not vest. See “Compensation Components and Fiscal 2023 Compensation Decisions” and “Employment Agreement - Harvey S. Kanter, Chief Executive Officer and Director” below for additional information regarding the performance award granted in 2023. Based on market insights from Segal, including information derived from published surveys on CEO compensation in retail companies with annual revenues of $500 million to $1.0 billion and trends in CEO compensation, there were no other changes to Mr. Kanter's compensation.

In March of 2023, the Compensation Committee also engaged Korn Ferry to review its peer group for purposes of reviewing and determining compensation decisions for fiscal 2023. The Compensation Committee has assessed Korn Ferry’s independence and has concluded that no conflict of interest exists with respect to the services that it performs.

13

Fiscal 2023 Target Compensation

CEO Compensation. The Compensation Committee is responsible for determining the target compensation of our CEO. With respect to setting 2023 target compensation, working with Segal, the Compensation Committee compared each element of the CEO’s Direct Compensation to published survey data and data from the Company’s peer group. The Compensation Committee’s objective was that total target compensation should approximate the median target compensation of the Company’s peer group. In addition, as discussed below, in August 2023, the Company extended its employment agreement with Mr. Kanter, which included a grant of a performance stock units.

Other Named Executive Officers. Our CEO makes recommendations regarding the compensation paid to our other Named Executive Officers to the Compensation Committee for its review and approval. Our Named Executive Officers other than the CEO are provided with a competitive base salary and an opportunity to earn performance awards each year, which are driven by our overall financial targets, and to participate in our equity incentive plans.

In 2022, Korn Ferry completed a study that evaluated all positions at our corporate office, from entry level to the CEO, and using their job leveling methodology, created a career framework of job levels based on scope, complexity, and responsibilities of each role. The CEO, together with the Chief Human Resources Officer, uses this framework and the respective job levels when evaluating the annual compensation paid to the other Named Executive Officers.

Our Peer Group

When determining peer companies for use in reviewing and establishing compensation for our Named Executive Officers, we focus primarily on public companies within the specialty retail apparel business with similar revenue and/or market capitalization. The companies in the fiscal 2023 peer group were:

• |

Big 5 Sporting Goods |

• |

J.Jill, Inc. |

• |

Vera Bradley |

|

|

|

|

|

|

• |

Build-A-Bear Workshop, Inc. |

• |

Kirkland’s, Inc. |

• |

Vince Holding Corp. |

|

|

|

|

|

|

• |

Cato Group |

• |

Movado Group |

• |

Zumiez, Inc. |

|

|

|

|

|

|

• |

Citi Trends |

• |

Shoe Carnival |

|

|

|

|

|

|

|

|

• |

Delta Apparel, Inc. |

• |

Tile Shop Holdings |

|

|

|

|

|

|

|

|

• |

Duluth Holding, Inc. |

• |

Tilly’s Inc. |

|

|

|

|

|

|

|

|

In order to develop an appropriate peer group, we considered domestic, publicly traded companies with a range of revenues and market capitalizations that may differ from those included by independent analysts such as Institutional Shareholder Services (ISS). We do so because we believe that companies doing business in specialty retail markets with omni-channel distribution models provide a better benchmark for total shareholder return. An independent analyst may include a company that falls within the same Standard & Poor’s GICS code with similar revenue and market capitalization but with a different business model, business risks, geographic locations, customer base and industry traffic trends which, consequently, may have nothing in common with our Company. For example, a company that owns automotive dealerships is within the same GICS code as our Company, but clearly has a distinctively different business model and is not affected by the same trends that affect specialty retail apparel. As compared to our fiscal 2023 peers, we fell just below the median for revenues and slightly below the 85% percentile for market capitalization. Because our stock is so thinly traded, more weight was given to revenue than to market capitalization.

In fiscal 2024, the Compensation Committee engaged Korn Ferry again to review its peer group for fiscal 2024. As a result of that review and based on the recommendations of Korn Ferry, the Company has added Rocky Brands to its fiscal 2024 peer group and removed Tile Shop Holdings because it is not in the apparel business and therefore may not be affected by the same trends that affect specialty retail apparel.

