UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Section 240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

P. O. Box 179

300 North Main Street

Moorefield, West Virginia 26836

March 31, 2023

Dear Shareholder:

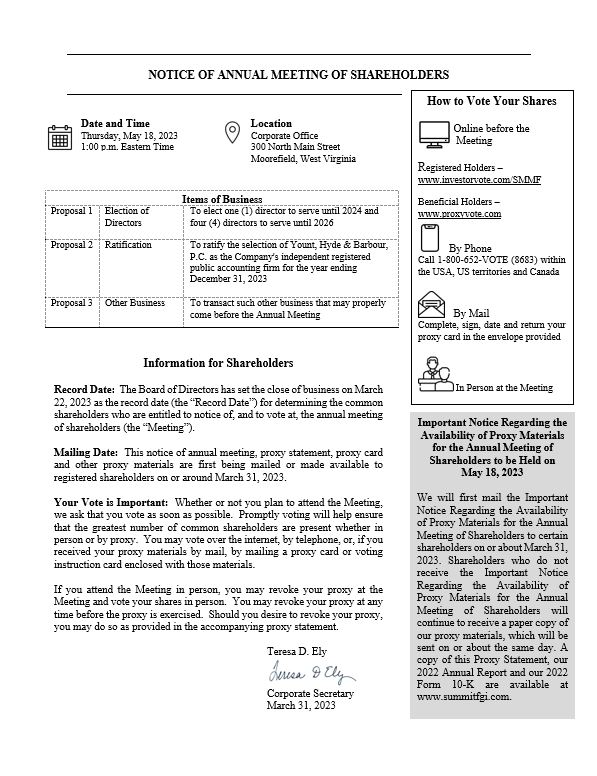

You are cordially invited to attend the Annual Meeting of Shareholders of Summit Financial Group, Inc. (the “Company”), a West Virginia corporation, which will be held on Thursday, May 18, 2023, at 1:00 p.m., EDT at our Company’s corporate office at 300 North Main Street, Moorefield, West Virginia.

This notice of the annual meeting and proxy statement describes the formal business to be transacted at the meeting. We will also report on our operations for the year ended December 31, 2022 and the first quarter of 2023. Your attention is directed to the proxy statement and notice of meeting accompanying this letter for more information regarding the matters proposed to be acted upon at the meeting.

We have elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to certain of our shareholders a notice of internet availability of proxy materials instead of paper copies. The notice contains instructions on how to access documents and vote online. The notice also contains instructions on how shareholders can request a paper copy of the proxy materials. This Proxy Statement, our Annual Report and our 2022 Form 10-K are also available online at www.summitfgi.com. We encourage you to access and review these materials prior to voting. Those who do not receive a notice, including shareholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy by mail unless they have previously requested delivery of materials electronically. We are constantly focused on improving the ways shareholders connect with information about Summit and believe that providing our proxy materials over the Internet increase the ability of our shareholders to connect with the information they need, while reducing the environmental impact of our annual meeting.

Please review the enclosed material and submit your proxy as soon as possible via the Internet, by phone, or if you have requested to receive printed materials, by mailing a proxy card or voting instruction card enclosed with those materials. Your vote is important so that matters coming before the meeting can be acted upon. If you have any questions regarding the information in the proxy materials, please do not hesitate to call Teresa Ely, Director of Shareholder Relations, (304) 530-1000. We are grateful for your continued support of our Board and Summit Financial Group.

Very truly yours,

Oscar M. Bean

Chairman of the Board

TABLE OF CONTENTS

| Page | |

| PROXY STATEMENT | 1 |

| Cost of Proxy Solicitation | 1 |

| Multiple Shareholders Sharing the Same Address | 1 |

| VOTING INFORMATION | 2 |

| Voting Information |

2 |

| Voting on Other Matters | 2 |

| Shareholders Entitled to Vote | 2 |

| PRINCIPAL SHAREHOLDERS | 4 |

| OWNERSHIP OF SECURITIES BY DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS | 4 |

| Delinquent Section 16(a) Reports | 8 |

| ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE | 8 |

| Environmental | 8 |

| Social Responsibility | 8 |

| Corporate Governance | 9 |

| Board Education | 9 |

| Board and Committee Membership | 10 |

| Board Leadership Structure; Lead Independent Director | 10 |

| Board’s Role in Risk Oversight |

10 |

| Board Diversity Matrix as of March 22, 2023 | 11 |

| Human Capital Management | 11 |

| Anti-Hedging Policy | 11 |

| Board Member Attendance at Annual Meeting | 12 |

| Shareholder Communication with Directors | 12 |

| Transactions with Related Persons | 12 |

| Independence of Directors and Nominees | 12 |

| Executive Committee | 13 |

| Audit and Compliance Committee | 13 |

| Compensation and Nominating Committee | 15 |

| Processes and Procedures Relating to Executive Compensation | 15 |

| Policies and Procedures Relating to the Nomination of Directors and Board Diversity | 16 |

| Director Qualifications and Review of Director Nominees | 17 |

| Retirement of Directors | 17 |

| Family Relationships | 18 |

| ITEM 1 - ELECTION OF DIRECTORS | 19 |

| Nominee for the Class Expiring in 2024 | 20 |

| Nominees for the Class Expiring in 2026 | 20 |

| Continuing Directors Whose Terms Expire in 2024 | 22 |

| Continuing Directors Whose Terms Expire in 2025 | 23 |

| EXECUTIVE OFFICERS | 26 |

| PAY VERSUS PERFORMANCE | 27 |

| COMPENSATION DISCUSSION AND ANALYSIS | 33 |

| Executive Compensation Program |

33 |

| Setting Executive Compensation; Peer Group | 34 |

| Plans Covering All Employees | 40 |

| Potential Payments Upon Termination or Change of Control | 41 |

| Compensation of Named Executive Officers | 47 |

| EXECUTIVE COMPENSATION | 48 |

| Summary Compensation Table | 48 |

| Grants of Plan-Based Awards During 2022 | 50 |

| Outstanding Equity Awards at December 31, 2022 | 51 |

| Options Exercised and Stock Vested During 2022 | 52 |

| Pension Benefits | 52 |

| Estimated Payments Upon Termination | 53 |

| Director Compensation 2022 | 57 |

| Pay Ratio | 59 |

| COMPENSATION AND NOMINATING COMMITTEE REPORT | 60 |

| ITEM 2 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 60 |

| AUDIT AND COMPLIANCE COMMITTEE REPORT | 61 |

| Fees to Independent Registered Public Accounting Firm |

62 |

| REQUIREMENTS, INCLUDING DEADLINE FOR SUBMISSION OF SHAREHOLDER PROPOSALS, NOMINATION OF DIRECTORS AND OTHER BUSINESS OF SHAREHOLDERS | 63 |

| Shareholder Proposals for the 2024 Annual Meeting | 63 |

| Nomination of Directors | 63 |

| Stock Transfers | 64 |

| ANNUAL REPORT | 64 |

| FORM 10-K | 65 |

PROXY STATEMENT

of

SUMMIT FINANCIAL GROUP, INC.

300 North Main Street

Moorefield, West Virginia 26836

ANNUAL MEETING OF SHAREHOLDERS

MAY 18, 2023

These proxy materials are delivered in connection with the solicitation by the Board of Directors of Summit Financial Group, Inc. (“Summit,” the “Company,” “we,” or “us”), a West Virginia corporation, of proxies to be voted at our 2023 Annual Meeting of Shareholders and at any adjournment or postponement.

You are invited to attend our Annual Meeting of Shareholders on May 18, 2023, beginning at 1:00 p.m., in Summit Financial Group headquarters on the second floor at 300 North Main Street, Moorefield, WV.

This Proxy Statement, form of proxy and voting instructions are being mailed or made available starting on or about March 31, 2023.

