| As filed with the Securities and Exchange Commission on | ||

| <R> | ||

| November 28, 2012 | ||

| </R> | ||

| Registration No. 2-10816 | ||

| 811-00058 | ||

| ----------------------------------------------------------------- | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| WASHINGTON, D.C. 20549 | ||

| --------------- | ||

| FORM N-1A | ||

| ---- | ||

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | / X / | |

| ---- | ||

| ---- | ||

| Pre-Effective Amendment No. | / / | |

| ---- | ||

| ---- | ||

| <R> | ||

| Post-Effective Amendment No. 104 | / X / | |

| </R> | ||

| and/or | ---- | |

| ---- | ||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY | / X / | |

| ACT OF 1940 | ---- | |

| ---- | ||

| <R> | ||

| Amendment No. 38 | / X / | |

| </R> | ||

| (Check appropriate box or boxes) | ---- | |

| --------------- | ||

| THE GEORGE PUTNAM FUND OF BOSTON | ||

| (Exact Name of Registrant as Specified in Charter) | ||

| One Post Office Square, Boston, Massachusetts 02109 | ||

| (Address of Principal Executive Offices) (Zip Code) | ||

| Registrant's Telephone Number, including Area Code | ||

| (617) 292-1000 | ||

| -------------- | ||

| It is proposed that this filing will become effective | ||

| (check appropriate box) | ||

| ---- | ||

| / / | immediately upon filing pursuant to paragraph (b) | |

| ---- | ||

| ---- | ||

| <R> | ||

| / X / | on November 30, 2012 pursuant to paragraph (b) | |

| </R> | ||

| ---- | ||

| ---- | ||

| / / | 60 days after filing pursuant to paragraph (a)(1) | |

| ---- | ||

| ---- | ||

| / / | on (date) pursuant to paragraph (a)(1) | |

| ---- | ||

| ---- | ||

| / / | 75 days after filing pursuant to paragraph (a)(2) | |

| ---- | ||

| ---- | ||

| / / | on (date) pursuant to paragraph (a)(2) of Rule 485. | |

| ---- | ||

| If appropriate, check the following box: | ||

| ---- | ||

| / / | this post-effective amendment designates a new | |

| ---- | effective date for a previously filed post-effective amendment. | |

| ----------------------- | ||

| <R> | ||

| ROBERT T. BURNS, Vice President | ||

| </R> | ||

| THE GEORGE PUTNAM FUND OF BOSTON | ||

| One Post Office Square | ||

| Boston, Massachusetts 02109 | ||

| (Name and address of agent for service) | ||

| --------------- | ||

| Copy to: | ||

| JOHN W. GERSTMAYR, Esquire | ||

| ROPES & GRAY LLP | ||

| Prudential Tower | ||

| 800 Boylston Street | ||

| Boston, Massachusetts 02199-3600 | ||

| FUND SYMBOLS | CLASS A | CLASS B | CLASS C | CLASS M | CLASS R | CLASS Y |

| PGEOX | PGEBX | PGPCX | PGEMX | PGPRX | PGEYX |

George Putnam

Balanced

Fund

Prospectus

11 | 30 | 12

| Fund summary | 2 |

| What are the fund’s main investment strategies and related risks? | 6 |

| Who oversees and manages the fund? | 12 |

| How does the fund price its shares? | 14 |

| How do I buy fund shares? | 15 |

| How do I sell or exchange fund shares? | 22 |

| Policy on excessive short-term trading | 24 |

| Distribution plans and payments to dealers | 27 |

| Fund distributions and taxes | 29 |

| Financial highlights | 31 |

| <R> | |

| Investment Category: Value | These securities have not been approved |

| or disapproved by the Securities and | |

| This prospectus explains what | Exchange Commission (SEC) nor has |

| you should know about this | the SEC passed upon the accuracy |

| mutual fund before you invest. | or adequacy of this prospectus. Any |

| Please read it carefully. | statement to the contrary is a crime. |

| </R> |

Fund summary

Goal

George Putnam Balanced Fund seeks to provide a balanced investment composed of a well-diversified portfolio of stocks and bonds which produce both capital growth and current income.

Fees and expenses

The following table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Putnam funds. More information about these and other discounts is available from your financial advisor and in How do I buy fund shares? beginning on page 15 of the fund’s prospectus and in How to buy shares beginning on page II-1 of the fund’s statement of additional information (SAI).

Shareholder fees (fees paid directly from your investment)

| Maximum deferred sales charge | ||

| Maximum sales charge (load) | (load) (as a percentage of original | |

| imposed on purchases (as a | purchase price or redemption | |

| Share class | percentage of offering price) | proceeds, whichever is lower) |

| Class A | 5.75% | 1.00%* |

| Class B | NONE | 5.00%** |

| Class C | NONE | 1.00%*** |

| Class M | 3.50% | 0.65%* |

| Class R | NONE | NONE |

| Class Y | NONE | NONE |

Annual fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

| Distribution | Total annual | |||

| Management | and service | Other | fund operating | |

| Share class | fees | (12b-1) fees | expenses | expenses |

| <R> | ||||

| Class A | 0.54% | 0.25% | 0.25% | 1.04% |

| Class B | 0.54% | 1.00% | 0.25% | 1.79% |

| Class C | 0.54% | 1.00% | 0.25% | 1.79% |

| Class M | 0.54% | 0.75% | 0.25% | 1.54% |

| Class R | 0.54% | 0.50% | 0.25% | 1.29% |

| Class Y | 0.54% | N/A | 0.25% | 0.79% |

* Applies only to certain redemptions of shares bought with no initial sales charge.

** This charge is phased out over six years.

*** This charge is eliminated after one year.

</R>| 2 Prospectus | |

Example

The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower.

| Share class | 1 year | 3 years | 5 years | 10 years |

| <R> | ||||

| Class A | $675 | $887 | $1,116 | $1,773 |

| Class B | $682 | $863 | $1,170 | $1,908 |

| Class B (no redemption) | $182 | $563 | $970 | $1,908 |

| Class C | $282 | $563 | $970 | $2,105 |

| Class C (no redemption) | $182 | $563 | $970 | $2,105 |

| Class M | $501 | $819 | $1,160 | $2,120 |

| Class R | $131 | $409 | $708 | $1,556 |

| Class Y | $81 | $252 | $439 | $978 |

Portfolio turnover

<R>The fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund performance. The fund’s turnover rate in the most recent fiscal year was 99%.

</R>Investments, risks, and performance

Investments

<R>We invest mainly in a combination of bonds and value stocks of large and midsized U.S. companies with a greater focus on value stocks. Value stocks are those that we believe are currently undervalued by the market. If we are correct and other investors ultimately recognize the value of the company, the price of its stock may rise. We buy bonds of governments and private companies that are mostly investment-grade in quality with intermediate- to long-term maturities (three years or longer). We may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell equity investments, and, among other factors, credit, interest rate and prepayment risks, as well as general market conditions, when deciding whether to buy or sell fixed income investments. We may also use derivatives, such as futures, options, warrants and swap contracts, for both hedging and non-hedging purposes.

</R>| Prospectus 3 | |

Risks

It is important to understand that you can lose money by investing in the fund.

