Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 10-K

___________________________

(Mark One)

|

| |

x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the fiscal year ended October 31, 2017

|

| |

¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number: 1-14977

___________________________

SANDERSON FARMS, INC.

(Exact name of registrant as specified in its charter)

___________________________

|

| |

Mississippi | 64-0615843 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| |

127 Flynt Road Laurel, Mississippi | 39443 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (601) 649-4030

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each Class: | Name of exchange on which registered: |

Common stock, $1.00 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

___________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | | | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

| | | | | | |

| | | | Emerging growth company | | ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant computed by reference to the closing sales price of the common equity in The NASDAQ Stock Market on the last business day of the Registrant’s most recently completed second fiscal quarter: $2,217,908,309.

Number of shares outstanding of the Registrant’s common stock as of December 7, 2017: 22,825,176 shares of common stock, $1.00 per share par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement filed or to be filed in connection with its 2018 Annual Meeting of Stockholders are incorporated by reference into Part III.

TABLE OF CONTENTS

|

| | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 4A. | | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

Item 15. | | |

Item 16. | | |

| |

| |

INTRODUCTORY NOTE

Definitions. This Annual Report on Form 10-K (the "Annual Report") is filed by Sanderson Farms, Inc., a Mississippi corporation. Except where the context indicates otherwise, the terms “Registrant,” “Company,” “Sanderson Farms,” “we,” “us,” or “our” refer to Sanderson Farms, Inc. and its subsidiaries and predecessor organizations. The use of these terms to refer to Sanderson Farms, Inc. and its subsidiaries collectively does not suggest that Sanderson Farms and its subsidiaries have abandoned their separate identities or the legal protections given to them as separate legal entities. “Fiscal year” means the fiscal year ended October 31, 2017, which is the year for which this Annual Report is filed.

Presentation and Dates of Information. Except for Item 4A herein, the Item numbers and letters appearing in this Annual Report correspond with those used in Securities and Exchange Commission Form 10-K (and, to the extent that it is incorporated into Form 10-K, those used in SEC Regulation S-K) as effective on the date hereof, which specifies the information required to be included in Annual Reports to the SEC. Item 4A (“Executive Officers of the Registrant”) has been included by the Registrant in accordance with General Instruction G(3) of Form 10-K and Instruction 3 of Item 401(b) of Regulation S-K. The information contained in this Annual Report is, unless indicated to be given as of a specified date or for a specified period, given as of the date of this Annual Report, which is December 14, 2017.

PART I

(a) GENERAL DEVELOPMENT OF THE REGISTRANT’S BUSINESS

The Registrant was incorporated in Mississippi in 1955, and is a fully, vertically-integrated poultry processing company engaged in the production, processing, marketing and distribution of fresh and frozen chicken products. In addition, the Registrant is engaged in the processing, marketing and distribution of processed and minimally prepared chicken.

The Registrant sells ice pack, chill pack, bulk pack and frozen chicken, in whole, cut-up and boneless form, primarily under the Sanderson Farms® brand name to retailers, distributors, and casual dining operators principally in the southeastern, southwestern, northeastern and western United States, and to customers who resell frozen chicken into export markets. During its fiscal year ended October 31, 2017, the Registrant processed approximately 567 million chickens, or approximately 4.3 billion dressed pounds. According to 2017 industry statistics, the Registrant was the third largest processor of dressed chicken in the United States based on average weekly processed pounds.

The Registrant’s fresh and frozen chicken operations presently encompass 10 hatcheries, 8 feed mills and 11 processing plants, including the facilities at its new St. Pauls, North Carolina complex. The Registrant began operations at the new St. Pauls hatchery in November 2016, and began processing chickens at the new processing plant in January 2017. The complex is currently operating near full capacity. The Registrant has one prepared chicken plant.

The Registrant has contracts with operators of approximately 759 grow-out farms that provide it with sufficient housing capacity for its current operations. The Registrant also has contracts with operators of 218 breeder farms.

The Company’s prepared chicken product line includes approximately 90 institutional and consumer packaged partially cooked or marinated chicken items that it sells nationally, primarily to distributors and food service establishments. A majority of the prepared chicken items are made to the specifications of food service users.

Since the Registrant completed the initial public offering of its common stock in May 1987, the Registrant has significantly expanded its operations by expanding existing facilities, adding second shifts and constructing new facilities to increase production capacity, product lines and marketing flexibility.

The Company changed its marketing strategy in 1997 to move away from growing small-sized birds serving primarily the fast food industry to concentrate its production in the medium-sized and larger-sized birds serving the retail grocery and food service industries, respectively. This shift resulted in larger average bird weights of the chickens processed by the Company, and substantially increased the number of pounds processed by the Company. In addition, the Company continually evaluates internal and external expansion opportunities to continue its growth in poultry and/or related food products.

In January 2011, the Company began initial operations at a new poultry processing complex in Kinston, North Carolina. The Kinston facilities comprise a poultry complex consisting of a hatchery, feed mill, processing plant, and wastewater facility with the capacity to process 1.25 million chickens per week. The facility reached full capacity during March 2012.

In February 2015, the Company began initial operations at a new poultry processing complex in Palestine, Texas. The complex consists of a hatchery, feed mill, processing plant and waste water facility with the capacity to process 1.25 million chickens per week, and the facility is currently operating at full capacity. During fiscal 2017, the Palestine processing plant processed approximately 539.4 million pounds of dressed poultry meat, as compared to 351.7 million pounds during fiscal 2016.

In March 2015, the Company announced the selection of sites in and near St. Pauls, North Carolina, for the construction of a new poultry complex. The completed complex consists of a hatchery, processing plant, waste water treatment facility, and an expansion of the Company's existing feed mill in Kinston, North Carolina. Construction began in July 2015, and initial operations of the new complex began during the first quarter of fiscal 2017. At full capacity, the new complex will process 1.25 million chickens per week. The facility steadily increased production throughout fiscal 2017 and is currently operating just below full capacity. During the fourth quarter of fiscal 2017, the St. Pauls processing plant processed approximately 122.4 million pounds of dressed poultry meat, as compared to 76.4 million pounds during the third quarter of fiscal 2017, 46.2 million pounds during the second quarter of fiscal 2017, and 4.0 million pounds during the first quarter of fiscal 2017. We expect the complex to reach full capacity in January 2018. See “The construction and potential benefits of our new facilities are subject to risks and uncertainties” in the Risk Factors Section of this Annual Report.

In March 2017, the Company announced the selection of sites in Lindale, Mineola and Smith County, Texas, for the construction of a new poultry processing complex. The completed complex will consist of a hatchery, feed mill, processing plant and waste water treatment facility with the capacity to process 1.25 million chickens per week. We are in the early stages of construction, and initial operations of the new complex are expected to begin during the first calendar quarter of 2019. Before the complex can become operational, we will need to obtain the necessary licenses and permits, enter into construction contracts, enter into contracts with a sufficient number of independent contract poultry producers to house the live inventory and hire and train our workforce. See "The construction and potential benefits of our new facilities are subject to risks and uncertainties" in the Risk Factors section of this Annual Report.

Capital expenditures for fiscal 2017 were funded by cash on hand and cash provided by operations during fiscal 2017. The Company is a party to a revolving credit facility dated April 28, 2017, as amended on November 22, 2017, with a maximum available borrowing capacity of $900.0 million. The facility has annual capital expenditure limitations of $100.0 million, $105.0 million, $110.0 million, $115.0 million, $120.0 million and $125.0 million for fiscal years 2017 through 2022, respectively, and permits up to $15.0 million of the unused capital expenditure limitation from fiscal year 2016 to be carried over to the fiscal year 2017; thereafter, up to $20.0 million of the unused limitation for any fiscal year starting with fiscal year 2017 may be carried over to the next fiscal year. The normal capital expenditure limitation for fiscal 2017 was $115.0 million (including $15.0 million carried over from fiscal 2016), and the normal limitation for fiscal 2018 is $125.0 million (including $20.0 million carried over from fiscal 2017).