Cost of Proxy Solicitation

We will pay the expenses of soliciting proxies. Proxies may be solicited on our behalf by Directors, officers or employees in person or by telephone, electronic transmission, or by facsimile transmission. Brokers, fiduciaries, custodians and other nominees have been requested to forward solicitation materials to the beneficial owners of the Company’s common stock. Upon request we will reimburse these entities for their reasonable expenses.

Multiple Shareholders Sharing the Same Address

Owners of common stock in street name may receive a notice from their broker or bank stating that only one proxy statement will be delivered to multiple shareholders sharing an address. This practice, known as “householding,” is designed to reduce printing and postage costs. However, if any shareholder residing at such an address wishes to receive a separate proxy statement, he or she may contact Teresa Ely, Director of Shareholder Relations, Summit Financial Group, Inc., P. O. Box 179, Moorefield, West Virginia 26836, or by telephone at (304) 530-1000, or by e-mail at tely@summitfgi.com.

VOTING INFORMATION

Voting Information

Your vote is important. To be valid, your vote must be received by the deadline specified on the proxy card, voting instruction form or Notice of Internet Availability. Shareholders of record may vote using one of the following four methods:

Online, prior to the Annual Meeting:

• Registered holders must go to www.investorvote.com/SMMF and follow the instructions on the website. Votes submitted online must be received by 10:00 a.m. Eastern Time on May 18, 2023.

• Beneficial holders must go to www.proxyvote.com and follow the instructions on the website.

Telephone: Please call toll-free 1-800-652-VOTE (8683) and follow the instructions on the proxy card or voting instruction form.

Mail: You may vote by signing, dating and mailing the enclosed proxy card or the voting instruction form you received.

In Person: You may vote your shares in person at the Annual Meeting.

Shareholders who hold shares through a broker, bank or other nominee are considered the “beneficial owners” of shares held in “street name” and should instruct their nominee to vote their shares by following the instructions provided by the nominee.

Proxies may be revoked at any time before they are exercised by (1) written notice to the Secretary of the Company, (2) timely delivery of a valid, later-dated proxy or (3) voting at the Annual Meeting. If your shares are held by a broker on your behalf (that is, in street name), you must contact your broker or nominee to revoke your proxy.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting in accordance with your instructions. If you sign your proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors.

Voting on Other Matters

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the enclosed form of proxy intend to exercise their discretionary authority in accordance with applicable federal and state laws and regulations to vote on those matters for you. As of the date this Proxy Statement went to press, we did not know of any other matter to be raised at the Annual Meeting.

Shareholders Entitled to Vote

Holders of record of Summit common shares at the close of business on March 22, 2023, are entitled to receive this notice and to vote their shares at the Annual Meeting. As of that date, there were 12,784,168 common shares outstanding, which are held by approximately 1,102 shareholders of record. Each common share is entitled to one vote on each matter properly brought before the Annual Meeting. A majority of the outstanding shares of Summit Financial Group, Inc. will constitute a quorum at the meeting.

Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

A plurality of the votes cast is required for the election of directors. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. Only “FOR” votes will affect the outcome of the election of directors. A properly executed proxy or voting instructions marked “WITHHOLD” with respect to the election of one or more directors will not be counted as a vote cast with respect to the director or directors indicated and will not affect the outcome of the vote, although it will be counted for the purposes of determining whether there is a quorum. Abstentions and broker “non-votes” will be disregarded and will have no effect on the outcome of the vote for the election of directors.

In the election of directors, shareholders cast one (1) vote for each nominee for each share held. However, every shareholder has the right of cumulative voting, electronically or by proxy, in the election of directors. Cumulative voting gives each shareholder the right to aggregate all votes which he or she is entitled to cast in the election of directors and to cast all such votes for one candidate or distribute them among as many candidates and in such a manner as the shareholder desires.

If you wish to exercise, by proxy, your right to cumulative voting in the election of directors, you must provide a proxy showing how your votes are to be distributed among one or more candidates. Unless contrary instructions are given by a shareholder who signs and returns a proxy, all votes for the election of directors represented by such proxy will be divided equally among the nominees for each class. The vote represented by the proxies delivered pursuant to this solicitation, which do not contain any instructions, may be cumulated at the discretion of the Board of Directors of Summit Financial Group, Inc. in order to elect to the Board of Directors the maximum nominees named in this Proxy Statement.

At our 2023 Annual Meeting, the total number of directors to be elected is one (1) to serve a one-year term expiring at our Annual Meeting in 2024 and four (4) in the class whose terms expire at our Annual Meeting in 2026. Each shareholder has the right to cast five (5) votes for each share of stock held on the record date.

For purposes of the ratification of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for the year ended December 31, 2023, an affirmative vote of a majority of the votes cast is required. In determining whether the proposal has received the requisite number of affirmative votes, abstentions and broker “non-votes” will be disregarded and will have no effect on the outcome of the vote.

PRINCIPAL SHAREHOLDERS

The following table lists each shareholder of Summit who is the beneficial owner of more than 5% of Summit’s voting securities as of March 22, 2023.

|

Title of Class |

Name and Address |

Amount and Nature of Beneficial Ownership |

% of Class |

|

Common Stock |

Castle Creek Capital Partners V, LP 6051 El Tordo P. O. Box 1329 Rancho Santa Fe, CA 92067 |

744,731 |

5.84% |

|

Common Stock |

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 |

753,859 (1) |

5.90% |

(1) BlackRock, Inc. holds sole dispositive authority for the 753,859 shares and sole voting authority over 738,851 shares. BlackRock, Inc.’s address and holdings are based solely on a Schedule 13G filing with the Securities and Exchange Commission dated February 1, 2023 made by BlackRock, Inc. setting forth information as of December 31, 2022.

OWNERSHIP OF SECURITIES BY DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS

As of March 22, 2023, Directors, nominees and executive officers as a group owned 1,651,457 shares or 12.88% of the Company’s common stock as indicated on the tables below. The number of shares shown as beneficially owned by each Director and executive officer is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. The information is not necessarily indicative of beneficial ownership for any other purposes.

Unless indicated, to our knowledge, the nominees, other Directors and executive officers named in the tables have sole voting and sole investment power with respect to all shares beneficially owned. As a key employee of the Company, H. Charles Maddy, III may be granted stock options, restricted stock and restricted stock units, performance units, stock settled stock appreciation rights (SARs) and other stock-based awards. Any shares of common stock issuable upon exercise of currently exercisable stock-based awards issued to Mr. Maddy within 60 days of March 22, 2023 are deemed to be outstanding and to be beneficially owned by Mr. Maddy for the purpose of computing his percentage ownership but are not treated as outstanding for the purpose of computing the percentage ownership of any other nominee or Director.

Under the Company’s bylaws, each Director of the Company is required to own stock in his or her own name with a minimum value of at least $500, which is the requirement imposed by West Virginia law. The Company has also adopted a policy that requires that a director own stock equal to the amount required

by West Virginia law to be appointed, and to own at least 2,000 shares of the Company’s common stock within twenty-four months of appointment. Ownership is defined as shares held solely in the Director’s name, shares held through the Company’s employee stock ownership plan, a profit-sharing plan, individual retirement account, retirement plan or similar arrangement, and shares owned by a company where the Director owns a controlling interest. Common shares held jointly by a Director and the Director’s spouse are counted when determining whether a Director owns 2,000 shares of the Company’s stock as long as the Director owns stock in his or her own name in the amount required by West Virginia law. Directors who are also employees of the Company or its subsidiaries are exempt from this requirement.

