|

|

|

Annual

Report |

|

December 31, 2010

|

|

CHURCHILL

TAX-FREE FUND OF

KENTUCKY

|

|

A tax-free income investment

|

|

|

Serving Kentucky Investors For More Than Two Decades

Churchill Tax-Free Fund of Kentucky

“Getting All the Pieces to Fit”

|

|

|

|

|

|

Lacy B. Herrmann

Founder and Chairman Emeritus |

Diana P. Herrmann

President |

|

Serving Kentucky Investors For More Than Two Decades

Churchill Tax-Free Fund of Kentucky

ANNUAL REPORT

Management Discussion

|

|

|

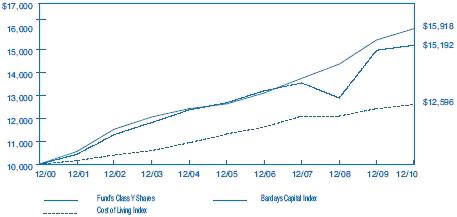

Average Annual Total Return

|

||||||||||||||||

|

for periods ended December 31, 2010

|

||||||||||||||||

|

Since

|

||||||||||||||||

|

Class and Inception Date

|

1 Year

|

5 Years

|

10 Years

|

Inception

|

||||||||||||

|

Class A (commenced operations on 5/21/87)

|

||||||||||||||||

|

With Maximum Sales Charge

|

(2.69 | )% | 2.70 | % | 3.69 | % | 5.47 | % | ||||||||

|

Without Sales Charge

|

1.38 | 3.54 | 4.11 | 5.66 | ||||||||||||

|

Class C (commenced operations on 4/01/96)

|

||||||||||||||||

|

With CDSC

|

(0.58 | ) | 2.66 | 3.23 | 3.61 | |||||||||||

|

Without CDSC

|

0.42 | 2.66 | 3.23 | 3.61 | ||||||||||||

|

Class I (commenced operations on 8/06/01)

|

||||||||||||||||

|

No Sales Charge

|

1.13 | 3.39 | n/a | 3.85 | ||||||||||||

|

Class Y (commenced operations on 4/01/96)

|

||||||||||||||||

|

No Sales Charge

|

1.44 | 3.67 | 4.27 | 4.63 | ||||||||||||

|

Barclays Capital Index

|

3.21 | 4.73 | 4.76 | 5.80 |

(Class A)

|

|||||||||||

| 5.02 |

(Class C&Y)

|

|||||||||||||||

| 4.58 |

(Class I)

|

|||||||||||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

General Obligation Bonds (4.3%)

|

(unaudited)

|

Value

|

||||||

| $ | 500,000 |

2.000%, 06/01/15

|

Aa2/AA-

|

$ | 503,155 | ||||

|

Campbell County, Kentucky Public Project

|

|||||||||

| 1,625,000 |

4.375%, 12/01/25 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

1,603,046 | ||||||

|

Henderson County, Kentucky

|

|||||||||

| 330,000 |

3.000%, 11/01/20

|

Aa3/NR

|

313,833 | ||||||

|

Highland Heights, Kentucky

|

|||||||||

| 235,000 |

4.500%, 12/01/25

|

A1/NR

|

235,317 | ||||||

| 370,000 |

4.600%, 12/01/27

|

A1/NR

|

368,265 | ||||||

| 500,000 |

5.125%, 12/01/38

|

A1/NR

|

486,590 | ||||||

|

Kenton County, Kentucky Public Project

|

|||||||||

| 500,000 |

4.625%, 04/01/34

|

Aa2/NR

|

471,740 | ||||||

|

Lexington-Fayette Urban County, Kentucky

|

|||||||||

| 4,175,000 |

4.250%, 05/01/23 NPFG Insured

|

Aa2/AA

|

4,215,581 | ||||||

|

Louisville & Jefferson County, Kentucky

|

|||||||||

| 955,000 |

4.200%, 11/01/22 NPFG Insured

|

Aa1/AA+****

|

970,251 | ||||||

|

Wilder, Kentucky

|

|||||||||

| 1,090,000 |

4.900%, 12/01/29 AGMC Insured

|

Aa3/AA+

|

1,103,429 | ||||||

|

Total General Obligation Bonds

|

10,271,207 | ||||||||

|

Revenue Bonds (96.1%)

|

|||||||||

|

State Agencies (15.1%)

|

|||||||||

|

Kentucky Area Development District Financing

|

|||||||||

| 500,000 |

5.000%, 12/01/23 LOC Wachovia Bank

|

NR/AA

|

529,800 | ||||||

|

Kentucky Asset & Liability Commission Federal

|

|||||||||

|

Highway Notes

|

|||||||||

| 1,000,000 |

5.000%, 09/01/22 Series A

|

Aa2/AA

|

1,077,730 | ||||||

|

Kentucky Asset & Liability Commission University

|

|||||||||

|

of Kentucky Project

|

|||||||||

| 1,500,000 |

4.500%, 10/01/22 NPFG FGIC Insured

|

Aa2/AA-

|

1,521,000 | ||||||

| 500,000 |

5.000%, 10/01/25 Series B

|

Aa2/AA-

|

517,300 | ||||||

| 750,000 |

5.000%, 10/01/26 Series B

|

Aa2/AA-

|

770,662 | ||||||

| 1,000,000 |

5.000%, 10/01/27 Series B

|

Aa2/AA-

|

1,021,720 | ||||||

|

Kentucky Economic Development Finance

|

|||||||||

|

Authority Louisville Arena Project

|

|||||||||

| 5,725,000 |

5.750%, 12/01/28 AGMC Insured

|

Aa3/AA+

|

5,937,512 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

State Agencies (continued)

|

|||||||||

|

Kentucky Infrastructure Authority

|

|||||||||

| $ | 230,000 |

5.000%, 06/01/2

|

Aa2/A+

|

$ | 232,298 | ||||

|

Kentucky State Property and Buildings Commission

|

|||||||||

| 1,000,000 |

5.000%, 11/01/17 AMBAC Insured

|

Aa3/A+

|

1,073,910 | ||||||

| 6,000,000 |

5.250%, 10/01/18

|

Aa2/A+

|

6,047,400 | ||||||

| 1,925,000 |

5.000%, 10/01/19

|

Aa2/A+

|

1,937,686 | ||||||

| 3,000,000 |

5.000%, 11/01/19 AGMC Insured

|

Aa2/AA+

|

3,116,880 | ||||||

| 1,020,000 |

5.000%, 11/01/20

|

Aa2/A+

|

1,094,960 | ||||||

| 1,375,000 |

5.375%, 11/01/23

|

Aa2/A+

|

1,474,110 | ||||||

| 2,820,000 |

5.750%, 04/01/24 Project 91

|

Aa3/A+

|

3,010,378 | ||||||

| 1,300,000 |

5.250%, 02/01/28 AGMC Insured

|

Aa2/AA+

|

1,331,720 | ||||||

| 750,000 |

5.500%, 11/01/28

|

Aa2/A+

|

779,880 | ||||||

| 2,500,000 |

5.000%, 02/01/29 AGMC Insured

|

Aa2/AA+

|

2,476,425 | ||||||

| 2,625,000 |

5.750%, 04/01/29 Project 91

|

Aa3/A+

|

2,733,413 | ||||||

|

Total State Agencies

|

36,684,784 | ||||||||

|

County Agencies (2.7%)

|

|||||||||

|

Jefferson County, Kentucky Capital Projects

|

|||||||||

| 1,575,000 |

4.250%, 06/01/23 AGMC Insured

|

Aa2/NR**

|

1,575,819 | ||||||

| 2,640,000 |

4.375%, 06/01/28 AGMC Insured

|

Aa2/NR**

|

2,448,230 | ||||||

|

Kentucky Association of Counties Finance Corp.