The credit facility also permits capital expenditures up to $200.5 million on the construction of a new poultry processing complex in Lindale, Mineola and Smith County, Texas, up to $210.0 million on the construction of a potential additional new poultry complex, up to $15.0 million on expansion of the Company's existing prepared chicken facility in Flowood, Mississippi, up to $60.0 million on a potential new prepared chicken facility, and up to $70.0 million on the purchase of three new aircraft. As amended on November 22, 2017, the facility also excludes from the normal capital expenditure limits certain capital projects in an aggregate amount of up to $135.0 million. These additional projects, which include the construction of a new feed mill, and other expansions, equipment and changes to the Laurel, Collins, McComb and Hazlehurst, Mississippi complexes; the Waco, Palestine and Brazos, Texas complexes; the Moultrie, Georgia complex; and the Kinston, North Carolina complex, are each subject to their own expenditure limitations.

Under the credit facility, the Company may not exceed a maximum debt to total capitalization ratio of 50%. The Company has a one-time right, at any time during the term of the agreement, to increase the maximum debt to total capitalization ratio then in effect by five percentage points in connection with the construction of any of the three aforementioned new complexes for the four fiscal quarters beginning on the first day of the fiscal quarter during which the Company gives written notice of its intent to exercise this right. The Company has not exercised this right. The facility also sets a minimum net worth requirement that at October 31, 2017, was $980.2 million. The credit is unsecured and, unless extended, will expire on April 28, 2022. As of October 31 and December 13, 2017, the Company had no outstanding draws under the facility, and had approximately $19.7 million outstanding in letters of credit, leaving $880.3 million of borrowing capacity available under the facility. For more information about the facility, see Item 1.01 of our Current Report on Form 8-K filed May 4, 2017, and Item 1.01 of our Current Report on Form 8-K filed November 29, 2017, which are incorporated herein by reference.

(b) FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS

Not applicable.

(c) NARRATIVE DESCRIPTION OF REGISTRANT’S BUSINESS

General

The Registrant is engaged in the production, processing, marketing and distribution of fresh and frozen chicken and the preparation, processing, marketing and distribution of processed and minimally prepared chicken items. The Registrant has one reporting segment, poultry products.

The Registrant sells chill pack, ice pack, bulk pack and frozen chicken, in whole, cut-up and boneless form, primarily under the Sanderson Farms® brand name, to retailers, distributors and casual dining operators principally in the southeastern, southwestern, northeastern and western United States. During its fiscal year ended October 31, 2017, the Registrant processed approximately 567 million chickens, or approximately 4.3 billion dressed pounds. In addition, the Registrant purchased and further processed 0.8 million pounds of poultry products during fiscal 2017. According to 2017 industry statistics, the Registrant was the third largest processor of dressed chicken in the United States based on average weekly processed pounds.

The Registrant conducts its chicken operations through Sanderson Farms, Inc. (Production Division) and Sanderson Farms, Inc. (Processing Division), both of which are wholly-owned subsidiaries of Sanderson Farms, Inc. The production subsidiary, Sanderson Farms, Inc. (Production Division), which has facilities in Laurel, Collins, Hazlehurst and McComb, Mississippi; Bryan, Waco, Palestine, Freestone County, and Robertson County, Texas; Adel, Georgia; and Kinston and Lumberton, North Carolina, is engaged in the production of chickens to the broiler stage. Sanderson Farms, Inc. (Processing Division), which has facilities in Laurel, Collins, Hazlehurst and McComb, Mississippi; Hammond, Louisiana; Bryan, Palestine, and Waco, Texas; Moultrie, Georgia; and Kinston and St. Pauls, North Carolina, is engaged in the processing, sale and distribution of chicken products.

The Registrant conducts its prepared chicken business through its wholly-owned subsidiary, Sanderson Farms, Inc. (Foods Division), which has a facility in Flowood, Mississippi. This facility is engaged in the processing, marketing and distribution of approximately 90 processed and minimally prepared chicken items, which it sells nationally and regionally, principally to distributors and national food service accounts. The facility is managed by the same senior management team that manages our Processing Division.

Products

The Registrant has the ability to produce a wide range of processed chicken products and prepared chicken items.

Processed chicken is first salable as an ice packed, whole chicken. The Registrant adds value to its ice packed, whole chickens by removing the giblets, weighing, packaging and labeling the product to specific customer requirements and cutting and deboning the product based on customer specifications. The additional processing steps of giblet removal, close tolerance weighing and cutting increase the value of the product to the customer over whole, ice packed chickens by reducing customer handling and cutting labor and capital costs, reducing the shrinkage associated with cutting, and ensuring consistently sized portions.

The Registrant adds additional value to the processed chicken by deep chilling and packaging whole chickens in bags or combinations of fresh chicken parts, including boneless product, in various sized, individual trays under the Registrant’s brand name, which then may be weighed and pre-priced, based on each customer’s needs. This chill pack process increases the value of the product by extending shelf life, reducing customer weighing and packaging labor, and providing the customer with a wide variety of products with uniform, well designed packaging, all of which enhance the customer’s ability to merchandise chicken products.

To satisfy some customers’ merchandising needs, the Registrant freezes the chicken product, which adds value by meeting the customers’ handling, storage, distribution and marketing needs and by permitting shipment of product overseas where transportation time may be as long as 60 days.

The following table sets forth, for the periods indicated, the contribution, as a percentage of net sales dollars, of each of the Registrant’s major product lines.

|

| | | | | | | | | | | | | | |

| Fiscal Year Ended October 31, |

| 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Registrant processed chicken: | | | | | | | | | |

Value added: | | | | | | | | | |

Chill pack | 31.0 | % | | 34.7 | % | | 36.9 | % | | 36.0 | % | | 34.4 | % |

Fresh bulk pack | 56.2 |

| | 52.7 |

| | 49.1 |

| | 48.3 |

| | 50.5 |

|

Frozen | 6.7 |

| | 5.1 |

| | 6.3 |

| | 9.2 |

| | 10.5 |

|

Subtotal | 93.9 |

| | 92.5 |

| | 92.3 |

| | 93.5 |

| | 95.4 |

|

Non-value added: | | | | | | | | | |

Ice pack | 1.0 |

| | 0.9 |

| | 1.0 |

| | 0.9 |

| | 1.0 |

|

Subtotal | 1.0 |

| | 0.9 |

| | 1.0 |

| | 0.9 |

| | 1.0 |

|

Total Company processed chicken | 94.9 |

| | 93.4 |

| | 93.3 |

| | 94.4 |

| | 96.4 |

|

Minimally prepared chicken | 5.1 |

| | 6.6 |

| | 6.7 |

| | 5.6 |

| | 3.6 |

|

Total | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Markets and Pricing

The three largest customer markets in the fresh and frozen chicken industry are big bird, chill pack and small birds.

The following table sets forth, for each of the Company’s poultry processing plants, the general customer market to which the plant is devoted, the weekly capacity of each plant at full capacity expressed in number of head processed, and the industry's average size of birds processed in the relevant market.

|

| | | | | | | |

Plant Location | Market | | Capacity Per Week | | Industry Bird Size |

Laurel, Mississippi | Big Bird | | 625,000 |

| | 8.99 |

|

Hazlehurst, Mississippi | Big Bird | | 625,000 |

| | 8.99 |

|

Hammond, Louisiana | Big Bird | | 625,000 |

| | 8.99 |

|

Collins, Mississippi | Big Bird | | 1,250,000 |

| | 8.99 |

|

Waco, Texas | Big Bird | | 1,250,000 |

| | 8.99 |

|

Palestine, Texas | Big Bird | | 1,250,000 |

| | 8.99 |

|

St. Pauls, North Carolina | Big Bird | | 1,250,000 |

| | 8.99 |

|

McComb, Mississippi | Chill Pack Retail | | 1,250,000 |

| | 6.46 |

|

Bryan, Texas | Chill Pack Retail | | 1,250,000 |

| | 6.46 |

|

Moultrie, Georgia | Chill Pack Retail | | 1,250,000 |

| | 6.46 |

|

Kinston, North Carolina | Chill Pack Retail | | 1,250,000 |

| | 6.46 |

|

Our big bird plants process a relatively large bird. The dark meat from these birds is sold primarily as frozen leg quarters in the export market or as fresh whole legs to further processors. While we have long-standing relationships with many of our export partners, virtually all of our export sales are at negotiated or spot commodity prices, which prices exhibit fluctuations typical of commodity markets. We have few long-term contracts for this product.

