SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05071 or 33-13247

SATURNA INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

1300 N. State Street

Bellingham, Washington 98225-4730

(Address of Principal Executive Offices, including ZIP Code)

Nicole Trudeau

1300 N. State Street

Bellingham, Washington 98225-4730

(Name and Address of Agent for Service)

Registrant's Telephone Number – (360) 734-9900

Date of fiscal year end: November 30, 2019

Date of reporting period: November 30, 2019

Item 1. Annual Report.

| Performance Summary (as of December 31, 2019) | (unaudited) |

| Expense Ratio1 | ||||||||||||||||||||||||||||

Average Annual Total Returns |

1 Year | 3 Year | 5 Year | 10 Year | 15 Year | Gross | Net | |||||||||||||||||||||

Sextant Short-Term Bond Fund (STBFX) |

4.01% | 1.85% | 1.62% | 1.54% | 2.30% | 0.91% | 0.60% | |||||||||||||||||||||

FTSE USBIG Govt/Corp 1-3 Year Index |

4.00% | 2.11% | 1.64% | 1.50% | 2.44% | n/a | ||||||||||||||||||||||

Sextant Bond Income Fund (SBIFX) |

10.22% | 4.64% | 3.24% | 4.20% | 4.00% | 0.84% | 0.65% | |||||||||||||||||||||

FTSE US Broad Investment-Grade Bond Index |

8.86% | 4.08% | 3.08% | 3.73% | 4.22% | n/a | ||||||||||||||||||||||

Sextant Core Fund (SCORX) |

19.99% | 9.46% | 5.52% | 6.11% | n/a | 0.88% | ||||||||||||||||||||||

Dow Jones Moderate US Portfolio Index |

18.60% | 8.98% | 6.60% | 7.75% | 6.43% | n/a | ||||||||||||||||||||||

Sextant Global High Income Fund (SGHIX) |

11.47% | 8.32% | 5.74% | n/a | n/a | 0.97% | 0.75% | |||||||||||||||||||||

S&P Global 1200 Index |

28.22% | 13.39% | 9.50% | 9.99% | 7.63% | n/a | ||||||||||||||||||||||

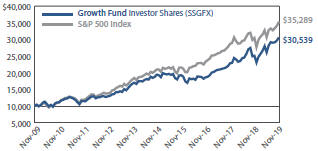

Sextant Growth Fund Investor Shares (SSGFX) |

36.38% | 18.78% | 10.29% | 11.68% | 8.81% | 0.92% | ||||||||||||||||||||||

Sextant Growth Fund Z Shares (SGZFX) |

36.77% | n/a | n/a | n/a | n/a | 0.70% | ||||||||||||||||||||||

S&P 500 Index |

31.49% | 15.26% | 11.69% | 13.55% | 8.99% | n/a | ||||||||||||||||||||||

Sextant International Fund Investor Shares (SSIFX) |

26.85% | 15.20% | 9.00% | 5.83% | 6.69% | 1.05% | ||||||||||||||||||||||

Sextant International Fund Z Shares (SIFZX) |

27.19% | n/a | n/a | n/a | n/a | 0.84% | ||||||||||||||||||||||

MSCI EAFE Index |

22.66% | 10.10% | 6.18% | 5.99% | 5.33% | n/a | ||||||||||||||||||||||

Performance data quoted above represents past performance, is before any taxes payable by shareowners, and is no guarantee of future results. Current performance may be higher or lower than that stated herein. Performance current to the most recent month-end is available by calling toll-free 1-800-728-8762 or visiting www.sextantfunds.com. Average annual total returns are historical and include change in share value as well as reinvestment of dividends and capital gains, if any. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Funds that invest in foreign securities may involve greater risk, including political and economic uncertainties of foreign countries as well as the risk of currency fluctuations.

Z Shares of Sextant Growth and International Funds began operations June 2, 2017.

A note about risk: Please see Notes to Financial Statements beginning on page 54 for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see the Funds’ prospectus or each Fund’s summary prospectus.

A Fund’s 30-Day Yield, sometimes referred to as “standardized yield” or “SEC yield,” is expressed as an annual percentage rate using a method of calculation adopted by the Securities and Exchange Commission (SEC). The 30-Day Yield provides an estimate of a Fund’s investment income rate, but may not equal the actual income distribution rate.

| 1 | By regulation, expense ratios shown in this table are as stated in the Funds’ most recent prospectus, which is dated March 27, 2019, and incorporate results for the fiscal year ended November 30, 2018. Ratios presented in this table differ from the expense ratios shown elsewhere in this report as they represent different periods. Also by regulation, the performance in this table represents the most recent quarter-end performance rather than performance through the Funds’ most recent fiscal period. |

The S&P 500 Index is an index comprised of 500 widely held common stocks considered to be representative of the US stock market in general. The MSCI EAFE Index is an international index focused on Europe, Australasia, and the Far East. The S&P Global 1200 Index is a global stock market index covering nearly 70% of the world’s equity markets. The Dow Jones Moderate Portfolio Index is a broad-based index of stock and bond prices. The FTSE USBIG Govt/Corp Index 1-3 Year is a broad-based index of shorter-term investment grade US government and corporate bond prices. The FTSE US Broad Investment-Grade Bond Index is a broad-based index of medium and long-term investment grade bond prices. Investors cannot invest directly in the indices.

Please consider an investment’s objectives, risks, charges, and expenses carefully before investing. To obtain this and other important information about the Sextant Funds in a prospectus or summary prospectus, ask your financial advisor, visit www.sextantfunds.com, or call toll-free 1-800-728-8762. Please read the prospectus or summary prospectus carefully before investing.

| 2 | November 30, 2019 | Annual Report | ||||

Fellow Shareowners: |

January 24, 2020 |

Following a mixed performance in 2018, US equity markets posted substantial returns for the year ended November 30, 2019. The S&P 500 Index rose 16.11%, while the Dow Jones Moderate US Portfolio Index gained 11.53%. Foreign markets were also positive, with the MSCI EAFE Index returning 13.04% and the S&P Global 1200 Index climbing 14.97%. Fixed-income markets were more subdued but still well into positive territory, with the FTSE USBIG Bond Index gaining 8.55% and the shorter-term FTSE USBIG Government/Corporate 1-3 Year Index gaining 4.53%.

The Sextant Funds performed respectably compared to these indices, with most funds outperforming their respective benchmarks. For the year ended November 30, 2019, Sextant Growth Fund Investor Shares gained 21.81%, Sextant International Fund Investor Shares gained 18.82%, Sextant Core Fund gained 13.04%, Sextant Global High Income Fund gained 7.06%, Sextant Bond Income Fund gained 12.45%, and Sextant Short-Term Bond Fund gained 4.64%.

The annualized expense ratios of the six no-12b-1 fee Sextant Fund share classes range from 0.55% to 0.90%. Saturna Capital helped by capping expenses for the Sextant Short-Term, Sextant Bond Income, and Sextant Global High Income Funds. Overall assets were up 34.36% to $194.16 million.

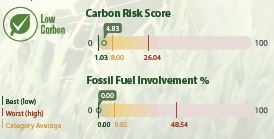

Morningstar Awards Sextant Top Sustainability Ratings

The Morningstar Sustainability Rating™ for funds gives investors around the world a way to compare fund portfolios based on a standardized measure of sustainability. These ratings are calculated using fund holdings data underpinned with company-level environmental, social, and governance (ESG) information from Sustainalytics, a leading provider of ESG research. Of the four Sextant funds Morningstar rated, one received the top “5 Globe” Sustainability Rating and two received a “4 Globe” above average rating, reflecting Saturna Capital’s emphasis on sustainability when making portfolio investment decisions. Investors are cautioned, however, that more than 200 vendors offer “sustainable” investments data, and that no single global measurement prevails. See page 5 for the details.

Going Forward

2019 was a great year for equity markets, with the S&P 500 Index returning 31.49% through December 31, 2019 – the best annual profit since 2013. At Saturna, we’re not forecasting 2020 to generate the outsized gains seen in 2019. Still, we enter the new decade optimistically.

It’s rare for the market to experience downturns or big profits following a year when returns exceed 25%. Since 1927, the S&P 500 experienced downturns in only 8% of the years following a year with returns in excess of 25%. Over this same period, only three years saw repeated returns greater than 25%. While statistics may support our forecast, we note “past returns may not indicate future performance.” Why then do we believe 2020 will follow a similar course of decent returns? Four reasons: the four-year US presidential election cycle, calming global trade tensions, a reduction of Brexit’s uncertainties, and accommodative yet stretched global monetary policies. The economy continues in a “goldilocks” state: low unemployment, low inflation, low interest rates, and lower taxes.

After minimal debate, both parties in the US Congress agreed to bigger spending and deficits, and the economy is roaring. Presidential election politicking gets our juices flowing from all sides of the spectrum. Then, as the country moves from primaries to the general election, an incumbent’s narrative always pulls the opposition toward the middle.

Also awaiting the election returns, the US-China trade war should see reduced agitations. As President Trump looks to claim victory and President Xi takes advantage of US election related pressures, the two sides were compelled to sign an agreement. The truce calls for China to increase imports of US farm goods and the US to decrease tariffs on Chinese products.

Brexit will also have continued impact through 2020. The UK leaving the European Union on January 31, 2020, will not mark the end of the process. As the UK “gets Brexit done” this month, we should notice bounces in their economy. However, details of the trade agreement, and uncertainty related to it, will likely produce volatility in 2020 as the December deadline approaches.