|

|||||||||

|

Financing Program Revenue

|

|||||||||

| 1,145,000 |

4.250%, 02/01/24

|

NR/A+

|

1,078,098 | ||||||

|

Lexington-Fayette Urban County, Kentucky Public

|

|||||||||

|

Facilities Revenue

|

|||||||||

| 500,000 |

4.125%, 10/01/23 NPFG Insured

|

Aa2/NR

|

491,460 | ||||||

| 500,000 |

4.250%, 10/01/26 NPFG Insured

|

Aa2/NR

|

469,460 | ||||||

|

Warren County, Kentucky Justice Center

|

|||||||||

| 365,000 |

4.300%, 09/01/22 NPFG Insured

|

Aa2/NR

|

367,431 | ||||||

|

Total County Agencies

|

6,430,498 | ||||||||

|

Colleges and Universities (5.6%)

|

|||||||||

|

Berea, Kentucky Educational Facilities (Berea College)

|

|||||||||

| 1,000,000 |

4.125%, 06/01/25

|

Aaa/NR

|

1,004,570 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Colleges and Universities (continued)

|

|||||||||

|

Boyle County, Kentucky College Refunding &

|

|||||||||

|

Improvement

|

|||||||||

| $ | 1,035,000 |

4.500%, 06/01/22 CIFG Insured

|

A3/A- | $ | 1,062,779 | ||||

| 200,000 |

4.625%, 06/01/24 CIFG Insured

|

A3/A- | 204,048 | ||||||

|

Louisville & Jefferson County, Kentucky University

|

|||||||||

|

of Louisville

|

|||||||||

| 525,000 |

5.000%, 06/01/20 AMBAC Insured

|

NR/NR*

|

546,641 | ||||||

| 1,000,000 |

4.500%, 10/01/32

|

Aa2/AA-

|

894,090 | ||||||

|

Murray State University Project, Kentucky General

|

|||||||||

|

Receipts Revenue

|

|||||||||

| 745,000 |

4.500%, 09/01/23 AMBAC Insured

|

Aa2/A+

|

733,661 | ||||||

|

University of Kentucky General Receipts

|

|||||||||

| 885,000 |

4.500%, 10/01/22 Syncora Guarantee, Inc. Insured

|

Aa2/AA-

|

901,080 | ||||||

| 1,545,000 |

4.500%, 10/01/23 Syncora Guarantee, Inc. Insured

|

Aa2/AA-

|

1,563,617 | ||||||

| 1,625,000 |

4.500%, 10/01/25 Syncora Guarantee, Inc. Insured

|

Aa2/AA-

|

1,612,796 | ||||||

| 1,010,000 |

4.500%, 10/01/26 Syncora Guarantee, Inc. Insured

|

Aa2/AA-

|

989,840 | ||||||

|

Western Kentucky University Revenue General

|

|||||||||

|

Receipts

|

|||||||||

| 2,000,000 |

4.200%, 09/01/25 Series A NPFG Insured

|

Aa2/A+

|

1,840,160 | ||||||

| 2,475,000 |

4.200%, 09/01/26 Series A NPFG Insured

|

Aa2/A+

|

2,234,554 | ||||||

|

Total Colleges and Universities

|

13,587,836 | ||||||||

|

Hospitals (12.5%)

|

|||||||||

|

Jefferson County, Kentucky Health Facilities, Jewish

|

|||||||||

|

Healthcare

|

|||||||||

| 1,715,000 |

5.650%, 01/01/17 AMBAC Insured

|

Baa1/A-

|

1,720,385 | ||||||

|

Jefferson County, Kentucky Health Facilities

|

|||||||||

|

University Hospital

|

|||||||||

| 1,000,000 |

5.250%, 07/01/22 NPFG Insured

|

Baa1/BBB

|

1,002,180 | ||||||

|

Jefferson County, Kentucky, Louisville Medical Center

|

|||||||||

| 2,200,000 |

5.250%, 05/01/17

|

NR/A

|

2,284,744 | ||||||

| 2,000,000 |

5.500%, 05/01/22

|

NR/A

|

2,075,520 | ||||||

|

Kentucky Economic Development Finance Authority,

|

|||||||||

|

Baptist Healthcare System

|

|||||||||

| 2,170,000 |

5.375%, 08/15/24

|

Aa3/NR**

|

2,274,203 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Hospitals (continued)

|

|||||||||

|

Kentucky Economic Development Finance Authority,

|

|||||||||

|

Catholic Health

|

|||||||||

| $ | 2,000,000 |

5.000%, 05/01/29

|

Aa2/AA

|

$ | 1,957,580 | ||||

| 1,000,000 |

5.000%, 05/01/29

|

Aa2/AA

|

978,790 | ||||||

|

Kentucky Economic Development Finance Authority,

|

|||||||||

|

Hospital Facilities St. Elizabeth Healthcare

|

|||||||||

| 1,000,000 |

5.500%, 05/01/39

|

NR/AA-**

|

1,005,880 | ||||||

|

Kentucky Economic Development Finance Authority,

|

|||||||||

|

Kings Daughter Medical Center

|

|||||||||

| 1,000,000 |

5.000%, 02/01/30

|

A1/A+ | 944,730 | ||||||

|

Louisville & Jefferson County, Kentucky Metropolitan

|

|||||||||

|

Government Health System, Sisters of Mercy

|

|||||||||

| 1,000,000 |

5.000%, 10/01/35

|

NR/NR***

|

917,590 | ||||||

|

Louisville & Jefferson County, Kentucky, Louisville

|

|||||||||

|

Medical Center

|

|||||||||

| 1,000,000 |

5.000%, 06/01/18

|

NR/A

|

1,033,400 | ||||||

|

Louisville & Jefferson County, Kentucky Metro Health,

|

|||||||||

|

Jewish Hospital Revenue

|

|||||||||

| 1,250,000 |

6.000%, 02/01/22

|

Baa1/A-

|

1,273,275 | ||||||

| 1,800,000 |

6.125%, 02/01/37

|

Baa1/A-

|

1,815,804 | ||||||

|

Louisville & Jefferson County, Kentucky Metropolitan

|

|||||||||

|

Government Health System, Norton

|

|||||||||

| 7,925,000 |

5.000%, 10/01/26

|

NR/A-***

|

7,391,965 | ||||||

| 4,000,000 |

5.000%, 10/01/30

|

NR/A-***

|

3,564,280 | ||||||

|

Total Hospitals

|

30,240,326 | ||||||||

|

Housing (14.0%)

|

|||||||||

|

Kentucky Housing Corporation Housing Revenue

|

|||||||||

| 555,000 |

4.200%, 01/01/17

|

Aaa/AAA

|

560,561 | ||||||

| 65,000 |

5.125%, 07/01/17

|

Aaa/AAA

|

65,035 | ||||||

| 470,000 |

4.800%, 01/01/18 AMT

|

Aaa/AAA

|

474,531 | ||||||

| 285,000 |

4.250%, 01/01/18

|

Aaa/AAA

|

286,753 | ||||||

| 575,000 |

4.800%, 07/01/18 AMT

|

Aaa/AAA

|

580,543 | ||||||

| 180,000 |

4.250%, 07/01/18

|

Aaa/AAA

|

181,102 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Housing (continued)

|

|||||||||

|

Kentucky Housing Corporation Housing Revenue

|

|||||||||

|

(continued)

|

|||||||||

| $ | 900,000 |

4.800%, 07/01/20 AMT

|

Aaa/AAA

|

$ | 903,879 | ||||

| 1,150,000 |

5.350%, 01/01/21 AMT FNMA collateralized

|

Aaa/AAA

|

1,152,013 | ||||||

| 6,025,000 |

5.450%, 07/01/22 AMT

|

Aaa/AAA

|

6,049,642 | ||||||

| 4,565,000 |

5.250%, 07/01/22 AMT

|

Aaa/AAA

|

4,577,143 | ||||||

| 245,000 |

5.200%, 07/01/22

|

Aaa/AAA

|

246,112 | ||||||

| 415,000 |

5.100%, 07/01/22 AMT

|

Aaa/AAA

|

415,527 | ||||||

| 2,570,000 |

4.800%, 07/01/22 AMT

|

Aaa/AAA

|

2,558,769 | ||||||

| 2,000,000 |

4.700%, 07/01/22 Series E AMT

|

Aaa/AAA

|

1,972,060 | ||||||

| 1,635,000 |

5.000%, 01/01/23 AMT

|

Aaa/AAA

|

1,642,178 | ||||||

| 665,000 |

5.000%, 07/01/24 FHA Insured

|

Aaa/AAA

|

677,755 | ||||||

| 4,140,000 |

5.200%, 07/01/25 AMT

|

Aaa/AAA

|

4,135,777 | ||||||

| 600,000 |

4.750%, 07/01/26

|

Aaa/AAA

|

590,304 | ||||||

| 235,000 |

5.375%, 07/01/27

|

Aaa/AAA

|

235,996 | ||||||

| 2,300,000 |

5.000%, 07/01/27 Series N AMT

|

Aaa/AAA

|

2,214,969 | ||||||

| 1,000,000 |

4.750%, 07/01/27 Series E AMT

|

Aaa/AAA

|

924,810 | ||||||

| 315,000 |

4.850%, 07/01/29

|

Aaa/AAA

|

312,341 | ||||||

| 445,000 |

5.550%, 07/01/33

|

Aaa/AAA

|

445,080 | ||||||

| 930,000 |

4.625%, 07/01/33

|

Aaa/AAA

|

867,113 | ||||||

| 600,000 |

5.150%, 07/01/39

|

Aaa/AAA

|

596,448 | ||||||

|

Kentucky Housing Multifamily Mortgage Revenue

|

|||||||||

| 1,325,000 |

5.000%, 06/01/35 AMT

|

NR/AAA

|

1,310,465 | ||||||

|

Total Housing

|

33,976,906 | ||||||||

|

School Building Revenue (24.8%)

