mtn-20240731false2024FY0000812011http://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#Goodwillhttp://fasb.org/us-gaap/2023#Goodwilliso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:Diso4217:CHFmtn:hour00008120112023-08-012024-07-3100008120112024-01-3100008120112024-09-2300008120112024-07-3100008120112023-07-3100008120112022-08-012023-07-3100008120112021-08-012022-07-310000812011us-gaap:CommonStockMember2021-07-310000812011us-gaap:AdditionalPaidInCapitalMember2021-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-310000812011us-gaap:RetainedEarningsMember2021-07-310000812011us-gaap:TreasuryStockCommonMember2021-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2021-07-310000812011us-gaap:NoncontrollingInterestMember2021-07-3100008120112021-07-310000812011us-gaap:RetainedEarningsMember2021-08-012022-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2021-08-012022-07-310000812011us-gaap:NoncontrollingInterestMember2021-08-012022-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-012022-07-310000812011us-gaap:AdditionalPaidInCapitalMember2021-08-012022-07-310000812011us-gaap:CommonStockMember2021-08-012022-07-310000812011us-gaap:TreasuryStockCommonMember2021-08-012022-07-310000812011us-gaap:CommonStockMember2022-07-310000812011us-gaap:AdditionalPaidInCapitalMember2022-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000812011us-gaap:RetainedEarningsMember2022-07-310000812011us-gaap:TreasuryStockCommonMember2022-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-07-310000812011us-gaap:NoncontrollingInterestMember2022-07-3100008120112022-07-310000812011us-gaap:RetainedEarningsMember2022-08-012023-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-08-012023-07-310000812011us-gaap:NoncontrollingInterestMember2022-08-012023-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012023-07-310000812011us-gaap:AdditionalPaidInCapitalMember2022-08-012023-07-310000812011us-gaap:CommonStockMember2022-08-012023-07-310000812011us-gaap:TreasuryStockCommonMember2022-08-012023-07-310000812011us-gaap:CommonStockMember2023-07-310000812011us-gaap:AdditionalPaidInCapitalMember2023-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000812011us-gaap:RetainedEarningsMember2023-07-310000812011us-gaap:TreasuryStockCommonMember2023-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-07-310000812011us-gaap:NoncontrollingInterestMember2023-07-310000812011us-gaap:RetainedEarningsMember2023-08-012024-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-08-012024-07-310000812011us-gaap:NoncontrollingInterestMember2023-08-012024-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012024-07-310000812011us-gaap:AdditionalPaidInCapitalMember2023-08-012024-07-310000812011us-gaap:CommonStockMember2023-08-012024-07-310000812011us-gaap:TreasuryStockCommonMember2023-08-012024-07-310000812011us-gaap:CommonStockMember2024-07-310000812011us-gaap:AdditionalPaidInCapitalMember2024-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-310000812011us-gaap:RetainedEarningsMember2024-07-310000812011us-gaap:TreasuryStockCommonMember2024-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2024-07-310000812011us-gaap:NoncontrollingInterestMember2024-07-310000812011srt:MinimumMemberus-gaap:LandImprovementsMember2024-07-310000812011srt:MaximumMemberus-gaap:LandImprovementsMember2024-07-310000812011srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-07-310000812011srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-07-310000812011srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-07-310000812011srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-07-310000812011srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-07-310000812011srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-07-310000812011us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-07-310000812011srt:MinimumMemberus-gaap:VehiclesMember2024-07-310000812011srt:MaximumMemberus-gaap:VehiclesMember2024-07-310000812011mtn:A6.25NotesMember2024-07-310000812011mtn:A00NotesMember2024-07-310000812011mtn:EPRSecuredNotesMember2024-07-310000812011mtn:NRPLoanMember2024-07-310000812011mtn:MountainOperatingExpenseMember2023-08-012024-07-310000812011mtn:MountainOperatingExpenseMember2022-08-012023-07-310000812011mtn:MountainOperatingExpenseMember2021-08-012022-07-310000812011mtn:LodgingOperatingExpenseMember2023-08-012024-07-310000812011mtn:LodgingOperatingExpenseMember2022-08-012023-07-310000812011mtn:LodgingOperatingExpenseMember2021-08-012022-07-310000812011mtn:RealEstateOperatingExpenseMember2023-08-012024-07-310000812011mtn:RealEstateOperatingExpenseMember2022-08-012023-07-310000812011mtn:RealEstateOperatingExpenseMember2021-08-012022-07-310000812011mtn:LiftTicketsMembermtn:LiftTicketsMember2023-08-012024-07-310000812011mtn:LiftTicketsMembermtn:LiftTicketsMember2022-08-012023-07-310000812011mtn:LiftTicketsMembermtn:LiftTicketsMember2021-08-012022-07-310000812011mtn:SkiSchoolMembermtn:SkiSchoolMember2023-08-012024-07-310000812011mtn:SkiSchoolMembermtn:SkiSchoolMember2022-08-012023-07-310000812011mtn:SkiSchoolMembermtn:SkiSchoolMember2021-08-012022-07-310000812011mtn:DiningMembermtn:DiningMember2023-08-012024-07-310000812011mtn:DiningMembermtn:DiningMember2022-08-012023-07-310000812011mtn:DiningMembermtn:DiningMember2021-08-012022-07-310000812011mtn:RetailRentalMembermtn:RetailRentalMember2023-08-012024-07-310000812011mtn:RetailRentalMembermtn:RetailRentalMember2022-08-012023-07-310000812011mtn:RetailRentalMembermtn:RetailRentalMember2021-08-012022-07-310000812011mtn:OtherMountainRevenueMembermtn:OtherMountainRevenueMember2023-08-012024-07-310000812011mtn:OtherMountainRevenueMembermtn:OtherMountainRevenueMember2022-08-012023-07-310000812011mtn:OtherMountainRevenueMembermtn:OtherMountainRevenueMember2021-08-012022-07-310000812011mtn:OwnedHotelRevenueMember2023-08-012024-07-310000812011mtn:OwnedHotelRevenueMember2022-08-012023-07-310000812011mtn:OwnedHotelRevenueMember2021-08-012022-07-310000812011mtn:ManagedcondominiumroomsMember2023-08-012024-07-310000812011mtn:ManagedcondominiumroomsMember2022-08-012023-07-310000812011mtn:ManagedcondominiumroomsMember2021-08-012022-07-310000812011mtn:DiningMember2023-08-012024-07-310000812011mtn:DiningMember2022-08-012023-07-310000812011mtn:DiningMember2021-08-012022-07-310000812011mtn:TransportationMember2023-08-012024-07-310000812011mtn:TransportationMember2022-08-012023-07-310000812011mtn:TransportationMember2021-08-012022-07-310000812011mtn:GolfMember2023-08-012024-07-310000812011mtn:GolfMember2022-08-012023-07-310000812011mtn:GolfMember2021-08-012022-07-310000812011mtn:OtherLodgingRevenueMember2023-08-012024-07-310000812011mtn:OtherLodgingRevenueMember2022-08-012023-07-310000812011mtn:OtherLodgingRevenueMember2021-08-012022-07-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2023-08-012024-07-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2022-08-012023-07-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2021-08-012022-07-310000812011mtn:PayrollcostreimbursementsMember2023-08-012024-07-310000812011mtn:PayrollcostreimbursementsMember2022-08-012023-07-310000812011mtn:PayrollcostreimbursementsMember2021-08-012022-07-310000812011srt:MinimumMember2023-08-012024-07-310000812011srt:MaximumMember2023-08-012024-07-310000812011mtn:CanyonsObligationMember2024-07-310000812011mtn:CanyonsObligationMember2023-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2024-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-07-310000812011mtn:NorthstarMember2024-07-310000812011mtn:NorthstarResortFinanceLeasesMember2024-07-310000812011us-gaap:ConvertibleDebtMember2020-12-180000812011srt:ScenarioForecastMember2024-09-252024-09-250000812011srt:ScenarioForecastMemberus-gaap:DividendDeclaredMember2024-10-242024-10-240000812011srt:ScenarioForecastMemberus-gaap:DividendDeclaredMember2024-10-082024-10-080000812011us-gaap:LineOfCreditMember2023-08-012024-07-310000812011us-gaap:LineOfCreditMember2024-07-310000812011us-gaap:LineOfCreditMember2023-07-310000812011mtn:TermLoanMember2023-08-012024-07-310000812011mtn:TermLoanMember2024-07-310000812011mtn:TermLoanMember2023-07-310000812011mtn:A6.50NotesMember2023-08-012024-07-310000812011mtn:A6.50NotesMember2024-07-310000812011mtn:A6.50NotesMember2023-07-310000812011mtn:A6.25NotesMember2023-08-012024-07-310000812011mtn:A6.25NotesMember2024-07-310000812011mtn:A6.25NotesMember2023-07-310000812011us-gaap:ConvertibleDebtMember2023-08-012024-07-310000812011us-gaap:ConvertibleNotesPayableMember2024-07-310000812011us-gaap:ConvertibleNotesPayableMember2023-07-310000812011mtn:WhistlerCreditAgreementrevolverMember2023-08-012024-07-310000812011mtn:WhistlerCreditAgreementrevolverMember2024-07-310000812011mtn:WhistlerCreditAgreementrevolverMember2023-07-310000812011mtn:EPRSecuredNotesMembersrt:MinimumMember2023-08-012024-07-310000812011mtn:EPRSecuredNotesMembersrt:MaximumMember2023-08-012024-07-310000812011mtn:EPRSecuredNotesMember2023-07-310000812011mtn:EmployeeHousingBondsMembersrt:MinimumMember2023-08-012024-07-310000812011mtn:EmployeeHousingBondsMembersrt:MaximumMember2023-08-012024-07-310000812011mtn:EmployeeHousingBondsMember2024-07-310000812011mtn:EmployeeHousingBondsMember2023-07-310000812011mtn:CanyonsObligationMember2023-08-012024-07-310000812011mtn:AndermattSedrunMembersrt:MinimumMember2023-08-012024-07-310000812011mtn:AndermattSedrunMember2024-07-310000812011mtn:AndermattSedrunMember2023-07-310000812011mtn:WhistlerEmployeeHousingLeasesMembersrt:MinimumMember2023-08-012024-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2024-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-07-310000812011mtn:OtherDebtMembersrt:MinimumMember2023-08-012024-07-310000812011mtn:OtherDebtMembersrt:MaximumMember2023-08-012024-07-310000812011mtn:OtherDebtMember2024-07-310000812011mtn:OtherDebtMember2023-07-310000812011mtn:A6.50NotesMember2024-07-310000812011us-gaap:ConvertibleNotesPayableMember2020-12-180000812011us-gaap:ConvertibleNotesPayableMember2023-08-012024-07-310000812011mtn:AlpineValleySecuredNoteMember2024-07-310000812011mtn:BostonMillsBrandywineSecuredNoteMember2024-07-310000812011mtn:JackFrostBigBoulderSecuredNoteMember2024-07-310000812011mtn:MountSnowSecuredNoteMember2024-07-310000812011mtn:HunterMountainSecuredNoteMember2024-07-310000812011mtn:HunterMountainSecuredNoteMember2023-08-012024-07-310000812011mtn:EPRSecuredNotesMember2023-08-012024-07-310000812011mtn:EPRSecuredNotesMember2023-08-012024-07-310000812011mtn:MountSnowSecuredNoteMember2023-08-012024-07-310000812011mtn:HunterMountainSecuredNoteMember2023-08-012024-07-310000812011mtn:EmployeeHousingBondsMember2023-08-012024-07-310000812011mtn:EmployeeHousingBondsMembermtn:BreckenridgeTerraceMember2023-08-012024-07-310000812011mtn:TrancheaMembermtn:BreckenridgeTerraceMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:TrancheBMembermtn:BreckenridgeTerraceMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:BreckenridgeTerraceMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:TarnesMember2023-08-012024-07-310000812011mtn:TrancheaMembermtn:TarnesMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:TrancheBMembermtn:TarnesMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:TarnesMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:BcHousingMember2023-08-012024-07-310000812011mtn:TrancheaMembermtn:BcHousingMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:TrancheBMembermtn:BcHousingMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:BcHousingMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:TenderfootMember2023-08-012024-07-310000812011mtn:TrancheaMembermtn:TenderfootMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:TrancheBMembermtn:TenderfootMembermtn:EmployeeHousingBondsMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:TenderfootMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:TrancheaMember2024-07-310000812011mtn:EmployeeHousingBondsMembermtn:TrancheBMember2024-07-310000812011mtn:CanyonsMember2013-05-282013-05-290000812011mtn:WhistlerEmployeeHousingLeasesMember2013-05-282013-05-290000812011mtn:CanyonsMember2024-07-310000812011mtn:CanyonsMember2023-08-012024-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2022-08-012023-07-310000812011mtn:NorthstarResortFinanceLeasesMember2023-08-012024-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-07-310000812011mtn:CransMontanaMember2024-05-020000812011mtn:CransMontanaMember2024-05-022024-05-020000812011mtn:CransMontanaMember2024-07-310000812011mtn:CransMontanaMember2023-08-012024-07-310000812011mtn:SevenSpringsResortsMember2023-08-012024-07-310000812011mtn:AndermattSedrunMember2022-08-030000812011mtn:AndermattSedrunMember2022-08-012023-07-310000812011mtn:AndermattSedrunMember2022-08-032022-08-030000812011mtn:AndermattSedrunMember2024-07-310000812011mtn:AndermattSedrunMember2023-08-012024-07-310000812011mtn:SevenSpringsResortsMember2021-12-312021-12-310000812011mtn:SevenSpringsResortsMember2024-07-310000812011mtn:SevenSpringsResortsMember2021-08-012022-07-310000812011mtn:CanyonsMember2023-07-310000812011mtn:MountainMember2022-07-310000812011mtn:LodgingMember2022-07-310000812011mtn:MountainMember2022-08-012023-07-310000812011mtn:LodgingMember2022-08-012023-07-310000812011mtn:MountainMember2023-07-310000812011mtn:LodgingMember2023-07-310000812011mtn:MountainMember2023-08-012024-07-310000812011mtn:LodgingMember2023-08-012024-07-310000812011mtn:MountainMember2024-07-310000812011mtn:LodgingMember2024-07-310000812011us-gaap:MoneyMarketFundsMember2024-07-310000812011us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-07-310000812011us-gaap:CommercialPaperMember2024-07-310000812011us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Member2024-07-310000812011us-gaap:CertificatesOfDepositMember2024-07-310000812011us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2024-07-310000812011us-gaap:FairValueInputsLevel2Member2024-07-310000812011us-gaap:FairValueInputsLevel3Member2024-07-310000812011us-gaap:MoneyMarketFundsMember2023-07-310000812011us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-07-310000812011us-gaap:CommercialPaperMember2023-07-310000812011us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Member2023-07-310000812011us-gaap:CertificatesOfDepositMember2023-07-310000812011us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2023-07-310000812011us-gaap:FairValueInputsLevel2Member2023-07-310000812011us-gaap:FairValueInputsLevel3Member2023-07-310000812011mtn:PeakResortsInc.Member2024-07-310000812011us-gaap:ForeignCountryMember2024-07-310000812011mtn:EmployeeHousingBondsMember2024-07-310000812011mtn:HollandCreekMetropolitanDistrictMember2024-07-310000812011mtn:WorkersCompensationAndGeneralLiabilityRelatedToConstructionAndDevelopmentActivitiesMember2024-07-310000812011mtn:NorthstarMember2023-08-012024-07-310000812011mtn:PerisherMember2023-08-012024-07-310000812011mtn:FallsCreekMember2023-08-012024-07-310000812011mtn:HothamMember2023-08-012024-07-310000812011mtn:MadRiverMountainMember2023-08-012024-07-310000812011mtn:UsernCorporationMember2023-08-012024-07-310000812011mtn:SwissConfederationLease1Member2023-08-012024-07-310000812011mtn:SwissConfederationLease2Member2023-08-012024-07-310000812011mtn:MunicipalityOfTujetschMember2023-08-012024-07-310000812011mtn:SwissConfederationLease3Member2023-08-012024-07-310000812011mtn:SwissConfederationLease4Member2023-08-012024-07-310000812011mtn:FederalOfficeOfTransportConcession1Member2023-08-012024-07-310000812011mtn:FederalOfficeOfTransportConcession2Member2023-08-012024-07-310000812011mtn:MountainMember2021-08-012022-07-310000812011mtn:LodgingMember2021-08-012022-07-310000812011mtn:ResortMember2023-08-012024-07-310000812011mtn:ResortMember2022-08-012023-07-310000812011mtn:ResortMember2021-08-012022-07-310000812011mtn:RealEstateSegmentMember2023-08-012024-07-310000812011mtn:RealEstateSegmentMember2022-08-012023-07-310000812011mtn:RealEstateSegmentMember2021-08-012022-07-310000812011mtn:DoubletreeBreckenridgeMember2023-08-012024-07-310000812011us-gaap:GeographicDistributionDomesticMember2023-08-012024-07-310000812011us-gaap:GeographicDistributionDomesticMember2022-08-012023-07-310000812011us-gaap:GeographicDistributionDomesticMember2021-08-012022-07-310000812011us-gaap:GeographicDistributionForeignMember2023-08-012024-07-310000812011us-gaap:GeographicDistributionForeignMember2022-08-012023-07-310000812011us-gaap:GeographicDistributionForeignMember2021-08-012022-07-310000812011us-gaap:GeographicDistributionDomesticMember2024-07-310000812011us-gaap:GeographicDistributionDomesticMember2023-07-310000812011us-gaap:GeographicDistributionForeignMember2024-07-310000812011us-gaap:GeographicDistributionForeignMember2023-07-310000812011country:CA2023-08-012024-07-310000812011country:CA2022-08-012023-07-310000812011country:CA2024-07-310000812011country:CA2023-07-3100008120112006-03-0900008120112008-07-1600008120112015-12-0400008120112023-03-0700008120112006-03-092023-07-310000812011srt:ScenarioForecastMember2024-09-250000812011srt:MinimumMember2022-08-012023-07-310000812011srt:MaximumMember2022-08-012023-07-310000812011srt:MinimumMember2021-08-012022-07-310000812011srt:MaximumMember2021-08-012022-07-310000812011us-gaap:StockAppreciationRightsSARSMember2023-08-012024-07-310000812011us-gaap:StockAppreciationRightsSARSMember2022-08-012023-07-310000812011us-gaap:StockAppreciationRightsSARSMember2021-08-012022-07-310000812011us-gaap:StockAppreciationRightsSARSMember2023-07-310000812011us-gaap:StockAppreciationRightsSARSMember2024-07-310000812011mtn:RestrictedStockUnitsRsusMember2023-07-310000812011mtn:RestrictedStockUnitsRsusMember2023-08-012024-07-310000812011mtn:RestrictedStockUnitsRsusMember2024-07-310000812011mtn:RestrictedStockUnitsRsusMember2022-08-012023-07-310000812011mtn:RestrictedStockUnitsRsusMember2021-08-012022-07-310000812011srt:ScenarioForecastMembermtn:ExpectedToBeRecognizedInOneYearMember2025-07-310000812011srt:ScenarioForecastMembermtn:ExpectedToBeRecognizedInOneYearMember2026-07-310000812011srt:ScenarioForecastMembermtn:ExpectedToBeRecognizedInOneYearMember2027-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-09614