The prices of stocks and bonds in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific company or industry. These risks are generally greater for small and midsize companies. Value stocks may fail to rebound, and the market may not favor value-style investing. The risks associated with bond investments include interest rate risk, which means the prices of the fund’s investments are likely to fall if interest rates rise. Interest rate risk is generally greater for longer term bonds. Bond investments are also subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Our use of derivatives may increase these risks by increasing investment exposure or, in the case of many over-the-counter instruments, because of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations.

The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

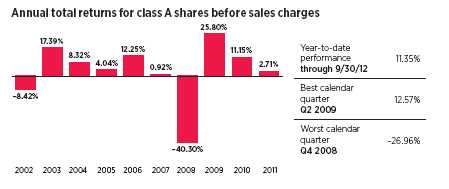

Performance

The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. The bar chart does not reflect the impact of sales charges. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the fund are available at putnam.com.

| 4 Prospectus | |

Average annual total returns after sales charges

(for periods ending 12/31/11)

| Share class | 1 year | 5 years | 10 years |

| Class A before taxes | –3.21% | –4.00% | 1.04% |

| Class A after taxes on distributions | –3.46% | –5.00% | –0.03% |

| Class A after taxes on distributions and | |||

| sale of fund shares | –1.78% | –3.66% | 0.54% |

| Class B before taxes | –3.10% | –3.92% | 0.87% |

| Class C before taxes | 0.86% | –3.58% | 0.88% |

| Class M before taxes | –1.47% | –4.01% | 0.78% |

| Class R before taxes | 2.45% | –3.07% | 1.41% |

| Class Y before taxes | 2.97% | –2.60% | 1.91% |

| Russell 1000 Value Index (no deduction for | |||

| fees, expenses or taxes) | 0.39% | –2.64% | 3.89% |

| Barclays U.S. Aggregate Bond Index | |||

| (no deduction for fees, expenses or taxes) | 7.84% | 6.50% | 5.78% |

| George Putnam Blended Index | |||

| (no deduction for fees, expenses or taxes) | 4.21% | 2.08% | 5.42% |

The George Putnam Blended Index is an unmanaged index administered by Putnam Management, 60% of which is the Russell 1000 Value Index and 40% of which is the Barclays U.S. Aggregate Bond Index.

</R>After-tax returns reflect the historical highest individual federal marginal income tax rates and do not reflect state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown for class A shares only and will vary for other classes. These after-tax returns do not apply if you hold your fund shares through a 401(k) plan, an IRA, or another tax-advantaged arrangement.

<R>Class B share performance does not reflect conversion to class A shares.

</R>Your fund’s management

Investment advisor

Putnam Investment Management, LLC

Portfolio managers

David Calabro, Portfolio Manager, portfolio manager of the fund since 2008

<R>Kevin Murphy, Portfolio Manager, portfolio manager of the fund since 2012

</R>Purchase and sale of fund shares

You can open an account, purchase and/or sell fund shares, or exchange them for shares of another Putnam fund by contacting your financial advisor or by calling Putnam Investor Services at 1-800-225-1581.

| Prospectus 5 | |

When opening an account, you must complete and mail a Putnam account application, along with a check made payable to the fund, to: Putnam Investor Services, P.O. Box 8383, Boston, MA 02266-8383. The minimum initial investment of $500 is currently waived, although Putnam reserves the right to reject initial investments under $500 at its discretion. There is no minimum for subsequent investments.

You can sell your shares back to the fund or exchange them for shares of another Putnam fund any day the New York Stock Exchange (NYSE) is open. Shares may be sold or exchanged by mail, by phone, or online at putnam.com. Some restrictions may apply.

Tax information

The fund’s distributions will be taxed as ordinary income or capital gains unless you hold the shares through a tax-advantaged arrangement, in which case you will generally be taxed only upon withdrawal of monies from the arrangement.

Financial intermediary compensation

If you purchase the fund through a broker/dealer or other financial intermediary (such as a bank or financial advisor), the fund and its related companies may pay that intermediary for the sale of fund shares and related services. Please bear in mind that these payments may create a conflict of interest by influencing the broker/dealer or other intermediary to recommend the fund over another investment. Ask your advisor or visit your advisor’s website for more information.

What are the fund’s main investment strategies and related risks?

This section contains greater detail on the fund’s main investment strategies and the related risks you would face as a fund shareholder. It is important to keep in mind that risk and reward generally go hand in hand; the higher the potential reward, the greater the risk. As mentioned in the fund summary, we pursue the fund’s goal by investing mainly in bonds and value stocks, with a greater emphasis on value stocks. However, under normal circumstances, we invest at least 25% of the fund’s total assets in fixed-income securities, including debt securities, preferred stocks and that portion of the value of convertible securities attributable to the fixed-income characteristics of those securities.

| 6 Prospectus | |

• Common stocks. Common stock represents an ownership interest in a company. The value of a company’s stock may fall as a result of factors directly relating to that company, such as decisions made by its management or lower demand for the company’s products or services. A stock’s value may also fall because of factors affecting not just the company, but also other companies in the same industry or in a number of different industries, such as increases in production costs. From time to time, the fund may invest a significant portion of its assets in companies in one or more related industries or sectors, which would make the fund more vulnerable to adverse developments affecting those industries or sectors. The value of a company’s stock may also be affected by changes in financial markets that are relatively unrelated to the company or its industry, such as changes in interest rates or currency exchange rates. In addition, a company’s stock generally pays dividends only after the company invests in its own business and makes required payments to holders of its bonds and other debt. For this reason, the value of a company’s stock will usually react more strongly than its bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. Stocks of smaller companies may be more vulnerable to adverse developments than those of larger companies.

Value stocks — Companies whose stocks we believe are undervalued by the market may have experienced adverse business developments or may be subject to special risks that have caused their stocks to be out of favor. If our assessment of a company’s prospects is wrong, or if other investors do not similarly recognize the value of the company, then the price of the company’s stock may fall or may not approach the value that we have placed on it.

<R>• Small and midsize companies. These companies, some of which may have a market capitalization of less than $1 billion, are more likely than larger companies to have limited product lines, markets or financial resources, or to depend on a small, inexperienced management group. Stocks of these companies often trade less frequently and in limited volume, and their prices may fluctuate more than stocks of larger companies. Stocks of small and midsize companies may therefore be more vulnerable to adverse developments than those of larger companies.

</R>• Interest rate risk. The values of bonds and other debt instruments usually rise and fall in response to changes in interest rates. Declining interest rates generally increase the value of existing debt instruments, and rising interest rates generally decrease the value of existing debt instruments. Changes in a debt instrument’s value usually will not affect the amount of interest income paid to the fund, but will affect the value of the fund’s shares. Interest rate risk is generally greater for investments with longer maturities.

| Prospectus 7 | |

In evaluating the potential performance of an investment in the fund, investors may find it useful to compare the fund’s current dividend rate with its “yield,” which is computed on a yield-to-maturity basis in accordance with SEC regulations and which reflects amortization of market premiums.

Some investments give the issuer the option to call or redeem an investment before its maturity date. If an issuer calls or redeems an investment during a time of declining interest rates, we might have to reinvest the proceeds in an investment offering a lower yield, and therefore the fund might not benefit from any increase in value as a result of declining interest rates.

• Credit risk. Investors normally expect to be compensated in proportion to the risk they are assuming. Thus, debt of issuers with poor credit prospects usually offers higher yields than debt of issuers with more secure credit. Higher-rated investments generally have lower credit risk.