|

|||||||||

|

Barren County, Kentucky School Building Revenue

|

|||||||||

| 1,265,000 |

4.250%, 08/01/25 CIFG Insured

|

Aa2/NR

|

1,224,849 | ||||||

| 1,670,000 |

4.375%, 08/01/26 CIFG Insured

|

Aa2/NR

|

1,617,662 | ||||||

|

Boone County, Kentucky School District Finance

|

|||||||||

|

Corp. School Building Revenue

|

|||||||||

| 140,000 |

4.750%, 06/01/20 AGMC Insured (pre-refunded)

|

Aa2/AA+

|

148,058 | ||||||

| 1,000,000 |

4.125%, 08/01/22 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

982,360 | ||||||

| 1,580,000 |

4.500%, 08/01/23 AGMC Insured

|

Aa2/NR

|

1,592,340 | ||||||

| 1,250,000 |

4.125%, 03/01/25 AGMC Insured

|

Aa2/NR

|

1,141,012 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

School Building Revenue (continued)

|

|||||||||

|

Bullitt County, Kentucky School District Finance Corp.

|

|||||||||

| $ | 200,000 |

4.300%, 10/01/21 NPFG Insured

|

Aa2/NR

|

$ | 202,470 | ||||

| 2,455,000 |

4.500%, 10/01/22 NPFG Insured

|

Aa2/NR

|

2,489,444 | ||||||

| 2,590,000 |

4.500%, 10/01/23 NPFG Insured

|

Aa2/NR

|

2,613,802 | ||||||

| 1,145,000 |

4.500%, 04/01/27

|

Aa2/NR

|

1,119,112 | ||||||

| 1,200,000 |

4.500%, 04/01/28

|

Aa2/NR

|

1,158,024 | ||||||

|

Christian County, Kentucky School District Finance

|

|||||||||

|

Corp.

|

|||||||||

| 855,000 |

4.000%, 08/01/20 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

857,821 | ||||||

| 905,000 |

4.000%, 08/01/21 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

906,475 | ||||||

| 1,525,000 |

4.125%, 08/01/23 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

1,508,011 | ||||||

| 1,590,000 |

4.125%, 08/01/24 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

1,544,049 | ||||||

|

Daviess County, Kentucky School District Finance

|

|||||||||

|

Corp.

|

|||||||||

| 200,000 |

5.000%, 06/01/24

|

Aa2/NR

|

204,638 | ||||||

|

Fayette County, Kentucky School District Finance

|

|||||||||

|

Corp.

|

|||||||||

| 5,000,000 |

4.250%, 04/01/23 AGMC Insured

|

Aa2/AA+

|

5,007,400 | ||||||

| 4,335,000 |

4.375%, 05/01/26 AGMC Insured

|

Aa2/AA+

|

4,191,295 | ||||||

|

Floyd County, Kentucky School Finance Corporation

|

|||||||||

|

School Building

|

|||||||||

| 1,320,000 |

4.000%, 03/01/23 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

1,302,431 | ||||||

| 1,255,000 |

4.125%, 03/01/26 Syncora Guarantee, Inc. Insured

|

Aa2/NR

|

1,199,642 | ||||||

|

Fort Thomas, Kentucky Independent School District

|

|||||||||

|

Finance Corp.

|

|||||||||

| 785,000 |

4.375%, 04/01/21

|

Aa2/NR

|

795,778 | ||||||

| 610,000 |

4.375%, 04/01/25

|

Aa2/NR

|

593,872 | ||||||

|

Franklin County, Kentucky School District Finance

|

|||||||||

|

Corp.

|

|||||||||

| 1,000,000 |

5.000%, 04/01/24

|

Aa2/NR

|

1,022,100 | ||||||

|

Graves County, Kentucky School Building Revenue

|

|||||||||

| 1,260,000 |

5.000%, 06/01/22

|

Aa2/NR

|

1,297,321 | ||||||

| 1,320,000 |

5.000%, 06/01/23

|

Aa2/NR

|

1,351,152 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

School Building Revenue (continued)

|

|||||||||

|

Jefferson County, Kentucky School District Finance

|

|||||||||

|

Corp. School Building

|

|||||||||

| $ | 150,000 |

5.000%, 04/01/20 AGMC Insured (pre-refunded)

|

Aa2/AA+

|

$ | 153,180 | ||||

| 1,360,000 |

4.250%, 06/01/21 AGMC Insured

|

Aa2/AA+

|

1,374,661 | ||||||

|

Kenton County, Kentucky School District Finance Corp.

|

|||||||||

| 445,000 |

4.300%, 04/01/22 CIFG Insured

|

Aa2/NR

|

445,801 | ||||||

| 4,250,000 |

5.000%, 06/01/22 NPFG Insured

|

Aa2/NR

|

4,458,420 | ||||||

| 590,000 |

4.250%, 10/01/22 AGMC Insured

|

Aa2/NR

|

592,655 | ||||||

| 750,000 |

4.375%, 04/01/24 CIFG Insured

|

Aa2/NR

|

740,677 | ||||||

| 325,000 |

4.400%, 04/01/26 CIFG Insured

|

Aa2/NR

|

314,112 | ||||||

|

Larue County, Kentucky School District Finance Corp.

|

|||||||||

| 270,000 |

4.500%, 07/01/21 NPFG Insured

|

Aa2/NR

|

275,792 | ||||||

| 470,000 |

4.500%, 07/01/22 NPFG Insured

|

Aa2/NR

|

478,690 | ||||||

| 785,000 |

4.500%, 07/01/23 NPFG Insured

|

Aa2/NR

|

794,899 | ||||||

|

Laurel County, Kentucky School District Finance Corp.

|

|||||||||

| 300,000 |

4.000%, 06/01/16 AGMC Insured

|

Aa2/NR

|

325,620 | ||||||

|

Magoffin County, Kentucky School District

|

|||||||||

| 375,000 |

4.250%, 08/01/23 AMBAC Insured

|

Aa2/NR

|

375,173 | ||||||

| 475,000 |

4.250%, 08/01/25 AMBAC Insured

|

Aa2/NR

|

462,393 | ||||||

|

Meade County, Kentucky School District

|

|||||||||

| 490,000 |

4.250%, 09/01/26 NPFG Insured

|

Aa2/NR

|

472,576 | ||||||

|

Ohio County, Kentucky School Building Revenue

|

|||||||||

| 790,000 |

4.500%, 05/01/24

|

Aa2/NR

|

796,826 | ||||||

| 325,000 |

4.500%, 05/01/25

|

Aa2/NR

|

325,182 | ||||||

|

Oldham County, Kentucky School District Finance Corp.

|

|||||||||

| 500,000 |

5.000%, 05/01/19 NPFG Insured

|

Aa2/NR

|

526,675 | ||||||

| 1,000,000 |

4.500%, 09/01/27 NPFG Insured

|

Aa2/NR

|

958,060 | ||||||

|

Owensboro, Kentucky Independent School District

|

|||||||||

|

Finance Corp. School Building Revenue

|

|||||||||

| 390,000 |

4.375%, 09/01/24

|

Aa2/NR

|

392,886 | ||||||

|

Pendleton County, Kentucky School District Finance

|

|||||||||

|

Corp. School Building Revenue

|

|||||||||

| 730,000 |

4.000%, 02/01/23 NPFG Insured

|

Aa2/NR

|

710,195 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

School Building Revenue (continued)

|

|||||||||

|

Pike County, Kentucky School Building Revenue

|

|||||||||

| $ | 1,355,000 |

4.375%, 10/01/26 NPFG Insured

|

Aa2/NR $

|

1,312,182 | |||||

|

Scott County, Kentucky School District Finance Corp.

