| As filed with the Securities and Exchange Commission on | ||

| <R> | ||

| January 27, 2020 | ||

| </R> | ||

| Registration No. 2-55091 | ||

| 811-02608 | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| WASHINGTON, D.C. 20549 | ||

| ---------------- | ||

| FORM N-1A | ||

| ---- | ||

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | / X / | |

| ---- | ||

| ---- | ||

| Pre-Effective Amendment No. | / / | |

| ---- | ||

| ---- | ||

| <R> | ||

| Post-Effective Amendment No. 62 | / X / | |

| And/or | ---- | |

| </R> | ||

| ---- | ||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY | / X / | |

| ACT OF 1940 | ---- | |

| ---- | ||

| <R> | ||

| Amendment No. 58 | / X / | |

| </R> | ||

| (Check appropriate box or boxes) | ---- | |

| PUTNAM MONEY MARKET FUND | ||

| (Exact name of registrant as specified in charter) | ||

| 100 Federal Street, Boston, Massachusetts 02110 | ||

| <R> | ||

| (Address of principal executive offices)(Zip Code) | ||

| Registrant’s Telephone Number, including Area Code | ||

| </R> | ||

| (617) 292-1000 | ||

| It is proposed that this filing will become effective (check appropriate box) | |

| / / | immediately upon filing pursuant to paragraph (b) |

| <R> | |

| / X / | on January 30, 2020 pursuant to paragraph (b) |

| </R> | |

| / / | 60 days after filing pursuant to paragraph (a) (1) |

| / / | on (date) pursuant to paragraph (a) (1) |

| / / | 75 days after filing pursuant to paragraph (a) (2) |

| / / | on (date) pursuant to paragraph (a) (2) of Rule 485. |

| If appropriate, check the following box: | |

| / / | this post-effective amendment designates a new effective date for a previously filed post- |

| effective amendment. | |

| ROBERT T. BURNS, Vice President | |

| PUTNAM MONEY MARKET FUND | |

| 100 Federal Street, Boston, Massachusetts 02110 | |

| (Name and address of agent for service) | |

| --------------- | |

| Copy to: | |

| BRYAN CHEGWIDDEN, Esquire | |

| ROPES & GRAY LLP | |

| 1211 Avenue of the Americas | |

| New York, New York 10036 | |

<R>

Table of contents

| Fund summary | 2 |

| What are the fund’s main investment strategies and related risks? | 6 |

| Who oversees and manages the fund? | 9 |

| How does the fund price its shares? | 11 |

| How do I buy fund shares? | 11 |

| How do I sell or exchange fund shares? | 15 |

| Policy on excessive short-term trading | 19 |

| Distribution plans and payments to dealers | 19 |

| Fund distributions and taxes | 21 |

| Financial highlights | 22 |

| Appendix | 26 |

</R>

Fund summary

Goal

<R>

Putnam Money Market Fund seeks as high a rate of current income as Putnam Investment Management, LLC believes is consistent with preservation of capital and maintenance of liquidity.

Fees and expenses

The following tables describe the fees and expenses you may pay if you buy and hold shares of the fund. Information about sales charge discounts is available from your financial advisor and in the Appendix to the fund’s prospectus.

</R>

Shareholder fees (fees paid directly from your investment)

| Share class | Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

| Class A | NONE | 1.00%* |

| Class B | NONE | 5.00%* |

| Class C | NONE | 1.00%* |

| <R> | ||

| </R> | ||

| Class R | NONE | NONE |

2 Prospectus

Annual

fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

<R>

| Share class | Management fees | Distribution and service (12b-1) fees# | Other expenses | Total annual fund operating expenses |

| Class A | 0.28% | 0.00% | 0.20% | 0.48% |

| Class B | 0.28% | 0.00% | 0.20% | 0.48% |

| Class C | 0.28% | 0.00% | 0.20% | 0.48% |

| Class R | 0.28% | 0.00% | 0.20% | 0.48% |

| * | A deferred sales charge on class A, B and C shares may apply to certain redemptions of shares purchased by exchange from another Putnam fund. The rate of the deferred sales charge for class B and C shares will be determined based on the time between the original purchase of class B or C shares from the other Putnam fund(s) and the date of redemption of shares from this fund. |

| # | The fund’s Board of Trustees determined to limit payments under the distribution and service (12b-1) plans in place with respect to class B, class C and class R shares to 0.00% of average net assets effective as of the close of business on March 31, 2017. Beginning on April 1, 2017, the fund no longer makes payments under the distribution and service (12b-1) plans in place with respect to class B, class C and class R shares. |

</R>

Example

The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then redeem or hold all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower.

<R>

| Share class | 1 year | 3 years | 5 years | 10 years |

| Class A | $49 | $154 | $269 | $604 |

| Class B* | $549 | $454 | $469 | $604 |

| Class B (no redemption) | $49 | $154 | $269 | $604 |

| Class C* | $149 | $154 | $269 | $604 |

| Class C (no redemption) | $49 | $154 | $269 | $604 |

| Class R | $49 | $154 | $269 | $604 |

| * | Reflects assessment of deferred sales charge assuming class B or C shares were acquired by exchange from one or more other Putnam funds immediately after purchase of shares from such other fund(s). |

</R>

Investments, risks, and performance

Investments

<R>

We invest mainly in money market instruments that are high quality and have short-term maturities. We invest significantly in certificates of deposit, commercial paper (including asset-backed commercial paper), U.S. government debt and repurchase agreements, corporate obligations and time deposits. We may also invest in U.S. dollar denominated foreign securities of these types. We may consider, among other factors, credit and interest rate risks and characteristics of the issuer or

Prospectus 3

counterparty, as well as general market conditions, when deciding whether to buy or sell investments.

</R>

Risks

The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions, investor sentiment and market perceptions, government actions, geopolitical events or changes, and factors related to a specific issuer, geography, industry or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings.

The values of money market investments usually rise and fall in response to changes in interest rates. Interest rate risk is generally lowest for investments with short maturities (a significant part of the fund’s investments). Changes in the financial condition of an issuer or counterparty, changes in specific economic or political conditions that affect a particular type of issuer, and changes in general economic or political conditions can increase the risk of default by an issuer or counterparty, which can affect a security’s or instrument’s credit quality or value. To the extent that the fund invests significantly in a particular industry, it runs an increased risk of loss if economic or other developments affecting that industry cause the prices of related money market investments to fall. Although the fund only buys high quality investments, investments backed by a letter of credit have the risk that the provider of the letter of credit will not be able to fulfill its obligations to the issuer. The effects of inflation may erode the value of your investment over time. Foreign investments, including money market instruments of foreign issuers that are denominated in U.S. dollars, involve certain special risks, such as unfavorable political and legal developments, limited financial information, and economic and financial instability.

The fund may not achieve its goal, and is not intended to be a complete investment program. You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below certain required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

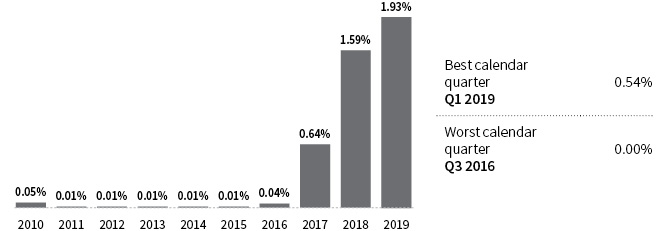

Performance

The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the fund are available at putnam.com.