The white meat produced at these plants is generally sold as bulk-packed, fresh boneless breast meat, chicken tenders and whole or cut wings, and is sold primarily to restaurants, food service customers and further processors at negotiated spreads from quoted commodity market prices for wings, tenders and boneless breast meat. We have long-term contracts with many of our customers for white meat produced at our big bird plants, but prices for products sold pursuant to those contracts fluctuate based on quoted commodity market prices. The contracts do not require the customers to purchase, or the Company to sell, any specific quantity of product.

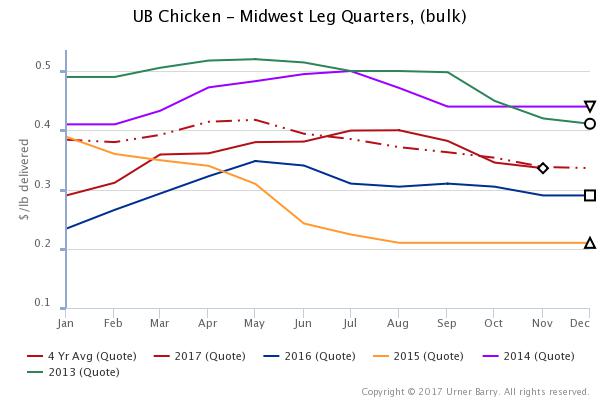

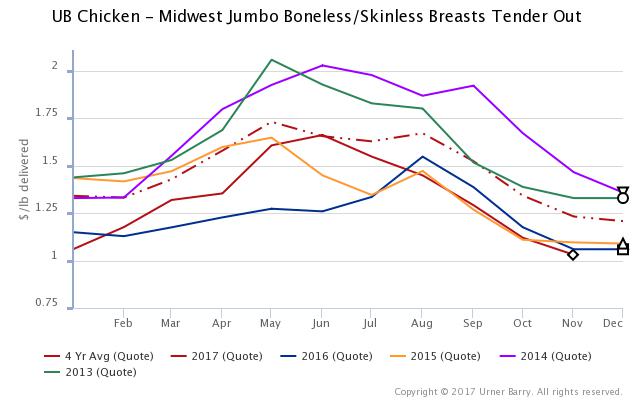

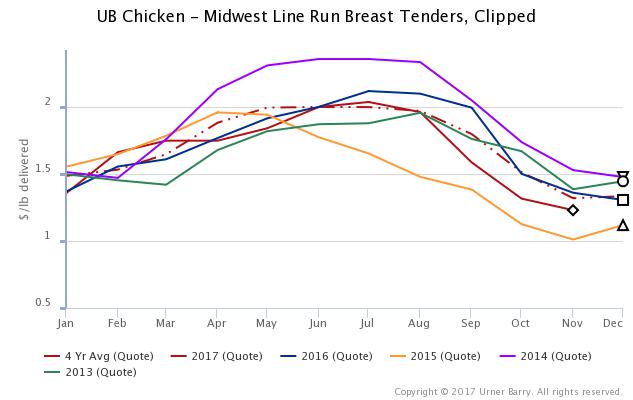

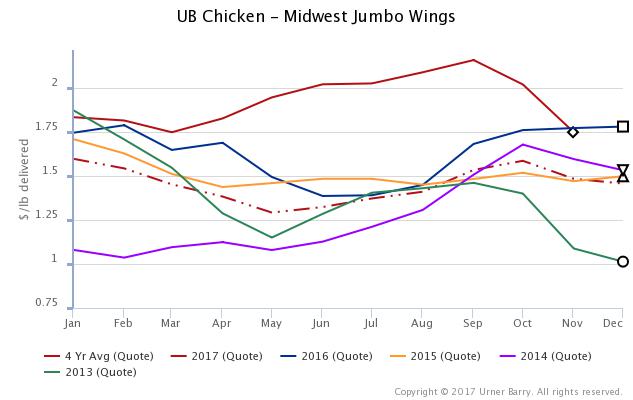

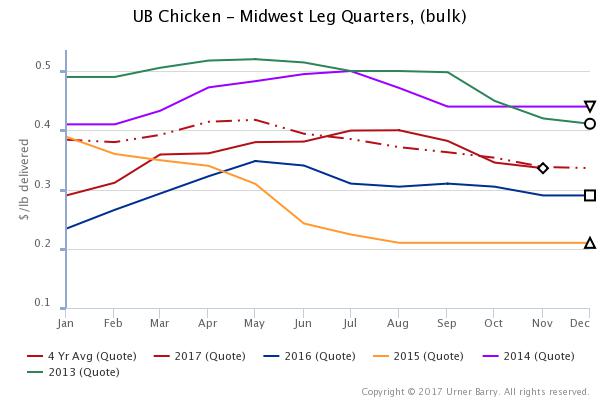

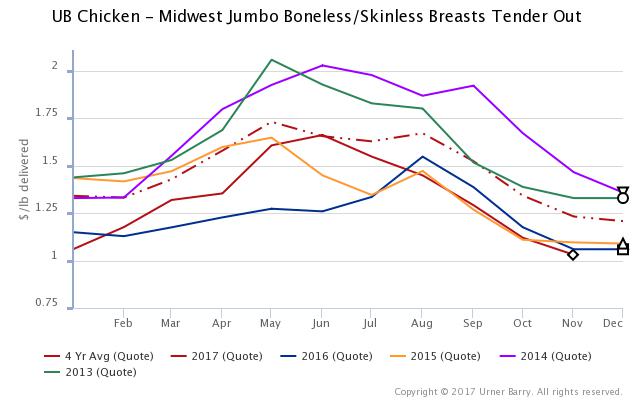

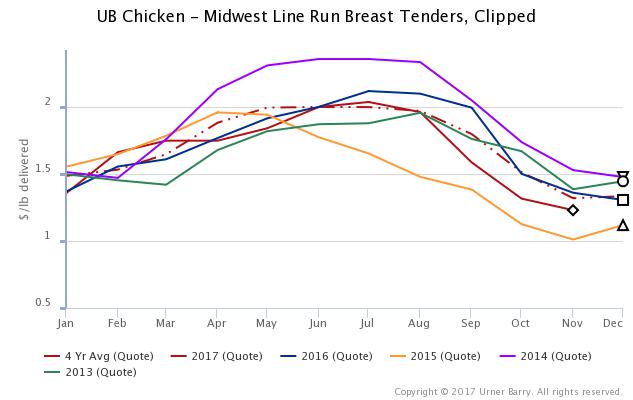

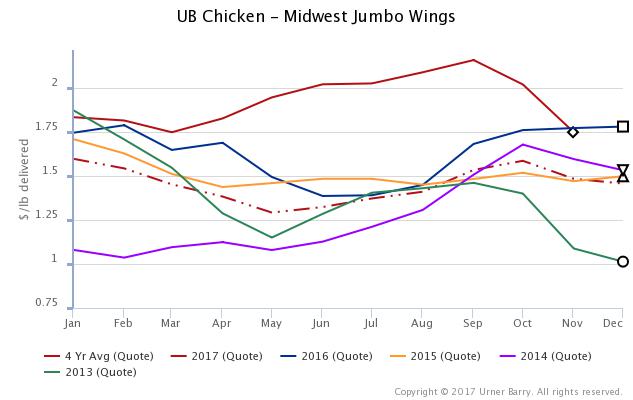

As of October 31, 2017, the Company had the capacity to process 6.875 million head per week in its big bird plants, and its results are materially affected by fluctuations in the commodity market prices for leg quarters, boneless breast meat, chicken tenders and wings, as quoted by Urner Barry.

