UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-15490

QUARTZ MOUNTAIN RESOURCES LTD.

(Exact name of Registrant as specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of

incorporation or organization)

15th Floor, 1040 West Georgia

Street

Vancouver, British Columbia, Canada, V6E 4H1

(Address

of principal executive offices)

Trevor Thomas, Corporate

Secretary

Facsimile No.: 604-681-2741

15th Floor, 1040 West Georgia

Street

Vancouver, British Columbia, Canada, V6E 4H1

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class: | Name of each exchange on which registered |

| Not applicable | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act

Common shares, no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

27,299,513 common shares as of July 31, 2014

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [X]

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer or non-accelerated filer. See definition of "accelerated filer" and "large accelerated filer" in Rule 126-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] | Non-Accelerated Filer [X] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued [X] | Other [ ] |

| by the International Accounting Standards Board |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes [ ] No [X]

2

| GENERAL | 5 | ||

| CURRENCY AND MEASUREMENT | 7 | ||

| NOTE ON FORWARD LOOKING STATEMENTS | 7 | ||

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 8 | |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 8 | |

| B. | ADVISORS | 8 | |

| C. | AUDITORS | 8 | |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 8 | |

| ITEM 3 | KEY INFORMATION | 8 | |

| A. | SELECTED FINANCIAL DATA | 8 | |

| B. | CAPITALIZATION AND INDEBTEDNESS | 10 | |

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS | 10 | |

| D. | RISK FACTORS | 10 | |

| ITEM 4 | INFORMATION ON THE COMPANY | 15 | |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY | 15 | |

| B. | BUSINESS OVERVIEW | 16 | |

| C. | MINERAL PROPERTIES AND EXPLORATION ACTIVITIES AND PLANS | 18 | |

| D. | ORGANIZATIONAL STRUCTURE | 23 | |

| E. | PROPERTY, PLANT AND EQUIPMENT | 23 | |

| F. | CURRENCY | 23 | |

| ITEM 4A | UNRESOLVED STAFF COMMENTS | 24 | |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 24 | |

| OVERVIEW | 24 | ||

| A. | OPERATING RESULTS | 24 | |

| B. | LIQUIDITY AND CAPITAL RESOURCES | 27 | |

| C. | RESEARCH EXPENDITURES | 29 | |

| D. | TREND INFORMATION | 29 | |

| E. | OFF – BALANCE SHEET ARRANGEMENTS | 30 | |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS | 31 | |

| G. | SAFE HARBOR | 31 | |

| ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 31 | |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 31 | |

| B. | COMPENSATION | 36 | |

| C. | BOARD PRACTICES | 37 | |

| D. | EMPLOYEES | 42 | |

| E. | SHARE OWNERSHIP | 42 | |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 43 | |

| A. | MAJOR SHAREHOLDERS | 43 | |

| B. | RELATED PARTY TRANSACTIONS | 45 | |

| C. | INTERESTS OF EXPERTS AND COUNSEL | 45 | |

| ITEM 8 | FINANCIAL INFORMATION | 46 | |

| A. | CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION | 46 | |

| B. | SIGNIFICANT CHANGES | 46 | |

| ITEM 9 | THE OFFER AND LISTING | 46 | |

3

| A. | OFFER AND LISTING DETAILS | 46 | |

| B. | PLAN OF DISTRIBUTION | 47 | |

| C. | MARKETS | 47 | |

| D. | SELLING SHAREHOLDERS | 47 | |

| E. | DILUTION | 48 | |

| F. | EXPENSES OF THE ISSUE | 48 | |

| ITEM 10 | ADDITIONAL INFORMATION | 48 | |

| A. | SHARE CAPITAL | 48 | |

| B. | MEMORANDUM AND ARTICLES OF ASSOCIATION | 48 | |

| C. | MATERIAL CONTRACTS | 50 | |

| D. | EXCHANGE CONTROLS | 50 | |

| E. | TAXATION | 51 | |

| F. | DIVIDENDS AND PAYING AGENTS | 58 | |

| G. | STATEMENT BY EXPERTS | 59 | |

| H. | DOCUMENTS ON DISPLAY | 59 | |

| I. | SUBSIDIARY INFORMATION | 59 | |

| ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 59 | |

| A. | TRANSACTION RISK AND CURRENCY RISK MANAGEMENT | 59 | |

| B. | EXCHANGE RATE SENSITIVITY | 59 | |

| C. | INTEREST RATE RISK AND EQUITY PRICE RISK | 59 | |

| D. | COMMODITY PRICE RISK | 59 | |

| ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 59 | |

| ITEM 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 59 | |

| ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 60 | |

| ITEM 15 | CONTROLS AND PROCEDURES | 60 | |

| A. | DISCLOSURE CONTROLS AND PROCEDURES | 60 | |

| B. | MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING | 60 | |

| CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING | 60 | ||

| LIMITATIONS OF CONTROLS AND PROCEDURES | 61 | ||

| ITEM 16 | [RESERVED] | 61 | |

| ITEM 16A | AUDIT COMMITTEE FINANCIAL EXPERT | 61 | |

| ITEM 16B | CODE OF ETHICS | 61 | |

| ITEM 16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 62 | |

| ITEM 16D | EXEMPTIONS FROM LISTING STANDARDS FOR AUDIT COMMITTEES | 62 | |

| ITEM 16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 62 | |

| ITEM 16F | CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT | 62 | |

| ITEM 16G | CORPORATE GOVERNANCE | 63 | |

| ITEM 16H | MINE SAFETY DISCLOSURE | 63 | |

| ITEM 17 | FINANCIAL STATEMENTS | 63 | |

| ITEM 18 | FINANCIAL STATEMENTS | 63 | |

| ITEM 19 | EXHIBITS | 63 | |

4

GENERAL

In this Annual Report on Form 20-F, all references to "we", the "Company" or "Quartz Mountain" refer to Quartz Mountain Resources Ltd. and its consolidated subsidiary.

The Company uses the Canadian dollar as its reporting currency. All references in this document to "dollars" or "$" are expressed in Canadian dollars, unless otherwise indicated. See also Item 3 – "Key Information" for more detailed currency and conversion information.

Except as noted, the information set forth in this Annual Report is as of October 9, 2014, and all information included in this document should only be considered correct as of such date.