4 Prospectus

<R>

Annual total returns for class A shares

Average annual total returns (for periods ending 12/31/19)

| Share class | 1 year | 5 years | 10 years |

| Class A before taxes | 1.93% | 0.84% | 0.43% |

| Class B before taxes | -3.07% | 0.42% | 0.42% |

| Class C before taxes | 0.93% | 0.81% | 0.42% |

| Class R before taxes | 1.93% | 0.81% | 0.42% |

</R>

Class B share performance reflects conversion to class A shares after eight years.

Your fund’s management

Investment advisor

Putnam Investment Management, LLC

Sub-advisor

Putnam Investments Limited*

| * | Though the investment advisor has retained the services of Putnam Investments Limited (PIL), PIL does not currently manage any assets of the fund. |

Purchase and sale of fund shares

In accordance with the Securities and Exchange Commission’s (SEC) rules governing money market funds, the fund operates as a retail money market fund and requires all beneficial owners to be natural persons.

You can open an account, purchase and/or sell fund shares, or exchange them for shares of another Putnam fund by contacting your financial advisor or by calling Putnam Investor Services at 1-800-225-1581. Purchases of class B shares are closed to new and existing investors except by exchange from class B shares of another Putnam fund or through dividend and/or capital gains reinvestment.

<R>

When opening an account, you must complete and mail a Putnam account application, along with a check made payable to the fund, to: Putnam Investments, P.O. Box 219697, Kansas City, MO 64121-9697. The minimum initial investment of $500 is currently waived, although Putnam reserves the right to reject initial investments

Prospectus 5

under $500 at its discretion. There is no minimum for subsequent investments. Shares are sold at a net asset value of $1.00 per share, without any initial sales charge.

</R>

You can sell your shares back to the fund or exchange them for shares of another Putnam fund any day the New York Stock Exchange (NYSE) is open. Shares may be sold or exchanged by mail, by phone, or online at putnam.com. Some restrictions may apply.

Tax information

Distributions from the fund will be taxed as ordinary income unless you hold the shares through a tax-advantaged arrangement, in which case you will generally be taxed only upon withdrawal of monies from the arrangement.

Financial intermediary compensation

If you purchase the fund through a broker/dealer or other financial intermediary (such as a bank or financial advisor), the fund and its related companies may pay that intermediary for the sale of fund shares and related services. Please bear in mind that these payments may create a conflict of interest by influencing the broker/dealer or other intermediary to recommend the fund over another investment. Ask your advisor or visit your advisor’s website for more information.

What are the fund’s main investment strategies and related risks?

This section contains greater detail on the fund’s main investment strategies and the related risks you would face as a fund shareholder. It is important to keep in mind that risk and reward generally go hand in hand; the higher the potential reward, the greater the risk.

Although the fund’s investments will comply with applicable rules governing the quality, maturity, diversification and liquidity of securities held by money market funds, the fund may invest up to 5% of its total assets in illiquid securities (securities that cannot be sold or disposed of in the ordinary course of business within seven days at approximately the market value ascribed to them by the fund).

We pursue the fund’s goal by investing mainly in money market and other fixed income investments, such as certificates of deposit, commercial paper (including asset-backed commercial paper), U.S. government debt and repurchase agreements, corporate obligations and time deposits.

- Focus of investments. We may invest without limit in money market investments from the banking industry. The fund’s shares may be more vulnerable to decreases in value than those funds that invest in issuers in a greater number of industries. To the extent that the fund invests significantly in a particular industry, it runs an increased

6 Prospectus

risk of loss if economic or other developments affecting that industry cause the prices of related money market investments to fall. At times, the fund and other accounts that we and our affiliates manage may own all or most of the debt of a particular issuer. This concentration of ownership may make it more difficult to sell, or to determine the fair value of, these investments.

- Foreign investments. We may invest in money market instruments of foreign issuers that are denominated in U.S. dollars. Foreign investments involve certain special risks, such as unfavorable political and legal developments, limited financial information, and economic and financial instability. In addition, the liquidity of these investments may be more limited than for most U.S. investments. Foreign settlement procedures may also involve additional risks.

- Interest rate risk. The values of money market and other fixed income investments usually rise and fall in response to changes in interest rates. Declining interest rates generally increase the value of existing money market investments, and rising interest rates generally decrease the value of existing money market investments. Changes in the values of money market investments usually will not affect the amount of income the fund receives from them, but could affect the value of the fund’s shares. Interest rate risk is generally lower for investments with shorter maturities, and the short-term nature of money market investments is designed to reduce this risk.

<R>

The fund may not hold an investment with more than 397 days remaining to maturity and the fund’s average weighted maturity will not exceed 60 days (in each case after giving effect to applicable maturity-shortening features such as interest rate resets or demand features, as described below). In addition, the weighted average life (determined without reference to maturity-shortening features) of the fund will not exceed 120 days. Short-term investments may have lower yields than longer-term investments.

</R>

Some investments that we purchase for the fund have an interest rate that changes based on a market interest rate and/or allow the holder to demand payment of principal and accrued interest before the scheduled maturity date. We measure the maturity of these obligations using the relatively short period until the interest rate resets and/or payment could be demanded, as applicable. Because the interest rate on these investments can change, these investments are unlikely to be able to lock in favorable longer-term interest rates.

- Credit quality. The fund buys only high quality investments that are eligible securities, as defined by Rule 2a-7 under the Investment Company Act of 1940, as amended. In general, in order to be an eligible security, Putnam Management must determine that the security presents minimal credit risk to the fund, based on policies and procedures adopted by the Board of Trustees.

The credit quality of an investment may be supported or enhanced by another company or financial institution through the use of a letter of credit or similar arrangements. The main risk in investments backed by a letter of credit is that the provider of the letter of credit will not be able to fulfill its obligations to the issuer.

Prospectus 7

- Liquidity and illiquid investments. The fund maintains certain minimum liquidity standards, including that:

| — | the fund may not purchase a security other than a security offering daily liquidity (as specified by applicable rules governing money market funds) if, immediately after purchase, the fund would have invested less than 10% of its total assets in securities offering daily liquidity, |

| — | the fund may not purchase a security other than a security offering weekly liquidity (as specified by applicable rules governing money market funds) if, immediately after purchase, the fund would have invested less than 30% of its total assets in securities offering weekly liquidity (i.e., liquidity within five business days) and |

| — | the fund may not purchase an illiquid security (a security that cannot be sold or disposed of in the ordinary course of business within seven days at approximately the market value ascribed to it by the fund) if, immediately after purchase, the fund would have invested more than 5% of its total assets in illiquid securities. |

The fund’s investments in illiquid securities may be considered speculative and may be difficult to sell. The sale of these investments may be prohibited or limited by law or contract. Some investments may be difficult to value for purposes of determining the fund’s net asset value. We may not be able to sell the fund’s investments when we consider it desirable to do so, or we may be able to sell them only at less than their value.

- When-issued and delayed delivery securities risk. The fund may purchase or sell a security at a future date for a predetermined price. The market value of the securities may change before delivery.

- Market risk. The value of securities in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general financial market conditions, changing market perceptions (including perceptions about the risk of default and expectations about monetary policy or interest rates), changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. During those periods, the fund may experience high levels of shareholder redemptions, and may have to sell securities at times when it would otherwise not do so, and at unfavorable prices.

- Other investments. In addition to the main investment strategies described above, the fund may make other types of investments and be subject to other risks as described under Miscellaneous Investments, Investment Practices and Risks in the statement of additional information (SAI).

<R>

- Liquidity fees and redemption gates. In accordance with SEC amendments to the rules governing money market funds, the fund has adopted policies and procedures permitting the Board of Trustees of the fund to impose a liquidity fee or to temporarily suspend redemptions from the fund (a “redemption gate”) if the fund’s weekly liquid assets fall below specified thresholds. If, at any time, the fund has invested less than 30% of its total assets in weekly liquid assets (cash, direct obligations of the U.S.