The Urner Barry spot market price for leg quarters, boneless breast meat, chicken tenders and whole wings for the past five calendar years is set forth below. Realized prices will not necessarily equal quoted market prices since most contracts offer negotiated discounts to quoted market prices, which discounts are negotiated on a customer by customer basis and are influenced by many factors. Selection of a particular market price benchmark is largely customer driven:

Our chill pack plants process medium sized birds and cut and package the product in various sized individual trays to customers’ specifications. The trays are weighed and pre-priced primarily for customers to resell through retail grocery outlets. While the Company sells some of its chill pack product under store brand names, most of its chill pack production is sold under the Company’s Sanderson Farms® brand name. The Company has long-term contracts with most of its chill pack customers. These agreements typically provide for the pricing of product based on negotiated formulas that use an agreed upon, regularly quoted market price as the base, as well as various other guidelines for the relationship between the parties. All of our contracts with retail grocery store customers also provide for the sale of negotiated quantities of product at fixed and periodically negotiated prices, rather than the formula-driven prices discussed above. None of our contracts with retail grocery store customers require the customers to purchase, or the Company to sell, any specific quantity of product. As of October 31, 2017, the Company had the capacity to process 5.0 million head per week at its chill pack plants, and its results are materially affected by fluctuations in Urner Barry prices and other market benchmarks.

As with products produced at our big bird plants, selection of the appropriate market benchmark for pricing chill pack products is largely customer driven. Prior to the discontinuation in November 2016 of the Georgia Dock index, which had been published by the Georgia Department of Agriculture, many of our chill pack customers used that index as the base for pricing formulas. Following its discontinuation, many of those customers preferred to continue using the last quoted Georgia Dock

price for the formula base until a new index could be developed. As new and renewing contracts were negotiated during fiscal 2017, discussions included determining which index would be used as the pricing formula base during the life of the contract. For that base, some of our customers have chosen to use the index published by Express Markets, Inc ("EMI"), and some have not yet decided which index will be used.

Almost all of our products sold by our prepared chicken plant are sold under long-term contracts at fixed prices related to the spot commodity price of chicken at the time the contract is negotiated, plus a premium for additional processing.

Sales and Marketing

The Registrant’s chicken products are sold primarily to retailers (including national and regional supermarket chains and local supermarkets) and distributors located principally in the southeastern, southwestern, northeastern and western United States. The Registrant also sells its chicken products to casual dining operators and to United States based customers who resell the products outside of the continental United States. This wide range of customers, together with the Registrant’s product mix, provides the Registrant with flexibility in responding to changing market conditions in its effort to maximize profits. This flexibility also assists the Registrant in its efforts to reduce its exposure to market volatility, although its ability to do so is limited.

Sales and distribution of the Registrant’s chicken products are conducted primarily by sales personnel at the Registrant’s general corporate offices in Laurel, Mississippi, by customer service representatives at each of its processing plants and one prepared chicken plant and through independent food brokers. Each plant has individual on-site distribution centers and uses contract carriers for distribution of its products.

Generally, the Registrant prices much of its chicken products based upon weekly and daily market prices reported by private firms such as EMI and Urner Barry. The Registrant’s profitability is affected by such market prices, which may fluctuate substantially and exhibit cyclical and seasonal characteristics. The Registrant will adjust base prices depending upon value added, volume, product mix and other factors. While base prices may change weekly and daily, the Registrant’s adjustments to those base prices are generally negotiated from time to time with the Registrant’s customers. The Registrant’s sales are generally made on an as-ordered basis, and the Registrant maintains some long-term sales contracts with its customers. These agreements, which provide for the pricing of product based on formulas that use market prices reported by private firms such as EMI and Urner Barry as a base, as well as various other guidelines for the relationship between the parties, do not require the customers to purchase or the Company to sell any specific quantity of product.

From time to time, the Registrant may use television, radio and newspaper advertising, point of purchase material and other marketing techniques to develop consumer awareness of and brand recognition for its Sanderson Farms® products. The Registrant has achieved a high level of public awareness and acceptance of its products in its core markets. Brand awareness is an important element of the Registrant’s marketing philosophy, and it intends to continue brand name merchandising of its products. During calendar 2004, the Company launched an advertising campaign designed to distinguish the Company’s fresh chicken products from competitors’ products. The campaign noted that the Company’s product is a natural product free from salt, water and other additives that some competitors inject into their fresh chicken. The Company continues to use various media to communicate this message today. During fiscal 2016, the Company launched a multi-media advertising campaign designed to explain and support the Company's position regarding the judicious use of antibiotics to prevent illness and treat chickens that become ill. During fiscal 2017, the Company launched a multi-media advertising campaign designed to dispel many of the myths about poultry production. The Company regularly evaluates the success of this campaign and expects to continue to use the campaign, at least for the near term.

The Registrant’s prepared chicken items are sold nationally, primarily to distributors and national food service accounts. Sales of such products are handled by sales personnel of the Registrant and by independent food brokers. Prepared chicken items are distributed from the Registrant’s plant in Flowood, Mississippi, through arrangements with contract carriers.

Production and Facilities

General. The Registrant is a fully, vertically-integrated producer of fresh, frozen and minimally prepared chicken products, controlling the production of hatching eggs, hatching, feed manufacturing, growing, processing and packaging of its product lines.

Breeding and Hatching. The Registrant maintains its own breeder flocks for the production of hatching eggs. The Registrant’s breeder flocks are acquired as one-day old chicks (known as pullets and cockerels) from primary breeding companies that specialize in the production of genetically designed breeder stock. As of October 31, 2017, the Registrant

maintained contracts with 63 independent contract pullet producers for the grow-out of pullets (growing the pullet to the point at which it is capable of egg production, which takes approximately six months). Thereafter, the mature breeder flocks are transported by the Registrant’s vehicles to breeder farms that are maintained, as of October 31, 2017, by 155 independent contractors under the Registrant’s supervision. Eggs produced on the farms of independent contract breeder producers are transported to the Registrant’s hatcheries in the Registrant’s vehicles.

The Registrant owns and operates ten hatcheries located in Mississippi, Texas, Georgia and North Carolina where eggs are incubated, vaccinated and hatched in a process requiring 21 days. The chicks are vaccinated against common poultry diseases and are transported by the Registrant’s vehicles to independent contract grow-out farms. As of October 31, 2017, the Registrant’s hatcheries were capable of producing an aggregate of approximately 12.7 million chicks per week.

Grow-out. The Registrant places its chicks on the farms of 759 independent contract broiler producers, as of October 31, 2017, located in Mississippi, Texas, Georgia and North Carolina, where broilers are grown to an age of approximately seven to nine weeks. The farms provide the Registrant with sufficient housing capacity for its operations, and are typically family-owned farms operated under contract with the Registrant. The farm owners provide facilities, utilities and labor; the Registrant supplies the day-old chicks, feed and veterinary and technical services. The farm owner is compensated pursuant to an incentive formula designed to promote production cost efficiency.

Historically, the Registrant has been able to accommodate expansion in grow-out facilities through additional contract arrangements with independent contract producers.

Feed Mills. An important factor in the grow-out of chickens is the rate at which chickens convert feed into body weight. The Registrant purchases primary feed ingredients on the open market. Ingredients include corn and soybean meal, which historically have been the largest cost components of the Registrant’s total feed costs. The quality and composition of the feed are critical to the conversion rate, and accordingly, the Registrant formulates and produces its own feed. As of October 31, 2017, the Registrant operated eight feed mills, four of which are located in Mississippi, two in Texas, one in Georgia and one in North Carolina. The Registrant’s annual feed requirements for fiscal 2017 were approximately 4,594,000 tons, and it has the capacity to produce approximately 5,866,000 tons of finished feed annually under current configurations.