2019 marked a year of renewed expansionary monetary policy as fears of recession sprouted across the globe. These fears led the Federal Reserve to cut interest rates while

| Annual Report | November 30, 2019 | 3 | ||||

central banks elsewhere amassed record levels of negative yielding debt during the summer of 2019. In turn, low to negative interest rates injected fuel into equities, igniting the record bull market. Although the amount of negative yielding debt has since been cut, central banks are operating with less dry powder to reignite the economy should fear of recession renew. We expect that in 2020 central banks will play the part of observer as they balance the need to keep tools on hand for an economic downturn with the want to see 2019’s stimulus work its way through the financial system.

Going forward, the Sextant Funds continue to offer investors a broad mix of investment vehicles: growth equities, international exposure, and a blended portfolio, plus global high income, short-term, and long-term fixed income options. This array of portfolios serves our investors in both bull and bear markets by seeking to provide steady, long-term growth with a focus on preservation of capital. Please review the following pages for more in-depth information about each Fund.

Respectfully,

(photo omitted)

Jane Carten,

President

(photo omitted)

Gary Goldfogel,

Independent Board Chairman

| Sextant Funds Portfolio Management | ||||||||||

| (photo omitted) | Nicholas Kaiser MBA, CFA®

Sextant International Fund Portfolio Manager |

(photo omitted) | Phelps McIlvaine

Sextant Short-Term Bond Fund Sextant Bond Income Fund Sextant Core Fund Portfolio Manager |

|||||||

| (photo omitted) | Scott Klimo CFA®

Sextant Growth Fund Portfolio Manager Sextant International Fund Deputy Portfolio Manager |

(photo omitted) | Bryce Fegley CFA®, CIPM®

Sextant Global High Income Fund Portfolio Manager |

|||||||

| (photo omitted) | Patrick Drum MBA, CFA®, CFP®

Sextant Short-Term Bond Fund Sextant Bond Income Fund Sextant Global High Income Fund Deputy Portfolio Manager |

(photo omitted) | Christopher Paul MBA, CFA®

Sextant Core Fund Portfolio Manager |

|||||||

| 4 | November 30, 2019 | Annual Report | ||||

| Morningstar Sustainability Ratings™ | (unaudited) | As of November 30, 2019 |

At Saturna Capital, we describe ourselves as value and values-based investors. We believe our approach improves the likelihood of achieving superior investment results over the long term. Our approach also leads to investment portfolios we can be proud of from the perspective of Environmental, Social, and Governance (ESG) issues. Morningstar recently partnered with leading ESG research firm Sustainalytics to develop the Morningstar Sustainability Rating™ – here are Sextant Funds’ recent results:

Sextant International Fund |

Sextant Core Fund | |||||||

Investor Shares (SSIFX) |

Ø Ø Ø Ø Ø | SCORX | Ø Ø Ø Ø Ø | |||||

Z Shares (SIFZX) |

Ø Ø Ø Ø Ø | |||||||

| 7th percentile among 395 Foreign Large Blend Funds | 16th percentile among 643 Allocation 50%-70% Equity Funds | |||||||

Sextant Growth Fund |

Sextant Global High Income Fund | |||||||

Investor Shares (SSGFX) |

Ø Ø Ø Ø Ø | SGHIX | Ø Ø Ø Ø Ø | |||||

Z Shares (SGZFX) |

Ø Ø Ø Ø Ø | 67th percentile among 378 World Allocation Funds | ||||||

| 27th percentile among 1,223 Large Growth Funds | ||||||||

The Sextant Bond Income and Sextant Short-Term Bond Funds were not rated by Morningstar for the period. |

||||||||

The Morningstar Sustainability Rating™ gives investors across the globe a way to compare fund portfolios based on a standard measure of sustainability. The rating is a holdings-based calculation using company-level environmental, social, and governance (ESG) analytics from Sustainalytics. |

||||||||

The Morningstar Sustainability Rating and the Morningstar Portfolio Sustainability Score are not based on fund performance and are not equivalent to the Morningstar Rating (“Star Rating”).

© 2020 Morningstar®. All rights reserved. Morningstar, Inc. is an independent fund performance monitor. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Morningstar Sustainability Ratings and Portfolio Sustainability Scores are as of November 30, 2019. The Morningstar Sustainability Rating™ is intended to measure how well the issuing companies of the securities within a fund’s portfolio are managing their environmental, social, and governance (“ESG”) risks and opportunities relative to the fund’s Morningstar category peers. The Morningstar Sustainability Rating calculation is a two-step process. First, each fund with at least 50% of assets covered by a company-level ESG score from Sustainalytics receives a Morningstar Portfolio Sustainability Score™. The Morningstar Portfolio Sustainability Score is an asset-weighted average of normalized company-level ESG scores with deductions made for controversial incidents by the issuing companies, such as environmental accidents, fraud, or discriminatory behavior. The Morningstar Sustainability Rating is then assigned to all scored funds within Morningstar Categories in which at least ten (10) funds receive a Portfolio Sustainability Score and is determined by each fund’s rank within the following distribution: High (highest 10%), Above Average (next 22.5%), Average (next 35%), Below Average (next 22.5%), and Low (lowest 10%). The Morningstar Sustainability Rating is depicted by globe icons where High equals 5 globes and Low equals 1 globe. A Sustainability Rating is assigned to any fund that has more than half of its underlying assets rated by Sustainalytics and is within a Morningstar Category with at least 10 scored funds; therefore, the rating it is not limited to funds with explicit sustainable or responsible investment mandates. Morningstar updates its Sustainability Ratings monthly. Portfolios receive a Morningstar Portfolio Sustainability Score and Sustainability Rating one month and six business days after their reported as-of date based on the most recent portfolio. As part of the evaluation process, Morningstar uses Sustainalytics’ ESG scores from the same month as the portfolio as-of date.

The Funds were rated on the following percentages of Assets Under Management:

| Sextant International Fund | 100% | |||

| Sextant Core Fund | 83% | |||

| Sextant Growth Fund | 100% | |||

| Sextant Global High Income Fund | 71% |

The Funds’ portfolios are actively managed and are subject to change, which may result in different Morningstar Sustainability Scores and Ratings.

% Rank in Category is the fund’s percentile rank for the specified time period relative to all funds that have the same Morningstar category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. Percentile ranks within categories are most useful in those categories that have a large number of funds.

| Annual Report | November 30, 2019 | 5 | ||||

| Performance Summary (as of November 30, 2019) | (unaudited) |

| Expense Ratio1 | ||||||||||||||||||||||||||||

Average Annual Total Returns |

1 Year | 3 Year | 5 Year | 10 Year | 15 Year | Gross | Net | |||||||||||||||||||||

Sextant Short-Term Bond Fund (STBFX) |

4.64% | 1.90% | 1.48% | 1.43% | 2.29% | 0.91% | 0.60% | |||||||||||||||||||||

FTSE USBIG Govt/Corp 1-3 Year Index |

4.53% | 2.06% | 1.54% | 1.42% | 2.44% | n/a | ||||||||||||||||||||||

Sextant Bond Income Fund (SBIFX) |

12.45% | 4.90% | 3.41% | 4.04% | 4.10% | 0.84% | 0.65% | |||||||||||||||||||||

FTSE US Broad Investment-Grade Bond Index |

10.97% | 4.16% | 3.11% | 3.56% | 4.30% | n/a | ||||||||||||||||||||||

Sextant Core Fund (SCORX) |

13.04% | 9.25% | 4.88% | 6.04% | n/a | 0.88% | ||||||||||||||||||||||

Dow Jones Moderate US Portfolio Index |

11.53% | 8.55% | 6.04% | 7.66% | 6.49% | n/a | ||||||||||||||||||||||

Sextant Global High Income Fund (SGHIX) |

7.06% | 8.00% | 5.02% | n/a | n/a | 0.97% | 0.75% | |||||||||||||||||||||

S&P Global 1200 Index |

14.97% | 13.04% | 8.40% | 9.82% | 7.65% | n/a | ||||||||||||||||||||||

Sextant Growth Fund Investor Shares (SSGFX) |

21.81% | 17.99% | 9.52% | 11.81% | 8.86% | 0.92% | ||||||||||||||||||||||

Sextant Growth Fund Z Shares (SGZFX) |

22.22% | n/a | n/a | n/a | n/a | 0.70% | ||||||||||||||||||||||

S&P 500 Index |

16.11% | 14.90% | 10.97% | 13.44% | 9.02% | n/a | ||||||||||||||||||||||

Sextant International Fund Investor Shares (SSIFX) |

18.82% | 15.23% | 7.74% | 5.77% | 6.93% | 1.05% | ||||||||||||||||||||||

Sextant International Fund Z Shares (SIFZX) |

19.14% | n/a | n/a | n/a | n/a | 0.84% | ||||||||||||||||||||||

MSCI EAFE Index |

13.04% | 10.18% | 4.76% | 5.81% | 5.41% | n/a | ||||||||||||||||||||||

Performance data quoted above represents past performance, is before any taxes payable by shareowners, and is no guarantee of future results. Current performance may be higher or lower than that stated herein. Performance current to the most recent month-end is available by calling toll-free 1-800-728-8762 or visiting www.sextantfunds.com. Average annual total returns are historical and include change in share value as well as reinvestment of dividends and capital gains, if any. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Funds that invest in foreign securities may involve greater risk, including political and economic uncertainties of foreign countries as well as the risk of currency fluctuations.

