UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05083

VAN ECK VIP TRUST - VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 Madison Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2011

Item 1: Report to Shareholders

|

|

|

|

|

SEMI-ANNUAL REPORT |

|

|

|

|

|

JUNE 30, 2011 |

|

|

|

|

|

(unaudited) |

Van Eck VIP Trust

Van Eck VIP Multi-Manager Alternatives Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

The information contained in these shareholder letters represent the personal opinions of the investment team members and may differ from those of other portfolio managers or of the firm as a whole. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, unless otherwise specifically noted, any discussion of the Fund’s holdings and the Fund’s performance, and the views of the investment team members are as of June 30, 2011 and are subject to change. |

||

|

|

The

Initial Class shares of the Van Eck VIP Multi-Manager Alternatives Fund gained

0.73% for the six months ended June 30, 2011, outperforming its benchmark, the

HFRX Global Hedge Fund Index1, which declined 2.12%. The S&P®

500 Index2 gained 6.02% for the same period. Many hedge fund

indices realized negative performance in the first half of 2011. Overall,

correlations between asset classes rose, making it difficult to generate alpha3

through superior stock selection or asset allocation. In addition, some hedge

funds flocked to information technology and energy stocks, which fell

dramatically in May and June. May proved to be the most difficult month for the

Fund, although it bounced back with solid outperformance in June.

The Fund is a

hedge-style mutual fund that can allocate among long/short equity, distressed

debt, market neutral, global macro, managed futures and other alternative

investment strategies. The Fund’s objective is to produce consistent (absolute)

returns in various market cycles. In this context, our investment team—which

averages eight years’ experience in managing a multi-manager, hedge-style

mutual fund strategy—manages the Fund with a goal of consistent returns, low

beta4 and low volatility. We intend to continue to search for

alpha-generating strategies with repeatable processes that exist within stable

business models. While the Fund was at the higher end of its beta range

(typically 0.1-0.35 to the S&P 500 Index) for a good portion of the period,

we tactically reduced beta during the month of May. This benefited the Fund

through most of June. At the end of the period, the Fund remained at the lower

end of its beta range, but going forward we intend to look to opportunistically

cover some of our hedges as the market appeared to be shaking off recent

economic headwinds. The mutual fund structure of the Fund provides portfolio

transparency, daily valuation and liquidity unlike many unregistered hedge

funds.

Market and Economic Review

The semi-annual period was a tale of four strong months in the equity markets and two weak months, with momentum dissipating along the way. Equity markets generally moved higher through April on the back of improved economic data and accommodative monetary policy from the Federal Reserve Board (the Fed). As the Fed’s second round of quantitative easing approached its scheduled expiration at the end of June, investors expressed their concern by selling heavily through May and most of June. Investors subsequently seemed to view the sell-off as a buying opportunity, as the broader equity markets staged a rally in the very last week of June.

With the Fed seemingly stuck between a rock and a hard place as the federal deficit piled up and economic headwinds remained persistent, there were some pockets of outperformance in the equity markets during the semi-annual period. The health care sector provided the strongest return. Also, gold was perceived as a safe haven for investors who see inflation looming as a result of the Fed’s loose monetary discipline. However, while most hard asset commodities began 2011 with positive momentum, they fell back equally as fast as equities, ending the semi-annual period up only marginally. Momentum sectors, such as information technology and energy, similarly started the period strong and then fell back to flat before finishing the semi-annual period on a positive note. Emerging equity markets showed mixed results for the first half. In our view, two overriding themes emerged during the semi-annual period. One was the accounting liabilities of Chinese equities trading on U.S. exchanges, with many stocks halting trading for extended periods. Second was the resurgence of Initial Public Offerings, especially in the information technology sector. On the fixed income side, high yield corporate bonds performed in line with equities, whereas municipal bonds performed surprisingly well.

Fund Review

The Fund,

as mentioned, posted positive results during the semi-annual period,

outperforming the HFRX Global Hedge Fund Index. Importantly, the Fund also

generated a lower standard deviation5 than both the HFRX Global

Hedge Fund Index and the S&P 500 Index during the semi-annual period.

Indeed, the Fund displayed only a fraction of either of the indices’ volatility

with a standard deviation of 2.67% versus 3.66% for the HFRX Global Hedge Fund

Index and 7.62% for the S&P 500 Index. Also, the Fund’s beta of just 0.16

to the S&P 500 Index was lower than the HFRX Global Hedge Fund Index’s

comparable beta of 0.48. (All figures are based on monthly data.)

During the

semi-annual period, we continued to broaden the diversification of the Fund’s

portfolio by adding three new sub-advisers—Millrace Asset Group, Inc

(“Millrace”) and Coe Capital Management, LLC (“Coe”), long/short equity

managers that each have a long track record of strong alpha generation in

various market conditions, and Acorn Derivatives Management Corp. (“Acorn”), a

firm whose arbitrage strategy tends to outperform in flat to down markets and

historically protects capital in bull markets by lightening exposure and even

exiting the markets at times. We also hired Medley Credit Strategies, LLC

(“Medley”, f/k/a Viathon Capital, LLC).

1

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

We redeemed two investments within the arbitrage strategy during the semi-annual period. In January, we redeemed from The Arbitrage Fund (“Arbitrage”). Our investment committee felt that though the Arbitrage team is highly skilled and runs a quality, low risk strategy, it is nearly impossible for them to generate double-digit annualized returns through merger arbitrage due to mutual fund leverage restrictions. Also, in March, we redeemed the Fund’s allocation to Centaur Performance Group, LLC (“Centaur”), as Centaur had decided to make a broad change to its strategy and to its team. While the Fund had garnered solid, slow and steady performance from Centaur, our investment committee was not comfortable with the changes being made.

We added two hedge-style mutual fund investments in March with the proceeds made available from the redemption from Centaur. The first was Marketfield Fund (“Marketfield”), a discretionary macro, long/short equity strategy run by Michael Aronstein. Mr. Aronstein historically has run the strategy with a long bias but will establish short positions to generate alpha should conditions warrant it, as was the case in 2008 when Marketfield profited from short positions in the financials sector. Mr. Aronstein is not averse to taking a contrarian view. The second mutual fund we added to the Fund is AQR Diversified Arbitrage Fund (“AQR Diversified Arbitrage”). This manager utilizes proprietary trading models and a research-driven strategy with a strict process and investment parameters to invest across three different types of arbitrage—merger arbitrage, convertible arbitrage and event-driven arbitrage, which includes arbitrage opportunities that may arise from corporate spin-offs, high yield corporate bonds, dual-class securities, closed-end funds and more.

As of June 30, 2011, the Fund had assets allocated to six sub-advisers and was invested in a variety of open-end mutual funds, ETFs, two UCITS6 Funds, structured notes and other securities.

Long/Short Equity Strategy

The Fund’s long/short equity investments delivered mixed

performance during the semi-annual period, as equity correlation remained high

making it difficult to generate alpha through fundamental bottom-up stock

selection.

