UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

MultiCell Technologies, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

MULTICELL TECHNOLOGIES, INC.

68 CUMBERLAND STREET, SUITE 301

WOONSOCKET, RI 02895

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On July 11, 2011

Dear Stockholder:

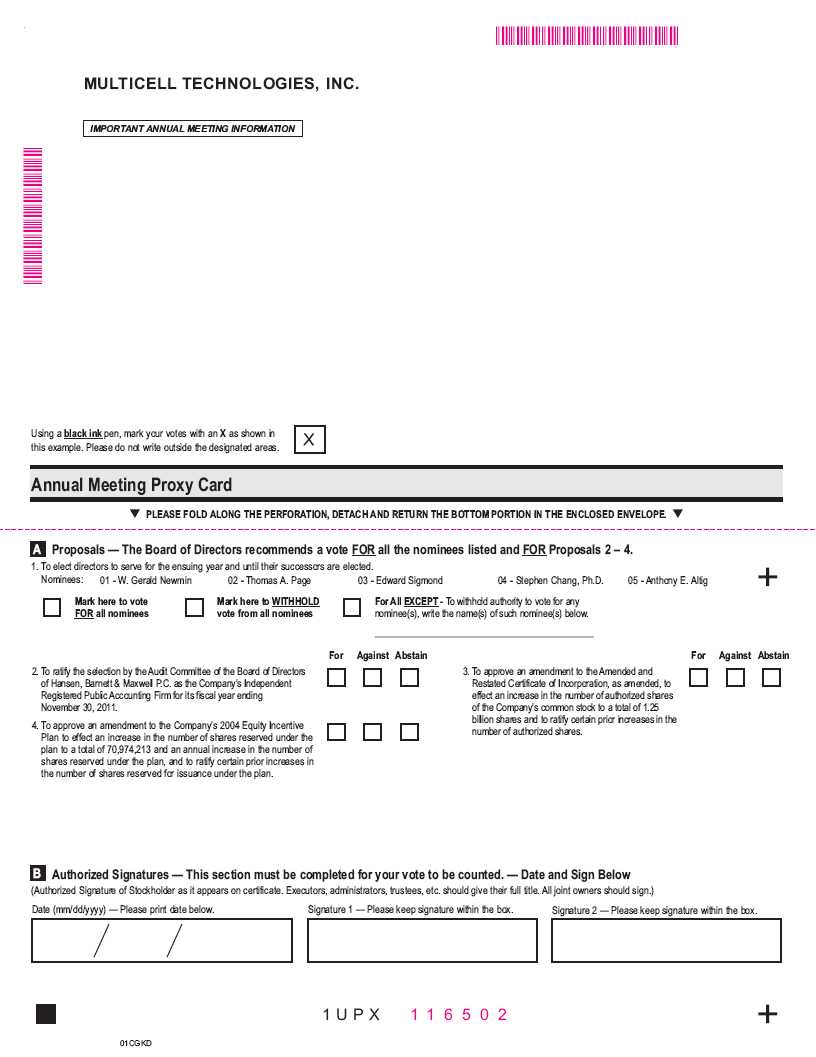

You are cordially invited to attend the Annual Meeting of Stockholders of MultiCell Technologies, Inc., a Delaware corporation (the “Company”). The meeting will be held on July 11, 2011 at 1:30 p.m. local time at the offices of Wilson Sonsini Goodrich & Rosati P.C. and located at 12235 El Camino Real, Suite 200, San Diego, CA 92130, for the following purposes:

|

1.

|

To elect directors to serve for the ensuing year and until their successors are elected.

|

|

2.

|

To ratify the selection by the Audit Committee of the Board of Directors of Hansen, Barnett & Maxwell P.C. as the Company’s Independent Registered Public Accounting Firm for its fiscal year ending November 30, 2011.

|

|

3.

|

To approve an amendment to the Amended and Restated Certificate of Incorporation, as amended, to effect an increase in the number of authorized shares of the Company’s common stock to a total of 1.25 billion shares and to ratify certain prior increases in the number of authorized shares.

|

|

4.

|

To approve an amendment to the Company’s 2004 Equity Incentive Plan to effect an increase in the number of shares reserved under the plan to a total of 70,974,213 and an annual increase in the number of shares reserved under the plan, and to ratify certain prior increases in the number of shares reserved for issuance under the plan.

|

|

5.

|

To conduct any other business properly brought before the meeting.

|

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is May 25, 2011. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

By Order of the Board of Directors

|

|

W. Gerald Newmin

|

|

Chairman, CEO and Secretary

|

San Diego, California

June 15, 2011

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

|

MULTICELL TECHNOLOGIES, INC.

68 CUMBERLAND STREET, SUITE 301

WOONSOCKET, RI 02895

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

June 15, 2011

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors, or the Board, of MultiCell Technologies, Inc., also referred to as the Company or MultiCell, is soliciting your proxy to vote at the 2011 Annual Meeting of Stockholders You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

The Company intends to mail this proxy statement and accompanying proxy card on or about June 10, 2011 all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on May 25, 2011 will be entitled to vote at the annual meeting. On this record date, there were 660,808,685 shares of common stock outstanding and entitled to vote. Holders of MultiCell Series B and Series I Preferred Stock do not possess voting rights and are not entitled to vote at the 2011 Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If on May 25, 2011 your shares were registered directly in your name with MultiCell’s transfer agent, Computershare, Inc. then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on May 25, 2011 your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are four matters scheduled for a vote:

|

|

·

|

Election of five directors;

|

|

|

·

|

Ratification of Hansen Barnett & Maxwell P.C. as the Company’s Independent Registered Public Accounting Firm for its fiscal year ending November 30, 2011.

|

|

|

·

|

To approve an amendment to the Amended and Restated Certificate of Incorporation, as amended, to effect an increase in the number of authorized shares of the Company’s common stock to a total of 1.25 billion shares and to ratify certain prior increases to the number of authorized shares.

|

|

|

·

|

To approve an amendment to the Company’s 2004 Equity Incentive Plan and to ratify certain prior increases to the number of shares authorized for issuance under the plan.

