mtn-20240131false2024Q20000812011--07-3100008120112023-08-012024-01-3100008120112024-03-07xbrli:shares00008120112024-01-31iso4217:USD00008120112023-07-3100008120112023-01-31iso4217:USDxbrli:shares00008120112023-11-012024-01-3100008120112022-11-012023-01-3100008120112022-08-012023-01-310000812011us-gaap:CommonStockMember2022-10-310000812011us-gaap:AdditionalPaidInCapitalMember2022-10-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310000812011us-gaap:RetainedEarningsMember2022-10-310000812011us-gaap:TreasuryStockCommonMember2022-10-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-10-310000812011us-gaap:NoncontrollingInterestMember2022-10-3100008120112022-10-310000812011us-gaap:RetainedEarningsMember2022-11-012023-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-11-012023-01-310000812011us-gaap:NoncontrollingInterestMember2022-11-012023-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-012023-01-310000812011us-gaap:AdditionalPaidInCapitalMember2022-11-012023-01-310000812011us-gaap:CommonStockMember2022-11-012023-01-310000812011us-gaap:CommonStockMember2023-01-310000812011us-gaap:AdditionalPaidInCapitalMember2023-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-310000812011us-gaap:RetainedEarningsMember2023-01-310000812011us-gaap:TreasuryStockCommonMember2023-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-01-310000812011us-gaap:NoncontrollingInterestMember2023-01-310000812011us-gaap:CommonStockMember2023-10-310000812011us-gaap:AdditionalPaidInCapitalMember2023-10-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310000812011us-gaap:RetainedEarningsMember2023-10-310000812011us-gaap:TreasuryStockCommonMember2023-10-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-10-310000812011us-gaap:NoncontrollingInterestMember2023-10-3100008120112023-10-310000812011us-gaap:RetainedEarningsMember2023-11-012024-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-11-012024-01-310000812011us-gaap:NoncontrollingInterestMember2023-11-012024-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-012024-01-310000812011us-gaap:AdditionalPaidInCapitalMember2023-11-012024-01-310000812011us-gaap:CommonStockMember2023-11-012024-01-310000812011us-gaap:CommonStockMember2024-01-310000812011us-gaap:AdditionalPaidInCapitalMember2024-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-310000812011us-gaap:RetainedEarningsMember2024-01-310000812011us-gaap:TreasuryStockCommonMember2024-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2024-01-310000812011us-gaap:NoncontrollingInterestMember2024-01-310000812011us-gaap:CommonStockMember2022-07-310000812011us-gaap:AdditionalPaidInCapitalMember2022-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000812011us-gaap:RetainedEarningsMember2022-07-310000812011us-gaap:TreasuryStockCommonMember2022-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-07-310000812011us-gaap:NoncontrollingInterestMember2022-07-3100008120112022-07-310000812011us-gaap:RetainedEarningsMember2022-08-012023-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-08-012023-01-310000812011us-gaap:NoncontrollingInterestMember2022-08-012023-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012023-01-310000812011us-gaap:AdditionalPaidInCapitalMember2022-08-012023-01-310000812011us-gaap:CommonStockMember2022-08-012023-01-310000812011us-gaap:CommonStockMember2023-07-310000812011us-gaap:AdditionalPaidInCapitalMember2023-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000812011us-gaap:RetainedEarningsMember2023-07-310000812011us-gaap:TreasuryStockCommonMember2023-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-07-310000812011us-gaap:NoncontrollingInterestMember2023-07-310000812011us-gaap:RetainedEarningsMember2023-08-012024-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-08-012024-01-310000812011us-gaap:NoncontrollingInterestMember2023-08-012024-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012024-01-310000812011us-gaap:AdditionalPaidInCapitalMember2023-08-012024-01-310000812011us-gaap:CommonStockMember2023-08-012024-01-310000812011us-gaap:TreasuryStockCommonMember2023-08-012024-01-310000812011mtn:A6.25NotesMember2024-01-310000812011mtn:A00ConvertibleNotesMember2024-01-310000812011mtn:EPRSecuredNotesMember2024-01-310000812011mtn:AndermattSedrunMember2024-01-310000812011mtn:LiftTicketsMember2023-11-012024-01-310000812011mtn:LiftTicketsMember2022-11-012023-01-310000812011mtn:LiftTicketsMember2023-08-012024-01-310000812011mtn:LiftTicketsMember2022-08-012023-01-310000812011mtn:SkiSchoolMember2023-11-012024-01-310000812011mtn:SkiSchoolMember2022-11-012023-01-310000812011mtn:SkiSchoolMember2023-08-012024-01-310000812011mtn:SkiSchoolMember2022-08-012023-01-310000812011mtn:DiningMember2023-11-012024-01-310000812011mtn:DiningMember2022-11-012023-01-310000812011mtn:DiningMember2023-08-012024-01-310000812011mtn:DiningMember2022-08-012023-01-310000812011mtn:RetailRentalMember2023-11-012024-01-310000812011mtn:RetailRentalMember2022-11-012023-01-310000812011mtn:RetailRentalMember2023-08-012024-01-310000812011mtn:RetailRentalMember2022-08-012023-01-310000812011mtn:OtherMountainRevenueMember2023-11-012024-01-310000812011mtn:OtherMountainRevenueMember2022-11-012023-01-310000812011mtn:OtherMountainRevenueMember2023-08-012024-01-310000812011mtn:OtherMountainRevenueMember2022-08-012023-01-310000812011mtn:OwnedHotelRevenueMember2023-11-012024-01-310000812011mtn:OwnedHotelRevenueMember2022-11-012023-01-310000812011mtn:OwnedHotelRevenueMember2023-08-012024-01-310000812011mtn:OwnedHotelRevenueMember2022-08-012023-01-310000812011mtn:ManagedcondominiumroomsMember2023-11-012024-01-310000812011mtn:ManagedcondominiumroomsMember2022-11-012023-01-310000812011mtn:ManagedcondominiumroomsMember2023-08-012024-01-310000812011mtn:ManagedcondominiumroomsMember2022-08-012023-01-310000812011mtn:TransportationMember2023-11-012024-01-310000812011mtn:TransportationMember2022-11-012023-01-310000812011mtn:TransportationMember2023-08-012024-01-310000812011mtn:TransportationMember2022-08-012023-01-310000812011mtn:GolfMember2023-11-012024-01-310000812011mtn:GolfMember2022-11-012023-01-310000812011mtn:GolfMember2023-08-012024-01-310000812011mtn:GolfMember2022-08-012023-01-310000812011mtn:OtherLodgingRevenueMember2023-11-012024-01-310000812011mtn:OtherLodgingRevenueMember2022-11-012023-01-310000812011mtn:OtherLodgingRevenueMember2023-08-012024-01-310000812011mtn:OtherLodgingRevenueMember2022-08-012023-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2023-11-012024-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2022-11-012023-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2023-08-012024-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2022-08-012023-01-310000812011mtn:PayrollcostreimbursementsMember2023-11-012024-01-310000812011mtn:PayrollcostreimbursementsMember2022-11-012023-01-310000812011mtn:PayrollcostreimbursementsMember2023-08-012024-01-310000812011mtn:PayrollcostreimbursementsMember2022-08-012023-01-31xbrli:pure0000812011us-gaap:ConvertibleDebtMember2020-12-180000812011srt:ScenarioForecastMember2024-03-072024-03-070000812011us-gaap:SubsequentEventMember2024-03-072024-03-070000812011srt:ScenarioForecastMember2024-04-112024-04-110000812011srt:ScenarioForecastMember2024-03-272024-03-270000812011mtn:TermLoanMember2023-08-012024-01-310000812011mtn:TermLoanMember2024-01-310000812011mtn:TermLoanMember2023-07-310000812011mtn:TermLoanMember2023-01-310000812011us-gaap:LineOfCreditMember2023-08-012024-01-310000812011us-gaap:LineOfCreditMember2024-01-310000812011us-gaap:LineOfCreditMember2023-07-310000812011us-gaap:LineOfCreditMember2023-01-310000812011mtn:A6.25NotesMember2023-08-012024-01-310000812011mtn:A6.25NotesMember2023-07-310000812011mtn:A6.25NotesMember2023-01-310000812011us-gaap:ConvertibleNotesPayableMember2023-08-012024-01-310000812011us-gaap:ConvertibleNotesPayableMember2024-01-310000812011us-gaap:ConvertibleNotesPayableMember2023-07-310000812011us-gaap:ConvertibleNotesPayableMember2023-01-310000812011mtn:WhistlerCreditAgreementrevolverMember2023-08-012024-01-310000812011mtn:WhistlerCreditAgreementrevolverMember2024-01-310000812011mtn:WhistlerCreditAgreementrevolverMember2023-07-310000812011mtn:WhistlerCreditAgreementrevolverMember2023-01-310000812011mtn:EPRSecuredNotesMembersrt:MinimumMember2023-08-012024-01-310000812011mtn:EPRSecuredNotesMembersrt:MaximumMember2023-08-012024-01-310000812011mtn:EPRSecuredNotesMember2023-07-310000812011mtn:EPRSecuredNotesMember2023-01-310000812011mtn:AndermattSedrunMember2023-08-012024-01-310000812011mtn:AndermattSedrunMember2024-01-310000812011mtn:AndermattSedrunMember2023-07-310000812011mtn:AndermattSedrunMember2023-01-310000812011srt:MinimumMembermtn:EmployeeHousingBondsMember2023-08-012024-01-310000812011srt:MaximumMembermtn:EmployeeHousingBondsMember2023-08-012024-01-310000812011mtn:EmployeeHousingBondsMember2024-01-310000812011mtn:EmployeeHousingBondsMember2023-07-310000812011mtn:EmployeeHousingBondsMember2023-01-310000812011mtn:CanyonsObligationMember2023-08-012024-01-310000812011mtn:CanyonsObligationMember2024-01-310000812011mtn:CanyonsObligationMember2023-07-310000812011mtn:CanyonsObligationMember2023-01-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-08-012024-01-310000812011mtn:WhistlerEmployeeHousingLeasesMember2024-01-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-01-310000812011srt:MinimumMembermtn:OtherDebtMember2023-08-012024-01-310000812011mtn:OtherDebtMembersrt:MaximumMember2023-08-012024-01-310000812011mtn:OtherDebtMember2024-01-310000812011mtn:OtherDebtMember2023-07-310000812011mtn:OtherDebtMember2023-01-310000812011us-gaap:LineOfCreditMember2023-11-012024-01-3100008120112020-12-18iso4217:CAD0000812011mtn:WhistlerCreditAgreementrevolverMember2023-08-012024-01-310000812011mtn:AlpineValleySecuredNoteMember2024-01-310000812011mtn:BostonMillsBrandywineSecuredNoteMember2024-01-310000812011mtn:JackFrostBigBoulderSecuredNoteMember2024-01-310000812011mtn:MountSnowSecuredNoteMember2024-01-310000812011mtn:HunterMountainSecuredNoteMember2024-01-310000812011mtn:AndermattSedrunMember2022-08-0300008120112023-08-012023-10-31iso4217:CHF00008120112022-08-030000812011mtn:AndermattSedrunMember2022-08-032022-08-0300008120112022-08-032022-08-030000812011mtn:MountainMember2023-07-310000812011mtn:LodgingMember2023-07-310000812011mtn:MountainMember2023-08-012024-01-310000812011mtn:LodgingMember2023-08-012024-01-310000812011mtn:MountainMember2024-01-310000812011mtn:LodgingMember2024-01-310000812011us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-01-310000812011us-gaap:CommercialPaperMember2024-01-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2024-01-310000812011us-gaap:CertificatesOfDepositMember2024-01-310000812011us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2024-01-310000812011us-gaap:FairValueInputsLevel2Member2024-01-310000812011us-gaap:FairValueInputsLevel3Member2024-01-310000812011us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-07-310000812011us-gaap:CommercialPaperMember2023-07-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-07-310000812011us-gaap:CertificatesOfDepositMember2023-07-310000812011us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2023-07-310000812011us-gaap:FairValueInputsLevel2Member2023-07-310000812011us-gaap:FairValueInputsLevel3Member2023-07-310000812011us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-01-310000812011us-gaap:CommercialPaperMember2023-01-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-01-310000812011us-gaap:CertificatesOfDepositMember2023-01-310000812011us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2023-01-310000812011us-gaap:FairValueInputsLevel2Member2023-01-310000812011us-gaap:FairValueInputsLevel3Member2023-01-310000812011mtn:CanyonsObligationMember2023-08-012024-01-310000812011mtn:EmployeeHousingBondsMember2024-01-310000812011mtn:HollandCreekMetropolitanDistrictMember2024-01-310000812011mtn:HollandCreekMetropolitanDistrictMember2024-01-310000812011mtn:MountainMember2023-11-012024-01-310000812011mtn:MountainMember2022-11-012023-01-310000812011mtn:MountainMember2022-08-012023-01-310000812011mtn:LodgingMember2023-11-012024-01-310000812011mtn:LodgingMember2022-11-012023-01-310000812011mtn:LodgingMember2022-08-012023-01-310000812011mtn:ResortMember2023-11-012024-01-310000812011mtn:ResortMember2022-11-012023-01-310000812011mtn:ResortMember2023-08-012024-01-310000812011mtn:ResortMember2022-08-012023-01-310000812011mtn:RealEstateSegmentMember2023-11-012024-01-310000812011mtn:RealEstateSegmentMember2022-11-012023-01-310000812011mtn:RealEstateSegmentMember2023-08-012024-01-310000812011mtn:RealEstateSegmentMember2022-08-012023-01-3100008120112006-03-0900008120112008-07-1600008120112015-12-0400008120112023-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended January 31, 2024

