Quartz Mountain Resources Ltd.: Exhibit 99.2 - Filed by newsfilecorp.com

QUARTZ MOUNTAIN RESOURCES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS

NINE MONTHS ENDED APRIL 30, 2014

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

T A B L E O F C O N T E N T S

- 2 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.1 DATE

This Management's Discussion and Analysis ("MD&A") should

be read in conjunction with the unaudited condensed interim consolidated

financial statements of Quartz Mountain Resources Ltd. ("Quartz Mountain" or the

"Company") for the nine months ended April 30, 2014, as publicly filed on SEDAR

at www.sedar.com. All dollar amounts herein are expressed in Canadian dollars

unless otherwise stated.

The Company reports in accordance with International

Financial Reporting Standards ("IFRS") and the following disclosure, and

associated financial statements, are presented in accordance with IFRS. All

comparative information provided is in accordance with IFRS.

For the purposes of the discussion below, date references refer

to calendar year and not the Company's fiscal reporting period.

This MD&A is prepared as of June 11, 2014.

Cautionary Note to Investors Concerning Forward-looking

Statements

This discussion includes certain statements that may be deemed

"forward-looking statements". All statements in this disclosure, other than

statements of historical facts, that address permitting, exploration drilling,

exploitation activities and events or developments that the Company expects are

forward-looking statements. Although the Company believes the expectations

expressed in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual

results or developments may differ materially from those in the forward-looking

statements. Assumptions used by the Company to develop forward-looking

statements include the following: the Company’s projects will obtain all

required environmental and other permits and all land use and other licenses,

and no geological or technical problems will occur. Factors that could cause

actual results to differ materially from those in forward-looking statements

include market prices, exploration and exploitation successes, continuity of

mineralization, potential environmental issues and liabilities associated with

exploration, development and mining activities, uncertainties related to the

ability to obtain necessary permits, licenses and title and delays due to third

party opposition or litigation, changes in laws and government policies

regarding mining and natural resource exploration and exploitation, continued

ability of the Company to raise necessary capital, and general economic, market

or business conditions. Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements. The Company

reviews its forward looking statements on an on-going basis and updates this

information when circumstances require it.

1.2

OVERVIEW

The information comprised in this MD&A relates to Quartz

Mountain Resources Ltd. and its subsidiary (together referred to as the

"Company").

Quartz Mountain is an exploration and development company

focused on acquiring and advancing promising mineral prospects in British

Columbia ("BC"). The Company’s most recent activities have been focused in

northwestern BC and central BC.

- 3 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

The Company’s Galaxie Project is situated in the Stikine

Terrane, a region in northwestern BC that hosts a number of important copper and

gold deposits. There is potential for the discovery of bulk tonnage copper-gold

and/or molybdenum and vein-type precious and base metal deposits in the

project-area. Historical exploration identified several copper occurrences,

including the Gnat porphyry copper deposit.

Ground surveys were undertaken at

Galaxie by Quartz Mountain in 2012 in the vicinity of the Gnat deposit and

several other prospects across the property and followed up with a two-hole

drilling program at the Gnat deposit in late 2012. The program confirmed the

presence of porphyry mineralization at depth in the deposit, returning intervals

of 55.7 metres grading 0.44% copper and 91.0 metres grading 0.37% copper in the

two holes drilled. Amarc Resources Ltd. (“Amarc”) earned an initial 40%

ownership interest in the Galaxie and ZNT Projects by funding the drilling

program.

At Galaxie in 2013, Amarc conducted ground exploration at some

of the target-areas identified by Quartz Mountain. A series of alkali intrusions

which are known to be the principal hosts in the Stikine-Iskut porphyry belt for

porphyry copper-gold deposits were observed during the 2013 program around the

Hu target. Although Amarc plans no further work, the potential at Hu and a

number of other remaining target-areas identified during Quartz Mountain’s 2012

program warrant further exploration.

The ZNT Project in central BC was staked by Quartz Mountain in

2012, and surface exploration work that year identified a high potential

silver-zinc target. Amarc earned a 60% interest in ZNT by carrying out

exploration in 2013. Initial surveys in 2013 indicated a strong drill target,

which were followed up by a 600-metre, 2-hole drill program that did not

encounter economic mineralization. No further work is planned at ZNT.

On March 31, 2014, Amarc terminated the joint ventures and

returned its interests in ZNT and Galaxie to Quartz Mountain. Consequently,

Quartz Mountain now holds a 100% interest in each property.

Market conditions, which have made financing for exploration

projects difficult over the past two years, have prevailed so far in 2014. In

2014, the Company will continue to seek partners to joint venture or farm out

its exploration projects.

1.2.1 Agreements – Galaxie Project

| Sale Agreement

with Finsbury Exploration Ltd. |

In August 2012, Quartz Mountain acquired a 100% interest in the

Galaxie Project from Finsbury Exploration Ltd. ("Finsbury") through a sale

agreement (the "Sale Agreement") dated July 27, 2012. The Galaxie Project area

acquired from Finsbury included an area of 1,488 square kilometres, comprised of

three mineral claims totalling approximately 1,294 hectares (the "Gnat Pass

Property") and the surrounding mineral claims staked by Finsbury to that time.

Pursuant to the terms of the Sale Agreement, Quartz Mountain

issued 2,038,111 shares to Finsbury and also assumed the rights and obligations

of Finsbury under a mineral property purchase agreement (the "Bearclaw

Agreement") between Finsbury and Bearclaw Capital Corp. ("Bearclaw") relating to

the Gnat Pass Property. Quartz Mountain also assumed the rights and obligations

under an net smelter returns ("NSR") royalty agreement which requires the

payment to Bearclaw of a 1% NSR royalty on the Gnat Pass Property up to a

maximum of $7,500,000.

The remaining payment obligations to Bearclaw for the Gnat Pass

Property under the Bearclaw Agreement assumed by Quartz Mountain consisted of:

- 4 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

-

a payment of $50,000 to Bearclaw (paid);

-

the issuance of a convertible debenture (the “Debenture”) to Bearclaw in

the amount of $650,000, bearing an interest rate of 8% per annum and with a

maturity date of January 31, 2014 (issued; however, the maturity date was

later amended – see below); and

-

the issuance to Bearclaw of 1,000,000 shares in the capital of Quartz

Mountain (issued).

In July 2013, Quartz Mountain and the holder of the Debenture

entered into an agreement to amend the Debenture, whereby the Galaxie Joint

Venture made a $50,000 principal payment toward the Debenture, reducing the

outstanding balance to $600,000. The interest rate was increased to 10% per

annum, and the maturity date was extended to October 31, 2014.

| Agreement with

Amarc Resources Ltd. |

Quartz Mountain and Amarc entered into a Letter Agreement dated

November 1, 2012, pursuant to which Amarc earned an initial 40% ownership

interest in the Galaxie and ZNT Projects (the "Galaxie ZNT Project"), by making

a cash payment of $1,000,000 to Quartz Mountain (completed) and funding

$1,000,000 in exploration expenditures to be incurred by Quartz Mountain

relating to the Galaxie Project on or before December 31, 2012 (completed).