|

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may abstain from voting for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from MultiCell. Simply complete and mail the proxy card to ensure that your vote is counted. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of May 25, 2011.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all five nominees for director, “For” the appointment of Hansen Barnett & Maxwell P.C. as the Company’s Independent Registered Public Accounting Firm, “For” the proposed amendment to the Amended and Restated Certificate of Incorporation, as amended, to effect an increase in the outstanding shares of the Company’s common stock and ratification of certain prior increases to the number of authorized shares, and “For” the proposed an amendment to the Company’s 2004 Equity Incentive Plan and ratification of certain prior increases in the number of shares authorized for issuance under the 2004 Equity Incentive Plan. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees, Broadridge Financial Services, Inc., or Broadridge, and Computershare, Inc., or Computershare, may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies, but Broadridge and Computershare will be paid their customary fees. We will, upon request, also reimburse brokerage firms, banks and other agents for the reasonable costs of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

|

|

·

|

You may submit another properly completed proxy card with a later date.

|

|

|

·

|

You may send a written notice that you are revoking your proxy to MultiCell’s Secretary at 68 Cumberland Street, Suite 301 Woonsocket, RI 02895.

|

|

|

·

|

You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

|

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by March 13, 2012 to W. Gerald Newmin; 68 Cumberland Street, Suite 301 Woonsocket, RI 02895. If you wish to bring a matter before the stockholders at next year’s annual meeting and you do not notify MultiCell before March 13, 2012 the Company’s management will have discretionary authority to vote all shares for which it has proxies in opposition to the matter.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and “broker non-votes.” Shares represented by proxies that reflect abstentions or include “broker non-votes” will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. “Broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in the calculation of “votes cast.”

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares.

How many votes are needed to approve each proposal?

|

|

·

|

For the election of directors, the five nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Only votes “For” or “Withheld” will affect the outcome.

|

|

|

·

|

To be approved, Proposal 2, ratifying Hansen Barnett & Maxwell P.C. as the Company’s Independent Registered Public Accounting Firm for its fiscal year ending November 30, 2011 must receive a “For” vote from the majority of shares present either in person or by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

|

|

|

·

|

To be approved, Proposal 3, approving the proposed amendment to our Amended and Restated Certificate of Incorporation, as amended, to effect an increase in the number of authorized shares of our outstanding common stock to a total of 1.25 billion shares and to ratify certain prior increases to the number of authorized shares must receive a “For” vote from a majority of the outstanding shares of the Company. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have the same effect as an “Against” vote.

|

|

|

·

|

To be approved, Proposal 4, approving an amendment to the Company’s 2004 Equity Incentive Plan an increase in the number of shares reserved under the plan to a total of 70,974,213 and an annual increase in the number of shares reserved under the plan, and ratifying certain prior increases to the number of shares authorized for issuance under the plan, must receive a “For” vote from the majority of shares present either in person or by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

|

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 660,808,685 outstanding and entitled to vote. Thus 330,404,343 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting. Abstentions and “broker non-votes” will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published by the Company on Form 8-K within four business days following the annual meeting.

PROPOSAL 1

Election Of Directors

The Company’s Bylaws give the Company’s Board of Directors, referred as the Board or Board of Directors, the power to set the number of directors at no less than three and no more than nine. The Board currently consists of five directors. There are five nominees for director this year. Each director to be elected will hold office until the next annual meeting of stockholders and until his successor is elected, or until the director’s death, resignation or removal. Each of the nominees listed below are currently directors of the Company who were previously elected by the stockholders. It is the Company's policy to require nominees for directors to attend the Annual Meeting. Tony Altig, Dr. Chang, Mr. Newmin and Mr. Sigmond attended the 2010 Annual Meeting of Stockholders, our most recent annual meeting.

Directors are elected by a plurality of the votes properly cast in person or by proxy. The five nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by MultiCell’s management. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees

The following is a brief biography of each nominee for director.

|

Name

|

Age

|

Director

Since

|

Principal Occupation/

Position Held With the Company

|

|||

|

W. Gerald Newmin

|

73

|

1995

|

Chairman of the Board, Chief Executive Officer, Treasurer, Secretary and Director

|

|||

|

Edward Sigmond

|

52

|

2000

|

Director

|

|||

|

Anthony E. Altig

|

55

|

2005

|

Director

|

|||

|

Thomas A. Page

|

77

|

2003

|

Director

|

|||

|

Stephen Chang, Ph.D.

|

55

|

2004

|

Director

|

Anthony E. Altig has served as a director of the Company since September 2005. Mr. Altig serves as the Chair of the Audit Committee of the Company. Since 2008, Mr. Altig has been the Chief Financial Officer of Biotix Holdings a manufacturer of laboratory and clinical disposable products. From 2004 to 2007 Mr. Altig was the Chief Financial Officer of Diversa Corporation (now Verenium Corporation) a leader in providing proprietary genomic technologies for the rapid discovery and optimization of novel protein based products. From 2002 through 2004 Mr. Altig served as the Chief Financial Officer of Maxim Pharmaceuticals, a public biopharmaceutical company. Prior to joining Maxim, Mr. Altig served as the Chief Financial Officer of NBC Internet, Inc., a leading internet portal company, which was acquired by General Electric. Mr. Altig’s additional experience includes his role as the Chief Accounting Officer at USWeb Corporation, as well as his experience serving biotechnology and other technology companies during his tenure at both PricewaterhouseCoopers and KPMG. Mr. Altig also serves on the Boards of Directors of Optimer Pharmaceuticals and Tearlab Corporation. Mr. Altig is a certified public accountant and is a graduate of the University of Hawaii. Mr. Altig’s experience as the Chief Financial Officer of several public companies brings respective regarding financial and accounting issues to the Board of Directors.

W. Gerald “Jerry” Newmin joined the Company as a director in June 1995. He currently serves as the Chairman, Chief Executive Officer, President, Chief Financial Officer and Secretary. Mr. Newmin served as Chief Executive Officer of the Company from June 1995 to May 2006, and was appointed to serve again as Chief Executive Officer on December 21, 2007. Mr. Newmin is Chairman, Chief Executive Officer, Secretary and a director of Xenogenics, a partially-owned subsidiary, Chairman, Chief Executive Officer, Secretary and director of MCT Rhode Island Corp, a wholly-owned subsidiary of the Company and Chief Executive Officer, Secretary and a director of MCTI, a partially-owned subsidiary of the Company. He has managed NYSE and American Stock Exchange Fortune 500 companies. He has been President of HealthAmerica Corporation, then the nation’s largest publicly held HMO management company. He was Chief Executive Officer and President of The International Silver Company, a diversified multi-national manufacturing company that he restructured. He was Chief Operating Officer of numerous Whittaker Corporation operating units, including Production Steel Company, Whittaker Textiles, Bertram Yacht, Trojan Yacht, Columbia Yacht, Narmco Materials and Anson Automotive. He was instrumental in Whittaker’s entry into the US and international health care markets. He was Western Regional Vice President of American Medicorp, Inc, where he managed 23 acute care hospitals in the Western United States. He retired as Chairman and Chief Executive Officer of SYS Technologies, Inc., a high-growth defense technology company in 2003. Mr. Newmin has a Bachelor’s degree in Accounting from Michigan State University. Mr. Newmin is specially qualified to serve on the Board because of his detailed knowledge of our operations and market.

