false--07-31Q120200000812011Large Accelerated Filer0.010.010.015700056000550000.010.010.011000000001000000001000000004609700046190000462570002036-12-312039-12-312032-12-312034-12-312027-12-312020-12-3120000000.010.010.01250000002500000025000000000000575000059050006000000

0000812011

2019-08-01

2019-10-31

0000812011

mtn:PeakResortsMember

2019-08-01

2019-10-31

0000812011

mtn:StevensPassMember

2019-08-01

2019-10-31

0000812011

mtn:TriplePeaksLLCMember

2019-08-01

2019-10-31

0000812011

mtn:FallsCreekandHothamMember

2019-08-01

2019-10-31

0000812011

2019-12-05

0000812011

2018-10-31

0000812011

2019-07-31

0000812011

2019-10-31

0000812011

2018-08-01

2018-10-31

0000812011

us-gaap:NoncontrollingInterestMember

2019-10-31

0000812011

us-gaap:NoncontrollingInterestMember

2019-08-01

2019-10-31

0000812011

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-07-31

0000812011

us-gaap:TreasuryStockMember

2018-08-01

2018-10-31

0000812011

us-gaap:RetainedEarningsMember

2018-08-01

2018-10-31

0000812011

mtn:ExchangeableSharesMember

2019-07-31

0000812011

us-gaap:AdditionalPaidInCapitalMember

2018-08-01

2018-10-31

0000812011

us-gaap:NoncontrollingInterestMember

2018-08-01

2018-10-31

0000812011

mtn:TotalVailResortsIncStockholdersEquityMember

2018-10-31

0000812011

us-gaap:CommonStockMember

2018-08-01

2018-10-31

0000812011

mtn:TotalVailResortsIncStockholdersEquityMember

2018-08-01

2018-10-31

0000812011

mtn:TotalVailResortsIncStockholdersEquityMember

2019-08-01

2019-10-31

0000812011

us-gaap:CommonStockMember

2018-10-31

0000812011

us-gaap:RetainedEarningsMember

2019-10-31

0000812011

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-10-31

0000812011

us-gaap:RetainedEarningsMember

2019-08-01

2019-10-31

0000812011

us-gaap:RetainedEarningsMember

2019-07-31

0000812011

us-gaap:RetainedEarningsMember

2018-10-31

0000812011

us-gaap:AdditionalPaidInCapitalMember

2018-10-31

0000812011

us-gaap:TreasuryStockMember

2018-07-31

0000812011

us-gaap:CommonStockMember

2018-07-31

0000812011

us-gaap:AdditionalPaidInCapitalMember

2019-08-01

2019-10-31

0000812011

us-gaap:RetainedEarningsMember

2018-07-31

0000812011

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-08-01

2019-10-31

0000812011

us-gaap:CommonStockMember

2019-10-31

0000812011

2018-07-31

0000812011

us-gaap:TreasuryStockMember

2018-10-31

0000812011

mtn:TotalVailResortsIncStockholdersEquityMember

2018-07-31

0000812011

us-gaap:TreasuryStockMember

2019-08-01

2019-10-31

0000812011

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-10-31

0000812011

mtn:TotalVailResortsIncStockholdersEquityMember

2019-07-31

0000812011

us-gaap:NoncontrollingInterestMember

2018-10-31

0000812011

mtn:ExchangeableSharesMember

2018-10-31

0000812011

us-gaap:AdditionalPaidInCapitalMember

2019-10-31

0000812011

us-gaap:NoncontrollingInterestMember

2019-07-31

0000812011

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-07-31

0000812011

mtn:ExchangeableSharesMember

2018-07-31

0000812011

us-gaap:TreasuryStockMember

2019-07-31

0000812011

mtn:TotalVailResortsIncStockholdersEquityMember

2019-10-31

0000812011

us-gaap:AdditionalPaidInCapitalMember

2019-07-31

0000812011

us-gaap:NoncontrollingInterestMember

2018-07-31

0000812011

us-gaap:AdditionalPaidInCapitalMember

2018-07-31

0000812011

us-gaap:TreasuryStockMember

2019-10-31

0000812011

mtn:ExchangeableSharesMember

2019-10-31

0000812011

us-gaap:CommonStockMember

2019-07-31

0000812011

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-08-01

2018-10-31

0000812011

us-gaap:CommonStockMember

2019-08-01

2019-10-31

0000812011

2019-08-01

0000812011

mtn:TransportationMember

2019-08-01

2019-10-31

0000812011

mtn:LiftTicketsMember

2019-08-01

2019-10-31

0000812011

mtn:OtherMountainRevenueMember

2018-08-01

2018-10-31

0000812011

mtn:GolfMember

2018-08-01

2018-10-31

0000812011

mtn:PayrollcostreimbursementsMember

2019-08-01

2019-10-31

0000812011

mtn:RetailRentalMember

2019-08-01

2019-10-31

0000812011

mtn:SkiSchoolMember

2018-08-01

2018-10-31

0000812011

mtn:DiningMember

2019-08-01

2019-10-31

0000812011

mtn:GolfMember

2019-08-01

2019-10-31

0000812011

mtn:SkiSchoolMember

2019-08-01

2019-10-31

0000812011

mtn:DiningMember

2018-08-01

2018-10-31

0000812011

mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember

2019-08-01

2019-10-31

0000812011

mtn:OwnedHotelRevenueMember

2019-08-01

2019-10-31

0000812011

mtn:TransportationMember

2018-08-01

2018-10-31

0000812011

mtn:ManagedcondominiumroomsMember

2018-08-01

2018-10-31

0000812011

mtn:OtherMountainRevenueMember

2019-08-01

2019-10-31

0000812011

mtn:OtherLodgingRevenueMember

2019-08-01

2019-10-31

0000812011

mtn:LiftTicketsMember

2018-08-01

2018-10-31

0000812011

mtn:OtherLodgingRevenueMember

2018-08-01

2018-10-31

0000812011

mtn:PayrollcostreimbursementsMember

2018-08-01

2018-10-31

0000812011

mtn:ManagedcondominiumroomsMember

2019-08-01

2019-10-31

0000812011

mtn:OwnedHotelRevenueMember

2018-08-01

2018-10-31

0000812011

mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember

2018-08-01

2018-10-31

0000812011

mtn:RetailRentalMember

2018-08-01

2018-10-31

0000812011

srt:MaximumMember

2019-08-01

2019-10-31

0000812011

mtn:CanyonsObligationMember

2019-08-01

2019-10-31

0000812011

srt:MinimumMember

2019-08-01

2019-10-31

0000812011

mtn:CanyonsObligationMember

2019-10-31

0000812011

2016-10-17

0000812011

us-gaap:CommonStockMember

2016-10-17

2016-10-17

0000812011

mtn:ExchangeableSharesMember

2016-10-17

2016-10-17

0000812011

mtn:EmployeeHousingBondsMember

2019-10-31

0000812011

mtn:TermLoanMember

2018-10-31

0000812011

mtn:EB5DevelopmentNotesMember

2019-07-31

0000812011

us-gaap:LineOfCreditMember

2019-07-31

0000812011

mtn:CanyonsObligationMember

2019-07-31

0000812011

mtn:TermLoanMember

2019-10-31

0000812011

mtn:WhistlerCreditAgreementrevolverMember

2019-08-01

2019-10-31

0000812011

us-gaap:LineOfCreditMember

2018-10-31

0000812011

mtn:EmployeeHousingBondsMember

2018-10-31

0000812011

mtn:WhistlerCreditAgreementrevolverMember

2018-10-31

0000812011

mtn:EPRSecuredNotesMember

2019-10-31

0000812011

mtn:EPRSecuredNotesMember

2019-07-31

0000812011

mtn:CanyonsObligationMember

2018-10-31

0000812011

mtn:OtherDebtMember

2018-10-31

0000812011

mtn:EmployeeHousingBondsMember

2019-07-31

0000812011

us-gaap:LineOfCreditMember

2019-10-31

0000812011

us-gaap:LineOfCreditMember

2019-08-01

2019-10-31

0000812011

mtn:CanyonsObligationMember

2019-10-31

0000812011

mtn:EPRSecuredNotesMember

2018-10-31

0000812011

mtn:WhistlerCreditAgreementrevolverMember

2019-10-31

0000812011

mtn:TermLoanMember

2019-08-01

2019-10-31

0000812011

mtn:EB5DevelopmentNotesMember

2018-10-31

0000812011

mtn:TermLoanMember

2019-07-31

0000812011

mtn:CanyonsObligationMember

2019-08-01

2019-10-31

0000812011

mtn:OtherDebtMember

2019-07-31

0000812011

mtn:EB5DevelopmentNotesMember

2019-08-01

2019-10-31

0000812011

mtn:EB5DevelopmentNotesMember

2019-10-31

0000812011

mtn:OtherDebtMember

2019-10-31

0000812011

mtn:WhistlerCreditAgreementrevolverMember

2019-07-31

0000812011

mtn:EB5DevelopmentNotesMember

mtn:ExtensionYear1Member

2019-10-31

0000812011

mtn:MountSnowSecuredNoteMember

2019-10-31

0000812011

mtn:BostonMillsBrandywineSecuredNoteMember

2019-10-31

0000812011

mtn:HunterMountainSecuredNoteMember

2019-08-01

2019-10-31

0000812011

mtn:MountSnowSecuredNoteMember

2019-08-01

2019-10-31

0000812011

mtn:AlpineValleySecuredNoteMemberMember

2019-10-31

0000812011

mtn:EPRSecuredNotesMember

2019-08-01

2019-10-31

0000812011

mtn:EB5DevelopmentNotesMember

mtn:ExtensionYear2Member

2019-10-31

0000812011

mtn:EB5DevelopmentNotesMember

mtn:EventofDefaultMember

2019-10-31