Quartz Mountain also granted to Amarc an option to acquire an

additional 10% (for a total of 50%) ownership interest in the Galaxie ZNT

Project, in consideration for Amarc funding an additional $1,000,000 in

exploration expenditures, on or before September 30, 2013. On June 26, 2013, the

Company entered into an amendment agreement (the "Amendment") whereby, among

other things, the Galaxie ZNT Project was divided into two separate joint

arrangements, named the "Galaxie Joint Venture" and the "ZNT Joint Venture"

governed by the terms of the previously executed agreement. Under the Amendment,

Amarc had an option to increase its interest in each of the ZNT Joint Venture

and Galaxie Joint Venture from its current 40% interest to a 60% ownership

interest by funding exploration expenditures of $210,000 and $235,000,

respectively.

In October 2013, Amarc completed the expenditures necessary to

earn a 60% interest in the ZNT Joint Venture, and chose to remain at a 40%

interest in the Galaxie Joint Venture. On March 31, 2014, Amarc terminated the

joint ventures and returned its interests in each property to Quartz Mountain.

1.2.2 Technical Programs – Galaxie

Project

The following disclosure on the Galaxie Project has been

summarized from a technical report (the “2013 technical report”) entitled

“Technical Report on the Galaxie Project, Liard Mining Division, British

Columbia” effective date April 30, 2013 by B.K. (Barney) Bowen, PEng, and

updated based on information from Company files.

The Galaxie Project is located on Highway 37, approximately 24

kilometres south of Dease Lake, BC. The Project-area currently consists of 306

mineral claims covering an area of approximately 1,165 square kilometres.

Paved Highway 37 passes through the center of the Galaxie

Project and provides year-round direct access to the adjacent project-area,

including the Gnat Pass Property. Other parts of the Galaxie Project can be

accessed by helicopter.

- 5 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

The operating season for surface exploration is from early June

through to early October. Because of its close proximity to Highway 37, diamond

drilling activities at the Gnat deposit, within the Gnat Pass Property, can be

carried out throughout the year.

Dease Lake (population of about 600) offers an array of

services, including motel accommodations, food, fuel, a variety of small

equipment operators, post office, health clinic and government services. Mining

and exploration make up the most substantial industry. Regional Power manages

the off-grid Dease Lake Generating Station, located about 30 km west of Dease

Lake. The facility supplies the entire energy load for the community of Dease

Lake. A new 287-kilovolt transmission line, extending 344 kilometres from the

existing Skeena substation south of Terrace to a new substation near Bob Quinn

Lake, about 180 kilometres by road south of Dease Lake, is currently being

constructed. It will supply the new mine development under construction at

Imperial Metals Corporation’s Red Chris Project by way of a spur line at Bob

Quinn Lake.

| Geology and

Mineralization |

The Galaxie Project is underlain mainly by volcanic, intrusive

and lesser sedimentary rocks of the Middle Triassic to Lower Jurassic Stikine

Terrane which, elsewhere in northern British Columbia is known to host the large

Red Chris, Schaft Creek, Galore and KSM and Snowfield porphyry deposits. Upper

Triassic Stuhini Group volcanic rocks and a quartz feldspar porphyry dike

complex host the Gnat copper deposit. The Gnat deposit is located near to the

northern contact of the Late Triassic to Middle Jurassic, multiphase Hotailuh

Batholith-Three Sisters Pluton intrusive complex, which occupies most of the

remainder of the Galaxie project-area and hosts a number of base and/or precious

metals prospects and showings.

The first record of exploration in the Gnat Pass Property area

was in 1960 when prospecting work by Cassiar Asbestos Corporation discovered

copper mineralization in the vicinity of Lower Gnat Lake. Since that time, at

least nine companies have explored the property completing geological mapping,

rock, soil and stream sediment geochemical sampling, magnetic and induced

polarization (“IP”) geophysical surveys and diamond drilling during the periods

of 1960-1971, 1990-1996 and in 2005. Most of the historical work focused on the

Gnat deposit, and occurrences in the vicinity.

During the period 1965-1969, previous operators completed

18,390 metres of diamond drilling in 110 holes in this area. Most of this

historical drilling was carried out in the Gnat deposit over an area measuring

about 600 metres by 600 metres, down to a maximum depth of about 300 metres

below surface.

A historical estimate of "indicated reserves" of about 30

million tonnes grading 0.389% Cu for the Gnat Deposit was reported by Lytton

Minerals Ltd, in 1972. The estimate uses categories that are not recognized by

National Instrument 43-101 Standards of Disclosure for Mineral Projects. The

qualified person for the 2013 technical report has not done sufficient work to

classify the historical estimate as a current mineral resource or mineral

reserve. Quartz Mountain is not treating the historical estimate as current.

Past work on other mineral occurrences on the Galaxie Project

area includes:

- 6 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

-

At Hu, during the period 1969 to 2007, several mining companies carried

out: silt, soil and rock geochemical sampling; geological mapping; Induced

Polarization ("IP") and ground magnetic surveys; and 22 bulldozer trenches.

-

At Disco, Stikine Moly and Stikine, during the period 1970-79, two

companies carried out: silt, soil and rock geochemical sampling; geological

mapping; IP, ground magnetic and VLF surveys; and limited hand trenching and

test-pitting.

-

At Nup, during the period 1970 to 2008, six mining companies and one

individual carried out: silt, soil and rock geochemical sampling; geological

mapping; IP and ground magnetic surveys; and limited hand trenching and

test-pitting. Three diamond drilling programs (14 holes) tested porphyry

molybdenum+/-copper showings and soil geochemical anomalies.

-

At Pat, during the period 1971-76, two companies carried out: grid soil

surveys; IP and ground magnetic surveys; and a refraction seismic survey.

Prospecting and geochemical silt, soil and rock sampling

program carried out by a previous owner in 2011 identified a number of target

areas at Galaxie. Much of the work was outside of known areas of mineralization,

but some work did overlap with known mineral occurrences, including some of

those listed above.

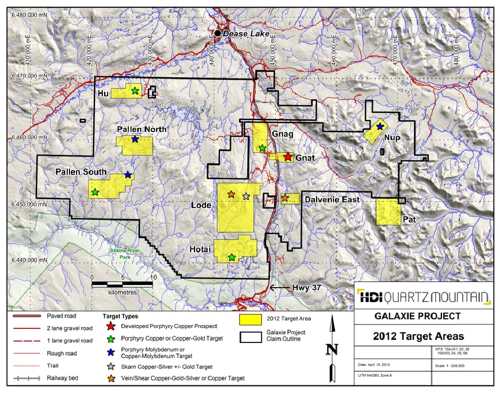

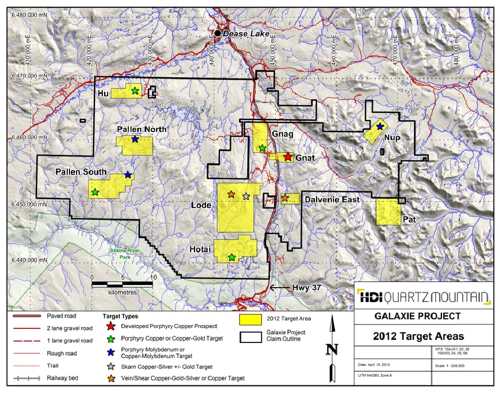

In 2012, Quartz Mountain completed extensive exploration work

on seven IP/soil grids and two other target areas at the Galaxie Project (see

below), collecting 182 silt, 6,155 soil and 498 rock samples and completing 309

line-km of IP surveys. Additionally, two holes were drilled at the Gnat

deposit.