Thomas A. Page has served as a director of the Company since September 2003. Mr. Page is Director Emeritus and former Chairman of the Board and CEO of Enova Corporation and San Diego Gas and Electric Company (now part of Sempra Energy). Prior to the formation of Sempra Energy Corporation as a holding company in 1996, at various times Mr. Page was SDG&E’s chairman, president and CEO and held one or more of these positions until his retirement in 1998. Mr. Page joined SDG&E in 1978 as executive vice president and COO. In 1981, he was elected president and CEO and added the chairmanship in 1983. Mr. Page has been active in numerous industrial, community and governmental associations and has funded medical research. He is a director of the Coronado First Bank and is an advisory director of Sorrento Ventures. Mr. Page earned a Bachelor of Science degree in civil engineering, a masters degree in industrial administration and was awarded an honorary doctorate in management, all from Purdue University. He has been licensed as an engineer and as a certified public accountant. Mr. Page is specially qualified to serve on the Board because of extensive experience and knowledge of our operations and market.

Edward Sigmond has served as a director of the Company since May 2000. He founded The Great American Food Chain, a public restaurant holding company with the mission to incubate and develop successful restaurant concepts, where he currently serves as CEO and Chairman of the Board. Mr. Sigmond is a partner in Sigmond and Johnson, Inc., a Dallas-based investment banking firm specializing in working with public micro cap companies through the early stages of development. Mr. Sigmond owns Kestrel Holdings, Inc., a real estate and equity investment company focusing on the restaurant and bar market in the Dallas area. He is a member of the Board of Directors of Na Zdravi Ventures, a.s., a Hooters of American franchisee for the Czech Republic and Slovak Republic. He is also an owner and the managing partner of The Elbow Room, a popular Dallas restaurant and bar founded in 1998. Mr. Sigmond has held other executive sales, marketing and operations management positions over his 25 years of working experience. Mr. Sigmond is specially qualified to serve on the Board because of his detailed knowledge of our operations and market.

Stephen Chang, Ph.D. has served as a director of the Company since June 2004, became President of the Company in February 2005, and became Chief Executive Officer in May 2006. Dr. Chang resigned as Chief Executive Officer and President on December 21, 2007. On December 21, 2007, Dr. Chang also resigned as President and CEO of MultiCell Immunotherapeutics, Inc., a subsidiary of the Company. In 2008, Dr. Chang became Chief Scientific Officer and Founder of Stemgent, Inc. In 2010, Dr. Chang joined the New York Stem Cell Foundation as its Vice-President of Research and Development. Dr. Chang is also President of CURES, a coalition of patient advocates, biotechnology companies, pharmaceutical companies and venture capitalists dedicated to ensuring the safety, research and development of innovative life saving medications. Dr. Chang was chief science officer and vice president of Canji Inc./Schering Plough Research Institute in San Diego from 1998 to 2004. Dr. Chang earned his doctoral degree in Biological Chemistry, Molecular Biology and Biochemistry from the University of California, Irvine. Prior to that he received a bachelor of science in Zoology, Microbiology, and Cell and Molecular Biology from the University of Michigan and a USPHS Postdoctoral Fellowship at the Baylor College of Medicine. Mr. Chang is specially qualified to serve on the Board because of his detailed knowledge of our operations and market.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Independence of The Board of Directors

The Board of Directors consults with the Company’s counsel to ensure that the Board’s determinations regarding director independence are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” as in effect time to time. In particular, the Board of Directors utilizes the criteria for independence set forth in the pertinent listing standards of the National Association of Securities Dealers’ Stock Market, or NASDAQ.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board affirmatively has determined that all of the Company’s directors are independent directors within the meaning of the NASDAQ listing standards and applicable IRS standards, except for W. Gerald Newmin and Stephen Chang, and all directors are independent directors within the meaning of the applicable U.S. Securities and Exchange Commission, or the SEC, rules, except for Mr. Newmin.

Information Regarding the Board of Directors and its Committees

The Company’s independent directors meet in regularly scheduled executive sessions at which only independent directors are present. Persons interested in communicating with the independent directors with their concerns or issues may address correspondence to a particular director, or to the independent directors generally, in care of MultiCell Technologies, Inc. at 68 Cumberland Street, Suite 301 Woonsocket, RI 02895. If no particular director is named, letters will be forwarded, depending on the subject matter, to the Chair of the Audit or Nominating, Corporate Governance and Compensation Committee.

The Board has two committees: an Audit Committee and a Nominating, Corporate Governance and Compensation Committee. The following table provides membership and meeting information for fiscal 2010 for each of the Board committees:

|

Name

|

Audit

|

Nominating,

Corporate

Governance and

Compensation

|

||

|

Edward Sigmond

|

X

|

X*

|

||

|

Anthony E. Altig

|

X*

|

X

|

||

|

Thomas A. Page

|

X

|

X

|

||

|

Total meetings in fiscal year 2010

|

|

4

|

|

1

|

* Committee Chairperson

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on the Company’s audit engagement team as required by law; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in the Company’s Annual Report on Form 10-K; and discusses with management and the independent auditors the results of the annual audit and the results of the Company’s quarterly financial statements. Three directors comprise the Audit Committee: Anthony E. Altig (Chairman), Edward Sigmond and Thomas A. Page, a certified public accountant (CPA).

The Board of Directors annually reviews the NASDAQ listing standards definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(a)(2) and 5605(c)(2) of the NASDAQ listing standards). The Board of Directors has determined that Anthony E. Altig and Thomas A. Page qualify as “audit committee financial experts,” as defined in applicable SEC rules. The Board made a qualitative assessment of Anthony E. Altig’s and Thomas A. Page’s level of knowledge and experience based on a number of factors, including their formal education and experience as financial experts and their prior experience as a certified public accountants. A biographical summary of Mr. Altig’s and Mr. Page’s background is included in Proposal 1 of this proxy. The Audit Committee met four times during the fiscal year ended November 30, 2010.

