UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05083

VAN ECK VIP TRUST - VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 Madison Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2012

Item 1: Report to Shareholders

|

|

|

|

|

SEMI-ANNUAL REPORT |

|

|

|

|

|

JUNE 30, 2012 |

|

|

|

|

|

(unaudited) |

Van Eck VIP Trust

Van Eck VIP Multi-Manager Alternatives Fund

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

1 |

||

|

|

|

|

|

6 |

||

|

|

|

|

|

8 |

||

|

|

|

|

|

9 |

||

|

|

|

|

|

15 |

||

|

|

|

|

|

16 |

||

|

|

|

|

|

17 |

||

|

|

|

|

|

18 |

||

|

|

|

|

|

19 |

||

|

|

|

|

|

24 |

||

|

|

|

|

|

The information contained in these shareholder letters represent the personal opinions of the investment team members and may differ from those of other portfolio managers or of the firm as a whole. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, unless otherwise specifically noted, any discussion of the Fund’s holdings and the Fund’s performance, and the views of the investment team members are as of June 30, 2012 and are subject to change. |

||

|

|

Dear Shareholder:

The Initial Class shares of the Van Eck VIP Multi-Manager Alternatives Fund (the “Fund”) gained 0.61% for the six months ended June 30, 2012, closely tracking its benchmark, the HFRX Global Hedge Fund Index1, which rose 1.22%. The S&P® 500 Index2 gained 9.49% for the same period.

The Fund is a hedge-style mutual fund that can allocate among long/short equity, distressed debt, market neutral, global macro, managed futures and other investment strategies. Our investment committee—which averages more than eight years’ experience in managing a multi-manager, hedge-style mutual fund strategy—manages the Fund with a goal of consistent returns, low beta3 and low volatility. Throughout the semi-annual period, we continued to search for alpha4-generating strategies with repeatable processes that exist within stable business models. The mutual fund structure of the Fund provides portfolio transparency, daily valuation and liquidity unlike many unregistered hedge funds.

With respect to the current economic environment, the developed nations are experiencing a global deleveraging that will take many years to unwind. This process will likely be resolved through tepid growth and haircuts in the form of artificially low interest rates. As the debt crises play out, we are expecting alternating periods of euphoria and fear to dominate the markets, with, unfortunately, more of the latter. As allocators of capital, we continue to navigate the tumultuous market environment by maintaining a diversified strategy mix and tactically adjusting our exposures at the margin. From an asset allocation perspective, our exposures remained mostly constant during the first half of the year. As of the end of the second quarter, our allocations included long/short equity (23%), fixed income (15%), arbitrage (23%), global macro (13%), and event driven (16%). Tactically, we have maintained a defensive posture via our active market hedges.

Fund Review

The Fund’s

positive, albeit modest, absolute returns closely tracked the performance of

the HFRX Global Hedge Fund Index on a relative basis during the semi-annual

period. Importantly, the Fund did so with similar volatility to the HFRX Global

Hedge Fund Index and substantially less volatility than the S&P 500 Index.

Specifically, the Fund had an annualized standard deviation6 of

3.55% versus 4.29% for HFRX Global Hedge Fund Index and 14.52% for the S&P

500 Index. (Figures are based on monthly data.) The Fund’s beta of just 0.21 to

the S&P 500 Index was on par with the HFRX Global Hedge Fund Index’s

comparable beta of 0.24. (Figures are based on monthly data.)

As of June 30,

2012, the Fund had assets of approximately 44% allocated to six sub-advisers

and the balance was directly invested in a variety of mutual funds, ETFs, a

UCITS9 Fund and individual equity securities.

Below is a table of sub-advisers that the Fund invested in as of June 30, 2012:

|

|

|

|

|

|

|

|

|

|

|

Sub-Adviser |

|

Investment Strategy |

|

Initial Allocation |

|

1H 2012 Return |

|

|

Tiburon |

|

Event-Driven |

|

November 2011 |

|

+1.08% |

|

|

Coe |

|

Long/Short Equity |

|

June 2011 |

|

+3.11% |

|

|

Millrace |

|

Long/Short Equity |

|

June 2011 |

|

+8.25% |

|

|

Acorn |

|

Volatility Arbitrage |

|

May 2011 |

|

-5.43% |

|

|

Medley |

|

Long/Short Fixed Income |

|

December 2010 |

|

-0.41% |

|

|

Primary |

|

Long/Short Equity |

|

March 2010 |

|

+4.00% |

Arbitrage Strategy

The results of the arbitrage strategies were mixed during

the semi-annual period. Arbitrage strategies were challenged by the “risk

on/risk off” market environment and the impact on spread-based investment

disciplines.

AQR Diversified Arbitrage Fund (“AQR Diversified Arbitrage”) (6.2% of Fund net assets†) generated a modestly positive return for the semi-annual period. AQR Diversified Arbitrage typically allocates an equivalent amount of assets to each of the strategy’s core investment disciplines—convertible arbitrage, merger arbitrage and event driven. While none of these sub-strategies were overly attractive during the semi-annual period, the committee found the most value in convertible arbitrage as spreads widened during the second quarter sell-off. The environment for merger arbitrage was lukewarm, as corporations demonstrated their preference for cash accumulation rather than merger and acquisition activity. Interestingly, given the unimpressive global economic growth expectations and excess cash reserves of many large capitalization companies, the backdrop for merger and acquisition activity could drive significant potential in the merger arbitrage area.

1

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

EMERALD 2X (Equity MEan Reversion ALpha InDex) (5.0% of Fund net assets†), a “rules based” volatility arbitrage strategy through a note that was structured by Deutsche Bank, seeks to extract value from the negative serial correlation between daily and weekly volatility. EMERALD generated a negative return for the semi-annual period, as volatility fluctuated virtually throughout.

The worst performing position within the strategy was the volatility arbitrage strategy of sub-adviser Acorn Derivatives Management Corp. (“Acorn”) (5.0% of Fund net assets†). Acorn seeks to exploit pricing inefficiencies in S&P 500 Index options. The protracted, uncorrected rise in the equity market during the first quarter of 2012 presented Acorn’s strategy with its most difficult challenge. The persistence of the advance was extreme and, as noted earlier, resulted in the best first quarter for the S&P 500 Index since 1998. The S&P 500 Index had only one day with a decline in excess of 75 basis points. (A basis point is 1/100th of a percentage point.) Additional monetary easing by both foreign and domestic central banks helped underpin the rally’s unrelenting momentum. During the second calendar quarter, Acorn was able to make up some ground, as the policy influence dissipated and the market reverted back to traditional drivers of volatility. As such, Acorn’s investment process signaled a consolidation and a range-bound market.

Long/Short Equity Strategy

Given the solid positive returns of global equities, the

Fund’s long/short equity managers that were positioned net long outperformed

the HFRX Equity Hedge Index5 in aggregate during the semi-annual

period but trailed the S&P 500 Index.