Say-on-Pay

At our 2023 Annual Meeting, stockholders voted on a non-binding advisory proposal as to the frequency with which we should conduct an advisory vote on executive compensation (a "say-on-pay proposal"). At that meeting, and in accordance with the recommendation of our Board, 97.2% of votes cast voted for the “one-year” frequency for advisory votes on executive compensation. Therefore, we intend to hold an advisory “say-on-pay” vote every year until the next “say-on-pay” frequency vote by our stockholders which will be at our 2029 Annual Meeting.

At our 2023 Annual Meeting, stockholders voted on a non-binding advisory vote on executive compensation as disclosed in the 2023 Proxy Statement. Of the votes cast at the 2023 Annual Meeting on the “say-on-pay” proposal, 98.9% voted in favor of the

14

proposal. The Compensation Committee considered the results of the 2023 advisory vote and believes that it affirms support of our stockholders for our approach to executive compensation, namely, to align short- and long-term incentives with the Company’s financial performance. We will continue to consider the outcome of subsequent say-on-pay votes when making future compensation decisions for our executive officers.

Risk Assessment

We believe that our compensation programs do not provide incentives for unnecessary risk-taking by our employees. Our emphasis on performance-based annual and long-term incentive awards is designed to align executives with preserving and enhancing stockholder value. In addition, we use multiple objectives for our annual incentive plan (“AIP”), which limits the potential benefit from any single event of excessive risk-taking, and a cap on total payouts, as well as management processes in place for establishing key performance targets and monitoring our metrics. In addition, we have clawback policies in place relating to recoupment of compensation in the event of accounting restatements and misconduct of our executives, as described below under “Clawback Policies.” Based on these considerations, among others, we do not believe that our compensation policies and practices create risks that are likely to have a material adverse effect on our Company.

Compensation Components and Fiscal 2023 Compensation Decisions

We believe that our executive compensation policies and practices appropriately align the interests of our executives with those of our stockholders and emphasize the shared responsibility of our executive officers for the Company’s financial performance. Accordingly, the compensation of our Named Executive Officers is heavily weighted toward “at-risk” performance-based compensation.