|

|||||||||

| 1,115,000 |

4.200%, 01/01/22 AMBAC Insured

|

Aa2/NR

|

1,131,357 | ||||||

| 1,955,000 |

4.250%, 01/01/23 AMBAC Insured

|

Aa2/NR

|

1,977,170 | ||||||

| 1,560,000 |

4.300%, 01/01/24 AMBAC Insured

|

Aa2/NR

|

1,572,511 | ||||||

| 1,000,000 |

4.250%, 02/01/27 AGMC Insured

|

Aa2/NR

|

926,630 | ||||||

|

Spencer County, Kentucky School District Finance

|

|||||||||

|

Corp., School Building Revenue

|

|||||||||

| 1,000,000 |

4.500%, 08/01/27 AGMC Insured

|

Aa2/NR

|

991,900 | ||||||

|

Warren County, Kentucky School District Finance Corp.

|

|||||||||

| 295,000 |

4.125%, 02/01/23 NPFG Insured

|

Aa2/NR

|

291,811 | ||||||

| 1,000,000 |

4.375%, 04/01/27 AGMC Insured

|

Aa2/NR

|

908,850 | ||||||

|

Total School Building Revenue

|

60,158,002 | ||||||||

|

Transportation (10.2%)

|

|||||||||

|

Kenton County, Kentucky Airport Board Airport Revenue

|

|||||||||

| 1,300,000 |

5.000%, 03/01/23 NPFG Insured AMT

|

A3/A- | 1,274,403 | ||||||

|

Kentucky State Turnpike Authority Revenue

|

|||||||||

| 3,000,000 |

4.450%, 07/01/22 Series B

|

Aa2/AA+

|

3,062,970 | ||||||

| 3,500,000 |

5.000%, 07/01/25

|

Aa2/AA+

|

3,657,500 | ||||||

| 2,250,000 |

5.000%, 07/01/27

|

Aa2/AA+

|

2,307,892 | ||||||

| 1,100,000 |

5.000%, 07/01/28

|

Aa2/AA+

|

1,121,318 | ||||||

| 1,165,000 |

5.000%, 07/01/29

|

Aa2/AA+

|

1,182,708 | ||||||

|

Louisville, Kentucky Regional Airport Authority

|

|||||||||

| 1,000,000 |

5.250%, 07/01/23 AGMC Insured AMT

|

Aa3/AA+

|

1,011,090 | ||||||

| 2,610,000 |

5.000%, 07/01/24 AMBAC Insured AMT

|

A1/A+ | 2,490,488 | ||||||

|

Louisville & Jefferson County Regional Airport, Kentucky

|

|||||||||

| 1,000,000 |

5.250%, 07/01/18 AGMC Insured AMT

|

Aa3/AA+

|

1,031,720 | ||||||

| 2,000,000 |

5.250%, 07/01/20 AGMC Insured AMT

|

Aa3/AA+

|

2,035,400 | ||||||

| 1,370,000 |

5.250%, 07/01/21 AGMC Insured AMT

|

Aa3/AA+

|

1,388,454 | ||||||

| 3,390,000 |

5.250%, 07/01/22 AGMC Insured AMT

|

Aa3/AA+

|

3,424,578 | ||||||

| 275,000 |

5.375%, 07/01/23 AGMC Insured AMT

|

Aa3/AA+

|

276,969 | ||||||

| 500,000 |

5.000%, 07/01/25 NPFG Insured AMT

|

A1/A+ | 471,440 | ||||||

|

Total Transportation

|

24,736,930 | ||||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||

|

DECEMBER 31, 2010

|

|||||||||

|

Rating

|

|||||||||

|

Principal

|

Moody’s/S&P

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Utilities (11.2%)

|

|||||||||

|

Campbell & Kenton Counties, Kentucky (Sanitation

|

|||||||||

|

District) Revenue

|

|||||||||

| $ | 1,695,000 |

4.300%, 08/01/24 NPFG Insured

|

Aa2/AA

|

$ | 1,699,119 | ||||

| 2,370,000 |

4.000%, 08/01/27

|

Aa2/AA

|

2,170,944 | ||||||

| 300,000 |

4.300%, 08/01/27 NPFG Insured

|

Aa2/AA

|

289,296 | ||||||

| 1,450,000 |

4.300%, 08/01/28 NPFG Insured

|

Aa2/AA

|

1,379,429 | ||||||

|

Carroll County, Kentucky Environmental Facilities

|

|||||||||

|

Revenue (Kentucky Utilities) AMT

|

|||||||||

| 1,500,000 |

5.750%, 02/01/26 AMBAC Insured

|

A2/BBB+

|

1,536,210 | ||||||

|

Kentucky Rural Water Finance Corp.

|

|||||||||

| 205,000 |

4.250%, 08/01/19 NPFG Insured

|

Baa1/AA-

|

209,176 | ||||||

| 595,000 |

5.000%, 02/01/20 NPFG Insured

|

Baa1/AA-

|

614,814 | ||||||

| 210,000 |

4.250%, 08/01/20 NPFG Insured

|

Baa1/AA-

|

212,909 | ||||||

| 200,000 |

4.375%, 08/01/22 NPFG Insured

|

Baa1/AA-

|

203,008 | ||||||

| 240,000 |

4.500%, 08/01/23 NPFG Insured

|

Baa1/AA-

|

243,658 | ||||||

| 200,000 |

4.500%, 02/01/24 NPFG Insured

|

Baa1/AA-

|

203,266 | ||||||

| 255,000 |

4.500%, 08/01/24 NPFG Insured

|

Baa1/AA-

|

257,369 | ||||||

| 355,000 |

4.600%, 02/01/25

|

NR/AA-

|

357,332 | ||||||

| 290,000 |

4.500%, 08/01/27 NPFG Insured

|

Baa1/AA-

|

284,345 | ||||||

| 245,000 |

4.600%, 08/01/28 NPFG Insured

|

Baa1/AA-

|

239,505 | ||||||

| 315,000 |

4.625%, 08/01/29 NPFG Insured

|

Baa1/AA-

|

305,251 | ||||||

|

Kentucky State Municipal Power Agency, Prairie St.

|

|||||||||

|

Project

|

|||||||||

| 1,000,000 |

5.000%, 09/01/23 AGMC Insured

|

Aa3/AA+

|

1,037,160 | ||||||

|

Louisville & Jefferson County, Kentucky Metropolitan

|

|||||||||

|

Sewer District

|

|||||||||

| 2,380,000 |

4.250%, 05/15/20 AGMC Insured

|

Aa3/AA+

|

2,447,640 | ||||||

| 2,510,000 |

4.250%, 05/15/21 AGMC Insured

|

Aa3/AA+

|

2,566,048 | ||||||

| 1,500,000 |

5.000%, 05/15/26 AGMC Insured

|

Aa3/AA+

|

1,537,680 | ||||||

|

Northern Kentucky Water District

|

|||||||||

| 660,000 |

5.000%, 02/01/23 NPFG FGIC Insured

|

Aa3/NR

|

672,692 | ||||||

| 1,825,000 |

6.000%, 02/01/28 AGMC Insured

|

Aa3/NR

|

1,996,495 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|||||||||||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||||||||||

|

DECEMBER 31, 2010

|

|||||||||||

|

Rating

|

|||||||||||

|

Principal

|

Moody’s/S&P

|

||||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||||

|

Utilities (continued)

|

|||||||||||

|

Owensboro, Kentucky Electric and Power

|

|||||||||||

| $ | 1,555,000 |

5.000%, 01/01/20 AGMC Insured (pre-refunded)

|

Aa3/AAA

|

$ | 1,555,000 | ||||||

| 1,000,000 |

5.000%, 01/01/21 AGMC Insured

|

Aa3/AA+

|

1,046,410 | ||||||||

|

Owensboro, Kentucky Water Revenue

|

|||||||||||

| 500,000 |

5.000%, 09/15/27 AGMC Insured

|

Aa3/NR

|

516,730 | ||||||||

|

Owensboro-Daviess County, Kentucky Regional

|

|||||||||||

|

Water Resource Agency Wastewater Refunding

|

|||||||||||

|

& Improvement Revenue

|

|||||||||||

| 930,000 |

4.375%, 01/01/27 Series A Syncora Guarantee, Inc.