8 Prospectus

Government, Government securities issued by agencies or instrumentalities that are issued at a discount and have a remaining maturity of 60 days or less, or securities that mature or are subject to a demand feature that is exercisable and payable within 5 business days), the fund may institute a liquidity fee of up to 2% or impose a redemption gate for a period of up to ten days in any rolling ninety day period, if the fund’s Trustees, including a majority of independent Trustees, determine that the liquidity fee or redemption gate is in the best interests of the fund. If, at the end of a business day, the fund’s weekly liquid assets equal less than 10% of its total assets, the fund must institute a liquidity fee of 1%, unless the Trustees, including a majority of the independent Trustees, determine that imposing the fee is not in the best interests of the fund. Any liquidity fee is assessed against, and deducted from, a shareholder’s proceeds from selling shares. For example, if a shareholder sells 1,000 shares worth $1,000 when a 2% liquidity fee is imposed, the shareholder would receive $980 and the fund would receive $20 as the liquidity fee.

</R>

- Temporary defensive strategies. In response to adverse market, economic, political or other conditions, we may take temporary defensive positions, such as investing some or all of the fund’s assets in cash and cash equivalents, that differ from the fund’s usual investment strategies. However, we may choose not to use these temporary defensive strategies for a variety of reasons, even in very volatile market conditions. These strategies may cause the fund to miss out on investment opportunities, and may prevent the fund from achieving its goal. Additionally, while temporary defensive strategies are mainly designed to limit losses, such strategies may not work as intended.

- Changes in policies. The Trustees may change the fund’s goal, investment strategies and other policies set forth in this prospectus without shareholder approval, except as otherwise provided in the prospectus or SAI.

<R>

- Portfolio holdings. The SAI includes a description of the fund’s policies with respect to the disclosure of its portfolio holdings. For information on the fund’s portfolio, you may visit the Putnam Investments website, putnam.com/individual, where the fund’s portfolio holdings and related portfolio information may be viewed monthly beginning no later than 5 business days after the end of each month. This information will remain available on the website at least until the fund files a Form N-CSR with the SEC for the period that includes the date of the information, after which such information can be found on the SEC’s website at http://www.sec.gov.

</R>

Who oversees and manages the fund?

The fund’s Trustees

As a shareholder of a mutual fund, you have certain rights and protections, including representation by a Board of Trustees. The Putnam Funds’ Board of Trustees oversees the general conduct of the fund’s business and represents the interests of the Putnam fund shareholders. At least 75% of the members of the Putnam Funds’ Board of Trustees are independent, which means they are not officers of the fund or affiliated with Putnam Investment Management, LLC (Putnam Management).

Prospectus 9

The Trustees periodically review the fund’s investment performance and the quality of other services such as administration, custody, and investor services. At least annually, the Trustees review the fees paid to Putnam Management and its affiliates for providing or overseeing these services, as well as the overall level of the fund’s operating expenses. In carrying out their responsibilities, the Trustees are assisted by an administrative staff, auditors and legal counsel that are selected by the Trustees and are independent of Putnam Management and its affiliates.

Contacting

the fund’s

Trustees

Address correspondence to:

The Putnam Funds Trustees

100 Federal Street

Boston, MA 02110

The fund’s investment manager

The Trustees have retained Putnam Management, which has managed mutual funds since 1937, to be the fund’s investment manager, responsible for making investment decisions for the fund and managing the fund’s other affairs and business.

<R>

The basis for the Trustees’ approval of the fund’s management contract and the sub-management contract described below is discussed in the fund’s annual report to shareholders dated September 30, 2019.

</R>

The fund pays a monthly management fee to Putnam Management. The fee is calculated by applying a rate to the fund’s average net assets for the month. The rate is based on the monthly average of the aggregate net assets of all open-end funds sponsored by Putnam Management (excluding net assets of funds that are invested in, or that are invested in by, other Putnam funds to the extent necessary to avoid “double counting” of those assets), and generally declines as the aggregate net assets increase.

Putnam Management may from time to time voluntarily undertake to waive fees and/or reimburse certain fund expenses in order to enhance the annualized net yield for the fund. Any such waiver or reimbursement would be voluntary and may be modified or discontinued by Putnam Management at any time without notice.

The fund paid Putnam Management a management fee (after any applicable waivers) of 0.28% of average net assets for the fund’s last fiscal year.

Putnam Management’s address is 100 Federal Street, Boston, MA 02110.

Putnam Management has retained its affiliate PIL to make investment decisions for such fund assets as may be designated from time to time for its management by Putnam Management. PIL is not currently managing any fund assets. If PIL were to manage any fund assets, Putnam Management (and not the fund) would pay a quarterly sub-management fee to PIL for its services at the annual rate of 0.25% of the average net asset value (NAV) of any fund assets managed by PIL. PIL, which provides a full range of international investment advisory services to institutional clients, is located at 16 St James’s Street, London, England, SW1A 1ER.

10 Prospectus

Pursuant to this arrangement, Putnam investment professionals who are based in foreign jurisdictions may serve as portfolio managers of the fund or provide other investment services, consistent with local regulations.

How does the fund price its shares?

The price of the fund’s shares is based on its NAV. The NAV per share of each class equals the total value of its assets, less its liabilities, divided by the number of its outstanding shares. Shares are only valued as of the scheduled close of regular trading on the NYSE each day the exchange is open.

The fund values its investments at amortized cost, which approximates market value.

The fund’s most recent NAV is available on Putnam Investments’ website at putnam.com/individual or by contacting Putnam Investor Services at 1-800-225-1581.

How do I buy fund shares?

Opening an account

The fund operates as a retail money market fund and has adopted policies and procedures reasonably designed to limit beneficial ownership of the fund to natural persons. Only natural person investors are permitted to open a fund account. Natural persons include individuals with social security number and individuals investing through certain trusts and tax-advantaged accounts (including, but not limited to, defined contribution plan accounts, 401(k) plan accounts, individual retirement accounts, college savings plans, Keogh plans and health savings account plans).

<R>

You can open a fund account and purchase class A, B and C shares by contacting your financial representative or Putnam Investor Services at 1-800-225-1581 and obtaining a Putnam account application. Class B shares are only available in exchange for class B shares of another Putnam fund. The completed application, along with a check made payable to the fund, must then be returned to Putnam Investor Services at the following address:

</R>

Putnam Investments

P.O. Box 219697

Kansas City, MO 64121-9697

You can open a fund account with as little as $500. The minimum investment is waived if you make regular investments weekly, semi-monthly or monthly through automatic deductions from your bank checking or savings account. Although Putnam is currently waiving the minimum, it reserves the right to reject initial investments under the minimum at its discretion. Shares are sold at a NAV of $1.00 per share, without any initial sales charge.

If you participate in an employer-sponsored retirement plan that offers the fund, please consult your employer for information on how to purchase shares of the fund through the plan, including any restrictions or limitations that may apply.

Prospectus 11

Purchase orders for shares are only accepted on days the fund is open for business and must be received by 4:00 p.m. Eastern Time to be processed that day.

Federal law requires mutual funds to obtain, verify, and record information that identifies investors opening new accounts. Investors must provide their full name, residential or business address, Social Security or tax identification number, and date of birth. Entities, such as trusts, estates, corporations and partnerships must also provide additional identifying documentation. For trusts, the fund must obtain and verify identifying information for each trustee listed in the account registration. For certain legal entities, the fund must also obtain and verify identifying information regarding beneficial owners and/or control persons. The fund is unable to accept new accounts if any required information is not provided. If Putnam Investor Services cannot verify identifying information after opening your account, the fund reserves the right to close your account at the then-current NAV, which may be more or less than your original investment, net of any applicable sales charges. Putnam Investor Services may share identifying information with third parties for the purpose of verification subject to the terms of Putnam’s privacy policy.