| 1 | By regulation, expense ratios shown in this table are as stated in the Funds’ most recent prospectus, which is dated March 27, 2019, and incorporate results for the fiscal year ended November 30, 2018. Ratios presented in this table differ from the expense ratios shown elsewhere in this report as they represent different periods. |

| 6 | November 30, 2019 | Annual Report | ||||

Sextant Short-Term Bond Fund

Performance Summary |

(unaudited) |

Average Annual Total Returns as of November 30, 2019 |

|

|||||||||||||||

| 1 Year | 5 Year | 10 Year | Expense Ratio1 | |||||||||||||

Sextant Short-Term Bond Fund |

4.64% | 1.48% | 1.43% | 0.91% | ||||||||||||

FTSE USBIG Govt/Corp 1-3 Year Index |

4.53% | 1.54% | 1.42% | n/a | ||||||||||||

Growth of $10,000

|

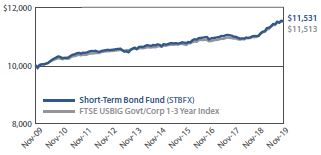

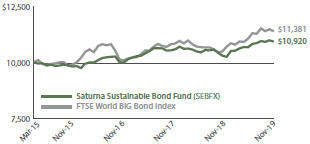

Comparison of any mutual fund to a market index must be made bearing in mind that the index is expense-free. Conversely, the fund will (1) be actively managed; (2) have an objective other than mirroring the index, such as limiting risk; (3) bear transaction and other costs; (4) stand ready to buy and sell its securities to shareowners on a daily basis; and (5) provide a wide range of services. The graph compares $10,000 invested in the Fund on November 30, 2009, to an identical amount invested in the FTSE USBIG Govt/Corp 1-3 Year Index, a broad-based index of shorter-term investment grade US government and corporate bond prices. The graph shows that an investment in the Fund would have risen to $11,531 versus $11,513 in the index. |

Past performance does not guarantee future results. The “Growth of $10,000” graph and “Average Annual Returns” performance table assume the reinvestment of dividends and capital gains. They do not reflect the deduction of taxes that a shareowner might pay on fund distributions or the redemption of fund shares.

| 1 | By regulation, the expense ratio shown in this table is as stated in the Fund’s most recent prospectus which is dated March 27, 2019, and incorporates results for the fiscal year ended November 30, 2018, before fee waivers. The actual expense ratio, shown in the most recent prospectus after fee waivers was 0.60%. The ratio presented in this table differs from expense ratios shown elsewhere in this report as they represent different periods. |

Fund Objective

The objectives of the Short-Term Bond Fund are capital preservation and current income.

Top 10 Holdings |

|

|||

| % of Total Net Assets | ||||

United States Treasury Note (3.625% due 02/15/2021) |

8.3% | |||

United States Treasury Note (2.875% due 04/30/2025) |

7.2% | |||

United States Treasury Note (2.50% due 08/15/2023) |

4.7% | |||

McCormick & Co. (2.70% due 08/15/2022) |

4.6% | |||

Honeywell International (4.25% due 03/01/2021) |

4.2% | |||

Loews (2.625% due 05/15/ 2023) |

4.1% | |||

Burlington Northern Santa Fe (3.05% due 09/01/2022) |

3.7% | |||

AvalonBay Communities (2.85% due 03/15/2023) |

3.7% | |||

Qualcomm (2.60% due 01/30/2023) |

3.7% | |||

Gilead Sciences (2.55% due 09/01/2020) |

3.6% | |||

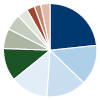

Portfolio Diversification |

|

|||||||||||

| % of Total Net Assets |

|

|||||||||||

Government Bonds |

23.4% | ∎ |  |

|||||||||

Financials |

14.1% | ∎ | ||||||||||

Consumer Staples |

13.8% | ∎ | ||||||||||

Health Care |

13.1% | ∎ | ||||||||||

Technology |

11.3% | ∎ | ||||||||||

Industrials |

6.9% | ∎ | ||||||||||

Consumer Discretionary |

5.5% | ∎ | ||||||||||

Materials |

3.6% | ∎ | ||||||||||

Energy |

2.9% | ∎ | ||||||||||

Utilities |

2.3% | ∎ | ||||||||||

Other assets (net of liabilities) |

3.1% | ∎ | ||||||||||

| Annual Report | November 30, 2019 | 7 | ||||

Sextant Short-Term Bond Fund

Discussion of Fund Performance |

(unaudited) |

(photo omitted)

Fiscal Year 2019

For the fiscal year ended November 30, 2019, the Sextant Short-Term Bond Fund returned 4.64%, which was lower than the 4.87% average return of its Morningstar Short-Term Bond category peer group. For the five years ended November 30, the Fund provided a 1.48% annualized total return versus 1.86% for its Morningstar category peer group. During the year, the Fund’s share price grew from $4.94 to $5.08. The ratio of net investment income (after fee waivers) to net assets rose from 1.44% to 1.75%. Fund shares outstanding rose 2.53, and Fund assets rose 7.91%. The Fund’s 30-day yield was 1.33%, and its unsubsidized 30-day yield was 0.82%. Reflecting Saturna Capital’s subsidies to cap operating expenses, the Fund’s effective expense ratio was reduced to 0.60% from 0.87%.

Factors Affecting Past Performance

2019 began with the US Federal Reserve Bank policy at an inflection point. Good US economic growth and low US unemployment justified policy normalization, meaning shrinking the Fed’s balance sheet (quantitative tightening) and moving the Federal Funds rates higher. However, softening global growth, trade tensions, a flat yield curve, a strong US dollar, and faltering financial asset prices required the opposite policy response. By November 2019, US policy makers had reversed rate normalization, setting Federal Funds at 1.50%, below their level in June 2018. Quantitative tightening was halted. The policy dichotomy between US economic strength and global economic weakness was resolved with global concerns and the urgent need for greater US dollar liquidity prevailing.

This rapid policy reversal triggered a “risk on” response in financial markets. The Fed succeeded in steepening the US Treasury yield curve, discounting a flat curve’s recession signal. Reinvigorated investors poured money into financial assets, and especially income producing assets such as high-yield bonds. Reinvestment risk suddenly re-emerged at the most urgent of investment objectives. Corporate bond spreads narrowed significantly, returning to previous lows in 1998, 2003, and 2018. High-yield spreads narrowed significantly more than investment grade spreads. US 30-yr bond yields established a new low, eclipsing the previous low in 2016.

More recently, the US Federal Reserve expanded short-term liquidity funding to address funding shortfalls in the US repo market. An unusual structural balance of payments deficit caused by record US government deficit spending, restrictive banking regulations, and weak foreign demand for US Treasury paper combined to create the funding deficit.

In echoes of 2008, the European Central Bank, Japan, and Britain also amplified their own monetary easing policies. With interest rates falling and corporate bond spreads narrowing simultaneously, bond markets produced exceptional returns.

Looking Forward

US economic growth and inflation will likely remain relatively benign, while progress on Brexit and the US China trade negotiations will relax some anxieties. New monetary and fiscal stimulus from the US, Britain, Japan, and others will be deployed to fund debt burdens, fiscal deficits, as well as boost economic growth and inflation. In the last decade, monetary and fiscal stimulus policies initially pushed bond yields higher. However, these reflation policies have a mixed record of producing lasting results. Once these policies run their course, inflation and bond yields may very well fall again, boosting bond prices. Despite these reflation initiatives, negative nominal and real rates will not disappear. Reinvestment risk will remain the most urgent concern for bond investors over the medium to long term. Easing US Federal Reserve monetary policy will remain the first line of defense against global economic weakness. Short rates will remain low.

With yields only slightly higher than recent lows, credit spreads offering historically little additional compensation, and real yields near zero, it is tempting to discount the appeal of bonds in 2020. But bonds still offer another exceptional quality: diversification. As an asset class, short-term bonds demonstrated excellent negative correlation to common stocks on days when stock prices fell during 2019. Higher yields in the next few quarters represent a buying opportunity.

For yield starved investors looking for a relatively calm mooring, short-term bonds may offer the comfort of low correlation that leads to better decision making when many asset classes offer persistently high valuations and low potential returns.

Management Fee Calculations

The Sextant Short-Term Bond Fund calculates the performance part of its management fee by comparing the Fund’s return to the average return of Morningstar’s™ Short-Term Bond category. The Fund’s 12-month return of 4.64% was less than 1% percent below the Morningstar™ category average of 4.87% at month-end November 30, 2019. Therefore, the basic annual management fee of 0.50% remained unchanged for the month of December 2019. Note that the management fee is partially waived due to the adviser’s cap on total Fund expenses.

| 8 | November 30, 2019 | Annual Report | ||||

Sextant Short-Term Bond Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||

| Corporate Bonds – 73.5% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| Consumer Discretionary | ||||||||||||||||||