Feed grains are commodities subject to volatile price changes caused by weather, size of the harvest, transportation and storage costs, domestic and export demand and the agricultural and energy policies of the United States and foreign governments. On October 31, 2017, the Registrant had the capacity to store approximately 3,697,000 bushels of corn at its feed mills, which was sufficient to store approximately one week's requirements for corn. Generally, the Registrant purchases its corn and other feed ingredients at current prices from suppliers and, to a limited extent, directly from farmers. Feed grains are available from an adequate number of sources. Although the Registrant has not experienced and does not anticipate problems in securing adequate supplies of feed grains, price fluctuations of feed grains have a direct and material effect upon the Registrant’s profitability. Although the Registrant attempts to manage the risk of volatile price changes in grain markets by sometimes purchasing grain at current prices for future delivery, it cannot eliminate the potentially adverse effect of grain price increases.

Processing. Once broilers reach processing weight, they are transported to the Registrant’s processing plants. These plants use modern, highly automated equipment to process and package the chickens. The Registrant’s McComb and Collins, Mississippi; Moultrie, Georgia; Kinston and St. Pauls, North Carolina and Bryan, Waco and Palestine, Texas processing plants operate two processing lines on a double shift basis and each had the capacity to process approximately 1,250,000 chickens per week on October 31, 2017. The Registrant’s Laurel and Hazlehurst, Mississippi and Hammond, Louisiana processing plants operate on a double shift basis and collectively had the capacity to process approximately 1,875,000 chickens per week on October 31, 2017. At October 31, 2017, the Company’s deboning facilities were operating on a double shift basis and had the capacity to produce approximately 19.2 million pounds of big bird boneless breast product and 9.0 million pounds of chill pack boneless breast product each week.

Prepared Chicken. The Company's prepared chicken plant is located in Flowood, Mississippi and has approximately 85,000 square feet of refrigerated manufacturing and storage space. The plant uses highly automated equipment to prepare, process and freeze prepared chicken items.

Executive Offices; Other Facilities. The Registrant’s laboratory and corporate offices are located on separate sites in Laurel, Mississippi. The office buildings house the Company’s corporate offices, meeting facilities and computer equipment and constitute the corporate headquarters. As of October 31, 2017, the Registrant operated 13 automotive maintenance shops, which service approximately 1,200 over-the-road and farm vehicles used to support the Registrant's operations. In addition, the

Registrant has one child care facility located near its Collins, Mississippi processing plant, serving on average approximately 215 children on October 31, 2017.

Quality Control

The Registrant believes that quality control is important to its business and conducts quality control activities throughout all aspects of its operations. The Registrant believes these activities are beneficial to efficient production and in assuring its customers receive wholesome, high quality products.

From its company owned laboratory in Laurel, Mississippi, the Director of Technical Services supervises the operation of a modern, well-equipped laboratory which, among other things, monitors sanitation at the hatcheries, quality and purity of the Registrant’s feed ingredients and feed, the health of the Registrant’s breeder flocks and broilers, and conducts microbiological tests on live chickens, facilities and finished products. The Registrant conducts on-site quality control activities at each of the ten processing plants and the prepared chicken plant.

Regulation

The Registrant’s facilities and operations are subject to regulation by various federal and state agencies, including, but not limited to, the Federal Food and Drug Administration (“FDA”), the United States Department of Agriculture (“USDA”), the Environmental Protection Agency ("EPA"), the Occupational Safety and Health Administration (“OSHA”) and corresponding state agencies. The Registrant’s chicken processing plants are subject to continuous on-site inspection by the USDA. The Registrant's prepared chicken plant operates under the USDA’s Total Quality Control Program, which is a strict self-inspection plan written in cooperation with and monitored by the USDA. The FDA inspects the production at the Registrant’s feed mills.

Compliance with existing regulations has not had a material adverse effect upon the Registrant’s earnings or competitive position in the past. Management believes that the Registrant is in substantial compliance with existing laws and regulations relating to the operation of its facilities and does not know of any major capital expenditures necessary to comply with such statutes and regulations.

The Registrant takes extensive precautions to ensure that its flocks are healthy and that its processing plants and other facilities operate in a healthy and environmentally sound manner. Events beyond the control of the Registrant, however, such as an outbreak of disease in its flocks or the adoption by governmental agencies of more stringent regulations, could materially and adversely affect its operations.

Competition

The Registrant is subject to significant competition from regional and national firms in all markets in which it competes. Some of the Registrant’s competitors have greater financial and marketing resources than the Registrant.

The primary methods of competition are price, product quality, number of products offered, brand awareness and customer service. The Registrant has emphasized product quality and brand awareness through its advertising strategy. See “Business — Sales and Marketing.” Although poultry is relatively inexpensive in comparison with other meats, the Registrant competes indirectly with the producers of other meats and fish, since changes in the relative prices of these foods may alter consumer buying patterns.

Customers

One customer accounted for more than 10% of the Registrant’s consolidated sales for the years ended October 31, 2017, 2016 and 2015. Sales to that customer accounted for 17.0%, 17.5% and 16.2% of the Company’s consolidated net sales in fiscal 2017, 2016 and 2015, respectively. The Company does not believe the loss of this or any other single customer would have a material adverse effect on the Company because it could sell poultry earmarked for any single customer to alternative customers at market prices.

Sources of Supply

During fiscal 2017, the Registrant purchased its pullets and cockerels from a single major breeder. The Registrant has found the genetic breeds or cross breeds supplied by this company produce chickens most suitable to the Registrant’s purposes. The Registrant has no written contracts with this breeder for the supply of breeder stock. Other sources of breeder stock are available, and the Registrant continually evaluates these sources of supply.

Should breeder stock from its present supplier not be available for any reason, the Registrant believes that it could obtain adequate breeder stock from other suppliers.

Other major raw materials used by the Registrant include feed grains and other feed ingredients, cooking ingredients and packaging materials. The Registrant purchases these materials from a number of vendors and believes that its sources of supply are adequate for its present needs. The Registrant does not anticipate any difficulty in obtaining these materials in the future.

Seasonality

The demand for the Registrant’s chicken products generally is greatest during the spring and summer months and lowest during the winter months.

Trademarks

The Registrant has registered with the United States Patent and Trademark Office the trademark Sanderson Farms®, which it uses in connection with the distribution of its prepared chicken and premium grade chill pack products. The Registrant considers the protection of this trademark to be important to its marketing efforts due to consumer awareness of and loyalty to the Sanderson Farms® label. The Registrant also has registered with the United States Patent and Trademark Office five other trademarks that are used in connection with the distribution of chicken and other products and for other competitive purposes.

The Registrant, over the years, has developed important non-public proprietary information regarding product related matters. While the Registrant has internal safeguards and procedures to protect the confidentiality of such information, it does not generally seek patent protection for its technology.

Employee and Labor Relations

As of October 31, 2017, the Registrant had 14,669 employees, including 1,815 salaried and 12,854 hourly employees. A collective bargaining agreement with the United Food and Commercial Workers International Union covering 536 hourly employees who work at the Registrant’s processing plant in Hammond, Louisiana expires on November 30, 2019.

The production, maintenance and clean-up employees at the Company’s Bryan, Texas poultry processing facility are represented by the United Food and Commercial Workers Union Local #408, AFL-CIO. A collective bargaining agreement covering 1,304 employees expires on December 31, 2017. The collective bargaining agreement has a grievance procedure and no strike-no lockout clause that should assist in maintaining stable labor relations at the Bryan, Texas processing facility. The Company and the union are currently negotiating a new collective bargaining agreement, but no assurance can be given that a new agreement will be reached.

(d) FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

All of the Company’s operations are domiciled in the United States. All of the Company’s products sold in the Company’s fiscal years 2017, 2016 and 2015 were produced in the United States and all long-lived assets of the Company are located in the United States. Gross domestic sales for fiscal years 2017, 2016 and 2015 totaled approximately $3,150.9 million, $2,670.3 million, and $2,662.5 million, respectively.