The number of shares of common stock of the Company beneficially owned by such Directors are set forth in the following table.

| Amount of Beneficial Ownership of Summit's Common Stock as of March 22, 2023 | ||||

| Name of Director |

Number of Shares |

Percent of Class |

||

|

Oscar M. Bean |

106,436(1) |

* |

||

|

Ronald L. Bowling |

9,000 |

* |

||

|

J. Scott Bridgeforth |

7,310(2) |

* |

||

|

James M. Cookman |

26,740 |

* |

||

|

John W. Crites II |

144,526(3) |

1.13% |

||

|

James P. Geary II |

37,886(4) |

* |

||

|

Georgette R. George |

255,297(5) |

2.00% |

||

|

Gary L. Hinkle |

511,799(6) |

4.00% |

||

|

Jason A. Kitzmiller |

22,685 |

* |

||

|

H. Charles Maddy, III |

119,493(7) |

* |

||

|

Charles S. Piccirillo |

45,479(8) |

* |

||

|

John H. Shott |

10,208 |

* |

||

|

Ronald B. Spencer |

195,168(9) |

1.53% |

||

|

Jill S. Upson |

357 |

* |

||

(1) Includes 23,344 shares owned by spouse.

(2) Includes 1,150 shares owned by spouse.

(3) Includes 90,555 shares in three subtrusts created for the benefit of children.

(4) Includes 7,213 shares owned by spouse.

(5) Includes 41,707 shares owned by self-directed IRA FBO spouse, 76,785 shares held by George Brothers Investment Partnership, 19,228 shares held by Sellaro Enterprises, Inc. and 77,973 held by the Leroy Rashid Estate.

(6) Includes 409,854 shares owned by Joint Revocable Trust, 63,853 shares owned by Hinkle Trucking, Inc., 4,800 shares owned by spouse, 528 shares owned as custodian for Grandchild, 13,220 shares held by H.T. Services.

(7) Includes 38,850 shares owned by spouse, 30,072 vested shares held in Company's ESOP and 9,321 securities underlying vested SARs.

(8) Includes 600 shares owned by spouse and 9,614 shares held by Auggus Enterprises.

(9) Includes 1,368 shares owned by spouse and 93,708 shares owned by a Trust FBO Ronald B Spencer.

* Indicates director owns less than 1% of the Company’s common stock.

The number of shares of common stock of the Company beneficially owned by the Company’s Executive Officers are set forth in the following table. Shares of common stock issuable upon exercise of currently exercisable stock-settled stock appreciation rights (SARs) within 60 days of March 22, 2023, are deemed to be outstanding and to be beneficially owned by the Executive Officer holding the SARs for the purpose of computing the percentage ownership of that Executive Officer but are not treated as outstanding for the purpose of computing the percentage ownership of the other Executive Officers.

| Amount of Beneficial Ownership of Summit's Common Stock as of March 22, 2023 | |||

| Name of Executive Officer |

Number of Shares(10) |

Percent of Class |

|

|

H. Charles Maddy, III |

119,493(1) |

* |

|

|

Robert S. Tissue |

82,538(2) |

* |

|

|

Patrick N. Frye |

37,365(3) |

* |

|

|

Scott C. Jennings |

33,539(4) |

* |

|

|

Bradford E. Ritchie |

37,813(5) |

* |

|

|

Patricia L. Owens |

15,050(6) |

* |

|

|

Danyl R. Freeman |

12,747(7) |

* |

|

|

Julie R. Markwood |

16,355(8) |

* |

|

|

Joseph W. Hager |

1,638(9) |

* |

|

(1) Includes 38,850 shares owned by spouse, 30,072 fully vested shares held in Company's ESOP and 9,321 securities underlying vested SARs.

(2) Includes 740 shares owned by self-directed IRA FBO spouse, 17,001 fully vested shares held in Company's ESOP and 4,800 securities underlying vested SARs.

(3) Includes 1,500 shares owned as custodian for grandchildren, 13,335 fully vested shares held in Company's ESOP, and 1,570 securities underlying vested SARs. 10,000 shares are pledged as collateral.

(4) Includes 11,956 fully vested shares held in Company's ESOP and 8,000 securities underlying vested SARs.

(5) Includes 8,403 fully vested shares held in Company's ESOP and 7,628 securities underlying vested SARs. 6,000 shares are pledged as collateral.

(6) Includes 5,347 fully vested shares held in Company's ESOP and 4,012 securities underlying vested SARs.

(7) Includes 10,704 fully vested shares held in Company's ESOP.

(8) Includes 253 shares owed as custodian for child, and12,041 fully vested shares held in Company’s ESOP.

(9) Includes 1,638 fully vested shares held in the Company’s ESOP.

(10) For purposes of the above table the number of shares of common stock that would be issuable under the vested SARs awarded in 2015 is based on the market price of the Company’s stock as of March 22, 2023 of $21.67 and the strike price of $12.01, the fair market value of the Company’s stock as of April 23, 2015, the date of grant of the SARs. The number of shares of common stock that would be issuable under the vested SARs awarded on February 9, 2017 is based on the market price of the Company’s stock as of March 22, 2023 of $21.67 and the strike price of $26.01, the fair market value of the Company’s stock as of February 9, 2017, the date of grant of the SARs. The number of shares of common stock that would be issuable under the vested SARs awarded on February 7, 2019 is based on the market price of the Company’s stock as of March 22, 2023 of $21.67 and the strike price of $23.94, the fair market value of the Company’s stock as of February 7, 2019, the date of grant of the SARs. The number of shares of common stock that would be issuable under the vested SARs awarded on July 15, 2021 is based on the market price of the Company’s stock as of March 22, 2023 of $21.67 and the strike price of $21.85, the fair market value of the Company’s stock as of July 15, 2021, the date of grant of the SARs.

* Indicates executive officer owns less than 1% of the Company’s common stock.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 and SEC regulations require the Company’s directors and executive officers and greater than ten percent shareholders to file reports of ownership on Form 3 and changes in ownership on Forms 4 or 5 with the SEC. Based solely on our review of copies of such reports received and/or written representations from such directors and executive officers and ten percent shareholders, the Company believes that all Section 16(a) filing requirements applicable to its directors, executive officers and ten percent shareholders were complied with during fiscal year 2022 except for Gary Hinkle and James M. Cookman who each had one late filing relating to one transaction.

ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE

The Company is mindful of its responsibilities in addressing environmental, social and governance practices that promote sustainability, social responsibility, and sound governance. We have highlighted below certain key components of our commitment to those areas, though they are not all inclusive and do not delineate all of such initiatives. Additionally, in 2022, the Board established an Environmental Social and Governance (ESG) Committee, which is a management level committee comprising of senior members across major functions of the Company. The ESG committee reports directly to the Board of Directors on its efforts and initiatives in these areas. For further information on this commitment, see our “Environmental, Social and Governance Report” that appears on our website at www.summitfgi.com.

Environmental

The Company is dedicated to good environmental stewardship and believes that companies have an obligation for sustainable profitability. As a community banking organization, we care about our customers and our communities. The Company believes all people deserve equal access to clean air, water, and a safe and healthy environment. Injustices exist in many forms and the impacts of climate change are largely determined by the population's vulnerability and resilience. The Company acknowledges the focused effort required to address climate risk and in doing our part to minimize our environmental impact we have several programs that help to reduce our carbon footprint.

The Company is incorporating environmental goals into the methods we use to build and renovate our buildings. The Company’s management team has adopted the plan to reduce square footage of any new bank locations, as compared to our legacy facilities, and increase technology allowing us to serve clients in a more environmentally efficient manner. Our Environmental Social and Governance Report provides detail on the initiatives taken at our facilities to make our operations more sustainable and to reduce our carbon footprint as well as the technology we have implemented and the digital products we offer to customers to promote efficiency and reduce paper waste.

Social Responsibility

Through its banking subsidiary, Summit Community Bank, the Company supports its community through community development loans, investments in community development projects, donations to non-profit organizations, charitable enterprises and community organizations and community service projects performed by employees. In 2022, Summit Community Bank made approximately $31.8 million in community development loans, invested $50.2 million in qualified community development projects, and donated approximately $292,000 to various charities, community organizations, food pantries and schools.

In 2022, the employees of the Company and Summit Community Bank devoted over 10,000 hours volunteering in the local communities across the Company’s footprint. Please see our Environmental Social and Governance Report to obtain additional information on how the Company and Summit Community Bank support our community.