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-09614

Vail Resorts, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | | 51-0291762 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 390 Interlocken Crescent | | |

| Broomfield, | Colorado | | 80021 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | | |

| (303) | 404-1800 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MTN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of March 7, 2024, 37,968,155 shares of the registrant’s common stock were outstanding.

Table of Contents

| | | | | | | | |

| | |

| PART I | FINANCIAL INFORMATION | Page |

| | |

| Item 1. | Financial Statements (unaudited). | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | OTHER INFORMATION | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

Vail Resorts, Inc.

Consolidated Condensed Balance Sheets

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | January 31, 2024 | | July 31, 2023 | | January 31, 2023 |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 812,163 | | | $ | 562,975 | | | $ | 1,295,252 | |

| Restricted cash | | 13,329 | | | 10,118 | | | 24,103 | |

| Trade receivables, net | | 138,269 | | | 381,067 | | | 160,393 | |

| Inventories, net | | 134,839 | | | 132,548 | | | 122,088 | |

| Other current assets | | 80,204 | | | 121,403 | | | 158,295 | |

| Total current assets | | 1,178,804 | | | 1,208,111 | | | 1,760,131 | |

Property, plant and equipment, net (Note 7) | | 2,349,424 | | | 2,371,557 | | | 2,421,395 | |

| Real estate held for sale or investment | | 86,737 | | | 90,207 | | | 90,354 | |

Goodwill, net (Note 7) | | 1,699,909 | | | 1,720,344 | | | 1,723,019 | |

| Intangible assets, net | | 304,115 | | | 309,345 | | | 310,666 | |

| Operating right-of-use assets | | 189,838 | | | 192,289 | | | 200,667 | |

| Other assets | | 38,837 | | | 55,901 | | | 58,730 | |

| Total assets | | $ | 5,847,664 | | | $ | 5,947,754 | | | $ | 6,564,962 | |

| Liabilities and Stockholders’ Equity | | | | | | |

| Current liabilities: | | | | | | |

Accounts payable and accrued liabilities (Note 7) | | $ | 1,141,624 | | | $ | 978,021 | | | $ | 1,144,795 | |

| Income taxes payable | | 18,015 | | | 83,514 | | | 73,559 | |

Long-term debt due within one year (Note 5) | | 69,135 | | | 69,160 | | | 69,582 | |

| Total current liabilities | | 1,228,774 | | | 1,130,695 | | | 1,287,936 | |

Long-term debt, net (Note 5) | | 2,721,598 | | | 2,750,675 | | | 2,789,827 | |

| Operating lease liabilities | | 168,716 | | | 168,326 | | | 184,298 | |

| Other long-term liabilities | | 291,330 | | | 286,261 | | | 237,478 | |

| Deferred income taxes, net | | 286,581 | | | 276,137 | | | 288,072 | |

| Total liabilities | | 4,696,999 | | | 4,612,094 | | | 4,787,611 | |

Commitments and contingencies (Note 9) | | | | | | |

| Stockholders’ equity: | | | | | | |

Preferred stock, $0.01 par value, 25,000 shares authorized, no shares issued and outstanding | | — | | | — | | | — | |

Common stock, $0.01 par value, 100,000 shares authorized, 46,852, 46,798 and 46,795 shares issued, respectively | | 469 | | | 468 | | | 468 | |

| Additional paid-in capital | | 1,133,275 | | | 1,124,433 | | | 1,112,519 | |

| Accumulated other comprehensive loss | | (29,838) | | | (10,358) | | | (8,565) | |

| Retained earnings | | 760,820 | | | 873,710 | | | 837,573 | |

Treasury stock, at cost, 8,885, 8,648 and 6,466 shares, respectively (Note 11) | | (1,034,822) | | | (984,306) | | | (479,417) | |

| Total Vail Resorts, Inc. stockholders’ equity | | 829,904 | | | 1,003,947 | | | 1,462,578 | |

| Noncontrolling interests | | 320,761 | | | 331,713 | | | 314,773 | |

| Total stockholders’ equity | | 1,150,665 | | | 1,335,660 | | | 1,777,351 | |

| Total liabilities and stockholders’ equity | | $ | 5,847,664 | | | $ | 5,947,754 | | | $ | 6,564,962 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Six Months Ended January 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net revenue: | | | | | | | | | | | |

| Mountain and Lodging services and other | $ | 905,053 | | | $ | 901,837 | | | $ | 1,087,887 | | | $ | 1,112,223 | | | | | |

| Mountain and Lodging retail and dining | 172,745 | | | 192,182 | | | 244,187 | | | 261,130 | | | | | |

| Resort net revenue | 1,077,798 | | | 1,094,019 | | | 1,332,074 | | | 1,373,353 | | | | | |

| Real Estate | 160 | | | 7,699 | | | 4,449 | | | 7,812 | | | | | |

| Total net revenue | 1,077,958 | | | 1,101,718 | | | 1,336,523 | | | 1,381,165 | | | | | |

| Operating expense (exclusive of depreciation and amortization shown separately below): | | | | | | | | | | | |

| Mountain and Lodging operating expense | 474,170 | | | 507,216 | | | 729,746 | | | 749,502 | | | | | |

| Mountain and Lodging retail and dining cost of products sold | 65,289 | | | 75,431 | | | 96,584 | | | 110,516 | | | | | |

| General and administrative | 112,714 | | | 116,616 | | | 220,739 | | | 215,415 | | | | | |

| Resort operating expense | 652,173 | | | 699,263 | | | 1,047,069 | | | 1,075,433 | | | | | |

| Real Estate operating expense | 1,676 | | | 6,310 | | | 6,857 | | | 7,692 | | | | | |

| Total segment operating expense | 653,849 | | | 705,573 | | | 1,053,926 | | | 1,083,125 | | | | | |

| Other operating (expense) income: | | | | | | | | | | | |

| Depreciation and amortization | (69,399) | | | (65,989) | | | (136,127) | | | (130,603) | | | | | |

| Gain on sale of real property | — | | | 757 | | | 6,285 | | | 757 | | | | | |

Change in estimated fair value of contingent consideration (Note 8) | (3,400) | | | (1,100) | | | (6,457) | | | (1,736) | | | | | |

| Loss on disposal of fixed assets and other, net | (758) | | | (1,780) | | | (2,801) | | | (1,786) | | | | | |

| Income from operations | 350,552 | | | 328,033 | | | 143,497 | | | 164,672 | | | | | |

| Mountain equity investment (loss) income, net | (579) | | | 42 | | | 280 | | | 388 | | | | | |

| Investment income and other, net | 4,863 | | | 7,108 | | | 8,547 | | | 9,994 | | | | | |

