1.6 Delivering value

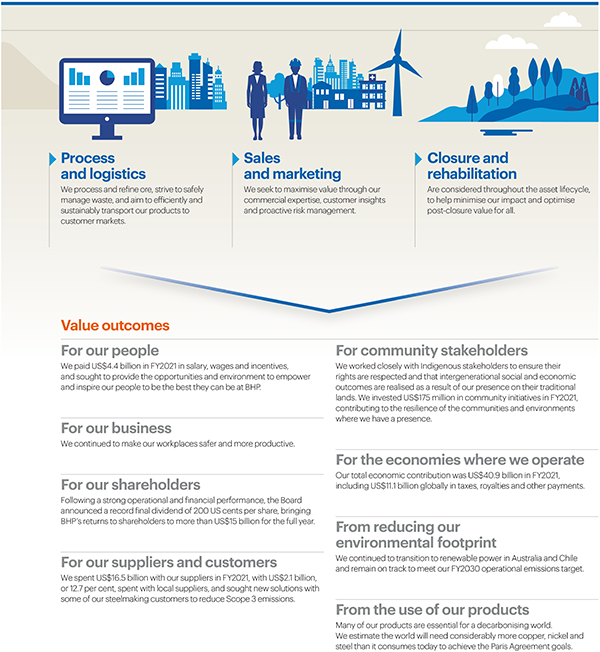

1.6.1 Our business model

7

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: |

Commission file number: | |

(ABN 49 004 028 077) |

(REG. NO. 3196209) | |

(Exact name of Registrant as specified in its charter) |

(Exact name of Registrant as specified in its charter) | |

VICTORIA, |

ENGLAND AND WALES | |

(Jurisdiction of incorporation or organisation) |

(Jurisdiction of incorporation or organisation) | |

VICTORIA (Address of principal executive offices) |

||

(Address of principal executive offices) | ||

BHP GROUP LIMITED TELEPHONE AUSTRALIA 1300 55 47 57 TELEPHONE INTERNATIONAL + FACSIMILE + (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) |

BHP GROUP PLC TELEPHONE + FACSIMILE + (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) | |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | |||||

value US$0.50 each |

||||||||||

| * | Evidenced by American Depositary Receipts. Each American Depositary Receipt represents two ordinary shares of BHP Group Limited or BHP Group Plc, as the case may be. |

| ** | Not for trading, but only in connection with the listing of the applicable American Depositary Shares. |

BHP Group Limited |

BHP Group Plc | |||

Fully Paid Ordinary Shares |

☒ |

Accelerated filer |

¨ | ||||

Non-accelerated filer |

¨ |

Emerging growth company |

||||

U.S. GAAP ¨ |

International Accounting Standards Board ☒ |

Other ¨ |

(1) |

References in this Annual Report to a ‘joint venture’ are used for convenience to collectively describe assets that are not wholly owned by BHP. Such references are not intended to characterise the legal relationship between the owners of the asset. |

Item Number |

Description |

Report section reference | ||||

1. |

Identity of Directors, Senior Management and Advisors |

Not applicable | ||||

2. |

Offer Statistics and Expected Timetable |

Not applicable | ||||

3. |

Key Information |

|||||

B |

Capitalization and indebtedness |

Not applicable | ||||

C |

Reasons for the offer and use of proceeds |

Not applicable | ||||

D |

Risk factors |

1.16 | ||||

4. |

Information on the Company |

|||||

A |

History and development of the company |

1.2 to 1.6, 1.8 to 1.17, 3.7, 4.3, 4.5 to 4.9, 4.10.1 to 4.10.5 and Corporate directory | ||||

B |

Business overview |

1.4 to 1.6, 1.8 to 1.11, 1.17, 3.7, 4.3, 4.5 to 4.9, 4.10.3, 4.10.4, 4.10.9 and Note 1 to the Financial Statements | ||||

C |

Organizational structure |

4.10.3 and Note 30 to the Financial Statements | ||||

D |

Property, plants and equipment |

1.10.1 to 1.10.4, 1.11, 1.13, 1.15, 1.16, 1.17, 3.7, 4.3, 4.5 to 4.7 and Notes 11, 15 and 21 to the Financial Statements | ||||

4A. |

Unresolved Staff Comments |

None | ||||

5. |

Operating and Financial Review and Prospects |

|||||

A |

Operating results |

1.8, 1.17 and 4.10.9 | ||||

B |

Liquidity and capital resources |

1.8, 3.1.4, Notes 11, 20 to 23, 34 and 39 to the Financial Statements | ||||

C |

Research and development, patents and licenses, etc. |

1.10 to 1.17, 2.3.14, 3.7, 4.3, 4.6, 4.7 and Notes 11 and 15 to the Financial Statements | ||||

D |

Trend information |

1.2 to 1.6, 1.13, 1.16 and 1.17 | ||||

E |

Critical Accounting Estimates |

IFRS is applied in the Financial Statements as issued by the IASB | ||||

6. |

Directors, Senior Management and Employees |

|||||

A |

Directors and senior management |

2.1.1, 2.1.2 and 2.1.5 | ||||

B |

Compensation |

2.2 | ||||

C |

Board practices |

2.1.2, 2.1.9, 2.1.10, 2.1.12 and 2.2 | ||||

D |

Employees |

1.12, 4.8 and Note 28 to the Financial Statements | ||||

E |

Share ownership |

2.2, 2.3.2, 2.3.5, 2.3.18 and Notes 16, 17 and 25 to the Financial Statements | ||||

7. |

Major Shareholders and Related Party Transactions |

|||||

A |

Major shareholders |

4.10.6 | ||||

B |

Related party transactions |

2.2 and Notes 24 and 33 to the Financial Statements | ||||

C |

Interests of experts and counsel |

Not applicable | ||||

8. |

Financial Information |

|||||

A |

Consolidated Statements and Other Financial Information |

1.15, 4.9, 4.10.7, 3.1, 3.2A and the Financial Statements beginning on page F-1 in this Annual Report | ||||

B |

Significant Changes |

Note 35 to the Financial Statements | ||||

9. |

The Offer and Listing |

|||||

A |

Offer and listing details |

4.10.2 | ||||

B |

Plan of distribution |

Not applicable | ||||

C |

Markets |

4.10.2 | ||||

D |

Selling shareholders |

Not applicable | ||||

E |

Dilution |

Not applicable | ||||

F |

Expenses of the issue |

Not applicable | ||||

10. |

Additional Information |

|||||

A |

Share capital |

Not applicable | ||||

B |

Memorandum and articles of association |

4.10.3 and 4.10.5 | ||||

C |

Material contracts |

4.10.4 | ||||

D |

Exchange controls |

4.10.9 | ||||

E |

Taxation |

4.10.10 | ||||

F |

Dividends and paying agents |

Not applicable | ||||

G |

Statement by experts |

Not applicable | ||||

H |

Documents on display |

4.10.5 | ||||

I |

Subsidiary information |

Note 30 to the Financial Statements and Exhibit 8.1 | ||||

11. |

Quantitative and Qualitative Disclosures About Market Risk |

Note 23 to the Financial Statements | ||||

12. |

Description of Securities Other than Equity Securities |

|||||

A |

Debt Securities |

Not applicable | ||||

B |

Warrants and Rights |

Not applicable | ||||

C |

Other Securities |

Not applicable | ||||

D |

American Depositary Shares |

4.10.8 and Exhibit 2.1 | ||||

13. |

Defaults, Dividend Arrearages and Delinquencies |

There have been no defaults, dividend arrearages or delinquencies | ||||

14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

There have been no material modifications to the rights of security holders and use of proceeds since our last Annual Report | ||||

15. |

Controls and Procedures |

2.1.10 and 3.2A | ||||

16A. |

Audit committee financial expert |

2.1.10 | ||||

16B. |

Code of Ethics |

2.1.15 | ||||

16C. |

Principal Accountant Fees and Services |

2.1.10 and Note 36 to the Financial Statements | ||||

16D. |

Exemptions from the Listing Standards for Audit Committees |

Not applicable | ||||

16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

2.3.2 | ||||

16F. |

Change in Registrant’s Certifying Accountant |

Not applicable | ||||

16G. |

Corporate Governance |

2 | ||||

16H. |

Mine Safety Disclosure |

Not applicable | ||||

16I. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

Not applicable | ||||

17. |

Financial Statements |

Not applicable as Item 18 complied with | ||||

18. |

Financial Statements |

The Financial Statements begin on page F-1 in this Annual Report | ||||

19. |

Exhibits |

5 | ||||

Our Purpose |

Our Values |

|||

Our purpose is to bring people and resources together to build a better world. |

Sustainability Putting health and safety first, being environmentally responsible and supporting our communities. | |||

