UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05083

VAN ECK VIP TRUST - VAN ECK VIP GLOBAL BOND FUND

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 Madison Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2011

Item 1. Report to Shareholders

|

|

|

|

|

SEMI-ANNUAL REPORT |

|

|

|

|

|

JUNE 30, 2011 |

|

|

|

|

|

(unaudited) |

Van Eck VIP Trust

Van Eck VIP Global Bond Fund

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

|

|

|

8 |

|

|

|

|

|

9 |

|

|

|

|

|

10 |

|

|

|

|

|

11 |

|

|

|

|

|

14 |

|

|

|

The information contained in this shareholder letter represents the personal opinions of the investment team members and may differ from those of other portfolio managers or of the firm as a whole. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, unless otherwise specifically noted, any discussion of the Fund’s holdings and the Fund’s performance, and the views of the investment team members are as of June 30, 2011, and are subject to change. |

|

|

For the six months ended June 30, 2011, the Initial Class shares of the Van Eck VIP Global Bond Fund gained 5.37%, outpacing its benchmark, the Citigroup World Government Bond (CGWGBI) Index1, which returned 4.00%. During the period, the Fund mostly benefited from its long-term strategy of favoring the major dollar-denominated bond markets, particularly the Australian and New Zealand bond markets. These markets performed well in the second quarter, as positive local market returns were enhanced by superior currency strength relative to the U.S. dollar, which weakened relative to other currencies in the first half.

The Fund invests primarily in high-quality debt instruments of bond markets worldwide, with heavy emphasis on government bonds of developed nations. As of June 30, 2011, 69.4% of the Fund’s bond holdings were rated AAA and 4.8% were rated AA.† Given the Fund’s focus on higher-grade government bonds, we believe that the Fund is well positioned in this environment. Since high-quality global bond markets move generally in different cycles and with varying supply/demand characteristics, global bonds can add balance to a diversified fixed income strategy.

Market and Economic Review

In the first six months of 2011, global bond markets were the beneficiaries of an investment climate that left investors confused and less tolerant of adding risk. As we near the three-year anniversary of the historic financial crisis, investors continue to debate the state of health of global financial markets and their prospects for stabilizing. The same macroeconomic concerns that dominated in 2010 continue to weigh on markets: slower global economic growth, with particular concern about the pace of growth in China and the U.S. economy; worsening sovereign debt crises in Europe and other developed markets; and rising inflation concerns in many emerging markets, including China, India and Brazil. In addition, early in the year, markets withstood the unpredictable macroeconomic shocks of civil unrest in the Middle East and North Africa (MENA), and Japan’s tragic March 11 Tohoku earthquake, tsunami, and the ensuing nuclear disaster. The Tohoku earthquake caused severe disruptions to Japanese manufacturing that contributed to global economic softening in the second quarter. Although events in the MENA region, including the overthrow of the Tunisian president and the Egyptian government, carried profound geopolitical consequences, they had little impact on global economies until civil war spread to Libya. As Libya’s production of light crude oil was interrupted, oil prices soared as investors were once again reminded of the importance of petroleum to the global economy. Given these geopolitical worries and other macroeconomic concerns, the prices of many commodities, including crude oil prices, increased rapidly during the period. Both gold bullion, which reached new price highs, and U.S. Treasury bonds enjoyed tremendous attention from investors in the first half of 2011 given their safe haven status.

Global bond markets were also impacted by ongoing sovereign debt issues, which reach beyond Europe’s borders, and have helped fuel investor’s aversion to risk. Greece (along with Ireland, Portugal and Spain) remained at the forefront of Europe’s woes, as it grows increasingly clear that Greece cannot service its debt without substantial assistance from other governments or international agencies. European authorities are desperately trying to avoid a Greek sovereign default, which has the potential to lead to widespread banking failures and contagion to other heavily indebted countries. Although Greece may be geographically and economically small in size, it is a substantial credit market participant and its default would have substantial repercussions worldwide. Japanese government debt was put on negative watch by Moody’s Investors Service (a leading provider of credit ratings) following the Tohoku earthquake, which disrupted an economy that was already struggling with persistently anemic growth, periodic deflation, an aging population, and high levels of government debt. The ratings agencies may revise their outlook on U.S. sovereign debt due to massive fiscal deficits and the government’s inability to devise a workable plan. Historically, U.S. Treasury bonds have been considered the world’s safe-haven investments and have enjoyed AAA ratings status, given the U.S.’s ability to stand behind its debt. A change to this status, could roil global credit markets; at this time, debate continued to wage in Washington over raising the nation’s debt ceiling, which translates into the total amount that the Treasury can borrow by issuing bonds.

U.S. economic growth was lower than anticipated for the period, and questions remain about the sustainability of the current economic expansion given that U.S. gross domestic product was an anemic 2.2% (annual rate) in the first quarter of 2011 and likely a similar level for Q2. The unemployment rate climbed above 9.0% in May, and the U.S. housing market continues to remain depressed. This economic recovery is proving to be much weaker than past recoveries that have followed deep recessions. The 10-year U.S. Treasury yield moved lower in the first half of 2011, starting the year at 3.30% and ending the half on June 30 at 3.16%. However, throughout the first half the Treasury market was very volatile: the yield reached a high of 3.74% in early February then declined to 2.86% on June 24 before ending June at 3.16%. At the same time, high-grade U.S. corporate bonds underperformed U.S. Treasuries for the period, having posted gains in the first quarter that were taken back in May and June. Although we did see some tightening of monetary policy (increasing of

1

|

|

|

VAN ECK VIP GLOBAL BOND FUND |

interest rates) among several emerging markets and the European Central Bank, we do not expect U.S. Federal Reserve tightening until next year at the earliest.