Certain terms used herein are defined as follows:

| ICP |

Inductively coupled plasma (ICP) mass spectrometry is a type of mass spectrometry which is capable of detecting metals and several non-metals at concentrations as low as one part per trillion. |

| ICP-AES |

Inductively coupled plasma atomic emission spectroscopy is an analytical technique used for the detection of trace metals. It is a type of emission spectroscopy that uses the inductively coupled plasma to produce excited atoms and ions that emit electromagnetic radiation at wavelengths characteristic of a particular element. The intensity of this emission is indicative of the concentration of the element within the sample. |

| Induced Polarization (IP) Survey |

A geophysical survey used to identify a feature that appears to be different from the typical or background survey results when tested for levels of electro-conductivity; IP detects both chargeable, pyrite-bearing rock and non-conductive rock that has a high content of quartz. |

| Epithermal Deposit |

Gold, gold-silver or silver deposits, some also include important base metals; occurring as narrow vein to large low grade disseminated deposits. |

| Mineral Reserve |

Securities and Exchange Commission Industry Guide 7 "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations" (under the United States Securities Exchange Act of 1934, as amended) defines a 'reserve' as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

|

(1) Proven (Measured) Reserves. Reserves for which: (a)

quantity is computed from dimensions revealed in outcrops, trenches,

workings or drill holes; grade and/or quality are computed from the

results of detailed sampling; and (b) the sites for inspection, sampling

and measurement are spaced so closely and the geologic character is so

well defined that size, shape, depth and mineral content of reserves are

well-established. | |

|

(2) Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. | |

|

As a reporting issuer under the Securities Acts of British Columbia and Alberta, the Company is subject to National Instrument 43-101 "Standards of Disclosure for Mineral Projects" of the Canadian Securities Administrators. Securities and Exchange Commission Industry Guide 7, as interpreted by Securities and Exchange Commission Staff, applies standards that are different from those prescribed by National Instrument 43-101 in order to classify mineralization as a reserve. Under the standards of the Securities and Exchange Commission, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issued imminently in order to classify mineralized material as reserves under Securities and Exchange Commission Industry Guide 7. Accordingly, mineral reserve estimates established in accordance with National Instrument 43-101 may not qualify as "reserves" under SEC standards. The Company does not currently have any mineral deposits that have been classified as reserves. |

5

| Mineral Resource |

National Instrument 43-101 "Standards of Disclosure for Mineral Projects" issued by the Canadian Securities Administrators defines a "Mineral Resource" as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

|

Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource. It cannot be assumed that all or any part of Measured Mineral Resources, Indicated Mineral Resources, or Inferred Mineral Resources will ever be upgraded to a higher category. It also cannot be assumed that any part of any reported Measured Mineral Resources, Indicated Mineral resources, or Inferred Mineral Resources is economically or legally mineable. Further, in accordance with Canadian rules, estimates of Inferred Mineral Resources cannot form the basis of feasibility or other economic studies. | |

|

| |

|

(1) Inferred Mineral Resource. An 'Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. | |

|

(2) Indicated Mineral Resource. An 'Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. | |

|

(3) Measured Mineral Resource. A 'Measured Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. | |

|

Industry Guide 7 – "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations" of the Securities and Exchange Commission does not define or recognize resources. In addition, disclosure of resources using "contained ounces" is permitted under Canadian regulations; however, the Securities and Exchange Commission only permits issuers to report mineralization that does not qualify as a reserve as in place tonnage and grade without reference to unit measures. As used in this Form 20-F, "resources" are as defined in National Instrument 43-101. For the above reasons, information in the Company's publicly-available documents containing descriptions of the Company's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. |

6

| Mineral Symbols |

As – arsenic; Au – gold; Ag – silver; Cu – copper; Fe – iron; Hg – mercury; Mo – molybdenum; Na – sodium; Ni – nickel; O – oxygen; Pd - palladium; Pt – platinum; Pb – lead; S – sulphur; Sb – antimony; Zn – zinc. |

| Net Smelter Return (NSR) |

Monies received for concentrate delivered to a smelter net of metallurgical recovery losses, transportation costs, smelter treatment-refining charges and penalty charges. |

| Porphyry Deposit |

Mineral deposit characterized by widespread disseminated or veinlet- hosted sulphide mineralization, characterized by large tonnage and moderate to low grade. |

| Skarn Deposit |

Sulphide-bearing deposits formed at the contact zone between granitic intrusions and carbonate sedimentary rocks. |

| Sulphide |

A compound of sulphur with another element, typically a metallic element or compound. |

| Vein |

A tabular or sheet-like mineral deposit with identifiable walls, often filling a fracture or fissure. |

CURRENCY AND MEASUREMENT

All currency amounts in this Annual Report are stated in Canadian dollars unless otherwise indicated. Conversion of metric units into imperial equivalents is as follows:

| Metric Units | Multiply by | Imperial Units |

| hectares | 2.471 | = acres |

| meters | 3.281 | = feet |

| kilometers | 0.621 | = miles (5,280 feet) |

| grams | 0.032 | = troy ounces |

| tonnes | 1.102 | = short tons (2,000 lbs) |

| grams per tonne | 0.029 | = troy ounces per ton |

NOTE ON FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains statements that constitute "forward-looking statements". Any statements that are not statements of historical facts may be deemed to be forward-looking statements. These statements appear in a number of different places in this Annual Report and, in some cases, can be identified by words such as "anticipates", "estimates", "projects", "expects", "intends", "believes", "plans", or their negatives or other comparable words. The forward-looking statements, including the statements contained in Item 3D "Risk Factors", Item 4B "Business Overview", Item 5 "Operating and Financial Review and Prospects" and Item 11 "Quantitative and Qualitative Disclosures About Market Risk", involve known and unknown risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such statements. Forward-looking statements include statements regarding the outlook for the Company's future operations, plans and timing for the Company's exploration programs, statements about future market conditions, supply and demand conditions, forecasts of future costs and expenditures, the outcome of legal proceedings, and other expectations, intentions and plans that are not historical facts.

7

You are cautioned that forward-looking statements are not guarantees. The risks and uncertainties that could cause the Company's actual results to differ materially from those expressed or implied by the forward-looking statements include:

| • | changes in general economic and business conditions, including commodity prices, costs associated with mineral exploration and development, changes in interest rates and the availability of financing on reasonable terms; |

| • | natural phenomena, including geological and meteorological phenomena; |

| • | actions by government authorities, including changes in government regulation and permitting requirements; |

| • | uncertainties associated with legal proceedings; |

| • | future decisions by management in response to changing conditions; |

| • | the Company's ability to execute prospective business plans; and |

| • | misjudgments in the course of preparing forward-looking statements. |

The Company advises you that these cautionary remarks expressly qualify, in their entirety, all forward-looking statements attributable to Quartz Mountain or persons acting on the Company's behalf. The Company assumes no obligation to update the Company's forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements. You should carefully review the cautionary statements and risk factors contained in this and other documents that the Company files from time to time with the Securities and Exchange Commission.

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| A. |

DIRECTORS AND SENIOR MANAGEMENT |

Not applicable.

| B. |

ADVISORS |

Not applicable.

| C. |

AUDITORS |

Not applicable.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3 | KEY INFORMATION |

| A. |

SELECTED FINANCIAL DATA |

The following tables summarize selected financial data for the Company (stated in Canadian dollars) prepared, in respect of the years ended July 31, 2014 and July 31, 2013, in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) (“IFRS-IASB”).

As permitted by SEC Release No. 33-8879 “Acceptance from Foreign Private Issuers of Financial Statements Prepared in Accordance with International Reporting Standards Without Reconciliation to U.S. GAAP”, the Company includes selected financial data prepared in compliance with IFRS-IASB without reconciliation to U.S. GAAP. The Company adopted IFRS at the beginning of its fiscal year ended July 31, 2011.

