The Company makes commercial loans, real estate and construction loans and consumer loans, and accepts savings, time, and demand deposits. In addition, the Company offers its corporate and institutional customers automated lock box collection services, cash management services and account reconciliation services, and actively promotes the marketing of these services to the municipal market. Also, the Company provides full-service securities brokerage services through a program called Investment Services at Century Bank, which is supported by LPL Financial, a third party full-service securities brokerage business.

The Company has municipal cash management client engagements in Massachusetts, New Hampshire and Rhode Island composed of approximately 302 government entities.

Net income for the nine months ended September 30, 2021, was $33,325,000 or $5.99 per Class A share diluted, an increase of 8.9% compared to net income of $30,609,000, or $5.50 per Class A share diluted, for the same period a year ago.

Earnings per share “EPS” for each class of stock and time period is as follows:

| Three Months Ended September 30, |

||||||||

2021 |

2020 | |||||||

| Basic EPS – Class A common |

$ |

2.54 |

$ | 2.36 | ||||

| Basic EPS – Class B common |

$ |

1.27 |

$ | 1.18 | ||||

| Diluted EPS – Class A common |

$ |

2.11 |

$ | 1.96 | ||||

| Diluted EPS – Class B common |

$ |

1.27 |

$ | 1.18 | ||||

| Nine Months Ended | ||||||||

| September 30, | ||||||||

2021 |

2020 | |||||||

| Basic EPS – Class A common |

$ |

7.22 |

$ | 6.64 | ||||

| Basic EPS – Class B common |

$ |

3.61 |

$ | 3.32 | ||||

| Diluted EPS – Class A common |

$ |

5.99 |

$ | 5.50 | ||||

| Diluted EPS – Class B common |

$ |

3.61 |

$ | 3.32 | ||||

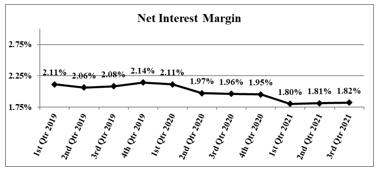

Net interest income totaled $88.9 million for the nine months ended September 30, 2021, compared to $78.4 million for the same period in 2020. The 13.5% increase in net interest income for the period is primarily due to a decrease in interest expense as a result of falling interest rates. The net interest margin decreased from 2.01% on a fully

tax-equivalent

basis for the first nine months of 2020 compared to 1.81% for the same period in 2021. This was primarily the result of increased margin pressure as a result of decreases in interest rates across the yield curve in 2020. The average balances of interest-earning assets increased for 2021 compared to the same period last year, by $1.36 billion, or 24.4%, combined with an average yield decrease of 0.68%, resulting in a decrease in interest income of $6.0 million. The average balance of interest-bearing liabilities increased for 2021 compared to the same period last year, by $1.04 billion, or 23.2%, combined with an average interest-bearing liabilities interest cost decrease of 0.59%, resulting in a decrease in interest expense of $16.5 million. The trends in the net interest margin are illustrated in the graph below:

Page 34 of 48