Finally, markets were also affected by the end of fiscal relief as QE2, “quantitative easing round two”, concluded in late June. This monetary support, via large-scale asset purchases by the U.S. government, has proved beneficial to stimulating economic growth and supporting markets. As we enter July, the U.S. Federal Reserve has concluded QE2, and its balance sheet stands just shy of $3 trillion dollars. Despite the monetary support and government-backed fiscal measures, including record low interest rates, home-buyer tax credits, mortgage assistance programs, and guarantees from federal agencies, home prices have yet to stabilize. At this writing, consumers, small businesses, and the public sector remained constrained by concerns ranging from the housing market to the debt and deficit struggles of governments at home and abroad.

In terms of currencies, the U.S. Dollar Index (DXY)2 lost 5.98% for the first six months, with all major currencies strengthening against the dollar. For the most part, the U.S. dollar weakened on the back of tepid economic news in the U.S. and the Federal Reserve’s very accommodative monetary policy.

Fund Review

In the first half of 2011, we continued our 2010 strategy of maintaining an overweight bias relative to the Fund’s benchmark in terms of both U.S. currency exposure and U.S. duration. Unfortunately, the Fund’s U.S. bond market overweighting proved to be a drag on relative performance for the period, as the U.S. government bond market was one of the poorer performing members in the first half. The U.S. bond market gained 2.14% in U.S. dollar terms. At the same time, the U.S. dollar weakened against most major currencies, as mentioned earlier.

Elsewhere among the dollar block countries, we continued to maintain an overweight position in Canadian bonds relative to the benchmark Index. This helped both the Fund’s absolute and relative performance slightly given that the Canadian bond market was up 4.82% in U.S. dollar terms. We also maintained the Fund’s overweight positions in both Australian and New Zealand bonds, which provided the biggest boost to performance during the period. On the relative strength of its currency, the Australian bond market was up 9.03% in U.S. dollar terms in the first half, in contrast to 4.39% in local currency terms. The Fund’s exposure to the New Zealand bond market also helped absolute and relative performance in the first half, with the New Zealand bond market climbing 12.34% in U.S. dollar terms, and 6.26% in local currency terms. As we did in 2010, we continue to favor the Australian, Canadian and New Zealand bond markets on a relative basis as we believe they should benefit from stronger fiscal health and benefit from growth in emerging market economies.

The Fund’s neutral position in terms of European bond exposure also helped performance. Although the core Eurozone bond markets performed poorly in the first half in local currency terms (-0.01%), the strength of the euro against the dollar helped boost results in U.S. dollar terms (+8.06%). The Fund also benefited from its relative underweight to ailing peripheral European markets. For example, the Irish and Portuguese bond markets were among the worst performers in local market and U.S. dollar terms as debt concerns continued to weigh on the European periphery. The Fund’s overweight U.K. bond position helped absolute and relative performance given that this market was up 4.30% in U.S. dollar terms.

Our long-standing underweighting in Japan (both in terms of its currency and bond markets) was a key driver of relative performance for the period, as Japan was the worst performing constituent after Ireland and Portugal. The Japanese bond market was up 1.02% in U.S. dollar terms in the first six months (compared to 0.59% in local yen terms). We continue to find Japanese bonds unattractive given low yields, Japan’s poor economic fundamentals, and its continued weak fiscal situation.

* * *

Our outlook for the remainder of 2011 remains somewhat reserved given the uncertainty of the global economic and fiscal landscape. The ending of QE2 is coincident with continued headwinds from European sovereign issues, the U.S. debt ceiling impasse and lackluster growth levels. Given this backdrop of modest growth and high unemployment the potential for a QE3 from the Federal Reserve cannot be ruled out. However, the Fed is also faced with some inflationary pressures related to commodity prices and the weakening U.S. dollar which has created concerns among some monetary policy makers. Our guess is that we are likely to see no significant change from the Fed for the balance of this year. At the same time, Washington must devise a workable plan to address the debt ceiling issue in order to maintain the U.S.’s triple-A credit rating. Although Treasury market participants have not yet appeared concerned about the debt ceiling issue, time is running short, and a political standoff that continues into August could weaken confidence and weigh heavily on financial markets. We remain confident that cool heads will prevail. Given this, our outlook for the second half of 2011 is for a continuation of modest economic growth and the possibility for macroeconomic headwinds to produce volatility for

2

|

|

investors. In terms of the Fund’s portfolio, this means that we are likely to keep duration’s shorter, and to continue to focus the bulk of our investments in core global bond markets.

The Fund is subject to risks associated with investments in debt securities, debt securities rated below investment grade, common stocks, convertible securities, derivatives, asset-backed securities, CMOs and to risks associated with investments in other investment companies. Bonds and bond funds will decrease in value as interest rates rise. The Fund’s investments in foreign securities involve risks related to adverse political and economic developments unique to a country or a region, currency fluctuations or controls, and the possibility of arbitrary action by foreign governments, including the takeover of property without adequate compensation or imposition of prohibitive taxation. The Fund is also subject to nondiversification risk and leverage risk. Please see the prospectus for information on these and other risk considerations.

We appreciate your investment in the Van Eck VIP Global Bond Fund, and we look forward to helping you meet your investment goals in the future.

Investment Team Members:

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles T. Cameron |

Gregory F. Krenzer |

|

Co-Portfolio Manager |

Co-Portfolio Manager |

|

|

|

|

† |

S&P is the credit rating agency (NRSRO) used to determine the ratings for the Fund holdings. |

Note: All country and regional bond market returns are Citigroup Government Bond Indices.

The performance quoted represents past performance. Past performance does not guarantee future results; current performance may be lower or higher than the performance data quoted. Investment return and value of shares of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance information reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Index returns assume that dividends of the Index constituents in the Index have been reinvested. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the redemption of Fund shares. Performance information current to the most recent month end is available by calling 1.800.826.2333 or by visiting vaneck.com.