0000812011

mtn:EB5DevelopmentNote2Member

2019-10-31

0000812011

mtn:EPRSecuredNotesMember

2019-10-31

0000812011

mtn:EPRSecuredNotesMember

2019-08-01

2019-10-31

0000812011

mtn:HunterMountainSecuredNoteMember

2019-08-01

2019-10-31

0000812011

mtn:HunterMountainSecuredNoteMember

2019-10-31

0000812011

mtn:EB5DevelopmentNote1Member

2019-10-31

0000812011

mtn:JackFrostBigBoulderSecuredNoteMember

2019-10-31

0000812011

currency:CAD

mtn:WhistlerCreditAgreementrevolverMember

2019-10-31

0000812011

srt:MinimumMember

mtn:EPRSecuredNotesMember

2019-08-01

2019-10-31

0000812011

srt:MinimumMember

mtn:OtherDebtMember

2019-08-01

2019-10-31

0000812011

srt:MaximumMember

mtn:EmployeeHousingBondsMember

2019-08-01

2019-10-31

0000812011

srt:MaximumMember

mtn:OtherDebtMember

2019-08-01

2019-10-31

0000812011

srt:MaximumMember

mtn:EPRSecuredNotesMember

2019-08-01

2019-10-31

0000812011

srt:MinimumMember

mtn:EmployeeHousingBondsMember

2019-08-01

2019-10-31

0000812011

mtn:StevensPassMember

2018-08-15

2018-08-15

0000812011

mtn:FallsCreekandHothamMember

2019-04-04

2019-04-04

0000812011

mtn:TriplePeaksLLCMember

2018-09-27

2018-09-27

0000812011

mtn:PeakResortsMember

2019-09-24

2019-09-24

0000812011

mtn:TriplePeaksLLCMember

2018-08-01

2018-10-31

0000812011

mtn:PeakResortsMember

2019-09-24

0000812011

mtn:StevensPassMember

2018-08-01

2018-10-31

0000812011

mtn:StevensPassMember

2018-08-15

0000812011

mtn:FallsCreekandHothamMember

2019-04-04

0000812011

mtn:TriplePeaksLLCMember

2018-09-27

0000812011

mtn:LodgingMember

2019-10-31

0000812011

mtn:MountainMember

2019-10-31

0000812011

mtn:MountainMember

2019-07-31

0000812011

mtn:LodgingMember

2019-07-31

0000812011

mtn:MountainMember

2019-08-01

2019-10-31

0000812011

us-gaap:CommercialPaperMember

2018-10-31

0000812011

us-gaap:FairValueInputsLevel3Member

2018-10-31

0000812011

us-gaap:CertificatesOfDepositMember

2019-07-31

0000812011

us-gaap:FairValueInputsLevel2Member

us-gaap:CommercialPaperMember

2018-10-31

0000812011

us-gaap:FairValueInputsLevel2Member

us-gaap:CommercialPaperMember

2019-07-31

0000812011

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

2019-07-31

0000812011

us-gaap:FairValueInputsLevel2Member

us-gaap:CommercialPaperMember

2019-10-31

0000812011

us-gaap:FairValueInputsLevel2Member

us-gaap:CertificatesOfDepositMember

2018-10-31

0000812011

us-gaap:FairValueInputsLevel1Member

2018-10-31

0000812011

us-gaap:FairValueInputsLevel3Member

2019-07-31

0000812011

us-gaap:FairValueInputsLevel2Member

us-gaap:CertificatesOfDepositMember

2019-10-31

0000812011

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

2019-10-31

0000812011

us-gaap:CertificatesOfDepositMember

2018-10-31

0000812011

us-gaap:FairValueInputsLevel3Member

2019-10-31

0000812011

us-gaap:FairValueInputsLevel2Member

us-gaap:CertificatesOfDepositMember

2019-07-31

0000812011

us-gaap:CommercialPaperMember

2019-10-31

0000812011

us-gaap:CertificatesOfDepositMember

2019-10-31

0000812011

us-gaap:CommercialPaperMember

2019-07-31

0000812011

mtn:EmployeeHousingBondsMember

2019-10-31

0000812011

mtn:RedSkyRanchMetropolitanDistrictMember

2019-10-31

0000812011

mtn:RedSkyRanchMetropolitanDistrictMember

2019-08-01

2019-10-31

0000812011

mtn:HollandCreekMetropolitanDistrictMember

2019-10-31

0000812011

mtn:WorkersCompensationAndGeneralLiabilityRelatedToConstructionAndDevelopmentActivitiesMember

2019-10-31

0000812011

mtn:HollandCreekMetropolitanDistrictMember

2019-08-01

2019-10-31

0000812011

mtn:RedSkyRanchMetropolitanDistrictMember

2018-10-31

0000812011

mtn:OtherMountainRevenueMember

2018-08-01

2018-10-31

0000812011

mtn:DiningMember

2018-08-01

2018-10-31

0000812011

mtn:LodgingMember

2019-08-01

2019-10-31

0000812011

mtn:LiftTicketsMember

2018-08-01

2018-10-31

0000812011

mtn:SkiSchoolMember

2019-08-01

2019-10-31

0000812011

mtn:OtherMountainRevenueMember

2019-08-01

2019-10-31

0000812011

mtn:RetailRentalMember

2019-08-01

2019-10-31

0000812011

mtn:RetailRentalMember

2018-08-01

2018-10-31

0000812011

mtn:SkiSchoolMember

2018-08-01

2018-10-31

0000812011

us-gaap:RealEstateMember

2019-08-01

2019-10-31

0000812011

mtn:ResortMember

2019-08-01

2019-10-31

0000812011

mtn:MountainMember

2018-08-01

2018-10-31

0000812011

mtn:LodgingMember

2018-08-01

2018-10-31

0000812011

mtn:ResortMember

2018-08-01

2018-10-31

0000812011

us-gaap:RealEstateMember

2018-08-01

2018-10-31

0000812011

mtn:LiftTicketsMember

2019-08-01

2019-10-31

0000812011

mtn:DiningMember

2019-08-01

2019-10-31

0000812011

2008-07-16

0000812011

2015-12-04

0000812011

2006-03-09

iso4217:AUD

iso4217:USD

xbrli:pure

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 31, 2019

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-09614

Vail Resorts, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| | | |

Delaware | | 51-0291762 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

390 Interlocken Crescent | | |

Broomfield, | Colorado | | 80021 |

(Address of Principal Executive Offices) | | (Zip Code) |

|

| |

(303) | 404-1800 |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, $0.01 par value | MTN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of December 5, 2019, 40,257,530 shares of the registrant’s common stock were outstanding.

Table of Contents

|

| | |

| | |

PART I | FINANCIAL INFORMATION | Page |

| | |

Item 1. | Financial Statements (unaudited). | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

PART II | OTHER INFORMATION | |

| | |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 5. | | |

Item 6. | | |

Vail Resorts, Inc.

Consolidated Condensed Balance Sheets

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | |

| | October 31, 2019 | | July 31, 2019 | | October 31, 2018 |

Assets | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 136,326 |

| | $ | 108,850 |

| | $ | 141,031 |

|

Restricted cash | | 14,027 |

| | 9,539 |

| | 12,005 |

|

Trade receivables, net | | 87,301 |

| | 270,896 |

| | 74,240 |

|

Inventories, net | | 127,859 |

| | 96,539 |

| | 114,984 |

|

Other current assets | | 62,821 |

| | 42,116 |

| | 50,752 |

|

Total current assets | | 428,334 |

| | 527,940 |

| | 393,012 |

|

Property, plant and equipment, net (Note 8) | | 2,280,089 |

| | 1,842,500 |

| | 1,825,982 |

|

Real estate held for sale and investment | | 96,938 |

| | 101,021 |

| | 101,743 |

|

Goodwill, net (Note 8) | | 1,757,463 |

| | 1,608,206 |

| | 1,543,941 |

|

Intangible assets, net | | 324,178 |

| | 306,173 |

| | 307,268 |

|

Operating right-of-use assets (Note 4) | | 229,709 |

| | — |

| | — |

|

Other assets | | 41,036 |

| | 40,237 |

| | 43,976 |

|

Total assets | | $ | 5,157,747 |

| | $ | 4,426,077 |

| | $ | 4,215,922 |

|

Liabilities and Stockholders’ Equity | | | | | | |

Current liabilities: | | | | | | |

Accounts payable and accrued liabilities (Note 8) | | $ | 856,934 |

| | $ | 607,857 |

| | $ | 703,633 |

|

Income taxes payable | | 50,759 |

| | 62,760 |

| | 38,303 |

|

Long-term debt due within one year (Note 6) | | 63,807 |

| | 48,516 |

| | 48,482 |

|

Total current liabilities | | 971,500 |

| | 719,133 |

| | 790,418 |

|

Long-term debt, net (Note 6) | | 2,005,057 |

| | 1,527,744 |

| | 1,486,968 |

|

Operating lease liabilities (Note 4) | | 231,182 |

| | — |

| | — |

|

Other long-term liabilities (Note 8) | | 238,964 |

| | 283,601 |

| | 273,566 |

|

Deferred income taxes, net | | 188,608 |

| | 168,759 |

| | 115,169 |

|

Total liabilities | | 3,635,311 |

| | 2,699,237 |

| | 2,666,121 |

|

Commitments and contingencies (Note 10) | |

|

| |

|

| |

|

|

Stockholders’ equity: | | | | | | |

Preferred stock, $0.01 par value, 25,000 shares authorized, no shares issued and outstanding | | — |