Foreign currency gain (loss) on intercompany loans (Note 5) | 3,040 | | | 2,338 | | | (1,925) | | | (3,797) | | | | | |

| Interest expense, net | (40,585) | | | (38,370) | | | (81,315) | | | (73,672) | | | | | |

| Income before provision for income taxes | 317,291 | | | 299,151 | | | 69,084 | | | 97,585 | | | | | |

| Provision for income taxes | (87,486) | | | (79,032) | | | (22,326) | | | (21,026) | | | | | |

| Net income | 229,805 | | | 220,119 | | | 46,758 | | | 76,559 | | | | | |

| Net income attributable to noncontrolling interests | (10,506) | | | (11,440) | | | (2,971) | | | (4,851) | | | | | |

| Net income attributable to Vail Resorts, Inc. | $ | 219,299 | | | $ | 208,679 | | | $ | 43,787 | | | $ | 71,708 | | | | | |

Per share amounts (Note 4): | | | | | | | | | | | |

| Basic net income per share attributable to Vail Resorts, Inc. | $ | 5.78 | | | $ | 5.17 | | | $ | 1.15 | | | $ | 1.78 | | | | | |

| Diluted net income per share attributable to Vail Resorts, Inc. | $ | 5.76 | | | $ | 5.16 | | | $ | 1.15 | | | $ | 1.77 | | | | | |

| Cash dividends declared per share | $ | 2.06 | | | $ | 1.91 | | | $ | 4.12 | | | $ | 3.82 | | | | | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Comprehensive Income

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Six Months Ended January 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net income | $ | 229,805 | | | $ | 220,119 | | | $ | 46,758 | | | $ | 76,559 | | | | | |

| Foreign currency translation adjustments, net of tax | 70,882 | | | 82,468 | | | (21,212) | | | (35,340) | | | | | |

| Change in estimated fair value of hedging instruments, net of tax | (3,592) | | | (2,787) | | | (6,062) | | | 5,220 | | | | | |

| Comprehensive income | 297,095 | | | 299,800 | | | 19,484 | | | 46,439 | | | | | |

| Comprehensive (income) loss attributable to noncontrolling interests | (29,258) | | | (30,778) | | | 4,823 | | | 5,781 | | | | | |

| Comprehensive income attributable to Vail Resorts, Inc. | $ | 267,837 | | | $ | 269,022 | | | $ | 24,307 | | | $ | 52,220 | | | | | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Stockholders’ Equity

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | Additional Paid in Capital | Accumulated Other Comprehensive Loss | Retained Earnings | Treasury Stock | Total Vail Resorts, Inc. Stockholders’ Equity | Noncontrolling Interests | Total Stockholders’ Equity |

| | Vail Resorts | | | | | | | | |

| Balance, October 31, 2022 | | $ | 468 | | | $ | 1,106,813 | | $ | (68,908) | | $ | 705,923 | | $ | (479,417) | | $ | 1,264,879 | | $ | 286,839 | | $ | 1,551,718 | |

| Comprehensive income: | | | | | | | | | | |

| Net income | | — | | | — | | — | | 208,679 | | — | | 208,679 | | 11,440 | | 220,119 | |

| Foreign currency translation adjustments, net of tax | | — | | | — | | 63,130 | | — | | — | | 63,130 | | 19,338 | | 82,468 | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | | — | | (2,787) | | — | | — | | (2,787) | | — | | (2,787) | |

| Total comprehensive income | | | | | | | | 269,022 | | 30,778 | | 299,800 | |

| | | | | | | | | | |

| Stock-based compensation expense | | — | | | 6,844 | | — | | — | | — | | 6,844 | | — | | 6,844 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | — | | | (1,138) | | — | | — | | — | | (1,138) | | — | | (1,138) | |

| | | | | | | | | | |

| Dividends (Note 4) | | — | | | — | | — | | (77,029) | | — | | (77,029) | | — | | (77,029) | |

| Distributions to noncontrolling interests, net | | — | | | — | | — | | — | | — | | — | | (2,844) | | (2,844) | |

| Balance, January 31, 2023 | | $ | 468 | | | $ | 1,112,519 | | $ | (8,565) | | $ | 837,573 | | $ | (479,417) | | $ | 1,462,578 | | $ | 314,773 | | $ | 1,777,351 | |

| | | | | | | | | | |

| Balance, October 31, 2023 | | $ | 469 | | | $ | 1,126,033 | | $ | (78,376) | | $ | 619,727 | | $ | (1,034,822) | | $ | 633,031 | | $ | 295,149 | | $ | 928,180 | |

| Comprehensive income: | | | | | | | | | | |

| Net income | | — | | | — | | — | | 219,299 | | — | | 219,299 | | 10,506 | | 229,805 | |

| Foreign currency translation adjustments, net of tax | | — | | | — | | 52,130 | | — | | — | | 52,130 | | 18,752 | | 70,882 | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | | — | | (3,592) | | — | | — | | (3,592) | | — | | (3,592) | |

| Total comprehensive income | | | | | | | | 267,837 | | 29,258 | | 297,095 | |

| Stock-based compensation expense | | — | | | 7,336 | | — | | — | | — | | 7,336 | | — | | 7,336 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | — | | | (94) | | — | | — | | — | | (94) | | — | | (94) | |

| | | | | | | | | | |

| Dividends (Note 4) | | — | | | — | | — | | (78,206) | | — | | (78,206) | | — | | (78,206) | |

| Distributions to noncontrolling interests, net | | — | | | — | | — | | — | | — | | — | | (3,646) | | (3,646) | |

| Balance, January 31, 2024 | | $ | 469 | | | $ | 1,133,275 | | $ | (29,838) | | $ | 760,820 | | $ | (1,034,822) | | $ | 829,904 | | $ | 320,761 | | $ | 1,150,665 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | Additional Paid in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Treasury Stock | Total Vail Resorts, Inc. Stockholders’ Equity | Noncontrolling Interests | Total Stockholders’ Equity |

| | Vail Resorts | | | | | | | | |

| Balance, July 31, 2022 | | $ | 467 | | | $ | 1,184,577 | | $ | 10,923 | | $ | 895,889 | | $ | (479,417) | | $ | 1,612,439 | | $ | 235,045 | | $ | 1,847,484 | |

| Comprehensive income (loss): | | | | | | | | | | |

| Net income | | — | | | — | | — | | 71,708 | | — | | 71,708 | | 4,851 | | 76,559 | |

| Foreign currency translation adjustments, net of tax | | — | | | — | | (24,708) | | — | | — | | (24,708) | | (10,632) | | (35,340) | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | | — | | 5,220 | | — | | — | | 5,220 | | — | | 5,220 | |

| Total comprehensive income (loss) | | | | | | | | 52,220 | | (5,781) | | 46,439 | |

| | | | | | | | | | |

| Stock-based compensation expense | | — | | | 13,189 | | — | | — | | — | | 13,189 | | — | | 13,189 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | 1 | | | (5,181) | | — | | — | | — | | (5,180) | | — | | (5,180) | |

| | | | | | | | | | |

| Dividends (Note 4) | | — | | | — | | — | | (154,047) | | — | | (154,047) | | — | | (154,047) | |

| Cumulative effect of adoption of ASU 2020-06 | | — | | | (80,066) | | — | | 24,023 | | — | | (56,043) | | — | | (56,043) | |

| Estimated acquisition date fair value of noncontrolling interests (Note 6) | | — | | | — | | — | | — | | — | | — | | 91,524 | | 91,524 | |

| Distributions to noncontrolling interests, net | | — | | | — | | — | | — | | — | | — | | (6,015) | | (6,015) | |

| Balance, January 31, 2023 | | $ | 468 | | | $ | 1,112,519 | | $ | (8,565) | | $ | 837,573 | | $ | (479,417) | | $ | 1,462,578 | | $ | 314,773 | | $ | 1,777,351 | |

| | | | | | | | | | |

| Balance, July 31, 2023 | | $ | 468 | | | $ | 1,124,433 | | $ | (10,358) | | $ | 873,710 | | $ | (984,306) | | $ | 1,003,947 | | $ | 331,713 | | $ | 1,335,660 | |

| Comprehensive income (loss): | | | | | | | | | | |

| Net income | | — | | | — | | — | | 43,787 | | — | | 43,787 | | 2,971 | | 46,758 | |

| Foreign currency translation adjustments, net of tax | | — | | | — | | (13,418) | | — | | — | | (13,418) | | (7,794) | | (21,212) | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | | — | | (6,062) | | — | | — | | (6,062) | | — | | (6,062) | |

| Total comprehensive income (loss) | | | | | | | | 24,307 | | (4,823) | | 19,484 | |

| Stock-based compensation expense | | — | | | 14,132 | | — | | — | | — | | 14,132 | | — | | 14,132 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | 1 | | | (5,290) | | — | | — | | — | | (5,289) | | — | | (5,289) | |