Sub-Adviser Primary Funds, LLC (“Primary”) (8.97% of Fund net assets†) performed well early in 2011, as it was titled toward long positions in information technology and energy stocks. Primary took some profits, but remained long biased in these sectors, as its investment orientation remained toward economic recovery. While it did significantly reduce the net and volatility exposures in response to market uncertainty surrounding global events, it remained invested in later-cycle companies operating in global industries, such as an oil and gas rig equipment supplier, a diversified semiconductor and components manufacturer and a construction and facilities management company. Primary’s short positions had exposure to consumer discretionary spending and health care, primarily in the U.S., where the sub-adviser believed continued high unemployment and commodity inflation would hamper growth in consumer spending. Valuations underlying Primary’s positioning supported the strategy, where many long positions were at attractive discounts to relative S&P 500 measures and short positions were at a premium. That said, Primary lost much of its early 2011 performance in May and June when cyclical sectors sold off and more defensive sectors were in favor. Primary employs a balanced, or low net exposure, long/short equity strategy that focuses primarily on mid-cap companies across multiple sectors. Its approach is a fundamentally-driven one, taking into account a top-down view of the economy broken down by sector.

As mentioned earlier, we established Fund positions in Sub-Advisers Millrace (9.14% of Fund net assets†) and Coe (9.08% of Fund net assets†) during the semi-annual period. Millrace began trading for the Fund at the beginning of June and Coe in the third week of June. In the weeks since funding these two sub-advisers, which were among the volatile of the period, each was profitable for the Fund. Millrace utilizes a fundamental, bottom up, long/short equity strategy, focused on small/mid cap U.S. equities. Coe is also a long/short equity strategy, focused on small/mid cap U.S. equities, but is highly catalyst driven in nature, trading around various events that may cause fluctuations in prices.

The Fund’s long/short equity mutual fund holding, Highland Long/Short Equity Fund (“Highland”) (4.7% of Fund net assets†), was a disappointment, declining marginally during the semi-annual period. Nevertheless, we maintained the Fund’s position in Highland.

Fixed Income Strategy

We significantly reduced the Fund’s exposure to the fixed

income strategy during the semi-annual period, primarily by redeeming the

Fund’s positions in several actively managed fixed income funds. High yield

corporate debt had had a run of strong performance in 2009 and 2010, and our

investment committee felt that better risk/reward opportunities lay elsewhere.

The Fund’s sole fixed income investment for most of the semi-annual period was

Sub-Adviser Medley Capital (which, as mentioned earlier, purchased Viathon)

(10.94% of Fund net assets†). The strategy did not change as a

result of the acquisition, and we felt comfortable with this investment because

the strategy is consistently run with significant short exposure and low beta

to the broader markets.

2

|

|

|

|

Despite the strong run in 2009 and 2010, the credit markets continued to perform strongly during the semi-annual period. Returns, new issuance and mutual fund inflation were particularly robust during the first four months of 2011, though the markets did struggle in May and June as weak economic data, record new issue volume and sovereign debt concerns eventually tempered risk appetites. During the semi-annual period, lower quality issuers outperformed, especially during the first quarter. Mutual fund inflows into the high yield asset class were strong during the first quarter, helping to fuel the market’s increased risk appetite for a record volume of new high yield issuance. Year-to-date through June 30 high yield issuance of approximately $180 billion was predominantly used to refinance shorter maturity bonds and bank debt, significantly denting the “maturity wall” that was a cause for much concern over the past year or two.

Medley Capital entered 2011 positioned for a tighter credit spread environment. As the market rallied, the sub-adviser began to take profits in several of its higher beta, long risk positions, including Ono, Fist Data and Rite-Aid. The credit markets then continued to rally into March and April, motivating Medley Capital to adopt a more cautious risk attitude. Although the sub-adviser believed such a stance was appropriate, it consequently did not fully participate in the later stages of the credit rally that materialized during March and April. Medley Capital maintained its risk-averse profile during May and June, as it believed that short risk positions in names including Best Buy, Range Resources and Borgata represented a compelling opportunity. The high yield corporate market generated negative returns during May and June, vindicating the sub-adviser’s cautious approach. During the second quarter, Medley Capital’s short positions focused on themes such as margin compression, competitive threats, impaired discretionary spending and relative value. Its long risk positions were focused on issuers expected to generate positive absolute returns with lower realized volatility, primarily due to an inherent undervaluation. At the end of the semi-annual period, Medley Capital’s risk profile was fairly neutral, while the sub-adviser’s overall view on the credit markets remained cautious. The sub-adviser intended to continue to search going forward for undervalued long risk positions and overvalued shorts, focusing on forward-looking credit metrics, including cash flow generation, cash burn, leverage, coverage, margins, asset values and enterprise valuation.

Global Macro Strategy

Of the Fund’s four global macro investments held during the

semi-annual period, two performed well and two faced some difficulties. The

Fund’s largest investment in this strategy was in the AC Risk Parity 12 Vol

(11.3% of Fund net assets†) and 7 Vol Funds (sold during the period)

(“Risk Parity Funds”) through an open-end UCITS III structure. The Risk Parity

Funds delivered solid uncorrelated performance during the semi-annual period.

Marketfield (5.2% of Fund net assets†), which, as mentioned earlier,

was a new position for the Fund, also performed strongly during the semi-annual

period, as Mr. Aronstein

took a contrarian approach to most hedge style funds, investing long in the

U.S. and short in the emerging markets.

Sub-Adviser Dix Hills Partners (“Dix Hills”) (1.09% of Fund net assets†), on the other hand, produced disappointing returns, as the semi-annual period proved to be a challenging one for Dix Hills’ active duration Alternative Treasury strategies. Dix Hills’ underperformance was generated primarily during the first week of February when stronger than expected economic data and lingering concerns about the sustainability of sovereign debt in peripheral eurozone countries helped push global rates upward against Dix Hills’ long U.S. Treasury position. Ongoing turmoil in the Middle East and North Africa and a nuclear power crisis in Japan resulting from devastating natural disasters negatively impacted performance as well. These largely unexpected events led to substantial declines in interest rates, when Dix Hills’ directional strategies were positioned for rising yields. On a positive note, the macro drivers of Dix Hills’ investment process were generally bearish on bonds throughout the first quarter and consistent with the overall tone of subsequently released macroeconomic data. Dix Hills’ performance during the second quarter was generally flat, as underperformance in April was mainly offset by gains in May and June. Prudently, the Fund’s investment committee had been reducing exposure to Dix Hills throughout the semi-annual period, not simply because of poor performance but because it is our belief that its models do not take into account the significant impact of federal intervention, i.e. buying U.S. Treasuries through the Fed’s quantitative easing programs. In addition, in our view, the investment parameters of Dix Hills’ strategy do not allow its investment team to shift exposures in the middle of a trade period. While this discipline benefited Dix Hills in the past, it hurt its performance over the past couple of years.