Alibaba Holding Group |

3.125% due 11/28/2021 | $350,000 | $356,710 | 3.2% | ||||||||||||||

Ford Motor Credit |

3.157% due 08/04/2020 | 250,000 | 250,928 | 2.3% | ||||||||||||||

| 607,638 | 5.5% | |||||||||||||||||

| Consumer Staples | ||||||||||||||||||

Church & Dwight |

2.875% due 10/01/2022 | 260,000 | 265,001 | 2.4% | ||||||||||||||

Costco Wholesale |

2.75% due 05/18/2024 | 385,000 | 397,558 | 3.6% | ||||||||||||||

Estee Lauder |

2.35% due 08/15/2022 | 350,000 | 353,594 | 3.2% | ||||||||||||||

McCormick & Co. |

2.70% due 08/15/2022 | 500,000 | 507,714 | 4.6% | ||||||||||||||

| 1,523,867 | 13.8% | |||||||||||||||||

| Energy | ||||||||||||||||||

Schlumberger Investment |

3.65% due 12/01/2023 | 310,000 | 326,135 | 2.9% | ||||||||||||||

| 326,135 | 2.9% | |||||||||||||||||

| Financials | ||||||||||||||||||

AvalonBay Communities |

2.85% due 03/15/2023 | 400,000 | 409,468 | 3.7% | ||||||||||||||

Loews |

2.625% due 05/15/2023 | 450,000 | 458,250 | 4.1% | ||||||||||||||

Paccar Financial |

2.05% due 11/13/2020 | 350,000 | 350,581 | 3.2% | ||||||||||||||

Simon Property Group |

2.00% due 09/13/2024 | 350,000 | 348,051 | 3.1% | ||||||||||||||

| 1,566,350 | 14.1% | |||||||||||||||||

| Health Care | ||||||||||||||||||

AbbVie |

2.50% due 05/14/2020 | 250,000 | 250,414 | 2.3% | ||||||||||||||

Astrazeneca |

2.375% due 01/16/2020 | 155,000 | 155,597 | 1.4% | ||||||||||||||

Celgene |

2.25% due 08/15/2021 | 300,000 | 301,531 | 2.7% | ||||||||||||||

Gilead Sciences |

2.55% due 09/01/2020 | 400,000 | 401,832 | 3.6% | ||||||||||||||

Teva Pharmaceutical |

3.65% due 11/10/2021 | 350,000 | 342,846 | 3.1% | ||||||||||||||

| 1,452,220 | 13.1% | |||||||||||||||||

| Industrials | ||||||||||||||||||

Burlington Northern Santa Fe |

3.05% due 09/01/2022 | 400,000 | 410,961 | 3.7% | ||||||||||||||

CSX Corporation |

4.25% due 06/01/2021 | 350,000 | 359,392 | 3.2% | ||||||||||||||

| 770,353 | 6.9% | |||||||||||||||||

| Materials | ||||||||||||||||||

3M |

2.00% due 06/26/2022 | 400,000 | 401,719 | 3.6% | ||||||||||||||

| 401,719 | 3.6% | |||||||||||||||||

| Technology | ||||||||||||||||||

Adobe Systems |

4.75% due 02/01/2020 | 379,000 | 380,759 | 3.4% | ||||||||||||||

Continued on next page.

| The accompanying notes are an integral part of these financial statements. | Annual Report | November 30, 2019 | 9 | |||||

Sextant Short-Term Bond Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||

| Corporate Bonds – 73.5% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| Technology (continued) | ||||||||||||||||||

Honeywell International |

4.25% due 03/01/2021 | $450,000 | $463,459 | 4.2% | ||||||||||||||

Qualcomm |

2.60% due 01/30/2023 | 400,000 | 406,126 | 3.7% | ||||||||||||||

| 1,250,344 | 11.3% | |||||||||||||||||

| Utilities | ||||||||||||||||||

PacifiCorp |

2.95% due 06/01/2023 | 250,000 | 256,930 | 2.3% | ||||||||||||||

| 256,930 | 2.3% | |||||||||||||||||

| Total Corporate Bonds | $8,155,556 | 73.5% | ||||||||||||||||

| Government Bonds – 23.4% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| United States Treasury Notes | ||||||||||||||||||

United States Treasury Note |

2.625% due 05/15/2021 | $355,000 | $359,771 | 3.2% | ||||||||||||||

United States Treasury Note |

3.625% due 02/15/2021 | 900,000 | 920,461 | 8.3% | ||||||||||||||

United States Treasury Note |

2.50% due 08/15/2023 | 500,000 | 515,801 | 4.7% | ||||||||||||||

United States Treasury Note |

2.875% due 04/30/2025 | 750,000 | 796,699 | 7.2% | ||||||||||||||

| 2,592,732 | 23.4% | |||||||||||||||||

| Total Government Bonds | 2,592,732 | 23.4% | ||||||||||||||||

| Total investments | (Cost is $10,648,234) | 10,748,288 | 96.9% | |||||||||||||||

| Other assets (net of liabilities) | 340,601 | 3.1% | ||||||||||||||||

| Total net assets | $11,088,889 | 100.0% | ||||||||||||||||

Bond Quality Diversification |

(unaudited) | |||||||||||

| % of Total Net Assets |

|

|||||||||||

Rated “AAA” |

23.4% | ∎ |  |

|||||||||

Rated “AA-” |

3.6% | ∎ | ||||||||||

Rated “A+” |

15.2% | ∎ | ||||||||||

Rated “A” |

14.2% | ∎ | ||||||||||

Rated “A-” |

22.3% | ∎ | ||||||||||

Rated “BBB+” |

3.2% | ∎ | ||||||||||

Rated “BBB” |

9.6% | ∎ | ||||||||||

Rated “BB+” |

2.3% | ∎ | ||||||||||

Rated “BB” |

3.1% | ∎ | ||||||||||

Other assets (net of liabilities) |

3.1% | ∎ | ||||||||||

| Credit ratings are the lesser of S&P Global Ratings or Moody’s Investors Service. If neither S&P nor Moody’s rate a particular security, that security is categorized as not rated (except for US Treasury securities and securities issued or backed by US agencies which inherit the credit rating for the US government). Ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings BB and below are lower-rated securities (junk bonds). Ratings apply to the creditworthiness of the issuers of the underlying securities and not the Fund or its shares. Ratings may be subject to change. |

|

|||||||||||

| 10 | November 30, 2019 | Annual Report | The accompanying notes are an integral part of these financial statements. | |||||

Sextant Short-Term Bond Fund

Statement of Assets and Liabilities

| As of November 30, 2019 |

|

|||

Assets |

||||

Investments in securities, at value (Cost $10,648,234) |

$10,748,288 | |||

Cash |

266,182 | |||

Dividends and interest receivable |

74,625 | |||

Other assets |

6,247 | |||

Receivable for Fund shares sold |

1,859 | |||

Receivable from adviser |

44 | |||

Total assets |

11,097,245 | |||

Liabilities |

||||

Accrued retirement plan custody fee |

3,138 | |||

Accrued audit expenses |

3,000 | |||

Accrued insurance expenses |

685 | |||

Accrued legal expenses |

510 | |||

Accrued trustee expenses |

362 | |||

Accrued Chief Compliance Officer expenses |

334 | |||

Accrued other expenses |

279 | |||

Distributions payable |

48 | |||

Total liabilities |

8,356 | |||

Net Assets |

$11,088,889 | |||

Analysis of net assets |

||||

Paid-in capital (unlimited shares authorized, without par value) |

$10,995,696 | |||

Total distributable earnings |

93,193 | |||

Net assets applicable to Fund shares outstanding |

$11,088,889 | |||

Fund shares outstanding |

2,181,911 | |||

Net asset value, offering, and redemption price per share |

$5.08 | |||

Statement of Operations

| Year ended November 30, 2019 |

|

|||

|

||||

Investment income |

||||

Interest income |

$252,039 | |||

Miscellaneous income |

269 | |||

Total investment income |

252,308 | |||

Expenses |

||||

Investment adviser fees |

53,500 | |||

Filing and registration fees |

18,335 | |||

Audit fees |

6,307 | |||

Retirement plan custodial fees |

3,477 | |||

Legal fees |

2,659 | |||

Trustee fees |

2,608 | |||

Chief Compliance Officer expenses |

2,591 | |||

Printing and posting fees |

1,933 | |||

Other expenses |

1,492 | |||

Custodian fees |

432 | |||

Total gross expenses |

93,334 | |||

Less adviser fees waived |

(28,421 | ) | ||

Less custodian fee credits |

(407 | ) | ||

Net expenses |

64,506 | |||

Net investment income |

$187,802 | |||

|

||||

Net realized gain from investments |

$6,528 | |||

Net increase in unrealized appreciation on investments |

299,329 | |||

Net gain on investments |

$305,857 | |||

Net increase in net assets resulting from operations |

$493,659 | |||

| The accompanying notes are an integral part of these financial statements. | Annual Report | November 30, 2019 | 11 | |||||

Sextant Short-Term Bond Fund

Statements of Changes in Net Assets |

Year ended Nov. 30, 2019 | Year ended Nov. 30, 2018 | ||||||

Increase (decrease) in net assets from operations |

||||||||

From operations |

||||||||

Net investment income |

$187,802 | $147,275 | ||||||

Net realized gain (loss) on investment |

6,528 | (16,794 | ) | |||||

Net increase (decrease) in unrealized appreciation |

299,329 | (110,471 | ) | |||||

Net increase in net assets |

493,659 | 20,010 | ||||||

Distributions to shareowners |

(187,268 | ) | (150,192 | ) | ||||

Capital share transactions |

||||||||

Proceeds from sales of shares |

1,406,263 | 974,206 | ||||||

Value of shares issued in reinvestment of dividends |

186,358 | 150,567 | ||||||

Cost of shares redeemed |

(1,085,719 | ) | (1,423,649 | ) | ||||

Total capital share transactions |

506,902 | (298,876 | ) | |||||

Total increase (decrease) in net assets |

813,293 | (429,058 | ) | |||||

Net assets |

||||||||

Beginning of year |

10,275,596 | 10,704,654 | ||||||

End of year |

$11,088,889 | $10,275,596 | ||||||

Shares of the Fund sold and redeemed |

||||||||

Number of shares sold |

279,784 | 196,541 | ||||||

Number of shares issued in reinvestment of dividends |

36,950 | 30,411 | ||||||

Number of shares redeemed |

(215,988 | ) | (286,428 | ) | ||||

Net increase (decrease) in number of shares outstanding |

100,746 | (59,476 | ) | |||||

Financial Highlights |

For year ended November 30, | |||||||||||||||||||

Selected data per share of outstanding capital stock throughout each year: |

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Net asset value at beginning of year |