Corporate Governance

The Company is committed to maintaining strong corporate governance and operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. The Sarbanes-Oxley Act of 2002, among other things, establishes a number of corporate governance standards and disclosure requirements. In addition, the Company is subject to the corporate governance and Marketplace Rules promulgated by NASDAQ. In light of the requirements of the Sarbanes-Oxley Act of 2002 and the NASDAQ corporate governance and Marketplace Rules, Summit has a Compensation and Nominating Committee and an Audit and Compliance Committee, all of the members of which are independent as defined by the NASDAQ listing standards and the SEC rules. The Compensation and Nominating Committee and the Audit and Compliance Committee have each adopted charters which are reviewed and assessed on an annual basis. The Company has adopted a Code of Ethics that applies to all directors, executive officers and employees of Summit Financial Group, Inc. and its subsidiaries. The Code of Ethics also contains supplemental provisions that apply to the Company’s Chief Executive Officer, the Chief Financial Officer, and the Chief Accounting Officer (the “Senior Financial Officers”). In addition, the Code of Ethics contains procedures for reporting violations of the Code of Ethics involving the Company’s financial statements and disclosures, accounting practices, internal control over financial reporting, disclosure controls and auditing matters. A copy of the Code of Ethics is available on the Company’s website at www.summitfgi.com.

Board Education

The Company provides onboarding for new directors and an opportunity for education and training for all board members to foster board effectiveness. In-house educational sessions are provided to all directors annually with subjects covering:

• Bank Secrecy Act (BSA)/Anti-Money Laundering (AML)

• Fair Lending

• Unfair, Deceptive, or Abusive Acts or Practices (UDAAP)

• Home Mortgage Disclosure Act

• Insider Lending

• Complaints

• Regulation BB – Community Reinvestment Act

Additional topics may be included as appropriate related to products, services or lines of business that have potential risk to the Company and other topics as identified by the board of directors or management from time-to-time.

Board members are also provided opportunities for external director education covering a range of issues facing the board to assist directors in staying abreast of the latest developments. External education opportunities are offered at various times of the year by professional organizations.

Board and Committee Membership

During 2022, the Board of Directors met ten (10) times. All of our Directors attended 75% or more of the meetings of the Board and the meetings held by committees of the Board on which the directors served in 2022.

The Company has a standing Executive Committee, Audit and Compliance Committee, Compensation and Nominating Committee, Equity Compensation Committee, Asset/Liability and Funds Management Committee, ESOP/401(K) Committee and Environmental Social and Governance Committee.

Board Leadership Structure; Lead Independent Director

The Board of Directors of the Company is led by a Chairman and Lead Independent Director who is not the Chief Executive Officer. Oscar M. Bean currently serves as the Chairman of the Board and Lead Independent Director and H. Charles Maddy, III is the Company’s Chief Executive Officer. The Board believes that it is important to formally separate the roles of Chairman of the Board of Directors and the Chief Executive Officer. The separation of these roles results in a more effective monitoring and objective evaluation of the Chief Executive Officer’s performance. The Board also believes that directors will be more likely to challenge the Chief Executive Officer if the Chief Executive Officer is not the Chairman of the Board. As Chairman of the Board and lead independent Director, Mr. Bean presides over all Board meetings. The Lead Independent Director has the responsibility of meeting and consulting with the Chief Executive Officer regarding the Board and committee meeting agendas, acting as a liaison between management and the non-management directors, including maintaining frequent contact with the Chief Executive Officer and advising him on the efficiency of the Board meetings, and facilitating teamwork and communication between the non-management directors and management.

Board’s Role in Risk Oversight

The Board is active in overseeing management in the execution of its responsibilities and for assessing the Company’s approach to risk management. The Board exercises these responsibilities as part of its meetings and also through adoption of policies and the Board’s committees, each of which examines various components of risk as part of their responsibilities. The Chief Risk Officer reports directly to the Chief Executive Officer and is responsible for assessing and managing the Company’s various exposures to risk on a day-to-day basis, including the creation of appropriate risk management programs and policies.

The Board’s role in the Company’s risk oversight process includes receiving regular reports from members of senior management and reports from committees of the Board on areas of material risk to the Company, including operational, cybersecurity, market, credit, financial, legal and regulatory risks. This enables the Board, senior management, and the committees of the Board to coordinate the risk oversight role, particularly with respect to risk interrelationships.

The Company has a Disclosure Committee of executive management, which meets quarterly with internal audit, Chief Risk Officer and representatives of the Company’s independent auditor to review material disclosures in the Company’s financial statements prior to their release. This Committee submits a quarterly report to the Audit and Compliance Committee. The Board also receives regular reports from the chairs of the Audit and Compliance Committee and Asset Liability Management Committee. The internal director of audit reports directly to the Audit and Compliance Committee.

In addition, an overall review of risk is inherent in the Board’s consideration of the Company’s long-term strategies and in the transactions and other matters presented to the Board, including capital expenditures, acquisitions and divestitures, and financial matters.

|

BOARD DIVERSITY MATRIX AS OF MARCH 22, 2023 |

||||

|

Total Number of Directors |

14 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|

|

Part I: Gender Identity |

||||

|

Directors |

2 |

12 |

- |

- |

|

Part II: Demographic Background |

||||

|

African American or Black |

1 |

- |

- |

- |

|

White |

1 |

12 |

- |

- |

|

LGBTQ+ |

- |

|||

|

Did Not Disclose Demographic Background |

- |

|||

|

Directors who are Military Veterans |

1 |

|||

Human Capital Management

The Board and its committees review and discuss with management matters related to human capital management, including the Company’s commitments and progress on diversity and inclusion, compensation and benefits, business conduct and compliance, and executive succession planning.

As discussed in more detail in the Company’s Form 10-K included in the 2022 Annual Report and the Company’s Environmental, Social and Governance Report located on the Company’s website at www.summitfgi.com, the Company focuses on competitive compensation and benefits to attract and retain the best employees, including the ability to participate in our 401(k) defined contribution plan and Employee Stock Ownership Plan as further discussed on page 40. The Company also supports professional development and on the job training to help our team members improve their skills to prepare them for advancement within the Company. We support work-life balance by offering paid time off for vacation, holidays, sick leave, and bereavement.

Summit values diversity in our employees, customers, suppliers, marketplace, and community. We believe employing a diverse workforce that is reflective of our customers and the communities that we serve helps us to better identify and deliver ‘Service Beyond Expectations’ to meet our customers’ and communities’ particular financial needs. Consistent with these efforts, 79% of our workforce is gender/racial diverse. Our workforce reflects the demographics of our Company’s footprint.

Anti-Hedging Policy

All of the Company’s directors, officers and employees are subject to the Summit Financial Group, Inc. Company Stock Transaction Policy. This policy provides that it is improper and inappropriate for any director, officer or other employee of the Company to engage in short-term or speculative transactions in the Company’s securities. Specifically, the policy discourages directors and officers and other employees and prohibits insiders from engaging in short-term trading and short sales of the Company’s securities. The policy also discourages directors, officers and employees from engaging in transactions in the Company’s stock in puts, calls or other derivative securities on an exchange or in any other organized market and from holding the Company’s securities in a margin account. In addition to the above-mentioned transactions, the Company also prohibits directors, officers and employees from engaging in any form of hedging strategy through which such person’s investment position would be improved as a result of a decrease in the value of the Company’s stock.

Board Member Attendance at Annual Meeting

The Company does not have a policy with regard to directors’ attendance at annual meetings. Eight (8) of fourteen (14) incumbent members of the Board of Directors attended the 2022 Annual Meeting of Shareholders.

Shareholder Communication with Directors

The Board of Directors of the Company provides a process for shareholders to send communications to the Board of Directors or to any of the individual Directors. Shareholders may send written communications to the Board of Directors or to any of individual Director c/o Corporate Secretary at the following address: Summit Financial Group, Inc., P. O. Box 179, 300 North Main Street, Moorefield, West Virginia 26836. All communications will be compiled by the Corporate Secretary of the Company and submitted to the Board of Directors or to the individual Directors on a periodic basis.