|

||||||||||

|

Insured

|

NR/AA-

|

854,930 | |||||||||

|

Trimble County, Kentucky Environmental Facilities

|

|||||||||||

| 3,000,000 |

4.600%, 06/01/33 AMBAC Insured

|

A2/A | 2,708,160 | ||||||||

|

Total Utilities

|

27,144,576 | ||||||||||

|

Total Revenue Bonds

|

232,959,858 | ||||||||||

|

Total Investments (cost $244,165,695-note 4)

|

100.4 | % | 243,231,065 | ||||||||

|

Other assets less liabilities

|

(0.4 | ) | (909,015 | ) | |||||||

|

Net Assets

|

100.0 | % | $ | 242,322,050 | |||||||

| * |

Any security not rated (NR) by any of the approved credit rating services has been determined by the Investment Adviser to have sufficient quality to be ranked in the top four credit ratings if a credit rating were to be assigned by a rating service.

|

|

Fitch ratings

|

|||

|

**

|

AA

|

||

|

***

|

A

|

||

|

****

|

AAA

|

||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

SCHEDULE OF INVESTMENTS (continued)

|

|

DECEMBER 31, 2010

|

|

Percent of

|

||||||

|

Portfolio Distribution By Quality Rating

|

Portfolio†

|

|||||

|

Aaa of Moody’s or AAA of S&P or Fitch

|

14.8 | % | ||||

|

Pre-refunded bonds††/ Escrowed to maturity bonds

|

0.8 | |||||

|

Aa of Moody’s or AA of S&P or Fitch

|

69.4 | |||||

|

A of Moody’s or S&P or Fitch

|

14.4 | |||||

|

Baa of Moody’s or BBB of S&P

|

0.4 | |||||

|

Not rated*

|

0.2 | |||||

| 100.0 | % | |||||

|

†

|

Calculated using the highest rating of the two rating services.

|

||

|

††

|

Pre-refunded bonds are bonds for which U.S. Government Obligations have been placed in escrow to retire the bonds at their earliest call date.

|

|

PORTFOLIO ABBREVIATIONS

|

||

|

AGMC - Assured Guaranty Municipal Corp.

|

||

|

AMBAC - American Municipal Bond Assurance Corp.

|

||

|

AMT - Alternative Minimum Tax

|

||

|

CIFG - CDC IXIS Financial Guaranty

|

||

|

FGIC - Financial Guaranty Insurance Co.

|

||

|

FHA - Financial Housing Administration

|

||

|

FNMA - Federal National Mortgage Association

|

||

|

LOC - Letter of Credit

|

||

|

NPFG - National Public Finance Guarantee

|

||

|

NR - Not Rated

|

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

|

DECEMBER 31, 2010

|

|

|

ASSETS

|

|

|

Investments at value (cost $244,165,695)

|

$243,231,065

|

|

Interest receivable

|

3,675,390

|

|

Receivable for Fund shares sold

|

115,468

|

|

Other assets

|

14,061

|

|

Total assets

|

247,035,984

|

|

LIABILITIES

|

|

|

Cash overdraft

|

3,662,180

|

|

Dividends payable

|

531,430

|

|

Payable for Fund shares redeemed

|

366,397

|

|

Management fee payable

|

84,017

|

|

Distribution and service fees payable

|

2,081

|

|

Accrued expenses

|

67,829

|

|

Total liabilities

|

4,713,934

|

|

NET ASSETS

|

$242,322,050

|

|

Net Assets consist of:

|

|

|

Capital Stock - Authorized an unlimited number of shares, par value $0.01 per share

|

$ 236,209

|

|

Additional paid-in capital

|

243,314,224

|

|

Net unrealized depreciation on investments (note 4)

|

(934,630)

|

|

Undistributed net investment income

|

110,451

|

|

Accumulated net realized loss on investments

|

(404,204)

|

|

$242,322,050

|

|

|

CLASS A

|

|

|

Net Assets

|

$186,297,707

|

|

Capital shares outstanding

|

18,161,132

|

|

Net asset value and redemption price per share

|

$ 10.26

|

|

Maximum offering price per share (100/96 of $10.26 adjusted to nearest cent)

|

$ 10.69

|

|

CLASS C

|

|

|

Net Assets

|

$ 8,657,448

|

|

Capital shares outstanding

|

844,433

|

|

Net asset value and offering price per share

|

$ 10.25

|

|

Redemption price per share (*a charge of 1% is imposed on the redemption

|

|

|

proceeds of the shares, or on the original price, whichever is lower, if redeemed

|

|

|

during the first 12 months after purchase)

|

$ 10.25*

|

|

CLASS I

|

|

|

Net Assets

|

$ 7,428,535

|

|

Capital shares outstanding

|

724,530

|

|

Net asset value, offering and redemption price per share

|

$ 10.25

|

|

CLASS Y

|

|

|

Net Assets

|

$ 39,938,360

|

|

Capital shares outstanding

|

3,890,849

|

|

Net asset value, offering and redemption price per share

|

$ 10.26

|

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

||||||||

|

STATEMENT OF OPERATIONS

|

||||||||

|

YEAR ENDED DECEMBER 31, 2010

|

||||||||

|

Investment Income:

|

||||||||

|

Interest income

|

$ | 11,615,189 | ||||||

|

Expenses:

|

||||||||

|

Management fee (note 3)

|

$ | 1,022,782 | ||||||

|

Distribution and service fees (note 3)

|

376,366 | |||||||

|

Transfer and shareholder servicing agent fees (note 3)

|

126,246 | |||||||

|

Trustees’ fees and expenses (note 8)

|

121,972 | |||||||

|

Legal fees (note 3)

|

73,844 | |||||||

|

Shareholders’ reports and proxy statements

|

43,175 | |||||||

|

Fund accounting fees

|

36,422 | |||||||

|

Auditing and tax fees

|

23,358 | |||||||

|

Custodian fees (note 6)

|

22,580 | |||||||

|

Insurance

|

13,219 | |||||||

|

Registration fees and dues

|

12,883 | |||||||

|

Chief compliance officer (note 3)

|

4,507 | |||||||

|

Miscellaneous

|

30,783 | |||||||

|

Total expenses

|

1,908,137 | |||||||

|

Expenses paid indirectly (note 6)

|

(182 | ) | ||||||

|

Net expenses

|

1,907,955 | |||||||

|

Net investment income

|

9,707,234 | |||||||

|

Realized and Unrealized Gain (Loss) on Investments:

|

||||||||

|

Net realized gain (loss) from securities transactions

|

294,298 | |||||||

|

Change in unrealized appreciation on investments

|

(6,494,881 | ) | ||||||

|

Net realized and unrealized gain (loss) on investments

|

(6,200,583 | ) | ||||||

|

Net change in net assets resulting from operations

|

$ | 3,506,651 | ||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

||||||||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

||||||||

|

Year Ended

|

Year Ended

|

|||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income

|

$ | 9,707,234 | $ | 9,481,325 | ||||

|

Net realized gain (loss) from securities transactions

|

294,298 | (200,761 | ) | |||||

|

Change in unrealized appreciation (depreciation) on investments

|

(6,494,881 | ) | 25,337,616 | |||||

|

Change in net assets from operations

|

3,506,651 | 34,618,180 | ||||||

|

DISTRIBUTIONS TO SHAREHOLDERS (note 10):

|

||||||||

|

Class A Shares:

|

||||||||

|

Net investment income

|

(7,511,295 | ) | (7,313,389 | ) | ||||

|

Class C Shares:

|

||||||||

|

Net investment income

|

(180,927 | ) | (98,972 | ) | ||||

|

Class I Shares:

|

||||||||

|

Net investment income

|

(293,441 | ) | (307,836 | ) | ||||

|

Class Y Shares:

|

||||||||

|

Net investment income

|

(1,687,816 | ) | (1,750,804 | ) | ||||

|

Change in net assets from distributions

|

(9,673,479 | ) | (9,471,001 | ) | ||||

|

CAPITAL SHARE TRANSACTIONS (note 7):

|

||||||||

|

Proceeds from shares sold

|

29,705,865 | 35,468,477 | ||||||

|

Reinvested dividends and distributions

|

3,954,939 | 3,804,880 | ||||||

|

Cost of shares redeemed

|

(38,196,770 | ) | (28,780,114 | ) | ||||

|

Change in net assets from capital share transactions

|

(4,535,966 | ) | 10,493,243 | |||||

|

Change in net assets

|

(10,702,794 | ) | 35,640,422 | |||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

253,024,844 | 217,384,422 | ||||||

|

End of period*

|

$ | 242,322,050 | $ | 253,024,844 | ||||

|

* Includes undistributed net investment income of:

|

$ | 110,451 | $ | 76,631 | ||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