Integrity Doing what is right and doing what we say we will do. | ||||

Respect Embracing openness, trust, teamwork, diversity and relationships that are mutually beneficial. | ||||

Performance Achieving superior business results by stretching our capabilities. | ||||

Simplicity Focusing our efforts on the things that matter most. | ||||

Accountability Defining and accepting responsibility and delivering on our commitments. | ||||

We are successful when: | ||||

• Our people start each day with a sense of purpose and end the day with a sense of accomplishment. | ||||

• Our teams are inclusive and diverse. | ||||

• Our communities, customers and suppliers value their relationships with us and are better off for our presence. | ||||

• Our asset portfolio is world class and sustainably developed. | ||||

• Our operational discipline and financial strength enables our future growth. | ||||

• Our shareholders receive a superior return on their investment. | ||||

• Our commodities support continued economic growth and decarbonisation. | ||||

| • | the commodities to create the steel that goes into the infrastructure needed for growing cities around the world, including to support the energy transition |

| • | the copper and nickel required for electrification, such as copper-intensive electric vehicles and nickel-intensive batteries that can reduce the need for fossil fuels and support decarbonisation |

| • | the energy that heats homes, enables transport and powers many of the household products we use every day |

Future facing commodities |

Steelmaking commodities |

Oil & Gas | ||||||||

| Product |

Copper |

Nickel |

Iron ore |

Metallurgical coal* |

Petroleum | |||||

| FY2021 production |

1,635.7 kt |

89.0 kt |

253.5 Mt |

40.6 Mt |

102.8 MMboe | |||||

| Traditional usage |

Wiring, power cables, cars, smartphones, televisions, laptops, air conditioners | Stainless steel, refrigerators, cookware, homeware, medical equipment | Cities, hospitals, schools, houses, bridges, trains, cars, smartphones * Metallurgical coal is also known as steelmaking coal. |

Driving, air travel, heating, generating electricity, cleaning products, medical and hygiene products, roads | ||||||

| Emerging usage |

Electrification mega trends |

Supporting development and clean energy transition |

Supporting mobility and modern life | |||||||

| Wind turbines, electric vehicles, solar panels, battery charging, electric vehicle batteries, grid storage solutions | Wind turbines, carbon capture infrastructure and climate adaption to adjust to current or expected climate change and its effects | Low-emissions shipping, technology-related materials, pairing with renewables, and the transportation impacts of the e-commerce revolution | ||||||||

| • | discovering and appraising resources |

| • | acquiring the right assets and asset options |

| • | defining the optimal ways to develop our resources |

| • | optimising our use of capital |

| • | continuous improvement and innovation |

| • | establishing and maintaining mutually beneficial stakeholder relationships |

| • | the principles, practices and tools of the BHP Operating System (BOS), BHP’s way of working that makes continuous improvement part of what we do in our business every day |

| • | the capabilities and standards housed in our technical functions, which includes Technology and our Centres of Excellence, which are designed to help deliver improved safety, productivity and sustainability outcomes |

| • | our internal venture capital unit, BHP Ventures, which looks to invest in emerging companies with game-changing technologies and management teams to help drive innovation and provide us with a valuable portfolio of growth options |

| • | an increase of over 1,000 productive hours a year for the automated truck fleet at our Jimblebar iron ore operation in Western Australia |

| • | improvements in the refining process at Olympic Dam in South Australia resulting in a copper recovery rate from scrap copper that was 25 per cent above the budgeted target for FY2021 and a record for scrap copper recovery at Olympic Dam |

| • | the development of an in-house machine learning tool, Trident, at Escondida that uses real-time data analytics to optimise vessel scheduling and improve the revenue per tonne from copper concentrate sales. The tool is being implemented across our other copper concentrate assets, including Spence |

| • | the use of machine learning and optimisation techniques at our Western Australia Iron Ore (WAIO) rail network to refine WAIO’s rail track grinding plan, which has simultaneously resulted in significantly increased grinding compliance and a reduction in hours lost |

| • | at our WAIO shipping facilities at Port Hedland, data scientists and mathematicians worked alongside the operations team on the ground to develop algorithms that lifted our port outflow capacity by more than 1.4 Mtpa, by helping to optimise transport routes to reduce dump times and vessel line-up |

(1) |

Refer to our Climate Change Report 2020 for the assumptions and outputs and limitations of our 1.5°C scenario, used in our most recent portfolio analysis. |

(2) |

The FY2020 baseline will be adjusted for any material acquisitions and divestments based on greenhouse gas emissions at the time of the transaction. Carbon offsets will be used as required. |

(3) |

These positions are expressed using terms that are defined in the Glossary, including the terms ‘net zero’, ‘target’ and ‘goal’. |

| • | Record annual production at WAIO in FY2021. |

| • | South Flank sustaining project in Western Australia achieved first ore in May 2021 and is expected to enhance our product mix in FY2022. |

| • | WAIO is among the world’s lowest carbon emissions intensity iron ore producers. |

| • | Seeking value growth by enhancing productivity and focusing on higher-grade coal with greatest potential for quality premiums. |

| • | Implementing technology applications to improve safety and productivity. |

| • | Renewable power purchasing agreement in September 2020 to supply up to half of the electricity needs of our Queensland Coal operations from low-emissions sources. |

| • | Securing more copper resources through exploration and early-stage entry options. |

| • | Pursuing technical innovation to unlock value. |

| • | Escondida and Spence on track for 100 per cent renewable electricity supply by the mid-2020s with four renewable power contracts to commence from FY2022. |

| • | One of the lowest carbon emissions nickel miners in the world. |

| • | Transitioning to new mines and focusing on higher-margin products and technical innovation. |

| • | Seeking more resources through exploration, acquisition and early-stage options. |

| • | Approved a US$5.7bn investment in the Jansen Stage 1 potash project in the world’s best potash basin in Canada. |

| • | Expected to be one of the world’s most sustainable potash mines, with a low carbon footprint and low water intensity. |

| • | Goal for a gender-balanced workforce and for First Nations employees to make up around 20 per cent of the team. |

| • | Proposed merger of our Petroleum business with Woodside expected to unlock synergies, value and choice for BHP shareholders. |

| • | On completion, existing BHP shareholders would own approximately 48 per cent of the combined business. |

| • | Combined business expected to benefit from a high-margin oil portfolio, long-life LNG assets and the financial resilience to help supply the energy needed for global growth over the energy transition. |

(1) |

Based on published unit costs by major iron ore producers. There may be differences in the manner that third parties calculate or report unit costs data compared to BHP, which means that third-party data may not be comparable to our data. |

(2) |

Based on published production figures. |

| Year ended 30 June US$M |

2021 |

2020 | ||||||

| Consolidated Income Statement (section 3.1.1) |

||||||||

| Revenue |

60,817 |

42,931 | ||||||

| Profit after taxation from Continuing and Discontinued operations attributable to BHP shareholders (Attributable profit) |

11,304 |

7,956 | ||||||

| Dividends per ordinary share – paid during the period (US cents) |

156.0 |

143.0 | ||||||

| Dividends per ordinary share – determined in respect of the period (US cents) |