Luxcellence-Virtuoso Fund (“Virtuoso”) (3.8% of Fund net assets†), run by Old Park Capital through a UCITS III structure, also generated poor results during the semi-annual period. Virtuoso takes a multi-asset class approach to using futures. Virtuoso can invest in four asset classes—equity (via the Dow Jones EURO STOXX 50 Index traded on Eurex), bonds (via euro-bond futures contracted traded on Eurex), real estate (via the S&P High Yield Europe Property Index), and cash (via the EONIA Index). The reasoning for this is that 95% of European institutional money is in those four asset classes. The assumption underlying the Virtuoso Strategy is that whenever money is reallocated, there are structural transfers among these asset classes according to the behavior of each of them. During the semi-annual period, volatility in the markets

3

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

broadly caused stop losses to be hit before markets turned, ultimately proving Virtuoso’s models correct. As a result, Virtuoso’s portfolio manager decided to reduce exposures to allow more room for trades to go against it until he felt more comfortable with the economic landscape and market volatility. Virtuoso returned to full exposures late in June.

Arbitrage Strategy

The arbitrage strategy contributed positively to the Fund’s

results during the semi-annual period, generating strong alpha. TFS Market

Neutral Fund (“TFS”) (9.17% of Fund net assets†) was the Fund’s top

performer within the strategy. We shifted categorization of TFS from the

long/short equity strategy to the arbitrage strategy, as its beta to the

S&P 500 Index has been consistently around 0.30.

EMERALD (Equity MEan Reversion ALpha InDex) (5.3% of Fund net assets†), a “rules based” volatility arbitrage strategy through notes that were structured by Deutsche Bank, seeks to capture returns from mean-reversion of the S&P 500 Index during the course of a single week. EMERALD performed well during the semi-annual period, generating particularly strong performance in June. EMERALD historically performs best in a market environment when daily volatility exceeds weekly volatility, which, indeed, was the case during the semi-annual period overall.

AQR Diversified Arbitrage (6.3% of Fund net assets†), as mentioned earlier, was a new position for the Fund, established because our investment committee believed it would help reduce the Fund’s overall beta and volatility. AQR Diversified Arbitrage disappointed somewhat during the semi-annual period but did generate modestly positive returns. Sub-Adviser Acorn (7.05% of Fund net assets†), another new position for the Fund, specializes in options volatility strategies. Acorn began trading at the beginning of June and supplied some protection early in the month. An investment with Acorn allows us, we believe, to be more aggressive in allocating to other funds that run strategies with positive beta.

Emerging Markets Strategy

The Fund’s emerging markets exposure detracted from its

results, as emerging market equities lagged their U.S. and developed

international equity counterparts during the semi-annual period. On the

positive side, the Fund’s emerging markets exposure finished the semi-annual

period with returns in line with the iShares MSCI Emerging Markets Index Fund7

and with substantially less beta to the S&P 500 Index and lower

volatility than the broader emerging market indices. The Fund’s long positions

actually generated alpha versus the exchange traded fund but part of the Fund’s

hedge in this sleeve is broad U.S. equity exposure, which detracted from

performance. The Fund’s investment committee continued to believe at the end of

the semi-annual period that emerging market equities are likely to outperform

developed market equities over the medium to long term.

Tactical Strategy

The Fund’s tactical, or opportunistic, strategy sleeve was

the strongest performing segment of the Fund during the semi-annual period.

Much of the Fund’s returns were generated from short positions, as the Fund had

opportunistically been short banks in Spain, Portugal, Ireland and Germany,

where sovereign debt crises and slower economic growth made headlines. We

tactically added to these positions after periods of short covering when the

banks’ shares bumped into resistance levels. While the tactical strategy

remained a relatively small sleeve for the Fund, it not only enhanced its

overall performance but also continued to be an effective tool to manage the

beta and standard deviation targets of the Fund.

Outlook

Going forward, we intend to continue to seek to allocate the Fund’s capital to the best risk/reward strategies given current economic and other macro conditions. We also look to add additional sub-advisers that may help diversify from a sub-strategy perspective. Among these are anticipated to be the inclusion of an emerging markets debt strategy and a multi-cap structure event-driven strategy. Further, as indicated, while the Fund was at the lower end of its beta range at the end of the semi-annual period, we may look to opportunistically cover some of the Fund’s hedges should the market successfully turn its focus more toward fundamentals and away from recent economic headwinds.

As the Fund implements a fund-of-funds strategy, an investor in the Fund will bear the operating expenses of the “Underlying Funds” in which the Fund invests. The total expenses borne by an investor in the Fund will be higher than if the investor invested directly in the Underlying Funds, and the returns may therefore be lower. The Fund, the Sub-Advisers and the Underlying Funds may use aggressive investment strategies, including absolute return strategies, which are riskier than those used by typical mutual funds. If the Fund and Sub-Advisers are unsuccessful in applying these investment strategies, the Fund and you may lose more money than if you had invested in another fund that did not invest aggressively. The Fund is subject to risks associated with the Sub-Advisers making trading decisions independently, investing in other investment companies, using a particular style or set of styles, basing investment decisions on historical relationships and correlations,

4

|

|

|

|

trading frequently, using leverage, making short sales, being non-diversified and investing in securities with low correlation to the market. The Fund is also subject to risks associated with investments in foreign markets, emerging market securities, small cap companies, debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities and CMOs.

We appreciate your investment in the Van Eck VIP Multi-Manager Alternatives Fund, and we look forward to helping you meet your investment goals in the future.

Investment Team Members:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen H. Scott |

|

Jan F. van Eck |

|

Michael F. Mazier |

|

Scott Schaffran |

|

Co-Portfolio Manager |

|

Co-Portfolio Manager |

|

Analyst |

|

Analyst |

|

|

|

|

|

|

|

|

|

July 15, 2011 |

|

|

|

|

|

|

|

|

|

|

† |

All Fund assets referenced are Total Net Assets as of June 30, 2011. |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted. Performance information reflects temporary waivers of expenses and/or fees and does not include insurance/annuity fees and expenses. Investment returns would have been reduced had these fees/expenses been included. Investment return and the value of the shares of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Index returns assume that dividends of the Index constituents in the Index have been reinvested. Performance information current to the most recent month end is available by calling 1.800.826.2333.

The Fund is only available to life insurance and annuity companies to fund their variable annuity and variable life insurance products. These contracts offer life insurance and tax benefits to the beneficial owners of the Fund. Your insurance or annuity company charges, fees and expenses for these benefits are not reflected in this report or in the Fund’s performance, since they are not direct expenses of the Fund. Had these fees been included, returns would have been lower. For insurance products, performance figures do not reflect the cost for insurance and if they did, the performance shown would be significantly lower. A review of your particular life and/or annuity contract will provide you with much greater detail regarding these costs and benefits.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

|

|

|

|

1 |

The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

|

|

|

2 |

S&P® 500 Index consists of 500 widely held common stocks, covering industrials, utility, financial and transportation sectors. |

|

|

|

|

3 |

Alpha is a measure of an investment’s performance over and above the performance of other investments of the same risk. A stock with an alpha of 1.25 is projected to rise by an annual premium of 1.25% above its comparable benchmark index. |

|

|

|

|

4 |

Beta is a measure of sensitivity to market movements. A beta higher than 1 indicates that a security or portfolio will tend to exhibit higher volatility than the market. A beta lower than 1 indicates that a security or portfolio will tend to exhibit lower volatility than the market. |

|

|

|

|

5 |

Standard deviation is a measure of the variability, or volatility, of a security, derived from the security’s historical returns, and used in determining the range of possible future returns. The higher the standard deviation, the greater the potential for volatility. |

|

|

|

|

6 |

UCITS stands for “Undertakings for Collective Investment in Transferable Securities.” |

|

|

|

|

7 |

iShares MSCI Emerging Markets Index Fund is an exchange traded fund that seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the MSCI Emerging Markets Index, net of expenses. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index provided by MSCI that is designed to measure the equity market performance of emerging markets. |