We invest mostly in investment-grade debt investments. These are rated at least BBB or its equivalent at the time of purchase by a nationally recognized securities rating agency, or are unrated investments that we believe are of comparable quality. We may invest in below-investment-grade investments. However, we will not invest in securities that are rated lower than B or its equivalent by each rating agency rating the investment, or are unrated securities that we believe are of comparable quality. We will not necessarily sell an investment if its rating is reduced after we buy it.

<R>Investments rated below BBB or its equivalent are below investment grade. This rating reflects a greater possibility that the issuers may be unable to make timely payments of interest and principal and thus default. If this happens, or is perceived as likely to happen, the values of those investments will usually be more volatile and are likely to fall. A default or expected default could also make it difficult for us to sell the investments at prices approximating the values we had previously placed on them. Lower-rated debt usually has a more limited market than higher-rated debt, which may at times make it difficult for us to buy or sell certain debt instruments or to establish their fair value. Credit risk is generally greater for zero coupon bonds and other investments that are issued at less than their face value and that are required to make interest payments only at maturity rather than at intervals during the life of the investment. Although investment-grade investments generally have lower credit risk, they may share some of the risks of lower-rated investments. U.S. government investments generally have the least credit risk, but are not completely free of credit risk. While some investments, such as U.S. Treasury obligations and Ginnie Mae certificates, are backed by the full faith and credit of the U.S. government, others are backed only by the credit of the issuer.

</R>| 8 Prospectus | |

Credit ratings are based largely on the issuer’s historical financial condition and the rating agencies’ investment analysis at the time of rating. The rating assigned to any particular investment does not necessarily reflect the issuer’s current financial condition, and does not reflect an assessment of the investment’s volatility or liquidity. Although we consider credit ratings in making investment decisions, we perform our own investment analysis and do not rely only on ratings assigned by the rating agencies. Our success in achieving the fund’s investment objective may depend more on our own credit analysis when we buy lower-rated debt than when we buy investment-grade debt. We may have to participate in legal proceedings involving the issuer or take possession of and manage assets that secure the issuer’s obligations. This could increase the fund’s operating expenses and decrease its net asset value.

Some convertible securities receive payments only after the company has paid the holders of its non-convertible debt; for this reason, the credit risk of a company’s convertible securities can be greater than that of its non-convertible debt.

• Prepayment risk. Traditional debt investments typically pay a fixed rate of interest until maturity, when the entire principal amount is due. By contrast, payments on mortgage-backed investments typically include both interest and partial payment of principal. Principal may also be prepaid voluntarily, or as a result of refinancing or foreclosure. We may have to invest the proceeds from prepaid investments in other investments with less attractive terms and yields.

Compared to debt that cannot be prepaid, mortgage-backed investments are less likely to increase in value during periods of declining interest rates and have a higher risk of decline in value during periods of rising interest rates. Such investments may increase the volatility of the fund. Some mortgage-backed investments receive only the interest portion or the principal portion of payments on the underlying mortgages. The yields and values of these investments are extremely sensitive to changes in interest rates and in the rate of principal payments on the underlying mortgages. The market for these investments may be volatile and limited, which may make them difficult to buy or sell. Asset-backed securities are structured like mortgage-backed securities, but instead of mortgage loans or interests in mortgage loans, the underlying assets may include such items as motor vehicle installment sales or installment loan contracts, leases of various types of real and personal property and receivables from credit card agreements. Asset-backed securities are subject to risks similar to those of mortgage-backed securities.

| Prospectus 9 | |

<R>

• Foreign investments. We may invest in foreign investments, although they do not represent a primary focus of the fund. Foreign investments involve certain special risks. For example, their values may decline in response to changes in currency exchange rates, unfavorable political and legal developments, unreliable or untimely information, and economic and financial instability. In addition, the liquidity of these investments may be more limited than for most U.S. investments, which means we may at times be unable to sell them at desirable prices. Foreign settlement procedures may also involve additional risks. These risks are generally greater in the case of developing (also known as emerging) markets, which typically have less developed legal and financial systems.

Certain of these risks may also apply to some extent to U.S.-traded investments that are denominated in foreign currencies, investments in U.S. companies that are traded in foreign markets or investments in U.S. companies that have significant foreign operations.

• Derivatives. We may engage in a variety of transactions involving derivatives, such as futures, options, warrants and swap contracts. Derivatives are financial instruments whose value depends upon, or is derived from, the value of something else, such as one or more underlying investments, pools of investments, indexes or currencies. We may make use of “short” derivatives positions, the values of which move in the opposite direction from the price of the underlying investment, pool of investments, index or currency. We may use derivatives both for hedging and non-hedging purposes, including as a substitute for a direct investment in the securities of one or more issuers. However, we may also choose not to use derivatives, based on our evaluation of market conditions or the availability of suitable derivatives. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

</R>Derivatives involve special risks and may result in losses. The successful use of derivatives depends on our ability to manage these sophisticated instruments. Some derivatives are “leveraged,” which means that they provide the fund with investment exposure greater than the value of the fund’s investment in the derivatives. As a result, these derivatives may magnify or otherwise increase investment losses to the fund. The risk of loss from certain short derivatives positions is theoretically unlimited. The prices of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility.

| 10 Prospectus | |

Other risks arise from the potential inability to terminate or sell derivatives positions. A liquid secondary market may not always exist for the fund’s derivatives positions at any time. In fact, many over-the-counter instruments (investments not traded on an exchange) will not be liquid. Over-the-counter instruments also involve the risk that the other party to the derivatives transaction will not meet its obligations. For further information about the risks of derivatives, see Miscellaneous Investments, Investment Practices and Risks in the SAI.

<R>• Other investments. In addition to the main investment strategies described above, the fund may make other types of investments, such as investments in preferred stocks, convertible securities and asset-backed securities. The fund may also loan portfolio securities to earn income. These practices may be subject to other risks, as described under Miscellaneous Investments, Investment Practices and Risks in the SAI.

• Alternative strategies. At times we may judge that market conditions make pursuing the fund’s usual investment strategies inconsistent with the best interests of its shareholders. We then may temporarily invest some or all of the fund’s assets by using alternative strategies, such as taking defensive positions, that are mainly designed to limit losses. However, we may choose not to use these strategies for a variety of reasons, even in very volatile market conditions. These strategies may cause the fund to miss out on investment opportunities, and may prevent the fund from achieving its goal.

• Changes in policies. The Trustees may change the fund’s goal, investment strategies and other policies set forth in this prospectus without shareholder approval, except as otherwise provided.

• Portfolio turnover rate. The fund’s portfolio turnover rate measures how frequently the fund buys and sells investments. A portfolio turnover rate of 100%, for example, would mean that the fund sold and replaced securities valued at 100% of the fund’s assets within a one-year period. From time to time the fund may engage in frequent trading. Funds with high turnover may be more likely to realize capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance. A fund’s portfolio turnover rate and the amount of brokerage commissions it pays will vary over time based on market conditions.

• Portfolio holdings. The SAI includes a description of the fund’s policies with respect to the disclosure of its portfolio holdings. For more specific information on the fund’s portfolio, you may visit the Putnam Investments website, putnam.com/individual, where the fund’s top 10 holdings and related portfolio information may be viewed monthly beginning approximately

| Prospectus 11 | |

15 days after the end of each month, and full portfolio holdings may be viewed beginning on the last business day of the month after the end of each calendar quarter. This information will remain available on the website until the fund files a Form N-CSR or N-Q with the SEC for the period that includes the date of the information, after which such information can be found on the SEC’s website at http://www.sec.gov.