| | — |

| | — |

|

Common stock, $0.01 par value, 100,000 shares authorized, 46,257, 46,190 and 46,097 shares issued, respectively | | 462 |

| | 461 |

| | 461 |

|

Exchangeable shares, $0.01 par value, 55, 56 and 57 shares issued and outstanding, respectively (Note 5) | | 1 |

| | 1 |

| | 1 |

|

Additional paid-in capital | | 1,126,492 |

| | 1,130,083 |

| | 1,130,855 |

|

Accumulated other comprehensive loss | | (27,269 | ) | | (31,730 | ) | | (20,596 | ) |

Retained earnings | | 582,235 |

| | 759,801 |

| | 551,863 |

|

Treasury stock, at cost, 6,000, 5,905, and 5,750 shares, respectively (Note 12) | | (379,433 | ) | | (357,989 | ) | | (322,989 | ) |

Total Vail Resorts, Inc. stockholders’ equity | | 1,302,488 |

| | 1,500,627 |

| | 1,339,595 |

|

Noncontrolling interests | | 219,948 |

| | 226,213 |

| | 210,206 |

|

Total stockholders’ equity | | 1,522,436 |

| | 1,726,840 |

| | 1,549,801 |

|

Total liabilities and stockholders’ equity | | $ | 5,157,747 |

| | $ | 4,426,077 |

| | $ | 4,215,922 |

|

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | |

| Three Months Ended October 31, |

| 2019 | | 2018 |

Net revenue: | | | |

Mountain and Lodging services and other | $ | 180,031 |

| | $ | 144,022 |

|

Mountain and Lodging retail and dining | 83,559 |

| | 75,884 |

|

Resort net revenue | 263,590 |

| | 219,906 |

|

Real Estate | 4,180 |

| | 98 |

|

Total net revenue | 267,770 |

| | 220,004 |

|

Operating expense (exclusive of depreciation and amortization shown separately below): | | | |

Mountain and Lodging operating expense | 228,710 |

| | 194,112 |

|

Mountain and Lodging retail and dining cost of products sold | 37,735 |

| | 34,876 |

|

General and administrative | 75,055 |

| | 64,379 |

|

Resort operating expense | 341,500 |

| | 293,367 |

|

Real Estate operating expense | 5,293 |

| | 1,370 |

|

Total segment operating expense | 346,793 |

| | 294,737 |

|

Other operating (expense) income: | | | |

Depreciation and amortization | (57,845 | ) | | (51,043 | ) |

Gain on sale of real property | 207 |

| | — |

|

Change in estimated fair value of contingent consideration (Note 9) | (1,136 | ) | | (1,200 | ) |

Gain (loss) on disposal of fixed assets and other, net | 2,267 |

| | (619 | ) |

Loss from operations | (135,530 | ) | | (127,595 | ) |

Mountain equity investment income, net | 1,191 |

| | 950 |

|

Investment income and other, net | 277 |

| | 463 |

|

Foreign currency gain (loss) on intercompany loans (Note 6) | 360 |

| | (2,311 | ) |

Interest expense, net | (22,690 | ) | | (18,638 | ) |

Loss before benefit from income taxes | (156,392 | ) | | (147,131 | ) |

Benefit from income taxes | 46,563 |

| | 36,405 |

|

Net loss | (109,829 | ) | | (110,726 | ) |

Net loss attributable to noncontrolling interests | 3,354 |

| | 2,931 |

|

Net loss attributable to Vail Resorts, Inc. | $ | (106,475 | ) | | $ | (107,795 | ) |

Per share amounts (Note 5): | | | |

Basic net loss per share attributable to Vail Resorts, Inc. | $ | (2.64 | ) | | $ | (2.66 | ) |

Diluted net loss per share attributable to Vail Resorts, Inc. | $ | (2.64 | ) | | $ | (2.66 | ) |

Cash dividends declared per share | $ | 1.76 |

| | $ | 1.47 |

|

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Comprehensive Loss

(In thousands)

(Unaudited)

|

| | | | | | | | |

| | Three Months Ended

October 31, |

| | 2019 | | 2018 |

Net loss | | $ | (109,829 | ) | | $ | (110,726 | ) |

Foreign currency translation adjustments and other, net of tax | | 5,323 |

| | (22,636 | ) |

Comprehensive loss | | (104,506 | ) |

| (133,362 | ) |

Comprehensive loss attributable to noncontrolling interests | | 2,492 |

| | 7,198 |

|

Comprehensive loss attributable to Vail Resorts, Inc. | | $ | (102,014 | ) | | $ | (126,164 | ) |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Stockholders’ Equity

(In thousands)

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | Additional Paid in Capital | Accumulated Other Comprehensive Loss | Retained Earnings | Treasury Stock | Total Vail Resorts, Inc. Stockholders’ Equity | Noncontrolling Interests | Total Stockholders’ Equity |

| Vail Resorts | Exchangeable | | | | | | | |

Balance, July 31, 2018 | $ | 460 |

| $ | 1 |

| $ | 1,137,467 |

| $ | (2,227 | ) | $ | 726,722 |

| $ | (272,989 | ) | $ | 1,589,434 |

| $ | 222,229 |

| $ | 1,811,663 |

|

Comprehensive loss: | | | | | | | | | |

Net loss | — |

| — |

| — |

| — |

| (107,795 | ) | — |

| (107,795 | ) | (2,931 | ) | (110,726 | ) |

Foreign currency translation adjustments, net of tax | — |

| — |

| — |

| (18,369 | ) | — |

| — |

| (18,369 | ) | (4,267 | ) | (22,636 | ) |

Total comprehensive loss | | | | | | | (126,164 | ) | (7,198 | ) | (133,362 | ) |

Stock-based compensation expense | — |

| — |

| 4,753 |

| — |

| — |

| — |

| 4,753 |

| — |

| 4,753 |

|

Cumulative effect for adoption of revenue standard | — |

| — |

| — |

| — |

| (7,517 | ) | — |

| (7,517 | ) | — |

| (7,517 | ) |

Issuance of shares under share award plans, net of shares withheld for employee taxes | 1 |

| — |

| (11,365 | ) | — |

| — |

| — |

| (11,364 | ) | — |

| (11,364 | ) |

Repurchase of common stock (Note 12) | — |

| — |

| — |

| — |

| — |

| (50,000 | ) | (50,000 | ) | — |

| (50,000 | ) |

Dividends (Note 5) | — |

| — |

| — |

| — |

| (59,547 | ) | — |

| (59,547 | ) | — |

| (59,547 | ) |

Distributions to noncontrolling interests, net | — |

| — |

| — |

| — |

| — |

| — |

| — |

| (4,825 | ) | (4,825 | ) |

Balance, October 31, 2018 | $ | 461 |

| $ | 1 |

| $ | 1,130,855 |

| $ | (20,596 | ) | $ | 551,863 |

| $ | (322,989 | ) | $ | 1,339,595 |

| $ | 210,206 |

| $ | 1,549,801 |

|

| | | | | | | | | |

Balance, July 31, 2019 | $ | 461 |

| $ | 1 |

| $ | 1,130,083 |

| $ | (31,730 | ) | $ | 759,801 |

| $ | (357,989 | ) | $ | 1,500,627 |

| $ | 226,213 |

| $ | 1,726,840 |

|

Comprehensive loss: | | | | | | | | | |

Net loss | — |

| — |

| — |

| — |

| (106,475 | ) | — |

| (106,475 | ) | (3,354 | ) | (109,829 | ) |

Foreign currency translation adjustments and other, net of tax | — |

| — |

| | 4,461 |

| — |

| — |

| 4,461 |

| 862 |

| 5,323 |

|

Total comprehensive loss | | | | | | | (102,014 | ) | (2,492 | ) | (104,506 | ) |