5

|

|

|

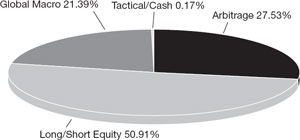

FUND ALLOCATION BY STRATEGY* |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Investment Strategy |

|

Implementation |

|

2Q 2011 |

|

4Q 2010 |

||

|

Arbitrage |

|

|

|

|

|

|

||

|

Blended Arbitrage |

|

Open-End Fund |

|

6.32 |

|

|

— |

|

|

Credit Arbitrage |

|

Sub-Adviser: Centaur |

|

— |

|

|

9.90 |

|

|

Market Neutral |

|

Open-End Fund |

|

9.17 |

|

|

9.17 |

|

|

Merger Arbitrage |

|

Open-End Fund |

|

— |

|

|

5.87 |

|

|

Volatility Arbitrage |

|

Structured Note |

|

4.99 |

|

|

5.19 |

|

|

Volatility Arbitrage |

|

Sub-Adviser: Acorn |

|

7.05 |

|

|

— |

|

|

Long/Short |

|

|

|

|

|

|

|

|

|

Emerging Markets |

|

ETFs, Other Securities |

|

8.07 |

|

|

8.33 |

|

|

Long/Short Equity |

|

Open-End Fund |

|

4.71 |

|

|

— |

|

|

Long/Short Equity |

|

Open-End Fund |

|

— |

|

|

7.55 |

|

|

Long/Short Equity |

|

Sub-Adviser: Coe |

|

9.08 |

|

|

— |

|

|

Long/Short Equity |

|

Sub-Adviser: Millrace |

|

9.14 |

|

|

— |

|

|

Long/Short Equity |

|

Sub-Adviser: Primary |

|

8.97 |

|

|

15.54 |

|

|

Long/Short Fixed Income |

|

Sub-Adviser: Medley |

|

10.94 |

|

|

9.97 |

|

|

Global Macro |

|

|

|

|

|

|

|

|

|

Discretionary Macro |

|

Sub-Adviser: Dix Hills |

|

1.09 |

|

|

5.47 |

|

|

Discretionary Macro |

|

Open-End Fund |

|

5.21 |

|

|

— |

|

|

Systematic Macro |

|

UCITS Fund: Statistical Value |

|

11.28 |

|

|

10.93 |

|

|

Systematic Macro |

|

UCITS Fund: Virtuoso |

|

3.81 |

|

|

9.30 |

|

|

Tactical Overlay |

|

ETFs, Other Securities |

|

— |

|

|

2.00 |

|

|

Cash/Equivalents |

|

— |

|

0.17 |

|

|

0.78 |

|

|

|

|

|

As of June 30, 2011. Portfolio subject to change. |

|

|

* |

Percentage of net assets. |

6

|

|

|

SECTOR WEIGHTING NET EXPOSURE** |

|

(unaudited) |

|

|

|

|

As of June 30, 2011. Portfolio subject to change. |

|

|

** |

Net exposure was calculated by adding long and short positions. |

7

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

(unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2011 to June 30, 2011.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as program fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning |

|

Ending |

|

Expenses Paid |

|

|||||||||

|

Initial Class |

|

Actual |

|

|

$ |

1,000.00 |

|

|

|

$ |

1,007.30 |

|

|

|

$ |

11.72 |

|

|

|

|

|

Hypothetical** |

|

|

$ |

1,000.00 |

|

|

|

$ |

1,013.12 |

|

|

|

$ |

11.75 |

|

|

|

|

|

|

* |

Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2011), of 2.15% multiplied by the average account value over the period, multiplied by 181 and divided by 365 (to reflect the one-half year period). |