Sub-Adviser Millrace Asset Group, Inc. (“Millrace”) (7.9% of Fund net assets†) was the best performer within this strategy, with the bulk of its positive return attributable to the first calendar quarter. Millrace utilizes a fundamental, bottom up, long/short equity strategy focused on small/mid-cap U.S. equities. During the first quarter, Millrace had an average net long exposure of 51.5% and benefited from strong stock selection on the long side within the business services, technology and health care industries. During the second quarter, Millrace gave up some of its gains, though long positions in health care and short positions in technology were significant contributors. Long positions in technology, specifically enterprise software, were the biggest detractors. Millrace ended June with a net long exposure of 81%.

Sub-Adviser Primary Funds (“Primary”) (5.5% of Fund net assets†) also generated solid positive returns during the semi-annual period. While Primary does not typically make large directional market calls, the sub-adviser was able to generate strong returns through fundamental stock selection. The largest positive contribution to its semi-annual performance came from positions in the information technology sector. Investments in a data center company, mobile software firm, two nanotechnology tools companies and a semiconductor company each produced substantial returns. Holdings within the industrials and consumer staples sectors also made a positive impact. Contributions from within the industrials sector were spread across several investments in industrial conglomerates, engineering and construction firms and transportation companies. In consumer staples, Primary benefited most from a long position in a pharmacy company. Detracting from Primary’s semi-annual performance most were positions in the health care, telecommunication services and materials sectors. Losses in health care were predominantly from short positions in medical technology and health care services companies. Negative bets on a cellular tower leasing company and a specialty chemicals company hurt as well.

TFS Market Neutral Fund (“TFS”) (7.1% of Fund net assets†) was also able to manage the market environment favorably during the semi-annual period, delivering solid positive returns. TFS relies on a quantitative model with nine factor inputs to extract value across the market capitalization spectrum. Its relatively consistent net exposure and diversified portfolio proved beneficial.

We increased the Fund’s exposure to the long/short fixed income strategy during the semi-annual period. Within the Fund’s fixed income allocation, Loomis Sayles Bond Fund (5.7% of Fund net assets†), under the direction of lead portfolio manager and legendary bond investor Dan Fuss, generated particularly strong positive returns. The Loomis Sayles Bond Fund is a long only actively managed fixed income fund. Sub-Adviser Medley Credit Strategies, LLC (“Medley”) (9.7% of Fund net assets†) also generated positive returns that outpaced the Fund’s benchmark index for the semi-annual period. Medley employs a deep fundamental credit analysis to identify long and short opportunities within relative value, event-driven and distressed investment opportunities. During the first quarter, Medley struggled due to its defensive positioning through security selection that benefits the strategy during market downturns but leaves it vulnerable to upside surprises. However, Medley performed particularly well in April 2012.

The Fund’s long/short event-driven managers both provided strong positive returns. Sub-Adviser Coe Capital Management, LLC (“Coe”) (9.4% of Fund net assets†) is a fundamental long/short manager with a catalyst-driven approach. It employs an active trading strategy that utilizes fundamental research to create what it believes is an informational advantage prior to earnings announcements. During the first quarter, Coe’s short positions detracted, as the market rallied. During the second quarter, when the equity market declined, short positions were profitable, while long positions detracted. The strategy also

2

|

|

|

|

tends to maintain large cash positions to allocate opportunistically, which benefited its portfolio during the second quarter when the market sold off. For the semi-annual period overall, Coe’s top winners were semiconductor company Mellanox Technologies, clinical software developer Allscripts Healthcare Solutions and medical device company Zoll Medical. Coe’s worst performers during the semi-annual period were computer memory device manufacturer Xyratex, diagnostic equipment company Cepheid and specialty chemicals company Kronos Worldwide.

Sub-Adviser Tiburon Capital Management (“Tiburon”) (6.5% of Fund net assets†) is an event-driven strategy that invests across the market capitalization structure. During the first quarter, there were virtually no events in its portfolio and thus the strategy posted effectively flat returns. However, during the second quarter, Tiburon posted positive returns, profiting from the occurrence of events in a long position in Amarin, which received FDA patent approval; MAG Silver, where a released study on a meaningful silver mine and activism assisted; as well as hedges, which moderated downside, especially in May. These hedges included being short the euro and short French and Spanish sovereign bonds. Tiburon remained confident at the end of the semi-annual period about the occurrence of additional events during the second half of 2012, but remained cautious of the deleveraging macro environment.

The Fund’s long/short emerging markets exposure (49.6% of Fund net assets†) added significant value to its results during the semi-annual period, outperforming the iShares MSCI Emerging Markets Index Fund7 by a wide margin. Indeed, the Fund’s long/short emerging markets exposure was the strongest performing segment of the Fund for the semi-annual period as a whole. Emerging market equities performed particularly well during the first quarter, partly driven by a reflexive bounce from a weak end to 2011. But as the second quarter progressed, uncertainty heightened, particularly regarding the Eurozone and the euro. Fears of a hard landing in China combined with concerns over slowing demand from the developed world also weighed on emerging market equities, particularly in May. The Fund’s dedicated emerging markets positioning reflects our favorable outlook on the long-term growth prospects of the developing world and the ability to generate alpha, or added value, in the various emerging market regions.

Global Macro Strategy

The Marketfield Fund (“Marketfield”) (7.0% of Fund net

assets†), a traditional discretionary macro fund managed by Michael

Aronstein, uses a top-down, often at times contrarian, thematic investment

approach. During the semi-annual period, Marketfield posted strong positive

returns, as Mr. Aronstein was able not only to protect on the downside but also

to capture most of the upside as well. Marketfield benefited, more

specifically, from Mr. Aronstein’s bullish sentiment on the U.S. economy and

preference for cyclically-oriented business models, especially during the first

calendar quarter. However, Mr. Aronstein was earlier than most in expressing

his concerns on the developing markets, and this view served as a detractor to

performance as emerging markets continued their upward trajectory. At the end

of the semi-annual period, Mr. Aronstein remained bearish on the emerging markets

and had maintained Marketfield’s emphasis on cyclically-oriented business

models within the U.S.

The Fund also had a global macro investment in the AC-Risk Parity 12 Vol Fund (6.1% of Fund net assets†) (“Risk Parity Fund”) through an open-end UCITS8 III structure. The Risk Parity Fund, managed by Aquila Capital, was another strong contributor to the Fund’s performance during the semi-annual period. Aquila Capital focuses on behavioral indicators to create a beta neutral portfolio using futures contracts on equities, energy commodities, bonds and short-term interest rates. Only partially offsetting Risk Parity Fund’s advance during the first quarter was performance during the second quarter when gains within its credit positioning were overwhelmed by losses from short equity positions. We reduced the Fund’s position in Risk Parity Fund toward the end of the semi-annual period.

Tactical Strategy

The Fund’s tactical, or opportunistic, strategy sleeve

allows us to control portfolio risk and leverage our internal capabilities to

add select investment opportunities where appropriate. We monitor risk at both

the Fund and strategy level, and within the tactical sleeve, we will often

hedge positions to control the overall risk to a particular segment of the market.

