| Label |

Element |

Value |

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Document Type |

dei_DocumentType |

485BPOS

|

|

| Document Period End Date |

dei_DocumentPeriodEndDate |

Dec. 31, 2017

|

|

| Registrant Name |

dei_EntityRegistrantName |

PUTNAM MONEY MARKET FUND

|

|

| Central Index Key |

dei_EntityCentralIndexKey |

0000081248

|

|

| Amendment Flag |

dei_AmendmentFlag |

false

|

|

| Trading Symbol |

dei_TradingSymbol |

PDDXX

|

|

| Document Creation Date |

dei_DocumentCreationDate |

Jan. 30, 2018

|

|

| Document Effective Date |

dei_DocumentEffectiveDate |

Jan. 30, 2018

|

|

| Prospectus Date |

rr_ProspectusDate |

Jan. 30, 2018

|

|

| Putnam Money Market Fund |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Fund Summary

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Goal

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

Putnam Money

Market Fund seeks as high a rate of current income as Putnam Investment Management, LLC believes is consistent with preservation

of capital and maintenance of liquidity.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following

table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

Restated to reflect current fees. The fund's Board of Trustees determined to limit payments under the distribution and service

(12b-1) plans in place with respect to class B, class C, class M, class R and class T1 shares to 0.00% of average net assets

effective as of the close of business on March 31, 2017. Beginning on April 1, 2017, the fund no longer makes payments under

the distribution and service (12b-1) plans in place with respect to class B, class C, class M, class R and class T1 shares.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The following

hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds.

It assumes that you invest $10,000 in the fund for the time periods indicated and then redeem or hold all your shares at the end

of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same.

Your actual costs may be higher or lower.

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Investments,

risks, and performance

Investments

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

We invest mainly

in money market instruments that are high quality and have short-term maturities. We invest significantly in certificates of deposit,

commercial paper (including asset-backed commercial paper), U.S. government debt and repurchase agreements, corporate obligations

and time deposits. We may also invest in U.S. dollar denominated foreign securities of these types. We may consider, among other

factors, credit and interest rate risks, as well as general market conditions, when deciding whether to buy or sell investments.

|

|

| Risk [Heading] |

rr_RiskHeading |

Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

The values

of money market investments usually rise and fall in response to changes in interest rates. Interest rate risk is generally lowest

for investments with short maturities (a significant part of the fund’s investments). Changes in the financial condition

of an issuer or counterparty, changes in specific economic or political conditions that affect a particular type of issuer, and

changes in general economic or political conditions can increase the risk of default by an issuer or counterparty, which can affect

a security’s or instrument’s credit quality or value. Although the fund only buys high quality

investments, investments backed by a letter of credit have the risk that the provider of the letter of credit will not be able

to fulfill its obligations to the issuer. The effects of inflation may erode the value of your investment over time.

The fund may

not achieve its goal, and is not intended to be a complete investment program. You could lose money by investing in the fund. Although

the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The fund may impose

a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below

certain required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed

by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to

provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at

any time.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You could lose money by investing in the fund.

|

|

| Risk Money Market Fund [Text] |

rr_RiskMoneyMarketFund |

Although

the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The fund may impose

a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below

certain required minimums because of market conditions or other factors.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not insured or guaranteed

by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

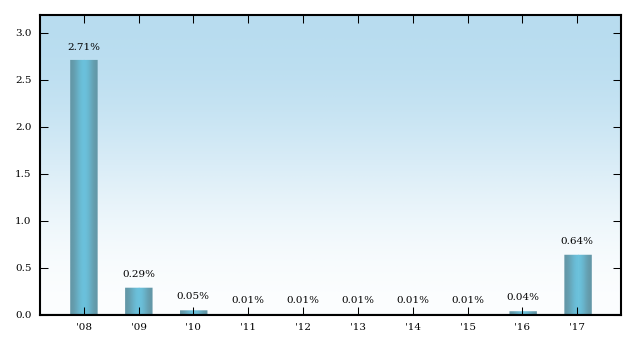

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The performance

information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance

year to year and over time. Please remember that past performance is not necessarily an indication of future results. Monthly performance

figures for the fund are available at putnam.com.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The performance

information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance

year to year and over time.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

putnam.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Please remember that past performance is not necessarily an indication of future results.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Annual total returns for class A shares

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

The bar chart does not reflect the impact of sales charges. If it did, performance would be lower.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Best calendar quarter

Q1 2008 0.92%

Worst calendar quarter

Q3 2016 0.00%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best calendar quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Mar. 30, 2008

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

0.92%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst calendar quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2016

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

none

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average annual total returns (for periods ended 12/31/17)

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

Class B share

performance reflects conversion to class A shares after eight years.

|

|

| Putnam Money Market Fund | Class A |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.29%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

[2] |

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 51

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

160

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

280

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 628

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

2.71%

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

0.29%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

0.05%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

0.01%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

0.01%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

0.01%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

0.01%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

0.01%

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

0.04%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

0.64%

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.64%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.14%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

0.37%

|

|

| Putnam Money Market Fund | Class B |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

5.00%

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.29%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

[2] |

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 551

|

[3] |

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

460

|

[3] |

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

480

|

[3] |

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

628

|

[3] |

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

51

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

160

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

280

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 628

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(4.45%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(0.28%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

0.31%

|

|

| Putnam Money Market Fund | Class C |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.29%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

[2] |

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 151

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

160

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

280

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 628

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.45%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.12%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

0.29%

|

|

| Putnam Money Market Fund | Class M |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.29%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

[2] |

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 51

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

160

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

280

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 628

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.60%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.13%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

0.35%

|

|

| Putnam Money Market Fund | Class R |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.29%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

[2] |

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 51

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

160

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

280

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 628

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.55%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.12%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

0.29%

|

|

| Putnam Money Market Fund | Class T1 |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.29%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

[2] |

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 51

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

160

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

280

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 628

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.58%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.12%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

0.33%

|

|

|

|