The Company sells certain of its products to foreign customers and customers who resell the product in foreign markets. These foreign markets for fiscal 2017 and 2016 were primarily Mexico, Central Asia and the Middle East. For fiscal 2015, these foreign markets were primarily Mexico, Russia, China, Eastern Europe, the Middle East and the Caribbean. These gross export sales for fiscal years 2017, 2016 and 2015 totaled approximately $268.5 million, $213.5 million and $207.8 million, respectively. The Company’s export sales are facilitated through independent food brokers located in the United States and the Company’s internal sales staff. For a discussion of risks related to our foreign markets, please see "A decrease in demand for our products in the export markets could materially and adversely affect our results of operations" in the Risk Factors section of this Annual Report.

(e) AVAILABLE INFORMATION

Our address on the World Wide Web is http://www.sandersonfarms.com. The information on our web site is not a part of this document. Our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and all amendments to those reports and the Company’s corporate code of conduct are available, free of charge, through our web site

as soon as reasonably practicable after they are filed with the SEC. Information concerning corporate governance matters is also available on the website.

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our Company. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

Industry volatility can affect our earnings, especially due to fluctuations in commodity prices of feed ingredients and chicken.

Profitability in the poultry industry is materially affected by the commodity prices of feed ingredients, chicken, and, to a lesser extent, alternative proteins. These prices are determined by supply and demand factors, and supply and demand factors related to feed ingredients and chicken may not correlate. As a result, the poultry industry is subject to wide fluctuations in profitability. Typically we do well when chicken prices are high and feed prices are low. We are less profitable, and sometimes have losses, when chicken prices are low and feed prices are high. For example, grain prices during 2011 were high, while prices for chicken products did not increase proportionally, and the Company lost money. During 2012 and 2013, grain prices remained high, but market prices for chicken also increased, and the Company was profitable. During fiscal 2014 and fiscal 2015, grain prices declined while market prices for chicken increased, and the Company earned near record-high margins.

Corn, soybean meal and other feed ingredients represented approximately 59% of our cost of growing a live chicken in fiscal 2017. Various factors that are beyond our control can affect the supply of corn and soybean meal, our primary feed ingredients. In particular, global weather patterns, including adverse weather conditions that may result from climate change, the global level of supply inventories and demand for feed ingredients, currency fluctuations and the agricultural and energy policies of the United States and foreign governments all affect the supply of feed ingredients. Weather patterns often change agricultural conditions in an unpredictable manner. A sudden and significant change in weather patterns could affect supplies of feed ingredients, as well as both the industry’s and our ability to obtain feed ingredients, grow chickens or deliver products. For example, historic drought conditions in the Midwestern United States in 2012 had a significant adverse effect on the supply and price of feed grains in fiscal 2012 and the first three quarters of 2013. Additionally, an increase in ethanol producers' demand for corn has historically resulted in increases in the costs for corn and other grains.

Increases in the prices of feed ingredients will result in increases in raw material costs and operating costs. Because prices for our products are related to the commodity prices of chickens, which depend on the supply and demand dynamics of fresh chicken, we typically are not able to increase our product prices to offset these increased grain costs. Although we periodically enter into contracts to purchase feed ingredients at current prices for future delivery to manage our feed ingredient costs, this practice does not eliminate the risk of increased operating costs from commodity price increases. In addition, if we are unsuccessful in our grain buying strategy, we could actually pay a higher cost for feed ingredients than we would if we purchased at current prices for current delivery.

It is very difficult to predict how the chicken and grain markets will perform. The exposure of our business to the cyclicality and volatility of commodities markets for raw materials and poultry could adversely affect our profitability, financial condition and results of operations.

Our stock price may be volatile.

The market price of our common stock could be subject to wide fluctuations in response to factors such as the following, many of which are beyond our control:

| |

• | market volatility and fluctuations in the price of feed grains and chicken products, as described above; |

| |

• | quarterly variations in our operating results, or results that vary from the expectations of securities analysts and investors; |

| |

• | changes in investor perceptions of the poultry industry in general, including our competitors; and |

| |

• | general economic and competitive conditions. |

In addition, purchases or sales of large quantities of our stock, or significant short positions in our stock, could have an unusual or adverse effect on our market price.

We may be required to write down the value of our inventories if the market price of our inventories is less than their accumulated cost of at the end of a fiscal period.

Prepared chicken and poultry inventories, and inventories of feed, eggs, medication, packaging supplies and live chickens, are stated on our balance sheet at the lower of cost (average method) or market value. Our cost of sales is calculated during a period by adding the value of our inventories at the beginning of the period to the cost of growing, processing and distributing products produced during the period and subtracting the value of our inventories at the end of the period. If the market prices of our inventories are below the accumulated cost of those inventories at the end of a period, we would record adjustments to write down the carrying value of the inventory from cost to market value. These write-downs would directly increase our cost of sales by the amount of the write-downs. This risk is greatest when the costs of feed ingredients are high and the market value for finished poultry products is declining.

Any such adjustment we may make in one period would effectively absorb into that period a portion of the costs to grow, process and distribute chickens that we would have otherwise incurred in the next fiscal period, thereby benefiting the next period. Any such adjustments that we make in the future could be material, and could materially adversely affect our financial condition and results of operations. The Company made no such adjustment during fiscal 2017.

Inclement weather, such as excessive heat or storms, or other disasters, could hurt our flocks, which could in turn have a material adverse effect on our results of operations.

Extreme weather in the Gulf South and Mid-Atlantic regions where we operate, such as extreme temperatures, hurricanes or other storms, or other natural disasters or calamities such as terrorist attacks or pandemics, could impair the health or growth of our flocks or interfere with our hatching, production or shipping operations. Some scientists believe that climate change could increase the frequency and severity of adverse weather events. Extreme weather, regardless of its cause, or other adverse events, could affect our business due to:

| |

• | damage to infrastructure or our facilities; |

| |

• | disruption of shipping channels; |

| |

• | less efficient or non-routine operating practices necessitated by adverse events; or |

| |

• | increased costs of insurance coverage in the aftermath of such events, among other things. |

Any of these factors could materially and adversely affect our results of operations. We may not be able to recover through insurance all of the damages, losses or costs that may result from such adverse events, including those that may be caused by climate change.

Outbreaks of avian disease, such as avian influenza, or the perception that outbreaks may occur, can significantly restrict our ability to conduct our operations and can significantly affect demand for our products.

Events beyond our control, such as the outbreak of avian disease or the perception that an outbreak may occur, even if it does not affect our flocks, could significantly restrict our ability to conduct our operations or our sales. An outbreak of disease could result in governmental restrictions on the import and export of fresh and frozen chicken, including our fresh and frozen chicken products, or other products to or from our suppliers, facilities or customers, or require us to destroy one or more of our flocks. This could result in the cancellation of orders by our customers and create adverse publicity that may have a material adverse effect on our business, reputation and prospects. In addition, world-wide fears about avian disease, such as avian influenza, have, in the past, depressed demand for fresh chicken, which adversely affected our sales.

In previous years there has been substantial publicity regarding a highly pathogenic Asian strain of avian influenza, or AI, known as H5N1, which has affected Asia since 2002 and which has been found in Europe, the Middle East and Africa. It is widely believed that this strain of AI is spread by migratory birds, such as ducks and geese. There have also been some cases where this strain of AI is believed to have passed from birds to humans as humans came into contact with live birds that were infected with the disease.

Although the Asian strains of AI described above have not been identified in North America, there have been outbreaks of both low and high pathogenic strains of non-Asian avian influenza in North America, including in the U.S. in 2002, 2004, 2006, 2015 and 2017, and in Mexico in 2005, 2012, 2013, 2015 and 2017.