Nominating, corporate governance and compensation committee

The Nominating, Corporate Governance and Compensation Committee of the Board of Directors reviews and approves the overall compensation strategy and policies for the Company. The Nominating, Corporate Governance and Compensation Committee also reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s executive officers and other senior management; reviews and recommends to the Board of Directors for approval the compensation and other terms of employment of the Company’s Chief Executive Officer; reviews and recommends to the Board of Directors for approval the compensation and other terms of employment of the other officers; and administers the Company’s stock option and purchase plans, and profit sharing plans, stock bonus plans, deferred compensation plans and other similar programs.

The Nominating, Corporate Governance and Compensation Committee is also responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board of Directors), reviewing and evaluating incumbent directors, recommending to the Board of Directors for selection candidates for election to the board of directors, making recommendations to the Board of Directors regarding the membership of the committees of the Board of Directors, and assessing the performance of management.

The Nominating, Corporate Governance and Compensation Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating, Corporate Governance and Compensation Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders.

However, the Nominating, Corporate Governance and Compensation Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board of Directors, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating, Corporate Governance and Compensation Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board of Directors and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating, Corporate Governance and Compensation Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating, Corporate Governance and Compensation Committee also determines whether the nominee will be independent for NASDAQ purposes, which determination is based upon NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating, Corporate Governance and Compensation Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating, Corporate Governance and Compensation Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors. The Nominating, Corporate Governance and Compensation Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board of Directors by majority vote.

At this time, the Nominating, Corporate Governance and Compensation Committee does not consider director candidates recommended by stockholders. The Nominating, Corporate Governance and Compensation Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the criteria for Board membership approved by the Board of Directors.

Three directors comprise the Nominating, Corporate Governance and Compensation Committee: Edward Sigmond (Chairman), Anthony E. Altig and Thomas A. Page. All members of the Company’s Nominating, Corporate Governance and Compensation Committee are independent (as independence is currently defined in the NASDAQ listing standards). The Nominating, Corporate Governance and Compensation Committee met once during the fiscal year ended November 30, 2010. The Committee’s functions are more fully described in its Charter which has been adopted by the Board of Directors and is available on the Company’s website at www.multicelltech.com.

Meetings of the Board of Directors

The Board of Directors met six times during the last fiscal year. With the exception of one board meetings missed by Mr. Page, each member of the Board of Directors attended all of the meetings of the Board and of the committees on which he or she served during the period for which he or she was a director or committee member, respectively.

Compensation of Directors

Each director of the Company earns fees of $1,000 for each board meeting attended and $250 for each teleconference of the board. The Chairman of the Audit Committee and the Chairman of the Nominating, Corporate Governance and Compensation Committee earn $500 for each Committee meeting, whether attended in person or by teleconference. Each member of the Nominating, Corporate Governance and Compensation Committee and each member of the Audit Committee earns $250 per Committee meeting, whether attended in person or by teleconference. The members of the Board of Directors are also eligible for reimbursement for their expenses incurred in attending Board meetings in accordance with Company policy.

Each director of the Company was also granted an option on June 28, 2010 to purchase 1,000,000 shares of the Company’s common stock. The options have an exercise price of $0.008, vest quarterly over one year from the grant date, and expire five years after the grant date. The options granted are pursuant to our 2004 Equity Incentive Plan. None of the options granted are incentive stock options, as defined in the Internal Revenue Code.

Each director of the Company also receives stock option grants under the 2004 Equity Incentive Plan . Options granted under the 2004 Equity Incentive Plan are intended by the Company not to qualify as incentive stock options under the Internal Revenue Code.

Option grants under the Directors’ Plan are non-discretionary. Each non-employee director is granted 250,000 stock options on the date he or she joins the Board of Directors. The exercise price of options granted under the Directors’ Plan is 100% of the fair market value of the common stock subject to the option on the date of the option grant. The standard terms of the plan call for vesting in equal installments over three years and expiring in five years.

Stockholder Communications with the Board of Directors

Historically, the Company’s process for stockholder communications with the Board has been through the Investor Relations function. Also, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board has been excellent. Further, during the upcoming year the Board will give full consideration to the adoption of a more formal process for stockholder communications with the Board and, if adopted, publish it promptly and post it to the Company's website.

Code Of Ethics

The Company has adopted the MultiCell Technologies, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available on our website at www.multicelltech.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

Compensation Committee Interlocks and Insider Participation

No member of the Nominating, Corporate Governance and Compensation Committee has ever been an officer or employee of the Company. None of the Company’s executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or the board of directors of any other entity that has one or more executive officers serving as a member of the Board or the Compensation Committee of the Company. As discussed in further detail under the heading “Certain Relationships and Related Transactions.”

Report of the Audit Committee of the Board of Directors

The primary purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Company’s financial reporting process. The Committee’s function is more fully described in its charter, which the Board of Directors has adopted and is available on the Company’s website at www.multicelltech.com. The Committee reviews the charter on an annual basis.

Management is responsible for the preparation, presentation, and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls, and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. The Company’s Independent Registered Public Accounting Firm, Hansen Barnett & Maxwell P.C., are responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles.

The Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended November 30, 2010 with the Company’s management and Hansen, Barnett & Maxwell P.C. The Committee has also discussed with Hansen, Barnett & Maxwell P.C. the matters required to be discussed by Statement on Auditing Standards Board Standard No. 61, as amended, “Communication with Audit Committees.” In addition, Hansen, Barnett & Maxwell P.C. has provided the Audit Committee with the written disclosures and the letter required by the Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Audit Committee has discussed with Hansen, Barnett & Maxwell P.C. their independence.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2010, for filing with the U.S. Securities and Exchange Commission.

AUDIT COMMITTEE MEMBERS:

Edward Sigmond

Anthony E. Altig

Thomas A. Page

Executive Compensation and Other Information

Our Executive Officers

The following table sets forth the name and position of each of the persons who were serving as our named executive officers as of April 15, 2011.

|

Name

|

Age

|

Position

|

||

|

W. Gerald Newmin

|

73

|

Chairman of the Board, Chief Executive Officer, Treasurer, Secretary and Director

|

A biography for Mr. Newmin can be found in the section entitled Nominees above.