NOTES TO FINANCIAL STATEMENTS

|

|

DECEMBER 31, 2010

|

|

a)

|

Portfolio valuation: Municipal securities which have remaining maturities of more than 60 days are valued each business day based upon information provided by a nationally prominent independent pricing service and periodically verified through other pricing services. In the case of securities for which market quotations are readily available, securities are valued by the pricing service at the mean of bid and asked quotations. If a market quotation or a valuation from the pricing service is not readily available, the security is valued at fair value determined in good faith under procedures established by and under the general supervision of the Board of Trustees. Securities which mature in 60 days or less are valued at amortized cost if their term to maturity at purchase is 60 days or less, or by amortizing their unrealized appreciation or depreciation on the 61st day prior to maturity, if their term to maturity at purchase exceeds 60 days.

|

|

b)

|

Fair Value Measurements: The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy.

|

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

NOTES TO FINANCIAL STATEMENTS (continued)

|

|

DECEMBER 31, 2010

|

|

Valuation Inputs

|

Investments in Securities

|

||||

|

Level 1 – Quoted Prices

|

$ | — | |||

|

Level 2 – Other Significant Observable Inputs —

|

|||||

|

Municipal Bonds*

|

243,231,065 | ||||

|

Level 3 – Significant Unobservable Inputs

|

— | ||||

|

Total

|

$ | 243,231,065 | |||

|

c)

|

Subsequent events: In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date these financial statements were issued.

|

|

d)

|

Securities transactions and related investment income: Securities transactions are recorded on the trade date. Realized gains and losses from securities transactions are reported on the identified cost basis. Interest income is recorded daily on the accrual basis and is adjusted for amortization of premium and accretion of original issue and market discount.

|

|

e)

|

Federal income taxes: It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code applicable to certain investment companies. The Fund intends to make distributions of income and securities profits sufficient to relieve it from all, or substantially all, Federal income and excise taxes.

|

|

f)

|

Multiple class allocations: All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based on the relative net assets of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributed to a particular class, are also charged directly to such class on a daily basis.

|

|

g)

|

Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

|

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

NOTES TO FINANCIAL STATEMENTS (continued)

|

|

DECEMBER 31, 2010

|

|

h)

|

Reclassification of capital accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. On December 31, 2010 the Fund increased undistributed net investment income by $65 and decreased additional paid-in capital by $65. These reclassifications had no effect on net assets or net asset value per share.

|

|

i)

|

Accounting pronouncement: In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update “Improving Disclosures about Fair Value Measurements” (“ASU”). The ASU requires enhanced disclosures about a) transfers into and out of Levels 1 and 2, and b) purchases, sales, issuances, and settlements on a gross basis relating to Level 3 measurements. The first disclosure became effective for the first reporting period beginning after December 15, 2009, and for interim periods within those fiscal years. There were no significant transfers into and out of Levels 1 and 2 during the current period presented.

|

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

NOTES TO FINANCIAL STATEMENTS (continued)

|

|

DECEMBER 31, 2010

|

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

NOTES TO FINANCIAL STATEMENTS (continued)

|

|

DECEMBER 31, 2010

|

|

Year Ended

|

Year Ended

|

|||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Class A Shares:

|

||||||||||||||||

|

Proceeds from shares sold .

|

1,803,306 | $ | 19,131,302 | 2,169,858 | $ | 22,316,773 | ||||||||||

|

Reinvested distributions

|

327,573 | 3,470,108 | 327,487 | 3,368,846 | ||||||||||||

|

Cost of shares redeemed

|

(2,503,968 | ) | (26,349,593 | ) | (1,956,408 | ) | (19,972,149 | ) | ||||||||

|

Net change

|

(373,089 | ) | (3,748,183 | ) | 540,937 | 5,713,470 | ||||||||||

|

Class C Shares:

|

||||||||||||||||

|

Proceeds from shares sold .

|

525,293 | 5,584,681 | 211,585 | 2,187,246 | ||||||||||||

|

Reinvested distributions

|

12,084 | 127,918 | 6,556 | 67,529 | ||||||||||||

|

Cost of shares redeemed

|

(93,357 | ) | (983,541 | ) | (103,685 | ) | (1,058,133 | ) | ||||||||

|

Net change

|

444,020 | 4,729,058 | 114,456 | 1,196,642 | ||||||||||||

|

Class I Shares:

|

||||||||||||||||

|

Proceeds from shares sold .

|

10,426 | 112,001 | 13,106 | 136,866 | ||||||||||||

|

Reinvested distributions

|

26,665 | 282,514 | 28,913 | 297,017 | ||||||||||||

|

Cost of shares redeemed

|

(106,910 | ) | (1,137,940 | ) | (76,705 | ) | (769,822 | ) | ||||||||

|

Net change

|

(69,819 | ) | (743,425 | ) | (34,686 | ) | (335,939 | ) | ||||||||

|

Class Y Shares:

|

||||||||||||||||

|

Proceeds from shares sold .

|

459,533 | 4,877,881 | 1,061,868 | 10,827,592 | ||||||||||||

|

Reinvested distributions

|

7,017 | 74,399 | 6,966 | 71,488 | ||||||||||||

|

Cost of shares redeemed

|

(916,419 | ) | (9,725,696 | ) | (683,019 | ) | (6,980,010 | ) | ||||||||

|

Net change

|

(449,869 | ) | (4,773,416 | ) | 385,815 | 3,919,070 | ||||||||||

|

Total transactions in Fund

|

||||||||||||||||

|

shares

|

(448,757 | ) | $ | (4,535,966 | ) | 1,006,522 | $ | 10,493,243 | ||||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

|

NOTES TO FINANCIAL STATEMENTS (continued)

|

|

DECEMBER 31, 2010

|

|

Year Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Net tax-exempt income

|

$ | 9,673,479 | $ | 9,470,948 | ||||

|

Taxable income

|

– | 53 | ||||||

|

Net realized gain on investments

|

– | – | ||||||

| $ | 9,673,479 | $ | 9,471,001 | |||||

|

Capital loss carry forward

|

$ | (287,861 | ) | |

|

Unrealized depreciation

|

(824,179 | ) | ||

|

Undistributed tax-exempt income

|

531,430 | |||

|

Other accumulated losses

|

(116,344 | ) | ||

|

Other temporary differences

|

(531,430 | ) | ||

| $ | (1,228,384 | ) | ||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

||||||||||||||||||||||||||||||||||||||||

|

FINANCIAL HIGHLIGHTS

|

||||||||||||||||||||||||||||||||||||||||

|

For a share outstanding throughout each period

|

||||||||||||||||||||||||||||||||||||||||

|

Class A

|

Class C

|

|||||||||||||||||||||||||||||||||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

|||||||||||||||||||||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 10.51 | $ | 9.42 | $ | 10.38 | $ | 10.59 | $ | 10.60 | $ | 10.51 | $ | 9.42 | $ | 10.38 | $ | 10.58 | $ | 10.59 | ||||||||||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||||||||||||||||||

|

Net investment income

|

0.40 | (1) | 0.41 | (1) | 0.40 | (1) | 0.39 | (1) | 0.39 | (2) | 0.31 | (1) | 0.32 | (1) | 0.31 | (1) | 0.31 | (1) | 0.30 | (2) | ||||||||||||||||||||

|

Net gain (loss) on securities (both

|

||||||||||||||||||||||||||||||||||||||||

|

realized and unrealized)

|

(0.25 | ) | 1.09 | (0.92 | ) | (0.15 | ) | 0.03 | (0.26 | ) | 1.09 | (0.91 | ) | (0.15 | ) | 0.03 | ||||||||||||||||||||||||

|

Total from investment operations

|

0.15 | 1.50 | (0.52 | ) | 0.24 | 0.42 | 0.05 | 1.41 | (0.60 | ) | 0.16 | 0.33 | ||||||||||||||||||||||||||||

|

Less distributions (note 10):

|

||||||||||||||||||||||||||||||||||||||||

|

Dividends from net investment income

|

(0.40 | ) | (0.41 | ) | (0.39 | ) | (0.39 | ) | (0.40 | ) | (0.31 | ) | (0.32 | ) | (0.31 | ) | (0.30 | ) | (0.31 | ) | ||||||||||||||||||||

|

Distributions from capital gains

|

– | – | (0.05 | ) | (0.06 | ) | (0.03 | ) | – | – | (0.05 | ) | (0.06 | ) | (0.03 | ) | ||||||||||||||||||||||||

|

Total distributions

|

(0.40 | ) | (0.41 | ) | (0.44 | ) | (0.45 | ) | (0.43 | ) | (0.31 | ) | (0.32 | ) | (0.36 | ) | (0.36 | ) | (0.34 | ) | ||||||||||||||||||||