8

The selected financial data of the Company for the fiscal years presented was derived from the consolidated financial statements of the Company that have been audited by Davidson & Company LLP, independent Registered Public Accountants, as indicated in their audit report which is included at Exhibit 99.1 in this Annual Report.

The auditors conducted their audits in accordance with United States and Canadian generally accepted auditing standards, and the standards of the Public Company Accounting Oversight Board (United States).

| Year ended July 31, 2014 |

Year ended | Year ended July | Year ended | ||||||||||

| July 31, 2013 | 31, 2012 | July 31, 2011 | |||||||||||

| Sales revenue | $ | – | $ | – | $ | – | $ | – | |||||

| Loss from operations | $ | 865,427 | $ | 3,458,827 | $ | 3,587,805 | $ | 174,867 | |||||

| Loss and comprehensive loss | $ | 865,427 | $ | 3,458,827 | $ | 3,587,805 | $ | 183,483 | |||||

| Basic and diluted loss per common share | $ | 0.03 | $ | 0.13 | $ | 0.20 | $ | 0.01 | |||||

| Dividends per share | – | – | – | – | |||||||||

| Working capital | $ | (2,527,095) | $ | (1,743,116) | $ | 911,035 | $ | 57,066 | |||||

| Total assets | $ | 1,975,310 | $ | 2,469,814 | $ | 2,821,289 | $ | 99,230 | |||||

| Shareholder’s equity | $ | (1,588,609) | $ | (723,182) | $ | 989,036 | $ | 57,067 | |||||

| Share capital | $ | 26,050,118 | $ | 26,050,118 | $ | 24,514,381 | $ | 20,375,746 | |||||

| Shares outstanding | 27,299,513 | 27,299,513 | 22,032,793 | 13,399,422 |

Currency and Exchange Rates

On October 9, 2014 the rate of exchange of the Canadian dollar, based on the daily noon rate in Canada as published by the Bank of Canada, was US$1 = Canadian $1.115. Exchange rates published by the Bank of Canada are, available on its website www.bankofcanada.ca, nominal quotations — not buying or selling rates — and are intended for statistical or analytical purposes.

The following tables set out the exchange rates, based on the daily noon rates in Canada as published by the Bank of Canada for the conversion of Canadian dollars per U.S. dollar.

| For the fiscal year ended

July 31 (Canadian Dollars per U.S. Dollar) | |||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |

| End of Period | $1.0890 | $1.0287 | $1.0014 | $0.9538 | $1.0290 |

| Average for the Period (1) | $1.0733 | $1.0070 | $1.0084 | $0.9930 | $1.0486 |

| High for the Period | $1.1251 | $1.0576 | $1.0604 | $1.0642 | $1.1079 |

| Low for the Period | $1.0237 | $0.9710 | $0.9980 | $0.9449 | $0.9961 |

| (1) |

The average rate for each period is the average of the daily noon rates on the last day of each month during the period. |

9

| Monthly High and Low Exchange Rate (Canadian Dollars per U.S. Dollar) | ||

| Month | High | Low |

| October 2014 (to October 9, 2014) | $1.1256 | $1.1149 |

| September 2014 | $1.1208 | $1.0863 |

| August 2014 | $1.0982 | $1.0857 |

| July 2014 | $1.0909 | $1.0634 |

| June 2014 | $ 1.0937 | $ 1.0676 |

| May 2014 | $ 1.0973 | $ 1.0837 |

| April 2014 | $ 1.1042 | $ 1.0903 |

| B. |

CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. |

REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| D. |

RISK FACTORS |

Due to the nature of the Company's business and the present stage of exploration and development of its projects in British Columbia, an investment in the securities of Quartz Mountain is highly speculative and subject to a number of risks. Briefly, these include the highly speculative nature of the resources industry, characterized by the requirement for large capital investments from an early stage and a very small probability of finding economic mineral deposits. In addition to the general risks of mining, there are country-specific risks, including currency, political, social, permitting and legal risk.

You should carefully consider the risks described below and the other information that Quartz Mountain furnishes to, or files with, the Securities and Exchange Commission and with Canadian securities regulators before investing in Quartz Mountain's common shares. You should not consider an investment in Quartz Mountain unless you are capable of sustaining the economic loss of your entire investment.

Going concern assumption

The Company's consolidated financial statements have been prepared assuming the Company will continue on a going concern basis. However, unless additional funding is obtained, this assumption will have to change. The Company has incurred losses since inception. Failure to continue as a going concern would require that Quartz Mountain's assets and liabilities be restated on a liquidation basis, which could differ significantly from the going concern basis.

Additional Funding Requirements

At July 31, 2014, the Company had cash and cash equivalents of $1.0 million and a working capital deficit of $2.6 million. Further corporate activities and development of the Company's properties will require additional capital. The Company currently does not have sufficient funds to fully develop the properties it holds. In addition, a positive production decision at these properties or any other development projects acquired in the future would require significant capital for project engineering and construction. Accordingly, the continuing development of the Company's properties will depend upon the Company's ability to obtain funding through debt or equity financings, the joint venturing of projects, or other means. It is possible that the financing required by the Company will not be available, or, if available, will not be available on acceptable terms. If the Company issues treasury shares to finance its operations or expansion plans, control of the Company may change and shareholders may suffer dilution of their investment. If adequate funds are not available, or are not available on acceptable terms, the Company may not be able to take advantage of opportunities, or otherwise respond to competitive pressures and remain in business. In addition, a positive production decision at any of the Company’s current projects or any other development projects acquired in the future would require significant resources/funding for project engineering and construction. Accordingly, the continuing development of the Company’s properties will depend upon the Company’s ability to obtain financing through debt financing, equity financing, the joint venturing of projects, or other means. There is no assurance that the Company will be successful in obtaining the required financing for these or other purposes, including for general working capital.

10

Market for Securities and Volatility of Share Price

There can be no assurance that active trading market in the Company's securities will be established or sustained. The market price for the Company's securities is subject to wide fluctuations. Factors such as announcements of exploration results, as well as market conditions in the industry or the economy as a whole, may have a significant adverse impact on the market price of the securities of the Company.

The stock market has from time to time experienced extreme price and volume fluctuations that have often been unrelated to the operating performance of particular companies.

Exploration, Development and Mining Risks

Resource exploration, development, and operations are highly speculative, characterized by a number of significant risks, which even a combination of careful evaluation, experience and knowledge may not reduce, including among other things, unsuccessful efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected formations, formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are other risks involved in the operation of mines and the conduct of exploration programs. The Company will rely upon consultants and others for exploration, development, construction and operating expertise. Substantial expenditures are required to establish mineral resources and mineral reserves through drilling, to develop metallurgical processes to extract the metal from mineral resources, and in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining.

No assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The exact effect of these factors cannot accurately be predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

The Company will carefully evaluate the political and economic environment in considering any properties for acquisition.