Repurchases of common stock (Note 11) | | — | | | — | | — | | — | | (50,516) | | (50,516) | | — | | (50,516) | |

Dividends (Note 4) | | — | | | — | | — | | (156,677) | | — | | (156,677) | | — | | (156,677) | |

| | | | | | | | | | |

| Distributions to noncontrolling interests, net | | — | | | — | | — | | — | | — | | — | | (6,129) | | (6,129) | |

| Balance, January 31, 2024 | | $ | 469 | | | $ | 1,133,275 | | $ | (29,838) | | $ | 760,820 | | $ | (1,034,822) | | $ | 829,904 | | $ | 320,761 | | $ | 1,150,665 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Six Months Ended January 31, |

| | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 46,758 | | | $ | 76,559 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 136,127 | | | 130,603 | |

| | | | |

| Stock-based compensation expense | | 14,132 | | | 13,189 | |

| Provision for income taxes | | 22,326 | | | 21,026 | |

| | | | |

| | | | |

| | | | |

| Other non-cash income, net | | 11,770 | | | 2,602 | |

| Changes in assets and liabilities: | | | | |

| Trade receivables, net | | 235,183 | | | 226,796 | |

| Inventories, net | | (2,708) | | | (12,962) | |

| Accounts payable and accrued liabilities | | 90,578 | | | 96,247 | |

| Deferred revenue | | 108,693 | | | 104,996 | |

| | | | |

| Income taxes payable | | (67,119) | | | (31,166) | |

| Other assets and liabilities, net | | (24,579) | | | (22,397) | |

| Net cash provided by operating activities | | 571,161 | | | 605,493 | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | | (130,291) | | | (206,554) | |

| Return of deposit for acquisition of business | | — | | | 114,506 | |

| Acquisition of business, net of cash acquired | | — | | | (38,567) | |

| Investments in short-term deposits | | — | | | (86,756) | |

| Maturity of short-term deposits | | 57,647 | | | — | |

| | | | |

| Other investing activities, net | | 6,565 | | | 11,346 | |

| Net cash used in investing activities | | (66,079) | | | (206,025) | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| Repayments of borrowings under Vail Holdings Credit Agreement | | (31,250) | | | (31,250) | |

| | | | |

| | | | |

| Employee taxes paid for share award exercises | | (5,289) | | | (5,181) | |

| Dividends paid | | (156,677) | | | (154,047) | |

| Repurchases of common stock | | (50,000) | | | — | |

| Other financing activities, net | | (7,961) | | | (10,899) | |

| Net cash used in financing activities | | (251,177) | | | (201,377) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | | (1,506) | | | (4,843) | |

| Net increase in cash, cash equivalents and restricted cash | | 252,399 | | | 193,248 | |

| Cash, cash equivalents and restricted cash: | | | | |

| Beginning of period | | 573,093 | | | 1,126,107 | |

| End of period | | $ | 825,492 | | | $ | 1,319,355 | |

| | | | |

| Non-cash investing activities: | | | | |

| Accrued capital expenditures | | $ | 11,784 | | | $ | 49,091 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Notes to Consolidated Condensed Financial Statements

(Unaudited)

1.Organization and Business

Vail Resorts, Inc. (“Vail Resorts”) is organized as a holding company and operates through various subsidiaries. Vail Resorts and its subsidiaries (collectively, the “Company”) operate in three reportable segments: Mountain, Lodging and Real Estate. The Company refers to “Resort” as the combination of the Mountain and Lodging segments.