301.0 |

120.0 | ||||||

| Basic earnings per ordinary share (US cents) |

223.5 |

157.3 | ||||||

| Consolidated Balance Sheet (section 3.1.3) (1) |

||||||||

| Total assets |

108,927 |

105,733 | ||||||

| Net assets |

55,605 |

52,175 | ||||||

| Consolidated Cash Flow Statement (section 3.1.4) |

||||||||

| Net operating cash flows |

27,234 |

15,706 | ||||||

| Capital and exploration expenditure |

7,120 |

7,640 | ||||||

| Other financial information (section 4.2) |

||||||||

| Net debt |

4,121 |

12,044 | ||||||

| Underlying attributable profit |

17,077 |

9,060 | ||||||

| Underlying EBITDA |

37,379 |

22,071 | ||||||

| Underlying basic earnings per share (US cents) |

337.7 |

179.2 | ||||||

| Underlying Return on Capital Employed (per cent) |

32.5 |

16.9 | ||||||

(1) |

All comparative periods have been restated to reflect changes to the Group’s accounting policy following a decision by the IFRS Interpretations Committee on IAS 12 ‘Income Taxes’, resulting in the retrospective recognition of US$950 million of goodwill at Olympic Dam (included in the Copper segment) and an offsetting US$1,021 million increase in deferred tax liabilities. Refer to note 39 ‘New and amended accounting standards and interpretations and changes to accounting policies’ in section 3 for further information. |

(1) |

Includes data for Continuing and Discontinued operations for the financial years being reported. |

(2) |

Excludes data from Discontinued operations for the financial years being reported. |

(3) |

For more information on APMs, refer to section 4.2. |

| Profit |

Earnings |

Cash |

Returns |

|||||||||||||||||||||||||||||

US$M |

US$M |

US$M |

US$M |

|||||||||||||||||||||||||||||

| Measure: |

Profit after taxation from Continuing operations |

|

13,451 |

Profit after taxation from Continuing operations |

13,451 |

Net operating cash flows from Continuing operations |

27,234 |

Profit after taxation from Continuing operations |

|

13,451 |

||||||||||||||||||||||

| Made up of: |

Profit after taxation | |

Profit after taxation | |

Cash generated by the Group’s consolidated operations, after dividends received, interest, proceeds and settlements of cash management related instruments, taxation and royalty-related taxation. It excludes cash flows relating to investing and financing activities. | |

Profit after taxation | | ||||||||||||||||||||||||

| Adjusted for: |

Exceptional items before taxation |

|

4,470 |

|

Exceptional items before taxation |

|

4,470 |

|

Exceptional items after taxation |

|

5,797 |

| ||||||||||||||||||||

| Tax effect of exceptional items | 1,327 |

Tax effect of exceptional items | 1,327 |

Net finance costs excluding exceptional items | |

1,220 |

||||||||||||||||||||||||||

| Exceptional items after tax attributable to non-controlling interests |

(24 |

) |

Depreciation and amortisation excluding exceptional items | 6,824 |

Income tax benefit on net finance costs | (337 |

) | |||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Impairments of property, | ||||||||||||||||||||||||||||||||

| plant and equipment, | Profit after taxation | |||||||||||||||||||||||||||||||

| Exceptional items | financial assets and | excluding net finance | ||||||||||||||||||||||||||||||

| attributable to BHP | intangibles excluding | costs and exceptional | ||||||||||||||||||||||||||||||

| shareholders | 5,773 |

exceptional items | 264 |

items | 20,131 |

|||||||||||||||||||||||||||

| Profit after taxation attributable to non-controlling interests |

(2,147 |

) |

Net finance costs excluding exceptional items | 1,220 |

Net Assets at the beginning of period | 52,175 |

||||||||||||||||||||||||||

| Taxation expense excluding exceptional items | 9,823 |

Net Debt at the beginning of period | 12,044 |

|||||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Capital employed at the beginning of period | 64,219 |

|||||||||||||||||||||||||||||||

| Net Assets at the end of period | 55,605 |

|||||||||||||||||||||||||||||||

| Net Debt at the end of period | 4,121 |

|||||||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Capital employed at the end of period | 59,726 |

|||||||||||||||||||||||||||||||

| Average capital employed | ||||||||||||||||||||||||||||||||

61,973 |

||||||||||||||||||||||||||||||||

| To reach our KPIs |

Underlying attributable profit |

|

17,077 |

|

Underlying EBITDA |

|

37,379 |

|

Net operating cash flows |

|

27,234 |

|

Underlying Return on Capital Employed |

|

32.5% |

| ||||||||||||||||

| Why do we use it? |

Underlying attributable profit allows the comparability of underlying financial performance by excluding the impacts of exceptional items and is also the basis on which our dividend payout ratio policy is applied. |

|

Underlying EBITDA is used to help assess current operational profitability excluding the impacts of sunk costs (i.e. depreciation from initial investment). It is a measure that management uses internally to assess the performance of the Group’s segments and make decisions on the allocation of resources. |

|

Net operating cash flows provide insights into how we are managing costs and increasing productivity across BHP. |

|

Underlying Return on Capital Employed is an indicator of the Group’s capital efficiency. It is provided on an underlying basis to allow comparability of underlying financial performance by excluding the impacts of exceptional items. |

| ||||||||||||||||||||||||

| Year ended 30 June |

2021 US$M |

2020 US$M |

2019 US$M |

|||||||||

| Continuing operations |

||||||||||||

| Revenue (1) |

60,817 |

42,931 | 44,288 | |||||||||

| Other income |

510 |

777 | 393 | |||||||||

| Expenses excluding net finance costs |

(34,500 |

) |

(28,775 | ) | (28,022 | ) | ||||||

| Loss from equity accounted investments, related impairments and expenses |

(921 |

) |

(512 | ) | (546 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Profit from operations |

25,906 |

14,421 | 16,113 | |||||||||

| |

|

|

|

|

|

|||||||

| Net finance costs |

(1,305 |

) |

(911 | ) | (1,064 | ) | ||||||

| Total taxation expense |

(11,150 |

) |

(4,774 | ) | (5,529 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Profit after taxation from Continuing operations |

13,451 |

8,736 | 9,520 | |||||||||

| |

|

|

|

|

|

|||||||

| Discontinued operations |

||||||||||||

| Loss after taxation from Discontinued operations |

– |

– | (335 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Profit after taxation from Continuing and Discontinued operations |

13,451 |

8,736 | 9,185 | |||||||||

| |

|

|

|

|

|

|||||||

| Attributable to non-controlling interests |

2,147 |

780 | 879 | |||||||||

| Attributable to BHP shareholders |

11,304 |

7,956 | 8,306 | |||||||||

| |

|

|

|

|

|

|||||||

(1) |

Includes the sale of third-party products. |

US$M |

||||||

Underlying EBITDA for year ended 30 June 2020 |

22,071 |

|||||

| Net price impact: |

||||||

| Change in sales prices |

16,965 |

Higher average realised prices for iron ore, copper, nickel, oil, natural gas and thermal coal, partially offset by lower average realised prices for metallurgical coal and LNG. | ||||

| Price-linked costs |

(870 |

) |

Increased royalties reflect higher realised prices for iron ore and higher third party concentrate purchase costs reflect higher nickel prices, partially offset by lower royalties for petroleum and metallurgical coal. | |||

16,095 |

||||||

| Change in volumes |

(312 |

) |

Record volumes at WAIO with strong performance across the supply chain, were offset by natural field decline at Petroleum. The expected lower grades at Escondida and Spence more than offset Escondida concentrator throughput maintained at record levels, the new stream of concentrate production from the Spence Growth Option that came online in December 2020 and highest annual copper production achieved at Olympic Dam since our acquisition in 2005. Lower volumes due to adverse weather impacts in the Gulf of Mexico (Petroleum) and NSWEC, combined with dragline maintenance and higher strip ratios at BMC. This was partially offset by the acquisition of the additional 28 per cent working interest at Shenzi and increased volumes at Nickel West following resource transition and major quadrennial maintenance shutdowns in the prior period. | |||

| Change in controllable cash costs: | ||||||

| Operating cash costs |

(34 |

) |

Higher inventory drawdowns at Olympic Dam due to stronger mill and smelter performance and at Nickel West as volumes increased following planned maintenance shutdowns in the prior period and additional costs associated with the ramp-up of South Flank. This was largely offset by strong cost performance supported by cost reduction initiatives across our assets, lower technology costs and a gain from the optimised outcome from renegotiation of cancelled power contracts at Escondida and Spence. | |||

| Exploration and business development |

109 |

Lower exploration expenses due to lower seismic activity in Petroleum. | ||||

75 |

||||||

| Change in other costs: | ||||||

| Exchange rates |

(1,588 |

) |

Impact of the stronger Australian dollar and Chilean peso against the US dollar. | |||

| Inflation |

(286 |

) |

Impact of inflation on the Group’s cost base. | |||

| Fuel and energy |

223 |

Predominantly lower diesel prices at our minerals assets. | ||||

| Non-Cash |

282 |

Lower deferred stripping depletion at Escondida in line with planned development phase of the mines. | ||||

| One-off items |

(122 |

) |

Volume loss across our operations due to COVID-19 restrictions, predominantly at our copper operations in Chile. | |||