$4.94 | $5.00 | $5.02 | $5.02 | $5.04 | |||||||||||||||

Income from investment operations |

||||||||||||||||||||

Net investment income |

0.09 | 0.07 | 0.06 | 0.05 | 0.05 | |||||||||||||||

Net gains (losses) on securities (both realized and unrealized) |

0.14 | (0.06 | ) | (0.02 | ) | 0.00 | A | (0.02 | ) | |||||||||||

Total from investment operations |

0.23 | 0.01 | 0.04 | 0.05 | 0.03 | |||||||||||||||

Less distributions |

||||||||||||||||||||

Dividends (from net investment income) |

(0.09 | ) | (0.07 | ) | (0.06 | ) | (0.05 | ) | (0.05 | ) | ||||||||||

Capital gains distribution |

- | (0.00 | )A | - | - | - | ||||||||||||||

Total distributions |

(0.09 | ) | (0.07 | ) | (0.06 | ) | (0.05 | ) | (0.05 | ) | ||||||||||

Net asset value at end of year |

$5.08 | $4.94 | $5.00 | $5.02 | $5.02 | |||||||||||||||

Total return |

4.64% | 0.26% | 0.87% | 1.06% | 0.67% | |||||||||||||||

Ratios / supplemental data |

||||||||||||||||||||

Net assets ($000), end of year |

$11,089 | $10,276 | $10,705 | $10,326 | $7,488 | |||||||||||||||

Ratio of expenses to average net assets |

||||||||||||||||||||

Before fee waivers and custodian fee credits |

0.87% | 0.91% | 1.01% | 1.15% | 1.21% | |||||||||||||||

After fee waivers |

0.61% | 0.61% | 0.68% | 0.76% | 0.76% | |||||||||||||||

After fee waivers and custodian fee credits |

0.60% | 0.60% | 0.68% | 0.75% | 0.75% | |||||||||||||||

Ratio of net investment income after fee waivers and custodian fee credits to average net assets |

1.75% | 1.44% | 1.26% | 1.05% | 1.06% | |||||||||||||||

Portfolio turnover rate |

32% | 36% | 31% | 11% | 13% | |||||||||||||||

| A | Amount is less than $0.01 |

| 12 | November 30, 2019 | Annual Report | The accompanying notes are an integral part of these financial statements. | |||||

Sextant Bond Income Fund

Performance Summary |

(unaudited) |

Average Annual Total Returns as of November 30, 2019 |

|

|||||||||||||||

| 1 Year | 5 Year | 10 Year | Expense Ratio1 | |||||||||||||

Sextant Bond Income Fund |

12.45% | 3.41% | 4.04% | 0.84% | ||||||||||||

FTSE US Broad Investment-Grade Bond Index |

10.97% | 3.11% | 3.56% | n/a | ||||||||||||

Growth of $10,000

|

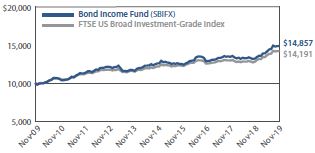

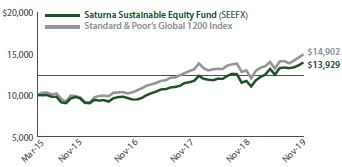

Comparison of any mutual fund to a market index must be made bearing in mind that the index is expense-free. Conversely, the fund will (1) be actively managed; (2) have an objective other than mirroring the index, such as limiting risk; (3) bear transaction and other costs; (4) stand ready to buy and sell its securities to shareowners on a daily basis; and (5) provide a wide range of services. The graph compares $10,000 invested in the Fund on November 30, 2009, to an identical amount invested in the FTSE US Broad Investment-Grade Bond Index, a broad-based index of medium and long-term investment grade bond prices. The graph shows that an investment in the Fund would have risen to $14,857 versus $14,191 in the index. |

Past performance does not guarantee future results. The “Growth of $10,000” graph and “Average Annual Returns” performance table assume the reinvestment of dividends and capital gains. They do not reflect the deduction of taxes that a shareowner might pay on fund distributions or the redemption of fund shares.

| 1 | By regulation, the expense ratio shown in this table is as stated in the Fund’s most recent prospectus which is dated March 27, 2019, and incorporates results for the fiscal year ended November 30, 2018, before fee waivers. The expense ratio shown in the most recent prospectus after fee waivers was 0.65%. The ratio presented in this table differs from expense ratios shown elsewhere in this report as they represent different periods. |

Fund Objective

The objective of the Bond Income Fund is current income.

Top 10 Holdings |

||||

| % of Total Net Assets | ||||

United States Treasury Bond (4.25% due 05/15/2039) |

8.3% | |||

United States Treasury Bond (5.375% due 02/15/2031) |

4.4% | |||

Apple (4.50% due 02/23/2036) |

3.4% | |||

Microsoft (4.20% due 11/03/2035) |

3.4% | |||

Intel (4.00% due 12/15/2032) |

3.3% | |||

Burlington Northern Santa Fe (5.05% due 03/01/2041) |

3.1% | |||

United States Treasury Note (3.625% due 02/15/2021) |

3.0% | |||

Praxair (3.55% due 11/07/2042) |

3.0% | |||

Puget Sound Energy (4.434% due 11/15/2041) |

2.8% | |||

United Technologies (6.05% due 06/01/2036) |

2.7% | |||

Portfolio Diversification |

||||||||||||

| % of Total Net Assets | ||||||||||||

Government Bonds |

24.5% | ∎ |  |

|||||||||

Health Care |

11.7% | ∎ | ||||||||||

Municipal Bonds |

10.6% | ∎ | ||||||||||

Technology |

10.1% | ∎ | ||||||||||

Industrials |

9.2% | ∎ | ||||||||||

Utilities |

7.5% | ∎ | ||||||||||

Financials |

6.2% | ∎ | ||||||||||

Energy |

5.8% | ∎ | ||||||||||

Consumer Discretionary |

4.6% | ∎ | ||||||||||

Materials |

3.0% | ∎ | ||||||||||

Consumer Staples |

2.2% | ∎ | ||||||||||

Other Assets (net of liabilities) |

4.6% | ∎ | ||||||||||

| Annual Report | November 30, 2019 | 13 | ||||

Sextant Bond Income Fund

Discussion of Fund Performance |

(unaudited) |

(photo omitted)

Fiscal Year 2019

For the fiscal year ended November 30, 2019, the Sextant Bond Income Fund returned 12.45%, lower than the 22.73% average return of its Morningstar Long-Term Bond category peer group. For the five years ended November 30, the Fund provided a 3.41% annualized total return versus 5.81% for its Morningstar category peer group. During the year, the Fund’s share price rose from $4.89 to $5.34 and the ratio of net investment income (after fee waivers) to net assets declined from 3.20% to 2.96%. Fund shares outstanding rose 5.42%, and fund assets rose 13.91%. The Fund’s 30-day yield was 2.13%, and its unsubsidized 30-day yield was 1.84%. Reflecting Saturna Capital’s subsidies to cap operating expenses, the Fund’s effective expense ratio was reduced to 0.55% from 0.71%.

Factors Affecting Past Performance

2019 began with the US Federal Reserve Bank policy at an inflection point. Good US economic growth and low US unemployment justified policy normalization, meaning shrinking the Fed’s balance sheet (quantitative tightening) and moving the Federal Funds rates higher. However, softening global growth, trade tensions, a flat yield curve, a strong US dollar, and faltering financial asset prices required the opposite policy response. By November 2019, US policy makers had reversed rate normalization, setting Federal Funds at 1.50%, below their level in June 2018. Quantitative tightening was halted. The policy dichotomy between US economic strength and global economic weakness was resolved with global concerns and the urgent need for greater US dollar liquidity prevailing.

This rapid policy reversal triggered a “risk on” response in financial markets. The Fed succeeded in steepening the US Treasury yield curve, discounting a flat curve’s recession signal. Reinvigorated investors poured money into financial assets, and especially income producing assets such as high-yield bonds. Reinvestment risk suddenly re-emerged as the most urgent of investment objectives. Corporate bond spreads narrowed significantly, returning to previous lows in 1998, 2003, and 2018. High-yield spreads narrowed significantly more than investment grade spreads. US 30-yr bond yields established a new low, eclipsing the previous low in 2016.

More recently, the US Federal Reserve expanded short-term liquidity funding to address funding shortfalls in the US repo market. An unusual structural balance of payments deficit caused by record US government deficit spending, restrictive banking regulations, and weak foreign demand for US Treasury paper combined to create the funding deficit.

In echoes of 2008, the European Central Bank, Japan, and Britain also amplified their own monetary easing policies. With interest rates falling and corporate bond spreads narrowing simultaneously, bond markets produced exceptional returns.

Looking Forward

US economic growth and inflation will likely remain relatively benign, while progress on Brexit and the US China trade negotiations will relax some anxieties. New monetary and fiscal stimulus from the US, Britain, Japan, and others will be deployed to fund debt burdens, fiscal deficits, as well as boost economic growth and inflation. In the last decade, monetary and fiscal stimulus policies initially pushed bond yields higher. However, these reflation policies have a mixed record of producing lasting results. Once these policies run their course, inflation and bond yields may very well fall again, boosting bond prices. Despite these reflation initiatives, negative nominal and real rates will not disappear. Reinvestment risk will remain the most urgent concern for bond investors over the medium to long term.

With yields only slightly higher than recent lows, credit spreads offering historically little additional compensation, and real yields near zero, it is tempting to discount the appeal of bonds in 2020. But bonds still offer another exceptional quality: diversification. As an asset class, bonds demonstrated excellent negative correlation to common stocks on days when stock prices fell during 2019. Higher yields in the next few quarters represent a buying opportunity.

For yield starved investors looking for a relatively calm mooring, bonds may offer the comfort of low correlation that leads to better decision making when many asset classes offer persistently high valuations and low potential returns.