Executive Compensation Table

|

Name and Principal Position(1)

|

Year

|

Salary

($)

|

Stock Awards

($)

|

Option Awards

($)

|

All Other

Compensation($)

|

Total

($)

|

||||||||||||||||

|

W. Gerald Newmin, (2)

|

2010

|

$ | 180,000 | $ | 2,875 | (3) | $ | 7,500 | (4) | $ | 2,250 | (5) | $ | 192,625 | ||||||||

|

Chairman of the Board, Chief Executive

|

2009

|

$ | 180,000 | $ | 0 | $ | 11,000 | (6) | $ | 2,250 | (7) | $ | 193,250 | |||||||||

|

Officer, President, Chief Financial Officer,

Treasurer, Secretary and Director

|

||||||||||||||||||||||

(1) During fiscal years ended November 30, 2010 and 2009, the listed person was the only Principal Executive Officer of the Company and the only person that earned more than $100,000 during either of such fiscal years.

(2) Appointed as President and Chief Executive Officer on December 21, 2007.

(3) In March 2010, Mr. Newmin was awarded 250,000 shares of common stock valued at $2,875, or $0.0115 per share, the closing price of our common stock on the date of the award.

(4) In June 2010, Mr. Newmin was granted an option to acquire 1,000,000 shares of common stock at an exercise price of $0.008 per share. The option vests quarterly over one year and expires five years after the grant date. The weighted average assumptions used in determining the fair value of the option under the Black-Scholes model for expected volatility, dividends, expected term, and risk-free interest rate were 165%; 0%; 5 years; and 1.83%; respectively.

(5) This amount represents fees earned in consideration for attending meetings of our Board of Directors during fiscal year 2010. Mr. Newmin earned $1,000 for each meeting of the Board of Directors attended in person and $250 for each meeting attended by teleconference during fiscal year 2010. The Company’s policy for director fees earned in fiscal year 2010 is to pay such fees in cash.

(6) In June 2009, Mr. Newmin was granted an option to acquire 1,000,000 shares of common stock at an exercise price of $0.011 per share. The option vests quarterly over one year and expires five years after the grant date. The weighted average assumptions used in determining the fair value of the option under the Black-Scholes model for expected volatility, dividends, expected term, and risk-free interest rate were 157%; 0%; 5 years; and 2.58%; respectively.

(7) This amount represents fees earned in consideration for attending meetings of our Board of Directors during fiscal year 2009. Mr. Newmin earned $1,000 for each meeting of the Board of Directors attended in person and $250 for each meeting attended by teleconference during fiscal year 2009. The Company’s policy for director fees earned in fiscal year 2009 is to pay one half of such fees in cash and the other half of such fees in capital stock of the Company. During the year ended November 30, 2009, the Company issued 59,211 shares of common stock in payment of $1,125 of director fees and the remaining $1,125 was paid in cash.

Outstanding equity awards at fiscal year-end

The following table shows for the fiscal year ended November 30, 2010, certain information regarding options granted to, exercised by, and held at year-end by, the Named Executive Officers:

|

Option Awards

|

Stock Awards

|

|||||||||||||||||||||||||||||||||

|

Name

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#)

|

Option

Exercise

Price ($)

|

Option

Expiration

Date

|

Number

of Shares

or Units

of Stock

That

Have Not

Vested (#)

|

Market

Value of

Shares or

Units of

Stock

That

Have Not

Vested ($)

|

Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights That

Have Not

Vested (#)

|

Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights That

Have Not

Vested ($)

|

|||||||||||||||||||||||||

|

W. Gerald Newmin

|

250,000 | 750,000 | (1) | 0 | $ | 0.008 |

6/28/15

|

0 | 0 | 0 | 0 | |||||||||||||||||||||||

|

W. Gerald Newmin

|

1,000,000 | 0 | 0 | $ | 0.011 |

6/25/14

|

0 | 0 | 0 | 0 | ||||||||||||||||||||||||

|

W. Gerald Newmin

|

333,553 | 0 | 0 | $ | 0.019 |

9/23/14

|

0 | 0 | 0 | 0 | ||||||||||||||||||||||||

(1) One quarter (25%) of the shares vest on the last day of each quarter over the next year, commencing with the date of the grant. 100% vested at the end of 12 months.

Option Exercises and Stock Vested at Fiscal Year End

There were no options exercised by our named executive officer during the fiscal year ended November 30, 2010.

Pension Benefits

Our named executive officer does not participate in or has no account balances in qualified or non-qualified defined benefit plans sponsored by us.

Nonqualified Deferred Compensation

Our named executive officer does not participate in or has no account balances in non-qualified deferred contribution plans or other deferred compensation plans maintained by us.

Non-Employee Director Compensation

The following table details the total compensation of our non-employee directors for the year ended November 30, 2010.

|

Name

|

Fees Earned or

Paid in Cash ($)

|

Stock Awards ($)

|

Option Awards

($) (1)

|

Total ($)

|

||||||||||||

|

Anthony F. Altig

|

$ | 3,750 | $ | 0 | $ | 7,500 | $ | 11,250 | ||||||||

|

Stephen Chang

|

$ | 2,250 | $ | 0 | $ | 7,500 | $ | 9,750 | ||||||||

|

Thomas A. Page

|

$ | 2,500 | $ | 0 | $ | 7,500 | $ | 10,000 | ||||||||

|

Edward Sigmond

|

$ | 3,750 | $ | 0 | $ | 7,500 | $ | 11,250 | ||||||||

(1) In June 2010, each director was granted an option to acquire 1,000,000 shares of common stock at an exercise price of $0.008 per share. The option vests quarterly over one year and expires five years after the grant date. The weighted average assumptions used in determining the fair value of the option under the Black-Scholes model for expected volatility, dividends, expected term, and risk-free interest rate were 165%; 0%; 5 years; and 1.83%; respectively.

Director Compensation Arrangements

Each director of the Company earns fees of $1,000 for each board meeting attended and $250 for each teleconference of the board. The Chairman of the Audit Committee and the Chairman of the Nominating, Corporate Governance and Compensation Committee earn $500 for each Committee meeting, whether attended in person or by teleconference. Each member of the Nominating, Corporate Governance and Compensation Committee and each member of the Audit Committee earns $250 per Committee meeting, whether attended in person or by teleconference. The members of the Board of Directors are also eligible for reimbursement for their expenses incurred in attending Board meetings in accordance with Company policy.