(1,491 |

) |

|||||

| Asset sales | 17 |

|||||

| Ceased and sold operations | 242 |

Reflects the divestment of Neptune and a decrease in costs related to the closure and rehabilitation provision for closed mines of US$311 million compared with the prior year. | ||||

| Other items | 682 |

Other includes higher average realised sales prices received by Antamina. | ||||

Underlying EBITDA for year ended 30 June 2021 |

37,379 |

|||||

(1) |

For information on the method of calculation of the principal factors that affect Underlying EBITDA, refer to section 4.2.2. |

| Year ended 30 June |

2021 US$M |

2020 US$M |

2019 US$M |

|||||||||

| Net operating cash flows from Continuing operations |

27,234 |

15,706 | 17,397 | |||||||||

| Net operating cash flows from Discontinued operations |

– |

– | 474 | |||||||||

| |

|

|

|

|

|

|||||||

| Net operating cash flows |

27,234 |

15,706 | 17,871 | |||||||||

| |

|

|

|

|

|

|||||||

| Net investing cash flows from Continuing operations |

(7,845 |

) |

(7,616 | ) | (7,377 | ) | ||||||

| Net investing cash flows from Discontinued operations |

– |

– | (443 | ) | ||||||||

| Proceeds from divestment of Onshore US, net of its cash |

– |

– | 10,427 | |||||||||

| |

|

|

|

|

|

|||||||

| Net investing cash flows |

(7,845 |

) |

(7,616 | ) | 2,607 | |||||||

| |

|

|

|

|

|

|||||||

| Net financing cash flows from Continuing operations |

(17,922 |

) |

(9,752 | ) | (20,515 | ) | ||||||

| Net financing cash flows from Discontinued operations |

– |

– | (13 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Net financing cash flows |

(17,922 |

) |

(9,752 | ) | (20,528 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net increase/(decrease) in cash and cash equivalents |

1,467 |

(1,662 | ) | (10,477 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Net increase/(decrease) in cash and cash equivalents from Continuing operations |

1,467 |

(1,662 | ) | (10,495 | ) | |||||||

| Net increase/(decrease) in cash and cash equivalents from Discontinued operations |

– |

– | 18 | |||||||||

| |

|

|

|

|

|

|||||||

| • | a strong balance sheet through the cycle |

| • | diversification of funding sources |

| • | maintain borrowings and excess cash predominantly in US dollars |

Facility available 2021 US$M |

Drawn 2021 US$M |

Undrawn 2021 US$M |

Facility available 2020 US$M |

Drawn 2020 US$M |

Undrawn 2020 US$M |

|||||||||||||||||||

| Revolving credit facility (2) |

5,500 |

– |

5,500 |

5,500 | – | 5,500 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total financing facility |

5,500 |

– |

5,500 |

5,500 | – | 5,500 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

(1) |

We use APMs to reflect our underlying financial performance. Refer to section 4.2 for a discussion on the APMs we use. For the definition and method of calculation of APMs, refer to section 4.2.1. For the composition of net debt, refer to note 20 ‘Net debt’ in section 3. |

(2) |

During the year we completed a one-year extension of the facility which is now due to mature on 10 October 2025. The committed US$5.5 billion revolving credit facility operates as a back-stop to the Group’s uncommitted commercial paper program. The combined amount drawn under the facility or as commercial paper will not exceed US$5.5 billion. As at 30 June 2021, US$ nil commercial paper was drawn (FY2020: US$ nil), therefore US$5.5 billion of committed facility was available to use (FY2020: US$5.5 billion). A commitment fee is payable on the undrawn balance and an interest rate comprising an interbank rate plus a margin applies to any drawn balance. The agreed margins are typical for a credit facility extended to a company with BHP’s credit rating. |

| Year ended 30 June |

2021 US$M |

2020 US$M |

||||||||||||||

| Net debt at the beginning of the financial year |

(12,044 |

) |

(9,446 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Net operating cash flows |

27,234 |

15,706 | ||||||||||||||

| Net investing cash flows |

(7,845 |

) |

(7,616 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Free cash flow |

19,389 |

8,090 | ||||||||||||||

| |

|

|

|

|||||||||||||

| Carrying value of interest bearing liability repayments |

7,433 |

1,533 | ||||||||||||||

| Net settlements of interest bearing liabilities and debt related instruments |

(7,424 |

) |

(1,984 | ) | ||||||||||||

| Dividends paid |

(7,901 |

) |

(6,876 | ) | ||||||||||||

| Dividends paid to non-controlling interests |

(2,127 |

) |

(1,043 | ) | ||||||||||||

| Other financing activities (1) |

(234 |

) |

(143 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Other cash movements |

(10,253 |

) |

(8,513 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Fair value adjustment on debt (including debt related instruments) (2) |

58 |

88 | ||||||||||||||

| Foreign exchange impacts on cash (including cash management related instruments) |

(1 |

) |

(26 | ) | ||||||||||||

| IFRS 16 leases taken on at 1 July 2019 |

– |

(1,778 | ) | |||||||||||||

| Lease additions |

(1,079 |

) |

(363 | ) | ||||||||||||

| Others |

(191 |

) |

(96 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Non-cash movements |

(1,213 |

) |

(2,175 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Net debt at the end of the financial year |

(4,121 |

) |

(12,044 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

(1) |

Other financing activities mainly comprises purchases of shares by Employee Share Option Plan trusts of US$234 million (FY2020: US$143 million). |

(2) |

The Group hedges against the volatility in both exchange and interest rates on debt, and also exchange on cash, with associated movements in derivatives reported in Other financial assets/liabilities as effective hedged derivatives (cross currency and interest rate swaps), in accordance with accounting standards. For more information, refer to note 23 ‘Financial risk management’ in section 3. |

| • | Risk identification – threats and opportunities are identified and each is assigned an owner, or accountable individual. |

| • | Risk assessments – risks are assessed using appropriate and internationally recognised techniques to determine their potential impacts and likelihood, prioritise them and inform risk treatment options. |

| • | Risk treatment – controls are implemented to prevent, reduce or mitigate threats, and enable or enhance opportunities. |

| • | Monitoring and review – risks and controls are reviewed periodically and on an ad hoc basis (including where there are high-potential events or changes in the external environment) to evaluate performance. |

| • | The Atlantis Phase 3 project, a new subsea production system that ties back to the Atlantis facility, achieved first production in July 2020. Atlantis Phase 3 is expected to have the capacity to produce up to 38,000 gross barrels of oil equivalent per day. |

| • | On 6 November 2020, BHP finalised a membership interest purchase and sale agreement with Hess Corporation to acquire an additional 28 per cent working interest in Shenzi for US$480 million, which brings our working interest to 72 per cent. |

| • | The Mad Dog Phase 2 project achieved a major milestone in April 2021 as the semi-submersible floating production platform, Argos, arrived in the US from South Korea. First production from Mad Dog Phase 2 is expected in the middle of the CY2022. |

| • | On 20 May 2021, BHP finalised a purchase and sale agreement with EnVen Energy Ventures, LLC to divest our interest in and operation of Neptune. |

| • | On 5 August 2021, the Board approved the funding to develop the Shenzi North Project, a two-well subsea tie-in to the Shenzi platform. First production is targeted in CY2024. |