Future Profits/Losses and Production Revenues/Expenses

The Company has no history of operations or earnings, and expects that its losses and negative cash flow will continue for the foreseeable future. The Company currently has a limited number of mineral properties and there can be no assurance that the Company will, if needed, be able to acquire additional properties of sufficient technical merit to represent a compelling investment opportunity. If the Company is unable to acquire additional properties, its entire prospects will rest solely with its current projects and accordingly, the risk of being unable to identify a mineral deposit will be higher than if the Company had additional properties to explore. There can be no assurance that the Company will ever be profitable in the future. The Company's operating expenses and capital expenditures may increase in subsequent years as needed consultants, personnel and equipment associated with advancing exploration, development and commercial production of its current properties and any other properties that the Company may acquire are added. The amounts and timing of expenditures will depend on the progress of on-going exploration and development, the results of consultants' analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners, and the Company's acquisition of additional properties and other factors, many of which are beyond the Company's control. The Company does not expect to receive revenues from operations in the foreseeable future, and will incur losses unless and until such time as its current properties, or any other properties the Company may acquire commence commercial production and generate sufficient revenues to fund its continuing operations. The development of the Company’s current properties and any other properties the Company may acquire will require the commitment of substantial resources to conduct the time-consuming exploration and development of properties. The Company anticipates that it will retain any cash resources and potential future earnings for the future operation and development of the Company's business.

11

The Company has not paid dividends since incorporation and the Company does not anticipate paying dividends in the foreseeable future. There can be no assurance that the Company will generate any revenues or achieve profitability.

There can be no assurance that the underlying assumed levels of expenses will prove to be accurate. To the extent that such expenses do not result in the creation of appropriate revenues, the Company's business may be materially adversely affected. It is not possible to forecast how the business of the Company will develop.

Permits and Licenses

The operations of the Company will require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary licenses and permits which may be required to carry out exploration and development of the Company's projects.

Infrastructure Risk

The operations of the Company are carried out in geographical areas which may lack adequate infrastructure and are subject to various other risk factors. Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants which affect capital and operating costs. Lack of such infrastructure or unusual or infrequent weather phenomena, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company's operations, financial condition and results of operations.

Changes in Local Legislation or Regulation

The Company's mining and processing operations and exploration activities are subject to extensive laws and regulations governing the protection of the environment, exploration, development, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, mine and worker safety, protection of endangered and other special status species and other matters. The Company's ability to obtain permits and approvals and to successfully operate in particular communities may be adversely impacted by real or perceived detrimental events associated with the Company's activities or those of other mining companies affecting the environment, human health and safety of the surrounding communities. Delays in obtaining or failure to obtain government permits and approvals may adversely affect the Company's operations, including its ability to explore or develop properties, commence production or continue operations. Failure to comply with applicable environmental and health and safety laws and regulations may result in injunctions, fines, suspension or revocation of permits and other penalties. The costs and delays associated with compliance with these laws, regulations and permits could prevent the Company from proceeding with the development of a project or the operation or further development of a mine or increase the costs of development or production and may materially adversely affect the Company's business, results of operations or financial condition. The Company may also be held responsible for the costs of addressing contamination at the site of current or former activities or at third party sites. The Company could also be held liable for exposure to hazardous substances.

Land Claims

In Canada, aboriginal interests, rights (including treaty rights), claims and title may exist notwithstanding that they may be unregistered or overlap with other tenures and interests granted to third parties. Generally speaking, the scope and content of such rights are not well defined and may be the subject of litigation or negotiation with the government. The government has a legal obligation to consult First Nations on proposed activities that may have an impact on asserted or proven aboriginal interests, claims, rights or title. All of the mineral claims in the Company’s projects are identified by the Province of British Columbia as overlapping with areas in which certain aboriginal groups have asserted aboriginal interests, rights, claims or, title. Nevertheless, potential overlaps between the Company’s properties and existing or asserted aboriginal interests, rights, claims or, title, or undefined rights under historic treaties may exist notwithstanding whether the Province of British Columbia has identified such interests, rights, claims, title or undefined rights under historic treaties.

12

Groups Opposed to Mining May Interfere with the Company's Efforts to Explore and Develop its Properties

Organizations opposed to mining may be active in the regions in which the Company conducts its exploration activities. Although the Company intends to comply with all environmental laws and maintain good relations with local communities, there is still the possibility that those opposed to mining will attempt to interfere with the development of the Company's properties. Such interference could have an impact on the Company's ability to explore and develop its properties in a manner that is most efficient or appropriate, or at all, and any such impact could have a material adverse effect on the Company's financial condition and the results of its operations.

Environmental Matters

All of the Company's operations are and will be subject to environmental laws and regulations, which can make operations expensive or prohibit them altogether. The Company may be subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products that could occur as a result of its mineral exploration, development and production. In addition, environmental hazards may exist on a property in which the Company directly or indirectly holds an interest, which are unknown to the Company at present and have been caused by previous or existing owners or operators of the Company’s projects. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties, or the requirement to remedy environmental pollution, which would reduce funds otherwise available to the Company and could have a material adverse effect on the Company. If the Company is unable to fully remedy an environmental problem, it could be required to suspend operations or undertake interim compliance measures pending completion of the required remedy, which could have a material adverse effect on the Company.

There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Company’s operations. There is also a risk that the environmental laws and regulations may become more onerous, making the Company's operations more expensive. Many of the environmental laws and regulations applicable to the Company’s operations will require the Company to obtain permits for its activities. The Company will be required to update and review its permits from time to time, and may be subject to environmental impact analyses and public review processes prior to approval of the additional activities. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have a significant impact on some portion of the Company's business, causing those activities to be economically re-evaluated at that time.

Conflicts of Interest

The Company's directors and officers may serve as directors or officers of other companies, joint venture partners, or companies providing services to the Company or they may have significant shareholdings in other companies. Situations may arise where the directors and/or officers of the Company may be in competition with the Company. Any conflicts of interest will be subject to and governed by the law applicable to directors' and officers' conflicts of interest. In the event that such a conflict of interest arises at a meeting of the Company's directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In accordance with applicable laws, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company.

Lack of Revenue and a History of Operating Losses

The Company does not have any operational history or earnings and the Company has incurred net losses and negative cash flow from its operations since its incorporation. Although the management of the Company hopes to eventually generate revenues, significant operating losses are to be anticipated for at least the next several years and possibly longer. To the extent that such expenses do not result in the creation of appropriate revenues, the Company's business may be materially adversely affected. It is not possible to forecast how the business of the Company will develop.

General Economic Conditions

Global financial markets have experienced a sharp increase in volatility during the last few years. Market conditions and unexpected volatility or illiquidity in financial markets may adversely affect the prospects of the Company and the value of the Company's shares.

13

Reliance on Key Personnel

The Company is dependent on the continued services of its senior management team, and its ability to retain other key personnel. The loss of such key personnel could have a material adverse effect on the Company. There can be no assurance that any of the Company's employees will remain with the Company or that, in the future, the employees will not organize competitive businesses or accept employment with companies competitive with the Company. Furthermore, as part of the Company's growth strategy, it must continue to hire highly qualified individuals. There can be no assurance that the Company will be able to attract, train or retain qualified personnel in the future, which would adversely affect its business.