- 7 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

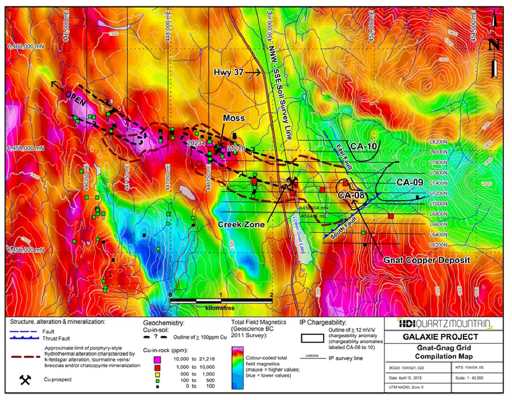

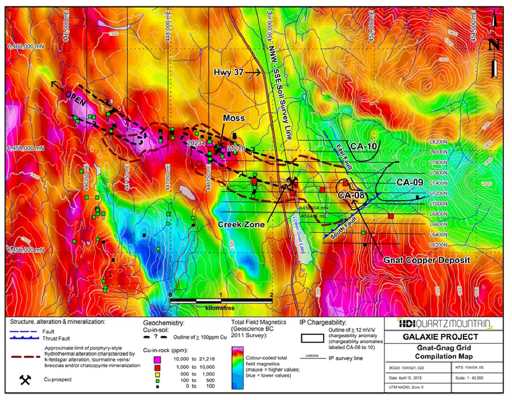

Gnat Deposit

In 2012, Quartz Mountain relogged historical drill holes and

carried out geological mapping in the Gnat deposit-area. The Company also

completed two deep diamond drill holes totaling 1,164 metres in the Gnat deposit

to test for continuation of copper mineralization beneath the historical reserve

estimate. Hole GT12001 intersected two intervals of significant copper

mineralization, including 56 metres grading 0.44% Cu, well below the extent of

the historical estimate, demonstrating that porphyry-style copper mineralization

in the Gnat deposit extends over a known vertical range of about 500 metres. In

their lower portions, both holes encountered a major thrust fault which has

structurally superimposed older deposit host rocks over younger Hazelton Group

sedimentary rocks.

Geological mapping in the Gnat deposit area identified

porphyry-style hydrothermal alteration characterized by occurrences of

k-feldspar veining and flooding, tourmaline in veins or breccia bodies and

chalcopyrite mineralization over a west-northwest trending zone measuring about

3.5 kilometres long by 700 metres to 1,000 metres wide. Contained within this

large 'hydrothermal footprint' are the Creek Zone and Moss copper prospects, the

two main known mineralized zones outside of the Gnat deposit area (see figure

below).

- 8 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

There is considerable room to explore for new zones of copper

mineralization at moderate to greater depths in portions of the Gnat deposit, in

the Creek Zone and Moss prospect areas, and elsewhere along the 3.5

kilometre-long zone of porphyry-style hydrothermal alteration. Mineralization

may include porphyry-type deposits or more constrained, but possibly higher

grade, mineralized breccia bodies.

Other Targets

As part of its earn-in obligations under the amended joint

venture agreement, in 2013 Amarc completed programs at some of the targets

identified by Quartz Mountain in 2012. These include Hu, Hotai and Silver Lode.

The 2013 programs included geological mapping, 10 line kilometres of IP ground

geophysical surveying and collection of 96 rock and 246 soil geochemical

samples. Although Amarc did not identify any immediate drill targets, a series

of alkali intrusions which are known to be the principal hosts in the

Stikine-Iskut porphyry belt for porphyry copper-gold deposits were observed

around the Hu target. The potential of these intrusions at Hu as well as

target-areas described in the 2013 technical report but not yet followed up

warrant further exploration. The latter includes the Dalvenie East target, which

is briefly described below:

Preliminary prospecting of two gossans in the

Dalvenie East target-area was successful in locating encouraging copper

mineralization in chalcopyrite +/- bornite veins up to 10 cm wide, hosted in

chlorite-altered diorite to monzodiorite wall rocks. Narrow k-feldspar

alteration envelopes surrounding the veins also contain chalcopyrite and

bornite. Magnetic signatures at Dalvenie East suggest that regional-scale faults, or subsidiary faults related to them, could control

vein-type or fault-controlled copper-gold mineralization similar to that seen at

the nearby Dalvenie prospect.

- 9 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.2.4 Other Properties

The Company holds a 100% interest in the ZNT property, which

consists of 21 claims covering an area of approximately 102 square kilometres

located in central British Columbia, some 15 kilometres southeast of the town of

Smithers, BC. The property was staked by Quartz Mountain in 2012. Target

definition was carried out in 2012 and 2013, and an initial drilling program was

done but no economic mineralization was encountered. No further work is planned.

The Company retains a 1% net smelter return royalty payable to

the Company on any production from the Angel's Camp property located in Lake

County, Oregon. The Angel's Camp property is currently held by Alamos Gold

Inc.

1.2.5 Market Trends

The discussion in this section references calendar years and

dollar amounts are stated in United States dollars.

Copper prices showed a significant increase between late 2003

and mid-2008, and after a steep decline in late 2008 and early 2009, steadily

increased until late 2011. The price of copper was variable in 2012 and 2013,

but averaged lower each year. Prices were on a downtrend to late March 2014, but

have stabilized since that time.

The gold price was on an uptrend for over the five years to

2012. Prices were on a general downtrend in 2013, and have been variable in

2014.

Silver prices were impacted by economic volatility in

2008-2009. An upward price trend began in 2010, and continued to late September

2011, with prices reaching as high as $43/oz, and resulting in the average price

in 2011 being the highest since 2008. Prices ranged between $26/oz and $35/oz

between October 2011 and the end of 2012. Prices have been variable in 2014,

resulting in a decrease in the average price from 2013.

- 10 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

Average annual prices through 2013 as well as the average

prices so far in 2014 for copper (Cu), gold (Au) and silver (Ag) are shown in

the table below:

| Calendar Year

|

Metal Prices |

| Cu |

Au |

Ag |

| 2008 |

$3.16/lb |

$871/oz |

$14.95/oz |

| 2009 |

$2.34/lb |

$974/oz |

$14.70/oz |

| 2010 |

$3.42/lb |

$1,228/oz |

$20.24/oz |

| 2011 |

$4.00/lb |

$1,572/oz |

$35.25/oz |

| 2012 |

$3.61/lb |

$1,669/oz |

$31.16/oz |

| 2013 |

$3.32/lb |

$1,410/oz |

$23.80/oz |

| 2014 to the date of this MD&A |

$3.15/lb |

$1,291/oz |

$20.05/oz |

1.3

SELECTED ANNUAL INFORMATION

Not required for interim MD&A.