| Well |

Location |

Target |

BHP equity |

Spud date |

Water depth |

Total well depth |

Status | |||||||

Broadside-1 |

Trinidad and Tobago Block 3 | Oil | 65% (BHP operator) |

20 August 2020 |

2,019 m | 7,064 m | Dry hole; plugged and abandoned |

(1) |

Leases were awarded in blocks: GC80 and GC123. |

(2) |

Leases were awarded in blocks: AC36, AC80 and AC81. |

| Year ended 30 June |

2021 US$M |

2020 US$M |

2019 US$M |

|||||||||

| Greenfield exploration |

54 |

44 | 62 | |||||||||

| Resources assessment |

138 |

132 | 126 | |||||||||

| |

|

|

|

|

|

|||||||

| Total metals exploration and assessment |

192 |

176 | 188 | |||||||||

| |

|

|

|

|

|

|||||||

| Year ended 30 June |

2021 US$M |

2020 US$M |

2019 US$M |

|||||||||

| Petroleum exploration |

322 |

564 | 685 | |||||||||

| |

|

|

|

|

|

|||||||

| Year ended 30 June |

2021 US$M |

2020 US$M |

2019 US$M |

|||||||||

| Exploration expense |

||||||||||||

| Petroleum (1) |

382 |

394 | 409 | |||||||||

| Copper |

53 |

54 | 62 | |||||||||

| Iron Ore |

55 |

47 | 41 | |||||||||

| Coal |

7 |

9 | 15 | |||||||||

| Group and unallocated items (2) |

19 |

13 | 10 | |||||||||

| |

|

|

|

|

|

|||||||

| Total Group |

516 |

517 | 537 | |||||||||

| |

|

|

|

|

|

|||||||

(1) |

Includes US$86 million (FY2020: US$ nil; FY2019: US$21 million) exploration expense previously capitalised, written off as impaired. |

(2) |

Group and unallocated items includes functions, other unallocated operations, including Potash, Nickel West and legacy assets (previously disclosed as closed mines in the Petroleum reportable segment), and consolidation adjustments. |

| • | embedding flexibility in the way we work |

| • | encouraging and working with our supply chain partners to support our commitment to inclusion and diversity |

| • | uncovering and taking steps to mitigate potential bias in our behaviours, systems, policies and processes |

| • | ensuring our brand and workplaces are attractive to a diverse range of people |

| • | improve employment messaging to target diverse audiences about why they should work for BHP |

| • | progress market mapping to proactively target people or groups of people not actively looking to work for BHP or our industry |

| • | broaden our employment and brand reach across social, digital and traditional media channels |

| • | enhance our workforce development and retention through coaching and support materials for leaders |

| • | develop a Ways of Working Framework to guide employees and leaders to ‘Work where you get great outcomes’ |

| • | implement mentoring and support networks for women |

(1) |

Based on a ‘point in time’ snapshot of employees as at 30 June 2021, as used in internal management reporting for the purposes of monitoring progress against our goals. This does not include contractors. For the first time this includes employees on extended absence (660 at 30 June 2021), who were previously not included in the active headcount. |

2021 |

2020 | 2019 | ||||||||||

| Female employees (1) |

11,868 |

8,072 | 6,874 | |||||||||

| Male employees (1) |

27,953 |

23,517 | 22,052 | |||||||||

| Female senior employees (2)(3) |

90 |

67 | 70 | |||||||||

| Male senior employees (2)(3) |

189 |

185 | 227 | |||||||||

| Female Executive Leadership Team (ELT) members (2) |

5 |

4 | 4 | |||||||||

| Male Executive Leadership Team (ELT) members (2) |

5 |

6 | 7 | |||||||||

| Female Board members (2) |

4 |

3 | 4 | |||||||||

| Male Board members (2) |

8 |

9 | 7 | |||||||||

(1) |

FY2021 employee numbers based on actual numbers at BHP operated location as at 30 June 2021, not 10-month averages. FY2020 and FY2019 are based on the average of the number of employees at the last day of each calendar month for a 10-month period from July to April which is then used to calculate a weighted average for the year to 30 June and adjusted based on BHP ownership. Data includes Continuing and Discontinued operations (Onshore US assets) for the financial years being reported. |

(2) |

Based on actual numbers as at 30 June 2021, not 10-month averages. |

(3) |

For the purposes of the UK Companies Act 2006, we are required to show information for ‘senior managers’, which are defined to include both senior leaders and any persons who are directors of any subsidiary company, even if they are not senior leaders. In FY2021, there were 297 senior leaders at BHP. There are 18 Directors of subsidiary companies who are not senior leaders, comprising 14 men and 4 women. Therefore, for UK law purposes, the total number of senior managers was 203 men and 94 women (31.6 per cent women) in FY2021. |

(1) |

Based on a ‘point in time’ snapshot of employees and labour hire contractors as at 30 June 2021. |

| • | ensuring we comply with legal obligations and regional labour regulations |

| • | negotiating where there are requirements to collectively bargain |

| • | closing out agreements with our workforce in South America and Australia, with no lost time due to industrial action, to the extent possible |

| • | creating solid relations with our workforce based on a culture of trust and cooperation |

| • | putting the health and safety of our people first |

| • | being environmentally responsible |

| • | respecting human rights |

| • | supporting the communities where we operate |

(1) |

The FY2020 baseline will be adjusted for any material acquisitions and divestments based on greenhouse gas emissions at the time of the transaction. Carbon offsets will be used as required. |

(2) |

Net zero includes the use of carbon offsets as required. |

(3) |

These positions are expressed using terms that are defined in the Glossary, including the terms ‘net zero’, ‘target’ and ‘goal’. |

(4) |

Our GRI Content Index is available at bhp.com/FY21ESGStandardsDatabook |

(5) |

https://www.bhp.com/media-and-insights/news-releases/2020/11/bhp-commits-to-copper-mark/. |

(1) |

We comply with the Non-financial Reporting Directive requirements and therefore report sustainability matters from sections 414CA and 414CB of the UK Companies Act 2006. |

(2) |

Although these standards are for internal use, we have made the HSEC-related elements of several of the Our Requirements |

(3) |

For further information on BHP’s principal risks, refer to section 1.16. |

| People |

Target |

FY2021 result |

Year-on-year | |||||||

| Zero work-related fatalities | Workplace fatalities |

0 |

FY2017 (1) FY2018 FY2019 (2) FY2020 FY2021 |

1 2 1 0 0 | ||||||

| Year-on-year improvement of total recordable injury frequency (3) (TRIF) per million hours worked |

Total recordable injury frequency decreased by 11 per cent compared to FY2020 |

FY2017 (4) FY2018 (4) FY2019 (5) FY2020 FY2021 |

4.2 4.4 4.7 4.2 3.7 | |||||||

| 50 per cent reduction in the number of workers potentially exposed (6) to our most material exposures of diesel particulate matter, respirable silica and coal mine dust compared to our FY2017(7) baseline by FY2022 |

Occupational exposures 70 per cent reduction compared to FY2017 baseline |

Adjusted FY2017 baseline FY2018 FY2019 (8) FY2020 FY2021 (9) |

4,266 3,032 2,192 1,744 1,280 | |||||||

| Society |

Zero significant community events (10) |

FY2021 | 0 |

FY2017 FY2018 FY2019 FY2020 FY2021 |

0 0 0 0 0 | |||||

| Not less than 1 per cent of pre-tax profits (11) invested in community programs that contribute to the quality of life in the communities where we operate and support the achievement of the UN Sustainable Development Goals |

Social investment spend US$174.8 million (12) |

FY2017 (13) FY2018 FY2019 (14) FY2020 FY2021 |

US$80.2 million US$77.1 million US$93.5 million US$149.6 million US$174.8 million | |||||||

| By FY2022, implement our Indigenous Peoples Strategy across all our operated assets through the development of Regional Indigenous Peoples Plans |

Regional Indigenous Peoples Plans being implemented across Australia (Reconciliation Action Plan (RAP)) and North and South America | |||||||||

| Environment |

Zero significant environmental events (10) |

FY2021 | 0 |

FY2017 FY2018 FY2019 FY2020 FY2021 |

0 0 0 0 0 | |||||

| Reduce FY2022 withdrawal of fresh water (15) by 15 per cent from FY2017 levels |

Freshwater withdrawal reduction from FY2017 baseline (16) |

27% |

Adjusted FY2017 baseline (16) FY2018 FY2019 FY2020 FY2021 |

156,120 ML 140,515 ML 155,570 ML 126,997 ML 113,444 ML | ||||||

| By FY2022, improve marine and terrestrial biodiversity outcomes by developing a framework to evaluate and verify the benefits of our actions, in collaboration with others |

