| Putnam Money Market Fund | ||||||||||||||||||||||||||||||||||||||||||||

| Fund Summary | ||||||||||||||||||||||||||||||||||||||||||||

| Goal | ||||||||||||||||||||||||||||||||||||||||||||

| Putnam Money Market Fund seeks as high a rate of current income as Putnam Investment Management, LLC believes is consistent with preservation of capital and maintenance of liquidity. | ||||||||||||||||||||||||||||||||||||||||||||

| Fees and expenses | ||||||||||||||||||||||||||||||||||||||||||||

| The following table describes the fees and expenses you may pay if you buy and hold shares of the fund. | ||||||||||||||||||||||||||||||||||||||||||||

| Shareholder fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Annual fund operating expenses (expenses you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||||||||||||||||

| The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then redeem or hold all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund's operating expenses remain the same. Your actual costs may be higher or lower. | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Investments | ||||||||||||||||||||||||||||||||||||||||||||

| We invest mainly in money market instruments that are high quality and have short-term maturities. We invest significantly in certificates of deposit, commercial paper (including asset-backed commercial paper), U.S. government debt and repurchase agreements, corporate obligations and time deposits. We may also invest in U.S. dollar denominated foreign securities of these types. We may consider, among other factors, credit and interest rate risks, as well as general market conditions, when deciding whether to buy or sell investments. | ||||||||||||||||||||||||||||||||||||||||||||

| Risks | ||||||||||||||||||||||||||||||||||||||||||||

| The values

of money market investments usually rise and fall in response to changes in interest rates. Interest rate risk is generally lowest

for investments with short maturities (a significant part of the fund’s investments). Although the fund only buys high quality

investments, investments backed by a letter of credit have the risk that the provider of the letter of credit will not be able

to fulfill its obligations to the issuer. The effects of inflation may erode the value of your investment over time. The fund may not achieve its goal, and is not intended to be a complete investment program. You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below certain required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. | ||||||||||||||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||||||||||||||

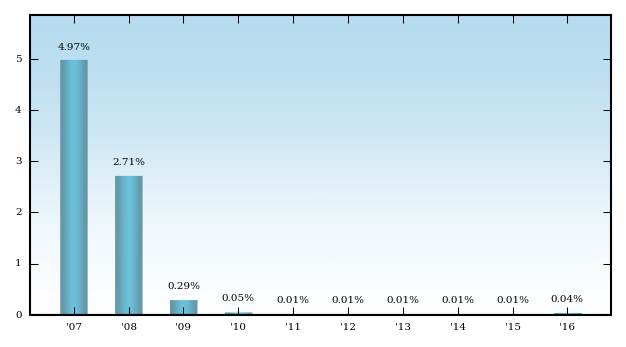

| The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the fund are available at putnam.com. | ||||||||||||||||||||||||||||||||||||||||||||

| Annual total returns for class A shares | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Best calendar quarter Q3 2007 1.26% Worst calendar quarter Q3 2016 0.00% | ||||||||||||||||||||||||||||||||||||||||||||

| Average annual total returns (for periods ending 12/31/16) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Class B share performance reflects conversion to class A shares after eight years. | ||||||||||||||||||||||||||||||||||||||||||||

| X | ||||||||||

- Definition Contains a command for the SEC Viewer for the role corresponding to OperatingExpensesData. No definition available.

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Risk/Return Bar Chart and Table. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Risk/Return Bar Chart and Table. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Contains a command for the SEC Viewer for the role corresponding to BarChartData. No definition available.

|

| X | ||||||||||

- Definition Distribution [and/or Service] (12b-1) Fees" include all distribution or other expenses incurred during the most recent fiscal year under a plan adopted pursuant to rule 12b-1 [17 CFR 270.12b-1]. Under an appropriate caption or a subcaption of "Other Expenses," disclose the amount of any distribution or similar expenses deducted from the Fund's assets other than pursuant to a rule 12b-1 plan. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Heading for Expense Example. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Contains a command for the SEC Viewer for the role corresponding to ExpenseExampleNoRedemption. No definition available.

|

| X | ||||||||||

- Definition Contains a command for the SEC Viewer for the role corresponding to ExpenseExample. No definition available.