Transactions with Related Persons

The Company has written policies and procedures for review, approval and monitoring of transactions involving the Company and “related persons” (directors, nominees for director, and executive officers or their immediate families, or shareholders owning five percent or greater of the Company’s outstanding voting stock). The policy covers any related person transaction that meets the minimum threshold for disclosure in the proxy statement under the relevant SEC rules (generally, transactions involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest).

Directors and executive officers of the Company and its subsidiaries, members of their immediate families, and business organizations and individuals associated with them have been customers of, and have had normal banking transactions with Summit Community Bank. All such transactions were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to Summit and did not involve more than the normal risk of collectability or present other unfavorable features. Loans made to directors and executive officers are in compliance with federal banking regulations and are thereby exempt from insider loan prohibitions included in the Sarbanes-Oxley Act of 2002.

The Board of Directors reviewed all transactions with related parties since January 1, 2022, to determine if such transactions were required to be reported in this Proxy Statement. The Company has not entered into any transactions with related persons since January 1, 2022, that met the threshold for disclosure in this Proxy Statement under the relevant SEC rules, nor has the Company entered into a current transaction, in which the amount of the transaction exceeds the threshold for disclosure in this Proxy Statement under relevant SEC rules and in which a related person had or will have a direct or indirect material interest.

Independence of Directors and Nominees

The Board of Directors annually reviews the relationships of each of its members with the Company to determine whether each director is independent. This determination is based on both subjective and objective criteria developed by the NASDAQ listing standards and the SEC rules.

The Board of Directors reviewed the directors’ responses to a questionnaire asking about their relationships with the Company (and those of their immediate family members) and other potential conflicts

of interest, as well as information provided by management related to transactions, relationships, or arrangements between the Company and the directors or parties related to the directors in order to determine the independence of the current members of the Board of Directors and the nominees for election as a director of the Company.

Based on the subjective and objective criteria developed by the NASDAQ listing standards and the SEC rules, the Board of Directors determined that the following nominees and current members of the Board of Directors are independent: Oscar M. Bean, Ronald L. Bowling, J. Scott Bridgeforth, James M. Cookman, John W. Crites, II, James P. Geary, II, Georgette R. George, Gary L. Hinkle, Jason A. Kitzmiller, Charles S. Piccirillo, John H. Shott, Ronald B. Spencer and Jill S. Upson. H. Charles Maddy, III is not independent because he is an executive officer of the Company.

The NASDAQ listing standards contain additional requirements for members of the Compensation and Nominating Committee and the Audit and Compliance Committee. All of the directors serving on each of these committees are independent under the additional requirements applicable to such committees.

The Board considered the following relationships in evaluating the independence of the Company’s Directors and determined that none of the relationships constitute a material relationship with the Company and each of the relationships satisfied the standards for independence:

• Summit Community Bank, Inc., a subsidiary of the Company, provided lending and/or other financial services to each member of the Company’s Board of Directors, their immediate family members, and/or their affiliated organizations during 2022 and 2021 in the ordinary course of business and on substantially the same terms as those available to unrelated parties; and

• Oscar M. Bean, James P. Geary, II, Charlie S. Piccirillo and Georgette George’s husband are partners of law firms that received payments for legal services provided to the Company or its subsidiaries during 2022 and 2021. The legal fees received were less than 1% of each of the law firms’ and Summit’s revenues in 2022 and 2021. Each law firm received less than $10,000 in legal fees from the Company and its subsidiaries in 2022 and 2021, except for Geary and Geary who received $11,803 in legal fees in 2021.

Executive Committee

The Executive Committee, on an as needed basis, approves loans above specified limits and performs such duties and exercises such powers as delegated to it by the Company’s Board of Directors. The current members of the Company’s Executive Committee are Oscar M. Bean, Chairman, John W. Crites, II, James P. Geary, II, Georgette R. George, Gary L. Hinkle, H. Charles Maddy, III and Charles S. Piccirillo. The Executive Committee met two times in 2022.

Audit and Compliance Committee

The Audit and Compliance Committee’s primary function is to assist the Board of Directors in fulfilling its oversight responsibilities to ensure the quality and integrity of Summit’s financial reports. This entails:

• Serving as an independent and objective party to monitor the Company’s financial reporting process and internal control system.

• Providing direction to and oversight of the Company’s internal audit function.

• Reviewing and appraising the efforts of the Company’s independent auditors.

• Maintaining a free and open means of communication between directors, internal audit staff, independent auditors, and management.

The Audit and Compliance Committee has adopted a written charter, a copy of which is available on the Company’s web site at www.summitfgi.com. The Audit and Compliance Committee charter requires that the committee be comprised of five (5) or more directors. The Audit and Compliance Committee met four times in 2022.

Current members of this committee are John W. Crites, II, Chairman, Georgette R. George, Gary L. Hinkle, Jason A. Kitzmiller, Charles S. Piccirillo and Ronald B. Spencer. All members of the Audit and Compliance Committee are independent, as independence is defined under the NASDAQ listing standards.

Pursuant to the provisions of the Sarbanes-Oxley Act, which was enacted in 2002, the SEC adopted rules requiring companies to disclose whether or not at least one member of the Audit and Compliance Committee is an “audit committee financial expert” as defined in such rules.

Under the SEC rules, an “audit committee financial expert” has the following attributes:

• An understanding of generally accepted accounting principles and financial statements;

• An ability to assess the general application of accounting principles generally accepted in the United States of America in connection with the accounting for estimates, accruals and reserves;

• Experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can be expected to be raised by the Company’s financial statements, or experience actively supervising one or more persons engaged in such activities;

• An understanding of internal controls and procedures for financial reporting; and

• An understanding of audit committee functions.

A person must possess all of the above attributes to qualify as an audit committee financial expert.

Based on Director Questionnaires, the Board of Directors has determined that John W. Crites, II of the Audit and Compliance Committee possesses all of the above five attributes so as to be deemed “audit committee financial expert” under the SEC rules.

In addition, John W. Crites, II and Gary L. Hinkle each qualify as a “financial expert” under the NASDAQ Marketplace Rules, which standards are different from the SEC rules. Under the NASDAQ Marketplace Rules, a “financial expert” must have past employment experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background which results in the individual’s financial sophistication, including being a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. Mr. Crites and Mr. Hinkle have the necessary experience to qualify them as “financial experts” under the NASDAQ Marketplace Rules.

For information concerning the audit fees paid by the Company in 2022 and for information about the Company’s independent auditors generally, see the Audit and Compliance Committee Report on page 62 of these Annual Meeting materials.

Compensation and Nominating Committee

The Compensation and Nominating Committee must consist of a minimum of four (4) independent, outside directors. Current members of the Compensation and Nominating Committee are Oscar M. Bean, Chairman, James M. Cookman, John W. Crites, II, James P. Geary, II, Gary L. Hinkle and Charles S. Piccirillo. The Equity Compensation Committee is a sub-committee of the Compensation and Nominating Committee and consists of the following members: Oscar M. Bean, James M. Cookman, John W. Crites, II, Gary L. Hinkle and Charles S. Piccirillo.

The Compensation and Nominating Committee has adopted a written charter, a copy of which is available on the Company’s website at www.summitfgi.com.

The Committee meets at scheduled times during the year as required, generally one to two times. The Committee reports on Committee actions at Board meetings. The Committee has the authority to retain outside counsel and any other advisors as the Company may deem appropriate in its sole discretion. The Compensation and Nominating Committee met one time in 2022.