Management Fee Calculations

The Sextant Bond Income Fund calculates the performance part of its management fee by comparing the Fund’s return to the return of Morningstar’s™ Long-Term Bond category. The Fund’s 12-month return of 12.45% was more than 2% below the Morningstar™ category average of 22.73% at month-end November 30, 2019. Therefore, the basic annual management fee of 0.50% was decreased by 0.20% to 0.30% for the month of December 2019. Note that the management fee is partially waived due to the adviser’s cap on total Fund expenses.

| 14 | November 30, 2019 | Annual Report | ||||

Sextant Bond Income Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||

| Corporate Bonds – 60.3% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| Consumer Discretionary | ||||||||||||||||||

Lowe’s |

5.80% due 10/15/2036 | $250,000 | $312,863 | 2.5% | ||||||||||||||

VF |

6.00% due 10/15/2033 | 200,000 | 258,775 | 2.1% | ||||||||||||||

| 571,638 | 4.6% | |||||||||||||||||

| Consumer Staples | ||||||||||||||||||

Unilever Capital |

5.90% due 11/15/2032 | 200,000 | 271,747 | 2.2% | ||||||||||||||

| 271,747 | 2.2% | |||||||||||||||||

| Energy | ||||||||||||||||||

Baker Hughes |

6.875% due 01/15/2029 | 100,000 | 124,507 | 1.0% | ||||||||||||||

Canadian Natural Resources |

6.45% due 06/30/2033 | 225,000 | 286,151 | 2.3% | ||||||||||||||

Statoil |

7.15% due 01/15/2029 | 224,000 | 304,803 | 2.5% | ||||||||||||||

| 715,461 | 5.8% | |||||||||||||||||

| Financials | ||||||||||||||||||

Affiliated Managers Group |

3.50% due 08/01/2025 | 250,000 | 260,658 | 2.1% | ||||||||||||||

Bank Of New York Mellon MTN |

3.30% due 08/23/2029 | 250,000 | 263,332 | 2.1% | ||||||||||||||

UBS AG Stamford CT |

7.75% due 09/01/2026 | 200,000 | 250,825 | 2.0% | ||||||||||||||

| 774,815 | 6.2% | |||||||||||||||||

| Health Care | ||||||||||||||||||

Becton Dickinson |

6.70% due 08/01/2028 | 240,000 | 298,360 | 2.4% | ||||||||||||||

Johnson & Johnson |

4.95% due 05/15/2033 | 226,000 | 286,927 | 2.3% | ||||||||||||||

Medtronic Inc |

4.375% due 03/15/2035 | 260,000 | 311,484 | 2.5% | ||||||||||||||

Merck & Co. |

6.50% due 12/01/2033 | 215,000 | 309,726 | 2.5% | ||||||||||||||

Teva Pharmaceutical |

3.65% due 11/10/2021 | 250,000 | 244,890 | 2.0% | ||||||||||||||

| 1,451,387 | 11.7% | |||||||||||||||||

| Industrials | ||||||||||||||||||

Boeing |

6.125% due 02/15/2033 | 215,000 | 286,145 | 2.3% | ||||||||||||||

Burlington Northern Santa Fe |

5.05% due 03/01/2041 | 310,000 | 385,448 | 3.1% | ||||||||||||||

Deere & Co. |

8.10% due 05/15/2030 | 95,000 | 138,669 | 1.1% | ||||||||||||||

United Technologies |

6.05% due 06/01/2036 | 250,000 | 338,145 | 2.7% | ||||||||||||||

| 1,148,407 | 9.2% | |||||||||||||||||

| Materials | ||||||||||||||||||

Praxair |

3.55% due 11/07/2042 | 350,000 | 372,778 | 3.0% | ||||||||||||||

| 372,778 | 3.0% | |||||||||||||||||

Continued on next page.

| The accompanying notes are an integral part of these financial statements. | Annual Report | November 30, 2019 | 15 | |||||

Sextant Bond Income Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||

| Corporate Bonds – 60.3% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| Technology | ||||||||||||||||||

Apple |

4.50% due 02/23/2036 | $350,000 | $427,926 | 3.4% | ||||||||||||||

Intel |

4.00% due 12/15/2032 | 360,000 | 416,946 | 3.3% | ||||||||||||||

Microsoft |

4.20% due 11/03/2035 | 350,000 | 416,965 | 3.4% | ||||||||||||||

| 1,261,837 | 10.1% | |||||||||||||||||

| Utilities | ||||||||||||||||||

Alabama Power |

4.15% due 08/15/2044 | 200,000 | 227,740 | 1.8% | ||||||||||||||

Entergy Louisiana |

5.40% due 11/01/2024 | 200,000 | 229,313 | 1.8% | ||||||||||||||

Florida Power & Light |

5.95% due 10/01/2033 | 100,000 | 134,457 | 1.1% | ||||||||||||||

Puget Sound Energy |

4.434% due 11/15/2041 | 300,000 | 347,575 | 2.8% | ||||||||||||||

| 939,085 | 7.5% | |||||||||||||||||

| Total Corporate Bonds | $7,507,155 | 60.3% | ||||||||||||||||

| Government Bonds – 24.5% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| Foreign Government Bonds | ||||||||||||||||||

Quebec Canada Yankee |

7.125% due 02/09/2024 | $175,000 | $210,954 | 1.7% | ||||||||||||||

| 210,954 | 1.7% | |||||||||||||||||

| United States Treasury Bonds | ||||||||||||||||||

United States Treasury Bond |

5.25% due 02/15/2029 | 170,000 | 220,230 | 1.8% | ||||||||||||||

United States Treasury Bond |

6.25% due 05/15/2030 | 75,000 | 106,893 | 0.8% | ||||||||||||||

United States Treasury Bond |

4.25% due 05/15/2039 | 770,000 | 1,038,898 | 8.3% | ||||||||||||||

United States Treasury Bond |

3.125% due 11/15/2041 | 145,000 | 169,310 | 1.4% | ||||||||||||||

United States Treasury Bond |

3.375% due 11/15/2048 | 60,000 | 75,073 | 0.6% | ||||||||||||||

United States Treasury Bond |

6.125% due 08/15/2029 | 225,000 | 312,275 | 2.5% | ||||||||||||||

United States Treasury Bond |

5.375% due 02/15/2031 | 400,000 | 544,703 | 4.4% | ||||||||||||||

| 2,467,382 | 19.8% | |||||||||||||||||

| United States Treasury Notes | ||||||||||||||||||

United States Treasury Note |

3.625% due 02/15/2021 | 370,000 | 378,412 | 3.0% | ||||||||||||||

| 378,412 | 3.0% | |||||||||||||||||

| Total Government Bonds | $3,056,748 | 24.5% | ||||||||||||||||

Continued on next page.

| 16 | November 30, 2019 | Annual Report | The accompanying notes are an integral part of these financial statements. | |||||

Sextant Bond Income Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||

| Municipal Bonds – 10.6% | Coupon / Maturity | Face Amount | Market Value | Percentage of Assets | ||||||||||||||

| General Obligation | ||||||||||||||||||

Blaine Co. ID SCD #61 Hailey |

5.25% due 08/01/2020 | $250,000 | $255,650 | 2.1% | ||||||||||||||

Idaho Hsg & Fin GARVEE BAB A-2 |

5.379% due 07/15/2020 | 180,000 | 183,467 | 1.5% | ||||||||||||||

San Marcos Texas ULTD GO BAB |

6.028% due 08/15/2030 | 200,000 | 205,994 | 1.6% | ||||||||||||||

Springville UT GO BAB |

5.30% due 05/01/2031 | 240,000 | 243,250 | 1.9% | ||||||||||||||

| 888,361 | 7.1% | |||||||||||||||||

| Municipal Leases | ||||||||||||||||||

Johnson Co KS Bldg Ls/Pr RevBAB |

4.60% due 09/01/2026 | 250,000 | 253,765 | 2.0% | ||||||||||||||

Oklahoma City Fin Auth Ed Lease Rev |

6.60% due 09/01/2022 | 160,000 | 178,230 | 1.5% | ||||||||||||||

| 431,995 | 3.5% | |||||||||||||||||

| Total Municipal Bonds | $1,320,356 | 10.6% | ||||||||||||||||

| Total investments | (Cost = $11,132,690) | $11,884,259 | 95.4% | |||||||||||||||

| Other assets (net of liabilities) | 569,294 | 4.6% | ||||||||||||||||

| Total net assets | $12,453,553 | 100.0% | ||||||||||||||||

Bond Quality Diversification |

(unaudited) | |||||||||||

| % of Total Net Assets | ||||||||||||

Rated “AAA” |

30.5% | ∎ |  |

|||||||||

Rated “AA+” |

3.4% | ∎ | ||||||||||

Rated “AA” |

10.9% | ∎ | ||||||||||

Rated “A+” |

11.3% | ∎ | ||||||||||

Rated “A” |

14.6% | ∎ | ||||||||||

Rated “A-” |

10.8% | ∎ | ||||||||||

Rated “BBB+” |

7.2% | ∎ | ||||||||||

Rated “BBB” |

2.3% | ∎ | ||||||||||

Rated “BB+” |

2.4% | ∎ | ||||||||||

Rated “BB” |

2.0% | ∎ | ||||||||||

Other assets (net of liabilities) |

4.6% | ∎ | ||||||||||

| Credit ratings are the lesser of S&P Global Ratings or Moody’s Investors Service. If neither S&P nor Moody’s rate a particular security, that security is categorized as not rated (except for US Treasury securities and securities issued or backed by US agencies which inherit the credit rating for the US government). Ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings BB and below are lower-rated securities (junk bonds). Ratings apply to the creditworthiness of the issuers of the underlying securities and not the Fund or its shares. Ratings may be subject to change. |

|

|||||||||||

| The accompanying notes are an integral part of these financial statements. | Annual Report | November 30, 2019 | 17 | |||||