During the first quarter, we implemented an active hedge against the Fund’s

technology holdings to reduce exposure to the sector. While the hedge was

initiated to reduce portfolio risk, it detracted from performance and led to a

disappointing return for the tactical sleeve as the technology sector rallied.

Such negative returns were only partially offset during the second quarter when

notable gains came from long positions in gold equities, which we added to

after a dismal first quarter that followed a weak 2011. Additionally, we

continued to hold a short equity overlay against the Fund’s equity managers,

and those hedges performed well with solid gains from the technology and

financial short positions we had established. While the tactical strategy detracted

from the Fund’s results during the semi-annual period, it remained a relatively

small sleeve for the Fund, and it continued to be an effective tool to manage

the beta and standard deviation targets of the Fund.

3

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

As the Fund implements a fund-of-funds strategy, an investor in the Fund will bear the operating expenses of the “Underlying Funds” in which the Fund invests. The total expenses borne by an investor in the Fund will be higher than if the investor invested directly in the Underlying Funds, and the returns may therefore be lower. The Fund, the Sub-Advisers and the Underlying Funds may use aggressive investment strategies, including absolute return strategies, which are riskier than those used by typical mutual funds. If the Fund and Sub-Advisers are unsuccessful in applying these investment strategies, the Fund and you may lose more money than if you had invested in another fund that did not invest aggressively. The Fund is subject to risks associated with the Sub-Advisers making trading decisions independently, investing in other investment companies, using a particular style or set of styles, basing investment decisions on historical relationships and correlations, trading frequently, using leverage, making short sales, being non-diversified and investing in securities with low correlation to the market. The Fund is also subject to risks associated with investments in foreign markets, emerging market securities, small cap companies, debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities and CMOs.

We appreciate your investment in the Van Eck VIP Multi-Manager Alternatives Fund, and we look forward to helping you meet your investment goals in the future.

Investment Committee:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen H. Scott |

|

Jan F. van Eck |

|

Michael F. Mazier |

|

Co-Portfolio Manager |

|

Co-Portfolio Manager |

|

Investment Committee Member |

|

|

|

|

|

|

|

July 17, 2012 |

|

|

|

|

|

|

|

|

† |

All Fund assets referenced are Total Net Assets as of June 30, 2012. |

4

|

|

|

|

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

|

|

|

|

1 |

HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

|

|

|

2 |

S&P® 500 Index consists of 500 widely held common stocks, covering industrials, utility, financial and transportation sectors. |

|

|

|

|

3 |

Beta is a measure of sensitivity to market movements. A beta higher than 1 indicates that a security or portfolio will tend to exhibit higher volatility than the market. A beta lower than 1 indicates that a security or portfolio will tend to exhibit lower volatility than the market. |

|

|

|

|

4 |

Alpha is a measure of an investment’s performance over and above the performance of other investments of the same risk. A stock with an alpha of 1.25 is projected to rise by an annual premium of 1.25% above its comparable benchmark index. |

|

|

|

|

5 |

HFRX Equity Hedge Index is designed to be representative of equity hedge strategies used in the hedge fund universe. Equity Hedge strategies maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. Equity Hedge managers would typically maintain at least 50%, and may in some cases be substantially entirely invested in equities, both long and short. |

|

|

|

|

6 |

Standard deviation is a measure of the variability, or volatility, of a security, derived from the security’s historical returns, and used in determining the range of possible future returns. The higher the standard deviation, the greater the potential for volatility. |

|

|

|

|

7 |

iShares MSCI Emerging Markets Index Fund is an exchange traded fund that seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the MSCI Emerging Markets Index, net of expenses. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index provided by MSCI that is designed to measure the equity market performance of emerging markets. |

|

|

|

|

8 |

UCITS stands for “Undertakings for Collective Investment in Transferable Securities.” |

5

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Investment Strategy |

|

Implementation |

|

2Q 2012 |

|

4Q 2011 |

||

|

Arbitrage |

|

|

|

23.3 |

|

|

23.76 |

|

|

Blended Arbitrage |

|

AQR Diversified Arbitrage Fund |

|

6.23 |

|

|

6.32 |

|

|

Market Neutral |

|

TFS Market Neutral Fund |

|

7.11 |

|

|

7.04 |

|

|

Volatility Arbitrage |

|

Structured Note |

|

5.01 |

|

|

5.08 |

|

|

Volatility Arbitrage |

|

Sub-Adviser: Acorn |

|

4.99 |

|

|

5.32 |

|

|

Long/Short |

|

|

|

49.6 |

|

|

47.34 |

|

|

Emerging Markets |

|

ETFs, Other Securities |

|

4.89 |

|

|

3.73 |

|

|

Event Driven |

|

Sub-Adviser: Tiburon |

|

6.47 |

|

|

6.45 |

|

|

Event Driven |

|

Sub-Adviser: Coe |

|

9.39 |

|

|

9.18 |

|

|

U.S. Equity |

|

Sub-Adviser: Millrace |

|

7.93 |

|

|

7.39 |

|

|

U.S. Equity |

|

Sub-Adviser: Primary |

|

5.54 |

|

|

5.37 |

|

|

Fixed Income |

|

Sub-Adviser: Medley |

|

9.65 |

|

|

9.76 |

|

|

Fixed Income |

|

Loomis Sayles Bond Fund |

|

5.73 |

|

|

5.46 |

|

|

Global Macro |

|

|

|

13.0 |

|

|

17.25 |

|

|

Discretionary Macro |

|

Marketfield Fund |

|

6.99 |

|

|

5.66 |

|

|

Systematic Macro |

|

UCITS III: Statistical Value |

|

6.05 |

|

|

11.59 |

|

|

Tactical/Cash |

|

|

|

14.1 |

|

|

11.65 |

|

|

Tactical Overlay |

|

ETFs, Other Securities |

|

3.16 |

|

|

3.01 |

|

|

Cash Equivalents |

|

— |

|

10.89 |

|

|

8.64 |

|

|

Total |

|

— |

|

100.00 |

|

|

100.00 |

|

|

|

|

|

As of June 30, 2012. Portfolio subject to change. |

|

|

* |

Percentage of net assets. |

6

|

|

|

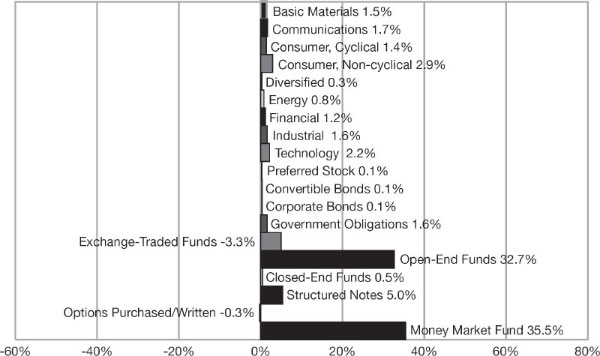

SECTOR WEIGHTING NET EXPOSURE** |

|

(unaudited) |

|

|

|

|

As of June 30, 2012. Portfolio subject to change. |

|

|

** |

Net exposure was calculated by adding long and short positions. |

7

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

(unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2012 to June 30, 2012.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Van Eck VIP Multi-Manager Alternatives Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning |

|

Ending |

|

Expenses

Paid |

|

|||||||||

|

Initial Class* |

|

Actual |

|

|

$ |

1,000.00 |

|

|

|

$ |

1,006.10 |

|

|

|

$ |

14.02 |

|

|

|

|

|

Hypothetical** |

|

|

$ |

1,000.00 |

|

|

|

$ |

1,010.89 |

|

|

|

$ |

14.05 |

|

|

|

Class S*** |

|

Actual |

|

|

$ |

1,000.00 |

|

|

|

$ |

985.00 |

|

|

|

$ |

4.91 |

|

|

|

|

|

Hypothetical** |

|

|

$ |

1,000.00 |

|

|

|

$ |

1,003.38 |

|

|

|

$ |

4.96 |

|

|

|

|

|

|

* |

Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2012), of 2.81% on Initial Class Shares multiplied by the average account value over the period, multiplied by 182 and divided by 366 (to reflect the one-half year period). |

|

|

|

|

** |

Assumes annual return of 5% before expenses |

|

|

|

|

*** |

Expenses are equal to the Fund’s annualized expense ratio (for the period from April 30, 2012 to June 30, 2012), of 2.97% on Class S Shares multiplied by the average account value over the period, multiplied by 61 and divided by 366 (to reflect the period from inception). |