Each director of the Company was also granted an option on June 28, 2010 to purchase 1,000,000 shares of the Company’s common stock. The options have an exercise price of $0.008, vest quarterly over one year from the grant date, and expire five years after the grant date. The options granted are pursuant to our 2004 Equity Incentive Plan. None of the options granted are incentive stock options, as defined in the Internal Revenue Code.

Equity compensation plan information

The following table summarizes the securities authorized for issuance under equity compensation plans as of November 30, 2010.

|

Number of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

|

Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

|

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans

|

||||||||||

|

Equity compensation plans approved by shareholders (1)

|

13,148,947 | $ | 0.02 | 32,825,266 | ||||||||

|

Equity compensation plans not approved by shareholders (2)

|

850,000 | $ | 0.36 | |||||||||

| 13,998,947 | $ | 0.04 | ||||||||||

(1) Pursuant to the 2004 Plan, from 2005 through the Company’s fiscal year end 2013, the number of shares of common stock authorized for issuance under the Plan is automatically increased on the first day of each year by the lesser of the following amounts: (a) 2.0% of the Company’s outstanding shares of common stock on the day preceding the first day of such fiscal year or (b) 1,500,000 shares of common stock. Additionally, on June 25, 2009 and on August 26, 2010, at special meetings of stockholders, the stockholders approved amendments to the Plan to increase the number of shares of common stock authorized under the Plan. At each meeting, the number of authorized shares was increased by 25,000,000 shares. The numbers of shares set forth in this row include all of such previous increases.

(2) Represents warrants issued to service providers in compensation for services provided.

Beneficial Ownership of Directors, Officers and 5% Stockholders

The following table sets forth, as of February 22, 2011, certain information as to shares of our common stock owned by (i) each person known to beneficially own more than 5% of our outstanding common stock or preferred stock, (ii) each of our directors, and executive officers named in our summary compensation table, and (iii) all of our executive officers and directors as a group. Unless otherwise indicated, the address of each named beneficial owner is the same as that of our principal executive offices located at 86 Cumberland Street, Suite 301, Woonsocket, Rhode Island, 02895.

|

Name and Address of Beneficial Owner (1)

|

Number of

Shares of

Common Stock

Beneficially

Owned (2)

|

Percent of

Common Stock

Beneficially

Owned

|

Number of

Shares of

Preferred Stock

Beneficially

Owned

|

Percent of

Preferred Stock

Beneficially

Owned

|

||||||||||||

|

Monarch Pointe Fund, Ltd. (3)

|

26,541,621 | 4.20 | % | 13,625 | 79.80 | % | ||||||||||

|

La Jolla Cove Investors, Inc. (4)

|

67,255,064 | 9.99 | % | – | – | |||||||||||

|

W. Gerald Newmin (5)

|

9,694,308 | 1.53 | % | – | – | |||||||||||

|

Thomas A. Page (6)

|

4,468,410 | * | – | – | ||||||||||||

|

Stephen Chang, Ph.D. (7)

|

3,358,812 | * | – | – | ||||||||||||

|

Edward Sigmond (8)

|

3,780,446 | * | – | – | ||||||||||||

|

Anthony E. Altig (9)

|

5,130,139 | * | – | – | ||||||||||||

|

All executive officers and directors as a group (five persons)

|

26,432,115 | 4.21 | % | – | – | |||||||||||

|

*

|

Represents less than 1% of the issued and outstanding shares of the applicable class of equity securities of the Company as of February 22, 2011.

|

|

(1)

|

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Pursuant to the rules of the Commission, shares of common stock that each named person and group has the right to acquire within 60 days pursuant to options, warrants, or other rights, are deemed outstanding for purposes of computing shares beneficially owned by the percentage ownership of each such person and group. Applicable percentages are based on 605,968,799 shares of common stock and 17,073 shares of preferred stock outstanding on February 22, 2011 (of which 11,339 are shares of our Series B preferred stock and 5,734 are shares of our Series I preferred stock), and are calculated as required by rules promulgated by the SEC.

|

|

(2)

|

Unless otherwise noted, all shares listed are owned of record and the record owner has sole voting and investment power, subject to community property laws where applicable.

|

|

(3)

|

Includes (i) 496,972 shares of common stock held by Monarch Pointe Fund, Ltd. (“MPF”), (ii) 5,096,203 shares of common stock issuable to MPF upon the exercise of warrants within 60 days of February 22, 2011, (iii) 2,293,600 shares of common stock issuable to MPF upon conversion of 5,734 shares of Series I Preferred Stock and (iv) 18,654,846 shares of common stock issuable to MPF upon conversion of 7,891 shares of Series B Preferred Stock. According to a Schedule 13G/A filed with the SEC by MPF on January 14, 2009, MPF is in liquidation, William Tacon serves as the liquidator of MPF and, as such, now has control over the securities owned by MPF.

|

|

(4)

|

Represents the maximum possible amount of shares of our commons stock (i) held by LJCI, (ii) issuable to LJCI upon the exercise of a common stock warrant it holds, and (iii) issuable to LJCI upon the conversion of a 4.75% convertible debenture its holds, all as of February 22, 2011. Pursuant to the terms of the warrant and convertible debenture, LJCI may not acquire shares of our commons stock to the extent such acquisition would cause LJCI to own more than 9.99% of our outstanding common stock immediately after such acquisition. Provided the aforementioned 9.99% cap is complied with, LJCI may in the future exercise or convert into, as applicable, a significant amount of additional shares of our common stock (e.g. as of February 22, 2011, there are a total of 7,198,129 shares remaining on the stock purchase warrant and a balance of $71,981 remaining on the convertible debenture, which is convertible pursuant to the formula set forth in the debentures listed in the Exhibits section of this report).

|

|

(5)

|

Includes (i) 5,853,690 shares of common stock, (ii) 1,287,065 shares of common stock issuable to Mr. Newmin upon the exercise of warrants within 60 days of February 22, 2011, (iii) 2,083,553 shares of common stock issuable to Mr. Newmin under options exercisable within 60 days of February 22, 2011, (iv) 9,139 shares of common stock owned by Mr. Newmin’s spouse, and (v) warrants to purchase 220,000 shares of common stock issuable upon exercise of warrants owned by Mr. Newmin’s spouse. Mr. Newmin disclaims beneficial ownership of the aforementioned stock beneficially owned by Mr. Newmin’s spouse, except to the extent of his pecuniary interest therein.