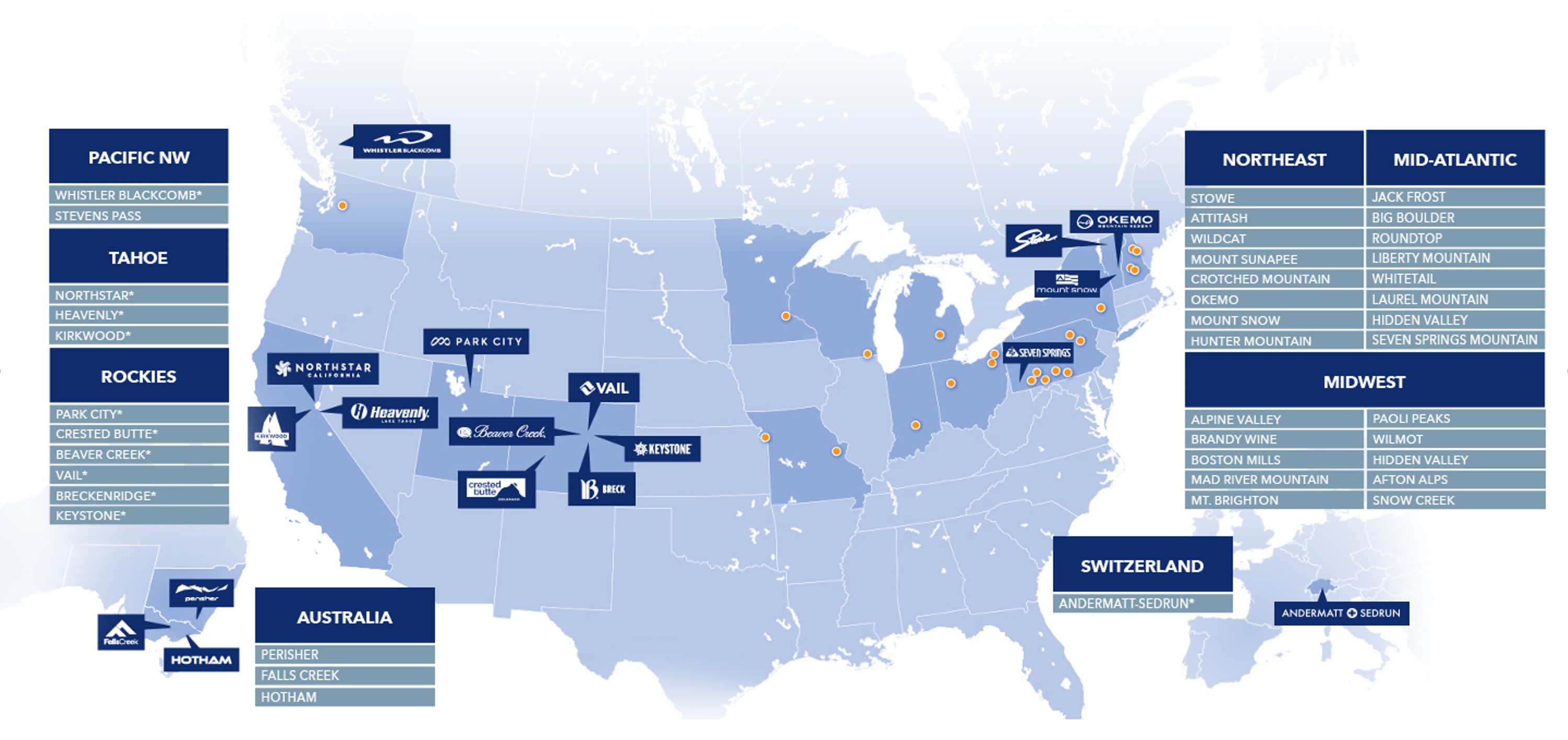

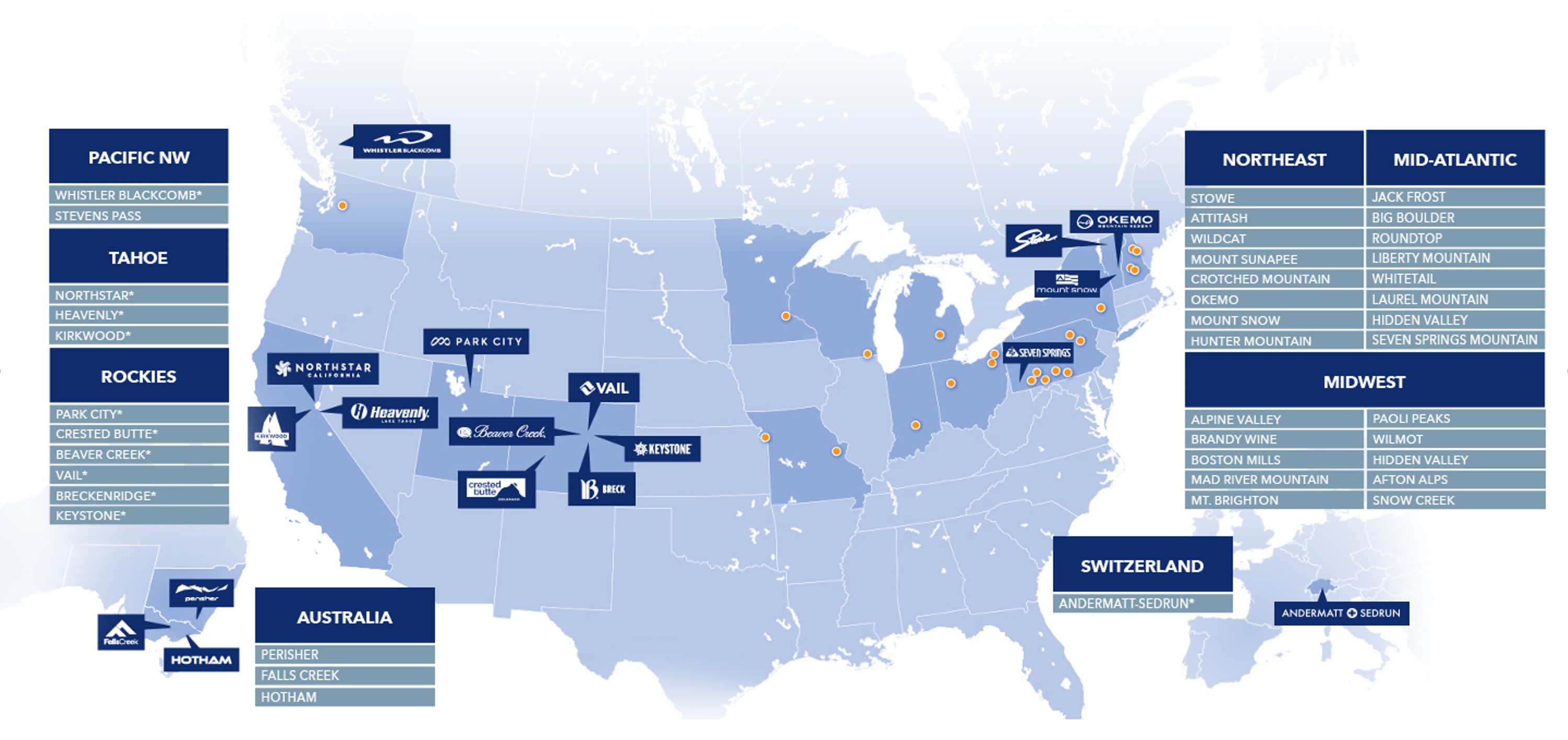

In the Mountain segment, the Company operates the following 41 destination mountain resorts and regional ski areas:

*Denotes a destination mountain resort, which generally receives a meaningful portion of skier visits from long-distance travelers, as opposed to the Company’s regional ski areas, which tend to generate skier visits predominantly from their respective local markets.

Additionally, the Mountain segment includes ancillary services, primarily including ski school, dining and retail/rental operations, and for the Company’s Australian ski areas, including lodging and transportation operations.

In the Lodging segment, the Company owns and/or manages a collection of luxury hotels and condominiums under its RockResorts brand; other strategic lodging properties and a large number of condominiums located in proximity to the Company’s North American mountain resorts; National Park Service (“NPS”) concessioner properties including the Grand Teton Lodge Company, which operates destination resorts in Grand Teton National Park; a Colorado resort ground transportation company and mountain resort golf courses.

The Company’s Real Estate segment primarily owns, develops and sells real estate in and around the Company’s resort communities.

The Company’s mountain business and its lodging properties at or around the Company’s mountain resorts are seasonal in nature, and typically experience their peak operating seasons primarily from mid-December through mid-April in North America and Europe. The peak operating season at the Company’s Australian resorts, NPS concessioner properties and golf courses generally occurs from June to early October.

Pending Acquisition of Crans-Montana Mountain Resort

On November 30, 2023, the Company announced that it had entered into an agreement to acquire Crans-Montana Mountain Resort (“Crans-Montana”) in Switzerland from CPI Property Group. Pursuant to the terms of the agreement, the Company will acquire (i) an 84% ownership stake in Remontées Mécaniques Crans Montana Aminona SA, which controls and operates all of the lifts and supporting mountain operations, including four retail and rental locations; (ii) an 80% ownership stake in SportLife AG, which operates one of the ski schools located at the resort; and (iii) 100% ownership of 11 restaurants located on and around the mountain. Subject to closing adjustments, the enterprise value of the resort operations is expected to be CHF 118.5 million. The Company expects to fund the purchase price for the acquired ownership interest of the resort operations through cash on hand when the transaction closes.

2. Summary of Significant Accounting Policies

Basis of Presentation

Consolidated Condensed Financial Statements — In the opinion of the Company, the accompanying Consolidated Condensed Financial Statements reflect all adjustments necessary to state fairly the Company’s financial position, results of operations and cash flows for the interim periods presented. All such adjustments are of a normal recurring nature. Results for interim periods are not indicative of the results for the entire fiscal year, particularly given the significant seasonality to the Company’s operating cycle. The accompanying Consolidated Condensed Financial Statements should be read in conjunction with the audited Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2023. Certain information and footnote disclosures, including significant accounting policies, normally included in fiscal year financial statements prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) have been condensed or omitted. The Consolidated Condensed Balance Sheet as of July 31, 2023 was derived from audited financial statements.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the balance sheet date and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

Fair Value of Financial Instruments — The estimated fair values of the 6.25% Notes and the 0.0% Convertible Notes (each as defined in Note 5, Long-Term Debt) are based on quoted market prices (a Level 2 input). The estimated fair value of the EPR Secured Notes and the NRP Loan (both as defined in Note 5, Long-Term Debt) have been estimated using analyses based on current borrowing rates for comparable debt instruments with similar maturity dates (a Level 2 input). The carrying values, including any unamortized premium or discount, and estimated fair values of the 6.25% Notes, 0.0% Convertible Notes, EPR Secured Notes and NRP Loan as of January 31, 2024 are presented below (in thousands):

| | | | | | | | | | | |

| January 31, 2024 |

| Carrying Value | | Estimated Fair Value |

| 6.25% Notes | $ | 600,000 | | | $ | 600,954 | |

| 0.0% Convertible Notes | $ | 575,000 | | | $ | 519,294 | |

| EPR Secured Notes | $ | 131,701 | | | $ | 170,865 | |

| NRP Loan | $ | 39,491 | | | $ | 31,453 | |

The carrying values for all other financial instruments not included in the above table approximate their respective fair value due to their short-term nature or the variable nature of their associated interest rates.

Recently Issued Accounting Standards

Standards Being Evaluated

In November 2023, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (“ASU”) 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures,” which is intended to improve reportable segment disclosures, primarily through incorporating enhanced segment disclosure requirements set forth by the Securities and Exchange Commission into U.S. GAAP. The enhanced disclosures will primarily require public entities to include specific disclosures regarding “significant expenses” that are regularly provided to or easily computed from information provided to the chief operating decision maker (“CODM”) and included within segment profit and loss. This ASU also requires that a public entity disclose the title and position of the CODM and an explanation of how the CODM uses the reported

measure(s) of segment profit or loss. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023 (the Company’s fiscal year ending July 31, 2025), and interim periods within fiscal years beginning after December 15, 2024 (the Company’s fiscal quarter ending October 31, 2025), with early adoption permitted. The Company is in the process of evaluating the effect that the adoption of this standard will have on its Consolidated Condensed Financial Statements, including determining the timing of adoption.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which includes amendments that further enhance the transparency and decision usefulness of income tax disclosures, primarily through standardization and disaggregation of rate reconciliation categories and income taxes paid by jurisdiction. This update is effective for annual periods beginning after December 15, 2024 (the Company’s fiscal year ending July 31, 2026), though early adoption is permitted. The Company is in the process of evaluating the effect that the adoption of this standard will have on its Consolidated Condensed Financial Statements, including determining the timing of adoption.

3. Revenues

Disaggregation of Revenues

The following table presents net revenues disaggregated by segment and major revenue type for the three and six months ended January 31, 2024 and 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Six Months Ended January 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Mountain net revenue: | | | | | | | | |

| Lift | | $ | 603,459 | | | $ | 592,603 | | | $ | 648,849 | | | $ | 652,143 | |

| Ski School | | 126,629 | | | 123,451 | | | 133,807 | | | 132,378 | |

| Dining | | 82,060 | | | 85,828 | | | 100,137 | | | 105,270 | |

| Retail/Rental | | 136,156 | | | 159,932 | | | 169,630 | | | 200,276 | |

| Other | | 51,677 | | | 51,628 | | | 120,013 | | | 125,092 | |

| Total Mountain net revenue | | $ | 999,981 | | | $ | 1,013,442 | | | $ | 1,172,436 | | | $ | 1,215,159 | |

| Lodging net revenue: | | | | | | | | |

| Owned hotel rooms | | $ | 13,583 | | | $ | 13,479 | | | $ | 38,760 | | | $ | 37,044 | |

| Managed condominium rooms | | 28,308 | | | 31,336 | | | 40,311 | | | 44,195 | |

| Dining | | 13,609 | | | 13,184 | | | 31,692 | | | 30,013 | |

| Transportation | | 6,405 | | | 5,888 | | | 7,910 | | | 7,348 | |

| Golf | | — | | | — | | | 6,471 | | | 5,939 | |

| Other | | 11,417 | | | 11,700 | | | 26,540 | | | 24,988 | |

| | 73,322 | | | 75,587 | | | 151,684 | | | 149,527 | |

| Payroll cost reimbursements | | 4,495 | | | 4,990 | | | 7,954 | | | 8,667 | |

| Total Lodging net revenue | | $ | 77,817 | | | $ | 80,577 | | | $ | 159,638 | | | $ | 158,194 | |

| Total Resort net revenue | | $ | 1,077,798 | | | $ | 1,094,019 | | | $ | 1,332,074 | | | $ | 1,373,353 | |

| Total Real Estate net revenue | | 160 | | | 7,699 | | | 4,449 | | | 7,812 | |

| Total net revenue | | $ | 1,077,958 | | | $ | 1,101,718 | | | $ | 1,336,523 | | | $ | 1,381,165 | |

Contract Balances

Deferred revenue balances of a short-term nature were $660.3 million and $572.6 million as of January 31, 2024 and July 31, 2023, respectively. For the three and six months ended January 31, 2024, the Company recognized approximately $238.0 million and $294.5 million, respectively, of revenue that was included in the deferred revenue balance as of July 31, 2023. Deferred revenue balances of a long-term nature, comprised primarily of long-term private club initiation fee revenue, were $108.3 million, $109.7 million and $113.3 million as of January 31, 2024, July 31, 2023 and January 31, 2023, respectively. As of January 31, 2024, the weighted average remaining period over which revenue for unsatisfied performance obligations on long-term private club contracts will be recognized was approximately 15 years.