|

| X | ||||||||||

- Definition Risk/Return Summary Fee Table Includes the following information, in plain English under rule 421(d) under the Securities Act, after Item 2 Fees and expenses of the Fund This table describes the fees and expenses that you may pay if you buy and hold shared of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $[_____] in [name of fund family] funds. Shareholder Fees (fees paid directly from your investment) Example This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then you redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return per year and that the Fund's operating expenses remained the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be You would pay the following expenses if you did not redeem your shares The Example does not reflect sales charges (loads) on reinvested dividends [and other distributions]. If these sales charges (loads) were included, your costs would be higher. Portfolio Turnover The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was __% of the average value of its whole portfolio. Instructions. A.3.instructions.6 New Funds. For purposes of this Item, a "New Fund" is a Fund that does not include in Form N-1A financial statements reporting operating results or that includes financial statements for the Fund's initial fiscal year reporting operating results for a period of 6 months or less. The following Instructions apply to New Funds. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition This table describes the fees and expenses that you may pay if you buy and hold shared of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $[_____] in [name of fund family] funds. Include the narrative explanations in the order indicated. A Fund may modify the narrative explanations if the explanation contains comparable information to that shown. The narrative explanation regarding sales charge discounts is only required by a Fund that offers such discounts and should specify the minimum level of investment required to qualify for a discount. Modify the narrative explanation to state that Fund shares are sold on a national securities exchange at the end of the time periods indicated, and that brokerage commissions for buying and selling Fund shares through a broker are not reflected. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Total Annual Fund Operating Expenses. If the Fund is a Feeder Fund, reflect the aggregate expenses of the Feeder Fund and the Master Fund in a single fee table using the captions provided. In a footnote to the fee table, state that the table and Example reflect the expenses of both the Feeder and Master Funds. If the prospectus offers more than one Class of a Multiple Class Fund or more than one Feeder Fund that invests in the same Master Fund, provide a separate response for each Class or Feeder Fund. Base the percentages of "Annual Fund Operating Expenses" on amounts incurred during the Fund's most recent fiscal year, but include in expenses amounts that would have been incurred absent expense reimbursement or fee waiver arrangements. If the Fund has changed its fiscal year and, as a result, the most recent fiscal year is less than three months, use the fiscal year prior to the most recent fiscal year as the basis for determining "Annual Fund Operating Expenses." Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Management Fees include investment advisory fees (including any fees based on the Fund's performance), any other management fees payable to the investment adviser or its affiliates, and administrative fees payable to the investment adviser or its affiliates that are not included as "Other Expenses." Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Maximum Deferred Sales Charge (Load) (as a percentage of ____) "Maximum Deferred Sales Charge (Load)" includes the maximum total deferred sales charge (load) payable upon redemption, in installments, or both, expressed as a percentage of the amount or amounts stated in response to Item 7(a), except that, for a sales charge (load) based on net asset value at the time of purchase, show the sales charge (load) as a percentage of the offering price at the time of purchase. A Fund may include in a footnote to the table, if applicable, a tabular presentation showing the amount of deferred sales charges (loads) over time or a narrative explanation of the sales charges (loads) (e.g., __% in the first year after purchase, declining to __% in the __ year and eliminated thereafter). If more than one type of sales charge (load) is imposed (e.g., a deferred sales charge (load) and a front-end sales charge (load)), the first caption in the table should read "Maximum Sales Charge (Load)" and show the maximum cumulative percentage. Show the percentage amounts and the terms of each sales charge (load) comprising that figure on separate lines below. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Maximum Deferred Sales Charge (Load) (as a percentage of ____) A.3.instructions.2.a.i "Maximum Deferred Sales Charge (Load)" includes the maximum total deferred sales charge (load) payable upon redemption, in installments, or both, expressed as a percentage of the amount or amounts stated in response to Item 7(a), except that, for a sales charge (load) based on net asset value at the time of purchase, show the sales charge (load) as a percentage of the offering price at the time of purchase. A Fund may include in a footnote to the table, if applicable, a tabular presentation showing the amount of deferred sales charges (loads) over time or a narrative explanation of the sales charges (loads) (e.g., __% in the first year after purchase, declining to __% in the __ year and eliminated thereafter). A.3.instructions.2.a.ii If more than one type of sales charge (load) is imposed (e.g., a deferred sales charge (load) and a front-end sales charge (load)), the first caption in the table should read "Maximum Sales Charge (Load)" and show the maximum cumulative percentage. Show the percentage amounts and the terms of each sales charge (load) comprising that figure on separate lines below. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Investment Objectives/Goals. Disclose the Fund's investment objectives or goals. A Fund also may identify its type or category (e.g., that it is a Money Market Fund or a balanced fund). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Investment Objectives/Goals. Disclose the Fund's investment objectives or goals. A Fund also may identify its type or category (e.g., that it is a Money Market Fund or a balanced fund). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Annual Fund Operating Expenses (ongoing expenses that you pay each year as a percentage of the value of your investment) Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition "Other Expenses" include all expenses not otherwise disclosed in the table that are deducted from the Fund's assets or charged to all shareholder accounts. The amount of expenses deducted from the Fund's assets are the amounts shown as expenses in the Fund's statement of operations (including increases resulting from complying with paragraph 2(g) of rule 6-07 of Regulation S-X [17 CFR 210.6-07]). "Other Expenses" do not include extraordinary expenses as determined under generally accepted accounting principles (see Accounting Principles Board Opinion No. 30). If extraordinary expenses were incurred that materially affected the Fund's "Other Expenses," disclose in a footnote to the table what "Other Expenses" would have been had the extraordinary expenses been included. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Risk/Return Bar Chart and Table. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition If the Fund has annual returns for at least one calendar year, provide a table showing the Fund's (A) average annual total return; (B) average annual total return (after taxes on distributions); and (C) average annual total return (after taxes on distributions and redemption). A Money Market Fund should show only the returns described in clause (A) of the preceding sentence. All returns should be shown for 1-, 5-, and 10- calendar year periods ending on the date of the most recently completed calendar year (or for the life of the Fund, if shorter), but only for periods subsequent to the effective date of the Fund's registration statement. The table also should show the returns of an appropriate broad-based securities market index as defined in Instruction 5 to Item 22(b)(7) for the same periods. A Fund that has been in existence for more than 10 years also may include returns for the life of the Fund. A Money Market Fund may provide the Fund's 7-day yield ending on the date of the most recent calendar year or disclose a toll-free (or collect) telephone number that investors can use to obtain the Fund's current 7-day yield. For a Fund (other than a Money Market Fund or a Fund described in General Instruction C.3.(d)(iii)), provide the information in the following table with the specified captions AVERAGE ANNUAL TOTAL RETURNS (For the periods ended December 31, _____) Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition This item represents Average Anuual Total Returns. If a Multiple Class Fund offers a Class in the prospectus that converts into another Class after a stated period, compute average annual total returns in the table by using the returns of the other Class for the period after conversion. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Contains a command for the SEC Viewer for the role corresponding to PerformanceTableData. No definition available.