</R>Who oversees and manages the fund?

<R>The fund’s Trustees

As a shareholder of a mutual fund, you have certain rights and protections, including representation by a Board of Trustees. The Putnam Funds’ Board of Trustees oversees the general conduct of the fund’s business and represents the interests of the Putnam fund shareholders. At least 75% of the members of the Putnam Funds’ Board of Trustees are independent, which means they are not officers of the fund or affiliated with Putnam Investment Management, LLC (Putnam Management).

</R>The Trustees periodically review the fund’s investment performance and the quality of other services such as administration, custody, and investor services. At least annually, the Trustees review the fees paid to Putnam Management and its affiliates for providing or overseeing these services, as well as the overall level of the fund’s operating expenses. In carrying out their responsibilities, the Trustees are assisted by an administrative staff, auditors and legal counsel that are selected by the Trustees and are independent of Putnam Management and its affiliates.

Contacting the fund’s Trustees

Address correspondence to:

The Putnam Funds Trustees

One Post Office Square

Boston, MA 02109

The fund’s investment manager

<R>The Trustees have retained Putnam Management, which has managed mutual funds since 1937, to be the fund’s investment manager, responsible for making investment decisions for the fund and managing the fund’s other affairs and business. The basis for the Trustees’ approval of the fund’s management contract and the sub-management contract described below is discussed in the fund’s annual report to shareholders dated July 31, 2012.

| 12 Prospectus | |

The fund pays a monthly management fee to Putnam Management. The fee is calculated by applying a rate to the fund’s average net assets for the month. The rate is based on the monthly average of the aggregate net assets of all open-end funds sponsored by Putnam Management (excluding fund assets that are invested in other Putnam funds). The fund paid Putnam Management a management fee (after any applicable waivers) of 0.54% of average net assets for the fund’s last fiscal year.

</R>Putnam Management’s address is One Post Office Square, Boston, MA 02109.

Putnam Management has retained its affiliate Putnam Investments Limited (PIL) to make investment decisions for such fund assets as may be designated from time to time for its management by Putnam Management. Putnam Management (and not the fund) will pay a quarterly sub-management fee to PIL for its services at the annual rate of 0.40% of the average aggregate net asset value of any fund assets managed by PIL. PIL, which provides a full range of international investment advisory services to institutional clients, is located at Cassini House, 57–59 St James’s Street, London, England, SW1A 1LD.

Pursuant to this arrangement, Putnam investment professionals who are based in foreign jurisdictions may serve as portfolio managers of the fund or provide other investment services, consistent with local regulations.

• Portfolio managers. The officers of Putnam Management identified below are primarily responsible for the day-to-day management of the fund’s portfolio.

| Portfolio managers | Joined fund | Employer | Positions over past five years |

| David Calabro | 2008 | Putnam Management | Portfolio Manager |

| 2008 – Present | |||

| <R> | |||

| MFS Investment | Portfolio Manager | ||

| Management | |||

| Prior to 2008 | |||

| Kevin Murphy | 2012 | Putnam Management | Portfolio Manager |

| 1999 – Present | Previously, Team Leader, | ||

| High Grade Credit | |||

The SAI provides information about these individuals’ compensation, other accounts managed by these individuals and these individuals’ ownership of securities in the fund.

| Prospectus 13 | |

How does the fund price its shares?

The price of the fund’s shares is based on its net asset value (NAV). The NAV per share of each class equals the total value of its assets, less its liabilities, divided by the number of its outstanding shares. Shares are only valued as of the close of regular trading on the NYSE each day the exchange is open.

<R>The fund values its investments for which market quotations are readily available at market value. It values short-term investments that will mature within 60 days at amortized cost, which approximates market value. It values all other investments and assets at their fair value, which may differ from recent market prices. For example, the fund may value a stock traded on a U.S. exchange at its fair value when the exchange closes early or trading in the stock is suspended. It may also value a stock at fair value if recent transactions in the stock have been very limited or if, in the case of a security traded on a market that closes before the NYSE closes, material information about the issuer becomes available after the close of the relevant market. Market quotations are not considered to be readily available for many debt securities. These securities are generally valued at fair value on the basis of valuations provided by an independent pricing service approved by the fund’s Trustees or dealers selected by Putnam Management. Pricing services and dealers determine valuations for normal institutional-size trading units of such securities using information with respect to transactions in the bond being valued, market transactions for comparable securities and various relationships, generally recognized by institutional traders, between securities. To the extent a pricing service or dealer is unable to value a security or provides a valuation which Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management.

The fund translates prices for its investments quoted in foreign currencies into U.S. dollars at current exchange rates, which are generally determined as of 4:00 p.m. Eastern time each day the NYSE is open. As a result, changes in the value of those currencies in relation to the U.S. dollar may affect the fund’s NAV. Because foreign markets may be open at different times than the NYSE, the value of the fund’s shares may change on days when shareholders are not able to buy or sell them. Many securities markets and exchanges outside the U.S. close before the close of the NYSE and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the NYSE. As a result, the fund has adopted fair value pricing procedures, which, among other things, require the fund to fair value foreign equity securities if there has been a movement in the U.S. market that exceeds a specified threshold that may

| 14 Prospectus | |

change from time to time. If events materially affecting the values of the fund’s foreign fixed-income investments occur between the close of foreign markets and the close of regular trading on the NYSE, these investments will also be valued at their fair value. As noted above, the value determined for an investment using the fund’s fair value pricing procedures may differ from recent market prices for the investment.

</R>How do I buy fund shares?

Opening an account

You can open a fund account and purchase class A, B, C, and M shares by contacting your financial representative or Putnam Investor Services at 1-800-225-1581 and obtaining a Putnam account application. The completed application, along with a check made payable to the fund, must then be returned to Putnam Investor Services at the following address:

Putnam Investor Services

P.O. Box 8383

Boston, MA 02266-8383

You can open a fund account with as little as $500. The minimum investment is waived if you make regular investments weekly, semi-monthly or monthly through automatic deductions from your bank checking or savings account. Although Putnam is currently waiving the minimum, it reserves the right to reject initial investments under the minimum at its discretion.

The fund sells its shares at the offering price, which is the NAV plus any applicable sales charge (class A and class M shares only). Your financial representative or Putnam Investor Services generally must receive your completed buy order before the close of regular trading on the NYSE for your shares to be bought at that day’s offering price.

If you participate in a retirement plan that offers the fund, please consult your employer for information on how to purchase shares of the fund through the plan, including any restrictions or limitations that may apply.

Mutual funds must obtain and verify information that identifies investors opening new accounts. If the fund is unable to collect the required information, Putnam Investor Services may not be able to open your fund account. Investors must provide their full name, residential or business address, Social Security or tax identification number, and date of birth. Entities, such as trusts, estates, corporations and partnerships, must also provide other identifying information. Putnam Investor Services may share identifying information with third parties for the purpose of verification. If

| Prospectus 15 | |

Putnam Investor Services cannot verify identifying information after opening your account, the fund reserves the right to close your account.

Also, the fund may periodically close to new purchases of shares or refuse any order to buy shares if the fund determines that doing so would be in the best interests of the fund and its shareholders.