Also, the fund may periodically close to new purchases of shares or refuse any order to buy shares if the fund determines that doing so would be in the best interests of the fund and its shareholders.

Financial intermediaries purchasing or holding shares for their customer accounts may charge customers fees for cash management and other services provided in connection with their accounts. You should therefore consider the terms of any account you may have with a financial intermediary before purchasing shares. Financial intermediaries purchasing shares on behalf of customers are responsible for transmitting orders to the fund in accordance with customer agreements.

Purchasing additional shares

Once you have an existing account, you can make additional investments at any time in any amount in the following ways:

- Through a financial representative. Your representative will be responsible for furnishing all necessary documents to Putnam Investor Services and may charge you for his or her services.

- Through Putnam’s Systematic Investing Program. You can make regular investments weekly, semi-monthly or monthly through automatic deductions from your bank checking or savings account.

- Via the Internet or phone. If you have an existing Putnam fund account and you have completed and returned an Electronic Investment Authorization Form, you can buy additional shares online at putnam.com or by calling Putnam Investor Services at 1-800-225-1581.

- By mail. You may also request a book of investment stubs for your account. Complete an investment stub and write a check for the amount you wish to invest, payable to the fund. Return the check and investment stub to Putnam Investor Services.

12 Prospectus

- By wire transfer. You may buy fund shares by bank wire transfer of same-day funds. Please call Putnam Investor Services at 1-800-225-1581 for wiring instructions. Any commercial bank can transfer same-day funds by wire. The fund will normally accept wired funds for investment on the day received if they are received by the fund’s designated bank before the close of regular trading on the NYSE. Your bank may charge you for wiring same-day funds. Although the fund’s designated bank does not currently charge you for receiving same-day funds, it reserves the right to charge for this service. You cannot buy shares for employer-sponsored retirement plans by wire transfer.

Which class of shares is best for me?

<R>

This prospectus offers you a choice of three classes of fund shares: A, B (only in exchange for class B shares of another Putnam fund) and C. Qualified employee-benefit plans may also choose class R shares of the fund.

</R>

This allows you to choose among different types of deferred sales charges and different levels of ongoing operating expenses, as illustrated in the Fund summary — Fees and expenses section. The class of shares that is best for you depends on a number of factors, including the amount you plan to invest and how long you plan to hold the shares.

Class A shares only

A deferred sales charge of 1.00% may apply to class A shares obtained by exchanging shares from another Putnam fund that were originally purchased without an initial sales charge, if the shares are redeemed within nine months of the original purchase.

Shares not subject to any charge will be redeemed first, followed by shares held the longest. The deferred sales charge will be based on the lower of the shares original cost and current NAV, because you may have acquired the shares in an exchange from a fund whose share values fluctuated. You may sell shares acquired by reinvestment of distributions without a charge at any time.

Class B and C shares only

Class B shares will only be offered to class B shareholders of other Putnam funds wishing to exchange into the fund. If you sell (redeem) class B shares obtained in an exchange of class B shares of another Putnam fund within six years after you originally acquired the class B shares of the other Putnam fund, you will pay a deferred sales charge according to the following schedule:

| Year after purchase | 1 | 2 | 3 | 4 | 5 | 6 | 7+ |

| Charge | 5% | 4% | 3% | 3% | 2% | 1% | 0% |

Shares not subject to any charge will be redeemed first, followed by shares held longest. The deferred sales charge will be based on the lower of the shares’ original cost and current NAV, because you may have acquired the shares in an exchange from a fund whose share values fluctuated. You may sell shares acquired by reinvestment of distributions without a charge at any time.

Prospectus 13

If you sell (redeem) class C shares obtained in an exchange of class C shares of another Putnam fund within one year after you originally acquired the class C shares of the other Putnam fund, you will pay a deferred sales charge of 1.00%.

<R>

</R>

Class B shares convert automatically to class A shares after eight years.

Orders for class C shares of one or more Putnam funds, other than class C shares sold to qualified employee-benefit plans, will be refused when the existing account balances that are eligible to be linked under a right of accumulation for purchases of class A shares, is $1,000,000 or more. Investors considering cumulative purchases of $1,000,000 or more should consider whether class A shares would be more advantageous and consult their financial representative.

<R>

Class C shares convert automatically to class A shares after ten years, thereby reducing 12b-1 fees (if applicable), provided that Putnam Investor Services or the financial intermediary through which a shareholder purchased class C shares has records verifying that the class C shares have been held for at least ten years, and that class A shares are available for purchase by residents in the shareholder’s jurisdiction. In certain cases, records verifying that the class C shares have been held for at least ten years may not be available (for example, participant level share lot aging may not be tracked by group retirement plan recordkeeping platforms through which class C shares of the fund are held in an omnibus account). If such records are unavailable, Putnam Investor Services or the relevant financial intermediary may not effect the conversion or may effect the conversion on a different schedule determined by Putnam Investor Services or the financial intermediary, which may be shorter or longer than ten years. Investors should consult their financial representative for more information about their eligibility for class C share conversion.

Class R shares only

Class R shares have no deferred sales charge.

</R>

- General (all classes). Because the fund seeks to be fully invested at all times, the fund only sells shares to you when it receives “same-day funds,” which are monies that are credited to the fund’s designated bank account at the Federal Reserve Bank of Boston. If the fund receives same-day funds before the close of trading on the NYSE, it will accept the order to buy shares that day.

- You may be eligible for reductions and waivers of deferred sales charges. Deferred sales charges may be reduced or waived under certain circumstances and for certain groups. The CDSC waiver categories described below do not apply to customers purchasing shares of the fund through any of the financial intermediaries specified in the Appendix to this prospectus (each, a “Specified Intermediary”).

Different financial intermediaries may impose different sales charges. Please refer to the Appendix for the CDSC waivers that are applicable to each Specified Intermediary.

14 Prospectus

Class B and class C shares

A CDSC is waived in the event of a redemption under the following circumstances:

| (i) | a withdrawal from a Systematic Withdrawal Plan (“SWP”) of up to 12% of the net asset value of the account (calculated as set forth in the SAI); |

| (ii) | a redemption of shares that are no longer subject to the CDSC holding period therefor; |

| (iii) | a redemption of shares that were issued upon the reinvestment of distributions by the fund; |

<R>

| (iv) | a redemption of shares that were exchanged for shares of another Putnam fund, provided that the shares acquired in such exchange or subsequent exchanges (including shares of a Putnam money market fund or Putnam Ultra Short Duration Income Fund) will continue to remain subject to the CDSC, if applicable, until the applicable holding period expires; and |

</R>

| (v) | in the case of individual, joint or Uniform Transfers to Minors Act accounts, in the event of death or post-purchase disability of a shareholder, for the purpose of paying benefits pursuant to tax-qualified retirement plans (“Benefit Payments”), or, in the case of living trust accounts, in the event of the death or post-purchase disability of the settlor of the trust. |

Additional information about reductions and waivers of deferred sales charges is included in the SAI. You may consult your financial representative or Putnam Retail Management for assistance.

How do I sell or exchange fund shares?

<R>

You can sell your shares back to the fund or exchange them for shares of another Putnam fund any day the NYSE is open, either through your financial representative or directly to the fund. In the case of exchanges, shareholders of class A shares will, in most cases, be required to pay a sales charge, which varies depending on the fund to which they exchange shares and the amount exchanged. If you redeem your shares shortly after purchasing them, your redemption payment for the shares may be delayed until the fund collects the purchase price of the shares, which may be up to 7 calendar days after the purchase date.