Costs to Obtain Contracts with Customers

Costs to obtain contracts with customers are recorded within other current assets on the Company’s Consolidated Condensed Balance Sheets, and were $14.4 million, $5.1 million and $13.0 million as of January 31, 2024, July 31, 2023 and January 31, 2023, respectively. The amounts capitalized are subject to amortization generally beginning in the second quarter of each fiscal year, commensurate with the recognition of revenue for related pass products. The Company recorded amortization of $13.9 million for these costs during both the three and six months ended January 31, 2024, which was recorded within Mountain and Lodging operating expense on the Company’s Consolidated Condensed Statements of Operations.

4. Net Income per Share

Earnings per Share

Basic EPS excludes dilution and is computed by dividing net income attributable to Vail Resorts stockholders by the weighted-average shares outstanding during the period. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised, resulting in the issuance of shares of common stock that would then share in the earnings of Vail Resorts.

In connection with the Company’s acquisition of Whistler Blackcomb in October 2016, the Company issued consideration in the form of shares of Vail Resorts common stock (the “Vail Shares”), redeemable preferred shares of the Company’s wholly-owned Canadian subsidiary Whistler Blackcomb Holdings Inc. (“Exchangeco Shares”) or cash (or a combination thereof). Effective September 26, 2022, all Exchangeco Shares had been exchanged for Vail Shares. Both Vail Shares and Exchangeco Shares have a par value of $0.01 per share, and Exchangeco Shares, while they were outstanding, were substantially the economic equivalent of the Vail Shares. The Company’s calculation of weighted-average shares outstanding as of January 31, 2023 included the Exchangeco Shares, but there were no Exchangeco Shares that remained outstanding as of January 31, 2023.

Presented below is basic and diluted EPS for the three months ended January 31, 2024 and 2023 (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Three Months Ended January 31, |

| | | 2024 | | 2023 |

| | | Basic | | Diluted | | Basic | | Diluted |

| Net income per share: | | | | | | | | |

| Net income attributable to Vail Resorts | | $ | 219,299 | | | $ | 219,299 | | | $ | 208,679 | | | $ | 208,679 | |

| Weighted-average Vail Shares outstanding | | 37,967 | | | 37,967 | | | 40,327 | | | 40,327 | |

| | | | | | | | |

| Effect of dilutive securities | | — | | | 79 | | | — | | | 107 | |

| Total shares | | 37,967 | | | 38,046 | | | 40,327 | | | 40,434 | |

| Net income per share attributable to Vail Resorts | | $ | 5.78 | | | $ | 5.76 | | | $ | 5.17 | | | $ | 5.16 | |

The Company computes the effect of dilutive securities using the treasury stock method and average market prices during the period. The number of shares issuable upon the exercise of share-based awards excluded from the calculation of diluted EPS because the effect of their inclusion would have been anti-dilutive totaled approximately 15,000 and 25,000 for the three months ended January 31, 2024 and 2023, respectively.

Presented below is basic and diluted EPS for the six months ended January 31, 2024 and 2023 (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Six Months Ended January 31, |

| | | 2024 | | 2023 |

| | | Basic | | Diluted | | Basic | | Diluted |

| Net income per share: | | | | | | | | |

| Net income attributable to Vail Resorts | | $ | 43,787 | | | $ | 43,787 | | | $ | 71,708 | | | $ | 71,708 | |

| Weighted-average Vail Shares outstanding | | 38,042 | | | 38,042 | | | 40,312 | | | 40,312 | |

| Weighted-average Exchangeco Shares outstanding | | — | | | — | | | 1 | | | 1 | |

| Total Weighted-average shares outstanding | | 38,042 | | | 38,042 | | | 40,313 | | | 40,313 | |

| Effect of dilutive securities | | — | | | 91 | | | — | | | 95 | |

| Total shares | | 38,042 | | | 38,133 | | | 40,313 | | | 40,408 | |

| Net income per share attributable to Vail Resorts | | $ | 1.15 | | | $ | 1.15 | | | $ | 1.78 | | | $ | 1.77 | |

The number of shares issuable upon the exercise of share-based awards excluded from the calculation of diluted EPS because the effect of their inclusion would have been anti-dilutive totaled approximately 18,000 and 26,000 for the six months ended January 31, 2024 and 2023 respectively.

In December 2020, the Company completed an offering of $575.0 million in aggregate principal amount of 0.0% Convertible Notes (as defined in Note 5, Long-Term Debt). The Company is required to settle the principal amount of the 0.0% Convertible Notes in cash and has the option to settle the conversion spread in cash or shares. The Company uses the if-converted method to calculate the impact of convertible instruments on diluted EPS when the instruments may be settled in cash or shares. If the conversion value of the 0.0% Convertible Notes exceeds their conversion price, then the Company will calculate its diluted EPS as if all the notes were converted into common stock at the beginning of the period. However, if reflecting the 0.0% Convertible Notes in diluted EPS in this manner is anti-dilutive, or if the conversion value of the notes does not exceed their conversion price for a reporting period, then the shares underlying the notes will not be reflected in the Company’s calculation of diluted EPS. For the three and six months ended January 31, 2024 and 2023, the price of Vail Shares did not exceed the conversion price and therefore there was no impact to diluted EPS during those periods.

Dividends

During the three and six months ended January 31, 2024, the Company paid cash dividends of $2.06 and $4.12 per share, respectively ($78.2 million and $156.7 million, respectively). During the three and six months ended January 31, 2023, the Company paid cash dividends of $1.91 and $3.82 per share, respectively ($77.0 million and $154.0 million), respectively. On March 7, 2024, the Company’s Board of Directors approved a cash dividend of $2.22 per share payable on April 11, 2024 to stockholders of record as of March 28, 2024.

5. Long-Term Debt

Long-term debt, net as of January 31, 2024, July 31, 2023 and January 31, 2023 is summarized as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maturity | | January 31, 2024 | | July 31, 2023 | | January 31, 2023 |

Vail Holdings Credit Agreement term loan (a) | | 2026 | | $ | 984,375 | | | $ | 1,015,625 | | | $ | 1,046,875 | |

Vail Holdings Credit Agreement revolver (a) | | 2026 | | — | | | — | | | — | |

| 6.25% Notes | | 2025 | | 600,000 | | | 600,000 | | | 600,000 | |

0.0% Convertible Notes (b) | | 2026 | | 575,000 | | | 575,000 | | | 575,000 | |

Whistler Credit Agreement revolver (c) | | 2028 | | — | | | — | | | 11,275 | |

EPR Secured Notes (d) | | 2034-2036 | | 114,162 | | | 114,162 | | | 114,162 | |

| NRP Loan | | 2036 | | 39,285 | | | 40,399 | | | 39,967 | |

| Employee housing bonds | | 2027-2039 | | 52,575 | | | 52,575 | | | 52,575 | |

| Canyons obligation | | 2063 | | 366,264 | | | 363,386 | | | 360,497 | |

| Whistler Blackcomb employee housing leases | | 2042 | | 28,796 | | | 29,491 | | | 29,346 | |

| Other | | 2024-2036 | | 33,574 | | | 35,011 | | | 37,633 | |

| Total debt | | | | 2,794,031 | | | 2,825,649 | | | 2,867,330 | |

| Less: Unamortized premiums, discounts and debt issuance costs | | | | 3,298 | | | 5,814 | | | 7,921 | |

Less: Current maturities (e) | | | | 69,135 | | | 69,160 | | | 69,582 | |

| Long-term debt, net | | | | $ | 2,721,598 | | | $ | 2,750,675 | | | $ | 2,789,827 | |

(a)As of January 31, 2024, the Vail Holdings Credit Agreement consists of a $500.0 million revolving credit facility and a $1.0 billion outstanding term loan. The term loan is subject to quarterly amortization of principal of approximately $15.6 million, in equal installments, for a total of 5% of principal payable in each year and the final payment of all amounts outstanding, plus accrued and unpaid interest is due upon maturity in September 2026. The proceeds of the loans made under the Vail Holdings Credit Agreement may be used to fund the Company’s working capital needs, capital expenditures, acquisitions, investments and other general corporate purposes, including the issuance of letters of credit. Borrowings under the Vail Holdings Credit Agreement, including the term loan, bear interest annually at the Secured Overnight Financing Rate (“SOFR”) plus a spread of 1.60% as of January 31, 2024 (6.93% as of January 31, 2024). Interest rate margins may fluctuate based upon the ratio of the Company’s Net Funded Debt to Adjusted EBITDA on a trailing four-quarter basis. The Vail Holdings Credit Agreement also includes a quarterly unused commitment fee, which is equal to a percentage determined by the Net Funded Debt to Adjusted EBITDA ratio, as each such term is defined in the Vail Holdings Credit Agreement, multiplied by the daily amount by which the Vail Holdings Credit Agreement commitment exceeds the total of outstanding loans and outstanding letters of credit (0.30% as of January 31, 2024). The Company is party to various interest rate swap agreements which hedge the cash flows associated with the SOFR-based variable interest rate component of $400.0 million in principal amount of its Vail Holdings Credit Agreement until September 23, 2024, at an effective rate of 1.38%.