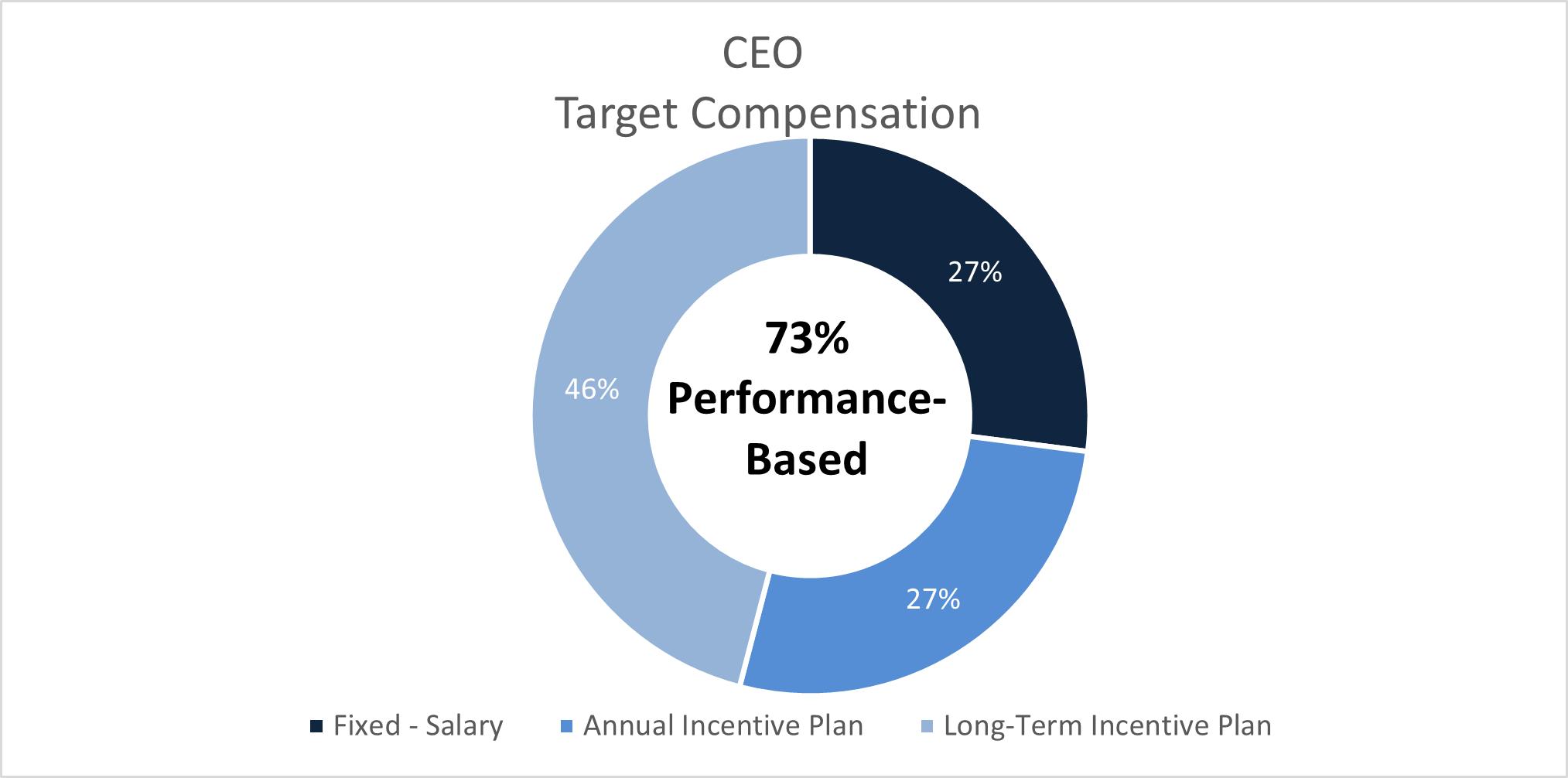

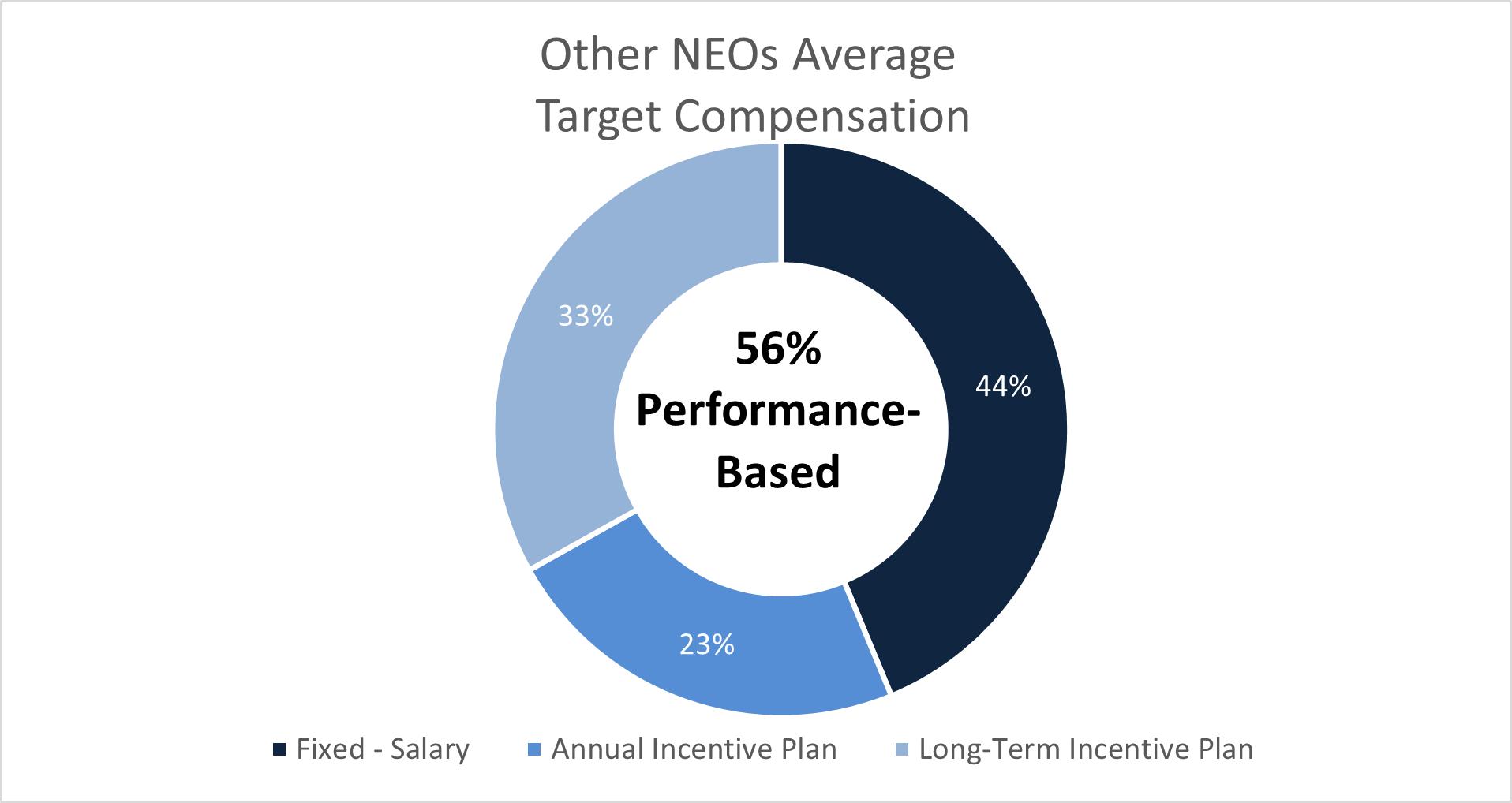

The primary components of compensation for our Named Executive Officers in 2023 included base salary (“fixed compensation”), annual performance-based cash incentives under our AIP and long-term cash and/or equity incentives under our Long-Term Incentive Plan (“LTIP") (“at-risk compensation”). The annual weight of each component leads to the following allocation of potential compensation that each executive can earn. The CEO Target Compensation excludes the grant of performance stock units granted to Mr. Kanter in connection with the extension in August 2023 of his employment agreement, which served as a retention award.

15

The components of executive compensation are as follows:

Base salary represents the fixed component of an executive’s annual compensation. In order to attract and retain top executive talent, we believe that it is important that our base salary be competitive, generally at or near the median of our industry peers.

Base salaries are reviewed annually and adjustments are influenced by the Company’s performance in the previous fiscal year and the executive’s contribution to that performance. The executive’s performance is measured by various factors, including, but not limited to, achievement of specific individual and department goals. Additionally, adjustments may be considered with respect to an individual’s promotion that may occur during the fiscal year, and any modifications in the individual's level of responsibility.