Stock-based compensation expense | — |

| — |

| 5,251 |

| — |

| — |

| — |

| 5,251 |

| — |

| 5,251 |

|

Issuance of shares under share award plans, net of shares withheld for employee taxes | 1 |

| — |

| (8,842 | ) | — |

| — |

| — |

| (8,841 | ) | — |

| (8,841 | ) |

Repurchase of common stock (Note 12) | — |

| — |

| — |

| — |

| — |

| (21,444 | ) | (21,444 | ) | — |

| (21,444 | ) |

Dividends (Note 5) | — |

| — |

| — |

| — |

| (71,091 | ) | — |

| (71,091 | ) | — |

| (71,091 | ) |

Distributions to noncontrolling interests, net | — |

| — |

| — |

| — |

| — |

| — |

| — |

| (3,773 | ) | (3,773 | ) |

Balance, October 31, 2019 | $ | 462 |

| $ | 1 |

| $ | 1,126,492 |

| $ | (27,269 | ) | $ | 582,235 |

| $ | (379,433 | ) | $ | 1,302,488 |

| $ | 219,948 |

| $ | 1,522,436 |

|

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Cash Flows

(In thousands)

(Unaudited)

|

| | | | | | | | |

| | Three Months Ended October 31, |

| | 2019 | | 2018 |

Cash flows from operating activities: | | | | |

Net loss | | $ | (109,829 | ) | | $ | (110,726 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | |

Depreciation and amortization | | 57,845 |

| | 51,043 |

|

Stock-based compensation expense | | 5,251 |

| | 4,753 |

|

Deferred income taxes, net | | (43,979 | ) | | (31,823 | ) |

Other non-cash (income) expense, net | | (797 | ) | | 1,280 |

|

Changes in assets and liabilities: | | | | |

Trade receivables, net | | 184,821 |

| | 157,759 |

|

Inventories, net | | (27,967 | ) | | (26,011 | ) |

Accounts payable and accrued liabilities | | (26,505 | ) | | (14,599 | ) |

Deferred revenue | | 194,597 |

| | 167,727 |

|

Income taxes payable - excess tax benefit from share award exercises | | (2,535 | ) | | (4,582 | ) |

Income taxes payable - other | | (9,405 | ) | | (7,421 | ) |

Other assets and liabilities, net | | (12,158 | ) | | (10,319 | ) |

Net cash provided by operating activities | | 209,339 |

| | 177,081 |

|

Cash flows from investing activities: | |

| | |

Capital expenditures | | (52,621 | ) | | (47,881 | ) |

Acquisition of businesses, net of cash acquired | | (327,581 | ) | | (292,878 | ) |

Other investing activities, net | | 3,448 |

| | 96 |

|

Net cash used in investing activities | | (376,754 | ) | | (340,663 | ) |

Cash flows from financing activities: | |

| | |

Proceeds from borrowings under Vail Holdings Credit Agreement | | 492,625 |

| | 335,625 |

|

Proceeds from borrowings under Whistler Credit Agreement | | — |

| | 7,667 |

|

Repayments of borrowings under Vail Holdings Credit Agreement | | (175,000 | ) | | (80,000 | ) |

Repayments of borrowings under Whistler Credit Agreement | | (7,529 | ) | | — |

|

Employee taxes paid for share award exercises | | (8,842 | ) | | (11,364 | ) |

Dividends paid | | (71,091 | ) | | (59,547 | ) |

Repurchases of common stock | | (21,444 | ) | | (50,000 | ) |

Other financing activities, net | | (10,279 | ) | | (6,486 | ) |

Net cash provided by financing activities | | 198,440 |

| | 135,895 |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash | | 939 |

| | (4,317 | ) |

Net increase (decrease) in cash, cash equivalents and restricted cash | | 31,964 |

| | (32,004 | ) |

Cash, cash equivalents and restricted cash: | | | | |

Beginning of period | | 118,389 |

| | 185,040 |

|

End of period | | $ | 150,353 |

| | $ | 153,036 |

|

Non-cash investing activities: | | | | |

Accrued capital expenditures | | $ | 32,038 |

| | $ | 33,051 |

|

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Notes to Consolidated Condensed Financial Statements

(Unaudited)

| |

1. | Organization and Business |

Vail Resorts, Inc. (“Vail Resorts”) is organized as a holding company and operates through various subsidiaries. Vail Resorts and its subsidiaries (collectively, the “Company”) operate in three business segments: Mountain, Lodging and Real Estate.

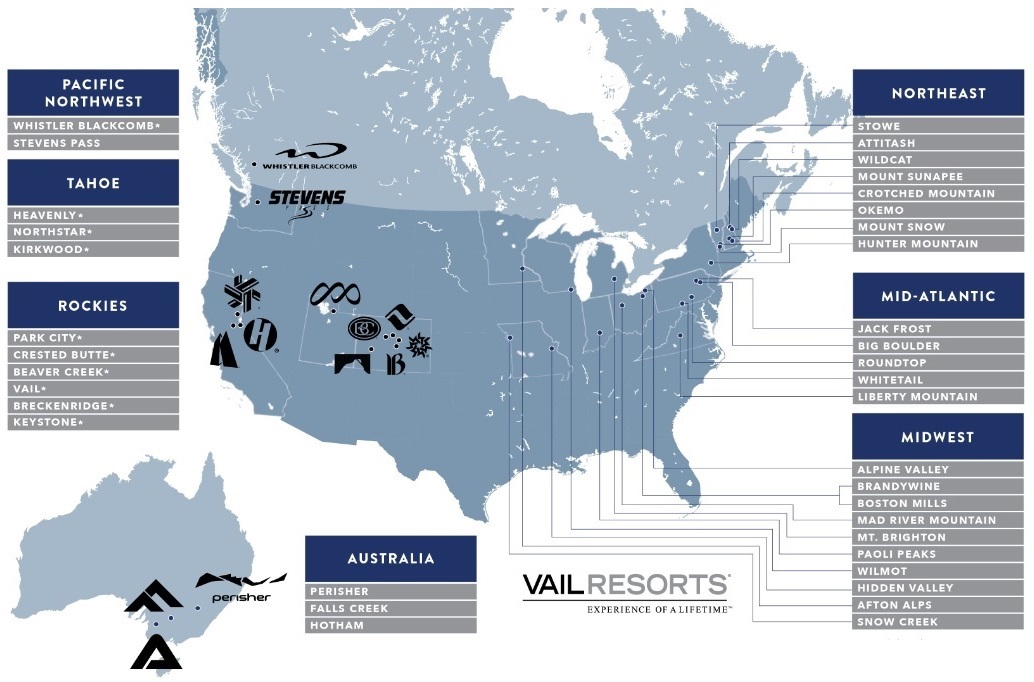

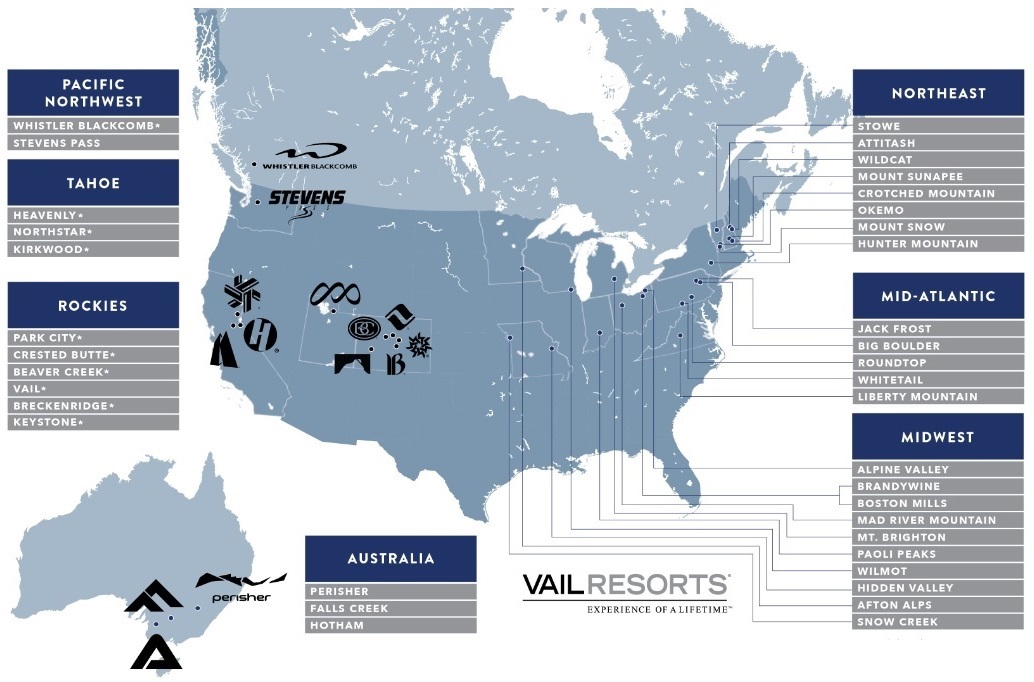

The Company refers to “Resort” as the combination of the Mountain and Lodging segments. In the Mountain segment, the Company operates the following thirty-seven destination mountain resorts and regional ski areas:

*Denotes a destination mountain resort which generally receives a meaningful portion of skier visits from long-distance travelers, as opposed to the Company’s regional ski areas which tend to generate skier visits from their respective local markets.