|

| X | ||||||||||

- Definition Narrative Risk Disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Narrative Risk Disclosure. A Fund may, in responding to this Item, describe the types of investors for whom the Fund is intended or the types of investment goals that may be consistent with an investment in the Fund. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Risk/Return Summary Investment Objectives/Goals Include the following information, in plain English under rule 421(d) under the Securities Act, in the order and subject matter indicated Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Shareholder Fees (fees paid directly from your investment). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Contains a command for the SEC Viewer for the role corresponding to ShareholderFeesData. No definition available.

|

| X | ||||||||||

- Definition Principal investment strategies of the Fund. Summarize how the Fund intends to achieve its investment objectives by identifying the Fund's principal investment strategies (including the type or types of securities in which the Fund invests or will invest principally) and any policy to concentrate in securities of issuers in a particular industry or group of industries. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Principal investment strategies of the Fund. Summarize how the Fund intends to achieve its investment objectives by identifying the Fund's principal investment strategies (including the type or types of securities in which the Fund invests or will invest principally) and any policy to concentrate in securities of issuers in a particular industry or group of industries. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Details

|

| X | ||||||||||

- Details

|

| X | ||||||||||

- Details

|

| X | ||||||||||

- Details

|

| X | ||||||||||

- Details

|

| X | ||||||||||

- Details

|

| X | ||||||||||

- Details

|