Purchasing additional shares

Once you have an existing account, you can make additional investments at any time in any amount in the following ways:

• Through a financial representative. Your representative will be responsible for furnishing all necessary documents to Putnam Investor Services and may charge you for his or her services.

• Through Putnam’s Systematic Investing Program. You can make regular investments weekly, semi-monthly or monthly through automatic deductions from your bank checking or savings account.

• Via the Internet or phone. If you have an existing Putnam fund account and you have completed and returned an Electronic Investment Authorization Form, you can buy additional shares online at putnam.com or by calling Putnam Investor Services at 1-800-225-1581.

• By mail. You may also request a book of investment stubs for your account. Complete an investment stub and write a check for the amount you wish to invest, payable to the fund. Return the check and investment stub to Putnam Investor Services.

• By wire transfer. You may buy fund shares by bank wire transfer of same-day funds. Please call Putnam Investor Services at 1-800-225-1581 for wiring instructions. Any commercial bank can transfer same-day funds by wire. The fund will normally accept wired funds for investment on the day received if they are received by the fund’s designated bank before the close of regular trading on the NYSE. Your bank may charge you for wiring same-day funds.

Although the fund’s designated bank does not currently charge you for receiving same-day funds, it reserves the right to charge for this service. You cannot buy shares for tax-qualified retirement plans by wire transfer.

Which class of shares is best for me?

<R>This prospectus offers you four classes of fund shares: A, B, C and M. Qualified employee-benefit plans may also choose class R shares, and certain investors described below may also choose class Y shares. Each share class represents investments in the same portfolio of securities, but each class has its own sales charge and expense structure, as illustrated in the Fund summary — Fees and expenses section, allowing you and your financial representative to

| 16 Prospectus | |

choose the class that best suits your investment needs. When you purchase shares of a fund, you must choose a share class. Deciding which share class best suits your situation depends on a number of factors that you should discuss with your financial representative, including:

</R>• How long you expect to hold your investment. Class B shares charge a contingent deferred sales charge (CDSC) on redemptions that is phased out over the first six years; class C shares charge a CDSC on redemptions in the first year.

• How much you intend to invest. While investments of less than $100,000 can be made in any share class, classes A and M offer sales charge discounts starting at $50,000.

• Total expenses associated with each share class. As shown in the section entitled Fund summary — Fees and expenses, each share class offers a different combination of up-front and ongoing expenses. Generally, the lower the up-front sales charge, the greater the ongoing expenses.

Here is a summary of the differences among the classes of shares

Class A shares

• Initial sales charge of up to 5.75%

• Lower sales charges available for investments of $50,000 or more

• No deferred sales charge (except that a deferred sales charge of 1.00% may be imposed on certain redemptions of shares bought without an initial sales charge)

<R>• Lower annual expenses, and higher dividends, than class B, C or M shares because of lower 12b-1 fees.

</R>Class B shares

• No initial sales charge; your entire investment goes to work immediately

• Deferred sales charge of up to 5.00% if shares are sold within six years of purchase

• Higher annual expenses, and lower dividends, than class A or M shares because of higher 12b-1 fees

• Convert automatically to class A shares after eight years, thereby reducing future 12b-1 fees

• Orders for class B shares of one or more Putnam funds will be refused when the total value of the purchase, plus existing account balances that are eligible to be linked under a right of accumulation for purchases of class A shares (as described below), is $100,000 or more. Investors considering cumulative purchases of $100,000 or more should consider whether class A shares would be more advantageous and consult their financial representative.

| Prospectus 17 | |

Class C shares

• No initial sales charge; your entire investment goes to work immediately

• Deferred sales charge of 1.00% if shares are sold within one year of purchase

• Higher annual expenses, and lower dividends, than class A or M shares because of higher 12b-1 fees

• No conversion to class A shares, so future 12b-1 fees do not decline over time

• Orders for class C shares of one or more Putnam funds, other than class C shares sold to qualified employee-benefit plans, will be refused when the total value of the purchase, plus existing account balances that are eligible to be linked under a right of accumulation for purchases of class A shares (as described below), is $1,000,000 or more. Investors considering cumulative purchases of $1,000,000 or more should consider whether class A shares would be more advantageous and consult their financial representative.

Class M shares

• Initial sales charge of up to 3.50%

• Lower sales charges available for investments of $50,000 or more

• No deferred sales charge (except that a deferred sales charge of 0.65% may be imposed on certain redemptions of shares bought without an initial sales charge)

• Lower annual expenses, and higher dividends, than class B or C shares because of lower 12b-1 fees

• Higher annual expenses, and lower dividends, than class A shares because of higher 12b-1 fees

• No conversion to class A shares, so future 12b-1 fees do not decline over time

• Orders for class M shares of one or more Putnam funds, other than class M shares sold to qualified employee-benefit plans, will be refused when the total value of the purchase, plus existing account balances that are eligible to be linked under a right of accumulation for purchases of class A shares (as described below), is $1,000,000 or more. Investors considering cumulative purchases of $1,000,000 or more should consider whether class A shares would be more advantageous and consult their financial representative.

Class R shares (available to qualified plans only)

• No initial sales charge; your entire investment goes to work immediately

• No deferred sales charge

| 18 Prospectus | |

• Lower annual expenses, and higher dividends, than class B, C or M shares because of lower 12b-1 fees

• Higher annual expenses, and lower dividends, than class A shares because of higher 12b-1 fees

• No conversion to class A shares, so future 12b-1 fees do not decline over time.

Class Y shares (available only to investors listed below)

<R>The following investors may purchase class Y shares if approved by Putnam:

</R>• qualified retirement plans that are clients of third-party administrators (including affiliates of Putnam) that have entered into agreements with Putnam and offer institutional share class pricing (no sales charge or 12b-1 fee);

• bank trust departments and trust companies that have entered into agreements with Putnam and offer institutional share class pricing to their clients;

• corporate IRAs administered by Putnam, if another retirement plan of the sponsor is eligible to purchase class Y shares;

• college savings plans that qualify for tax-exempt treatment under Section 529 of the Internal Revenue Code;

• other Putnam funds and Putnam investment products;

<R>• investors purchasing shares through an asset-based fee program that regularly offers institutional share classes and that is sponsored by a registered broker-dealer or other financial institution;

</R>• clients of a financial representative who are charged a fee for consulting or similar services;

<R>• corporations, endowments and foundations that have entered into an arrangement with Putnam;

• fee-paying clients of a registered investment advisor (RIA) who initially invests for clients an aggregate of at least $100,000 in Putnam funds; and

• current and retired Putnam employees and their immediate family members (including an employee’s spouse, domestic partner, fiancé(e), or other family members who are living in the same household), current and retired directors of Putnam Investments, LLC, and current and retired Trustees of the fund. Upon the departure of any member of this group of individuals from Putnam or the fund’s Board of Trustees, the member’s class Y shares would convert automatically to class A shares, unless the member’s departure is a retirement, as determined by Putnam in its discretion for employees and directors and by the Board of Trustees in its discretion for Trustees.

</R>| Prospectus 19 | |

Trust companies or bank trust departments that purchased class Y shares for trust accounts may transfer them to the beneficiaries of the trust accounts, who may continue to hold them or exchange them for class Y shares of other Putnam funds. Defined contribution plans (including corporate IRAs) that purchased class Y shares under prior eligibility criteria may continue to purchase class Y shares.