8

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

June 30, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

COMMON STOCKS: 18.3% |

|

|

|

|

||

|

Basic Materials: 1.7% |

|

|

|

|

||

|

2,525 |

|

Argonaut Gold, Inc. (CAD) * |

|

$ |

19,047 |

|

|

2,400 |

|

Continental Gold Ltd. (CAD) * |

|

|

15,535 |

|

|

390 |

|

Eldorado Gold Corp. |

|

|

4,805 |

|

|

824 |

|

Eldorado Gold Corp. (CAD) |

|

|

10,149 |

|

|

2,960 |

|

Fortuna Silver Mines, Inc. (CAD) * |

|

|

10,118 |

|

|

350 |

|

Goldcorp, Inc. |

|

|

13,153 |

|

|

1,326 |

|

MAG Silver Corp. * |

|

|

11,536 |

|

|

1,035 |

|

New Gold, Inc. * |

|

|

9,833 |

|

|

1,490 |

|

Osisko Mining Corp. (CAD) * |

|

|

10,245 |

|

|

68 |

|

PPG Industries, Inc. |

|

|

7,216 |

|

|

560 |

|

Tahoe Resources, Inc. * |

|

|

7,778 |

|

|

128,999 |

|

Tiangong

International Co. Ltd. |

|

|

25,750 |

|

|

6,920 |

|

Volta Resources, Inc. (CAD) * |

|

|

4,282 |

|

|

589 |

|

Wausau Paper Corp. |

|

|

5,731 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

155,178 |

|

|

|

|

|

|

|

||

|

Communications: 1.9% |

|

|

|

|

||

|

2,824 |

|

Alcatel-Lucent (ADR) * |

|

|

4,603 |

|

|

521 |

|

Bankrate, Inc. * |

|

|

9,581 |

|

|

971 |

|

CalAmp Corp. * |

|

|

7,117 |

|

|

1,648 |

|

Cbeyond, Inc. * |

|

|

11,157 |

|

|

914 |

|

Ceragon Networks Ltd. * |

|

|

7,833 |

|

|

1,421 |

|

Cincinnati Bell, Inc. * |

|

|

5,286 |

|

|

32 |

|

Google, Inc. * |

|

|

18,562 |

|

|

1,154 |

|

ICG Group, Inc. * |

|

|

10,675 |

|

|

259 |

|

InterDigital, Inc. |

|

|

7,643 |

|

|

1,774 |

|

Internap Network Services Corp. * |

|

|

11,549 |

|

|

4,031 |

|

Lionbridge Technologies, Inc. * |

|

|

12,698 |

|

|

130 |

|

News Corp. |

|

|

2,898 |

|

|

407 |

|

Pandora Media, Inc. * |

|

|

4,424 |

|

|

1,367 |

|

Perficient, Inc. * |

|

|

15,351 |

|

|

2,895 |

|

RF Micro Devices, Inc. * |

|

|

12,304 |

|

|

317 |

|

SPS Commerce, Inc. * |

|

|

9,630 |

|

|

2,148 |

|

Support.com, Inc. * |

|

|

6,852 |

|

|

1,240 |

|

Valuevision Media, Inc. * |

|

|

2,579 |

|

|

392 |

|

Yahoo!, Inc. * |

|

|

6,205 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

166,947 |

|

|

|

|

|

|

|

||

|

Consumer, Cyclical: 2.7% |

|

|

|

|

||

|

57 |

|

AFC Enterprises, Inc. * |

|

|

1,319 |

|

|

373 |

|

Asbury Automotive Group, Inc. * |

|

|

8,836 |

|

|

83 |

|

Barnes & Noble, Inc. * |

|

|

1,366 |

|

|

164 |

|

Bob Evans Farms, Inc. |

|

|

6,593 |

|

|

74 |

|

Cooper-Standard Holding, Inc. * |

|

|

2,738 |

|

|

593 |

|

Crocs, Inc. * |

|

|

9,577 |

|

|

417 |

|

CVS Caremark Corp. |

|

|

19,486 |

|

|

240 |

|

Dufry A.G. * # |

|

|

29,090 |

|

|

1,030 |

|

Kia Motors Corp. (KRW) # |

|

|

67,887 |

|

|

126 |

|

Life Time Fitness, Inc. * |

|

|

5,860 |

|

|

277 |

|

Marriott International, Inc. |

|

|

10,858 |

|

|

137 |

|

MSC Industrial Direct Co. |

|

|

8,980 |

|

|

87 |

|

Polaris Industries, Inc. |

|

|

6,219 |

|

|

502 |

|

Select Comfort Corp. * |

|

|

10,502 |

|

|

1,205 |

|

Sonic Corp. * |

|

|

12,074 |

|

|

98 |

|

Starbucks Corp. |

|

|

5,225 |

|

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

Consumer, Cyclical: (continued) |

|

|

|

|

||

|

335 |

|

Titan Machinery, Inc. * |

|

$ |

10,174 |

|

|

463 |

|

Universal Entertainment Corp. |

|

|

9,663 |

|

|

1,817 |

|

Wabash National Corp. * |

|

|

12,029 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

238,476 |

|

|

|

|

|

|

|

||

|

Consumer, Non-cyclical: 3.4% |

|

|

|

|

||

|

84 |

|

Abbott Laboratories |

|

|

5,415 |

|

|

1,295 |

|

Amarin Corp. Plc (ADR) * |

|

|

18,726 |

|

|

136 |

|

Beam, Inc. |

|

|

8,499 |

|

|

2,032 |

|

BioScrip, Inc. * |

|

|

15,098 |

|

|

577 |

|

Cardiovascular Systems, Inc. * |

|

|

5,649 |

|

|

88 |

|

Community Health Systems, Inc. * |

|

|

2,467 |

|

|

129 |

|

Dean Foods Co. * |

|

|

2,197 |

|

|

3,874 |

|

EnteroMedics, Inc. * |

|

|

13,365 |

|

|

109 |

|

Gen-Probe, Inc. * |

|

|

8,960 |

|

|

4,657 |

|

Guided Therapeutics, Inc. * |

|

|

3,674 |

|

|

1,881 |

|

Healthways, Inc. * |

|

|

15,010 |

|

|

244 |

|

Heartland Payment Systems, Inc. |

|

|

7,340 |

|

|

1,243 |

|

IRIS International, Inc. * |

|

|

14,046 |

|

|

192 |

|

Iron Mountain, Inc. |

|

|

6,328 |

|

|

678 |

|

K12, Inc. * |

|

|

15,797 |

|

|

54 |

|

Laboratory

Corp. of America |

|

|

5,001 |

|

|

329 |

|

Lender Processing Services, Inc. |

|

|

8,317 |

|

|

289 |

|

Medtox Scientific, Inc. * |

|

|

7,791 |

|

|

155 |

|

Neogen Corp. * |

|

|

7,161 |

|

|

652 |

|

On Assignment, Inc. * |

|

|

10,406 |

|

|

84 |

|

PepsiCo, Inc. |

|

|

5,935 |

|

|

352 |

|

Pfizer, Inc. |

|

|

8,096 |

|

|

160 |

|

Philip Morris International, Inc. |

|

|

13,962 |

|

|

1,345 |

|

Quanta Services, Inc. * |

|

|

32,375 |

|

|

824 |

|

Solta Medical, Inc. * |

|

|

2,414 |

|

|

1,376 |

|

Spectranetics Corp. * |

|

|

15,714 |

|

|

79 |

|

The Andersons, Inc. |

|

|

3,370 |

|

|

862 |

|

TMS International Corp. * |

|

|

8,594 |

|

|

348 |

|

United Rentals, Inc. * |

|

|

11,846 |

|

|

59 |

|

Universal Health Services, Inc. |

|

|

2,546 |

|

|

147 |

|

Valeant