Progressed framework development, including pilots and approaches to data validation in collaboration with others. On track to deliver by end of FY2022 |

Year-on-year progress on development of framework to evaluate and verify the benefits of our actions | ||||||||

(1) |

FY2018 and FY2019 data includes Continuing and Discontinued operations (Onshore US assets to 28 February 2019). |

(2) |

FY2019 data includes Discontinued operations (Onshore US assets) to 28 February 2019 and Continuing operations. |

(3) |

The sum of (fatalities + lost-time cases + restricted work cases + medical treatment cases) multiplied by 1 million/actual hours worked by our employees and contractors. Stated in units of per million hours worked. We adopt the US Government’s Occupational Safety and Health Administration Guidelines for the recording and reporting of occupational injuries and illnesses. |

(4) |

FY2017 and FY2018 TRIF data includes Continuing and Discontinued operations (Onshore US assets). |

(5) |

FY2019 TRIF data includes Discontinued operations (Onshore US assets) to 28 February 2019 and Continuing operations. |

(6) |

For exposures exceeding our FY2017 baseline occupational exposure limits discounting the use of personal protective equipment, where required. The baseline exposure profile (as at 30 June 2017) is derived through a combination of quantitative exposure measurements and qualitative assessments undertaken by specialist occupational hygienists consistent with best practice as defined by the American Industrial Hygiene Association. |

(7) |

New FY2017 baseline due to the removal of 98 exposures attributed to the Onshore US assets. |

(8) |

Data excludes Discontinued operations (Onshore US assets). |

(9) |

As of FY2021, the Occupational Exposure Limit for Coal was reduced to 1.5 mg/m 3 compared to 2.0 mg/m3 in previous years. |

(10) |

A significant event resulting from BHP operated activities is one with an actual severity rating of four or above, based on our internal severity rating scale (tiered from one to five by increasing severity) as defined in our mandatory minimum performance requirements for risk management. |

(11) |

Our voluntary social investment is calculated as 1 per cent of the average of the previous three years’ pre-tax profit. |

(12) |

Expenditure includes BHP’s equity share for operated and non-operated joint ventures, and comprises cash, administrative costs, including costs to facilitate the operation of the BHP Foundation. |

(13) |

FY2017 and FY2018 social investment figures includes Discontinued operations (Onshore US assets). |

(14) |

FY2019 social investment figure includes Discontinued operations (Onshore US assets) to 31 October 2018 and Continuing operations. |

(15) |

Where ‘withdrawal’ is defined as water withdrawn and intended for use (in accordance with ‘A Practical Guide to Consistent Water Reporting’, ICMM (2017)). |

(16) |

The FY2017 baseline data has been adjusted to account for: the materiality of the strike affecting water withdrawals at Escondida in FY2017 and improvements to water balance methodologies at WAIO, BMA and BMC and exclusion of hypersaline, wastewater, entrainment, supplies from desalination and Discontinued operations (Onshore US assets) in FY2019 and FY2020. |

| • | no fatalities at our operated assets |

| • | a decrease of 17 per cent in high-potential injury frequency rate from FY2020. The highest number of events with potential for one or more fatalities were related to vehicle and mobile equipment accidents. High-potential injury trends will remain a primary focus to assess progress against our most important safety objective, eliminating fatalities |

| • | a decrease in total recordable injury frequency (TRIF) of 11 per cent from FY2020. The highest number of injuries are related to slips, trips and falls for both employees and contractors |

| • | an increase in field leadership activities, which occurred at a sustainable frequency rate of 9,400 activities per million hours worked with over 1,573,000 activities completed in the period and over 44,000 employees and contractors participating in the program at least once. Scheduled activities compared to non-scheduled activities increased by 72 per cent from FY2020 and coaching increased by 5 per cent |

| • | we took a number of significant steps to improve our controls to address sexual assault and sexual harassment, however we have further to go to fully stop this behaviour from occurring across BHP |

| • | no safety fines were received at our operated assets in FY2021 |

| Year ended 30 June |

2021 | 2020 | 2019 | |||||||||

| High-potential injury events |

33 | 42 | 50 | |||||||||

| Employees | Contractors | |||||||

| High-potential injury frequency (3) |

0.02 | 0.05 | ||||||

| Year ended 30 June |

2021 | 2020 | 2019 | |||||||||

| Total recordable injury frequency (4) |

3.7 | 4.2 | 4.7 | |||||||||

| Employees | Contractors | |||||||

| Total recordable injury frequency (3) |

0.67 | 0.80 | ||||||

(1) |

FY2019 data includes Discontinued operations (Onshore US assets) to 28 February 2019 and Continuing operations. Due to the lag nature of incident reporting and subsequent verification, final results may vary post reporting. Prior year data has not been adjusted. |

(2) |

High-potential injury includes injuries with fatality potential. The basis of calculation revised in FY2020 from event count to injury count as part of a safety reporting methodology improvement. |

(3) |

Employee and contractor frequency per 200,000 hours worked. |

(4) |

Combined employee and contractor frequency per 1 million hours worked. |

| • | Fatality Elimination Program |

| • | Integrated Contractor Management Program |

| • | Field Leadership Program |

| • | engaged subject matter experts and mining, equipment, technology and services (METS) organisations to provide control solutions to our top 10 safety risks |

| • | identified over 60 recommended controls for our top 10 safety risks, including new controls and material improvements to existing controls |

| • | conducted assessments at our operated assets and relevant functions against the recommended controls to determine the actions that need to be taken |

| • | established a global project team to prioritise and deliver a global five-year fatality elimination roadmap |

| • | commenced planning to update the Our Requirements for Safety |

| • | Our Scope of Work Library is an online resource containing best practice examples for different types of contractor engagements. This assists our contractor partners to better understand the work required at our sites, enabling them to assign contractors with the right skills and competencies to perform the work. |

| • | To assist in defining the minimum requirements for key roles, governance and process routines, we introduced an operational tiering model. The model factors in work scope, operational safety risks and contract arrangements to inform the robustness of process requirements, including key performance indicators. |

| • | We developed a specific contractor perception survey to ensure we receive contractor feedback on our culture and their experience working at BHP. |

| • | We developed systems to support the contractor management process to improve supervision and training of contractors across our operated assets. A pilot was conducted at one of our Australian operated assets to ensure the system was fit-for-purpose |

| • | increased supervisor time in the field through BOS and reduced the large spans of control that some supervisors had over their teams |

| • | continued to improve the quality of field leadership activities by increasing coaching and delivery of field leadership engagements at our operated assets |

| • | focused on ensuring our leaders were proactively scheduling Fatality Elimination Program activities and executing them to plan to ensure adequate verification of all fatality risks across our operated assets |

| • | developed a global, standardised field leadership procedure designed to increase the effectiveness of field leadership activities by reducing variances in practices across the business |

| • | conducted field leadership on COVID-19 controls, which increased our understanding of control application and effectiveness by engaging our workforce for direct feedback |

| • | introduced sexual harassment field leadership activities, which provided information on progress and areas for improvement in this space |

(1) |

The data for FY2017 and FY2018 includes Continuing and Discontinued operations (Onshore US assets). FY2019 data includes Discontinued operations (Onshore US assets) to 31 October 2018 and Continuing operations. |

(2) |

Occupational illnesses excludes COVID-19 related data. |

(3) |

Due to the lag nature of incident reporting and subsequent verification, final results may vary post reporting. Prior year data has not been adjusted. |

(4) |

Due to regulatory regimes and limited access to data, we do not have full oversight of the incidence of contractor noise-induced hearing loss (NIHL) cases. |

(1) |

An illness that occurs as a consequence of work-related activities or exposure. |

(1) |

For exposures exceeding our FY2017 occupational exposure limits discounting the use of personal protective equipment, where required. |

(2) |

The baseline exposure profile is derived through a combination of quantitative exposure measurements and qualitative assessments undertaken by specialist occupational hygienists consistent with best practice as defined by the American Industrial Hygiene Association. |

(3) |

The baseline has been adjusted to exclude Discontinued operations (Onshore US assets). |