Sextant Bond Income Fund

Statement of Assets and Liabilities

|

||||

| As of November 30, 2019 |

|

|||

|

||||

Assets |

||||

Investments in securities, at value |

$11,884,259 | |||

Cash |

443,124 | |||

Interest receivable |

118,150 | |||

Receivable for Fund shares sold |

8,665 | |||

Other assets |

10,955 | |||

Total assets |

12,465,153 | |||

Liabilities |

||||

Accrued audit expenses |

3,709 | |||

Distributions payable |

2,695 | |||

Accrued retirement plan custody fee |

2,516 | |||

Accrued advisory fees |

1,237 | |||

Accrued insurance expenses |

475 | |||

Accrued other operating expenses |

439 | |||

Accrued Chief Compliance Officer expenses |

243 | |||

Accrued legal expenses |

189 | |||

Accrued trustee expenses |

92 | |||

Payable for Fund shares redeemed |

5 | |||

Total liabilities |

11,600 | |||

Net assets |

$12,453,553 | |||

Analysis of net assets |

||||

Paid-in capital (unlimited shares authorized, without par value) |

$11,705,518 | |||

Total distributable earnings |

748,035 | |||

Net assets applicable to Fund shares outstanding |

$12,453,553 | |||

Fund shares outstanding |

2,333,514 | |||

Net asset value, offering, and redemption price per share

|

$5.34 | |||

Statement of Operations

|

||||

| Year ended November 30, 2019 |

|

|||

Investment income |

||||

Interest income |

$397,306 | |||

Total investment income |

397,306 | |||

Expenses |

||||

Investment adviser fees |

48,988 | |||

Filing and registration fees |

10,432 | |||

Audit fees |

6,760 | |||

Retirement plan custodial fees |

2,753 | |||

Chief Compliance Officer expenses |

2,513 | |||

Trustee fees |

2,364 | |||

Legal fees |

2,322 | |||

Printing and postage fees |

1,829 | |||

Other expenses |

1,675 | |||

Custodian fees |

456 | |||

Total gross expenses |

80,092 | |||

Less adviser fees waived |

(17,370 | ) | ||

Less custodian fee credits |

(429 | ) | ||

Net expenses |

62,293 | |||

Net investment income |

$335,013 | |||

Net realized gain from investments |

$41,830 | |||

Net increase in unrealized appreciation on investments |

$933,335 | |||

Net gain on investments |

$975,165 | |||

Net increase in net assets resulting from operations

|

$1,310,178 | |||

| 18 | November 30, 2019 | Annual Report | The accompanying notes are an integral part of these financial statements. | |||||

Sextant Bond Income Fund

Statements of Changes in Net Assets |

Year ended Nov. 30, 2019 | Year ended Nov. 30, 2018 | ||||||

Increase (decrease) in net assets from operations |

||||||||

From operations |

||||||||

Net investment income |

$335,013 | $309,853 | ||||||

Net realized gain on investments |

41,830 | - | ||||||

Net increase (decrease) in unrealized appreciation |

933,335 | (480,051 | ) | |||||

Net increase (decrease) in net assets |

1,310,178 | (170,198 | ) | |||||

Distributions to shareowners |

(334,236 | ) | (309,851 | ) | ||||

Capital share transactions |

||||||||

Proceeds from sales of shares |

1,865,586 | 3,232,820 | ||||||

Value of shares issued in reinvestment of dividends |

328,512 | 306,251 | ||||||

Cost of shares redeemed |

(1,649,526 | ) | (1,621,814 | ) | ||||

Total capital share transactions |

544,572 | 1,917,257 | ||||||

Total increase (decrease) in net assets |

1,520,514 | 1,437,208 | ||||||

Net assets |

||||||||

Beginning of year |

10,933,039 | 9,495,831 | ||||||

End of year |

$12,453,553 | $10,933,039 | ||||||

Shares of the Fund sold and redeemed |

||||||||

Number of shares sold |

361,579 | 650,577 | ||||||

Number of shares issued in reinvestment of dividends |

63,399 | 61,384 | ||||||

Number of shares redeemed |

(327,334 | ) | (322,372 | ) | ||||

Net increase in number of shares outstanding |

97,644 | 389,589 | ||||||

Financial Highlights |

For year ended November 30, | |||||||||||||||||||

Selected data per share of outstanding capital stock throughout each year: |

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Net asset value at beginning of year |

$4.89 | $5.14 | $5.07 | $5.07 | $5.26 | |||||||||||||||

Income from investment operations |

||||||||||||||||||||

Net investment income |

0.15 | 0.16 | 0.16 | 0.15 | 0.17 | |||||||||||||||

Net gains (losses) on securities (both realized and unrealized) |

0.45 | (0.25 | ) | 0.07 | 0.00 | A | (0.19 | ) | ||||||||||||

Total from investment operations |

0.60 | (0.09 | ) | 0.23 | 0.15 | (0.02 | ) | |||||||||||||

Less distributions |

||||||||||||||||||||

Dividends (from net investment income) |

(0.15 | ) | (0.16 | ) | (0.16 | ) | (0.15 | ) | (0.17 | ) | ||||||||||

Total distributions |

(0.15 | ) | (0.16 | ) | (0.16 | ) | (0.15 | ) | (0.17 | ) | ||||||||||

Net asset value at end of year |

$5.34 | $4.89 | $5.14 | $5.07 | $5.07 | |||||||||||||||

Total return |

12.45% | (1.78 | )% | 4.51% | 2.91% | (0.47 | )% | |||||||||||||

Ratios / supplemental data |

||||||||||||||||||||

Net assets ($000), end of year |

$12,454 | $10,933 | $9,496 | $9,703 | $7,998 | |||||||||||||||

Ratio of expenses to average net assets |

||||||||||||||||||||

Before fee waivers and custodian fee credits |

0.71% | 0.86% | 0.98% | 1.01% | 1.03% | |||||||||||||||

After fee waivers |

0.55% | 0.66% | 0.78% | 0.89% | 0.90% | |||||||||||||||

After fee waivers and custodian fee credits |

0.55% | 0.65% | 0.78% | 0.88% | 0.90% | |||||||||||||||

Ratio of net investment income after fee waivers and custodian fee credits to average net assets |

2.96% | 3.20% | 3.05% | 2.85% | 3.21% | |||||||||||||||

Portfolio turnover rate |

21% | 0% | 4% | 11% | 4% | |||||||||||||||

| A | Amount is less than $0.01 |

| The accompanying notes are an integral part of these financial statements. | Annual Report | November 30, 2019 | 19 | |||||

Sextant Core Fund

Performance Summary |

(unaudited) |

Average Annual Total Returns as of November 30, 2019 |

|

|||||||||||||||

| 1 Year | 5 Year | 10 Year | Expense Ratio1 | |||||||||||||

Sextant Core Fund |

13.04% | 4.88% | 6.04% | 0.88% | ||||||||||||

Dow Jones Moderate US Portfolio Index |

11.53% | 6.04% | 7.66% | n/a | ||||||||||||

Growth of $10,000

|

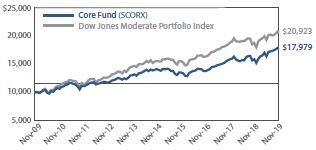

Comparison of any mutual fund to a market index must be made bearing in mind that the index is expense-free. Conversely, the fund will (1) be actively managed; (2) have an objective other than mirroring the index, such as limiting risk; (3) bear transaction and other costs; (4) stand ready to buy and sell its securities to shareowners on a daily basis; and (5) provide a wide range of services. The graph compares $10,000 invested in the Fund on November 30, 2009, to an identical amount invested in the Dow Jones Moderate US Portfolio Index, a broad-based index of stock and bond prices. The graph shows that an investment in the Fund would have risen to $17,979 versus $20,923 in the index. |

Past performance does not guarantee future results. The “Growth of $10,000” graph and “Average Annual Returns” performance table assume the reinvestment of dividends and capital gains. They do not reflect the deduction of taxes that a shareowner might pay on fund distributions or the redemption of fund shares.

| 1 | By regulation, the expense ratio shown in this table is as stated in the Fund’s most recent prospectus, which is dated March 27, 2019, and incorporates results for the fiscal year ended November 30, 2018. The ratio presented in this table differs from expense ratios shown elsewhere in this report as they represent different periods. |

Fund Objective

The objectives of the Core Fund are long-term appreciation and capital preservation.

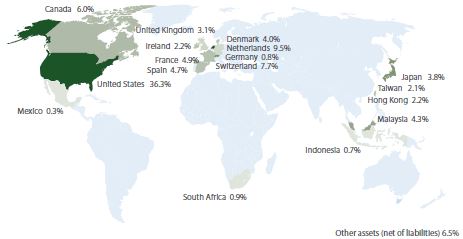

Portfolio Diversification |

||||||||

% of Total Net Assets |

||||||||

Sectors |

Equity | Fixed Income | ||||||

Health Care |

12.0% | 4.0% | ||||||

Industrials |

8.4% | 4.4% | ||||||

Government Bonds |

0.0% | 12.2% | ||||||

Technology |

9.9% | 1.9% | ||||||

Consumer Discretionary |

7.0% | 2.3% | ||||||

Financials |

3.3% | 2.9% | ||||||

Utilities |

4.1% | 2.1% | ||||||

Communications |

3.7% | 1.3% | ||||||

Materials |

4.7% | 0.0% | ||||||

Consumer Staples |

4.1% | 0.0% | ||||||

Energy |

2.6% | 0.0% | ||||||

Municipal Bonds |

0.0% | 2.6% | ||||||

Total |

59.8% | 33.7% | ||||||

Top 10 Holdings |

||||

| % of Total Net Assets | ||||

United States Treasury Bond (6.25% due 08/15/2023) |

3.0% | |||

Welltower (4.25% due 04/15/2028) |

2.3% | |||

United States Treasury Note (2.75% due 11/15/2023) |

2.2% | |||

PacificCorp (6.00% due 01/15/2039) |

2.1% | |||

Lowe’s (4.25% due 09/15/2044) |

1.6% | |||

Boeing (5.875% due 02/15/2040) |

1.6% | |||

Gilead Sciences (3.70% due 04/01/2024) |

1.6% | |||

Union Pacific Corp (3.375% due 02/01/2035) |

1.5% | |||

Amgen |

1.5% | |||

United States Treasury Note (2.00% due 11/30/2022) |

1.5% | |||

Asset Allocation |

||||||||||||

| % of Total Net Assets |

|

|||||||||||

Equity Securities |

59.8% | ∎ |  |

|||||||||

Fixed Income Securities |

33.7% | ∎ | ||||||||||

Other assets (net of liabilities) |

6.5% | ∎ | ||||||||||

| 20 | November 30, 2019 | Annual Report | ||||

Sextant Core Fund

Discussion of Fund Performance |

(unaudited) |

(photo omitted)

Fiscal Year 2019

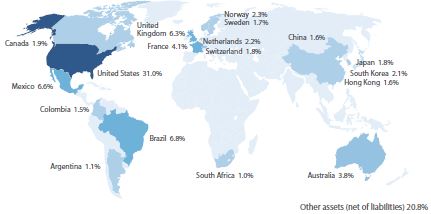

The Sextant Core Fund completed fiscal year 2019 with a return of 13.04% for the period versus 11.53% for its Dow Jones Moderate Portfolio Index benchmark.