</R>

Regarding exchanges, not all Putnam funds offer all classes of shares or may be open to new investors. If you exchange shares otherwise subject to a deferred sales charge, the transaction will not be subject to the deferred sales charge. When you redeem the shares acquired through the exchange, however, the redemption may be subject to the deferred sales charge, depending upon when and from which fund you originally purchased the shares. The deferred sales charge will be computed using the schedule of any fund into or from which you have exchanged your shares that would result in your paying the highest deferred sales charge applicable to your class of shares. For purposes of computing the deferred sales charge, the length of time you have owned your shares will be measured from the date of original purchase, unless you originally purchased the shares from another Putnam fund that does not directly charge a

Prospectus 15

deferred sales charge, in which case the length of time you have owned your shares will be measured from the date you exchange those shares for shares of another Putnam fund that does charge a deferred sales charge, and will not be affected by any subsequent exchanges among funds.

- Selling or exchanging shares through your financial representative. Your representative must receive your request in proper form before the close of regular trading on the NYSE for you to receive that day’s NAV, less any applicable deferred sales charge. Your representative will be responsible for furnishing all necessary documents to Putnam Investor Services on a timely basis and may charge you for his or her services.

- Selling or exchanging shares directly with the fund. Putnam Investor Services must receive your request in proper form before the close of regular trading on the NYSE in order to receive that day’s NAV, less any applicable deferred sales charge.

- By mail. Send a letter of instruction signed by all registered owners or their legal representatives to Putnam Investor Services.

- By telephone. You may use Putnam’s telephone redemption privilege to redeem shares valued at less than $100,000 unless you have notified Putnam Investor Services of an address change within the preceding 15 days, in which case other requirements may apply. Unless you indicate otherwise on the account application, Putnam Investor Services will be authorized to accept redemption instructions received by telephone. A telephone exchange privilege is currently available for amounts up to $500,000. The telephone redemption and exchange privileges may be modified or terminated without notice.

- Via the Internet. You may also exchange shares via the Internet at www.putnam.com/individual.

- Selling shares by check. If you would like to use the check-writing service, mark the proper box on the application or authorization form and complete the signature card (and, if applicable, the resolution). The fund will send you checks when it receives these properly completed documents. You can then make the checks payable to the order of anyone. The fund will redeem a sufficient number of full and fractional shares in your account at the next NAV that is calculated after the check is accepted to cover the amount of the check and any applicable deferred sales charge. The minimum redemption amount per check is $250. Currently, Putnam is waiving this minimum. The use of checks is subject to the rules of your fund’s designated bank for its checking accounts. If you do not have a sufficient number of shares in your account to cover the amount of the check and any applicable deferred sales charge, the check will be returned and no shares will be redeemed. Because it is not possible to determine your account’s value in advance, you should not write a check for the entire value of your account or try to close your account by writing a check. The fund may change or end check-writing privileges at any time without notice. The check-writing service is not available for tax-qualified retirement plans.

16 Prospectus

- Additional requirements. In certain situations, for example, if you sell shares with a value of $100,000 or more, the signatures of all registered owners or their legal representatives must be guaranteed by a bank, broker-dealer or certain other financial institutions. In addition, Putnam Investor Services usually requires additional documents for the sale of shares by a corporation, partnership, agent or fiduciary, or surviving joint owner. For more information concerning Putnam’s signature guarantee and documentation requirements, contact Putnam Investor Services.

The fund also reserves the right to revise or terminate the exchange privilege, limit the amount or number of exchanges or reject any exchange. The fund into which you would like to exchange may also reject your exchange. These actions may apply to all shareholders or only to those shareholders whose exchanges Putnam Management determines are likely to have a negative effect on the fund or other Putnam funds. Consult Putnam Investor Services before requesting an exchange. Ask your financial representative or Putnam Investor Services for prospectuses of other Putnam funds. Some Putnam funds are not available in all states.

<R>

Class A shares obtained by exchanging shares from another Putnam fund that were originally purchased on or after March 1, 2018 without an initial sales charge may be subject to a 1.00% deferred sales charge if redeemed within twelve months of the original purchase. Class A shares obtained by exchanging shares from another Putnam fund that were originally purchased prior to March 1, 2018 without and initial sales charge may be subject to a 1.00% deferred sales charge if redeemed within nine months of the original purchase.

Deferred sales charges will be based on the lower of the shares’ cost and current NAV. Shares not subject to any charge will be redeemed first, followed by shares held longest. You may sell shares acquired by reinvestment of distributions without a charge at any time.

</R>

- Payment information. The fund typically expects to send you payment for your shares the business day after your request is received in good order, although if you hold your shares through certain financial intermediaries or financial intermediary programs, the fund typically expects to send payment for your shares within three business days after your request is received in good order. However, it is possible that payment of redemption proceeds may take up to seven days. Under unusual circumstances, the fund may suspend redemptions, or postpone payment for more than seven days, as permitted by federal securities law. Under normal market conditions, the fund typically expects to satisfy redemption requests by using holdings of cash and cash equivalents or selling portfolio assets to generate cash. Under stressed market conditions, the fund may also satisfy redemption requests by borrowing under the fund’s lines of credit or interfund lending arrangements. For additional information regarding the fund’s lines of credit and interfund lending arrangements, please see the Statement of Additional Information.

<R>

To the extent consistent with applicable laws and regulations, the fund reserves the right to satisfy all or a portion of a redemption request by distributing securities or other property in lieu of cash (“in-kind” redemptions), under both normal and

Prospectus 17

stressed market conditions. The fund generally expects to use in-kind redemptions only in stressed market conditions or stressed conditions specific to the fund, such as redemption requests that represent a large percentage of the fund’s net assets in order to minimize the effect of the large redemption on the fund and its remaining shareholders. The fund will not use in-kind redemptions for retail investors who hold shares of the fund through a financial intermediary. Any in-kind redemption will be effected through a pro rata distribution of all publicly traded portfolio securities or securities for which quoted bid prices are available, subject to certain exceptions. The securities distributed in an in-kind redemption will be valued in the same manner as they are valued for purposes of computing the fund’s net asset value. Once distributed in-kind to an investor, securities may increase or decrease in value before the investor is able to convert them into cash. Any transaction costs or other expenses involved in liquidating securities received in an in-kind redemption will be borne by the redeeming investor. The fund has committed, in connection with an election under Rule 18f-1 under the Investment Company Act of 1940, to pay all redemptions of fund shares by a single shareholder during any 90-day period in cash, up to the lesser of (i) $250,000 or (ii) 1% of the fund’s net assets measured as of the beginning of such 90-day period. For information regarding procedures for in-kind redemptions, please contact Putnam Retail Management. You will not receive interest on uncashed redemption checks.

</R>

- Redemption by the fund. If you own fewer shares than the minimum set by the Trustees (presently 500 shares), the fund may redeem your shares without your permission and send you the proceeds after providing you with at least 60 days’ notice to attain the minimum. To the extent permitted by applicable law, the fund may also redeem shares if you own more than a maximum amount set by the Trustees. There is presently no maximum, but the Trustees could set a maximum that would apply to both present and future shareholders.