(4) |

CMDLD is the name given to the lung diseases related to exposure to coal mine dust and includes coal workers’ pneumoconiosis, silicosis, mixed dust pneumoconiosis and chronic obstructive pulmonary disease. |

(1) |

Employees and contractors engaged by BHP. |

(2) |

A person with a laboratory confirmation of COVID-19 infection, using polymerase chain reaction (PCR) test methodology, irrespective of clinical signs and symptoms. |

(3) |

Potentially infectious while at work is defined as being in one of BHP’s managed locations (including camps and offices) within 48 hours before onset of symptoms and/or while symptomatic. Figures for persons potentially infectious while at work are included irrespective of where infection may have occurred. |

(4) |

https://www.bhp.com/our-approach/our-company/our-code-of-conduct/. |

(5) |

Some EthicsPoint reports are enquiries, or are not related to business conduct concerns, or are a duplicate of an existing report |

(6) |

This excludes reports not containing a business conduct concern, and excludes reports logged by leaders on behalf of others. |

(7) |

The calculation is based on reports received and completed in FY2021, containing one or more substantiated allegations. |

| • | the disclosures we make about the taxes and royalties we pay to governments, which enable the public to see what we have paid |

| • | transparency of the contracts we have with governments which allows comparison of our actual payments against what is required to be paid |

(1) |

Net zero includes the use of carbon offsets as required. |

(1) |

bhp.com/climate |

(2) |

Scenarios highlight critical elements of assumed future states and draw attention to the key factors that may drive future developments. They are hypothetical constructs, not forecasts, predictions or sensitivity analyses. As they are a tool to enhance critical strategic thinking, a key feature of scenarios is they should challenge conventional wisdom about the future. In a world of uncertainty, scenarios are intended to explore alternatives that may significantly alter the basis for ‘business as usual’ assumptions. There are inherent limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed. |

(3) |

This scenario aligns with the Paris Agreement goals and requires steep global annual GHG emissions reductions, sustained for decades, to stay within a 1.5°C carbon budget. Refer to the BHP Climate Change Report 2020 available at bhp.com for information about the assumptions, outputs and limitations of our 1.5°C Paris-aligned scenario. 1.5°C is above pre-industrial levels. |

(4) |

Net zero includes the use of carbon offsets as required. |

(5) |

FY2020 baseline will be adjusted for any material acquisitions and divestments based on GHG emissions at the time of the transaction. Carbon offsets will be used as required. |

(6) |

These positions are expressed using terms that are defined in the Glossary, including the terms ‘net zero’, ‘target’ and ‘goal’. |

(7) |

FY2017 will be adjusted for any material acquisitions and divestments based on GHG emissions at the time of the transaction. Carbon offsets will be used as required. |

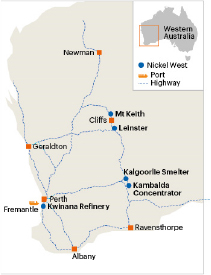

| • | We signed a renewable power purchasing agreement (PPA) to supply up to 50 per cent of our electricity needs at the Nickel West Kwinana Refinery from the Merredin Solar Farm. |

| • | We secured firm renewable electricity via a PPA to meet half of the electricity needs across Queensland Coal mines from low-emissions sources. |

| • | We continued to implement power purchase agreements for renewable electricity commencing from FY2022 at our Chilean copper operated assets, Escondida and Spence, which are on track to reach net zero Scope 2 GHG emissions by the mid-2020s. |

| • | we are targeting net zero for the operational GHG emissions of our direct suppliers (5) and the emissions from maritime transport of our products; and |

| • | recognising the particular challenge of a net zero pathway for customers’ processing of our products, (6) which is dependent on the development and downstream deployment of solutions and supportive policy, we cannot set a target, but will continue to partner with customers and others to accelerate the transition to carbon neutral(7) steelmaking and other downstream processes. We will also support the value chain by pursuing carbon neutral production of our future facing commodities, such as copper, nickel and potash, to provide the essential building blocks of a net zero transition. |

(1) |

On 17 August 2021, BHP announced it had entered into a merger commitment deed with Woodside to combine their respective oil and gas portfolios by an all-stock merger. Completion of the merger is subject to confirmatory due diligence, negotiation and execution of full form transaction documents, and satisfaction of conditions precedent including shareholder, regulatory and other approvals, and expected to occur in the second quarter of the 2022 calendar year, with an effective date of 1 July 2021. For more information, refer to the Joint Announcement ‘Woodside and BHP to create a global energy company’ by Woodside and BHP dated 17 August 2021, available at bhp.com/investor-centre. On 28 June 2021, BHP announced its agreement with Glencore to divest its 33.3 per cent interest in Cerrejón, a non-operated energy coal joint venture in Colombia, with an effective economic date of 31 December 2020. Completion is subject to the satisfaction of customary competition and regulatory requirements and expected to occur in the first half of the 2022 calendar year. |

(2) |

This position is expressed using terms that are defined in the Glossary, including the terms ‘net zero’, ‘target’ and ‘goal’. |

(3) |

Subject to completion of both of the divestment of our oil and gas business and the sale of our interest in Cerrejón. |

(4) |

Net zero includes the use of carbon offsets as required. |

(5) |

‘Operational GHG emissions of our direct suppliers’ means the Scope 1 and Scope 2 emissions of our direct suppliers included in BHP’s Scope 3 emissions reporting categories of purchased goods and services (including capital goods), fuel and energy related activities, business travel, and employee commuting. |

(6) |

In line with our reporting methodology for Scope 3 emissions, we define ‘processing of our products’ as emissions resulting from our customers’ processing of our products comprising iron ore and metallurgical coal (steelmaking materials) and copper (assumed to be processed into copper wire for end use). |

(7) |

Carbon neutral includes all those GHG emissions as defined for BHP reporting purposes. |

| • | We will target net zero (2) by 2050 for the operational GHG emissions of our direct suppliers,(3) subject to the widespread availability of carbon neutral(4) goods and services to meet our requirements. |

| • | We will target net zero (5) by 2050 for GHG emissions from all shipping(6) of our products,(7) subject to the widespread availability of carbon-neutral(8) solutions including low/zero-emission technology on board suitable ships and low/zero-emission marine fuels. |

(1) |

These targets are referable to a FY2020 baseline year, which will be adjusted for any material acquisitions and divestments based on emissions at the time of the transaction, and to reflect progressive refinement of the Scope 3 emissions reporting methodology. The targets’ boundaries may in some cases differ from required reporting boundaries. Carbon offsets will be used as required. |

(2) |

Net zero includes the use of carbon offsets as required. |

(3) |

‘Operational GHG emissions of our direct suppliers’ means the Scope 1 and Scope 2 emissions of our direct suppliers included in BHP’s Scope 3 reporting categories of purchased goods and services (including capital goods), fuel and energy related activities, business travel, and employee commuting. |

(4) |

Carbon neutral includes all those greenhouse gas emissions as defined for BHP reporting purposes. |

(5) |

Net zero includes the use of carbon offsets as required. |

(6) |

BHP-chartered and third party-chartered shipping. |

(7) |

Target excludes maritime transportation of products purchased by BHP. |

(8) |

Carbon neutral includes all those greenhouse gas emissions as defined for BHP reporting purposes. |

(1) |

REDD and REDD+ are UN programs for reducing GHG emissions from deforestation and forest degradation. |

| • | Community perception research was conducted at 11 of our operated assets providing an aggregated view of local community perceptions and a valuable input into asset planning. |

| • | All of our operated assets had a stakeholder engagement plan in place and conducted regular stakeholder engagement activities, including one-on-one |

| • | The primary concerns of community members, as reported to our operated assets, largely related to community support (including economic contribution, capacity building, resilience and social inclusion), environmental sustainability and a desire for more communications or engagement from BHP. |

| • | Complaints and grievance mechanisms were in place across all our operated assets. |

| • | 103 community complaints (four classified as grievances ( 1 ) ) were received globally across our operated assets. While this was a 10 per cent decrease in community complaints compared to FY2020, we are revising our approach to reporting to ensure we capture and record all concerns, complaints and grievances received through our community engagement channels. |

| • | No significant community incidents were recorded, meeting our five-year public target of no significant community events between FY2017 and FY2022. ( 2 ) |

| • | No artisanal or small-scale mining on or adjacent to our operations was reported. |