The Fund is only available to life insurance and annuity companies to fund their variable annuity and variable life insurance products. These contracts offer life insurance and tax benefits to the beneficial owners of the Fund. Your insurance or annuity company’s charges, fees and expenses for these benefits are not reflected in this report or in the Fund’s performance, since they are not direct expenses of the Fund. Had these fees been included, returns would have been lower. For insurance products, performance figures do not reflect the cost for insurance and if they did, the performance shown would be significantly lower. A review of your particular life and/or annuity contract will provide you with much greater detail regarding these costs and benefits.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

|

|

|

|

1 |

Citigroup World Government Bond Index (CGWGB) is a market capitalization weighted benchmark that tracks the performance of approximately 20 world government bond markets. |

|

|

|

|

2 |

U.S. Dollar Index (DXY) indicates the general international value of the U.S. dollar. The DXY does this by averaging the exchange rates between the U.S. dollar and six major world currencies. |

3

|

|

|

VAN ECK VIP GLOBAL BOND FUND |

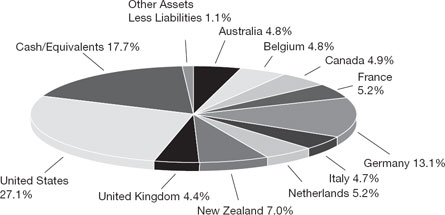

Geographical Weightings*

(unaudited)

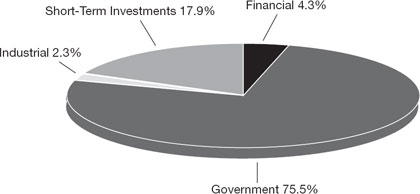

Sector Weightings**

(unaudited)

|

|

|

|

As of June 30, 2011. Portfolio subject to change. |

|

|

* |

Percentage of net assets. |

|

** |

Percentage of investments. |

4

|

|

|

(unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2011 to June 30, 2011.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning |

|

|

Ending |

|

|

|

|

|

Initial Class |

|

|

Actual |

|

|

$1,000.00 |

|

|

$1,053.70 |

|

|

$5.60 |

|

|

|

|

|

Hypothetical** |

|

|

$1,000.00 |

|

|

$1,019.34 |

|

|

$5.51 |

|

|

Class R1 |

|

|

Actual |

|

|

$1,000.00 |

|

|

$1,053.70 |

|

|

$5.60 |

|

|

|

|

|

Hypothetical** |

|

|

$1,000.00 |

|

|

$1,019.34 |

|

|

$5.51 |

|

|

|

|

|

* |

Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2011), of 1.10% on Initial Class and 1.10% on Class R1 Shares, multiplied by the average account value over the period, multiplied by 181 and divided by 365 (to reflect the one-half year period). |

|

|

|

|

** |

Assumes annual return of 5% before expenses |

5

|

|

|

VAN ECK VIP GLOBAL BOND FUND |

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

Value |

|

|

|

|

||||||

|

BONDS AND NOTES: 81.2% |

|

|

|

|

||

|

Australia: 4.8% |

|

|

|

|

||

|

AUD 2,400,000 |

|

Australian

Government Bond |

|

$ |

2,680,183 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Belgium: 4.8% |

|

|

|

|

||

|

EUR 1,800,000 |

|

Belgian

Government Bond |

|

|

2,666,304 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Canada: 4.9% |

|

|

|

|

||

|

CAD 2,700,000 |

|

Canadian

Government Bond |

|

|

2,757,782 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

France: 5.2% |

|

|

|

|

||

|

EUR 1,900,000 |

|

French

Government Bond |

|

|

2,886,634 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Germany: 13.1% |

|

|

|

|

||

|

3,000,000 |

|

Bundesrepublik

Deutschland |

|

|

4,941,666 |

|

|

1,600,000 |

|

Kreditanstalt

fuer Wiederaufbau |

|

|

2,364,468 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

7,306,134 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Italy: 4.7% |

|

|

|

|

||

|

1,800,000 |

|

Italian

Government Bond |

|

|

2,653,871 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Netherlands: 5.2% |

|

|

|

|

||

|

1,900,000 |

|

Dutch

Government Bond |

|

|

2,937,803 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

New Zealand: 7.0% |

|

|

|

|

||

|

NZD 4,500,000 |

|

New Zealand

Government Bond |

|

|

3,941,009 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

United Kingdom: 4.4% |

|

|

|

|

||

|

GBP 1,500,000 |

|

United

Kingdom Gilt |

|

|

2,479,257 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

|

Value |

|

|

|

||||||

|

United States: 27.1% |

|

|

|

|

||

|

$1,000,000 |

|

Caterpillar, Inc. |

|

|

|

|

|

|

|

7.90%, 12/15/18 |

|

$ |

1,281,238 |

|

|

|

|

U.S. Treasury Notes |

|

|

|

|

|

2,500,000 |

|

2.13%, 02/29/16 |

|

|

2,559,765 |

|

|

3,500,000 |

|

2.63%, 11/15/20 |

|

|

3,371,484 |

|

|

5,000,000 |

|

3.63%, 02/15/20 |

|

|

5,290,235 |

|

|

2,000,000 |

|

6.63%, 02/15/27 |

|

|

2,646,250 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

15,148,972 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Bonds and Notes |

|

|

45,457,949 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENTS: 17.7% |

|

|

|

|

||

|

|

|

|

|

|

||

|

Money Market Fund: 12.3% |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Number

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,900,980 |

|

AIM Treasury Portfolio - Institutional Class |

|

|

6,900,980 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

United States Treasury Obligations: 5.4% |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$3,000,000 |

|

U.S.