(b)The Company issued $575.0 million in aggregate principal amount of 0.0% Convertible Notes due 2026 (the “0.0% Convertible Notes) under an indenture dated December 18, 2020. As of January 31, 2024, the conversion price of the 0.0% Convertible Notes, adjusted for cash dividends paid since the issuance date, was $377.76.

(c)Whistler Mountain Resort Limited Partnership (“Whistler LP”) and Blackcomb Skiing Enterprises Limited Partnership (“Blackcomb LP” and together with Whistler LP, the “WB Partnerships”) are party to a credit agreement consisting of a C$300.0 million credit facility which was most recently amended on April 14, 2023, by and among Whistler LP, Blackcomb LP, certain subsidiaries of Whistler LP and Blackcomb LP party thereto as guarantors, the financial institutions party thereto as lenders and The Toronto-Dominion Bank, as administrative agent. The Whistler Credit Agreement has a maturity date of April 14, 2028 and uses rates based on SOFR with regard to borrowings under the facility made in U.S. dollars. As of January 31, 2024, there were no borrowings under the Whistler Credit Agreement. The Whistler Credit Agreement also includes a quarterly unused commitment fee based on the Consolidated Total Leverage Ratio, which as of January 31, 2024 is equal to 0.39% per annum.

(d)In September 2019, in conjunction with the acquisition of Peak Resorts, Inc. (“Peak Resorts”), the Company assumed various secured borrowings (the “EPR Secured Notes”) under the master credit and security agreements and other related agreements, as amended, (collectively, the “EPR Agreements”) with EPT Ski Properties, Inc. and its affiliates (“EPR”). The EPR Secured Notes include the following:

i.The Alpine Valley Secured Note. The $4.6 million Alpine Valley Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2024, interest on this note accrued at a rate of 11.90%.

ii.The Boston Mills/Brandywine Secured Note. The $23.3 million Boston Mills/Brandywine Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2024, interest on this note accrued at a rate of 11.41%.

iii.The Jack Frost/Big Boulder Secured Note. The $14.3 million Jack Frost/Big Boulder Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2024, interest on this note accrued at a rate of 11.41%.

iv.The Mount Snow Secured Note. The $51.1 million Mount Snow Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2024, interest on this note accrued at a rate of 12.32%.

v.The Hunter Mountain Secured Note. The $21.0 million Hunter Mountain Secured Note provides for interest payments through its maturity on January 5, 2036. As of January 31, 2024, interest on this note accrued at a rate of 9.03%.

In addition, Peak Resorts is required to maintain a debt service reserve account which amounts are applied to fund interest payments and other amounts due and payable to EPR.

(e)Current maturities represent principal payments due in the next 12 months.

Aggregate maturities of debt outstanding as of January 31, 2024 reflected by fiscal year (August 1 through July 31) are as follows (in thousands):

| | | | | |

| Total |

| 2024 (February 2024 through July 2024) | $ | 35,317 | |

| 2025 | 676,063 | |

| 2026 | 643,837 | |

| 2027 | 851,454 | |

| 2028 | 4,883 | |

| Thereafter | 582,477 | |

Total debt | $ | 2,794,031 | |

The Company recorded interest expense of $40.6 million and $38.4 million for the three months ended January 31, 2024 and 2023, respectively, of which $1.7 million and $1.6 million, respectively, was amortization of deferred financing costs. The Company recorded interest expense of $81.3 million and $73.7 million for the six months ended January 31, 2024 and 2023, respectively, of which $3.2 million was amortization of deferred financing costs in both periods. The Company was in compliance with all of its financial and operating covenants required to be maintained under its debt instruments for all periods presented.

In connection with the acquisition of Whistler Blackcomb, VHI funded a portion of the purchase price through an intercompany loan to Whistler Blackcomb, which was effective as of November 1, 2016, and requires foreign currency remeasurement to Canadian dollars, the functional currency for Whistler Blackcomb. As a result, foreign currency fluctuations associated with the loan are recorded within the Company’s results of operations. The Company recognized approximately $3.0 million and $(1.9) million of non-cash foreign currency gains (losses) on the intercompany loan to Whistler Blackcomb for the three and six months ended January 31, 2024, respectively, on the Company’s Consolidated Condensed Statements of Operations. The Company recognized approximately $2.3 million and $(3.8) million of non-cash foreign currency gains (losses) on the intercompany loan to Whistler Blackcomb for the three and six months ended January 31, 2023, respectively, on the Company’s Consolidated Condensed Statements of Operations.

6. Acquisitions

Andermatt-Sedrun

On August 3, 2022, through a wholly-owned subsidiary, the Company acquired a 55% controlling interest in Andermatt-Sedrun Sport AG (“Andermatt-Sedrun”) from Andermatt Swiss Alps AG (“ASA”). The consideration paid consisted of an investment of $114.4 million (CHF 110.0 million) into Andermatt-Sedrun for use in capital investments to enhance the guest experience on mountain (which was prepaid to fund the acquisition and was recorded in other current assets on the Company’s Consolidated Condensed Balance Sheet as of July 31, 2022) and $41.3 million (CHF 39.3 million) paid to ASA (which was paid on August 3, 2022, commensurate with closing). As of August 3, 2022 the total fair value of the consideration paid was $155.4 million (CHF 149.3 million).

Andermatt-Sedrun operates mountain and ski-related assets, including lifts, most of the restaurants and a ski school operation at the ski area. Ski operations are conducted on land owned by ASA as freehold or leasehold properties, land owned by Usern Corporation, land owned by the municipality of Tujetsch and land owned by private property owners. ASA retained a 40% ownership stake, with a group of existing shareholders comprising the remaining 5% ownership stake. ASA and the other noncontrolling economic interests contain certain protective rights pursuant to a shareholder agreement (the “Andermatt Agreement”) and no ability to participate in the day-to-day operations of Andermatt-Sedrun. The Andermatt Agreement provides that no dividend distributions be made by Andermatt-Sedrun until the end of the fiscal year ending July 31, 2026, after which time there shall be annual distributions of 50% of the available cash (as defined in the Andermatt Agreement) for the most recently completed fiscal year. In addition, the distribution rights are non-transferable and transfer of the noncontrolling interests are limited.

The following summarizes the purchase consideration and the purchase price allocation to estimated fair values of the identifiable assets acquired and liabilities assumed at the date the transaction was effective (in thousands):

| | | | | |

| Acquisition Date Estimated Fair Value |

| Total cash consideration paid by Vail Resorts, Inc. | $ | 155,365 | |

| Estimated fair value of noncontrolling interests | 91,524 | |

| Total estimated purchase consideration | $ | 246,889 | |

| |

| Allocation of total estimated purchase consideration: | |

| Current assets | $ | 119,867 | |

| Property, plant and equipment | 176,805 | |

| Goodwill | 3,368 | |

| Identifiable intangible assets and other assets | 7,476 | |

| Assumed long-term debt | (44,130) | |

| Other liabilities | (16,497) | |

| Net assets acquired | $ | 246,889 | |

Identifiable intangible assets acquired in the transaction were primarily related to a trade name. The process of estimating the fair value of the property, plant, and equipment includes the use of certain estimates and assumptions related to replacement cost and physical condition at the time of acquisition. The excess of the purchase price over the aggregate estimated fair values of the assets acquired and liabilities assumed was recorded as goodwill. The goodwill recognized is attributable primarily to expected synergies, the assembled workforce of the resort and other factors, and is not expected to be deductible for income tax purposes. The operating results of Andermatt-Sedrun are reported within the Mountain segment prospectively from the date of acquisition.

7. Supplementary Balance Sheet Information

The composition of property, plant and equipment follows (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | January 31, 2024 | | July 31, 2023 | | January 31, 2023 |

| Land and land improvements | | $ | 800,460 | | | $ | 796,730 | | | $ | 793,271 | |

| Buildings and building improvements | | 1,649,112 | | | 1,643,517 | | | 1,635,700 | |

| Machinery and equipment | | 1,914,253 | | | 1,792,378 | | | 1,769,052 | |

| Furniture and fixtures | | 316,269 | | | 298,725 | | | 330,257 | |

| Software | | 160,072 | | | 152,033 | | | 141,595 | |

| Vehicles | | 90,303 | | | 87,298 | | | 85,329 | |

| Construction in progress | | 74,884 | | | 134,113 | | | 135,903 | |

| Gross property, plant and equipment | | 5,005,353 | | | 4,904,794 | | | 4,891,107 | |

| Accumulated depreciation | | (2,655,929) | | | (2,533,237) | | | (2,469,712) | |

| Property, plant and equipment, net | | $ | 2,349,424 | | | $ | 2,371,557 | | | $ | 2,421,395 | |

The composition of accounts payable and accrued liabilities follows (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | January 31, 2024 | | July 31, 2023 | | January 31, 2023 |

| Trade payables | | $ | 130,796 | | | $ | 148,521 | | | $ | 179,221 | |

| Deferred revenue | | 660,281 | | | 572,602 | | | 619,511 | |

| Accrued salaries, wages and deferred compensation | | 66,064 | | | 38,908 | | | 66,275 | |

| Accrued benefits | | 63,314 | | | 60,466 | | | 54,129 | |

| Deposits | | 90,217 | | | 37,798 | | | 81,612 | |

| Operating lease liabilities | | 38,765 | | | 36,904 | | | 36,667 | |

| Other liabilities | | 92,187 | | | 82,822 | | | 107,380 | |

| Total accounts payable and accrued liabilities | | $ | 1,141,624 | | | $ | 978,021 | | | $ | 1,144,795 | |

The changes in the net carrying amount of goodwill by segment for the six months ended January 31, 2024 are as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| Mountain | | Lodging | | Goodwill, net |

| Balance at July 31, 2023 | $ | 1,675,338 | | | $ | 45,006 | | | $ | 1,720,344 | |

| | | | | |

| | | | | |

| Effects of changes in foreign currency exchange rates | (20,435) | | | — | | | (20,435) | |

| Balance at January 31, 2024 | $ | 1,654,903 | | | $ | 45,006 | | | $ | 1,699,909 | |

8. Fair Value Measurements

The Company utilizes FASB-issued fair value guidance that establishes how reporting entities should measure fair value for measurement and disclosure purposes. The guidance establishes a common definition of fair value applicable to all assets and liabilities measured at fair value and prioritizes the inputs into valuation techniques used to measure fair value. Accordingly, the Company uses valuation techniques which maximize the use of observable inputs and minimize the use of unobservable inputs when determining fair value. The three levels of the hierarchy are as follows:

Level 1: Inputs that reflect unadjusted quoted prices in active markets that are accessible to the Company for identical assets or liabilities;

Level 2: Inputs include quoted prices for similar assets and liabilities in active and inactive markets or that are observable for the asset or liability either directly or indirectly; and

Level 3: Unobservable inputs which are supported by little or no market activity.