|

Net asset value, end of period

|

$ | 10.26 | $ | 10.51 | $ | 9.42 | $ | 10.38 | $ | 10.59 | $ | 10.25 | $ | 10.51 | $ | 9.42 | $ | 10.38 | $ | 10.58 | ||||||||||||||||||||

|

Total return

|

1.38 | %(3) | 16.05 | %(3) | (5.05 | )%(3) | 2.38 | %(3) | 4.02 | %(3) | 0.42 | %(4) | 15.06 | %(4) | (5.85 | )%(4) | 1.61 | %(4) | 3.15 | %(4) | ||||||||||||||||||||

|

Ratios/supplemental data

|

||||||||||||||||||||||||||||||||||||||||

|

Net assets, end of period

|

||||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

$ | 186,298 | $ | 194,816 | $ | 169,582 | $ | 194,140 | $ | 211,501 | $ | 8,657 | $ | 4,207 | $ | 2,694 | $ | 4,120 | $ | 5,686 | ||||||||||||||||||||

|

Ratio of expenses to average

|

||||||||||||||||||||||||||||||||||||||||

|

net assets

|

0.75 | % | 0.76 | % | 0.79 | % | 0.75 | % | 0.76 | % | 1.59 | % | 1.60 | % | 1.64 | % | 1.60 | % | 1.62 | % | ||||||||||||||||||||

|

Ratio of net investment income to

|

||||||||||||||||||||||||||||||||||||||||

|

average net assets

|

3.80 | % | 3.96 | % | 3.97 | % | 3.77 | % | 3.71 | % | 2.90 | % | 3.06 | % | 3.10 | % | 2.92 | % | 2.87 | % | ||||||||||||||||||||

|

Portfolio turnover rate

|

8.32 | % | 8.18 | % | 13.76 | % | 18.92 | % | 19.07 | % | 8.32 | % | 8.18 | % | 13.76 | % | 18.92 | % | 19.07 | % | ||||||||||||||||||||

|

The expense ratios after giving effect to the expense offset for uninvested cash balances were:

|

||||||||||||||||||||||||||||||||||||||||

|

Ratio of expenses to average

|

||||||||||||||||||||||||||||||||||||||||

|

net assets

|

0.75 | % | 0.76 | % | 0.78 | % | 0.74 | % | 0.76 | % | 1.59 | % | 1.60 | % | 1.63 | % | 1.59 | % | 1.61 | % | ||||||||||||||||||||

|

CHURCHILL TAX-FREE FUND OF KENTUCKY

|

||||||||||||||||||||||||||||||||||||||||

|

FINANCIAL HIGHLIGHTS (continued)

|

||||||||||||||||||||||||||||||||||||||||

|

For a share outstanding throughout each period

|

||||||||||||||||||||||||||||||||||||||||

|

Class I

|

Class Y

|

|||||||||||||||||||||||||||||||||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

|||||||||||||||||||||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 10.51 | $ | 9.42 | $ | 10.38 | $ | 10.58 | $ | 10.59 | $ | 10.52 | $ | 9.43 | $ | 10.39 | $ | 10.59 | $ | 10.61 | ||||||||||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||||||||||||||||||

|

Net investment income

|

0.39 | (1) | 0.39 | (1) | 0.38 | (1) | 0.38 | (1) | 0.38 | (2) | 0.42 | (1) | 0.42 | (1) | 0.41 | (1) | 0.41 | (1) | 0.41 | (2) | ||||||||||||||||||||

|

Net gain (loss) on securities (both

|

||||||||||||||||||||||||||||||||||||||||

|

realized and unrealized)

|

(0.27 | ) | 1.09 | (0.91 | ) | (0.14 | ) | 0.02 | (0.26 | ) | 1.09 | (0.91 | ) | (0.14 | ) | 0.01 | ||||||||||||||||||||||||

|

Total from investment operations

|

0.12 | 1.48 | (0.53 | ) | 0.24 | 0.40 | 0.16 | 1.51 | (0.50 | ) | 0.27 | 0.42 | ||||||||||||||||||||||||||||

|

Less distributions (note 10):

|

||||||||||||||||||||||||||||||||||||||||

|

Dividends from net investment income

|

(0.38 | ) | (0.39 | ) | (0.38 | ) | (0.38 | ) | (0.38 | ) | (0.42 | ) | (0.42 | ) | (0.41 | ) | (0.41 | ) | (0.41 | ) | ||||||||||||||||||||

|

Distributions from capital gains

|

– | – | (0.05 | ) | (0.06 | ) | (0.03 | ) | – | – | (0.05 | ) | (0.06 | ) | (0.03 | ) | ||||||||||||||||||||||||

|

Total distributions

|

(0.38 | ) | (0.39 | ) | (0.43 | ) | (0.44 | ) | (0.41 | ) | (0.42 | ) | (0.42 | ) | (0.46 | ) | (0.47 | ) | (0.44 | ) | ||||||||||||||||||||

|

Net asset value, end of period

|

$ | 10.25 | $ | 10.51 | $ | 9.42 | $ | 10.38 | $ | 10.58 | $ | 10.26 | $ | 10.52 | $ | 9.43 | $ | 10.39 | $ | 10.59 | ||||||||||||||||||||

|

Total return

|

1.13 | % | 15.89 | % | (5.16 | )% | 2.33 | % | 3.87 | % | 1.44 | % | 16.21 | % | (4.88 | )% | 2.63 | % | 4.08 | % | ||||||||||||||||||||

|

Ratios/supplemental data

|

||||||||||||||||||||||||||||||||||||||||

|

Net assets, end of period

|

||||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

$ | 7,429 | $ | 8,345 | $ | 7,810 | $ | 8,363 | $ | 8,018 | $ | 39,938 | $ | 45,657 | $ | 37,299 | $ | 41,648 | $ | 46,625 | ||||||||||||||||||||

|

Ratio of expenses to average

|

||||||||||||||||||||||||||||||||||||||||

|

net assets

|

0.90 | % | 0.90 | % | 0.93 | % | 0.89 | % | 0.91 | % | 0.60 | % | 0.61 | % | 0.64 | % | 0.60 | % | 0.61 | % | ||||||||||||||||||||

|

Ratio of net investment income to

|

||||||||||||||||||||||||||||||||||||||||

|

average net assets

|

3.64 | % | 3.82 | % | 3.83 | % | 3.62 | % | 3.57 | % | 3.95 | % | 4.10 | % | 4.12 | % | 3.92 | % | 3.86 | % | ||||||||||||||||||||

|

Portfolio turnover rate

|

8.32 | % | 8.18 | % | 13.76 | % | 18.92 | % | 19.07 | % | 8.32 | % | 8.18 | % | 13.76 | % | 18.92 | % | 19.07 | % | ||||||||||||||||||||

|

The expense ratios after giving effect to the expense offset for uninvested cash balances were:

|

||||||||||||||||||||||||||||||||||||||||

|

Ratio of expenses to average

|

||||||||||||||||||||||||||||||||||||||||

|

net assets

|

0.90 | % | 0.90 | % | 0.92 | % | 0.88 | % | 0.90 | % | 0.60 | % | 0.61 | % | 0.63 | % | 0.59 | % | 0.61 | % | ||||||||||||||||||||

|

Six months ended December 31, 2010

|

||||

|

Actual

|

||||

|

Total Return

|

Beginning

|

Ending

|

Expenses

|

|

|

Without

|

Account

|

Account

|

Paid During

|

|

|

Sales Charges(1)

|

Value

|

Value

|

the Period(2)

|

|

|

Class A

|

(1.28)%

|

$1,000.00

|

$987.20

|

$3.76

|

|

Class C

|

(1.80)%

|

$1,000.00

|

$982.00

|

$7.99

|

|

Class I

|

(1.46)%

|

$1,000.00

|

$985.40

|

$4.60

|

|

Class Y

|

(1.30)%

|

$1,000.00

|

$987.00

|

$3.00

|

|

(1)

|

Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year.