Until 2015, the outbreaks in North America had not generated the same level of concern, or received the same level of publicity, or been accompanied by the same reduction in demand for poultry products in certain countries, as that associated with the Asian strains. Beginning in January 2015, however, the United States experienced what some industry observers believe was

the worst avian influenza outbreak in United States history. According to the United States Animal and Plant Health Inspection Service (APHIS), approximately 7.8 million turkeys and 40.3 million chickens were affected in the United States by this avian influenza outbreak, and the last reported case was in June 2015. The affected chickens were almost all hens that lay eggs for the table egg industry, and not broiler chickens such as those we raise. We have a high degree of confidence in our industry’s biosecurity program, but we cannot be certain our flocks or others in our industry will not be affected. Given our high degree of confidence in our biosecurity programs, we believe the primary risks associated with domestic outbreaks of avian influenza are market risks, as many countries to which our industry sells product imposed partial or total bans on the import of broiler meat produced in the United States as a result of the outbreak.

All AI related bans that were imposed following the 2015 outbreak in the United States have been lifted, except China's. While these bans were in place, the market price for leg quarters fell significantly below historical averages. During our fourth fiscal quarter ended October 31, 2015, quoted market prices for leg quarters were lower by 53.3% when compared to the fourth fiscal quarter of 2014. For more information on the impact of this outbreak on exports, please see the risk factor below entitled “A decrease in demand for our products in the export markets could materially and adversely affect our results of operations.”

While domestic demand for broiler meat was not materially affected by the 2015 outbreak, we cannot assure you that further spread of AI or the outbreak of the Asian strains of AI either in other countries or in the United States will not materially adversely affect both domestic and international demand for poultry products produced in the United States. Because the virus is carried by migratory water fowl, it is possible the virus could be spread to domestic poultry flocks during any seasonal migration of those water fowl. If AI were to affect a significant number of our flocks, or materially reduce domestic demand for our products, either or both of these events could have a material adverse effect on our business, reputation or prospects.

A decrease in demand for our products in the export markets could materially and adversely affect our results of operations.

Nearly all of our customers are based in the United States, but some of our product is sold directly to foreign customers, and some of our United States based customers resell poultry products in the export markets. Our chicken products have been sold in Russia and other former Soviet countries, China and Mexico, among other countries. Approximately 7.9% of our gross sales in fiscal 2017 were to export markets, including approximately $154.0 million to Mexico and $51.9 million to countries in Central Asia. Any disruption to the export markets, such as trade embargoes, tariffs, import bans, duties, quotas, currency fluctuations, adverse political and economic conditions in countries to which we export our products, disruptions in shipping channels, or changes in governmental trade policies or agreements with countries to which we sell products, can materially affect our sales or create an oversupply of chicken in the United States. This, in turn, can cause domestic poultry prices to decline. Any quotas or bans can materially and adversely affect our sales and our results of operations.

On February 5, 2010, China announced that it would impose anti-dumping duties on U.S. chicken products beginning on February 13, 2010. The duty applicable to Sanderson Farms products was 64.5%. On April 28, 2010, China imposed countervailing duties on United States chicken products, raising the duty applicable to Sanderson Farms’ products by 6.1% to 70.6%. A challenge to China’s anti-dumping determination was filed by the U.S. government with the World Trade Organization (WTO), which ruled in favor of the U.S. on September 25, 2013. China did not appeal the WTO ruling. On July 8, 2014, China announced that it had re-investigated charges that United States chicken exporters dump product in the China domestic market, causing substantial harm to the local industry. Despite the WTO’s findings, China announced that its re-investigation revealed that United States exporters continue to dump product into the local China market. While China announced lower anti-dumping tariffs on certain United States producers in its July 8, 2014 announcement, the tariffs actually increased on most United States producers, including Sanderson Farms. The United States government continues to believe that the WTO ruling was correct and that China’s anti-dumping determination lacks merit. Accordingly, the United States government continues to challenge China’s actions at the WTO.

On January 8, 2015, China announced a ban on the import of United States poultry meat following the discovery of avian influenza in a wild bird in the Pacific Northwest. Avian influenza was later detected in commercial poultry flocks in fifteen states. There has been no indication from China of how long the ban will last. During fiscal 2014, the Company sold approximately 74.9 million pounds of poultry meat, primarily chicken paws and wing tips, to customers who resold the product in China, reflecting approximately $62.1 million in total sales. Because there were no material domestic or export markets for these products other than China, the Company began rendering most of those products after imposition of the Chinese ban for significantly lower returns. As a result, during fiscal 2015 before the ban's effective date, the Company sold only approximately 22.8 million pounds of poultry meat, primarily chicken paws and wing tips, to customers who resold the product in China, reflecting approximately $20.0 million in total sales. During fiscal 2016 and 2017, the Company did not sell any poultry meat to customers who resold the meat in China.

In addition to China's ban listed above, several countries imposed varying degrees of bans on United States poultry imports as a result of the avian influenza outbreak in the United States during 2015. The bans varied in degree in that some

applied to all United States poultry imports, while others were specific to the areas of the country in which avian influenza was detected. The collective result of these bans was a decrease in demand for the Company's dark meat products, which are the Company's primary exports. The duration of such bans varied by country, and all the bans, except China's, have since been lifted. Due to the bans, overall industry exports of chicken parts, excluding paws, were lower by approximately 13.4% in volume and 26.1% in value during calendar 2015 compared to the same period in 2014 for the reasons described above. During calendar year 2016, overall industry exports of chicken parts, excluding paws, were higher by approximately 5.1% in volume and lower by approximately 4.9% in value compared to calendar year 2015. During the first ten months of calendar 2017, overall industry exports of chicken parts, excluding paws, were higher by approximately 2.8% in volume and 9.9% in value compared to the same period in 2016. For more information regarding the impact of the 2015 outbreak, please see the risk factor above entitled "Outbreaks of avian disease, such as avian influenza, or the perception that outbreaks may occur, can significantly restrict our ability to conduct our operations and can significantly affect demand for our products."

The loss of our major customers could have a material adverse effect on our results of operations.

Our sales to our top ten customers represented approximately 49.6% of our net sales during fiscal 2017. Our contracts with our customers provide pricing structures, but do not require customers to purchase any specific quantity of product. Therefore, our customers could significantly reduce or cease their purchases from us with little or no advance notice, which could materially and adversely affect our sales and results of operations.

We must identify changing consumer preferences and offer food products that consumers want.

Our success depends, in part, on our ability to offer products that appeal to our customers and to respond to evolving consumer preferences and trends. Consumer preferences and trends are influenced by, among other things, perceptions concerning the health implications, social implications, safety and quality of food products and ingredients, and price. In some cases, consumer perceptions are influenced by negative publicity about food production, including stories that are inaccurate or misleading. The expanding role of social and digital media in publicity has increased the speed and extent to which information (whether or not accurate) and opinions about our products can be shared. If we do not identify and react timely to changes in consumer perceptions or trends, we may experience reduced demand and pricing for our products. Prolonged negative perceptions concerning our products, our brand or our company, or a loss of confidence by consumers in the safety and quality of our products, could materially and adversely affect our reputation, sales, financial condition and results of operations.

We may also introduce new products and improved products from time to time to satisfy evolving consumer preferences, and may incur significant development and marketing costs in doing so. If our products fail to meet consumer preferences, then these products and our marketing strategy will be less successful. Additionally, because we produce only chicken products, we may be limited in our ability to respond to changes in consumer preferences towards other animal proteins or away from animal proteins entirely.

We have devoted significant resources to marketing and public relations programs that inform consumers about the safety and quality of our products and our production practices, including our use of antibiotics in raising live chickens. However, we are subject to legal and regulatory restrictions on the marketing and labeling of our products, which may hamper our marketing efforts. We must also keep pace with a rapidly changing media environment and advertising and marketing channels. If our marketing and public relations efforts to inform consumers and respond to negative perceptions are not effective, if consumers believe we have acted irresponsibly, or we are not successful in developing and marketing new products in response to changing trends, then our competitive position, reputation and market share may suffer. This, in turn, could lead to lower sales and profits, which could materially and adversely affect our results of operations and financial condition.