|

|

|

|

** |

Assumes annual return of 5% before expenses |

8

|

|

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

||||||

|

COMMON STOCKS: 26.4% |

|

|

|

|

||

|

Basic Materials: 1.1% |

|

|

|

|

||

|

181 |

|

CF Industries Holdings, Inc. |

|

$ |

25,643 |

|

|

308 |

|

Huntsman Corp. |

|

|

5,806 |

|

|

331 |

|

KapStone Paper and Packaging Corp. |

|

|

5,485 |

|

|

554 |

|

Kronos Worldwide, Inc. |

|

|

17,424 |

|

|

201 |

|

Potash Corp of Saskatchewan, Inc. |

|

|

11,455 |

|

|

1,235 |

|

Steel Dynamics, Inc. |

|

|

20,069 |

|

|

109 |

|

The Mosaic Co. |

|

|

7,383 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

93,265 |

|

|

|

|

|

|

|

||

|

Communications: 2.7% |

|

|

|

|

||

|

4,960 |

|

Alcatel-Lucent (ADR) |

|

|

28,619 |

|

|

599 |

|

Allot Communications Ltd. |

|

|

10,956 |

|

|

559 |

|

Arris Group, Inc. |

|

|

6,490 |

|

|

553 |

|

Calix, Inc. |

|

|

11,513 |

|

|

596 |

|

Ceragon Networks Ltd. |

|

|

7,086 |

|

|

331 |

|

Constant Contact, Inc. |

|

|

8,401 |

|

|

297 |

|

DealerTrack Holdings, Inc. |

|

|

6,816 |

|

|

335 |

|

Equinix, Inc. |

|

|

33,842 |

|

|

337 |

|

GeoEye, Inc. |

|

|

12,604 |

|

|

1,028 |

|

KIT Digital, Inc. |

|

|

12,274 |

|

|

551 |

|

Liquidity Services, Inc. |

|

|

13,009 |

|

|

248 |

|

Motricity, Inc. |

|

|

1,917 |

|

|

530 |

|

Neutral Tandem, Inc. |

|

|

9,233 |

|

|

395 |

|

NIC, Inc. |

|

|

5,317 |

|

|

1,365 |

|

RF Micro Devices, Inc. |

|

|

8,354 |

|

|

960 |

|

SPS Commerce, Inc. |

|

|

17,078 |

|

|

638 |

|

ValueClick, Inc. |

|

|

10,591 |

|

|

979 |

|

VASCO Data Security International, Inc. |

|

|

12,189 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

216,289 |

|

|

|

|

|

|

|

||

|

Consumer, Cyclical: 3.5% |

|

|

|

|

||

|

370 |

|

Ascena Retail Group, Inc. |

|

|

12,598 |

|

|

559 |

|

Beacon Roofing Supply, Inc. |

|

|

12,756 |

|

|

311 |

|

Buffalo Wild Wings, Inc. |

|

|

20,622 |

|

|

243 |

|

California Pizza Kitchen, Inc. |

|

|

4,488 |

|

|

348 |

|

CVS Caremark Corp. |

|

|

13,078 |

|

|

326 |

|

DSW, Inc. |

|

|

16,499 |

|

|

305 |

|

Ezcorp, Inc. |

|

|

10,850 |

|

|

1,000 |

|

First Cash Financial Services, Inc. * |

|

|

41,990 |

|

|

181 |

|

Foot Locker, Inc. |

|

|

4,301 |

|

|

202 |

|

Hibbett Sports, Inc. |

|

|

8,223 |

|

|

643 |

|

Interface, Inc. |

|

|

12,455 |

|

|

174 |

|

Lear Corp. |

|

|

9,306 |

|

|

313 |

|

Life Time Fitness, Inc. |

|

|

12,492 |

|

|

295 |

|

Mobile Mini, Inc. |

|

|

6,251 |

|

|

435 |

|

National CineMedia, Inc. |

|

|

7,356 |

|

|

1,137 |

|

Pier 1 Imports, Inc. |

|

|

13,155 |

|

|

182 |

|

Regal Entertainment Group. |

|

|

2,248 |

|

|

538 |

|

Select Comfort Corp. |

|

|

9,673 |

|

|

466 |

|

Starbucks Corp. |

|

|

18,402 |

|

|

251 |

|

Tempur-Pedic International, Inc. |

|

|

17,023 |

|

|

279 |

|

The Finish Line, Inc. |

|

|

5,971 |

|

|

138 |

|

The Wendy’s Co. |

|

|

700 |

|

|

277 |

|

Titan International, Inc. |

|

|

6,720 |

|

|

186 |

|

Titan Machinery, Inc. |

|

|

5,353 |

|

|

743 |

|

Wabash National Corp. |

|

|

6,962 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

279,472 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

||||||

|

Consumer, Non-cyclical: 2.3% |

|

|

|

|

||

|

1,481 |

|

ACCO Brands Corp. |

|

$ |

11,626 |

|

|

259 |

|

Arthrocare Corp. |

|

|

8,669 |

|

|

476 |

|

Dollar Financial Corp. |

|

|

10,305 |

|

|

2,604 |

|

EnteroMedics, Inc. |

|

|

7,057 |

|

|

175 |

|

Express Scripts, Inc. |

|

|

9,447 |

|

|

353 |

|

Heartland Payment Systems, Inc. |

|

|

7,272 |

|

|

790 |

|

IRIS International, Inc. |

|

|

7,892 |

|

|

1,566 |

|

Merge Healthcare, Inc. |

|

|

8,143 |

|

|

500 |

|

Merit Medical Systems, Inc. |

|

|

8,985 |

|

|

646 |

|

Mylan, Inc. |

|

|

15,937 |

|

|

411 |

|

NuVasive, Inc. |

|

|

13,514 |

|

|

1,524 |

|

On Assignment, Inc. |

|

|

14,981 |

|

|

9 |

|

Paychex, Inc. |

|

|

276 |

|

|

109 |

|

Perrigo Co. |

|

|

9,578 |

|

|

956 |

|

Quanta Services, Inc. |

|

|

19,311 |

|

|

349 |

|

Team, Inc. |

|

|

8,421 |

|

|

282 |

|

The Andersons, Inc. |

|

|

11,914 |

|

|

1,121 |

|

Uroplasty, Inc. |

|

|

8,408 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

181,736 |

|

|

|

|

|

|

|

||

|

Diversified: 1.2% |

|

|

|

|

||

|

1,990 |

|

Imperial Holdings Ltd. # |

|

|

35,714 |

|

|

17,580 |

|

Noble Group Ltd. (SGD) # |

|

|

28,310 |

|

|

2,000 |

|

Swire Pacific Ltd. (HKD) # |

|

|

29,497 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

93,581 |

|

|

|

|

|

|

|

||

|

Energy: 2.0% |

|

|

|

|

||

|

296 |

|

Clayton Williams Energy, Inc. |

|

|

17,775 |

|

|

249 |

|