- 11 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.4

SUMMARY OF QUARTERLY RESULTS

The amounts in the following table are expressed in thousands

of Canadian Dollars, except per share amounts and the weighted average number of

common shares outstanding. Minor differences are due to rounding.

| |

|

Apr-30 |

|

|

Jan-31 |

|

|

Oct-31 |

|

|

Jul-31 |

|

|

Apr-30 |

|

|

Jan-31 |

|

|

Oct-31 |

|

|

Jul-31 |

|

| |

|

2014 |

|

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

|

2012 |

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration and evaluation |

$ |

6 |

|

$ |

25 |

|

$ |

236 |

|

$ |

(20 |

) |

$ |

160 |

|

$ |

1,202 |

|

$ |

2,538 |

|

$ |

1,206 |

|

| General and administration

|

|

139 |

|

|

187 |

|

|

165 |

|

|

242 |

|

|

326 |

|

|

436 |

|

|

355 |

|

|

417 |

|

| Share-based payments |

|

– |

|

|

– |

|

|

– |

|

|

23 |

|

|

28 |

|

|

76 |

|

|

85 |

|

|

171 |

|

| Loss from operations |

|

(145 |

)

|

|

(212 |

)

|

|

(401 |

)

|

|

(245 |

)

|

|

(514 |

)

|

|

(1,714 |

)

|

|

(2,978 |

)

|

|

(1,794 |

)

|

| Gain (i) |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

1,579 |

|

|

– |

|

|

– |

|

| Other items (ii) |

|

(9 |

) |

|

(8 |

) |

|

27 |

|

|

23 |

|

|

4 |

|

|

5 |

|

|

380 |

|

|

172 |

|

| Loss for the quarter |

$ |

(154 |

) |

$ |

(220 |

) |

$ |

(374 |

) |

$ |

(222 |

) |

$ |

(510 |

) |

$ |

(130 |

) |

$ |

(2,598 |

) |

$ |

(1,622 |

) |

| Loss per share (iii) |

$ |

0.02 |

|

$ |

0.01 |

|

$ |

0.01 |

|

$ |

0.01 |

|

$ |

0.02 |

|

$ |

0.01 |

|

$ |

0.11 |

|

$ |

0.08 |

|

| (i) |

Relates to gain on disposition of a mineral property

interest |

| |

|

| (ii) |

Includes flow-through share premium, interest income and

expense, and foreign exchange. |

| |

|

| (iii) |

Basic and diluted loss per common share are the same

amount in each period presented. |

Exploration and evaluation (“E&E”) expenditures increased

in the first half of fiscal 2013 due to the acquisition of the Galaxie Project,

and ZNT project. E&E costs decreased after January 2013 as the Company had

been mainly focused on property evaluation activities. In the quarter ended July

31, 2013, the Company accrued a $200,000 estimate for Mineral Exploration Tax

Credit receivable within E&E expenses.

Administrative costs have tended to follow the trend in the

Company's exploration and business development activities of the Company. They

have been reduced to minimum levels necessary to meet continued disclosure and

corporate governance requirements of a public company.

Expenses for share-based payments typically fluctuate based on

the timing of share purchase option grants and the vesting periods (which drive

the amortization) associated with these grants.

- 12 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.5

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The following financial data has been prepared in accordance

with IFRS and is expressed in Canadian dollars unless otherwise stated.

1.5.1 Comprehensive loss for the nine month period ended

April 30, 2014 vs. 2013

The Company recorded a loss from operations of $748,000 in the

current period compared to a loss from operations of $3,237,000 in the prior

fiscal year, primarily due to a decrease in E&E activities during the

current period.

Total E&E costs during nine months ended April 30, 2014

decreased to $267,000, compared to $3,900,000 in E&E costs during nine

months ended April 30, 2013. The following tables provide a breakdown of

exploration costs incurred during the nine month period ended April 30, 2014 and

2013:

| Nine months

ended April 30, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| E&E costs |

|

Galaxie |

|

|

Hotai |

|

|

ZNT |

|

|

Other |

|

|

Total |

|

| Assaying |

$ |

7,274 |

|

$ |

1,053 |

|

$ |

12,104 |

|

$ |

140 |

|

$ |

20,571 |

|

| Drilling |

|

– |

|

|

– |

|

|

90,773 |

|

|

– |

|

|

90,773 |

|

| Engineering |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

| Geological |

|

30,570 |

|

|

3,200 |

|

|

45,615 |

|

|

6,113 |

|

|

85,498 |

|

| Graphics |

|

204 |

|

|

– |

|

|

153 |

|

|

1,998 |

|

|

2,355 |

|

| Property fees |

|

1,409 |

|

|

– |

|

|

– |

|

|

– |

|

|

1,409 |

|

| Site activities |

|

8,530 |

|

|

676 |

|

|

19,571 |

|

|

– |

|

|

28,777 |

|

| Sustainability |

|

– |

|

|

34 |

|

|

17,148 |

|

|

– |

|

|

17,182 |

|

| Transportation |

|

4,770 |

|

|

– |

|

|

– |

|

|

– |

|

|

4,770 |

|

| Travel |

|

4,673

|

|

|

5,530

|

|

|

5,337

|

|

|

– |

|

|

15,540 |

|

| Total |

$ |

57,430 |

|

$ |

10,493 |

|

$ |

190,701 |

|

$ |

8,251 |

|

$ |

266,875 |

|

- 13 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

| Nine months

ended April 30, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| E&E costs |

|

Galaxie |

|

|

Hotai |

|

|

ZNT |

|

|

Other |

|

|

Total |

|

| Assaying |

$ |

239,526 |

|

$ |

5,547 |

|

$ |

51,295 |

|

$ |

48,391 |

|

$ |

344,759 |

|

| Drilling |

|

265,336 |

|

|

– |

|

|

– |

|

|

– |

|

|

265,336 |

|

| Engineering |

|

9,044 |

|

|

– |

|

|

– |

|

|

12,474 |

|

|

21,518 |

|

| Geological |

|

1,310,116 |

|

|

100,895 |

|

|

152,579 |

|

|

113,814 |

|

|

1,677,404 |

|

| Graphics |

|

17,664 |

|

|

255 |

|

|

8,235 |

|

|

16,890 |

|

|

43,044 |

|

| Property fees |

|

15,375 |

|

|

14,555 |

|

|

53,692 |

|

|

125 |

|

|

83,747 |

|

| Site activities |

|

626,464 |

|

|

– |

|

|

32,544 |

|

|

3,471 |

|

|

662,479 |

|

| Sustainability |

|

11,847 |

|

|

333 |

|

|

30,038 |

|

|

14,125 |

|

|

56,343 |

|

| Transportation |

|

620,716 |

|

|

40,220 |

|

|

– |

|

|

– |

|

|

660,936 |

|

| Travel |

|

74,839 |

|

|

– |

|

|

8,193

|

|

|

1,696

|

|

|

84,728 |

|

| Total |

$ |

3,190,927 |

|

$ |

161,805 |

|

$ |

336,576 |

|

$ |

210,986 |

|

$ |

3,900,294 |

|

The following table provides a breakdown of the administration

costs incurred:

| Administration costs |

|

Nine months ended |

|

|

Nine months ended |

|

| |

|

April 30, 2014 |

|

|

April 30, 2013 |

|

| Legal, accounting and audit

|

$ |

50,044 |

|

$ |

49,843 |

|

| Office and administration |

|

398,982 |

|

|

947,259 |

|

| Shareholder communication |

|

17,029 |

|

|

47,073 |

|

| Travel and conferences |

|

6,853 |

|

|

32,557 |

|

| Trust and filing |

|

19,497 |

|

|

40,912 |

|

| Total |

$ |

492,405 |

|

$ |

1,117,644 |

|

1.5.2 Comprehensive loss for the three months ended April

30, 2014 vs. 2013

The Company recorded a loss from operations of $154,000 during

the three months ended April 30, 2014, compared to a loss from operations of

$510,000 during the same period of the prior fiscal year, primarily due to a

decrease in E&E activities during the current period.