Competition

The resources industry is highly competitive in all its phases, and the Company will compete with other mining companies, many of which have greater financial, technical and other resources. Competition in the mining industry is primarily for: attractive mineral rich properties capable of being developed and producing economically; the technical expertise to find, develop and operate such properties; the labour to operate the properties; and the capital for the purpose of funding such properties. Many competitors not only explore for and mine certain minerals, but also conduct production and marketing operations on a worldwide basis. Such competition may result in the Company being unable to acquire desired properties, to recruit or retain qualified employees or to acquire the capital necessary to fund its operations and develop its properties. The Company's inability to compete with other mining companies for these resources could have a materially adverse effect on the Company's results of operations and its business.

Uninsurable Risks

In the course of exploration, development and production of mineral properties, certain risks, and in particular, unexpected or unusual geological operating conditions including rock bursts, cave ins, fires, flooding and earthquakes may occur. It is not always possible to fully insure against such risks and the Company may decide not to take out insurance against such risks as a result of high premiums or other reasons.

Property Title

The acquisition of title to resource properties is a very detailed and time-consuming process. Title to, and the area of, resource claims may be disputed. Although the Company believes it has taken reasonable measures to ensure that title to the mineral claims comprising its projects are held as described, there is no guarantee that title to any of those claims will not be challenged or impaired. There may be valid challenges to the title of any of the mineral claims comprising the Company’s projects that, if successful, could impair development or operations or both.

The mineral property underlying the Company's net smelter return royalty interest contains no known ore.

The Company holds a 1% net smelter return ("NSR") royalty interest on the Quartz Mountain Property (recently renamed "Angel's Camp"), an exploration stage prospect in Oregon. The Company's interest in the property will be limited to any future NSR that would be forthcoming only if or when any mining commences on the property. There is currently no known body of ore on the property. Extensive additional exploration work will be required to ascertain if any mineralization may be economic.

Likely PFIC status has consequences for United States investors

Potential investors who are U.S. taxpayers should be aware that the Company expects to be classified for U.S. tax purposes as a passive foreign investment company ("PFIC") for the current fiscal year, and may also have been a PFIC in prior years and may also be a PFIC in future years. If the Company is a PFIC for any year during a U.S. taxpayer's holding period, then such U.S. taxpayer generally will be required to treat any so-called "excess distribution" on its common shares, or any gain realized upon a disposition of common shares, as ordinary income which would be taxed at the shareholder's highest marginal rates and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer has made a timely qualified electing fund ("QEF") election or a mark-to-market election with respect to the shares of the Company. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of the Company's net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer's tax basis therein. See also Item 10E – "Passive Foreign Investment Company".

14

Potential investors should also note that recently enacted legislation may require U.S. shareholders to report their interest in a PFIC on an annual basis. US shareholders of the Company should consult their tax advisors as to these reporting requirements as well as the consequences of investing in the Company.

Penny stock classification

Penny stock classification could affect the marketability of the Company's common stock and shareholders could find it difficult to sell their stock

The penny stock rules in the United States require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation.

Further, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These additional broker-dealer practice and disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Company's common shares in the U.S., and shareholders may find it more difficult to sell their shares.

| ITEM 4 | INFORMATION ON THE COMPANY |

| A. |

HISTORY AND DEVELOPMENT OF THE COMPANY |

Incorporation

The legal name of the Company is "Quartz Mountain Resources Ltd."

Quartz Mountain Resources Ltd. was incorporated on August 3, 1982, in British Columbia, Canada, and it continues to subsist under the laws of the Province of British Columbia.

The Company was originally incorporated as Wavecrest Resources Ltd., but changed its name to Quartz Mountain Gold Corp. on June 18, 1986. On November 5, 1997, the name of the Company was changed from Quartz Mountain Gold Corp. to Quartz Mountain Resources Ltd., and the common shares were consolidated on a ten-old-for-one-new share basis.

Market for the Company's Securities

The Company's common shares were quoted on NASDAQ SmallCap Market in the United States from September 17, 1987 until May 12, 1994. The Company's common shares were also listed on the Toronto Stock Exchange until November 10, 1994. The Company voluntarily surrendered its listing on the Vancouver Stock Exchange.

In October 2000, the Company listed on a newly created Tier 3 of the Canadian Venture Exchange (now renamed the TSX Venture Exchange ("TSX-V")). In December 2003, the Company was reclassified as a Tier 2 company on the TSX-V. On February 17, 2005, the Company transferred its listing to NEX, a separate board of the TSX-V established in 2003 to provide a new trading forum for listed companies that had fallen below the TSX-V's continued listing standards, due to low levels of business activity.

The Company was relisted on the TSX-V on December 30, 2011.

Currently, the Company's common shares trade on the TSX-V under the symbol QZM, and certain broker-dealers in the United States make market in the Company's common shares on the OTC Grey Market under the symbol QZMRF.

15

Offices

The Company's business office is located at 15th Floor, 1040 West Georgia Street, Vancouver, British Columbia V6E 4H1; telephone (604) 684-6365. The Company's registered office is Suite 1500 – 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7; telephone (604) 689-9111.

| B. |

BUSINESS OVERVIEW |

The Company's Business Strategy and Principal Activities

Quartz Mountain is in the business of exploring and developing mineral properties. The Company’s current activities are primarily focused in British Columbia, Canada, where it has assembled a portfolio of projects through option or purchase agreements and ground staking. Exploration activities on the properties are primarily focused on ascertaining whether the properties host commercially viable mineral deposits.

In the first three years of its existence, the Company was active in the exploration of small gold and silver prospects in Canada, but none of these prospects warranted further exploration or development. In 1986, the Company acquired the Quartz Mountain gold property, located in south central Oregon, and until January 2002 most of the Company's efforts were expended on the exploration and maintenance of these claims. The Company's interests in the Quartz Mountain gold property, and in its other properties, were acquired by direct purchase, lease and option, or through joint ventures.

The Company sold the Quartz Mountain gold property during 2002, to Seabridge Resources Ltd. and Seabridge Resources Inc. (collectively "Seabridge"). Seabridge subsequently changed its name to Seabridge Gold Inc. At closing, Quartz Mountain received 300,000 Seabridge common shares, 200,000 Seabridge common share purchase warrants, US$100,000 and a 1% NSR from any future production on the Quartz Mountain gold property. The Seabridge warrants were exercised and all Seabridge common shares held by the Company have been sold. The Company's interest in the Quartz Mountain gold property is limited to the 1% NSR royalty. The Company does not expect to generate any royalty revenue from the Quartz Mountain gold property (renamed "Angel's Camp" by its subsequent owners) for several years, and it is not known at this time when any mining will commence, if at all, on that property.

Following the sale of the Quartz Mountain gold property, the Company continued in its efforts to find a suitable mineral property for potential acquisition and exploration during the period of 2002 to 2011.

In December 2011, the Company acquired an option to earn a 100% interest in the Buck gold-silver property near the town of Houston in central British Columbia (the “Buck Project”). Concurrently with the Buck Project acquisition, the Company completed a $4.2 million private placement financing and began trading on the TSX-V. Exploration programs were carried out at Buck in 2011 and 2012, confirming targets. Difficult financing conditions for junior companies in 2013 necessitated that the Company limit its exploration expenditures and prioritize its property holdings. As a result, Quartz Mountain terminated its option on the Buck Project in July 2013.