Additionally, the Mountain segment includes ancillary services, primarily including ski school, dining and retail/rental operations, and for the Company’s Australian resorts, including lodging and transportation operations. Several of the resorts located in the United States (“U.S.”) operate primarily on federal land under the terms of Special Use Permits granted by the U.S. Department of Agriculture Forest Service. The operations of Whistler Blackcomb are conducted on land owned by the government of the Province of British Columbia, Canada within the traditional territory of the Squamish and Lil’wat Nations. The operations of the Company’s Australian resorts are conducted pursuant to long-term leases and licenses on land owned by the governments of New South Wales and Victoria, Australia. Okemo, Mount Sunapee and Stowe operate on land leased from the respective states in which the resorts are located and on land owned by the Company.

In the Lodging segment, the Company owns and/or manages a collection of luxury hotels and condominiums under its RockResorts brand; other strategic lodging properties and a large number of condominiums located in proximity to the Company’s North American mountain resorts; National Park Service (“NPS”) concessionaire properties including the Grand Teton Lodge Company (“GTLC”), which operates destination resorts in Grand Teton National Park; a Colorado resort ground transportation company and mountain resort golf courses.

Vail Resorts Development Company (“VRDC”), a wholly-owned subsidiary, conducts the operations of the Company’s Real Estate segment, which owns, develops and sells real estate in and around the Company’s resort communities.

The Company’s mountain business and its lodging properties at or around the Company’s mountain resorts are seasonal in nature with peak operating seasons primarily from mid-November through mid-April in North America. The operating season at the Company’s Australian resorts, NPS concessionaire properties and golf courses generally occurs from June to early October.

2. Summary of Significant Accounting Policies

Basis of Presentation

Consolidated Condensed Financial Statements— In the opinion of the Company, the accompanying Consolidated Condensed Financial Statements reflect all adjustments necessary to state fairly the Company’s financial position, results of operations and cash flows for the interim periods presented. All such adjustments are of a normal recurring nature. Results for interim periods are not indicative of the results for the entire fiscal year, particularly given the significant seasonality to the Company’s operating cycle. The accompanying Consolidated Condensed Financial Statements should be read in conjunction with the audited Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2019. Certain information and footnote disclosures, including significant accounting policies, normally included in fiscal year financial statements prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) have been condensed or omitted. The Consolidated Condensed Balance Sheet as of July 31, 2019 was derived from audited financial statements.

Use of Estimates— The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the balance sheet date and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

Fair Value of Financial Instruments— The recorded amounts for cash and cash equivalents, receivables, other current assets and accounts payable and accrued liabilities approximate fair value due to their short-term nature. The fair value of amounts outstanding under the Company’s credit agreements and the Employee Housing Bonds (as defined in Note 6, Long-Term Debt) approximate book value due to the variable nature of the interest rate, which is a market rate, associated with the debt. The recorded amounts outstanding under the Company’s EPR Secured Notes and EB-5 Development Notes (each as defined in Note 6, Long-Term Debt), which were assumed by the Company during the three months ended October 31, 2019, approximate fair value as the debt obligations were recorded at fair value in conjunction with the preliminary purchase accounting for the Peak Resorts acquisition (see Note 7, Acquisitions).

Leases— The Company determines if an arrangement is or contains a lease at inception or modification of the arrangement. An arrangement is or contains a lease if there is one or more assets identified and the right to control the use of any identified asset is conveyed to the Company for a period of time in exchange for consideration. Control over the use of an identified asset means the lessee has both the right to obtain substantially all of the economic benefits from the use of the asset and the right to direct the use of the asset. Generally, the Company classifies a lease as a finance lease if the terms of the agreement effectively transfer control of the underlying asset; otherwise, it is classified as an operating lease. For contracts that contain lease and non-lease components, the Company accounts for these components separately. For leases with terms greater than twelve months, the associated lease right-of-use (“ROU”) assets and lease liabilities are recognized at the estimated present value of the future minimum lease payments over the lease term at commencement date. The Company’s leases do not provide a readily determinable implicit rate; therefore, the Company uses an estimated incremental borrowing rate to discount the future minimum lease payments. For leases containing fixed rental escalation clauses, the escalators are factored into the determination of future minimum lease payments. The Company includes options to extend a lease when it is reasonably certain that such options will be exercised. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term. See Note 4, Leases for more information.

Recently Issued Accounting Standards

Adopted Standards

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU’) No. 2016-02, “Leases (Topic 842),” which supersedes “Leases (Topic 840).” The standard requires lessees to recognize the assets and liabilities arising from all leases on the balance sheet, including those classified as operating leases under previous accounting guidance, and to disclose key information about leasing arrangements. The standard also allows for an accounting policy election not to recognize on the balance sheet lease assets and liabilities for leases with a term of 12 months or less. Under the new guidance, lessees are required to recognize a lease liability and an ROU asset on their balance sheets, while lessor accounting is largely unchanged. In July 2018, the FASB released ASU No. 2018-11, “Leases (Topic 842): Targeted Improvements” which, among other items, provided an additional and optional transition method. Under this method, an entity initially applies the standard at

the adoption date, including the election of certain transition reliefs, and recognizes a cumulative effect adjustment to the opening balance of retained earnings in the period of adoption.

The Company adopted ASU No. 2016-02 on August 1, 2019 using the modified retrospective transition method as provided by the standard. In accordance with this transition method, results for reporting periods beginning on August 1, 2019 are presented under the new standard, while prior periods were not adjusted and continue to be reported in accordance with the previously applicable accounting guidance. The Company has elected the package of practical expedients permitted under the transition guidance which allowed the Company to not reassess: (i) whether any existing or expired contracts are or contain leases; (ii) lease classification of any expired or existing leases; or (iii) initial direct costs for any existing leases. The Company has made an accounting policy election to not record leases on the balance sheet with an initial term of 12 months or less. The Company will recognize those lease payments in the Consolidated Condensed Statements of Operations on a straight-line basis over the lease term. Additionally, the Company has elected the practical expedient to not evaluate existing or expired land easements that were not previously accounted for as leases. At adoption, the Company was not able to determine the interest rate implicit in its leases; therefore, for existing operating leases, the lease liability was measured using the Company’s estimated incremental borrowing rate. For existing leases, the incremental borrowing rate used was based on the remaining lease term at the adoption date. For leases with minimum lease payments adjusted periodically for inflation, the lease liability was measured using the minimum lease payments adjusted by the inflation index at the adoption date.

On August 1, 2019, as a result of adopting the standard, the Company recorded $225.6 million of operating ROU assets and $258.0 million of related total operating lease liabilities in the Consolidated Condensed Balance Sheet (of which $223.1 million was recorded to operating lease liabilities and $34.9 million was recorded to accounts payable and accrued liabilities). As a result of the adoption, the Company reclassified $32.4 million of unfavorable lease obligations, deferred rent credits and other similar amounts to the operating ROU assets balance, primarily from other long-term liabilities, which reduced the amount recognized as operating ROU assets to $225.6 million. The adoption of the new lease standard did not result in a cumulative effect adjustment to beginning retained earnings, and did not materially affect the Company’s Consolidated Condensed Statement of Operations or Consolidated Condensed Statement of Cash Flows for the three months ended October 31, 2019. The Company’s Canyons finance lease was not affected by the implementation of this standard as the arrangement is classified and recorded as a finance lease arrangement under both the previous and new accounting guidance.

3. Revenues

Disaggregation of Revenues

The following table presents net revenues disaggregated by segment and major revenue type for the three months ended October 31, 2019 and 2018 (in thousands):

|

| | | | | | | | |

| | Three Months Ended October 31, |

| | 2019 | | 2018 |

Mountain net revenue: | | | | |

Lift | | $ | 41,829 |

| | $ | 24,685 |

|

Ski School | | 8,534 |

| | 4,272 |

|

Dining | | 21,629 |

| | 18,292 |

|

Retail/Rental | | 47,915 |

| | 43,342 |

|

Other | | 60,925 |

| | 54,415 |

|

Total Mountain net revenue | | $ | 180,832 |

| | $ | 145,006 |

|

Lodging net revenue: | | | | |

Owned hotel rooms | | $ | 19,946 |

| | $ | 19,599 |

|

Managed condominium rooms | | 14,740 |

| | 11,118 |

|

Dining | | 18,143 |

| | 16,129 |

|

Transportation | | 2,351 |

| | 2,474 |

|

Golf | | 10,221 |

| | 9,150 |

|

Other | | 14,166 |

| | 12,777 |

|

| | 79,567 |

| | 71,247 |

|

Payroll cost reimbursements | | 3,191 |

| | 3,653 |

|

Total Lodging net revenue | | $ | 82,758 |

| | $ | 74,900 |

|

Total Resort net revenue | | $ | 263,590 |

| | $ | 219,906 |

|

Total Real Estate net revenue | | 4,180 |

| | 98 |

|

Total net revenue | | $ | 267,770 |

| | $ | 220,004 |

|

Contract Balances

Deferred revenue balances of a short-term nature were $549.1 million and $335.7 million as of October 31, 2019 and July 31, 2019, respectively. Deferred revenue balances of a long-term nature, comprised primarily of long-term private club initiation fee revenue, were $125.3 million and $124.3 million as of October 31, 2019 and July 31, 2019, respectively. For the three months ended October 31, 2019, the Company recognized approximately $34.6 million of revenue that was included in the deferred revenue balance as of July 31, 2019. As of October 31, 2019, the weighted average remaining period over which revenue for unsatisfied performance obligations on long-term private club contracts will be recognized was approximately 16 years. Trade receivable balances were $87.3 million and $270.9 million as of October 31, 2019 and July 31, 2019, respectively.