Processes and Procedures Relating to Executive Compensation

One purpose of the Compensation and Nominating Committee is to review, approve and report to the Board of Directors the compensation of all executive officers of the Company who are subject to the requirements of Section 16 of the Securities Exchange Act of 1934 (the “Executive Officers”), including salaries and bonuses, and to approve and report to the Board of Directors all other incentive and equity compensation awards. The Compensation and Nominating Committee also annually reviews the Board Attendance and Compensation Policy which includes the compensation paid to the Board of Directors. The Compensation and Nominating Committee recommends any revisions to the Board Attendance and Compensation Policy to the full Board of Directors for approval. The Committee’s primary processes and procedures for carrying out these purposes include:

• Scope of Authority. The Committee has the following duties and responsibilities:

• Annually review and approve corporate goals and objectives relevant to compensation of the Chief Executive Officer (the “CEO”) established by the Board of Directors, evaluate the CEO’s performance in light of these goals and objectives, and review, approve and report to the Board of Directors all compensation arrangements, including base salary, incentive compensation and long-term compensation for the CEO.

• Annually review, approve and report to the Board of Directors all compensation arrangements, including base salary, incentive compensation and long-term compensation, for all other Executive Officers.

• Review, approve and report to the Board of Directors compensation packages for new Executive Officers and termination packages for Executive Officers.

• Review and make recommendations to the Board of Directors for ratification decisions relating to long-term incentive compensation plans, including the use of equity-based plans. Except as otherwise delegated by the Board of Directors, the Equity Compensation Committee acts on behalf of the Board of Directors and the Compensation and Nominating Committee as the “committee” established to administer equity-based and employee benefit plans, and as such, discharges any responsibilities imposed on the committee under those plans, including making and authorizing grants in accordance with the terms of those plans. All such grants must be ratified by the Board of Directors.

• Make recommendations to the Board of Directors with respect to matters relating to incentive compensation and equity-based plans which are appropriate for action by the Board of Directors under applicable NASDAQ and SEC rules.

• Oversee the Company’s compliance with SEC rules and regulations regarding shareholder approval of certain executive compensation matters, including advisory votes on executive compensation and the frequency of such votes.

• Review all director compensation and benefits for service on the Board and Board committees and recommend any changes to the Board as necessary.

• Delegation of Authority. The Committee has the authority to delegate any of its responsibilities to subcommittees as the Committee may deem appropriate.

• Role of Executive Officers. The Chief Executive Officer provides the Committee with a verbal performance assessment and compensation recommendation for each of the other Executive Officers. In addition to the following items, these performance assessments and recommendations are considered by the Committee in reviewing, approving and reporting to the Board the compensation arrangements of each Executive Officer other than the CEO: (i) an assessment of the Company’s performance, (ii) the perquisites provided to the Executive Officers, (iii) the salaries paid by a peer group to executive officers holding equivalent positions, (iv) tally sheets showing the aggregate amount of all components of compensation paid to the Executive Officers, and (v) the complexity of the job duties of each Executive Officer.

• Role of Independent Consultant. The Committee has the authority to retain any advisors as the Committee deems appropriate in carrying out its duties, but only after taking into consideration factors relevant to the advisor’s independence from management specified in the NASDAQ listing standards. The Committee has not retained the services of an independent consultant in reviewing and approving the form and amount of executive and director compensation.

Policies and Procedures Relating to the Nomination of Directors and Board Diversity

The Compensation and Nominating Committee assists the Board in (i) identifying qualified individuals to become board members, (ii) determining the composition of the Board of Directors and its committees, (iii) monitoring a process to assess board effectiveness, and (iv) developing and implementing the Company’s corporate governance guidelines.

In determining nominees for the Board of Directors, the Compensation and Nominating Committee selects individuals who have the highest personal and professional integrity and who have demonstrated exceptional ability and judgment. The Committee also selects individuals who are most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the shareholders. In identifying first-time nominees for director, or evaluating individuals recommended by shareholders, the Compensation and Nominating Committee determines, in its sole discretion, whether an individual meets the minimum qualifications approved by the Board of Directors and may consider the current composition of the Board of Directors in light of the diverse communities served by the Company and the interplay of the candidate’s experience with the experience of other Board members.

In performing its responsibilities for identifying, recruiting and recommending nominees for director, the Compensation and Nominating Committee will consider all aspects of each candidate’s qualifications and skills in the context of the needs of the Company at that time with a view to creating a Board with a diversity of experience and perspectives, including diversity with respect to race, gender, geography and areas of expertise. In 2021, the Compensation and Nominating Committee committed to

increase the diversity of the Board and amended its charter to expand the definition of diversity of board experience and perspectives to include ethnicity, nationality, sexual orientation, disabilities and cultural background. The Compensation and Nominating Committee achieved its goal of increasing diversity. The Company currently has two women, one of whom is diverse, on its Board of Directors. The Company has also added a question to its Director and Officer Questionnaire to require directors and officers to self-identify diverse characteristics to allow the Company to assess and track this information. This will allow the Company to monitor its progress in promoting diversity of the Board of Directors as well as diversity of the Company’s management.

The Compensation and Nominating Committee does not have a specific policy with regard to the consideration of persons nominated for Directors by shareholders. The Articles of Incorporation of the Company describe the procedures that a shareholder must follow to nominate persons for election as Directors. For more information regarding these procedures, see Requirements, Including Deadline for Submission of Shareholder Proposals, Nomination of Directors and Other Business of Shareholders on page 63 of these Annual Meeting materials. The Compensation and Nominating Committee will consider nominees for Director recommended by shareholders provided the procedures set forth in the Articles of Incorporation of the Company are followed by shareholders in submitting recommendations. The Committee does not intend to alter the manner in which it evaluates nominees, including the minimum criteria set forth above, based on whether the candidate was recommended by a shareholder or not.

Director Qualifications and Review of Director Nominees

In connection with the Director nominations for the 2023 Annual Meeting, the Compensation and Nominating Committee considered the Nominee’s and the Continuing Directors’ roles in identifying and understanding the Company’s risks and overseeing the Company’s compliance with its risk management program. These considerations were in addition to the qualifications, skills and attributes described above that are considered by the Compensation and Nominating Committee in selecting Nominees for the Board of Directors.

In addition to fulfilling the above criteria, all of the Nominees for election as directors are independent under the NASDAQ listing standards and the SEC rules. All of the directors whose terms expire in 2024 and 2025 (the “Continuing Directors”) are independent under the NASDAQ listing standards and the SEC rules except H. Charles Maddy, III. Mr. Maddy is not independent as he is an executive officer and employee of the Company.

Each Nominee and Continuing Director brings a strong and unique background and set of skills to the Board providing the Board as a whole competence and experience in a wide variety of areas including banking, accounting, audit and financial reporting, legal, finance, renewable energy, governmental relations, business management, contracting, insurance, timber, transportation, farming, hospitality and retail.

Retirement of Directors

Members of the Board of Directors of Summit and its subsidiaries are subject to a mandatory retirement age of 75. When a Summit or subsidiary bank board member reaches age 75, he/she will not be renominated. If a Summit or subsidiary bank board member would attain the age of 75 at any time during his or her three-year term, then such director will be nominated for such lesser term so as to comply with the mandatory retirement age. The only permissible exception to the mandatory retirement age is for any member of the Board of Directors of Summit or any of its subsidiaries who remains an active employee of Summit or any of its subsidiaries. We have not yet granted any exceptions. Because Mr. Shott will attain the age of 75 in 2024, he is only being nominated for a one-year term, expiring at the 2024 Annual Meeting.

Family Relationships

There are no family relationships between any director, executive officer or nominee for director.

ITEM 1 – ELECTION OF DIRECTORS

The Board of Directors is divided into three (3) classes. The terms of the Directors in each class expire at successive annual meetings. One (1) Director will be elected at our 2023 Annual Meeting to serve a one-year term expiring at our Annual Meeting in 2024. Four (4) Directors will be elected at our 2023 Annual Meeting to serve a three-year term expiring at our Annual meeting in 2026, provided that David H. Wilson Sr.’s appointment as a member of the Board of Directors is contingent on the closing of the merger of PSB Holding Corp. (“PSB”) with and into Summit (the “Merger”). If the proposed nominees are elected, the Company will have a Board of Directors consisting of one class of four (4) directors, one class of six (6) directors and one class of five (5) directors.