Pharmaceuticals |

|

|

6,584 |

|

|

387 |

|

Volcano Corp. * |

|

|

11,088 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

303,771 |

|

|

|

|

|

|

|

||

|

Diversified: 0.3% |

|

|

|

|

||

|

27,580 |

|

Noble Group Ltd. (SGD) # |

|

|

24,644 |

|

|

|

|

|

|

|

||

|

Energy: 0.8% |

|

|

|

|

||

|

1,761 |

|

Abraxas Petroleum Corp. * |

|

|

5,618 |

|

|

23,360 |

|

Afren Plc (GBP) * # |

|

|

37,973 |

|

|

211 |

|

BP Plc (ADR) |

|

|

8,554 |

|

|

601 |

|

Energy Partners Ltd. * |

|

|

10,157 |

|

|

118 |

|

Energy XXI Bermuda Ltd. |

|

|

3,692 |

|

|

158 |

|

National Oilwell Varco, Inc. |

|

|

10,182 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

76,176 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Financial: 1.4% |

|

|

|

|

||

|

478 |

|

American International Group, Inc. * |

|

|

15,339 |

|

|

833 |

|

Assured Guaranty Ltd. |

|

|

11,745 |

|

|

3,660 |

|

BR Properties S.A. |

|

|

43,187 |

|

|

393 |

|

Evoq Properties, Inc. * |

|

|

1,169 |

|

See Notes to Financial Statements

9

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

SCHEDULE OF INVESTMENTS |

|

(continued) |

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

Financial: (continued) |

|

|

|

|

||

|

435 |

|

JPMorgan Chase & Co. |

|

$ |

15,543 |

|

|

6,213 |

|

Kasikornbank PCL (NVDR) (THB) # |

|

|

32,036 |

|

|

1,041 |

|

KeyCorp |

|

|

8,057 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

127,076 |

|

|

|

|

|

|

|

||

|

Industrial: 2.8% |

|

|

|

|

||

|

184 |

|

Analogic Corp. |

|

|

11,408 |

|

|

3 |

|

Aptargroup, Inc. |

|

|

154 |

|

|

14,105 |

|

Arctic Glacier Income Fund * |

|

|

2,920 |

|

|

736 |

|

Benchmark Electronics, Inc. * |

|

|

10,267 |

|

|

255 |

|

Carlisle Cos, Inc. |

|

|

13,520 |

|

|

244 |

|

Danaher Corp. |

|

|

12,708 |

|

|

504 |

|

Dycom Industries, Inc. * |

|

|

9,379 |

|

|

370 |

|

EMCOR Group, Inc. |

|

|

10,293 |

|

|

29 |

|

FedEx Corp. |

|

|

2,657 |

|

|

172 |

|

FEI Co. * |

|

|

8,228 |

|

|

2,593 |

|

Flow International Corp. * |

|

|

8,168 |

|

|

1,540 |

|

Heckmann Corp. * |

|

|

5,205 |

|

|

126 |

|

Ingersoll-Rand Plc |

|

|

5,315 |

|

|

531 |

|

Jabil Circuit, Inc. |

|

|

10,795 |

|

|

293 |

|

Jacobs Engineering Group, Inc. * |

|

|

11,093 |

|

|

267 |

|

Lennox International, Inc. |

|

|

12,450 |

|

|

391 |

|

MasTec, Inc. * |

|

|

5,881 |

|

|

318 |

|

Newport Corp. * |

|

|

3,822 |

|

|

182 |

|

OSI Systems, Inc. * |

|

|

11,528 |

|

|

155 |

|

Regal-Beloit Corp. |

|

|

9,650 |

|

|

148 |

|

Roadrunner

Transportation |

|

|

2,500 |

|

|

194 |

|

Robbins & Myers, Inc. |

|

|

8,113 |

|

|

597 |

|

Spirit Aerosystems Holdings, Inc. * |

|

|

14,227 |

|

|

26,993 |

|

Techtronic Industries Co. (HKD) # |

|

|

34,273 |

|

|

396 |

|

Tetra Tech, Inc. * |

|

|

10,328 |

|

|

322 |

|

Trex Co, Inc. * |

|

|

9,689 |

|

|

184 |

|

Waste Connections, Inc. |

|

|

5,505 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

250,076 |

|

|

|

|

|

|

|

||

|

Technology: 3.3% |

|

|

|

|

||

|

277 |

|

ACI Worldwide, Inc. * |

|

|

12,246 |

|

|

605 |

|

Atmel Corp. * |

|

|

4,054 |

|

|

1,627 |

|

AuthenTec, Inc. * |

|

|

7,045 |

|

|

371 |

|

Cadence Design Systems, Inc. * |

|

|

4,077 |

|

|

1,703 |

|

Callidus Software, Inc. * |

|

|

8,481 |

|

|

309 |

|

Cavium, Inc. * |

|

|

8,652 |

|

|

1,228 |

|

CDC Corp. * |

|

|

5,686 |

|

|

60 |

|

Computer Programs & Systems, Inc. |

|

|

3,433 |

|

|

1,362 |

|

Datalink Corp. * |

|

|

13,007 |

|

|

1,769 |

|

FSI International, Inc. * |

|

|

6,351 |

|

|

1,474 |

|

Glu Mobile, Inc. * |

|

|

8,181 |

|

|

2,915 |

|

inContact, Inc. * |

|

|

14,604 |

|

|

291 |

|

Mentor Graphics Corp. * |

|

|

4,365 |

|

|

480 |

|

Monolithic Power Systems, Inc. * |

|

|

9,538 |

|

|

425 |

|

Netscout Systems, Inc. * |

|

|

9,176 |

|

|

2,064 |

|

O2Micro International Ltd. (ADR) * |

|

|

9,102 |

|

|

582 |

|

Omnicell, Inc. * |

|

|

8,520 |

|

|

832 |

|

Pericom Semiconductor Corp. * |

|

|

7,488 |

|

|

1,018 |

|

PLX Technology, Inc. * |

|

|

6,464 |

|

|

969 |

|

RealD, Inc. * |

|

|

14,496 |

|

|

875 |

|

Rudolph Technologies, Inc. * |

|

|

7,630 |

|

|

45 |

|

Samsung Electronics Co. Ltd. (KRW) # |

|

|

47,654 |

|

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

Technology: (continued) |

|

|

|

|

||

|

855 |

|

SciQuest, Inc. * |

|

$ |

15,356 |

|

|

240 |

|

Semtech Corp. * |

|

|

5,837 |

|

|

804 |

|

Silicon

Motion Technology Corp. |

|

|

11,344 |

|

|

384 |

|

Skyworks Solutions, Inc. * |

|

|

10,510 |

|

|

909 |

|

Super Micro Computer, Inc. * |

|

|

14,417 |

|

|

11,056 |

|

Trident Microsystems, Inc. * |

|

|

4,234 |

|

|

381 |

|

Ultratech, Inc. * |

|

|

12,002 |

|

|

209 |

|

Veeco Instruments, Inc. * |

|

|

7,181 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

301,131 |

|

|

|

|

|

|

|

||

|

Total Common Stocks |

|

|

1,643,475 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

||

|

PREFERRED STOCK: 0.1% |

|

|

|

|

||

|

Financial: 0.1% |

|

|

|

|

||

|

51 |

|

Citigroup, Inc. |

|

|

4,364 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONVERTIBLE BOND: 0.1% |