The Compensation Committee expects the CEO’s base salary to be at or near the peer group median, and to approximate 25%-33% of his target Direct Compensation. The base salary of our other Named Executive Officers is recommended by our CEO to the Compensation Committee for its review and approval, and targets the median of the peer group and published industry compensation surveys.

In April 2023, Mr. Gaeta was named Chief Stores and Real Estate Officer, and his salary was increased from $325,000 to $400,000, and Ms. Surette's salary was adjusted from $350,000 to $375,000.

Subsequent to fiscal 2023, Messrs. Stratton, Gaeta and Molloy and Ms. Surette each received a 3% merit increase.

The Compensation Committee believes that a substantial portion of each Named Executive Officer’s compensation should tie directly to our Company’s financial performance. The Company’s AIP is an annual performance-based incentive plan that provides a cash award to participants based on achievement of specified corporate, departmental and individual targets.

2023 AIP Awards

On April 27, 2023, the Compensation Committee established the financial, operating and performance metrics for the 2023 AIP. Traditionally, the metrics for the AIP have been focused on the financial and operating performance of the Company in relation to our board-approved budget. However, given the significant uncertainty surrounding the U.S. economy, and the retail industry in particular, in order to keep employees engaged and motivated to achieve our strategic objectives should the macroeconomic situation deteriorate in 2023, the Compensation Committee added a second tier to the 2023 AIP program that was a relative measure, comparing the Company's financial performance in fiscal 2023 against the financial performance of its 2023 peer group, as listed above under "Our Peer Group".