Vail Resorts, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 51-0291762 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 390 Interlocken Crescent | | |

| Broomfield, | Colorado | | 80021 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | |

| (303) | 404-1800 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MTN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

☐ Yes ☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of $222.00 per share as reported on the New York Stock Exchange Composite Tape on January 31, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter) was $8,336,162,160.

As of September 23, 2024, 37,485,473 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days of July 31, 2024 are incorporated by reference herein into Part III, Items 10 through 14, of this Annual Report.

Table of Contents

| | | | | | | | |

|

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

|

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

|

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

|

| Item 15. | | |

| Item 16. | | |

FORWARD-LOOKING STATEMENTS

Except for any historical information contained herein, the matters discussed or incorporated by reference in this Annual Report on Form 10-K (this “Form 10-K”) contain certain forward-looking statements within the meaning of the federal securities laws. These statements relate to analyses and other information, available as of the date hereof which are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our contemplated future prospects, developments and business strategies.

These forward-looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” and similar terms and phrases, including references to assumptions. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that such plans, intentions or expectations will be achieved. Important factors that could cause actual results to differ materially from our forward-looking statements include, but are not limited to:

•prolonged weakness in general economic conditions, including adverse effects on the overall travel and leisure related industries and our business and results of operations;

•risks associated with the effects of high or prolonged inflation, elevated interest rates and financial institution disruptions;

•unfavorable weather conditions or the impact of natural disasters or other unexpected events;

•the ultimate amount of refunds that we could be required to refund to our pass product holders for qualifying circumstances under our Epic Coverage program;

•the willingness or ability of our guests to travel due to terrorism, the uncertainty of military conflicts or public health emergencies, and the cost and availability of travel options and changing consumer preferences or discretionary spending habits;

•risks related to travel and airline disruptions, and other adverse impacts on the ability of our guests to travel;

•risks related to interruptions or disruptions of our information technology systems, data security or cyberattacks;

•risks related to our reliance on information technology, including our failure to maintain the integrity of our customer or employee data and our ability to adapt to technological developments or industry trends;

•our ability to acquire, develop and implement relevant technology offerings for customers and partners;

•the seasonality of our business combined with adverse events that may occur during our peak operating periods;

•competition in our mountain and lodging businesses or with other recreational and leisure activities;

•risks related to the high fixed cost structure of our business;

•our ability to fund resort capital expenditures, or accurately identify the need for, or anticipate the timing of certain capital expenditures;

•risks related to a disruption in our water supply that would impact our snowmaking capabilities and operations;

•our reliance on government permits or approvals for our use of public land or to make operational and capital improvements;

•risks related to resource efficiency transformation initiatives;

•risks related to federal, state, local and foreign government laws, rules and regulations, including environmental and health and safety laws and regulations;

•risks related to changes in security and privacy laws and regulations which could increase our operating costs and adversely affect our ability to market our products, properties and services effectively;

•potential failure to adapt to technological developments or industry trends regarding information technology;

•our ability to successfully launch and promote adoption of new products, technology, services and programs;

•risks related to our workforce, including increased labor costs, loss of key personnel and our ability to maintain adequate staffing, including hiring and retaining a sufficient seasonal workforce;

•our ability to successfully integrate acquired businesses, including their integration into our internal controls and infrastructure; our ability to successfully navigate new markets, including Europe; or that acquired businesses may fail to perform in accordance with expectations;

•a deterioration in the quality or reputation of our brands, including our ability to protect our intellectual property and the risk of accidents at our mountain resorts;

•risks related to scrutiny and changing expectations regarding our environmental, social and governance practices and reporting;

•risks associated with international operations, including fluctuations in foreign currency exchange rates where the Company has foreign currency exposure, primarily the Canadian and Australian dollars and the Swiss franc, as compared to the U.S. dollar;

•changes in tax laws, regulations or interpretations, or adverse determinations by taxing authorities;

•risks related to our indebtedness and our ability to satisfy our debt service requirements under our outstanding debt including our unsecured senior notes, which could reduce our ability to use our cash flow to fund our operations, capital expenditures, future business opportunities and other purposes;

•a materially adverse change in our financial condition;

•adverse consequences of current or future litigation and legal claims;

•changes in accounting judgments and estimates, accounting principles, policies or guidelines; and

•other risks and uncertainties included under Part I, Item 1A. “Risk Factors” in this document.

All forward-looking statements attributable to us or any persons acting on our behalf are expressly qualified in their entirety by these cautionary statements.

If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected. Given these uncertainties, users of the information included or incorporated by reference in this Form 10-K, including investors and prospective investors, are cautioned not to place undue reliance on such forward-looking statements. Actual results may differ materially from those suggested by the forward-looking statements that we make for a number of reasons including those described above and in Part I, Item 1A. “Risk Factors” of this Form 10-K. All forward-looking statements are made only as of the date hereof. Except as may be required by law, we do not intend to update these forward-looking statements, even if new information, future events or other circumstances have made them incorrect or misleading.

PART I

ITEM 1.BUSINESS.

General

Vail Resorts, Inc., together with its subsidiaries, is referred to throughout this document as “we,” “us,” “our” or the “Company.”

Vail Resorts, Inc., a Delaware corporation, was organized as a holding company in 1997 and operates through various subsidiaries. Our operations are grouped into three reportable segments: Mountain, Lodging and Real Estate, which represented approximately 88%, 12% and 0%, respectively, of our net revenue for our fiscal year ended July 31, 2024 (“Fiscal 2024”).