<R>

- Liquidity fees and redemption gates. The fund has adopted policies and procedures permitting the Board of Trustees of the fund to impose a liquidity fee or redemption gate in the event the fund’s weekly liquid assets fall below specified thresholds. If, at any time, the fund has invested less than 30% of its total assets in weekly liquid assets, the fund may institute a liquidity fee of up to 2% or impose a redemption gate for a period of up to ten days in any rolling ninety day period, if the fund’s Trustees, including a majority of independent Trustees, determine that the liquidity fee or redemption gate is in the best interests of the fund. If, at the end of a business day, the fund’s weekly liquid assets equal less than 10% of its total assets, the fund must institute a liquidity fee of 1%, unless the Trustees, including a majority of the independent Trustees, determine that imposing the fee is not in the best interests of the fund. Any liquidity fees paid by shareholders are retained by the fund and may be used by the fund to maintain the fund’s liquidity and satisfy redemption orders from the fund.

</R>

A liquidity fee or redemption gate will remain in effect until the Trustees, including a majority of the independent Trustees, determine that the liquidity fee or redemption gate is no longer in the best interests of the fund, or until the fund’s weekly liquid

18 Prospectus

assets equal 30% or more of its total assets. A redemption gate will also be lifted if it has been in effect for ten business days in any rolling 90 calendar day period.

Any liquidity fees will reduce the amount you will receive upon the redemption of your shares, and generally will decrease the amount of any capital gain or increase the amount of any capital loss you will recognize with respect to the redemption. In the absence of further guidance, the fund expects to treat liquidity fees as reducing proceeds paid to shareholders in redemption of fund shares, and therefore potentially generating a tax loss for redeeming shareholders, but not constituting income to the fund.

The fund will notify shareholders of the imposition or termination of any liquidity fee or redemption gate on the fund’s website at putnam.com. Announcement of the imposition or termination of a liquidity fee or redemption gate will also be filed with the SEC on Form N-CR.

Policy on excessive short-term trading

- Policy on excessive short-term trading. Because the fund is a money market fund that investors may seek to use as a source of short-term liquidity, Putnam Management and the fund’s Trustees have not adopted policies to discourage short-term trading in the fund. However, because very large cash flows based on short-term trading may, under some market conditions, decrease the fund’s performance, Putnam Management and the fund reserve the right to revise or terminate the exchange privilege, limit the amount or number of exchanges or reject any exchange. Any fund into which you would like to exchange may also reject your exchange. These actions may apply to all shareholders or only to those shareholders whose exchanges Putnam Management determines are likely to have a negative effect on the fund or other Putnam funds. Consult Putnam Investor Services before requesting an exchange.

Distribution plans and payments to dealers

Putnam funds are distributed primarily through dealers (including any broker, dealer, bank, bank trust department, registered investment advisor, financial planner, retirement plan administrator, and any other institution having a selling, services, or any similar agreement with Putnam Retail Management or one of its affiliates). In order to pay for the marketing of fund shares and services provided to shareholders, the fund has adopted distribution and service (12b-1) plans, which increase the annual operating expenses you pay each year in certain share classes, as shown in the table of annual fund operating expenses in the section Fund summary — Fees and expenses. Putnam Retail Management and its affiliates also make additional payments to dealers that do not increase your fund expenses, as described below.

<R>

- Distribution and service (12b-1) plans. The fund has adopted distribution plans to pay for the marketing of its class B, class C and class R shares and for services provided to shareholders. The plans provide for payments at annual rates (based on average net assets) of up to 0.75% on class B shares and 1.00% on class C and class R

Prospectus 19

shares. The Trustees currently limit payments on class B, class C, and class R shares to 0.00% of average net assets.

</R>

- Payments to dealers. If you purchase your shares through a dealer, your dealer generally receives payments from Putnam Retail Management representing some or all of the sales charges and distribution and service (12b-1) fees, if any, shown in the tables under Fund summary — Fees and expenses at the front of this prospectus.

Putnam Retail Management and its affiliates also pay additional compensation to selected dealers in recognition of their marketing support and/or program servicing (each of which is described in more detail below). These payments may create an incentive for a dealer firm or its representatives to recommend or offer shares of the fund or other Putnam funds to its customers. These additional payments are made by Putnam Retail Management and its affiliates and do not increase the amount paid by you or the fund as shown under Fund summary — Fees and expenses.

The additional payments to dealers by Putnam Retail Management and its affiliates are generally based on one or more of the following factors: average net assets of a fund attributable to that dealer, sales or net sales of a fund attributable to that dealer, or reimbursement of ticket charges (fees that a dealer firm charges its representatives for effecting transactions in fund shares), or on the basis of a negotiated lump sum payment for services provided.

<R>

Marketing support payments are generally available to most dealers engaging in significant sales of Putnam fund shares. These payments are individually negotiated with each dealer firm, taking into account the marketing support services provided by the dealer, including business planning assistance, educating dealer personnel about the Putnam funds and shareholder financial planning needs, placement on the dealer’s preferred or recommended fund company list, access to sales meetings, sales representatives and management representatives of the dealer, market data, as well as the size of the dealer’s relationship with Putnam Retail Management. Although the total amount of marketing support payments made to dealers in any year may vary, on average, the aggregate payments are not expected, on an annual basis, to exceed 0.085% of the average net assets of Putnam’s retail mutual funds attributable to the dealers.

</R>

Program servicing payments, which are paid in some instances to dealers in connection with investments in the fund through dealer platforms and other investment programs, are not expected, with certain limited exceptions, to exceed 0.20% of the total assets in the program on an annual basis. These payments are made for program or platform services provided by the dealer, including shareholder recordkeeping, reporting, or transaction processing, as well as services rendered in connection with dealer platform development and maintenance, fund/investment selection and monitoring, or other similar services.

<R>

You can find a list of all dealers to which Putnam made marketing support and/or program servicing payments in 2019 in the SAI, which is on file with the SEC and is also available on Putnam’s website at putnam.com. You can also find other details in the SAI about the payments made by Putnam Retail Management and

20 Prospectus

its affiliates and the services provided by your dealer. Your dealer may charge you fees or commissions in addition to those disclosed in this prospectus. You can also ask your dealer about any payments it receives from Putnam Retail Management and its affiliates and any services your dealer provides, as well as about fees and/or commissions it charges.

- Other payments. Putnam Retail Management and its affiliates may make other payments (including payments in connection with educational seminars or conferences) or allow other promotional incentives to dealers to the extent permitted by SEC and NASD (as adopted by FINRA) rules and by other applicable laws and regulations. The fund’s transfer agent may also make payments to certain financial intermediaries in recognition of subaccounting or other services they provide to shareholders or plan participants who invest in the fund or other Putnam funds through their retirement plan. See the discussion in the SAI under Management — Investor Servicing Agent for more details.

</R>

Fund distributions and taxes

The fund declares a distribution daily of all its net income. The fund normally distributes any net investment income monthly. You may choose to reinvest distributions from net investment income in additional shares of your fund or other Putnam funds, or you may receive them in cash in the form of a check or an electronic deposit to your bank account. If you do not select an option when you open your account, all distributions will be reinvested. If you choose to receive distributions in cash, but correspondence from the fund or Putnam Investor Services is returned as “undeliverable,” the distribution option on your account may be converted to reinvest future distributions in the fund. You will not receive interest on uncashed distribution checks.

For federal income tax purposes, distributions of net investment income are generally taxable to you as ordinary income. Taxes on distributions of capital gains are determined by how long the fund owned (or is deemed to have owned) the investments that generated them, rather than by how long you have owned (or are deemed to have owned) your shares. Distributions that the fund properly reports to you as gains from investments that the fund owned for more than one year are generally taxable to you as long-term capital gains includible in net capital gain and taxed to individuals at reduced rates. Distributions of gains from investments that the fund owned for one year or less are generally taxable to you as ordinary income. Distributions are taxable in the manner described in this paragraph whether you receive them in cash or reinvest them in additional shares of this fund or other Putnam funds.