Under this two-tier structure, the payout related to corporate or departmental targets accounted for 80% of the potential award and was determined based on the higher achievement of either TIER I (based on the Company’s approved financial plan) or TIER II (based on the relative financial performance of the Company to its 2023 peers).

TIER I Company performance metrics consisted of corporate targets for Sales and Adjusted EBITDA and departmental targets, if applicable, for Store Operations, Marketing & Digital, and Merchandise/Planning and Allocation. Under TIER I, the Company’s financial performance metrics accounted for 80% of the potential award for Messrs. Kanter, Stratton and Molloy and 40% of the potential award for Mr. Gaeta and Ms. Surette. Mr. Gaeta’s performance metrics included specific store operation targets, and Ms. Surette's performance metrics included specific merchandising, planning and allocation targets, and accounted for 40% of their respective potential award. The performance metrics were derived from the Company’s annual operating plan for fiscal 2023. The Compensation Committee believed that sales and adjusted EBITDA continued to be the two most significant financial metrics for the 2023 AIP.

TIER II Company performance metrics consisted of corporate targets for Comparable Sales and Adjusted EBITDA Margin, each accounting for 40% of the potential award for each participant. Our Comparable Sales and Adjusted EBITDA Margin results for fiscal 2023 were compared to our 2023 peer group on a quartile ranking. For each metric, if the Company ranked in (i) the top quartile, the payout would be 100%; (ii) the second quartile, the payout would be 75%; and (iii) the third quartile, the payout would be 50%. No payout would be earned if the Company finished in the fourth quartile.

Individual performance metrics consisted of discretionary personal goals that accounted for the remaining 20% of the potential award for each of the Named Executive Officers under either TIER I or TIER II. See footnote 6 to the below table for a discussion of these individual targets.

For fiscal 2023, Mr. Kanter’s target participation in the AIP was at 100% of his earned salary with the potential to earn up to 200% of the TIER I corporate targets and 100% of the TIER II corporate targets; Mr. Stratton's target participation was 60%

16

of his earned salary with the potential to earn up to 150% of the TIER I corporate targets and 100% of the TIER II corporate targets, and the target participation for Messrs. Molloy and Gaeta and Ms. Surette was 50% of their respective earned salaries with the potential to earn up to 150% of the TIER I corporate and departmental targets and 100% of the TIER II corporate targets. Mr. Kanter had the potential to earn up to 200% of his individual target and Messrs. Stratton, Molloy and Gaeta and Ms. Surette had the potential to earn up to 150% of their individual targets.

The 2023 AIP metrics were intended to be achievable, with an approximate 50% probability of achievement. The 2023 AIP performance metrics and actual results against these metrics were as follows:

|

|

Metric |

|

Award % |

|

Award % Weight for Metric for Mr. Gaeta |

Award % Weight for Metric for Ms. Surette |

Minimum/Maximum Potential Payout |

|

2023 Target |

2023 Actual |

Payout % earned |

TIER I - Company's Financial Performance (1) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Target 1 |

|

Sales |

|

40.0% |

|

20.0% |

20.0% |

100% payout at target, with 50% payout at 95.3% of target and 150% payout at 100.5% of target, with the exception of Mr. Kanter who is eligible for a maximum payout of 200% at 100.5% of target.

|

|

$576.9 million |

$521.8 million |

0.0% |

Corporate Target 2 |

|

Adjusted EBITDA (2) |

|

40.0% |

|

20.0% |

20.0% |

100% payout at target, with 50% payout at 91.6% of target and 150% payout at 102.3% of target, with the exception of Mr. Kanter who is eligible for a maximum payout of 200% at 102.3% of target.