(photo omitted)

Factors Affecting Past Performance

Equities

The Sextant Core Fund’s mandate specifies a 60% allocation to equity securities, with two-thirds being US-domiciled companies and one-third foreign-domiciled companies. The Fund’s average equity allocation for the year was 61.7%. During the year, the Fund increased the number of equity positions, increased the average dividend yield, maintained the average position size, and increased the average market capitalization. The Energy, Consumer Discretionary, and Utilities sector were the largest contributors, offset by the Financial and Industrial sectors. The largest sector allocation, Technology, contributed modest performance for the year.

Fixed Income

2019 began with the US Federal Reserve Bank policy at an inflection point. Good US economic growth and low US unemployment justified policy normalization, meaning shrinking the Fed’s balance sheet (quantitative tightening) and moving the Federal Funds rates higher. However, softening global growth, trade tensions, a flat yield curve, a strong US dollar, and faltering financial asset prices required the opposite policy response. By November 2019, US policy makers had reversed rate normalization, setting Federal Funds at 1.50%, below their level in June 2018. Quantitative tightening was halted. The policy dichotomy between US economic strength and global economic weakness was resolved with global concerns and the urgent need for greater US dollar liquidity prevailing.

This rapid policy reversal triggered a “risk on” response in financial markets. The Fed succeeded in steepening the US Treasury yield curve, discounting a flat curve’s recession signal. Reinvigorated investors poured money into financial assets, and especially income producing assets such as high-yield bonds. Reinvestment risk suddenly re-emerged as the most urgent of investment objectives. Corporate bond spreads narrowed significantly, returning to previous lows in 1998, 2003, and 2018. High-yield spreads narrowed significantly more than investment grade spreads. US 30-yr bond yields established a new low, eclipsing the previous low in 2016.

More recently, the US Federal Reserve expanded short-term liquidity funding to address funding shortfalls in the US repo market. An unusual structural balance of payments deficit caused by record US government deficit spending, restrictive banking regulations, and weak foreign demand for US Treasury paper combined to create the funding deficit.

Looking Forward

US economic growth and inflation will likely remain relatively benign, while progress on Brexit and the US China trade negotiations will relax some anxieties. New monetary and fiscal stimulus from the US, Britain, Japan, and others will be deployed to fund debt burdens, fiscal deficits, as well as boost economic growth and inflation. In the last decade, monetary and fiscal stimulus policies initially pushed bond yields higher. However, these reflation policies have a mixed record of producing lasting results. Once these policies run their course, inflation and bond yields may very well fall again, boosting bond prices and those of income producing equities. Despite these reflation initiatives, negative nominal and real rates will not disappear.

With regard to equities, we expect to maintain the number of positions and emphasize the Fund’s value and income characteristics. The recent strong equity market performance inflated valuations and constrains the quantity of candidates for inclusion in the portfolio. The Fund’s fiscal 2019 turnover of 28% will likely be similar in 2020, as the Fund pursues its mandate of quality, attractively valued, income producing common equities.

With yields only slightly higher than recent lows, credit spreads offering historically little additional compensation, and real yields near zero, it is tempting to discount the appeal of bonds in 2020. But bonds still offer another exceptional quality: diversification. As an asset class, bonds demonstrated excellent negative correlation to common stocks on days when stock prices fell during 2019. Higher yields in the next few quarters represent a buying opportunity.

Management Fee Calculations

The Sextant Core Fund calculates the performance part of its management fee by comparing the Fund’s return to the return of Morningstar’s™ Allocation – 50% to 70% Equity category. The Fund’s 12-month return of 13.13% was more than 2% above the Morningstar™ category average of 10.92% as of November 30, 2019. Therefore, the basic annual management fee of 0.50% was increased by 0.20% to 0.70% for the month of December 2019.

| Annual Report | November 30, 2019 | 21 | ||||

Sextant Core Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||||||

| Common Stocks – 59.8% | Number of Shares | Cost | Market Value | Country1 | Percentage of Assets | |||||||||||||||||

| Communications | ||||||||||||||||||||||

| Internet Media | ||||||||||||||||||||||

Alphabet, Class A2 |

100 | $77,588 | $130,409 | United States | 0.8% | |||||||||||||||||

| Telecom Carriers | ||||||||||||||||||||||

AT&T |

4,400 | 150,315 | 164,472 | United States | 1.0% | |||||||||||||||||

BCE |

3,300 | 140,233 | 158,631 | Canada | 0.9% | |||||||||||||||||

Verizon Communications |

2,700 | 149,436 | 162,648 | United States | 1.0% | |||||||||||||||||

| 439,984 | 485,751 | 2.9% | ||||||||||||||||||||

| 517,572 | 616,160 | 3.7% | ||||||||||||||||||||

| Consumer Discretionary | ||||||||||||||||||||||

| Apparel, Footwear & Accessory Design |

||||||||||||||||||||||

VF |

2,400 | 153,720 | 212,496 | United States | 1.2% | |||||||||||||||||

| Automobiles | ||||||||||||||||||||||

Subaru ADR |

11,700 | 130,741 | 153,229 | Japan | 0.9% | |||||||||||||||||

| Home Products Stores | ||||||||||||||||||||||

Home Depot |

600 | 114,158 | 132,306 | United States | 0.8% | |||||||||||||||||

Lowe’s |

1,400 | 86,638 | 164,234 | United States | 1.0% | |||||||||||||||||

| 200,796 | 296,540 | 1.8% | ||||||||||||||||||||

| Specialty Apparel Stores | ||||||||||||||||||||||

Industria de Diseno Textil ADR |

12,000 | 152,848 | 186,720 | Spain | 1.1% | |||||||||||||||||

Ross Stores |

1,750 | 125,298 | 203,263 | United States | 1.2% | |||||||||||||||||

TJX Companies |

2,200 | 109,838 | 134,486 | United States | 0.8% | |||||||||||||||||

| 387,984 | 524,469 | 3.1% | ||||||||||||||||||||

| 873,241 | 1,186,734 | 7.0% | ||||||||||||||||||||

| Consumer Staples | ||||||||||||||||||||||

| Beverages | ||||||||||||||||||||||

PepsiCo |

1,350 | 139,207 | 183,371 | United States | 1.1% | |||||||||||||||||

| Household Products | ||||||||||||||||||||||

Procter & Gamble |

1,150 | 93,040 | 140,369 | United States | 0.8% | |||||||||||||||||

Unilever ADR |

2,900 | 132,633 | 172,521 | United Kingdom | 1.0% | |||||||||||||||||

| 225,673 | 312,890 | 1.8% | ||||||||||||||||||||

| Packaged Food | ||||||||||||||||||||||

Nestle ADR |

1,900 | 147,925 | 197,486 | Switzerland | 1.2% | |||||||||||||||||

| 512,805 | 693,747 | 4.1% | ||||||||||||||||||||

| Energy | ||||||||||||||||||||||

| Exploration & Production | ||||||||||||||||||||||

ConocoPhillips |

1,490 | 71,757 | 89,311 | United States | 0.5% | |||||||||||||||||

Continued on next page.

| 22 | November 30, 2019 | Annual Report | The accompanying notes are an integral part of these financial statements. | |||||

Sextant Core Fund

| Schedule of Investments | As of November 30, 2019 | |||||||||||||||||||||

| Common Stocks – 59.8% | Number of Shares | Cost | Market Value | Country1 | Percentage of Assets | |||||||||||||||||

| Energy (Continued) | ||||||||||||||||||||||

| Integrated Oils | ||||||||||||||||||||||

Equinor ADR |

10,200 | $179,884 | $189,006 | Norway | 1.1% | |||||||||||||||||

Total ADR |

3,182 | 170,950 | 167,182 | France | 1.0% | |||||||||||||||||

| 350,834 | 356,188 | 2.1% | ||||||||||||||||||||

| 422,591 | 445,499 | 2.6% | ||||||||||||||||||||

| Financials | ||||||||||||||||||||||

| Banks | ||||||||||||||||||||||

PNC Financial Services Group |

600 | 42,748 | 91,926 | United States | 0.6% | |||||||||||||||||

Toronto-Dominion Bank |

1,500 | 51,382 | 86,700 | Canada | 0.5% | |||||||||||||||||

| 94,130 | 178,626 | 1.1% | ||||||||||||||||||||

| Consumer Finance | ||||||||||||||||||||||

Ally Financial |