The persons named in the enclosed proxy intend to vote the proxy for the election of each of the five (5) nominees, unless you indicate on the proxy card that your vote should be withheld from any or all of such nominees. Each nominee elected as a Director will continue in office until his or her successor has been elected, or until his or her death, resignation or retirement.

The Board of Directors has proposed John H. Shott for election as Director, with a one-year term expiring at our Annual Meeting in 2024. The Board of Directors has proposed the following nominees for election as Directors, with three-year terms expiring at the Annual Meeting in 2026: Ronald L. Bowling, J. Scott Bridgeforth, Georgette R. George and David H. Wilson, Sr., provided, that, Mr. Wilson’s appointment as a Director is contingent on the close of the Merger prior to the 2023 Annual Meeting. All of the nominees were recommended by the Compensation and Nominating Committee and approved by the Board of Directors of the Company. Each of the nominees except for Mr. Wilson are Directors standing for re-election.

The Board of Directors recommends a vote FOR the election of these nominees for election as Directors.

We expect each nominee for election as a Director to be able to serve if elected. David H. Wilson’s appointment to the Board of Directors is contingent upon the closing of the Merger prior to the 2023 Annual Meeting of Shareholders. It is anticipated that the Merger will close on April 1, 2023. As of the date of the mailing of this Proxy Statement, all of the regulatory applications required for the closing of the Merger have been obtained. The PSB shareholders approved the Merger at the special shareholder meeting held on March 16, 2023. However, Mr. Wilson will not serve as a director unless and until the Merger closes, even if shareholders vote to elect him at the 2023 Annual Meeting. To the extent permitted by applicable law, if any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board chooses to reduce the number of Directors serving on the Board.

The principal occupation, experience, qualifications, skills, and other attributes considered by the Board in concluding that the nominees and other Directors whose terms of office continue after the Annual Meeting are qualified to serve as Directors of the Company are set forth below on the following pages 20-25.

Nominee for the Class Expiring in 2024

|

Name |

Age as of the May 18, 2023 Meeting Date |

Year First Elected Director |

|

John H. Shott |

74 |

2017 |

John H. Shott has served as a member of the Board of Directors of the Company and Summit’s banking subsidiary since April 2017. Mr. Shott practiced law from September 1975 until 2015. Mr. Shott served as a member of the West Virginia House of Delegates from 2010 through 2020 and was Chairman of its Judiciary Committee from 2014 through 2020. Mr. Shott served on the former First Century Bankshares, Inc. Board of Directors since 1999 where he served as a member of its Compensation Committee and the Trust Committee of First Century Bank, First Century Bankshares, Inc.’s banking subsidiary. Mr. Shott brings to our Board relevant experience with legal and regulatory compliance issues. Mr. Shott obtained his law degree from the University of North Carolina, Chapel Hill. Mr. Shott is also a member of the Board of Directors of several non-profit entities and community organizations. Mr. Shott is a member of the Asset/Liability and Funds Management Committee and the ESOP/401(K) Committee.

Nominees for the Class Expiring in 2026

|

Name |

Age as of the May 18, 2023 Meeting Date |

Year First Elected Director |

|

Ronald L. Bowling |

69 |

2020 |

|

J. Scott Bridgeforth |

59 |

2011 |

|

Georgette R. George |

62 |

2010 |

|

David H. Wilson, Sr. |

64 |

New Nominee |

Ronald L. Bowling has served as a member of the Board of Directors since January 1, 2020. Mr. Bowling served as Market President for Summit’s banking subsidiary from January 1, 2019 to December 31, 2019. Mr. Bowling was past Chairman, President, CEO and Director of the former First Peoples Bank from April 2011 to December 31, 2018. Mr. Bowling has over 46 years of banking experience. Mr. Bowling received his Bachelor of Science degree in business administration with a concentration in accounting from Concord College and is a licensed Certified Public Accountant. Mr. Bowling is the past president and director of the West Virginia Community Bankers Association, past director of the Wyoming County Economic Development Authority and past director of the West Virginia Bankers Association. Mr. Bowling is a member of the Wyoming County Council on Aging and Director of the City of Mullens Foundation. Mr. Bowling is a member of the ESOP/401(k) Committee and the Asset/Liability and Funds Management Committee.

J. Scott Bridgeforth has served as a member of the Board of Directors since 2011. Mr. Bridgeforth has served as a member of the Board of Directors of Summit’s banking subsidiary since 1999. Mr. Bridgeforth is currently the owner and Vice-President of Royal Crown Bottling Company of Winchester, Inc. and Royal Crown Bottling Company of Hagerstown, Maryland, and the owner and President of Sure Bet Services, Inc. Mr. Bridgeforth received his Bachelor of Business Administration degree in business management from James Madison University and has 31 years of experience in owning and operating his own business. Mr. Bridgeforth is a member of the ESOP/401(K) Committee and Asset/Liability and Funds Management Committee.

Georgette R. George has served as a member of the Board of Directors since 2010. Ms. George also served as a member of the Board of Directors of Summit from March 1998 to December 1999 and served as a member of the Board of Directors of Summit’s banking subsidiary from 1995 to 2005. Ms. George was re-appointed as a member of the Board of Directors of Summit’s banking subsidiary in December 2009. Ms. George is the Chief Executive Officer and Executive Team Member of Monarch Holdings. She has been engaged with the businesses within Monarch for more than 30 years. She is a principal in a number of business enterprises involved in various retail, office, and hotel development projects, of which she manages the administrative, hotel, and financial operations. She has most recently been involved in the development and sale of a SaaS business targeted for the hotel industry. In addition, Ms. George is the co-president of Affiliate Services and vice-president of Ridgeline, Inc. Previously, she held a position in sales management at the Hewlett-Packard Company where she received the President’s Award, that company’s highest sales achievement award. Ms. George has a strong understanding of business management and finance through her experience in managing and operating multiple businesses. Ms. George has served on the Boards of numerous non-profit organizations, including the Thomas Hospital Foundation, Community Council of Kanawha Valley, and the Convention Bureaus of the cities of both Charleston and South Charleston. She currently serves as a director of the West Virginia Regional Technology Park Corp, Greater Kanawha Valley Foundation, West Virginia Investment Management Board and the West Virginia School of Osteopathic Medicine Foundation. She is a member of the Federal Reserve West Virginia Advisory Committee for the Fifth District. Ms. George was a recipient of the Women of Achievement Award conferred by the Young Women’s Christian Association of Charleston. Ms. George is a graduate of Vanderbilt University where she earned a Bachelor of Engineering degree in biomedical and electrical engineering. Ms. George is a member of the Audit and Compliance Committee, the Executive Committee and the Asset/Liability and Funds Management Committee.