Total E&E costs during three months ended April 30, 2014

reduced to $6,000, compared to $160,000 in E&E costs during three months

ended April 30, 2013.

- 14 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

The following tables provide a breakdown of exploration costs

incurred during the three month period ended April 30, 2014 and 2013:

| Three months

ended April 30, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| E&E

costs |

|

Galaxie |

|

|

Hotai |

|

|

ZNT |

|

|

Other |

|

|

Total |

|

| Assaying |

$ |

– |

|

$ |

– |

|

$ |

– |

|

$ |

140 |

|

$ |

140 |

|

| Engineering |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

| Geological |

|

– |

|

|

– |

|

|

– |

|

|

3,716 |

|

|

3,716 |

|

| Graphics |

|

– |

|

|

– |

|

|

– |

|

|

383 |

|

|

383 |

|

| Property fees |

|

1,201 |

|

|

– |

|

|

– |

|

|

– |

|

|

1,201 |

|

| Site activities |

|

– |

|

|

– |

|

|

435 |

|

|

– |

|

|

435 |

|

| Sustainability |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

| Total |

$ |

1,201 |

|

$ |

– |

|

$ |

435 |

|

$ |

4,239 |

|

$ |

5,875 |

|

| Three months

ended April 30, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| E&E

costs |

|

Galaxie |

|

|

Hotai |

|

|

ZNT |

|

|

Other |

|

|

Total |

|

| Assaying |

$ |

7,963 |

|

$ |

204 |

|

$ |

– |

|

$ |

1,515 |

|

$ |

9,682 |

|

| Engineering |

|

9,044 |

|

|

– |

|

|

– |

|

|

12,474 |

|

|

21,518 |

|

| Geological |

|

30,071 |

|

|

842 |

|

|

13,493 |

|

|

62,546 |

|

|

106,952 |

|

| Graphics |

|

3,328 |

|

|

– |

|

|

– |

|

|

13,218 |

|

|

16,546 |

|

| Property fees |

|

87 |

|

|

– |

|

|

– |

|

|

– |

|

|

87 |

|

| Sustainability |

|

2,067

|

|

|

41

|

|

|

– |

|

|

3,430

|

|

|

5,538

|

|

| Total |

$ |

52,560 |

|

$ |

1,087 |

|

$ |

13,493 |

|

$ |

93,183 |

|

$ |

160,323 |

|

The following table provides a breakdown of the administration

costs incurred:

| Administration costs |

|

Three months ended |

|

|

Three months ended |

|

| |

|

April 30, 2014 |

|

|

April 30, 2013 |

|

| Legal, accounting and audit |

$ |

11,870 |

|

$ |

4,496 |

|

| Office and administration |

|

107,102 |

|

|

270,733 |

|

| Shareholder communication |

|

10,788 |

|

|

20,941 |

|

| Travel and conferences |

|

– |

|

|

12,895 |

|

| Trust and filing |

|

9,846 |

|

|

17,042 |

|

| Total |

$ |

139,606 |

|

$ |

326,107 |

|

- 15 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.6

LIQUIDITY

Historically, the Company's primary source of funding has been

the issuance of equity securities for cash through private placements to

sophisticated investors and institutions. The Company is in the process of

acquiring and exploring mineral property interests. The Company's continuing

operations are entirely dependent upon the ability of the Company to obtain the

necessary financing to complete the exploration and development of its projects,

the existence of economically recoverable mineral reserves at its projects, the

ability of the Company to obtain the necessary permits to mine, on future

profitable production of any mine and the proceeds from the disposition of its

mineral property interests.

At April 30, 2014, the Company had cash and cash equivalents of

$0.8 million and a working capital deficit of $2.6 million. Of the total

short-term liabilities of $3.5 million at April 30, 2014, $2.9 million was

payable to Hunter Dickinson Services Inc. ("HDSI"), a related party.

To address its working capital deficit at April 30, 2014, the

Company has obtained a confirmation from HDSI that HDSI will continue to provide

services to the Company and will not demand repayment of amounts outstanding,

prior to July 31, 2015.

Management believes that its liquid assets at April 30, 2014

are sufficient to meet its known obligations it expects to pay over the next 12

months and to maintain its mineral rights in good standing for this next 12

month period. The Company is actively managing its cash reserves, and curtailing

activities as necessary in order to ensure its ability to meet payments as they

come due.

Additional debt or equity financing will be required to fund

additional exploration or development programs. The Company has a reasonable

expectation that additional funds will be available to meet ongoing exploration

and development costs. However, there can be no assurance that the Company will

continue to obtain additional financial resources or that it will be able to

achieve positive cash flows. If the Company is unable to obtain adequate

additional financing, the Company will be required to reevaluate its planned

expenditures and will rely on short term borrowings to finance its minimum

expenditure requirement until additional funds can be raised through financing

activities.

General market conditions for junior exploration companies have

resulted in depressed equity prices, despite higher commodity prices. Although

the Company was able to successfully complete private placements in each of the

2012 and 2013 fiscal years, a further and continued deterioration in market

conditions will increase the cost of obtaining capital and limit the

availability of funds to the Company in the future. Accordingly, management is

actively monitoring the effects of the current economic and financing conditions

on our business and reviewing our discretionary spending, capital projects and

operating expenditures, and implementing appropriate cash and cash management

strategies.

Debenture

In August 2012, pursuant to the Sale Agreement relating to the

Galaxie Project, the Company issued a convertible debenture (the "Debenture") in

the amount of $650,000 maturing on October 31, 2013, and bearing interest at a

rate of 8% per annum (payable quarterly in arrears) to Bearclaw. The Debenture

was convertible into the Company's common shares at a conversion price of $0.40

per share at any time before its expiry.

In July 2013, Quartz Mountain and the debentureholder entered

into an agreement to amend the Debenture, whereby among other things, a $50,000

principal payment was made reducing the outstanding balance to $600,000, the

interest rate was increased to 10% per annum, and the maturity date was extended

to October 31, 2014.

- 16 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

Interest payments for the Debenture are payable quarterly in

arrears and the Debenture is convertible into the Company's common shares at an

exercise price of $0.15 per share (previously $0.40 per share) on or before

maturity of the Debenture on October 31, 2014. Any interest accrued, but unpaid,

shall also be converted at an exercise price of the higher of $0.15 per share

(previously $0.40 per share) and the market price at the time of conversion.