Costs to Obtain Contracts with Customers

As of October 31, 2019, $11.1 million of costs to obtain contracts with customers were recorded within other current assets on the Company’s Consolidated Condensed Balance Sheet. The amounts capitalized will be subject to amortization generally beginning in the second quarter of fiscal 2020, commensurate with the revenue recognized for skier visits, and will be recorded within Mountain and Lodging operating expenses on the Company’s Consolidated Condensed Statement of Operations.

4. Leases

The Company’s operating leases consist primarily of commercial and retail space, office space, employee residential units, vehicles and other equipment. The Company determines if an arrangement is or contains a lease at contract inception or modification. The Company’s lease contracts generally range from 1 year to 60 years, with some lease contracts containing one or more lease extension options, exercisable at the Company’s discretion. The Company generally does not include these lease extension options in the initial lease term as it is not reasonably certain that it will exercise such options at contract inception. In addition, certain lease arrangements contain fixed and variable lease payments. The variable lease payments are primarily contingent rental payments

based on: (i) a percentage of revenue related to the leased property; (ii) payments based on a percentage of sales over contractual levels; or (iii) lease payments adjusted for changes in an index or market value. These variable lease payments are typically recognized when the underlying event occurs and are included in operating expenses in the Company's Consolidated Condensed Statements of Operations in the same line item as the expense arising from fixed lease payments. The Company’s lease agreements may also include non-lease components, such as common area maintenance and insurance, which are accounted for separately as non-lease components. Future lease payments that are contingent and non-lease components are not included in the measurement of the operating lease liability. The Company’s lease agreements do not contain any material residual value guarantees or restrictive covenants. Lease expense related to lease payments is recognized on a straight-line basis over the term of the lease.

The Company’s leases do not provide a readily determinable implicit rate. As a result, the Company measures the lease liability using an estimated incremental borrowing rate which is intended to reflect the rate of interest the Company would pay on a collateralized basis to borrow an amount equal to the lease payments under similar terms. The Company applies the estimated incremental borrowing rates at a portfolio level based on the economic environment associated with the lease.

The Company uses the long-lived assets impairment guidance to determine recognition and measurement of an ROU asset impairment, if any. The Company monitors for events or changes in circumstances that require a reassessment.

The components of lease expense for the three months ended October 31, 2019, were as follows (in thousands):

|

| | | | |

| | Three Months Ended October 31, 2019 |

Finance leases: | | |

Amortization of the finance ROU assets | | $ | 2,438 |

|

Interest on lease liabilities | | $ | 8,509 |

|

Operating leases: | | |

Operating lease expense |

| $ | 10,037 |

|

Short-term lease expense1 | | $ | 2,353 |

|

Variable lease expense |

| $ | 843 |

|

1 Short-term lease expense is attributable to leases with terms of 12 months or less which are not included within the Company’s Consolidated Condensed Balance Sheet.

The following table presents the supplemental cash flow information associated with the Company’s leasing activities for the three months ended October 31, 2019 (in thousands):

|

| | | | |

| | Three Months Ended October 31, 2019 |

Cash flow supplemental information: | | |

Operating cash outflows for operating leases | | $ | 11,218 |

|

Operating cash outflows for finance leases | | $ | 1,049 |

|

Financing cash outflows for finance leases | | $ | 5,387 |

|

Weighted-average remaining lease terms and discount rates are as follows:

|

| | | |

| | As of October 31, 2019 |

Weighted-average remaining lease term (in years) | | |

Operating leases | | 10.9 |

|

Finance leases | | 43.6 |

|

Weighted-average discount rate | | |

Operating leases | | 4.5 | % |

Finance leases | | 10.0 | % |

Future minimum lease payments for operating and finance leases as of October 31, 2019 reflected by fiscal year (August 1 through July 31) are as follows (in thousands):

|

| | | | | | | |

| Operating Leases | | Finance Leases |

2020 (November 2019 through July 2020) | $ | 38,383 |

| | $ | 21,190 |

|

2021 | 44,188 |

| | 28,818 |

|

2022 | 41,256 |

| | 29,394 |

|

2023 | 36,656 |

| | 29,982 |

|

2024 | 32,899 |

| | 30,582 |

|

Thereafter | 165,267 |

| | 1,805,047 |

|

Total future minimum lease payments | 358,649 |

| | 1,945,013 |

|

Less amount representing interest | (92,331 | ) | | (1,603,309 | ) |

Total lease liabilities | $ | 266,318 |

| | $ | 341,704 |

|

Future minimum lease payments in accordance with Topic 840 as of July 31, 2019, reflected by fiscal year, are as follows (in thousands):

|

| | | | | | | |

| Operating Leases | | Capital Leases |

2020 | $ | 44,984 |

| | $ | 28,253 |

|

2021 | 42,512 |

| | 28,818 |

|

2022 | 39,440 |

| | 29,394 |

|

2023 | 34,840 |

| | 29,982 |

|

2024 | 30,836 |

| | 30,582 |

|

Thereafter | 142,526 |

| | 1,805,048 |

|

Total future minimum lease payments | $ | 335,138 |

| | $ | 1,952,077 |

|

Less amount representing interest | | | (1,611,816 | ) |

Net future minimum lease payments | | | $ | 340,261 |

|

The current portion of operating lease liabilities of approximately $35.1 million as of October 31, 2019 is recorded within accounts payables and accrued liabilities in the Consolidated Condensed Balance Sheet. Finance lease liabilities are recorded within long-term debt, net in the Consolidated Condensed Balance Sheets.

The Canyons finance lease obligation represents the only material finance lease entered into by the Company as of October 31, 2019. As of October 31, 2019, the Company has recorded $125.1 million of finance lease ROU assets in connection with the Canyons lease, net of $58.5 million of accumulated amortization, which is included within property, plant and equipment in the Company’s Consolidated Condensed Balance Sheet.

Earnings per Share

Basic earnings per share (“EPS”) excludes dilution and is computed by dividing net loss attributable to Vail Resorts stockholders by the weighted-average shares outstanding during the period. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised, resulting in the issuance of shares of common stock that would then share in the earnings of Vail Resorts.

In connection with the Company’s acquisition of Whistler Blackcomb in October 2016, the Company issued consideration in the form of shares of Vail Resorts common stock (the “Vail Shares”) and shares of the Company’s wholly-owned Canadian subsidiary (“Exchangeco”). Whistler Blackcomb shareholders elected to receive 3,327,719 Vail Shares and 418,095 shares of Exchangeco (the “Exchangeco Shares”). Both Vail Shares and Exchangeco Shares have a par value of $0.01 per share, and Exchangeco Shares, while outstanding, are substantially the economic equivalent of Vail Shares and are exchangeable, at any time prior to the seventh anniversary of the closing of the acquisition, into Vail Shares. The Company’s calculation of weighted-average shares outstanding includes the Exchangeco Shares.

Presented below is basic and diluted EPS for the three months ended October 31, 2019 and 2018 (in thousands, except per share amounts):

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, |

| | 2019 | | 2018 |

| | Basic | | Diluted | | Basic | | Diluted |

Net loss per share: | | | | | | | | |

Net loss attributable to Vail Resorts | | $ | (106,475 | ) | | $ | (106,475 | ) | | $ | (107,795 | ) | | $ | (107,795 | ) |

Weighted-average Vail Shares outstanding | | 40,286 |

| | 40,286 |

| | 40,447 |

| | 40,447 |

|

Weighted-average Exchangeco Shares outstanding | | 56 |

| | 56 |

| | 58 |

| | 58 |

|

Total Weighted-average shares outstanding | | 40,342 |

| | 40,342 |

| | 40,505 |

| | 40,505 |

|

Effect of dilutive securities | | — |

| | — |

| | — |

| | — |

|

Total shares | | 40,342 |

| | 40,342 |

| | 40,505 |

| | 40,505 |

|

Net loss per share attributable to Vail Resorts | | $ | (2.64 | ) | | $ | (2.64 | ) | | $ | (2.66 | ) | | $ | (2.66 | ) |

The Company computes the effect of dilutive securities using the treasury stock method and average market prices during the period. The number of shares issuable upon the exercise of share based awards excluded from the calculation of diluted EPS because the effect of their inclusion would have been anti-dilutive totaled approximately 0.7 million and 1.0 million for the three months ended October 31, 2019 and 2018, respectively.