|

|

|

|

||

|

Industrial: 0.1% |

|

|

|

|

||

|

$12,000 |

|

DryShips,

Inc. |

|

|

8,790 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

CORPORATE BONDS: 5.6% |

|

|

|

|

||

|

|

|

|

|

|

||

|

Basic Materials: 0.3% |

|

|

|

|

||

|

|

|

Catalyst Paper Corp. |

|

|

|

|

|

50,000 |

|

11.00%,12/15/12 (c) 144A t |

|

|

24,750 |

|

|

|

|

|

|

|

||

|

Communications: 2.2% |

|

|

|

|

||

|

|

|

Clear Channel Communications, Inc. |

|

|

|

|

|

11,000 |

|

5.75%,01/15/13 (c) |

|

|

10,959 |

|

|

11,000 |

|

11.00%,08/06/12 (c) |

|

|

6,875 |

|

|

|

|

Earthlink, Inc. |

|

|

|

|

|

55,000 |

|

8.88%,05/15/15 (c) |

|

|

53,831 |

|

|

|

|

FiberTower Corp. |

|

|

|

|

|

61,499 |

|

9.00%,01/01/16 (c) |

|

|

37,668 |

|

|

|

|

Integra Telecom Holdings, Inc. |

|

|

|

|

|

30,000 |

|

10.75%,04/15/13 (c) 144A |

|

|

29,400 |

|

|

|

|

Nextel Communications, Inc. |

|

|

|

|

|

5,000 |

|

6.88%,07/16/12 (c) |

|

|

5,044 |

|

|

|

|

Satmex Escrow S.A. de C.V. |

|

|

|

|

|

50,000 |

|

9.50%,05/15/14 (c) |

|

|

52,750 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

196,527 |

|

|

|

|

|

|

|

||

|

Consumer, Cyclical: 1.9% |

|

|

|

|

||

|

|

|

Lions Gate Entertainment, Inc. |

|

|

|

|

|

15,000 |

|

10.25%,11/01/13 (c) 144A |

|

|

16,500 |

|

|

|

|

Liz Claiborne, Inc. |

|

|

|

|

|

70,000 |

|

10.50%,04/15/14 (c) 144A |

|

|

78,225 |

|

|

|

|

Mohegan Tribal Gaming Authority |

|

|

|

|

|

8,000 |

|

11.00%,08/06/12 (c) Reg S |

|

|

5,380 |

|

|

|

|

Production Resource Group, Inc. |

|

|

|

|

|

35,000 |

|

8.88%,05/01/14 (c) |

|

|

26,600 |

|

|

|

|

RadioShack Corp. |

|

|

|

|

|

12,500 |

|

6.75%,05/15/19 (c) |

|

|

9,344 |

|

|

|

|

Shingle Springs Tribal Gaming Authority |

|

|

|

|

|

9,000 |

|

9.38%,08/16/12 (c) Reg S |

|

|

6,930 |

|

See Notes to Financial Statements

10

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

Value |

|

|

|

Consumer, Cyclical: (continued) |

|

|

|

|

||

|

|

|

The Bon-Ton Department Stores, Inc. |

|

|

|

|

|

$ 11,000 |

|

10.25%,08/06/12 (c) |

|

$ |

9,350 |

|

|

|

|

The River Rock Entertainment Authority |

|

|

|

|

|

11,000 |

|

9.00%,11/01/15 (c) |

|

|

7,315 |

|

|

432 |

|

9.75%,11/01/11 (c) t |

|

|

287 |

|

|

|

|

Tower Automotive Holdings USA LLC |

|

|

|

|

|

15,000 |

|

10.63%,09/01/14 (c) 144A |

|

|

15,975 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

175,906 |

|

|

|

|

|

|

|

||

|

Energy: 0.5% |

|

|

|

|

||

|

|

|

Calumet Specialty Products Partners LP |

|

|

|

|

|

12,500 |

|

9.38%,05/01/15 (c) |

|

|

12,594 |

|

|

|

|

Chesapeake Energy Corp. |

|

|

|

|

|

11,000 |

|

6.78%,11/15/12 (c) |

|

|

10,739 |

|

|

|

|

Endeavour International Corp. |

|

|

|

|

|

17,000 |

|

12.00%,03/01/15 (c) Reg S |

|

|

17,765 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

41,098 |

|

|

|

|

|

|

|

||

|

Financial: 0.3% |

|

|

|

|

||

|

|

|

CIT Group, Inc. |

|

|

|

|

|

19,196 |

|

7.00%,08/06/12 (c) 144A |

|

|

19,256 |

|

|

|

|

MBIA Insurance Corp. |

|

|

|

|

|

17,000 |

|

14.00%,01/15/13 (c) 144A |

|

|

9,350 |

|

|

|

|

MBIA Insurance Corp. |

|

|

|

|

|

6,000 |

|

14.00%,01/15/13 (c) Reg S |

|

|

3,240 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

31,846 |

|

|

|

|

|

|

|

||

|

Industrial: 0.1% |

|

|

|

|

||

|

|

|

Heckmann Corp. |

|

|

|

|

|

10,000 |

|

9.88%,04/15/15 (c) 144A |

|

|

9,525 |

|

|

|

|

|

|

|

||

|

Technology: 0.2% |

|

|

|

|

||

|

|

SRA International, Inc. |

|

|

|

||

|

14,000 |

|

11.00%,10/01/15 (c) |

|

|

14,140 |

|

|

|

|

|

|

|

||

|

Utilities: 0.1% |

|

|

|

|

|

|

|

|

|

Energy Future Intermediate Holding Co. LLC |

|

|

|

|

|

10,000 |

|

11.75%,03/01/17 (c) 144A |

|

|

10,275 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Corporate Bonds |

|

|

504,067 |

|

||

|

|

|

|

||||

|

GOVERNMENT OBLIGATIONS: 1.6% |

|

|

|

|

||

|

|

|

United States Treasury Notes |

|

|

|

|

|

40,000 |

|

2.00%,02/15/22 |

|

|

41,353 |

|

|

99,000 |

|

2.13%,08/15/21 |

|

|

104,074 |

|

|

500 |

|

3.63%,02/15/21 |

|

|

568 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Government Obligations |

|

|

145,995 |

|

||

|

|

|

|

||||

|

STRUCTURED NOTES: 5.0% |

|

|

|

|

||

|

|

|

Deutsche

Bank A.G. London Branch, |

|

|

|

|

|

380,000 |

|

09/24/12 § (b) |

|

|

376,998 |

|

|

57,000 |

|

02/08/13 § (b) |

|

|

54,464 |

|

|

20,000 |

|

07/03/13 § (b) |

|

|

19,304 |

|

|

|

|

|

|

|

||

|

Total Structured Notes |

|

|

450,766 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

CLOSED-END FUND: 0.5% |

|

|

|

|

||

|

5,050 |

|

Eaton Vance

Tax-Managed |

|

$ |

45,804 |

|

|

|

|

|

|

|

||

|

EXCHANGE TRADED FUNDS: 2.1% |

|

|

|

|

||

|

76 |

|

iShares Silver Trust * |

|

|

2,025 |

|

|

3,670 |

|

Market

Vectors Emerging Markets |

|

|

93,805 |

|

|

2,000 |

|

Market

Vectors Mortgage REIT |

|

|

52,580 |

|

|

270 |

|

SPDR Gold Trust * |

|

|

41,901 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Exchange Traded Funds |

|

|

190,311 |

|

||

|

|

|

|

||||

|

OPEN-END FUNDS: 32.7% |

|

|

|

|

||

|

3,773 |

|

AC Risk Parity 12 Vol Fund * # |

|

|

566,647 |

|

|

1,039 |

|

American

Independence Funds |

|

|

20,738 |

|

|

51,200 |

|

AQR Diversified Arbitrage Fund |

|

|

560,643 |

|

|

35,332 |

|

Loomis Sayles Bond Fund |

|

|

511,960 |

|

|

116 |

|

Luxcellence - Virtuoso Fund * # § |

|

|

13,455 |

|

|

41,265 |

|

Marketfield Fund * |

|

|

629,298 |

|

|

42,590 |

|

TFS Market Neutral Fund * |

|

|

640,134 |

|

|

|

|

|

|

|

||

|

Total Open-End Funds |

|

|

2,942,875 |

|

||

|

|

|

|

||||

|

OPTIONS PURCHASED: 0.2% |

|

|

|

|

||

|

1,000 |

|

S&P 500

Index Call |

|

|

19,000 |

|

|

500 |

|

SPDR

S&P 500 ETF Trust Put |

|

|

5 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Options Purchased |

|

|

19,005 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

MONEY MARKET FUND: 35.5% |

|

|

|

|

||

|

3,196,231 |

|

AIM

Treasury Portfolio - Institutional |

|

|

3,196,231 |

|

|

|

|

|

|

|

||

|

Total Investments: 101.7% |

|

|

9,151,683 |

|

||

|

Liabilities in excess of other assets: (1.7)% |

|

|

(154,293 |

) |

||

|

|

|

|

||||

|

NET ASSETS: 100.0% |

|

$ |

8,997,390 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SECURITIES SOLD SHORT: (15.5)% |