• No initial sales charge; your entire investment goes to work immediately

• No deferred sales charge

• Lower annual expenses, and higher dividends, than class A, B, C, M or R shares because of no 12b-1 fees.

Initial sales charges for class A and M shares

| Class A sales charge as | Class M sales charge as | |||

| a percentage of*: | a percentage of*: | |||

| Amount of purchase at offering | Net amount | Offering | Net amount | Offering |

| price ($) | invested | price** | invested | price** |

| Under 50,000 | 6.10% | 5.75% | 3.63% | 3.50% |

| 50,000 but under 100,000 | 4.71 | 4.50 | 2.56 | 2.50 |

| 100,000 but under 250,000 | 3.63 | 3.50 | 1.52 | 1.50 |

| 250,000 but under 500,000 | 2.56 | 2.50 | 1.01 | 1.00 |

| 500,000 but under 1,000,000 | 2.04 | 2.00 | 1.01 | 1.00 |

| 1,000,000 and above | NONE | NONE | NONE | NONE |

* Because of rounding in the calculation of offering price and the number of shares purchased, actual sales charges you pay may be more or less than these percentages.

** Offering price includes sales charge.

Reducing your class A or class M sales charge

The fund offers two principal ways for you to qualify for discounts on initial sales charges on class A and class M shares, often referred to as “breakpoint discounts”:

• Right of accumulation. You can add the amount of your current purchases of class A or class M shares of the fund and other Putnam funds to the value of your existing accounts in the fund and other Putnam funds. Individuals can also include purchases by, and accounts owned by, their spouse and minor children, including accounts established through different financial representatives. For your current purchases, you will pay the initial sales charge applicable to the total value of the linked accounts and purchases, which may be lower than the sales charge otherwise applicable to each of your current purchases. Shares of Putnam money market funds, other than money market fund shares acquired by exchange from other Putnam funds, are not included for purposes of the right of accumulation.

| 20 Prospectus | |

To calculate the total value of your existing accounts and any linked accounts, the fund will use the higher of (a) the current maximum public offering price of those shares or (b) if you purchased the shares after December 31, 2007, the initial value of the total purchases, or, if you held the shares on December 31, 2007, the market value at maximum public offering price on that date, in either case, less the market value on the applicable redemption date of any of those shares that you have redeemed.

• Statement of intention. A statement of intention is a document in which you agree to make purchases of class A or class M shares in a specified amount within a period of 13 months. For each purchase you make under the statement of intention, you will pay the initial sales charge applicable to the total amount you have agreed to purchase. While a statement of intention is not a binding obligation on you, if you do not purchase the full amount of shares within 13 months, the fund will redeem shares from your account in an amount equal to the difference between the higher initial sales charge you would have paid in the absence of the statement of intention and the initial sales charge you actually paid.

Account types that may be linked with each other to obtain breakpoint discounts using the methods described above include:

• Individual accounts

• Joint accounts

• Accounts established as part of a retirement plan and IRA accounts (some restrictions may apply)

• Shares of Putnam funds owned through accounts in the name of your dealer or other financial intermediary (with documentation identifying beneficial ownership of shares)

• Accounts held as part of a Section 529 college savings plan managed by Putnam Management (some restrictions may apply)

In order to obtain a breakpoint discount, you should inform your financial representative at the time you purchase shares of the existence of other accounts or purchases that are eligible to be linked for the purpose of calculating the initial sales charge. The fund or your financial representative may ask you for records or other information about other shares held in your accounts and linked accounts, including accounts opened with a different financial representative. Restrictions may apply to certain accounts and transactions. Further details about breakpoint discounts can be found on Putnam Investments’ website at putnam.com/individual by selecting Investment Choices, then Mutual Funds, and then Pricing policies, and in the SAI.

| Prospectus 21 | |

• Additional reductions and waivers of sales charges. In addition to the breakpoint discount methods described above, sales charges may be reduced or waived under certain circumstances and for certain categories of investors. For instance, an employer-sponsored retirement plan is eligible to purchase class A shares without sales charges if its plan administrator or dealer of record has entered into an agreement with Putnam Retail Management. Information about reductions and waivers of sales charges, including deferred sales charges, is included in the SAI. You may consult your financial representative or Putnam Retail Management for assistance.

How do I sell or exchange fund shares?

You can sell your shares back to the fund or exchange them for shares of another Putnam fund any day the NYSE is open, either through your financial representative or directly to the fund. If you redeem your shares shortly after purchasing them, your redemption payment for the shares may be delayed until the fund collects the purchase price of the shares, which may be up to 10 calendar days after the purchase date.

<R>Regarding exchanges, not all Putnam funds offer all classes of shares or may be open to new investors. If you exchange shares otherwise subject to a deferred sales charge, the transaction will not be subject to the deferred sales charge. When you redeem the shares acquired through the exchange, however, the redemption may be subject to the deferred sales charge, depending upon when and from which fund you originally purchased the shares. The deferred sales charge will be computed using the schedule of any fund into or from which you have exchanged your shares that would result in your paying the highest deferred sales charge applicable to your class of shares. For purposes of computing the deferred sales charge, the length of time you have owned your shares will be measured from the date of original purchase, unless you originally purchased the shares from another Putnam fund that does not directly charge a deferred sales charge, in which case the length of time you have owned your shares will be measured from the date you exchange those shares for shares of another Putnam fund that does charge a deferred sales charge, and will not be affected by any subsequent exchanges among funds.

</R>• Selling or exchanging shares through your financial representative. Your representative must receive your request in proper form before the close of regular trading on the NYSE for you to receive that day’s NAV, less any applicable deferred sales charge. Your representative will be responsible for furnishing all necessary documents to Putnam Investor Services on a timely basis and may charge you for his or her services.

| 22 Prospectus | |

• Selling or exchanging shares directly with the fund. Putnam Investor Services must receive your request in proper form before the close of regular trading on the NYSE in order to receive that day’s NAV, less any applicable deferred sales charge.

• By mail. Send a letter of instruction signed by all registered owners or their legal representatives to Putnam Investor Services. If you have certificates for the shares you want to sell or exchange, you must return them unendorsed with your letter of instruction.

• By telephone. You may use Putnam’s telephone redemption privilege to redeem shares valued at less than $100,000 unless you have notified Putnam Investor Services of an address change within the preceding 15 days, in which case other requirements may apply. Unless you indicate otherwise on the account application, Putnam Investor Services will be authorized to accept redemption instructions received by telephone. A telephone exchange privilege is currently available for amounts up to $500,000. Sale or exchange of shares by telephone is not permitted if there are certificates for your shares. The telephone redemption and exchange privileges may be modified or terminated without notice.

• Via the Internet. You may also exchange shares via the Internet at putnam.com/individual.

• Shares held through your employer’s retirement plan. For information on how to sell or exchange shares of the fund that were purchased through your employer’s retirement plan, including any restrictions and charges that the plan may impose, please consult your employer.

• Additional requirements. In certain situations, for example, if you sell shares with a value of $100,000 or more, the signatures of all registered owners or their legal representatives must be guaranteed by a bank, broker-dealer or certain other financial institutions. In addition, Putnam Investor Services usually requires additional documents for the sale of shares by a corporation, partnership, agent or fiduciary, or surviving joint owner. For more information concerning Putnam’s signature guarantee and documentation requirements, contact Putnam Investor Services.