|

|

(6)

|

Includes (i) 1,636,586 shares of common stock, (ii) 525,903 shares of common stock issuable upon the exercise of common stock warrants within 60 days of February 22, 2011, and (iii) 2,305,921 shares of common stock issuable under options exercisable within 60 days of February 22, 2011.

|

|

(7)

|

Includes (i) 988,163 shares of common stock, (ii) 364,071 shares of common stock issuable upon the exercise of common stock warrants within 60 days of February 22, 2011 and (iii) 2,006,578 shares of common stock issuable under options exercisable within 60 days of February 22, 2011.

|

|

(8)

|

Includes (i) 1,560,974 shares of common stock, (ii) 161,577 shares of common stock issuable upon the exercise of common stock warrants within 60 days of February 22, 2011 and (iii) 2,057,895 shares of common stock issuable under options exercisable within 60 days of February 22, 2011.

|

|

(9)

|

Includes (i) 2,232,209 shares of common stock, (ii) 172,930 shares of common stock issuable upon the exercise of common stock warrants within 60 days of February 22, 2011 and (iii) 2,725,000 shares of common stock issuable under options exercisable within 60 days of February 22, 2011.

|

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected Hansen, Barnett & Maxwell P.C. as the Company’s Independent Registered Public Accounting Firm for the fiscal year ending November 30, 2011 and has further directed that management submit the selection of our Independent Registered Public Accounting Firm for ratification by the stockholders at the Annual Meeting. Hansen, Barnett & Maxwell P.C. has audited the Company’s financial statements since January 7, 2009. Representatives of Hansen, Barnett & Maxwell P.C. are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Hansen, Barnett & Maxwell P.C. as the Company’s Independent Registered Public Accounting Firm . However, the Audit Committee of the Board is submitting the selection of Hansen, Barnett & Maxwell P.C. to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different Independent Registered Public Accounting Firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Hansen, Barnett & Maxwell P.C. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table represents aggregate fees billed to the Company for fiscal years ended November 30, 2010 and November 30, 2009, by Hansen, Barnett & Maxwell P.C., the Company’s principal accountant:

|

Fiscal Year

Ended

|

||||||||

|

2010

|

2009

|

|||||||

|

Audit Fees

|

$ | 41,444 | $ | 35,050 | ||||

|

Audit-related Fees (principally related to the review of various SEC filings)

|

0 | 6,135 | ||||||

|

Tax Fees (related to the preparation of the Company’s tax returns)

|

7,025 | 8,071 | ||||||

|

All Other Fees

|

0 | $ | 0 | |||||

|

Total Fees

|

$ | 48,469 | $ | 43,121 | ||||

All fees described above were approved by the Audit Committee.

No percentage of Hansen, Barnett & Maxwell P.C.’s audit for the fiscal year ended November 30, 2010 was provided by persons other than its full-time permanent employees.

Pre-Approval Policies and Procedures.

The Audit Committee has adopted policies and procedures for the pre-approval of audit and non-audit services rendered by our independent auditor, Hansen, Barnett & Maxwell P.C. The policy requires pre-approval of specified services in the defined categories of audit services, audit-related services, and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service.

The Audit Committee has determined that the rendering of services other than audit services by Hansen, Barnett & Maxwell P.C. is compatible with maintaining the principal accountant’s independence.

Change in Independent Auditors

On January 15, 2008, MultiCell Technologies, Inc. ("MultiCell") dismissed J.H. Cohn LLP ("Cohn") as MultiCell's independent registered public accounting firm. The decision to dismiss Cohn was approved by the Audit Committee of the Board of Directors of MultiCell. The reports of Cohn on the financial statements of MultiCell for the years ended November 30, 2006 and 2005 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle, but did include explanatory paragraphs for the effects of a restatement of the financial statements for the year ended November 30, 2004, the adoption of Statement of Financial Accounting Standards No. 123(R), "Share-Based Payment" in 2006, and the Company's ability to continue as a going concern.

During the years ended November 30, 2006 and 2005 and through January 15, 2008, there have been no disagreements with Cohn on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Cohn, would have caused Cohn to make reference thereto in its reports on the financial statements of MultiCell for such years. As previously reported in MultiCell's Annual Report on Form 10-KSB filed on March 3, 2006, MultiCell and Cohn identified errors in connection with the Company’s accounting for stock options and warrants issued to consultants and scientific advisory board members during fiscal years 2004 and 2005, which led to the conclusion that MultiCell did not maintain effective internal controls over accounting for stock options and warrants as of November 30, 2005. As reported in MultiCell's Annual Report on Form 10-KSB filed on March 15, 2007, Cohn noted several deficiencies related to the presentation of the basic financial statements and the accompanying notes to the financial statements and proposed certain entries that should have been recorded as part of the normal closing process. MultiCell's internal control over financial reporting did not detect such matters and, therefore, was determined to be not effective in detecting misstatements and disclosure deficiencies as of November 30, 2006.

MultiCell had furnished a copy of the above disclosures to Cohn and had requested that Cohn furnish MultiCell with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the above disclosures. A copy of such letter is attached as Exhibit 16.1 to this Current Report on Form 8-K. On January 15, 2008, MultiCell engaged Hansen, Barnett Maxwell P.C. (“Hansen”) as its new independent registered public accounting firm to audit MultiCell’s financial statements for the year ending November 30, 2007 and to review the financial statements to be included in MultiCell's quarterly report on Form 10-QSB for the quarters ending February 29, 2008, May 31, 2008 and August 30, 2008. Prior to the engagement of Hansen, neither MultiCell nor anyone on behalf of MultiCell consulted with Hansen during MultiCell's two most recent fiscal years and through January 15, 2008 in any manner regarding either: (A) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on MultiCell's financial statements; or (B) any matter that was the subject of either a disagreement or a reportable event (as defined in Item 304(a)(1)(iv) of Regulation S-K).

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

PROPOSAL 3

To approve an amendment to the Amended and Restated Certificate of Incorporation, as amended, to effect an increase in the number of authorized shares of the Company’s common stock to a total of 1.25 billion shares and to ratify certain prior increases in the number of authorized shares

Background

The Board of Directors has adopted, subject to stockholder approval, the certificate of amendment, attached as Appendix A to this proxy statement, to the Company’s amended and restated certificate of incorporation, as amended (the “Restated Certificate”), which increases the number of authorized shares of common stock, $0.01 par value per share, from 775,000,000 million shares to 1.25 billion shares (as so amended, the “Amended Certificate”). Proposal 3 approves the Certificate of Amendment, which increases the number of authorized shares of common stock to a total of 1.25 billion shares and ratifies the prior increases to the number of authorized shares of common stock in 2008 and 2009 to 500,000,000 shares, and 775,000,000 shares, respectively. If the stockholders approve this Proposal 3, the Board of Directors intends to file the Amended Certificate with the Secretary of State of the State of Delaware. The increase in the number of authorized shares would become effective upon such filing.