Gulf Island Fabrication, Inc. |

|

|

8,038 |

|

|

500 |

|

Lukoil (ADR) |

|

|

31,851 |

|

|

222 |

|

Mitcham Industries, Inc. |

|

|

3,841 |

|

|

429 |

|

National Oilwell Varco, Inc. |

|

|

33,552 |

|

|

376 |

|

Schlumberger Ltd. |

|

|

32,486 |

|

|

813 |

|

Superior Energy Services, Inc. |

|

|

30,195 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

157,738 |

|

|

|

|

|

|

|

||

|

Financial: 1.7% |

|

|

|

|

||

|

55,250 |

|

Bank of China Ltd. (HKD) # |

|

|

27,114 |

|

|

3,300 |

|

BR Malls Participacoes S.A. |

|

|

37,744 |

|

|

478 |

|

Home Bancshares, Inc. |

|

|

11,300 |

|

|

29,888 |

|

Raven Russia Ltd. (GBP) |

|

|

27,582 |

|

|

24,117 |

|

Tisco Financial Group PCL (THB) # |

|

|

29,564 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

133,304 |

|

|

|

|

|

|

|

||

|

Industrial: 7.4% |

|

|

|

|

||

|

54 |

|

AAR Corp. |

|

|

1,463 |

|

|

829 |

|

Arkansas Best Corp. |

|

|

19,672 |

|

|

362 |

|

Armstrong World Industries, Inc. |

|

|

16,493 |

|

|

415 |

|

Astec Industries, Inc. |

|

|

15,347 |

|

|

229 |

|

Atlas Air Worldwide Holdings, Inc. |

|

|

13,628 |

|

|

228 |

|

BE Aerospace, Inc. |

|

|

9,305 |

|

|

557 |

|

Celadon Group, Inc. |

|

|

7,776 |

|

|

57 |

|

Coherent, Inc. |

|

|

3,150 |

|

|

220 |

|

Crane Co. |

|

|

10,870 |

|

|

650 |

|

Danaher Corp. |

|

|

34,443 |

|

|

417 |

|

Darling International, Inc. |

|

|

7,381 |

|

|

427 |

|

DXP Enterprises, Inc. |

|

|

10,824 |

|

|

1,641 |

|

Dycom Industries, Inc. |

|

|

26,814 |

|

|

1,189 |

|

EMCOR Group, Inc. |

|

|

34,850 |

|

|

56 |

|

FedEx Corp. |

|

|

5,312 |

|

|

1,027 |

|

FEI Co. |

|

|

39,221 |

|

|

1,700 |

|

Globaltrans Investment Plc (GDR) |

|

|

31,566 |

|

See Notes to Financial Statements

9

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

SCHEDULE OF INVESTMENTS |

|

(continued) |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

||||||

|

Industrial: (continued) |

|

|

|

|

||

|

152 |

|

Goodrich Corp. |

|

$ |

14,516 |

|

|

74 |

|

GrafTech International Ltd. |

|

|

1,500 |

|

|

316 |

|

Jacobs Engineering Group, Inc. |

|

|

13,667 |

|

|

513 |

|

JB Hunt Transport Services, Inc. |

|

|

24,157 |

|

|

391 |

|

Kennametal, Inc. |

|

|

16,504 |

|

|

1,027 |

|

LeCroy Corp. |

|

|

12,365 |

|

|

552 |

|

Leggett & Platt, Inc. |

|

|

13,458 |

|

|

141 |

|

Martin Marietta Materials, Inc. |

|

|

11,276 |

|

|

398 |

|

Metalico, Inc. |

|

|

2,348 |

|

|

38 |

|

Middleby Corp. |

|

|

3,574 |

|

|

914 |

|

Molex, Inc. |

|

|

23,554 |

|

|

1,090 |

|

NCI Building Systems, Inc. |

|

|

12,415 |

|

|

466 |

|

Old Dominion Freight Line, Inc. |

|

|

17,382 |

|

|

389 |

|

Owens Corning |

|

|

14,529 |

|

|

370 |

|

Progressive Waste Solutions Ltd. |

|

|

9,213 |

|

|

1,721 |

|

Roadrunner Transportation Systems, Inc. |

|

|

25,953 |

|

|

252 |

|

Roper Industries, Inc. |

|

|

20,992 |

|

|

200 |

|

Trimble Navigation Ltd. |

|

|

7,928 |

|

|

211 |

|

Triumph Group, Inc. |

|

|

21,011 |

|

|

514 |

|

TTM Technologies, Inc. |

|

|

8,234 |

|

|

222 |

|

Tyco International Ltd. |

|

|

10,973 |

|

|

236 |

|

Vitran Corp, Inc. |

|

|

2,997 |

|

|

357 |

|

Waste Connections, Inc. |

|

|

11,328 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

587,989 |

|

|

|

|

|

|

|

||

|

Technology: 4.5% |

|

|

|

|

||

|

275 |

|

ACI Worldwide, Inc. |

|

|

9,287 |

|

|

2,057 |

|

Atmel Corp. |

|

|

28,942 |

|

|

300 |

|

ATMI, Inc. |

|

|

6,129 |

|

|

2,154 |

|

AXT, Inc. |

|

|

18,266 |

|

|

169 |

|

CACI International, Inc. |

|

|

10,661 |

|

|

415 |

|

Ceva, Inc. |

|

|

12,641 |

|

|

1,474 |

|

Convio, Inc. |

|

|

15,934 |

|

|

1,035 |

|

Cypress Semiconductor Corp. |

|

|

21,880 |

|

|

98 |

|

Entropic Communications, Inc. |

|

|

871 |

|

|

337 |

|

Fairchild Semiconductor International, Inc. |

|

|

5,631 |

|

|

815 |

|

Freescale Semiconductor Holdings I Ltd. |

|

|

14,988 |

|

|

1,710 |

|

inContact, Inc. |

|

|

8,123 |

|

|

51 |

|

Infosys Ltd. (ADR) |

|

|

3,327 |

|

|

1,125 |

|

LTX-Credence Corp. |

|

|

10,057 |

|

|

1,821 |

|

Magma Design Automation, Inc. |

|

|

14,550 |

|

|

636 |

|

MEMC Electronic Materials, Inc. |

|

|

5,425 |

|

|

1,209 |

|

Micron Technology, Inc. |

|

|

9,043 |

|

|

259 |

|

MICROS Systems, Inc. |

|

|

12,875 |

|

|

351 |

|

NXP Semiconductor N.V. |

|

|

9,382 |

|

|

979 |

|

OCZ Technology Group, Inc. |

|

|

7,832 |

|

|

962 |

|

Omnicell, Inc. |

|

|

14,998 |

|

|

287 |

|

Omnivision Technologies, Inc. |

|

|

9,990 |

|

|

329 |

|

Opnet Technologies, Inc. |

|

|

13,469 |

|

|

1,738 |

|

Radisys Corp. |

|

|

12,670 |

|

|

466 |

|

SciQuest, Inc. |