David H. Wilson, Sr. is currently Chairman of the Board of Directors of PSB Holding Corp. and has served as a director of Provident State Bank since 1989. Mr. Wilson is also the Chairman of Preston Automotive Group, one of the largest dealer groups in the United States. He began his career in the automotive field at age 16 in 1975 and quickly became a first-generation automotive dealer at age 22. Since then, Preston Automotive Group (PAG) has added numerous locations in Maryland, Delaware, and Virginia and now employs over 850 and sells nearly 14,000 retail units a year. Mr. Wilson has been inducted into the Ford Volume Dealers Hall of Fame (2019), bestowed the inaugural Ford Treat Customers Like Family Award (2022), the Ford Salute to Dealers Award (2003), and is currently a Vice Chairman for National Ford Dealer Council. Mr. Wilson has been on the Ford Credit Advisory Board since 2008, Ford Marketing Dealer Advisory Board since 2019, and was previously on the Hyundai Dealer Council, the Better Business Bureau Board of Directors, the Ford Dealers Advertising Fund board, Ford Washington Dealer Advertising Fund, National Ford Dealer Council, and the Trial Courts Judicial Nominating Commission for Maryland District 16. Wilson is currently Chairman of Triton Automotive Group. Outside of PSB and the automotive industry, Mr. Wilson is also the owner of a host of property, holding, and funding companies across Maryland, Delaware, and Virginia, culminating in one of the largest commercial real estate portfolios on the Delmarva Peninsula. He is also Founder of iFrog Marketing Solutions, a full-service advertising/marketing agency specializing in automotive but quickly growing into other verticals, and SafeHouse/Bay Country Security, which specializes in security solutions for commercial, residential, and agricultural platforms and locations. In the community, Mr. Wilson’s crowning achievement is the Wilson Family Community Foundation, which he launched in 2019 with his wife, Peggy Wilson. His charitable and philanthropic work has raised funds for organizations such as March of Dimes, the American Cancer Society’s Relay for Life, and numerous local schools, sports teams, fire companies, and civic initiatives.

Continuing Directors Whose Terms Expire in 2024

|

Name |

Age as of the May 18, 2023 Meeting Date |

Year First Elected Director |

|

James M. Cookman |

69 |

1994 |

|

Gary L. Hinkle |

73 |

1993 |

|

Jason A. Kitzmiller |

49 |

2018 |

|

H. Charles Maddy, III |

60 |

1993 |

|

Ronald B. Spencer |

70 |

2020 |

James M. Cookman has served as a member of the Board of Directors of the Company since 1994 and served as a member of the Board of Directors of Summit’s banking subsidiary from 1994 to 2008. Mr. Cookman was reappointed as a member of the Board of Directors of Summit’s banking subsidiary in May, 2011 and has served in that capacity since that time. Mr. Cookman has over four decades of diverse business experience in the areas of insurance, renewable energy and communications and currently serves as the President of Cookman Insurance Group, Inc., an Independent Insurance Agency, is a member manager of Laurel Renewable Partners, LLC, a renewable energy development company, and is a member of the board of directors of two farm mutual insurance companies, Mutual Protective Association of West Virginia, and West Virginia Farmers Mutual Insurance Association. Mr. Cookman is politically active at the local and state levels and is actively involved in community initiatives, including his service as regional board member of the American Red Cross, immediate Past President of the Potomac Highlands Shrine Club, and a member of the Eastern West Virginia Community and Technical College Foundation Board of Directors. Mr. Cookman is a member of the Compensation and Nominating Committee, the Equity Compensation Committee and ESOP/401(K) committee.

Gary L. Hinkle has served as a member of the Board of Directors of the Company since 1993 and has served as a member of the Board of Directors of Summit’s banking subsidiary since 1993. Mr. Hinkle is currently the President of Hinkle Trucking, Inc., Dettinburn Transport, Inc., Mt. Storm Fuel Inc., and H. T. Services, Inc. Mr. Hinkle received his Bachelor of Science in business management from West Virginia University and has over 35 years of experience in owning and operating his own business. Mr. Hinkle serves as a member of the Executive Committee, the Audit and Compliance Committee, the Asset/Liability and Funds Management Committee, the Compensation and Nominating Committee and Chairman of the Equity Compensation Committee.

Jason A. Kitzmiller has served as a member of the Board of Directors of the Company since 2018. Mr. Kitzmiller serves as president of A.L.L. Construction Inc., specializing in excavating and utility contracting in WV, MD, PA and VA, where he is actively involved in daily management, financial and operational decisions. Mr. Kitzmiller is the vice-president of ALL Construction and Excavating LLC and also serves as managing member of Alleghany Investments LLC and OSA Enterprises LLC. In addition, Mr. Kitzmiller is president of D.P. Southbound LLC and ALL Concrete Inc. and is the sole owner of ALL Outdoors, LLC. Mr. Kitzmiller served in the U.S. Navy as an aircraft mechanic and was honorably discharged. Mr. Kitzmiller received his Bachelor of Science degree in civil engineering from West Virginia University and has over 27 years of construction related experience. Mr. Kitzmiller is past president and current board member of the West Virginia Construction Labor Council and a member of the West Virginia Contractors Association. Mr. Kitzmiller is very active in youth sports and is the vice-president and board member of Grant County Little League Basketball and board member of the Grant County Little League Baseball. Mr. Kitzmiller serves as a member of the Company’s Audit and Compliance Committee and the Asset/Liability and Funds Management Committee.

H. Charles Maddy, III has served as a member of the Board of Directors since 1993 and has served as a member of the Board of Directors of Summit’s banking subsidiary, Summit Community Bank, since 1993. Mr. Maddy is currently the President and Chief Executive Officer of the Company and has served in this capacity since 1994. Mr. Maddy has demonstrated exceptional leadership through his participation in a variety of professional and community service activities, including his service as Director and past President of the West Virginia Bankers’ Association, chairman of its Audit Committee and member of its Legislative/Government Relations Committee, Pension & Benefits Committee and BankPAC Committee; Director of the Federal Home Loan Bank of Pittsburgh and serves on its Finance Committee and Operational Risk Committee and past Chairman of its Audit Committee; member of American Bankers Association and serves on its Federal Home Loan Bank Open Committee; Director and a Founder of the Hardy County Child Care Center; Director of Valley View Golf Association; past President and past Director of the West Virginia Association of Community Bankers and past Director of the Hardy County Community Foundation. Mr. Maddy has also been recognized as a leader in his industry and has been the recipient of the Outstanding CPA in Business and Industry Award and the AICPA Business and Industry Hall of Fame Award. Mr. Maddy received his Bachelor of Science degree in business administration with a concentration in accounting from Concord College. Mr. Maddy is a member of the Executive Committee, the Asset/Liability and Funds Management Committee, the ESOP/401(K) Committee, and the Environmental, Social and Governance Committee.

Ronald B. Spencer has served as a member of the Board of Directors of the Company and Summit’s banking subsidiary since January 1, 2020. Mr. Spencer is the owner and president of Mid-Atlantic of West Virginia, Inc. and owner and manager of Spencer Enterprises. Mr. Spencer is the former owner and president of Eagle Aviation, Yeager Airport and former vice president of Executive Air, Yeager Airport. Mr. Spencer served as Director and Chairman of the Board of Directors of the former Cornerstone Financial Services, Inc. from 2003 to 2019 and served as a member of the Board of Directors of Cornerstone’s banking subsidiary, Cornerstone Bank, Inc., from 2006 until 2019. He also served as Chairman of Cornerstone’s Audit Committee. Inclusive of Mr. Spencer’s service on the board of the predecessor bank to Cornerstone, Mr. Spencer has maintained 40 years aggregate experience as a bank board member. Mr. Spencer earned a Bachelor of Science degree in political science from West Virginia University and attended Camden Military Academy, Camden, South Carolina. Mr. Spencer was appointed to the West Virginia Board of Education in November 1999 by Governor Cecil H. Underwood to a term ending November 4, 2008 and was elected secretary of the West Virginia Board of Education in 2002 and 2007. He was also elected to the Doddridge County Commission serving 1989-1995. Additionally, Mr. Spencer was formerly a member of the West Virginia School Boards Association; Board of Directors, and served 15 years as a board member of the Secondary Schools Activities Commission. Mr. Spencer is also involved with several non-profit entities and community organizations. Mr. Spencer is a member of the Audit and Compliance Committee and the Asset/Liability and Funds Management Committee.

Continuing Directors Whose Terms Expire in 2025

|

Name |

Age as of the May 18, 2023 Meeting Date |

Year First Elected Director |

|

Oscar M. Bean |

72 |

1987 |

|

John W. Crites, II |

53 |

2016 |

|

James P. Geary, II |

67 |

2007 |

|

Charles S. Piccirillo |

68 |

1998 |

|

Jill S. Upson |

56 |

2021 |