Table of Obligations and Commitments

The following obligations existed at April 30, 2014:

| |

|

Payments due by period |

|

| |

|

|

|

|

Less than 1 |

|

|

|

|

|

|

|

| |

|

Total |

|

|

year |

|

|

1-5 years |

|

|

After 5 years |

|

| Amounts payable and other liabilities |

$ |

28,164 |

|

$ |

28,164 |

|

$ |

– |

|

$ |

– |

|

| Convertible debenture |

|

600,000 |

|

|

600,000 |

|

|

– |

|

|

– |

|

| Due to related parties |

|

2,874,033 |

|

|

– |

|

|

2,874,033 |

|

|

– |

|

| Total |

$ |

3,502,197 |

|

$ |

628,164 |

|

$ |

2,874,033 |

|

$ |

– |

|

The Company has no material capital lease or operating lease

obligations. The Company has no "Purchase Obligations", defined as any agreement

to purchase goods or services that is enforceable and legally binding on the

Company that specifies all significant terms, including: fixed or minimum

quantities to be purchased; fixed, minimum or variable price provisions; and the

approximate timing of the transaction.

1.7

CAPITAL RESOURCES

The Company had no material commitments for capital

expenditures as at April 30, 2014.

The Company has no lines of credit or other sources of

financing which have been arranged but are as of yet, unused.

At April 30, 2014, there were no externally imposed capital

requirements to which the Company is subject and with which the Company has not

complied.

As the Company continues to incur losses in support of the

advancement of exploration activities on its projects, shareholders’ equity is

in a deficit position.

1.8

OFF-BALANCE SHEET ARRANGEMENTS

None.

1.9

TRANSACTIONS WITH RELATED PARTIES

The required disclosure is provided in note 9 of the

accompanying financial statements.

- 17 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.10 FOURTH QUARTER

Not applicable.

1.11

PROPOSED TRANSACTIONS

There are no proposed assets or business acquisitions or

dispositions, other than those in the ordinary course, before the board of

directors for consideration.

1.12

CRITICAL ACCOUNTING ESTIMATES

Not required. The Company is a Venture Issuer.

1.13 CHANGES IN

ACCOUNTING POLICIES INCLUDING INITIAL ADOPTION

The required disclosure is provided in note 2 of the

accompanying financial statements.

1.14 FINANCIAL

INSTRUMENTS AND OTHER INSTRUMENTS

The carrying amounts of cash and cash equivalents, amounts

receivable, accounts payable and accrued liabilities, and balances due to

related parties, approximate their fair values due to their short-term

nature.

1.15 OTHER

MD&AREQUIREMENTS

1.15.1 Additional Disclosure for Venture Issuers Without

Significant Revenue

| (a) |

exploration and evaluation assets or

expenditures |

The required disclosure is presented in the

unaudited condensed interim consolidated statements of comprehensive loss

and Section 1.5 of this MD&A. |

| |

|

|

| (b) |

expensed research and development costs |

Not applicable |

| |

|

|

| (c) |

intangible assets arising from development |

Not applicable |

| |

|

|

| (d) |

general and administration expenses |

The required disclosure is presented in the

unaudited condensed interim consolidated statements of comprehensive loss

and Section 1.5 of this MD&A. |

| |

|

|

| (e) |

any material costs, whether expensed or

recognized as assets, not referred to in paragraphs (a) through (d) |

None |

- 18 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.15.2 Disclosure of Outstanding Share Data

The following details the share capital structure as at the

date of this MD&A:

| |

|

Number |

|

| |

|

|

|

| Common shares |

|

27,299,513 |

|

| |

|

|

|

| Share options |

|

1,592,700 |

|

| |

|

|

|

| Convertible debenture |

|

4,000,000 |

|

1.15.3 Internal Controls over Financial Reporting

Procedures

The Company's management, including the Chief Executive Officer

and the Chief Financial Officer, is responsible for establishing and maintaining

adequate internal control over financial reporting. Under the supervision of the

Chief Executive Officer and Chief Financial Officer, the Company's internal

control over financial reporting is a process designed to provide reasonable

assurance regarding the reliability of financial reporting and the preparation

of financial statements for external purposes in accordance with IFRS. The

Company's internal control over financial reporting includes those policies and

procedures that:

-

pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions of the assets

of the Company;

-

provide reasonable assurance that transactions are recorded as necessary to

permit preparation of financial statements in accordance with IFRS, and that

receipts and expenditures of the Company are being made only in accordance

with authorizations of management and directors of the company; and

-

provide reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use or disposition of the Company's assets that

could have a material effect on the financial statements.

There has been no change in the design of the Company's

internal control over financial reporting that has materially affected, or is

reasonably likely to materially affect, the Company's internal control over

financial reporting during the period covered by this Management's Discussion

and Analysis.

1.15.4 Disclosure Controls and Procedures

The Company has disclosure controls and procedures in place to

provide reasonable assurance that any information required to be disclosed by

the Company under securities legislation is recorded, processed, summarized and

reported within the appropriate time periods and that required information is

accumulated and communicated to the Company's management, including the Chief

Executive Officer and Chief Financial Officer, as appropriate, so that decisions

can be made about the timely disclosure of that information.

- 19 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

1.15.5 Limitations of Controls and Procedures

The Company's management, including its Chief Executive Officer

and Chief Financial Officer, believe that any system of disclosure controls and

procedures or internal control over financial reporting, no matter how well

conceived and operated, can provide only reasonable, not absolute, assurance

that the objectives of the control system are met. Furthermore, the design of a

control system must reflect the fact that there are resource constraints and the

benefits of controls must be considered relative to their costs. Because of the

inherent limitations in all control systems, they cannot provide absolute

assurance that all control issues and instances of fraud, if any, within the

Company have been prevented or detected. These inherent limitations include the

realities that judgments in decision-making can be faulty and breakdowns can

occur because of simple error or mistake. Additionally, controls can be

circumvented by the individual acts of some persons, by collusion of two or more

people, or by unauthorized override of controls. The design of any system of

controls is also based in part upon certain assumptions about the likelihood of

future events, and there can be no assurance that any design will succeed in

achieving its stated goals under all potential future conditions. Accordingly,

because of the inherent limitations in a cost effective control system,

misstatements due to error or fraud may occur and not be detected.

1.16 RISK FACTORS

The risk factors associated with the principal business of the

Company are discussed below. Due to the nature of the Company's business and the

present stage of exploration and development of its projects in British

Columbia, an investment in the securities of Quartz Mountain is highly

speculative and subject to a number of risks. Briefly, these include the highly

speculative nature of the resources industry characterized by the requirement

for large capital investments from an early stage and a very small probability

of finding economic mineral deposits. In addition to the general risks of

mining, there are country-specific risks, including currency, political, social,

permitting and legal risk. An investor should carefully consider the risks

described below and the other information that Quartz Mountain furnishes to, or

files with, the Securities and Exchange Commission and with Canadian securities

regulators before investing in Quartz Mountain's common shares, and should not

consider an investment in Quartz Mountain unless the investor is capable of

sustaining an economic loss of the entire investment. The Company's actual

exploration and operating results may be very different from those expected as

at the date of this MD&A.