Treasury Bill |

|

|

2,999,952 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Short-term Investments |

|

|

9,900,932 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Total Investments: 98.9% |

|

|

55,358,881 |

|

||

|

Other assets less liabilities: 1.1% |

|

|

603,654 |

|

||

|

|

|

|

||||

|

NET ASSETS: 100.0% |

|

$ |

55,962,535 |

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

AUD — Australian Dollar |

|

|

CAD — Canadian Dollar |

|

|

EUR — Euro |

|

|

GBP — British Pound |

|

|

NZD — New Zealand Dollar |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary of Investments |

|

|

%

of |

|

Value |

|

|||

|

|

|

|

|

||||||

|

Financial |

|

|

4.3 |

% |

|

$ |

2,364,468 |

|

|

|

Government |

|

|

75.5 |

|

|

|

41,812,243 |

|

|

|

Industrial |

|

|

2.3 |

|

|

|

1,281,238 |

|

|

|

Short-term Investments |

|

|

17.9 |

|

|

|

9,900,932 |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

100.0 |

% |

|

$ |

55,358,881 |

|

|

|

|

|

|

|

|

|

||||

The summary of inputs used to value the Fund’s investments as of June 30, 2011 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level

1 |

|

Level

2 |

|

Level

3 |

|

Value |

|

||||

|

|

|

|

|

|

|

||||||||

|

Bonds and Notes * |

|

$ |

— |

|

$ |

45,457,949 |

|

$ |

— |

|

$ |

45,457,949 |

|

|

Short-term Investments |

|

|

9,900,932 |

|

|

— |

|

|

— |

|

|

9,900,932 |

|

|

|

|

|

|

|

|

||||||||

|

Total |

|

$ |

9,900,932 |

|

$ |

45,457,949 |

|

$ |

— |

|

$ |

55,358,881 |

|

|

|

|

|

|

|

|

||||||||

* See Schedule of Investments for security type and geographic country breakouts.

See Notes to Financial Statements

6

|

|

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

Investments, at value (Cost $47,859,461) |

|

$ |

55,358,881 |

|

|

Receivables: |

|

|

|

|

|

Shares of beneficial interest sold |

|

|

54,265 |

|

|

Dividends and interest |

|

|

702,270 |

|

|

Foreign tax reclaims |

|

|

3,549 |

|

|

Prepaid expenses |

|

|

649 |

|

|

|

|

|

||

|

Total assets |

|

|

56,119,614 |

|

|

|

|

|

||

|

Liabilities: |

|

|

|

|

|

Payables: |

|

|

|

|

|

Shares of beneficial interest redeemed |

|

|

30,653 |

|

|

Due to Adviser |

|

|

37,725 |

|

|

Deferred Trustee fees |

|

|

17,011 |

|

|

Accrued expenses |

|

|

71,690 |

|

|

|

|

|

||

|

Total liabilities |

|

|

157,079 |

|

|

|

|

|

||

|

NET ASSETS |

|

$ |

55,962,535 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Initial Class Shares: |

|

|

|

|

|

Net Assets |

|

$ |

43,620,609 |

|

|

|

|

|

||

|

Shares of beneficial interest outstanding |

|

|

3,821,380 |

|

|

|

|

|

||

|

Net asset value, redemption and offering price per share |

|

|

$11.41 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Class R1 Shares: |

|

|

|

|

|

Net Assets |

|

$ |

12,341,926 |

|

|

|

|

|

||

|

Shares of beneficial interest outstanding |

|

|

1,081,328 |

|

|

|

|

|

||

|

Net asset value, redemption and offering price per share |

|

|

$11.41 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Net Assets consist of: |

|

|

|

|

|

Aggregate paid in capital |

|

$ |

47,077,233 |

|

|

Net unrealized appreciation |

|

|

7,521,901 |

|

|

Undistributed net investment income |

|

|

651,169 |

|

|

Accumulated net realized gain |

|

|

712,232 |

|

|

|

|

|

||

|

|

|

$ |

55,962,535 |

|

|

|

|

|

See Notes to Financial Statements

7

|

|

|

VAN ECK VIP GLOBAL BOND FUND |

|

For the Six Months Ended June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