|

|

(2)

|

Expenses are equal to the annualized expense ratio of 0.75%, 1.60%, 0.92% and 0.60% for the Fund’s Class A, C, I and Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

|

Six months ended December 31, 2010

|

||||

|

Hypothetical

|

||||

|

Annualized

|

Beginning

|

Ending

|

Expenses

|

|

|

Total

|

Account

|

Account

|

Paid During

|

|

|

Return

|

Value

|

Value

|

the Period(1)

|

|

|

Class A

|

5.00%

|

$1,000.00

|

$1,021.42

|

$3.82

|

|

Class C

|

5.00%

|

$1,000.00

|

$1,017.14

|

$8.13

|

|

Class I

|

5.00%

|

$1,000.00

|

$1,020.57

|

$4.69

|

|

Class Y

|

5.00%

|

$1,000.00

|

$1,022.18

|

$3.06

|

|

(1)

|

Expenses are equal to the annualized expense ratio of 0.75%, 1.60%, 0.92% and 0.60% for the Fund’s Class A, C, I and Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

|

Additional Information (unaudited)

|

||||||||

|

Trustees(1)

|

||||||||

|

and Officers

|

||||||||

|

Number of

|

||||||||

|

Positions

|

Portfolios

|

Other Directorships

|

||||||

|

Held with

|

in Fund

|

Held by Trustee

|

||||||

|

Name,

|

Fund and

|

Principal

|

Complex(4)

|

(The position held is

|

||||

|

Address(2)

|

Length of

|

Occupation(s)

|

Overseen

|

a directorship unless

|

||||

|

and Date of Birth

|

Service(3)

|

During Past 5 Years

|

by Trustee

|

indicated otherwise.)

|

||||

|

Interested Trustee(5)

|

||||||||

|

Diana P. Herrmann

New York, NY

(02/25/58)

|

Trustee

since 1995

and President

since 1999

|

Vice Chair and Chief Executive Officer of Aquila Management Corporation, Founder of the Aquila Group of Funds(6) and parent of Aquila Investment Management LLC, Manager since 2004, President since 1997, Chief Operating Officer, 1997-2008, a Director since 1984, Secretary since 1986 and previously its Executive Vice President, Senior Vice President or Vice President, 1986-1997; Chief Executive Officer and Vice Chair since 2004, President and Manager since 2003, and Chief Operating Officer (2003-2008), of the Manager; Chair, Vice Chair, President, Executive Vice President and/or Senior Vice President of funds in the Aquila Group of Funds since 1986; Director of the Distributor since 1997; Governor, Investment Company Institute (the trade organization for the U.S. mutual fund industry dedicated to protecting shareholder interests and educating the public about investing) for various periods since 2004, and head of its Small Funds Committee, 2004-2009; active in charitable and volunteer organizations.

|

12

|

ICI Mutual Insurance Company, a Risk Retention Group (2006-2009 and since 2010)

|

||||

|

Non-interested Trustees

|

||||||||

|

Thomas A. Christopher

Danville, KY

(12/19/47)

|

Chair of

the Board

of Trustees

since 2005

and Trustee

since 1992

|

Vice President of Robinson, Hughes & Christopher, C.P.A.s, P.S.C., since 1977; President, A Good Place for Fun, Inc., a sports facility, since 1987; Director, Sunrise Children’s Services Inc. (2010); currently or formerly active with various professional and community organizations.

|

5

|

None

|

||||

|

Number of

|

||||||||

|

Positions

|

Portfolios

|

Other Directorships

|

||||||

|

Held with

|

in Fund

|

Held by Trustee

|

||||||

|

Name,

|

Fund and

|

Principal

|

Complex(4)

|

(The position held is

|

||||

|

Address(2)

|

Length of

|

Occupation(s)

|

Overseen

|

a directorship unless

|

||||

|

and Date of Birth

|

Service(3)

|

During Past 5 Years

|

by Trustee

|

indicated otherwise.)

|

||||

|

David A. Duffy

North Kingstown, RI

(08/07/39)

|

Trustee

since 2009

|

Chairman, Rhode Island Convention Center Authority since 2003; director (advisory board) of Citizens Bank of Rhode Island and Connecticut since 1999; retired Founder, formerly President, Duffy & Shanley, Inc., a marketing communications firm, 1973-2003; past National Chairman, National Conference for Community and Justice (NCCJ); Past Chair, Providence College President’s Council; Past Vice Chair, Providence College Board of Trustees; officer or director of numerous civic and non-profit organizations.

|

2

|

Delta Dental of Rhode Island

|

||||

|

Theodore T. Mason

Hastings-on-Hudson,

NY

(11/24/35)

|

Trustee

since 1987

|

Executive Director, East Wind Power Partners LTD since 1994 and Louisiana Power Partners, 1999-2003; Assistant Treasurer, Fort Schuyler Maritime Alumni Association, Inc., successor to Alumni Association of SUNY Maritime College, since 2010 (Treasurer, 2004-2009, President, 2002-2003, First Vice President, 2000-2001, Second Vice President, 1998-2000) and director of the same organization since 1997; Director, STCM Management Company, Inc., 1973-2004; twice national officer of Association of the United States Navy (formerly Naval Reserve Association), Commanding Officer of four naval reserve units and Captain, USNR (Ret); director, The Navy League of the United States New York Council since 2002; trustee, The Maritime Industry Museum at Fort Schuyler, 2000-2004; and Fort Schuyler Maritime Foundation, Inc., successor to the Maritime College at Fort Schuyler Foundation, Inc., since 2000.

|

9

|

None

|

|

Number of

|

||||||||

|

Positions

|

Portfolios

|

Other Directorships

|

||||||

|

Held with

|

in Fund

|

Held by Trustee

|

||||||

|

Name,

|

Fund and

|

Principal

|

Complex(4)

|

(The position held is

|

||||

|

Address(2)

|

Length of

|

Occupation(s)

|

Overseen

|

a directorship unless

|

||||

|

and Date of Birth

|

Service(3)

|

During Past 5 Years

|

by Trustee

|

indicated otherwise.)

|

||||

|

Anne J. Mills

Castle Rock, CO

(12/23/38)

|

Trustee

since 1987

|

President, Loring Consulting Company since 2001; Vice President for Business Management and CFO, Ottawa University, 1992-2001, 2006-2008; IBM Corporation, 1965-1991; currently active with various charitable, educational and religious organizations.

|

5

|

None

|

||||

|

John J. Partridge

Providence, RI

(05/05/40)

|

Trustee

since 2009

|

Founding Partner, Partridge Snow & Hahn LLP, a law firm, Providence, Rhode Island, since 1988, Senior Counsel, since January 1, 2007; Assistant Secretary – Advisor to the Board, Narragansett Insured Tax-Free Income Fund, 2005-2008, Trustee 2002-2005; director or trustee of various educational, civic and charitable organizations, including Ocean State Charities Trust, Memorial Hospital of Rhode Island, and The Pawtucket Foundation.

|

5

|

None

|

||||

|

James R. Ramsey

Louisville, KY

(11/14/48)

|

Trustee

since 1987

|

President, University of Louisville since November 2002; Professor of Economics, University of Louisville, 1999-present; Kentucky Governor’s Senior Policy Advisor and State Budget Director, 1999-2002; Vice Chancellor for Finance and Administration, the University of North Carolina at Chapel Hill, 1998 to 1999; previously Vice President for Finance and Administration at Western Kentucky University, State Budget Director for the Commonwealth of Kentucky, Chief State Economist and Executive Director for the Office of Financial Management and Economic Analysis for the Commonwealth of Kentucky, Adjunct Professor at the University of Kentucky, Associate Professor at Loyola University-New Orleans and Assistant Professor at Middle Tennessee State University.

|

2

|

Community Bank and Trust, Pikeville, KY and Texas Roadhouse Inc.

|

|

Number of

|

||||||||

|

Positions

|

Portfolios

|

Other Directorships

|

||||||

|

Held with

|

in Fund

|

Held by Trustee

|

||||||

|

Name,

|

Fund and

|

Principal

|

Complex(4)

|

(The position held is

|

||||

|

Address(2)

|

Length of

|

Occupation(s)

|

Overseen

|

a directorship unless

|

||||

|

and Date of Birth

|

Service(3)

|

During Past 5 Years

|

by Trustee

|

indicated otherwise.)

|

||||

|

Laureen L. White

North Kingstown, RI

(11/18/59)

|

Trustee

since 2009

|

President, Greater Providence Chamber of Commerce, since 2005, Executive Vice President 2004-2005 and Senior Vice President, 1989-2002; Executive Counselor to the Governor of Rhode Island for Policy and Communications, 2003-2004.

|

2

|

None

|

||||

|

Other Individuals

Chairman Emeritus(7)

|

||||||||

|

Lacy B. Herrmann

New York, NY

(05/12/29)

|

Founder and

Chairman

Emeritus

since 2005,

Chairman

of the Board

of Trustees,

1987-2005

|