In August 2012, the Company acquired 100% of the Galaxie copper-gold property in northwestern British Columbia (the “Galaxie Project”), and carried out exploration programs in 2012 at five new prospects within the property as well as at the Gnat porphyry copper deposit.

Quartz Mountain acquired the ZNT Project by utilizing British Columbia’s on-line mineral tenure system in 2012. The ZNT Project is located 15 kilometers southeast of the town of Smithers, British Columbia. Exploration in 2012 and 2013 has identified potential for the discovery of a bulk tonnage silver deposit at ZNT.

In November 2012, Quartz Mountain entered into an option and joint venture agreement with Amarc Resources Ltd. (“Amarc”) pursuant to which Amarc could earn a 40% ownership interest, with an option to acquire an additional 10% ownership interest, in the Galaxie and ZNT Projects. Amarc gained an initial 40% interest in the Galaxie and ZNT Projects by funding a drilling program at Gnat porphyry copper deposit at the Galaxie Project in late 2012.

In June 2013, Quartz Mountain and Amarc entered into an amendment agreement through which Amarc had an option until October 31, 2013 to earn a 60% interest in each of the ZNT and Galaxie properties, by making certain property expenditures. Amarc earned a 60% interest in the ZNT Project but earned only a 40% interest in the Galaxie Project.

In April 2014, Amarc terminated joint ventures with the Company and returned earned interests in the Galaxie and ZNT Projects in British Columbia. As a result, Quartz Mountain owns 100% of the Galaxie and ZNT Projects.

The Company does not have any operating revenue and anticipates that it will rely on sales of its equity securities in order to finance its acquisition and exploration activities.

16

British Columbia Mineral Tenure

On January 12, 2005, the Province of British Columbia adopted an on-line mineral tenure system that includes mineral tenure acquisition and tenure maintenance procedures, as well as a method of converting previous format claims (legacy claims) to new format claims (cell claims). All of the Company's mineral tenures have been converted to cell claims resulting in new tenure numbers and marginally larger claim boundaries. The mineral claims are maintained through the completion of exploration activities referred to as "Assessment Work". The financial requirements related to these exploration works defined by the Provincial Government. Currently the cost to stake a mineral claim is $1.75 per hectare and the cost of maintaining a claim is $5.00 per hectare per year during the first two years following location of the mineral claim, $10.00 per hectare per year in the third and fourth years, $15.00 per hectare in the fifth and sixth years, and $20.00 per hectare in the seventh and all succeeding years. If the assessment work is not completed the mineral claims may be maintained by a cash payment, but if this payment is not made before the forfeiture date, the tenure is relinquished.

Another type of mineral tenure exists, called crown-granted mineral claims, on which the perimeter has been physically surveyed. Crown-granted mineral claims are maintained by paying taxes on an annual basis. Unlike mineral claims, the taxes can be paid late with penalties and interest. If the taxes remain unpaid after a specified period of time, the claims will revert to the Crown and will be subsequently made available for acquisition by normal procedures.

Environmental Matters

Environmental matters related to mineral exploration companies in British Columbia are administered by the Ministry of Energy, Mines and Petroleum Resources. The Company files notice of its work programs with the Ministry, and a reclamation security is determined that will set aside sufficient monies to reclaim the exploration sites to their pre-exploration land use. Typically, no reclamation security is required for non-mechanized exploration activities such as surface geological, geochemical and geophysical surveys. However, a reclamation security is generally required for mechanized activities such as machine work and drilling. The required level of reclamation usually involves leaving the sites in a geotechnically stable condition, and grooming the sites to both prevent forest fire hazards and to ensure that natural regeneration of indigenous plant species can progress within a reasonable period of time.

17

| C. |

MINERAL PROPERTIES AND EXPLORATION ACTIVITIES AND PLANS |

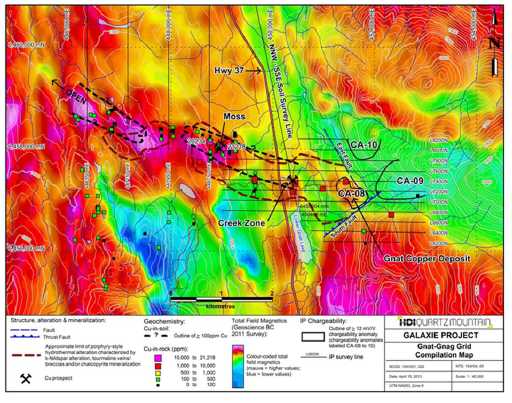

The location of Quartz Mountain’s Galaxie Project is shown on the map below.

Figure 1 Property Location

Galaxie Project, Northwestern British Columbia

Agreements

Sale Agreement with Finsbury Exploration Ltd.

In August 2012, Quartz Mountain completed the acquisition of a 100% interest in the Galaxie Project from Finsbury Exploration Ltd (“Finsbury”), a Non-Arm’s Length Party, through a sale agreement (the “Sale Agreement”) dated July 27, 2012. The Galaxie Project-area, acquired from Finsbury, included an area of 1,488 square kilometers, comprised of three mineral claims totalling 1,294.3 hectares (the “Gnat Pass Property”) and the surrounding mineral claims staked by Finsbury to that time.

Pursuant to the terms of the Sale Agreement, Quartz Mountain issued 2,038,111 shares to Finsbury and assumed the rights and obligations of Finsbury under a mineral property purchase agreement (the “Bearclaw Agreement”) on the Gnat Pass Property between Finsbury and Bearclaw Capital Corp. (“Bearclaw”). Quartz Mountain also assumed the rights and obligations under an NSR Royalty Agreement which requires the payment to Bearclaw of a 1% NSR royalty on the Gnat Pass Property up to a maximum of $7,500,000.

18

The remaining payment obligations to Bearclaw for the Gnat Pass Property under the Bearclaw Agreement to be assumed by Quartz Mountain consisted of:

| 1. |

a payment, on or before August 20, 2012, to Bearclaw of $50,000 in cash (paid); |

| 2. |

the issuance, on or before August 20, 2012, to Bearclaw of a convertible debenture note in the amount of $650,000 at a rate of 8% per annum and with a maturity date of October 31, 2013 (issued); and |

| 3. |

the issuance, following the closing date of the transactions contemplated in the Sale Agreement, to Bearclaw of 1,000,000 shares in the capital of Quartz Mountain (issued). |

The convertible debenture was subsequently amended in July 2013 and October 2014 (See ITEM 5B).

Quartz Mountain and Amarc Joint Venture on Galaxie and ZNT

In November 2012, Quartz Mountain and Amarc Resources Ltd. (“Amarc”), a public company listed on the TSX-V, entered into a binding letter agreement (“Letter Agreement”) pursuant to which Quartz Mountain would grant to Amarc an initial 40% ownership interest in the Galaxie and ZNT Projects, upon Amarc making a cash payment of $1 million to Quartz and funding $1 million in exploration expenditures on the Galaxie Project on or before December 31, 2012 (completed).