|

|

|

|

||

|

|

|

|

|

|

||

|

COMMON STOCKS: (4.6)% |

|

|

|

|

||

|

|

|

|

|

|

||

|

Basic Materials: (0.2)% |

|

|

|

|

||

|

(197 |

) |

A. Schulman, Inc. |

|

|

(3,910 |

) |

|

(58 |

) |

Huntsman Corp. |

|

|

(751 |

) |

|

(328 |

) |

Noranda Aluminum Holding Corp. |

|

|

(2,611 |

) |

|

(510 |

) |

RPM International, Inc. |

|

|

(13,872 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(21,144 |

) |

|

|

|

|

|

|

||

|

Communications: (0.2)% |

|

|

|

|

||

|

(631 |

) |

Dice Holdings, Inc. * |

|

|

(5,925 |

) |

|

(86 |

) |

EZchip Semiconductor Ltd. * |

|

|

(3,443 |

) |

|

(260 |

) |

LogMeIn, Inc. * |

|

|

(7,935 |

) |

|

(249 |

) |

ValueClick, Inc. * |

|

|

(4,081 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(21,384 |

) |

|

|

|

|

|

|

||

See Notes to Financial Statements

11

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

SCHEDULE OF INVESTMENTS |

|

(continued) |

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

|

||||||

|

Consumer, Cyclical: (1.3)% |

|

|

|

|

||

|

(129 |

) |

BJ’s Restaurants, Inc. * |

|

$ |

(4,902 |

) |

|

(36 |

) |

BorgWarner, Inc. * |

|

|

(2,361 |

) |

|

(39 |

) |

Cinemark Holdings, Inc. |

|

|

(891 |

) |

|

(154 |

) |

Copart, Inc. * |

|

|

(3,648 |

) |

|

(38 |

) |

Darden Restaurants, Inc. |

|

|

(1,924 |

) |

|

(171 |

) |

DTS, Inc. * |

|

|

(4,460 |

) |

|

(322 |

) |

Herman Miller, Inc. |

|

|

(5,963 |

) |

|

(469 |

) |

LKQ Corp. * |

|

|

(15,665 |

) |

|

(296 |

) |

Maidenform Brands, Inc. * |

|

|

(5,896 |

) |

|

(112 |

) |

McDonald’s Corp. |

|

|

(9,915 |

) |

|

(437 |

) |

Mobile Mini, Inc. * |

|

|

(6,293 |

) |

|

(56 |

) |

O’Reilly Automotive, Inc. * |

|

|

(4,691 |

) |

|

(263 |

) |

PACCAR, Inc. |

|

|

(10,307 |

) |

|

(129 |

) |

Red Robin Gourmet Burgers, Inc. * |

|

|

(3,936 |

) |

|

(808 |

) |

Regal Entertainment Group |

|

|

(11,118 |

) |

|

(112 |

) |

WESCO International, Inc. * |

|

|

(6,446 |

) |

|

(73 |

) |

WW Grainger, Inc. |

|

|

(13,960 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(112,376 |

) |

|

|

|

|

|

|

||

|

Consumer, Non-cyclical: (0.5)% |

|

|

|

|

||

|

(171 |

) |

Bio-Reference Labs, Inc. * |

|

|

(4,494 |

) |

|

(242 |

) |

Bruker Corp. * |

|

|

(3,221 |

) |

|

(191 |

) |

DENTSPLY International, Inc. |

|

|

(7,222 |

) |

|

(88 |

) |

Peet’s Coffee & Tea, Inc. * |

|

|

(5,284 |

) |

|

(50 |

) |

Quest Diagnostics, Inc. |

|

|

(2,995 |

) |

|

(333 |

) |

The Procter & Gamble Co. |

|

|

(20,396 |

) |

|

(19 |

) |

WD-40 Co. |

|

|

(946 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(44,558 |

) |

|

|

|

|

|

|

||

|

Energy: (0.0)% |

|

|

|

|

||

|

(293 |

) |

Hercules Offshore, Inc. * |

|

|

(1,037 |

) |

|

|

|

|

|

|

||

|

Financial: (0.1)% |

|

|

|

|

||

|

(241 |

) |

The Progressive Corp. |

|

|

(5,020 |

) |

|

(107 |

) |

Tower Group, Inc. |

|

|

(2,233 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(7,253 |

) |

|

|

|

|

|

|

||

|

Industrial: (1.2)% |

|

|

|

|

||

|

(456 |

) |

Advanced Energy Industries, Inc. * |

|

|

(6,120 |

) |

|

(3 |

) |

Aptargroup, Inc. |

|

|

(153 |

) |

|

(234 |

) |

Arkansas Best Corp. |

|

|

(2,948 |

) |

|

(149 |

) |

Boeing Co. |

|

|

(11,071 |

) |

|

(194 |

) |

Brady Corp. |

|

|

(5,337 |

) |

|

(30 |

) |

CH Robinson Worldwide, Inc. |

|

|

(1,756 |

) |

|

(162 |

) |

Clean Harbors, Inc. * |

|

|

(9,140 |

) |

|

(278 |

) |

Emerson Electric Co. |

|

|

(12,949 |

) |

|

(500 |

) |

Fabrinet * |

|

|

(6,275 |

) |

|

(342 |

) |

FARO Technologies, Inc. * |

|

|

(14,391 |

) |

|

(222 |

) |

Graco, Inc. |

|

|

(10,230 |

) |

|

(75 |

) |

HEICO Corp. |

|

|

(2,964 |

) |

|

(152 |

) |

Middleby Corp. * |

|

|

(15,141 |

) |

|

(246 |

) |

Molex, Inc. |

|

|

(5,889 |

) |

|

(67 |

) |

Trimble Navigation Ltd. * |

|

|

(3,083 |

) |

|

(110 |

) |

Zebra Technologies Corp. * |

|

|

(3,780 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(111,227 |

) |

|

|

|

|

|

|

||

|

Technology: (1.1)% |

|

|

|

|

||

|

(189 |

) |

ARM Holdings Plc (ADR) |

|

|

(4,496 |

) |

|

(253 |

) |

ASML Holding N.V. |

|

|

(13,009 |

) |

|

(657 |

) |

Cypress Semiconductor Corp. * |

|

|

(8,686 |

) |

|

(284 |

) |

Informatica Corp. * |

|

|

(12,030 |

) |

|

(482 |

) |

Intel Corp. |

|

|

(12,845 |

) |

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

Value |

|

|

|

|

||||||

|

Technology: (continued) |

|

|

|

|

||

|

(162 |

) |

Interactive Intelligence Group, Inc. * |

|

$ |

(4,570 |

) |

|

(254 |

) |

JDA Software Group, Inc. * |

|

|

(7,541 |

) |

|

(38 |

) |

MicroStrategy, Inc. * |

|

|

(4,935 |

) |

|

(173 |

) |

Netscout Systems, Inc. * |

|

|

(3,735 |

) |

|

(107 |

) |

Open Text Corp. * |

|

|

(5,339 |

) |

|

(202 |

) |

Pegasystems, Inc. |

|

|

(6,662 |

) |

|

(90 |

) |

SAP A.G. (ADR) |

|

|

(5,342 |

) |

|

(164 |

) |

Silicon Laboratories, Inc. * |

|

|

(6,216 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(95,406 |

) |

|

|

|

|

|

|

||

|

Total Common Stocks |

|

|

(414,385 |

) |

||

|

|

|

|

||||

|

REAL ESTATE INVESTMENT TRUST: (0.0)% |

|

|

|

|

||

|

Financial: (0.0)% |

|

|

|

|

||

|

(117 |

) |

DuPont Fabros Technology, Inc. |

|

|

(3,342 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

CORPORATE BONDS: (5.5)% |

|

|

|

|

|||

|

Basic Materials: (1.3)% |

|

|

|

|

|||

|

|

|

|

Eastman Chemical Co. |

|

|

|

|

|

$ |

(20,000 |

) |

3.60%, 08/15/22 |

|

|

(20,441 |

) |

|

|

|

|

EI du Pont de Nemours & Co. |

|

|

|

|

|

|

(47,000 |

) |

4.25%, 04/01/21 |

|

|

(53,757 |

) |

|

|

|

|

Sappi Papier Holding GmbH |

|

|

|

|

|

|

(10,000 |

) |

7.75%, 07/15/17 144A |

|

|

(10,163 |

) |

|

|

|

|

United States Steel Corp. |

|

|

|

|

|

|

(30,000 |

) |

7.38%, 04/01/20 |

|

|

(29,100 |

) |

|

|

(7,000 |

) |

7.50%, 03/15/22 |

|

|

(6,755 |

) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

(120,216 |

) |

|

|

|

|

|

|

|

|||

|

Communications: (1.7)% |

|

|

|

|

|||

|

|

|

France Telecom S.A. |

|

|

|

|

|

|

(60,000 |

) |

4.13%, 09/14/21 |

|

|

(62,899 |

) |

|

|

|

|

Sprint Capital Corp. |

|

|

|

|

|

|

(7,000 |

) |

8.75%, 03/15/32 |

|

|

(6,405 |

) |

|

|

|

|

Sprint Nextel Corp. |

|

|

|

|

|

|

(15,000 |

) |

8.38%,08/15/17 |

|