As of April 15, 2011, approximately 645,530,907 shares of common stock were issued and outstanding, 13,108,947 shares of common stock were reserved for issuance upon exercise of outstanding options, 45,974,213 shares of common stock were reserved for future option grants under our 2004 Equity Incentive Plan, 22,240,529 shares of common stock were reserved for issuance upon exercise of outstanding warrants, 23,891,695 shares of common stock were reserved for issuance upon the conversions of the Company’s outstanding preferred stock, and 17,073 share of the company preferred stock were issued and outstanding.

The additional shares of common stock to be authorized by the Amended Certificate would have rights identical to the currently outstanding common stock of the Company. Future issuances of common stock may, depending on the circumstances, have a dilutive effect on the earnings per share, voting power and other interests of existing stockholders. The Board of Directors does not presently intend to seek further stockholder approval of any particular issuance of shares unless such approval is required by applicable law.

The Board of Directors believes that a increase in authorized shares is desirable for a number of reasons. The Board of Directors believes that it is in the best interest of stockholders to raise additional equity capital and an increase in authorized shares is therefore necessary in order to have a sufficient number of authorized shares to satisfy the Company’s commitments and to allow the Company to conduct its business. Further, the Company currently has a limited number of shares of common stock which it can sell to raise capital, and the Board of Directors believes that an increase in authorized shares could improve the Company’s ability to raise new capital. Finally, the Company’s stated objective of acquiring additional intellectual property through license agreements, the hiring of key scientists or acquisition, is currently limited in light of the number shares of common stock currently authorized for issues.

In light of the above, the Board of Directors believes that it is prudent to increase the authorized number of shares of common stock in order to maintain a reserve of shares available for immediate issuance to meet business needs promptly as they arise. In addition, the increase in the number of authorized shares of common stock will allow us to continue providing equity incentives to our employees, officers and directors. All authorized but unissued shares of common stock will be available for issuance from time to time for any proper purpose approved by the Board of Directors (including issuances in connection with stock-based employee benefit plans, future stock splits by means of a dividend and issuances to raise capital or effect acquisitions). The Board of Directors believes that maintaining a reserve of common stock will save time and money in responding to future events requiring the issuance of additional shares of common stock, such as a stock split, raising capital, expanding our business or product lines through the acquisition of other businesses or products, or establishing strategic relationships with other companies.

At this time, the Company does not have any specific agreements or arrangements to acquire any business or engage in any investment opportunity or otherwise to issue additional shares of the Company’s common stock, except for the convertible debenture and related warrants issued pursuant to the Company’s agreement with La Jolla Cove Investors (“LJCI”) as described in the paragraph below.

If this proposal is not approved by the stockholders, our Restated Certificate will continue as currently in effect, and the Company will face several very critical issues impacting its ability to operate in the future. Since March 2008, the Company has operated on working capital provided by LJCI. Pursuant to the terms of our agreement with LJCI, upon the conversion of any portion of the principal amount of the LJCI’s convertible debenture, LJCI is required to simultaneously exercise and purchase that same percentage of the warrant shares equal to the percentage of the dollar amount of the debenture being converted. As of February 22, 2011 there are 7,198,129 shares remaining on the stock purchase warrant and a balance of $71,981 remaining on the convertible debenture. Should LJCI continue to exercise all of its remaining warrants approximately $7.8 million of cash would be provided to the Company. As most of the currently authorized shares have been issued, the Company would be unable to honor its current agreement with LJCI to issue shares of its common stock, which would likely lead to demand for payment of all convertible debt, the repurchase of outstanding warrants and to employee turnover due to the inability to exercise outstanding options.

If this proposal is approved by stockholders, the increase in the authorized number of shares of common stock and the subsequent issuance of such shares could have the effect of delaying or preventing a change in control of the Company without further action by the stockholders. Shares of authorized but unissued common stock could (within the limits imposed by applicable law) be issued in one or more transactions, which would make a change in control of the Company more difficult, and therefore less likely. Any such issuance of additional stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of common stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to obtain control of the Company. However, this proposal is not in response to any effort of which we are aware to accumulate our common stock or obtain control of us. In addition, this proposal is not part of a plan by the Board of Directors to recommend or implement a series of anti-takeover measures.

Stockholders should note that the proposed increase in authorized shares may not achieve the desired results, which have been outlined above.

Required Vote

The affirmative vote of the holders of a majority of the outstanding shares of our common stock will be required to approve Proposal 3.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 3.

PROPOSAL 4

To approve an amendment to the Company’s 2004 Equity Incentive Plan to effect an increase in the number of shares reserved for the plan to a total of 70,974,213 and an annual increase in the number of shares reserved under the plan, and to ratify certain prior increases in the number of shares reserved for issuance under the plan

In March 2004, the Board of Directors adopted, and the stockholders subsequently approved, the Company’s 2004 Equity Incentive Plan, attached as Appendix B (the “Incentive Plan”). As of April 15, 2011 there were 45,974,213 shares of common stock reserved for issuance under the Incentive Plan.

In April 2011, our Board of Directors approved a proposal to amend the Incentive Plan, subject to stockholder approval, to increase the shares reserved for issuance thereunder by 25,000,000 shares. Proposal 4 approves that increase to a total of 70,974,213 shares and ratifies prior increases that took place in 2009 and 2010, reserving 25,000,000 and 25,000,000 shares for issuance under the Incentive Plan, respectively, which increases are included in the total of 70,974,213 shares. By approving this proposal, you will also be approving an amendment to the Incentive Plan to provide that the number of shares of Company common stock reserved for issuance under the Incentive Plan will be increased annually on the first day of our fiscal year, from 2011 until 2013, by the least of (i) 2% of the shares of common stock outstanding on the day preceding the first day of such fiscal year, (ii) 1,500,000 shares of common stock or (iii) such lesser number of shares as determined by the Board. The Board adopted this amendment in order to ensure that the Company can continue to grant equity awards at levels determined appropriate by the Board.