Dividends

The Company paid cash dividends of $1.76 and $1.47 per share ($71.1 million and $59.5 million in the aggregate) during the three months ended October 31, 2019 and 2018, respectively. On December 5, 2019, the Company’s Board of Directors declared a quarterly cash dividend of $1.76 per share, for Vail Shares, payable on January 9, 2020 to stockholders of record as of December 26, 2019. Additionally, a Canadian dollar equivalent dividend on the Exchangeco Shares will be payable on January 9, 2020 to the shareholders of record on December 26, 2019.

6. Long-Term Debt

Long-term debt, net as of October 31, 2019, July 31, 2019 and October 31, 2018 is summarized as follows (in thousands):

|

| | | | | | | | | | | | | | |

| | Maturity | | October 31, 2019 | | July 31, 2019 | | October 31, 2018 |

Vail Holdings Credit Agreement term loan (a) | | 2024 | | $ | 1,250,000 |

| | $ | 914,375 |

| | $ | 950,000 |

|

Vail Holdings Credit Agreement revolver (a) | | 2024 | | 190,000 |

| | 208,000 |

| | 120,000 |

|

Whistler Credit Agreement revolver (b) | | 2023 | | 37,962 |

| | 45,454 |

| | 72,170 |

|

EPR Secured Notes (c) | | 2034-2036 | | 114,162 |

| | — |

| | — |

|

EB-5 Development Notes (d) | | 2021 | | 52,000 |

| | — |

| | — |

|

Employee housing bonds | | 2027-2039 | | 52,575 |

| | 52,575 |

| | 52,575 |

|

Canyons obligation | | 2063 | | 341,704 |

| | 340,261 |

| | 335,947 |

|

Other | | 2020-2032 | | 19,583 |

| | 19,465 |

| | 8,821 |

|

Total debt | | | | 2,057,986 |

| | 1,580,130 |

| | 1,539,513 |

|

Less: Unamortized premiums, discounts and debt issuance costs | | | | (10,878 | ) | | 3,870 |

| | 4,063 |

|

Less: Current maturities (e) | | | | 63,807 |

| | 48,516 |

| | 48,482 |

|

Long-term debt, net | | | | $ | 2,005,057 |

| | $ | 1,527,744 |

|

| $ | 1,486,968 |

|

| |

(a) | On September 23, 2019, in order to fund the acquisition of Peak Resorts, Inc. (“Peak Resorts”), which included the prepayment of certain portions of the outstanding debt and lease obligations of Peak Resorts contemporaneous with the closing of the transaction (see Note 7, Acquisitions), the Company’s wholly-owned subsidiary, Vail Holdings, Inc. (“VHI”), entered into the Second Amendment to the Eighth Amended and Restated Credit Agreement (the “Vail Holdings Credit Agreement”), with Bank of America, N.A., as administrative agent, and other lenders named therein, through which those lenders agreed to provide an additional $335.6 million in incremental term loans and agreed, on behalf of all lenders, to extend the maturity date for the outstanding term loans and revolver facility under the Vail Holdings Credit Agreement to |

September 23, 2024. No other material terms of the Vail Holdings Credit Agreement were altered under the amendment. As of October 31, 2019, the Vail Holdings Credit Agreement consists of a $500.0 million revolving credit facility and a $1.25 billion term loan facility. The term loan facility is subject to quarterly amortization of principal of approximately $15.6 million, which will begin on January 31, 2020, in equal installments, for a total of five percent of principal payable in each year and the final payment of all amounts outstanding, plus accrued and unpaid interest due in September 2024. The proceeds of the loans made under the Vail Holdings Credit Agreement may be used to fund the Company’s working capital needs, capital expenditures, acquisitions, investments and other general corporate purposes, including the issuance of letters of credit. Borrowings under the Vail Holdings Credit Agreement, including the term loan facility, bear interest annually at LIBOR plus 1.25% as of October 31, 2019 (3.04% as of October 31, 2019). Interest rate margins may fluctuate based upon the ratio of the Company’s Net Funded Debt to Adjusted EBITDA on a trailing four-quarter basis. The Vail Holdings Credit Agreement also includes a quarterly unused commitment fee, which is equal to a percentage determined by the Net Funded Debt to Adjusted EBITDA ratio, as each such term is defined in the Vail Holdings Credit Agreement, multiplied by the daily amount by which the Vail Holdings Credit Agreement commitment exceeds the total of outstanding loans and outstanding letters of credit (0.25% as of October 31, 2019). During the three months ended October 31, 2019, the Company entered into an interest rate swap agreement to hedge the cash flows of $100.0 million in principal amount of its Vail Holdings Credit Agreement.

| |

(b) | Whistler Mountain Resort Limited Partnership (“Whistler LP”) and Blackcomb Skiing Enterprises Limited Partnership (“Blackcomb LP”), together “The WB Partnerships,” are party to a credit agreement, dated as of November 12, 2013 (as amended, the “Whistler Credit Agreement”), by and among Whistler LP, Blackcomb LP, certain subsidiaries of Whistler LP and Blackcomb LP party thereto as guarantors (the “Whistler Subsidiary Guarantors”), the financial institutions party thereto as lenders and The Toronto-Dominion Bank, as administrative agent. The Whistler Credit Agreement consists of a C$300.0 million revolving credit facility. As of October 31, 2019, all borrowings under the Whistler Credit Agreement were made in Canadian dollars and by way of the issuance of bankers’ acceptances plus 1.75% (approximately 3.76% as of October 31, 2019). The Whistler Credit Agreement also includes a quarterly unused commitment fee based on the Consolidated Total Leverage Ratio, which as of October 31, 2019 is equal to 0.3937% per annum. |

| |

(c) | On September 24, 2019, in conjunction with the acquisition of Peak Resorts (see Note 7, Acquisitions), the Company assumed various secured borrowings (the “EPR Secured Notes”) under the master credit and security agreements and other related agreements, as amended, (collectively, the “EPR Agreements”) with EPT Ski Properties, Inc. and its affiliates (“EPR”). The EPR Secured Notes include the following: |

| |

i. | The Alpine Valley Secured Note. The $4.6 million Alpine Valley Secured Note provides for interest payments through its maturity on December 1, 2034. As of October 31, 2019, interest on this note accrued at a rate of 11.04%. |

| |

ii. | The Boston Mills/Brandywine Secured Note. The $23.3 million Boston Mills/Brandywine Secured Note provides for interest payments through its maturity on December 1, 2034. As of October 31, 2019, interest on this note accrued at a rate of 10.75%. |

| |

iii. | The Jack Frost/Big Boulder Secured Note. The $14.3 million Jack Frost/Big Boulder Secured Note provides for interest payments through its maturity on December 1, 2034. As of October 31, 2019, interest on this note accrued at a rate of 10.75%. |

| |

iv. | The Mount Snow Secured Note. The $51.1 million Mount Snow Secured Note provides for interest payments through its maturity on December 1, 2034. As of October 31, 2019, interest on this note accrued at a rate of 11.61%. |

| |

v. | The Hunter Mountain Secured Note. The $21.0 million Hunter Mountain Secured Note provides for interest payments through its maturity on January 5, 2036. As of October 31, 2019, interest on this note accrued at a rate of 8.43%. |

The EPR Secured Notes are secured by all or substantially all of the assets of Peak Resorts and its subsidiaries, including mortgages on the Alpine Valley, Boston Mills, Brandywine, Jack Frost, Big Boulder, Mount Snow and Hunter Mountain ski resorts. The EPR Secured Notes bear interest at specified interest rates, as discussed above, which are subject to increase each year by the lesser of (i) three times the percentage increase in the Consumer Price Index or (ii) a capped index (the “Capped CPI Index”), which is 1.75% for the Hunter Mountain Secured Note and 1.50% for all other notes. The EPR Agreements provide for affirmative and negative covenants that restrict, among other things, the ability of Peak Resorts and its subsidiaries to incur indebtedness, dispose of assets, make distributions and make investments. In addition, the EPR Agreements include restrictive covenants, including maximum leverage ratio and consolidated fixed charge ratio. An additional contingent interest payment would be due to EPR if, on a calendar year basis, the gross receipts from the properties securing any of the individual EPR Secured Notes (the “Gross Receipts”) are more than the result (the “Interest Quotient”) of dividing the total interest charges for the EPR Secured Notes by a specified percentage rate (the “Additional Interest Rate”). In such a case, the additional interest payment would equal the difference between the Gross Receipts and the

Interest Quotient multiplied by the Additional Interest Rate. This calculation is made on an aggregated basis for the notes secured by the Jack Frost, Big Boulder, Boston Mills, Brandywine and Alpine Valley ski resorts, where the Additional Interest Rate is 10.0%; on a standalone basis for the note secured by the Company’s Mount Snow ski resort, where the Additional Interest Rate is 12.0%; and on a standalone basis for the note secured by the Company’s Hunter Mountain ski resort, where the Additional Interest Rate is 8.0%. Peak Resorts does not have the right to prepay the EPR Secured Notes. The EPR Secured Notes were recorded at their estimated fair value in conjunction with the acquisition of Peak Resorts on September 24, 2019, and as such their respective carrying values approximate fair value as of October 31, 2019. The EPR Agreements grant EPR certain other rights including (i) the option to purchase the Boston Mills, Brandywine, Jack Frost, Big Boulder or Alpine Valley resorts, which is exercisable no sooner than two years and no later than one year prior to the maturity dates of the applicable EPR Secured Note for such properties, with any closings to be held on the applicable maturity dates; and, if EPR exercises the purchase option, EPR will enter into an agreement with the Company for the lease of each acquired property for an initial term of 20 years, plus options to extend the lease for two additional periods of ten years each; (ii) a right of first refusal through 2021, subject to certain conditions, to provide all or a portion of the financing associated with any purchase, ground lease, sale/leaseback, management or financing transaction contemplated by Peak Resorts with respect to any new or existing ski resort properties; and (iii) a right of first refusal through 2021 to purchase the Company’s Attitash ski resort in the event the Company were to desire to sell the Attitash ski resort. To date, EPR has not exercised any such purchase options.