(1) |

An event or community complaint relating to an adverse impact/event that has escalated to the point where a third-party intervention or adjudication is required to resolve it. |

(2) |

A significant event resulting from BHP operated activities is one with an actual severity rating of four or above, based on our internal severity rating scale (tiered from one to five by increasing severity) as defined in our mandatory minimum performance requirements for risk management. |

| • | labour rights, specifically to operate consistently with the terms of the International Labor Organization (ILO) Declaration on Fundamental Principles and Rights at Work, including the four core labour standards |

| • | human rights requirements of the Global Industry Standard on Tailings Management |

| • | A total of 610 employees completed human rights training, ( 1 ) including teams across Corporate Affairs and Commercial functions. The training is publicly available at bhp.com. |

| • | Our human rights impact assessment (HRIA) pilot project was finalised resulting in a globally consistent methodology for HRIAs to be applied across our operated assets. |

| • | HRIAs were conducted by an external consultant across Minerals Australia and Minerals Americas, with self-assessments conducted at each of these operated assets. A HRIA was also conducted for the Jansen Potash Project in Canada. The Our Requirements |

| • | No resettlements or physical or economic displacement of families or communities occurred as a result of the activities of our operated assets. |

(1) |

The number of employees trained has been annualised using data from a 10-month period, July to April, to determine a total for the year. |

| • | We developed an Australian Indigenous Cultural Respect Framework, including developing a package of additional Aboriginal and Torres Strait Islander training and awareness sessions targeted at our leaders and employees, which is intended to be delivered in partnership with Traditional Owner groups where possible. Elements of the framework were delivered in FY2021, with further rollouts scheduled for FY2022. |

| • | We provided a submission to the Australian Government’s Indigenous Voice co-design consultation process outlining support for Aboriginal and Torres Strait Islander people to have a greater voice on the laws, policies and services that impact them, their communities and their lives. This submission is consistent with our broader support for the Uluru Statement from the Heart. The Uluru Statement calls for meaningful structural reforms designed to enable a new relationship between First Nations and the Australian nation based on justice and self-determination. |

| • | BMC and the Barada Barna people negotiated an Indigenous Land Use Agreement to provide BMC with consents for past, current and future acts associated with the South Walker Creek mine and deliver a comprehensive benefits package for immediate and intergenerational benefits to the Barada Barna people. In conjunction, a Cultural Heritage Management Plan was agreed, providing for the protection and appropriate management of Aboriginal cultural heritage at the mine. Further work is underway with the Widi people in relation to shared country at South Walker Creek. |

(1) |

Suppliers that have any ownership by a Traditional Owner(s) from one of the language groups in which BHP operates or as defined in an Indigenous Land Use Agreement or other formal agreement, providing a minimum overall Indigenous ownership of 50 per cent exists. |

(1) |

http://www.icmm.com/en-gb/about-us/member-requirements/position-statements/indigenous-peoples. |

(2) |

Our voluntary social investment is calculated as 1 per cent of the average of the previous three years’ pre-tax profit. |

(3) |

The direct costs associated with implementing social investment activities, including labour, travel, research and development, communications and costs to facilitate the operation of the BHP Foundation. |

Social Investment Framework | ||||

Theme |

Aim | FY2021 | ||

| Future of work |

We aim to enhance human capability and social inclusion through education and vocational training and skills development. | • Through our support, approximately 19,000 people completed education or training courses in digital, technology, leadership and/or problem-solving initiatives. Over 9,750 of these participants were Indigenous people and 6,187 were female. • 313 education institutions aligned course content to business needs in order to better prepare participants for future work readiness. • 1,559 participants found paid employment following completion of their training. | ||

| Future of environment |

We aim to contribute to environmental resilience through biodiversity conservation, ecosystem restoration, water stewardship and climate change mitigation and adaptation. | • We made 29 investments in nature-based solutions. • Contributed to improved management of approximately 13 million hectares. • 75 scientific or thought leadership papers or specific knowledge sharing events were supported. | ||

| Future of communities |

We aim to contribute to the understanding, development and sustainable use of resources to support communities to be more adaptive and resilient. | • 836 organisations enhanced internal capability to support efficient and sustainable communities. • 505 organisations planned or delivered initiatives that increase/improve infrastructure, use of technology and/or use of resources that enhance community resilience, including 68 initiatives specific to Indigenous peoples. | ||

(1) |

Where ‘withdrawal’ is defined as water withdrawn and intended for use (in accordance with ‘A Practical Guide to Consistent Water Reporting’, ICMM (2017)). ‘Fresh water’ is defined as waters other than seawater, wastewater from third parties and hypersaline groundwater. Freshwater withdrawal also excludes entrained water that would not be available for other uses. These exclusions have been made to align with the target’s intent to reduce the use of freshwater sources of potential value to other users or the environment. |

(2) |

The FY2017 baseline data has been adjusted to account for: the materiality of the strike affecting water withdrawals at Escondida in FY2017 and improvements to water balance methodologies at WAIO, BMA and BMC and exclusion of hypersaline, wastewater, entrainment, supplies from desalination and Discontinued operations (Onshore US assets) in FY2019 and FY2020. |

(1) |

https://waterriskfilter.panda.org/. |

| • | We do not explore or extract resources within the boundaries of World Heritage listed properties. |

| • | We do not explore or extract resources adjacent to World Heritage listed properties, unless the proposed activity is compatible with the outstanding universal values for which the World Heritage property is listed. |

| • | We do not explore or extract resources within or adjacent to the boundaries of the International Union for Conservation of Nature (IUCN) Protected Areas Categories I to IV, unless a plan is implemented that meets regulatory requirements, takes into account stakeholder expectations and contributes to the values for which the protected area is listed. |

| • | We do not operate where there is a risk of direct impacts to ecosystems that could result in the extinction of an IUCN Red List Threatened Species in the wild. |

| • | We do not dispose of mined waste rock or tailings into a river or marine environment. |

| • | comply with legal requirements and obligations, and our mandatory minimum performance requirements for closure |

| • | achieve safe and stable outcomes and meet approved environment outcomes |

| • | manage pre and post-closure risks (including opportunities) |

| • | progressively reduce obligations, including progressive closure of the area disturbed by our operational footprint |

| • | manage and optimise closure costs |

|

|

|

(1) |

The number of tailings storage facilities (TSFs) is based on the definition agreed to by the ICMM Tailings Advisory Group at the original time of submission and expanded to align with the TSF definition established in the Global Industry Standard for Tailings Management (GISTM). An increase of five TSFs is reported since our Church of England submission in 2019 due to the updated BHP definition of TSF to align with the GISTM. We keep this definition under review. |

(2) |

The Island Copper tailing facility originally disclosed in our Church of England submission in 2019 for the purposes of transparency has been removed as it is not a dam nor considered a TSF under the GISTM definition of a TSF. Tailings at Island Copper were deposited in the ocean under an approved license and environmental impact assessment. This historic practice ceased in the 1990s. We have since committed not to dispose of mine waste rock or tailings in river or marine environments. We continue to conduct environmental effects monitoring. |

(3) |

The following classifications aligned to the CDA classification system. It is important to note that the classification is based on the modelled, hypothetical most significant failure mode and consequences possible without controls, and not on the current physical stability of the dam. |

(4) |

For the purposes of this chart, ANCOLD and other classifications have been converted to their CDA equivalent. |

(5) |

Hamburgo TSF at Escondida is an inactive facility where tailings were deposited into a natural depression. Hamburgo TSF is not considered a dam and is, therefore, not subject to CDA classification, the assessment to determine the GISTM classification will be completed in CY2021. |

(6) |

SP1/2 and SP3 TSF at NSWEC are inactive facilities which have been assessed to have no credible failure modes and are therefore shown as not having a CDA classification. |

(7) |

Seven TSFs are currently under assessment to determine their consequence classification. |

(8) |

“Other” includes dams with a raising method that combines upstream, downstream and centreline or are of in-pit design. |

(9) |

“Inactive” includes facilities not in operational use, under reclamation, reclaimed, closed and/or in post-closure care and maintenance. |