Going Concern Assumption

The Company's condensed interim consolidated financial

statements have been prepared assuming the Company will continue on a going

concern basis. However, unless additional funding is obtained, this assumption

will have to change. The Company has a negative working capital position, and

has incurred losses since inception. Failure to continue as a going concern

would require that Quartz Mountain's assets and liabilities be restated on a

liquidation basis, which could differ significantly from the going concern

basis.

Additional Funding Requirements

Further development of the Company's properties and continued

operations will require additional capital. The Company currently does not have

sufficient funds to fully develop the properties it holds. It is possible that the financing required by the Company will not be

available, or, if available, will not be available on acceptable terms. If the

Company issues treasury shares to finance its operations or expansion plans,

shareholders will suffer dilution of their investment and control of the Company

may change. If adequate funds are not available, or are not available on

acceptable terms, the Company will not be able to take advantage of

opportunities, or otherwise respond to competitive pressures and remain in

business. In addition, a positive production decision at any of the Company's

current projects or any other development projects acquired in the future will

require significant resources and funding for project engineering and

construction. Accordingly, the continuing development of the Company's

properties depends upon the Company's ability to obtain financing through debt

financing, equity financing, the joint venturing or disposition of its current

projects, or other means. There is no assurance that the Company will be

successful in obtaining the required financing for these or other purposes,

including for general working capital.

- 20 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

Future Profits/Losses and Production Revenues/Expenses

The Company has no history of operations or earnings, and

expects that its losses and negative cash flow will continue for the foreseeable

future. The Company currently has a limited number of mineral properties and

there can be no assurance that the Company will, if needed, be able to acquire

additional properties of sufficient technical merit to represent a compelling

investment opportunity. If the Company is unable to acquire additional

properties, its entire prospects will rest solely with its current projects and

accordingly, the risk of being unable to identify a mineral deposit will be

higher than if the Company had additional properties to explore. There can be no

assurance that the Company will ever be profitable in the future. The Company's

operating expenses and capital expenditures may increase in subsequent years as

needed consultants, personnel and equipment associated with advancing

exploration, development and commercial production of its current properties and

any other properties that the Company may acquire are added. The amounts and

timing of expenditures will depend on the progress of on-going exploration and

development, the results of consultants' analyses and recommendations, the rate

at which operating losses are incurred, the execution of any joint venture

agreements with strategic partners, and the Company's acquisition of additional

properties and other factors, many of which are beyond the Company's control.

The Company does not expect to receive revenues from operations in the

foreseeable future, and expects to incur losses unless and until such time as

its current properties, or any other properties the Company may acquire,

commence commercial production and generate sufficient revenues to fund its

continuing operations. The development of the Company's current properties and

any other properties the Company may acquire will require the commitment of

substantial resources to conduct the time-consuming exploration and development

of properties. The Company anticipates that it will retain any cash resources

and potential future earnings for the future operation and development of the

Company's business. The Company has not paid dividends since incorporation and

the Company does not anticipate paying dividends in the foreseeable future.

There can be no assurance that the Company will generate any revenues or achieve

profitability. There can be no assurance that the underlying assumed levels of

expenses will prove to be accurate. To the extent that such expenses do not

result in the creation of appropriate revenues, the Company's business may be

materially adversely affected. It is not possible to forecast how the business

of the Company will develop.

Exploration, Development and Mining Risks

Resource exploration, development, and operations are highly

speculative, characterized by a number of significant risks, which even a

combination of careful evaluation, experience and knowledge may not reduce, including among other things, unsuccessful efforts

resulting not only from the failure to discover mineral deposits but from

finding mineral deposits which, though present, are insufficient in quantity and

quality to return a profit from production. Few properties that are explored are

ultimately developed into producing mines. Unusual or unexpected formations,

formation pressures, fires, power outages, labour disruptions, flooding,

explosions, cave-ins, landslides and the inability to obtain suitable or

adequate machinery, equipment or labour are other risks involved in the

operation of mines and the conduct of exploration programs. The Company will

rely upon consultants and others for exploration, development, construction and

operating expertise. Substantial expenditures are required to establish mineral

resources and mineral reserves through drilling, to develop metallurgical

processes to extract the metal from mineral resources, and in the case of new

properties, to develop the mining and processing facilities and infrastructure

at any site chosen for mining.

- 21 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

No assurance can be given that minerals will be discovered in

sufficient quantities to justify commercial operations or that funds required

for development can be obtained on a timely basis. Whether a mineral deposit

will be commercially viable depends on a number of factors, some of which are:

the particular attributes of the deposit, such as size, grade and proximity to

infrastructure; metal prices, which are highly cyclical; and government

regulations, including regulations relating to prices, taxes, royalties, land

tenure, land use, importing and exporting of minerals, and environmental

protection. The exact effect of these factors cannot accurately be predicted,

but the combination of these factors may result in the Company not receiving an

adequate return on invested capital.

The Company will carefully evaluate the political and economic

environment in considering any properties for acquisition.

Permits and Licenses

The operations of the Company will require licenses and permits

from various governmental authorities. There can be no assurance that the

Company will be able to obtain all necessary licenses and permits which may be

required to carry out exploration and development of the Galaxie and ZNT

Projects.

Infrastructure Risk

The operations of the Company are carried out in geographical

areas which may lack adequate infrastructure and are subject to various other

risk factors. Mining, processing, development and exploration activities depend,

to one degree or another, on adequate infrastructure. Reliable roads, bridges,

power sources and water supply are important determinants which affect capital

and operating costs. Lack of such infrastructure or unusual or infrequent

weather phenomena, government or other interference in the maintenance or

provision of such infrastructure could adversely affect the Company's

operations, financial condition and results of operations.

Changes in Local Legislation or Regulation

The Company's mining and processing operations and exploration

activities are subject to extensive laws and regulations governing the

protection of the environment, exploration, development, production, exports,

taxes, labour standards, occupational health, waste disposal, toxic substances,

mine and worker safety, protection of endangered and other special status

species and other matters. The Company's ability to obtain permits and approvals

and to successfully operate in particular communities may be adversely impacted

by real or perceived detrimental events associated with the Company's activities

or those of other mining companies affecting the environment,

human health and safety of the surrounding communities. Delays in obtaining or

failure to obtain government permits and approvals may adversely affect the

Company's operations, including its ability to explore or develop properties,

commence production or continue operations. Failure to comply with applicable

environmental and health and safety laws and regulations may result in

injunctions, fines, suspension or revocation of permits and other penalties. The

costs and delays associated with compliance with these laws, regulations and

permits could prevent the Company from proceeding with the development of a

project or the operation or further development of a mine or increase the costs

of development or production and may materially adversely affect the Company's

business, results of operations or financial condition. The Company may also be

held responsible for the costs of addressing contamination at the site of

current or former activities or at third party sites. The Company could also be

held liable for exposure to hazardous substances.