Income: |

|

|

|

|

|

|

|

|

Dividends |

|

|

|

|

$ |

238 |

|

|

Interest |

|

|

|

|

|

953,688 |

|

|

|

|

|

|

|

|

||

|

Total income |

|

|

|

|

|

953,926 |

|

|

|

|

|

|

|

|

||

|

|

|||||||

|

Expenses: |

|

|

|

|

|

|

|

|

Management fees |

|

$ |

252,751 |

|

|

|

|

|

Transfer agent fees - Initial Class |

|

|

6,908 |

|

|

|

|

|

Transfer agent fees - R1 Class Shares |

|

|

5,245 |

|

|

|

|

|

Custodian fees |

|

|

4,140 |

|

|

|

|

|

Professional fees |

|

|

19,117 |

|

|

|

|

|

Reports to shareholders |

|

|

21,929 |

|

|

|

|

|

Insurance |

|

|

1,765 |

|

|

|

|

|

Trustees’ fees and expenses |

|

|

3,048 |

|

|

|

|

|

Other |

|

|

3,309 |

|

|

|

|

|

|

|

|

|

|

|

||

|

Total expenses |

|

|

318,212 |

|

|

|

|

|

Waiver of management fees |

|

|

(39,951 |

) |

|

|

|

|

|

|

|

|

|

|

||

|

Net expenses |

|

|

|

|

|

278,261 |

|

|

|

|

|

|

|

|

||

|

Net investment income |

|

|

|

|

|

675,665 |

|

|

|

|

|

|

|

|

||

|

|

|||||||

|

Net realized gain (loss) on: |

|

|

|

|

|

|

|

|

Investments |

|

|

|

|

|

1,562,812 |

|

|

Foreign currency transactions and foreign denominated assets and liabilities |

|

|

|

|

|

(839,632 |

) |

|

|

|

|

|

|

|

||

|

Net realized gain |

|

|

|

|

|

723,180 |

|

|

|

|

|

|

|

|

||

|

|

|||||||

|

Change in net unrealized appreciation on: |

|

|

|

|

|

|

|

|

Investments |

|

|

|

|

|

1,314,107 |

|

|

Foreign currency transactions and foreign denominated assets and liabilities |

|

|

|

|

|

15,668 |

|

|

|

|

|

|

|

|

||

|

Change in net unrealized appreciation |

|

|

|

|

|

1,329,775 |

|

|

|

|

|

|

|

|

||

|

Net Increase in Net Assets Resulting from Operations |

|

|

|

|

$ |

2,728,620 |

|

|

|

|

|

|

|

|

See Notes to Financial Statements

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six

Months |

|

Year

Ended |

|

||

|

|

|

|

|

||||

|

|

|

(unaudited) |

|

|

|

||

|

|

|||||||

|

Operations: |

|

|

|

|

|

|

|

|

Net investment income |

|

$ |

675,665 |

|

$ |

1,226,096 |

|

|

Net realized gain |

|

|

723,180 |

|

|

2,541,291 |

|

|

Net change in unrealized appreciation (depreciation) |

|

|

1,329,775 |

|

|

(2,660,137 |

) |

|

|

|

|

|

||||

|

Net increase in net assets resulting from operations |

|

|

2,728,620 |

|

|

1,107,250 |

|

|

|

|

|

|

||||

|

|

|||||||

|

Dividends and Distributions to shareholders from: |

|

|

|

|

|

|

|

|

Net investment income |

|

|

|

|

|

|

|

|

Initial Class Shares |

|

|

(2,850,676 |

) |

|

(1,213,045 |

) |

|

Class R1 Shares |

|

|

(911,737 |

) |

|

(444,772 |

) |

|

|

|

|

|

||||

|

|

|

|

(3,762,413 |

) |

|

(1,657,817 |

) |

|

|

|

|

|

||||

|

Net realized gains |

|

|

|

|

|

|

|

|

Initial Class Shares |

|

|

(726,759 |

) |

|

— |

|

|

Class R1 Shares |

|

|

(232,441 |

) |

|

— |

|

|

|

|

|

|

||||

|

|

|

|

(959,200 |

) |

|

— |

|

|

|

|

|

|

||||

|

Total dividends and distributions |

|

|

(4,721,613 |

) |

|

(1,657,817 |

) |

|

|

|

|

|

||||

|

Settlement payments from unaffiliated third parties |

|

|

— |

|

|

1,684,964 |

|

|

|

|

|

|

||||

|

|

|||||||

|

Share transactions*: |

|

|

|

|

|

|

|

|

Proceeds from sale of shares |

|

|

|

|

|

|

|

|

Initial Class Shares |

|

|

10,996,266 |

|

|

10,960,563 |

|

|

Class R1 Shares |

|

|

1,611,028 |

|

|

1,197,634 |

|

|

|

|

|

|

||||

|

|

|

|

12,607,294 |

|

|

12,158,197 |

|

|

|

|

|

|

||||

|

Reinvestment of dividends and distributions |

|

|

|

|

|

|

|

|

Initial Class Shares |

|

|

3,577,435 |

|

|

1,213,045 |

|

|

Class R1 Shares |

|

|

1,144,178 |

|

|

444,772 |

|

|

|

|

|

|

||||

|

|

|

|

4,721,613 |

|

|

1,657,817 |

|

|

|

|

|

|

||||

|

Cost of shares redeemed |

|

|

|

|

|

|

|

|

Initial Class Shares |

|

|

(5,124,638 |

) |

|

(11,095,673 |

) |

|

Class R1 Shares |

|

|

(1,428,688 |

) |

|

(3,067,923 |

) |

|

Redemption fees |

|

|

— |

|

|

86 |

|

|

|

|

|

|

||||

|

|

|

|

(6,553,326 |

) |

|

(14,163,510 |

) |

|

|

|

|

|

||||

|

Net increase (decrease) in net assets resulting from share transactions |

|

|

10,775,581 |

|

|

(347,496 |

) |

|

|

|

|

|

||||

|

Total increase in net assets |

|

|

8,782,588 |

|

|

786,901 |

|

|

|

|

|

|

|

|

|

|

|

Net Assets: |

|

|

|

|

|

|

|

|

Beginning of period |

|

|

47,179,947 |

|

|

46,393,046 |

|

|

|

|

|

|

||||

|

End of period (including undistributed net investment income of $651,169 and $3,737,917, respectively) |

|

$ |

55,962,535 |

|

$ |

47,179,947 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

* Shares of beneficial interest issued, reinvested and redeemed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Class Shares: |

|

|

|

|

|

|

|

|

Shares sold |

|

|

979,727 |

|

|

930,726 |

|

|

Shares reinvested |

|

|

329,111 |

|

|

107,826 |

|

|

Shares redeemed |

|

|

(454,030 |

) |

|

(945,461 |

) |

|

|

|

|

|

||||

|

Net increase |

|

|

854,808 |

|

|

93,091 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Class R1 Shares: |

|

|

|

|

|

|

|

|

Shares sold |

|

|

147,683 |

|

|

102,380 |

|

|

Shares reinvested |

|

|

105,260 |

|

|

39,570 |

|

|

Shares redeemed |

|

|

(127,029 |

) |

|

(262,297 |

) |

|

|

|

|

|

||||

|

Net increase (decrease) |

|

|

125,914 |

|

|

(120,347 |

) |

|

|

|

|

|

||||

See Notes to Financial Statements

9

|

|

|

VAN ECK VIP GLOBAL BOND FUND |

|

For a share outstanding throughout each year: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Class Shares |

|

|||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

For the Six |

|

|

|

|||||||||||||||

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

Year Ended December 31, |

|

||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

2010 |

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Net asset value, beginning of period |

|

|

$12.03 |

|

|

|

$11.75 |

|

|

$11.52 |

|

|

$12.12 |

|

|

$11.78 |

|

|

$12.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Income from investment operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