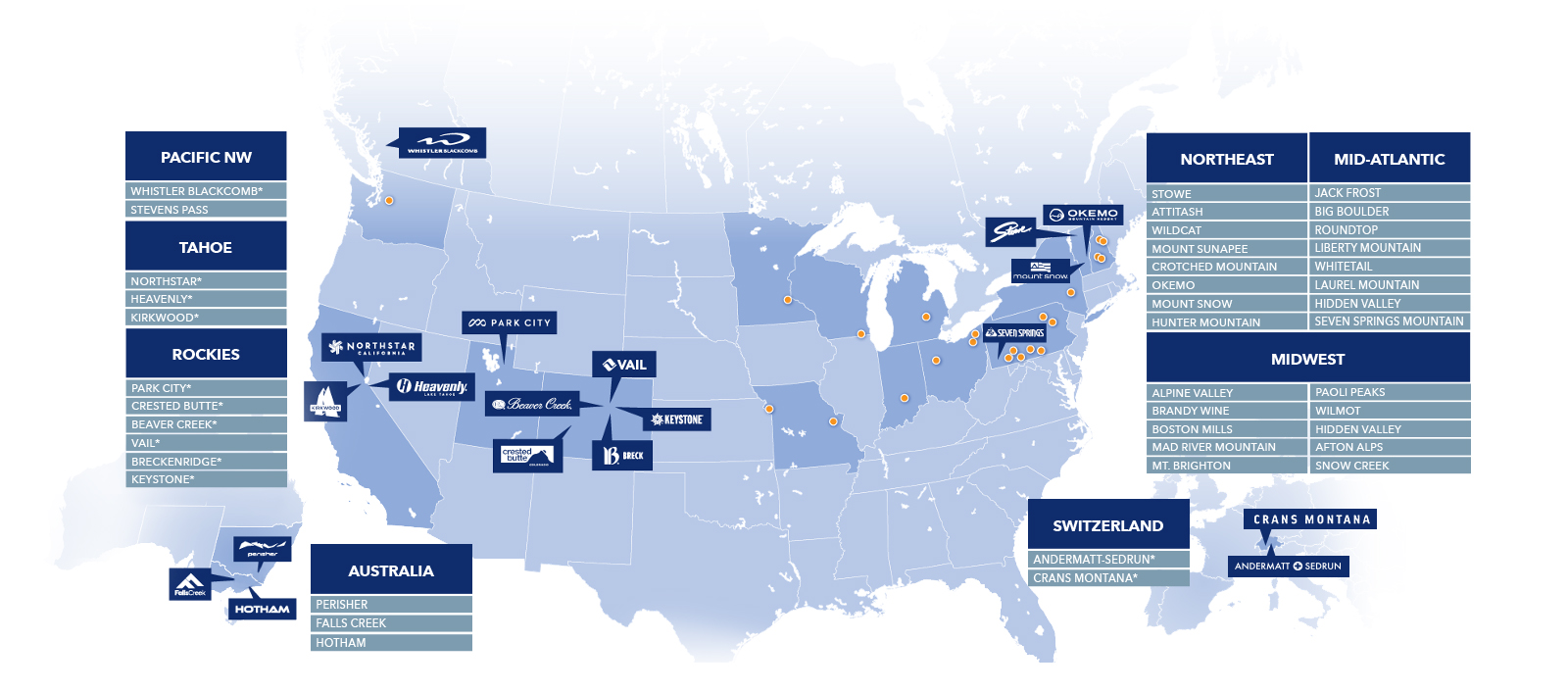

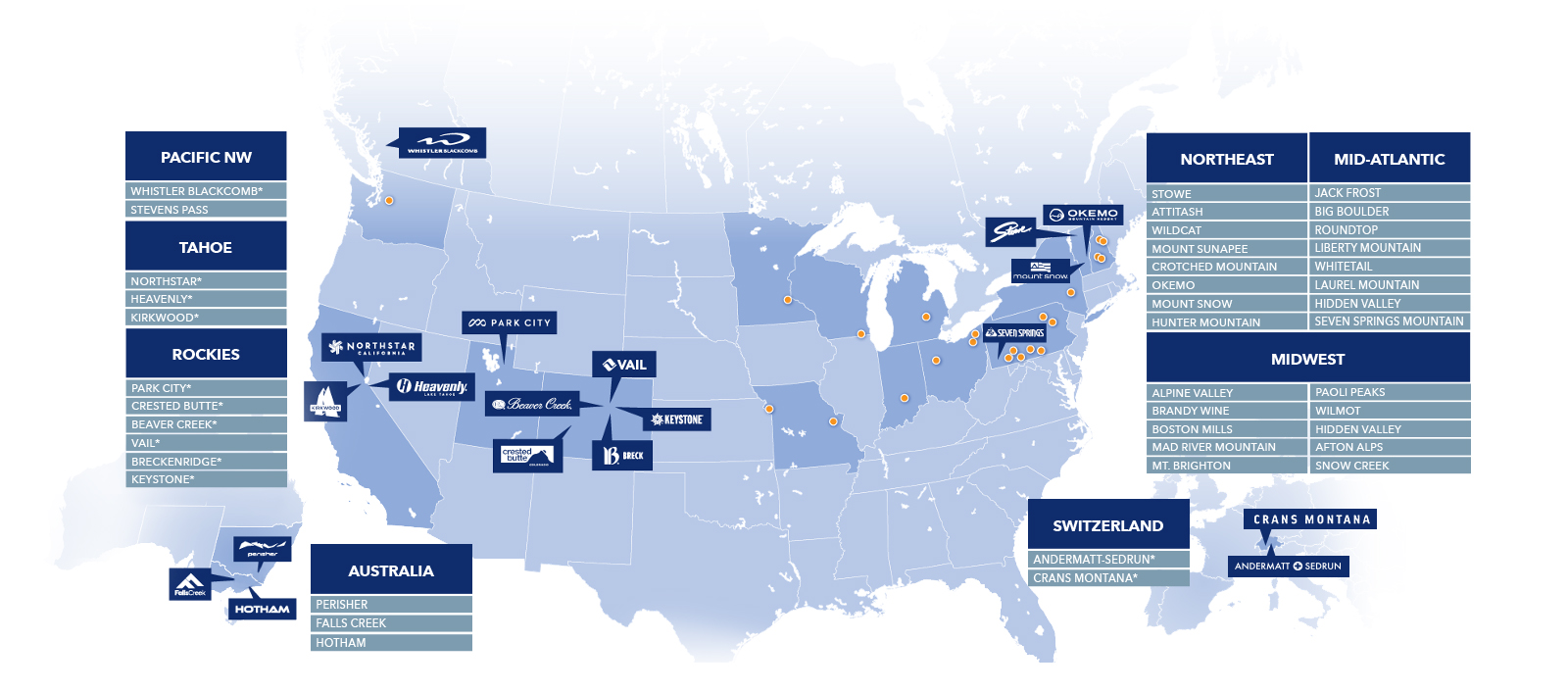

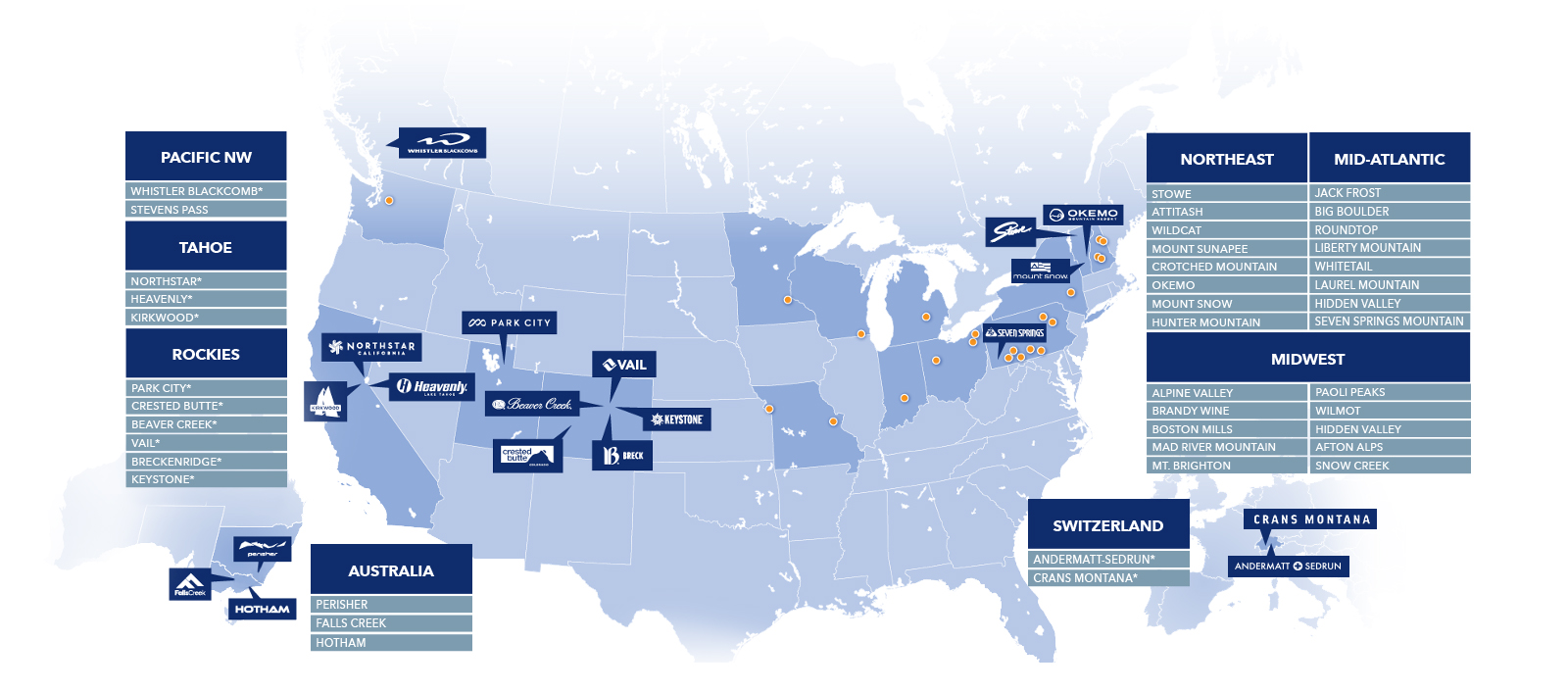

Our Mountain segment operates 42 world-class destination mountain resorts and regional ski areas (collectively, our “Resorts”). Additionally, the Mountain segment includes ancillary services, primarily including ski school, dining and retail/rental operations.

In the Lodging segment, we own and/or manage a collection of luxury hotels and condominiums under our RockResorts brand, other strategic lodging properties and a large number of condominiums located in proximity to our North American mountain resorts, National Park Service (“NPS”) concessioner properties including the Grand Teton Lodge Company (“GTLC”), which operates destination resorts in Grand Teton National Park, a Colorado resort ground transportation company and mountain resort golf courses.

We refer to “Resort” as the combination of the Mountain and Lodging segments. Our Real Estate segment owns, develops and sells real estate in and around our resort communities.

For financial information and other information about the Company’s segments and geographic areas, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8. “Financial Statements and Supplementary Data.”

Mountain Segment

In the Mountain segment, the Company operates the following 42 destination mountain resorts and regional ski areas, including four resorts within the top ten most visited resorts in the United States for the 2023/2024 North American ski season:

*Denotes a destination mountain resort, which generally receives a meaningful portion of skier visits from long-distance travelers, as opposed to our regional ski areas, which tend to generate skier visits predominantly from their respective local markets.