Distributions by the fund to retirement plans that qualify for tax-advantaged treatment under federal income tax laws will not be taxable. Special tax rules apply to investments through such plans. You should consult your tax advisor to determine the suitability of the fund as an investment through such a plan and the tax treatment

Prospectus 21

of distributions (including distributions of amounts attributable to an investment in the fund) from such a plan.

The fund’s investments in certain debt obligations may cause the fund to recognize taxable income in excess of the cash generated by such obligations. Thus, the fund could be required at times to liquidate other investments, including when it is not advantageous to do so, in order to satisfy its distribution requirements.

The fund’s investments in foreign securities, if any, may be subject to foreign withholding or other taxes. In that case, the fund’s return on those investments would be decreased.

Shareholders generally will not be entitled to claim a credit or deduction with respect to these foreign taxes.

Any gain resulting from the sale or exchange of your shares generally also will be subject to tax.

The above is a general summary of the tax implications of investing in the fund. Please refer to the SAI for further details. You should consult your tax advisor for more information on your own tax situation, including possible foreign, state and local taxes.

Information about the Summary Prospectus, Prospectus, and SAI

The summary prospectus, prospectus, and SAI for a fund provide information concerning the fund. The summary prospectus, prospectus, and SAI are updated at least annually and any information provided in a summary prospectus, prospectus, or SAI can be changed without a shareholder vote unless specifically stated otherwise. The summary prospectus, prospectus, and the SAI are not contracts between the fund and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Financial highlights

<R>

The financial highlights tables are intended to help you understand the fund’s recent financial performance. Certain information reflects financial results for a single fund share. Effective November 25, 2019, all class M shares of the fund were converted to class A shares of the fund. The total returns represent the rate that an investor would have earned or lost on an investment in the fund, assuming reinvestment of all dividends and distributions. The financial highlights have been audited by PricewaterhouseCoopers LLP. The Independent Registered Public Accounting Firm’s report and the fund’s financial statements are included in the fund’s annual report to shareholders, which is available upon request.

</R>

22 Prospectus

This page intentionally left blank.

Prospectus 23

Financial highlights (For a common share outstanding throughout the period)

<R>

| INVESTMENT OPERATIONS | LESS DISTRIBUTIONS | RATIOS AND SUPPLEMENTAL DATA | ||||||||||

| Period ended | Net asset value, beginning of period | Net investment income (loss) | Net realized gain (loss) on investments | Total from investment operations | From net investment income | Total distributions | Non-recurring payments | Net asset value, end of period | Total return at net asset value (%) a | Net assets, end of period (in thousands) | Ratio of expenses to average net assets (%) b | Ratio of net investment income (loss) to average net assets (%) |

| Class A | ||||||||||||

| September 30, 2019 | $1.00 | .0203 | — | .0203 | (.0203) | (.0203) | — | $1.00 | 2.05 | $702,331 | .48 | 2.03 |

| September 30, 2018 | 1.00 | .0129 | — | .0129 | (.0129) | (.0129) | — | 1.00 | 1.30 | 713,763 | .50 | 1.29 |

| September 30, 2017 | 1.00 | .0046 | — | .0046 | (.0046) | (.0046) | — | 1.00 | .46 | 738,646 | .50 c | .45 c |

| September 30, 2016 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 868,914 | .44 c | .01 c |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0023 e | 1.00 | .01 | 1,141,026 | .16 c | .01 c |

| Class B | ||||||||||||

| September 30, 2019 | $1.00 | .0203 | — | .0203 | (.0203) | (.0203) | — | $1.00 | 2.05 | $3,044 | .48 | 2.04 |

| September 30, 2018 | 1.00 | .0129 | — | .0129 | (.0129) | (.0129) | — | 1.00 | 1.30 | 3,941 | .50 | 1.21 |

| September 30, 2017 | 1.00 | .0034 | — | .0034 | (.0034) | (.0034) | — | 1.00 | .34 | 9,460 | .61 c | .33 c |

| September 30, 2016 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 9,155 | .44 c | .01 c |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0020 e | 1.00 | .01 | 8,597 | .16 c | .01 c |

| Class C | ||||||||||||

| September 30, 2019 | $1.00 | .0203 | — | .0203 | (.0203) | (.0203) | — | $1.00 | 2.05 | $16,076 | .48 | 2.03 |

| September 30, 2018 | 1.00 | .0129 | — | .0129 | (.0129) | (.0129) | — | 1.00 | 1.30 | 10,794 | .50 | 1.20 |

| September 30, 2017 | 1.00 | .0034 | — | .0034 | (.0034) | (.0034) | — | 1.00 | .34 | 19,347 | .60 c | .34 c |

| September 30, 2016 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 26,581 | .44 c | .02 c |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0020 e | 1.00 | .01 | 39,085 | .16 c | .01 c |

| Class R | ||||||||||||

| September 30, 2019 | $1.00 | .0203 | — | .0203 | (.0203) | (.0203) | — | $1.00 | 2.05 | $5,605 | .48 | 2.02 |

| September 30, 2018 | 1.00 | .0129 | — | .0129 | (.0129) | (.0129) | — | 1.00 | 1.30 | 5,567 | .50 | 1.25 |

| September 30, 2017 | 1.00 | .0034 | — | .0034 | (.0034) | (.0034) | — | 1.00 | .34 | 7,470 | .61 c | .33 c |

| September 30, 2016 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 12,536 | .44 c | .01 c |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0020 e | 1.00 | .01 | 15,692 | .16 c | .01 c |

</R>

| a | Total return assumes dividend reinvestment and does not reflect the effect of sales charges. |

| b | Includes amounts paid through expense offset and/or brokerage/service arrangements, if any. Also excludes acquired fund fees and expenses, if any. |

| c | Reflects a voluntary waiver of certain fund expenses in effect during the period relating to the enhancement of certain annualized net yields of the fund. As a result of such waivers, the expenses of each class reflect a reduction of the following amounts as a percentage of average net assets: |

<R>

| 9/30/17 | 9/30/16 | 9/30/15 | |

| Class A | 0.00% | 0.08% | 0.32% |

| Class B | 0.14 | 0.58 | 0.82 |

| Class C | 0.15 | 0.58 | 0.82 |

| Class R | 0.14 | 0.58 | 0.82 |

</R>

| d | Amount represents less than $0.0001 per share. |

| e | Reflects a voluntary non-recurring payment from Putnam Investments. |

| 24 Prospectus | Prospectus 25 |

Appendix

Financial intermediary specific sales charge waiver information

<R>

As described in the prospectus, class A, B and C shares may be subject to a CDSC if purchased by exchange from another Putnam fund. Certain financial intermediaries may waive the CDSC in certain circumstances. This Appendix details the variations in sales charge waivers by financial intermediary. Not all financial intermediaries specify financial intermediary-specific sales charge waiver categories for every share class. You should consult your financial representative for assistance in determining whether you may qualify for a particular sales charge waiver.