|

0.15 |

(f) |

|

|

0.31 |

|

|

0.34 |

|

|

0.41 |

|

|

0.41 |

|

|

0.53 |

|

|

Net realized and unrealized gain (loss) on investments |

|

|

0.44 |

|

|

|

(0.02 |

) |

|

0.30 |

|

|

0.02 |

|

|

0.66 |

|

|

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total from investment operations |

|

|

0.59 |

|

|

|

0.29 |

|

|

0.64 |

|

|

0.43 |

|

|

1.07 |

|

|

0.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Less distributions from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

|

(0.96 |

) |

|

|

(0.42 |

) |

|

(0.41 |

) |

|

(1.03 |

) |

|

(0.73 |

) |

|

(0.98 |

) |

|

Net realized gains |

|

|

(0.25 |

) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total distributions |

|

|

(1.21 |

) |

|

|

(0.42 |

) |

|

(0.41 |

) |

|

(1.03 |

) |

|

(0.73 |

) |

|

(0.98 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Settlement payments from unaffiliated third parties |

|

|

— |

|

|

|

0.41 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Redemption fees |

|

|

— |

(b) |

|

|

— |

(b) |

|

— |

(b) |

|

— |

(b) |

|

— |

(b) |

|

— |

(b) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net asset value, end of period |

|

|

$11.41 |

|

|

|

$12.03 |

|

|

$11.75 |

|

|

$11.52 |

|

|

$12.12 |

|

|

$11.78 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total return (a) |

|

|

5.37 |

%(c) |

|

|

6.20 |

% (e) |

|

5.98 |

% |

|

3.61 |

% |

|

9.71 |

% |

|

6.48 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets, end of period (000’s) |

|

|

$43,621 |

|

|

|

$35,688 |

|

|

$33,757 |

|

|

$35,200 |

|

|

$39,745 |

|

|

$39,071 |

|

|

Ratio of gross expenses to average net assets |

|

|

1.24 |

%(d) |

|

|

1.30 |

% |

|

1.31 |

% |

|

1.17 |

% |

|

1.32 |

% |

|

1.28 |

% |

|

Ratio of net expenses to average net assets |

|

|

1.10 |

%(d) |

|

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

Ratio of net expenses, excluding interest expense, to average net assets |

|

|

1.10 |

%(d) |

|

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

Ratio of net investment income to average net assets |

|

|

2.67 |

%(d) |

|

|

2.60 |

% |

|

2.95 |

% |

|

3.08 |

% |

|

3.31 |

% |

|

3.77 |

% |

|

Portfolio turnover rate |

|

|

14 |

%(c) |

|

|

35 |

% |

|

0 |

% |

|

2 |

% |

|

20 |

% |

|

19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class R1 Shares |

|

|||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

For the Six |

|

|

|

|||||||||||||||

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

Year Ended December 31, |

|

||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

2010 |

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Net asset value, beginning of period |

|

|

$12.03 |

|

|

|

$11.75 |

|

|

$11.52 |

|

|

$12.11 |

|

|

$11.77 |

|

|

$12.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Income from investment operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

|

0.15 |

(f) |

|

|

0.33 |

|

|

0.35 |

|

|

0.41 |

|

|

0.40 |

|

|

0.52 |

|

|

Net realized and unrealized gain (loss) on investments |

|

|

0.44 |

|

|

|

(0.04 |

) |

|

0.29 |

|

|

0.03 |

|

|

0.67 |

|

|

0.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total from investment operations |

|

|

0.59 |

|

|

|

0.29 |

|

|

0.64 |

|

|

0.44 |

|

|

1.07 |

|

|

0.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Less distributions from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

|

(0.96 |

) |

|

|

(0.42 |

) |

|

(0.41 |

) |

|

(1.03 |

) |

|

(0.73 |

) |

|

(0.98 |

) |

|

Net realized gains |

|

|

(0.25 |

) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total distributions |

|

|

(1.21 |

) |

|

|

(0.42 |

) |

|

(0.41 |

) |

|

(1.03 |

) |

|

(0.73 |

) |

|

(0.98 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Settlement payments from unaffiliated third parties |

|

|

— |

|

|

|

0.41 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Redemption fees |

|

|

— |

(b) |

|

|

— |

(b) |

|

— |

(b) |

|

— |

(b) |

|

— |

(b) |

|

— |

(b) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net asset value, end of period |

|

|

$11.41 |

|

|

|

$12.03 |

|

|

$11.75 |

|

|

$11.52 |

|

|

$12.11 |

|

|

$11.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total return (a) |

|

|

5.37 |

%(c) |

|

|

6.20 |

%(e) |

|

5.98 |

% |

|

3.70 |

% |

|

9.73 |

% |

|

6.48 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets, end of period (000’s) |

|

|

$12,342 |

|

|

|

$11,492 |

|

|

$12,636 |

|

|

$14,472 |

|

|

$14,533 |

|

|

$12,238 |

|

|

Ratio of gross expenses to average net assets |

|

|

1.29 |

%(d) |

|

|

1.37 |

% |

|

1.36 |

% |

|

1.21 |

% |

|

1.38 |

% |

|

1.35 |

% |

|

Ratio of net expenses to average net assets |

|

|

1.10 |

%(d) |

|

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

Ratio of net expenses, excluding interest expense, to average net assets |

|

|

1.10 |

%(d) |

|

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

1.10 |

% |

|

Ratio of net investment income to average net assets |

|

|

2.68 |

%(d) |

|

|

2.60 |

% |

|

2.95 |

% |

|

3.08 |

% |

|

3.31 |

% |

|

3.75 |

% |

|

Portfolio turnover rate |

|

|

14 |

%(c) |

|

|

35 |

% |

|

0 |

% |

|

2 |

% |

|

20 |

% |

|

19 |

% |

|

|

|

|

|

|

||

|

(a) |

Total return is calculated assuming an initial investment made at the net asset value at the beginning of period, reinvestment of any dividends and distributions at net asset value on the dividend/distributions payment date and a redemption on the last day of the period. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends/distributions or the redemption of Fund shares. |