On June 27, 2013, the Company entered into an amendment agreement (the "Amendment") whereby, among other things, the Galaxie ZNT Project was divided into two separate joint ventures, named the "Galaxie Joint Venture" and the "ZNT Joint Venture". Under the Amendment, Amarc had an option, until October 31, 2013, to increase its interest in each of the ZNT Joint Venture and the Galaxie Joint Venture from its current 40% interest to a 60% ownership interest by funding exploration expenditures of $210,000 and $235,000, respectively.

In November 2013, Amarc completed sufficient expenditures to earn a 60% interest in the ZNT Joint Venture. Amarc also advised that it expected to remain at a 40% interest in the Galaxie Joint Venture. Amarc returned operatorship of Galaxie and ZNT to Quartz Mountain. In April 2014, Amarc terminated the joint ventures and returned its interests in the Galaxie and ZNT Projects to Quartz Mountain.

Location, Access and Local Resources

The Galaxie Project is located on Highway 37, approximately 24 kilometers south of Dease Lake, BC. The Project area currently consists of mineral claims covering an area of approximately 1,165 square kilometers.

Paved Highway 37 passes through the center of the Galaxie Project (Figure 1) and provides year-round direct access to the adjacent project area, including the Gnat Pass Property. Other parts of the Galaxie Project can be accessed by helicopter.

The operating season for surface exploration is from early June through to early October. Because of its close proximity to Highway 37, diamond drilling activities at the Gnat deposit, within the Gnat Pass Property, can be carried out throughout the year.

Dease Lake (population of about 600) offers an array of services, including motel accommodations, food, fuel, a variety of small equipment operators, post office, health clinic and government services. Mining and exploration make up the most substantial industry. Regional Power manages the off-grid Dease Lake Generating Station, located about 30 km west of Dease Lake. The facility supplies the entire energy load for the community of Dease Lake. Construction of a 287-kilovolt transmission line, extending 344 kilometers from the existing Skeena substation south of Terrace to a new substation near Bob Quinn Lake, about 180 kilometers by road south of Dease Lake was completed in 2014. It will supply a new mine development under construction at Red Chris by way of a spur line at Bob Quinn Lake.

Property Description

The Galaxie Project is comprised of claims acquired through the sale agreement described above and also some additional claims staked by Quartz Mountain. Names and expiry dates for the claims are summarized below:

19

| Property | Claim Name | Expiry date |

| Gnat Pass |

Tenure # 512878 (no name) | Aug 17, 2016 |

| Gnat North | ||

| Gnat 3 | ||

| Galaxie Claims | Hot 10-33, 34 (1014099), 34 (1014104) | |

|

Stu 001-012, 13, 014-024, 050, 055-060, 063-064, 067-070, 074, 077-078, 080-089, 155, 157-158, 161-162, 168, 171-174, 178- 181, 228-237, 240-241, 246-247, 250-260, 274-289 (880610), 300-302, 372 (942614), 372 (983855), 373 (983863), 374 (983874), 373 (991847), 374 (991824), 374 (983876), 375-388 | ||

| Stu 025-049, 051-054, 062, 066, 071, 075-076, 079, 090-094, 95, 096, 097, 98, 136-154, 156, 159-160, 175, 182, 186-190, 223- 227, 238-239, 242-245, 248-249, 262-273, 289 (880909)-299, 303, 308-312, 314-315, 317, 319 (940641), 319 (940649)-322, 324-341, 370, 393-396, 398, 399 | July 28, 2015 |

Quartz Mountain will decide whether to retain the mineral

claims expiring in fiscal 2015 as they come due.

Geological Setting

The Galaxie Project is underlain mainly by volcanic, intrusive and lesser sedimentary rocks of the Middle Triassic to Lower Jurassic Stikine Terrane which, elsewhere in northern British Columbia is known to host the large Red-Chris, Schaft Creek, Galore and KSM and Snowfield porphyry deposits.

Upper Triassic Stuhini Group volcanic rocks and a quartz feldspar porphyry dike complex host the Gnat copper deposit. The Gnat deposit is located near to the northern contact of the Late Triassic to Middle Jurassic, multiphase Hotailuh Batholith-Three Sisters Pluton intrusive complex, which occupies most of the remainder of the Galaxie project-area and hosts a number of base and/or precious metals prospects and showings.

Exploration and Development History

The first record of exploration in the Gnat Pass Property area was in 1960 when prospecting work by Cassiar Asbestos Corporation discovered copper mineralization in the vicinity of Lower Gnat Lake. Since that time, at least nine companies have explored the property completing geological mapping, rock, soil and stream sediment geochemical sampling, magnetic and induced polarization (IP) geophysical surveys and diamond drilling during the periods of 1960-1971, 1990-1996 and in 2005. Most of the historical work focused on the Gnat deposit, and occurrences in the vicinity.

During the period 1965-69, previous operators completed 18,390 meters of diamond drilling in 110 holes in this area. Most of this historical drilling was carried out in the Gnat deposit over an area measuring about 600 meters by 600 meters, down to a maximum depth of about 300 meters below surface. The result of a historical estimate of the “indicated reserves” in the Gnat deposit was reported in 1972.

Past work on other mineral occurrences on the Galaxie Project area includes:

| • |

At Hu, during the period 1969 to 2007, several mining companies carried out: silt, soil and rock geochemical sampling; geological mapping; Induced Polarization (IP) and ground magnetic surveys; and 22 bulldozer trenches. |

| • |

At Disco, Stikine Moly and Stikine, during the period 1970-79, two companies carried out: silt, soil and rock geochemical sampling; geological mapping; IP, ground magnetic and VLF surveys; and limited hand trenching and test-pitting. |

| • |

At Nup, during the period 1970 to 2008, six mining companies and one individual carried out: silt, soil and rock geochemical sampling; geological mapping; IP and ground magnetic surveys; and limited hand trenching and test-pitting. Three diamond drilling programs (14 holes) tested porphyry molybdenum+/-copper showings and soil geochemical anomalies. |

| • |

At Pat, during the period 1971-76, two companies carried out: grid soil surveys; IP and ground magnetic surveys; and a refraction seismic survey. |

In September 2011, Finsbury completed a first-pass reconnaissance prospecting and geochemical silt, soil and rock sampling program within a number of target areas in the Galaxie Claims area. Much of the work was outside of known areas of mineralization, but some work did overlap with known mineral occurrences, including some of those listed above. A total of 486 silt, 912 soil and 35 rock grab samples were collected.

20

Sample Preparation and Analyses for 2012-2013 Programs

Silt samples are comprised of fines material taken from the active part of streams. Sample protocols for soil samples were similar to those for silt samples. For soil samples, “B” horizon material was collected at most sites; in disturbed areas, the top of the “C” horizon was the preferred sample medium with surface material or buried organic materials avoided as well as larger rock fragments, with an average sample size of about 500 grams. For both soils and silts, sample material was placed into a standard kraft sample bag and the location was marked by a survey ribbon. Rock samples were collected as a composite or select grabs of variably mineralized, altered and/or iron-stained rock chip material. About 2-3 kilograms of sample material was placed into a plastic bag, identified by an assay ticket and secured with a nylon cable tie.