Our Mountain segment derives revenue through the sale of lift tickets, including pass products, as well as a comprehensive offering of amenities available to guests, including ski and snowboard lessons, equipment rentals and retail merchandise sales, a variety of dining venues, private club operations and other winter and summer recreational activities. In addition to providing extensive guest amenities, we also lease some of our owned and leased commercial space to third party operators to add unique restaurants and retail stores to the mix of amenities at the base of our resorts.

Many of our destination mountain resorts operate year-round and provide a comprehensive resort experience to a diverse clientele with an attractive demographic profile. We offer a broad complement of winter and summer recreational activities, including skiing, snowboarding, snowshoeing, snowtubing, sightseeing, mountain biking, guided hiking, zip lines, challenge ropes courses, alpine slides, mountain coasters, children’s activities and other recreational activities. Collectively, our Resorts are located in close proximity to population centers totaling approximately 110 million people.

Destination Mountain Resorts

Rocky Mountains (Colorado and Utah Resorts)

•Vail Mountain Resort (“Vail Mountain”) - the most visited mountain resort in the United States (“U.S.”) for the 2023/2024 ski season. Vail Mountain offers some of the most expansive and varied terrain in North America with approximately 5,300 skiable acres including seven world renowned back bowls and the resort’s Blue Sky Basin.

•Breckenridge Ski Resort (“Breckenridge”) - the second most visited mountain resort in the U.S. for the 2023/2024 ski season with five interconnected peaks offering an expansive variety of terrain for every skill level, including access to above tree line intermediate and expert terrain, and progressive and award-winning terrain parks.

•Park City Resort (“Park City”) - the third most visited mountain resort in the U.S. for the 2023/2024 ski season and the largest by acreage in the U.S. Park City offers 7,300 skiable acres, including diverse terrain for every type of skier and snowboarder. In 2024, the International Olympic Committee selected Salt Lake City as the host for the 2034 Winter Olympics, naming Park City as an official venue for certain competitions.

•Keystone Resort (“Keystone”) - the ninth most visited mountain resort in the U.S. for the 2023/2024 ski season, as well as the largest area for night skiing in Colorado. In December 2023, we completed our transformational lift-served terrain expansion project in Bergman Bowl, increasing lift-served terrain by 555 acres with the addition of a new six-

person high speed lift, and also providing lift-served access to Erickson Bowl. Keystone is a premier destination for families with its “Kidtopia” program focused on providing activities for kids on and off the mountain.

•Beaver Creek Resort (“Beaver Creek”) - the eleventh most visited mountain resort in the U.S. for the 2023/2024 ski season. Beaver Creek is a European-style resort with multiple villages and also includes a world renowned children’s ski school program focused on providing a first-class experience with unique amenities such as a dedicated children’s gondola.

•Crested Butte Mountain Resort (“Crested Butte”) - located in southwest Colorado and includes over 1,500 skiable acres and over 3,000 feet of vertical drop. Crested Butte is known for its historic town, iconic mountain peaks and legendary skiing and riding terrain.

Pacific Northwest (British Columbia, Canada)

•Whistler Blackcomb (“Whistler Blackcomb”) - located in the Coast Mountains of British Columbia, Canada, approximately 85 miles (135 kilometers) from the Vancouver International Airport, Whistler Blackcomb is the largest year-round mountain resort in North America, with two mountains connected by the PEAK 2 PEAK gondola, which combined offer over 200 marked runs, over 8,000 skiable acres (3,300 hectares), 14 alpine bowls, three glaciers and one of the longest ski seasons in North America. In the summer Whistler Blackcomb offers a variety of activities, including hiking trails, a bike park and sightseeing. Whistler Blackcomb is a popular destination for international visitors and was home to the 2010 Winter Olympics.

Lake Tahoe Resorts

•Heavenly Mountain Resort (“Heavenly”) - the twelfth most visited mountain resort in the U.S. for the 2023/2024 ski season. Located near the South Shore of Lake Tahoe with over 4,800 skiable acres, Heavenly straddles the border of California and Nevada and offers unique and spectacular views of Lake Tahoe. Heavenly offers great nightlife, including its proximity to several casinos.

•Northstar Resort (“Northstar”) - located near the North Shore of Lake Tahoe, Northstar is the premier luxury mountain resort destination near Lake Tahoe which offers premium lodging, a vibrant base area and over 3,000 skiable acres. Northstar’s village features high-end shops and restaurants, a conference center and a 9,000 square-foot skating rink.

•Kirkwood Mountain Resort (“Kirkwood”) - located about 35 miles southwest of South Lake Tahoe, offering a unique location atop the Sierra Crest, Kirkwood is recognized for offering some of the best high alpine advanced terrain in North America with 2,000 feet of vertical drop and over 2,300 skiable acres.

Switzerland

•Andermatt-Sedrun (“Andermatt-Sedrun”) - located approximately 70 miles (110 kilometers) from Zurich, Switzerland in the Ursern Valley of the Swiss Alps and approximately 200 miles (320 kilometers) from Geneva, Switzerland. Andermatt-Sedrun offers nearly 75 miles (120 kilometers) of varied terrain and a top elevation of 9,800 feet (3,000 meters) across the mountains of Andermatt, Sedrun and Gemsstock, with connected access to Disentis, which is independently owned. The ski area spans over 10 miles (16 kilometers) of scenic high alpine terrain between Andermatt and Sedrun, including the iconic Oberalp Pass, and is connected by the Matterhorn Gothard Bahn, a railway which operates year-round.

•Crans-Montana Mountain Resort (“Crans-Montana”) - during Fiscal 2024, we acquired a controlling interest in Crans-Montana, marking our second owned and operated resort in Europe. Crans-Montana Mountain Resort is located in the Valais canton of Switzerland, approximately 125 miles (200 kilometers) from Geneva and approximately 190 miles (310 kilometers) from Zurich. The resort spans nearly 4,600 feet (1,400 meters) of skiable vertical terrain, and approximately 87 miles (140 kilometers) of trails. Crans-Montana has a legacy of being a renowned outdoor sports destination, having hosted signature events such as the Ski World Cup, Mountain Bike World Cup, Omega European Masters and Caprices Festival. The commune of Crans-Montana has gourmet restaurants and luxury retail stores, as well as five-star hotels, including the recently developed Six Senses lodge and spa, a luxury 45-room ski-in, ski-out chalet-style property situated above the main gondola. Additionally, the International Ski Federation Council has awarded the FIS Alpine World Ski Championships 2027 to Crans-Montana.

Regional Ski Areas

Our ski resort network allows us to connect guests with drive-to access and destination resort access on a single pass product. Building a presence near major metropolitan areas with large populations enables us to drive advance commitment pass product sales among a broad array of guests.

Northeast

We own and operate eight regional ski areas in the Northeast that we believe provide a compelling regional and local connection to guests within driving distance from the New York, Boston and the greater New England markets. Stowe is the premier, high-end regional ski area in the Northeast offering outstanding skiing and an exceptional base area experience. Okemo and Mount Snow are compelling regional destinations serving guests in the New York metropolitan area and throughout New England. Hunter Mountain is a day-trip ski area primarily serving the New York metropolitan area. Additionally, we own four ski areas in New Hampshire serving guests throughout New England.

Mid-Atlantic (Pennsylvania)

We own and operate eight ski areas in the Mid-Atlantic region serving guests in Philadelphia, Pittsburgh, Southern New Jersey, Baltimore and Washington D.C. Our presence in the region allows us to offer compelling local options and easy overnight weekend and holiday trips to our premium Northeast regional ski areas, which are within driving distance from these markets.

Midwest

We own and operate ten ski areas in the Midwest that draw guests from Chicago, Detroit, Minneapolis, St. Louis, Indianapolis, Cleveland, Columbus, Kansas City and Louisville, among others. Located within close proximity to major metropolitan markets, these ski areas provide beginners with easy access to beginner ski programs and many also offer night skiing for young adults and families. Additionally, the proximity of these ski areas to metropolitan areas allows for regular usage by avid skiers.

Pacific Northwest (U.S.)

Stevens Pass Resort (“Stevens Pass’’) - located less than 85 miles from Seattle on the crest of Washington State’s Cascade Range, Stevens Pass offers terrain for all levels across more than 1,100 acres of skiable terrain. Stevens Pass has operated for over 80 years and is known for its numerous bowls, glades and faces, as well as extensive lighted terrain for skiing and riding well into the evening.

Australia

Australia is an important market for both domestic skiing during the Australian winter and as a source of international visitation to the Northern Hemisphere in the Australian off-season, with typically over one million estimated Australian skier visits annually to North America, Europe and Japan. We own three of the five largest ski areas in Australia, which we serve with the Epic Australia Pass, an Australian dollar denominated pass product marketed specifically to Australian guests. Perisher, located in New South Wales, is the largest ski resort in Australia and targets guests in the Sydney metropolitan area and the broader New South Wales market, while Falls Creek and Mount Hotham are two of the largest ski areas in Victoria and target guests in the Melbourne metropolitan area and the broader Victoria market.