</R>

AMERIPRISE FINANCIAL

Class A Shares Front-End Sales Charge Waivers Available at Ameriprise Financial

The following information applies to class A share purchases if you have an account with or otherwise purchase class A shares through Ameriprise Financial:

Effective June 1, 2018, shareholders purchasing class A shares of the fund through Ameriprise Financial will be eligible for the following front-end sales charge waivers only, which may differ from those disclosed elsewhere in this prospectus or the SAI:

- Employer-sponsored retirement plans (e.g., 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans and defined benefit plans). For purposes of this provision, employer-sponsored retirement plans do not include SEP IRAs, Simple IRAs or SAR-SEPs

- Shares purchased through an Ameriprise Financial investment advisory program

- Shares purchased by third party investment advisors on behalf of their advisory clients through Ameriprise Financial’s platform

- Shares purchased through reinvestment of capital gains distributions and dividend reinvestment when purchasing shares of the same fund (but not any other Putnam fund)

- Shares exchanged from Class C shares of the same fund in the month of or following the 10-year anniversary of the purchase date. To the extent that this prospectus elsewhere provides for a waiver with respect to such shares following a shorter holding period, that waiver will apply to exchanges following such shorter period. To the extent that this prospectus elsewhere provides for a waiver with respect to exchanges of Class C shares for load waived shares, that waiver will also apply to such exchanges

- Employees and registered representatives of Ameriprise Financial or its affiliates and their immediate family members

- Shares purchased by or through qualified accounts (including IRAs, Coverdell Education Savings Accounts, 401(k)s, 403(b) TSCAs subject to ERISA and defined benefit plans) that are held by a covered family member, defined as an Ameriprise financial advisor and/or the advisor’s spouse, advisor’s lineal ascendant (mother, father, grandmother, grandfather, great grandmother, great grandfather), advisor’s lineal descendant (son, step-son, daughter, step-daughter, grandson, granddaughter,

26 Prospectus

great grandson, great granddaughter) or any spouse of a covered family member who is a lineal descendant

- Shares purchased from the proceeds of redemptions within the same fund family, provided (1) the repurchase occurs within 90 days following the redemption, (2) the redemption and purchase occur in the same account, and (3) redeemed shares were subject to a front-end or deferred sales load (i.e. Rights of Reinstatement)

MERRILL LYNCH

Effective April 10, 2017, if you purchase fund shares through a Merrill Lynch platform or account held at Merrill Lynch, you will be eligible only for the following sales charge waivers (front-end sales charge waivers and CDSC waivers) and discounts, which may differ from those disclosed elsewhere in the fund’s prospectus or SAI. It is your responsibility to notify your financial representative at the time of purchase of any relationship or other facts qualifying you for sales charge waivers or discounts.

Front-end Sales Charge Waivers on Class A Shares available through Merrill Lynch

- Employer-sponsored retirement, deferred compensation and employee benefit plans (including health savings accounts) and trusts used to fund those plans, provided that the shares are not held in a commission-based brokerage account and shares are held for the benefit of the plan

- Shares purchased by college savings plans that qualify for tax-exempt treatment under Section 529 of the Internal Revenue Code of 1986, as amended

- Shares purchased through a Merrill Lynch-affiliated investment advisory program

- Shares purchased by third party investment advisors on behalf of their advisory clients through Merrill Lynch’s platform

- Shares of funds purchased through the Merrill Edge Self-Directed platform

- Shares purchased through reinvestment of capital gains distributions and dividend reinvestment when purchasing shares of the fund (but not any other Putnam fund)

- Shares exchanged from Class C shares of the same fund in the month of or following the 10-year anniversary of the purchase date

- Employees and registered representatives of Merrill Lynch or its affiliates and their family members

- Trustees of the fund, and employees of Putnam Management or any of its affiliates, as described in the fund’s prospectus

Prospectus 27

- Shares purchased from the proceeds of redemptions from a Putnam fund, provided (1) the repurchase occurs within 90 days following the redemption, (2) the redemption and purchase occur in the same account, and (3) redeemed shares were subject to a front-end or deferred sales charge (known as Rights of Reinstatement)

CDSC Waivers on A, B and C Shares available through Merrill Lynch

- Death or disability of the shareholder

- Shares sold as part of a systematic withdrawal plan as described in the fund’s prospectus

- Return of excess contributions from an IRA Account

- Shares sold as part of a required minimum distribution for IRA and retirement accounts due to the shareholder reaching age 70½

- Shares sold to pay Merrill Lynch fees but only if the transaction is initiated by Merrill Lynch

- Shares acquired through a right of reinstatement

- Shares held in retirement brokerage accounts that are exchanged for a share class with lower operating expenses due to transfer to certain fee based accounts or platforms (applicable to A and C shares only)

Front-end Sales Charge Discounts available through Merrill Lynch: Breakpoints, Rights of Accumulation & Letters of Intent

- Breakpoints as described in the fund’s prospectus and SAI

- Rights of Accumulation (ROA), which entitle you to breakpoint discounts, will be automatically calculated based on the aggregated holding of fund family assets held by accounts within your household at Merrill Lynch. Eligible Putnam fund assets not held at Merrill Lynch may be included in the ROA calculation only if you notify your financial representative about such assets

- Letters of Intent (LOI), which allow for breakpoint discounts based on anticipated purchases of Putnam funds, through Merrill Lynch, over a 13-month period

MORGAN STANLEY WEALTH MANAGEMENT

Effective July 1, 2018, shareholders purchasing fund shares through a Morgan Stanley Wealth Management transactional brokerage account will be eligible only for the following front-end sales charge waivers with respect to class A shares, which may differ from and may be more limited than those disclosed elsewhere in this fund’s Prospectus or SAI.

Front-end Sales Charge Waivers on class A Shares available at Morgan Stanley Wealth Management:

- Employer-sponsored retirement plans (e.g., 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans and defined benefit plans). For purposes of this provision, employer-sponsored retirement plans do not include SEP IRAs, Simple IRAs, SAR-SEPs or Keogh plans

- Morgan Stanley employee and employee-related accounts according to Morgan Stanley’s account linking rules

28 Prospectus

- Shares purchased through reinvestment of dividends and capital gains distributions when purchasing shares of the same fund

- Shares purchased through a Morgan Stanley self-directed brokerage account

- Class C (i.e., level-load) shares that are no longer subject to a contingent deferred sales charge and are converted to Class A shares of the same fund pursuant to Morgan Stanley Wealth Management’s share class conversion program

- Shares purchased from the proceeds of redemptions within the same fund family, provided (i) the repurchase occurs within 90 days following the redemption, (ii) the redemption and purchase occur in the same account, and (iii) redeemed shares were subject to a front-end or deferred sales charge

<R>

RAYMOND JAMES & ASSOCIATES, INC., RAYMOND JAMES FINANCIAL SERVICES, INC. AND EACH ENTITY’S AFFILIATES (“RAYMOND JAMES”)

Effective March 1, 2019, shareholders purchasing fund shares through a Raymond James platform or account, or through an introducing broker-dealer or independent registered investment adviser for which Raymond James provides trade execution, clearance, and/or custody services, will be eligible only for the following load waivers (front-end sales charge waivers and contingent deferred, or back-end, sales charge waivers) and discounts, which may differ from those disclosed elsewhere in this fund’s prospectus or SAI.

In all instances, it is the purchaser’s responsibility to notify the fund or the purchaser’s financial intermediary at the time of purchase of any relationship or other facts qualifying the purchaser for sales charge waivers or discounts. For waivers and discounts not available through a particular intermediary, shareholders will have to purchase fund shares directly from the fund or through another intermediary to receive these waivers or discounts.

Front-end sales load waivers on Class A shares available at Raymond James

- Shares purchased in an investment advisory program.

- Shares purchased within the same fund family through a systematic reinvestment of capital gains and dividend distributions.

- Employees and registered representatives of Raymond James or its affiliates and their family members as designated by Raymond James.

- Shares purchased from the proceeds of redemptions within the same fund family, provided (1) the repurchase occurs within 90 days following the redemption, (2) the redemption and purchase occur in the same account, and (3) redeemed shares were subject to a front-end or deferred sales load (known as Rights of Reinstatement).