|

|

$74.8 million |

$55.9 million |

0.0% |

Departmental Goals, if applicable |

|

Store Operations |

|

- |

|

40.0% |

- |

Includes payroll as a percentage of sales target, net promoter score target and store conversion target. |

|

(3) |

(3) |

(3) |

|

|

Merchandise, Planning and Allocation |

|

- |

|

- |

40.0% |

Includes targets for sales by category, gross margin rates by category, inventory turnover and store conversion target. |

|

(3) |

(3) |

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

TIER II - Company’s Financial Performance Measured Against the Company's 2023 Peers (1) |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate - Target 1 |

|

Comparable Sales (4)

|

|

40.0% |

|

40.0% |

40.0% |

Top Quartile 100%; 2nd Quartile 75%; 3rd Quartile 50%; 4th Quartile no payout. |

|

Top Quartile |

2nd Quartile |

75.0% |

Corporate - Target 2 |

|

Adjusted EBITDA Margin (5)

|

|

40.0% |

|

40.0% |

40.0% |

Top Quartile 100%; 2nd Quartile 75%; 3rd Quartile 50%; 4th Quartile no payout. |

|

Top Quartile |

Top Quartile |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL PERFORMANCE (6) |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

17

Individual Targets |

|

Discretionary- Personal Goals |

|

20.0% |

|

20.0% |

20.0% |

Discretionary, at target, based upon individual performance, were evaluated by the CEO (except with respect to the CEO whose individual performance was evaluated by the Compensation Committee). Participants were eligible to receive a discretionary award up to 30%, with the exception of Mr. Kanter who was eligible to receive a discretionary award up to 40%. |

|

20% |

Varied by NEO |

20-25% (30% for Mr. Kanter) |

As a result of achieving the performance targets under TIER II for fiscal 2023 pursuant to the 2023 AIP, as shown above, in April 2024 the Compensation Committee approved cash bonus payouts to our NEOs as follows:

Named Executive Officer |

|

Payout at |

|

|

Total |

|

|

Total Cash Payout |

|

|||

Harvey S. Kanter |

|

$ |

866,346 |

|

|

|

100 |

% |

|

$ |

866,346 |

|

Peter H. Stratton, Jr. |

|

$ |

248,896 |

|

|

|

90 |

% |

|

$ |

224,007 |

|

Anthony J. Gaeta |

|

$ |

195,914 |

|

|

|

95 |

% |

|

$ |

186,118 |

|

Robert S. Molloy |

|

$ |

196,712 |

|

|

|

95 |

% |

|

$ |

186,876 |

|

Allison Surette |

|

$ |

188,289 |

|

|

|

90 |

% |

|

$ |

169,460 |

|

2024 AIP

On April 1, 2024, the Compensation Committee established the financial, operating and performance metrics for the 2024 AIP. Given the continued uncertainty surrounding the U.S. economy and reduced consumer discretionary spending, the Compensation Committee believed that the two-tier approach used in fiscal 2023 provided the appropriate balance to keep employees engaged and motivated to achieve our strategic objectives. Similar to the 2023 AIP, the Compensation Committee added a second tier to the 2024 AIP program that would be a relative measure, comparing the Company's financial

18

performance in fiscal 2024 against the financial performance of its 2024 peer group, as discussed above under "Our Peer Group."

Under this two-tier structure, the payout related to corporate or departmental targets, if any, will be determined based on the higher achievement of either TIER I (based on the Company’s approved financial plan) or TIER II (based on the relative financial performance of the Company to its 2024 peers). The maximum payout under TIER I remains 150% (200% for Mr. Kanter); however, the maximum payout under TIER II is capped at 100%.

TIER I Company performance metrics are structured in the same manner as our historical AIPs and consist of corporate targets for Sales and Adjusted EBITDA with departmental targets for Store Operations, Marketing & Digital, and Merchandise/Planning and Allocation. Under TIER I, the Company’s financial performance metrics account for 80% of the potential award for Messrs. Kanter, Stratton and Molloy and 40% of the potential award for Mr. Gaeta and Ms. Surette. Mr. Gaeta’s performance metrics include specific store operation targets, and Ms. Surette's performance metrics include specific merchandising, planning and allocation targets, and account for 40% of their respective TIER I targets.