Ski Industry/Competition

There are approximately 770 ski areas operating in North America with approximately 485 in the U.S., ranging from small ski area operations that service day skiers to large resorts that attract both day skiers and destination guests looking for a comprehensive vacation experience. During the 2023/2024 North American ski season, combined skier visits for all ski areas in North America were approximately 78.4 million. Our North American Resorts had approximately 15.8 million skier visits during the 2023/2024 ski season, representing approximately 20.2% of North American skier visits.

There is limited opportunity for development of new destination ski resorts due to the limited private lands on which ski areas can be built, the difficulty in obtaining the appropriate governmental approvals to build on public lands and the significant capital needed to construct the necessary infrastructure. As such, there have been virtually no new destination ski resorts of scale in North America for nearly 45 years, which has allowed and should continue to allow the best-positioned destination resorts to benefit from future industry growth. Our resorts compete with other major destination mountain resorts, including, among others, Aspen Snowmass, Deer Valley, Jackson Hole, Copper Mountain, Steamboat, Winter Park, Snowbird, Palisades Tahoe, Killington, Mammoth, St. Moritz and Zermatt, as well as other ski areas in Colorado, California, Nevada, Utah, the Pacific Northwest, the Northeast, the Southwest, British Columbia, Canada, Australia and Switzerland, and other destination ski areas worldwide as well as non-ski related vacation options and destinations. Additionally, our pass products compete with other single and multi-resort frequency pass products in North America, including the IKON Pass, the Mountain Collective Pass and various regional and local pass products.

The ski industry statistics stated in this section have been derived primarily from data published by the Canadian Ski Council and Kottke National End of Season Surveys as well as other industry publications.

Our Competitive Strengths

We believe our premier resorts and business model differentiate our Company from the rest of the ski industry. We own and operate some of the most iconic, branded destination mountain resorts in geographically diverse and important ski destinations in North America, including Colorado, Utah, Lake Tahoe and the Pacific Northwest, including British Columbia, Canada. These resorts are complemented by regional ski areas in the Northeast, Pacific Northwest, Midwest and Mid-Atlantic regions, which are strategically positioned near key U.S. population centers, as well as three ski areas in Australia and two ski resorts in Switzerland. Through our data-driven marketing analytics and personalized marketing capabilities, we target increased penetration of ski pass products, providing our guests with a strong value proposition in return for guests committing to ski or ride at our resorts prior to, or very early into the ski season, which we believe attracts more guests to our resorts. We believe we invest in more capital improvements than our competitors and we create synergies through our owned and operated network of resorts, which enhances our profitability by enabling customers to access our network of resorts with our pass products. Many of our destination mountain resorts located in the U.S. typically rank in the most visited ski resorts in the U.S. (four of the top ten for the 2023/2024 U.S. ski season), and most of our destination mountain resorts are consistently in the top ranked ski resorts in North America according to industry surveys, which we attribute to our ability to provide a high-quality experience.

We believe the following factors contribute directly to each Resort’s success:

Exceptional Mountain Experience

•World-Class Destination Mountain Resorts and Integrated Base Resort Areas

Our destination mountain resorts offer a multitude of skiing and snowboarding experiences for the beginner, intermediate, advanced and expert levels. Each destination mountain resort is fully integrated into expansive resort base areas offering a broad array of lodging, dining, retail, nightlife and other amenities, some of which we own or manage.

•Snow Conditions

Our Resorts in the Rocky Mountain region of Colorado and Utah, the Sierra Nevada Mountains in Lake Tahoe and the Coast Mountains in British Columbia, Canada generally receive abundant snowfall each year, but we have invested significantly in snowmaking systems in these areas which help to provide a more consistent guest experience, especially in the early season. We have made significant investments in our snowmaking systems within the past several years in Colorado that transformed the early-season terrain experience at Vail, Keystone and Beaver Creek. Our other ski areas receive less snowfall than our western North American mountain resorts, but we have invested in snowmaking operations at these resorts in order to provide a consistent experience for our guests. In calendar year 2024, the Company plans to invest in snowmaking projects at Park City, Hunter Mountain and Andermatt-Sedrun in order to enhance the early season guest experience. Additionally, we provide several hundred acres of groomed terrain at each of our mountain resorts with extensive fleets of snow grooming equipment.

•Lift Service

We systematically upgrade our lifts and put in new lifts to increase uphill capacity and streamline skier traffic to maximize the guest experience. Discretionary capital expenditures expected for calendar year 2024 include, among other projects:

•replacing Whistler Blackcomb’s existing four-person high speed Jersey Cream lift with a new six-person high-speed lift, which is expected to provide a meaningful increase to uphill capacity and better distribute guests at a central part of the resort;

•replacing Hunter Mountain’s existing fixed-grip four-person Broadway lift with a new high-speed six-person lift and relocating the two-person fixed-grip E lift, providing a meaningful increase in uphill capacity and improved access to terrain that is key to the progressive learning experience for our guests;

•replacing Perisher’s Double and Triple Chairs with a new high-speed six-person lift, which is expected in advance of the 2025 winter season in Australia; and

•preparatory work for the planned replacement of Park City’s fixed-grip two-person lift with a new ten-person Sunrise Gondola in calendar year 2025 in partnership with Canyons Village Management Association, which will provide improved access and enhanced guest experience for existing and future developments within Canyons Village.

•In the past several years, we have installed or upgraded several high speed chairlifts and gondolas across our Resorts, including five new or replacement lifts across five Resorts for the 2023/2024 North American ski season, which meaningfully increased lift capacity and reduced wait times at those lift locations. Investments in the past several years include:

•a new high-speed six-person lift in Bergman Bowl at Keystone;

•replacing Breckenridge’s fixed-grip double 5-Chair with a new high-speed four-person lift;

•replacing Whistler Blackcomb’s existing four-person high speed Fitzsimmons lift with a new high-speed eight-person lift;

•replacing Stevens Pass’ current fixed-grip double Kehr’s Chair lift with a new four-person lift;

•replacing the three-person fixed-grip Summit Triple lift at Attitash with a new high-speed four-person lift;

•a new high-speed ten-person gondola at Whistler Blackcomb replacing the existing six-person gondola;

•replacing Whistler Blackcomb’s existing Big Red Express high-speed four-person lift with a high-speed six-person lift;

•a new high-speed four-person lift in Vail’s Sun Down Bowl;

•replacing the four-person lift in Vail’s Game Creek Bowl with a new high-speed six-person lift;

•replacing Breckenridge’s fixed-grip double Rip’s Ride lift with a high-speed four-person lift;

•a new high-speed six-person chair replacing Northstar’s Comstock four-person lift;

•replacing Heavenly’s fixed-grip triple North Bowl lift with a high-speed four-person lift;

•replacing 11 existing lifts at Stowe, Mount Snow, Attitash, Boston Mills, Brandywine, Jack Frost and Big Boulder with new high-speed and fixed-grip lifts;

•the 250-acre lift-served terrain expansion in the McCoy Park area of Beaver Creek;

• a new four-person high speed lift to serve Peak 7 at Breckenridge;

• replacing the four-person Peru lift at Keystone with a six-person high speed lift;

• replacing the Peachtree lift at Crested Butte with a new three-person fixed-grip lift; and

• an upgrade of the four-person Quantum lift at Okemo with a six-person high speed lift, and relocating the four-person Quantum lift to replace the Green Ridge three-person fixed-grip lift.

•Terrain Parks

We are committed to leading the industry in terrain park design, education and events for the growing segment of freestyle skiers and snowboarders. Each of our destination mountain resorts has multiple terrain parks that include progressively-challenging features. These park structures, coupled with freestyle ski school programs, promote systematic learning from basic to professional skills.

Extraordinary Service and Amenities

•Commitment to the Guest Experience

Our focus is to provide quality service at every touch point of the guest journey. Prior to arrival at our mountain resorts, guests can receive personal assistance through our full-service, central reservations group and through our comprehensive websites to book desired lodging accommodations, lift tickets and pass products, ski school lessons, equipment rentals, activities and other resort services. Upon arrival, our resort staff serve as ambassadors to engage guests, answer questions and foster a customer-focused environment. We are also committed to ongoing technological innovation as a means to further enhance the quality of the guest experience and continue to shape our industry and culture. We recently achieved the following technological milestones:

•My Epic mobile application (“My Epic App”) - During the 2023/2024 North American ski season, we launched the My Epic App, which allows our guests to purchase their pass product or lift ticket online and access our Resorts via the new app, utilizing hands free Bluetooth® technology, eliminating the need to wait in line to purchase lift tickets. In addition, the My Epic App allows guests to capture their activity on the mountain (e.g. number of ski days, vertical feet skied and chairlift activity); provides current trail maps along with real-time trail and lift status; allows guests to access real and forecasted lift line wait times; and provides information regarding parking, dining, events and other on-mountain activities. The My Epic App also provides access to My Epic Gear and My Epic Assistant, as discussed below.

•My Epic Gear membership program (“My Epic Gear”) - During the 2023/2024 North American ski season, we piloted our new gear membership program, My Epic Gear, to a limited number of Epic Pass holders at Vail, Beaver Creek, Breckenridge and Keystone. The program will be launched for the 2024/2025 ski season at 12 destination and regional resorts across North America, including kids gear, with further expansions planned for future seasons. My Epic Gear provides members with the ability to choose the gear they want from a selection of popular ski and snowboard models, and have that gear delivered to them when and where they want it, with free slopeside pick up and drop off. My Epic Gear is designed to allow users to manage their entire experience from gear selection to boot fitting to delivery all from the new My Epic App.