|

|

(b) |

Amount represents less than $0.005 per share |

|

|

(c) |

Not annualized |

|

|

(d) |

Annualized |

|

|

(e) |

For the year ended December 31, 2010, the Fund received settlement payments from unaffiliated third parties which represented 3.71% of the Initial Class Shares and Class R1 Shares total return. |

|

|

(f) |

Calculated based upon weighted average shares outstanding. |

|

See Notes to Financial Statements

10

|

|

|

June 30, 2011 (unaudited) |

Note 1—Fund Organization—Van Eck VIP Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on January 7, 1987. The Van Eck VIP Global Bond Fund, formerly Worldwide Bond Fund, (the “Fund”) is a non-diversified series of the Trust and seeks high total return (income plus capital appreciation) by investing globally, primarily in a variety of debt securities. The Fund offers two classes of shares: Initial Class Shares and Class R1 Shares. The two classes are identical except Class R1 Shares are, under certain circumstances, subject to a redemption fee on redemptions within 60 days of purchase.

Note 2—Significant Accounting Policies—The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

|

|

|

|

A. |

Security Valuation—Securities traded on national exchanges or traded on the NASDAQ National Market System are valued at the last sales price as reported at the close of each business day. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ official closing price. Over-the-counter securities not included in the NASDAQ National Market System and listed securities for which no sale was reported are valued at the mean of the bid and ask prices. To the extent these securities are actively traded they are categorized as level 1 in the fair value hierarchy (as described below). The Fund may also fair value securities in other situations, such as, when a particular foreign market is closed but the Fund is open. Bonds and notes are fair valued by pricing service which utilized models that incorporate observable data such as sales of similar securities, broker quotes, yields, bids, offers and reference data and are categorized as level 2 in the fair value hierarchy. Short-term obligations purchased with more than sixty days remaining to maturity are valued at market value. Short-term obligations purchased with sixty days or less to maturity are valued at amortized cost, which with accrued interest approximates fair value. Money market fund investments are valued at net asset value. Forward foreign currency contracts are valued at the spot currency rate plus an amount (“points”), which reflects the differences in interest rates between the U.S. and foreign markets. Securities for which quotations are not available are stated at fair value as determined by a Pricing Committee of Van Eck Associates Corporation (the “Adviser”) appointed by the Board of Trustees. Certain factors such as economic conditions, political events, market trends, the nature of and duration of any restrictions on disposition, trading in similar securities of the issuer or comparable issuers and other security specific information are used to determine the fair value for these securities. Depending on the relative significance of valuation inputs, these securities may be classified either as level 2 or level 3 in the fair value hierarchy. The price which the Fund may realize upon sale of an investment may differ materially from the value presented on the Schedule of Investments. |

|

|

|

|

|

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis which includes a hierarchy that prioritizes inputs to valuation methods used to measure fair value. GAAP establishes a fair value hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The hierarchy gives highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three levels of the fair value hierarchy are described below: |

|

|

|

|

|

Level 1 – Quoted prices in active markets for identical securities. |

|

|

|

|

|

Level 2 – Significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

|

|

|

|

|

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

|

|

|

|

B. |

Federal Income Taxes—It is the Fund’s policy to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required. |

|

|

|

|

C. |

Currency Translation—Assets and liabilities denominated in foreign currencies and commitments under forward foreign currency contracts are translated into U.S. dollars at the closing prices of such currencies each business day. Purchases and sales of investments are translated at the exchange rates prevailing when such investments are acquired or sold. Income and expenses are translated at the exchange rates prevailing when accrued. The portion of realized and unrealized gains and losses on investments that result from fluctuations in foreign currency exchange rates is not separately disclosed. Recognized gains or losses attributable to foreign currency fluctuations on foreign currency denominated assets, other than investments, and liabilities are recorded as net realized gains and losses from foreign currency transactions. |

11

|

|

|

VAN ECK VIP GLOBAL BOND FUND |

|

NOTES TO FINANCIAL STATEMENTS |

|

(continued) |

|

|

|

|

D. |

Dividends and Distributions to Shareholders—Dividends to shareholders from net investment income and distributions from net realized capital gains, if any, are declared and paid annually. Income dividends and capital gain distributions are determined in accordance with income tax regulations, which may differ from such amounts determined in accordance with GAAP. |

|

|

|

|

E. |

Use of Derivative Instruments—The Fund may make investments in derivative instruments, including, but not limited to, options, futures, swaps and other derivatives relating to foreign currency transactions. A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. Derivative instruments may be privately negotiated contracts (often referred to as over the counter (“OTC”) derivatives) or they may be listed and traded on an exchange. Derivative contracts may involve future commitments to purchase or sell financial instruments at specified terms on a specified date, or to exchange interest payment streams or currencies based on a notional or contractual amount. Derivative instruments may involve a high degree of financial risk. The use of derivatives also involves the risk of loss if the Adviser is incorrect in its expectation of the timing or level of fluctuations in securities prices, interest rates or currency prices. Investments in derivative instruments also include the risk of default by the counterparty, the risk that the investment may not be liquid and the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument. GAAP requires enhanced disclosures about the Fund’s derivatives and hedging activities. The Fund had no derivatives during the period ended June 30, 2011. |

|

|

|

|

|

Forward Foreign Currency Contracts—The Fund is subject to foreign currency risk in the normal course of pursuing its investment objectives. The Fund may buy and sell forward foreign currency contracts to settle purchases and sales of foreign denominated securities or to hedge foreign denominated assets. Realized gains and losses from forward foreign currency contracts are included in realized gain (loss) on forward foreign currency contracts and foreign currency transactions. The Fund may incur additional risk from investments in forward foreign currency contracts if the counterparty is unable to fulfill its obligation or there are unanticipated movements of the foreign currency relative to the U.S. dollar. The Fund had no outstanding forward foreign currency contracts during the period ended June 30, 2011. |