The fund also reserves the right to revise or terminate the exchange privilege, limit the amount or number of exchanges or reject any exchange. The fund into which you would like to exchange may also reject your exchange. These actions may apply to all shareholders or only to those shareholders whose exchanges Putnam Management determines are likely to have a negative effect on the fund or other Putnam funds. Consult Putnam Investor Services before requesting an exchange. Ask your financial representative or Putnam

| Prospectus 23 | |

Investor Services for prospectuses of other Putnam funds. Some Putnam funds are not available in all states.

Deferred sales charges for class B, class C and certain class A and class M shares

If you sell (redeem) class B shares within six years of purchase, you will generally pay a deferred sales charge according to the following schedule:

| Year after purchase | 1 | 2 | 3 | 4 | 5 | 6 | 7+ |

| Charge | 5% | 4% | 3% | 3% | 2% | 1% | 0% |

A deferred sales charge of 1.00% will apply to class C shares if redeemed within one year of purchase. Class A shares that are part of a purchase of $1 million or more (other than by a qualified retirement plan) will be subject to a 1.00% deferred sales charge if redeemed within nine months of purchase. A deferred sales charge of 0.65% may apply to class M shares purchased without a sales charge for certain rollover IRA accounts if redeemed within one year of purchase.

Deferred sales charges will be based on the lower of the shares’ cost and current NAV. Shares not subject to any charge will be redeemed first, followed by shares held longest. You may sell shares acquired by reinvestment of distributions without a charge at any time.

• Payment information. The fund generally sends you payment for your shares the business day after your request is received. Under unusual circumstances, the fund may suspend redemptions, or postpone payment for more than seven days, as permitted by federal securities law. You will not receive interest on uncashed redemption checks.

• Redemption by the fund. If you own fewer shares than the minimum set by the Trustees (presently 20 shares), the fund may redeem your shares without your permission and send you the proceeds after providing you with at least 60 days’ notice to attain the minimum. To the extent permitted by applicable law, the fund may also redeem shares if you own more than a maximum amount set by the Trustees. There is presently no maximum, but the Trustees could set a maximum that would apply to both present and future shareholders.

Policy on excessive short-term trading

<R>• Risks of excessive short-term trading. Excessive short-term trading activity may reduce the fund’s performance and harm all fund shareholders by interfering with portfolio management, increasing the fund’s expenses and

| 24 Prospectus | |

diluting the fund’s NAV. Depending on the size and frequency of short-term trades in the fund’s shares, the fund may experience increased cash volatility, which could require the fund to maintain undesirably large cash positions or buy or sell portfolio securities it would not have bought or sold otherwise. The need to execute additional portfolio transactions due to these cash flows may also increase the fund’s brokerage and administrative costs and, for investors in taxable accounts, may increase taxable distributions received from the fund.

When the fund invests in foreign securities, its performance may be adversely impacted and the interests of longer-term shareholders may be diluted as a result of time-zone arbitrage, a short-term trading practice that seeks to exploit changes in the value of the fund’s investments that result from events occurring after the close of the foreign markets on which the investments trade, but prior to the later close of trading on the NYSE, the time as of which the fund determines its NAV. If an arbitrageur is successful, he or she may dilute the interests of other shareholders by trading shares at prices that do not fully reflect their fair value.

</R>When the fund invests in securities that may trade infrequently or may be more difficult to value, such as securities of smaller companies, it may be susceptible to trading by short-term traders who seek to exploit perceived price inefficiencies in the fund’s investments. In addition, the market for securities of smaller companies may at times show “market momentum,” in which positive or negative performance may continue from one day to the next for reasons unrelated to the fundamentals of the issuer. Short-term traders may seek to capture this momentum by trading frequently in the fund’s shares, which will reduce the fund’s performance and may dilute the interests of other shareholders. Because securities of smaller companies may be less liquid than securities of larger companies, the fund may also be unable to buy or sell these securities at desirable prices when the need arises (for example, in response to volatile cash flows caused by short-term trading). Similar risks may apply if the fund holds other types of less liquid securities, including below-investment-grade bonds.

• Fund policies. In order to protect the interests of long-term shareholders of the fund, Putnam Management and the fund’s Trustees have adopted policies and procedures intended to discourage excessive short-term trading. The fund seeks to discourage excessive short-term trading by using fair value pricing procedures to value investments under some circumstances. In addition, Putnam Management monitors activity in those shareholder

| Prospectus 25 | |

accounts about which it possesses the necessary information in order to detect excessive short-term trading patterns and takes steps to deter excessive short-term traders.

• Account monitoring. Putnam Management’s Compliance Department currently uses multiple reporting tools to monitor activity in retail customer accounts for which Putnam Investor Services maintains records. This review is based on the fund’s internal parameters for detecting excessive short-term trading, which consider the number of “round trip” transactions above a specified dollar amount within a specified period of time. These parameters may change from time to time. If a monitored account engages in short-term trading that Putnam Management or the fund considers to be excessive or inappropriate, Putnam Management will issue the investor and his or her financial intermediary, if any, a written warning. Continued excessive short-term trading activity by an investor or intermediary that has received a warning may lead to the termination of the exchange privilege. The fund also reserves the right to terminate the exchange privilege without a warning. In addition, Putnam Management will also communicate instances of excessive short-term trading to the compliance staff of an investor’s broker, if one is identified.

• Account restrictions. In addition to enforcing these exchange parameters, Putnam Management and the fund reserve the right to reject or restrict purchases or exchanges for any reason. Putnam Management or the fund may determine that an investor’s trading activity is excessive or otherwise potentially harmful based on various factors, including an investor’s or financial intermediary’s trading history in the fund, other Putnam funds or other investment products, and may aggregate activity in multiple accounts under common ownership or control. If the fund identifies an investor or intermediary as a potential excessive trader, it may, among other things, require further trades to be submitted by mail rather than by phone or over the Internet, impose limitations on the amount, number, or frequency of future purchases or exchanges, or temporarily or permanently bar the investor or intermediary from investing in the fund or other Putnam funds. The fund may take these steps in its discretion even if the investor’s activity may not have been detected by the fund’s current monitoring parameters.

• Limitations on the fund’s policies. There is no guarantee that the fund will be able to detect excessive short-term trading in all accounts. For example, Putnam Management currently does not have access to sufficient information to identify each investor’s trading history, and in certain circumstances there are operational or technological constraints on its ability to enforce the fund’s policies. In addition, even when Putnam Management has

| 26 Prospectus | |

sufficient information, its detection methods may not capture all excessive short-term trading.

<R>In particular, many purchase, redemption and exchange orders are received from financial intermediaries that hold omnibus accounts with the fund. Omnibus accounts, in which shares are held in the name of an intermediary on behalf of multiple beneficial owners, are a common form of holding shares among retirement plans and financial intermediaries such as brokers, advisers and third-party administrators. The fund is generally not able to identify trading by a particular beneficial owner within an omnibus account, which makes it difficult or impossible to determine if a particular shareholder is engaging in excessive short-term trading. Putnam Management monitors aggregate cash flows in omnibus accounts on an ongoing basis. If high cash flows or other information indicate that excessive short-term trading may be taking place, Putnam Management will contact the financial intermediary, plan sponsor or recordkeeper that maintains accounts for the beneficial owner and attempt to identify and remedy any excessive trading. However, the fund’s ability to monitor and deter excessive short-term traders in omnibus accounts ultimately depends on the capabilities and cooperation of these third-party financial firms. A financial intermediary or plan sponsor may impose different or additional limits on short-term trading.