•My Epic Assistant mobile application (“My Epic Assistant”) - During the 2023/2024 North American ski season, we announced the launch of the new My Epic Assistant, a new technology within My Epic App, which is scheduled to launch to a limited number of Epic Pass holders at Vail, Beaver Creek, Breckenridge and Keystone for the upcoming 2024/2025 North American ski season. Expansion of the application is planned to additional resorts in future seasons. Powered by artificial intelligence and resort experts, My Epic Assistant will provide real-time service to allow our guests to navigate their day at our resorts with confidence, efficiency and ease. Whether looking for the latest snow conditions, or on-mountain support with rentals and lessons, guests can simply open the My Epic App and use My Epic Assistant to point them in the right direction.

We also solicit guest feedback through a variety of surveys and results, which are used to ensure high levels of customer satisfaction, understand trends and develop future resort programs and amenities. We then utilize this guest feedback to help us focus our capital spending and operational efforts to the areas of the greatest need.

•Frontline Talent

Our talent philosophy is designed to enable us to fully achieve our mission and vision by ensuring we have the talent in place to deliver on our future growth plans, and we believe our frontline talent is a strategic advantage. Over the past several years, ongoing investments in frontline talent have driven strong staffing levels, with high engagement and season-to-season return rates, enabling our mountain resorts to deliver strong guest experience results, including on-mountain activities as well as at our restaurants, lodging, ski and ride school, and retail/rental locations. For more information, refer to the “Human Capital Management” section.

•Season Pass & Epic Day Pass Products

We offer a variety of pass products, primarily season pass and Epic Day Pass products, for all of our Resorts that are marketed towards both out-of-state and international (“Destination”) guests as well as in-state and local (“Local”) guests. These pass products are available for purchase prior to the start of the ski season, offering our guests a better value in exchange for their commitment to pass products with access to our Resorts before the season begins. Our pass program drives strong customer loyalty and mitigates exposure to more weather sensitive guests, leading to greater revenue stability and allowing us to capture valuable guest data. Additionally, our pass product customers typically ski more days each season than those guests who do not buy pass products, which leads to additional ancillary spending. In addition, our pass products attract new guests to our Resorts. Our pass products generated approximately 65% of our total lift revenue for Fiscal 2024, and generated approximately 75% of total visitation (excluding complimentary access) for Fiscal 2024. Sales of pass products are a key component of our overall Mountain segment revenue and help create strong synergies among our Resorts. Our pass product offerings range from providing access for a certain number of days to one or a combination of our Resorts to our Epic Pass, which allows pass holders unlimited and unrestricted access to all of our Resorts. The Epic Day Pass is a customizable one to seven day pass product purchased in advance of the season, for those skiers and riders who want to purchase access for a certain number of days during the season, and which is available in three tiers of resort offerings. All of our various pass product options can be found on our consumer website www.snow.com. Information on our websites does not constitute part of this document.

As part of our continued strategy to drive pass product sales and create a stronger connection between key skier markets and our iconic destination mountain resorts, we have continued to expand our portfolio of properties in recent years. We acquired Crans-Montana and Andermatt-Sedrun in May 2024 and August 2022, respectively. These acquisitions represent strategic investments to operate ski resorts in Europe as a part of our continued focus to expand our network of resort offerings, which provides a differentiated suite of options to our guests. In December 2021, we acquired Seven Springs Mountain Resort, Hidden Valley Resort and Laurel Mountain Ski Area in Pennsylvania (collectively, the “Seven Springs Resorts”), which added three regional ski areas strategically located near Pittsburgh, expanding our presence in the Mid-Atlantic region and generating incremental drive-to business from other major metropolitan areas such as Washington DC, Baltimore and Cleveland. Additionally, we enter into strategic long-term season pass alliance agreements with third-party mountain resorts, which for the 2024/2025 ski season include Telluride Ski Resort in Colorado, Hakuba Valley and Rusutsu Resort in Japan, Resorts of the Canadian Rockies in Canada, Les 3 Vallées in France, Disentis Ski Area and Verbier 4 Vallées in Switzerland, Skirama Dolomiti in Italy and Ski Arlberg in Austria, which further increase the value proposition of our pass products.

Pass product holders also receive additional value in exchange for their advance commitment through our Epic Mountain Rewards program, which provides pass product holders a discount of 20% off on-mountain food and beverage, lodging, group ski school lessons, equipment rentals and more at our North American owned and operated Resorts. Epic Mountain Rewards is available for everyone who purchases an Epic Pass, Epic Local Pass, Epic Day Pass, Epic Military Pass and most of our other pass products, regardless of whether guests plan to ski one day or every day of the season. Additionally, Epic Coverage is included with the purchase of all pass products for no additional charge and provides refunds in the event of certain resort closures and certain travel restrictions, giving pass holders a refund for any portion of the season that is lost due to qualifying circumstances. Additionally, Epic Coverage provides refunds for qualifying personal circumstances including eligible injuries, job losses and other personal events.

•Premier Ski Schools

Our mountain resorts are home to some of the highest quality and most widely recognized ski schools in the industry. Through a combination of outstanding training and abundant work opportunities, our ski schools have become home to many of the most experienced and credentialed professionals in the business. We complement our instructor staff with state-of-the-art facilities and extensive learning terrain, all with a keen attention to guest needs. We offer a wide variety of adult and child group and private lesson options with a goal of creating lifelong skiers and riders and showcasing to our guests all the terrain our resorts have to offer.

•Dining

Our Resorts provide a variety of quality on-mountain and base village dining venues, ranging from top-rated fine dining restaurants to on-mountain express service restaurants. For the 2023/2024 ski season, we operated approximately 275 dining venues at our Resorts.

•Retail/Rental

We have approximately 330 retail/rental locations specializing in sporting goods including ski, snowboard and cycling equipment. Several of our rental locations offer delivery services, bringing ski and snowboard gear and expert advice directly to our guests. In addition to providing a major retail/rental presence at each of our Resorts, we also have retail/rental locations throughout the Colorado Front Range and Minneapolis. Starting with the 2023/2024 North American ski season, we piloted our new rental membership program, My Epic Gear, which reimagines the traditional gear rental and ownership model, with the goal of providing more choices, at a lower cost and less hassle to our customers. The program will be launched for the 2024/2025 ski season at 12 destination and regional resorts across North America, including kids gear, with further expansions planned for future seasons. My Epic Gear provides members with the ability to choose the gear they want from a selection of popular ski and snowboard models, and have it delivered to them when and where they want it, with free slopeside pick up and drop off.

•On-Mountain Activities

We are a ski industry leader in providing comprehensive destination vacation experiences, including on-mountain activities designed to appeal to a broad range of interests. During the winter season, in addition to our offered ski experiences, guests can choose from a variety of non-ski related activities such as snowtubing, snowshoeing, scenic snow cat tours, backcountry expeditions, horse-drawn sleigh rides and high-altitude dining. During the summer season, our mountain resorts offer non-ski related recreational activities including scenic chairlift and gondola rides, mountain biking, horseback riding, guided hiking, 4x4 Jeep tours and our Epic Discovery program at Vail Mountain, Heavenly and Breckenridge. The Epic Discovery program encourages “learn through play” by featuring extensive environmental

educational elements interspersed between numerous activities, consisting of zip lines, children’s activities, challenge ropes courses, tubing, mountain excursions, an alpine slide and alpine coasters. The Mountain segment also operates several company-owned mountain resort golf courses, including three in Colorado, one in Vermont and two in Pennsylvania.

•Lodging and Real Estate

High quality lodging options are an integral part of providing a complete resort experience. Our owned and managed properties proximate to our mountain resorts, including six RockResorts branded properties (with a seventh RockResorts property planned for opening in 2025 in Keystone, Colorado) and a significant inventory of managed condominium units, provide numerous accommodation options for our mountain resort guests. Our recent real estate efforts have primarily focused on the potential to expand our destination bed base and upgrade our resorts through the sale of land parcels to third-party developers, which in turn provides opportunity for the development of condominiums, luxury hotels, parking and commercial space for restaurants and retail shops. Our Lodging and Real Estate segments have and continue to invest in resort related assets and amenities or seek opportunities to expand and enhance the overall resort experience.

Lodging Segment

Our Lodging segment includes owned and managed lodging properties, including those under our luxury hotel brand, RockResorts; managed condominium units which are in and around our mountain resorts in Colorado, Lake Tahoe, Utah, Vermont, New York, Pennsylvania and British Columbia, Canada; two NPS concessioner properties in and near Grand Teton National Park in Wyoming; a resort ground transportation company in Colorado; and company-owned and operated mountain resort golf courses managed by our Lodging operations, including two in Colorado, one in Wyoming, one in Lake Tahoe, California, and one in Park City, Utah. For additional property details, see Item 2. “Properties”.