Failure of our information technology infrastructure or software could adversely affect our day-to-day operations and decision making processes and have an adverse effect on our performance.

We depend on accurate and timely information and numerical data from key software applications to aid our day-to-day business, financial reporting and decision-making and, in many cases, proprietary and custom-designed software is necessary to operate equipment in our feed mills, hatcheries and processing plants. In our day-to-day business, we depend on information technology for, among other things, electronic communications between our facilities, personnel, customers and suppliers, and for digital marketing and public information.

We have put in place disaster recovery plans for our critical systems. However, any disruption caused by the failure of these systems, the underlying equipment, or communication networks could delay or otherwise adversely impact our day-to-day business and decision making, could make it impossible for us to operate critical equipment, and could have a materially adverse effect on our performance, if our disaster recovery plans do not mitigate the disruption. Disruptions could be caused by a variety of factors,

such as catastrophic events or weather, natural disasters, power or telecommunications outages, viruses, terrorist attacks, unauthorized access or cyber-attacks on our systems by outside parties. In addition, a breach of our cyber-security measures could result in the loss, destruction or theft of confidential or proprietary data or other consequences, and could expose us to material losses or liability to third parties. Similar risks exist with respect to third parties who may possess our confidential data, such as our IT support providers, third party benefit and other administrators, professional advisors and consultants, and our financial institutions.

Cyber-attacks and other cyber incidents are occurring more frequently, and are constantly evolving in nature and sophistication. Our failure to maintain our cyber-security measures and keep abreast of new and evolving threats may make our systems vulnerable. The vulnerability of our systems and our failure to identify or respond timely to cyber incidents could have an adverse effect on our operations and reputation and expose us to liability or regulatory enforcement actions.

We would be adversely affected if we expand our business by acquiring other businesses or by building new processing plants, but fail to successfully integrate the acquired business or run a new plant efficiently.

We regularly evaluate expansion opportunities such as acquiring other businesses or building new processing plants. Significant expansion involves risks such as:

| |

• | the availability and terms of additional debt or equity financing and its effect on our financial condition; |

| |

• | increases in our expenses and working capital needs; |

| |

• | integrating the acquired business or new plant into our operations; |

| |

• | attracting and retaining growers; |

| |

• | streamlining overlapping supply chains; |

| |

• | identifying customers for additional product we generate and retaining existing customers; and |

| |

• | identifying and training our key managers and employees to run the new business or plant, while continuing to operate our existing plants efficiently. |

Additional risks related to acquisition transactions may include:

| |

• | difficulty identifying suitable candidates for acquisitions or consummating transactions on terms that are favorable; |

| |

• | implementing and maintaining consistent standards, controls, procedures and information systems; |

| |

• | potential loss of key employees or customers of any acquired business; |

| |

• | managing the geographic distance of an acquired business from our other facilities; and |

| |

• | exposure to unforeseen or undisclosed liabilities of any acquired business. |

Successful expansion depends on our ability to timely integrate the acquired business or efficiently operate the new plant, to devote significant management attention to the project and its integration in our business, and to manage a larger overall company efficiently. If we are unable to do this, expansion could adversely affect our operations, financial results and prospects, and we might not realize the cost savings and synergies we expected from the expansion. Additionally, the diversion of management’s attention from day-to-day business operations and the execution of our strategic plan could adversely impact our performance.

The construction and potential benefits of our new facilities are subject to risks and uncertainties.

For any new facility that we build, our ability to complete construction on a timely basis and within budget is subject to a number of risks and uncertainties described below. In addition, when a new facility becomes operational, it may not generate the benefits we expect if demand for the products to be produced by the facility is different from what we expect or we do not operate the facility efficiently.

In order to complete construction of a new facility, we need to take a significant number of steps and obtain a number of approvals and permits, none of which we can assure will be obtained. For example, for each new fresh and frozen chicken complex, we need to:

| |

• | identify a site and purchase or lease such site; |

| |

• | obtain a number of licenses and permits; |

| |

• | enter into construction contracts; |

| |

• | identify and enter into contracts with a sufficient number of independent contract poultry producers; |

| |

• | complete construction on time; and |

| |

• | hire and train our workforce. |

If we are unable to complete construction on schedule, attract independent contract poultry producers, find customers for the additional product generated by the new facility, run the facility efficiently, or otherwise achieve the expected benefits of our new facilities, our business could be negatively affected.

The poultry industry is highly competitive.

In general, the competitive factors in the U.S. poultry industry include:

| |

• | breadth of product line; and |

Competitive factors vary by major customer markets. Some of our competitors have greater financial and marketing resources than we have. In the food service market, competition is based on consistent quality, product development, customer service and price. In the U.S. retail grocery market, we believe that competition is based on product quality, brand awareness, price and customer service. Our success depends in part on our ability to manage costs and be efficient in the highly competitive poultry industry.

We depend on the availability of, and good relations with, our employees and contract growers.

We have approximately 14,669 employees, approximately 1,840 of which are covered by collective bargaining agreements. In addition, we contract with approximately 977 independent contract poultry producers in Mississippi, Texas, North Carolina and Georgia for the grow-out of our breeder and broiler stock and the production of broiler eggs. Our operations depend on the availability of labor and contract growers and maintaining good relations with these persons and with labor unions. If we fail to maintain good relations with our employees or with the unions, we may experience labor strikes or work stoppages. If we do not attract and maintain contracts with our growers, including new growers for our new poultry complexes, our production operations could be negatively impacted and/or our growth could be constrained.

Immigration legislation and enforcement may affect our ability to hire hourly workers.

Immigration reform continues to attract significant attention in the public arena and the United States Congress. If new immigration legislation is enacted at the federal level or in states in which we do business, such legislation may contain provisions that could make it more difficult or costly for us to hire United States citizens and/or legal immigrant workers. In such case, we may incur additional costs to run our business or may have to change the way we conduct our operations, either of which could have a material adverse effect on our business, operating results and financial condition. Also, despite our past and continuing efforts to hire only United States citizens and/or persons legally authorized to work in the United States, increased enforcement efforts with respect to existing immigration laws by governmental authorities may disrupt a portion of our workforce or our operations at one or more of our facilities, thereby negatively affecting our business. Officials with the Bureau of Immigration and Customs Enforcement have informally indicated intent to focus their enforcement efforts on meat and poultry processors.

If our poultry products become contaminated, we may be subject to product liability claims and product recalls.

Poultry products may contain disease-producing organisms, or pathogens, such as Listeria monocytogenes, Salmonella and generic E. coli. These pathogens are generally found in the environment and, as a result, there is a risk that they could be present in our processed poultry products as a result of food processing. In addition, it is possible foreign material such as metal, plastic or other material used in our processing plants could contaminate product during processing. Pathogens or foreign material can also be introduced as a result of improper handling by our customers, consumers or third parties after we have shipped the products. We control these risks through careful processing and testing of our finished product, but we cannot entirely eliminate them. We have little, if any, control over proper handling once the product has been shipped. Nevertheless, contamination that results from improper handling by our customers, consumers or third parties, or tampering with our products by those persons, may be blamed on us. Any publicity regarding product contamination or resulting illness or death, even if we did not cause the contamination, could lead to increased scrutiny by regulators and could have a material adverse effect on our business, reputation and future prospects.

If our products are contaminated or damaged, we could also be required to recall our products or close our plants, and product liability claims could be asserted against us. A widespread product recall could be costly and could cause significant losses, the destruction of product inventory, lost sales or customers due to the unavailability of product, adverse publicity, damage to our reputation, and a loss of consumer confidence in our products.

We are exposed to risks relating to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate.

Our business operations entail a number of risks, including risks relating to product liability claims, product recalls, property damage and injuries to persons. The insurance we maintain with respect to certain of these risks, including product liability and recall insurance, property insurance, workers compensation insurance and general liability insurance, is expensive and difficult to obtain. We cannot assure you that we can maintain on reasonable terms sufficient coverage to protect us against losses due to any of these events.

Governmental regulation and litigation are constant factors affecting our business.