Field notes were recorded for each sample including sampler name; property name; target area and grid number; date and time; sample site coordinates (UTM, NAD 83 - Zone 9); sample number and sample description. For rock samples, the size of the occurrence, its orientation (strike and dip if measurable), host rock, sulphides present and their amounts in percent, and any other data that would aid in later interpretation after receipt of analytical results were also recorded. All field notes were later compiled into a digital file.

Silt and soil samples were hung to dry, then packed in a secure container and shipped to the Acme Analytical Laboratories Ltd. (“Acme”) preparation facility in Smithers, B.C where they were dried at 60° Celsius and sieved to -80 mesh (0.18 mm or 180µm), then shipped to Acme’s laboratory in Vancouver where they were analyzed for gold and multi-elements by ICP methods.

Rock samples were packed in a secure container and also shipped to Acme’s preparation lab in Smithers, B.C. Entire rock samples were crushed to 80% passing 10 mesh, from which a 250 gram split was taken, and shipped to Acme’s laboratory in Vancouver where the sub-samples were pulverized to 85% passing 200 mesh (0.075 mm or 75 microns). Then 15 gram splits were analyzed for gold and multi-elements by acid digestion ICP methods.

All soil, silt and rock samples in the 2013 program were prepared at the Acme Laboratories in Smithers or Vancouver and analyzed using their 36 element aqua regia digestion ICP/MS package at the Vancouver, Canada facility. Rock chip samples >10,000 ppm Zn were also analyzed by 4 acid digestion ICP-AES finish.

Acme is ISO 9001:2005 certified for the provision of assays and geochemical analysis.

Quality assurance/quality control (“QA/QC”) samples were done at the laboratory. QA/QC samples were inserted as flows: 1 blank for every 30 regular samples, 1 standard for every 30 regular samples and 1 duplicate for every 20 regular samples.

Recent Work

Gnat Deposit

In 2012, Quartz Mountain relogged historical drill holes and carried out geological mapping in the Gnat deposit-area. Two deep diamond drill holes totaling 1,164 meters were also drilled into the Gnat deposit to test for continuation of copper mineralization beneath an area in which a historical reserve estimate had been completed by a prior operator in 1972. Hole GT12001 drilled in 2012 intersected two intervals of significant copper mineralization, including 56 meters grading 0.44% Cu, well below the extent of the historical estimate, demonstrating that porphyry-style copper mineralization in the Gnat deposit extends over a known vertical range of about 500 meters. In their lower portions, both holes encountered a major thrust fault which has structurally superimposed older deposit host rocks over younger, Hazelton Group sedimentary rocks.

Geological mapping in the Gnat deposit area identified porphyry-style hydrothermal alteration characterized by occurrences of k-feldspar veining and flooding, tourmaline in veins or breccia bodies and chalcopyrite mineralization over a west-northwest trending zone measuring about 3.5 kilometers long by 700 meters to 1,000 meters wide. Contained within this large 'hydrothermal footprint' are the Creek Zone and Moss copper prospects, the two main known mineralized zones outside of the Gnat deposit area (see Figure 2 below).

21

Figure 2 Gnat Deposit Area

There is considerable room to explore for new zones of copper mineralization at moderate to greater depths in portions of the Gnat deposit, in the Creek Zone and Moss prospect areas, and elsewhere along the 3.5 kilometer-long zone of porphyry-style hydrothermal alteration. Mineralization may include porphyry-type deposits or more constrained, but possibly higher grade, mineralized breccia bodies.

Other Targets

In 2012, Quartz Mountain completed extensive exploration work on seven IP/soil grids and two target areas throughout the Galaxie Project-area. Totals of 182 silt, 6,155 soil and 498 rock samples were collected and 308.5 line-km of IP surveys were completed on the grids. These surveys delineated four porphyry copper targets and a silver skarn target for ground follow-up.

Amarc completed programs at a few of these targets in 2013 as part of its earn-in obligations under the amended joint venture agreement on Galaxie. The 2013 programs included geological mapping, 10 line kilometers of IP ground geophysical surveying and collection of 96 rock and 246 soil geochemical samples. No immediate drill targets were identified; however, a series of alkali intrusions which are known to be the principal hosts in the Stikine-Iskut porphyry belt for porphyry copper-gold deposits were observed during the 2013 program around one of the targets, called Hu.

One of the target areas identified by Quartz Mountain but not followed up in 2013 is called Dalvenie East. The Dalvenie East target-area is located about 7 km south of the Gnat deposit. Preliminary prospecting of two gossans in the area by Quartz Mountain was successful in locating encouraging copper mineralization in chalcopyrite +/- bornite veins up to 10 cm wide, hosted in chlorite-altered diorite to monzodiorite wall rocks. Narrow k-feldspar alteration envelopes surrounding the veins also contain chalcopyrite and bornite. Magnetic signatures at Dalvenie East suggest that regional-scale faults, or subsidiary faults related to them, could control vein-type or fault-controlled copper-gold mineralization similar to that seen at the nearby Dalvenie prospect.

As a result of difficult financing conditions for junior exploration companies, no work was completed at Galaxie in 2014. The potential of the intrusions at Hu and the mineralization at the Dalvenie East target warrant further exploration when funds become available.

Other Properties

ZNT Property

The ZNT Property is located in central British Columbia, some 15 kilometers southeast of the town of Smithers, BC. The property consists of 102 square kilometers of mineral claims owned 100% by Quartz Mountain.

Claim expiry dates are as follows:

22

| Claim Name | Expiry |

| ZNT 01-21 | August 06, 2016 |

The ZNT property was staked by Quartz Mountain in 2012 on the basis of significant zinc and gold values in regional till samples, as well as copper and silver mineral occurrences as reported by Geoscience BC and the provincial government surveys, respectively.

Work in 2012 by Quartz Mountain included soil geochemistry grid and an IP geophysical survey. A high-contrast, 1,800 meter by 1,200 meter silver-zinc geochemical anomaly, in part coincident with an extensive IP chargeability anomaly, was outlined. Programs in 2013 were carried out under the amended joint venture agreement. A pitting and trenching program was done to further refine the target identified in 2012, and later tested by a 600-meter, 2-hole drill program. The drill holes indicated a limited extent to the prospective host rock package and did not encounter economic mineralization. No further work is planned.

Angel's Camp Property

The Company retains a 1% net smelter return royalty payable to the Company on any production from the Angel's Camp property located in Lake County, Oregon. The Angel's Camp property is currently held by Alamos Gold Inc.

During the year ended July 31, 2002, the Company sold 100% of its title, rights and interest in the Angel's Camp property located in Lake County, Oregon to Seabridge Resources Inc. ("Seabridge"), which later changed its name to Seabridge Gold Inc., for 300,000 common shares of Seabridge (sold in prior years), 200,000 common share purchase warrants of Seabridge (exercised and sold in prior years), cash of $100,000, and a 1% net smelter return royalty payable to the Company on any production from the Angel's Camp property.