</R>Distribution plans and payments to dealers

Putnam funds are distributed primarily through dealers (including any broker, dealer, bank, bank trust department, registered investment advisor, financial planner, retirement plan administrator, and any other institution having a selling, services, or any similar agreement with Putnam Retail Management or one of its affiliates). In order to pay for the marketing of fund shares and services provided to shareholders, the fund has adopted distribution and service (12b-1) plans, which increase the annual operating expenses you pay each year in certain share classes, as shown in the table of annual fund operating expenses in the section Fund summary — Fees and expenses. Putnam Retail Management and its affiliates also make additional payments to dealers that do not increase your fund expenses, as described below.

• Distribution and service (12b-1) plans. The fund’s 12b-1 plans provide for payments at annual rates (based on average net assets) of up to 0.35% on class A shares and 1.00% on class B, class C, class M and class R shares. The Trustees currently limit payments on class A, class M and class R shares to 0.25%, 0.75% and 0.50% of average net assets, respectively. Because these fees are paid out of the fund’s assets on an ongoing basis, they will increase the cost of your investment. The higher fees for class B, class C, class M and class R shares may cost you more over time than paying the initial sales

| Prospectus 27 | |

charge for class A shares. Because class C and class M shares, unlike class B shares, do not convert to class A shares, class C and class M shares may cost you more over time than class B shares. Class R shares will generally be less expensive than class B shares for shareholders who are eligible to purchase either class. Class Y shares, for shareholders who are eligible to purchase them, will be less expensive than other classes of shares because they do not bear sales charges or 12b-1 fees.

• Payments to dealers. If you purchase your shares through a dealer, your dealer generally receives payments from Putnam Retail Management representing some or all of the sales charges and distribution and service (12b-1) fees, if any, shown in the tables under the heading Fund summary — Fees and expenses at the front of this prospectus.

Putnam Retail Management and its affiliates also pay additional compensation to selected dealers in recognition of their marketing support and/or program servicing (each of which is described in more detail below). These payments may create an incentive for a dealer firm or its representatives to recommend or offer shares of the fund or other Putnam funds to its customers. These additional payments are made by Putnam Retail Management and its affiliates and do not increase the amount paid by you or the fund as shown under the heading Fund summary — Fees and expenses.

The additional payments to dealers by Putnam Retail Management and its affiliates are generally based on one or more of the following factors: average net assets of a fund attributable to that dealer, sales or net sales of a fund attributable to that dealer, or reimbursement of ticket charges (fees that a dealer firm charges its representatives for effecting transactions in fund shares), or on the basis of a negotiated lump sum payment for services provided.

Marketing support payments are generally available to most dealers engaging in significant sales of Putnam fund shares. These payments are individually negotiated with each dealer firm, taking into account the marketing support services provided by the dealer, including business planning assistance, educating dealer personnel about the Putnam funds and shareholder financial planning needs, placement on the dealer’s preferred or recommended fund company list, and access to sales meetings, sales representatives and management representatives of the dealer, as well as the size of the dealer’s relationship with Putnam Retail Management. Although the total amount of marketing support payments made to dealers in any year may vary, on average, the aggregate payments are not expected, on an annual basis, to exceed 0.085% of the average net assets of Putnam’s retail mutual funds attributable to the dealers.

| 28 Prospectus | |

Program servicing payments, which are paid in some instances to dealers in connection with investments in the fund by retirement plans and other investment programs, are not expected, with certain limited exceptions, to exceed 0.20% of the total assets in the program on an annual basis. These payments are made for program services provided by the dealer, including participant recordkeeping, reporting, or transaction processing, as well as services rendered in connection with fund/investment selection and monitoring, employee enrollment and education, plan balance rollover or separation, or other similar services.

<R>You can find a list of all dealers to which Putnam made marketing support and/or program servicing payments in 2011 in the SAI, which is on file with the SEC and is also available on Putnam’s website at putnam.com. You can also find other details in the SAI about the payments made by Putnam Retail Management and its affiliates and the services provided by your dealer. Your dealer may charge you fees or commissions in addition to those disclosed in this prospectus. You can also ask your dealer about any payments it receives from Putnam Retail Management and its affiliates and any services your dealer provides, as well as about fees and/or commissions it charges.

</R>• Other payments. Putnam Retail Management and its affiliates may make other payments (including payments in connection with educational seminars or conferences) or allow other promotional incentives to dealers to the extent permitted by SEC and NASD (as adopted by FINRA) rules and by other applicable laws and regulations. The fund’s transfer agent may also make payments to certain dealers in recognition of subaccounting or other services they provide to shareholders or plan participants who invest in the fund or other Putnam funds through their retirement plan. See the discussion in the SAI under the heading Management — Investor Servicing Agent for more details.

Fund distributions and taxes

The fund normally distributes any net investment income quarterly and any net realized capital gains annually. You may choose to reinvest distributions from net investment income, capital gains or both in additional shares of this fund or other Putnam funds, or you may receive them in cash in the form of a check or an electronic deposit to your bank account. If you do not select an option when you open your account, all distributions will be reinvested. If you choose to receive distributions in cash, but correspondence from the fund or Putnam Investor Services is returned as “undeliverable,” the distribution option on your account may be converted to reinvest future distributions in the fund. You will not receive interest on uncashed distribution checks.

| Prospectus 29 | |

For shares purchased through your employer’s retirement plan, the terms of the plan will govern how the plan may receive distributions from the fund.

<R>For federal income tax purposes, distributions of net investment income are generally taxable to you as ordinary income. Taxes on distributions of capital gains are determined by how long the fund owned (or is deemed to have owned) the investments that generated them, rather than by how long you have owned (or are deemed to have owned) your shares. Distributions that the fund properly reports to you as gains from investments that the fund owned for more than one year are generally taxable to you as long-term capital gains. Distributions of gains from investments that the fund owned for one year or less and gains on the sale of or payment on bonds characterized as market discount are generally taxable to you as ordinary income. For taxable years beginning before January 1, 2013, distributions that the fund properly reports to you as “qualified dividend income” are taxable at the rate applicable to long-term capital gains provided that both you and the fund meet certain holding period and other requirements. Distributions are taxable in the manner described in this paragraph whether you receive them in cash or reinvest them in additional shares of this fund or other Putnam funds.

</R>Distributions by the fund to retirement plans that qualify for tax-exempt treatment under federal income tax laws will not be taxable. Special tax rules apply to investments through such plans. You should consult your tax advisor to determine the suitability of the fund as an investment through such a plan and the tax treatment of distributions (including distributions of amounts attributable to an investment in the fund) from such a plan.

Unless you are investing through a tax-advantaged retirement account (such as an IRA), you should consider avoiding a purchase of fund shares shortly before the fund makes a distribution because doing so may cost you money in taxes. Distributions are taxable to you even if they are paid from income or gains earned by the fund before your investment (and thus were included in the price you paid). Contact your financial representative or Putnam to find out the distribution schedule for your fund.

<R>The fund’s investments in certain debt obligations may cause the fund to recognize taxable income in excess of the cash generated by such obligations. Thus, the fund could be required at times to liquidate other investments, including when it is not advantageous to do so, in order to satisfy its distribution requirements.

</R>| 30 Prospectus | |