|

|

7,964 |

|

|

2,410 |

|

Taiwan Semiconductor Manufacturing |

|

|

30,390 |

|

|

363 |

|

Ultratech, Inc. |

|

|

11,028 |

|

|

376 |

|

Veeco Instruments, Inc. |

|

|

18,202 |

|

|

459 |

|

Velti Plc |

|

|

7,762 |

|

|

429 |

|

Volterra Semiconductor Corp. |

|

|

10,579 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

362,896 |

|

|

|

|

|

|

|

||

|

Total

Common Stocks |

|

|

2,106,210 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

Value |

|

||

|

|

|||||||

|

CORPORATE BONDS: 8.0% |

|

|

|

|

|||

|

|

|

|

Arch Coal, Inc. |

|

|

|

|

|

$ |

31,000 |

|

7.00%,06/15/19 144A |

|

$ |

31,077 |

|

|

|

31,000 |

|

7.25%,06/15/21 144A |

|

|

31,194 |

|

|

|

|

|

Berry Plastics Corp. |

|

|

|

|

|

|

23,000 |

|

9.50%, 05/15/18 |

|

|

22,942 |

|

|

|

|

|

Catalyst Paper Corp. |

|

|

|

|

|

|

50,000 |

|

11.00%, 12/15/16 144A |

|

|

43,000 |

|

|

|

|

|

Celanese US Holdings LLC |

|

|

|

|

|

|

12,500 |

|

5.88%, 06/15/21 |

|

|

12,797 |

|

|

|

|

|

Cumulus Media, Inc. |

|

|

|

|

|

|

12,500 |

|

7.75%, 05/01/19 144A |

|

|

12,125 |

|

|

|

|

|

Earthlink, Inc. |

|

|

|

|

|

|

55,000 |

|

8.88%, 05/15/19 144A |

|

|

50,187 |

|

|

|

|

|

Intelsat Jackson Holdings S.A. |

|

|

|

|

|

|

50,000 |

|

11.25%, 06/15/16 |

|

|

53,125 |

|

|

|

|

|

International Lease Finance Corp. |

|

|

|

|

|

|

25,000 |

|

5.75%,05/15/16 |

|

|

24,644 |

|

|

|

25,000 |

|

6.25%,05/15/19 |

|

|

24,464 |

|

|

|

|

|

Lions Gate Entertainment, Inc. |

|

|

|

|

|

|

15,000 |

|

10.25%, 11/01/16 144A |

|

|

15,337 |

|

|

|

|

|

Liz Claiborne, Inc. |

|

|

|

|

|

|

70,000 |

|

10.50%, 04/15/19 144A |

|

|

71,750 |

|

|

|

|

|

PAETEC Holding Corp. |

|

|

|

|

|

|

30,000 |

|

9.88%, 12/01/18 144A |

|

|

31,237 |

|

|

|

|

|

Production Resource Group, Inc. |

|

|

|

|

|

|

35,000 |

|

8.88%, 05/01/19 144A |

|

|

34,912 |

|

|

|

|

|

RadioShack Corp. |

|

|

|

|

|

|

12,500 |

|

6.75%, 05/15/19 144A |

|

|

12,094 |

|

|

|

|

|

Satmex Escrow S.A. de C.V. |

|

|

|

|

|

|

50,000 |

|

9.50%, 05/15/17 144A |

|

|

51,250 |

|

|

|

|

|

Seagate HDD Cayman |

|

|

|

|

|

|

50,000 |

|

7.75%, 12/15/18 144A |

|

|

52,750 |

|

|

|

|

|

The Gap, Inc. |

|

|

|

|

|

|

68,000 |

|

5.95%, 04/12/21 |

|

|

65,447 |

|

|

|

|

|

|

|

|

||

|

Total

Corporate Bonds |

|

|

640,332 |

|

|||

|

|

|

|

|||||

|

GOVERNMENT BONDS: 2.1% |

|

|

|

|

|||

|

|

|

|

U.S. Treasury Bond |

|

|

|

|

|

|

20,000 |

|

4.25%, 11/15/40 |

|

|

19,553 |

|

|

|

|

|

U.S. Treasury Notes |

|

|

|

|

|

|

43,000 |

|

1.50%,06/30/16 |

|

|

42,483 |

|

|

|

101,500 |

|

3.63%,02/15/21 |

|

|

105,853 |

|

|

|

|

|

|

|

|

||

|

Total

Government Bonds |

|

|

167,889 |

|

|||

|

|

|

|

|||||

|

STRUCTURED NOTES: 5.4% |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Deutsche Bank A.G. London Branch, |

|

|

|

|

|

|

380,000 |

|

09/24/12 * § (b) |

|

|

406,562 |

|

|

|

20,000 |

|

07/03/13 (b) |

|

|

20,000 |

|

|

|

|

|

|

|

|

||

|

Total

Structured Notes |

|

|

426,562 |

|

|||

|

|

|

|

|||||

See Notes to Financial Statements

10

|

|

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

||||||

|

EXCHANGE TRADED FUNDS: 3.7% |

|

|

|

|

||

|

550 |

|

iShares MSCI All Peru Capped Index Fund |

|

$ |

20,691 |

|

|

2,920 |

|

Market Vectors Emerging Markets |

|

|

80,169 |

|

|

2,290 |

|

Market Vectors India Small-Cap Index ETF ‡ |

|

|

37,144 |

|

|

3,000 |

|

WisdomTree Emerging Markets SmallCap |

|

|

157,590 |

|

|

|

|

|

|

|

||

|

Total

Exchange Traded Funds |

|

|

295,594 |

|

||

|

|

|

|

||||

|

OPEN-END FUNDS: 40.7% |

|

|

|

|

||

|

6,362 |

|

AC Risk Parity 12 Vol Fund # |

|

|

913,077 |

|

|

45,198 |

|

AQR Diversified Arbitrage Fund |

|

|

505,314 |

|

|

33,435 |

|

Highland Long/Short Equity Fund |

|

|

376,810 |

|

|

348 |

|

Luxcellence - Virtuoso Fund * # |

|

|

304,591 |

|

|

30,369 |

|

Marketfield Fund |

|

|

416,972 |

|

|

47,270 |

|

TFS Market Neutral Fund |

|

|

733,626 |

|

|

|

|

|

|

|

||

|

Total Open-End Funds |

|

|

3,250,390 |

|

||

|

|

|

|

||||

|

OPTIONS

PURCHASED: 0.1% |

|

|

|

|

||

|

1,100 |

|

S&P 500 Index Calls($1,360, |

|

|

9,658 |

|

|

|

|

|

||||

|

MONEY

MARKET FUND: 18.9% |

|

|

|

|

||

|

1,504,671 |

|

AIM Treasury Portfolio - Institutional Class |

|

|

1,504,671 |

|

|

|

|

|

||||

|

Total

Investments: 105.3% |

|

|

8,401,306 |

|

||

|

Liabilities in excess of other assets: (5.3)% |

|

|

(424,226 |

) |

||

|

|

|

|

||||

|

NET ASSETS: 100.0% |

|

$ |

7,977,080 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SECURITIES SOLD SHORT: (29.0)% |