In addition, Peak Resorts is required to, maintain a debt service reserve account which amounts are applied to fund interest payments and other amounts due and payable to EPR. As of October 31, 2019 the Company had funded the debt service reserve account in an amount equal to approximately $2.5 million, which was included in other current assets in the Company’s Consolidated Condensed Balance Sheet.

| |

(d) | Peak Resorts serves as the general partner for two limited partnerships, Carinthia Group 1, LP and Carinthia Group 2, LP (together, the “Carinthia Partnerships”), which were formed to raise $52.0 million through the Immigrant Investor Program administered by the U.S. Citizenship and Immigration Services (“USCIS”), pursuant to the Immigration and Nationality Act (the “EB-5 Program”). The EB-5 Program was created to stimulate the U.S. economy through the creation of jobs and capital investments in U.S. companies by foreign investors. The program allocates immigrant visas to qualified individuals (“EB-5 Investors”) seeking lawful permanent resident status based on their investment in a U.S commercial enterprise. On December 27, 2016, Peak Resorts borrowed $52.0 million from the Carinthia Partnerships to fund two capital projects at Mount Snow. The amounts were borrowed through two loan agreements, which provided $30.0 million and $22.0 million (together, the “EB-5 Development Notes”). Amounts outstanding under the EB-5 Development Notes accrue simple interest at a fixed rate of 1.0% per annum until the maturity date, which is December 27, 2021, subject to an extension of up to two additional years at the option of the borrowers, with lender consent. If the maturity date is extended, amounts outstanding under the EB-5 Development Notes will accrue simple interest at a fixed rate of 7.0% per annum during the first year of extension and a fixed rate of 10.0% per annum during the second year of extension. Upon an event of default (as defined), amounts outstanding under the EB-5 Development Notes shall bear interest at the rate of 5.0% per annum, subject to the extension increases. While the EB-5 Development Notes are outstanding, Peak Resorts is restricted from taking certain actions without the consent of the lenders, including, but not limited to, transferring or disposing of the properties or assets financed with loan proceeds. In addition, Peak Resorts is prohibited from prepaying outstanding amounts owed if such prepayment would jeopardize any of the EB-5 Investors from being admitted to the U.S. via the EB-5 Program. |

| |

(e) | Current maturities represent principal payments due in the next 12 months. |

Aggregate maturities of debt outstanding as of October 31, 2019 reflected by fiscal year (August 1 through July 31) are as follows (in thousands):

|

| | | |

| Total |

2020 (November 2019 through July 2020) | $ | 53,829 |

|

2021 | 63,640 |

|

2022 | 115,919 |

|

2023 | 63,719 |

|

2024 | 101,756 |

|

Thereafter | 1,659,123 |

|

Total debt | $ | 2,057,986 |

|

The Company recorded gross interest expense of $22.7 million and $18.6 million for the three months ended October 31, 2019 and 2018, respectively, of which $0.4 million and $0.3 million, respectively, were amortization of deferred financing costs. The

Company was in compliance with all of its financial and operating covenants required to be maintained under its debt instruments for all periods presented.

In connection with the Company’s acquisition of Whistler Blackcomb in October 2016, VHI funded a portion of the purchase price through an intercompany loan to Whistler Blackcomb of $210.0 million, which was effective as of November 1, 2016, and requires foreign currency remeasurement to Canadian dollars, the functional currency for Whistler Blackcomb. As a result, foreign currency fluctuations associated with the loan are recorded within the Company’s results of operations. The Company recognized approximately $0.4 million and ($2.3 million), respectively, of non-cash foreign currency gain (loss) on the intercompany loan to Whistler Blackcomb for the three months ended October 31, 2019 and 2018 on the Company’s Consolidated Condensed Statements of Operations.

7. Acquisitions

Peak Resorts

On September 24, 2019, the Company, through a wholly-owned subsidiary, acquired 100 percent of the outstanding stock of Peak Resorts, Inc. (“Peak Resorts”) at a purchase price of $11.00 per share or approximately $264.5 million. In addition, contemporaneous with the closing of the transaction, Peak Resorts was required to pay approximately $70.2 million of certain outstanding debt instruments and lease obligations in order to complete the transaction. Accordingly, the total purchase price, including the repayment of certain outstanding debt instruments and lease obligations, was approximately $334.7 million, for which the Company borrowed approximately $335.6 million under the Vail Holdings Credit Agreement (see Note 6, Long-Term Debt) to fund the acquisition, repayment of debt instruments and lease obligations, and associated acquisition related expenses. The newly acquired resorts include: Mount Snow in Vermont; Hunter Mountain in New York; Attitash Mountain Resort, Wildcat Mountain and Crotched Mountain in New Hampshire; Liberty Mountain Resort, Roundtop Mountain Resort, Whitetail Resort, Jack Frost and Big Boulder in Pennsylvania; Alpine Valley, Boston Mills, Brandywine and Mad River Mountain in Ohio; Hidden Valley and Snow Creek in Missouri; and Paoli Peaks in Indiana. The Company assumed the Special Use Permits from the U.S. Forest Service for Attitash, Mount Snow and Wildcat Mountain, and assumed the land leases for Mad River and Paoli Peaks. The acquisition included the mountain operations of the resorts, including base area skier services (food and beverage, retail and rental, lift ticket offices and ski and snowboard school facilities), as well as lodging operations at certain resorts.

The following summarizes the purchase consideration and the preliminary purchase price allocation to estimated fair values of the identifiable assets acquired and liabilities assumed at the date the transaction was effective (in thousands):

|

| | | |

| Acquisition Date Estimated Fair Value |

Current assets | $ | 18,976 |

|

Property, plant and equipment | 425,604 |

|

Goodwill | 146,361 |

|

Identifiable intangible assets | 19,219 |

|

Other assets | 16,809 |

|

Assumed long-term debt | (181,714 | ) |

Other liabilities | (110,525 | ) |

Net assets acquired | $ | 334,730 |

|

Identifiable intangible assets acquired in the transaction were primarily related to trade names and property management contracts. The process of estimating the fair value of the property, plant, and equipment includes the use of certain estimates and assumptions related to replacement cost and physical condition at the time of acquisition. The excess of the purchase price over the aggregate estimated fair values of the assets acquired and liabilities assumed was recorded as goodwill. The goodwill recognized is attributable primarily to expected synergies, the assembled workforce of the resorts and other factors, and is not expected to be deductible for income tax purposes. The Company assumed various debt obligations of Peak Resorts, which were recorded at their respective estimated fair values as of the acquisition date (see Note 6, Long-Term Debt). The Company recognized $3.2 million of acquisition related expenses associated with the transaction within Mountain and Lodging operating expense in its Consolidated Condensed Statement of Operations for the three months ended October 31, 2019. The operating results of Peak Resorts are reported within the Mountain and Lodging segments prospectively from the date of acquisition.

Falls Creek and Hotham Resorts

On April 4, 2019, the Company, through a wholly-owned subsidiary, acquired ski field leases and related infrastructure used to operate two resorts in Victoria, Australia. The Company acquired Australian Alpine Enterprises Holdings Pty. Ltd and all related corporate entities that operate the Falls Creek and Hotham resorts from Living and Leisure Australia Group, a subsidiary of Merlin Entertainments, for a cash purchase price of approximately AU$178.9 million ($127.4 million), after adjustments for certain agreed-upon terms, including an increase in the purchase price for operating losses incurred for the period from December 29, 2018 through closing. The acquisition included the mountain operations of both resorts, including base area skier services (ski and snowboard school facilities, retail and rental, reservation and property management operations).

The following summarizes the purchase consideration and the preliminary purchase price allocation to estimated fair values of the identifiable assets acquired and liabilities assumed at the date the transaction was effective (in thousands):

|

| | | |

| Acquisition Date Estimated Fair Value |

Current assets | $ | 6,986 |

|

Property, plant and equipment | 54,889 |

|

Goodwill | 71,538 |

|

Identifiable intangible assets and other assets | 5,833 |

|

Liabilities | (11,894 | ) |

Net assets acquired | $ | 127,352 |

|