The Lodging segment currently includes approximately 5,300 owned and managed hotel rooms and condominium units. Our lodging strategy seeks to complement and enhance our mountain resort operations through our ownership or management of lodging properties and condominiums proximate to our mountain resorts and selective management of luxury resort hotels in premier destination locations.

In addition to our portfolio of owned and managed luxury resort hotels and other hotels and properties, our lodging business also features a Colorado ground transportation company, which represents the first point of contact with many of our guests when they arrive by air to Colorado. We offer year-round ground transportation from Denver International Airport and Eagle County Airport to the Vail Valley (locations in and around Vail, Beaver Creek, Avon and Edwards) and Summit County (which includes Keystone, Breckenridge, Copper Mountain, Frisco and Silverthorne).

Lodging Industry/Market

Hotels are categorized by Smith Travel Research, a leading lodging industry research firm, as luxury, upper upscale, upscale, upper midscale, midscale and economy. The service quality and level of accommodations of our RockResorts’ hotels place them in the luxury segment, which represents hotels achieving the highest average daily rates (“ADR”) in the industry, and includes such brands as the Four Seasons, Ritz-Carlton and Marriott’s Luxury Collection hotels. Our other hotels are categorized in the upper upscale and upscale segments of the hotel market. The luxury and upper upscale segments consist of approximately 860,000 rooms at approximately 2,800 properties in the U.S. as of July 31, 2024. For Fiscal 2024, our owned hotels, which include a combination of RockResort hotels as well as other hotels in proximity to our Resorts, had an overall ADR of $317.65, a paid occupancy rate of 50.9% and revenue per available room (“RevPAR”) of $161.82, as compared to the upper upscale segment’s ADR of $225.01, a paid occupancy rate of 68.3% and RevPAR of $153.70. We believe that this comparison to the upper upscale segment is appropriate as our mix of owned hotels include those in the luxury and upper upscale segments, as well as some of our hotels that fall in the upscale segment. The highly seasonal nature of our lodging properties typically results in lower average occupancy as compared to the upper upscale segment of the lodging industry as a whole.

Competition

Competition in the hotel industry is generally based on quality and consistency of rooms, restaurants, meeting facilities and services, the attractiveness of locations, availability of a global distribution system and price. Our properties compete within their geographic markets with hotels and resorts that include locally-owned independent hotels, as well as facilities owned or managed by national and international chains, including such brands as Four Seasons, Hilton, Hyatt, Marriott, Ritz-Carlton and Westin. Our properties also compete for convention and conference business across the national market. We believe we are highly competitive in the resort hotel niche for the following reasons:

•all of our hotels are located in unique, highly desirable resort destinations;

•our hotel portfolio has achieved some of the most prestigious hotel designations in the world, including two properties in our portfolio that are currently rated as AAA 4-Diamond;

•many of our hotels (both owned and managed) are designed to provide a look that feels indigenous to their surroundings, enhancing the guest’s vacation experience;

•each of our RockResorts hotels provides the same high level of quality and services, while still providing unique characteristics which distinguish the resorts from one another. This appeals to travelers looking for consistency in quality and service offerings together with an experience more unique than typically offered by larger luxury hotel chains;

•many of the hotels in our portfolio provide a wide array of amenities available to the guest such as access to world-class ski and golf resorts, spa and fitness facilities, water sports and a number of other outdoor activities, as well as highly acclaimed dining options;

•conference space with the latest technology is available at most of our hotels. In addition, guests at Keystone can use our company-owned Keystone Conference Center, the largest conference facility in the Colorado Rocky Mountain region with more than 100,000 square feet of meeting, exhibit and function space. The Seven Springs Resorts also provide conference services, offering over 77,000 square feet of meeting and function space;

•we have a central reservations system that leverages our mountain resort reservations system and has an online planning and booking platform, offering our guests a seamless and useful way to make reservations at our resorts; and

•we actively upgrade the quality of the accommodations and amenities available at our hotels through capital improvements. Capital funding for third-party owned properties is provided by the owners of those properties to maintain standards required by our management contracts.

National Park Concessioner Properties

We own GTLC, which is based in the Jackson Hole area in Wyoming and operates within Grand Teton National Park under a concession agreement with the NPS with an initial term that would have expired on December 31, 2021. In June 2021, we agreed to an amendment extending the term of the agreement an additional two years, with an expiration date of December 31, 2023. Additionally, in November 2023, we agreed to an amendment to the agreement extending the term until December 31, 2024. The NPS currently expects to release a contract solicitation for the services offered by GTLC by the end of calendar year 2024. We currently expect that our existing agreement will be extended for an additional one year through December 31, 2025 due to the time needed for solicitation, preparation, review and award of a new contract. We expect the NPS to confirm this extension in the fall of 2024. We also own Flagg Ranch, located in Moran, Wyoming and centrally located between Yellowstone National Park and Grand Teton National Park on the John D. Rockefeller, Jr. Memorial Parkway (the “Parkway”). Flagg Ranch operates under a concession agreement with the NPS that expires October 31, 2028. GTLC also owns Jackson Hole Golf & Tennis Club (“JHG&TC”), located outside Grand Teton National Park near Jackson, Wyoming. GTLC’s operations within Grand Teton National Park and JHG&TC have operating seasons that generally run from mid-May through the end of September.

We primarily compete with such companies as Aramark Parks & Resorts, Delaware North Companies Parks & Resorts, ExploreUS and Xanterra Parks & Resorts in retaining and obtaining NPS concession agreements. Four full-service concessioners provide accommodations within Grand Teton National Park, including GTLC. In a normal operating season, GTLC offers three lodging options within Grand Teton National Park: Jackson Lake Lodge, a full-service, 385-room resort with 17,000 square feet of conference facilities; Jenny Lake Lodge, a small, rustically elegant retreat with 37 cabins; and Colter Bay Village, a facility with 166 log cabins, 66 tent cabins, 337 campsites and a 112-space recreational vehicle park. We also operate two additional campgrounds separate from these facilities: the 304-site Gros Ventre Campground and 51-site Jenny Lake Campground. GTLC offers dining options as extensive as its lodging options, with cafeterias, casual eateries and fine dining establishments. Additionally we operate 11 retail outlets located throughout the GTLC properties. GTLC’s resorts provide a wide range of activities for guests to enjoy, including cruises on Jackson Lake, boat rentals, horseback riding, guided fishing, float trips, golf and guided Grand Teton National Park tours. As a result of the extensive amenities offered, as well as

the tremendous popularity of the National Park System, GTLC’s accommodations within Grand Teton National Park generally operate near full capacity during their operating season.

Real Estate Segment

We have extensive holdings of real property at our mountain resorts primarily throughout Summit and Eagle Counties in Colorado, as well as proximate to our resorts in Park City and Whistler Blackcomb. The principal activities of our Real Estate segment include the sale of land parcels to third-party developers and planning for future real estate development projects, including zoning and acquisition of applicable permits. We continue undertaking preliminary planning and design work on future projects and are pursuing opportunities with third-party developers rather than undertaking our own significant vertical development projects. In addition to the cash flow generated from real estate development sales, these development activities benefit our Mountain and Lodging segments by (1) creating additional resort lodging and other resort related facilities and venues (primarily restaurants, spas, commercial space, private mountain clubs, skier services facilities and parking structures) that provide us with the opportunity to create new sources of recurring revenue, enhance the guest experience and expand our destination bed base; (2) controlling the architectural themes of our resorts; and (3) expanding our property management and commercial leasing operations.

Marketing and Sales

Our Mountain segment’s marketing and sales efforts are focused on leveraging marketing analytics to drive targeted and personalized marketing to our existing and prospective guests. We capture guest data on the vast majority of guest transactions through sales of our pass products, lift tickets, ski and ride school products, gear rentals, and lodging properties on our e-commerce platform, as well as through our mobile applications and our lift ticket windows. We promote our Resorts using guest-centric omni-channel marketing campaigns leveraging email, direct mail, promotional programs, digital marketing (including social, search and display) and traditional media advertising where appropriate (e.g. targeted print, TV and radio). We also have marketing programs directed at attracting groups, corporate meetings and convention business. Most of our marketing efforts drive traffic to our websites, where we provide our guests with information regarding each of our Resorts, including services and amenities, reservations information, virtual tours and the opportunity to book/purchase our full suite of products (e.g. lift access, lodging, ski and ride school, rentals, etc.) for their visits. We also enter into strategic alliances with companies to enhance the guest experience at our Resorts, as well as to create opportunities for cross-marketing.

For our Lodging segment, we promote our hotels and lodging properties through marketing and sales programs, which include marketing directly to many of our guests through our digital channels (search, social and display), promotional programs and print media advertising, all of which are designed to drive traffic to our websites and central reservations call center. We also promote comprehensive vacation experiences through various package offerings and promotions (combining lodging, lift tickets, ski school lessons, ski rental equipment, transportation and dining). In addition, our hotels have active sales forces to generate conference and group business. We market our resort properties in conjunction with our mountain resort marketing efforts where appropriate, given the strong synergies across the two businesses.

Across both the Mountain and Lodging segments, sales made through our websites and call center allow us to transact directly with our guests, which further expands our customer base and enables analytics to deliver an increasingly guest-centric marketing experience.

Seasonality