TIER II Company performance metrics consist of corporate targets for Comparable Sales and Adjusted EBITDA Margin, each accounting for 40% of the potential award for each participant. Our Comparable Sales and Adjusted EBITDA Margin results for fiscal 2024 will be compared to our 2024 peer group on a quartile ranking. For each metric, if the Company ranks in (i) the top quartile, the payout would be 100%; (ii) the second quartile, the payout would be 75%; and (iii) the third quartile, the payout would be 50%. No payout will be earned if the Company finishes in the fourth quartile.

Individual performance targets consisting of discretionary personal goals account for the remaining 20% of the potential award for each of the Named Executive Officers under either TIER I or TIER II. Mr. Kanter has the potential to earn up to 200% of his individual target and Messrs. Stratton, Molloy and Gaeta and Ms. Surette have the potential to earn up to 150% of their individual targets.

The 2024 AIP performance metrics approved by the Compensation Committee are as follows:

|

|

Metric |

|

Award % |

|

Award % Attributable to Metric for Mr. Gaeta |

Award % Attributable to Metric for Ms. Surette |

Minimum/Maximum Potential Payout |

|

TIER I - Company's Financial Performance |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Corporate Target 1 |

|

Sales (52-week year) |

|

40.0% |

|

20.0% |

20.0% |

100% payout at target, with 50% payout at 97.2% of target and 150% payout at 101.8% of target, with the exception of Mr. Kanter who is eligible for a maximum payout of 200% at 101.8% of target.

|

|

Corporate Target 2 |

|

Adjusted EBITDA |

|

40.0% |

|

20.0% |

20.0% |

100% payout at target, with 50% payout at 86.5% of target and 150% payout at 108.1% of target, with the exception of Mr. Kanter who is eligible for a maximum payout of 200% at 108.1% of target.

|

|

Departmental Goals, if applicable |

|

Store Operations |

|

- |

|

40.0% |

- |

Includes payroll as a percentage of sales target, net promoter score target and store conversion target. |

|

|

|

Merchandise, Planning and Allocation |

|

- |

|

- |

40.0% |

Includes targets for sales by category, gross margin rates by category, inventory turnover and store conversion target. |

|

|

|

|

|

|

|

|

|

Departmental goals payouts range from 50% to 150% dependent upon achievement of the various targets. |

|

TIER II - Company's Financial Performance Measured Against the Company's 2024 Peers |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Corporate - Target 1 |

|

Comparable Sales

|

|

40.0% |

|

40.0% |

40.0% |

Top Quartile 100%; 2nd Quartile 75%; 3rd Quartile 50%; 4th Quartile no payout. |

|

Corporate - Target 2 |

|

Adjusted EBITDA Margin

|

|

40.0% |

|

40.0% |

40.0% |

Top Quartile 100%; 2nd Quartile 75%; 3rd Quartile 50%; 4th Quartile no payout. |

|

19

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL PERFORMANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Targets |

|

Discretionary- Personal Goals |

|

20.0% |

|

20.0% |

20.0% |

Discretionary, at target, based upon individual performance, as evaluated by the CEO (except with respect to the CEO whose individual performance will be evaluated by the Compensation Committee). Participants are eligible to receive a discretionary award up to 30%, with the exception of Mr. Kanter who is eligible to receive a discretionary award up to 40%. |

|

|

|

|

|

|

|

|

|

|

|

The above targets for each metric in TIER I were derived from the Company’s annual operating plan and budget for the 2024 fiscal year, and are intended to be achievable, with an approximate 50% probability of achievement. The likelihood of achieving the 2024 targets reflects the challenges inherent in achieving the goals and objectives of an ambitious operating plan, given the continuing uncertainty with respect to the economy, higher costs, and consumer discretionary spending. The Compensation Committee's adoption of the TIER II plan is to ensure that all participants in the AIP will be motivated in fiscal 2024.

For fiscal 2024, Mr. Kanter will continue to participate at 100% of his salary, Mr. Stratton will continue to participate at 60% of his salary, and Messrs. Molloy and Gaeta and Ms. Surette will continue to participate at 50% of their respective salaries.