- 22 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

Environmental Matters

All of the Company's operations are and will be subject to

environmental regulations, which can make operations expensive or prohibit them

altogether. The Company may be subject to potential risks and liabilities

associated with pollution of the environment and the disposal of waste products

that could occur as a result of its mineral exploration, development and

production. In addition, environmental hazards may exist on a property in which

the Company directly or indirectly holds an interest, which are unknown to the

Company at present and have been caused by previous or existing owners or

operators of the Company's projects. Environmental legislation provides for

restrictions and prohibitions on spills, releases or emissions of various

substances produced in association with certain mining industry operations which

would result in environmental pollution. A breach of such legislation may result

in the imposition of fines and penalties, or the requirement to remedy

environmental pollution, which would reduce funds otherwise available to the

Company and could have a material adverse effect on the Company. If the Company

is unable to fully remedy an environmental problem, it could be required to

suspend operations or undertake interim compliance measures pending completion

of the required remedy, which could have a material adverse effect on the

Company.

There is no assurance that future changes in environmental

regulation, if any, will not adversely affect the Company's operations. There is

also a risk that the environmental laws and regulations may become more onerous,

making the Company's operations more expensive. Many of the environmental laws

and regulations will require the Company to obtain permits for its activities.

The Company will be required to update and review its permits from time to time,

and may be subject to environmental impact analyses and public review processes

prior to approval of the additional activities. It is possible that future

changes in applicable laws, regulations and permits or changes in their

enforcement or regulatory interpretation could have a significant impact on some

portion of the Company's business, causing those activities to be economically

re-evaluated at that time.

Groups Opposed to Mining May Interfere with the Company's

Efforts to Explore and Develop its Properties

Organizations opposed to mining may be active in the regions in

which the Company conducts its exploration activities. Although the Company

intends to comply with all environmental laws and maintain good relations with

local communities, there is still the possibility that those opposed to mining

will attempt to interfere with the development of the Company's properties. Such

interference could have an impact on the Company's ability to explore and

develop its properties in a manner that is most efficient or appropriate, or at all, and any such impact could have a

material adverse effect on the Company's financial condition and the results of

its operations.

- 23 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

Market for Securities and Volatility of Share Price

There can be no assurance that active trading market in the

Company's securities will be established or sustained. The market price for the

Company's securities is subject to wide fluctuations. Factors such as

announcements of exploration results, as well as market conditions in the

industry or the economy as a whole, may have a significant adverse impact on the

market price of the securities of the Company.

The stock market has from time to time experienced extreme

price and volume fluctuations that have often been unrelated to the operating

performance of particular companies.

Conflicts of Interest

The Company's directors and officers may serve as directors or

officers of other companies, joint venture partners, or companies providing

services to the Company or they may have significant shareholdings in other

companies. Situations may arise where the directors and/or officers of the

Company may be in competition with the Company. Any conflicts of interest will

be subject to and governed by the law applicable to directors' and officers'

conflicts of interest. In the event that such a conflict of interest arises at a

meeting of the Company's directors, a director who has such a conflict will

abstain from voting for or against the approval of such participation or such

terms. In accordance with applicable laws, the directors of the Company are

required to act honestly, in good faith and in the best interests of the

Company.

General Economic Conditions

Global financial markets have experienced a sharp increase in

volatility during the last few years. Market conditions and unexpected

volatility or illiquidity in financial markets may adversely affect the

prospects of the Company and the value of the Company's shares.

Reliance on Key Personnel

The Company is dependent on the continued services of its

senior management team, and its ability to retain other key personnel. The loss

of such key personnel could have a material adverse effect on the Company. There

can be no assurance that any of the Company's employees will remain with the

Company or that, in the future, the employees will not organize competitive

businesses or accept employment with companies competitive with the Company.

Furthermore, as part of the Company's growth strategy, it must

continue to hire highly qualified individuals. There can be no assurance that

the Company will be able to attract, train or retain qualified personnel in the

future, which would adversely affect its business.

Risks Related to Flow-Through Shares

Financing of the Company may involve the issuance of

flow-through common shares under the Income Tax Act (Canada). There is no

guarantee that there will not be any differences of opinion between the Canadian

federal and British Columbia provincial tax authorities with respect to the tax

treatment of flow-through common shares issued under a financing, if any, and the

activities contemplated by the Company's exploration and development

programs.

- 24 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

If the Company does not expend an amount equal to the gross

proceeds from the sale of flow-through common shares so as to incur sufficient

qualifying expenditures within the relevant timeframe, subscribers in the

flow-through financing may be reassessed. The Company shall be obligated to

indemnify any subscribers of flow-through common shares for tax payable pursuant

to any such reassessment pursuant to the terms and conditions set out in the

subscription agreements that the Company will enter into with each subscriber in

a flow-through financing. There can be no assurances that the Company will have

sufficient funds to satisfy such obligations.

Competition

The resources industry is highly competitive in all its phases,

and the Company will compete with other mining companies, many of which have

greater financial, technical and other resources. Competition in the mining

industry is primarily for: attractive mineral rich properties capable of being

developed and producing economically; the technical expertise to find, develop

and operate such properties; the labour to operate the properties; and the

capital for the purpose of funding such properties. Many competitors not only

explore for and mine certain minerals, but also conduct production and marketing

operations on a worldwide basis. Such competition may result in the Company

being unable to acquire desired properties, to recruit or retain qualified

employees or to acquire the capital necessary to fund its operations and develop

its properties. The Company's inability to compete with other mining companies

for these resources could have a materially adverse effect on the Company's

results of operation and its business.

Uninsurable Risks

In the course of exploration, development and production of

mineral properties, certain risks, and in particular, unexpected or unusual

geological operating conditions including rock bursts, cave ins, fires, flooding

and earthquakes may occur. It is not always possible to fully insure against

such risks and the Company may decide not to take out insurance against such

risks as a result of high premiums or other reasons.

Land Claims

In Canada, aboriginal interests, rights (including treaty

rights), claims and title may exist notwithstanding that they may be

unregistered or overlap with other tenures and interests granted to third

parties. Generally speaking, the scope and content of such rights are not well

defined and may be the subject of litigation or negotiation with the government.

The government has a legal obligation to consult First Nations on proposed

activities that may have an impact on asserted or proven aboriginal interests,

claims, rights or title. All of the mineral claims in the Company's projects are

identified by the Province of British Columbia as overlapping with areas in

which certain aboriginal groups have asserted aboriginal interests, rights,

claims or, title or undefined rights under historic treaties. Nevertheless,

potential overlaps between the Company's properties and existing or asserted

aboriginal interests, rights, claims or, title, or undefined rights under

historic treaties, may exist notwithstanding whether the Province of British

Columbia has identified such interests, rights, claims or, title, or undefined

rights under historic treaties.

- 25 -

| QUARTZ MOUNTAIN

RESOURCES LTD. |

| FOR THE NINE MONTHS ENDED APRIL 30, 2014 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| |

Property Title

The acquisition of title to resource properties is a very

detailed and time consuming process. Title to, and the area of, resource claims

may be disputed. Although the Company believes it has taken reasonable measures

to ensure that title to the mineral claims comprising part of its projects are

held as described, there is no guarantee that title to any of those claims will

not be challenged or impaired. There may be valid challenges to the title of any

of the mineral claims comprising the Company's projects that, if successful,

could impair development or operations or both.

The Mineral Property Underlying the Company's Net Smelter

Return Royalty Interest Contains no Known Ore

The Company holds a 1% net smelter return ("NSR") royalty

interest on the Quartz Mountain Property (recently renamed "Angel's Camp"), an

exploration stage prospect in Oregon. The Company's interest in the property