|

|

|

|

||

|

COMMON STOCKS: (13.5)% |

|

|

|

|

||

|

Basic Materials: (0.8)% |

|

|

|

|

||

|

(218 |

) |

Celanese Corp. |

|

|

(11,622 |

) |

|

(909 |

) |

RPM International, Inc. |

|

|

(20,925 |

) |

|

(183 |

) |

The Sherwin-Williams Co. |

|

|

(15,348 |

) |

|

(420 |

) |

Valspar Corp. |

|

|

(15,145 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(63,040 |

) |

|

|

|

|

|

|

||

|

Communications: (0.8)% |

|

|

|

|

||

|

(49 |

) |

Acme Packet, Inc. |

|

|

(3,436 |

) |

|

(474 |

) |

EZchip Semiconductor Ltd. |

|

|

(17,524 |

) |

|

(57 |

) |

Factset Research Systems, Inc. |

|

|

(5,832 |

) |

|

(549 |

) |

Juniper Networks, Inc. |

|

|

(17,294 |

) |

|

(449 |

) |

Viasat, Inc. |

|

|

(19,428 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(63,514 |

) |

|

|

|

|

|

|

||

|

Consumer, Cyclical: (2.8)% |

|

|

|

|

||

|

(107 |

) |

Abercrombie & Fitch Co. |

|

|

(7,160 |

) |

|

(811 |

) |

BJ’s Restaurants, Inc. |

|

|

(42,464 |

) |

|

(409 |

) |

Bob Evans Farms, Inc. |

|

|

(14,303 |

) |

|

(54 |

) |

Chipotle Mexican Grill, Inc. |

|

|

(16,642 |

) |

|

(811 |

) |

Cintas Corp. |

|

|

(26,787 |

) |

|

(823 |

) |

Fastenal Co. |

|

|

(29,620 |

) |

|

(74 |

) |

Group 1 Automotive, Inc. |

|

|

(3,047 |

) |

|

(110 |

) |

Limited Brands, Inc. |

|

|

(4,230 |

) |

|

(44 |

) |

MSC Industrial Direct Co. |

|

|

(2,918 |

) |

|

(312 |

) |

O’Reilly Automotive, Inc. |

|

|

(20,439 |

) |

|

(73 |

) |

Phillips-Van Heusen Corp. |

|

|

(4,779 |

) |

|

(35 |

) |

Polo Ralph Lauren Corp. |

|

|

(4,641 |

) |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

||||||

|

Consumer, Cyclical: (continued) |

|

|

|

|

||

|

(73 |

) |

The Childrens Place Retail Stores, Inc. |

|

$ |

(3,248 |

) |

|

(131 |

) |

The Gap, Inc. |

|

|

(2,371 |

) |

|

(874 |

) |

Thor Industries, Inc. |

|

|

(25,206 |

) |

|

(317 |

) |

Urban Outfitters, Inc. |

|

|

(8,924 |

) |

|

(235 |

) |

Zumiez, Inc. |

|

|

(5,868 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(222,647 |

) |

|

|

|

|

|

|

||

|

Consumer, Non-cyclical: (1.5)% |

|

|

|

|

||

|

(52 |

) |

Alliance Data Systems Corp. |

|

|

(4,892 |

) |

|

(109 |

) |

Colgate-Palmolive Co. |

|

|

(9,528 |

) |

|

(79 |

) |

Edwards Lifesciences Corp. |

|

|

(6,887 |

) |

|

(106 |

) |

Global Payments, Inc. |

|

|

(5,406 |

) |

|

(78 |

) |

HMS Holdings Corp. |

|

|

(5,996 |

) |

|

(86 |

) |

Kinetic Concepts, Inc. |

|

|

(4,956 |

) |

|

(467 |

) |

Laboratory Corp of America Holdings |

|

|

(45,201 |

) |

|

(56 |

) |

Monro Muffler Brake, Inc. |

|

|

(2,088 |

) |

|

(37 |

) |

RSC Holdings, Inc. |

|

|

(443 |

) |

|

(407 |

) |

Safeway, Inc. |

|

|

(9,512 |

) |

|

(487 |

) |

SAIC, Inc. |

|

|

(8,191 |

) |

|

(127 |

) |

The Scotts Miracle-Gro Co. |

|

|

(6,516 |

) |

|

(92 |

) |

Whole Foods Market, Inc. |

|

|

(5,837 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(115,453 |

) |

|

|

|

|

|

|

||

|

Financial: (2.9)% |

|

|

|

|

||

|

(11,100 |

) |

Allied Irish Banks Plc (ADR) |

|

|

(23,643 |

) |

|

(5,300 |

) |

Banco Bilbao Vizcaya Argentaria S.A. (ADR) |

|

|

(62,222 |

) |

|

(5,300 |

) |

Banco Santander S.A. (ADR) |

|

|

(61,003 |

) |

|

(1,050 |

) |

Deutsche Bank AG |

|

|

(62,202 |

) |

|

(38 |

) |

Jones Lang LaSalle, Inc. |

|

|

(3,583 |

) |

|

(19,000 |

) |

The Governor & Co. of the Bank of |

|

|

(20,520 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(233,173 |

) |

|

|

|

|

|

|

||

|

Industrial: (2.5)% |

|

|

|

|

||

|

(178 |

) |

Aerovironment, Inc. |

|

|

(6,292 |

) |

|

(328 |

) |

Aptargroup, Inc. |

|

|

(17,168 |

) |

|

(136 |

) |

Badger Meter, Inc. |

|

|

(5,031 |

) |

|

(138 |

) |

Belden, Inc. |

|

|

(4,811 |

) |

|

(536 |

) |

Boeing Co. |

|

|

(39,626 |

) |

|

(367 |

) |

Briggs & Stratton Corp. |

|

|

(7,289 |

) |

|

(324 |

) |

Ceradyne, Inc. |

|

|

(12,633 |

) |

|

(59 |

) |

CH Robinson Worldwide, Inc. |

|

|

(4,652 |

) |

|

(118 |

) |

Cymer, Inc. |

|

|

(5,842 |

) |

|

(362 |

) |

ESCO Technologies, Inc. |

|

|

(13,322 |

) |

|

(476 |

) |

Fabrinet |

|

|

(11,557 |

) |

|

(146 |

) |

FEI Co. |

|

|

(5,576 |

) |

|

(200 |

) |

Forward Air Corp. |

|

|

(6,758 |

) |

|

(453 |

) |

II-VI, Inc. |

|

|

(11,597 |

) |

|

(146 |

) |

Lennox International, Inc. |

|

|

(6,288 |

) |

|

(81 |

) |

Precision Castparts Corp. |

|

|

(13,337 |

) |

|

(107 |

) |

Regal-Beloit Corp. |

|

|

(7,144 |

) |

|

(312 |

) |

Swift Transportation Co. |

|

|

(4,228 |

) |

|

(302 |

) |

Thermo Fisher Scientific, Inc. |

|

|

(19,446 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(202,597 |

) |

|

|

|

|

|

|

||

|

Technology: (2.2)% |

|

|

|

|

||

|

(86 |

) |

ANSYS, Inc. |

|

|

(4,702 |

) |

|

(186 |

) |

ARM Holdings Plc (ADR) |

|

|

(5,288 |

) |

|

(984 |

) |

ASML Holding N.V. |

|

|

(36,369 |

) |

|

(561 |

) |

Cavium, Inc. |

|

|

(24,454 |

) |

|

(544 |

) |

Emulex Corp. |

|

|

(4,678 |

) |

|

(998 |

) |

Hewlett-Packard Co. |

|

|

(36,327 |

) |

See Notes to Financial Statements

11

|

|

|

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND |

|

SCHEDULE OF INVESTMENTS |

|

(continued) |

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

Value |

|

|

|

|

||||||

|

Technology: (continued) |

|

|

|

|

||

|

(186 |

) |

Intel Corp. |

|

$ |

(4,122 |

) |

|

(244 |

) |

JDA Software Group, Inc. |

|

|

(7,537 |

) |

|

(71 |

) |

Lam Research Corp. |

|

|

(3,144 |

) |

|

(244 |

) |

LivePerson, Inc. |

|

|

(3,450 |

) |

|

(292 |

) |

Mercury Computer Systems, Inc. |

|

|

(5,455 |

) |

|

(111 |

) |

ON Semiconductor Corp. |

|

|

(1,162 |

) |

|

(159 |

) |

RADWARE Ltd. |

|

|

(5,540 |

) |

|

(148 |

) |

RightNow Technologies, Inc. |

|

|

(4,795 |

) |

|

(124 |

) |

Riverbed Technology, Inc. |

|

|

(4,909 |

) |

|

(183 |

) |

Rudolph Technologies, Inc. |

|

|

(1,960 |

) |

|

(187 |

) |

SYNNEX Corp. |

|

|

(5,928 |

) |

|

(111 |

) |

Texas Instruments, Inc. |

|

|

(3,644 |

) |

|

(382 |

) |

The Keyw Holding Corp. |

|

|

(4,733 |

) |

|

(118 |

) |

VeriFone Systems, Inc. |

|

|

(5,233 |

) |

|

|

|

|

|

|

||

|

|

|

|

|

|

(173,430 |

) |

|

|

|

|

|

|

||

|

Total

Common Stocks |

|

|

(1,073,854 |

) |

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

CORPORATE BONDS: (6.7)% |

|

|

|

|

|||

|

|

|

|

Best Buy Co., Inc. |

|

|

|

|

|

$ |

(50,000 |

) |

5.50%, 03/15/21 |

|

|

(49,320 |

) |

|

|

|

|

First Data Corp. |

|

|

|

|

|

|

(30,000 |

) |

10.55%,09/24/15 |

|

|

(31,275 |

) |

|

|

(15,000 |

) |

11.25%,03/31/16 |

|

|

(14,850 |

) |

|

|

|

|

Genworth Financial, Inc. |

|

|

|

|

|

|

(50,000 |

) |