|

|

|

|

F. |

Other—Security transactions are accounted for on trade date. Realized gains and losses are calculated on the identified cost basis. Interest income, including amortization of premiums and discounts, is accrued as earned. Estimated foreign taxes that are expected to be withheld from proceeds at the sale of certain foreign investments are accrued by the Fund and decrease the unrealized gain on investments. The Fund received regulatory settlement payments during 2010 from unaffiliated third parties which is included in the Statement of Changes in Net Assets. |

|

|

|

|

|

Income, expenses (excluding class-specific expenses), realized and unrealized gains/losses are allocated proportionately to each class of shares based upon the relative net asset value of outstanding shares of each class at the beginning of the day (after adjusting for current capital share activity of the respective classes). Class-specific expenses are charged directly to the applicable class of shares. |

|

|

|

|

|

In the normal course of business, the Fund enters into contracts that contain a variety of general indemnifications. The Fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Adviser believes the risk of loss under these arrangements to be remote. |

Note 3—Investment Management and Other Agreements—The Adviser is the investment adviser to the Fund. The Adviser receives a management fee, calculated daily and payable monthly based on an annual rate of 1.00% on the first $500 million of average daily net assets, 0.90% on the next $250 million of average daily net assets and 0.70% on the average daily net assets in excess of $750 million. The Adviser has agreed, at least until May 1, 2012 to waive management fees and/or assume expenses, excluding interest, taxes, and extraordinary expenses, exceeding 1.10% of average daily net assets, for both Initial Class Shares and Class R1 Shares. For the period ended June 30, 2011, the Adviser waived management fees in the amount of $38,838. Certain officers and trustees of the Trust are officers, directors or stockholders of the Adviser and Van Eck Securities Corporation, the distributor.

Note 4—Investments—For the period ended June 30, 2011, the cost of purchases and proceeds from sales of investments, other than U.S. government securities and short-term obligations, aggregated $7,664,819 and $6,455,070, respectively.

Note 5—Income Taxes—For Federal income tax purposes, the identified cost of investments owned at June 30, 2011 was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund |

|

|

Cost

of |

|

Gross

Unrealized |

|

Gross

Unrealized |

|

Net

Unrealized |

|

|

|

|

|

|

|

|

|||||

|

Van Eck VIP Global Bond Fund |

|

$47,859,461 |

|

$7,499,420 |

|

$— |

|

$7,499,420 |

|

|

12

The tax character of dividends and distributions paid to shareholders

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period

Ended |

|

Year

Ended |

|

||||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Income |

|

|

$ |

3,762,413 |

|

|

|

$ |

1,657,817 |

|

|

|

Long term capital gains |

|

|

|

959,200 |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

$ |

4,721,613 |

|

|

|

$ |

1,657,817 |

|

|

|

|

|

|

|

|

|

|

|

||||

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by applicable tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on return filings for open tax years (tax years ended December 31, 2007-2010), or expected to be taken in the Fund’s current tax year. Therefore, no provision for income tax is required in the Fund’s financial statements.

The Fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Note 6—Concentration of Risk—The Fund invests in foreign securities. Investments in foreign securities may involve a greater degree of risk than investments in domestic securities due to political, economic or social instability. Foreign investments may also be subject to foreign taxes and settlement delays. Since the Fund may have significant investments in foreign debt securities it may be subject to greater credit and interest risks and greater currency fluctuations than portfolios with significant investments in domestic debt securities.

At June 30, 2011, the aggregate shareholder accounts of five insurance companies own approximately 27%,18%, 15%, 8% and 8% of the Initial Class Shares and three of whom own approximately 46%, 39%, and 12% of the Class R1 Shares.

Note 7—Trustee Deferred Compensation Plan—The Trust has a Deferred Compensation Plan (the “Plan”) for Trustees under which the Trustees can elect to defer receipt of their trustee fees until retirement, disability or termination from the Board of Trustees. The fees otherwise payable to the participating Trustees are deemed invested in shares of the Van Eck Funds (another registered investment company managed by the Adviser) as directed by the Trustees.

The expense for the Plan is included in “Trustees’ fees and expenses” in the Statement of Operations. The liability for the plan is shown as “Deferred Trustee fees” in the Statement of Assets and Liabilities.

Note 8—Bank Line of Credit—The Trust may participate with Van Eck Funds (collectively the “VE/VIP Funds”) in a $20 million committed credit facility (the “Facility”) to be utilized for temporary financing until the settlement of sales or purchases of portfolio securities, the repurchase or redemption of shares of the Funds at the request of the shareholders and other temporary or emergency purposes. The VE/VIP Funds have agreed to pay commitment fees, pro rata, based on the unused but available balance. Interest is charged to the VE/VIP Funds at rates based on prevailing market rates in effect at the time of borrowings. During the period ended June 30, 2011, the Fund had no outstanding borrowings under the Facility.

Note 9—Securities Lending—To generate additional income, the Fund may lend its securities pursuant to a securities lending agreement with State Street Bank & Trust Co., the securities lending agent and also the Fund’s custodian. During the period ended June 30, 2011, there was no securities lending activity.

Note 10—Custodian Fees—The Fund has entered into an expense offset agreement with its custodian wherein it receives credit toward the reduction of custodian fees whenever there are uninvested cash balances. For the period ended June 30, 2011, there were no offsets of custodial fees.

Note 11—Subsequent Event Review—The Funds have evaluated subsequent events and transactions for potential recognition or disclosure through the date the financial statements were issued.

13

|

|

|

VAN ECK VIP GLOBAL BOND FUND |