The table below summarizes the Company’s cash equivalents, restricted cash, other current assets, interest rate swaps and Contingent Consideration (defined below) measured at estimated fair value (all other assets and liabilities measured at fair value are immaterial) (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Estimated Fair Value Measurement as of January 31, 2024 |

| Description | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | |

| Money Market | | $ | 102,608 | | | $ | 102,608 | | | $ | — | | | $ | — | |

| Commercial Paper | | $ | 2,401 | | | $ | — | | | $ | 2,401 | | | $ | — | |

| Certificates of Deposit | | $ | 240,450 | | | $ | — | | | $ | 240,450 | | | $ | — | |

| Interest Rate Swaps | | $ | 9,115 | | | $ | — | | | $ | 9,115 | | | $ | — | |

| Liabilities: | | | | | | | | |

| Contingent Consideration | | $ | 62,700 | | | $ | — | | | $ | — | | | $ | 62,700 | |

| | | | | | | | |

| | | Estimated Fair Value Measurement as of July 31, 2023 |

| Description | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | |

| Money Market | | $ | 170,872 | | | $ | 170,872 | | | $ | — | | | $ | — | |

| Commercial Paper | | $ | 2,401 | | | $ | — | | | $ | 2,401 | | | $ | — | |

| Certificates of Deposit | | $ | 144,365 | | | $ | — | | | $ | 144,365 | | | $ | — | |

| Interest Rate Swaps | | $ | 17,229 | | | $ | — | | | $ | 17,229 | | | $ | — | |

| Liabilities: | | | | | | | | |

| Contingent Consideration | | $ | 73,300 | | | $ | — | | | $ | — | | | $ | 73,300 | |

| | |

| | | Estimated Fair Value Measurement as of January 31, 2023 |

| Description | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | |

| Money Market | | $ | 614,439 | | | $ | 614,439 | | | $ | — | | | $ | — | |

| Commercial Paper | | $ | 2,401 | | | $ | — | | | $ | 2,401 | | | $ | — | |

| Certificates of Deposit | | $ | 111,140 | | | $ | — | | | $ | 111,140 | | | $ | — | |

| Interest Rate Swaps | | $ | 19,270 | | | $ | — | | | $ | 19,270 | | | $ | — | |

| Liabilities: | | | | | | | | |

| Contingent Consideration | | $ | 25,200 | | | $ | — | | | $ | — | | | $ | 25,200 | |

The Company’s cash equivalents, restricted cash, other current assets and interest rate swaps are measured utilizing quoted market prices or pricing models whereby all significant inputs are either observable or corroborated by observable market data. The estimated fair value of the interest rate swaps are included within other current assets on the Company’s Consolidated Condensed Balance Sheet as of January 31, 2024 and included within other assets as of July 31, 2023 and January 31, 2023.

The changes in Contingent Consideration during the six months ended January 31, 2024 and 2023 were as follows (in thousands):

| | | | | | | | | | | | | | |

| Balance as of July 31, 2023 and 2022, respectively | | $ | 73,300 | | | $ | 42,400 | |

| Payments | | (17,057) | | | (18,936) | |

| Change in estimated fair value | | 6,457 | | | 1,736 | |

| Balance as of January 31, 2024 and 2023, respectively | | $ | 62,700 | | | $ | 25,200 | |

The lease for Park City provides for participating contingent payments (the “Contingent Consideration”) to the landlord of 42% of the amount by which EBITDA for the Park City resort operations, as calculated under the lease, exceeds approximately $35 million, as established upon the Company’s acquisition of the resort, with such threshold amount subsequently increased annually by an inflation linked index and an adjustment equal to 10% of any capital improvements or investments made under the lease by the Company. Contingent Consideration is classified as a liability, which is remeasured to fair value at each reporting date until the contingency is resolved.

The Company estimated the fair value of the Contingent Consideration payments using an option pricing valuation model. The estimated fair value of Contingent Consideration includes future period resort operations of Park City in the calculation of EBITDA on which participating contingent payments are made, which is determined on the basis of estimated subsequent year performance, escalated by an assumed annual growth factor and discounted to present value. Other significant assumptions included a discount rate of 11.1%, and volatility of 17.0%, which together with future period Park City EBITDA, are all unobservable inputs and thus are considered Level 3 inputs. The Company prepared a sensitivity analysis to evaluate the effect that changes on certain key assumptions would have on the estimated fair value of the Contingent Consideration. A change in the discount rate of 100 basis points or a 5% change in estimated subsequent year performance of the resort would result in a change in the estimated fair value within the range of approximately $10.1 million to $13.8 million.

During the six months ended January 31, 2024, the Company made a payment to the landlord for Contingent Consideration of approximately $17.1 million and recorded an increase of approximately $6.5 million, primarily related to the estimated Contingent Consideration payment for the fiscal year ending July 31, 2024. These changes resulted in an estimated fair value of the Contingent Consideration of approximately $62.7 million, which is reflected in other long-term liabilities in the Company’s Consolidated Condensed Balance Sheet.

9. Commitments and Contingencies

Guarantees/Indemnifications

As of January 31, 2024, the Company had various letters of credit outstanding totaling $95.0 million, consisting of $53.4 million to support the Employee Housing Bonds; $6.4 million to support bonds issued by Holland Creek Metropolitan District; and $35.2 million primarily for workers’ compensation, a wind energy purchase agreement and insurance-related deductibles. The Company also had surety bonds of $9.5 million as of January 31, 2024, primarily to provide collateral for its U.S. workers compensation self-insurance programs.

In addition to the guarantees noted above, the Company has entered into contracts in the normal course of business that include certain indemnifications under which it could be required to make payments to third parties upon the occurrence or non-occurrence of certain future events. These indemnities include indemnities related to licensees in connection with third-parties’ use of the Company’s trademarks and logos, liabilities associated with the infringement of other parties’ technology and software products, liabilities associated with the use of easements, liabilities associated with employment of contract workers and the Company’s use of trustees and liabilities associated with the Company’s use of public lands and environmental matters. The duration of these indemnities generally is indefinite and generally do not limit the future payments the Company could be obligated to make.

As permitted under applicable law, the Company and certain of its subsidiaries have agreed to indemnify their directors and officers over their lifetimes for certain events or occurrences while the officer or director is, or was, serving the Company or its subsidiaries in such a capacity. The maximum potential amount of future payments the Company could be required to make under these indemnification agreements is unlimited; however, the Company has a director and officer insurance policy that should enable the Company to recover a portion of any amounts paid.

Unless otherwise noted, the Company has not recorded any significant liabilities for the letters of credit, indemnities and other guarantees noted above in the accompanying Consolidated Condensed Financial Statements, either because the Company has recorded on its Consolidated Condensed Balance Sheets the underlying liability associated with the guarantee, the guarantee is with respect to the Company’s own performance and is therefore not subject to the measurement requirements as prescribed by GAAP, or because the Company has calculated the estimated fair value of the indemnification or guarantee to be immaterial based on the current facts and circumstances that would trigger a payment under the indemnification clause. In addition, with respect to certain indemnifications, it is not possible to determine the maximum potential amount of liability under these potential obligations due to the unique set of facts and circumstances likely to be involved in each particular claim and indemnification provision. Historically, payments made by the Company under these obligations have not been material.

As noted above, the Company makes certain indemnifications to licensees for their use of the Company’s trademarks and logos. The Company does not record any liabilities with respect to these indemnifications.

Additionally, the Company has entered into strategic long-term season pass alliance agreements with third-party mountain resorts in which the Company has committed to pay minimum revenue guarantees over the remaining terms of these agreements.

Self-Insurance

The Company is self-insured for claims under its U.S. health benefit plans and for the majority of workers’ compensation claims in the U.S. Workers compensation claims in the U.S. are subject to stop loss policies. The self-insurance liability related to workers’ compensation is determined actuarially based on claims filed. The self-insurance liability related to claims under

the Company’s U.S. health benefit plans is determined based on analysis of actual claims. The amounts related to these claims are included as a component of accrued benefits in accounts payable and accrued liabilities (see Note 7, Supplementary Balance Sheet Information).

Legal

The Company is a party to various lawsuits arising in the ordinary course of business. Management believes the Company has adequate insurance coverage and/or has accrued for all loss contingencies for asserted and unasserted matters deemed to be probable and estimable losses. As of January 31, 2024, July 31, 2023 and January 31, 2023, the accruals for the above loss contingencies were not material individually or in the aggregate.

10. Segment Information